Why YouTube TV's New Sports Subscription Is Causing Uproar Among Subscribers [2025]

Google just dropped a sports subscription bomb, and the internet's reaction has been pretty brutal. In January 2025, YouTube TV announced a new sports-focused add-on tier priced at $14.99 per month. Sounds reasonable on paper, right? But there's a catch that's got subscribers absolutely losing it: ESPN won't be included until sometime in 2026.

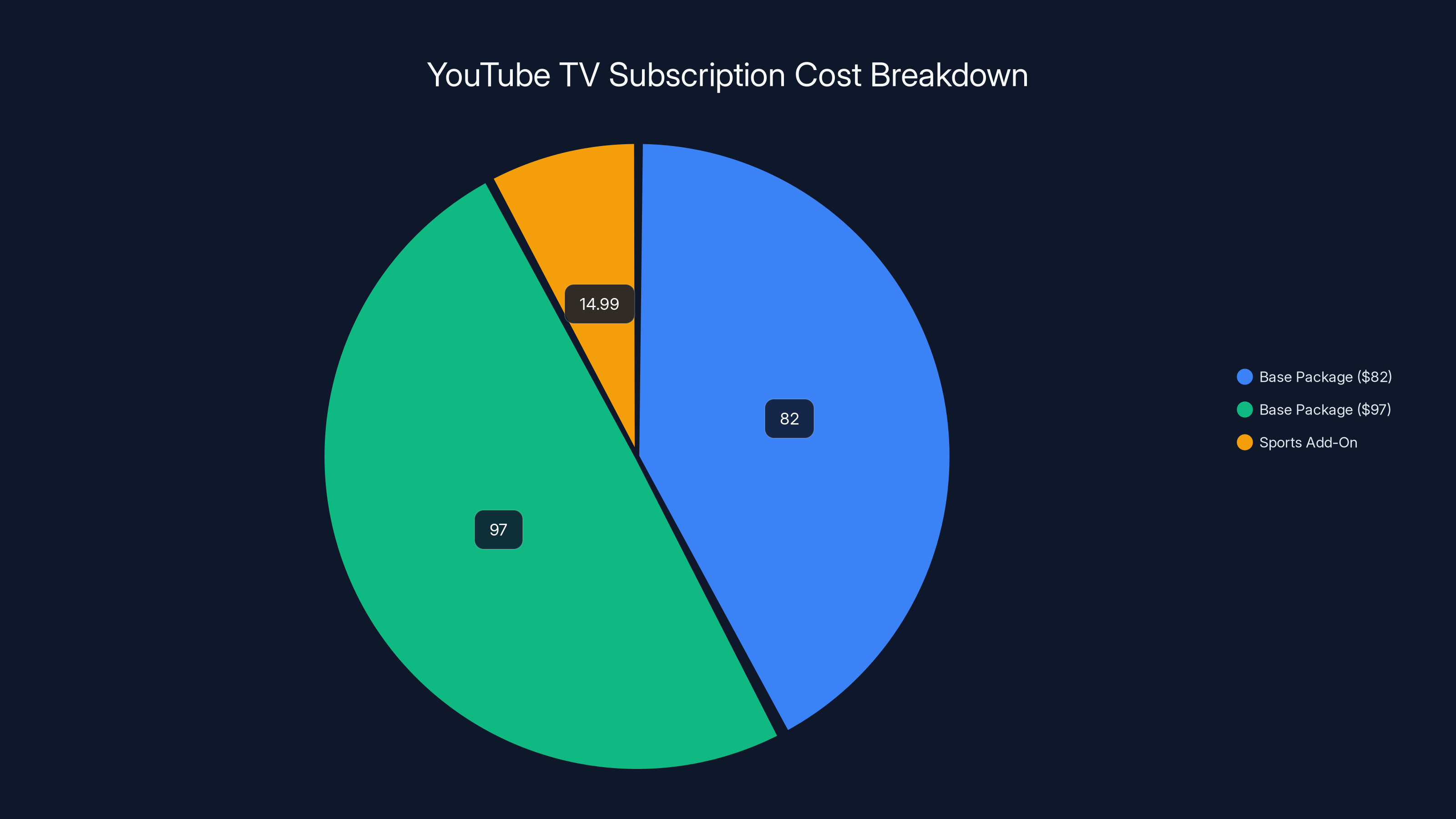

I'll be honest, this move is a masterclass in how to frustrate your most loyal customers. YouTube TV already costs between

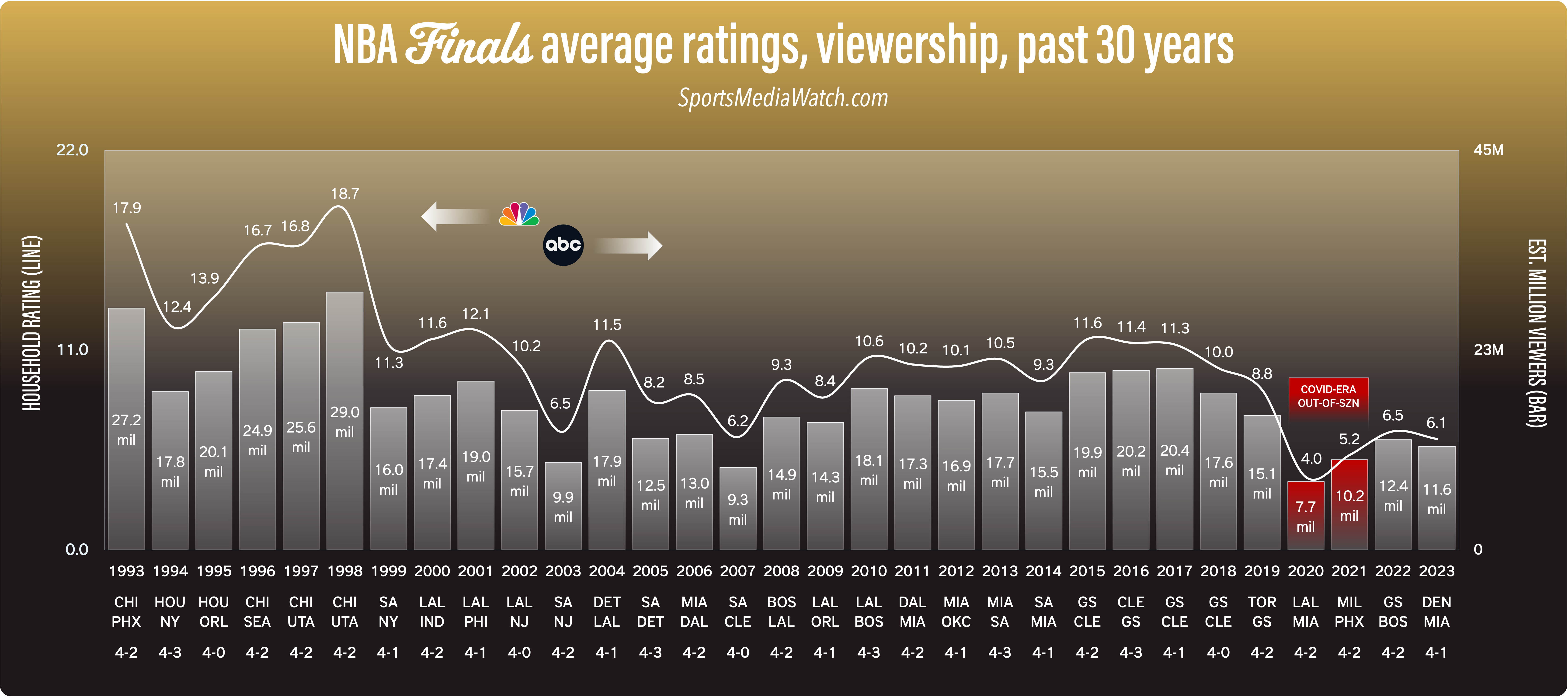

Here's the thing though: this isn't just about YouTube TV being greedy. There's a bigger story happening in the streaming wars right now. Cable is collapsing. Live sports are one of the few things still tethering people to traditional TV. Networks know this. So they're squeezing hard while they still can. YouTube TV's new strategy is basically admitting they're betting everything on live sports being the last thing people will actually pay premium prices for.

But let's dig into what's actually happening here, why subscribers are so mad, and whether this price tag makes any sense at all.

The YouTube TV Sports Tier: What You Actually Get

The new sports add-on from YouTube TV includes access to over 35 sports networks. We're talking about the big names here: NFL Network, NBA TV, NHL Network, MLB Network, and college sports channels. You also get access to major league games across football, basketball, hockey, and baseball through their primary feeds.

But that's where the good news basically ends. The package doesn't include Peacock premium content (where NBC's games live), and it doesn't include mainstream ESPN channels. That's a massive gap. ESPN airs everything from NBA games to college football to the World Series. Excluding ESPN from a sports subscription in 2025 is like launching a music streaming service without Taylor Swift.

YouTube TV claims they're negotiating ESPN access and plan to add it sometime in 2026. Sometime. Not a specific date. Just "sometime." If you've ever negotiated a contract, you know how vague that language is. It basically means the deal isn't done, and they're hedging their bets.

The other kicker: if you already subscribe to YouTube TV, this sports tier isn't bundled into your existing package. It's a complete add-on. So a family paying

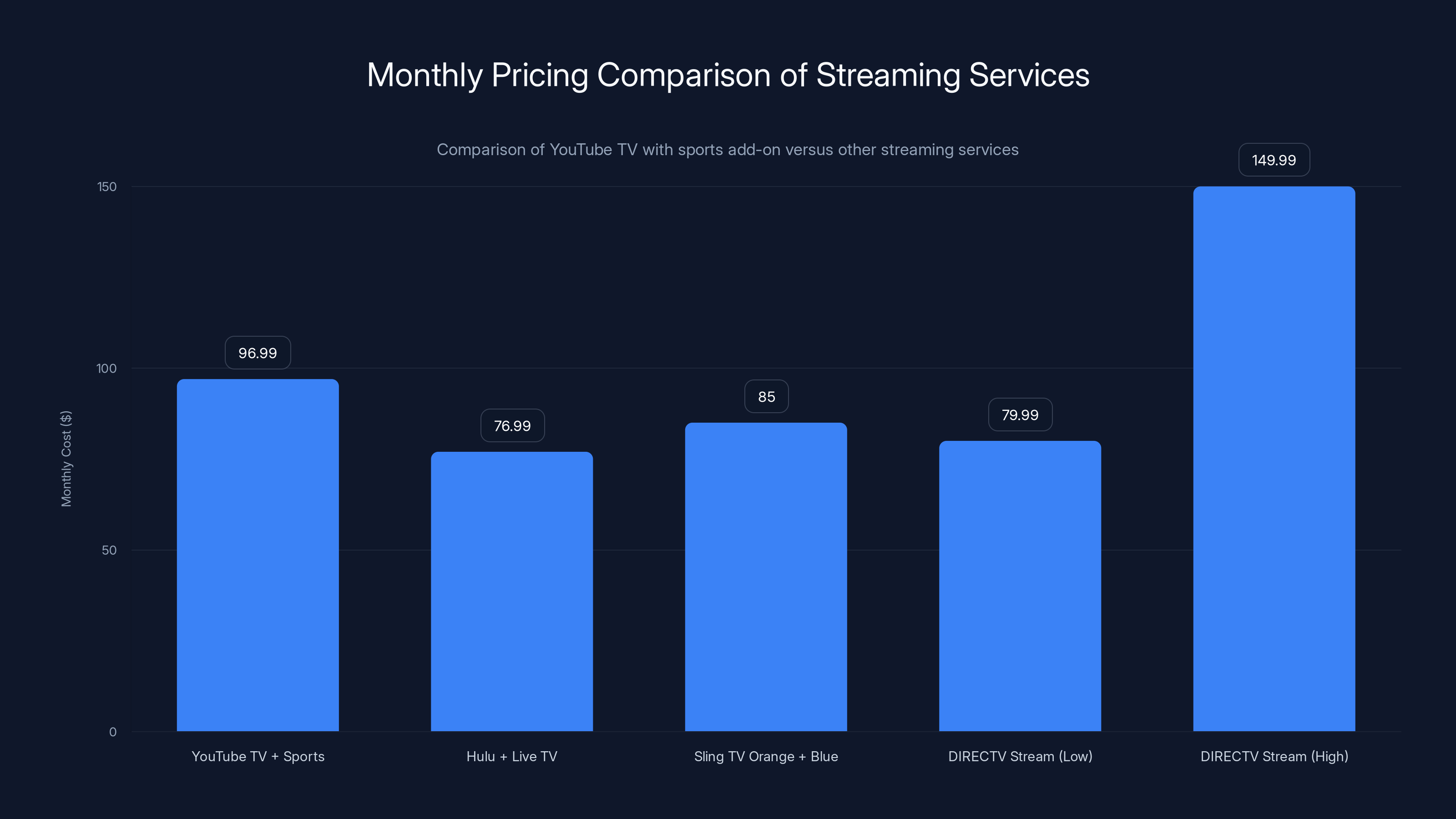

YouTube TV with sports add-on is the most expensive option at

Why Subscribers Are Calling It "Absurd"

Reddit, Twitter, and YouTube TV's own support forums have been absolutely roasting this announcement. And reading through the complaints, I actually get it. The frustration isn't really about the $14.99 price point itself. It's about the incompleteness of the offering.

A typical complaint looks something like this: "I pay

Sports fans have specific needs. They don't want some of their sports channels. They want all of them. A baseball fan needs MLB games. A football fan needs NFL content. A basketball fan needs NBA access. If YouTube TV's sports tier is missing any of these major components, it's basically useless to that person. You can't build a product around sports, exclude the most important sports network in America, and expect people to celebrate.

Here's another issue that's not being talked about enough: YouTube TV already raised prices multiple times in the last three years. The base package went from

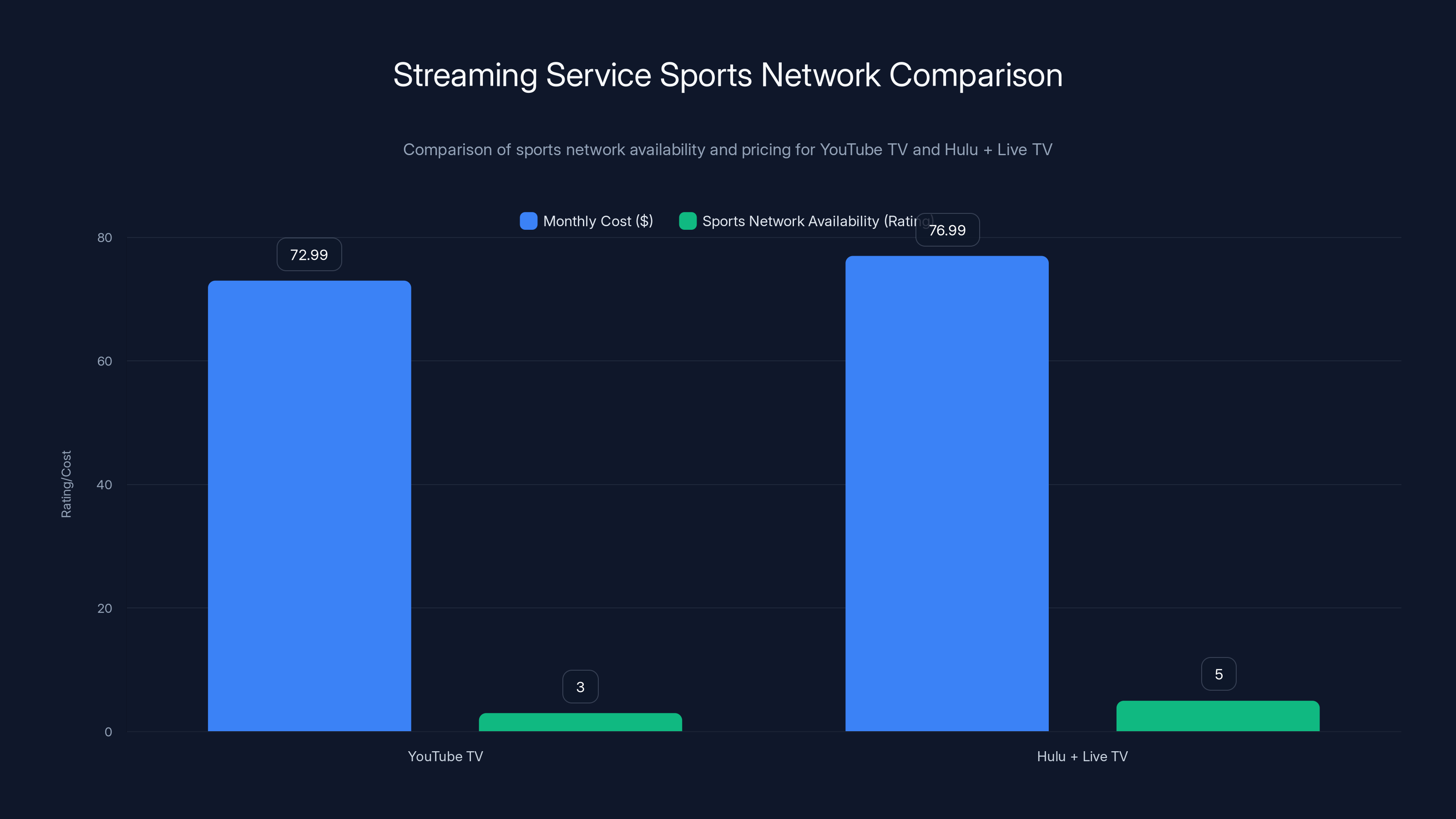

Hulu + Live TV offers the best value for comprehensive sports coverage at

The ESPN Problem: Google's Missing Piece

Let's talk about the elephant in the room. ESPN is owned by Disney. Disney owns a massive chunk of the sports rights in America. The Walt Disney Company controls ESPN, ABC Sports, and countless other broadcast outlets. Google needs ESPN access to make this work. Everybody knows it. Subscribers know it. But Google apparently couldn't negotiate the deal before launching.

That's either terrible negotiating or a deliberate strategy. If it's the latter, Google might be launching this sports tier as a pressure tactic to force Disney's hand in negotiations. "We're offering sports without ESPN, and customers hate it. Now maybe you'll give us better licensing terms." It's cynical, but it's plausible.

The real problem is that licensing sports content is brutally expensive. Networks pay billions of dollars for broadcasting rights. Those costs get passed down to consumers through subscription fees. ESPN's fees alone have historically been some of the highest in the cable bundle. When YouTube TV tries to offer sports without ESPN, they're trying to sell a Porsche without the engine and calling it a good deal.

Meanwhile, competitors like Hulu + Live TV still include ESPN in their base packages. Sure, Hulu costs $76.99 (slightly cheaper than YouTube TV), but you're getting the full sports network lineup. It's a no-brainer comparison when you stack it up against YouTube TV's fragmented approach.

The six-month wait for ESPN access means Google is essentially asking customers to pay for an incomplete product and trust that ESPN will be added "soon." In the streaming world, that's basically asking for a leap of faith. No customer likes that.

Pricing Strategy: Is $14.99 Actually Competitive?

If we're being objective about the price itself, **

But context matters. Here's the math on what YouTube TV is actually charging:

YouTube TV Base Package:

For comparison:

Hulu + Live TV:

When you stack these side by side, YouTube TV's sports tier pricing looks aggressive, not competitive. You're paying nearly

There's also the psychological pricing issue. People hate fragmentation. They hate feeling like they're getting nickel-and-dimed. A clean, all-in pricing model is simpler to understand and feels less exploitative. By splitting sports into a separate add-on, YouTube TV is triggering that "death by a thousand cuts" feeling that made people hate cable in the first place.

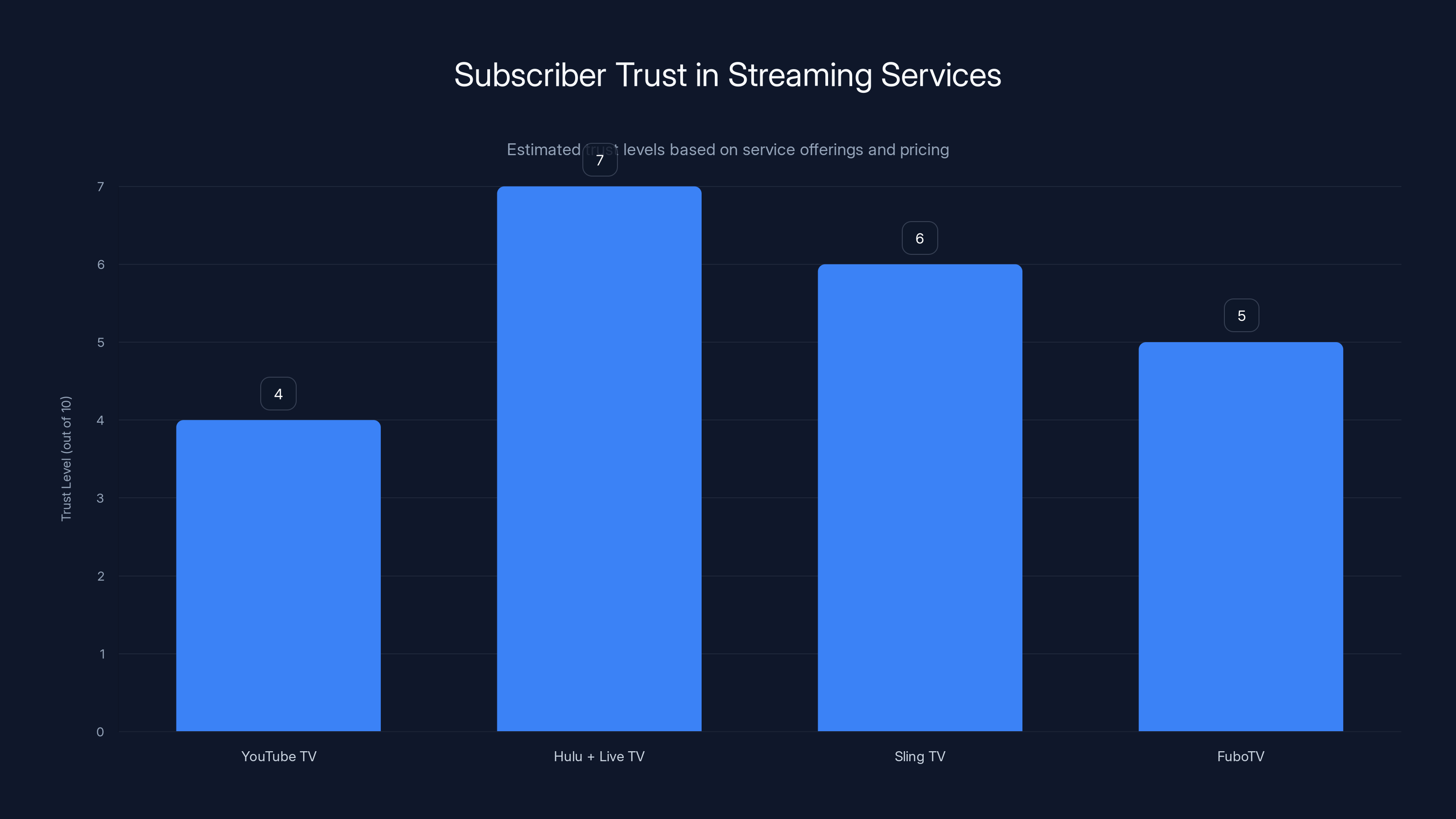

Estimated data suggests YouTube TV has lower trust levels compared to competitors due to pricing and service changes.

The Bigger Picture: How Streaming Is Becoming Cable 2.0

Here's what's really going on. Streaming services launched as the antidote to cable. No long-term contracts. No inflated bundles. Just the content you want at a reasonable price. But five years in, streaming companies realized they can't make money on pure content. They need scale. They need more subscription revenue.

So they started raising prices. First by small amounts ($1-2 per month increases that nobody really noticed). Then they started adding ad-supported tiers, pushing premium prices higher to make the ad tier look attractive. Then they cracked down on password sharing. And now they're creating add-on tiers for specific content categories.

YouTube TV is following the exact same playbook that made people hate cable. Create a base package at a "reasonable" price, then charge extra for premium content. The difference is that cable at least bundled everything together. With YouTube TV, you get to pay for one service, then decide which add-ons you need.

It's the worst of both worlds. You've got the complexity of cable bundling combined with the fragmentation of a la carte pricing. And the price keeps creeping up no matter what tier you're on.

Regional Sports Networks: The Content Puzzle

Here's a detail that doesn't get enough attention. YouTube TV's sports tier primarily focuses on national sports networks. But a huge chunk of sports content lives in regional sports networks. If you want to watch your local NBA team, or your regional college football conference, or minor league baseball, you might need access to specific regional feeds.

These regional networks have incredibly complicated licensing rights. They're often owned by local broadcasters or teams themselves. Getting all of them onto a single streaming platform is technically a nightmare. YouTube TV's national-focused sports tier works for people who care about national championships and league-level broadcasts. But for fans with regional attachments, it's probably incomplete.

That's another reason subscribers are frustrated. It's not just about ESPN. It's about the whole sports ecosystem being fragmented across so many different platforms. You might need:

- YouTube TV for some games

- ESPN+ for exclusive broadcasts

- Peacock for NBC sports

- Paramount+ for CBS sports

- Amazon Prime for Thursday Night Football

- Individual team apps for regional broadcasts

That's six different subscriptions just to catch all of your team's games. YouTube TV's sports tier doesn't solve that problem. It just adds another layer to the complexity.

The new sports add-on increases the total cost of YouTube TV subscriptions, with the base package already ranging from

The Negotiation Problem: Why ESPN Wasn't Ready at Launch

The fact that ESPN isn't included at launch is the real tell here. Google clearly couldn't negotiate a deal before announcing this product. That suggests the negotiation is either still ongoing or it fell apart and they're trying to regroup.

Licensing negotiations in the sports world are incredibly tense right now. ESPN's parent company, Disney, is trying to figure out its own streaming strategy. They launched ESPN+ as a direct competitor to services like YouTube TV. Disney wants to push people toward ESPN+ for premium sports content, not toward YouTube TV. So negotiating ESPN access to YouTube TV goes against Disney's own strategic interests.

Google probably had to offer significant money or concessions to get ESPN on board. Maybe they couldn't reach a deal at the last minute. Maybe Disney wanted too much money. Or maybe Google is launching without ESPN specifically to pressure Disney into better licensing terms. Whatever happened, the customer is left holding the bag.

This is the dirty secret of streaming. The best deals happen behind closed doors, and customer-facing products are built around whatever deals actually get signed. YouTube TV is literally asking customers to wait six months for an incomplete product because of behind-the-scenes licensing negotiations that haven't concluded yet.

That's terrible customer service. And it's exactly the kind of thing that makes people nostalgic for cable, believe it or not.

Comparing Sports Streaming Options: What Actually Works

If sports are your primary need, let's be honest about which services actually deliver the full package right now.

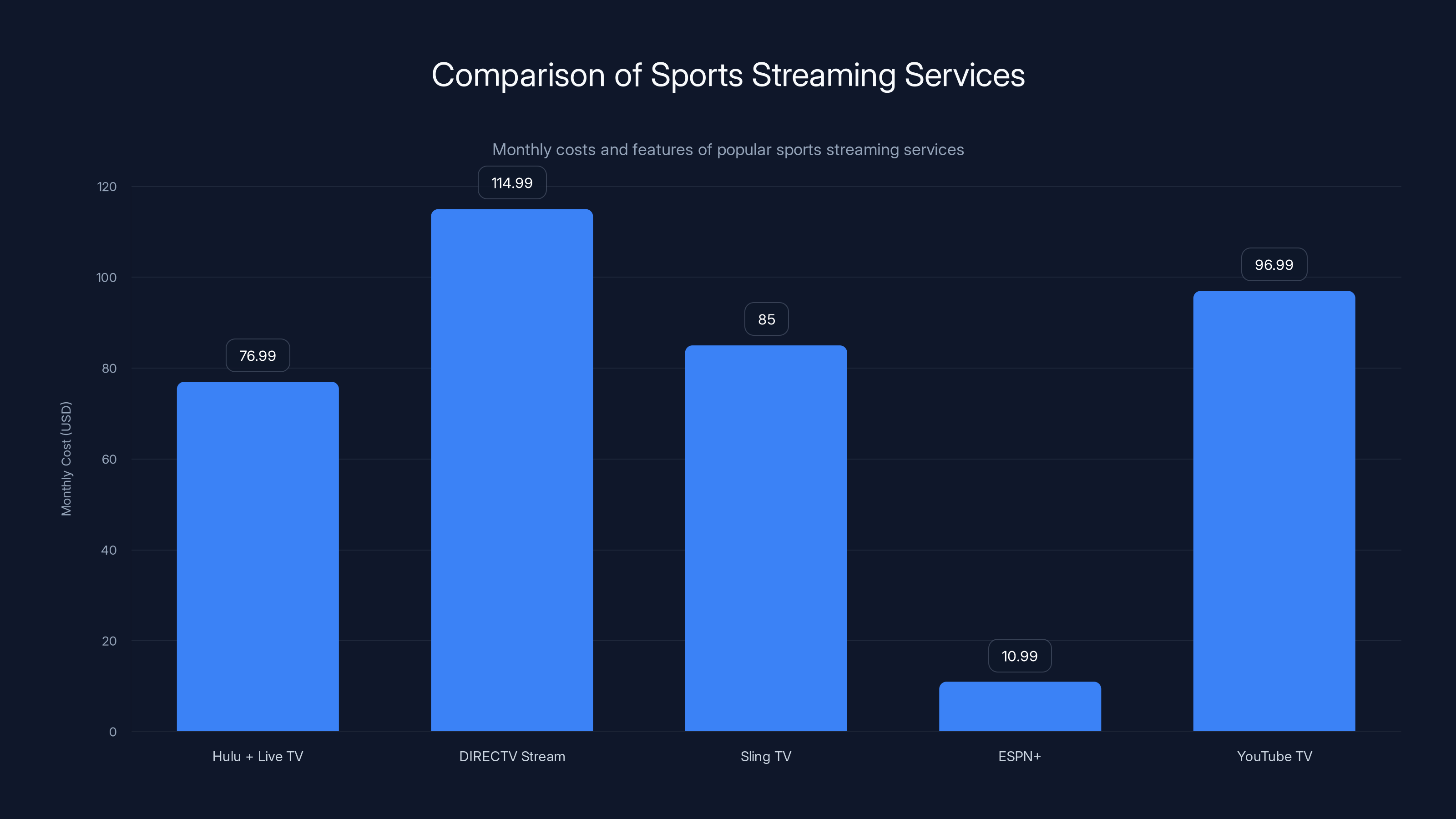

Hulu + Live TV remains the most comprehensive option for sports fans willing to pay for streaming. You get ESPN, ABC, Fox, and a massive lineup of regional and national sports networks. The interface is integrated with Hulu's on-demand content, so you can watch full games or highlights on demand. It costs $76.99/month, and honestly, it's probably still the best value for casual sports fans.

DIRECTV Stream is basically cable pricing but without the cable box. You can get the full sports lineup, but you're paying

Sling TV offers a weird but workable solution. The Orange tier includes ESPN and some sports content, while the Blue tier includes other sports networks. Together they're about $85 per month. It's budget-friendly compared to other options, but the interface is clunky and some streaming quality issues persist.

ESPN+ on its own is cheap at $10.99/month, but it's really just for exclusive ESPN content and original programming. It doesn't include live games from major networks. It's a supplement, not a replacement.

YouTube TV with the new sports add-on would slot into this comparison at $96.99/month (once ESPN is added), making it the most expensive option and offering less integrated content than Hulu or DIRECTV Stream.

Hulu + Live TV offers a more complete sports network lineup, including ESPN, at a slightly higher cost than YouTube TV, which lacks ESPN access.

Will The Sports Tier Survive Long-Term?

Here's my prediction: YouTube TV's sports tier either becomes wildly successful, or it gets quietly killed within two years.

For it to succeed, Google needs ESPN access to launch quickly. Like, not in "2026 sometime," but in the next 2-3 months. Otherwise, the product is dead on arrival. Nobody's going to pay $15/month for sports that don't include the most important sports network.

Second, Google needs to add more value around the sports content. Right now, it's just channel access. But imagine if YouTube TV bundled in sports analysis, AI-powered highlight compilations, personalized game recommendations, or fantasy sports integration. That would actually justify the add-on cost and differentiate it from competitors.

Third, Google needs to be aggressive on the ESPN licensing deal. They need to offer Disney whatever it takes to get ESPN included and available at launch. The cost is worth it if it means the product actually sells.

If Google fumbles any of these three things, the sports tier will become another embarrassing failed product launch from a tech giant trying to break into media. Google has a track record of this. Remember Google Play Music? Remember Stadia? Google is good at a lot of things, but sustained media success isn't one of them.

The sports tier could become another casualty.

The Subscriber Trust Problem

There's something else happening here that isn't about the price or the product. It's about trust.

YouTube TV subscribers have already absorbed multiple price increases. They've watched the service get worse in some ways (it used to be cheaper, and you could get more channels in the base package). Now YouTube TV is asking them to trust that:

- ESPN will actually be added in 2026

- The price won't increase again in the next year

- The service is worth paying nearly $100/month for

None of those are safe assumptions. YouTube TV will probably raise prices again. ESPN might take longer than 2026 to integrate. And even if everything goes perfectly, $100/month is hard to justify when Hulu + Live TV delivers more for less.

Trust is the real currency in the streaming wars right now. People don't just want good products. They want to feel like they're getting a fair deal and that the company isn't constantly trying to squeeze more money out of them.

YouTube TV is failing on that front. This sports tier announcement reeks of desperation and greed. It's a company that's no longer confident in its value proposition, so it's trying to carve out a niche product for a specific audience and charge premium pricing for it.

Subscribers are rightfully calling that out.

What YouTube TV Should Have Done

If I were advising Google, here's what I would have recommended:

First, lock down ESPN before announcing anything. Don't launch a sports product that's missing the most important sports network. That's negotiation 101. If Disney won't play ball, either offer more money or don't launch the product.

Second, bundle sports into the existing YouTube TV tiers instead of creating a separate add-on. Raise the base price by $12-15 if you have to, but keep the pricing model simple. People hate fragmentation.

Third, add value-added services around the sports content. Partner with sports betting apps. Integrate fantasy sports. Offer AI-powered highlight reels. Make the sports tier actually different from just adding channels.

Fourth, offer a promotional rate for the first year. Make it $9.99/month as an introductory offer to drive adoption. The goal should be to build a subscriber base quickly, not to maximize short-term revenue.

Fifth, be transparent about pricing. Tell customers exactly when ESPN will be added and commit to no price increases for 12-24 months. Rebuild some trust.

None of these ideas are revolutionary. They're just good business practices that YouTube TV completely ignored.

The Bigger Streaming Wars Context

It's worth remembering that YouTube TV operates in a crowded market where everyone is scrambling to compete. Netflix, Disney+, Amazon Prime, and traditional cable companies are all fighting for the same dollars.

Live sports are genuinely one of the few competitive advantages left. It's hard to pirate live sports. People will pay for them. And unlike on-demand content (which is increasingly available on free ad-supported services), sports require a real-time broadcast that people are willing to pay for.

So every streaming service is betting everything on live sports. That's why the negotiations are so tense, and why ESPN is worth billions of dollars to Disney.

YouTube TV's sports tier is essentially Google admitting they're all-in on this bet. But they're doing it half-heartedly. They're launching without ESPN, without value-added services, and without a clear price advantage. It's not a winning strategy.

What Subscribers Should Do Right Now

If you're a YouTube TV subscriber trying to decide whether to add the sports tier, here's my honest advice:

Don't, at least not yet. Wait until ESPN is actually integrated and available. Then reassess whether the full service is worth $96.99/month compared to alternatives like Hulu + Live TV.

If you're considering YouTube TV specifically for sports, I'd probably recommend Hulu + Live TV instead. It's cheaper, more complete, and less likely to fragment in the future.

If you're already paying for YouTube TV and you have sports channels you want to watch, check which sports networks are actually included in the tier. Make sure it covers your specific needs before paying for it.

Most importantly, don't feel pressured to subscribe to incomplete products. YouTube TV has great things going for it (the interface is clean, cloud DVR works well), but this sports tier isn't one of them. Not yet anyway.

The Future of Sports Streaming

In the next two years, I expect we'll see massive consolidation in sports streaming. Services that can't negotiate comprehensive sports rights will start folding or selling off their streaming divisions. The winners will be whoever can offer the most complete sports lineup at the best price.

Right now, that's Hulu + Live TV. But if YouTube TV manages to add ESPN quickly and keeps the price reasonable, they could become a serious competitor. If they don't, this entire sports tier experiment will be quietly discontinued within 18 months.

The bigger trend is that streaming is becoming cable 2.0. Services are adding price tiers, introducing ads, fragmenting content, and creating add-on channels. The dream of cheap, simple streaming is basically dead. We're back to paying $80-100/month for bundled media, except now it's fragmented across different services instead of consolidated in one cable box.

That's not a win for consumers. It's just a different flavor of the same exploitation that made people hate cable in the first place.

FAQ

What is the YouTube TV sports subscription tier?

The YouTube TV sports subscription tier is a $14.99/month add-on service that provides access to over 35 sports networks including NFL Network, NBA TV, NHL Network, and MLB Network. However, it notably excludes ESPN, which Google says will be added sometime in 2026.

How much does YouTube TV cost with the sports add-on?

YouTube TV's base package starts at

Why don't ESPN channels come with the sports tier at launch?

Google has not publicly disclosed specific reasons, but ESPN is owned by Disney, which operates its own streaming services including ESPN+ and has complex licensing agreements. The companies are apparently still negotiating terms, which is why ESPN access has been delayed to sometime in 2026.

Which sports networks are included in the YouTube TV sports tier?

The tier includes NFL Network, NBA TV, NHL Network, MLB Network, college sports channels, and over 35 total sports networks. However, it excludes ESPN, Peacock premium sports content, and many regional sports networks that carry local team broadcasts.

Is YouTube TV's sports tier cheaper than other streaming services?

No. When you factor in YouTube TV's base package price, the combined cost of

When will ESPN be available on YouTube TV's sports tier?

Google has stated that ESPN access will come "sometime in 2026," but no specific date has been announced. This vague timeline is one of the primary complaints from subscribers, who are hesitant to pay for an incomplete product.

Should I switch to YouTube TV for sports?

Not necessarily. Unless you have specific requirements that YouTube TV uniquely meets, services like Hulu + Live TV offer more comprehensive sports coverage at a lower price. It's worth comparing what specific sports networks and games you actually need before making a decision.

What other sports streaming options are available?

Main alternatives include Hulu + Live TV (

Are regional sports networks included in the YouTube TV sports tier?

Regional sports networks have limited availability on YouTube TV's sports tier. Local team broadcasts often aren't included, which is a significant limitation for fans who want to follow their regional teams throughout the season.

Has Google given a reason for excluding ESPN at launch?

Google has not provided a detailed explanation, but industry analysts believe licensing negotiations with Disney (ESPN's parent company) didn't conclude before the product launch. This suggests the companies are still working out terms, which is why ESPN access is projected for later in 2026.

Key Takeaways

- YouTube TV's 96.99, making it more expensive than competing services like Hulu + Live TV at $76.99/month

- ESPN exclusion from launch until 'sometime in 2026' makes the sports tier incomplete and uncompetitive against services that include ESPN in base packages

- Streaming services are replicating cable's bundling and fragmentation strategies, eliminating the original value proposition of cheap, simple streaming

- Subscribers have already absorbed multiple YouTube TV price increases and are skeptical of paying for incomplete products with vague delivery timelines

- Regional sports networks remain fragmented across multiple platforms, requiring customers to subscribe to 5-6 different services to watch all games

Related Articles

- YouTube TV Custom Bundles: Breaking Streaming Costs Down [2025]

- YouTube TV Custom Channel Packages & Pricing Guide [2025]

- YouTube TV Curated Subscription Packages: Save Money on Streaming [2025]

- HBO Max UK Launch Date, Pricing & How It Compares to Netflix [2025]

- YouTube TV $80 Discount: How to Get It Before 2025 Ends

- Spotify Hits 750M Users: Growth Drivers Behind the Numbers [2025]

![YouTube TV Sports Subscription: Why Subscribers Are Furious [2025]](https://tryrunable.com/blog/youtube-tv-sports-subscription-why-subscribers-are-furious-2/image-1-1770743524583.jpg)