Netflix DOJ Antitrust Investigation: What It Means for Streaming [2025]

You've probably noticed how Netflix keeps swallowing up competition. First, it was content deals, then password sharing restrictions, now it's talking about acquiring entire studios. The US Department of Justice certainly noticed. And they're not happy about it.

In early 2025, The Wall Street Journal broke the story that the DOJ had launched a formal investigation into Netflix's proposed acquisition of Warner Bros. Discovery. But here's the part that matters: they're not just reviewing the deal itself. They're actively investigating whether Netflix engaged in anticompetitive practices—the kind of monopolistic behavior that could justify blocking the entire transaction.

This isn't your typical merger review. This is the government asking hard questions about market power, exclusionary conduct, and whether Netflix's dominance in streaming has already crossed into illegal territory.

Let me walk you through what's actually happening, why it matters, and what comes next. Because if the DOJ's investigation succeeds, it could reshape the entire streaming landscape.

TL; DR

- The DOJ investigation targets "exclusionary conduct": Federal investigators are examining whether Netflix used anticompetitive tactics to entrench its market position, going beyond standard merger review

- Deal value is massive: $82.7 billion: Netflix's proposed acquisition of Warner Bros. Discovery represents one of the largest entertainment consolidation moves ever attempted

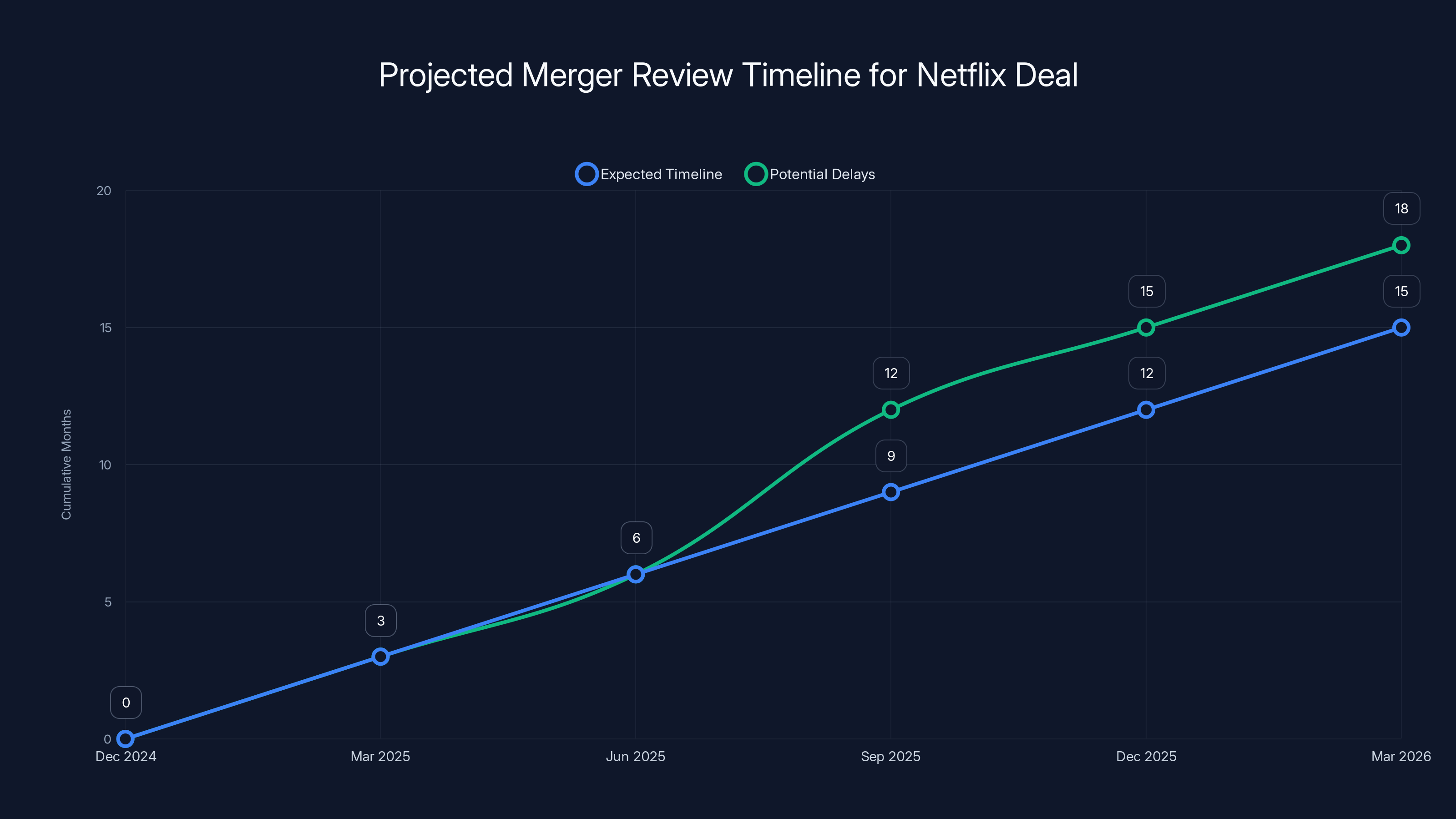

- Timeline is critical: 12-18 months expected: The investigation could take a year or longer, meaning the deal remains in regulatory limbo throughout 2025

- Streaming market consolidation is accelerating: Just three companies now control most US streaming content, with Netflix leading by subscriber count and content library size

- Precedent suggests real risk: The FTC's aggressive antitrust stance under current leadership suggests this investigation could actually block the deal

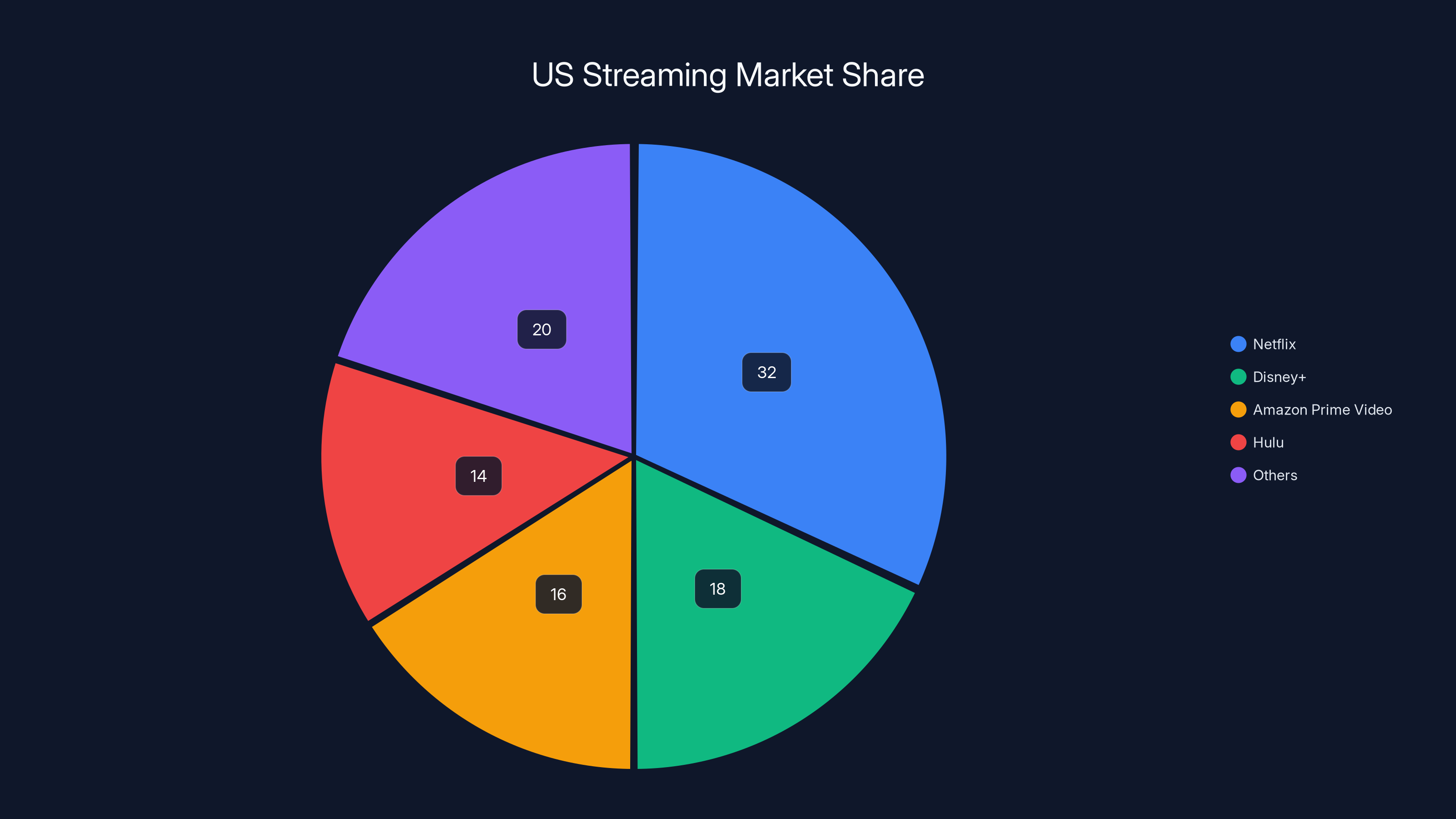

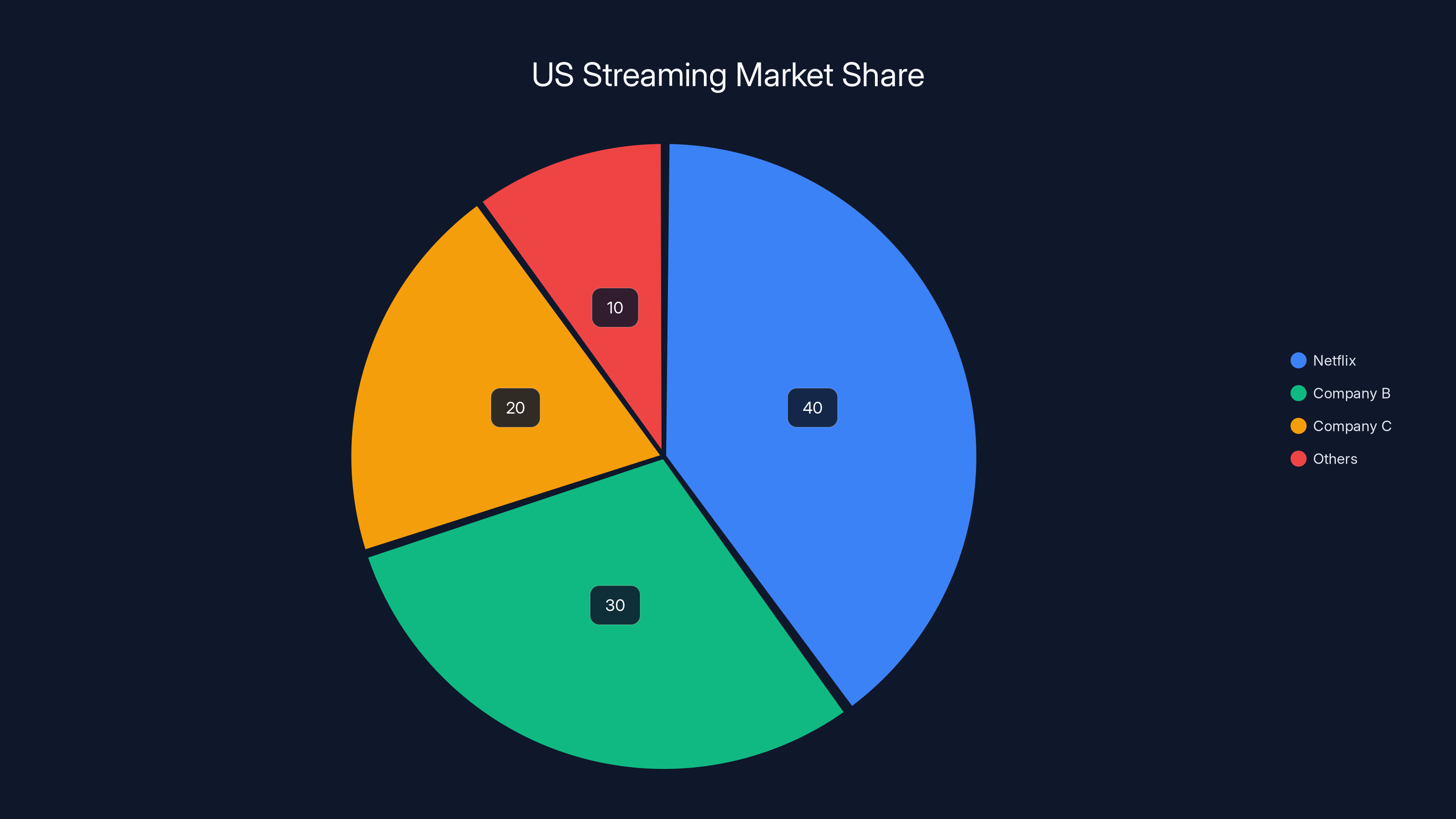

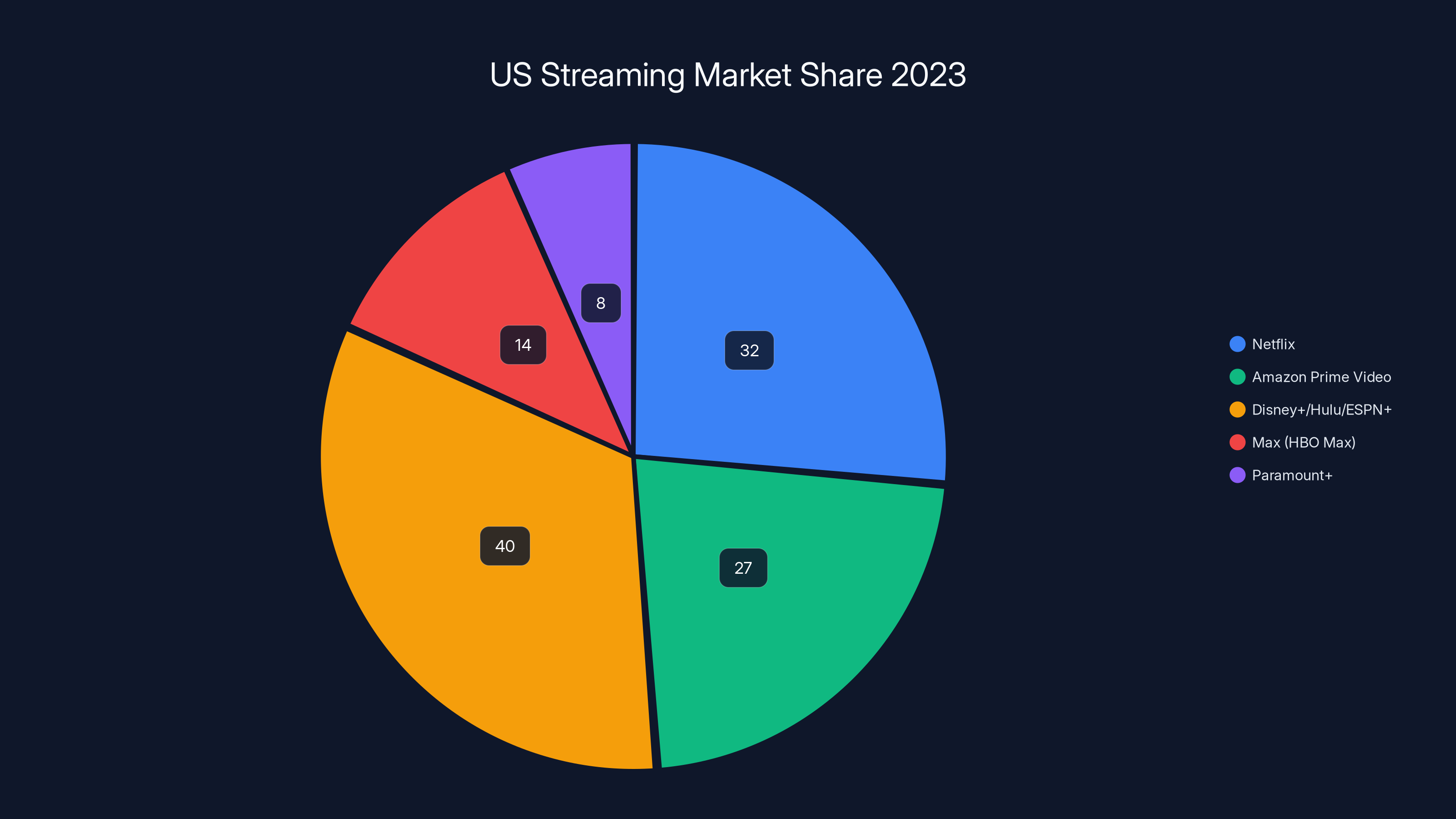

Netflix holds a dominant 32% share of the US streaming market, leading over competitors like Disney+ and Amazon Prime Video. Estimated data.

The Netflix-Warner Bros Deal and Why the DOJ Cares

Let's start with the basics. In December 2024, Netflix announced it would acquire Warner Bros. Discovery for approximately $82.7 billion. That's a staggering amount of money for a media company acquisition, even by entertainment industry standards.

On the surface, this makes sense from Netflix's perspective. Warner Bros. owns the DC Universe, HBO content libraries, and control over massive franchises. Adding all that to Netflix's existing originals and licensed content would create an entertainment behemoth with unmatched scale.

But that's exactly why the DOJ launched an investigation. When one company already controls about 30% of the US streaming market and then buys a major content producer, regulators start asking uncomfortable questions. Is this good for consumers or just good for Netflix shareholders?

The regulatory environment has shifted dramatically. Five years ago, this deal might have sailed through without much scrutiny. But the current Federal Trade Commission and Department of Justice have taken an aggressive stance on tech and media consolidation. They're looking at every major merger through a lens of "does this reduce competition?"

Netflix's defense is straightforward: we're still smaller than cable companies, and streaming is growing. But the DOJ's investigation suggests federal investigators think that argument isn't good enough. They want to know about exclusionary conduct—not just the deal itself, but how Netflix got here in the first place.

Understanding the DOJ's Civil Subpoena and Investigation Scope

The DOJ didn't just casually ask Netflix some questions. They issued a civil subpoena, which is a formal legal document demanding Netflix produce evidence. This is serious. Civil subpoenas mean the investigation has teeth.

According to the subpoena, the DOJ is specifically investigating "exclusionary conduct on the part of Netflix that would reasonably appear capable of entrenching market or monopoly power." That's important language. They're not looking at whether Netflix has monopoly power—they're asking whether Netflix used unfair tactics to maintain it.

What kind of conduct qualifies as "exclusionary"? The government might be looking at:

- Content licensing deals: Did Netflix negotiate exclusive deals that locked competitors out of premium content?

- Password sharing crackdowns: Did Netflix artificially restrict account sharing to force subscriber growth rather than competing on service quality?

- Bundling practices: Does Netflix package services in ways that make competitors harder to use?

- Exclusive production arrangements: Did Netflix tie up talent and creators so competitors couldn't access them?

- Platform favoritism: Does Netflix prioritize its own content over licensed content in recommendation algorithms?

Each of these could, theoretically, be considered anticompetitive if the government can prove Netflix used them specifically to entrench market dominance rather than just compete normally.

Netflix's legal team, led by attorney Steven Sunshine, immediately pushed back. They told The Wall Street Journal that the investigation was standard procedure and that Netflix hadn't received notice of any separate monopolization probe. That statement is important because it suggests Netflix wants to separate the merger review from any potential monopoly charges.

But the subpoena itself tells a different story. The DOJ is clearly thinking about monopoly behavior, not just deal specifics.

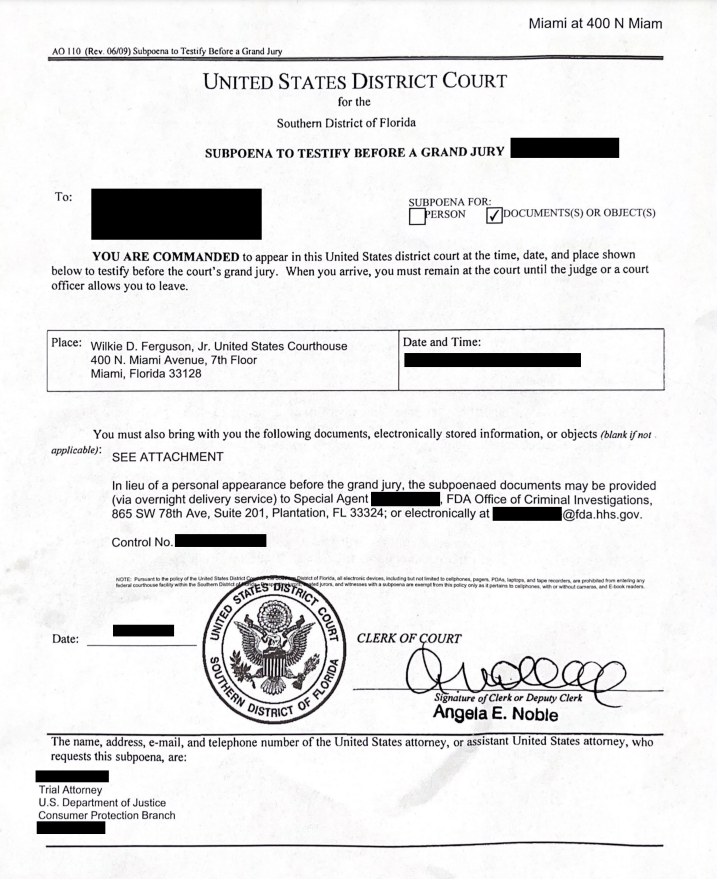

Streaming service prices have consistently increased over time, with Netflix's ad-free plan showing a significant rise from

The Streaming Market Consolidation Crisis

To understand why the DOJ cares about this specific deal, you need to see the bigger picture of streaming market consolidation. And honestly, it's pretty bleak if you care about competition.

When streaming started in the 2010s, there were dozens of players. Netflix, obviously, but also Hulu, Amazon Prime, YouTube, Apple TV, and hundreds of smaller services. The promise was that cord-cutting would reduce prices and increase consumer choice.

Instead, we got consolidation.

Today, the US streaming market is dominated by a tiny number of companies:

- Netflix: ~32 million US subscribers, control of content licensing and exclusive originals

- Amazon Prime Video: ~27 million US subscribers, bundled with Amazon Prime membership

- Disney+/Hulu/ESPN+: ~40 million combined subscribers when bundled together, plus major entertainment franchises

- Max (HBO Max): ~14 million US subscribers, plus HBO's extensive content library

- Paramount+: ~8 million US subscribers, backed by traditional Paramount media

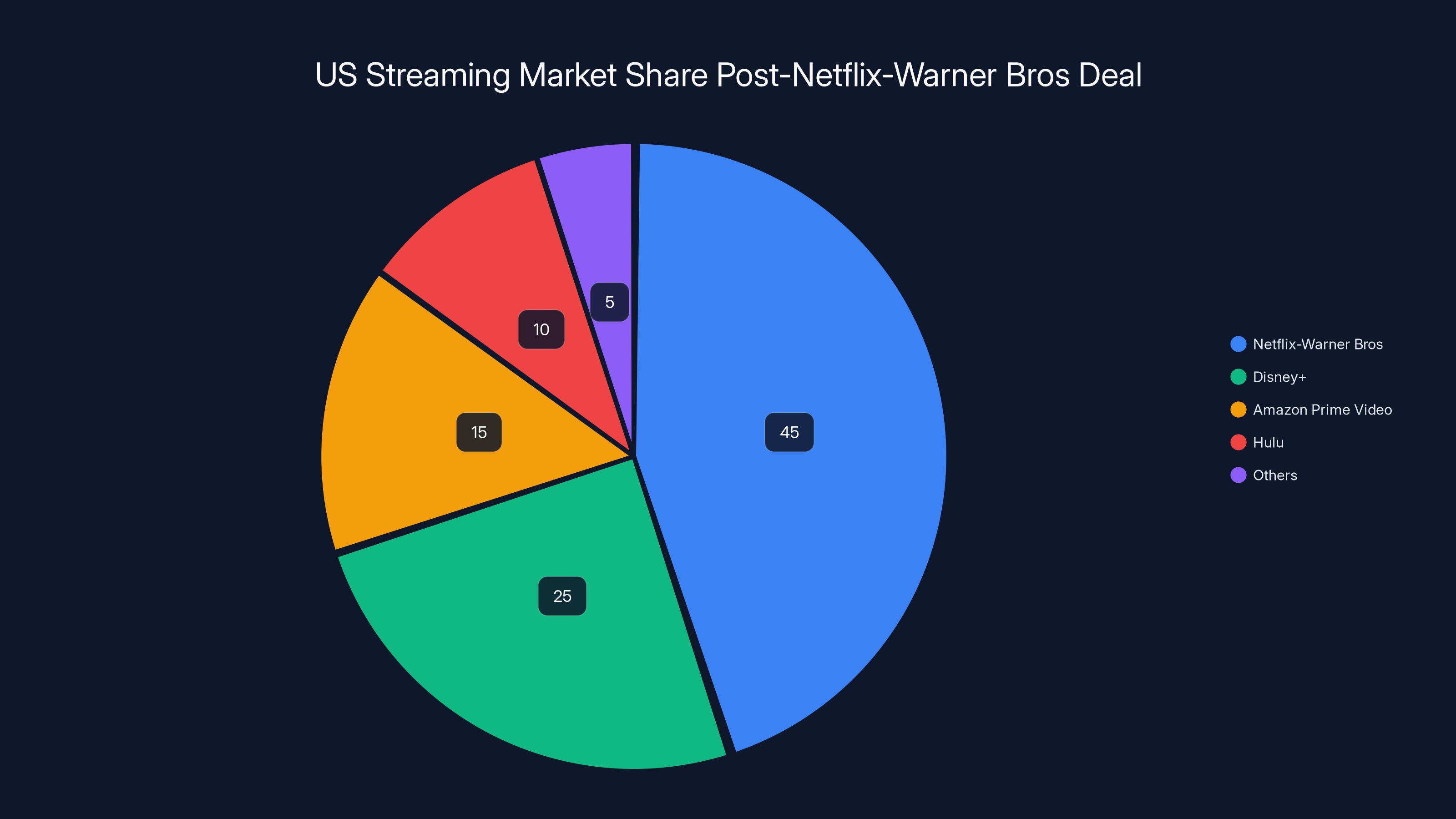

Notice something? Five companies control essentially the entire US streaming market. And Netflix's proposed acquisition of Warner Bros. Discovery would consolidate Max into Netflix's ecosystem, reducing competition even further.

From the DOJ's perspective, this is a pattern. Media companies keep buying competitors or merging with them. Consumers end up paying more for fragmented subscriptions rather than less. The promise of streaming disrupting cable never really materialized—instead, we got cable companies becoming streaming companies.

Netflix has been the most aggressive player in this consolidation. They've outspent everyone else on content, built the largest subscriber base, and now they're trying to acquire a major studio. At some point, regulators ask: when does dominance become a problem?

Netflix's Anticompetitive History and Prior Conduct

The DOJ's investigation isn't happening in a vacuum. Netflix has a documented history of behavior that regulators view as anticompetitive, even if nothing's been proven illegal yet.

Start with content exclusivity. For years, Netflix negotiated exclusive streaming rights for premium content. They'd bid up prices to make sure competitors couldn't get the same shows. That's not necessarily illegal—everyone does it in media. But if the government can show Netflix used exclusivity specifically to entrench dominance and lock out competitors from viably competing, that becomes a problem.

Then there's the password sharing crackdown. In 2023-2024, Netflix began cracking down on password sharing, a practice that millions of households had used for years. The company's stated reason was preventing account sharing. But the practical effect was forcing millions of non-paying household members to either buy their own accounts or lose access. This benefited Netflix financially, obviously. But did it harm competition? The government might argue that Netflix forced subscriber growth artificially rather than competing on service quality.

Consider also Netflix's algorithm and recommendation system. Netflix controls how content appears to users. Do they bias recommendations toward their own originals over licensed content? Do they make it harder to discover competitors' content if it were available? These are hard to prove but incredibly important for understanding market power.

The company's exclusive production deals are another angle. Netflix has tied up major creators, directors, and writers with exclusive deals that prevent them from working with other streaming platforms. In theory, creators should be free to work where they choose. But if Netflix's market power lets them offer deals competitors can't match, that's exclusionary.

None of this necessarily means Netflix broke the law. But it creates a pattern. The DOJ is asking: did Netflix use these practices to maintain dominance unfairly, or just to compete normally?

The Merger Review Timeline and What Comes Next

Let's talk timeline, because this matters. Netflix announced the deal in December 2024 with expectations it would close in 12 to 18 months, subject to regulatory approval. That was before the DOJ investigation became public.

Now, expect delays. The DOJ investigation could take a full year or longer. The agency doesn't move fast, and they have serious questions to answer:

- They need to gather documents from Netflix, competitors, and content providers

- They'll likely interview industry experts about market conditions

- They'll analyze Netflix's business practices and whether they're anticompetitive

- They'll need to produce a detailed legal analysis explaining their conclusions

Here's how the process typically works. The DOJ has about 30 days to decide whether to challenge a deal. But if they determine the deal is problematic, they can ask for more information under the Hart-Scott-Rodino Act. That extends the review. Then if they determine the deal violates antitrust law, they can file a suit to block it.

Unlike merger reviews in many other countries, the US process is relatively fast. But it's also adversarial. The government and Netflix's lawyers will battle it out, potentially in federal court.

Netflix's statement that they're "constructively engaging" with the DOJ is corporate speak for "we're cooperating and hoping they don't block us." They'll produce the requested documents, their lawyers will attend meetings, and they'll make arguments about why the deal doesn't harm competition.

But here's what matters: the DOJ initiated this investigation. That means they already think there's a real issue. If it were a routine deal, they'd approve it with minimal review. The fact that they're investigating exclusionary conduct suggests they're seriously considering blocking it.

Estimated data suggests Netflix-Warner Bros could control 45% of the US streaming market post-acquisition, raising competition concerns.

Recent Antitrust Enforcement Trends and What They Mean for Netflix

Understanding the current antitrust environment is critical. The FTC and DOJ haven't been this aggressive toward tech and media consolidation in decades.

Under FTC Chair Lina Khan, the agency has taken on major tech acquisitions. They've challenged Microsoft's acquisition of Activision Blizzard (though ultimately approved), pursued antitrust cases against Amazon and Apple, and generally signaled that large acquisitions by already-dominant companies face serious scrutiny.

The DOJ has been equally aggressive. They've pursued major cases against Google and pursued significant merger challenges. The philosophical shift is clear: regulators are less willing to assume that scale is good for consumers and more willing to challenge acquisitions that further concentrate market power.

For Netflix specifically, this creates risk. The company is already dominant in streaming. They're not some scrappy competitor that antitrust law is designed to protect—they're the market leader. Adding a major studio to their portfolio is the exact kind of vertical integration that regulators view skeptically.

Historical precedent matters here. Back in the 1980s, the government had a much more lenient approach to mergers. But that changed after the 2000s-2010s, when tech consolidation accelerated and consumers felt the effects through higher prices and reduced choice.

The lesson: large, dominant companies acquiring competitors in concentrated markets face real regulatory risk. Netflix's size and market position mean this deal isn't a given. It could actually be blocked.

What "Exclusionary Conduct" Actually Means in the Streaming Context

The DOJ's focus on "exclusionary conduct" deserves deeper analysis because it's the real legal threat to Netflix's deal.

Exclusionary conduct is different from just having market power. A company can have monopoly power legally if it earned that power through innovation, superior products, or better service. But if a company with monopoly power uses unfair tactics to maintain that power or extend it to new markets, that violates antitrust law.

In Netflix's case, the government might argue:

-

Market power baseline: Netflix already has dominant market power in streaming with ~32% of US subscribers and disproportionate influence over content licensing

-

Exclusionary practices: Netflix used anticompetitive tactics like exclusive content deals, algorithm manipulation, and aggressive password-sharing crackdowns to maintain that dominance

-

The acquisition extends that power: Acquiring Warner Bros. Discovery would extend Netflix's dominance from distribution into production, creating "vertical integration" that further harms competitors' ability to compete

The hardest part for the government to prove is causation. They need to show that Netflix's exclusionary practices actually harmed competition and consumers. That's harder than it sounds.

Netflix will argue that streaming is competitive, that many alternatives exist, and that their practices are standard industry behavior. They'll point out that consumers benefit from Netflix's investment in original content and technology innovation.

But the DOJ's subpoena language suggests they're already past the theoretical stage. They're investigating specific conduct and asking whether that conduct was exclusionary.

The Content Licensing Wars and Exclusive Deals

One area the DOJ almost certainly cares about is content licensing. This is where Netflix's dominance becomes most visible to the government.

When Netflix dominates streaming, they can bid up prices for content and negotiate exclusive rights other platforms can't match. This isn't inherently illegal. But if Netflix uses that market power to deliberately exclude competitors from viable alternatives, it becomes anticompetitive.

Here's how it might work:

- Major studio wants to license a hit show to a streaming service

- Netflix bids $500 million for exclusive streaming rights (price only Netflix can afford)

- Competitor like Paramount+ would bid $200 million but loses because Netflix's deeper pockets win

- Result: Netflix gets the content, competitors don't, Netflix grows stronger, competitors weaker

Multiply this across hundreds of licensing deals over years, and Netflix's dominance becomes self-reinforcing. They're not competing on better service—they're winning through bigger budgets enabled by their existing dominance.

Is this illegal? Probably not, if it's just normal competitive bidding. But if the government can show Netflix deliberately excluded content to harm competitors rather than just to serve consumers, that's different.

The government might argue: did Netflix bid aggressively for content specifically to prevent competitors from accessing good programming? Or did they bid aggressively because they wanted good content for their service? That distinction matters legally.

Warner Bros. Discovery acquisition makes this even more important. If Netflix acquires a major content producer, they no longer need to bid for content. They own it. That's vertical integration, and it's where antitrust gets very interested.

Estimated data shows Netflix leading with 40% market share, followed by Company B and C. This highlights the consolidation trend in the US streaming market.

Password Sharing and Forced Monetization

Netflix's password sharing crackdown deserves specific attention because it might be the DOJ's strongest argument for exclusionary conduct.

For years, millions of households shared Netflix passwords. This wasn't against the terms of service in spirit—Netflix tolerated it. It was a way for Netflix to grow its network and user base without paying development costs. Netflix even knew people were doing it and didn't aggressively stop it.

Then, in 2023-2024, Netflix changed course. They started cracking down on password sharing, requiring separate payments for additional users outside a household. Publicly, Netflix's stated reason was piracy prevention. But the practical effect was forcing millions of users to pay more or lose access.

This is where exclusionary conduct arguments get interesting. Netflix didn't make their service better or cheaper. They reduced access to force more people to pay. From a competitive standpoint, that's concerning because:

- It artificially inflates Netflix's subscriber growth numbers

- It forces spending on Netflix rather than competitors

- It's not competing on merit but on restricting access

A competitor like Paramount+ can't match Netflix's strategy because Paramount doesn't have Netflix's established user base. Even if Paramount wanted to allow password sharing to gain competitive advantage, they don't have millions of existing users to leverage.

The government's question becomes: did Netflix use its dominance and established network to force monetization that competitors couldn't match? If so, that's exclusionary.

Netflix will counter that they have every right to enforce their terms of service and monetize their own product. And they're right. But antitrust law doesn't protect standard business practices—it protects the competitive process. If the effect is to harm competitors' ability to compete, the DOJ cares.

Market Definition and the Streaming vs. Video Market Question

One critical legal question will shape the entire investigation: what market is Netflix in?

This sounds simple but it's actually complex and hugely important for antitrust law.

Netflix might argue: we're not just in "streaming" or "subscription video." We're in "video entertainment" broadly, which includes cable, broadcast, YouTube, TikTok, and even video games. In that massive market, Netflix is only maybe 5-10% of all video consumption. We're not dominant. We face tremendous competition.

But the DOJ will likely argue: no, we're talking about the "subscription video-on-demand" market specifically. In that specific market, Netflix dominates with 32% market share. Consumers can't easily substitute YouTube free video or cable for subscription streaming. They're different products. So the relevant market is SVOD, and in that market, Netflix is dominant.

The market definition matters because it determines whether Netflix has monopoly power. If you define the market broadly (all video), Netflix isn't dominant. If you define it narrowly (subscription streaming), Netflix clearly is.

Historically, courts have defined markets narrowly to focus on actual competition between real alternatives. Under that framework, Netflix is the dominant streaming service in the subscription market. That's the framework the DOJ likely uses.

If the government wins on market definition, they've essentially won the case. Because once they establish Netflix is dominant in a real market, they can pursue exclusionary conduct claims.

The Consumer Impact and Pricing Consequences

Here's what actually matters to you if you're reading this as a Netflix subscriber: consolidation in streaming is making things worse, not better.

When Netflix dominated and faced real competition from multiple strong platforms, prices stayed lower. Netflix's $9.99/month plan was the standard. But as Netflix's market dominance strengthened and competition weakened, prices climbed.

Today, Netflix's cheapest tier with ads is

And Netflix isn't alone. Across the industry, prices have climbed as consolidation advanced. Disney+ started at

The average household now subscribes to 5-7 different streaming services, spending $150-200 per month. That's actually more expensive than the cable packages people cut the cord to escape.

This is exactly why the DOJ cares about consolidation. Consumers were promised lower prices and more choice. What they got was fragmented, expensive, worse service. Netflix's dominance drives that problem.

If Netflix acquires Warner Bros. Discovery, consumers get even fewer choices. They have to pay Netflix for both the distribution they want (to watch Netflix originals) and the content they want (HBO programming). That reduces their leverage to negotiate better prices or switch services.

The DOJ's investigation is, fundamentally, about protecting consumer welfare. That's the test antitrust law uses. Does this deal harm consumers? The government's subpoena suggests they think it might.

Five major companies dominate the US streaming market, with Disney+/Hulu/ESPN+ leading in subscriber count. Estimated data highlights the consolidation trend.

International Regulatory Perspectives and Global Precedent

The DOJ investigation isn't happening in isolation. Other countries are watching Netflix consolidation closely too.

The European Union has been far more aggressive about regulating streaming and media consolidation than the US. The EU's Digital Markets Act specifically targets large digital platforms and imposes rules about interoperability, data access, and content availability.

Under EU rules, Netflix might be classified as a "gatekeeper" platform subject to specific obligations. That could prevent the Warner Bros. acquisition entirely or require Netflix to operate HBO content separately and guarantee competitors access to certain content.

The UK has been similarly skeptical. After Brexit, UK regulators are charting their own course and showing less willingness to approve mega-mergers in media. They're concerned about British content access and local competition.

Canada and Australia have also signaled skepticism toward streaming consolidation.

What this means: if the DOJ blocks or conditions Netflix's acquisition, other regulators will likely follow. Conversely, if the DOJ approves it, that gives other regulators political cover to do the same.

Netflix's strategy is important here. They might try to negotiate conditions rather than fight an all-out battle. Maybe they agree to license certain content to competitors. Maybe they commit to investment in local content. Maybe they price cap certain services. These kinds of conditions can make deals politically acceptable even if they're anticompetitive.

But the DOJ's investigation suggests that strategy might not work this time. The agency sounds serious about exclusionary conduct, not just merger effects.

The Broader Question: What Is Netflix Trying to Accomplish?

Zoom out for a moment. Why is Netflix even trying to acquire Warner Bros. Discovery? What's the strategic goal?

The answer reveals a lot about Netflix's thinking. Netflix started as a subscription streaming distributor. They had no content production capabilities. Over time, they invested heavily in originals to differentiate themselves.

But originals alone aren't enough. Netflix needs a constant stream of licensed content to keep subscribers happy between original releases. And they need that content to be scarce—so competitors can't get it.

The problem Netflix faces is that content producers are consolidating too. Disney owns studios and the Disney+ platform. Paramount owns studios and Paramount+. Warner Bros. owns studios and HBO Max.

Netflix doesn't own studios. They depend on licensing from others. That's a vulnerability. Content creators could raise prices, demand exclusivity concessions, or pull content entirely.

Acquiring Warner Bros. solves that problem. Netflix would suddenly own DC, HBO, major franchises, and enormous content libraries. They'd have the power of vertical integration.

But that's exactly why it's anticompetitive. Netflix isn't acquiring Warner Bros. to serve consumers better. They're acquiring it to reduce competitors' access to content and entrench their market position.

This is the core of the DOJ's investigation. It's not really about the deal itself. It's about whether allowing this deal to proceed would harm competition in the streaming market.

Potential Outcomes and What Each Means

The DOJ's investigation could end in several ways. Let's explore each scenario:

Scenario 1: DOJ Approves with No Conditions

This is the Netflix best-case scenario. It probably won't happen. If the DOJ approved the deal outright after investigating exclusionary conduct, it would signal that the agency thinks Netflix's practices were acceptable. That's unlikely given their current enforcement posture.

If it did happen, Netflix would immediately close the deal. Warner Bros. Discovery would be folded into Netflix. Shareholders would be happy. Competitors would panic. Subscribers might eventually face higher prices as competition decreased.

Scenario 2: DOJ Approves with Conditions

This is more likely. The DOJ might approve the deal but require Netflix to:

- License certain Warner Bros. content to competitors on fair terms

- Refrain from exclusive deals that lock out competitors

- Maintain separate operations for HBO Max to avoid integration-related anticompetitive effects

- Commit to specific investment levels in original content

- Price-cap certain services

Conditions like these are common in merger cases. They let the deal go forward while protecting competition. Netflix might accept conditions to avoid outright rejection.

But conditions also limit Netflix's ability to leverage the acquisition for competitive advantage. That's the point. Netflix wanted to integrate Warner Bros. into their platform. Conditions might prevent that.

Scenario 3: DOJ Blocks the Deal

This is the worst-case scenario for Netflix and the most dramatic outcome. The DOJ could decide that exclusionary conduct is so serious, or the anticompetitive effects are so severe, that no conditions can remedy them.

If the DOJ blocks the deal, Netflix would have to either:

- Appeal to federal court and fight it out

- Walk away from the deal entirely

- Renegotiate on completely different terms

A court challenge would take years and cost hundreds of millions in legal fees. Netflix might lose. If they do, they lose the deal and face reputational damage suggesting they tried anticompetitive practices.

Historically, when the DOJ challenges major mergers, they win more often than not. Blocking a deal is a dramatic step, but it's not unprecedented.

Scenario 4: Negotiated Settlement and Restructuring

Netflix and the DOJ might reach a settlement where Netflix acquires Warner Bros. but restructures the deal. Maybe Netflix spins off certain content properties. Maybe they commit to specific behavioral changes beyond the merged entity.

Settlements are common because they let both sides claim victory. The DOJ gets remedies addressing their concerns. Netflix gets to do the deal with modifications.

This scenario might actually be most likely. It splits the difference between approval and rejection.

The merger review timeline for Netflix's deal could extend from the expected 12-18 months to 15-18 months due to DOJ investigation delays. Estimated data.

What Netflix's Response Tells Us

Netflix's public statements about the DOJ investigation are worth analyzing because they're carefully crafted to shape the narrative.

Netflix's attorney said the investigation is "standard practice." That's true—most large mergers do trigger DOJ review. But calling it "standard" downplays that the investigation is specifically about exclusionary conduct, not just merger effects.

Netflix also said they haven't seen any sign of a separate monopolization investigation. That's interesting because it suggests the company wants to separate the merger review from potential monopoly liability. They're saying: "We're not worried about you charging us with monopolistic behavior. We only care about the merger."

But that's not what the subpoena says. The subpoena specifically asks about exclusionary conduct. That sounds like a monopolization investigation to many observers.

Netflix also emphasized "constructively engaging" with regulators. That's lawyer-speak for "we're cooperating and hope they approve the deal." It's also intended to signal to the DOJ that Netflix is willing to negotiate.

What Netflix is not saying is interesting too. They're not arguing the deal is good for consumers. They're not arguing streaming is competitive. They're not defending exclusionary conduct. They're just cooperating and hoping the government approves.

That strategy suggests Netflix's lawyers know the deal faces real risk.

The Streaming Market's Future Competitive Landscape

If we step back from this specific deal, the broader question is: what does the streaming market look like in 3-5 years?

If Netflix's deal gets blocked, the market probably remains competitive but fragmented. Netflix, Disney, Warner Bros., Paramount, and others all operate separately. Consumers have choices but need multiple subscriptions. Prices stay high.

If Netflix successfully acquires Warner Bros., consolidation accelerates. Netflix becomes even more dominant. Disney and Paramount face pressure to merge too. The market becomes dominated by 2-3 giants. Prices likely increase. Competition decreases.

If Netflix gets conditional approval, the market remains fragmented but with some guardrails. Netflix can't exploit the merger too aggressively. Competition survives but Netflix maintains advantages.

The DOJ is essentially choosing between these futures. Their investigation will shape not just Netflix but the entire streaming industry's trajectory.

From a consumer perspective, this matters enormously. The promise of streaming was lower prices and more choice than cable. That promise hasn't materialized. More consolidation makes it less likely to materialize ever.

The DOJ's investigation is the last real opportunity to preserve streaming as a competitive market. If they approve the deal or impose weak conditions, streaming probably follows the cable industry pattern: consolidation, price increases, and reduced innovation.

If they block or heavily condition the deal, there's still a chance streaming remains competitive enough to deliver on its original promise.

Timeline Projections and Key Dates to Watch

Let's project the timeline for this investigation and identify key dates that matter.

Early 2025 (Current): DOJ investigation underway, Netflix producing documents in response to subpoenas

Mid-2025: DOJ likely completes initial evidence gathering, begins legal analysis of whether deal violates antitrust law

Late 2025: DOJ makes preliminary decision—either approve, block, or signal intent to challenge if brought to court

Early-Mid 2026: If DOJ decides to challenge, they file suit in federal court seeking preliminary injunction to block deal closing while litigation proceeds

Late 2026-2027: Federal court litigation proceeds, potentially reaching trial or summary judgment decision

2027-2028: Appeal possible depending on initial court decision

The deal was supposed to close in 12-18 months from announcement. That would be mid-2026. But the investigation almost certainly delays that timeline. Netflix might miss the original deadline entirely.

Warner Bros. Discovery shareholders might get nervous if the deal drags on for years. Conditions or a blocked deal could trigger shareholder lawsuits. Netflix faces pressure to close the deal but also risk of it never closing.

That uncertainty itself is costly. Netflix can't fully plan strategy around Warner Bros. assets if they don't own them. Warner Bros. management remains in limbo. Both companies' valuations are affected.

For context: when Microsoft's Activision Blizzard deal faced FTC challenge, it took nearly two years to resolve. The deal ultimately closed but only after extended litigation. That's the timeline Netflix potentially faces.

Expert Analysis: What Antitrust Scholars Are Saying

Let's look at what antitrust experts actually think about Netflix and this investigation.

The consensus among serious antitrust scholars is that Netflix's market position is concerning even before the Warner Bros. acquisition. They've built dominance in streaming through a combination of superior execution, aggressive content spending, and yes, arguably anticompetitive tactics.

The password sharing crackdown, in particular, draws skepticism from experts. Multiple antitrust professors have noted that while Netflix has the right to enforce terms of service, doing so specifically to harm competitors' ability to attract free users starts looking anticompetitive when Netflix is already dominant.

On the acquisition itself, expert opinion is mixed but leans skeptical. Some argue that vertical integration isn't inherently anticompetitive and that the streaming market is still competitive with multiple viable alternatives (Disney, Paramount, Apple TV, Amazon Prime). Others argue that the market is consolidating dangerously and that allowing Netflix to integrate with major content production capabilities would entrench dominance unacceptably.

Few experts think the deal is unambiguously pro-consumer. Even friendly analysts acknowledge that consolidation reduces consumer choice and likely increases prices.

What experts universally agree on: this is a serious antitrust question that deserves serious investigation. The DOJ's scrutiny is appropriate given Netflix's market position and the degree of consolidation already occurring in streaming.

If this investigation succeeds (i.e., if it results in a block or conditions), it would represent a significant victory for the FTC and DOJ's aggressive antitrust enforcement agenda. If it fails, it would suggest that even dominant market positions with potentially anticompetitive practices can still pursue consolidating acquisitions.

The stakes are enormous not just for Netflix but for how the DOJ approaches tech and media consolidation broadly.

FAQ

What is the Netflix DOJ investigation about?

The US Department of Justice launched an investigation into Netflix's proposed acquisition of Warner Bros. Discovery, but significantly, the investigation focuses not just on the deal itself but on whether Netflix engaged in "exclusionary conduct" to build and maintain market dominance. This means the DOJ is examining Netflix's past business practices—like exclusive content deals, password sharing restrictions, and licensing negotiations—to determine if those practices were anticompetitive.

Why is the DOJ investigating Netflix for anticompetitive practices?

The DOJ is concerned that Netflix uses its dominant market position (approximately 32% of US streaming subscribers) to exclude competitors from competing fairly. The agency is specifically looking at whether Netflix negotiated exclusive content deals to lock out competitors, used aggressive billing practices like password sharing crackdowns to force monetization, or leveraged its dominance in streaming distribution to unfairly advantage itself in content licensing. The acquisition of Warner Bros. Discovery would further concentrate Netflix's power in both content production and distribution.

What does "exclusionary conduct" mean in Netflix's case?

Exclusionary conduct refers to business practices that limit competitors' ability to compete, not through superior products or lower prices, but through raising competitors' costs, restricting access to essential inputs, or leveraging market power across different markets. For Netflix, the DOJ is investigating whether practices like exclusive content licensing, password-sharing restrictions, and algorithm-based recommendation advantages were designed to entrench Netflix's dominance and make it impossible for competitors like Disney+, Paramount+, and others to viably compete. The investigation seeks to determine if Netflix competed on merit or used unfair tactics to maintain power.

What is the $82.7 billion Netflix-Warner Bros. deal and why does it matter?

Netflix proposed acquiring Warner Bros. Discovery, which owns HBO, the DC Universe, and massive content libraries, for approximately $82.7 billion. This would consolidate the largest streaming service with a major content producer, potentially allowing Netflix to control both distribution and production. The deal matters because it would further concentrate the already-consolidated streaming market, giving Netflix even more power to exclude competitors and set pricing. With Warner Bros. content owned by Netflix rather than available to all platforms, competitors' ability to compete would be severely diminished.

What timeline should I expect for the DOJ investigation and deal decision?

The DOJ investigation could take 12-18 months or longer to complete. Netflix originally expected the deal to close within 12-18 months of the December 2024 announcement, but regulatory delays mean the deal closing is probably pushed to 2026 or 2027, if it closes at all. The DOJ will spend several months gathering evidence and documents, then several more months conducting legal analysis. If they decide to challenge the deal in court, litigation could extend the timeline further, potentially pushing final resolution to 2027 or 2028. This uncertainty is costly for both Netflix and Warner Bros. Discovery shareholders.

What are Netflix's options if the DOJ blocks or challenges the deal?

If the DOJ challenges the Netflix-Warner Bros. deal, Netflix has several options. They can appeal to federal court and fight the government's legal position, which would cost hundreds of millions in legal fees and take years to resolve. They can accept DOJ conditions on the deal (like licensing certain Warner Bros. content to competitors or operating HBO Max separately) and close on those terms. They can walk away from the deal entirely. Or they can negotiate a settlement where they restructure the deal to address the DOJ's antitrust concerns while still gaining some strategic benefits from the acquisition.

What outcomes would be best for consumers in this investigation?

Consumers would benefit most if the DOJ either blocks the deal or imposes strong conditions that preserve competition in streaming. The streaming market promised lower prices and more choice than cable, but consolidation has made both services worse and more expensive. The average household now pays $150-200 monthly for 5-7 streaming services. If the Netflix-Warner Bros. deal closes without strong protections, consumers would face even less choice and likely higher prices as Netflix leverages Warner Bros. content to increase market power and pricing power. A blocked deal or heavily conditioned approval protects the consumer interest in competitive streaming markets.

How does this investigation compare to other major tech/media consolidation cases?

The Netflix investigation follows the FTC's aggressive enforcement trend under current leadership. Similar investigations examined Microsoft's Activision Blizzard acquisition (ultimately approved after years of litigation), Amazon's market practices, and Apple's platform favoritism. The DOJ under this administration has shown willingness to challenge large acquisitions by dominant companies in concentrated markets. Netflix's case is particularly important because streaming is a relatively new market where consolidation patterns are still forming. The outcome here will likely influence how regulators approach future streaming, tech, and media consolidation deals.

What international perspectives matter for this investigation?

The European Union, UK, Canada, and Australia are all monitoring Netflix's deal and DOJ's investigation closely. The EU's Digital Markets Act would likely classify Netflix as a "gatekeeper" platform with specific obligations. UK regulators have signaled skepticism toward media consolidation. If the DOJ blocks or conditions the deal, other regulators will likely follow, making global approval impossible. Conversely, DOJ approval gives other countries political cover to approve as well. Netflix's global strategy and the deal's success depends partly on international antitrust alignment, not just US DOJ decisions.

How would this deal affect content creators, talent, and the creative industry?

If Netflix acquires Warner Bros., the company would control distribution to hundreds of millions of subscribers plus ownership of major production capabilities and content libraries. Talent and creators would have reduced alternatives for where their content can be distributed. Netflix could more aggressively negotiate exclusive deals and control how content appears in the platform. Creators would lose leverage. Independent producers would find it harder to get their content distributed fairly when Netflix controls both the largest distribution platform and major production resources. The creative industry would become more concentrated with less competition for talent and content.

What should Netflix subscribers watch for as this investigation unfolds?

Subscribers should monitor Netflix price increases, which often accelerate when companies have less competitive pressure. Watch whether Netflix stops licensing popular third-party content or makes their recommendation algorithms favor original content more obviously. Pay attention to quarterly earnings calls where Netflix management discusses the DOJ investigation timeline. Consider whether consolidation benefits you (integrated libraries potentially easier to use) or harms you (reduced choice and higher prices). Consider tracking your actual monthly streaming spending—most people are shocked by the total cost of maintaining multiple subscriptions. The DOJ's decision will ultimately affect your wallet and viewing options.

Conclusion

The DOJ's investigation into Netflix and its Warner Bros. Discovery acquisition represents a critical moment for the streaming industry. On the surface, it's about one company acquiring another. But at a deeper level, it's about whether dominant companies can leverage that dominance to exclude competitors and consolidate further, or whether antitrust law actually protects competitive markets.

Netflix has built something remarkable. They disrupted cable, forced the entire industry to innovate, and created subscriber experiences that billions of people value. They've invested more in content than anyone else and have the largest audience. By many measures, Netflix earned their market position through superior execution.

But earning dominance doesn't mean you can use that dominance to prevent others from competing. The password sharing crackdown, the exclusive content deals, the leveraging of their distribution network to advantage their own position in content licensing—these tactics might be individually defensible. But taken together, especially if they were designed to maintain dominance rather than serve consumers, they start looking anticompetitive.

The Warner Bros. acquisition is the ultimate test. If Netflix can integrate a major content producer with the largest streaming platform, they cement dominance that competitors can't realistically challenge. Future competitors, however innovative, can't win if Netflix controls both the essential content and the essential distribution platform.

The DOJ's investigation is taking this seriously. A civil subpoena for exclusionary conduct isn't standard merger review language. It's the government saying: "We think you might have broken the law with your business practices, and we're investigating."

What happens next matters enormously. For Netflix shareholders, for competitors trying to survive, for content creators seeking fair terms, and especially for consumers who were promised that streaming would offer choice and lower prices.

The timeline is uncertain. The outcome is genuinely unpredictable. But the stakes are clear. This investigation will shape not just Netflix's future, but the entire streaming industry's competitive landscape for the next decade.

Watch this space. The DOJ's decision will tell you whether antitrust law still functions to protect competitive markets or whether dominant companies have won the power to consolidate freely. Everything else follows from that.

Key Takeaways

- The DOJ investigation focuses on Netflix's 'exclusionary conduct'—not just the merger itself, but whether Netflix used anticompetitive tactics to build dominance

- Netflix controls approximately 32% of the US streaming market, making it the dominant platform by significant margin over competitors

- The investigation could take 12-18+ months, delaying the $82.7 billion Warner Bros. Discovery deal beyond original 12-18 month timeline

- Streaming market consolidation has worsened consumer outcomes: average household pays $150-200 monthly for 5-7 services, more expensive than cable

- Vertical integration (Netflix owning content production) is the core antitrust concern—reduces competitors' access to essential content

Related Articles

- The SCAM Act Explained: How Congress Plans to Hold Big Tech Accountable for Fraudulent Ads [2025]

- SpaceX Acquires xAI: The 1 Million Satellite Gambit for AI Compute [2025]

- SpaceX Acquires xAI: Creating the World's Most Valuable Private Company [2025]

- SpaceX Acquires xAI: Building a 1 Million Satellite AI Powerhouse [2025]

- Microsoft's Maia 200 AI Chip Strategy: Why Nvidia Isn't Going Away [2025]

- Amazon's $309M Returns Settlement: What Consumers Need to Know [2025]

![Netflix DOJ Antitrust Investigation: What It Means for Streaming [2025]](https://tryrunable.com/blog/netflix-doj-antitrust-investigation-what-it-means-for-stream/image-1-1770500169395.jpg)