The Robot Revolution Playing Out on China's Biggest Stage

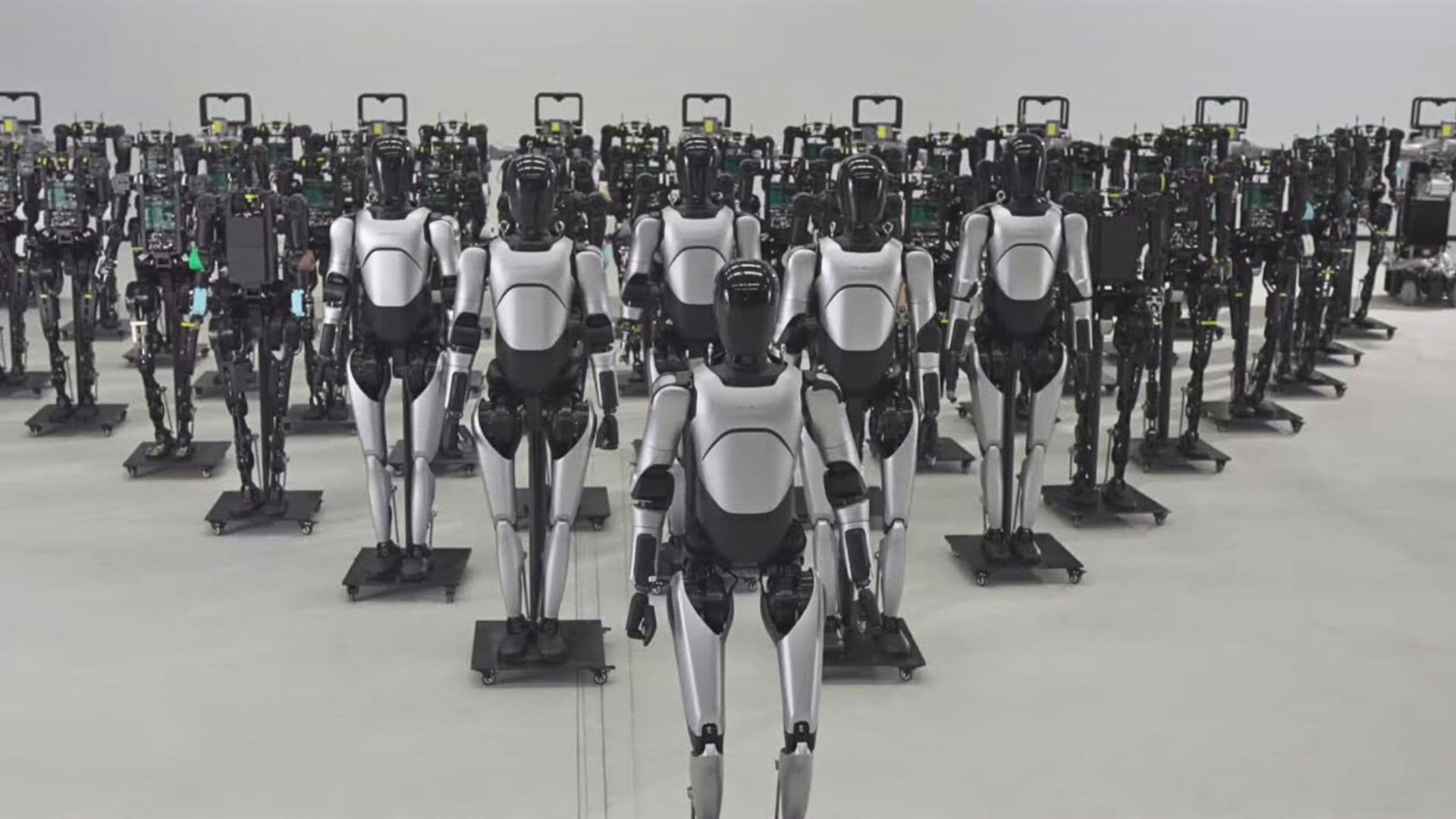

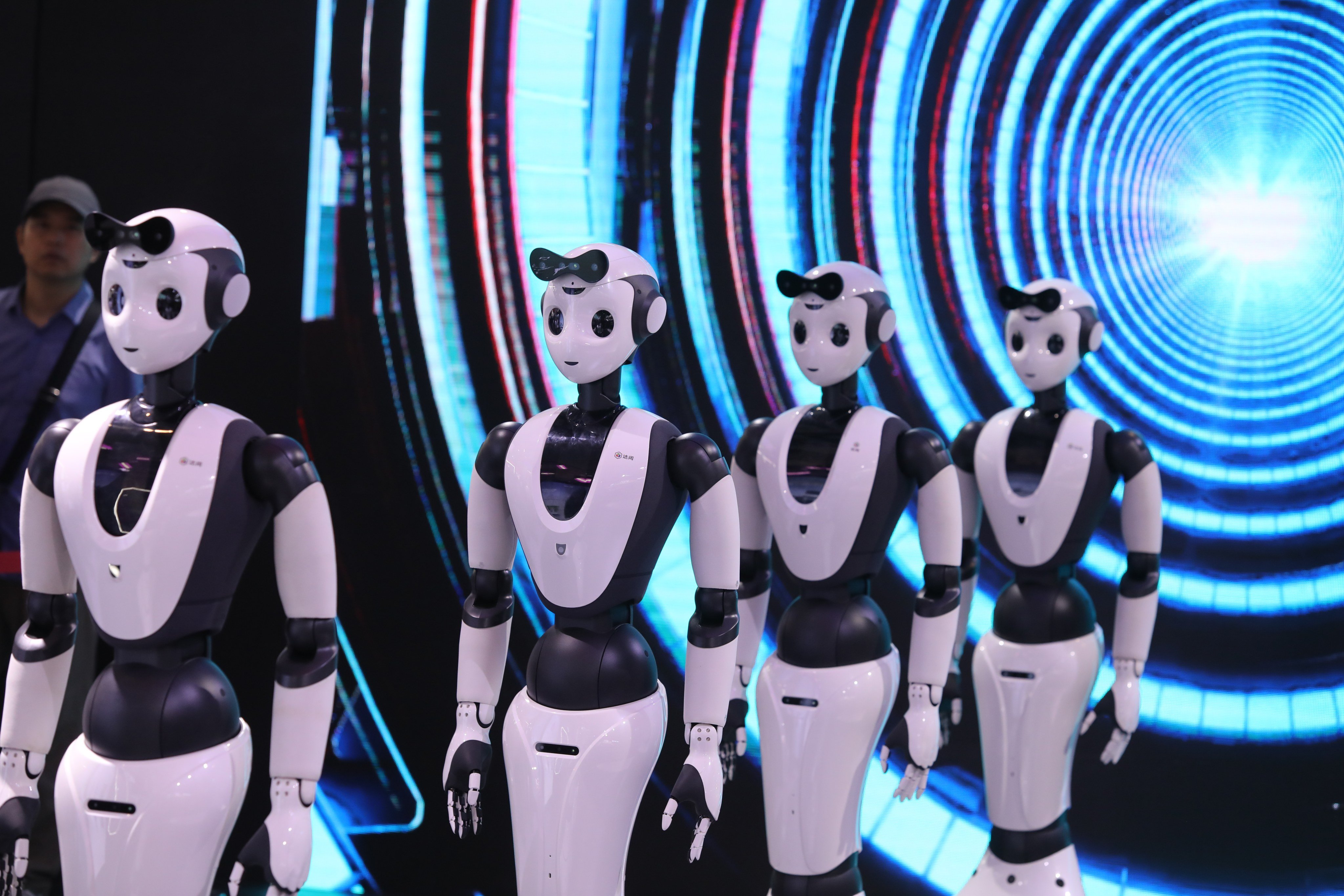

Imagine a television event so massive that it dwarfs the Super Bowl in viewership. Now picture it completely dominated by humanoid robots performing tasks with startling precision and agility. That's exactly what happened when China's most-watched television program showcased an army of advanced humanoid robots, cementing the country's position as a genuine robotics powerhouse.

This wasn't some niche tech demo hidden in a convention center. We're talking about prime-time television watched by hundreds of millions of people, where humanoid robots became the stars. They weren't just standing there looking sleek either. These machines danced, performed dexterous tasks, collaborated with each other, and demonstrated capabilities that made headlines globally.

What makes this moment so significant? For years, the conversation around humanoid robotics centered on Tesla's Optimus, Boston Dynamics robots, and research programs at universities across the West. But China's public display on mainstream television suggests the competitive landscape has shifted dramatically. These aren't experimental platforms. They're sophisticated machines being positioned as solutions for manufacturing, service work, and beyond.

The irony? While Western robotics companies focus heavily on intelligence and autonomous decision-making, China's approach emphasizes demonstrated capability and practical deployment. It's a classic contrast in innovation philosophy: brains versus brawn, as one observer noted. But that distinction matters less when your robots can actually perform complex tasks reliably at scale.

This article dives deep into what China's robot showcase reveals about the global robotics race, how these machines compare to their Western counterparts, and what it means for the future of automation worldwide.

TL; DR

- Chinese TV Dominance: Humanoid robots appeared on China's most-watched television program, reaching hundreds of millions of viewers in a single broadcast

- Capability Demonstration: The robots performed complex tasks including dexterous manipulation, collaboration, and coordinated movements that surprised international observers

- Market Positioning: China is advancing physical robotics deployment faster than Western companies, focusing on practical manufacturing and service applications

- Intelligence Gap: While Tesla and other Western firms emphasize AI decision-making, China's current robots excel at structured, predictable tasks with less autonomous reasoning

- Global Implications: The broadcast signals China's commitment to robotics as a strategic economic priority, potentially reshaping global manufacturing automation markets

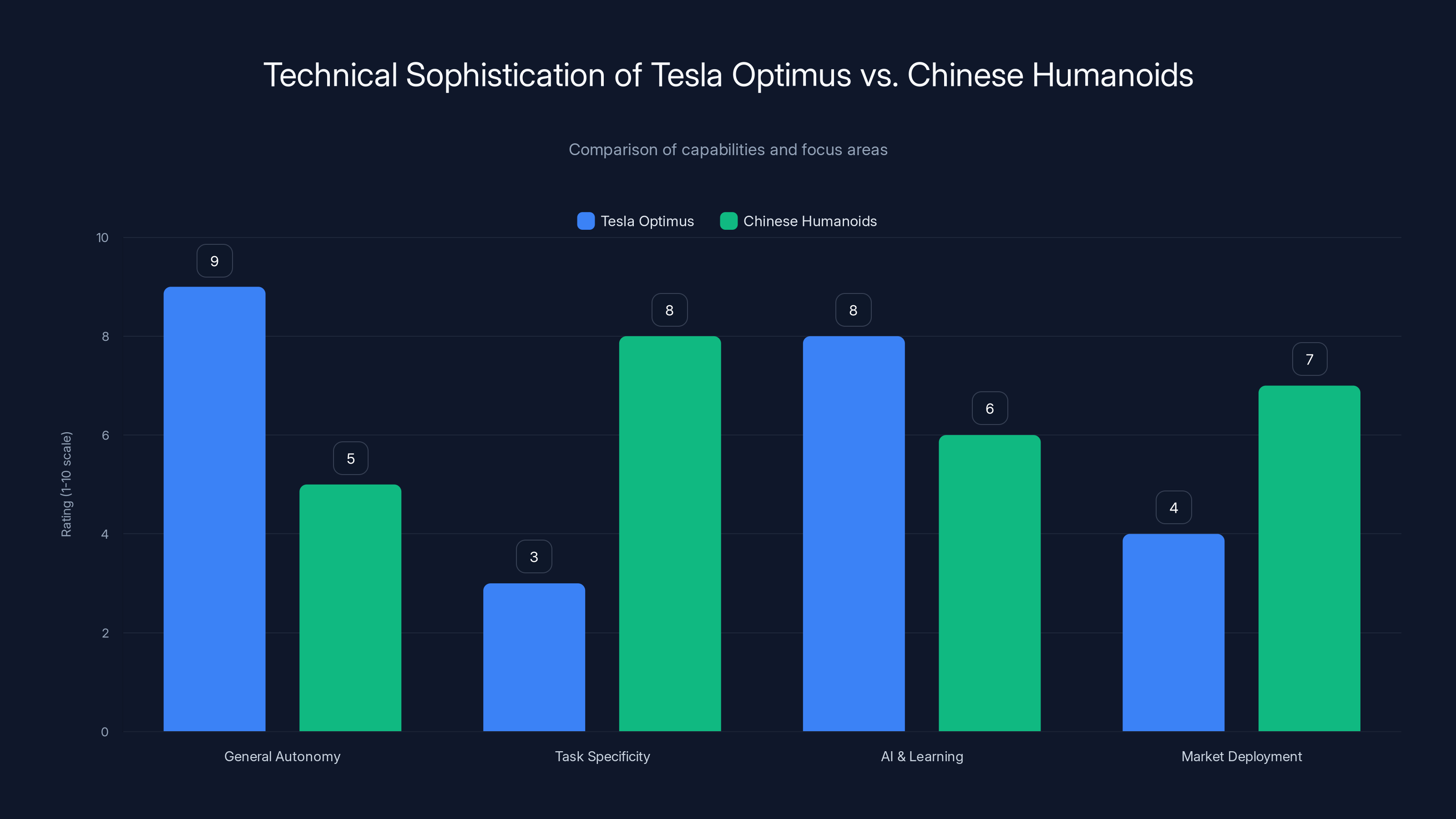

Tesla's Optimus focuses on general autonomy and advanced AI, while Chinese humanoids prioritize task specificity and market deployment. Estimated data based on project descriptions.

Understanding China's Robotics Industry Today

China didn't accidentally become a robotics powerhouse. This is the result of deliberate government policy, massive private investment, and a manufacturing ecosystem perfectly positioned to iterate on hardware rapidly.

The country has been actively investing in robotics since the mid-2000s, with major acceleration after 2015 when China's government included advanced robotics in its national economic development strategy. But here's what most Western observers missed: the investment went beyond funding research. It included tax incentives for robotics companies, subsidies for domestic adoption, and strategic coordination between state-owned enterprises and private companies.

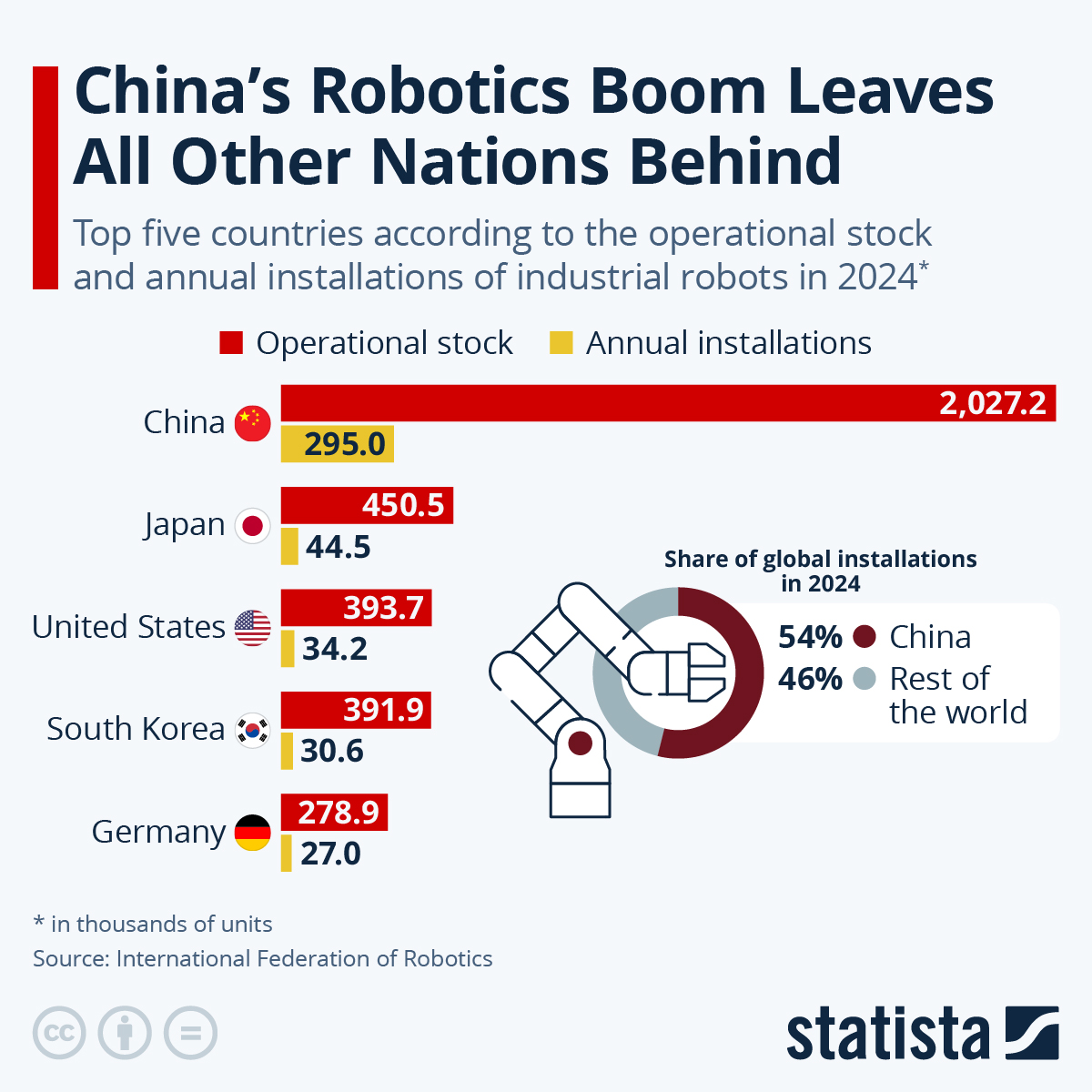

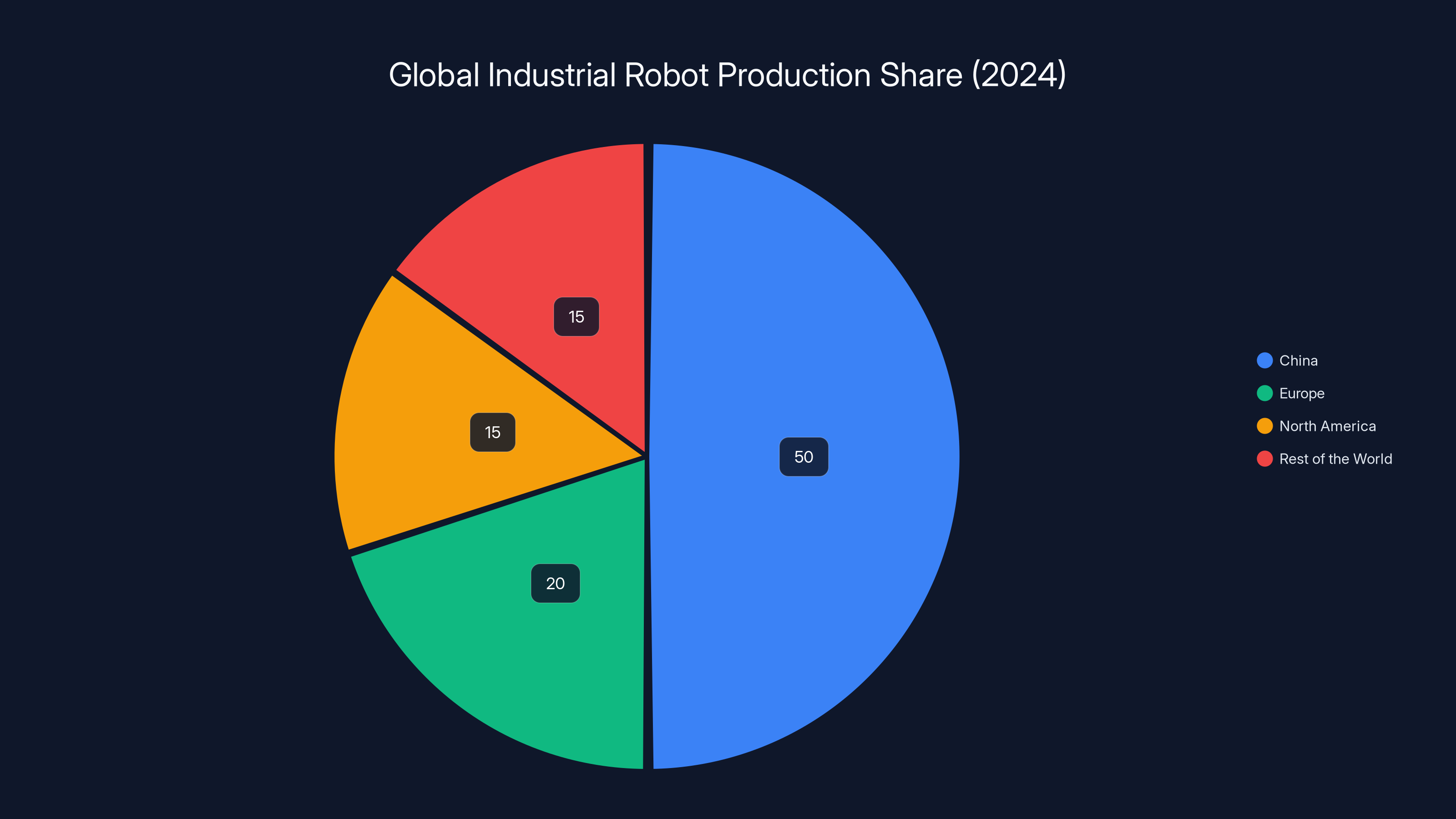

The scale matters here. China produces more industrial robots annually than the rest of the world combined. In 2024, the country manufactured roughly 50% of all industrial robots globally. That's not just a statistic. That means Chinese companies have built supply chains, manufacturing expertise, and optimization experience that Western competitors can't easily match.

What's different about humanoid robots specifically? Industrial arms and specialized robots can be highly profitable, but they're tools. Humanoid robots are different. They're platform plays. A robot that can walk, grasp, and interact in human-designed spaces could theoretically replace human workers across dozens of industries.

The companies building these robots include names most Western tech enthusiasts have never heard of. Unitree Robotics, Fengbu Robotics, and a dozen others are competing fiercely to build better humanoid platforms. They're not operating in isolation. They're embedded in a national ecosystem where government contracts, university partnerships, and state funding provide both capital and guaranteed markets.

The Broadcast Moment: A Cultural and Economic Milestone

China's most-watched television program isn't a drama or variety show. It's a massive entertainment and cultural event that regularly attracts over 600 million viewers per episode. Broadcast during prime time, this show reaches a demographic that spans from urban professionals to rural communities across the entire country.

When humanoid robots became the centerpiece of the broadcast, it served multiple purposes simultaneously. For viewers, it was entertainment and spectacle. For the government, it was messaging about national technological capability. For the robotics industry, it was validation and market building.

The robots didn't just appear on stage. They performed. They danced. They manipulated objects with precision. They worked alongside human performers. This wasn't a technical presentation where engineers explained what the robots could do. It was a demonstration where the public saw the robots performing real tasks in real time.

This distinction matters profoundly. In Western tech culture, we often see robots in controlled lab environments or in concept videos. The viewer's brain accepts that these might be staged or optimized scenarios. But when you see a robot perform live on national television, in front of a studio audience, the psychological impact shifts. The robots became less abstract and more tangible.

Why did the show's producers choose humanoid robots? The answer reveals how deeply robotics has entered mainstream Chinese culture. Robots are no longer niche technology topics. They're entertainment value. They're symbols of national progress. They're part of how China wants to be perceived globally.

Compare this to how humanoid robots have been integrated into Western entertainment. Usually, they appear in science fiction contexts or as cautionary tales about technology. In China's mainstream broadcast, they appeared as achievements worthy of celebration.

Breaking Down the Robots' Technical Capabilities

Now let's talk specifics. What could these robots actually do? The answer depends on which robots we're discussing, since multiple manufacturers likely provided equipment for such a large broadcast.

Based on current generation humanoid robots from leading Chinese manufacturers, these machines likely demonstrated several technical capabilities that represent real engineering achievements:

Bipedal Locomotion and Balance: Walking upright on two legs is harder than it sounds. It requires real-time sensor input, balance calculation, and dynamic weight shifting. Early humanoid robots were notoriously unstable. Modern versions can walk, turn, adjust stride length, and navigate uneven surfaces with increasing reliability. The robots at the broadcast likely demonstrated smooth, human-like walking patterns that don't immediately trigger the "uncanny valley" response.

Dexterous Manipulation: Grasping and manipulating objects requires both hardware sophistication and software control. Modern humanoid robots can perform tasks like picking up objects of varying shapes and sizes, assembling components, and responding to visual feedback about what they're holding. Some systems can perform tasks like stacking objects or inserting components into precise positions.

Coordination and Synchronization: Getting multiple robots to work together without colliding or interfering requires communication between units and environmental awareness. The broadcast likely featured multiple robots performing synchronized movements, whether that was dancing, moving in formation, or collaborating on physical tasks.

Real-Time Responsiveness: The robots had to react to their environment and performers. This might have included responding to human movement, avoiding obstacles, or adjusting behavior based on real-time conditions rather than pre-programmed sequences alone.

Here's the honest assessment though: these capabilities, while impressive, represent the current state of robotics technology globally. Boston Dynamics robots can do comparable things. Tesla's Optimus prototypes can perform similar manipulation tasks. The difference isn't in what they can do on their individual capabilities. The difference is in the cultural positioning and the scale of deployment.

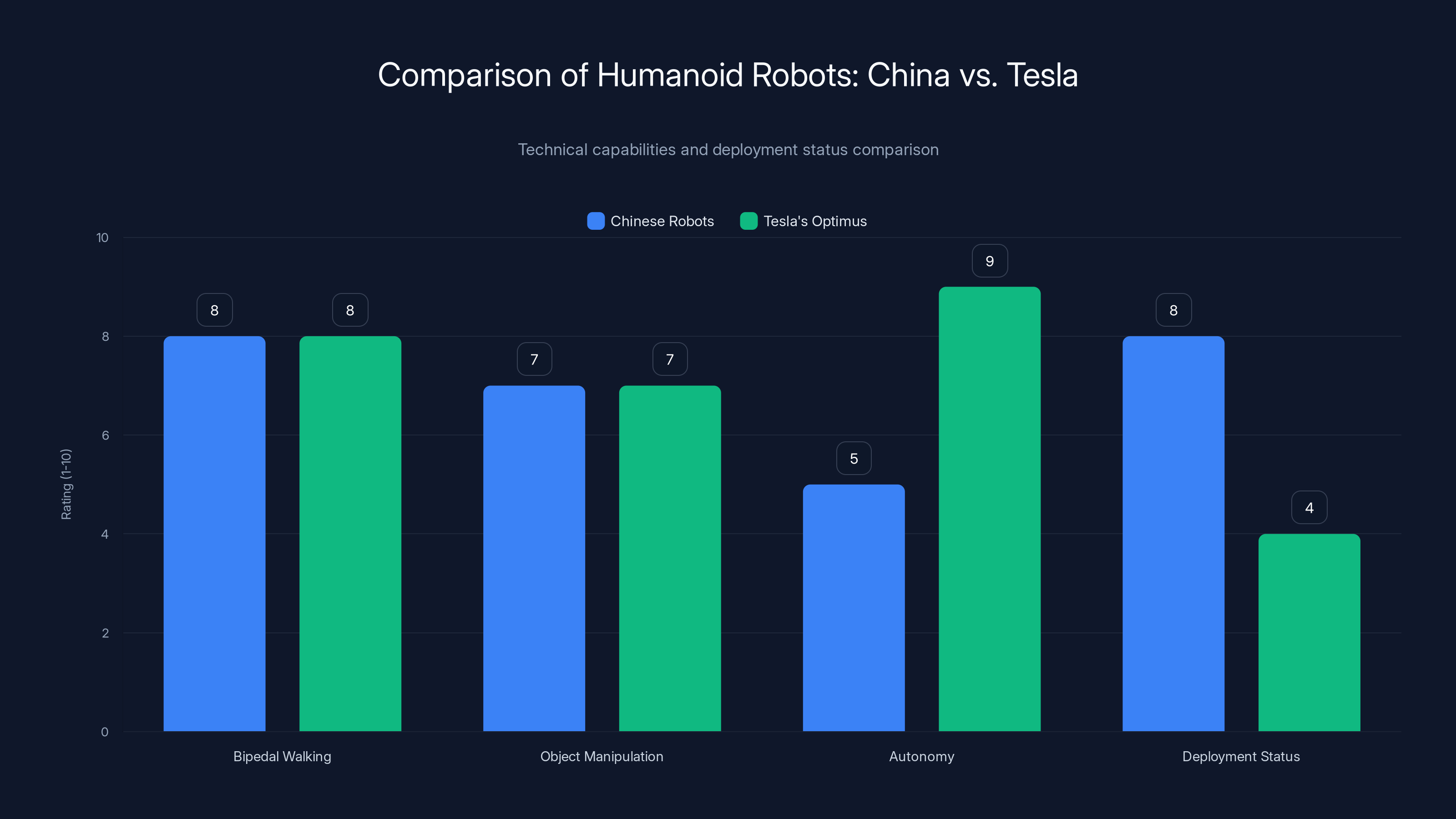

Chinese robots excel in deployment and structured environment performance, while Tesla's Optimus leads in autonomy. Estimated data.

China's Robotics vs. Tesla's Optimus: A Detailed Comparison

Let's directly address the elephant in the room. How do China's humanoid robots compare to Tesla's Optimus project?

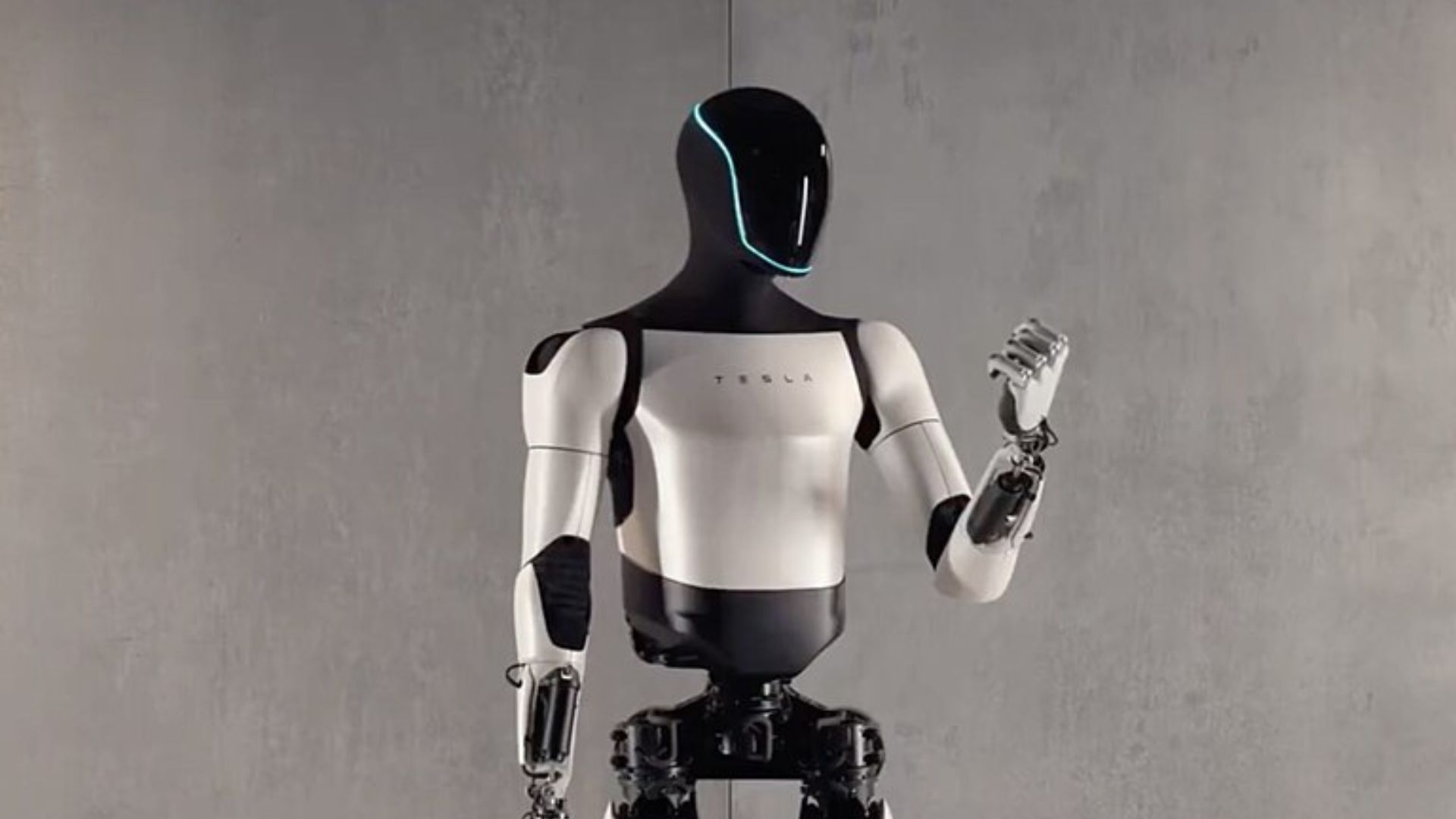

Tesla's Optimus has received enormous media attention, partly because Elon Musk is involved and partly because Tesla has been publicly developing the project for years. The company has shown videos of prototypes performing increasingly sophisticated tasks. But here's the critical detail: Tesla is building Optimus as a research and development project first. The company is solving fundamental engineering problems around bipedal walking, precise grasping, and autonomous task completion.

China's approach is different. Rather than a single manufacturer dominating the space, multiple companies are competing simultaneously. They're not necessarily trying to create fully autonomous robots yet. Instead, they're optimizing for capabilities that have immediate market applications.

Technical Sophistication Comparison

Tesla Optimus: Designed for ultimate generality and autonomy. Tesla envisions a robot that could work across manufacturing, service, domestic, and research applications with minimal reconfiguration. This requires solving hard problems in visual understanding, manipulation in unstructured environments, and decision-making under uncertainty. The project emphasizes AI and learning.

Chinese Humanoids: Optimized for specific task categories. Rather than one robot doing everything, the strategy involves specialized platforms for manufacturing, service, hospitality, and entertainment. This reduces the autonomy requirement and allows for more reliable operation in defined environments.

Manufacturing and Deployment Timeline

Tesla's manufacturing for Optimus is still in prototype phases. The company hasn't announced large-scale production dates. Meanwhile, Chinese humanoid robots are already being deployed in limited real-world settings. Some models are working in manufacturing facilities, hotels, and research institutions.

This matters because manufacturing experience translates into design optimization. Every unit produced generates feedback that informs the next version. China's companies are accumulating this experience faster.

Market Strategy and Positioning

Tesla is positioning Optimus as a world-changing technology that will eventually cost under $25,000 per unit. That's aggressive pricing that assumes massive scale and automation in manufacturing.

Chinese manufacturers are currently selling humanoid robots at much higher prices, sometimes

The Intelligence Question

Here's where the famous observation becomes relevant: China's robots are "brawn over brains." This is accurate but needs context. Tesla is betting on developing sophisticated AI that allows robots to understand tasks, adapt to variations, and operate autonomously. The company believes the hard part is the reasoning.

China's approach assumes that for the next decade at least, most robot work will be in structured environments where the tasks are predictable. Don't need advanced reasoning if the task is always the same and the environment is optimized for robot operation.

Which approach will win? That depends entirely on how quickly AI development accelerates and whether structured automation or general-purpose robots become the dominant market first.

The Manufacturing Advantages China Possesses

Why is China advancing humanoid robotics faster in practical deployment? Start with manufacturing. China has spent decades becoming the world's manufacturing hub. This created advantages in robotics that go far beyond simple cost.

First, supply chain resilience. A Chinese robotics company can source specialized actuators, sensors, controllers, and materials from nearby suppliers. A US company building humanoid robots has to source globally or build components in-house, both of which increase costs and development time.

Second, manufacturing expertise in iteration. Chinese manufacturers excel at rapid prototyping and hardware optimization. Tesla has this capability internally, but most Western robotics companies don't have the manufacturing DNA that Chinese companies do.

Third, talent availability. China has trained enormous numbers of mechanical engineers, mechatronic specialists, and hardware engineers. The labor pool specifically trained for robotics work is simply larger in China.

Fourth, demand signals and testing grounds. Manufacturing facilities across China need automation solutions. Logistics companies need robots. Hospitality is expanding rapidly. There are immediate, real market needs pushing robotics development forward rather than funding speculative research.

Fifth, government support. The Chinese government actively facilitates robotics companies through contracts, subsidies, and guaranteed procurement. A Chinese robotics manufacturer knows there's institutional demand. This reduces investment risk.

The Role of AI and Autonomous Decision-Making

Here's where the narrative gets interesting. For humanoid robots to truly replace human workers at scale, they need to make decisions autonomously. They need to understand tasks in abstract terms, adapt when conditions change, and figure out solutions they weren't explicitly programmed for.

This is genuinely hard. It's an AI problem, not purely a hardware problem. And this is where Western companies like Tesla, Boston Dynamics, and various research institutions have advantages.

Tesla has access to cutting-edge AI research and can integrate large language models with robotics systems. Boston Dynamics has been solving perception and manipulation challenges for over a decade. Universities across the West have been publishing research in computer vision, motor control, and reinforcement learning that directly applies to humanoid robotics.

China is rapidly closing this gap. Research institutions like Tsinghua University are producing world-class robotics research. Chinese tech companies are investing heavily in AI. And the country has prioritized AI development at the national level.

But right now, in 2025, the AI systems that would enable fully autonomous humanoid robots are still emerging. Large language models can't yet seamlessly integrate with real-time robotic perception and control in the way that would enable true general-purpose robots.

This is why China's current approach makes sense. Rather than wait for perfect autonomy, deploy robots that operate in structured environments where the decision-making requirements are minimal. As AI improves, these robots can be upgraded with smarter control systems.

Think of it this way: a robot working in a manufacturing facility doesn't need to understand the meaning of its work. It needs to reliably repeat motion sequences, respond to sensors, and avoid obstacles. These are hard engineering problems, but they're not AI-complete problems.

Market Demand: Where Humanoid Robots Add Value Today

For humanoid robots to become common, there has to be actual market demand. Robots don't exist for their own sake. They exist because they solve economic problems.

What problems could humanoid robots solve?

Manufacturing and Assembly: Factories have thousands of tasks that don't require significant judgment. Picking components, assembling parts, testing products, packing items. If a humanoid robot can do these tasks reliably and cheaper than human labor, it will be adopted immediately. China's massive manufacturing sector provides obvious immediate demand.

Logistics and Material Handling: Sorting, moving, and organizing items. Humanoid robots could work in warehouses, sorting facilities, and distribution centers. Particularly valuable for tasks that are dangerous or repetitive.

Service Work: Hospitality, cleaning, basic maintenance. A humanoid robot that can move around human spaces without requiring extensive modification could do hotel cleaning, restaurant setup, building maintenance. Again, high immediate demand.

Dangerous or Unpleasant Work: Inspection in hazardous environments, waste handling, sewage system maintenance. If robots can do this work, human workers don't have to.

Elderly Care and Assistance: This is lower near-term market but enormous long-term potential. Aging populations in China, Japan, and Europe need care work. Robots that can assist with mobility, basic hygiene, and monitoring could address critical labor shortages.

The irony is that the biggest near-term market opportunity isn't in building intelligent robots. It's in deploying robots that are reliable, consistent, and cheaper to operate than human workers for specific, well-defined tasks.

China's broadcast made implicit statements about these markets. We could perform these tasks. We can scale production. Our robots work. This signals confidence to potential customers and investors.

China is a dominant force in industrial robot production, manufacturing 50% of global output in 2024. This highlights its strong manufacturing ecosystem and strategic investments. Estimated data.

The Competitive Landscape: Who's Actually Winning

Let's map out who's actually leading in humanoid robotics in 2025.

Tesla (United States): Optimus is the most famous project. Tesla has engineering talent, manufacturing experience, and Elon Musk's unwavering commitment to the technology. But it's still primarily a prototype. No commercial sales have occurred.

Boston Dynamics (Hyundai, South Korea): The company has some of the most impressive video demonstrations of humanoid robots performing complex tasks. But commercial deployment has been limited. The robots are still primarily used for research and select industrial applications.

Unitree Robotics (China): Among the most capable and visible Chinese humanoid robot manufacturers. The company has demonstrated bipedal robots that can perform industrial tasks. They're actively selling units and iterating rapidly.

Other Chinese Manufacturers: Fengbu, Fourier Intelligence, and others are competing in different niches. Each optimized for specific use cases.

Established Industrial Robotics Companies: Companies like ABB and Kawasaki are watching the humanoid space closely but remain focused on their existing industrial robot portfolios.

Who's actually winning? In 2025, it depends on the definition. If "winning" means most impressive prototypes and most advanced AI, it's probably Tesla and Boston Dynamics. If "winning" means shipping products and generating revenue, it's the Chinese manufacturers. If "winning" means market share in future deployment at scale, nobody knows yet.

The honest answer is that the industry is still in early innings. We're seeing proof-of-concept demonstrations, not mature commercial markets.

Economic Implications and Labor Market Effects

Now let's talk about the implications. If humanoid robots start displacing human workers, what happens?

This is a genuinely important question that economists, policy makers, and workers are all thinking about. And the answer is complex because robot deployment will be uneven geographically and by sector.

China is particularly vulnerable to rapid robot displacement because:

- The manufacturing workforce is already smaller than it was a decade ago, but still enormous

- Wages have been rising, making automation more economically attractive

- The government is actively encouraging robot deployment

- There's less regulatory friction around displacing workers compared to Europe or North America

This could create a situation where robot deployment accelerates dramatically in China over the next 5-10 years, while slower adoption elsewhere creates diverging economic outcomes.

For workers, the implications are significant but not uniformly negative. Displaced manufacturing workers will need retraining. But new jobs typically emerge in robot maintenance, programming, and supervision. The transition is painful, but not necessarily permanent displacement.

For China, rapid robot deployment could be economically advantageous, at least in the near term. Labor costs would decline, making Chinese manufacturing more competitive globally.

For the West, it creates pressure. If Chinese manufacturers can operate with robotic workforces and produce goods cheaper, that impacts global competitiveness. This is partly why Western governments are increasingly focused on robotics investment.

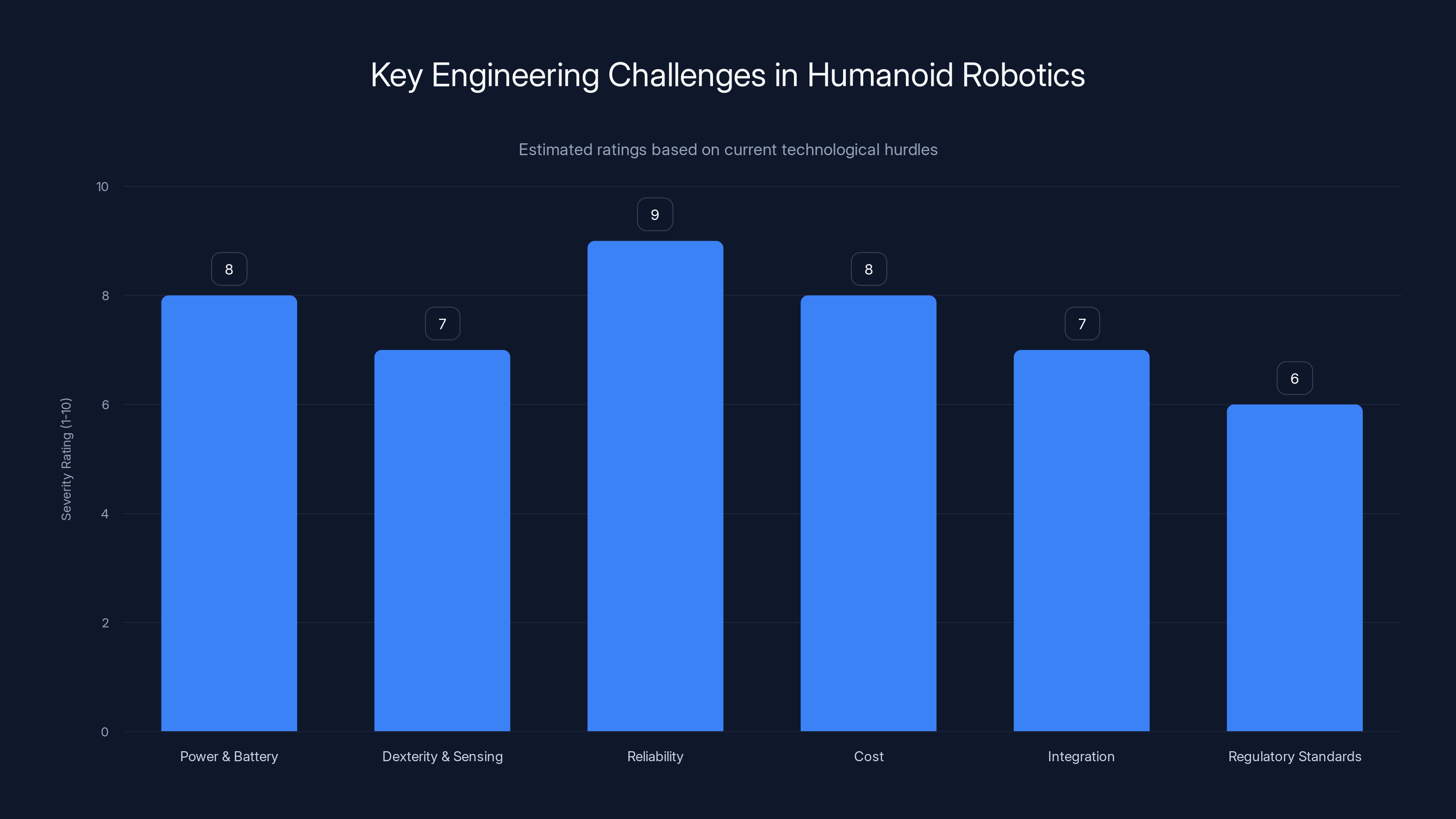

Engineering Challenges Still Being Solved

Despite the impressive demonstrations, significant engineering challenges remain unsolved in humanoid robotics.

Power and Battery Technology: Humanoid robots require tremendous power for bipedal locomotion, arm movement, and onboard computing. Current batteries limit runtime to 4-8 hours per charge. This is fine for scheduled work, but impractical for robots that need to work full shifts. Battery research continues, but breakthroughs haven't arrived yet.

Dexterity and Sensing: Human hands have 27 degrees of freedom (roughly). Robot hands have far fewer, and controlling even 10-15 degrees of freedom precisely is complex. Tactile sensing is still primitive compared to human touch. If you want robots doing delicate assembly or handling fragile items, this needs improvement.

Reliability and Mean Time Between Failures: Humanoid robots are mechanical systems. They wear out. They fail. Moving from prototype reliability (where failures are acceptable) to production reliability (where you need 99%+ uptime) is a massive engineering challenge. This is partly why manufacturing robots have been so successful: decades of optimization.

Cost: Current humanoid robots cost

Integration with Existing Systems: Most factories and workplaces were designed for human workers. Getting robots to work in these spaces requires either modification of the environment or highly adaptable robots. Actual deployment involves significant integration costs beyond the robot purchase price.

Regulatory and Safety Standards: There aren't yet clear regulatory frameworks for humanoid robots in workplaces. Safety standards are still being developed. This creates legal uncertainty for early adopters.

The Role of Software and Control Systems

The spectacular parts of humanoid robots are the hardware and the visual impression. But the real engineering happens in software and control systems.

Modern humanoid robots use control architectures that combine multiple layers:

Low-Level Motor Control: Real-time systems that manage joint angles, torques, and velocities. These run on dedicated processors at high update rates (1000+ Hz) and are critical for smooth, responsive movement.

Sensor Integration and Perception: Computer vision systems that process camera input, force sensors in arms that provide feedback about what's being grasped, inertial sensors that help with balance. All this data streams into perception systems that create an internal model of the robot's environment.

Task Planning and Execution: Higher-level systems that receive instructions ("grasp the object") and break them down into motion sequences. This might involve path planning to avoid collisions, trajectory generation for smooth movement, and adjustment based on sensor feedback.

Learning and Adaptation: Modern systems can learn from experience. If a grasp fails, the system might adjust its approach. This is where AI and machine learning become relevant.

The complexity here is significant. Getting all these systems to work together, in real time, with reliability, requires deep expertise in control theory, computer vision, and software engineering.

China's advantage here is partly in the accumulated engineering talent and partly in the willingness to solve problems pragmatically. Rather than waiting for perfect algorithms, Chinese developers deploy systems that work well enough for their specific use cases and refine from there.

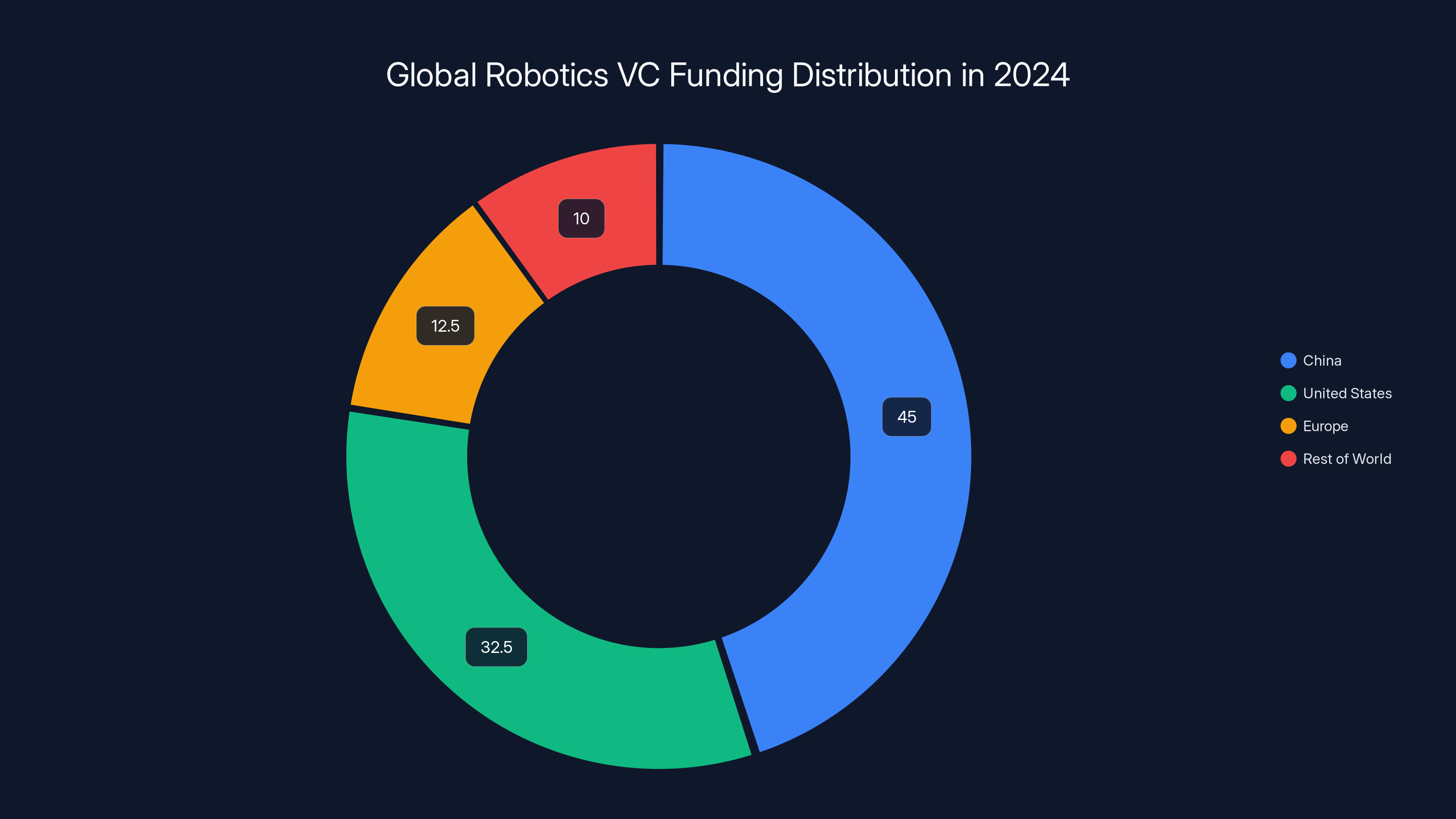

China leads in humanoid robotics VC funding with an estimated 45% share, followed by the US at 32.5%. Europe's share is 12.5%, with the rest of the world at 10%. Estimated data.

Government Strategy and National Competition

Let's be direct: humanoid robotics is becoming a geopolitical competition proxy.

China's government has identified robotics as a strategic priority. This means funding research, providing market incentives for adoption, and positioning the country as a robotics superpower. The broadcast wasn't just entertainment. It was a statement about national capability.

The United States sees this and recognizes the competitive threat. Congressional interest in robotics has increased. Funding for robotics research has grown. There's awareness that if the US falls behind in robotics deployment, it's a strategic disadvantage.

Europe is trying to position itself in the middle, emphasizing ethical robotics and careful deployment while investing in research and manufacturing.

Japan has been in robotics for decades and sees opportunities in aging-care robotics and high-precision manufacturing applications.

This international competition isn't about the inherent value of humanoid robots. It's about the technologies and manufacturing capabilities that cluster around robotics. Companies that excel at humanoid robotics build expertise in materials science, precision manufacturing, control systems, and AI. These capabilities transfer to other industries.

It's also about employment and economic output. If robot manufacturing becomes a major industry, countries and companies that lead will capture significant economic value.

Current Limitations and Honest Assessment

Let's be realistic about what humanoid robots can and can't do today.

What they're genuinely good at:

- Repetitive tasks in structured environments

- Tasks that don't require adaptive reasoning

- Work that's dangerous for humans

- Tasks with clear success/failure criteria

- Operating in environments that have been optimized for robot operation

What they struggle with:

- Unstructured environments with lots of variation

- Tasks requiring real-time judgment about safety or quality

- Work requiring social interaction and emotional intelligence

- Tasks that need creative problem-solving

- Adapting to novel situations they weren't trained for

The honest assessment from the broadcast: China demonstrated impressive engineering and showed that humanoid robots can work reliably in entertainment and demonstration contexts. But this isn't the same as proving they can function at scale in complex real-world environments.

Many experts interviewed about the broadcast noted that while the physical capability was impressive, the robots were still essentially performing choreographed sequences. True autonomy and adaptability weren't on display.

This isn't a criticism. It's a realistic assessment of where the technology is. Choreographed robots can still be extremely valuable economically. But it's important to distinguish between "impressive demonstration" and "ready to replace human workers universally."

Future Trajectory and Timeline Predictions

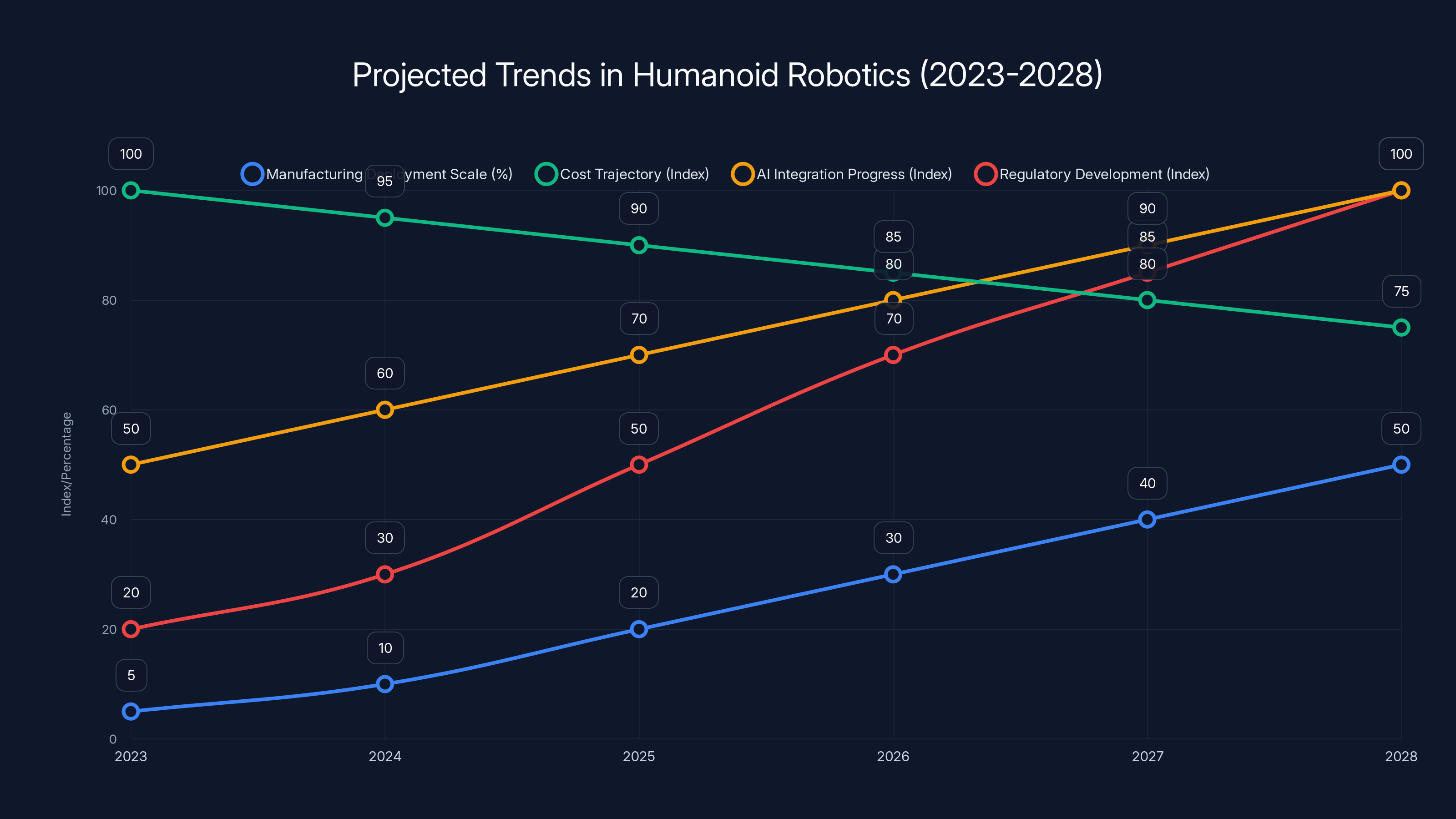

What should we expect in the next 3-5 years?

2025-2026: Continued refinement of existing platforms. More companies entering the market, both in China and globally. First significant manufacturing deployments becoming visible. Costs beginning to decrease as production scales. Regulatory frameworks for robot safety starting to solidify.

2027-2028: Possible breakthrough in AI-enabled robotics if language models and robotic systems integrate more effectively. Widespread adoption in specific sectors (e.g., certain types of manufacturing, logistics). Costs dropping significantly as manufacturing optimizes. Emergence of robot-as-a-service models where companies lease robot labor rather than purchase.

2029-2030: Depending on AI progress, we might see more genuinely autonomous robots. Or we might see acceptance that specialized robots for specific tasks are the viable near-term path. International workforce displacement becoming measurable and noticeable. Significant policy responses from governments worldwide.

The timeline isn't predetermined. It depends on:

- How quickly AI integrates with robotics

- How rapidly manufacturing costs decline

- Whether major breakthroughs occur in dexterity and sensing

- How quickly market demand for robot labor grows

- How governments regulate robot deployment

My best assessment? 3-5 years is when humanoid robots transition from impressive demonstrations to serious commercial deployments. 10 years is when we'll have clarity on whether they become dominant in certain industries.

Lessons for Western Companies and Countries

What should Western companies and policy makers take from China's broadcast moment?

First, China is serious about robotics as an economic priority, and they're making tangible progress in deployment, not just research. This isn't hype. This is actual engineering and market development.

Second, the competitive advantage isn't purely in having the smartest AI. It's in manufacturing infrastructure, supply chain coordination, and the ability to iterate rapidly on hardware. China has advantages here that took decades to develop.

Third, cultural and political acceptance matters. China's public positioning of humanoid robots as achievements has likely accelerated adoption and investment. In the West, robots are often positioned as threats. This narrative difference has real economic consequences.

Fourth, if there's going to be a Western response, it needs to be comprehensive. You can't win a robotics competition with just research funding. You need manufacturing, you need supply chains, you need market development, you need regulatory clarity. This requires coordination across government, industry, and education that doesn't currently exist in most Western countries.

Fifth, the humanoid robot question might be a red herring. Maybe specialized robots for specific tasks are the actual market winner, not humanoid general-purpose robots. Western companies should watch what actually gets deployed and adopted, not just what gets publicized.

Power and battery technology, reliability, and cost are the most severe challenges in humanoid robotics, with ratings of 8 or higher. Estimated data.

The Broader AI Integration Story

Humanoid robotics doesn't exist in isolation. It's deeply connected to broader AI development trends.

The most significant recent developments in AI have been in large language models and multimodal AI systems. Companies like Open AI have shown that language models can be connected to robotic systems, allowing robots to understand instructions in natural language.

China's robotics companies are watching these developments closely. If language models become the interface for robotic control, then companies that can effectively integrate large language models with hardware will have significant advantages.

This creates an interesting dynamic: AI capability concentrates in a few companies (Open AI, Anthropic, Google, Chinese AI labs). Robotics hardware is being developed globally but concentrated in specific countries. The companies that can effectively bridge this gap—linking state-of-the-art AI with manufacturing hardware—will lead the market.

Tesla has this potential because it has hardware manufacturing and AI research. Chinese companies have manufacturing but are building AI capability. Western robotics companies have engineering expertise but often lack both manufacturing scale and AI research capacity.

Supply Chain Vulnerabilities and Resilience

Humanoid robot supply chains involve specialized components: servo motors, actuators, sensors, specialized processors. Where are these manufactured?

Many critical components are manufactured in China or Taiwan. Servo motors come from Japan and China. Specialized semiconductors come from Taiwan and South Korea. Advanced sensors come from Germany, Japan, and the US.

This creates an interesting vulnerability situation. No single country can manufacture a complete humanoid robot entirely domestically. Everyone is dependent on international supply chains.

For China, this is actually an advantage. The country can secure components from anywhere and manufactures many of them domestically. For the US and Europe, fragmented supply chains create complexity and vulnerability.

This is another advantage China's broadcast implicitly highlighted: we have the manufacturing ecosystem to produce humanoid robots at scale, while our competitors still struggle with supply chain complexity.

Investment and Funding Trends

Venture capital is increasingly funding humanoid robotics startups. In 2024, funding for robotics startups exceeded $3 billion globally. While this is a fraction of overall VC funding, it's growing faster than most sectors.

Geographically, funding is concentrated in:

- China (probably 40-50% of global robotics VC funding)

- United States (30-35%)

- Europe (10-15%)

- Rest of world (5-10%)

This concentration of funding reflects where the innovation is actually happening. China's dominance in robotics funding is noteworthy and likely understated because much Chinese robotics funding comes from government sources rather than VC.

If capital is a leading indicator, we should expect accelerating humanoid robot development in China, continued large bets in the US (Tesla, Boston Dynamics, smaller startups), and gradual scaling in Europe.

For investors, humanoid robotics is high risk. These are complex technologies with uncertain timelines and markets. But the companies that successfully develop and deploy humanoid robots will likely become enormous if the market matures.

The Role of Entertainment and Public Perception

Back to the television broadcast: it's important because it shapes perception and cultural acceptance.

Technology adoption is often driven by more than pure technical capability. It's shaped by whether people think the technology is advanced, whether they trust it, whether they see it as inevitable. A humanoid robot performing on national television sends a powerful cultural signal.

In China, that signal is: robotics is advanced, it's working, it's part of our national future. This culturally primes people to accept robot deployment. When their factory introduces humanoid robots, or their hotel uses robotic service assistants, it doesn't feel shocking or threatening. It feels like inevitable progress.

In the US, the cultural narrative has been different. Robots are often portrayed as threats to employment or as far-future science fiction. This shapes acceptance. Even if US robotics technology is equally advanced, American workers might be more resistant to robot deployment because of narrative framing.

This is partly why China's approach of large public broadcasts is strategically valuable. It's not just showcasing technology. It's building narrative that makes deployment and adoption easier.

This chart estimates trends in humanoid robotics over the next five years, highlighting potential growth in deployment, cost reduction, AI integration, and regulatory development. Estimated data.

Skills and Education Implications

If humanoid robots become common in workplaces, what skills do workers need?

Traditional manufacturing workers need to understand:

- Robot programming and operation

- System troubleshooting and maintenance

- Integration of robots into existing workflows

- Safety protocols around robotic systems

These are genuinely learnable skills, but they require education and training programs. China has been developing these programs aggressively. Technical schools are incorporating robotics into curricula. Manufacturing companies are training workers on robotic systems.

In the West, this educational infrastructure is emerging more slowly. This could create a talent gap where China has workers ready for robot-integrated manufacturing while the West is still transitioning.

From an education perspective, the key insight is that robots don't eliminate the need for human workers. They shift what kind of skills are valuable. Workers who can operate, maintain, and integrate robotic systems are increasingly valuable.

Ethical Considerations and Worker Concerns

Let's acknowledge the human side of this story. Humanoid robots represent real job displacement risk for millions of workers.

In China, the government narrative frames robots as progress. But workers understand that robot adoption in manufacturing could reduce employment opportunities. This creates genuine economic anxiety even if government messaging is positive.

Ethical questions arise:

- Should governments subsidize robot adoption if it eliminates jobs?

- What responsibilities do companies have to displaced workers?

- How do we ensure robot technology benefits workers, not just employers?

- Should there be limits on robot deployment in certain sectors?

These aren't technical questions. They're policy and value questions. Different countries will answer them differently based on their political and social systems.

China's government has taken an approach of enabling rapid deployment while investing in retraining programs. The West is debating whether to restrict robot deployment or accelerate it with support systems. Neither approach is obviously correct.

What's clear is that ignoring these questions isn't viable. Robot deployment that impoverishes workers creates social instability. Successful deployment requires thinking about how to manage transition for affected populations.

The China-US Tech Rivalry Context

China's humanoid robot broadcast happens in the context of broader tech competition with the United States.

The US still leads in:

- Semiconductor design and advanced chip manufacturing (partially)

- Software and cloud computing

- AI research and model development

- Internet platforms and services

China leads in:

- 5G deployment and infrastructure

- Battery and electric vehicle technology

- Manufacturing scale and efficiency

- Manufacturing robotics application

- Solar panel production

Humanoid robotics could be an area where China pulls ahead entirely. If this happens, it signals a broader shift in technological leadership that has implications beyond just robotics.

For policy makers and investors, humanoid robotics is becoming a proxy for broader technological competitiveness.

Real-World Applications Emerging Now

Beyond the broadcast, actual robot deployments are starting. Where?

Manufacturing Plants: Several large Chinese manufacturers have begun replacing assembly line workers with humanoid robots. The transition is gradual, but happening.

Logistics Hubs: Some warehouses are testing robot material handling. Less impressive visually than manufacturing, but economically significant.

Hotels and Hospitality: Robot receptionists and cleaning robots are being deployed in select high-end hotels, particularly in China. These are often humanoid or vaguely humanoid designs.

Research Institutions: Universities and research labs are acquiring humanoid platforms for research into AI control, perception, and human-robot interaction.

Manufacturing Supply: This is perhaps most interesting. Some companies have shifted from making components for human-operated tools to making components optimized for robot operation.

None of these deployments involve fully autonomous humanoid robots making independent decisions. They're all specialized robots operating in carefully optimized environments with human supervision.

But they're happening now, at scale. This is the key difference between China's position and the West's position. China has made the jump from prototype to early deployment.

The Next Five Years: What to Watch

If you're tracking this space, here are the key indicators to watch:

-

Manufacturing Deployment Scale: How many factories actually adopt humanoid robots? What percentage of the manufacturing workforce do they replace?

-

Cost Trajectory: Do costs decline at the rate manufacturers predict? If they do, adoption accelerates. If not, it stalls.

-

AI Integration Progress: Do breakthroughs in AI autonomy matter? If humanoid robots become genuinely autonomous, it's game-changing. If they remain specialized performers, it limits market.

-

US and European Response: Do Western governments and companies mount competitive research and manufacturing initiatives? If not, China could achieve overwhelming dominance.

-

Regulatory Development: Do clear safety and operational standards emerge? This affects deployment speed significantly.

-

Technical Breakthroughs: Do unexpected engineering advances solve longstanding problems (like battery life or dexterity)? Breakthroughs accelerate everything.

-

Market Acceptance: Do workers and employers actually embrace robot deployment, or does resistance slow adoption?

-

New Entrants: Which companies successfully enter the humanoid robotics market? There will be consolidation, and winners and losers will emerge.

Connecting the Dots: From TV to Global Impact

China's humanoid robot broadcast seems like an entertainment moment, but it's actually a window into several important trends:

First, China is advancing the practical application of robotics technology faster than Western companies, driven by manufacturing advantages and government support.

Second, the competitive game in robotics isn't purely about raw technological capability. It's about manufacturing scale, supply chain strength, and cultural acceptance. China has advantages in all three.

Third, the distinction between intelligent robotics and performant robotics is crucial. China's robots excel at the latter. This is economically valuable even if it's less philosophically interesting than fully autonomous robots.

Fourth, this is part of a broader pattern of China becoming competitive in capital-intensive manufacturing technology sectors. Solar panels, batteries, EVs, and now humanoid robots.

Fifth, the West isn't standing still, but it's clearly less coordinated and moving slower on humanoid robotics specifically. US dominance in AI research hasn't translated into robotics market leadership yet.

Finally, the pace is accelerating. What seemed impossible five years ago is now being demonstrated. What's being demonstrated now could be commercialized in five years.

FAQ

What exactly did China's TV broadcast show with humanoid robots?

China's most-watched television program, which broadcasts to over 600 million viewers, featured humanoid robots performing on stage alongside human performers. The robots demonstrated bipedal walking, object manipulation, synchronized movement with other robots, and various choreographed sequences. The broadcast was designed to showcase humanoid robot capabilities to a massive audience rather than provide technical demonstrations.

How do Chinese humanoid robots compare technically to Tesla's Optimus?

Chinese robots and Tesla's Optimus have different design philosophies. Tesla emphasizes autonomous decision-making and general-purpose capability through advanced AI integration, while Chinese manufacturers focus on reliable performance in structured environments. Tesla's Optimus is still largely in prototype testing phases, whereas Chinese robots are being deployed in limited real-world applications. Technical capabilities overlap significantly—both can walk, grasp, and perform manipulation tasks—but the autonomy levels differ, with Tesla aiming for greater independence and Chinese robots relying more on programming and operator guidance.

Why is China advancing humanoid robotics faster in practical deployment?

China's advantages include a mature manufacturing infrastructure with specialized supply chains, enormous engineering talent pools trained in mechanical and robotic systems, immediate market demand from manufacturing and logistics sectors, government financial support and procurement guarantees, and rapid iteration capability from producing more robots at larger scales. These structural advantages enable faster progression from development to deployment compared to Western companies that often lack integrated manufacturing capacity.

What are the main limitations of current humanoid robots?

Current humanoid robots struggle with battery life (typically 4-8 hours), precise dexterous manipulation compared to human hands, true autonomous decision-making in unstructured environments, cost (still

What jobs are most at risk from humanoid robot displacement?

Humanoid robots will likely first impact repetitive manufacturing and assembly work, warehouse and logistics tasks, basic cleaning and maintenance roles, and routine service work. The timeline varies by sector and region, but manufacturing and logistics are seeing initial deployments now. Jobs requiring creative problem-solving, emotional intelligence, or adaptive reasoning in truly unstructured environments are less vulnerable near-term.

How does AI fit into humanoid robot development?

AI enables robots to understand instructions in natural language, perceive and interpret environments, make decisions about task execution, learn from experience, and adapt to variations. Current AI (language models and computer vision) can be integrated with robotic systems, but true general-purpose autonomous robots require AI systems that don't yet exist at production-ready maturity. Most deployed robots use AI primarily for perception and basic decision-making while relying on pre-programmed behaviors for complex tasks.

Why did China broadcast humanoid robots on prime-time television?

The broadcast served multiple purposes: entertainment value to engage a massive audience, signaling national technological achievement and capability, building cultural acceptance for robot deployment, attracting investment and talent to the robotics sector, and establishing narrative dominance in how humanoid robotics are perceived internationally. It positioned humanoid robots as inevitable progress rather than threatening technology.

What is the timeline for commercial humanoid robot adoption?

Expect first significant deployments in specific manufacturing and logistics applications within 2-3 years, broader adoption across multiple sectors within 5-7 years, and potential major market transition (if fully autonomous AI-powered robots emerge) within 10+ years. Timeline depends heavily on AI breakthroughs, cost reductions, regulatory clarity, and market demand growth. Near-term focus will be on specialized robots for specific tasks rather than general-purpose humanoid replacements.

How is this affecting US and European robotics companies?

Western companies recognize China's competitive advantage and are accelerating research investment. Governments are increasing robotics funding through CHIPS Act programs and equivalent initiatives. However, Western companies lack China's manufacturing ecosystem integration, making large-scale deployment more expensive. The response has been partly to focus on advanced autonomy (where Western AI research leads) and partly to develop collaborative robots that work alongside humans rather than replace them entirely.

What skills will workers need as humanoid robots become more common?

Workers will need training in robot programming and operation, system maintenance and troubleshooting, safety protocols for working with robotic systems, and integration of robots into existing workflows. Educational institutions are developing curriculum around these areas. The transition favors workers with technical skills and adaptability over those in purely manual labor roles, creating both displacement challenges and new opportunity categories.

Key Takeaways

- China's humanoid robot showcase on the country's most-watched television program signals serious market commitment and demonstrates technological capability at unprecedented public visibility scale

- The robots displayed impressive physical capability but operate primarily through pre-programmed sequences rather than true autonomous decision-making, making them "brawn over brains"

- Manufacturing advantages (supply chains, engineering talent, iteration speed) are enabling China to transition from research to deployment faster than Western competitors

- Tesla's Optimus emphasizes AI autonomy and general-purpose capability, while Chinese robots optimize for reliability and cost in structured environments

- Near-term economic impact will be concentrated in manufacturing, logistics, and service sectors where tasks are predictable and structured

- Battery life, dexterity, cost reduction, and regulatory frameworks remain key challenges for broader humanoid robot adoption

- The competitive dynamic extends beyond pure robotics technology to manufacturing infrastructure, supply chains, and cultural acceptance narratives

- AI integration will become increasingly critical as language models and multimodal systems enable more sophisticated robot control and decision-making

- Global investment in humanoid robotics is accelerating, with China dominating funding concentration but US and Europe increasing commitments

- The next 3-5 years will reveal whether humanoid robots become transformative workplace technology or remain specialized tools for specific high-value applications

Related Articles

- Amazon's Blue Jay Robotics Project Failure: What Went Wrong [2025]

- Agentic AI & Supply Chain Foresight: Turning Volatility Into Strategy [2025]

- The AI Agent 90/10 Rule: When to Build vs Buy SaaS [2025]

- RentAHuman: How AI Agents Are Hiring Humans [2025]

- Peter Steinberger Joins OpenAI: The Future of Personal AI Agents [2025]

- OpenAI Hires OpenClaw Developer Peter Steinberger: The Future of Personal AI Agents [2025]

![China's Humanoid Robots Dominate TV, Outpacing Tesla Optimus [2025]](https://tryrunable.com/blog/china-s-humanoid-robots-dominate-tv-outpacing-tesla-optimus-/image-1-1771450754590.jpg)