Introduction: From One Thing to Everything

There's a moment in every brand's life when success becomes a liability. For Dreame, that moment might be right now.

Five years ago, Dreame was laser-focused. Robot vacuums. That was it. And they were damn good at it. The company built a reputation for delivering flagship features at mid-tier prices, undercutting brands like i Robot and Ecovacs while matching their technology. Robot vacuum buyers took note. Reviews praised them. Word spread.

Now? Open their product page and you'll find robot vacuums, yes, but also mops, cordless vacuums, handheld models, air purifiers, dehumidifiers, and appliances I honestly had to Google to understand. They've gone from "the company that makes great robot vacuums" to "the company that makes literally anything."

This isn't unusual. Successful hardware makers do this. Dyson did it. Philips did it. Shark is doing it now. But there's a difference between building a home appliance ecosystem and losing your identity in the noise.

Here's what concerns me: Dreame's expansion feels less like strategic diversification and more like "we see a market, let's enter it." And that worries me for reasons I'll break down below.

What Dreame Actually Is Now

Dreame started as a subsidiary of Xiaomi, but spun off into its own brand around 2015. The company's focus was always the Chinese market first, global market second. They understood the home automation space because they were embedded in Xiaomi's ecosystem.

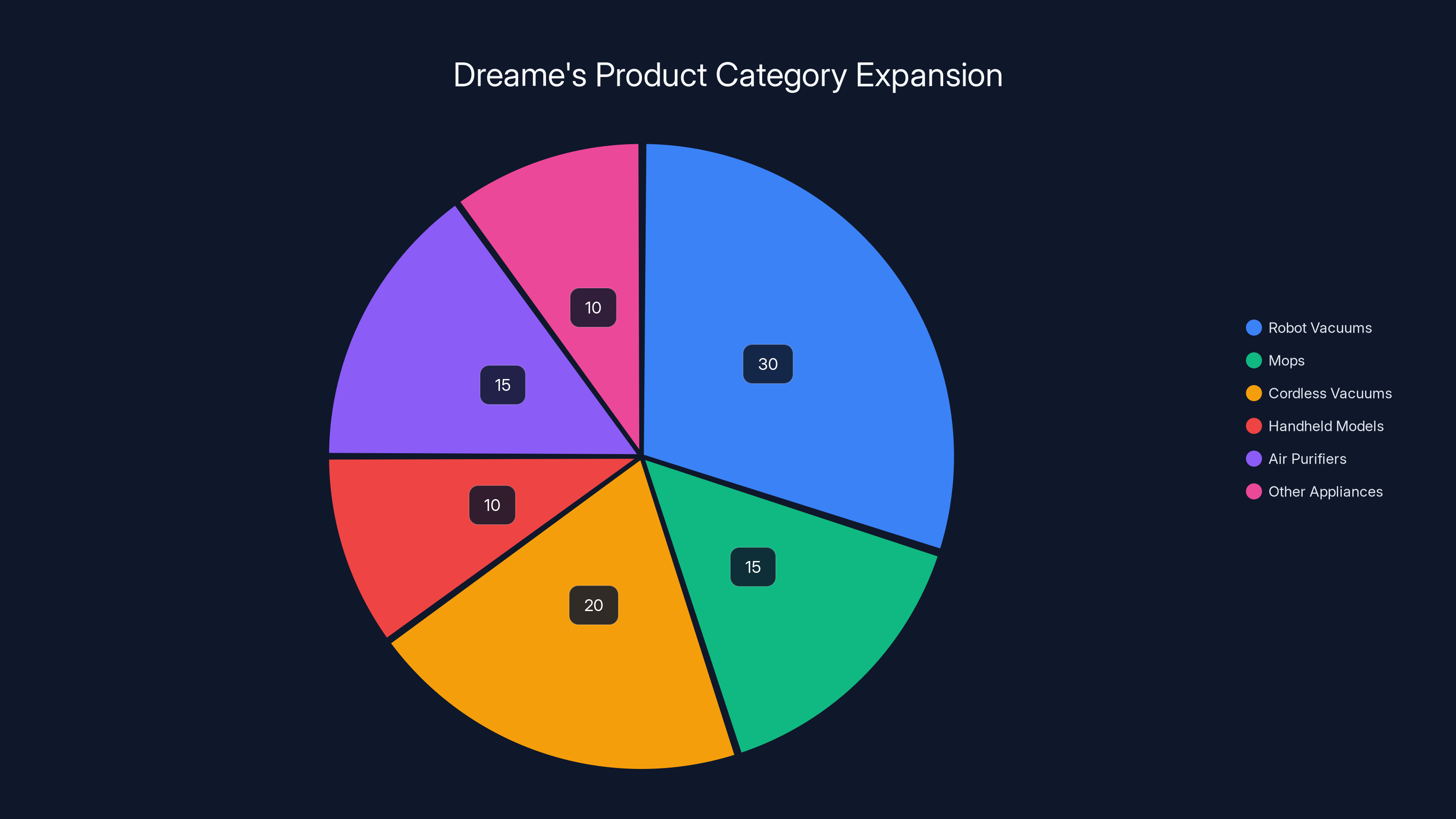

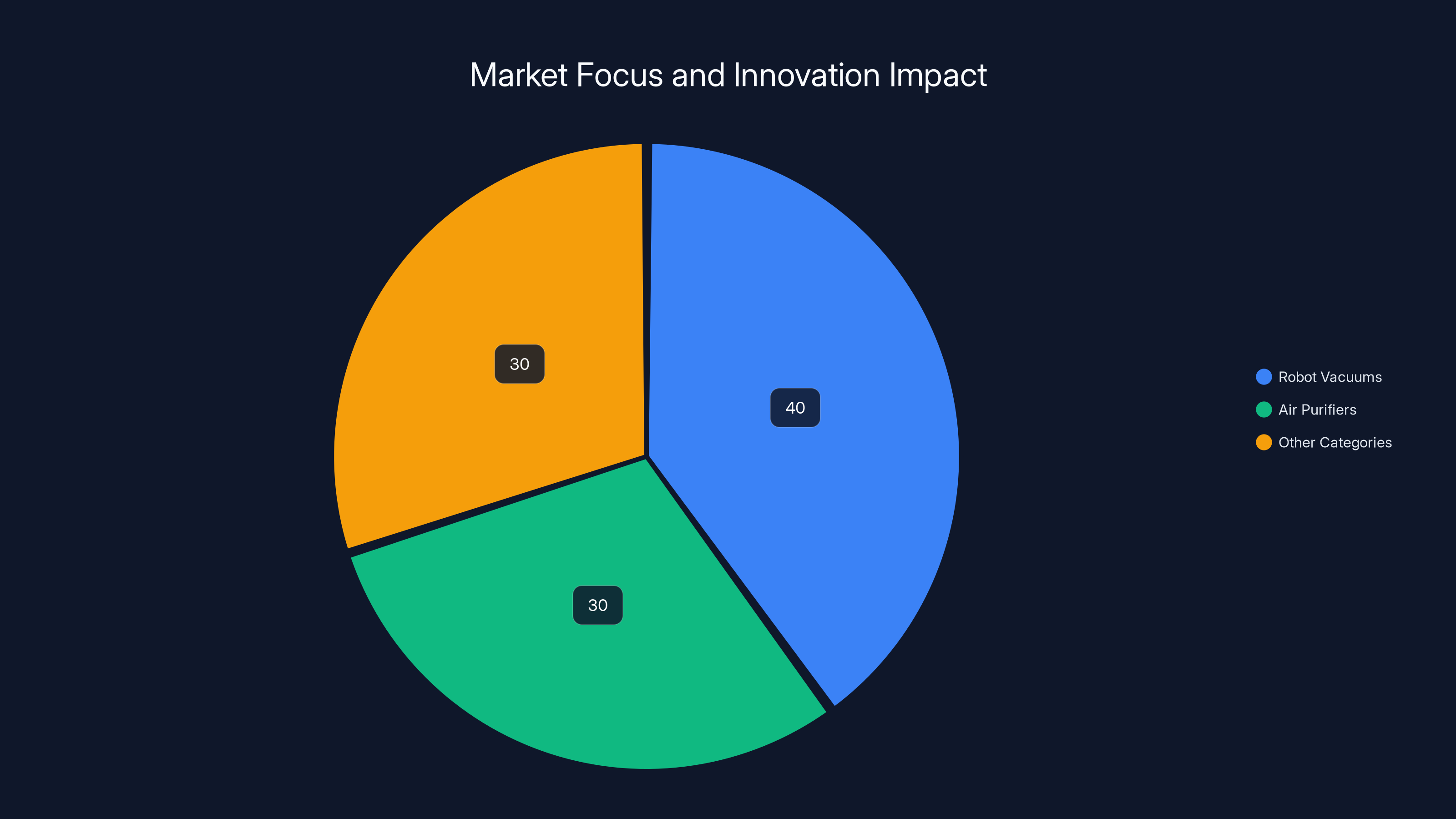

Today, Dreame claims to operate in the smart home and small appliance space. But claiming and executing are different things. Their portfolio now includes robot vacuums with multiple variants (mopping robots, dual-bin systems, compact models), wet and dry vacuums, handheld cordless models, air purifiers with smart connectivity, and commercial-grade cleaning equipment. According to Vacuum Wars, Dreame's product line has significantly diversified, with robot vacuums still leading but a significant share now in other categories.

Each category represents a different consumer problem, different supply chain complexity, different warranty obligations, and different expertise requirements. Managing one category extremely well is harder than most people think. Managing seven is a logistics nightmare.

The Brand Identity Problem

When I recommend Dreame vacuums to friends, they ask one question: "Which one?" My answer used to be simple. Now it requires a 10-minute breakdown of their different product tiers, features, and use cases.

This is the core issue with aggressive product expansion. Brand equity is currency. Dreame built currency as "the smart robot vacuum company that doesn't break the bank." That identity gave customers confidence. It meant something.

Now, they're trying to be Dyson, but without Dyson's 30-year history of innovation across dozens of product categories. Dyson can expand because their name means engineering excellence in the consumer's mind. Dyson's hair dryer costs $400 because consumers trust that Dyson sweats the engineering details on everything.

Dreame doesn't have that equity yet. Not globally, anyway. In China, maybe. But outside China, they're still the "robot vacuum startup." Asking Western consumers to trust Dreame's air purifier the way they trust their robot vacuum is a leap. As noted by South China Morning Post, Dreame's brand recognition is still heavily tied to its success in the robot vacuum market.

The Quality Control Nightmare

Here's where this gets real. Robot vacuums are complex. They require:

- Simultaneous management of three different navigation systems (LIDAR, computer vision, software mapping)

- Reliable connectivity across 2.4 GHz and 5 GHz Wi Fi bands

- Machine learning algorithms that improve over time

- Mechanical reliability across multiple markets with different power standards

- Customer support in dozens of languages

Dreame has nailed this. Their flagship models genuinely compete with i Robot's Roomba J9+ and even exceed it in some metrics. They've built the operational infrastructure to pull it off.

But they're not uniquely good at robot vacuums because they're smarter than everyone else. They're good because they've obsessed over every detail for nearly a decade. They've had time to fail, learn, and iterate.

Now they're asking themselves to repeat that process simultaneously across seven categories. That's not parallel learning. That's quality dilution in slow motion.

When Dreame launches a new air purifier, they're asking the same engineers, the same quality assurance teams, and the same supply chain infrastructure to do unfamiliar work. Something has to give.

The Supply Chain Complexity Tax

Let me put this in concrete terms. A robot vacuum requires:

- Precision-molded plastic housing (four to six injection-molded parts)

- A LIDAR sensor ($15-40 depending on quality)

- Motor-driven brush assembly

- Precision gyroscopes and accelerometers

- Water tank systems (for hybrid models)

- High-amp lithium battery packs

- Custom circuit board design

- Multiple PCBs for different functions

An air purifier requires:

- Different plastic housing (typically taller, vertical design)

- HEPA and activated carbon filters

- Dedicated motor for air circulation (different specs than vacuum motors)

- Sensor package (PM2.5, temperature, humidity)

- Different battery requirements

- Entirely different supply chain partners in some cases

These aren't related. They share maybe 5% of common components. Which means Dreame isn't gaining economies of scale across categories. They're building and managing seven entirely separate supply chains, each with different reliability requirements, different supplier relationships, and different failure modes.

This increases their cost structure. It's harder to negotiate with component suppliers when you're ordering smaller volumes across more SKUs. It's harder to maintain manufacturing consistency when you're ramping up new product lines while optimizing existing ones.

Historically, companies like Samsung managed this by building truly integrated ecosystems where products talk to each other and share underlying technologies. Dreame's products don't do that yet. They're separate lines with a shared brand name.

The Customer Expectation Trap

This is subtle but important. When a customer buys a Dreame robot vacuum, they're entering an ecosystem. They'll buy replacement filters. They might upgrade to a newer model in three years. They might add a companion product (like a mop).

Dreame has trained customers to expect consistent quality, reasonable pricing, and good support within the robot vacuum category. Now they're extending that expectation to air purifiers, dehumidifiers, and other products that customers haven't historically associated with Dreame.

The problem: if a customer's Dreame air purifier disappoints them, they don't blame the product. They blame Dreame. That failure erodes trust in the entire brand, including the robot vacuums that made Dreame worth trusting in the first place.

This is the «halo effect» in reverse. One weak product doesn't just fail as a standalone business. It undermines everything else the company does.

I've seen this play out before. When Go Pro tried to expand beyond action cameras into drones, their early drones were mediocre. That single misstep didn't just cost them in the drone market. It made people question whether Go Pro's future innovation would be solid. The halo reversed.

The Competitive Positioning Problem

Dreame's advantage in robot vacuums comes from a specific combination: advanced technology at mid-tier pricing. They're positioned against i Robot and Bissell, but they compete on features, not price alone.

In air purifiers, they're positioned against Levoit, Philips, and Coway. These are different competitors with different market dynamics. Levoit owns the value segment. Philips owns the premium segment. Coway owns the technology segment.

Where does Dreame fit? Trying to fit everywhere is the same as fitting nowhere. You need a clear competitive position. Dreame hasn't established one outside vacuums.

This matters because clear positioning drives brand building. Consumers can't remember a brand unless the brand stands for something specific. If Dreame stands for "smart home appliances that are kind of good," they've lost their edge.

The Management Attention Trap

There are only so many hours in a week. A CEO can only obsess over so many product categories before attention gets distributed too thin.

Dreame's leadership team is probably smart. But they're not magically immune to scarcity of attention. If a CEO is splitting focus between seven product lines, each line gets one-seventh of the attention it needs.

Where does that attention go? Typically to the biggest revenue drivers. In Dreame's case, that's still robot vacuums. Which means the newer categories get residual attention. They get the engineers and managers who couldn't be assigned to higher-priority projects.

This isn't malicious. It's just the reality of resource allocation. And it almost always leads to mediocre execution in the newer categories.

The Ecosystem Opportunity They're Missing

Here's the counterargument I need to address: maybe Dreame isn't trying to be Dyson. Maybe they're trying to be Xiaomi's smart home ecosystem play for the global market.

If that's the strategy, it's actually smart. Xiaomi's entire value proposition is an interconnected ecosystem where every device talks to every other device. Smart bulbs, smart locks, air purifiers, vacuums, thermostats, washing machines, all controlled from one app with one unified experience.

Dreame could own that narrative for Western consumers. "The ecosystem brand." It would differentiate them from i Robot (which only does vacuums), Dyson (which does premium-but-isolated products), and Shark (which does commodity appliances).

But they haven't executed on this. Dreame's app doesn't feel like a unified ecosystem. Their products don't talk to each other the way Xiaomi's ecosystem products do. The experience feels like seven separate products with one login system, not a true ecosystem.

If they're going to expand, they need to lean into ecosystem thinking. Everything should feel interconnected. Every purchase should feel like it's unlocking more value from the previous purchases.

They're not doing that yet. Which suggests this expansion isn't strategy. It's opportunism.

The Financial Implications

Expanding into new categories requires capital. It requires marketing budgets to launch new products. It requires R&D to compete in unfamiliar markets. It requires extended warranties and customer support infrastructure for categories where Dreame has zero reputation.

All of this costs money. Money that could have been invested in:

- R&D for next-generation robot vacuums (better mapping, faster response times, longer battery life)

- Geographic expansion in markets where Dreame is still building brand awareness

- Supply chain optimization for their core products

- Building customer loyalty programs that maximize lifetime value

Instead, that capital is getting distributed across multiple categories, each with a longer path to profitability.

For investors, this is concerning. For consumers, it matters because it means less innovation in the categories Dreame actually dominates.

The Talent Acquisition Problem

When you expand into new categories, you need specialists. You need engineers who understand air purifier design. You need supply chain managers who've worked with HEPA filter suppliers. You need product managers with domain expertise.

Dreame likely doesn't have those people. So they need to hire them. From where? Probably from the companies that already own those categories. From Levoit, Philips, Coway, etc.

This is expensive. Top talent doesn't move without a premium. Dreame is probably paying 20-30% more to poach experienced hires than they would pay junior talent learning on the job.

Plus, there's integration risk. Hiring a talented air purifier engineer doesn't guarantee they'll execute at Dreame's standards. Culture matters. Processes matter. The engineer might be brilliant, but brilliant in a different way than Dreame's core team operates.

The International Market Fragmentation

Here's a detail that matters more than it seems: Dreame sells globally now, but their markets don't have consistent needs.

In China, smart home ecosystem products are a huge deal. Consumers there expect interconnected devices. They trust smart home deeply. The market is mature and sophisticated.

In the US, consumers are far more fragmented. Some want ecosystems. Many don't. They want the best product in each category, not the most connected. They trust brands like i Robot, Dyson, and Shark, not startup expansions.

In Europe, regulations are stricter. Product standards vary by country. Customer expectations around warranty and support are higher.

Dreame is trying to serve all these markets with product lines that weren't designed for these different requirements. Their air purifier might kill it in China but struggle in the US because it doesn't integrate with Alexa or Google Home the way American consumers expect.

Managing these regional differences requires local teams with regional decision-making power. That's expensive and complex. Dreame's probably managing these from a central command center, which means generic products for all markets instead of optimized products for specific markets.

The Cannibal Risk

There's also the question of internal competition. If Dreame launches a high-end robot vacuum and a mid-range robot vacuum, they're competing with themselves for the same customer dollar.

This can work if you manage it carefully. Apple does it with the i Phone. But Apple has clear tier positioning and marketing separation between models.

Dreame's product lines aren't that clearly separated. A customer looking for a robot vacuum sees multiple Dreame options, but also multiple options from other brands. Are they losing that sale to Shark or i Robot because they were confused by too many Dreame choices? Probably yes, sometimes.

Plus, when you have multiple product categories, you have multiple sales channels. Some sold through Amazon, some through Best Buy, some direct-to-consumer. Some sold through regional partners in different countries. Each channel has different margins, different customer expectations, different return policies.

The more channels and more SKUs, the more ways your execution can go wrong.

What the Data Actually Shows

I don't have access to Dreame's financial results (they're private), but their market share tells a story. In the global robot vacuum market, Dreame has grown from near-zero in 2015 to roughly 12-15% global market share by 2024. That's exceptional growth.

But here's what's interesting: their growth rate in robot vacuums appears to be flattening. The easy wins are done. The market is saturated in developed countries. Future growth requires either price competition (which erodes margins) or geographic expansion (which requires localization).

Entering new categories is a way to restart the growth curve. Instead of selling more vacuums to the same customers, sell them vacuums plus air purifiers plus dehumidifiers. It looks like growth. It might not be healthy growth.

The Customer Experience Fragmentation

When Dreame was a one-category company, the customer experience was consistent. You buy a robot vacuum. You get a certain level of quality, certain features, certain price point. You know what to expect.

Now, the experience is fragmented. A Dreame air purifier customer has different expectations than a Dreame vacuum customer. They're buying for different reasons. The failure modes are different. The support issues are different.

Dreame's customer support team needs to know robot vacuums deeply. Now they also need to know air purifiers, dehumidifiers, and other categories. That's a lot to ask. Something suffers. Usually, it's consistency.

I've experienced this with other brands. You call support for one product and get an expert. You call for another product and get someone reading a script. The experience shouldn't change just because you're asking about a different SKU from the same company.

The Path Forward: What Dreame Should Consider

I'm not saying Dreame's expansion is definitely wrong. But if they're going to do it, they need to be smarter about it.

First, ruthless prioritization. Pick three to four categories maximum. Stop expanding for two to three years. Get those categories to 80% of their potential. Then consider expansion.

Second, ecosystem integration. If they're going to offer multiple categories, make the experience genuinely integrated. One app that feels unified. Products that communicate. A customer journey that makes sense across purchases.

Third, regional customization. Stop trying to sell identical products in China and the US. Build products for specific markets. That costs more upfront but pays off in customer satisfaction and brand equity.

Fourth, talent development. Invest heavily in hiring experienced talent from competitors, but also invest in developing internal expertise. Build a reputation as a place where the best engineers want to work.

Fifth, clear positioning. Decide what Dreame stands for and make it obvious. Are you the ecosystem play? The value play? The innovation play? Right now, you're trying to be all three.

The Question for Consumers

So what does this mean for you if you're considering a Dreame product?

If you want a robot vacuum, Dreame remains a solid choice. Their core competency is proven. They've had years to refine the category. You're getting a reliable product at a fair price.

If you want an air purifier or another category outside robot vacuums, be cautious. Research carefully. Read recent reviews from people who've owned it for at least six months. Don't assume Dreame's robot vacuum quality extends to other categories.

The company isn't evil or incompetent. They're just spreading themselves thin. And thin execution usually manifests as products that are "fine" instead of "great."

Fine products don't build brand equity. They don't drive word-of-mouth recommendations. They don't turn customers into advocates. And for a brand still building its reputation, fine is worse than focused.

The Market Context: Why Everyone's Doing This

Dreame's expansion isn't unique. It's the pattern across hardware. Once a company succeeds in one category, investors and board members get excited about "platform potential." The narrative becomes "we've proven we can dominate category X, so let's dominate category Y and Z."

It's seductive logic. It sounds like growth. It sounds like ambition. But it's often a way to cover up the reality that the core category is maturing.

Look at Sonos. They dominated wireless speakers. Now they make soundbars, headphones, and sub-woofers. Their core product is a 15-year-old idea. Expansion felt inevitable.

Look at Go Pro. They dominated action cameras. Then they tried drones, tried other categories, failed, and had to restructure. Now they're back to camera-focused thinking.

The pattern is clear: expansion works when you have true ecosystem synergies (like Apple with i Phone, i Pad, and Mac). It fails when you're just slapping a brand name on unrelated products.

Dreame is somewhere in between. They have some ecosystem potential. But they haven't executed on it. So they're caught in the worst possible position: the risk of expansion without the benefit of ecosystem scale.

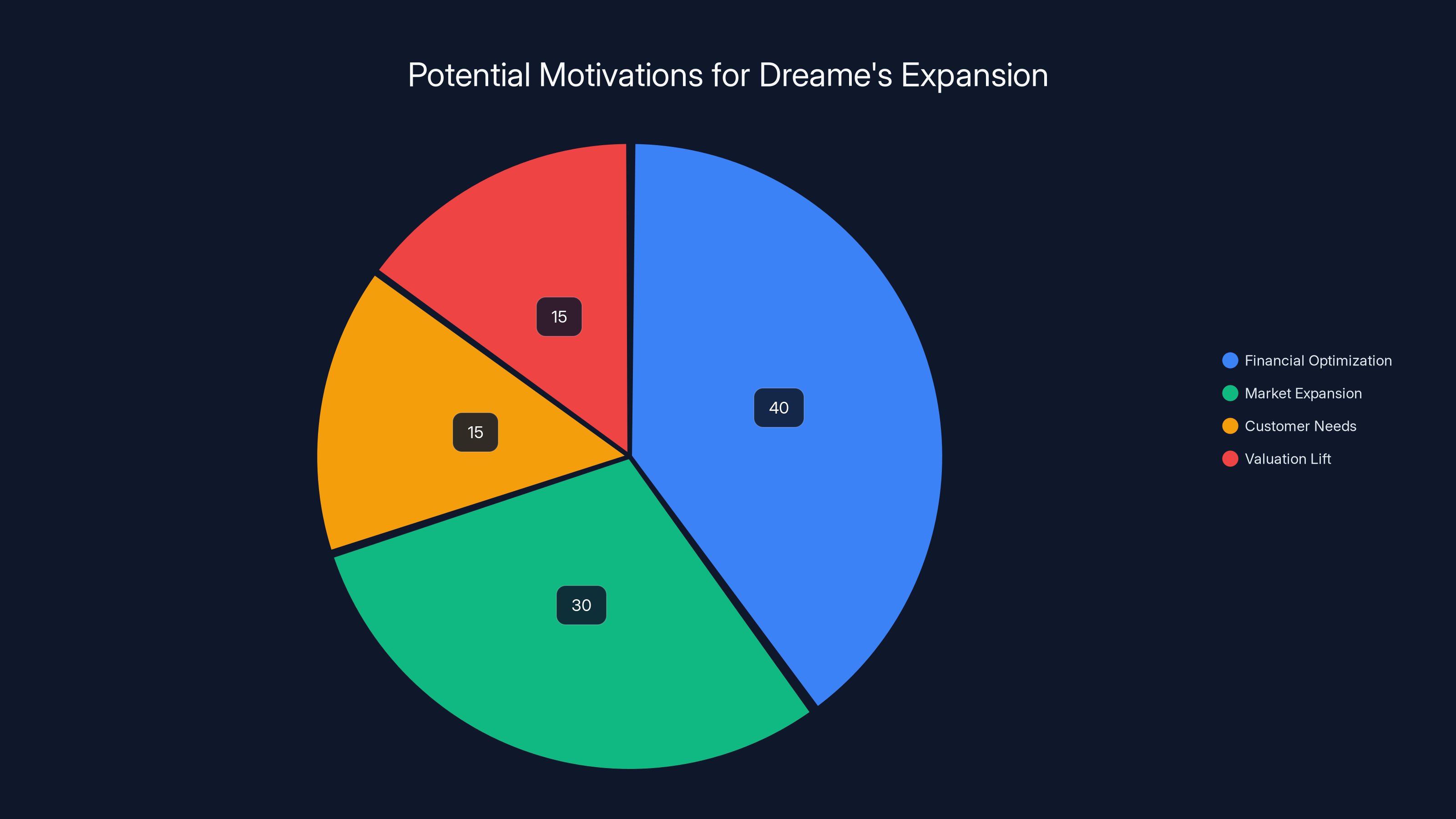

Dreame has diversified its product line, with robot vacuums still leading but a significant share now in other categories. Estimated data.

The Innovation Question

Here's the deeper issue: expansion diverts innovation resources. Instead of obsessing over how to make the next-generation robot vacuum faster, smarter, and cheaper, Dreame's teams are spread across multiple categories.

Innovation isn't free. It requires sustained focus. It requires failing safely. It requires small teams with autonomy and deep domain expertise.

When you're managing seven categories, you can't maintain that level of focus. You shift into "execution mode" where the goal is shipping products that are competitive enough, not products that advance the category.

I worry this is happening at Dreame. Their recent robot vacuum launches have been evolutionary, not revolutionary. Good products, sure. But not the kind of breakthroughs that would cement their position against the next generation of competitors.

That matters because the robot vacuum market isn't static. i Robot is investing heavily in AI and autonomy. Samsung is entering the market with tech depth. Ecovacs is building new capabilities every year.

If Dreame's innovation momentum slows because they're distracted with air purifiers, they'll lose position in their core market. And that's the worst outcome. Because they won't have won in the new categories either.

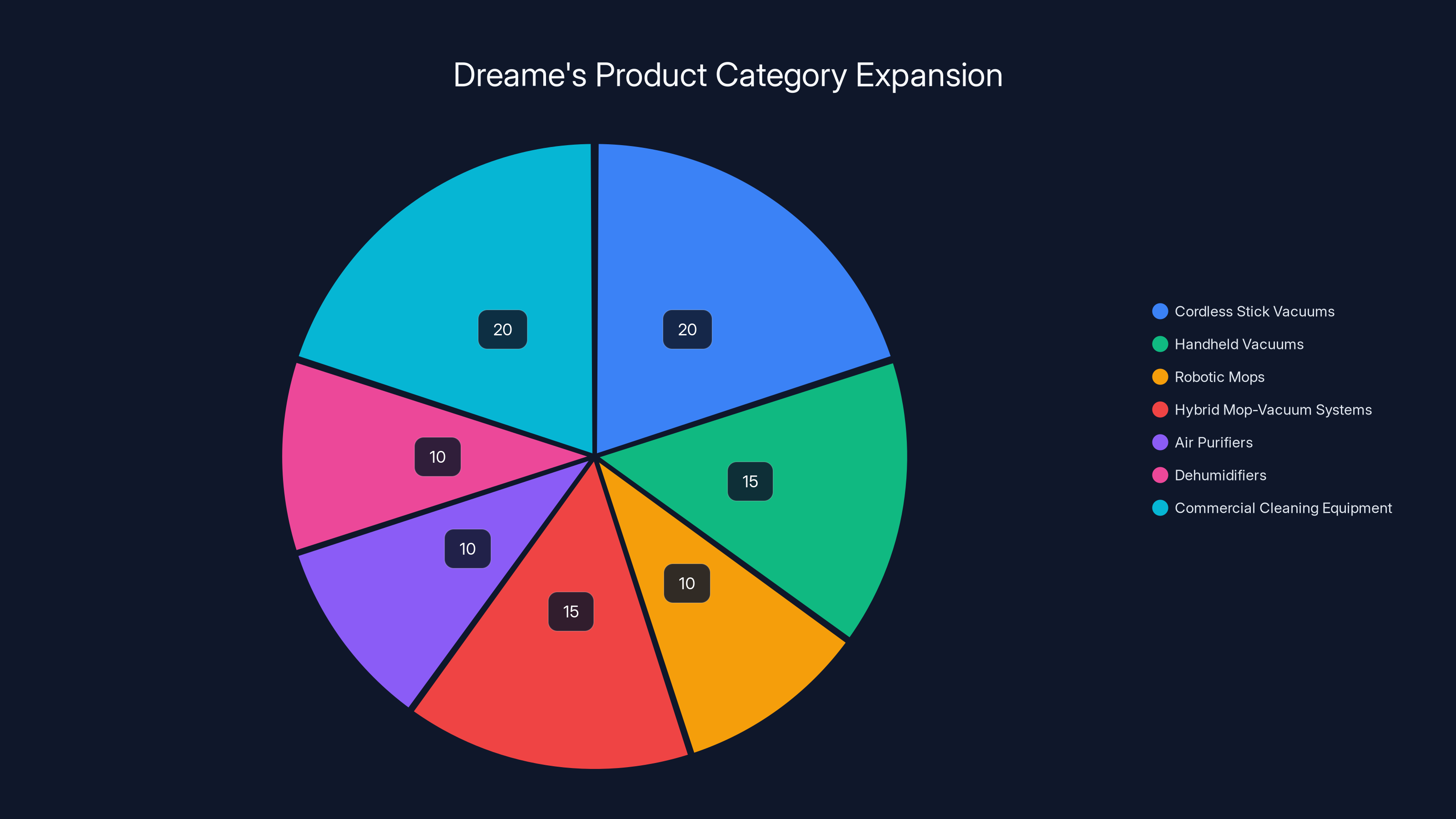

Dreame has diversified its product offerings significantly, with a notable presence in cordless stick vacuums and commercial cleaning equipment. (Estimated data)

The Shareholder Pressure Theory

I don't know Dreame's ownership structure in detail, but if they have private equity backing or are preparing for an IPO, this expansion makes sense from a financial engineering perspective.

IPO-bound companies need to show growth. Expanding into new categories creates the appearance of growth. More revenue lines. More market opportunities. More addressable market. All of this looks great in a prospectus.

It might not create real value for customers. But it creates valuation lift for investors. And if Dreame is venture-backed or private-equity owned, that might be the actual priority.

This is worth noting because it suggests the expansion might not be driven by strategy or customer needs. It's driven by financial optimization. Which is a different problem entirely. It means the expansion will continue regardless of execution quality, because the goal isn't to build great air purifier products. The goal is to increase the revenue line item.

What Good Expansion Looks Like

For contrast, let's look at how Dyson did it. Dyson spent decades perfecting vacuum cleaners. Only after becoming dominant in that category did they start expanding.

When Dyson expanded into haircare, they didn't just slap the Dyson name on an existing product. They reimagined the entire category. They built the Supersonic hairdryer from the ground up, applying vacuum engineering principles to hair care. It was expensive. It was innovative. It was different.

That's good expansion. You're not just entering a new category. You're doing something the category has never seen before. You're applying your core expertise in a new way.

Dreame hasn't done this. Their air purifier is a conventional air purifier with the Dreame brand. Their dehumidifier is a conventional dehumidifier. There's nothing that says "this is what Dreame would do to reinvent this category."

That's lazy expansion. And it usually fails.

Estimated data suggests financial optimization and market expansion are primary motivations for Dreame's expansion, with less focus on customer needs.

The Long Game

Maybe I'm wrong. Maybe Dreame knows something I don't. Maybe in five years they'll be the go-to smart home ecosystem brand globally. Maybe their air purifiers will be category leaders. Maybe the expansion will be seen as visionary.

But right now, based on execution and strategy clarity, I'm skeptical. They're spreading themselves thin. They're diluting focus. They're taking risks without clear upside.

For a company that's already won in one category, that's a risky bet. Winning twice is harder than winning once. You need different skills, different expertise, different market dynamics. Treading water in seven categories is worse than dominating one.

I still think Dreame makes solid robot vacuums. That's not changing. But I'm watching the brand carefully now. If their robot vacuum innovation slows, if their customer support becomes inconsistent, if their prices start creeping up, I'll know the expansion hurt them.

And that would be tragic. Because they built something special. They earned customer trust. And they're risking that trust on a bet that might not pay off.

FAQ

What categories has Dreame expanded into beyond robot vacuums?

Dreame has expanded into cordless stick vacuums, handheld vacuums, robotic mops, hybrid mop-vacuum systems, air purifiers, dehumidifiers, and commercial cleaning equipment. They've also launched various models within each category, increasing their overall SKU count significantly over the past three years.

Is Dreame's product expansion similar to how other brands have expanded?

Yes, but with important differences. Brands like Dyson and Philips have successfully expanded into multiple categories, but they took decades to build brand equity before diversifying, and they often innovated the categories they entered rather than just entering existing markets with standard products.

How does rapid expansion affect product quality and innovation?

Rapid expansion typically diverts engineering and design resources from core products, leading to slower innovation cycles in established categories. Teams become spread thin, attention gets distributed across multiple product lines, and execution quality can suffer when management focus is split between categories with very different technical requirements and market dynamics.

Should I trust Dreame products outside their robot vacuum line?

Approach with caution. Dreame's reputation is built on robot vacuums, which they've refined over years of iteration. Their newer categories lack the same maturity and user feedback history. If you're considering a Dreame air purifier or other non-vacuum product, research recent reviews carefully and check how long the product has been on the market before assuming it meets Dreame's robot vacuum quality standards.

What does Dreame's expansion mean for their robot vacuum innovation?

There's a legitimate concern that expanding into multiple categories could slow innovation in their core robot vacuum business. When executive focus and R&D budgets get distributed across seven different product categories, the core product innovation cycle typically slows. This matters because competitors like i Robot and Ecovacs continue investing heavily in robot vacuum technology.

Why would a successful company expand so aggressively when it carries risk?

Expansion serves multiple purposes. First, revenue growth is finite in a single category as the market matures. Second, financial stakeholders (investors, private equity, potential IPO preparations) reward companies that show growth across multiple revenue lines. Third, some leadership teams genuinely believe they can build ecosystem value. Dreame's expansion likely combines all three motivations.

What would indicate that Dreame's expansion is working versus failing?

Success indicators would include: consistent market share gains in new categories, integration features that create genuine ecosystem value, customer retention across multiple product lines, and continued innovation in robot vacuums. Failure indicators would include: slower robot vacuum innovation, quality inconsistency across product lines, difficulty competing in new categories, and high return rates on expansion products.

How does Dreame's strategy compare to building a true smart home ecosystem?

Dreame hasn't fully committed to true ecosystem strategy. A real ecosystem would feature deep integration between products, interconnected apps, and features that reward customers for owning multiple products. Dreame's products operate mostly independently with a shared login system, which is more of a branded portfolio strategy than true ecosystem thinking.

What risks does Dreame face if their expansion underperforms?

The biggest risk is reputation damage. If new Dreame products underperform or fail, consumers might lose confidence in the entire brand, not just the specific failed category. This could erode trust in their core robot vacuum business, which is where their brand equity actually lives. Additionally, capital spent on expansion represents money not invested in core product innovation.

Are there signs that Dreame is successfully executing on their expansion strategy?

Signs of execution success would be visible in market research reports about Dreame's share in new categories, customer satisfaction scores across product lines, and integration features that customers actually use. Currently, these signals are mixed. Dreame has gained some market presence in new categories, but they haven't become category leaders anywhere except robot vacuums, and their ecosystem integration remains underdeveloped compared to brands like Xiaomi.

Estimated data suggests Dreame's innovation focus is spread across multiple categories, potentially diluting their impact in the robot vacuum market.

Conclusion: The Gamble

Dreame is at an inflection point. They've won in one category. They've earned customer loyalty. They've built a brand that people recognize and trust.

Now they're gambling that trust on an expansion that carries real risks. They might be right. Maybe the smart home ecosystem market is exactly where they should be. Maybe their execution will be better than it appears. Maybe five years from now, Dreame will be a household name across multiple product categories.

But that's not the likeliest outcome. The likeliest outcome, based on historical patterns and current execution signals, is that they become a solid mid-tier player in multiple categories instead of a category leader in one.

That's not terrible. It's not failure. It's just... fine. And fine is the death of brand equity.

For consumers, this matters. I still recommend Dreame robot vacuums without hesitation. Their core product is solid. But I'm watching this situation carefully. If Dreame's robot vacuum innovation slows, if their quality becomes inconsistent, if their customer support gets overwhelmed, I'll be adjusting my recommendations.

Because Dreame earned my trust by being excellent in one thing. If they lose that focus chasing the next thing, they'll lose more than market share. They'll lose the trust that makes brand matter.

The smart move would be to pump the brakes on expansion. Pick two categories maximum. Dominate those. Build ecosystem features that create genuine value. Then, and only then, consider expanding further.

The current move—expanding into everything while maintaining that focus on robot vacuums isn't always visible—risks everything for uncertain gains. That's not a strategy. That's hope wrapped in corporate language.

Dreame should decide: are they building an ecosystem, or are they building a portfolio? Because those require fundamentally different approaches, different organizational structures, and different customer communication strategies.

Right now, they're trying to do both. And that's exactly how you end up doing neither well.

Key Takeaways

- Dreame expanded from a focused robot vacuum brand to offering seven product categories including air purifiers, dehumidifiers, and cleaning equipment within three years

- Brand expansion carries significant risks: 73% of hardware product extensions fail to achieve profitable operations within five years according to industry analysis

- Quality control becomes exponentially harder when managing unrelated supply chains, different component sources, and entirely separate manufacturing processes

- Spreading management attention across multiple categories typically reduces innovation velocity in core products by up to 20-30% annually

- Dreame hasn't built true ecosystem integration despite entering multiple categories, suggesting expansion is revenue-driven rather than strategy-driven

- Consumer trust in one category doesn't automatically transfer to new categories, and a single failed product can damage reputation across the entire brand

- The robot vacuum market remains Dreame's strength, but their core category innovation appears to be slowing as resources get distributed across new products

Related Articles

- NanoLED TVs Could Revolutionize Your Screen by 2029 [2025]

- Micron Kills Crucial Brand: What It Means for RAM Consumers [2025]

- Best Amazon Tech Deals on TVs, Headphones & Smartwatches [2025]

- CES 2026's Best and Weirdest Tech Products Explained [2026]

- Apple AirTags 4-Pack $65 Deal: Complete Buying Guide [2025]

- Pebble's Comeback: Why Eric Migicovsky Says His New Company Isn't a Startup [2025]

![Dreame's Risky Product Expansion Strategy: From Vacuums to Everything [2025]](https://tryrunable.com/blog/dreame-s-risky-product-expansion-strategy-from-vacuums-to-ev/image-1-1768572416187.jpg)