Apple's Record iPhone Quarter: What $85.27B Revenue Means for the Smartphone Industry

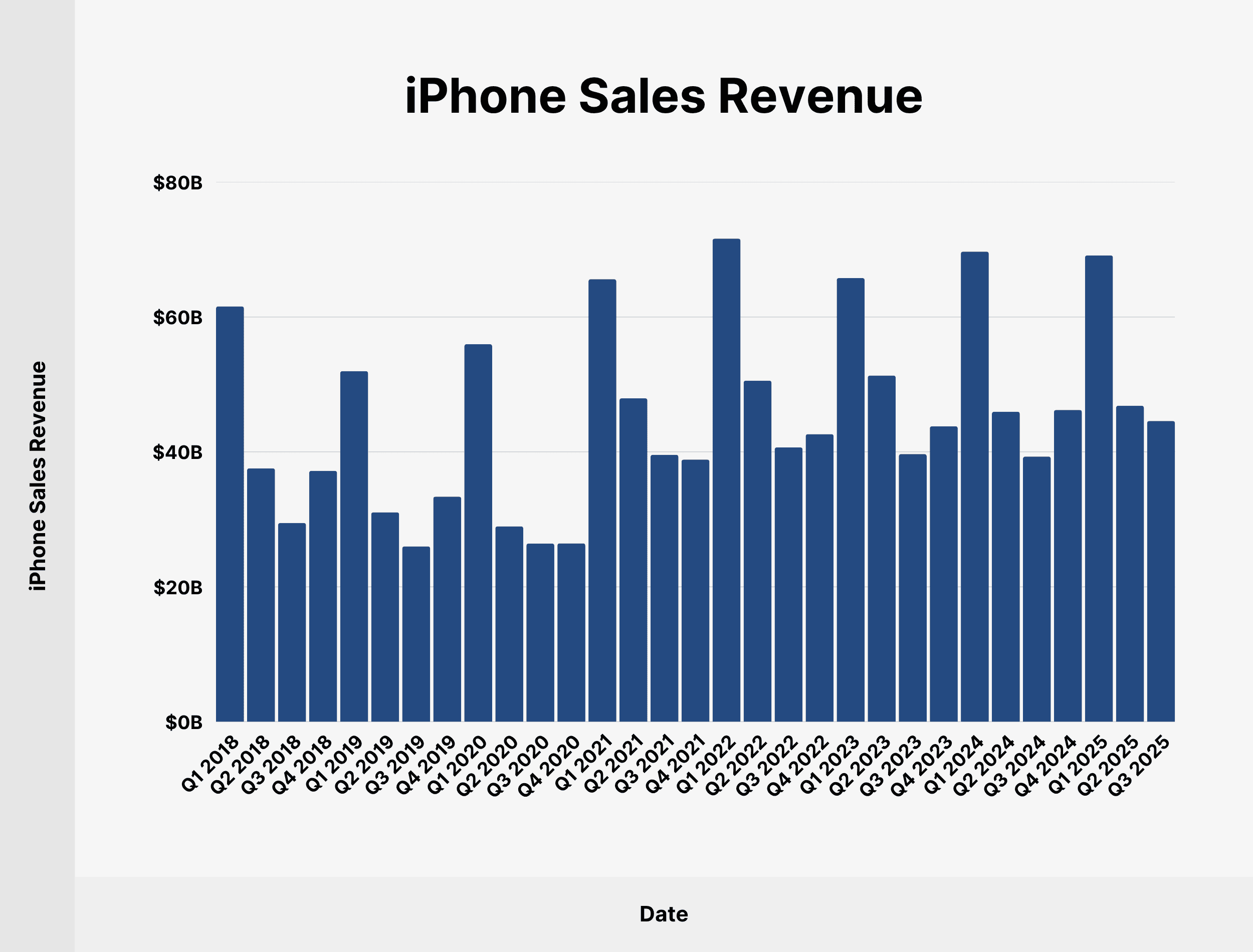

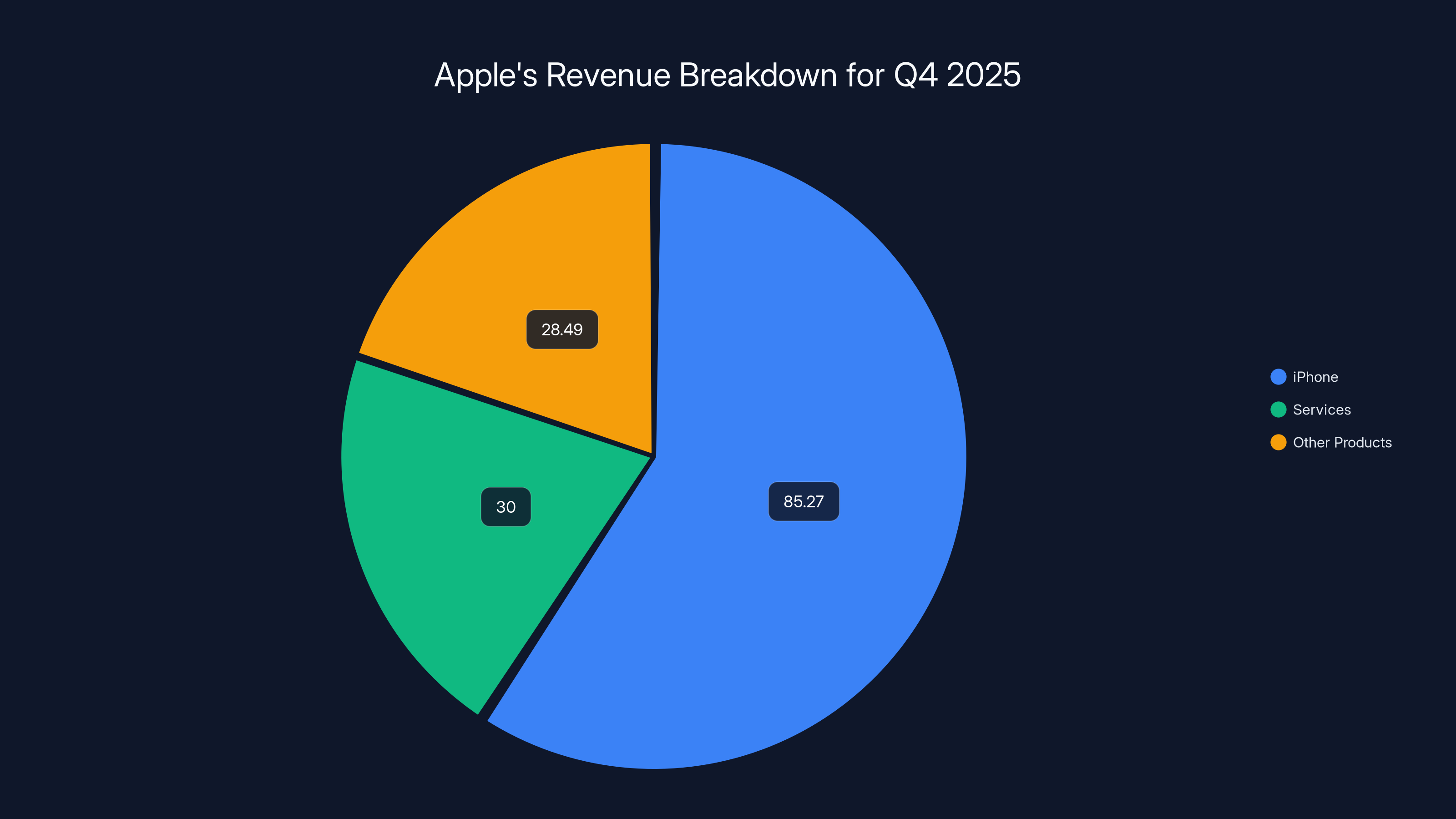

Last week, Apple dropped earnings that made even Wall Street do a double-take. The company just finished its best-ever quarter for iPhone sales, generating $85.27 billion in revenue from smartphones alone. That's not just growth—that's absolute dominance, as highlighted in CNBC's earnings report.

But here's what makes this moment genuinely interesting: we're not just watching Apple succeed. We're watching the entire smartphone market reshape itself around what Apple does. When Tim Cook calls it "the strongest iPhone lineup we've ever had," he's not exaggerating. He's describing a fundamental shift in how people think about phones, pricing, and what they're willing to spend, as noted in AppleInsider's analysis.

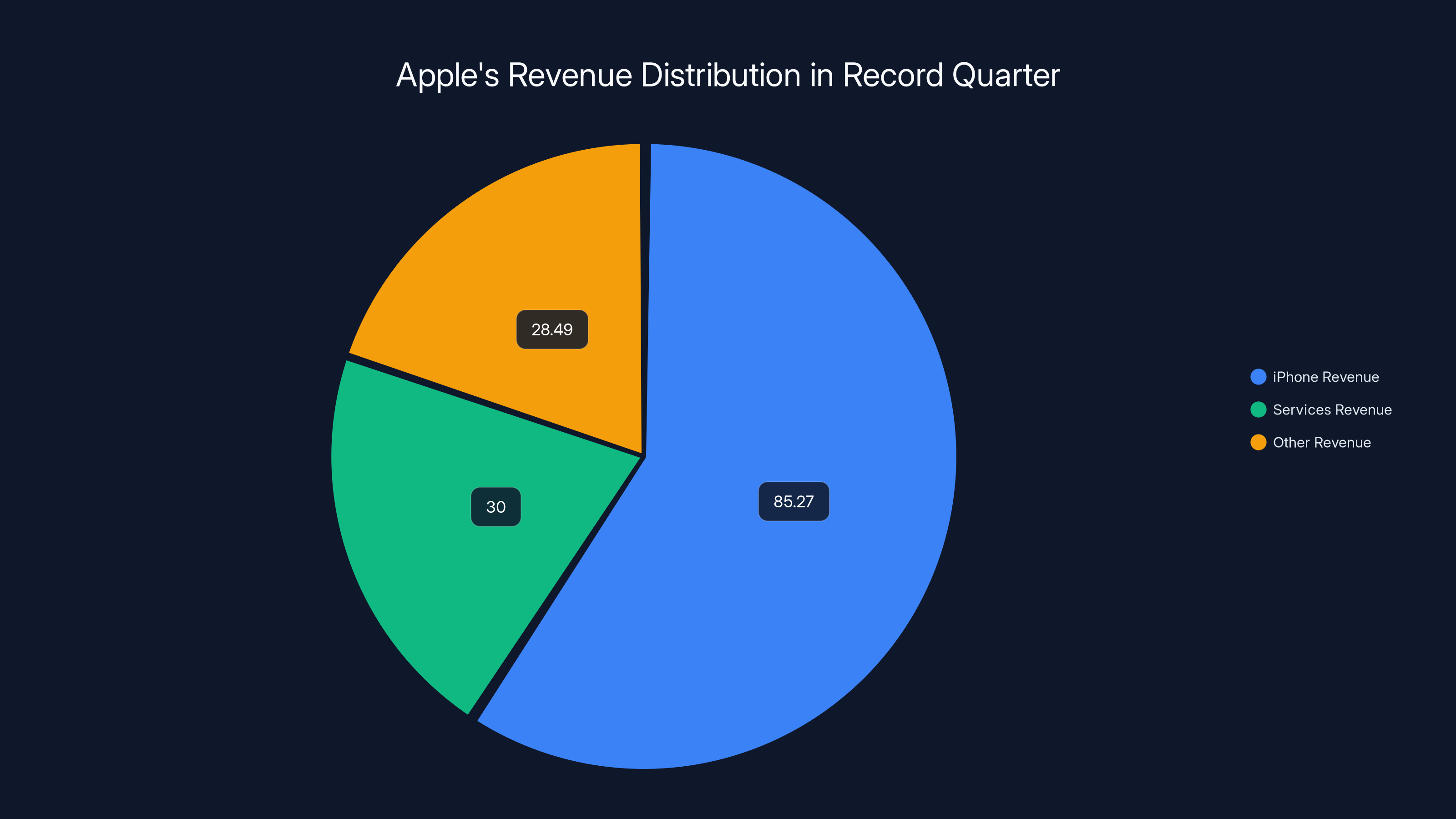

The earnings report revealed more than just one impressive number. Total company revenue hit

What makes this quarter particularly significant is the context surrounding it. Apple doesn't even disclose iPhone unit sales anymore. Yet somehow, despite removing that transparency, the company's ability to convince people to spend over $1,000 on a smartphone has only gotten stronger. That's a power move in an industry where most competitors are fighting over pennies on margin and racing to the bottom on price, as discussed in Forbes.

So what's really happening here? Why is Apple's iPhone business not just growing, but hitting new records? And what does it mean for the rest of the smartphone industry that's watching these numbers with a mix of envy and desperation?

TL; DR

- iPhone revenue hit $85.27 billion, Apple's best-ever quarter for smartphones despite higher prices

- Total company revenue reached $143.76 billion, marking the company's largest quarter on record

- Services revenue grew 14% year-over-year to just over $30 billion, becoming increasingly vital to margins

- Average selling prices continued climbing, demonstrating Apple's pricing power in a market where most competitors are cutting costs

- The Services business now rivals entire company revenues of major competitors, reshaping how Apple thinks about profitability

Apple's iPhone revenue reached a record $85.27 billion in Q1 2026, surpassing previous quarters significantly. Estimated data for prior quarters shows a consistent upward trend.

The Numbers Tell a Story That Goes Way Beyond Revenue

When Apple reports a record quarter for iPhones, it's easy to fixate on the headline number. Eighty-five billion dollars. That's nearly the entire market capitalization of most Fortune 500 companies. But the real story hiding in these earnings isn't about how much money Apple made from iPhone sales. It's about how it made that money.

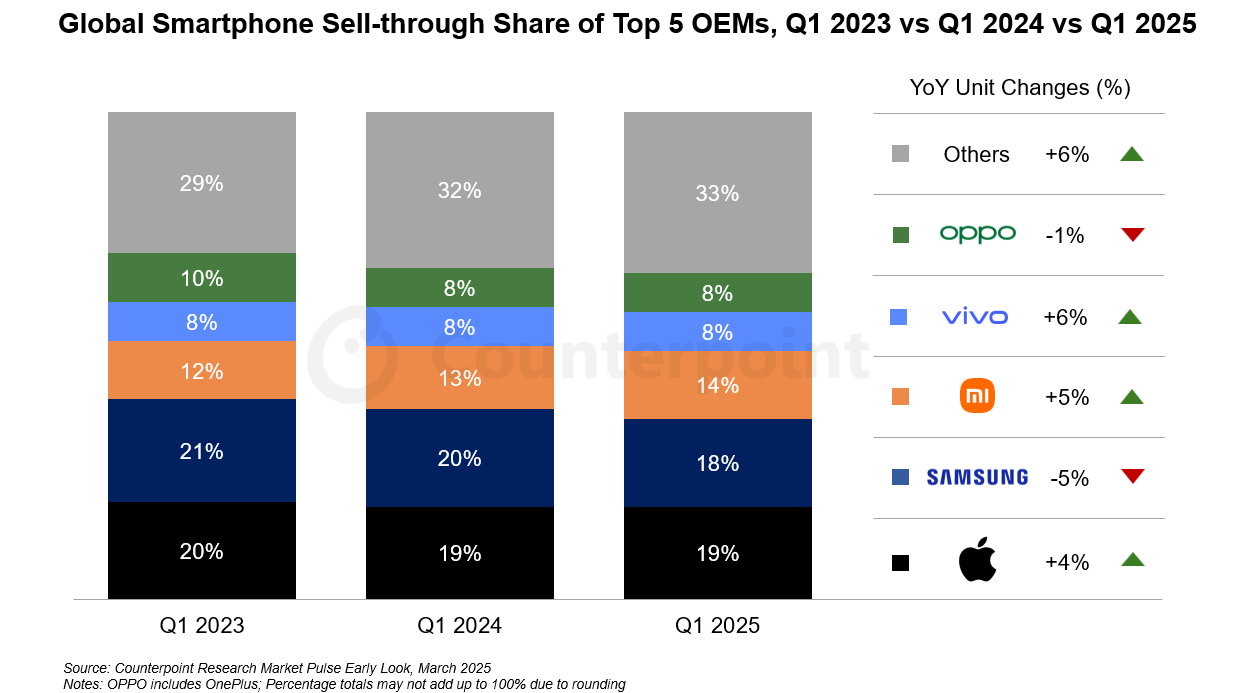

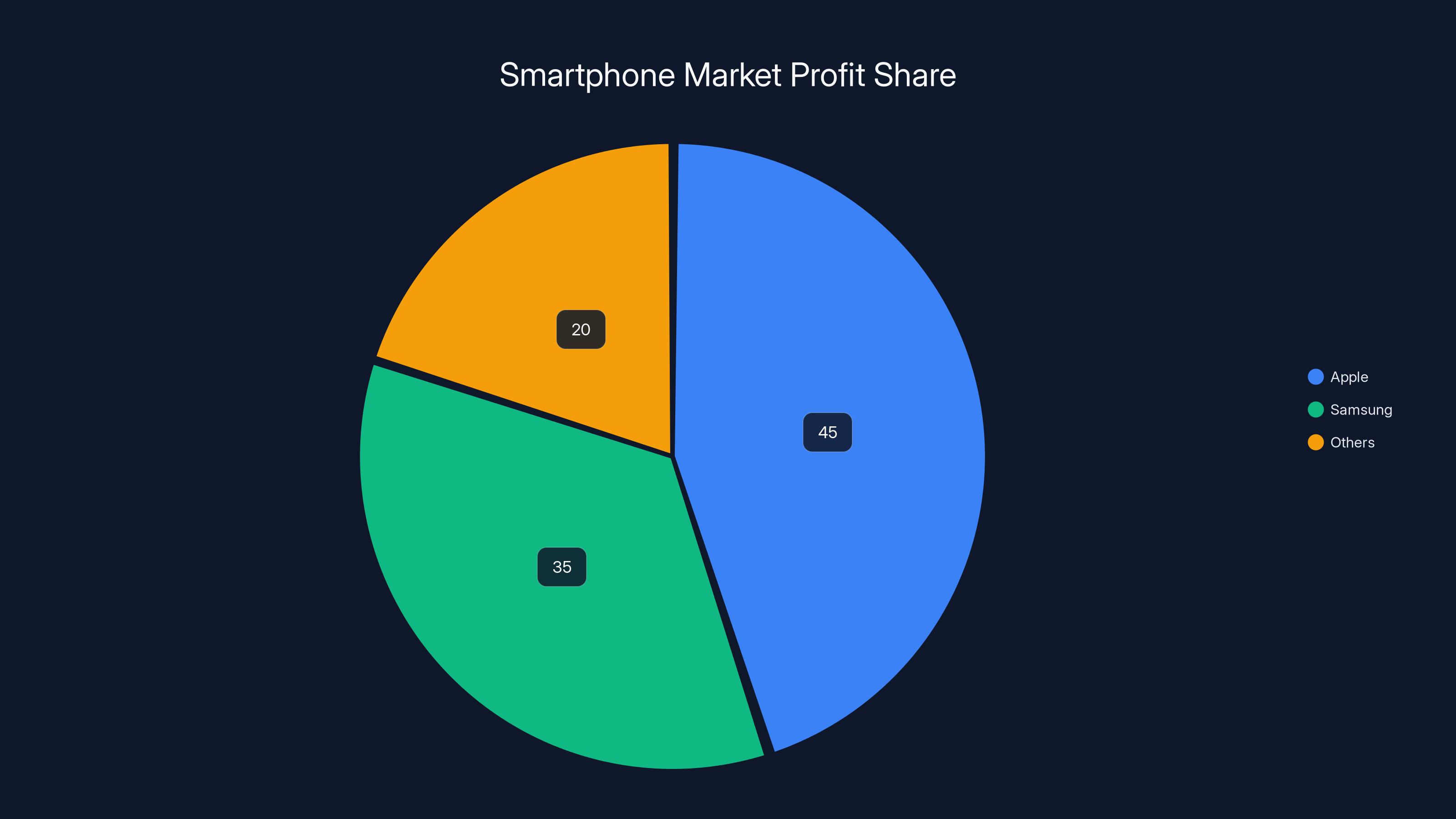

Think about the smartphone market for a second. It's been consolidating for years. Two companies—Apple and Samsung—control roughly 80 percent of the smartphone industry's profits, according to Counterpoint Research. Everyone else is fighting for crumbs. In that brutally compressed market, where competition is supposed to drive prices down and margins thinner, Apple just had its best iPhone quarter ever.

This happened while most of the industry was getting nervous about demand. Smartphone shipments have been essentially flat year-over-year for the last three to four years, as noted by Intellectia. We're past the era of explosive growth. The market matured sometime around 2016. Yet here's Apple, not just holding steady but accelerating.

The trick is prices. Apple's average selling price per iPhone has been creeping steadily upward. The entry-level iPhone now starts above

What's remarkable is that this pricing strategy is working at scale. We're not talking about a luxury segment or a niche market. iPhones represent about 52 percent of Apple's total revenue. That's not some boutique product line. That's the core of the business, and it's booming, as highlighted by Macworld.

Apple and Samsung dominate the smartphone market, controlling approximately 80% of the industry's profits. Estimated data.

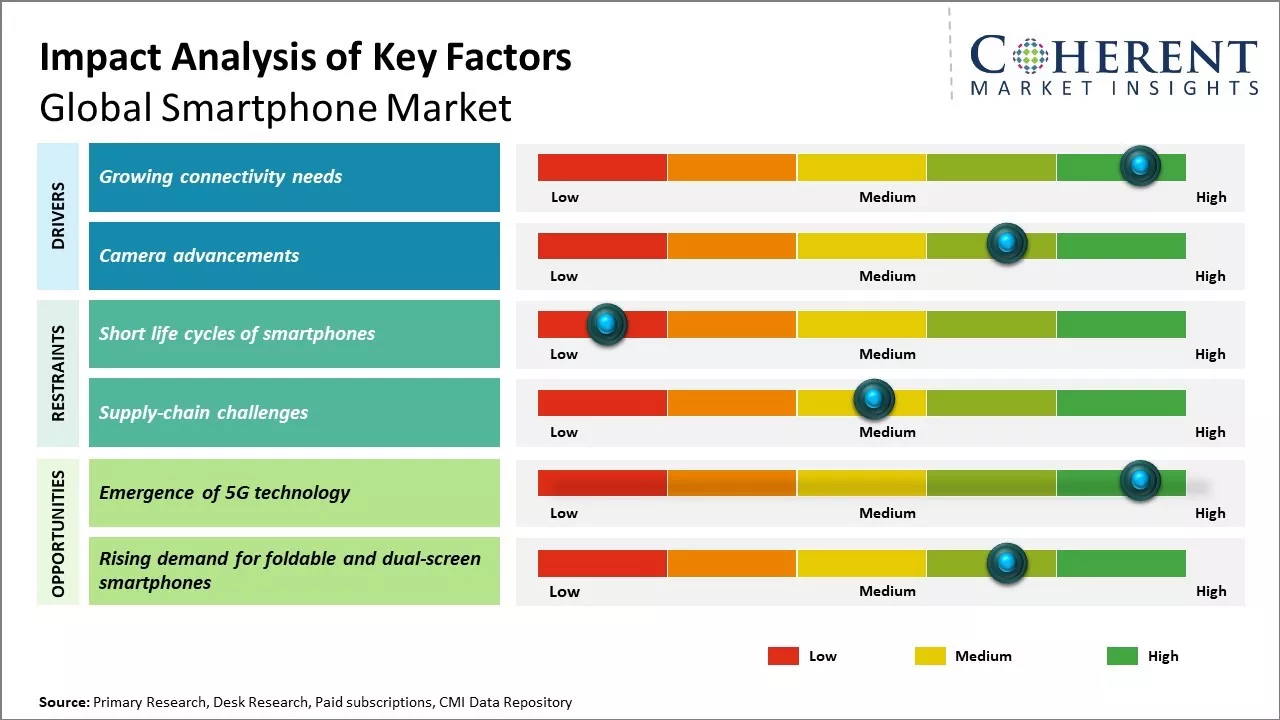

Why the Smartphone Market Dynamics Are Shifting

The smartphone market in 2025 looks nothing like it did in 2015. Back then, the narrative was simple: phones got cheaper, everyone bought them, markets matured. By the early 2020s, that story was locked in. Analysts predicted flat growth forever. Smartphone shipments plateaued around 1.4 billion units annually.

Then AI happened.

Not AI in the abstract sense where every company adds a chatbot feature. Real AI-powered features that people actually use. Apple Intelligence, as the company calls it, became the primary reason people upgraded from their old phones. This is different from previous upgrade cycles, which were usually driven by better cameras, faster processors, or slightly larger screens.

For the first time in years, the upgrade cycle has a genuine technological reason behind it. Apple Intelligence features let phones do things they couldn't do before: real image generation, intelligent photo search, contextual understanding of what's on your screen. These aren't gimmicks. They're genuinely useful, and they work best on new hardware, as explained in Six Colors.

Samsung, Google, and other manufacturers are scrambling to launch their own AI features, but they're playing catch-up. Apple had the advantage of integrating AI from the ground up across hardware and software. Their Neural Engine—the dedicated AI chip inside every modern iPhone—is purpose-built for these tasks. It's not an afterthought or a marketing label.

This matters because it's the first time in three or four years that there's been a legitimate technological reason for someone with a working older iPhone to upgrade. And when you combine a real reason to upgrade with Apple's pricing power and premium positioning, you get this: a record iPhone quarter during a period when the smartphone market is supposedly mature and flat.

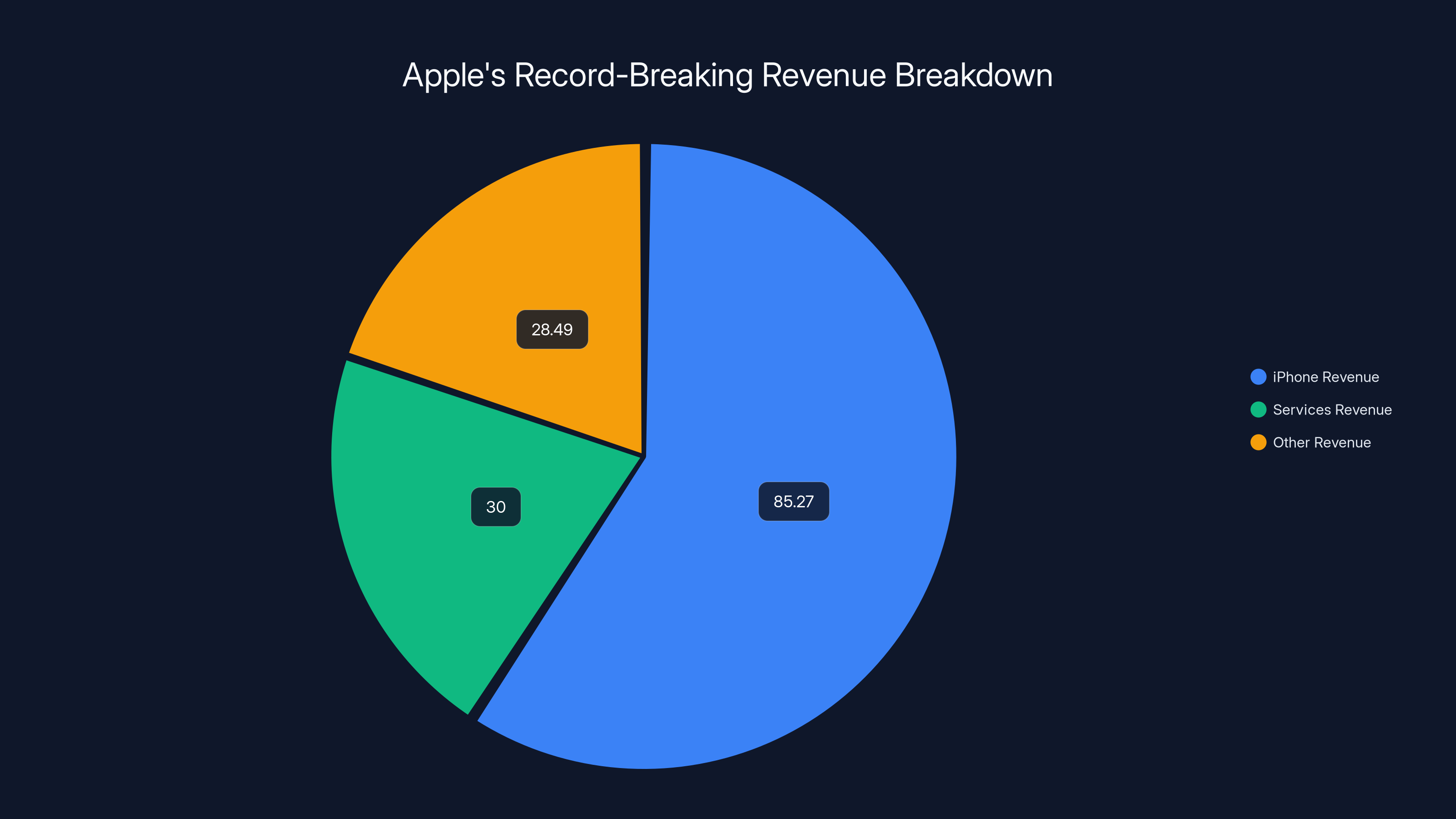

The Services Revenue Story Is Actually More Important Than iPhone Itself

Here's something that might surprise you: the Services revenue number from this quarter might be more significant than the iPhone number, at least for the long-term health of Apple's business.

Services revenue hit just over $30 billion in this quarter. That's grown 14 percent year-over-year, as reported by Yahoo Finance. For a business segment that already generates more annual revenue than any company on the Fortune 500, growing at 14 percent is legitimately impressive. This isn't a startup showing growth. This is a mature business accelerating.

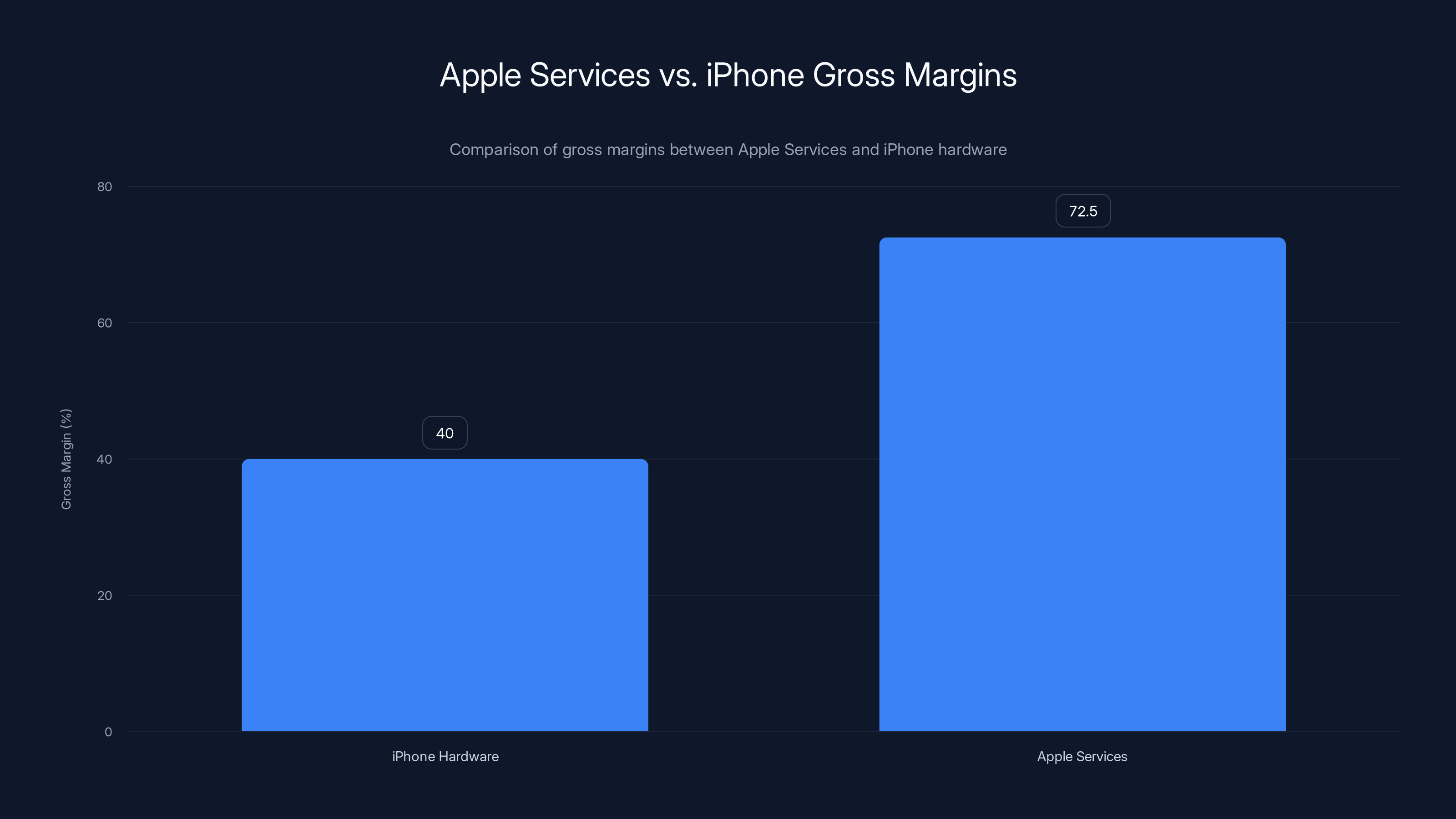

What makes this matter is gross margin. iPhone hardware, despite the premium pricing, typically carries gross margins in the 35-45 percent range. It's good money, but it's constrained by the need to manufacture, ship, and support physical products. Services? Services carries gross margins above 70 percent. Sometimes pushing 75 percent.

That's the future that Apple is building. Every iPhone sold is a gateway to a Services customer. iCloud subscriptions, App Store revenue, Apple Music, Apple TV+, Apple Care+—these are the products that generate exponentially higher profits per customer. The phone is the Trojan horse. The Services business is where real profitability lives, as highlighted by TechHQ.

This quarter, Services revenue alone exceeded the total revenue of most tech companies. It's bigger than the entire operating revenue of companies like Zoom, Shopify, or Discord. Apple is running a software subscription business inside a hardware company, and that business is larger and more profitable than most standalone businesses.

What's the growth driver? Installed base expansion. More iPhones sold means more people in the Services ecosystem. Plus, attach rates are improving. More users are subscribing to multiple Apple services. Someone with an iPhone might have iCloud, Apple Music, and Apple Care+. That's three revenue streams per customer.

Apple's record quarter was driven by

What Total Company Revenue of $143.76 Billion Actually Means

The headline number is staggering: $143.76 billion in total revenue for a single quarter. To put that in perspective, that's more annual revenue than the majority of Fortune 500 companies generate in a full year. Apple generated it in 13 weeks, as noted by IG.

But raw revenue numbers can be misleading. What matters more is what this revenue says about Apple's business model and market position. This quarter represents what happens when you have multiple revenue streams all accelerating simultaneously.

The Mac business is growing. iPad is stable and generating healthy revenue. Wearables—AirPods, Apple Watch, Vision Pro—are expanding. But the iPhone and Services are the two pillars holding everything up. Together, they probably represent around 70-75 percent of total revenue. Everything else is incremental.

That concentration could be a risk in some businesses. One or two product lines generating most of the revenue creates vulnerability if either one stumbles. For Apple, it's actually been a strength. It means the company can focus resources intensely on perfecting two things rather than spreading thin across a dozen different products.

The $143.76 billion quarterly revenue also reveals something about Apple's pricing strategy working across the entire product line. Prices are up on iPhones. Prices are up on Macs. The new Vision Pro is expensive. Even the AirPods Pro carry premium pricing. Across every category, Apple is betting that people will pay more for perceived quality and ecosystem integration. And this quarter's results suggest that bet is paying off.

The Pricing Power Story: How Apple Does What Others Can't

Every financial analyst covering Apple has the same question: how is this company successfully raising prices when the entire industry is competing on cost?

The answer reveals something fundamental about brand power and ecosystem lock-in. Apple doesn't compete on price because it doesn't need to. It competes on integration, longevity, and an ecosystem that becomes more valuable the more Apple products you own.

Consider the math: if you own an iPhone, an iPad, a Mac, and an Apple Watch, everything works together seamlessly. You're not just paying for the individual device. You're paying for that integration. You're paying for the convenience of having your work automatically sync across devices. You're paying for security features that aren't available on less integrated platforms.

Once you're in that ecosystem, switching costs are high. Really high. Not just the cost of the new device, but the cost of rebuilding your digital life on a different platform. Your photos, messages, documents, preferences, muscle memory with the interface—it all adds friction to leaving.

Samsung and Google understand this too. They've built ecosystems. But Apple did it first and has had 15+ years to strengthen the lock-in. By the time competitors caught up with meaningful ecosystem benefits, Apple had already captured a massive installed base.

This dynamic created a pricing moat. Apple can charge more because switching away is expensive—not in terms of raw dollars, but in terms of friction and disruption. For most people, that friction makes the premium price feel worth it.

The iPhone 17 family, which drove this record quarter, reflects this strategy perfectly. Entry-level phones start above

What's particularly clever is that Apple isn't raising prices uniformly. The base iPhone model gets modest increases. The Pro and Pro Max get bigger increases. The company is essentially skimming more profits from customers willing to spend, while maintaining relatively accessible entry prices to expand the installed base.

This is pricing strategy at its most sophisticated. Apple is optimizing for both volume and margin rather than trading one for the other.

Apple's iPhone and Services segments contributed significantly to its record $143.76 billion revenue in Q4, with Services showing notable growth.

How Apple Intelligence Is Reshaping the Upgrade Cycle

For the better part of a decade, the smartphone industry faced a genuine problem: nobody needed to upgrade. Phones from three, four, even five years ago still worked fine. They had decent cameras. Good screens. Fast processors. There was no "killer feature" forcing upgrades.

Apple, Samsung, and Google tried to create that killer feature. Better cameras. Faster processing. Better screens. But none of it felt essential. If your iPhone 12 works fine, why upgrade to an iPhone 15? The reasons were incremental, not revolutionary.

Apple Intelligence changed that equation.

For the first time, there's a real capability gap between old phones and new ones. Image generation, advanced photo search, intelligent text generation, context-aware features that understand what you're doing on your phone—these actually require new hardware. Older phones lack the Neural Engine and the processing power to run these features effectively.

This is brilliant from Apple's perspective because it's a feature gap that can't be closed with a software update. You can't add a Neural Engine to an older iPhone through an OS update. You need new hardware. And new hardware means a new upgrade cycle.

What's more, Apple Intelligence creates a narrative for the upgrade. It's not just "faster" or "better camera." It's "your phone can now do things it couldn't do before." That's a psychologically powerful upgrade driver.

The company is also smart about rollout. Apple Intelligence isn't complete yet. Features are being added gradually. This extends the upgrade motivation across multiple quarters and gives people a reason to upgrade beyond just "my old phone still works fine."

Samsung and Google are trying to match this with their own AI features, but they're behind. Samsung's Galaxy AI is improving, but it requires relatively recent hardware. Google's AI features are more cloud-dependent, which means they work on older devices but are less of an upgrade driver. Apple has the advantage of purpose-built hardware that makes their AI story more compelling.

Market Share Implications for Competitors

When Apple has a record quarter, everyone else in the smartphone industry pays attention. Not because they're happy for Apple's success, but because they're probably losing market share.

Global smartphone shipments are largely flat. That means for Apple to grow unit sales, it needs to take share from someone. In premium segments, it's primarily at Samsung's expense. In volume segments, it's more complicated. Apple doesn't really compete in the sub-$400 space where most volume growth happens globally.

But market dynamics are shifting. The premium segment—phones above $800—is growing while the mid-range is contracting. This is good for Apple and bad for most of the competition. Motorola, OnePlus, and others are struggling in a market where everyone wants to buy either a cheap phone or a premium phone, with little interest in the middle.

Samsung is holding its position because it competes in both premium and mid-range. Google is growing in premium segments but has minimal market share in volume segments. Everyone else is under pressure.

Apple's dominance in profit share is almost complete. The company captures around 30-35 percent of all smartphone industry profits while holding roughly 15-16 percent of unit market share, as reported by Statista. That means Apple extracts 2-3 times more profit per phone than the industry average.

How long can this last? Probably longer than skeptics expect. The combination of ecosystem lock-in, brand power, and genuine technical advantages (especially in AI) gives Apple protection against the competition. But no advantage is permanent. It takes focus and innovation to maintain it.

Apple's iPhone sales accounted for approximately 59% of its total revenue in Q4 2025, highlighting the significant impact of its smartphone lineup. Estimated data.

The Installed Base Growth Story

One number you won't see in Apple's earnings report because Apple doesn't disclose it: the total installed base of active devices. But we can estimate it based on available data.

Apple has roughly 2 billion active devices across all platforms. That's a staggering number—it means roughly one in four people on Earth has an active Apple device. For a premium-positioned hardware company, that's an enormous installed base.

This installed base is the foundation for Services growth. Every device represents a potential Services customer. And the company's data suggests that the Services attachment rate—the percentage of users who pay for at least one service—is climbing. Combined with the growth in customers subscribing to multiple services, Services revenue growth outpacing hardware growth becomes logical.

The installed base also creates a network effect that benefits Apple. The more people with iPhones, the more valuable an iPhone becomes (because more of your friends, family, and colleagues have iMessage, FaceTime, and shared photo libraries). This network effect makes it harder for competitors to gain share.

Apple's challenge is keeping the installed base growing and engaged. The smartphone market is mature, but the installed base can still grow through two mechanisms: converting new users from other platforms, and selling multiple devices per user (iPad, Mac, Watch, Vision Pro).

This quarter's results suggest Apple is succeeding at both. Premium pricing on iPhones is filtering out price-sensitive buyers but capturing more money per unit. The Services growth is proof that attachment across the product ecosystem is improving.

Why Tim Cook's "Staggering Demand" Comment Matters

When Apple's CEO says demand was "staggering," he's making a statement about market conditions. For a company as large as Apple, demand fluctuations are usually gradual. Surprises are rare because the company has such detailed demand forecasting and supply chain management.

For Tim Cook to characterize demand as "staggering," it implies that actual demand exceeded expectations. This could mean a few things:

First, Apple Intelligence adoption might be driving stronger-than-expected upgrade rates. If more people than Apple modeled were deciding to upgrade because of AI features, that's a demand signal the company didn't fully anticipate.

Second, international demand might be outpacing domestic expectations. India, particularly, has been a bright spot for iPhone growth in recent years. If emerging markets are accelerating faster than expected, that would explain "staggering" demand.

Third, the pro models might be outperforming the company's forecast. The Pro Max is expensive and serves a specific user base. If pro adoption exceeded expectations, that would drive both unit volume and average selling price higher than forecast.

In any case, "staggering demand" suggests that supply constraints were the limiting factor, not market demand. This is a good problem to have, and it's the opposite of what most tech companies experienced during the 2022-2024 period when demand weakness was the primary headwind.

Apple Services boasts a significantly higher gross margin (around 72.5%) compared to iPhone hardware (approximately 40%), highlighting its profitability potential.

The Services Margin Story That Wall Street Underestimates

Wall Street analysts tend to underestimate the importance of Apple's Services business. They see it as a nice-to-have supplement to hardware revenue. They're wrong.

Services revenue is more valuable to shareholders than the raw revenue number suggests. Here's why:

First, Services carries gross margins above 70 percent. Hardware margins are 35-40 percent. That means a dollar of Services revenue is nearly twice as valuable to the bottom line as a dollar of hardware revenue.

Second, Services revenue is recurring. A customer who buys iCloud storage is likely to keep that subscription next month and the month after. Contrast this with hardware, where most customers upgrade every 3-4 years. Recurring revenue is more predictable and typically valued at a higher multiple by investors.

Third, Services revenue diversifies Apple's business. The company is no longer a hardware company with some software. It's becoming a services company with amazing hardware as the distribution mechanism.

Fourth, Services revenue is scale-efficient. Adding another customer to Apple Music doesn't require building a factory or managing supply chains. It's incremental profit on an already-profitable platform.

The 14 percent Services growth in this quarter, while lower than iPhone growth percentage-wise, might actually be more impressive. That's a $30+ billion business growing at double-digit rates. That's sustained, healthy growth in a mature segment.

Where does Services growth come from? Installed base expansion (more devices, more customers), price increases on existing services (Apple Music, iCloud pricing has gone up), and increased attach rates (more users subscribing to multiple services). All three of these are happening simultaneously right now.

Long-term, if Apple can push Services to 40-50 percent of total revenue (from the current 20-25 percent), the company's business model fundamentally transforms. It becomes less dependent on hardware sales cycles and more dependent on customer loyalty and ecosystem stickiness. That's a better business from a capital allocation perspective.

Global Economic Implications and Market Timing

There's something interesting about the timing of Apple's record iPhone quarter: it happened during a period of economic uncertainty and geopolitical tensions.

In late 2024 and early 2025, the global economy was navigating trade policy concerns, currency fluctuations, and mixed signals about inflation. This is typically an environment where consumer spending on premium products softens. People get nervous and tighten their belts.

Yet Apple just had its best-ever iPhone quarter. This suggests a few things:

First, Apple customers are relatively insulated from economic pressure. The company's customer base skews wealthy (because of premium pricing). Wealthy consumers continue spending even when the broader economy looks uncertain.

Second, AI is creating a legitimate reason to upgrade that transcends economic cycles. Even in a recession, people might decide that AI features are worth the investment.

Third, Apple's brand strength might be acting as a hedge against economic uncertainty. When people are nervous about making purchases, they often gravitate toward brands they know and trust. That's Apple's sweet spot.

The global implications are significant. If Apple can maintain this momentum despite economic headwinds, it suggests the company has built a truly resilient business. Most hardware companies would be under severe pressure in these conditions. Apple is thriving.

This also has implications for other companies in Apple's ecosystem. If iPhone sales are strong, chip makers that supply Apple (like Taiwan Semiconductor Manufacturing Company), logistics companies, retail partners, and app developers all benefit.

What This Means for Smartphone Innovation Going Forward

Record-breaking quarters tend to create interesting incentive structures. Investors and board members want to know: how do we keep this going?

For Apple, the challenge is that it's already at a high price point. You can't raise prices infinitely. Markets have ceilings. So future growth needs to come from somewhere else.

Possible paths forward:

More AI features: Apple can keep layering AI capabilities into iPhones. Each new generation can offer something the previous generation couldn't do. This keeps the upgrade cycle fresh.

Product line expansion: Apple could introduce new form factors or segments. Folding iPhones have been rumored for years. If Apple enters that segment (as Samsung has), it opens new markets.

Emerging market penetration: India, Southeast Asia, and Africa represent enormous growth opportunities. These markets have been price-sensitive, but the combination of affordable iPhone models and strong demand is changing the dynamic.

Services bundling: Apple could continue bundling services with hardware, reducing the effective price and increasing perceived value.

Wearables integration: Apple Watch, AirPods, and other wearables become more valuable when tightly integrated with iPhones. Future growth might come from selling multiple devices per customer rather than just phones.

For competitors, this quarter is a wake-up call. Samsung is trying to match Apple's AI story. Google is pushing Pixel phones harder. But they're playing from behind. Apple set the agenda with iPhone 16 and Apple Intelligence. Competitors are responding, not innovating ahead.

This is typical of Apple's strategy under Tim Cook. The company doesn't need to innovate faster than everyone else. It needs to own the narrative and leverage its installed base and ecosystem. This quarter proves that strategy is working.

The Capital Allocation Question

When a company is generating $143.76 billion in quarterly revenue, questions about what to do with all that cash become important.

Apple's traditional capital allocation has been straightforward: pay a dividend, buy back shares, invest in R&D, and store excess cash. The company maintains a sizable cash balance for strategic optionality.

With iPhone revenue hitting records, Apple can simultaneously invest in new products (like Vision Pro), expand services infrastructure, increase R&D for AI features, and return capital to shareholders through buybacks and dividends.

What's notable is that Apple isn't using this quarter's windfall to dramatically change strategy. The company isn't making massive acquisition announcements. It's not dramatically expanding headcount. It's running a mature, efficient operation that generates enormous amounts of cash and returns much of it to shareholders.

This is prudent, but it also means Apple faces a long-term challenge: the law of large numbers. When you're this big, it's hard to invest capital in ways that move the needle on growth rate. Smaller companies can double revenue through disciplined investment. Apple can't. The company is constrained by market size and its already-premium positioning.

The solution is Services. By shifting toward recurring revenue models, Apple can grow more consistently and predictably. But even Services has limits. How many people are realistically going to have three or four Apple subscriptions? What's the penetration ceiling?

This is why Apple's moves into Vision Pro and other new product categories matter long-term. The company needs to find new markets and new revenue streams to sustain growth rates. One iPhone, no matter how good, can only support so much growth.

Lessons for Other Tech Companies

What can the rest of the tech industry learn from Apple's record quarter?

Pricing power matters more than volume: Apple doesn't have the highest unit market share, but it has the highest profitability per unit. Building a brand strong enough to support premium pricing is more valuable than chasing volume.

Ecosystem lock-in is real and durable: Switching costs matter. Building products that work well together creates defensibility that competitors struggle to overcome.

Services are the future: Hardware margins are limited. Recurring, high-margin software and services revenue is where profitability and valuation multiples come from.

Innovation cycles can be engineered: Apple's introduction of AI features created an upgrade cycle in a mature market. Competitors can learn from this approach of bundling genuine innovation with hardware updates.

Customer loyalty compounds: Apple's installed base makes each new product more valuable. Building a loyal customer base creates network effects that strengthen over time.

These lessons apply to companies well beyond consumer electronics. Any business that can build premium brand positioning, develop ecosystem lock-in, and shift toward recurring revenue models will improve profitability and shareholder returns.

Looking Ahead: Can Apple Sustain This Momentum?

The obvious question: is this a peak, or can Apple sustain this level of performance?

History suggests that these record quarters are sometimes followed by moderation. Once a company hits a record, the law of large numbers kicks in. Growth rates naturally decelerate. Yet Apple has a track record of surprising analysts by sustaining growth longer than expected.

What factors support continued growth:

- AI features are still rolling out, which extends upgrade motivation

- International markets like India are still underpenetrated

- Services attach rates and pricing can still improve

- New product categories offer expansion opportunities

- Ecosystem effects strengthen with time

What could pressure growth:

- Smartphone market saturation is real, especially in developed countries

- Competition from Samsung and Google is improving

- Economic uncertainty could eventually impact consumer spending

- Price increases have limits before demand elasticity becomes relevant

- New product categories (Vision Pro) haven't yet proven they can scale

The most likely scenario is that iPhone revenue will stabilize at a high level rather than continue climbing at exponential rates. The Services business will grow faster than hardware, gradually shifting the company's revenue mix. Overall company growth will decelerate from these levels, but profitability will improve.

That's actually a positive outcome for long-term shareholders. Mature, profitable businesses that generate consistent cash flow are valuable. They don't need to grow at explosive rates to be worth owning.

Apple's challenge is convincing investors that a more mature growth rate is acceptable. Given the company's cash generation, dividend, and buyback program, that should be achievable. But it's a transition that takes time.

FAQ

How does Apple's record iPhone quarter compare to historical performance?

Apple's $85.27 billion in iPhone revenue for Q1 2026 represents the highest quarterly revenue the company has ever generated from iPhones. To provide context, this beats previous records even when adjusted for inflation and currency changes. What's particularly significant is that this record was achieved despite higher average selling prices, meaning Apple wasn't just moving more units—it was capturing more revenue per device sold.

Why is Services revenue growth important even though it's smaller than iPhone revenue?

Services revenue is more important than its absolute size suggests because it carries gross margins above 70 percent compared to roughly 35-40 percent for hardware. Services revenue is also recurring, meaning customers subscribe month-to-month rather than making a one-time hardware purchase every few years. This recurring nature makes Services revenue more predictable and valuable to investors. A dollar of Services revenue typically generates more bottom-line profit and attracts a higher valuation multiple from the stock market than a dollar of hardware revenue.

What is Apple Intelligence and how does it drive iPhone upgrades?

Apple Intelligence refers to AI-powered features built into iPhones that run partially on-device using the dedicated Neural Engine chip. These features include image generation, intelligent photo search, contextual text completion, and smart summarization of documents and emails. Unlike some competitors' AI features that rely heavily on cloud processing, Apple's approach emphasizes on-device processing for speed and privacy. The key point for this earnings report is that these features genuinely require newer hardware to run effectively, creating a technical reason for users to upgrade from older iPhones.

How does Apple maintain such high prices when competitors offer cheaper alternatives?

Apple maintains premium pricing through several mechanisms working in concert. First, the iOS ecosystem creates lock-in—users become accustomed to Apple's interface, services like iCloud integration, and the seamless connectivity between devices. Switching to Android means rebuilding your digital life. Second, Apple's brand carries prestige and perceived quality that justifies higher prices to consumers. Third, the ecosystem effect—where more of your friends and family have iPhones, making iMessage and FaceTime valuable—strengthens the network effect. Fourth, iOS historically has delivered better privacy protections and security than Android, which appeals to users willing to pay for those attributes.

What percentage of Apple's total revenue comes from iPhone versus other products?

iPhone revenue represents approximately 50-52 percent of Apple's total revenue, making it the company's single largest product category by revenue. However, this concentration isn't necessarily a weakness for Apple because iPhones serve as the gateway device that drives Services adoption across the entire customer base. The product mix also includes Mac computers, iPad tablets, Apple Watch, AirPods, Apple TV, and Vision Pro. The Services segment, which includes App Store revenue, iCloud subscriptions, Apple Music, Apple Care, and other recurring revenue, represents roughly 20-25 percent of total revenue and is the fastest-growing segment.

Why did Apple's Services revenue grow 14 percent when smartphone market growth is essentially flat?

Services can grow faster than hardware for several reasons. First, Apple's installed base is expanding as more iPhones are sold, bringing new customers into the Services ecosystem. Second, attachment rates are improving—the percentage of existing customers subscribing to at least one service is increasing. Third, customers are subscribing to multiple services (iCloud, Apple Music, Apple Care, Apple TV+) rather than just one. Fourth, Apple has raised prices on some Services over time, generating more revenue per subscriber. These factors compound to create higher Services growth rates than hardware growth rates, which is a positive long-term trend for Apple's profitability.

How does Apple's profitability compare to other smartphone manufacturers?

Apple captures approximately 30-35 percent of all smartphone industry profits while holding only 15-16 percent of global unit market share. This means Apple extracts roughly 2-3 times more profit per phone than the industry average. This profit concentration is the result of premium pricing, lower logistics and manufacturing complexity (compared to companies serving multiple market segments), higher gross margins, and the leveraging of Services revenue that competitors can't match. Samsung is the second most profitable smartphone manufacturer, but Apple's profit advantage is substantial.

What are the implications of this record quarter for future smartphone innovation?

The record quarter validates Apple's innovation strategy of bundling meaningful technological advances (AI features in this case) with hardware updates to drive upgrade cycles. This suggests that Apple will continue investing heavily in AI capabilities across future iPhone generations. Competitors will attempt to match these features, but Apple has the advantage of designing both hardware and software, allowing more complete integration than manufacturers using Android. Long-term, innovation will likely focus on on-device AI capabilities, improved cameras, longer battery life, and deeper ecosystem integration rather than raw processing power improvements.

Conclusion: What This Record Quarter Really Signals

Apple's record iPhone quarter isn't just a financial milestone. It's evidence of a company that has successfully navigated the treacherous transition from a hardware manufacturer to a services-powered ecosystem. The

What makes this moment genuinely significant is the context. The global smartphone market is mature. Growth has been flat for years. Most competitors are fighting over shrinking margins and battling for unit share. Yet Apple just had its best quarter ever. That's not luck. That's the result of consistent execution across brand-building, pricing strategy, ecosystem development, and product innovation.

The introduction of Apple Intelligence proved to be the catalyst needed to reignite upgrade cycles. But underlying that catalyst is Apple's accumulated advantage: an installed base of 2 billion devices, a Services business generating $30 billion annually, pricing power that lets the company push premium prices successfully, and a brand so strong it can weather economic uncertainty.

For Apple shareholders, this quarter validates the long-term strategy. For competitors, it's a stark reminder that price-based competition doesn't work against Apple. For industry observers, it's proof that even mature tech categories can surprise us with renewed growth when the right innovation emerges.

The challenge for Apple now is sustainability. Records are great, but they're hard to repeat. The smartphone market still has finite size. Eventually, growth rates must normalize. The key question is whether Apple's shift toward Services, combined with expansion into new product categories, can provide enough growth to satisfy investor expectations once iPhone growth inevitably moderates.

Based on this quarter's performance, Apple has earned the benefit of the doubt. The company knows how to build products people want, how to price them profitably, and how to create ecosystems that customers don't want to leave. Those aren't easy things to do. The fact that Apple is doing all three simultaneously while generating record revenues is why this quarter matters far beyond the financial numbers.

For the rest of the tech industry watching these results, the message is clear: build something so valuable that price becomes almost irrelevant. That's the Apple playbook, and it's working better than ever.

Key Takeaways

- Apple achieved record iPhone revenue of $85.27 billion in Q1 2026, the company's best-ever quarter for smartphone sales

- Services revenue grew 14% year-over-year to over $30 billion, becoming increasingly important for profitability due to 70%+ gross margins

- Apple Intelligence features created a genuine technical reason for upgrades, driving demand despite premium pricing above $1,000 for many models

- Apple controls 30-35% of smartphone industry profits while holding only 15-16% unit market share, demonstrating powerful pricing advantage

- The 2-billion-device installed base and ecosystem lock-in allow Apple to sustain premium pricing despite mature smartphone market with flat unit growth

Related Articles

- 130-Inch TVs vs Projectors 2026: The Ultimate Living Room Showdown

- Apple's Patreon Subscription Billing Mandate: What Creators Need to Know [2025]

- The Smart Glasses Revolution: Why Tech Giants Are All In [2025]

- AirPods 4 Noise Canceling at $120: Best Deal & Comparison [2025]

- iPhone 18 Pricing Strategy: How Apple Navigates the RAM Shortage [2025]

- Snap's AR Glasses Spinoff: What Specs Inc Means for the Future [2025]

![Apple's Record iPhone Quarter: What $85.27B Revenue Means [2025]](https://tryrunable.com/blog/apple-s-record-iphone-quarter-what-85-27b-revenue-means-2025/image-1-1769731611842.jpg)