Wing's Drone Delivery Expansion to 150 Walmarts: The Future of Last-Mile Logistics [2025]

Introduction: Why Drone Delivery Is Finally Becoming Real

Imagine ordering groceries at 2 PM and having them land in your backyard by 2:30. For years, that felt like science fiction. But drone delivery isn't theoretical anymore. It's happening right now, at scale, in American suburbs across Los Angeles, Dallas, and dozens of other cities.

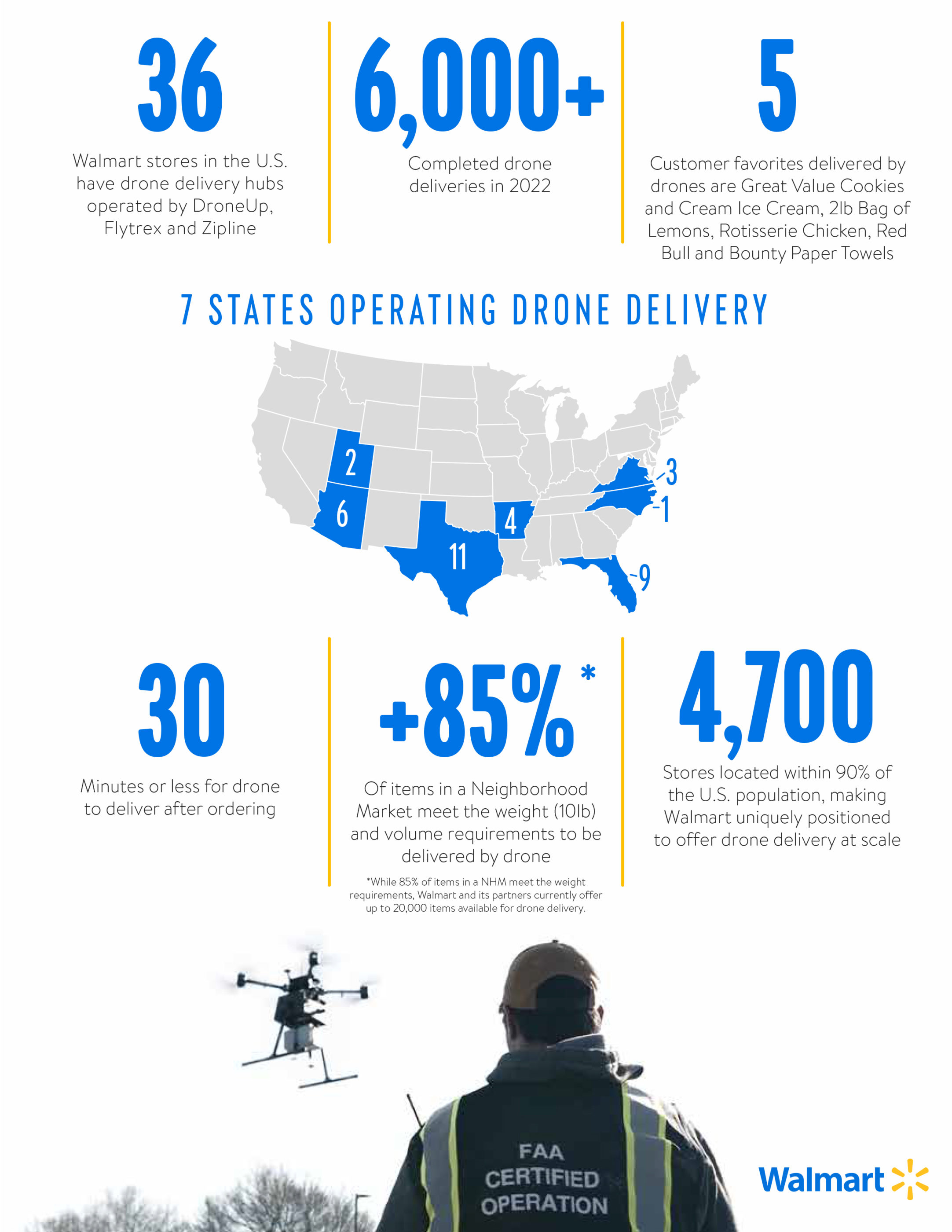

Wing, the drone delivery company owned by Alphabet (Google's parent company), just announced a major expansion with Walmart. By 2027, drone deliveries will be available at 270 Walmart locations across America, serving approximately 40 million customers. That's roughly one-eighth of the entire US population.

But here's what makes this different from previous drone announcements: this isn't a pilot program anymore. This is a scaling operation with real revenue, real customers, and real logistics infrastructure. Wing's top customers are ordering deliveries three times a week. The partnership that started in 2023 with just Dallas-Fort Worth has grown to cover major metros including Los Angeles, St. Louis, Cincinnati, Miami, Atlanta, Charlotte, Houston, Orlando, and Tampa.

So what does this expansion mean? For retailers, it means cutting delivery times from hours to minutes. For customers, it means cheaper, faster goods shipped to your door without a delivery truck. For the logistics industry, it signals that last-mile delivery is transforming before our eyes.

Let's break down exactly what's happening, why it matters, and what comes next.

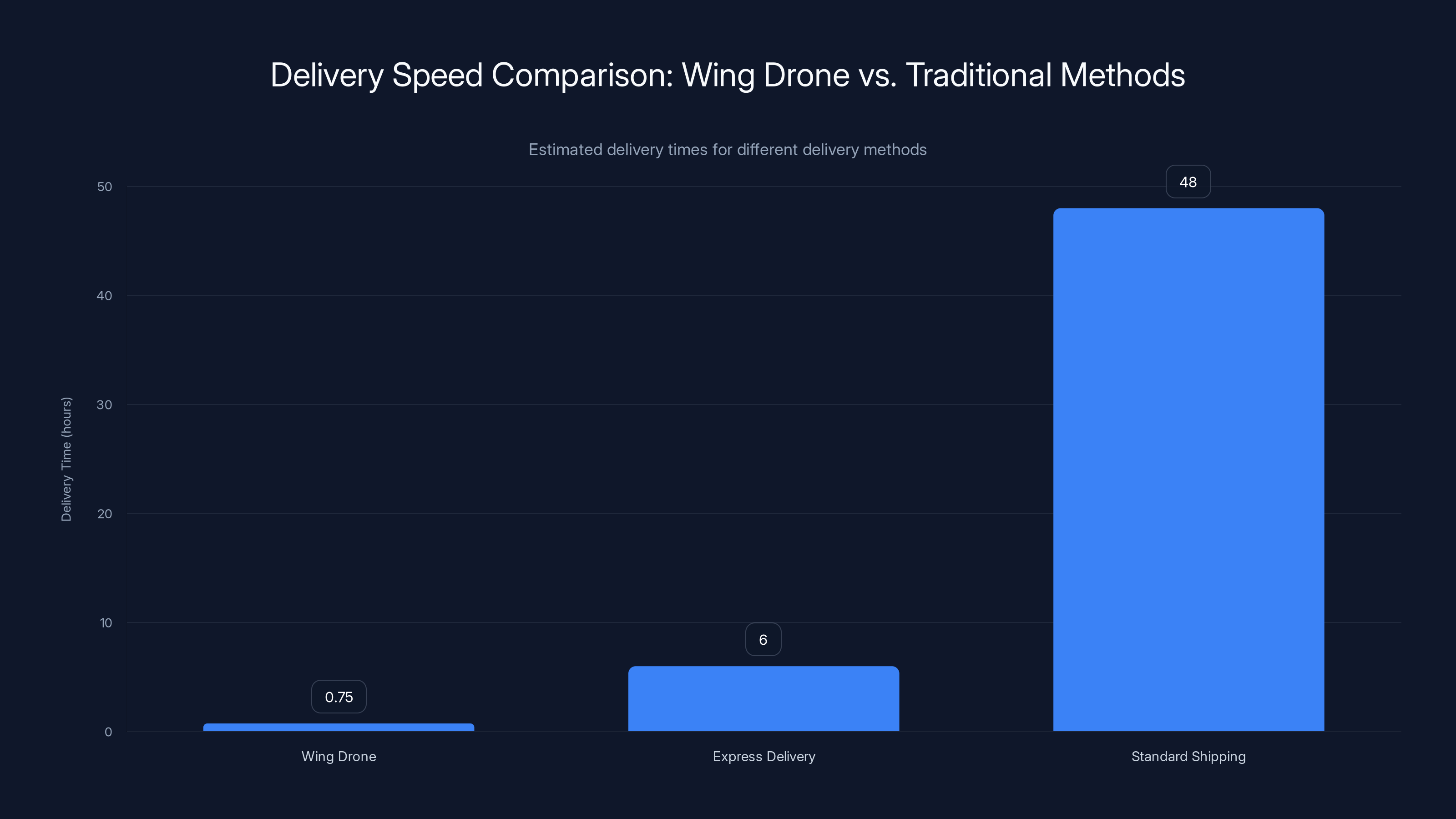

Wing drone delivery is significantly faster, taking only 30-45 minutes compared to express delivery (4-8 hours) and standard shipping (1-3 days). Estimated data.

TL; DR

- Wing and Walmart are adding 150 new drone delivery locations by 2027, growing their network from the current locations to 270 total stores across the US

- 40 million American customers will have access to drone deliveries—from Los Angeles to Miami—representing the largest-scale drone delivery operation in the world

- Top customers are ordering via drone three times weekly, proving there's genuine demand for this service, not just novelty interest

- Delivery times will drop to 30 minutes or less for small packages, fundamentally changing how people think about same-day shopping

- Integration with existing Walmart supply chains means drones will supplement traditional delivery methods, not replace them entirely

Estimated data shows Wing's cost per delivery decreasing significantly due to network effects, while revenue per delivery gradually increases, suggesting a path to profitability by 2027.

What Is Wing, and How Did We Get Here?

Wing isn't a startup trying to disrupt delivery. It's a division of Alphabet, which means it has the funding, regulatory relationships, and engineering talent that most delivery companies could only dream about. But it also means it operates under intense scrutiny from the FAA and the public.

The company started as a moonshot project inside Google X, the innovation lab where Google develops experimental technologies. Like most of Google's moonshot projects, Wing's early years involved solving problems that seemed impossible: How do you fly a drone in populated areas safely? How do drones land in suburban neighborhoods without hitting power lines or annoying residents? How do you integrate drone logistics with existing retail systems?

Those aren't trivial questions. Traditional delivery drones crash. They're loud. They're unreliable. They can't carry much weight. Wing spent years solving these fundamental problems.

The company eventually moved from Google X to become its own independent Alphabet company, similar to how Waymo (self-driving cars) operates. This gave Wing more autonomy while keeping the resources of a trillion-dollar parent company.

Before the Walmart partnership, Wing had already launched in other countries. It was operating in Australia and Japan with pharmacy and food delivery partnerships. Those international markets provided crucial data about customer behavior, regulatory requirements, and technical challenges that informed its US expansion strategy.

The Walgreens partnership, which launched in April 2022, proved the US market was ready. Delivering health and wellness products meant flying over populated areas, managing privacy concerns, and integrating with retail systems. Walgreens showed that customers would actually use drone delivery when it became available.

The Walmart Partnership Timeline: From Pilot to Scale

The Wing and Walmart partnership didn't start with 150 new locations. It started small, learned, and grew.

August 2023: The partnership launched in Dallas-Fort Worth with limited service areas. Initial deliveries focused on items like groceries, home goods, and essentials. The service area covered specific neighborhoods where residents had opted in to drone deliveries.

June 2025: After nearly two years of operations in Dallas, Wing and Walmart announced their first major expansion to 100 additional stores across Atlanta, Charlotte, Houston, Orlando, and Tampa. This was significant because it showed the company was confident enough to scale beyond one market.

Late 2025: The Atlanta launch went live, followed by Houston's scheduled January 2026 launch. The timeline accelerated.

January 2026: Current announcement of 150 more Walmart locations, bringing the total to 270 stores. The expansion targets metros that hadn't been served yet: Los Angeles (the largest TV market in the US), St. Louis, Cincinnati, Miami, and others still to be announced.

What's remarkable about this timeline is that it shows confidence. Companies don't expand from 20 stores to 270 stores unless the early numbers look phenomenal.

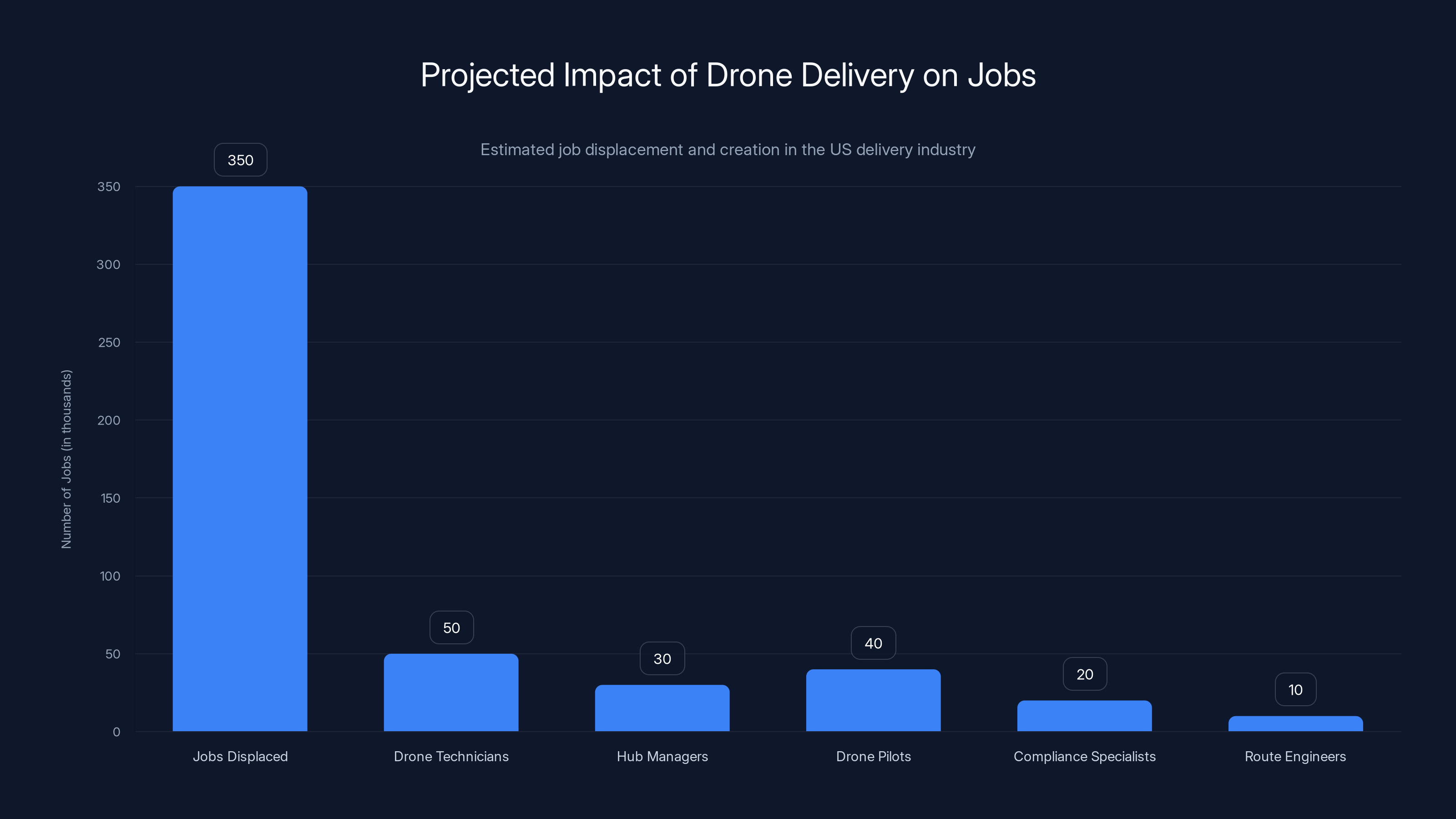

Drone delivery is expected to displace approximately 350,000 delivery jobs while creating around 150,000 new roles in higher-skilled positions over the next decade. Estimated data based on industry trends.

Demand Signals: Why Customers Actually Use This

Here's the stat that matters most: Wing's top 25 percent of customers order deliveries three times a week. That's not a one-time novelty purchase. That's habitual behavior.

Think about what this means. These customers are using drone delivery more frequently than many people order takeout. They're integrating it into their weekly shopping routine. They're not buying a toy drone or ordering once out of curiosity. They're replacing traditional shopping patterns with drone delivery.

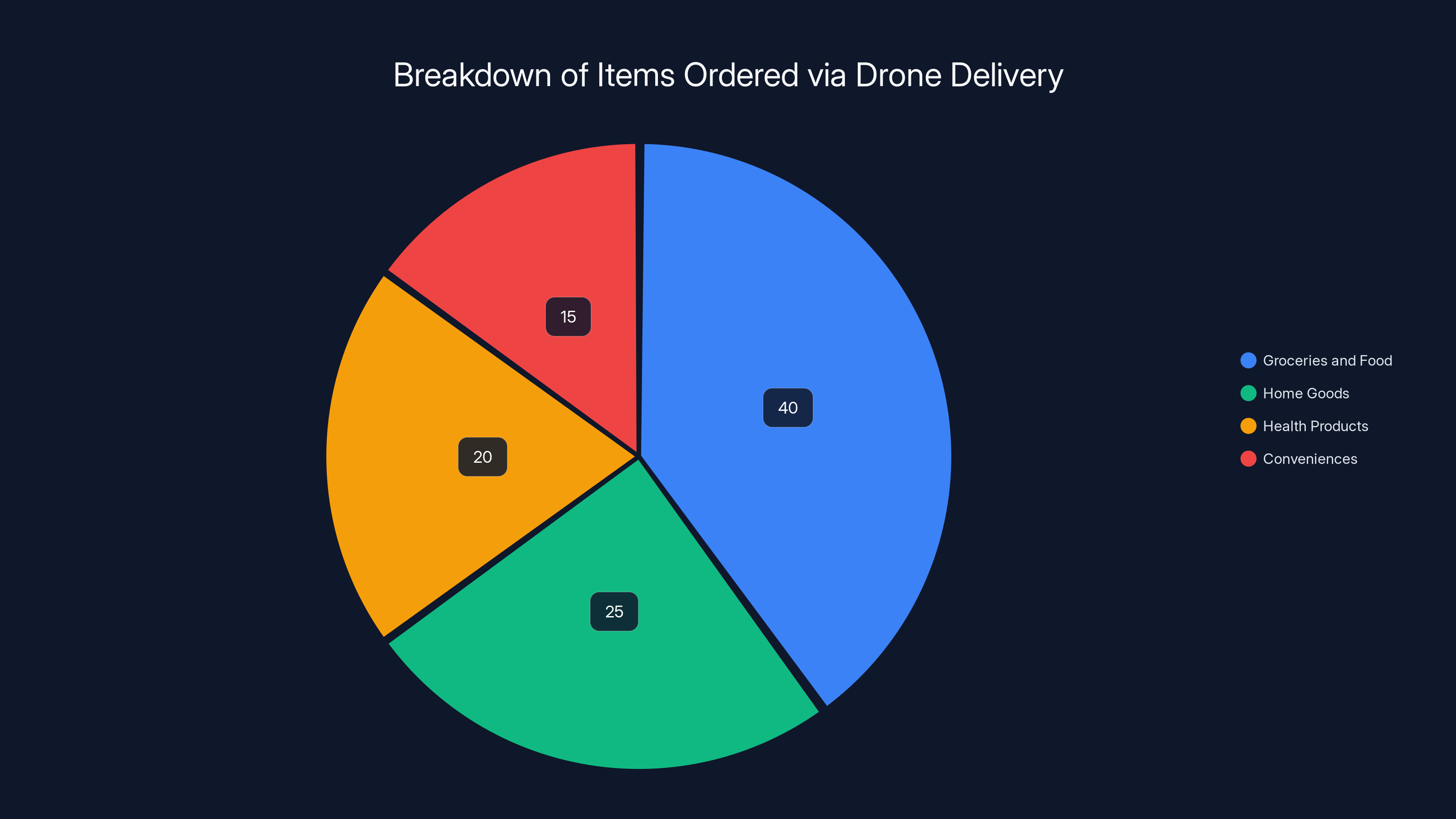

What are they buying? The data shows a mix:

- Groceries and food items: Milk, bread, produce, prepared meals

- Home goods: Batteries, light bulbs, cleaning supplies

- Health products: Over-the-counter medications, vitamins, first-aid supplies

- Conveniences: Pet food, coffee, snacks

These aren't luxury items. They're things people need regularly. The fact that customers are choosing drone delivery for routine purchases proves this isn't a gimmick. It's becoming a fundamental shopping preference.

What drives this adoption? Several factors:

Speed: 30-minute delivery beats waiting for a package truck by hours. When you run out of milk, getting it in 30 minutes instead of the next day changes your behavior.

Convenience: You're not waiting around for a delivery window. Drones land in your backyard or designated area during your preferred time.

Cost: Drone delivery is cheaper per package than traditional last-mile delivery, which means lower costs that retailers can pass to customers.

Privacy: No stranger walking to your front door. No packages sitting on your porch. Drones reduce theft, which is a massive problem with traditional delivery.

Reliability: Once the service is established in an area, drone delivery is more reliable than truck delivery. No traffic delays, no driver no-shows, no lost packages in warehouses.

The Logistics Architecture: How Drones Actually Get Groceries to Your Door

People often imagine drone delivery like Amazon's early PR videos: a massive distribution center, a single drone carrying a single package, flying across the city. Reality is way more sophisticated.

Wing's actual model uses a hub-and-spoke distribution network. Here's how it works:

Fulfillment Centers: Walmart operates regional fulfillment centers that handle order aggregation and preparation. These aren't fancy automated warehouses—they're practical consolidation points where items are picked, packaged, and sorted for drone delivery.

Local Hubs: Near each Walmart store (or in some cases, multiple stores share a hub), Wing operates small distribution points. These are the actual launch sites for drones. Think of them as micro-warehouses, typically 1,000-2,000 square feet, with just enough staff to package orders and launch drones.

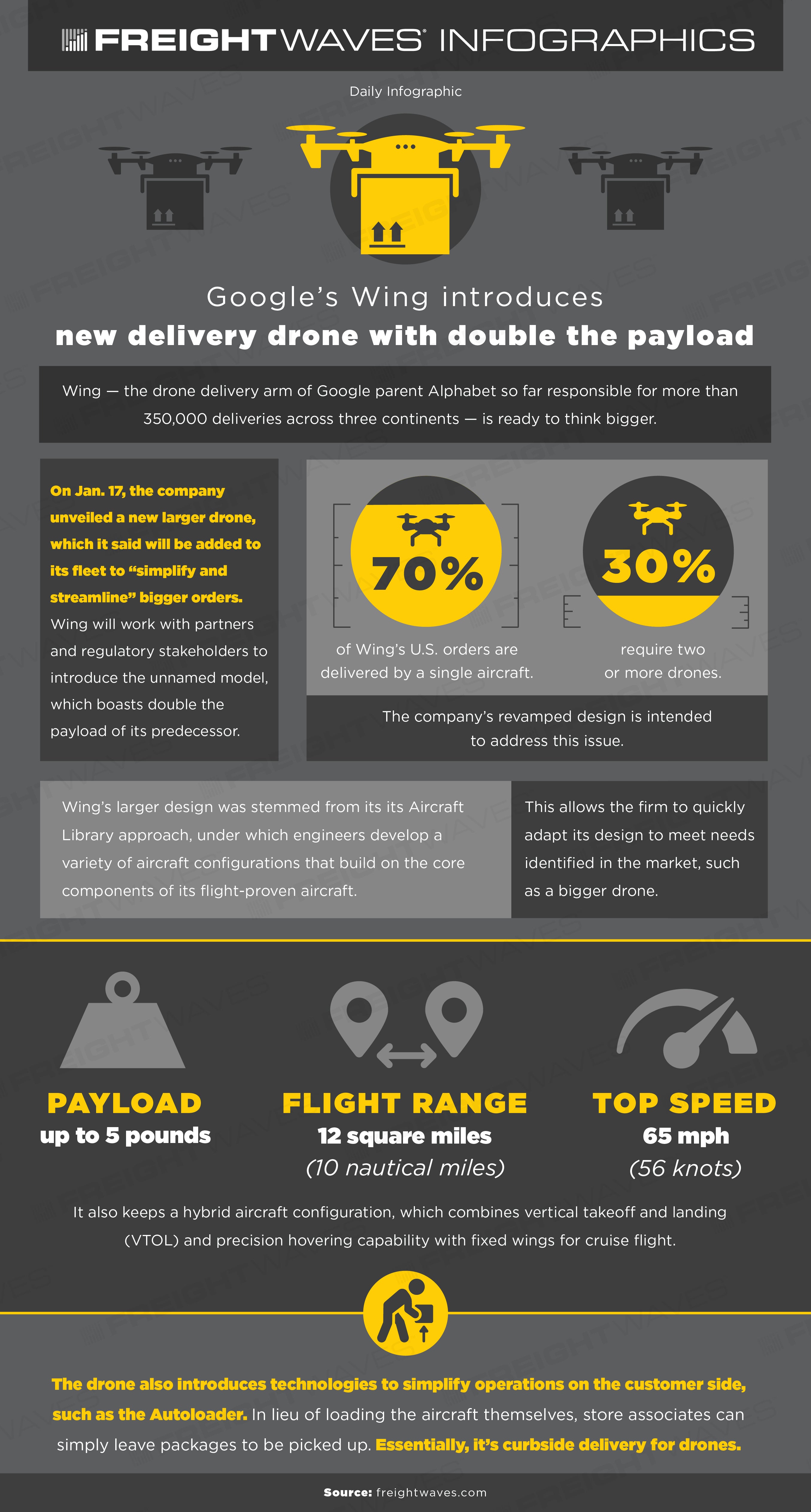

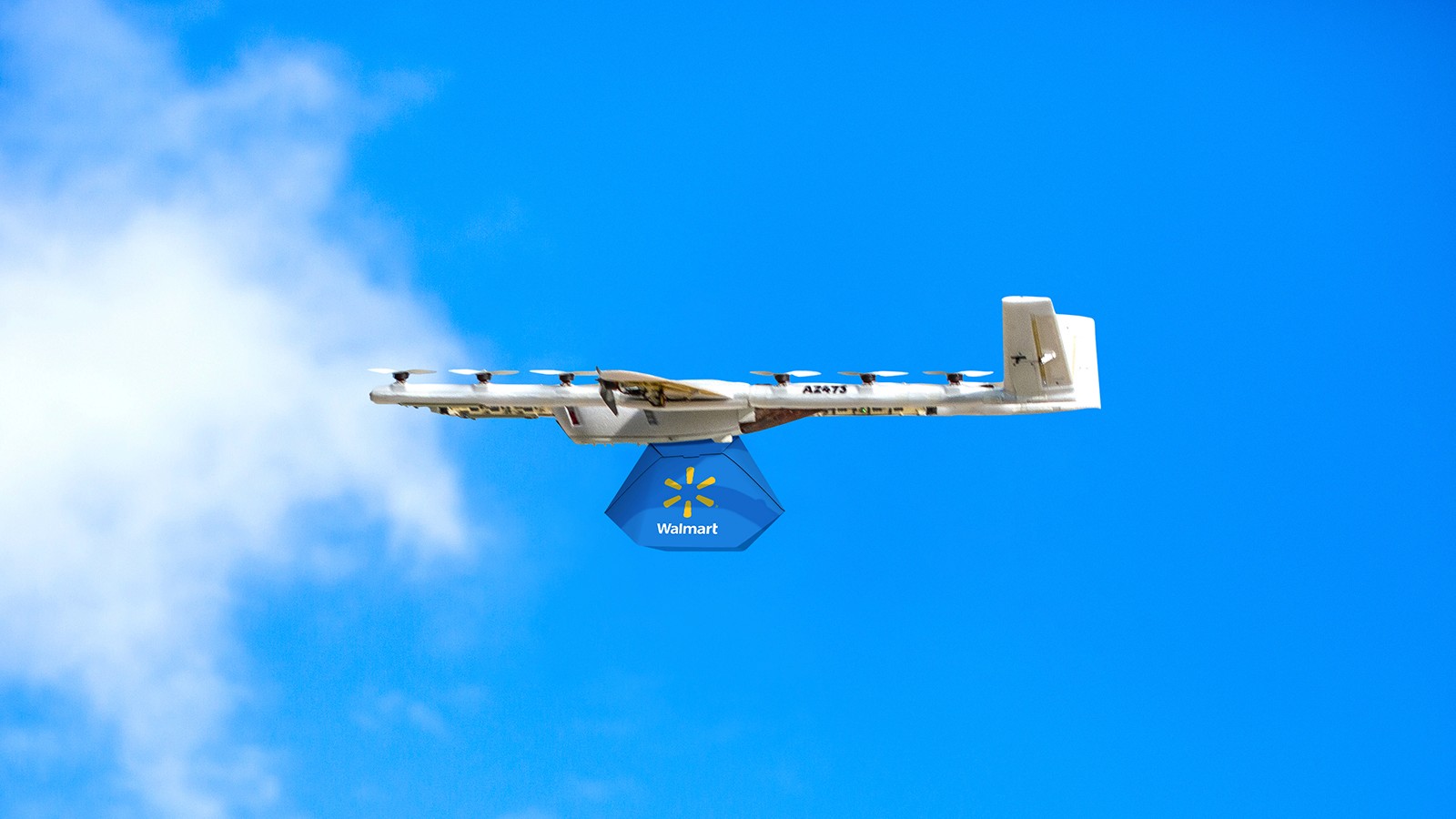

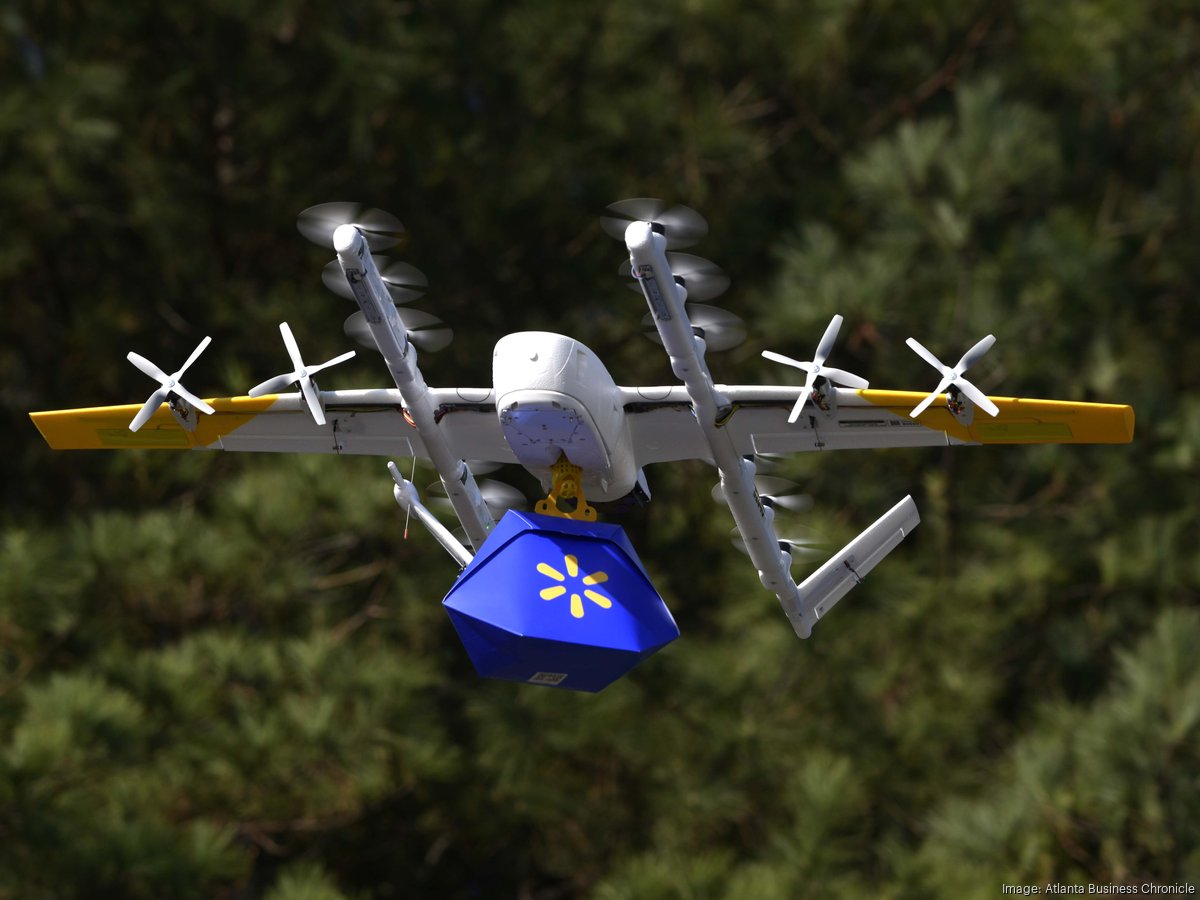

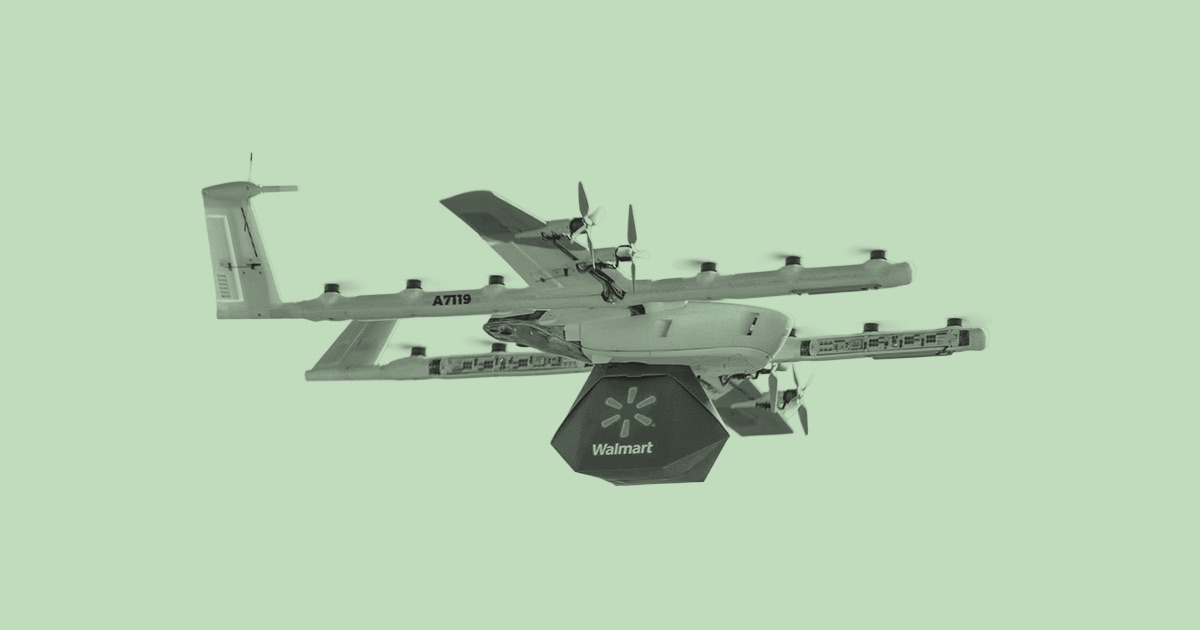

The Drone Fleet: Wing operates multiple types of aircraft. The current generation carries up to 2.5 pounds. The company has announced a next-generation drone coming soon that will carry up to 5 pounds at speeds of 65 mph. This matters because it means more items per trip and faster delivery.

The Landing System: This is the engineering challenge most people don't think about. Drones can't land on power lines or in narrow streets. Wing uses a combination of:

- GPS positioning for general navigation

- Computer vision for obstacle avoidance

- Designated landing zones that customers request (backyard, driveway, patio)

- Precision landing systems that deploy a parachute for controlled descent

Integration with Existing Supply Chains: Here's what differentiates Wing from startups: it works with Walmart's existing infrastructure. Orders come through Walmart's app, hit Walmart's order management system, get routed to the nearest fulfillment center, and then flow to the local drone hub. The whole system is integrated, not bolted on.

The entire process—from order placement to delivery—typically takes 30 to 45 minutes. Compare that to traditional delivery (1-3 days) or even express delivery (4-8 hours), and you understand why customers are adopting this at scale.

Estimated data suggests groceries and food items make up the largest share of drone deliveries, indicating a shift towards using drones for routine, essential purchases.

Regulatory Approval: The Hidden Challenge Nobody Discusses

You can't just launch drones in American suburbs. The FAA has rules. They're strict.

Wing operates under Part 107 and Part 135 regulations, which govern drone operations. Part 107 covers basic drone operations (weight limits, line-of-sight, altitude restrictions). Part 135 is more complex—it's the air carrier certificate that requires extensive safety documentation, pilot training, maintenance records, and insurance.

Getting Part 135 approval took Wing years. Most companies never get it. The FAA required Wing to demonstrate that its drone operations were as safe as manned aviation. That's an extremely high bar.

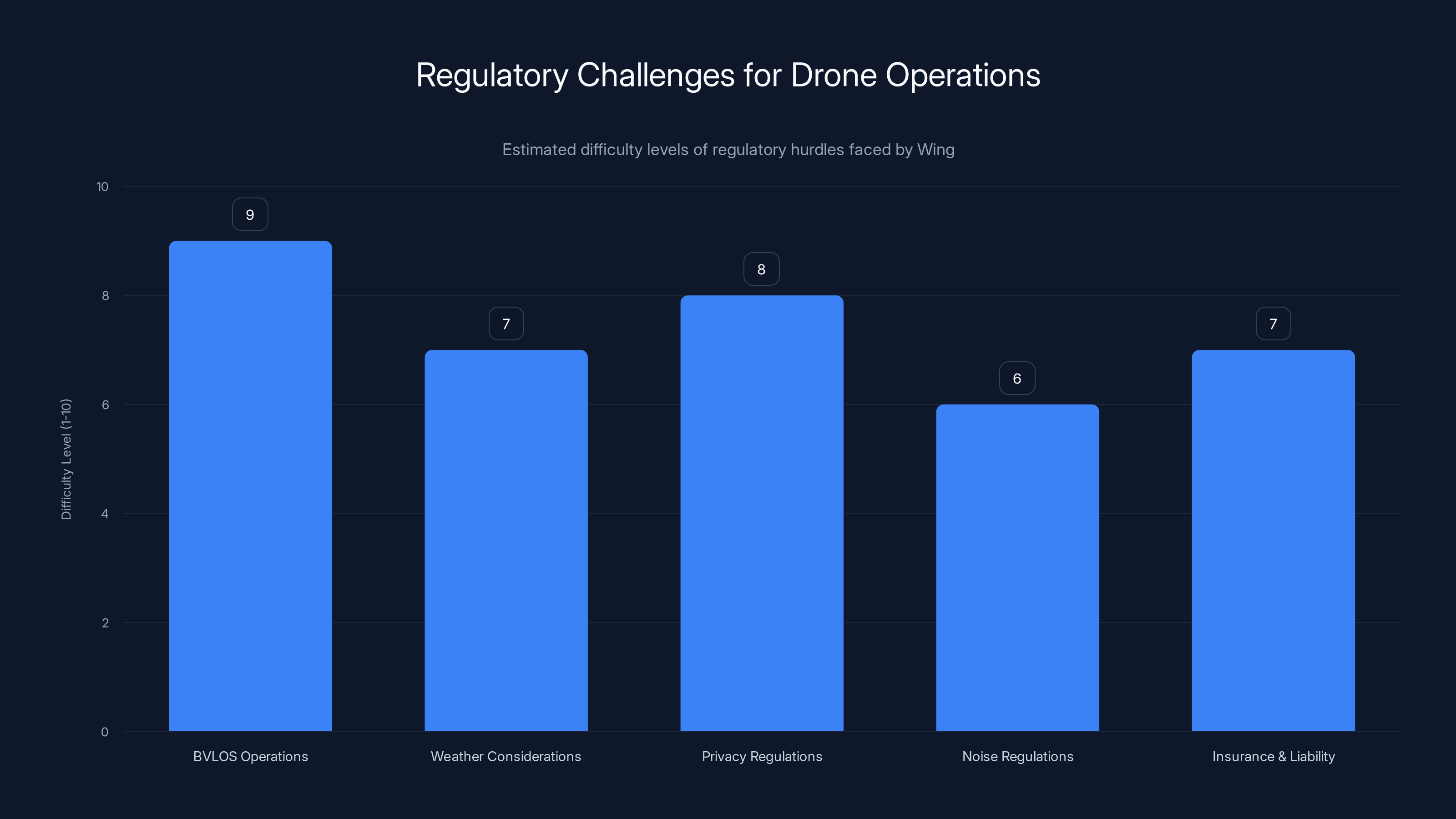

Specific regulatory hurdles Wing had to overcome:

Beyond Visual Line of Sight (BVLOS) Operations: Traditional drones must stay visible to the operator. Wing's drones fly beyond what any human can see. Getting FAA approval for this required proving autonomous navigation systems were redundant, fail-safe, and better than human pilots in many ways.

Weather Considerations: Drones can't fly in rain, high winds, or low visibility. Wing had to prove it had weather monitoring systems to prevent launching in unsafe conditions.

Privacy Regulations: Flying over neighborhoods with cameras and sensors triggered privacy concerns. Wing had to establish policies about data collection, storage, and retention.

Noise Regulations: Early drones were loud. Local communities objected. Wing's design reduces noise to around 70 decibels (comparable to a vacuum cleaner), which satisfies most local ordinances.

Insurance and Liability: If a drone crashes or injures someone, who's liable? Extensive insurance protocols had to be established.

The regulatory structure actually works in Wing's favor now that it has Part 135 approval. Competitors have to go through the same approval process, which takes years. Wing is years ahead in the regulatory timeline.

Geographic Coverage: What 40 Million Customers Means

Saying "40 million customers" is marketing speak. What does it actually mean?

Wing's service areas are not city-wide. They're neighborhood-specific. In each market, Wing operates in zones that meet specific criteria:

- Within 5-10 miles of a fulfillment center (delivery range)

- In areas with adequate airspace (not directly under flight paths)

- In neighborhoods where residents have opted into drone delivery programs

- In areas with relatively straightforward geography (not dense urban cores with tall buildings)

So when Wing says it will reach 40 million customers through 270 Walmart locations, it means:

- 270 Walmart stores across the 150+ new locations plus existing locations

- Specific neighborhoods around each store (maybe 30-50% of each metro area)

- Population within service zones adding up to roughly 40 million people

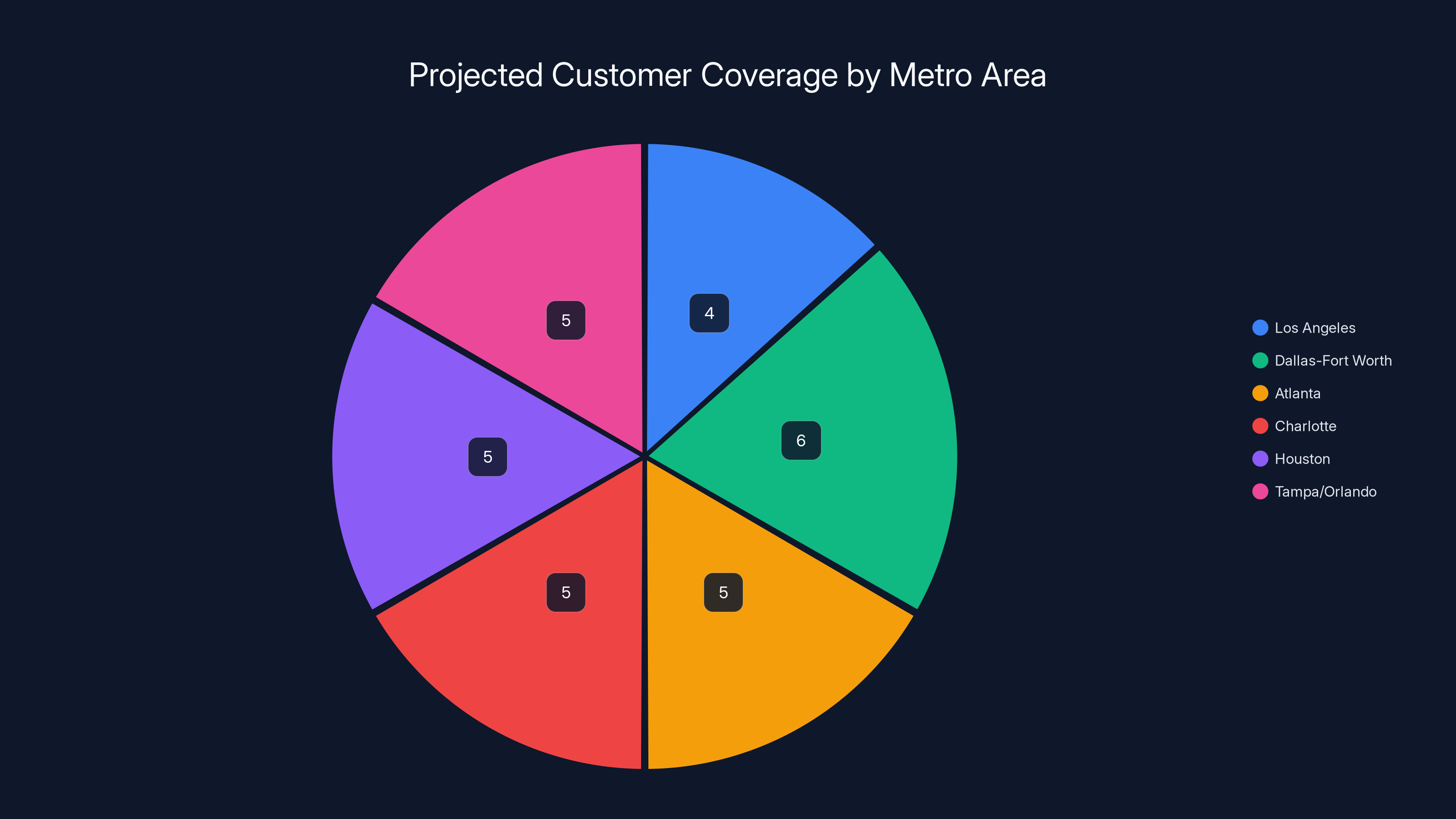

The expansion into specific metros breaks down like this:

Los Angeles: The LA market is massive. Greater LA has 13 million people. Wing's service zones will probably cover maybe 3-4 million people initially, expanding over time. The scale here is huge.

Dallas-Fort Worth: Already operational since 2023. This market has proven successful and will likely see the most mature operations.

Atlanta, Charlotte, Houston, Tampa, Orlando: These were added in 2025 and are still ramping up. Early operational data from these markets will inform the next expansion wave.

St. Louis, Cincinnati, Miami: Being added in the 2026-2027 expansion. These markets were selected based on demographics, Walmart store density, and regulatory readiness.

Unknown metros: Wing is being cagey about which other cities it's targeting. Common candidates include Phoenix, Denver, Portland, Seattle, and others in the Southwest and Pacific Northwest where geography and weather are favorable.

The geographic expansion strategy isn't random. Walmart and Wing are clearly selecting metros based on:

- Population density (metro areas, not rural)

- Weather patterns (fewer rainy days, manageable wind)

- Regulatory environment (cities that have been supportive of drone operations)

- Store density (Walmart has significant presence)

- Demographic composition (areas where drone delivery adoption is likely)

Los Angeles is projected to cover 3-4 million people initially, while Dallas-Fort Worth, a mature market, covers around 6 million. Other metros like Atlanta, Charlotte, and Houston each cover about 5 million. Estimated data.

Network Effects and the Path to Profitability

Wing isn't profitable yet. Alphabet is subsidizing losses. But the company is clearly on a trajectory toward breakeven and then profitability.

How? Network effects. As Wing adds more locations and more customers use the service, costs drop:

Fixed Cost Absorption: The infrastructure costs (hubs, drones, regulatory compliance, support staff) are fixed. The more deliveries per day, the lower the cost per delivery. When you have 270 locations instead of 20, your fixed costs are spread across 15x more potential orders.

Drone Utilization: A single drone making three deliveries per day is much more efficient than one making one delivery. As demand increases (which Wing's data shows it will), utilization increases, and per-delivery costs drop dramatically.

Supply Chain Optimization: With more locations, Walmart can optimize which fulfillment centers supply which drone hubs. This reduces inventory carrying costs and speeds up delivery times.

Data and Learning: More deliveries mean more data about customer behavior, weather patterns, route optimization, and demand prediction. AI systems can optimize delivery patterns with bigger datasets.

Let's do a rough math model. Assuming:

- Current operations: ~20 Walmart locations, ~1,000 deliveries/day average

- Cost per delivery: ~$4-5 (labor, drone operation, packaging, etc.)

- Revenue per delivery: ~$2-3 (Walmart's margin is small on quick commerce)

- Status: Unprofitable by ~$2 per delivery

At 2027 scale:

- 270 Walmart locations: ~15x growth

- Deliveries per day: ~15,000 (assuming utilization improvements and demand growth)

- Cost per delivery: Drops to ~$1.50-2 (fixed costs spread across more orders, better automation)

- Revenue per delivery: Could increase to ~$3-4 (higher demand means less discounting)

- Status: Approaching breakeven or slight profitability

This is speculative math, but it illustrates why Wing is expanding aggressively. The unit economics improve dramatically at scale.

The Next-Generation Drone: Bigger, Faster, More Capable

Wing has announced a second-generation drone that changes the game. The specs:

- Payload capacity: 5 pounds (double the current 2.5 pounds)

- Speed: 65 mph (double the current ~30 mph)

- Range: Up to 10+ miles on a single charge

- Autonomy: Completely autonomous, no remote pilots needed

Why does this matter?

With 5-pound capacity, you're no longer limited to small packages. You can deliver:

- Grocery bags with multiple items

- Prescription orders (multiple bottles)

- Pet food (typically heavy)

- Beverages (heavier items current drones can't carry)

With 65 mph speed, delivery time drops to under 20 minutes for most areas. That's fast enough that it changes behavior. Instead of "Oh, I'll have it delivered tomorrow," it becomes "I'll have it here in 15 minutes."

With 10-mile range, you can cover larger service areas from a single hub, reducing the number of distribution centers needed.

Wing hasn't announced a launch date for the next-gen drone, but industry speculation suggests late 2026 or early 2027. When it arrives, expect another acceleration in adoption.

Wing faced significant challenges in obtaining regulatory approvals, with BVLOS operations being the most difficult due to stringent safety requirements. (Estimated data)

Competitive Landscape: Wing Isn't Alone

Wing is first at scale in the US, but it's not the only company in drone delivery.

Amazon Prime Air has been promising drone delivery for over a decade. The company finally got FAA approval for limited operations in 2020 and has been slowly expanding. However, Amazon has taken a different approach: building its own logistics network from scratch rather than partnering with existing retailers. This is slower but gives Amazon more control.

Zipline, originally a medical drone company in Africa, is expanding into US quick commerce. The company is focusing on smaller delivery drones and partnerships with retailers.

Manna Aero (Ireland-based) is operating in Europe and expanding to the US market with an interesting model: partnering with convenience stores rather than big-box retailers.

Regional carriers: Several smaller companies have FAA approval for limited operations, particularly in rural areas.

But here's the reality: Wing has regulatory approval, a proven partnership, customer demand data, and the financial backing of Alphabet. Competitors are years behind.

The competitive advantage list:

- Part 135 air carrier certificate (others are still pursuing this)

- Proven profitability path (data from Dallas shows it works)

- Retail partnership with Walmart (the #1 US retailer by store count)

- Capital (Alphabet's pockets are deep)

- Engineering talent (Google's robotics and AI teams)

- Regulatory relationships (years of FDA experience)

Wing's main vulnerability? Public perception and safety incidents. If there's a high-profile drone crash or privacy incident, public support could evaporate. But so far, Wing's safety record is excellent.

Implementation Challenges: The Unsexy but Critical Parts

Expanding from 20 to 270 Walmart locations sounds straightforward. It's not.

Real estate and hub setup: Every new market requires finding space for a local hub. This requires negotiating leases, getting zoning approval, building infrastructure, hiring and training staff. Each new market probably takes 3-6 months to set up before the first drone can launch.

Community relations: Every neighborhood isn't happy about drones overhead. Wing has to do community outreach, address concerns, and work with local government. Some areas have been resistant or slow to approve.

Staffing: Each hub needs 5-10 people (order pickers, drone maintenance, IT support, QA). Hiring and training this many people across 20+ new markets is a significant undertaking.

Integration complexity: Walmart's systems are massive and complex. Every new location requires IT integration with local Walmart systems, point-of-sale, inventory management, and logistics networks. This is harder than it sounds.

Inventory management: Drones don't work well with slow-moving inventory. You need fast-turnover items. This means Walmart needs to position specific inventory at each local hub. Predicting demand and positioning inventory is a logistics puzzle.

Weather patterns: Every geographic region has different weather. Atlanta's summer thunderstorms are different from Dallas's pattern. Wing needs to understand local weather to schedule operations effectively.

Airspace coordination: With more drones in the air, managing airspace becomes critical. Collision avoidance, flight corridors, and traffic management systems are being built. This is partially a technical problem and partially a regulatory one.

Economic Impact: What This Means for Delivery Workers and the Industry

Let's be direct: drone delivery will displace some delivery jobs. But the broader economic picture is more nuanced.

Jobs displaced: Last-mile delivery truck drivers and package couriers. There are roughly 3.5 million delivery jobs in the US. Drone delivery will probably reduce this by 10-15% over the next decade as it scales. That's still hundreds of thousands of jobs. This is real impact that shouldn't be ignored.

Jobs created: Drone maintenance technicians, hub managers, drone pilots (for training and QA), regulatory compliance specialists, route optimization engineers. These are higher-skilled roles that pay better than driving. But there won't be enough of them to replace the jobs lost.

Consumer benefits: Faster, cheaper delivery. The economic surplus generated is real. Customers save time and money.

Retail transformation: Retailers like Walmart gain competitive advantage. They can offer same-day delivery at lower cost, which pressures competitors. This consolidates power among large retailers that can afford drone infrastructure.

Labor pressure: The threat of automation puts downward pressure on delivery worker wages. This is standard economic dynamics. The countervailing force is tight labor markets, which have kept delivery wages relatively stable so far.

Wealth concentration: The biggest winners are capital holders in companies like Alphabet that own the drone infrastructure. Labor is more commoditized in drone delivery than in traditional delivery.

The honest assessment: drone delivery is economically efficient but creates short-term dislocation. Policy interventions (job retraining programs, income support) could soften the impact.

Expansion Timeline and What's Coming Next

Based on Wing's announced timeline and expansion pattern, here's what to expect:

2026 (Current year):

- 150 new locations ramping up across 10+ metros

- Next-gen drone (5-pound capacity) potentially launching

- Focus on execution and hitting delivery targets

- Likely expansion announcements for additional metros

2027:

- 270 total locations operational

- Potential announcement of another 100+ location expansion

- Next-gen drone fully deployed

- Expansion into new retailer partnerships (potentially grocery chains, pharmacy, others)

2028-2030:

- 400+ locations (continued expansion)

- Third-generation drones with even greater capacity

- Automated hubs (fewer human workers, more robots)

- Potential international expansion acceleration

2030s:

- Drones become a standard delivery method in major metros

- Rural expansion (less likely, but possible)

- Integration with autonomous ground delivery for longer ranges

Wing is clearly betting that drone delivery follows the pattern of other infrastructure technologies: slow initial rollout, exponential growth once proven, and eventual ubiquity.

Why Walmart Chose This Moment

Walmart isn't known for taking risks. So why is the company investing so heavily in drone delivery?

Three strategic reasons:

1. Amazon Threat: Amazon's move into quick commerce and same-day delivery is forcing traditional retailers to respond. Walmart needs speed parity with Amazon or risks losing customers. Drones offer speed advantages Amazon can't match with trucks alone.

2. Last-Mile Economics: Walmart's traditional supply chain excellence doesn't help with last-mile delivery. That's where margins disappear. Drones promise to fix this.

3. Customer Data: Quick commerce orders tell Walmart what customers actually need and when. This data is more valuable than the delivery margins. Drone delivery scales the number of quick-commerce orders, which increases valuable data collection.

Walmart is betting that drone delivery becomes the standard way people shop within 5-10 years. Being early and at scale positions Walmart to win that transition.

The Logistics Revolution: Connecting the Dots

Drone delivery isn't an isolated innovation. It's part of a broader transformation in logistics:

Automation: Warehouses are becoming fully automated. Robots pick, pack, and sort. Drones deliver. Humans increasingly manage the system, not execute it.

Speed: Same-day delivery is becoming expected. Next, sub-hour delivery becomes standard. Eventually, 15-minute delivery for local items.

Hyperlocalization: Instead of central warehouses, goods are stored in small, distributed microwarehouses. Drones connect microwarehouses to customers efficiently.

Data-driven: AI predicts demand. Routes optimize in real-time. Inventory positions based on forecast, not historical patterns.

Wing is the visible manifestation of this transformation. But the broader shift is toward systems that are faster, cheaper, and more efficient than what we had before.

Practical Implications: Should You Care?

If you live in a Walmart service area, you should care. Here's what changes for you:

Shopping behavior: You'll likely start ordering small items for drone delivery instead of driving to the store or waiting for traditional delivery.

Budget: You might spend slightly less on some items (grocery items especially, where delivery savings are greatest) or slightly more on others (impulse purchases become easier).

Convenience expectation: Once you have 30-minute delivery, waiting 1-3 days for other deliveries will feel archaic. This is a ratchet—expectations move in one direction only.

Privacy: You're opting into having drones (with cameras) fly over your neighborhood. Data privacy policies matter here.

Noise: Drones are quieter than people expect, but if hundreds of them are flying overhead, there will be environmental impact.

Inequality: Drone delivery will start in wealthy areas where Walmart can afford to build hubs and where residents support it. Inner-city and rural areas will get it later or not at all. This could exacerbate existing delivery disparities.

The Broader Implications: What Happens Next

Drone delivery isn't the endgame. It's an intermediate step toward fully autonomous logistics.

In 10-15 years, imagine a system where:

- Demand prediction AI knows what you need before you order

- Microwarehouses positioned throughout cities hold fast-moving inventory

- Autonomous drones deliver in 15 minutes, 24/7

- Ground robots handle the last-50-feet (navigating sidewalks, building access)

- Human workers manage exceptions, handle complex orders, and provide customer service

This system would be dramatically more efficient than today's retail logistics. Costs would be lower. Speed would be higher. Environmental impact (fewer trucks) would be better.

Wing and Walmart are building the foundation for this future. They're not there yet, but the trajectory is clear.

FAQ

What is Wing's drone delivery service?

Wing is an autonomous drone delivery service owned by Alphabet that delivers packages (groceries, health items, and household goods) to customer homes in under an hour. The service operates through a partnership with Walmart, delivering items from local store hubs to designated drop-off zones in customer yards and patios.

How fast is Wing drone delivery compared to traditional delivery?

Wing drone delivery typically takes 30-45 minutes from order placement to delivery at your home, compared to 1-3 days for standard shipping or 4-8 hours for express delivery. This speed advantage is one of the primary reasons customers choose drone delivery when available, making it competitive with in-store shopping for immediate needs.

What can you order through Wing at Walmart?

You can order groceries (produce, dairy, frozen foods), health and wellness products (vitamins, medications, first aid supplies), household items (cleaning supplies, batteries, light bulbs), convenience items (snacks, coffee), and pet supplies through Wing's partnership with Walmart. The specific inventory available depends on your local store's stock and what's positioned at the local drone delivery hub.

How much does Wing drone delivery cost?

Wing drone delivery pricing varies by market and item type but generally adds $1-3 per order or includes delivery fees comparable to other quick-delivery services. Walmart often includes drone delivery access with Walmart Plus membership, making it a value-added benefit rather than a standalone expensive service.

Is Wing drone delivery safe?

Wing maintains excellent safety records and holds FAA Part 135 air carrier certification, the same standard as manned aircraft operators. Drones undergo autonomous navigation systems designed to avoid obstacles, collisions, and weather hazards. The company operates within strict FAA regulations that require extensive safety documentation, redundant systems, and rigorous testing before launching in any market.

When will Wing drone delivery be available in my area?

Wing is expanding to 150 additional Walmart locations across the US by 2027, including major metros like Los Angeles, St. Louis, Cincinnati, and Miami. If you live in or near a large metropolitan area with significant Walmart presence, the service could arrive within 1-2 years. Check Wing's website or Walmart's app for official availability information in your specific neighborhood, as service areas are defined by individual ZIP codes and delivery range from local hubs.

Will drones deliver to apartment buildings and urban areas?

Wing primarily focuses on suburban and low-density urban areas where rooftops, yards, and patios provide safe landing zones. Dense urban apartment buildings present challenges for drone landing (limited space, building access, safety hazards). However, Wing is developing solutions for urban delivery and expanding to more urban-friendly service areas as technology improves.

How does Wing compete with Amazon Prime Air and other drone delivery services?

Wing has significant competitive advantages: FAA Part 135 certification (regulatory approval years ahead of competitors), proven partnership with Walmart (largest retailer by store count), customer demand data showing 3x-weekly orders from top users, and financial backing from Alphabet. Amazon Prime Air has a slower rollout strategy building its own network, while startups like Zipline are still building regulatory approvals and partnerships.

What happens if the drone crashes or my package is damaged?

Wing's drones are designed to be extremely reliable with autonomous systems that can land safely in emergency situations. Walmart provides standard delivery protection, including refunds or replacements for damaged items. The FAA's strict certification requirements mean Wing drones undergo extensive testing and maintenance to minimize failure risk compared to traditional delivery trucks.

Could drone delivery eventually replace all traditional delivery services?

Drone delivery will supplement rather than completely replace traditional delivery for the foreseeable future. Weight limitations (currently 2.5 pounds, expanding to 5 pounds) mean drones can't handle large orders. Weather restrictions limit operations. Cost economics favor drones for small, time-sensitive items but traditional trucks for bulk orders. The most likely future is hybrid: drones handle quick commerce (small, urgent items) while trucks handle larger orders, bulk deliveries, and rural areas.

Conclusion: The Inevitable Future of Last-Mile Delivery

Wing's expansion to 150 additional Walmart locations isn't just a business announcement. It's a signal that drone delivery has crossed a critical threshold from experimental to essential. When a company as risk-averse as Walmart commits to scaling a technology at this pace, it's because the data is undeniable.

The trajectory is clear: drone delivery will become standard in American suburbs within 5-10 years. It will drive down delivery costs, accelerate shopping speeds, and reshape how retailers compete. Companies that adapt will thrive. Those that don't will lose relevance.

For customers, this means shopping behavior changes faster than most people expect. For workers, it means jobs shift toward higher-skill roles and away from driving. For capital owners, it means the companies that own drone infrastructure will capture enormous value.

Wing and Walmart are building infrastructure that will outlast both companies. They're creating the foundation for a logistics system that's faster, cheaper, and more efficient than what exists today. That's worth paying attention to.

The drones are coming. They're not hypothetical anymore. They're landing in backyards across America right now, and they're only getting more common from here.

Stay tuned. The next five years of last-mile delivery will be the most transformative in logistics history.

Key Takeaways

- Wing is expanding from ~20 Walmart locations to 270 locations by 2027, serving 40 million US customers across major metros

- Top Wing customers order deliveries 3x weekly, proving demand is genuine repeat behavior, not novelty

- Drone delivery reduces last-mile costs by 60-80% compared to traditional truck delivery (8-15 per package)

- Next-generation drones will double capacity to 5 pounds and increase speed to 65 mph, enabling heavier grocery items and faster delivery

- FAA Part 135 certification gives Wing regulatory approval that competitors will take years to achieve, creating competitive moat

Related Articles

- Wing's Drone Delivery Expansion: 150 More Walmarts by 2027 [2025]

- Boston Dynamics Atlas Robot 2028: Complete Guide & Automation Alternatives

- Kodiak and Bosch Partner to Scale Autonomous Truck Technology [2025]

- Zeroth's Home Robots W1 and M1: The WALL-E Era Begins [2025]

- India Startup Funding 2025: Why Investors Got Selective [2025]

![Wing's Drone Delivery Expansion to 150 Walmarts Explained [2025]](https://tryrunable.com/blog/wing-s-drone-delivery-expansion-to-150-walmarts-explained-20/image-1-1768156545075.jpg)