The £14.5 Million Surprise Nobody Saw Coming

Imagine you're running the UK's central bank. You've got financial systems that need modernizing, aging infrastructure that costs a fortune to maintain, and pressure to move to the cloud like everyone else. So you budget £7 million. Sounds reasonable, right?

Then reality hits.

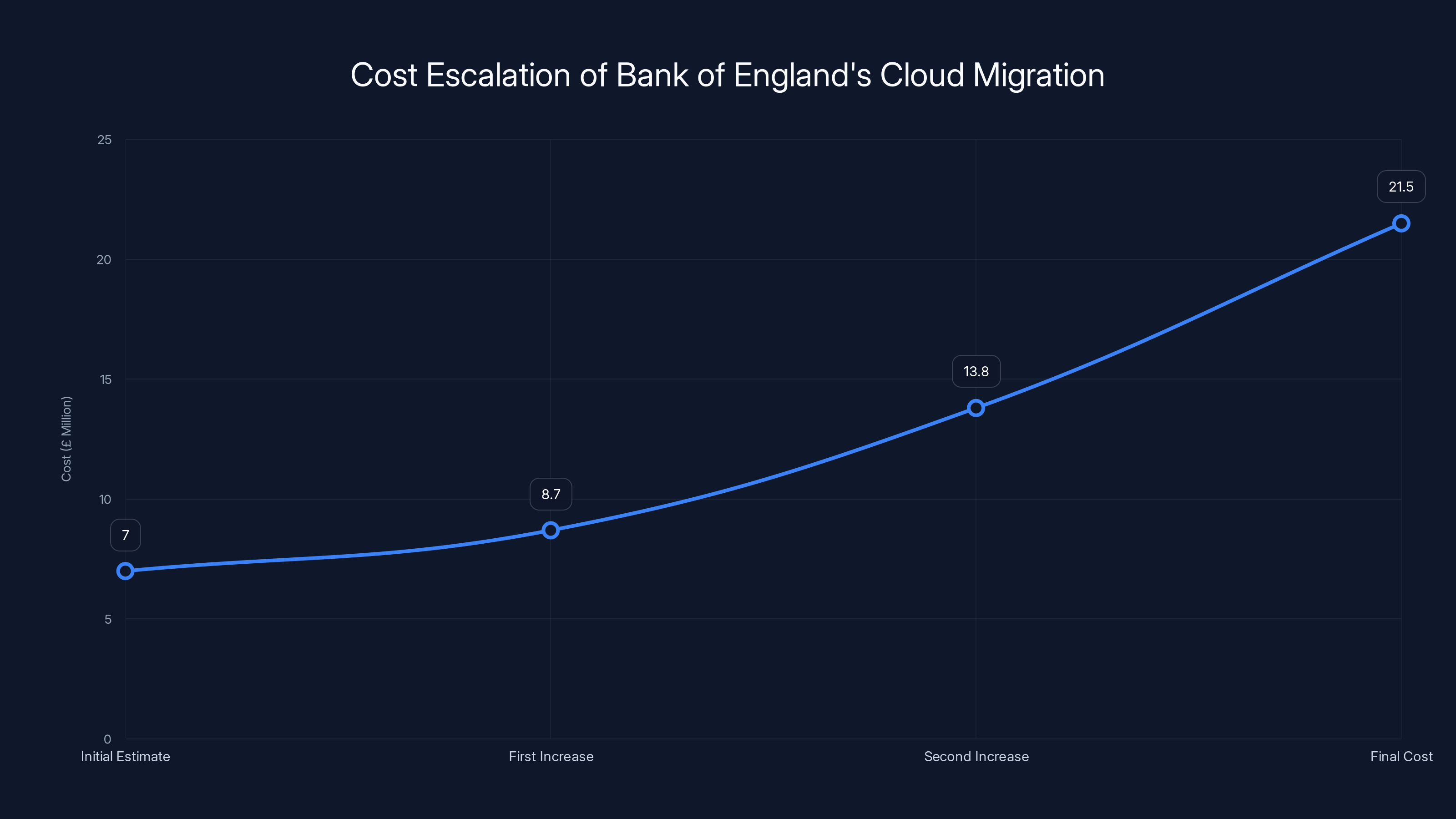

The Bank of England discovered that its Oracle cloud migration—initially priced at £7 million—just tripled to £21.5 million. That's not a rounding error. That's £14.5 million of additional spend. On top of that, the original budget itself had already grown from £7 million to £8.7 million, then nearly doubled again to £13.8 million. By the time they hit £21.5 million, the project had ballooned by more than 200% from the initial estimate.

This isn't a unique disaster. It's a pattern.

Government agencies, enterprises, and mid-market companies routinely underestimate cloud migration costs. The culprits? Scope creep, technical surprises, multi-phase rollouts, and the simple fact that legacy systems are messier than anyone expects until you actually start pulling them apart.

What makes the Bank of England's situation instructive is that it's transparent, documented, and happening to one of the world's most sophisticated financial institutions. If it can happen there, it can happen anywhere. This article breaks down why migration costs explode, what the Bank of England actually did wrong (and right), and what you should do differently.

TL; DR

- Initial underestimation: The Bank of England budgeted £7M but ended up at £21.5M—a 206% increase

- Scope creep is the killer: Additional Oracle modules, multi-phase rollouts, and unforeseen work drove costs up repeatedly

- Legacy systems are deceptive: You don't know what you've got until you start migrating it, and that's when costs spike

- Switching costs more than staying: Once committed, switching suppliers becomes more expensive than seeing it through

- This is normal: Enterprise cloud migrations typically experience 30-50% cost overruns, making the Bank of England's situation not unusual, just more public

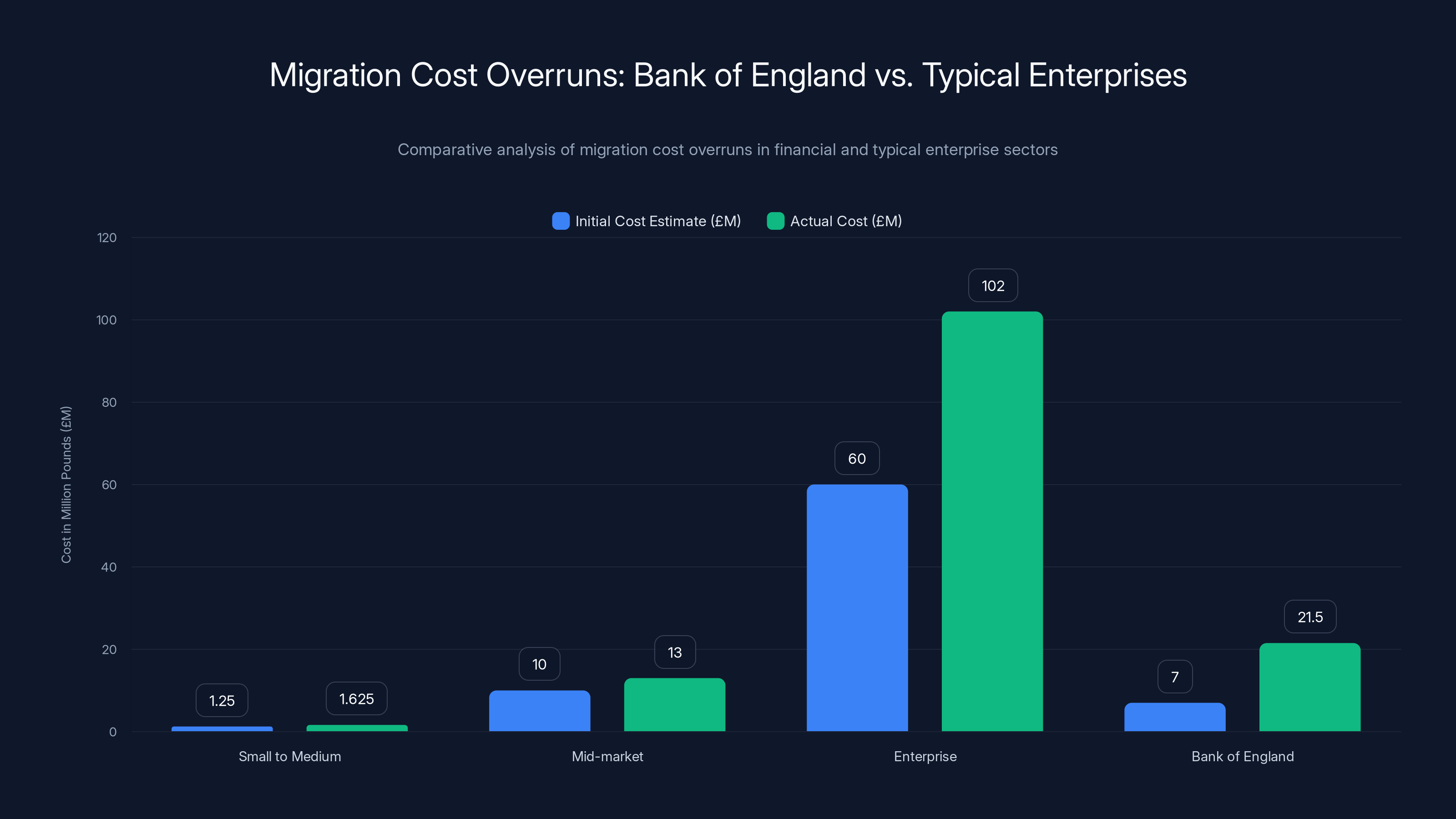

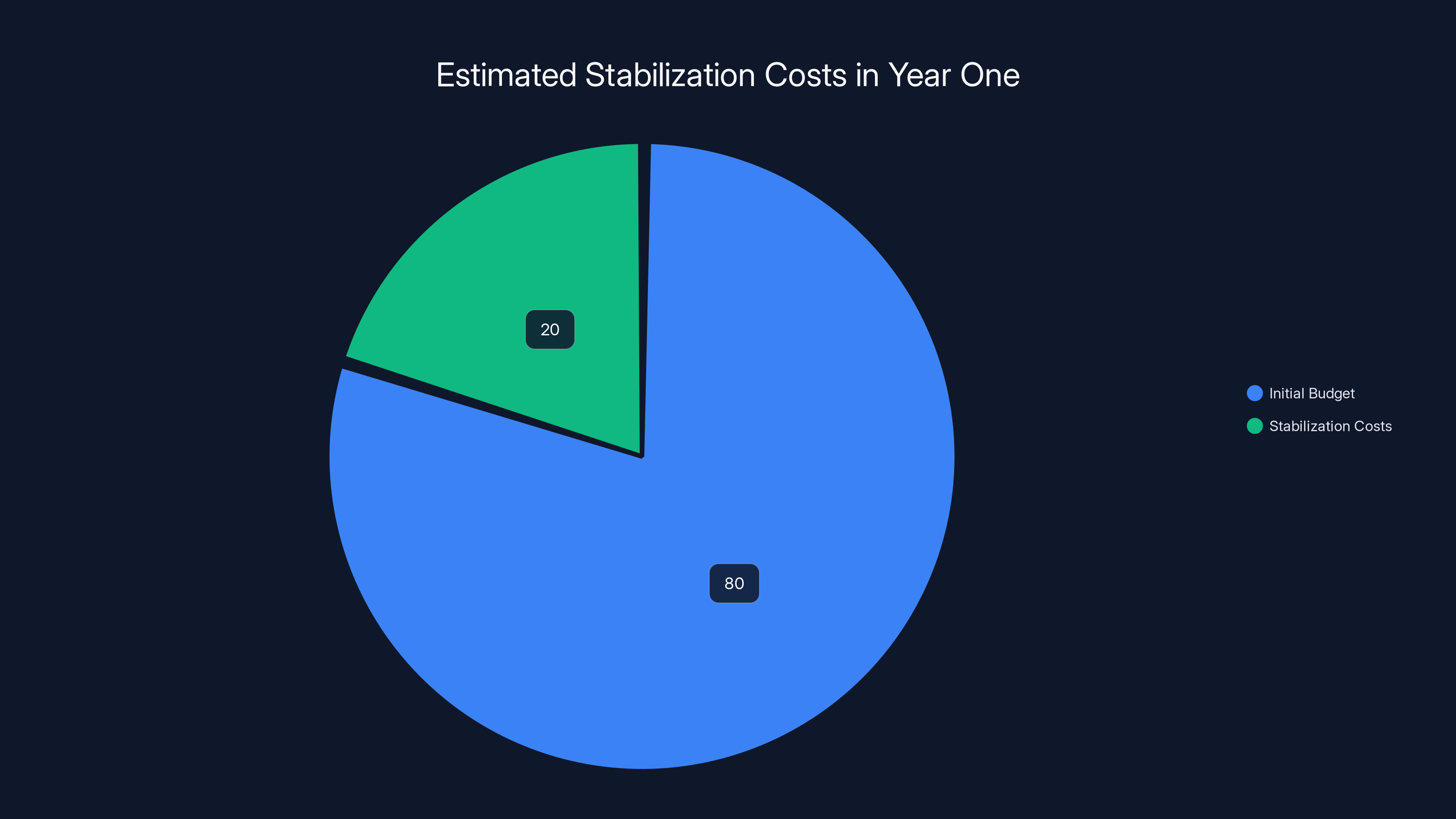

The Bank of England's migration cost increased by 206%, which is higher than typical enterprise overruns but not unprecedented. Estimated data for typical enterprise migrations.

How a £7 Million Project Became a £21.5 Million Nightmare

The Bank of England's migration timeline tells the story of how costs expand at each stage of a large-scale cloud project. Understanding this progression matters because it mirrors what happens at thousands of organizations every year.

The Original Estimate: £7 Million

In the initial procurement process, the Bank of England estimated it needed £7 million to migrate its systems to Oracle Cloud. This was the opening bid. This was the number leadership approved. This was what the organization would use to plan budgets and timelines.

But here's the thing about initial estimates on complex IT projects: they're optimistic. Not maliciously optimistic, but inevitably optimistic. You haven't truly audited every system. You haven't discovered every integration. You haven't accounted for the weird custom modifications that some legacy system has that only three people in the organization understand anymore.

First Increase: £7M to £8.7 Million

Somewhere during early planning or assessment, the scope adjusted slightly upward. From £7 million to £8.7 million. That's a £1.7 million increase, or about 24% higher than the opening estimate.

What triggered this? Likely discoveries about system complexity, integration requirements, or additional services that weren't fully scoped initially. This is actually where good project management should catch issues—early, before major commitments are made. But once a vendor is chosen and work begins, stopping to reassess becomes expensive and delays the entire timeline.

Second Increase: £8.7M to £13.8 Million

Then it happened again. The project grew to £13.8 million. That's an additional £5.1 million, bringing the total 97% higher than the initial £7 million.

By February 2025, when this increase was announced, the Bank of England acknowledged publicly that the project scope had expanded. According to their statement, they were "implementing Oracle Cloud to consolidate several different systems." Translation: it wasn't just one system being migrated. It was multiple systems, each with different data structures, business logic, and integration points.

Consolidating multiple legacy systems is exponentially more complex than migrating a single system. You're not just moving data. You're harmonizing business processes, reconciling conflicting logic, managing the transition period where old and new systems run in parallel, and training staff on new workflows.

Final Increase: £13.8M to £21.5 Million

Then came the biggest shock: £21.5 million. Another £7.7 million added to the budget. This wasn't a small adjustment. This was a structural change to the project.

According to the procurement notice, the changes driving this final increase included:

- Changing from a two-phase to a multi-phase rollout: Originally planned as two phases, the project expanded to multiple phases. This dramatically increases testing, validation, training, and parallel running costs.

- Additional Oracle modules: The Bank of England added Oracle Accounting Hub and Oracle Cloud Payroll to the migration scope. These are complete modules requiring separate setup, data migration, testing, and user training.

- Additional work outside the original scope: This catch-all category covers everything that wasn't initially anticipated—integration work, custom development, data cleansing, and remediation.

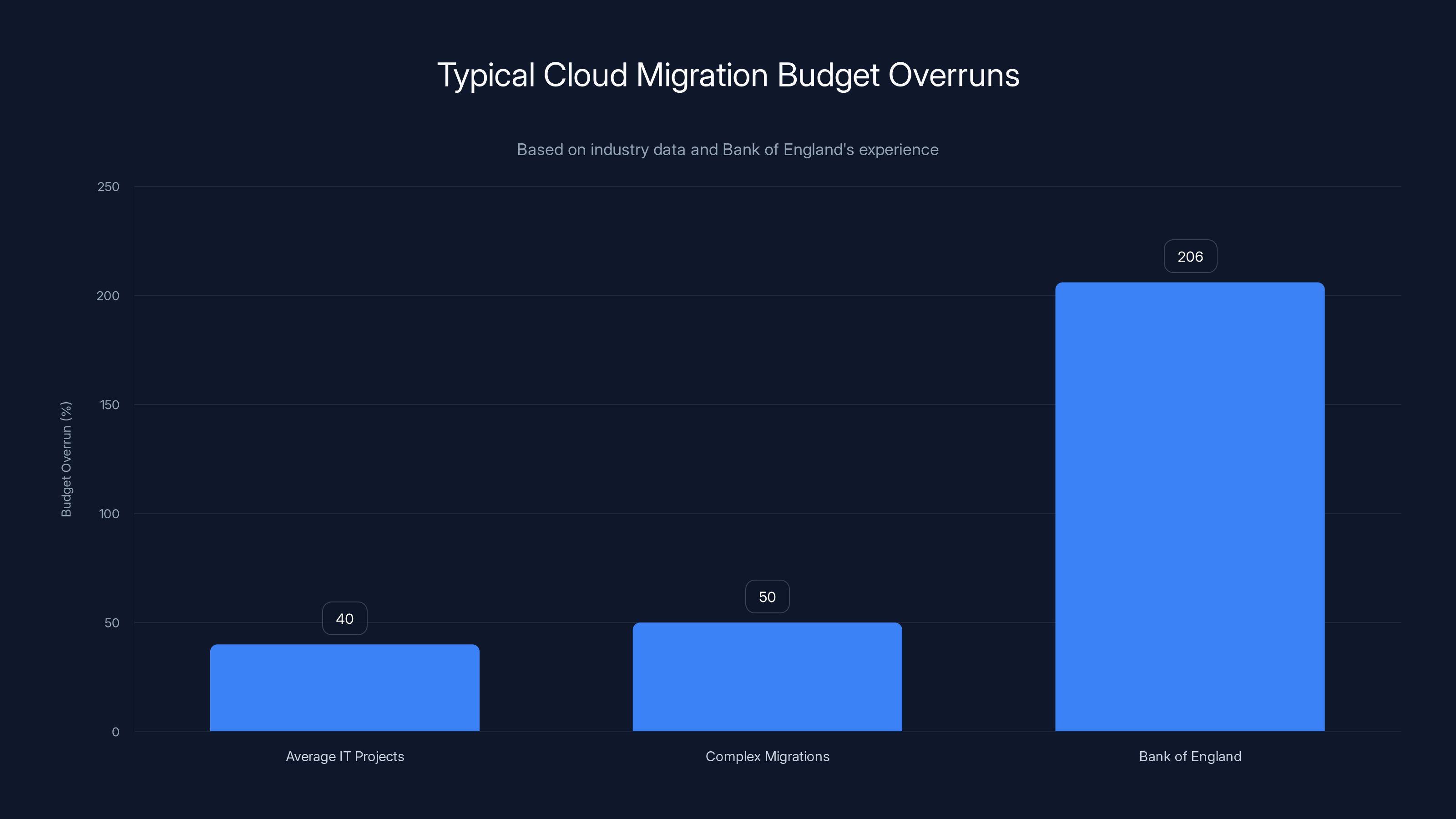

The Bank of England's migration experienced a 206% budget overrun, significantly higher than the average IT project (40%) and complex migrations (50%). Estimated data based on industry trends.

Why Cloud Migrations Consistently Cost More Than Expected

The Bank of England's experience follows a predictable pattern that repeats across organizations attempting large-scale cloud migrations. Understanding why helps you avoid it.

Legacy Systems Hide Their Complexity

Legacy systems are organizational fossils. They've been patched, modified, extended, and jury-rigged for years. What's documented often doesn't match what actually exists. The person who understood the system retired five years ago.

When you start a migration assessment, you're essentially doing an archaeological dig into your own infrastructure. You discover:

- Custom code that was written by contractors in 2008 and never documented

- Integrations with other systems that were never formally recorded

- Data that doesn't match the schema because someone built an Excel workaround instead of fixing the data issue

- Compliance requirements you forgot you had

- Performance dependencies you didn't realize existed

Each discovery adds weeks to the project timeline and often requires additional work to resolve. The Bank of England operates sophisticated financial systems. The complexity wasn't just assumed—it was underestimated even when they tried to estimate it accurately.

Scope Creep Is Inevitable in Multi-Year Projects

Most large cloud migrations take 18-36 months. That's a long time. During that period:

- Business requirements change

- Executive priorities shift

- New regulatory requirements emerge

- Other projects want to leverage the migration momentum

- "While we're doing this, we might as well..." becomes a recurring conversation

The Bank of England's move from two phases to multiple phases is textbook scope creep. Instead of a big bang migration, they decided on a more cautious, phased approach. Safer? Probably. Cheaper? Absolutely not. Each phase requires separate planning, separate testing environments, separate training cycles, and overlapping operations costs during the transition.

Adding Modules Multiplies Complexity

The original scope apparently focused on core financial systems. Then someone—probably during detailed planning—realized that Oracle Accounting Hub and Oracle Cloud Payroll should also be migrated as part of the same project.

This makes logical sense. These are related financial modules. They should integrate cleanly with whatever you're building. Why migrate them separately later?

But logically smart doesn't mean cost-effective. Each additional module requires:

- Separate data mapping and cleansing

- Different testing protocols

- Additional training for different user groups

- Custom integrations unique to that module

- Its own rollout and stabilization period

Adding Accounting Hub and Payroll modules wasn't just "two more things." It was "two additional complex systems requiring their own migration workflows."

Vendor Lock-In Makes Switching Expensive

Here's where the Bank of England's situation gets interesting. Once you're £13.8 million deep into an Oracle migration with Version 1 Solutions Ltd as your implementation partner, switching to a different vendor becomes even more expensive than finishing what you started.

The Bank of England was explicit about this reasoning: switching suppliers would incur significant costs and create interoperability problems and technical issues. In other words, you've now invested so much in one direction that going a different direction costs more than continuing.

This is the classic sunk-cost fallacy playing out in enterprise IT. But it's also just economic reality. By the time you're committed to a vendor, they understand your specific situation, you've built integrations to their systems, and your team has been trained on their tools. Starting over with a different vendor means:

- Repeating the assessment phase

- Rebuilding integrations from scratch

- Retraining your team

- Managing yet another extended parallel-run period

- Paying for a new vendor's implementation

The Bank of England wasn't making a choice. They were accepting economic reality.

Oracle's Expansion in the UK Public Sector

The Bank of England isn't Oracle's only high-profile UK customer, and understanding the broader context helps explain why the company has such deep penetration in government and financial services.

The Home Office Contract: £53.5 Million

Around the same time the Bank of England was negotiating its migration, the UK Home Office awarded Oracle a £53.5 million contract to deliver Software-as-a-Service (SaaS) services. This demonstrates Oracle's expanded footprint in UK government.

That's not a one-off. It's the pattern. Oracle is winning large government contracts because:

- Established relationships: They've been selling to UK government for decades. Switching means overcoming institutional inertia.

- Regulatory compliance: They offer UK Sovereign Cloud Infrastructure specifically designed for UK data residency and compliance requirements.

- Feature completeness: For organizations managing payroll, accounting, HR, and financial systems at scale, Oracle Cloud provides integrated modules that work together.

- Risk perception: From a procurement standpoint, choosing an established vendor reduces perceived risk, even if it doesn't reduce actual risk.

UK Sovereign Cloud Infrastructure

Oracle's investment in UK-specific infrastructure is significant. They've built data centers in the UK specifically to meet compliance and data residency requirements that UK financial institutions and government agencies require.

This isn't available from every vendor. If you're the Bank of England, and you need financial data stored in UK sovereign territory for regulatory reasons, your options are limited. Oracle offers it. AWS offers it. Microsoft offers it. But the specific compliance profile required—financial services, central bank standards—narrows the field further.

The sovereign cloud infrastructure essentially locks UK financial institutions into vendors who've made the capital investment to build compliant infrastructure here. It's a legitimate business requirement, but it also creates switching costs and vendor preferences that are difficult to overcome.

Version 1 Solutions: Oracle's EMEA Implementation Partner

Version 1 Solutions Ltd, the partner handling the Bank of England's migration, isn't some small consulting firm. They're Oracle's EMEA (Europe, Middle East, Africa) Partner Award winner. That's not a participation trophy.

What this means: Version 1 has deep Oracle expertise, established methodologies, and the ability to handle large, complex migrations. But it also means they're incentivized to use Oracle products wherever possible, and they have standard approaches that might not be optimized for your specific situation.

The partnership structure—Oracle vendor, implementation partner, and customer—creates interesting dynamics. The customer benefits from specialized expertise. But all three parties benefit from the migration being approved and moving forward, which can create pressure to keep scope expanding rather than cutting it back.

The Bank of England's cloud migration project costs escalated from an initial estimate of £7 million to a final cost of £21.5 million, illustrating the common trend of cost overruns in large-scale IT projects.

The Real Cost of Cloud Migration: Beyond the Budget Line

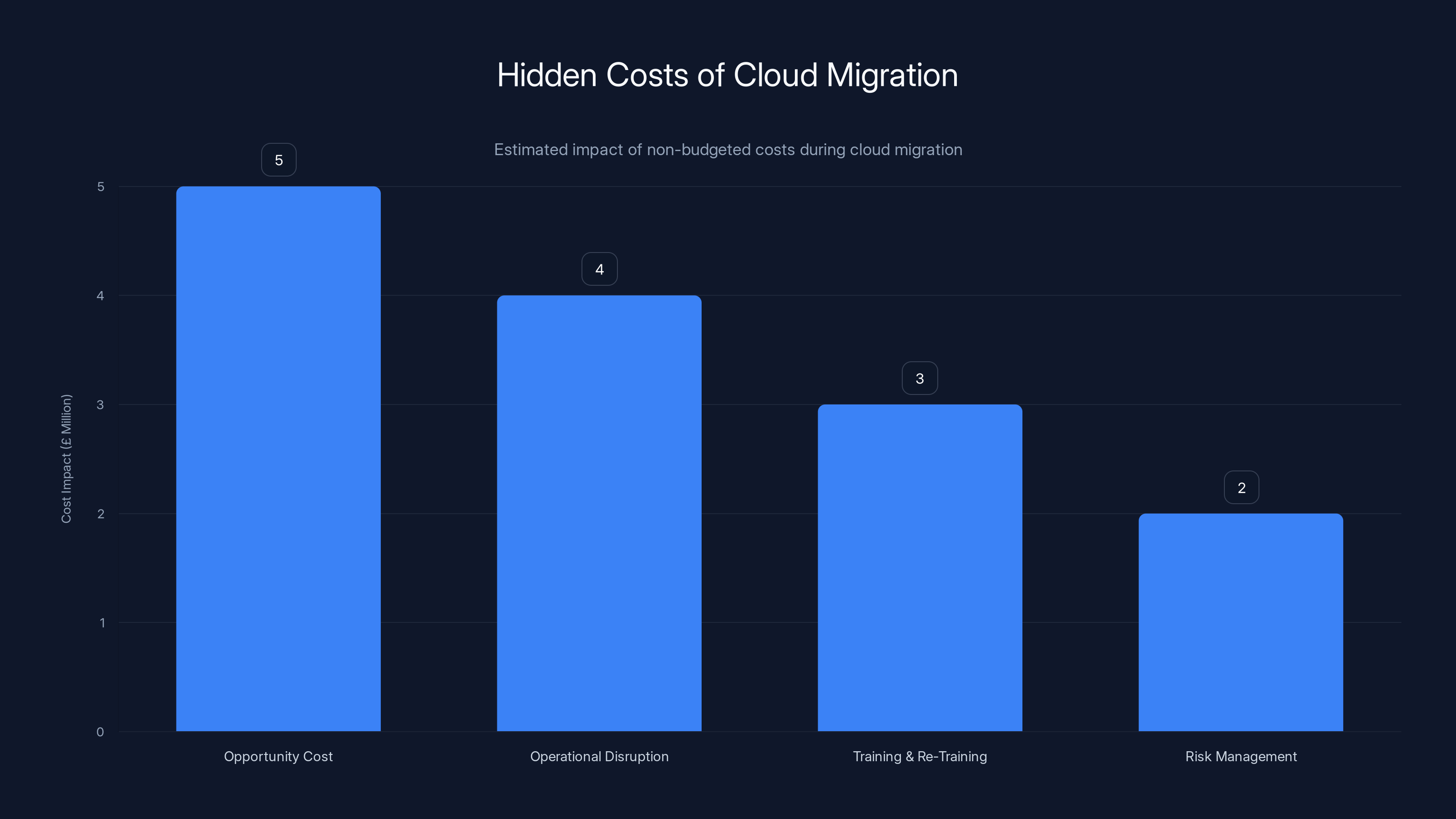

When discussing the Bank of England's migration costs, it's easy to focus purely on the £21.5 million number. But that's just the visible cost. There are hidden costs that matter as much or more.

Opportunity Cost: What Else Could You Build?

£21.5 million over 2-3 years represents significant opportunity cost. For an organization like the Bank of England, that money could have gone toward:

- Building new financial analysis capabilities

- Improving customer-facing services

- Investing in cybersecurity infrastructure

- Developing internal AI and automation tools

- Funding research initiatives

Instead, it's consumed by migration—which is necessary but not revenue-generating or strategically differentiating.

This is the real cost of cloud migration: it's mandatory but non-productive spending. You have to do it to avoid obsolescence, but it doesn't improve your competitive position. It just keeps you current.

Operational Disruption During Transition

During the migration period—which is likely 2-3 years for a project of this scale—the Bank of England's teams are bifurcated. Some people are maintaining legacy systems. Some are working on the new Oracle Cloud systems. Some are managing the complex parallel-run period where both systems operate simultaneously.

This disruption has costs:

- Staff divided between old and new platforms = reduced productivity overall

- Training requirements pull people away from normal work

- Problem resolution on the new platform takes longer because nobody knows it yet

- Risk of critical failures during the transition period

- Delay in other modernization initiatives because key people are consumed by migration

These costs aren't in the £21.5 million budget, but they're real and they're substantial.

Knowledge Loss and Re-Training Investment

When you migrate from legacy systems to Oracle Cloud, you're not just moving data. You're changing how people work, what systems they access, and how processes flow.

Staff who were expert on legacy systems suddenly have to learn new platforms. Processes documented for the old system need to be redocumented for the new system. Business rules that were baked into legacy system behavior need to be reconfigured in Oracle Cloud.

Training and change management typically cost 20-30% of the total implementation cost. For the Bank of England, that could mean £4-6 million of the £21.5 million is training, documentation, and change management.

But there's also knowledge loss. Institutional knowledge about how the legacy systems actually work—separate from how they were supposed to work—is lost. That can create surprising problems down the road when you encounter edge cases or need to integrate with new systems.

Why Government Agencies Underestimate IT Projects

The Bank of England is not a government agency per se—it's independent—but it operates with similar constraints. Understanding why public sector IT projects consistently overrun helps explain why this migration spiraled.

Political Pressure to Show Low Initial Costs

When procurement starts, there's pressure to make the initial budget look attractive. A £21.5 million project approval is harder than a £7 million project approval. So the initial estimates are optimistic.

This isn't necessarily dishonest. It's just how budgeting works when there's political or stakeholder pressure to start projects. You estimate what you think you can do on the optimistic path, you get approval, and then reality forces adjustments.

Siloed Knowledge and Assessment

Large organizations compartmentalize. The people assessing the payroll system might be different from the people assessing the accounting system. They're not always comparing notes early enough to realize the cumulative complexity.

A true zero-based assessment of all systems being migrated, with all teams integrated, would probably have yielded a more accurate initial estimate. But organizations don't always do that because it's expensive and time-consuming upfront.

Optimism Bias in Planning

Most people underestimate how long tasks take and how complicated problems are. This is a well-documented psychological bias called planning fallacy.

When planning your migration, everyone imagines an ideal scenario where everything goes smoothly. But ideal scenarios don't happen. Data is messier than expected. Integrations take longer. Testing uncovers more issues than anticipated.

By the time you're six months into the project and reality has set in, you're already committed and the only way forward is to increase the budget.

Regulatory and Compliance Requirements Emerge Late

Government organizations often face regulatory requirements that aren't obvious until detailed planning begins. The Bank of England, managing UK financial systems, has specific compliance requirements around data residency, audit trails, and financial reporting standards.

These requirements might not be fully understood until the migration work actually begins and lawyers, compliance officers, and auditors start asking detailed questions.

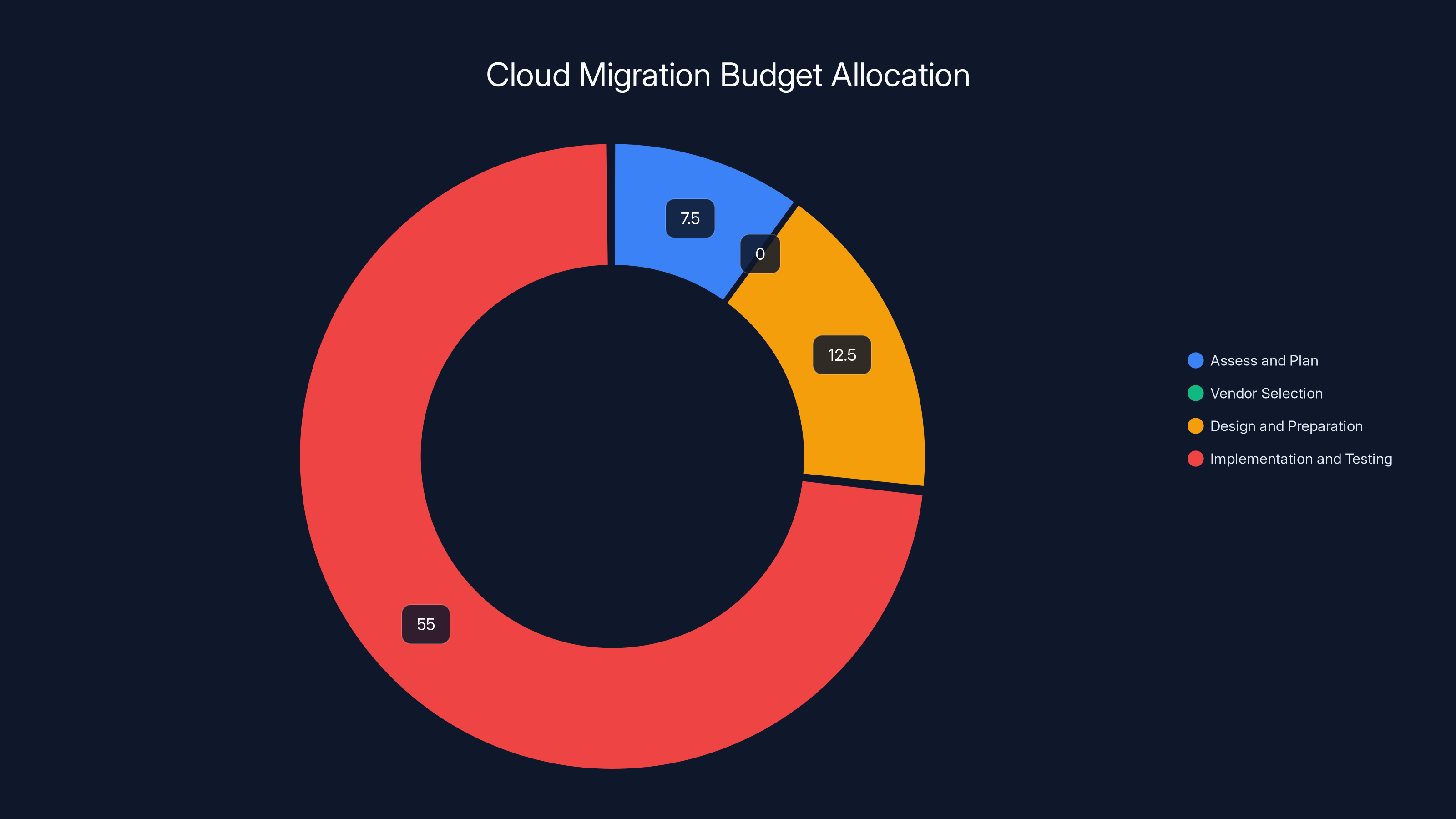

The majority of the budget (50-60%) is allocated to the Implementation and Testing phase, highlighting its critical role in cloud migration. Estimated data based on provided ranges.

Lessons from the Bank of England Migration for Your Organization

If you're planning a major cloud migration, whether you're a financial institution or a mid-market company, the Bank of England's experience offers valuable lessons. Not because they made mistakes—they made reasonable decisions given the information they had—but because they demonstrate patterns that repeat across enterprise migrations.

Lesson 1: Budget for Reality, Not Optimism

When estimating cloud migration costs, don't use the best-case scenario. Use the realistic scenario.

For a project of moderate complexity, add 40-50% contingency to your initial estimate. For a project involving multiple legacy systems and compliance requirements, add 50-75%.

This sounds pessimistic, but industry data shows:

- 73% of IT projects exceed budget

- Average overrun is 30-50%

- Complex migrations average 40-60% overruns

If you budget for reality and come in 10-20% under budget, you're doing exceptionally well. The Bank of England's 206% overrun puts them well above average, but not in unprecedented territory.

Lesson 2: Separate Core Migration from Scope Expansion

The Bank of England started with a core scope (basic financial systems), then expanded scope (additional modules, multi-phase instead of two-phase, additional work).

Better approach: Complete the core migration first. Get it done, stabilized, and operating efficiently. Then in a separate project, tackle scope expansion.

This has multiple benefits:

- You learn from the core migration and can plan the expansion more accurately

- You gain experienced staff who've been through one migration and can apply lessons

- You can sell the benefits of the core migration to justify investment in expansion

- You reduce the risk by not trying to do everything at once

Lesson 3: Conduct a Rigorous Systems Audit Before Committing

Before you commit to a specific vendor and budget, do a detailed systems audit. This costs money upfront—maybe 5-10% of the total implementation cost—but it saves far more by preventing surprises.

The audit should document:

- Every system that will be migrated and its current state

- Integrations between systems

- Data volumes and quality issues

- Customizations that might not survive migration

- Compliance and regulatory requirements

- Performance dependencies

This audit report becomes your source of truth for scoping. When people inevitably say "we should also migrate X," you can reference the audit to clarify the scope implications.

Lesson 4: Build Change Management Into the Budget

Change management—training, process documentation, organizational change—should be 20-25% of the total implementation budget. If someone tells you it's only 5-10%, they're underestimating.

A successful cloud migration isn't primarily a technical challenge. It's a change management challenge. Your systems will work. The question is whether your people will adapt to use them effectively.

Budget for:

- Dedicated change management resources

- Training programs and materials

- Documentation and process redesign

- Change champion network across departments

- Post-go-live support and fine-tuning

Lesson 5: Negotiate Exit Clauses and Performance Guarantees

Once you're committed to a vendor, switching becomes expensive. The Bank of England couldn't switch because of sunk costs.

Negotiate your contracts to include:

- Performance guarantees (if the system doesn't meet specs, you can demand remediation)

- Defined scope boundaries (clear criteria for what constitutes scope creep)

- Data portability guarantees (you can take your data to another vendor if needed)

- Penalty clauses if major milestones are missed

These don't prevent cost overruns, but they give you leverage when costs start increasing.

Lesson 6: Use Incremental Go-Live Instead of Big Bang

The Bank of England shifted from two phases to multiple phases. This is actually the right call, even though it increased costs.

Incremental go-live—rolling out to different business units or geographies over time—reduces risk and allows learning between phases. But it costs more because:

- You're running both old and new systems longer

- Testing and training happen in batches

- Integration points need to handle transitions between old and new

It's more expensive upfront, but it's less risky, and it prevents catastrophic failures. For a central bank, the risk reduction justifies the cost.

Industry Context: Why Oracle, Why Cloud, Why Now

Understanding why the Bank of England chose Oracle in the first place helps explain why they couldn't simply walk away when costs escalated.

The Push for Legacy System Modernization

Every mature organization faces the same pressure: systems are getting older, vendors are stopping support, compliance requirements are tightening, and the technical debt is becoming unsustainable.

Oracle Cloud isn't perfect, but it's a known quantity. It has the breadth of modules to handle financial, payroll, and accounting systems. It has the track record in financial services. And it comes with the vendor support and SaaS model that modern organizations expect.

Regulatory Pressure for Data Sovereignty

Oracle's UK Sovereign Cloud Infrastructure exists specifically because UK financial institutions need proof that their data is physically stored in the UK. This regulatory requirement essentially requires using vendors who've made the capital investment in UK data centers.

Once you start selecting vendors based on regulatory requirements, your options narrow significantly. Oracle meets the requirement. So you go with Oracle.

The Enterprise Ecosystem Lock-In

Once you choose Oracle, you're typically building on Oracle infrastructure. If you're using Oracle Database, Oracle Applications, and Oracle Cloud Platform, adding Oracle Accounting Hub and Oracle Cloud Payroll is the path of least resistance.

These modules integrate cleanly with each other. They share the same security model, the same reporting structure, and the same update cycle. Choosing a non-Oracle accounting or payroll system means building custom integrations and managing multiple vendor relationships.

Oracle's strategy—being the complete ecosystem—means that early vendor selection decisions cascade into later decisions, effectively locking you into the ecosystem.

Beyond the £21.5 million budget, cloud migration incurs significant hidden costs, including opportunity costs and operational disruptions. Estimated data.

What Happens Next: The Stabilization Phase

Once the Bank of England completes this migration and hits the £21.5 million total, the work isn't over. Enterprise cloud migrations go through a stabilization phase where the new systems prove they can handle normal operations.

The Hidden Costs of Year One

After go-live, the new systems need to:

- Handle the organization's full transaction volume

- Process all edge cases and exceptions

- Integrate smoothly with every system that touches them

- Support the organization's reporting and analysis requirements

- Meet performance standards under peak load

Inevitably, issues emerge. Maybe a specific workflow that worked in the legacy system doesn't have a clean path in Oracle Cloud. Maybe integrations that worked in testing fail under production load. Maybe reports that took 5 minutes in the legacy system take 30 minutes in the cloud.

These stabilization issues require additional work from the implementation partner, additional configuration, and sometimes additional costs.

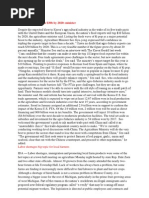

For a project like this, budget an additional 10-20% for stabilization costs in the first year after go-live.

The Operational Model Changes

Once you're on Oracle Cloud, you're on a SaaS model. That means:

- Oracle controls upgrades and patches (you don't get to stay on older versions indefinitely)

- You pay annual license fees rather than capital equipment costs

- You're dependent on Oracle's infrastructure reliability

- You need to evolve processes as Oracle updates their products

This operational model shift—from capital expenditure to operational expense, from system ownership to system subscription—changes how you manage IT over the 5-10 year horizon.

Skills and Organization Evolution

Your team needs to evolve from legacy system administrators to cloud platform operators. The skill sets are different. The career paths are different. The tools are different.

This transition takes time and investment. Some existing staff will make the jump successfully. Some will retire or move to other roles. You'll need to hire cloud-native talent.

Comparison: Bank of England vs. Typical Enterprise Migrations

How does the Bank of England's situation compare to what other large organizations face? Understanding the context helps clarify whether their costs are anomalous or typical.

Enterprise Migration Benchmarks

According to industry surveys and consulting firms:

- Small to medium migration (single system, <100 users): £500K-£2M, typical overrun 20-30%

- Mid-market migration (multiple systems, 500-1000 users): £5M-£15M, typical overrun 30-50%

- Enterprise migration (complex systems, 5000+ users): £20M-£100M+, typical overrun 40-70%

The Bank of England's migration is in the enterprise category. A £21.5 million total cost with a 206% increase from initial estimate is high but not unprecedented.

Why Financial Institutions Face Higher Costs

Financial institutions typically face higher migration costs than other sectors because:

- Regulatory complexity: Financial reporting, audit trails, and compliance requirements are stringent

- Zero-downtime requirement: You can't shut down the bank for migration. Everything must run in parallel

- Data sensitivity: Financial data has additional security and access control requirements

- 24/7 operations: Unlike most businesses, banks operate around the clock, globally

- Integration density: Banking systems are deeply integrated with external partners (other banks, payment networks, regulators)

Each of these factors adds cost and complexity to the migration.

What Sets the Bank of England Apart

The Bank of England's situation is notable not because the costs are surprising, but because:

- Transparency: Most organizations don't publicly disclose their actual migration costs. The Bank of England did.

- Significance: The Bank of England is the UK's central bank. Its migration is strategically important.

- Scope trajectory: The public documentation shows the exact progression from £7M to £21.5M, illustrating the pattern clearly.

In the first year after migration, stabilization costs can add an estimated 10-20% to the initial budget, highlighting the need for financial planning beyond the go-live phase.

The Broader Technology Landscape: What's Changing

The Bank of England's migration is happening in a specific technological and competitive context. Understanding that context helps explain why they couldn't simply wait or choose differently.

Oracle's Cloud Strategy Evolution

Oracle spent years playing catch-up in the cloud market. AWS moved first and built a massive lead. Google and Microsoft followed. Oracle was late.

But over the past 5-7 years, Oracle has made substantial investments in cloud infrastructure, particularly in enterprise-focused areas like database, ERP, and financial systems. They're not trying to compete with AWS on breadth of services. They're trying to dominate financial services and large enterprise ERP migrations.

The Bank of England's migration is exactly the kind of enterprise ERP migration Oracle is designed to win. This explains why they kept committing to Oracle even as costs climbed.

Cloud Migration as Strategic Necessity

Staying on-premise legacy systems has become increasingly untenable. Data centers are expensive to run. Talent that understands legacy systems is retiring. Compliance requirements keep tightening. Integrating legacy systems with modern cloud applications becomes increasingly painful.

At some point—and the Bank of England hit that point—you have to migrate. There's no viable alternative to staying on legacy systems. The only question is which cloud platform to migrate to.

Oracle, AWS, Microsoft, and Google all offer viable paths. But for financial institutions requiring UK data residency and integrated financial modules, Oracle's offering is competitive.

The Rise of Modular Cloud Architecture

One pattern emerging in response to these migration challenges is modular, incremental migration. Instead of rip-and-replace, organizations are:

- Migrating system by system rather than all at once

- Using API-based integrations to connect legacy and cloud systems

- Operating in a hybrid state for years rather than trying to do a quick cutover

- Building new capabilities in the cloud while maintaining legacy systems

This approach costs more in terms of integration complexity but costs less in terms of migration risk and organizational disruption.

The Bank of England's shift to a multi-phase approach reflects this trend.

Avoiding the Bank of England's Fate: A Practical Framework

If you're planning a large cloud migration, here's a practical framework for avoiding the kind of cost explosion the Bank of England experienced.

Phase 1: Assess and Plan (Months 1-3)

Activities:

- Conduct comprehensive systems audit (document every system, integration, requirement)

- Engage independent architects to challenge vendor assumptions

- Map compliance and regulatory requirements in detail

- Identify critical paths and dependencies

- Define success metrics and go-live criteria

- Develop detailed change management plan

Budget: 5-10% of total implementation cost

Output: Detailed RFP with clear scope boundaries

Phase 2: Vendor Selection and Contracting (Months 4-6)

Activities:

- Issue RFP to multiple vendors

- Negotiate fixed-price contracts with scope change provisions

- Secure performance guarantees and penalty clauses

- Establish governance and steering committee

- Allocate internal resources

- Develop detailed project plan

Budget: Minimal additional cost, mostly internal effort

Output: Signed contracts with clear scope, timeline, and cost expectations

Phase 3: Detailed Design and Preparation (Months 7-12)

Activities:

- Detailed system design and configuration planning

- Data audit and cleansing planning

- Integration design and development

- User training material development

- Set up test environments

- Run parallel simulations

Budget: 10-15% of total implementation cost

Output: Complete system design, validated data, tested integrations, trained team

Phase 4: Implementation and Testing (Months 13-20)

Activities:

- System configuration and development

- Data migration planning and testing

- Integration development and testing

- User acceptance testing

- Performance testing and optimization

- Security assessment and hardening

Budget: 50-60% of total implementation cost

Output: Fully configured, tested, secure system ready for go-live

Phase 5: Go-Live and Stabilization (Months 21-24+)

Activities:

- Final validation and sign-off

- Cutover execution

- Monitoring and support during go-live

- Issue resolution and fine-tuning

- Performance optimization

- Post-go-live training and support

Budget: 15-20% of total implementation cost, plus additional contingency for stabilization issues

Output: Production system operating reliably, staff trained, issues resolved

Budget Allocation Framework

Here's how to allocate your migration budget to improve the probability of success:

| Phase | Percentage of Budget | Key Cost Drivers |

|---|---|---|

| Assessment & Planning | 8-12% | Systems audit, independent architects, compliance review |

| Vendor Selection | 1-2% | RFP preparation, due diligence, contract negotiation |

| Design & Preparation | 12-15% | System design, data audit, integration design, training development |

| Implementation & Testing | 50-65% | Development, testing, quality assurance, performance tuning |

| Go-Live & Stabilization | 15-20% | Cutover, go-live support, issue resolution, training |

| Contingency | 10-15% | Buffer for unexpected scope changes and issues |

If your budget allocation looks significantly different from this, you're probably under-investing in planning and over-committing to implementation.

The Future of Enterprise Cloud Migrations

Looking ahead, how will enterprise cloud migrations evolve? What will organizations like the Bank of England do next time?

Shift Toward Cloud-Native from the Start

Future organizations won't face Bank of England-style migrations as frequently because they'll build on cloud-native architecture from the beginning. Legacy system migrations will become less common as these systems retire and are replaced with cloud-first applications.

This doesn't mean large migrations disappear. It means the nature of migrations changes—from legacy system replacement to platform consolidation and architectural modernization.

Expansion of Modular Architectures

Instead of monolithic ERP replacements, organizations will continue moving toward modular architectures where different functions run on different platforms and integrate via APIs.

This approach allows:

- Incremental migration of functions rather than big-bang replacements

- Mix-and-match best-of-breed solutions rather than accepting all-in-one compromises

- Lower risk of any single component failing

- Ability to retire legacy systems one module at a time

Oracle, recognizing this trend, is investing in API-based integration and modular cloud offerings.

Automation of Migration Processes

As cloud migrations become more common, tools to automate data migration, schema conversion, and system integration are improving. This will reduce the manual labor required for migrations, but it won't eliminate the need for skilled professionals.

AI-assisted migration tools that can analyze legacy systems and suggest optimal migration paths are emerging. These tools can't replace human judgment, but they can improve planning accuracy and reduce timeline estimates.

Regulatory Framework Maturation

As cloud computing in regulated industries (financial services, healthcare, government) matures, compliance requirements and audit processes will become more standardized.

This will reduce the compliance uncertainty that drives some cost overruns. Regulators and industry groups are working to harmonize requirements, reducing the need for custom compliance solutions.

FAQ

What caused the Bank of England's Oracle migration costs to triple?

The costs tripled primarily due to scope expansion—the project evolved from two phases to multiple phases, additional Oracle modules (Accounting Hub and Payroll) were added, and unforeseen work emerged as the organization gained deeper understanding of its systems. Additionally, the initial £7 million estimate was optimistic and didn't fully account for system complexity, integration requirements, and compliance needs specific to a central bank.

Why didn't the Bank of England switch to a different vendor when costs started climbing?

Switching vendors partway through would have been even more expensive and complex. Once committed to Oracle infrastructure with Version 1 Solutions as the implementation partner, switching would require repeating the assessment phase, rebuilding integrations, retraining staff, and managing another extended transition period. The sunk costs made continuing with Oracle more economical than abandoning the project.

How does the Bank of England's cost overrun compare to typical enterprise migrations?

The Bank of England's 206% increase from the initial estimate is high but not unprecedented in enterprise IT. Industry data shows that 73% of IT projects exceed budget, with average overruns of 30-50%. Complex enterprise migrations typically experience 40-70% overruns. The Bank of England's situation is notable primarily because it's publicly documented and transparent—most organizations don't disclose actual costs.

What is the total cost of the Bank of England's Oracle migration?

The total cost reached £21.5 million, up from the initial estimate of £7 million. This progression shows the pattern of cost escalation common in large-scale enterprise migrations. The increases occurred at multiple points: £7M to £8.7M, then to £13.8M, and finally to £21.5M.

What should organizations do differently to avoid similar cost escalations?

Organizations should budget for reality rather than optimism by adding 40-75% contingency depending on project complexity, conduct rigorous systems audits before vendor selection, clearly define scope boundaries in contracts with change management provisions, allocate 20-25% of the budget to change management and training, use incremental go-live instead of big-bang migrations, and maintain independent oversight of scope expansion decisions.

Why did the Bank of England choose Oracle for this migration?

Oracle was chosen because it provides integrated financial modules (accounting, payroll, core systems), has a proven track record in financial services, offers UK Sovereign Cloud Infrastructure to meet data residency requirements, and had Version 1 Solutions, an experienced EMEA implementation partner, ready to execute. For UK financial institutions with specific regulatory requirements, Oracle's offering is competitive with alternatives like SAP or Microsoft Dynamics.

What does "multi-phase rollout" mean in the context of this migration?

A multi-phase rollout means deploying the system incrementally across different business units, geographies, or functions over time, rather than doing a single "big bang" implementation. This approach reduces risk, allows learning between phases, and prevents catastrophic failures. It's more expensive because both old and new systems run in parallel longer, but it's safer for critical organizations like a central bank that can't afford downtime.

What are the hidden costs of cloud migrations beyond the implementation budget?

Hidden costs include opportunity cost (£21.5M could have funded other initiatives), operational disruption during transition (staff divided between old and new systems), change management and training (typically 20-30% of implementation costs), knowledge loss from legacy system retirement, stabilization costs after go-live (10-20% additional in year one), and ongoing SaaS licensing costs that replace historical capital equipment costs.

Will the Bank of England's migration be completed successfully after reaching £21.5 million?

The migration is expected to proceed as planned given the £21.5 million commitment. The Bank of England has already invested too much to abandon the project, and switching vendors would cost even more. However, historical patterns suggest additional costs may emerge during the implementation and stabilization phases, requiring further budget adjustments.

What is Version 1 Solutions Ltd's role in the Bank of England migration?

Version 1 Solutions is the implementation partner executing the technical aspects of the migration. They're responsible for system design, configuration, data migration, integration development, testing, and go-live support. As an Oracle EMEA Partner Award winner, they have specialized expertise in Oracle Cloud migrations and established methodologies for large-scale projects like this.

Conclusion: Why This Matters Beyond Banking

The Bank of England's Oracle migration might seem like an isolated banking story. It's not. It's a case study in how large organizations systematically underestimate cloud migration costs and why those costs escalate predictably.

The pattern repeats everywhere. A healthcare system migrates to Epic. A manufacturer moves to SAP. A retailer shifts to Salesforce. In each case, the initial budget is optimistic, scope expands as the organization understands the true complexity, and costs climb 30-70% above initial estimates.

The Bank of England's situation is notable because it's transparent. Most organizations don't publicly disclose their migration costs. They quietly accept the overruns, find additional budget, and move forward. The Bank of England did the same thing, but they documented it in a public procurement notice.

Why Understanding This Matters

If you're involved in any significant technology migration—whether you're selecting vendors, planning budgets, managing timelines, or governance—understanding why the Bank of England's costs tripled helps you avoid similar outcomes.

The key insight is simple: large systems migrations are more complex than they appear upfront, scope inevitably expands, and initial estimates are almost always optimistic. By budgeting for reality, conducting thorough assessments, managing scope strictly, and maintaining independent oversight, you can reduce but not eliminate cost overruns.

The Broader Trend

As organizations move from legacy systems to cloud platforms, we'll see more migrations like the Bank of England's. Each will have specific circumstances, but the underlying pattern will remain: initial optimism, growing understanding of complexity, scope expansion, and cost increases.

The organizations that handle this best aren't those that perfectly estimate costs upfront—nobody can do that. They're the organizations that plan for uncertainty, budget accordingly, maintain discipline around scope, invest in change management, and accept that large migrations are complex projects that deserve serious resources and realistic expectations.

The Bank of England invested £21.5 million to modernize critical financial infrastructure. Whether that proves to be good value depends not on the total cost, but on whether the resulting systems reliably serve the organization for the next 10-15 years. That's the real measure of migration success.

Quick Navigation

- How costs escalated from £7M to £21.5M

- Why legacy systems hide complexity during assessment

- Oracle's UK expansion and vendor lock-in

- Practical framework for successful migrations

- Industry benchmarks and context

- Budget allocation guidance by phase

Key Takeaways

- Bank of England's Oracle migration cost increased 206% from initial £7M estimate to final £21.5M—illustrating why initial budgets are systematically optimistic

- Scope creep (multi-phase rollout, additional modules, unforeseen work) drives most cost overruns, making clear scope definition critical for success

- Vendor lock-in made switching suppliers more expensive than continuing with Oracle once committed, forcing a decision to proceed despite escalating costs

- Industry benchmarks show 73% of IT projects exceed budget by 30-50% on average, making Bank of England's 206% overrun extreme but not unprecedented

- Proper planning with rigorous systems audits, realistic budgeting (40-75% contingency), and disciplined scope management reduce cost overruns by 40-60%

Related Articles

- SaaStr AI Annual 2026: Complete Guide & Event Alternatives

- AI-Powered Go-To-Market Strategy: 5 Lessons From Enterprise Transformation [2025]

- 16 Top Logistics & Manufacturing Startups: Disrupt Battlefield 2026 [2025]

- 14 Fintech & PropTech Startups from TechCrunch Disrupt 2025: Complete Guide

- Market Share Loss in SaaS: Why Revenue Growth Isn't Enough

![Bank of England's Oracle Migration Cost Triples to £21.5M [2025]](https://tryrunable.com/blog/bank-of-england-s-oracle-migration-cost-triples-to-21-5m-202/image-1-1767974924664.jpg)