California's $200 Million EV Tax Credit Program: What You Need to Know

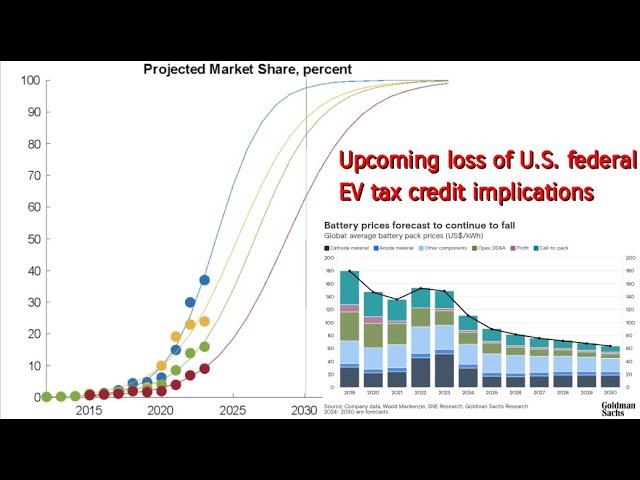

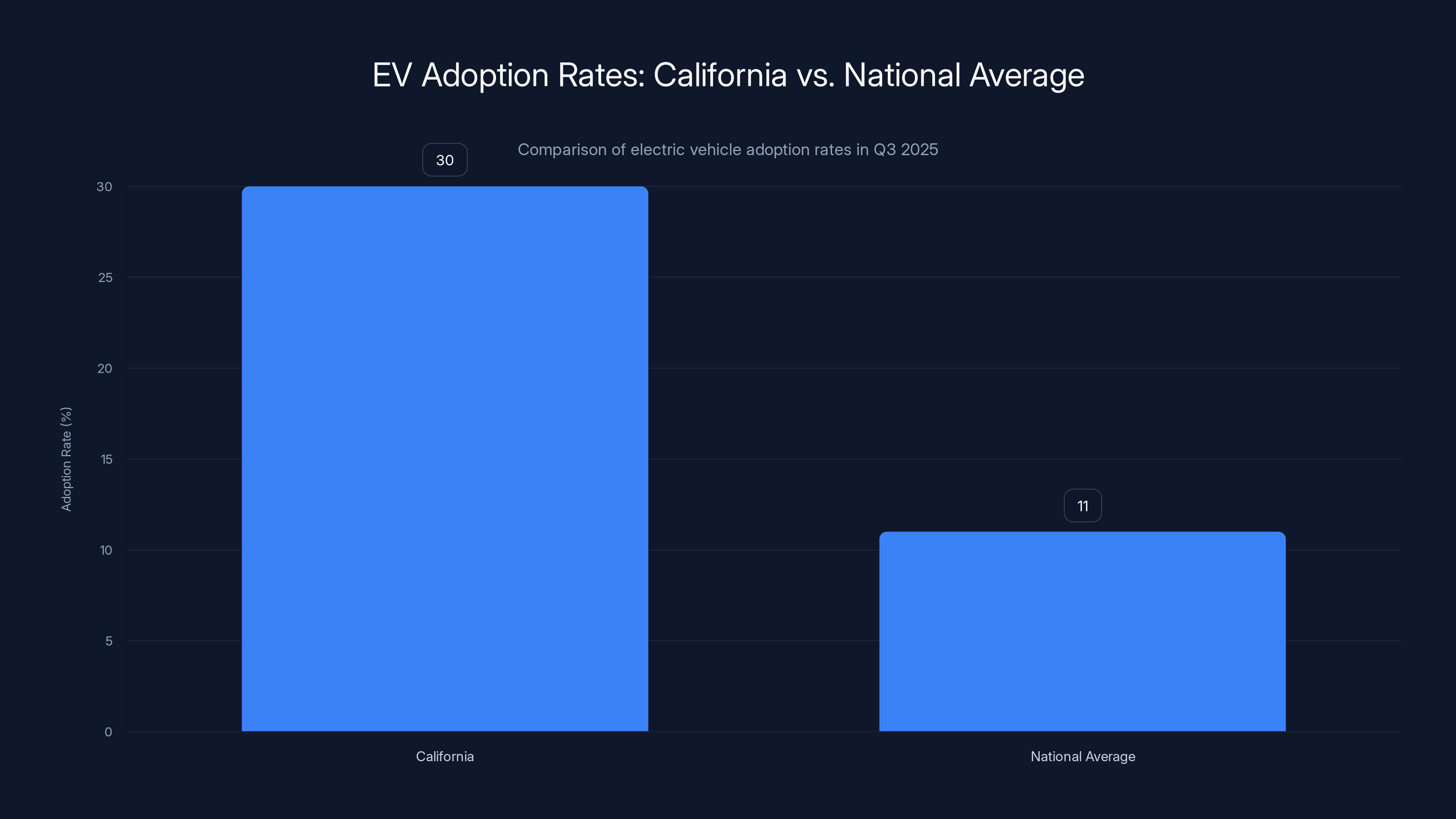

Electric vehicle adoption in California hit a historic milestone in 2025. Almost 30 percent of all auto sales in the state were EVs during the third quarter, according to the California Energy Commission. That's not a typo. Not 3 percent. Not 10 percent. Thirty percent.

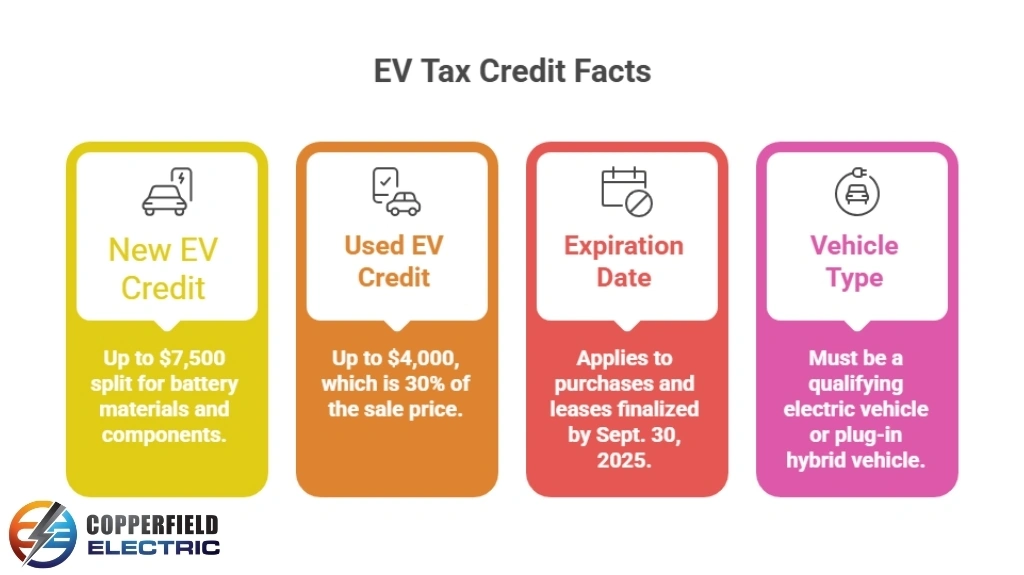

But here's the problem: the federal tax credit that once offered up to

Enter Governor Gavin Newsom's solution. His proposed 2026-2027 budget includes a game-changing initiative: a $200 million "light-duty zero-emission vehicle (ZEV) incentive program" designed to keep electric vehicles affordable for California residents. It's not just a band-aid fix. It's an aggressive move to maintain the state's EV leadership while Washington's incentives disappear.

But the details matter. The budget proposal doesn't specify exactly how much each buyer will get, and there are still major questions about used vehicle eligibility. This comprehensive guide breaks down everything you need to understand about California's bold new EV incentive strategy, how it compares to what came before, and what it means for your next vehicle purchase.

TL; DR

- **200 million for a new EV tax credit program to replace lost federal incentives

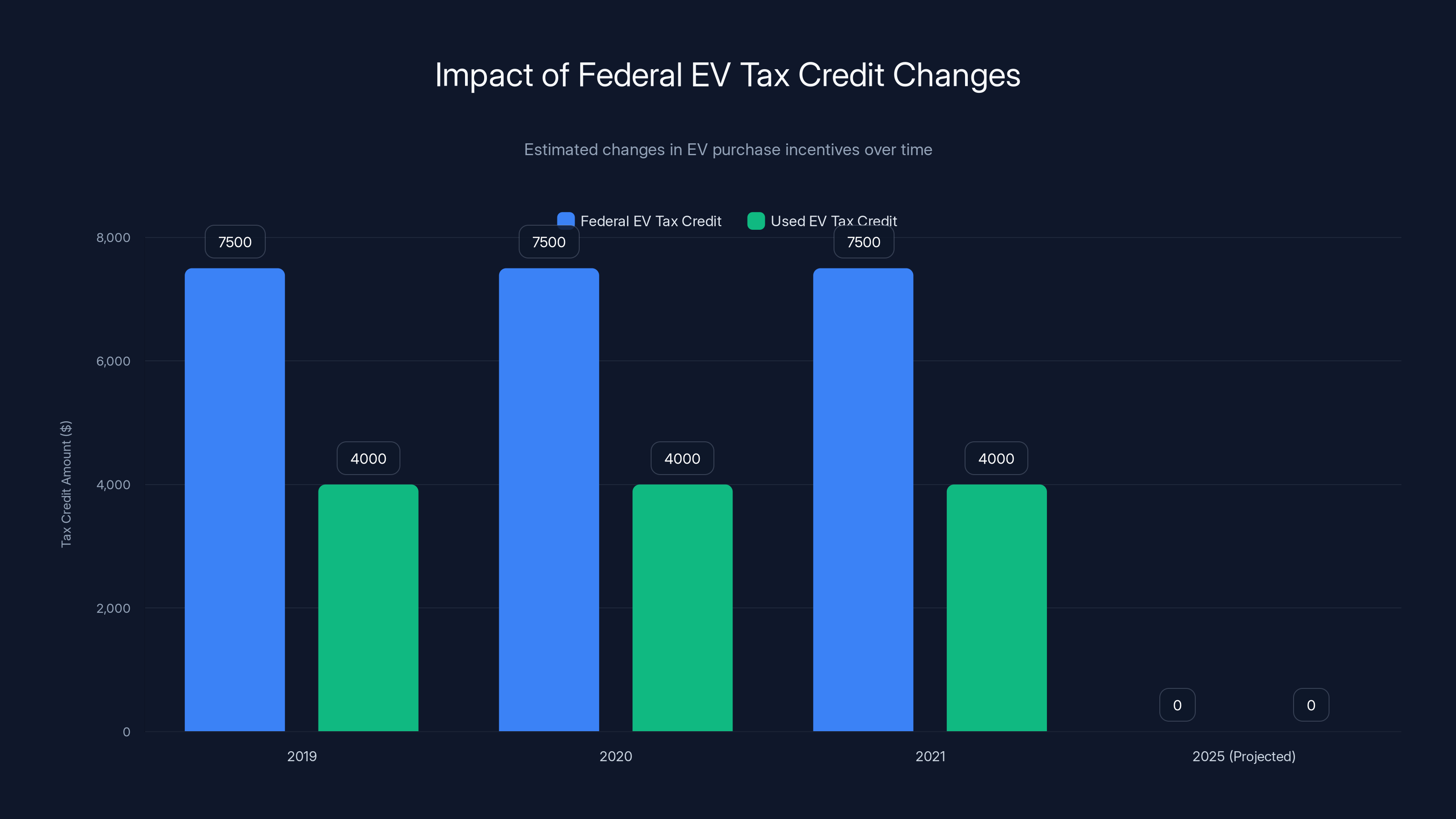

- Federal Credit Elimination: The 4,000 for used EVs are no longer available to most California buyers

- Instant Rebate Structure: The new credits are designed as "on the hood" instant discounts at the point of purchase, not tax credits claimed later

- Used EV Eligibility Unclear: State officials haven't finalized whether used EV buyers will qualify for the rebate program

- Legislative Approval Required: The budget must pass through California's legislature later in 2025 to become law

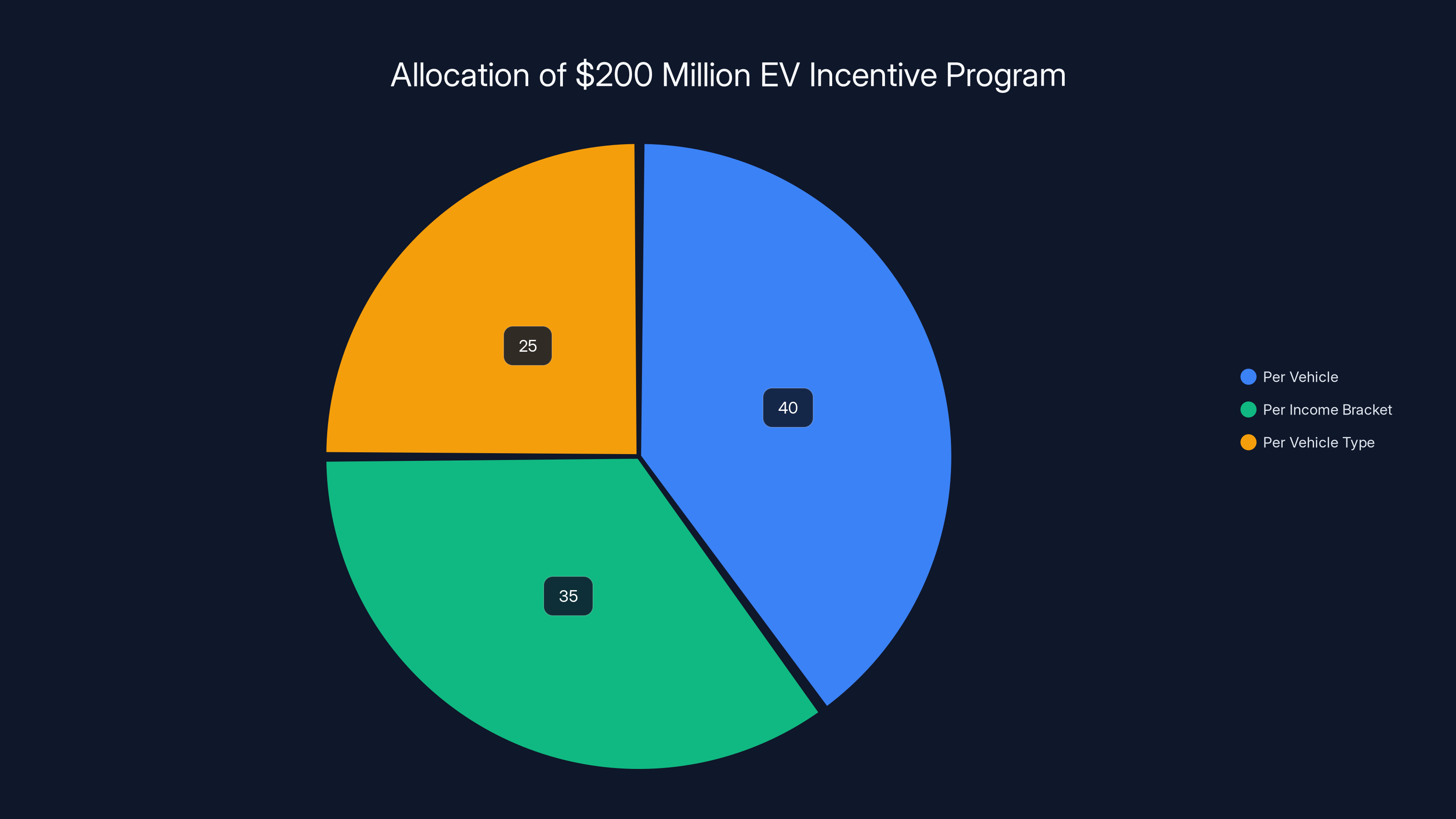

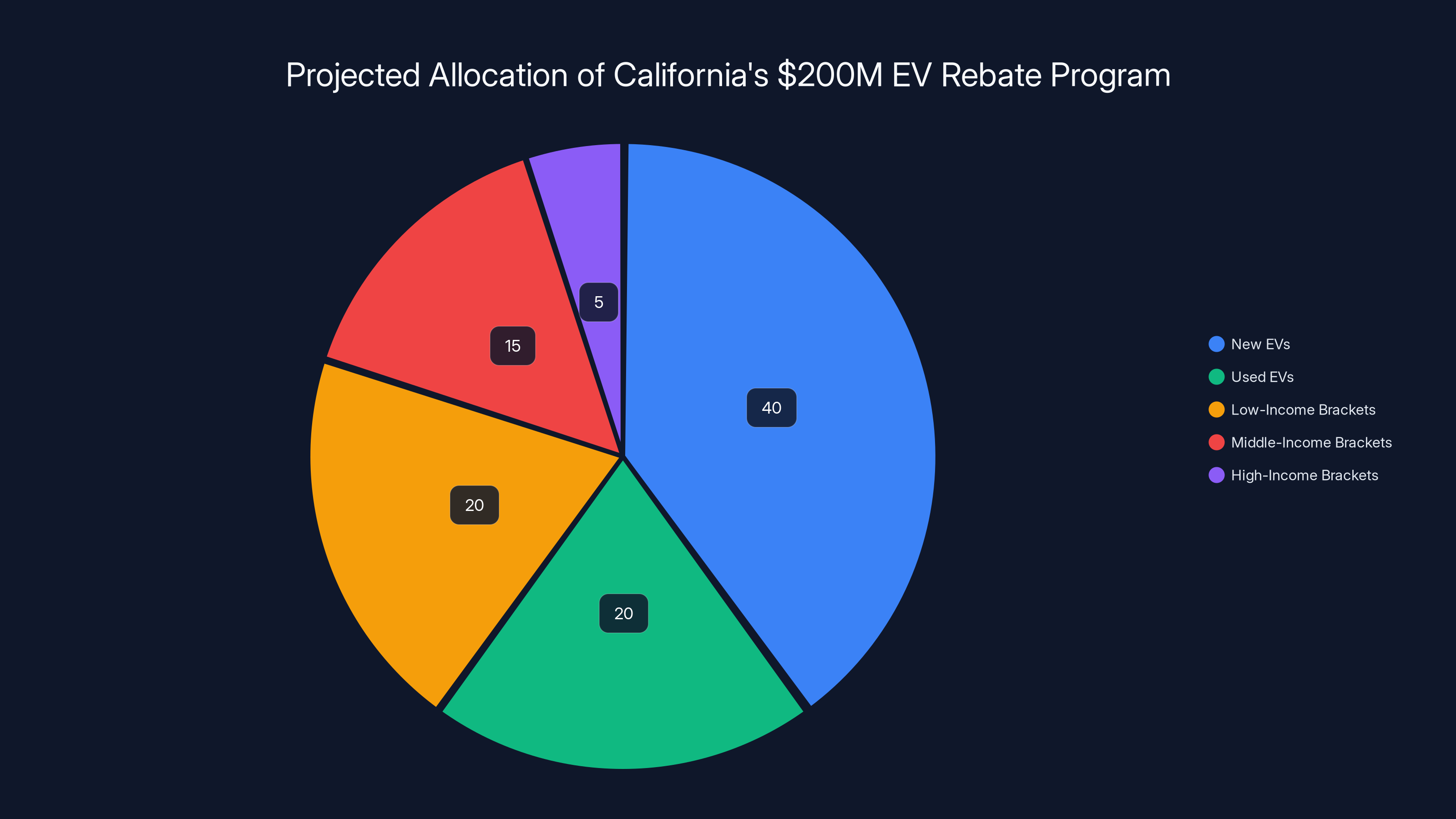

Estimated data suggests the $200 million will be allocated across vehicle incentives, income-based incentives, and vehicle type incentives, with the largest share potentially going to per vehicle discounts.

The Federal Tax Credit Collapse: How California Lost $7,500

For years, the federal EV tax credit was the backbone of American electric vehicle economics. If you bought a new EV, you could claim up to

For a family considering a

Then the credit got restricted. Income limits kicked in. Vehicle price caps were implemented. Battery component sourcing rules became stricter. By 2025, the majority of EVs on the market no longer qualified. The credit, which was supposed to democratize electric vehicle ownership, became a program that helped only certain buyers in certain income brackets purchasing certain vehicles.

California watched this happen and realized the state couldn't rely on federal incentives anymore. The state had built momentum. EV adoption was accelerating. If incentives disappeared overnight, that momentum would vanish. Dealers would shift focus back to gas cars. Consumers would reconsider. The entire ecosystem would reset.

So California did what California does: it stepped in with its own solution.

Governor Newsom's $200 Million Strategy

Governor Gavin Newsom released his 2026-2027 budget proposal on Friday, and buried in the details was a crucial new program. The "light-duty zero-emission vehicle incentive program" gets a one-time infusion of $200 million specifically designed to support EV adoption.

The budget document describes this as "a critical part of the Administration's strategy to keep ZEVs affordable and accessible for all." That's not flowery language. That's stating the central purpose clearly: accessibility.

Here's what makes this different from the federal program. First, it's not a tax credit you claim months later on your 1040 form. According to USA Today's reporting, this will be an "on the hood" instant discount. You walk into a dealership, negotiate the price, and the state rebate comes off at the point of sale. You get the benefit immediately, not when you file taxes next April.

That's actually genius from a behavioral economics standpoint. Instant discounts feel more real to buyers. The reduction happens right there in the sales contract. It's tangible. It changes the comparison a buyer makes in the moment: not "I'll get

Second, California is taking control of the parameters. The state can decide income limits, vehicle eligibility, pricing thresholds, and everything else. No waiting for federal rule changes. No congressional gridlock. California makes the rules.

Lauren Sanchez, chairwoman of the California Air Resources Board (CARB), is leading the effort to determine how the money breaks down. Per vehicle? Per income bracket? Per vehicle type? Those details are being finalized now.

The federal EV tax credit, once up to

Understanding California's EV Market Leadership

Why is California willing to spend $200 million on this? Look at the numbers.

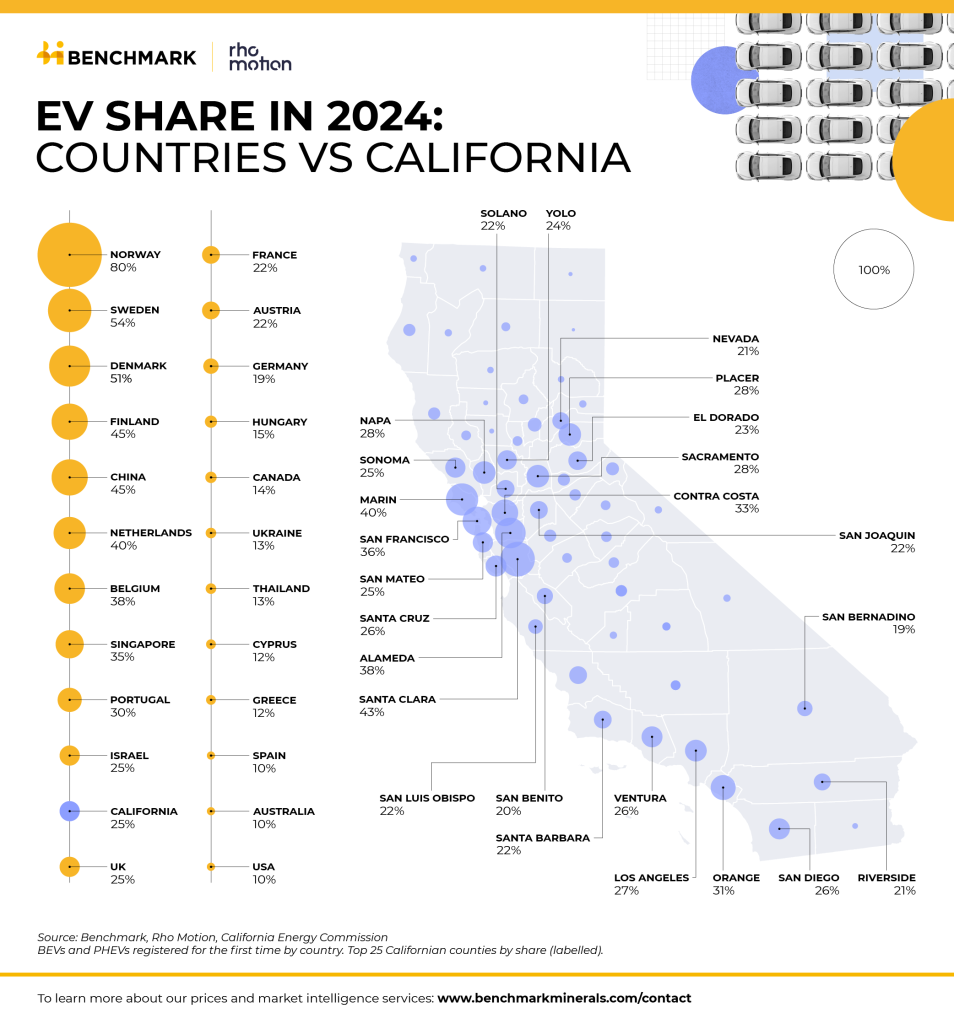

During Q3 2025, 30 percent of auto sales in California were electric vehicles. That's not just impressive. That's a market transformation. In context, national EV adoption sits around 10-12 percent of new vehicle sales. California is nearly three times ahead of the national average.

This didn't happen by accident. It's the result of years of policy decisions, infrastructure investment, and incentive programs. California built the ecosystem. Charging networks expanded. Dealer knowledge improved. Consumer confidence grew. Each factor reinforced the others.

The state also has serious environmental commitments. California has pledged to eliminate new gasoline car sales by 2035. That's not a suggestion. It's a legal mandate. You can't hit that target if EV adoption stalls when incentive programs expire.

There's also an economic argument. EV manufacturing is becoming a major industry. Tesla's Gigafactory in Nevada brings thousands of jobs and hundreds of millions in tax revenue. Lucid, Fisker, and other manufacturers have operations in California. The EV transition represents economic transformation, not just environmental responsibility.

California wants to stay ahead of that curve. If the state becomes the EV leader, related industries follow: battery manufacturing, charging infrastructure, software development, recycling. The $200 million investment returns value through job creation and tax revenue.

The Used EV Question: A Crucial Uncovered Detail

Here's where the budget proposal gets vague. It doesn't specify whether used EV buyers will qualify for the new incentive program.

This matters enormously. Used EVs serve a completely different market than new vehicles. New EV buyers tend to have higher incomes and better access to charging at home. Used EV buyers include people priced out of new vehicles, apartment dwellers, and families with tighter budgets. Used EVs are where mass accessibility lives.

The old federal program included used EV support: up to $4,000 back on qualifying used vehicles purchased from licensed dealers. That program helped people who couldn't afford new cars access electric transportation.

Lauren Sanchez told USA Today that CARB is still working through whether California's $200 million program will include used vehicles. That's not dodging the question. It's acknowledging that used EV support requires different infrastructure and verification systems than new vehicle incentives.

With a new car purchase, the dealership confirms everything. The vehicle is new, its price is known, its emissions rating is clear. With used cars, nothing is guaranteed. The vehicle's battery health is uncertain. Its actual mileage might vary. The true residual value is harder to pin down.

But the potential impact of including used EVs is enormous. A

How the "On the Hood" Discount Changes Buyer Psychology

The details of how you deliver an incentive matter as much as the amount. California's decision to use "on the hood" instant discounts instead of tax credits fundamentally changes how buyers experience the benefit.

Consider two scenarios. In Scenario A, you buy a

Economically, both scenarios deliver the same benefit. Psychologically, they're completely different. Scenario A requires you to predict future tax benefits, remember to claim them, and wait months to see the money. Scenario B changes the actual purchase price. You negotiate based on the real number.

Research in behavioral economics shows that immediate benefits feel larger than delayed ones. The same dollar amount delivered today feels more valuable than the same dollar promised later. Instant discounts also reduce the cognitive load of the purchase process. Buyers don't need to understand tax law or worry about eligibility requirements.

This explains why California chose this approach. The $200 million will feel more impactful if delivered as instant rebates than if structured as tax credits.

There's also a practical angle. Some EV buyers don't owe federal income taxes. Self-employed people with business losses, retirees with minimal income, and young adults claiming dependents might not benefit from a $7,500 tax credit because they have no tax liability to offset. An instant rebate works for everyone, regardless of tax situation.

In Q3 2025, California's EV adoption rate was 30%, nearly three times the national average of 11%. This highlights California's leadership in the EV market.

California's Role in the Broader EV Ecosystem

California doesn't just lead in EV adoption. The state shapes the entire EV industry through policy and regulation.

Start with emissions standards. California has authority under the Clean Air Act to set its own vehicle emissions standards, which are typically stricter than federal requirements. Other states can adopt California's standards or the federal standards, but they can't adopt something in between. This creates two regulatory tiers in the US: California standards and federal standards.

Because California is so large and valuable as a market, manufacturers essentially design for California. If you meet California's requirements, the vehicle can sell anywhere. This gives California outsized influence over the entire American automotive industry.

Add in the Zero Emission Vehicle (ZEV) mandate. California requires manufacturers to sell an increasing percentage of zero-emission vehicles in the state. This regulatory requirement, combined with consumer incentives, creates a powerful one-two punch.

The state also invested heavily in charging infrastructure. California's alternative fuel network includes thousands of public EV chargers. Private networks from Tesla, Lucid, and others add more capacity. This infrastructure is what makes EV ownership practical for most people.

Now add consumer incentives back in. California's previous EV rebate program, which offered up to $10,000 in state funding combined with federal credits, created a complete ecosystem: regulatory mandates for manufacturers, consumer incentives for buyers, and infrastructure for support. That's how the state hit 30 percent EV adoption.

The $200 million program is designed to maintain this ecosystem when federal incentives disappear.

Comparing $200 Million to Other State Incentive Programs

California isn't the only state considering EV incentives as federal credits shrink. How does the $200 million stack up against other state programs?

New York recently proposed a

California's $200 million sits somewhere in the middle. It's not the largest state program, but California has a massive head start in EV adoption already. The question isn't just funding size. It's funding efficiency. Can California extend affordability to the remaining 70 percent of buyers who haven't chosen EVs yet?

The math is interesting. If California's

A

Lauren Sanchez and the CARB team are making that calculation right now. They need to decide: is this funding meant to reach more buyers with smaller rebates, or fewer buyers with larger rebates that are truly transformative?

The Legislative Process and Timeline

Here's the critical part that often gets overlooked: the budget proposal isn't law yet. It has to pass through California's legislature.

The state budget process typically happens on an annual cycle. Governor Newsom proposed the 2026-2027 budget in January. The legislature reviews it, holds hearings, makes amendments, and votes. Final passage is often contentious because the state budget includes everything: education funding, infrastructure, healthcare, environmental programs, everything.

The EV incentive program is one line item in a massive budget document. It could face opposition from different angles. Fiscal conservatives might argue the state shouldn't spend money on vehicle subsidies. Some legislators might prefer the funding go to charging infrastructure instead. Others might want used EV support explicitly included, which could change the program design.

Historically, California's budget process gets contentious. The state constitution requires a two-thirds majority for budget passage (recently reduced to a simple majority for most items, but some funding still requires two-thirds). This creates leverage points where minority parties can demand concessions.

The timeline matters too. If the budget passes quickly, the program could launch in the fall of 2025. If there are disputes, it could drag into 2026. The longer the delay, the longer California goes without state-level EV incentives to replace federal ones.

There's also the possibility that the

But given California's EV leadership and Newsom's track record on climate policy, passing some version of this program is likely.

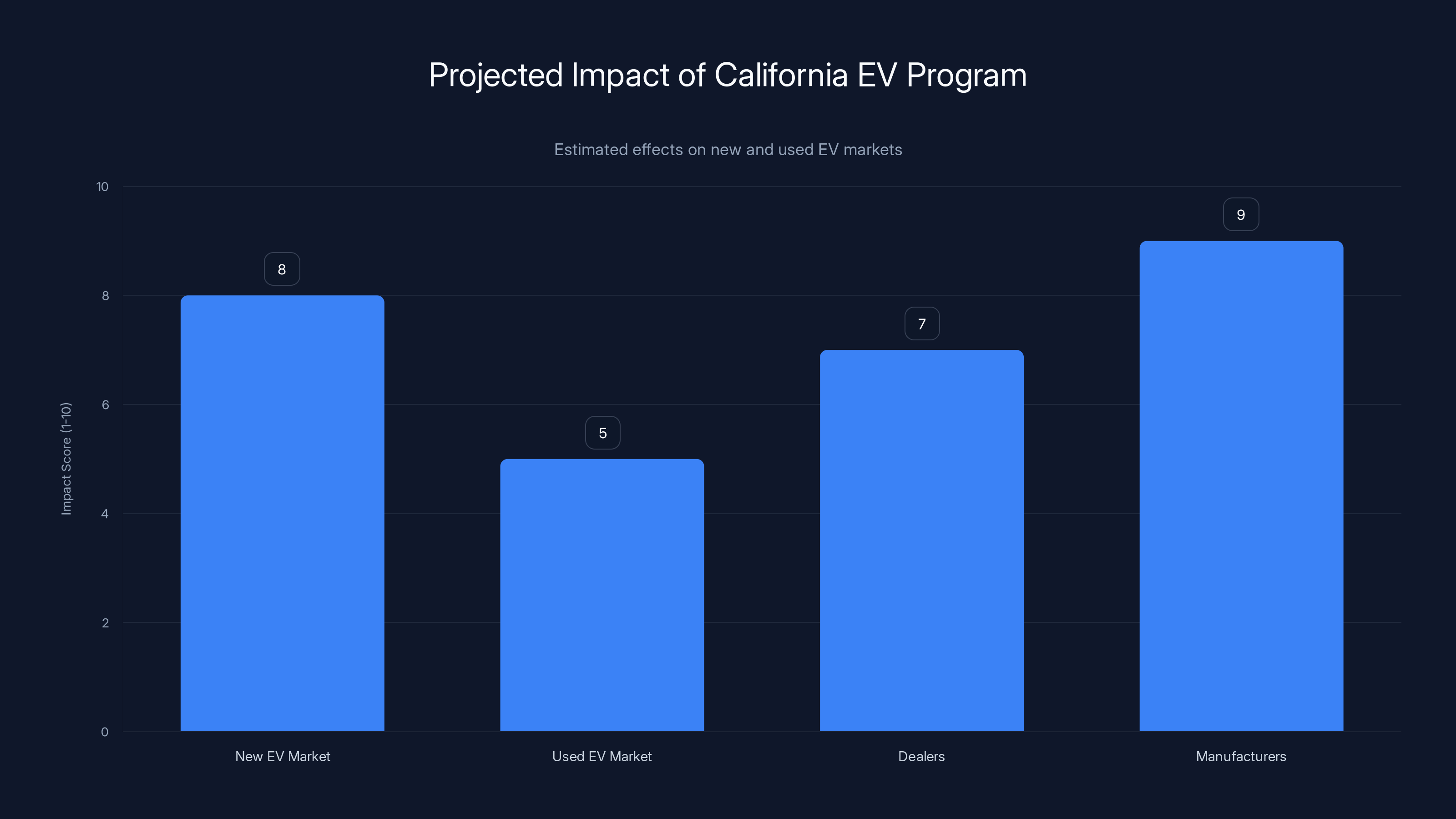

The new EV market and manufacturers are expected to benefit most from California's commitment to EVs. The used EV market faces uncertainty without clear program details. (Estimated data)

What This Means for California EV Buyers

If you're in California and considering an EV purchase, the immediate implications are unclear. The $200 million program isn't active yet. It requires legislative approval, implementation details, and administrative setup.

You can't plan your purchase around a benefit that might not materialize or might look entirely different than the proposal suggests.

However, the long-term signal is clear: California is committed to maintaining EV affordability even if federal incentives disappear. That commitment reduces the risk of the EV market collapsing in the state. It suggests that EV pricing and availability will remain favorable.

For used EV buyers, the situation is more uncertain. If the program includes used vehicles, prices could become significantly more accessible. If it doesn't, the used EV market will face headwinds as federal incentives fade.

For dealers and manufacturers, the signal is equally clear: California will remain a competitive EV market. Manufacturers should continue investing in EV lineups and California service networks. Dealers should continue training staff and building EV inventory. The state isn't stepping back from EVs. It's stepping forward with its own support.

The Broader Question: Why State-Level Incentives Matter

At the highest level, California's $200 million program raises a fundamental question: should vehicle subsidies come from the state, federal government, or market forces?

Federal incentives theoretically create a level playing field across the entire country. Every American gets the same benefit regardless of where they live. That's equitable from a national perspective.

But federal incentives also get politicized. Tax credits require congressional approval. When political control of Congress changes, incentive policies shift. Manufacturers and consumers face uncertainty. Investment decisions get postponed until the political landscape stabilizes.

State incentives are more stable in that sense. California's legislature makes this decision. If the EV program succeeds, it stays. If it fails, the state adjusts. The decision-making is faster and more localized.

State incentives also align incentives. California has the strictest emissions standards in the country. The state benefits from EV adoption through improved air quality, reduced petroleum dependence, and economic growth. California taxpayers directly benefit from the programs they fund.

There's an equity argument too. Some states have taken different approaches. Texas, Florida, and other states that don't prioritize EV adoption won't match California's incentive spending. This creates a two-tier system where electric vehicles are more affordable in California than elsewhere.

Is that fair? It depends on your perspective. If you believe environmental policy should be national, state-level incentives seem inefficient. If you believe states should make their own environmental choices, California's approach makes sense.

The Infrastructure Angle: Charging Matters as Much as Price

Here's something the $200 million budget doesn't directly address: charging infrastructure.

A $7,500 rebate is meaningless if you can't charge your EV at home and there are no public chargers nearby. Price is only one barrier to EV adoption. Infrastructure is equally critical.

California has made significant investments in charging. The state's alternative fuel network has thousands of public chargers. DC fast-charging corridors exist along major highways. Apartment building regulations now require charging-ready infrastructure even if actual chargers aren't installed yet.

But gaps remain. Rural areas have minimal charging. Some urban apartments can't support charging due to electrical infrastructure limitations. Workplace charging is still spotty.

The $200 million vehicle incentive program could be paired with additional charging infrastructure funding to create a comprehensive strategy. That doesn't appear to be in this budget proposal, though other ongoing programs fund charging separately.

From a policy perspective, this is short-sighted. Price without infrastructure leaves buyers stranded. Infrastructure without price incentives is underutilized. The most effective strategy combines both.

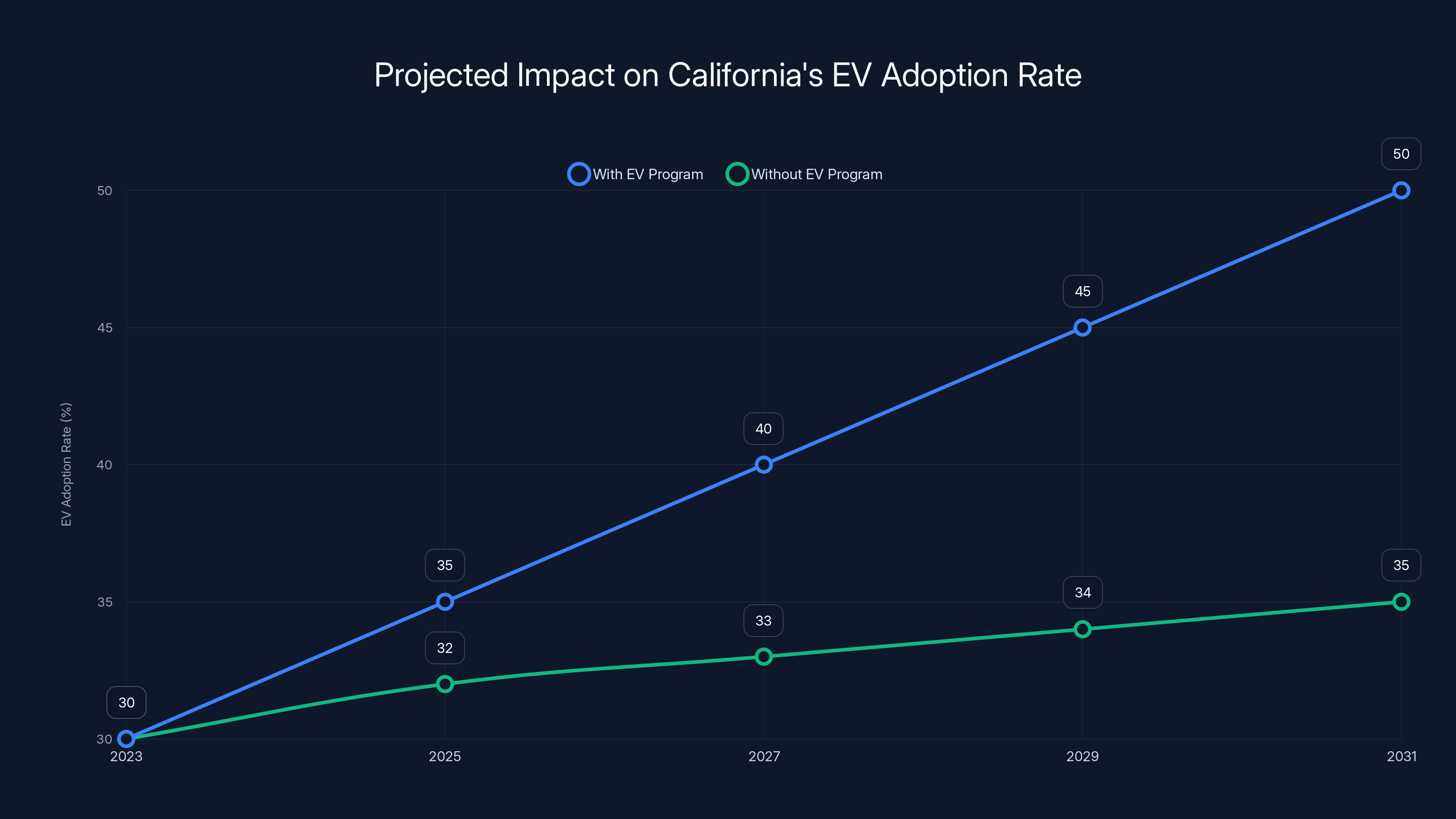

Estimated data shows that without the EV program, California's EV adoption rate would grow more slowly, potentially reaching only 35% by 2031 compared to 50% with the program.

Economic Impact: Jobs, Manufacturing, and Tax Revenue

California's $200 million EV incentive program has economic dimensions beyond environmental goals.

EV manufacturing is energy-intensive and value-additive. A

California's EV leadership has attracted manufacturers. Tesla's Gigafactory is the world's largest battery manufacturing facility. Lucid Motors manufactures vehicles in the state. Fisker operated in California. This infrastructure represents billions in capital investment and hundreds of millions in annual payroll.

If EV adoption slows in California, these facilities become less valuable. Manufacturing capacity goes underutilized. Job growth stalls. The state loses its position as the EV center of the American economy.

The $200 million incentive program should be viewed as an investment in this industrial ecosystem, not just an environmental subsidy.

There's also a supply chain angle. California battery manufacturers, electrical component suppliers, and technology companies depend on strong EV demand. More EV sales mean more factory orders, more supply contracts, and more economic activity.

From a fiscal perspective, the state estimates tax revenue from all this activity. EV manufacturing facilities pay property taxes, sales taxes, and corporate income taxes. Workers pay state income taxes. Suppliers generate their own tax revenue. If the

This economic argument is often missing from incentive debates. People focus on the direct cost: "The state spent

Why the Details Are Still Being Finalized

The fact that crucial details—per-vehicle amounts, income limits, used vehicle eligibility—haven't been finalized might seem like poor planning. It's actually normal for budget proposals.

Budgets start as policy proposals. They outline intent and allocate funding. Details get worked out after the budget passes. The CARB team needs to design the program parameters, set up administrative systems, create dealer enrollment processes, and establish verification procedures.

You can't fully specify these details until you know the budget is approved. Why spend months designing administrative systems for a

So the budget says: "Here's $200 million for EV incentives." The CARB team says: "We'll figure out how to deploy it most effectively." This is actually efficient governance.

The vagueness also provides flexibility. If the legislature wants to modify the program, they can do it during the amendment process. If different stakeholders want to propose different designs, they have room to do that.

What matters is that the funding is allocated. The specific mechanisms can be finalized through administrative rulemaking once the money is actually available.

Comparing to California's Previous Rebate Program

California isn't new to EV rebates. The state previously had its own EV incentive program that worked alongside federal credits.

California's Clean Vehicle Rebate Project offered up to

But that program was funded through a different mechanism: California's greenhouse gas reduction fund from cap-and-trade revenue. That funding wasn't guaranteed to be perpetual. Climate-related funding is always subject to budget pressures and political changes.

The new $200 million allocation comes from general budget funding, which suggests a more permanent commitment. It's not tied to a specific revenue source that could dry up. It's a direct legislative allocation that says: "EV incentives are a state priority."

This is actually a stronger signal than the previous program. It indicates that California considers EV affordability important enough to fund directly from the general budget, competing with other priorities like education and healthcare.

Estimated data suggests that the majority of California's $200 million EV rebate program could be allocated to new EV purchases, with significant portions also supporting used EVs and low-income buyers. Estimated data.

International Context: How California Stacks Up

Stated another way, how does California's approach compare to EV incentive programs in other countries?

China offers massive EV subsidies. At various points, the country has provided

Germany offers up to 9,000 euros in EV purchase incentives. Norway, the EV adoption leader in the world, offers value-added tax exemption on EVs, reduced tolls on highways, and access to bus lanes. These add up to enormous effective subsidies.

Europe generally accepts that mass EV adoption requires temporary financial support. The idea is that subsidies accelerate adoption, allow manufacturers to achieve scale, and reduce unit costs. Eventually, EVs become cheaper than gas cars without subsidies. At that point, the subsidies phase out.

California's approach aligns with this global strategy. The $200 million supports adoption in the near term, betting that as manufacturing scales and costs decline, subsidies become unnecessary.

However,

This suggests that California's $200 million is a floor, not a ceiling. If the program succeeds, expect the state to invest more heavily.

The Environmental and Health Benefits of Continued EV Adoption

Beyond economics and policy, why does California care so much about maintaining EV adoption momentum?

Start with air quality. Transportation is a major source of air pollution in California, especially in the Central Valley and Los Angeles metro areas. Particulate matter from vehicle exhaust contributes to respiratory disease, heart problems, and premature death.

Electric vehicles eliminate tailpipe emissions. If the electricity grid is powered by renewable sources (which California is increasingly) then EVs are nearly emission-free.

Scaling EV adoption from 30 percent to 50 percent to 70 percent of vehicle sales means proportionally cleaner air. The health benefits are real and quantifiable. Studies show that every ton of NOx pollution reduced saves lives.

There's also the climate angle. Transportation accounts for roughly 27 percent of California's greenhouse gas emissions. Electrifying vehicles is essential to hitting the state's climate targets. The 2035 ban on gasoline car sales can't be achieved without making EVs affordable for mainstream buyers.

California's climate commitments aren't aspirational. They're codified in law. The state has to hit them. The $200 million EV program is part of the mechanism to do that.

Finally, there's petroleum dependence. California still imports substantial petroleum. EVs reduce this import dependence, improving energy security and reducing exposure to global oil price shocks. When gas prices spike, EV owners are unaffected. This becomes increasingly valuable as climate disruption increases oil supply uncertainty.

What Happens If the Program Doesn't Pass or Gets Cut

It's worth considering the downside scenario. What if California's legislature doesn't approve the EV program, or approves a much smaller version?

The immediate impact would be a cliff effect. Federal tax credits already disappeared for most buyers. If state credits don't materialize, there's no substitute incentive. EV prices would effectively increase relative to gas cars.

This wouldn't cause the EV market to collapse entirely. California's 30 percent EV adoption is partly driven by emissions regulations, partly by true consumer preference for electric vehicles, and partly by incentives.

But adoption would slow. Growth would moderate. Some buyers would decide that gas vehicles made more financial sense. Used EV prices would soften as future demand expectations decline.

Manufacturers would notice. If California's EV market slows, the investment case for building and servicing EVs in the state weakens. Manufacturers might invest more in other states or countries with stronger EV markets.

Over a 5-10 year horizon, losing the EV incentive could set California back several years in its transition to electrified transportation. The state's 2035 gasoline vehicle ban might become more difficult to achieve.

But this is a worst-case scenario. Given Newsom's track record on climate policy and California's legislative consensus around EV adoption, some version of the program is likely to pass.

Future Evolution: What Happens After 2026-2027

The proposed budget is for 2026-2027, a single fiscal year. What happens after that?

If the program succeeds and the economy permits, California could extend or increase funding. The state might allocate $200 million annually, making it a permanent program. Or the state might adjust the structure based on what works.

Over time, EV manufacturing costs are expected to decline. Battery costs continue falling. Manufacturing processes become more efficient. The per-vehicle cost of producing an EV drops year by year.

As this happens, the need for purchase incentives diminishes. At some point, an EV becomes cheaper than a gas car without any subsidies. At that point, incentive programs become unnecessary.

The timeline for this is uncertain. Some analysts think it could happen by 2030. Others say 2035 or later. It depends on battery technology progress, manufacturing scale, and petroleum prices.

Until that point arrives, California will likely need some form of purchase incentive to accelerate adoption and meet climate targets.

Implementation Challenges: The Unglamorous Details

One more dimension worth considering: actually implementing this program is hard.

The federal tax credit works through the tax system. You buy a car, you claim it on your taxes, the IRS verifies eligibility, you get the credit. It's administratively simple because it uses existing tax infrastructure.

An "on the hood" instant rebate requires different infrastructure. Dealers need to be able to verify buyer eligibility at the point of sale. The state needs to track rebate amounts to ensure they match the budget. Verification systems need to prevent fraud.

Does the rebate apply only to California residents? How does the state verify residency at the dealership? Is there income verification? Income limits can be gamed, so the state needs auditable systems.

For used vehicles, it gets even more complex. The state needs to verify the vehicle's history, its battery condition, its actual market value. Used car pricing is more subjective than new car pricing.

Lauren Sanchez and CARB have done this before with California's previous rebate program, so the institutional knowledge exists. But it's not trivial. It requires hiring additional staff, setting up verification systems, training dealers, and managing the program.

If the budget passes without clear implementation guidance, the program could launch months later than hoped while administrative details get finalized. This matters because every month of delay means some buyers miss out on incentives.

FAQ

What is California's EV tax credit program?

California's proposed $200 million light-duty zero-emission vehicle (ZEV) incentive program is a state-funded rebate initiative designed to fill the gap left by eliminated federal EV tax credits. Governor Newsom's 2026-2027 budget proposal allocates this funding to make electric vehicles more affordable for California residents through instant point-of-sale rebates.

How much will California's EV rebate be worth?

The specific rebate amount per vehicle hasn't been finalized yet. The $200 million total budget could be divided among different vehicle types, income brackets, and purchase types in various ways. The California Air Resources Board (CARB) is still determining the per-vehicle amounts, but the rebate is expected to work as an instant "on the hood" discount at purchase time rather than a tax credit claimed later.

When will California's EV rebate program start?

The program cannot launch until California's legislature approves the 2026-2027 budget proposal, which typically occurs sometime during 2025. Once approved, implementation and administrative setup would follow, likely resulting in a program launch in late 2025 or early 2026. The exact timeline depends on legislative deliberation and CARB's implementation timeline.

Will used EV buyers qualify for California's rebate program?

California Air Resources Board chairwoman Lauren Sanchez has stated that officials are still working through whether the $200 million program will include used EV purchases. The budget proposal doesn't specify this detail, leaving it uncertain whether used vehicle buyers will have access to the state rebate.

How much federal EV tax credit is available now?

The federal tax credits for new and used electric vehicles have been substantially restricted by income limits, vehicle price caps, and battery component sourcing requirements. While up to

Why is California proposing an EV incentive program?

California is implementing this program for several reasons: to maintain EV adoption momentum after federal credits were eliminated, to support the state's 2035 gasoline vehicle ban mandate, to improve air quality and public health through reduced vehicle emissions, to strengthen California's EV manufacturing industry, and to prevent the state's electric vehicle market from slowing without federal incentive support.

How does California's instant rebate differ from a tax credit?

An instant "on the hood" rebate reduces the purchase price at the dealership immediately, while a tax credit requires claiming the benefit months later when filing taxes. Instant rebates simplify the purchasing decision, work for all buyers regardless of tax liability, and make the benefit feel more tangible and real.

What percentage of California auto sales are currently electric vehicles?

In the third quarter of 2025, electric vehicles represented approximately 30 percent of all new auto sales in California, according to the California Energy Commission. This is significantly higher than the national EV adoption rate of 10-12 percent.

Does California's proposal require legislative approval?

Yes, Governor Newsom's 2026-2027 budget proposal, including the $200 million EV incentive program, must pass through California's legislature to become law. The state legislature reviews, amends, and votes on the governor's budget proposal, typically completing this process in mid-2025.

How does California's EV incentive compare to other states?

California's

Key Takeaways

California's proposed $200 million EV tax credit program represents the state's commitment to maintaining electric vehicle affordability after federal incentives were eliminated for most buyers. The program will function as instant point-of-sale rebates rather than traditional tax credits, making the benefits immediately tangible to purchasers. While specific details like per-vehicle amounts and used EV eligibility remain to be finalized, the allocation demonstrates California's determination to support the ongoing transition to zero-emission vehicles. The program must pass through the state legislature during 2025 before implementation can begin, with administrative details to be worked out by the California Air Resources Board. This initiative positions California to continue its leadership in EV adoption while supporting the state's legally mandated 2035 ban on new gasoline vehicle sales and advancing critical air quality and climate goals.

Related Articles

- Crossy Road: Why This 8-Bit Hopper Became Mobile Gaming's Most Addictive Phenomenon [2025]

- 25+ Best Gadgets to Achieve Your New Year's Resolutions [2025]

- Google Pulls AI Overviews From Medical Searches: What Happened [2025]

- The Night Manager Season 2: Release Date, Cast & Plot [2025]

- Wing's Drone Delivery Expansion to 150 Walmarts Explained [2025]

- Google Removes AI Overviews for Medical Queries: What It Means [2025]

![California's $200M EV Tax Credit Program Explained [2025]](https://tryrunable.com/blog/california-s-200m-ev-tax-credit-program-explained-2025/image-1-1768161949782.jpg)