Apple's Severance Acquisition: What It Means for Streaming Content Strategy

Apple just made a power move in the streaming wars, and it tells you everything you need to know about where the industry is heading. In December, the company acquired the intellectual property and full production rights to Severance from Fifth Season Studios—a deal worth approximately $70 million. Starting with Season 3, Apple Studios will take over production entirely, though Fifth Season remains on as an executive producer. This isn't just a routine acquisition. It's a fundamental shift in how Apple approaches content creation, and it has ripple effects across the entire streaming industry.

Here's what's actually happening beneath the surface: Apple isn't just buying a hit show. It's buying complete control over its own destiny. For years, streaming platforms have outsourced production to independent studios, which gives those studios creative independence but creates budget headaches and operational fragmentation. Apple got tired of that model. When Severance's second season became Apple TV+'s most-watched series, the company realized they had a genuine cultural phenomenon on their hands. But the original production studio couldn't sustain the show's ambition without constant financial infusions from Apple itself.

The numbers tell the story. Fifth Season was already asking Apple for budget advances. The studio was seriously considering moving production from New York to Canada just to capture bigger tax rebates. That's desperation disguised as logistics. Meanwhile, Apple was footing the bill anyway, handling business development, securing advertising deals, and bankrolling the entire operation. At that point, the question became obvious: why pay someone else to manage your own money?

This acquisition represents a calculated bet on vertical integration in streaming. Apple's betting that controlling the entire production pipeline—from creative vision through post-production—will deliver better shows, faster, cheaper, and with more creative alignment to their brand. It's the same logic that made the iPhone work: control the hardware, the software, and the experience.

But here's the tension nobody's talking about yet: Apple is a hardware and services company, not a traditional media studio. Sure, they've hired experienced executives and built a decent content division, but they lack the muscle memory of someone like Netflix or Disney. They're learning to be a studio while simultaneously learning to be a broadcaster. That's genuinely difficult. Fifth Season Studios, on the other hand, developed Severance from nothing into a cultural conversation. There's tribal knowledge there that doesn't transfer cleanly in acquisition documents.

What comes next matters enormously. Showrunner Dan Erickson and director Ben Stiller are apparently open to spinoffs now that Apple owns the IP. That's significant because spinoffs require the kind of sustained investment and franchise thinking that studios have always owned. Deadline reports that four seasons total are planned. If Apple executes this right, Severance becomes the tentpole franchise that Apple TV+ has been searching for since launch. If they stumble—lose the creative chemistry, try to cut corners, impose corporate thinking—they could destroy the thing they just paid $70 million to own.

The acquisition also tells us something about Apple's confidence in its own infrastructure. They're signaling that they believe their production capabilities, facilities, and post-production teams are now good enough to handle premium television. They're saying they don't need to rent that expertise anymore. Whether that confidence is justified will become obvious in Season 3's production timeline and eventual quality.

The Business Logic: Why Apple Moved Now

Apple doesn't make acquisition decisions on whim. There's always a financial and strategic calculation underneath. In this case, several factors converged that made the Severance acquisition inevitable.

First, the success metrics became impossible to ignore. Severance's second season didn't just perform well for Apple—it became a cultural event. People talked about it. Critics celebrated it. More importantly, it drove subscription activity and retention, which is the only metric that matters in streaming. When a show becomes your network's most-watched series ever, you stop thinking about it as a creative project and start thinking about it as infrastructure. Infrastructure you need to control completely.

Second, the financial burden of the status quo became unsustainable for Fifth Season. Here's the dynamic that most people miss: when a studio outsources production to an independent partner, that partner assumes financial risk. But if the show becomes expensive and the independent studio lacks resources to absorb additional costs, the streamer effectively subsidizes the production anyway—without ownership. Apple was already in that position. They were already funding overages. The only question was whether to keep funding as a patron or fund as an owner.

Third, tax incentives and production infrastructure made sense from an operational standpoint. Severance shoots in New York. Apple could have said "move to Canada, get the tax rebates, reduce costs." But they didn't. Instead, they absorbed the full production cost and kept it in New York. That's because Apple TV+ cares about its identity and brand perception. New York productions have cultural cachet. They produce content that feels substantial and grounded, not just algorithmically optimized. Moving to Canada would have cheapened the brand, even if it cut costs.

Fourth, the expansion potential became clear. Severance exists in a complete universe. There are other characters, other corporate mysteries, other ethical dilemmas baked into the world-building. Dan Erickson and Ben Stiller have clearly thought about where the story can go beyond the main narrative. Spinoffs, limited series, potential movies—there's franchise juice in Severance. Apple paid $70 million partly for the existing IP, but also for the optionality of what comes next. That's venture capital thinking applied to entertainment.

Fifth, Apple's streaming strategy was maturing. Early Apple TV+ pursued prestige above all else. They threw money at established filmmakers, A-list actors, recognized storytellers. That approach built credibility but didn't build audience scale. The streamer needed shows that combined prestige with popularity. Severance is exactly that—critically acclaimed and commercially successful simultaneously. It's the proof point that Apple's content division is capable of producing hits, not just prestigious programming.

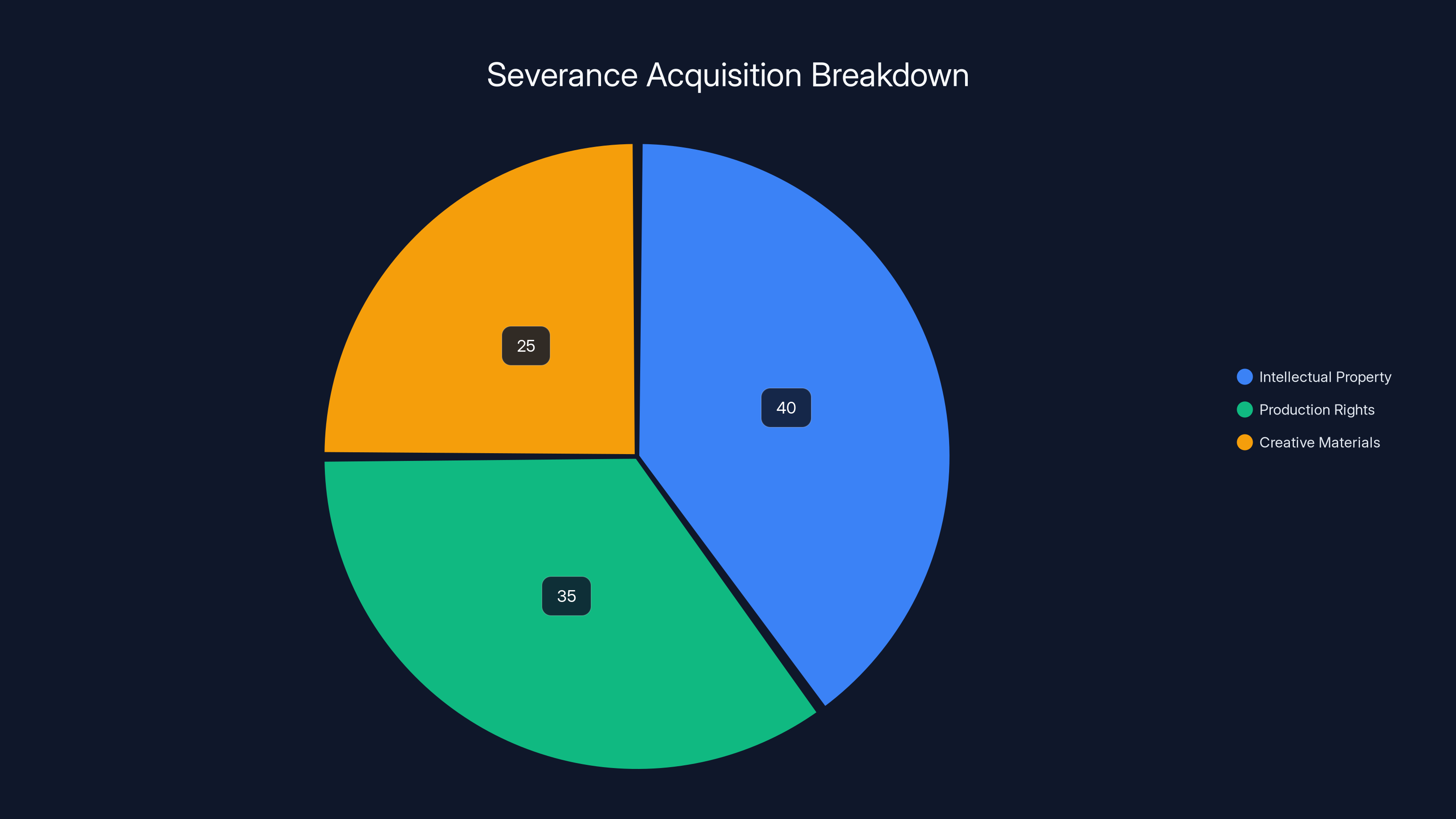

Apple's acquisition of Severance includes intellectual property, production rights, and creative materials, enabling full control over the show's universe and future expansions. Estimated data.

What Fifth Season Studios Loses and Gains

When Fifth Season agreed to this deal, they weren't just losing a show. They were making a calculated exit from their own creation. That's worth understanding from their perspective.

What they lost is obvious: control. Fifth Season developed Severance from scratch. They shepherded it through production, managed the creative process, solved problems, and delivered a series that became a cultural phenomenon. That's the kind of accomplishment that builds a studio's reputation and future opportunities. Now, someone else owns it. Future seasons won't be made by Fifth Season. They won't control the spinoffs. They won't decide which creative directions the franchise takes. From a creative pride standpoint, that's a real loss.

They also lost the revenue upside of a growing franchise. If Severance generates $500 million in cumulative value over the next five years (spinoffs, merchandise, licensing, production services), Fifth Season gets none of that. Apple gets it. That's the future value they surrendered.

But what they gained is worth examining too. First, they got a guaranteed payment of $70 million in cash, immediately. For an independent studio, that's transformative capital. It solves financial pressures, allows them to invest in new projects, and creates runway to develop multiple series simultaneously. Cash now is always better than speculative future revenue.

Second, they got continued employment as an executive producer on future seasons. That keeps them involved, keeps them learning, and keeps them earning. It's not ownership, but it's credibility and ongoing income.

Third, they got out of the escalating cost spiral. Severance's production budget was growing faster than their own resources could support. They were running on Apple's goodwill and advance payments. That's precarious. Now they're free to focus on shows that fit their own financial capacity. They can develop projects at their own scale.

Fourth, they got a path to sell their next hit. Fifth Season proved they can create premium television at the level of major streamers. Now they have a blueprint. They know what works, what doesn't, how to manage production at scale. That knowledge applies to whatever comes next. And when their next hit emerges, they'll know they can negotiate a deal like this again—or better.

Fifth, the acquisition validates their creative judgment. Apple didn't pay $70 million because they thought the show was mediocre. They paid because they believe in it completely. That validation matters for Fifth Season's brand and for their ability to attract talent, investment, and partners going forward.

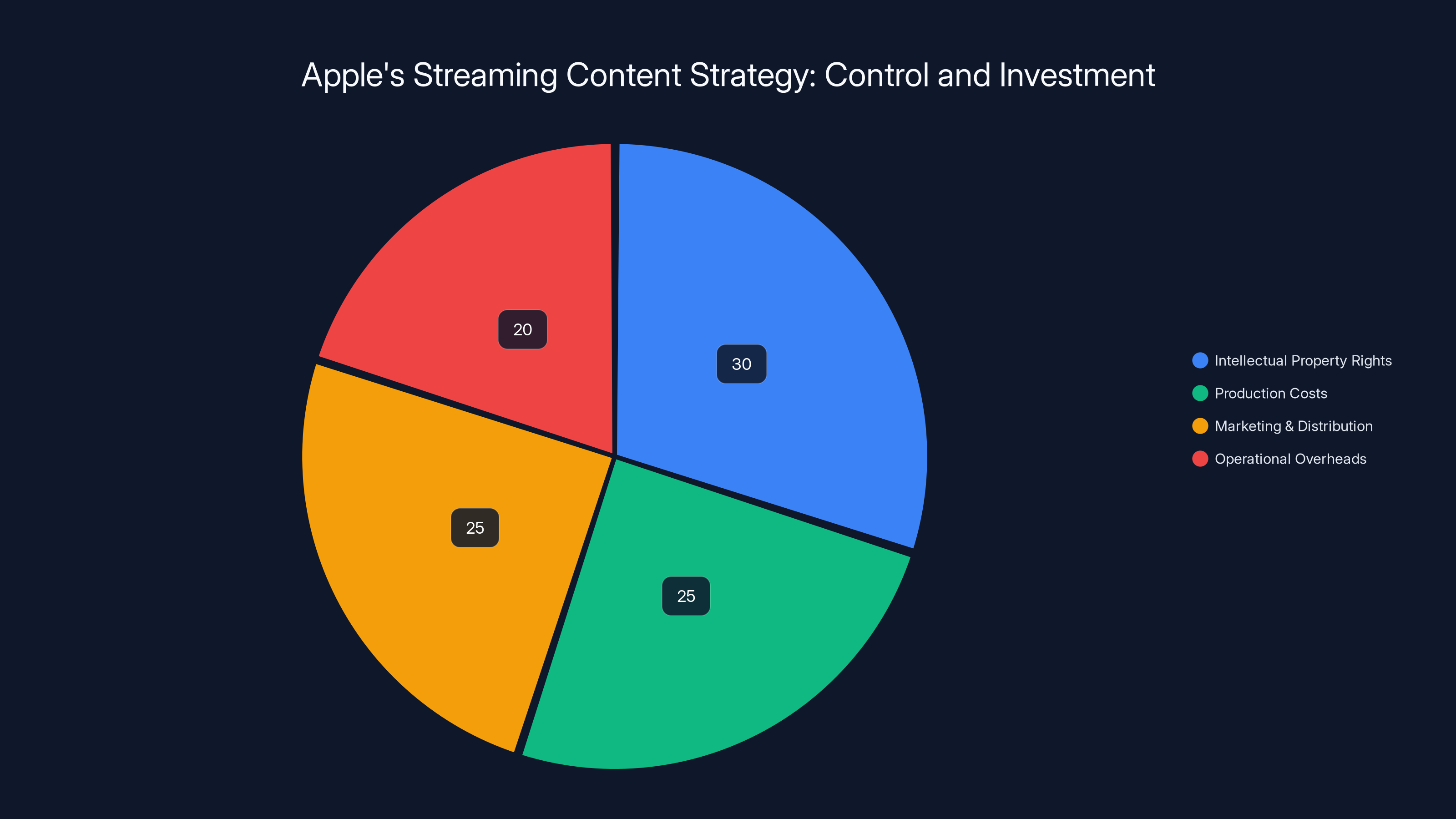

Apple's $70 million acquisition of Severance is strategically divided across intellectual property rights, production costs, marketing, and operational overheads. Estimated data.

Apple Studios' Expansion and Vertical Integration Strategy

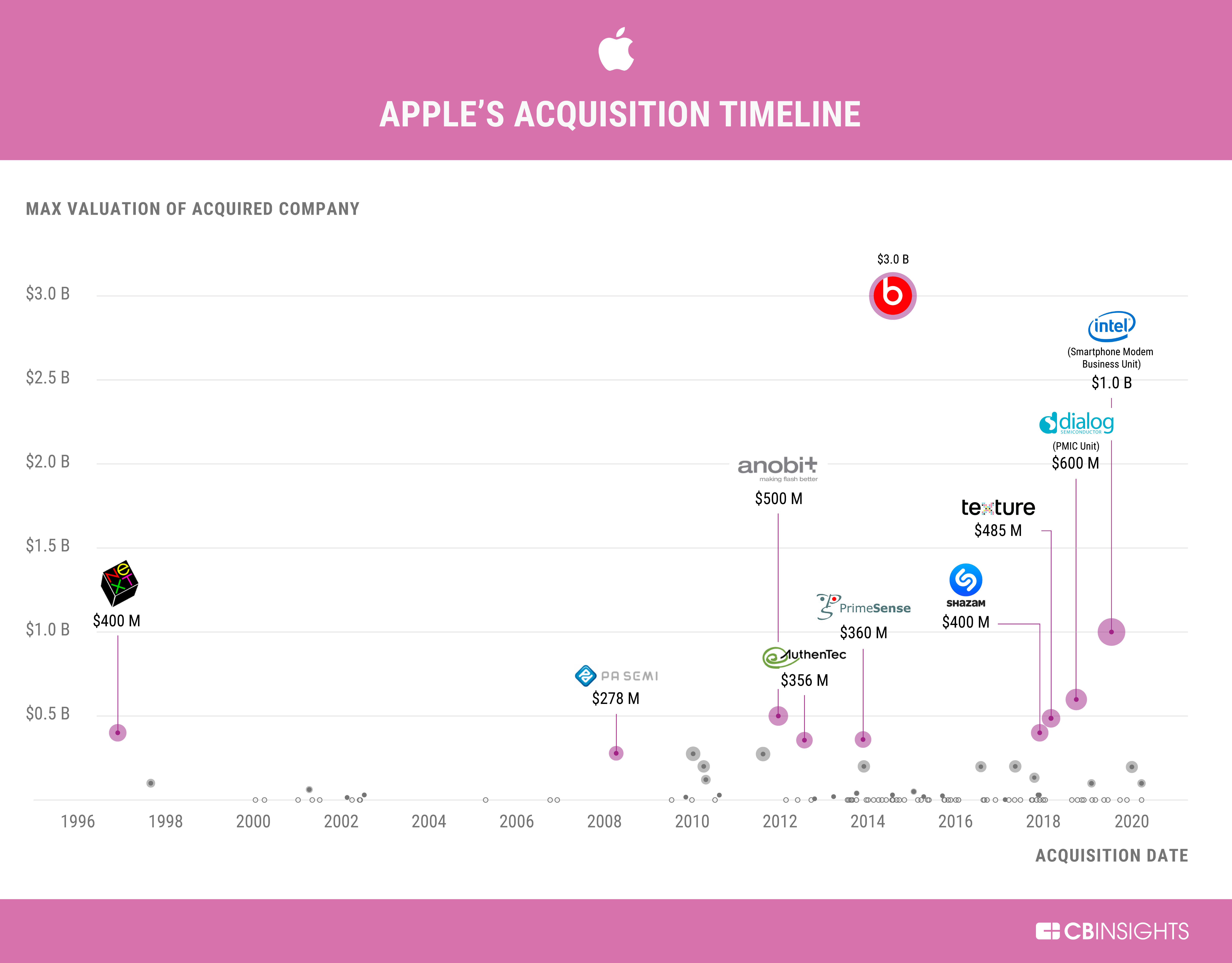

Apple's acquisition of Severance isn't an anomaly. It's part of a broader pattern of Apple moving toward complete operational control over its content ecosystem. Understanding this pattern matters because it predicts what Apple will do next.

Let's look at the timeline. Apple acquired Silo after its first season aired. That's a sci-fi dystopian series that showed promise but hadn't proven long-term viability. Apple decided not to wait around—they bought the IP and brought production in-house. Fast-forward to Severance: Apple waited for the show to become a certified hit before acquiring it. That's a different risk calculus. With Silo, they were betting on potential. With Severance, they're betting on proven success.

This tells us Apple's acquisition strategy has two tracks. They'll acquire promising shows early if they see potential and want to control the narrative. They'll also acquire established hits after they've proven commercial viability. Both approaches serve the same goal: consolidation of production under Apple's direct management.

Why does this matter? Because vertical integration changes the incentive structure. When you outsource production, your partner optimizes for their own profitability and sustainability. When you own production, you optimize for your platform's overall success. These aren't the same thing. An independent studio might prefer to make five shows at lower cost each. Apple would rather make three shows at higher quality and cultural impact. The profit motive aligns differently.

Apple Studios is essentially building an internal production capacity that rivals traditional media companies. They have facilities, crews, post-production capabilities, and increasingly, owned IP. They're not renting Hollywood. They're becoming it. That's a fundamental shift from where they started.

The strategic advantage becomes clear when you think about long-term planning. If Apple controls Severance production entirely, they control the production timeline, the budget priorities, the creative freedom, and the potential for spinoffs or franchise expansion. They can make decisions that serve Apple TV+'s overall strategy rather than negotiating with an external partner who has their own priorities.

It also creates a different relationship with creators. When Dan Erickson and Ben Stiller work on Severance under Apple's direct production, they're working for a company with unlimited resources and clear strategic support. That's different from working for an independent studio that needs to manage costs carefully. Apple can say yes to creative ambitions that an independent studio would have to decline.

The Production Cost Reality: Why Budget Pressures Led to Acquisition

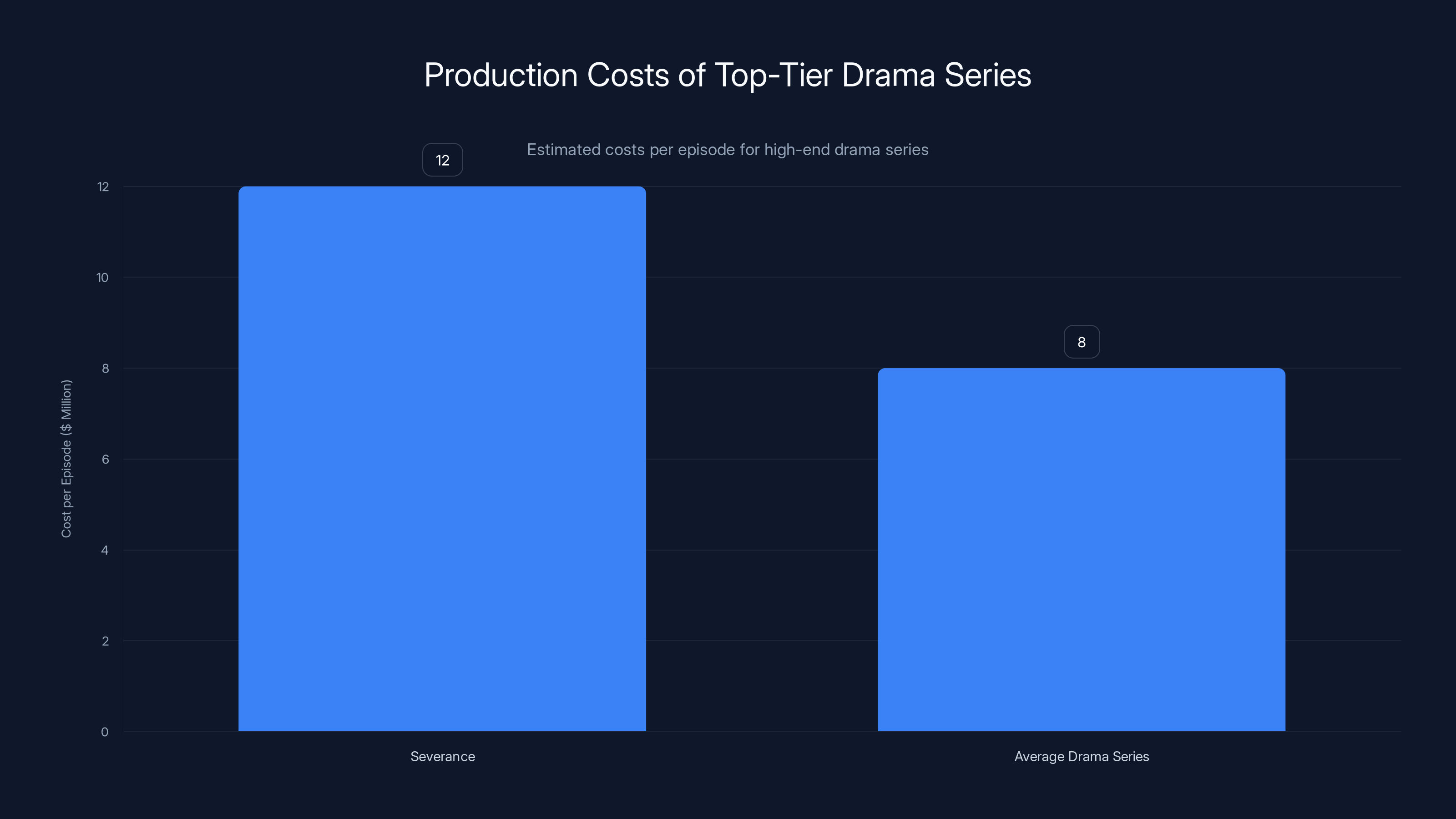

The real story here is hidden in the budget numbers. Severance is expensive. Genuinely expensive. And Fifth Season Studios couldn't bear the full load.

Prestige television production costs have exploded. A top-tier drama series now runs

When you multiply

Here's the math that explains the decision: Fifth Season had already absorbed significant costs to develop Severance. They'd invested in writers, producers, development staff, and pre-production work. Once the show got made, it became a money-losing proposition for them because Apple paid the production costs but retained creative control as the financier. Fifth Season made money from their producer fees and executive producer credits, but not from the show's success or its future potential.

At some point, that arrangement stops making sense. Better to take a $70 million payment and move on than to keep managing a show you don't own financially or creatively.

Apple made the opposite calculation. They were already funding the show. They were already guaranteeing loans and advances. Paying $70 million to formalize that relationship and eliminate the middleman costs made financial sense. The break-even point came when Apple's annual subsidies to Severance matched the cost of outright acquisition.

There's also a future cost consideration. If Severance runs for four seasons as planned, we're talking about

Severance's production cost per episode is estimated at

The Creative Implications: What Happens to Severance's Vision?

Here's the question nobody wants to ask but everyone should: will Severance get better or worse under Apple's direct ownership?

The optimistic case is that Apple's resources eliminate constraints. Dan Erickson and Ben Stiller wanted something for Season 3? It gets greenlit. They need an extra shooting week? They get it. They want to improve post-production quality? Budget increased. When you remove financial friction, creativity can flow more freely. Under this scenario, Severance improves because its creators finally have the resources their ambitions deserve.

But there's a pessimistic case too. Apple is a company that optimizes for products, not art. Even their most artistic moves—Apple Music, Apple TV+—are optimized for user acquisition and retention metrics. The danger is that Apple starts making decisions based on engagement optimization rather than creative integrity. They might push for broader appeal when the show's strength comes from its willingness to be weird and niche. They might want more romantic tension, or clearer resolutions, or faster pacing—all the things that would make the show more commercially accessible but less true to its vision.

Historically, independent studios navigate this differently than major corporations. Fifth Season had the advantage of operating at arm's length from the financial metrics. They could make decisions based on creative judgment without quarterly earnings calls pressuring them toward broader appeal.

The reality probably sits between extremes. Apple won't sabotage its own hit. But they'll definitely apply corporate thinking to creative problems. That's neither entirely good nor entirely bad—it just changes the character of the show. Severance might become more polished and less experimental. It might reach a bigger audience but lose some edge.

The key variable is how much autonomy Apple grants to Erickson and Stiller. If they stay hands-off and trust the creators, Severance stays true to itself. If they insert themselves into creative decisions, it changes. The acquisition documents probably include language about "creative control" and "showrunner authority," but those terms always have wiggle room in practice.

Spinoffs and Franchise Expansion: The Real Reason for $70 Million

The acquisition price tells you something important: Apple isn't paying $70 million just for Severance as it currently exists. They're paying for the universe Severance exists in and everything that can be built from it.

Severance is set in a world where a procedure called "innate" separates your consciousness at the office from your consciousness at home. That's a premise with enormous franchise potential. There are stories lurking everywhere in that world. Different companies, different procedures, different ethical implications. Characters we haven't met. Mysteries beyond Lumon Industries.

Dan Erickson has apparently been open to spinoffs now that Apple owns the IP. That's the tell. Independent studios are cautious about spinoffs because they require massive investment and risk. But Apple can sustain multiple series in the same universe. They can explore different corners of the Severance world simultaneously. Maybe a spinoff focused on a different company using the innate procedure. Maybe a limited series about the people who invented the technology. Maybe something set years in the future.

This is where the

Franchise thinking is what separates streaming services that sustain themselves from those that burn cash. Netflix understood this. Disney understood this. Apple is learning it. Severance isn't just a TV show—it's the foundation for a potential billion-dollar entertainment property. From that perspective, $70 million is a bargain.

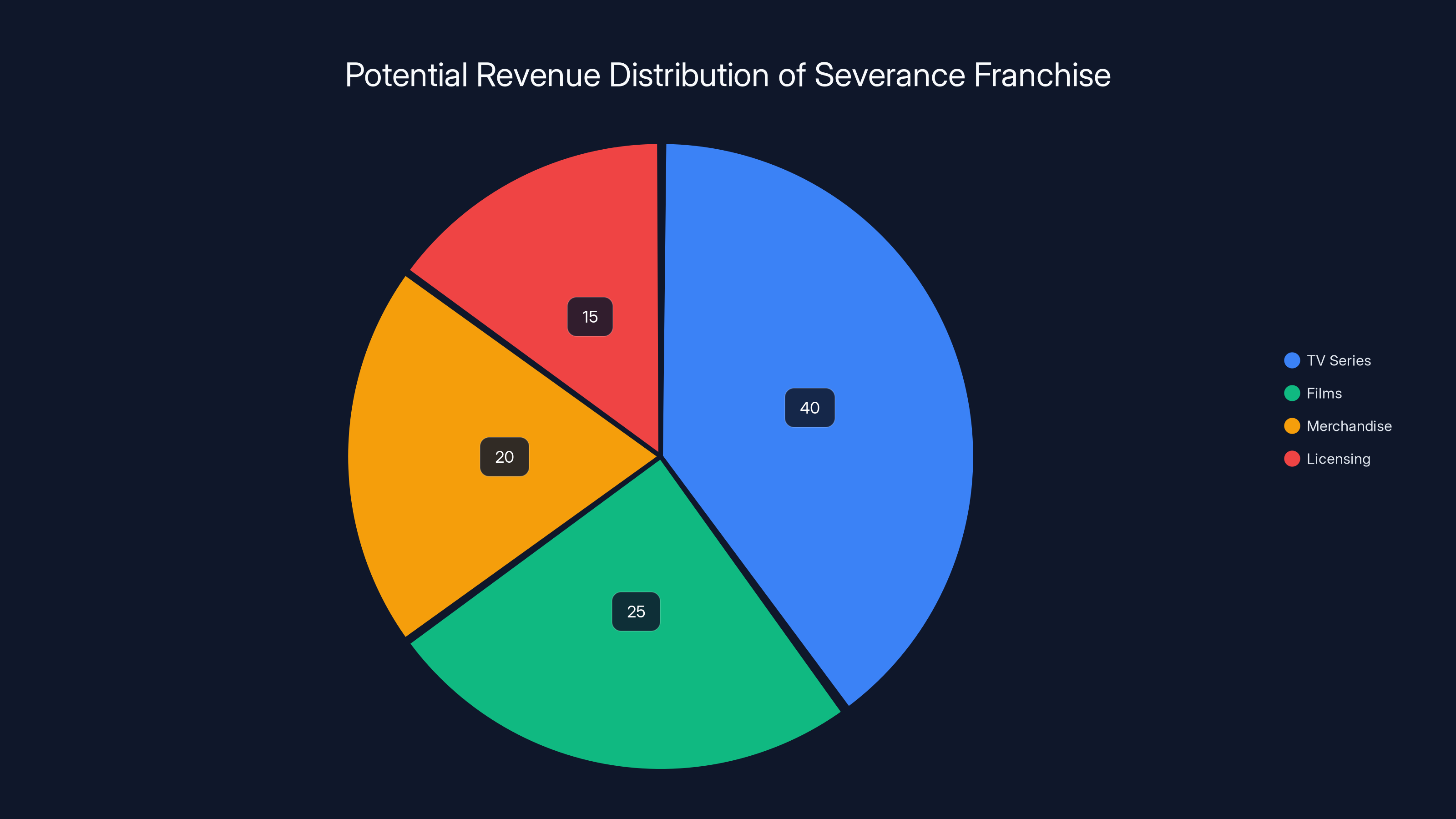

Estimated data suggests that TV series could account for the largest share of the Severance franchise revenue, followed by films, merchandise, and licensing.

Competitive Implications: What This Means for Other Streamers

Apple's Severance acquisition sends signals to Netflix, Disney+, Amazon Prime Video, and every other major platform. The message is clear: if you make something truly successful, your upstream partner might buy you outright.

This creates interesting dynamics for independent studios. On one hand, it's validation. If your show becomes a hit, you can negotiate from a position of strength. Netflix or Apple might offer life-changing money to acquire your IP. That's the upside of the current streaming economy.

But there's also a consolidation pressure. If every major streaming platform starts acquiring hit shows from independent studios, independent studios can't sustain themselves long-term. They become production houses for hire rather than creative entities that own their work. The industry slowly consolidates around the platforms themselves.

We're already seeing this with Netflix's acquisition of Wondery, Shondaland's transition to Netflix, and similar moves. Apple's Severance acquisition fits this pattern. Each major platform wants to control more of its own content supply chain. The days of the independent studio as a creative powerhouse are slowly ending.

This is partly good and partly bad. Good because platforms can invest more heavily in shows they own completely. Bad because the power imbalance favors enormous tech companies over independent creative voices. The same forces that created diverse streaming options are now consolidating control.

Production Timeline and Season 3 Expectations

So when does Season 3 actually happen? That's the question subscribers are asking.

With the acquisition complete and Apple Studios taking over production, the timeline becomes clearer than it would have been under Fifth Season. Apple has internal production infrastructure, established workflows, and operational experience. They've already produced multiple seasons of various shows. They can mobilize faster than Fifth Season could.

Generally, television productions operate on 18-24 month cycles from pre-production through post-production. Factor in time for scripts, casting, location scouting, set building, shooting, editing, and visual effects work, and you're looking at roughly two years from "go" to "final delivery." Severance's complexity probably puts it toward the longer end of that timeline.

If Apple started pre-production immediately after the acquisition closed, Season 3 could potentially air in 2026 or early 2027. But Apple hasn't announced a timeline, which suggests they're not rushing. They're probably taking time to evaluate scripts, ensure creative continuity, and plan for spinoffs simultaneously.

The advantage of Apple owning the show is that they can absorb production into their overall scheduling without negotiating release dates with an independent partner. They own the show, the studio, and the distribution platform. They can make decisions that serve all three simultaneously.

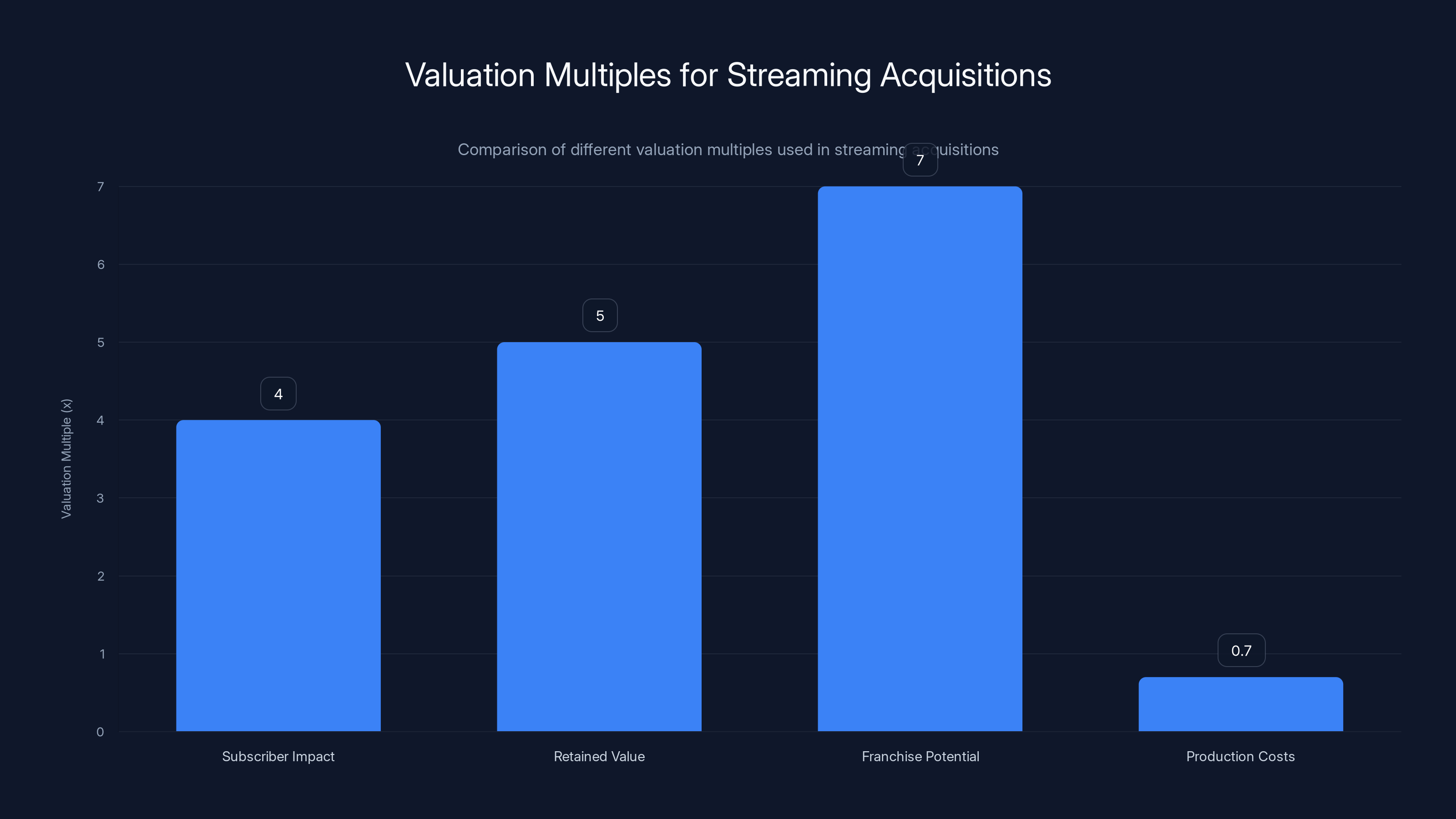

The $70 million acquisition price for Severance reflects a 4-7x multiple on various valuation factors, with production costs being valued at 0.7x. Estimated data based on typical industry practices.

Apple's Broader Streaming Strategy Shift

The Severance acquisition is part of a larger recalibration at Apple TV+. The platform has been running for five years and has learned some hard lessons about the streaming business.

Early Apple TV+ strategy was built on prestige. They signed big names—Martin Scorsese, Alfonso Cuarón, David Fincher—and gave them resources to make their vision. The results were critically acclaimed but didn't move the needle on subscriber growth the way hits like Stranger Things or The Crown did for other platforms.

Apple learned that critical success and cultural impact aren't the same thing. You can make a beautiful film that wins awards but fails to drive subscriptions. You need shows that combine artistic quality with genuine audience enthusiasm. Severance is that rare thing: it's genuinely good television that also became a cultural phenomenon.

The platform is now pivoting toward building franchises and sustained properties rather than betting everything on prestige standalone work. That requires owning IP. It requires long-term commitment. It requires the kind of vertical integration that the Severance acquisition represents.

Apple also seems to be accepting that streaming is a long-game play, not a quick path to dominance. They're building infrastructure, taking stakes in creative properties, and planning for multiple years of content development. That's maturing strategy.

The Future of Independent Studios in Streaming

If you're an independent studio in 2025, the Severance acquisition means something important: your upside is capped. You can produce shows, develop talent, create intellectual property, but when something becomes genuinely valuable, the streamer might just buy you. That's both opportunity and existential threat.

Some studios will embrace it. They'll see acquisition as a path to generating value and capital. Make great shows, get bought by a streamer, take that capital and develop new shows. It's a startup mentality applied to entertainment.

Other studios will resist it. They'll try to maintain independence, control their own destiny, and build sustainable operations that don't depend on getting acquired. That's harder but more potentially rewarding long-term.

Apple's move signals that the ecosystem is moving toward platform consolidation. The streamers aren't just competing for subscribers—they're competing for the ability to produce content internally. That shifts power from creators and independent studios to the platforms themselves.

This has real consequences. Less creative independence. More homogenization. More power concentrated in the hands of tech companies. It's not necessarily dystopian, but it's a different industry than the one that existed five years ago.

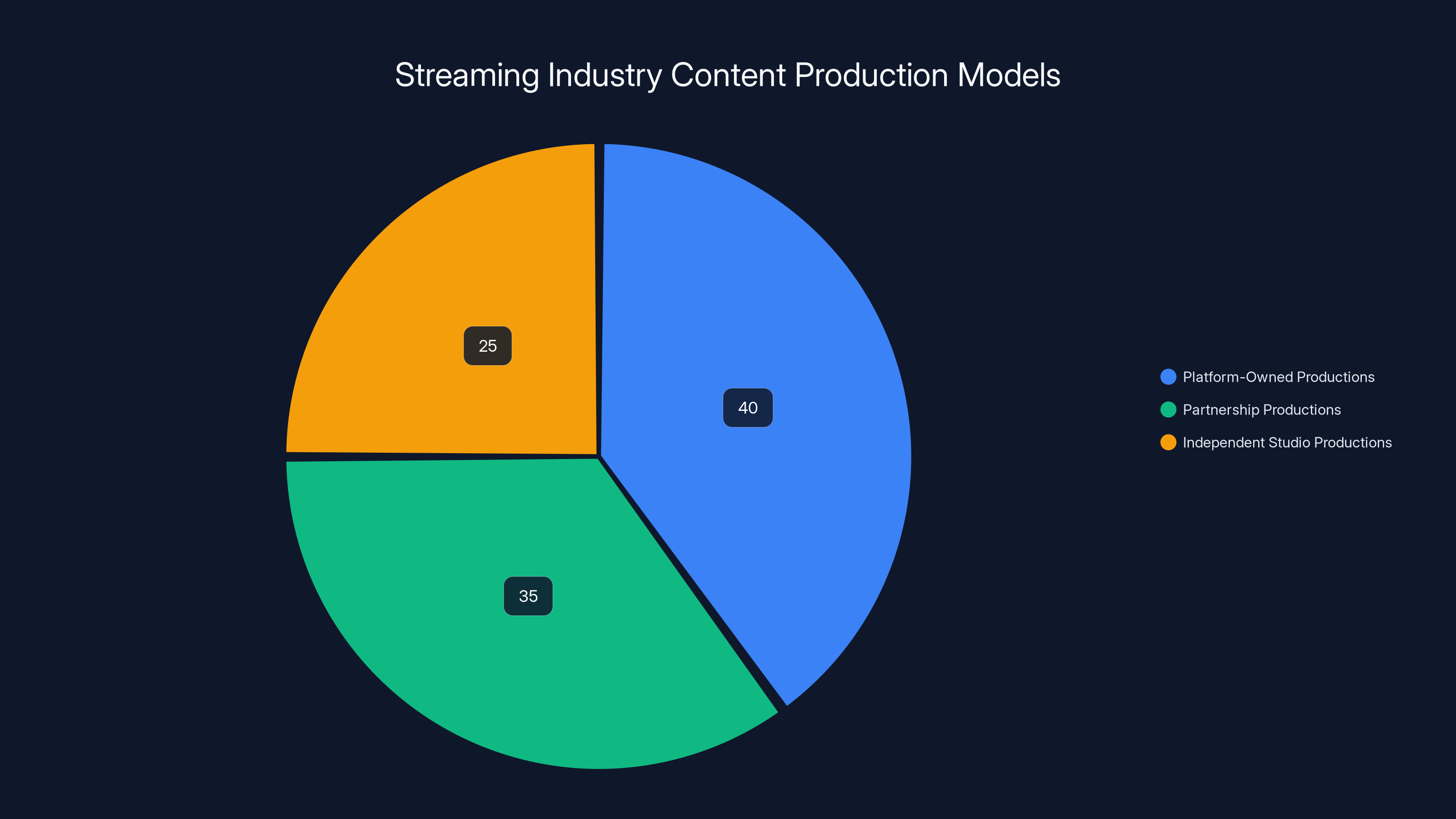

Estimated data suggests a shift towards platform-owned productions, with 40% of content now produced in-house by streaming platforms, indicating a trend towards vertical integration.

Financial Models: How Streamers Calculate Acquisition Prices

Why $70 million specifically? What's the methodology behind that number?

Streaming platforms typically value content based on discounted future cash flows, subscriber impact, and strategic value. For Severance, Apple likely calculated something like: expected lifetime revenue from the show, divided by acquisition cost, accounting for discount rates and probability of success.

Severance's second season was their most-watched series. That data drives forecasting. If Season 2 drove 2-3 million net new subscribers and generated

But Apple also factors in strategic value. Owning Severance means Apple owns the universe, the characters, the potential spinoffs, the franchise opportunities. That's worth more than just the current show. It's optionality. For a company with Apple's resources, optionality has real value.

Independent studios typically sell for 3-5x annual revenues for the property in question, or at a multiple of production costs plus some margin. At

The actual negotiations probably involved detailed financial modeling, forecasting for multiple seasons, and some haggling about the franchise's true potential. Apple likely had leverage because Fifth Season needed capital. That probably improved Apple's negotiating position compared to what the deal would have looked like if Fifth Season had other bidders.

Talent Implications: How This Affects Writers and Creators

When a platform acquires a show, what happens to the talent that created it?

For Dan Erickson and Ben Stiller, the acquisition probably doesn't change much day-to-day. They're both too established to experience this as a loss of autonomy. Apple wants their creative vision—that's why they paid $70 million for the show. Erickson and Stiller have leverage.

But for mid-level writers, producers, and crew members, the impact is more direct. They might shift from being employed by Fifth Season to being employed by Apple Studios. That changes health insurance, retirement benefits, and long-term stability. For some people, that's an improvement. For others, it might mean less flexibility or different creative culture.

The acquisition also affects future hiring. When shows become corporate products, hiring tends to become more formal, more risk-averse, and less about personal relationships. You're not hiring for a scrappy independent studio anymore—you're hiring for a division of Apple Inc. That changes the tone.

Long-term, the consolidation of production in platforms' own studios probably hurts mid-level creative talent. When you could develop your career by moving between independent studios, you had more options and more negotiating power. As platforms consolidate production, your options narrow. You work for Apple, or Netflix, or Disney, or Amazon. The number of employers shrinks.

But in the near-term, Severance's creators are probably in an excellent position. They've proven they can create hits. Apple just gave them $70 million in validation and resources. That translates to better deals, more creative freedom, and stronger negotiating position for their next projects.

The Precedent: What Gets Acquired Next?

Apple's Severance acquisition creates a precedent. Other streamers will look at this and ask themselves: which of our shows should we own?

Netflix might look at successful series where they're financing production but don't own the IP. They might start acquiring those properties. Disney+ might do the same with Marvel and Star Wars adjacent shows. Amazon Prime might consolidate control over their most valuable franchises.

The question then becomes: which independent studios will be acquired, and which will resist?

Studios with breakout hits will have acquisition offers. Studios without hits will struggle to maintain independence. This creates a two-tier ecosystem where the most successful studios get bought, and the rest operate at smaller scale.

For aspiring creators, this means the path to success narrows. You need to either work for a major studio's internal creative team, or create something so exceptional that you get acquired. The middle ground of independent but sustainable studios becomes rarer.

This isn't unique to Severance. It's the trajectory of creative industries everywhere. Independent bookstores became rare. Independent record labels became rare. Independent film distribution became rare. The same consolidation happens in television and streaming. It's not personal—it's economic gravity.

Looking Forward: The Future of Apple TV+ and Severance

If you're a fan of Severance, the acquisition is probably good news. Apple has the resources to support the show's ambitions indefinitely. They won't cancel it because of budget pressures or quarterly earnings calls. They'll make it as good as it can be.

But if you're concerned about creative independence in entertainment, the acquisition represents a concerning trend. Another successful independent studio becomes another division of a tech giant. Another franchise gets absorbed into a corporate portfolio. Another set of creators becomes employees of a multinational corporation.

The tension is real. Corporate scale and resources can enable great art. But corporate thinking and metrics optimization often undermine it. The question is which force wins in practice.

For Apple specifically, the Severance acquisition is a test. If they can deliver Season 3-4 that matches Season 2's quality, they'll prove they can manage creative properties at the highest level. If they stumble, it suggests they're better at hardware than storytelling. The next few years will answer that question.

The broader streaming industry will watch closely. If Severance thrives under Apple's ownership, expect more acquisitions. If it stumbles, expect more caution. Either way, the relationship between platforms and independent studios has fundamentally changed. The era of the autonomous creative studio is slowly ending. The era of platform-owned production is slowly beginning.

FAQ

What does Apple's $70 million Severance acquisition actually include?

Apple acquired the intellectual property, production rights, and all creative materials for Severance from Fifth Season Studios. This means Apple owns the show's universe, characters, storylines, and all franchise opportunities going forward. Fifth Season remains as an executive producer but no longer controls creative or financial decisions. Apple Studios now handles all production in-house for future seasons.

Why did Fifth Season Studios sell Severance to Apple instead of maintaining independence?

Fifth Season faced escalating production costs that exceeded their financial capacity to sustain independently. The show's budget was climbing beyond

How does Apple's ownership change the creative direction of future Severance seasons?

Apple Studios taking direct ownership provides more resources and eliminates budget constraints that previously limited creative ambitions. However, it also means Apple's corporate thinking influences decisions that were previously made purely on creative merit. Showrunner Dan Erickson and director Ben Stiller retain significant creative authority given their track record, but Apple's metrics-focused approach may subtly shift storytelling toward broader appeal compared to the more experimental sensibilities of an independent studio.

What does the acquisition mean for Severance spinoffs and franchise expansion?

With Apple owning the IP completely, spinoff series, limited runs, and other franchise extensions become much more feasible. The acquisition specifically enables exploration of different characters, companies, and time periods within the Severance universe. Erickson and Stiller have indicated openness to spinoff development now that Apple controls franchise rights, something that was unlikely under the previous arrangement with Fifth Season Studios.

When will Severance Season 3 actually air?

Apple has not announced an official premiere date, but typical television production timelines suggest Season 3 could arrive in 2026 or early 2027. With Apple Studios handling production directly, they have more operational flexibility than Fifth Season could provide, but sophisticated series with the visual complexity of Severance require 18-24 months from pre-production through final delivery. Apple's internal infrastructure and established workflows could accelerate the timeline compared to independent production schedules.

How does this acquisition fit into Apple's broader streaming strategy?

The Severance acquisition represents Apple's pivot from early emphasis on prestige standalone content toward building sustainable franchises they own completely. Apple TV+ learned that critical acclaim doesn't always drive subscriber growth the way culturally impactful shows do. By acquiring Severance—a show that combines artistic quality with genuine audience enthusiasm—Apple invests in infrastructure for long-term franchise expansion. This mirrors Netflix's strategy of controlling more of its own content supply chain through acquisitions and internal production.

What happens to independent studios like Fifth Season in an era of platform acquisitions?

Independent studios face a fundamental shift in their business model. When successful shows get acquired by platforms, the studios lose long-term ownership and franchise participation rights but gain immediate capital and an exit opportunity. This creates a two-tier ecosystem where hit studios get acquired quickly, while studios without breakout successes struggle to maintain independence. The era of autonomous creative studios operating sustainably alongside platforms is gradually ending in favor of platform-owned production infrastructure.

Does Apple's ownership guarantee that Severance will complete all four planned seasons?

Apple's acquisition significantly increases the probability that four seasons will be produced since Apple has both resources and strategic motivation to sustain the franchise. However, no contract absolutely guarantees this—if viewership declines dramatically or production problems emerge, even Apple could theoretically cancel the show. That said, Apple's $70 million investment and ownership position strongly incentivize them to complete the planned run and develop spinoffs rather than abandon the franchise prematurely.

How much revenue does Apple expect to generate from owning Severance?

While Apple hasn't disclosed specific financial projections, industry analysis suggests Severance could generate

What competitive advantages does owning Severance give Apple compared to other streamers?

Ownership eliminates dependency on external partners and provides Apple complete control over production timelines, creative decisions, and franchise expansion. Unlike Netflix or Disney+ which may license content from independent studios, Apple owns the entire Severance ecosystem. This allows Apple to make decisions optimizing for overall platform strategy rather than negotiating with partners who have competing interests. It also enables rapid spinoff development and merchandise opportunities that would require complex negotiations with external IP holders.

Conclusion: The Streaming Industry at an Inflection Point

Apple's acquisition of Severance for approximately $70 million represents more than a routine business transaction. It marks an inflection point where streaming platforms transition from content distributors to vertically integrated production companies. For years, streamers like Apple, Netflix, and Disney+ outsourced production to independent studios and traditional media companies. That model gave creators independence but created operational fragmentation and conflicting incentives.

The Severance deal signals that this era is ending. When a show becomes essential to a platform's identity and commercially successful, the platform increasingly chooses ownership over partnership. Apple watched Severance become their most-watched series, then watched Fifth Season Studios struggle under escalating costs. The logical conclusion was obvious: acquire the show, own the IP, consolidate production in-house.

This has immediate consequences for the show itself. Apple can now invest in spinoffs, maintain production in New York despite higher costs, and support creative ambitions without quarterly budget negotiations. Dan Erickson and Ben Stiller get to work for a company with unlimited resources and clear strategic commitment. That's genuinely good for the quality of future seasons.

But it has broader implications for the industry. Independent studios that once thrived by creating premium television now face a choice: build to get acquired by a platform, or operate at significantly smaller scale. The middle ground of sustainable independent studios is shrinking. Creative talent finds fewer employers and less negotiating leverage. Power consolidates further toward the platforms themselves.

For viewers, the consolidation probably doesn't hurt immediately. Shows like Severance will still get made, arguably better resourced than before. But over time, less creative independence means more optimization for metrics, more homogenization, and more corporate thinking applied to storytelling. That's the long-term cost of this shift.

Apple's $70 million bet on Severance ownership probably proves to be a smart investment. The show will likely deliver four solid seasons, potentially launch successful spinoffs, and justify the acquisition price. But the precedent Apple sets matters more than the individual transaction. When the most successful streaming platform in the world decides that owning production is better than outsourcing it, other platforms follow. That consolidation trajectory shapes what television becomes in the next decade.

For now, Severance fans should celebrate. Their favorite show just got the resources and commitment it deserves. But keep an eye on what happens next. The future of television depends on whether platforms like Apple can maintain creative integrity while optimizing for corporate success. That's a genuinely difficult balance, and the industry hasn't figured it out yet.

Key Takeaways

- Apple acquired Severance IP and production rights for ~$70 million, taking over from Fifth Season Studios for all future seasons

- Fifth Season faced unsustainable budget pressures ($100-120M per season) that made independent operation impossible, forcing the acquisition

- Apple's vertical integration strategy consolidates content production under direct platform control, eliminating dependency on external partners

- Severance becomes a test case for Apple Studios' ability to manage premium television production at the highest creative levels

- The acquisition signals broader industry consolidation where successful independent studios get acquired by major platforms rather than sustaining independence

- Four seasons of Severance are planned, with spinoff potential now possible under Apple's complete franchise ownership

Related Articles

- Live Nation's Monopoly Trial: Inside the DOJ's Internal Battle [2025]

- YouTube TV Sports Subscription: Why Subscribers Are Furious [2025]

- Bad Bunny's Super Bowl LX Halftime Show: Behind-the-Scenes [2025]

- Netflix DOJ Antitrust Investigation: What It Means for Streaming [2025]

- Chris Hemsworth Crime 101 Stunts: Director Reveals Truth [2025]

- Disney+ Losing Dolby Vision & HDR10+: Patent Wars or Tech Issues? [2025]

![Apple's Severance Acquisition: Vertical Integration Strategy [2025]](https://tryrunable.com/blog/apple-s-severance-acquisition-vertical-integration-strategy-/image-1-1770888968405.jpg)