Live Nation's Monopoly Trial: Inside the DOJ's Internal Battle and What It Means for Corporate America [2025]

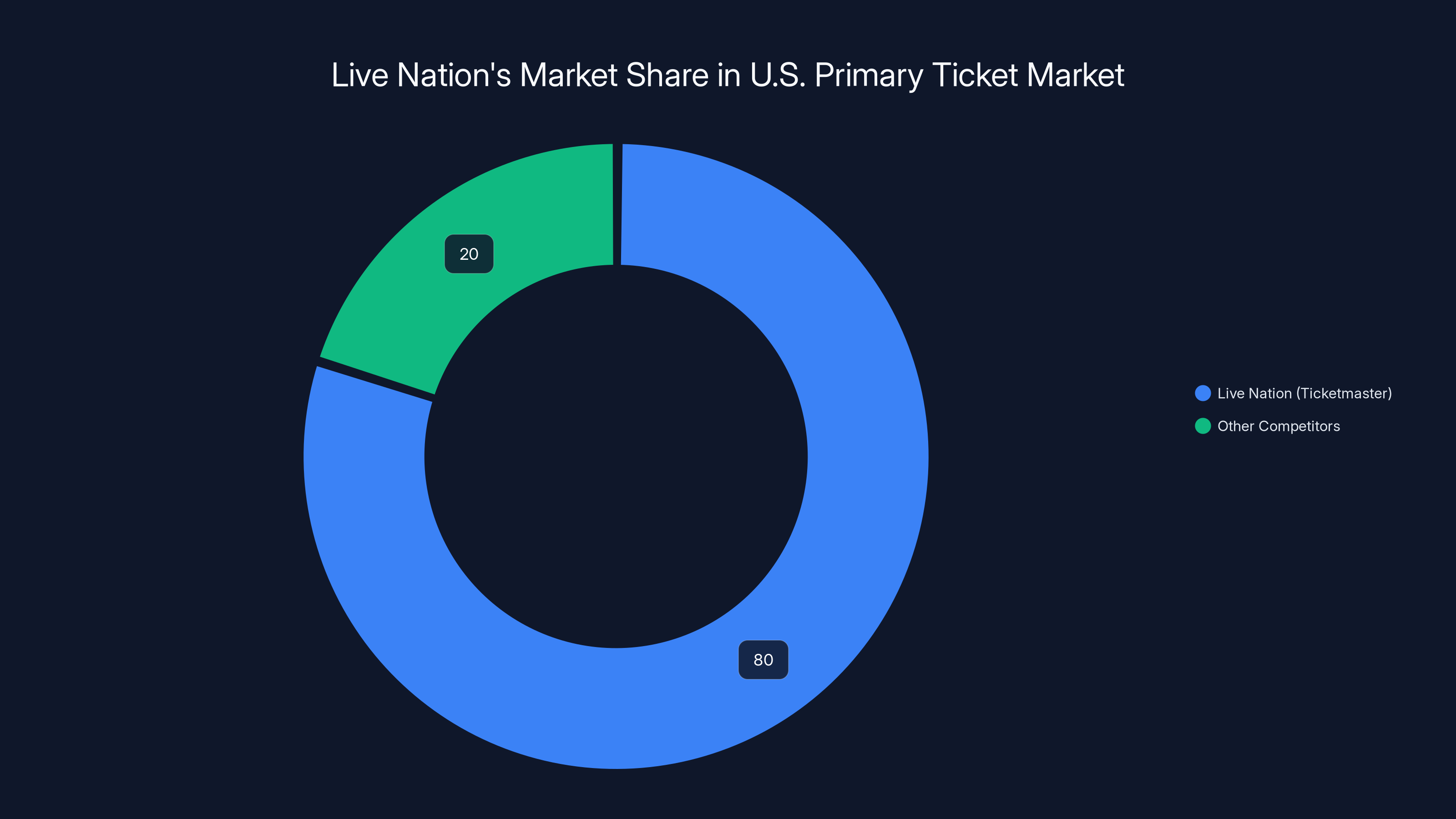

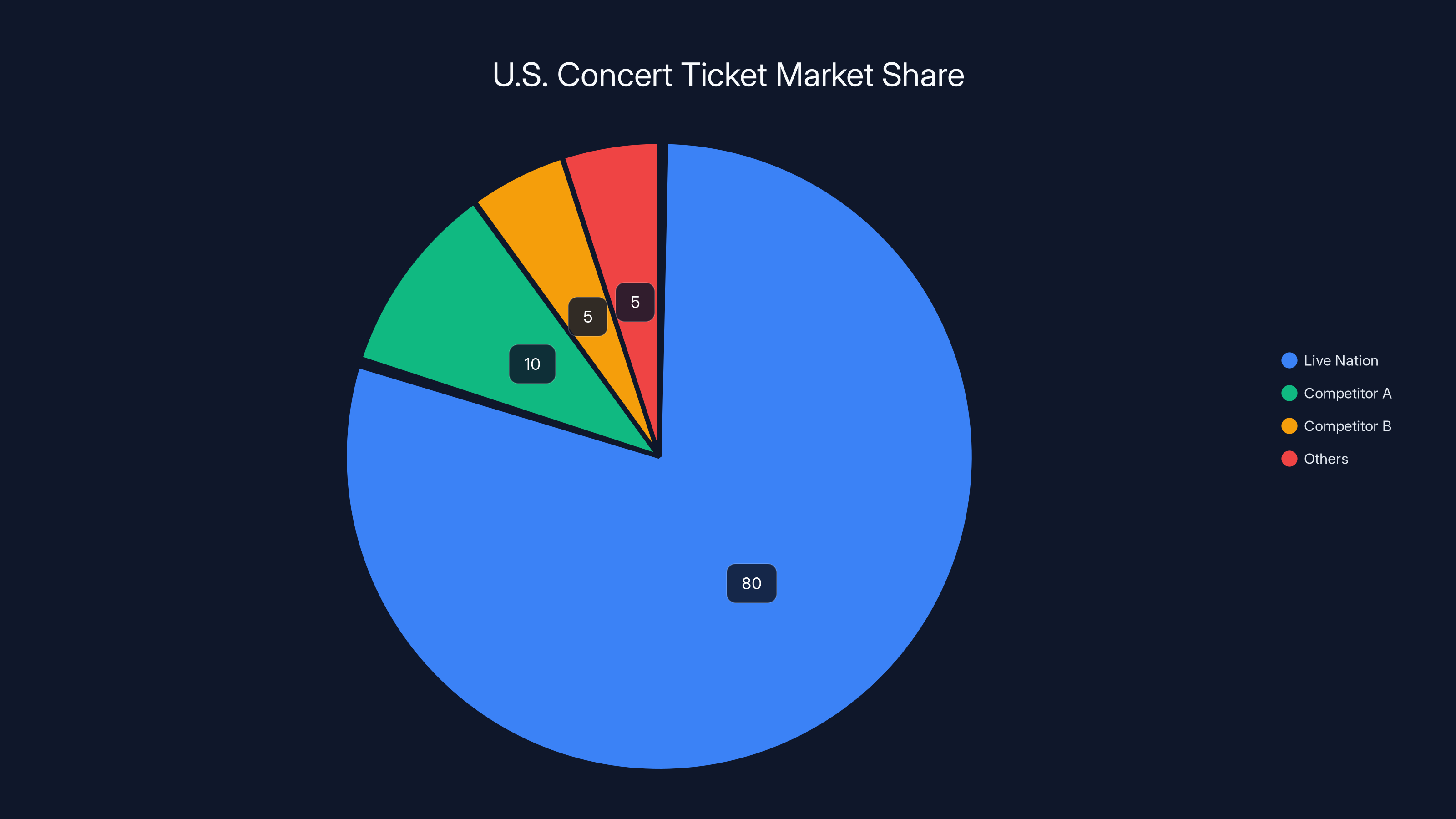

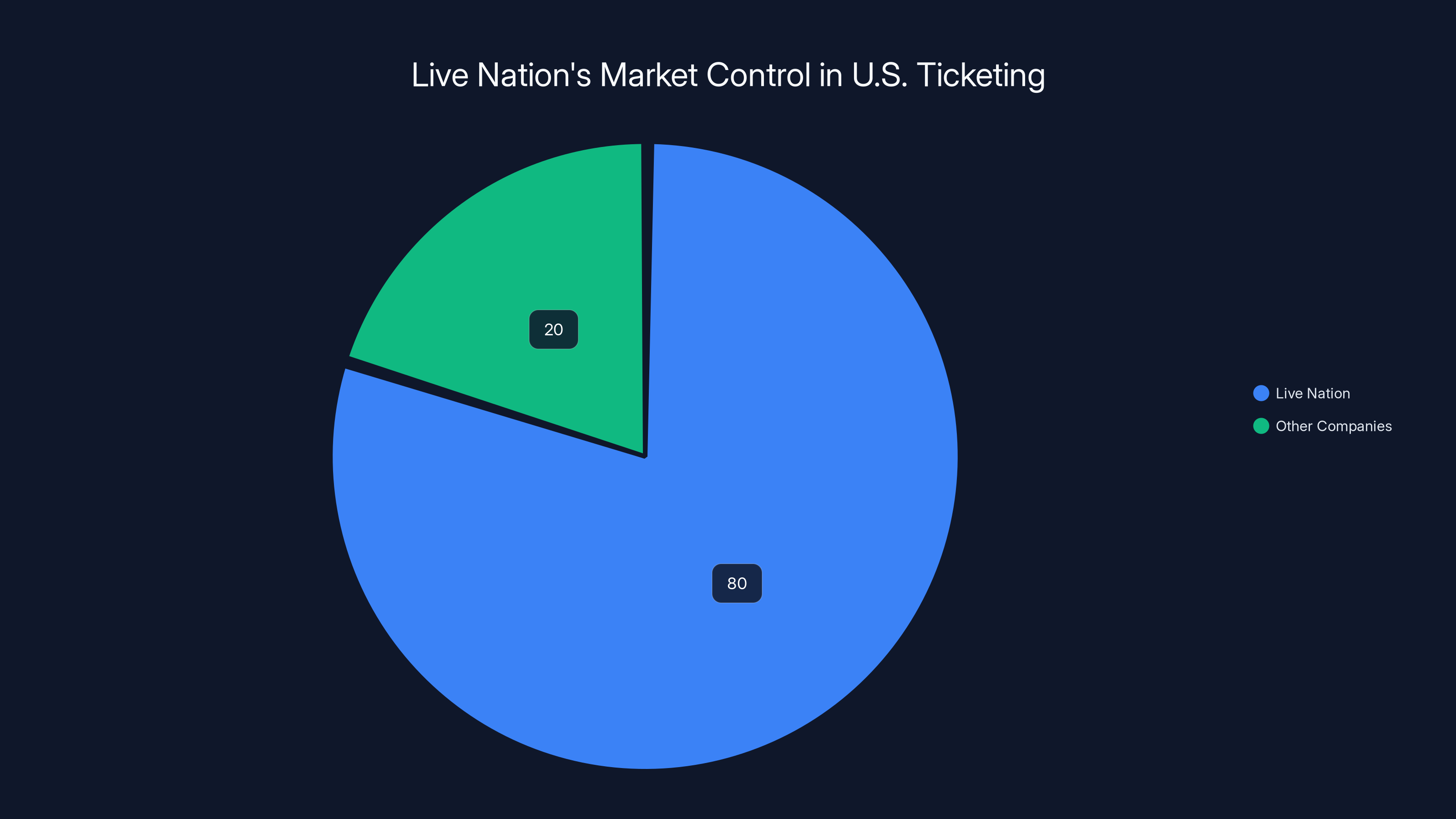

Something weird is happening inside the Trump administration's Justice Department, and it involves one of the entertainment industry's biggest power players. Live Nation, the ticketing and events giant that controls roughly 80% of the U.S. concert ticket market, is reportedly having settlement discussions with Trump administration officials. But here's the kicker: these talks are allegedly happening outside of the Justice Department's antitrust division, with Live Nation executives sidestepping the very people who brought the monopoly case in the first place.

If you're thinking this sounds backwards, you're right. This situation exposes a fundamental tension that's been brewing for months inside the Trump Justice Department: pro-business officials who want to settle things quietly are clashing with antitrust chief Gail Slater, who inherited the case from the Biden administration and wants a full trial in March. It's corporate politics meets government dysfunction, and the stakes are enormous.

What's happening with Live Nation isn't just another antitrust case. It's a window into how the Trump administration approaches corporate regulation, and whether the government actually follows through on consumer protection cases when political pressure mounts. The case was filed in May 2024 by the Justice Department and 30 state and district attorneys general, alleging that Live Nation's dominance in the ticketing industry creates unfair commercial advantages that suppress competition and harm consumers. The goal? Break up Live Nation-Ticketmaster. That's a huge ask, and it's increasingly clear that not everyone inside the DOJ agrees it should happen.

The reported settlement discussions reveal something uncomfortable: the administration's economic philosophy might be winning out over antitrust enforcement. When pro-business officials in the Trump DOJ bypass antitrust leadership, they're essentially saying: we believe in letting large companies operate largely unfettered, even if it harms competition. That's a dramatic shift from the Biden administration's more aggressive stance on monopolies and corporate consolidation.

TL; DR

- Settlement talks are happening outside antitrust leadership: Live Nation executives are reportedly negotiating with pro-business Trump officials while excluding antitrust chief Gail Slater, who wants a March trial

- This reveals deep DOJ fractures: The Trump administration's pro-business mentality is directly clashing with inherited antitrust enforcement priorities

- The case involves massive market control: Live Nation controls approximately 80% of U.S. ticketing and concert promotion, giving it significant power over artist selection and ticket pricing

- Consumer impact is real: Artists, venues, and fans all suffer when one company dominates the entire pipeline from artist booking to ticket sales to venue operation

- This signals broader regulatory rollback: If Live Nation avoids trial, it suggests Trump's DOJ will deprioritize antitrust cases against large corporations

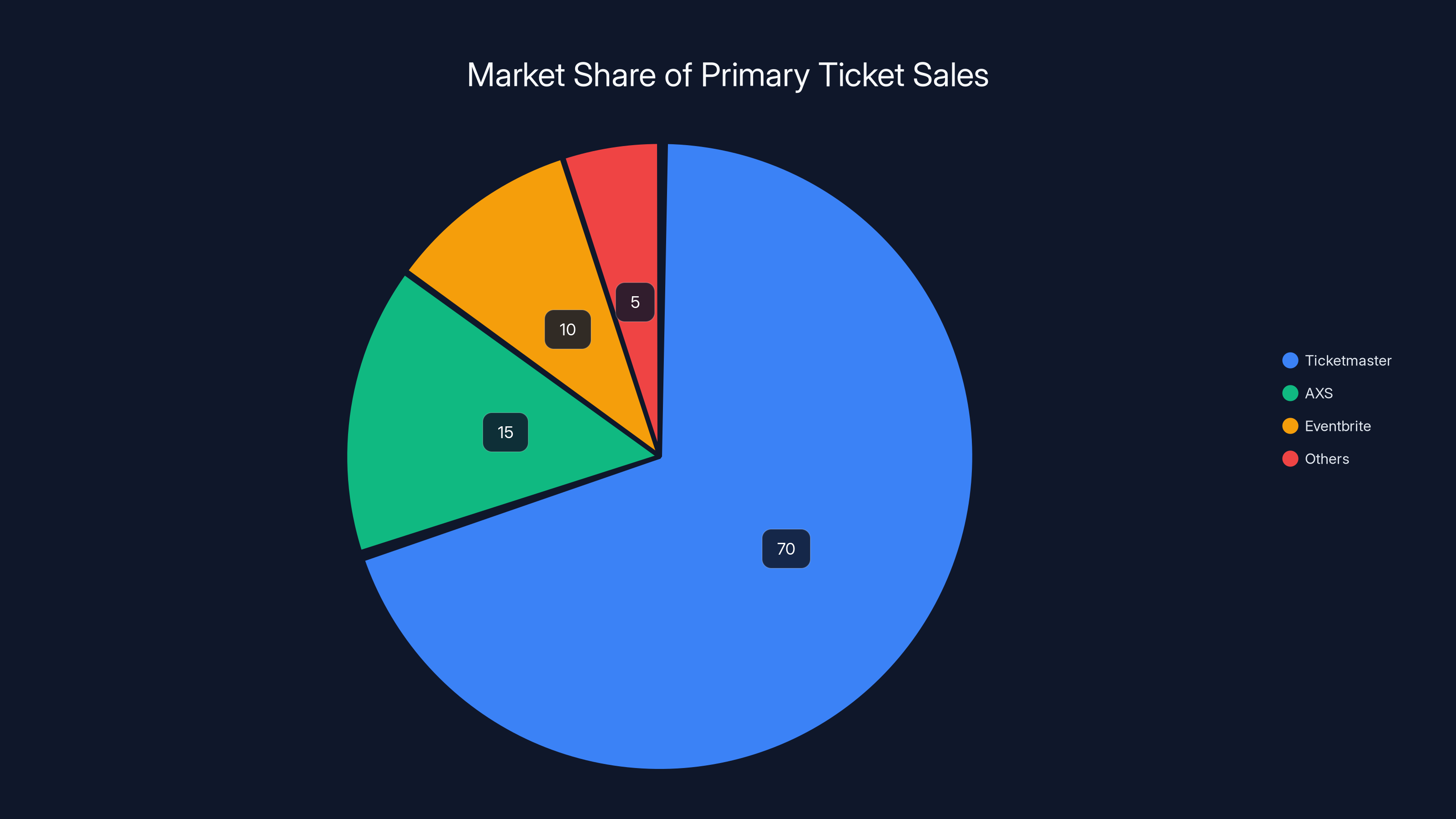

Ticketmaster dominates the primary ticket sales market with an estimated 70% share, leaving competitors like AXS and Eventbrite with significantly smaller portions. (Estimated data)

Understanding Live Nation's Market Dominance and the Antitrust Problem

Live Nation isn't just a big company. It's a vertically integrated behemoth that touches nearly every part of the live entertainment value chain. The company owns or operates Ticketmaster, which controls the lion's share of primary ticket distribution. It owns or has stakes in hundreds of concert venues worldwide. It promotes concerts and manages major festivals. It even manages artists through its management division.

This vertical integration is the core of the antitrust case. When one company owns the ticketing system, the venues, and the promotion pipeline, it creates what economists call "gatekeeping power." Want to hold a concert? You probably need Ticketmaster's systems. Want to book a venue? Live Nation owns many of them. Want to promote a major tour? Live Nation's promotion division can crush independent competitors. Artists and smaller venues find themselves trapped in a system where they have limited alternatives.

The numbers tell the story. Ticketmaster processes over 500 million tickets annually across primary and secondary markets. Live Nation Entertainment, the parent company, reported over $32 billion in revenue in 2023. But more important than the revenue figures is the market control: there's simply no serious alternative to Ticketmaster in primary ticket sales. Competitors like AXS and Eventbrite exist, but they capture only a fraction of major concert tickets. When artists announce tours, Ticketmaster handles the vast majority of sales.

This dominance translates directly into price increases for consumers. If you've noticed that concert tickets cost far more than they used to, and that fees are often 25-30% of the face value, this is part of the story. With Ticketmaster as the only viable option for major venues, venues and artists have limited ability to negotiate better terms. Those fees get passed down to fans. According to the complaint filed by the DOJ, these fees have increased substantially, and Live Nation's control of the ecosystem allows it to maintain higher prices than would exist in a more competitive market.

The case also highlights something less visible but equally important: artist selection and venue access. When Live Nation owns both the ticket distribution system and many of the venues, it can favor artists and shows that benefit its entire ecosystem. Independent venues and smaller artists face higher barriers to reach large audiences. This isn't just about prices; it's about competition and fairness in how the entire industry operates.

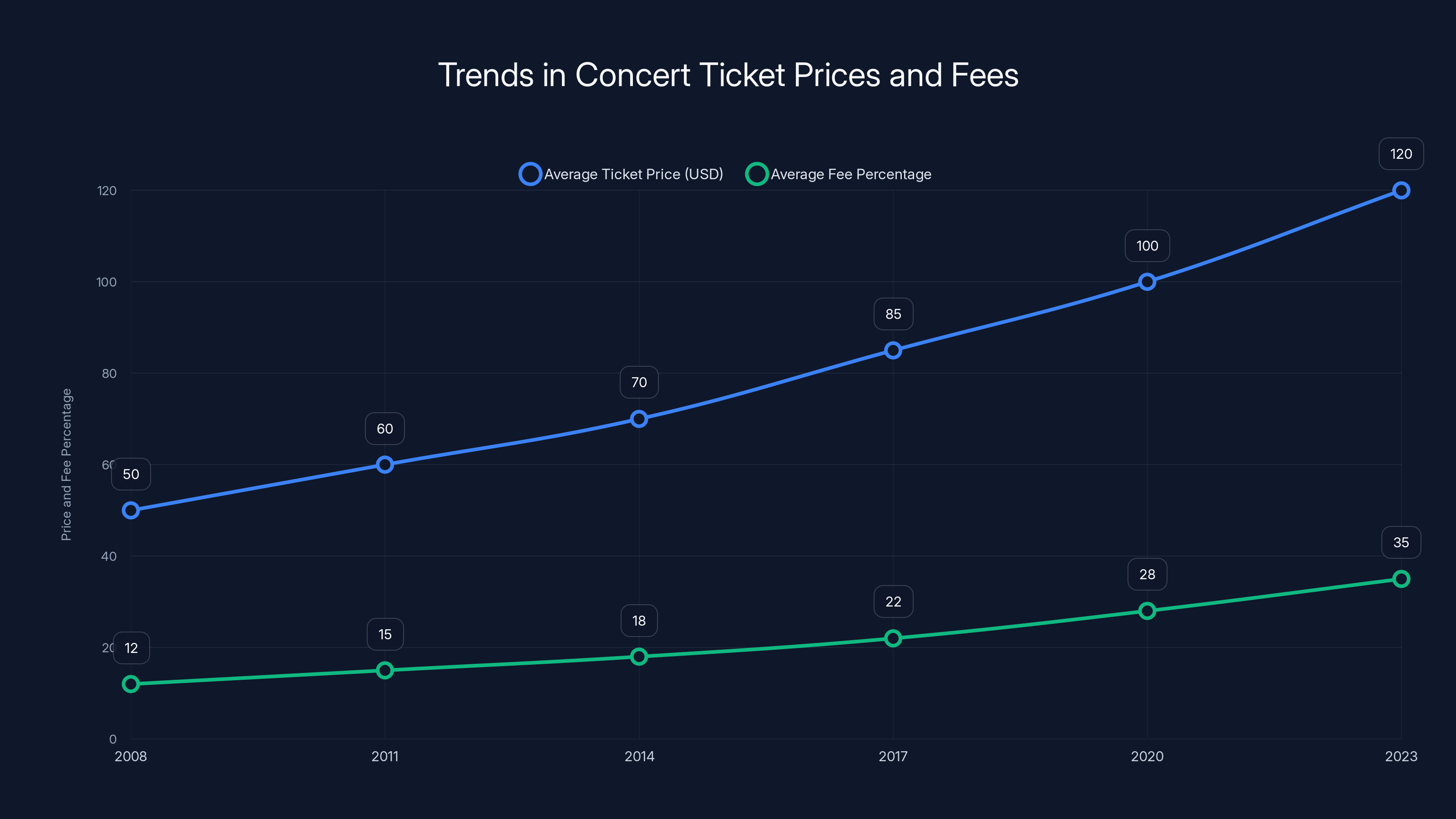

Concert ticket prices and associated fees have risen significantly over the past 15 years, with fees increasing from 12% to 35% of the ticket price. Estimated data.

The Biden Administration's Aggressive Antitrust Approach vs. Trump's Pro-Business Stance

When the Biden administration filed the Live Nation case in May 2024, it was part of a broader enforcement campaign against what it viewed as anticompetitive corporate behavior. The strategy was straightforward: use antitrust law to challenge what the administration saw as excessive market concentration in major industries. Live Nation was one of several targets, alongside cases against tech giants and healthcare consolidation.

The Biden DOJ, led initially by antitrust chief Jonathan Kanter, took a hardline approach. The thinking was that antitrust law exists for a reason: to prevent companies from using market dominance to crush competitors and harm consumers. From that perspective, Live Nation's control of ticketing plus venue ownership plus artist management represented exactly the kind of conduct that antitrust law was designed to address. Breaking up the company might sound radical, but it follows a long tradition of U.S. antitrust enforcement. AT&T was broken up in 1982. Standard Oil was famously dismantled. The principle: when a company gets too big and uses its size to block competition, government can and should intervene.

That was the mentality carrying the case forward. Gail Slater, who took over as antitrust chief, was committed to the case and scheduled trial for March. The plan was to build a public case against Live Nation, expose the company's conduct to a jury, and potentially force restructuring of the live entertainment industry.

Enter the Trump administration, which arrived in January 2025 with a fundamentally different philosophy. Trump has consistently positioned himself as pro-business, skeptical of what he views as overreach by regulatory agencies. His rhetoric on antitrust has been mixed: he's criticized Big Tech aggressively, but his Justice Department appointees tend to favor a lighter regulatory touch when it comes to most industries. The administration's economic philosophy emphasizes business confidence, investment, and growth over aggressive enforcement of competition law.

This philosophical difference created immediate friction. According to reporting, the Trump DOJ's pro-business officials have been skeptical of the Live Nation case for months. The argument from their perspective: why push for a trial that could harm a major entertainment company, create uncertainty, and potentially trigger appeals and years of litigation? Why not negotiate a settlement that preserves Live Nation's business while addressing specific competitive concerns?

This tension isn't unique to Live Nation. It reflects a broader ideological split within the Trump administration between those who want aggressive antitrust enforcement and those who prioritize business-friendly policies. In the case of Live Nation, the pro-business camp appears to be winning, at least according to the settlement reports.

How Settlement Discussions Are Happening Outside Antitrust Leadership

The reported settlement talks represent something unusual and concerning: Live Nation executives are negotiating directly with senior Trump administration officials outside the formal antitrust division structure. This isn't how antitrust cases typically work. In standard litigation, the antitrust division handles all settlement negotiations. The division sets policy, manages the legal strategy, and either proceeds to trial or negotiates terms.

But according to sources cited in media reports, Live Nation representatives have been meeting with Trump administration officials who operate outside the antitrust division's hierarchy. These officials apparently have the ear of senior Trump appointees and carry influence over how cases are prioritized and resolved. By going around antitrust chief Gail Slater, Live Nation is essentially appealing to what it sees as a more sympathetic audience within the DOJ: officials who share the administration's pro-business outlook and who might be persuaded that settling is better than proceeding to trial.

Why would this matter strategically for Live Nation? Because settlement negotiations give the company leverage to shape the outcome. In a trial, a judge or jury decides the case based on evidence and law. The company has less control. In settlement discussions, both sides negotiate terms. Live Nation could potentially agree to limited operational changes (maybe divesting a few venues, or changing some fees) in exchange for avoiding a full breakup or major restructuring. From the company's perspective, a negotiated settlement is far better than a trial verdict that could force dramatic changes.

The end-run around Slater signals that Live Nation (or its advisors) believes it has better odds with the Trump DOJ's pro-business wing than with the antitrust-focused division. This calculation might be correct. If the administration's top officials are skeptical of aggressive antitrust enforcement, they might pressure Slater to settle or might override her preferences in settlement discussions.

A DOJ spokesperson responded to reporting about the settlement discussions by stating that the antitrust chief "is very much involved" and that "anonymous attempts to alter markets or outcomes will not undermine the integrity of this process." This is a careful, legalistic response that doesn't deny the substance of the reporting. It acknowledges that talks are happening while asserting that the antitrust division remains in control. But the very fact that such a statement was necessary suggests that the reporting hit close to home. The DOJ felt compelled to defend the integrity of the process, which implies that integrity was being questioned.

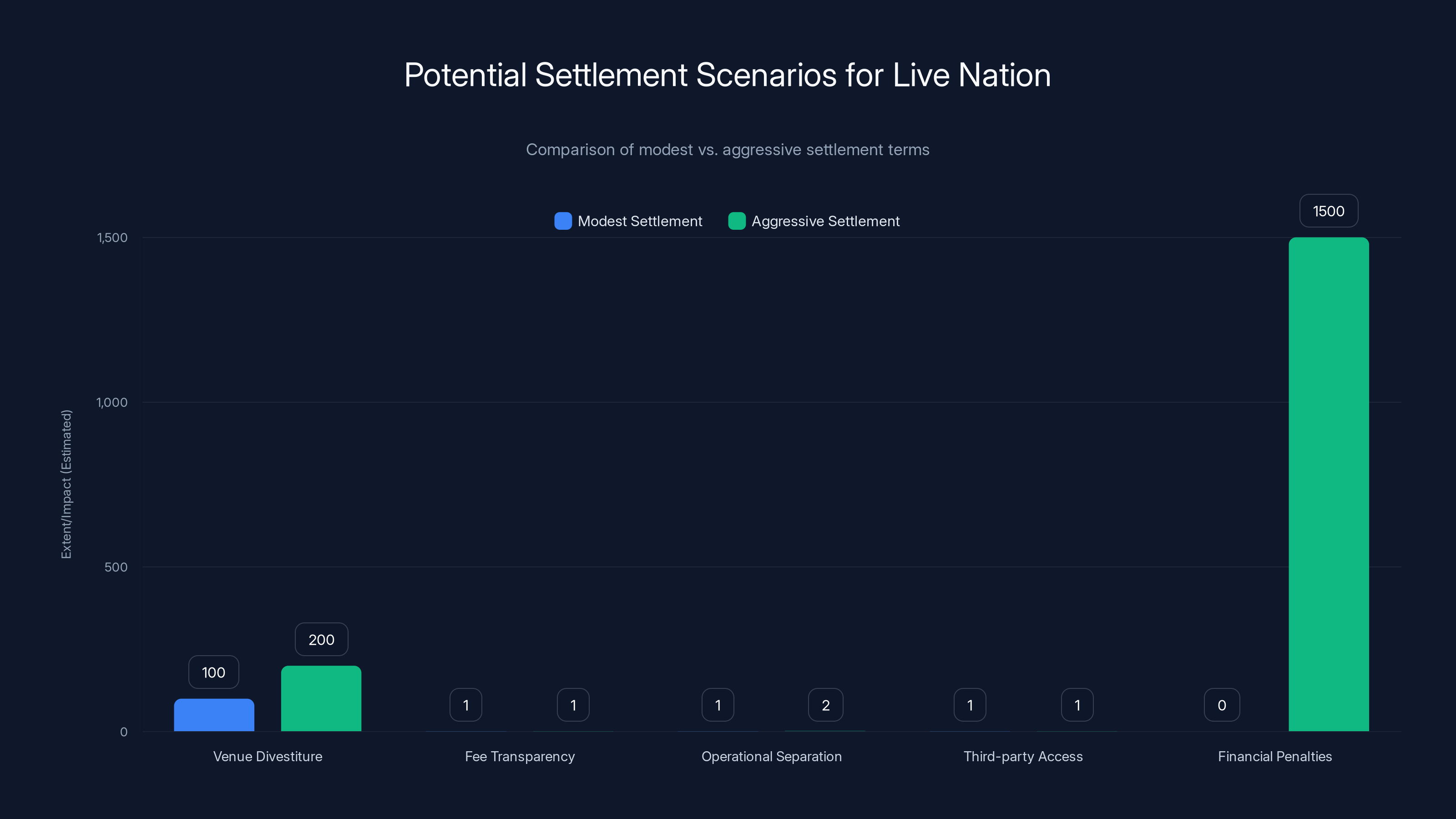

The aggressive settlement scenario involves more significant divestitures and financial penalties compared to the modest scenario. Estimated data based on potential settlement terms.

The Role of Gail Slater and the Antitrust Division's Strategy

Gail Slater represents a particular approach to antitrust enforcement: aggressive, evidence-focused, and committed to pursuing cases through trial if necessary. She inherited the Live Nation case from the Biden administration and maintained the trial timeline. Her position sends a signal: this case is important, the violations are real, and the Justice Department will see it through to a verdict.

Slater's skepticism toward settlement discussions reflects a strategic judgment about antitrust enforcement. Some antitrust experts argue that settlements often let large companies off lightly. Instead of forcing real structural change, settlements typically result in modest operational adjustments. The company pays a penalty or modifies some practices, but the underlying market concentration remains. From this perspective, trials matter because they establish precedent and can force actual competition-enhancing remedies.

But Slater also faces institutional pressure. The Trump administration's leadership doesn't share the Biden administration's commitment to aggressive antitrust enforcement. As reports suggest, pro-business officials within the DOJ have been skeptical of the Live Nation case for months. Slater can maintain her position and push for trial, but if the administration's top leadership decides to settle, she may be overruled. This creates a dynamic where the antitrust chief is fighting an internal battle within her own agency.

The March trial date that Slater championed is particularly important. If the Trump administration can delay or cancel that trial date, settlement becomes more likely. Trials force both sides to commit resources and prepare comprehensively. The closer a trial date gets, the more real the litigation becomes. The further away the date is pushed, the more opportunity for negotiation and pressure to settle. If the DOJ's settlement-minded officials can convince courts or the antitrust division to postpone trial, they increase leverage to negotiate a settlement.

Slater's position is also influenced by the unusual nature of this enforcement action: it's being brought by both the federal DOJ and 30 state and district attorneys general. This multi-jurisdictional approach makes settlement more complex. States have their own views about what they want. Some state attorneys general might favor settlement; others might prefer trial. Coordinating across all these jurisdictions is challenging, and fragmented state views could give the Trump DOJ arguments for settlement (we need consensus, negotiations are more efficient, etc.).

What a Settlement Might Look Like vs. Full Trial Victory

If Live Nation and the Trump DOJ reach a settlement, what might it entail? Several possibilities, ranging from modest to more aggressive changes:

Modest Settlement Scenario: Live Nation agrees to some structural changes that don't fundamentally alter the company's business model. Possible terms might include:

- Divesting a certain number of venues, perhaps 50-150 locations, to reduce venue control

- Establishing more transparent fee structures or fee caps on primary ticket sales

- Creating separate operating divisions so that Ticketmaster ticketing decisions are made independently from venue promotion or artist management

- Allowing third-party ticketing systems more access to venues

- Agreeing to regular reporting to the DOJ on competitive metrics

This scenario preserves Live Nation's fundamental business model. The company remains dominant in ticketing, but with reduced venue control and more operational separation. Consumers might see modest fee reductions or more competitive pressures, but the basic ecosystem remains dominated by a large, integrated company.

More Aggressive Settlement Scenario: If the Trump DOJ wants to show that it's taking antitrust seriously while still settling, the terms might be more demanding:

- Divesting Ticketmaster entirely or spinning it off as a truly independent company

- Selling or divesting 200+ venues to create multiple competing venue operators

- Separating artist management from ticketing and venue operations to prevent conflicts of interest

- Establishing an independent monitor to oversee Live Nation's competitive practices

- Significant financial penalties (2+ billion range)

This scenario represents real structural change. It fundamentally alters the vertically integrated model that has defined Live Nation. It creates competing entities and forces divestiture of major assets.

Full Trial Victory (Government Case): If the case goes to trial and the government wins, the remedy could be even more comprehensive:

- Forced breakup of Live Nation into separate entities: ticketing, venue operation, artist promotion/management

- Potential financial damages to customers who paid inflated prices

- Broader restructuring of how the live entertainment industry operates

- Precedent-setting decision that discourages similar vertical integration in other industries

From the government's perspective, trial has advantages because it establishes facts and law that shape how the industry operates going forward. From Live Nation's perspective, trial is a risk because outcomes are less predictable.

Live Nation, through Ticketmaster, controls approximately 80% of the U.S. primary ticket market, highlighting its dominant position and the antitrust concerns raised.

The Trump Administration's Broader Regulatory Philosophy and Antitrust Approach

Understanding the Live Nation settlement discussions requires stepping back to see Trump's broader approach to regulation and antitrust law. The Trump administration has been consistent in one area: skepticism of aggressive government intervention in business. This applies particularly to cases where enforcement might slow economic growth or hurt major companies.

Trump's public statements on antitrust have been selective. He's been harshly critical of Big Tech companies, particularly Amazon, which he views as competing with his interests. He's supported antitrust actions against tech giants. But his Justice Department has been less uniformly aggressive across all industries. In cases where enforcement might harm large, politically connected companies, or where the administration sees broader business confidence concerns, the DOJ has been more willing to consider settlements.

The Trump team's economic advisors tend to believe in minimal regulatory burden and maximum business flexibility. This isn't necessarily a fringe position. There's a legitimate economic debate about whether aggressive antitrust enforcement helps or hurts consumers. Some economists argue that large, consolidated companies drive efficiency and innovation. Others argue that competition drives better outcomes. The Trump administration has tilted toward the "consolidation isn't necessarily harmful" side of that debate.

Live Nation's case is a test of this philosophy. If the Trump DOJ settles for modest terms, it signals that antitrust enforcement against large entertainment companies isn't a priority. If the administration goes to trial or negotiates strong structural remedies, it suggests that antitrust enforcement will continue despite the administration's pro-business leanings. The Live Nation outcome will likely influence how other companies with antitrust exposure view their litigation prospects under Trump.

It's also worth noting that the Trump administration faces a split within itself. Some officials, particularly those in the antitrust division, came from positions where they believed in vigorous antitrust enforcement. Others came from corporate law or business backgrounds where they're more skeptical of aggressive regulation. This internal tension is playing out in the Live Nation case.

Impact on the Live Entertainment Industry and Consumer Welfare

The Live Nation case matters because the live entertainment industry affects millions of people. Roughly 400 million tickets are sold annually in the United States across concerts, sports, theater, and other live events. When Ticketmaster dominates primary ticketing, Live Nation controls the mechanisms through which artists reach fans and fans reach artists.

Consumers have already experienced the effects of this concentrated market. Concert ticket prices, adjusted for inflation, have increased significantly over the past 15 years. Dynamically priced tickets, where fans pay different prices for the same seat depending on demand, have become standard. Fees that were once 10-15% of the ticket price now routinely reach 25-35%. Some of this price increase reflects genuine costs and market forces, but some also reflects the pricing power that comes from limited competition.

Artists and venues are affected differently. Major artists with negotiating power can push back against Ticketmaster's terms and sometimes use alternative systems. But mid-sized and emerging artists have fewer options. If they want to play major venues, Ticketmaster is often the only practical ticketing option. This limiting of choices affects which artists get promoted, which shows reach audiences, and ultimately what music gets made and heard.

Venues themselves are squeezed. When Live Nation owns competing venues, it can offer more favorable terms to shows that benefit its own properties while making it harder for independent venues to attract major artists. This consolidation of venue ownership has reduced options for promoters and artists, particularly in smaller markets where there might have been multiple competing venues a decade ago.

If the case settles without structural change, these dynamics will likely continue and potentially intensify. Live Nation, confident that antitrust enforcement isn't a major threat, might continue consolidating venues and controlling the ticketing pipeline. If the case goes to trial and the government wins, the remedy would necessarily address these structural issues.

Consumer advocates and some industry participants have called for stronger remedies, arguing that Ticketmaster's market power is genuinely harmful. They point to examples like the Taylor Swift ticket sales debacle, where Ticketmaster's systems were overwhelmed and fans couldn't purchase tickets despite sitting in virtual queues for hours. They argue that having a single dominant ticketer creates bottlenecks and makes the system fragile. Multiple competing ticketers would provide alternatives and redundancy.

Live Nation controls an estimated 80% of the U.S. concert ticket market, highlighting its significant dominance and the focus of antitrust scrutiny. (Estimated data)

State Attorneys General and Their Role in the Multi-Jurisdictional Case

One factor that complicates the Live Nation case is the involvement of 30 state and district attorneys general alongside the federal DOJ. This creates a multi-jurisdictional enforcement action that requires coordination and consensus. It's also potentially a liability for settlement discussions because states may have different preferences about resolution.

Some states, particularly those with strong consumer protection traditions (California, New York, etc.), have been aggressive on antitrust issues. Their attorneys general may be less willing to accept a modest settlement that doesn't address core competition concerns. Other states may be more business-friendly and willing to settle. Coordinating across all these jurisdictions is complex, and fractures in the state coalition could give the Trump DOJ arguments for settling: "Let's get a deal done rather than litigate for years across multiple jurisdictions."

State involvement also reflects a broader point: antitrust enforcement has been increasingly federalized at the state level. Federal antitrust enforcement has been lighter in recent administrations, so states have stepped up. This creates a pattern where state attorneys general are often more aggressive on antitrust than the federal DOJ. The Live Nation case exemplifies this dynamic. The Biden DOJ brought the federal case, and states joined in. Now, under Trump, the federal side is wavering on settlement, but states may hold firm.

Historically, when state attorneys general are committed to a case, they can affect outcomes. They file their own lawsuits, pursue their own litigation strategies, and can continue cases even if the federal government backs down. However, coordination becomes messier and more expensive for everyone. The Trump DOJ might use this jurisdictional complexity as an argument for settlement: "Let's reach a unified resolution rather than litigate in multiple jurisdictions."

Some legal experts have suggested that the Trump DOJ could, in theory, drop the federal claims while allowing states to continue. This would be a political move signaling that the federal government is backing off antitrust enforcement while technically allowing states to pursue the case. From the perspective of settlement pressure, this would be a major shift. It would signal to Live Nation that the federal government isn't behind the case and that the company only needs to negotiate with states, not the federal DOJ.

The Symbolism and Precedent of Backing Down on Live Nation

Beyond the specific facts of the Live Nation case, the decision to settle or proceed to trial carries huge symbolic weight. If the Trump DOJ backs away from the Live Nation case, it sends a clear message about the administration's commitment to antitrust enforcement. The message would be: We're not going to aggressively pursue antitrust cases against large companies that might have political connections or economic importance.

That message would likely ripple across corporate America. Every CEO concerned about antitrust exposure would see the Live Nation outcome and calibrate accordingly. If Live Nation, with its obvious market dominance, can get out of an antitrust case through settlement discussions outside the normal process, what does that say about the risks of other business practices? Companies might become more aggressive about consolidation, pricing, and competitive conduct, knowing that antitrust enforcement is less likely.

Conversely, if the case proceeds to trial and the government wins, the message is the opposite: We take antitrust law seriously even under a pro-business administration, and your market dominance doesn't protect you from enforcement. This would likely discourage similar consolidated structures in other industries.

The precedent is particularly important in entertainment and tech, industries where consolidation has been proceeding rapidly. If entertainment companies see that antitrust enforcement isn't a major risk, consolidation in live events might accelerate. Ticketers, venues, promoters, and artists could be acquired by larger players, further concentrating power. The same pattern could extend to other industries: streaming, gaming, e-commerce, etc.

From a historical perspective, the Live Nation case is significant because antitrust enforcement has been so weak for decades. After the 1990s, antitrust actions became rarer and settlements more common. The Biden administration's return to aggressive enforcement was notable. If the Trump administration scales it back, we're returning to a lighter-touch antitrust environment. Live Nation is the test case for whether that reversal is actually happening.

Live Nation controls an estimated 80% of the U.S. ticketing and concert promotion market, highlighting its significant influence over the industry. (Estimated data)

Comparing Live Nation's Case to Other Major Antitrust Litigation

To understand what might happen with Live Nation, it's useful to look at other major antitrust cases and their outcomes. Here are several important parallels:

AT&T (1982): The Justice Department pursued AT&T for decades and eventually forced a breakup, dividing the company into seven regional operating companies. The remedy was comprehensive and structural. This case is the gold standard for successful antitrust enforcement, but it happened in an era when enforcement was stronger. Could the Trump DOJ achieve a similar outcome for Live Nation? Unlikely, unless political pressure or trial evidence becomes overwhelming.

Microsoft (1990s-2000s): The Justice Department sued Microsoft for anticompetitive practices related to bundling Internet Explorer with Windows. The case went to trial, but the verdict was appealed multiple times. The final settlement in 2004 imposed behavioral remedies (certain business practices were prohibited) but not structural remedies (no forced breakup). Many experts view the Microsoft settlement as insufficient and believe that structural remedies would have been more effective. This case shows how settlement can result in weaker outcomes than full trial victory.

Google: The Justice Department and states have pursued Google on antitrust grounds for search practices, Android, and ad tech. The litigation is ongoing, with some preliminary rulings and settlements in specific areas (like Android), but no comprehensive resolution. The Google case shows that modern tech monopolies can sustain extended litigation and partial settlements without forced breakup.

Amazon: The FTC under Biden pursued Amazon on antitrust grounds, but enforcement momentum has slowed under Trump. The case exemplifies how administration changes can affect antitrust enforcement. Under Biden, the FTC was aggressive. Under Trump, enforcement has been less consistent.

The pattern across these cases: settlement tends to result in weaker remedies than trial victory. Behavioral remedies work less effectively than structural remedies. Cases take years and involve multiple appeals. Companies can often achieve a more favorable outcome through settlement than through full litigation. This explains why Live Nation would prefer settlement: it's lower-risk and likely to result in a more favorable outcome.

The Role of Public Opinion and Media Pressure

One factor that could influence the Live Nation case is public opinion. If the settlement discussions generate significant media criticism and public concern, it could put pressure on the Trump DOJ to show that it's taking antitrust seriously. Conversely, if the public sees the case as a minor regulatory matter, the DOJ has more freedom to settle quietly.

So far, coverage of the Live Nation settlement discussions has been limited to tech and business media. General news outlets haven't picked up the story widely. This is notable because it means public pressure remains limited. If mainstream media ran prominent stories about Live Nation's market dominance and the Trump DOJ backing away from antitrust enforcement, it could change the political calculus. Politicians might feel pressure to support antitrust enforcement even in a business-friendly administration.

There's also the question of whether major events related to Ticketmaster (like another ticket sales disaster, or a viral story about excessive fees) could reignite public interest. When Ticketmaster's systems crashed during Taylor Swift ticket sales, it generated enormous media attention and public outrage. If a similar incident happens, it could increase pressure on the DOJ to pursue the case aggressively, making settlement politically difficult.

Media coverage of antitrust cases often follows a predictable pattern: initial reporting of the lawsuit, quiet years of litigation, and dramatic spikes around major events (trial dates, settlement announcements, verdicts). The Live Nation case is currently in the quiet years phase, but upcoming milestones could change that.

Future Scenarios: What Happens Next in the Live Nation Case

Several scenarios are possible for how the Live Nation case develops:

Scenario 1: Modest Settlement: Live Nation and the Trump DOJ negotiate a settlement in the next 3-6 months. The settlement includes divestiture of 50-100 venues, modest fee transparency requirements, and operational separation of some divisions. The case ends without trial. Live Nation remains a dominant, vertically integrated company, but with somewhat reduced venue control. Most industry dynamics remain unchanged. This is the outcome that the pro-business Trump officials appear to be pushing for.

Scenario 2: Extended Negotiation with Trial Threat: Negotiations continue for 6-12 months, with the trial date getting closer. As trial approaches, pressure increases on both sides to settle. A settlement eventually emerges, but negotiated closer to trial, which means it likely includes stronger remedies than the initial settlement offers. The trial threat forces Live Nation to make more concessions, but full trial still doesn't happen. This scenario is possible if Slater and the antitrust division successfully resist pressure and maintain the trial schedule.

Scenario 3: Trial Proceeds, Government Wins: The case goes to trial in March or later. The government presents evidence of Live Nation's anticompetitive conduct. The court rules in favor of the government and orders structural remedies, including potentially forced divestiture of Ticketmaster or major venue portfolios. Live Nation appeals, and litigation continues for years, but the initial verdict favors the government. This outcome would be a major victory for antitrust enforcement and would likely be appealed extensively.

Scenario 4: Trial Proceeds, Live Nation Wins or Partial Victory: The case goes to trial, but evidence doesn't persuade the court that antitrust violations occurred, or the court finds that any violations were minimal. Live Nation prevails or achieves a partial victory. This outcome would be a major setback for antitrust enforcement and would signal that even dominant companies with obvious market power are difficult to challenge in court. This is less likely than Scenario 3, but possible.

Scenario 5: Federal Government Withdraws, States Continue: The Trump DOJ drops federal claims or signals it won't appeal an adverse judgment aggressively, allowing state attorneys general to continue the case. Litigation becomes more fragmented, with states pursuing separate or coordinated cases. This would be a dramatic signal that the federal government is abandoning antitrust enforcement while formally allowing states to continue. It's a face-saving way for the Trump DOJ to back away while maintaining political cover.

Which scenario is most likely? Based on current reporting and the Trump administration's pro-business orientation, Scenario 1 (modest settlement) appears most likely. But Scenario 2 (extended negotiation with stronger eventual settlement) is possible if the antitrust division successfully resists pressure. Scenarios 3 and 4 require the case going to trial, which becomes less likely as months pass without trial and settlement pressure mounts.

Implications for Other Tech and Entertainment Companies with Antitrust Exposure

Companies across tech and entertainment are watching the Live Nation case closely because it signals broader enforcement priorities. If Live Nation settles for modest terms, every other company facing antitrust exposure gets a signal: the Trump DOJ might be willing to settle. This could encourage other companies to negotiate rather than prepare for trial.

Tech companies in particular are affected. Amazon, Google, Meta, and Apple all face antitrust scrutiny at federal and state levels. If the Trump DOJ signals a preference for settlements over trials, these companies might become more willing to negotiate. Conversely, if the Live Nation case proceeds to trial, tech companies would take that as a signal that antitrust enforcement is serious even under a pro-business administration.

Streaming companies and other entertainment consolidation is also relevant. If Live Nation's vertical integration is left intact through a modest settlement, other entertainment companies might feel encouraged to pursue similar consolidation. Sports leagues, streaming platforms, and music companies might see the Live Nation outcome and decide that vertical integration is acceptable.

The broader implication: the Live Nation case functions as a signal to corporate America about antitrust enforcement priorities. That signal will influence corporate behavior in consolidation decisions, pricing strategies, and competitive practices for years to come.

The Integrity Question: How Should Antitrust Cases Be Negotiated?

Beyond the specific facts of Live Nation, the reported settlement discussions raise a broader governance question: How should antitrust cases be negotiated, and who should have decision-making authority? The fact that settlement discussions are reportedly happening outside the antitrust division hierarchy suggests potential process problems.

In a normal administrative proceeding, authority flows through established hierarchies. The antitrust division has technical expertise and legal responsibility for the case. When senior officials outside the division start negotiating independently, it can create confusion about who's actually in charge and whether decisions are being made based on legal and factual merits or political considerations.

The DOJ's statement that the antitrust chief "is very much involved" is a careful response, but it doesn't deny that parallel settlement discussions are happening. If Slater is "very much involved" but live Nation executives are also meeting with other senior officials, the case has multiple negotiation channels, which creates opportunities for confusion and potentially for one side to play different parties against each other.

Good governance practices in antitrust cases suggest that:

- Settlement negotiations should go through the antitrust division as the primary channel

- Senior DOJ officials can set policy direction, but technical decisions should rest with career attorneys and the antitrust chief

- Settlement decisions should be based on factual analysis and legal merit, not political convenience

- All negotiation channels should be coordinated so that one party isn't playing different officials against each other

The reported settlement discussions in Live Nation appear to violate some of these principles, which is why the case has generated concern about process integrity even before discussing substantive outcomes.

What Consumers, Artists, and Venues Should Know About This Case

If you're a concert fan, artist, venue owner, or anyone with interest in the live entertainment industry, here's what you should understand about the Live Nation case:

For Consumers: Your ticket prices are affected by market concentration in ticketing and venue ownership. If the case settles modestly, you're unlikely to see significant changes in fees or prices. If the case produces structural remedies, competing ticketers might offer alternatives, potentially driving prices down. The settlement decision will likely affect prices you pay for concert tickets for years to come.

For Artists: Your ability to reach audiences and negotiate favorable terms depends partly on competitive options in ticketing and venue booking. If Live Nation remains vertically integrated, your options remain limited. If the case produces structural remedies, you'll have more leverage in negotiations and more platforms for reaching audiences.

For Venues: Independent venues in particular are affected by Live Nation's venue ownership and control of ticketing. If the case settles and Live Nation retains control, competitive pressures on independent venues will likely continue. If structural remedies occur, the landscape becomes more competitive for all venue operators.

For Music Industry Workers: Consolidation in the live entertainment industry affects employment, working conditions, and career paths for promoters, ticketing staff, venue workers, and others. More competition typically means more jobs and better wages. More consolidation typically means fewer jobs and lower pay.

The ultimate question: Do you want the live entertainment industry to be more competitive with multiple players offering ticketing, venues, and promotion? Or do you accept the current model where one company controls most of the pipeline? That's what the Live Nation case is fundamentally about.

Expert Perspectives on the Case and What It Means

Antitrust experts, economists, and legal scholars have offered perspectives on the Live Nation case. There's broad agreement that Live Nation's market dominance is real and substantial. The disagreement is about whether forced structural remedies are the appropriate response.

Those Favoring Stronger Remedies argue that:

- Vertical integration by a dominant firm inherently creates antitrust concerns

- Live Nation's control of ticketing, venues, and promotion creates barriers to entry for competitors

- Behavioral remedies (changed policies) are weaker than structural remedies (forced divestiture)

- The live entertainment industry would be more competitive with separate ticketing, venue, and promotion players

- Consumer prices would be lower with more competition

Those Favoring Settlement or Lighter Remedies argue that:

- Live Nation's integration may create efficiencies that benefit consumers

- The company faces emerging competition (streaming, virtual concerts, alternative ticketing)

- Settlement that includes some structural elements (venue divestiture) might achieve similar outcomes as full trial without years of litigation

- Forcing divestiture is a drastic remedy that should be reserved for extreme cases

- Market dynamics are changing, and forced breakup might be unnecessary if the market is already shifting

The debate reflects genuine disagreement about how antitrust law should work. It's not a simple question of good guys vs. bad guys, but rather different philosophies about competition, market power, and appropriate remedies.

Looking Forward: Timeline, Key Milestones, and What to Watch

If you're tracking the Live Nation case, here are the key milestones to watch:

Spring 2025: Settlement discussions may reach conclusions. If a settlement is announced, the case effectively ends with the terms becoming public. If no settlement emerges and talks stall, that signals the case is heading toward trial.

Summer 2025: If trial is still scheduled, this is when intensive trial preparation intensifies. Both sides finalize evidence, file motions, and prepare arguments. Activity in the case accelerates.

Fall 2025 and Beyond: If trial proceeds, it likely begins in fall 2025 or early 2026. The trial itself may last weeks or months, depending on complexity. Verdict could come in late 2025 or 2026.

Appeals Timeline: If either side appeals an adverse verdict, appeals could extend litigation into 2027 and beyond.

What to watch for:

- Any settlement announcement, which would indicate the shape of compromise terms

- Changes to the trial date, which could signal settlement pressure or procedural delays

- Statements from the DOJ or state attorneys general about their commitment to the case

- Public statements from Live Nation or its representatives about litigation strategy

- Major incidents affecting Ticketmaster (technical problems, high-profile customer complaints) that could reignite public interest

- Changes in personnel at the Justice Department that could affect antitrust enforcement priority

The case is at an inflection point. The decisions made in the coming months will determine whether antitrust enforcement continues aggressively under Trump or scales back to a lighter approach.

FAQ

What is the Live Nation monopoly case?

The Live Nation monopoly case is an antitrust lawsuit filed by the U.S. Justice Department and 30 state and district attorneys general in May 2024. The case alleges that Live Nation Entertainment, which owns Ticketmaster and hundreds of concert venues, uses its vertical integration to create unfair competitive advantages that suppress competition and harm consumers in the live entertainment industry. The government seeks to break up the company or impose significant structural remedies that would separate its ticketing, venue, and promotion operations.

Why is Live Nation considered a monopoly?

Live Nation controls approximately 80% of the U.S. primary ticket market through Ticketmaster, owns or operates hundreds of concert venues worldwide, and manages or promotes major concert tours and festivals through its Ticketmaster Entertainment division. This vertical integration—controlling ticketing, venue operation, and promotion simultaneously—gives Live Nation significant gatekeeping power. Artists who want to hold concerts in major venues often must use Ticketmaster's systems. Venues that want major acts often must use Live Nation's ticketing and promotion services. This concentration of control allows Live Nation to charge higher fees, suppress competitors, and maintain market dominance.

What does vertical integration mean in this context?

Vertical integration means Live Nation owns or controls multiple stages of the value chain in live entertainment: ticketing (Ticketmaster), venues, and promotion/management. This is different from horizontal integration (owning multiple competitors at the same level). Vertical integration can create efficiencies, but when a dominant firm integrates vertically, it can use control of one stage (ticketing) to disadvantage competitors at other stages (promoters, independent venues). That's the core antitrust concern with Live Nation.

Why would settlement discussions exclude the antitrust division?

According to reports, Live Nation executives have met with Trump administration officials outside the Justice Department's antitrust division hierarchy. This apparently reflects different views on the case: the antitrust division wants to pursue the case aggressively through trial, while other Trump administration officials favor settlement. By negotiating outside the antitrust division, Live Nation may be appealing to pro-business officials who are more sympathetic to settlement than trial. This raises governance concerns because antitrust cases traditionally flow through the antitrust division's authority.

What does the Trump administration's position on antitrust mean for this case?

The Trump administration has emphasized pro-business policies and lighter regulation. While the administration has been critical of some Big Tech companies, it's generally skeptical of aggressive antitrust enforcement that might harm large corporations or create uncertainty. In the Live Nation case, pro-business Trump officials reportedly favor settlement over trial. The antitrust division, which inherited the case from the Biden administration, wants to proceed with trial. This split reflects broader tension in the Trump DOJ between pro-business officials and career antitrust professionals.

What would happen if Live Nation settles versus goes to trial?

If Live Nation settles, the outcome would likely be modest structural changes (some venue divestiture, fee transparency requirements) without the full breakup the government initially sought. If the case goes to trial and the government wins, the remedy could include forced divestiture of Ticketmaster, major venue portfolios, and artist management operations, fundamentally restructuring the live entertainment industry. From Live Nation's perspective, settlement is preferable because it's lower-risk and likely to preserve more of the company's integrated model.

How do concert ticket prices relate to this case?

Ticket fees (the 25-35% charges added to face value) partially reflect Live Nation's market dominance and lack of competitive pressure. With Ticketmaster as the only viable primary ticketer for major venues, venues and artists have limited ability to negotiate better terms, so higher fees get passed to consumers. If the case produces structural remedies creating competing ticketers, the additional competition might pressure Live Nation to reduce fees, benefiting consumers.

Why do 30 state attorneys general care about this case?

Antitrust law is enforced at both federal and state levels. States have their own consumer protection and antitrust laws. Since the Trump DOJ might be less aggressive on antitrust, state attorneys general stepped up to bring the case with the federal DOJ. States have constituents (voters, local businesses) who are affected by Live Nation's market dominance through high ticket prices and reduced venue competition. State involvement makes settlement more complex because states may have different preferences than the federal government about whether to settle or proceed to trial.

Could the Trump DOJ drop the case entirely?

Theoretically, the Trump administration could drop the federal claims, though this would be politically controversial and would likely trigger a backlash from state attorneys general. Dropping federal claims while allowing states to continue would be a face-saving way to signal that the federal government is deprioritizing the case without formally backing away. However, this would likely energize state-level antitrust enforcement even more.

What does this case signal about Trump's antitrust approach?

The Live Nation case serves as a test of Trump's administration's antitrust enforcement priorities. If the case settles for modest terms, it signals that aggressive antitrust enforcement against large corporations won't be a priority. If the case proceeds to trial, it signals that antitrust enforcement continues despite the administration's pro-business orientation. Other companies with antitrust exposure are watching closely to see what outcome the Live Nation case produces.

How long could this litigation take?

If the case settles, resolution could come in months. If it goes to trial, the trial itself could last weeks or months, followed by appeals that could extend litigation for years. Based on comparable antitrust cases, the entire process could take 5-10 years if fully litigated through appeals. This extended timeline is itself an incentive for settlement, because both sides might prefer certainty over years of uncertainty.

Conclusion: A Pivotal Moment for Antitrust Enforcement

The Live Nation settlement discussions reveal a deeper struggle within the Trump Justice Department between antitrust enforcement and pro-business ideology. This isn't just about Live Nation or the live entertainment industry. It's about whether the United States government takes antitrust law seriously or whether corporate consolidation becomes the path of least resistance.

The case encapsulates real problems that consumers experience: ticket fees that seem unjustifiable, lack of alternatives in ticketing, and consolidation in the live entertainment industry that reduces competition and options. These problems are genuine. The question is whether government will address them or accept them as inevitable consequences of business consolidation.

What makes the Live Nation case particularly significant is that it's one of the first major antitrust cases to be tested under the Trump administration. The outcome will shape enforcement priorities for years. If settlement occurs on favorable terms for Live Nation, it sends a message to corporate America: aggressive antitrust enforcement is unlikely, and you can negotiate your way out of cases. If the case proceeds to trial or produces strong structural remedies, the message is different: we take market dominance seriously even in a pro-business administration.

The reported settlement discussions happening outside the antitrust division also raise governance concerns. In a healthy administrative system, policy flows through established hierarchies and is informed by career expertise. When settlement negotiations happen in parallel channels, it creates opportunities for political pressure to override legal and factual judgment. The DOJ's statement that the antitrust chief is "very much involved" is a necessary affirmation, but the fact that such affirmation was needed suggests that the normal process has been questioned.

For consumers, artists, venues, and anyone with interest in how the live entertainment industry operates, the stakes are real. The case will influence ticket prices, competitive options, and the structure of the industry for years. A settlement that preserves Live Nation's integrated model means continuing current dynamics. A full trial victory for the government could fundamentally reshape the industry.

The broader lesson: antitrust law is not some abstract legal principle. It affects prices you pay, choices you have, and who benefits from industry consolidation. The Live Nation case is a test of whether government will enforce antitrust law or step back. The answer will matter far beyond ticketing.

As the case progresses over the coming months, watch for settlement announcements, trial date changes, and statements from DOJ officials. These signals will reveal whether the Trump administration's pro-business approach extends to blocking aggressive antitrust enforcement or whether career antitrust professionals successfully maintain enforcement priorities. The outcome will likely define antitrust enforcement for the Trump era and potentially beyond.

Key Takeaways

- Live Nation settlement discussions are reportedly happening outside the Justice Department's antitrust division, suggesting internal DOJ fractures over enforcement priorities

- Live Nation controls approximately 80% of U.S. primary ticket market through Ticketmaster and owns hundreds of venues, creating significant market dominance

- Trump administration pro-business officials favor settlement while antitrust chief Gail Slater pushes for trial in March, reflecting broader ideological differences

- Settlement would likely preserve Live Nation's integrated business model with modest operational changes, while trial could result in forced divestiture and structural remedies

- The case's outcome signals whether Trump's DOJ will maintain aggressive antitrust enforcement or scale back to lighter regulation favored by business-friendly officials

Related Articles

- Netflix DOJ Antitrust Investigation: What It Means for Streaming [2025]

- The SCAM Act Explained: How Congress Plans to Hold Big Tech Accountable for Fraudulent Ads [2025]

- Bad Bunny's Super Bowl LX Halftime Show: Behind-the-Scenes [2025]

- Chris Hemsworth Crime 101 Stunts: Director Reveals Truth [2025]

- Uber Liable for Sexual Assault: What the $8.5M Verdict Means [2025]

- Disney's Parks CEO Becomes Company Leader: What Changes for Guests [2025]

![Live Nation's Monopoly Trial: Inside the DOJ's Internal Battle [2025]](https://tryrunable.com/blog/live-nation-s-monopoly-trial-inside-the-doj-s-internal-battl/image-1-1770640607254.jpg)