Climate Tech Investing in 2026: What 12 Major VCs Predict

Everybody called it. 2025 was supposed to be climate tech's funeral.

When Trump swept back into office on promises to dismantle the Biden administration's climate policies, the betting markets shifted hard. Venture capitalists who'd poured billions into decarbonization started bracing for impact. The European Union, meanwhile, began quietly stepping back from its most aggressive emissions targets. It looked like the whole sector was about to face a reckoning.

Except it didn't.

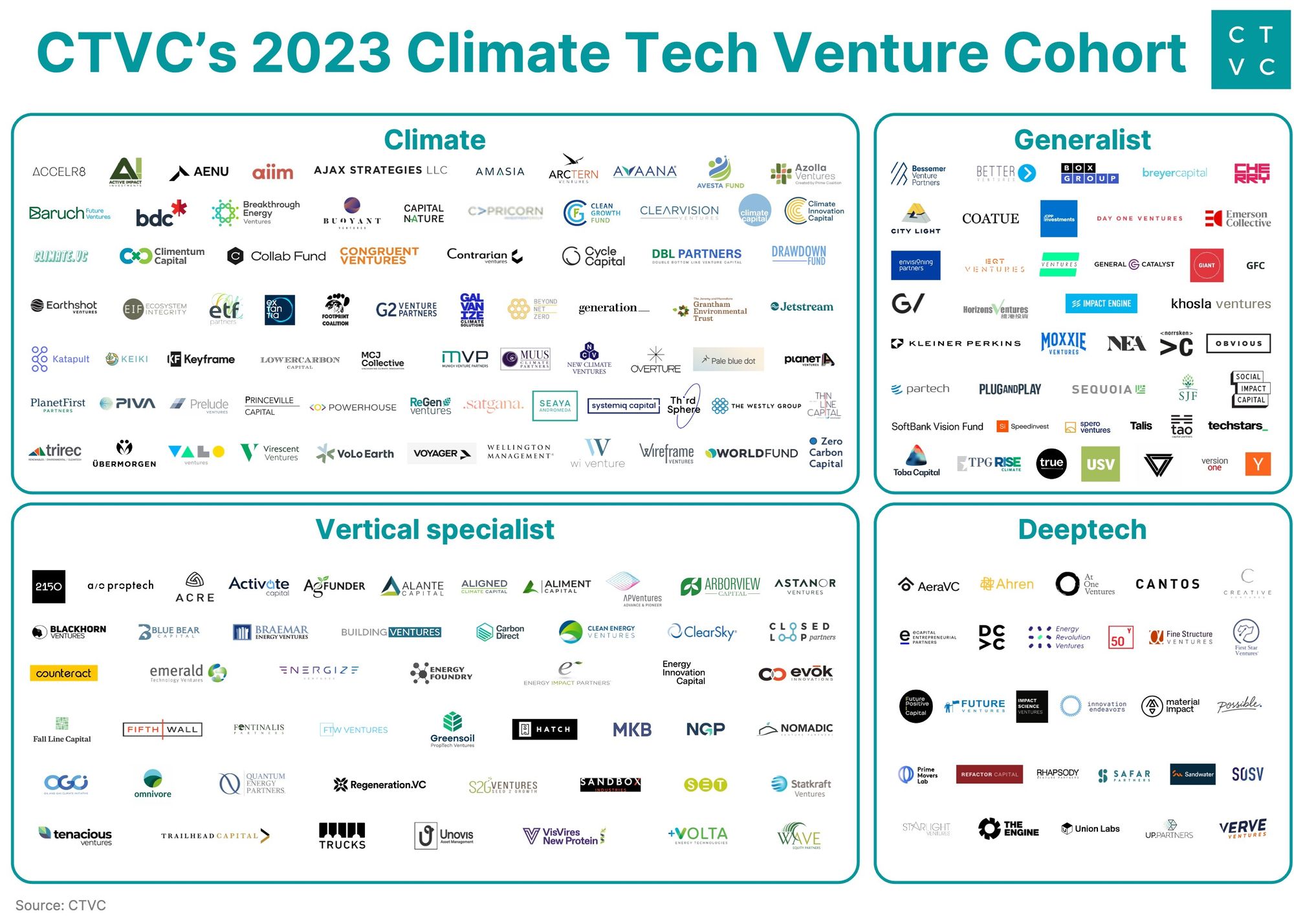

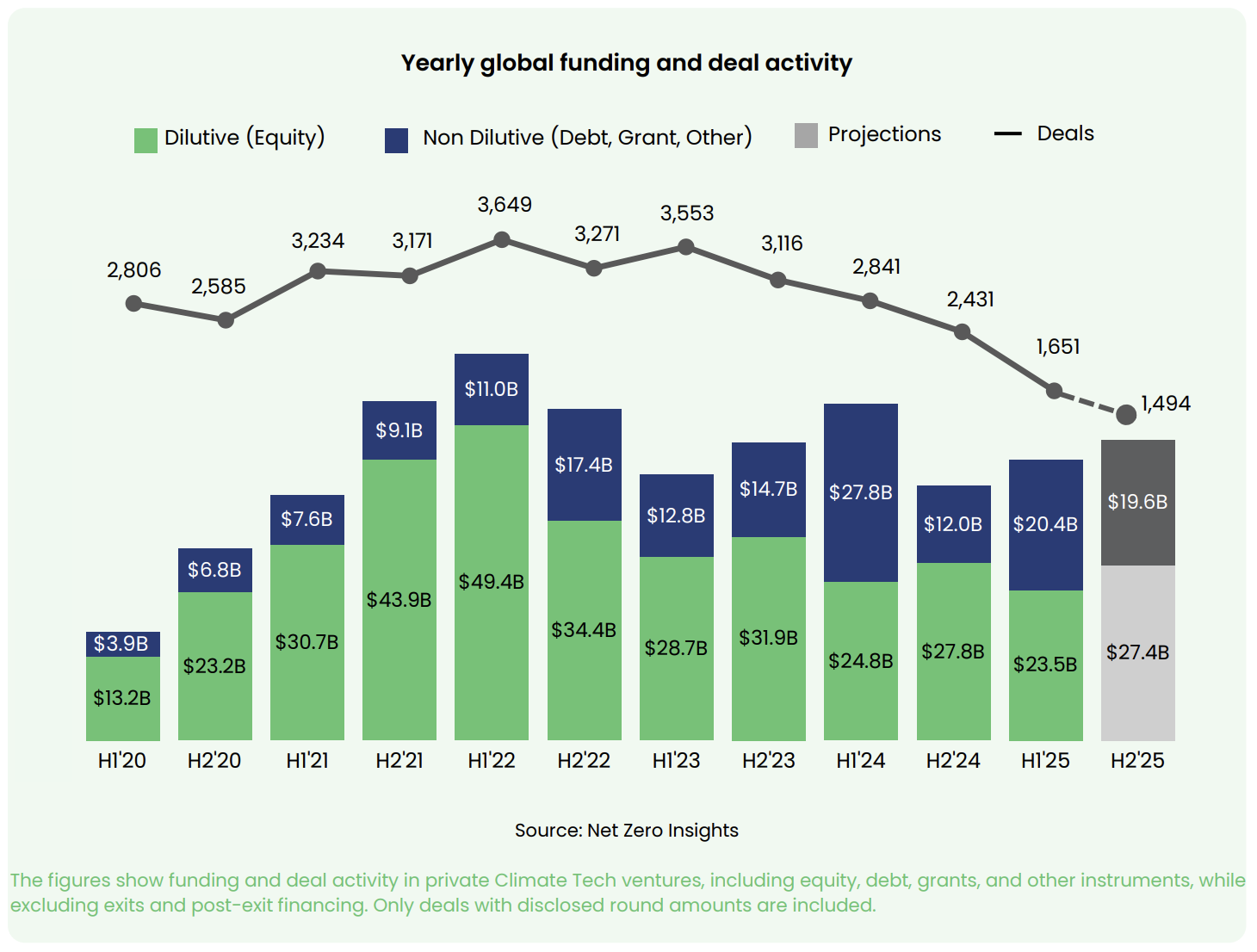

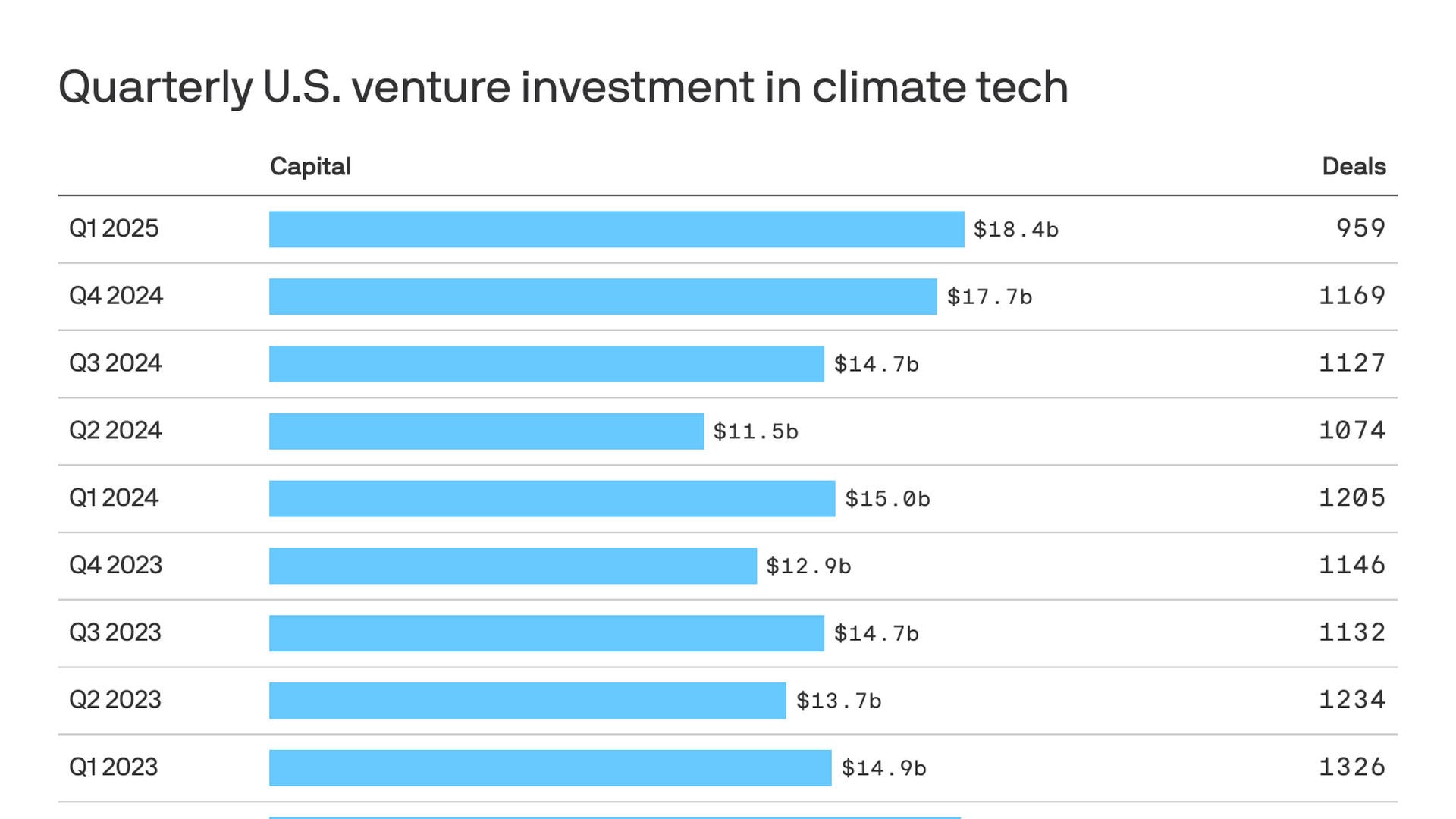

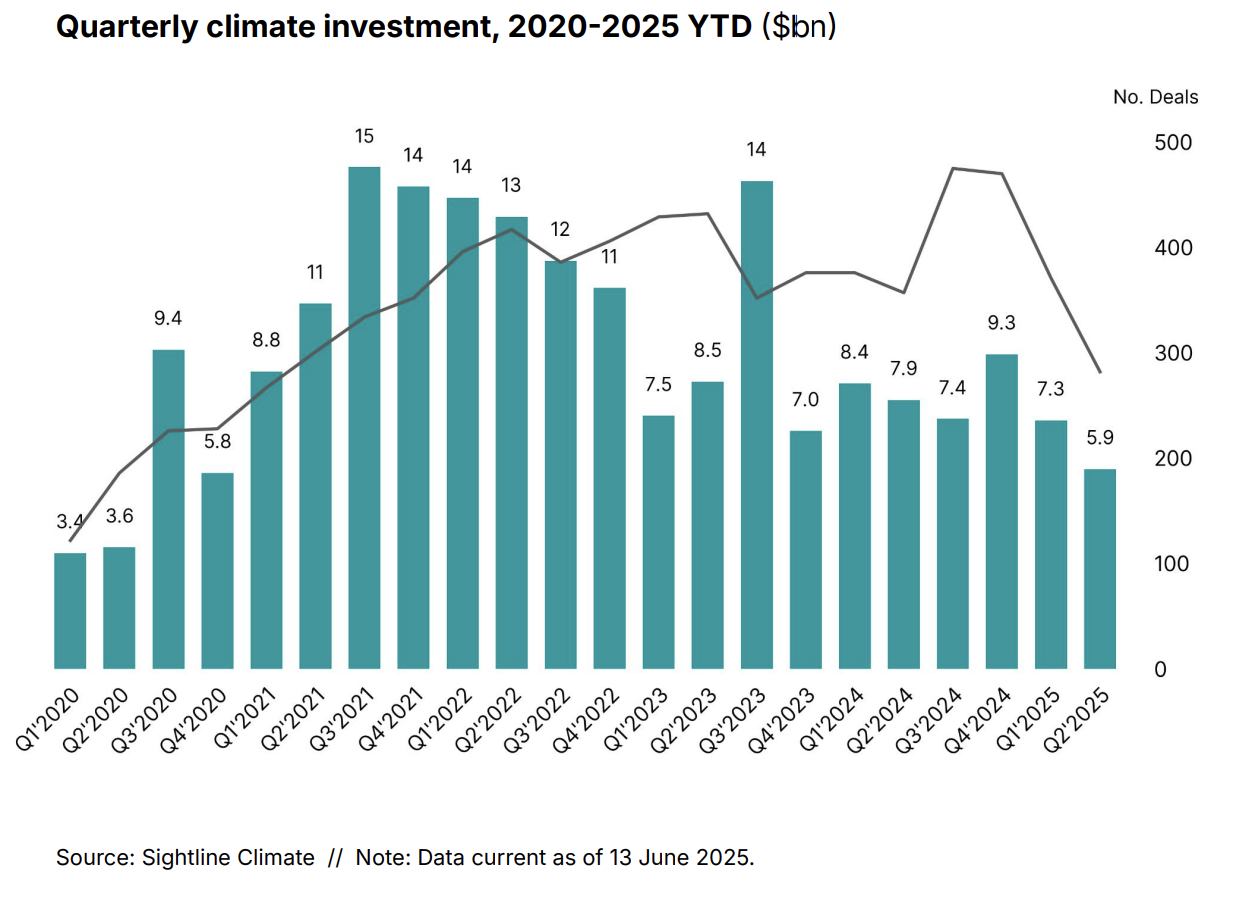

When the numbers came in at year's end, something unexpected happened. Venture funding for climate tech remained essentially flat compared to 2024, according to data from CTVC. No crash. No exodus. Just... resilience.

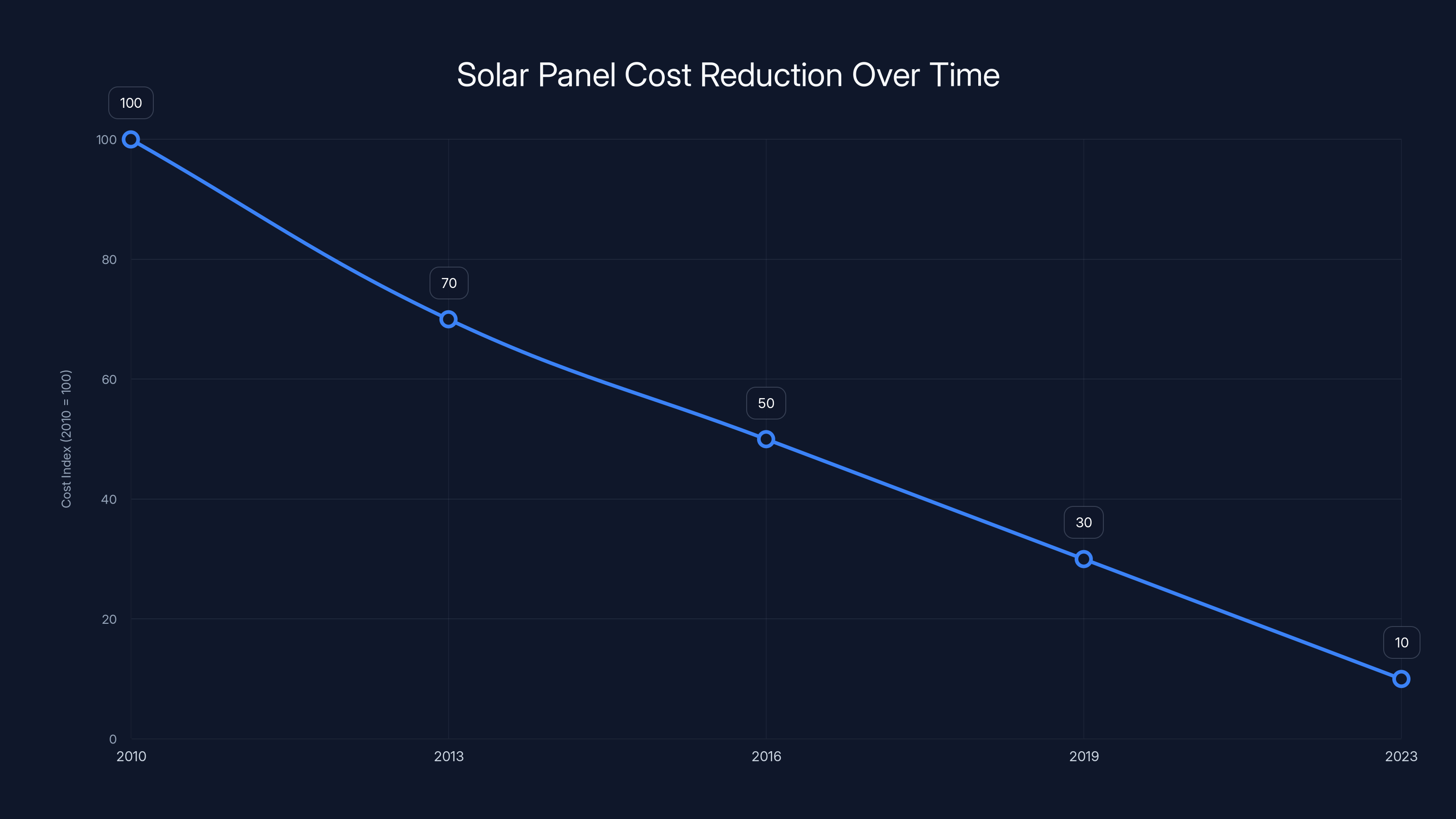

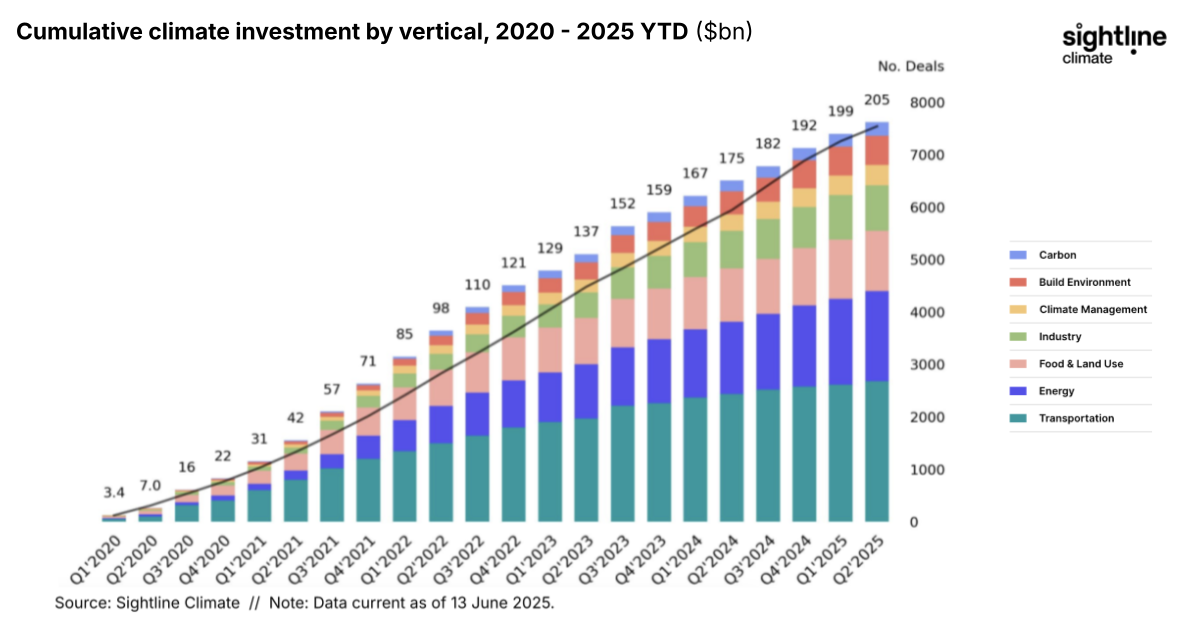

I spent the last few weeks talking to twelve major venture capital firms that are actively investing in climate solutions. What they told me was surprisingly consistent: the climate tech wave isn't over. It's just entering a new phase. The old assumptions about government subsidies and policy tailwinds? Those are fading. But something more durable is taking their place: economics. Real, hard-nosed, doesn't-require-a-politician unit economics.

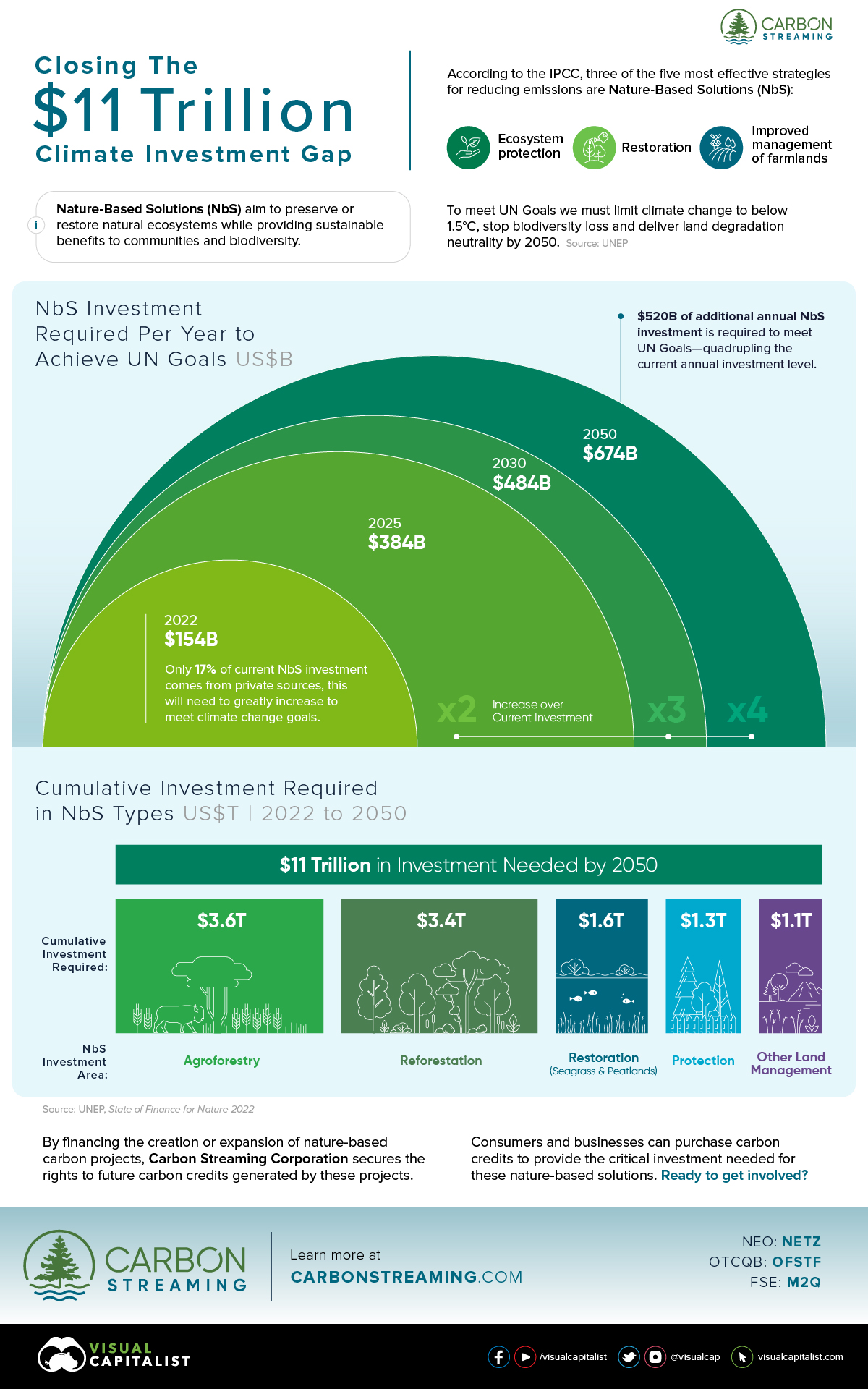

The conversation around climate tech in 2026 will look different than 2024. Less about government mandates. More about data centers, grid resilience, manufacturing decoupling, and the simple fact that solar panels, wind turbines, and batteries have become cheaper than the fossil fuels they're replacing. That's not a subsidy story anymore. That's just math.

Here's what the investors I spoke with are betting on.

The Political Headwind That Wasn't

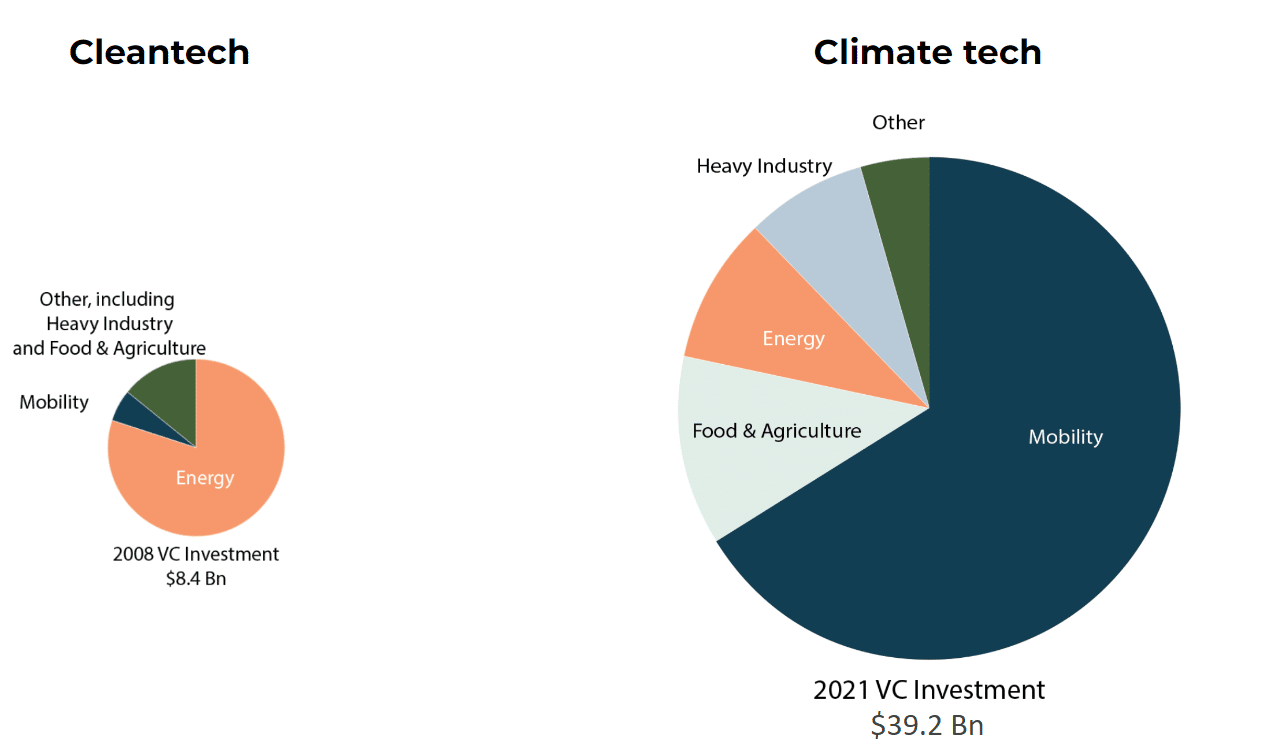

Let's address the elephant in the room first: Trump's return to office and the rollback of climate-focused industrial policy should have devastated the sector. The Biden administration had spent roughly $400 billion across the Inflation Reduction Act and the Bipartisan Infrastructure Law on clean energy incentives. That's a massive lever for venture-backed companies.

When those policies became uncertain, conventional wisdom said venture funding would crater. The data tells a different story.

"Everyone was bracing for impact," Tom Chi, founding partner at At One Ventures, told me. "But here's what I think happened: the market realized that many climate technologies have simply gotten better and cheaper than their fossil fuel equivalents. That's not dependent on a subsidy or a tax credit."

The resilience in funding wasn't about faith in policy. It was about something more fundamental: physics and economics. A solar panel that costs 70% less than it did in 2015 doesn't need a government check to compete. It just needs to exist.

That said, policy uncertainty isn't gone. It's just less relevant to the actual valuations and unit economics. Investors are pricing deals assuming a world where subsidies shrink or disappear. If they don't disappear, great. If they do, the companies can still win.

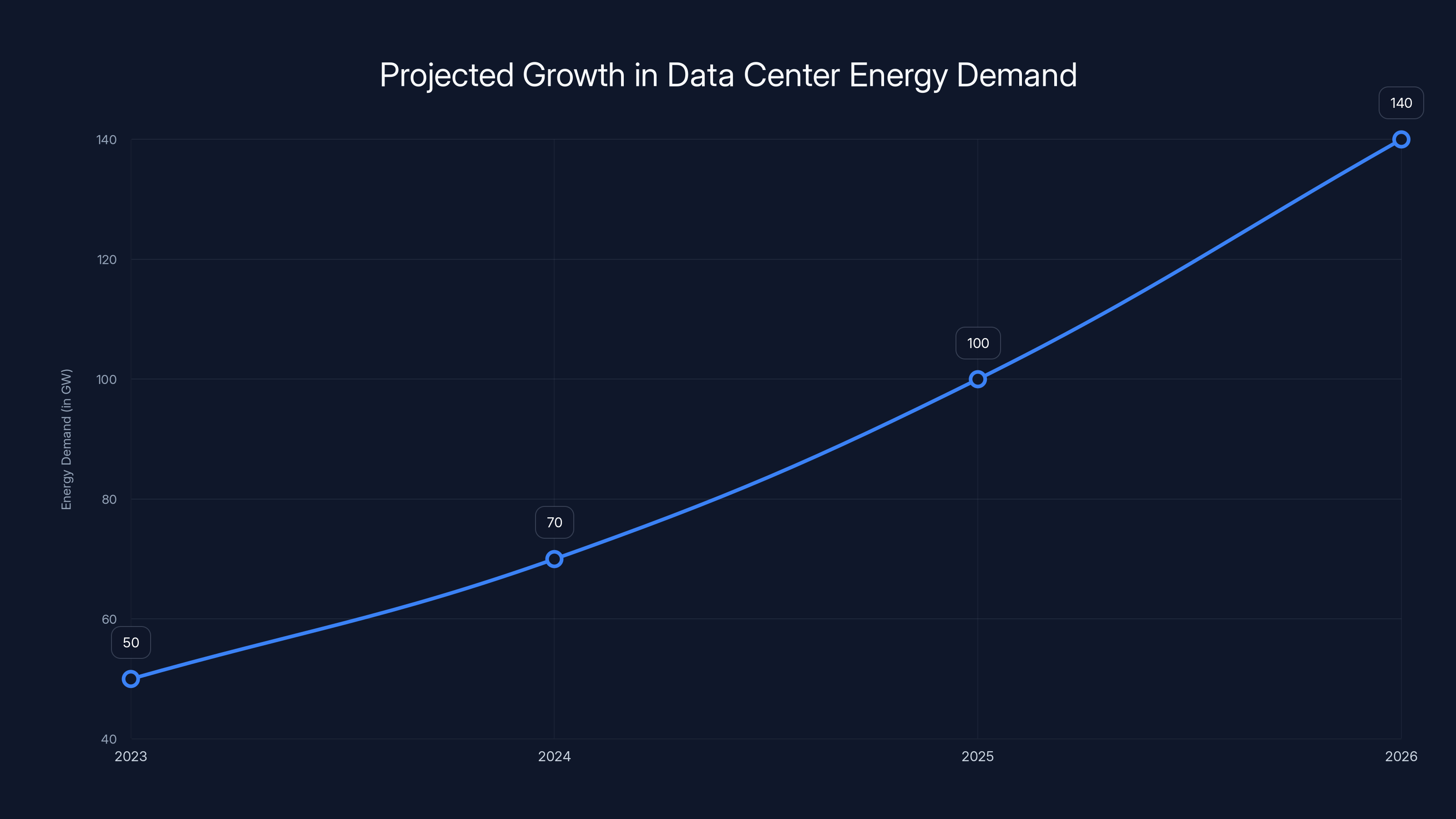

"The spending for 2026 is already budgeted. The train has left the station," Kyle Teamey, managing partner at RA Capital Planetary Health, told me. He was talking specifically about data center infrastructure spending, but the principle applies more broadly. Companies have already committed to electricity procurement. Those commitments don't evaporate when an administration changes.

Estimated data shows a significant increase in data center energy demand, projected to nearly triple from 2023 to 2026 as AI and computational needs grow.

The Data Center Revolution That's Actually Happening

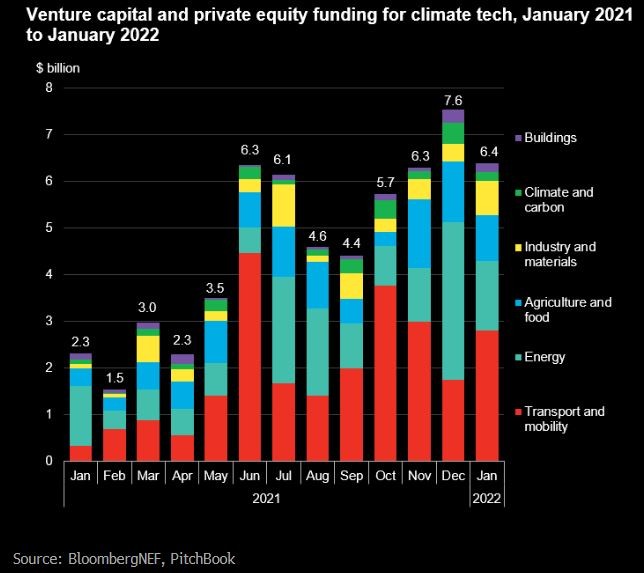

If there's one thing that unified every investor I spoke with, it's this: data centers will dominate the climate tech conversation in 2026. Not as a sideline. As the main event.

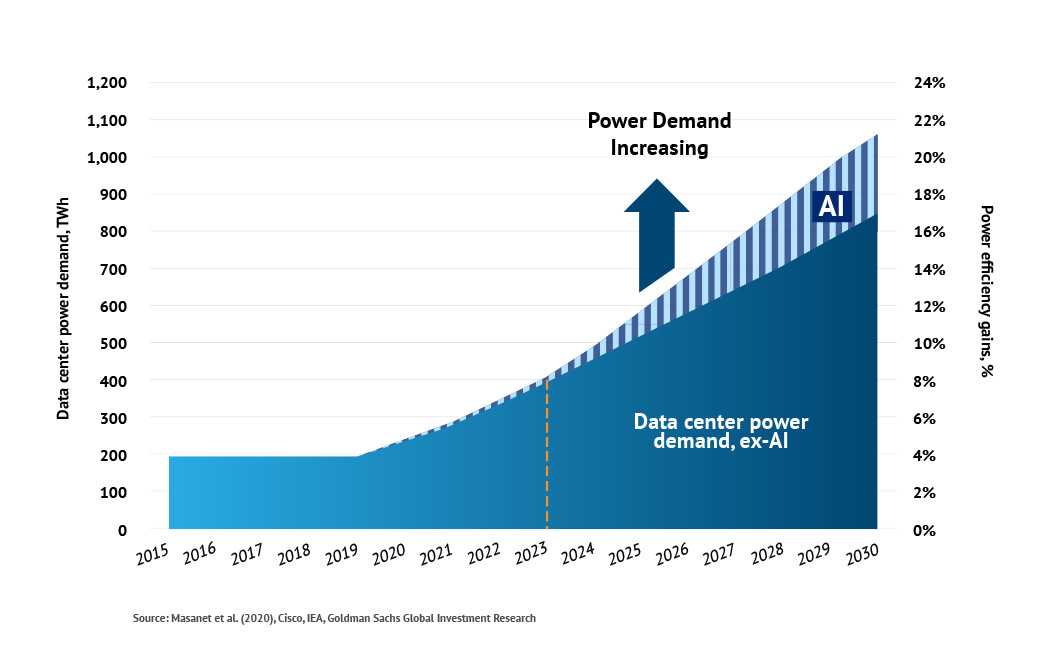

The narrative arc is familiar by now. AI exploded. Training and inference require massive computational infrastructure. That infrastructure needs power. A lot of power. The largest hyperscalers are now racing to secure reliable electricity sources that can scale without creating grid instability.

What surprised me wasn't that investors expect data centers to matter. It's how much they expect that attention to shift in 2026.

"I'm hearing about data center energy decisions virtually every single day in meetings," Po Bronson, managing director at SOSV's Indie Bio, told me. "Not every few weeks. Every day. Even from corporate partners who aren't in the tech industry."

This creates a strange new dynamic. Data centers are suddenly the primary driver of demand for electricity generation. In 2025, most of that demand manifested as a hunt for power sources, any power sources. Companies were asking: where can we get cheap electricity? Can we strike a deal with a coal plant that's about to retire? Can we build solar and wind capacity fast enough?

In 2026, the question shifts. It has to.

Lisa Coca, partner at Toyota Ventures, explained the pivot. "The 2026 data center energy conversation is likely to shift from demand to resilience and the need to accelerate plans to decouple from the grid," she said.

Let me unpack that. Right now, data centers need grid connections. They draw massive amounts of power and feed that consumption back into utility infrastructure that wasn't designed for it. Grid operators are getting nervous. The public is getting nervous. Electricity rates in some regions are already rising as a side effect of data center sprawl.

Decoupling means building power infrastructure that serves data centers independently. Onsite solar arrays. Onsite batteries. Potentially micro grids with their own generation. Some proposals even include small modular nuclear reactors dedicated entirely to data center power.

This is a massive opportunity for startups. It's also technically complicated and requires solving problems that don't have straightforward answers yet.

"There's a real gap between what these facilities need and what current grid infrastructure can support," Daniel Goldman, managing partner at Clean Energy Ventures, told me. "Companies that bridge that gap will do very well."

What kinds of companies? Think grid-scale battery systems. Think distributed energy management software. Think companies that can design and deploy renewable energy infrastructure faster than anyone else. Think companies solving the permitting nightmare that comes with building anything.

The economics here are compelling. Zero-carbon generation is already among the cheapest sources of power available. Solar costs about

"We're seeing growth in new plays on battery chemistry and business models," Leo Banchik, director at Voyager, told me. "Sodium-ion, zinc-based systems, thermal storage. The innovation is accelerating."

Solar panel costs have decreased by 90% since 2010, driven by advancements in technology and economies of scale, rather than government incentives. (Estimated data)

Nuclear's Moment Isn't Coming, It's Here

Nuclear power is having a moment. Not a predicted moment. An actual moment.

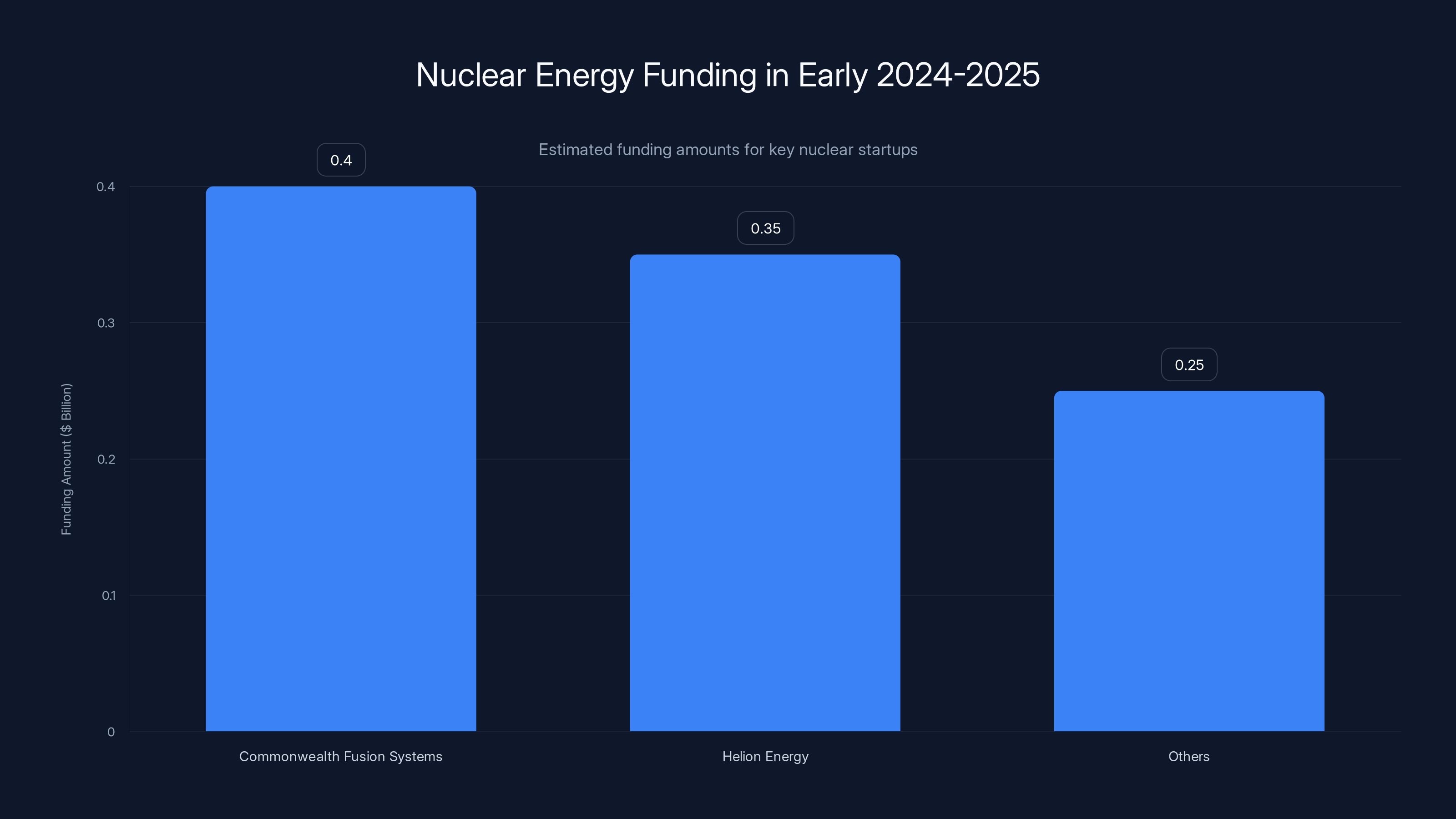

In just the last few weeks of 2024 and early 2025, nuclear startups announced funding rounds totaling over $1 billion. Companies like Commonwealth Fusion Systems, Helion Energy, and others have attracted capital from major investors, corporations, and even governments. The speculation around public offerings is getting louder.

"Nuclear everything is in vogue right now," Kyle Teamey told me flatly. "But understand what that means. That means capital is flowing. It doesn't mean reactors are going to be online anytime soon."

That's the crucial distinction. Nuclear enthusiasm and nuclear deployment are not the same thing. Advanced reactor designs—small modular reactors (SMRs), molten salt reactors, fusion concepts—are technologically interesting and politically appealing. They're also years away from commercial viability at scale.

The real energy demand problem gets solved in 2026 with solar, wind, and batteries. Not with nuclear. Nuclear is the longer-term play.

But here's what's interesting: the nuclear boom validates something else. It proves that capital markets believe electricity demand is going to remain elevated for a very long time. You don't raise $1 billion for nuclear energy if you think data center buildout is a bubble.

Andrew Beebe, managing director at Obvious Ventures, put it this way: "We still need a LOT more power, and we'll use that. No build-out bubble there. Yet."

Note the "yet." Even bullish investors acknowledge that the AI spending boom could contract. But they're betting that even if it does, the baseline electricity demand stays elevated. Either from continued AI infrastructure, or from electrification more broadly (EVs, heat pumps, industrial processes), or from some combination of both.

In 2026, expect more nuclear announcements. Expect funding to continue flowing. Expect companies to move through regulatory pathways and design iterations. But don't expect operational reactors. That's a 2028+ story.

Solar and Batteries: The Technologies That Actually Work

Here's the thing about solar and batteries: they don't get the venture capital hype that nuclear does. They're not novel enough for that. But they're the actual workhorses of the clean energy transition.

Both technologies have become genuinely cheaper than fossil fuel alternatives in most markets. Deployment is accelerating. Cost curves continue to improve. And because the technology is proven, scaling capacity is a capital problem, not an innovation problem.

For venture capital, proven technology that has clear demand is actually better than experimental technology with speculative demand. You can build a real business with predictable unit economics.

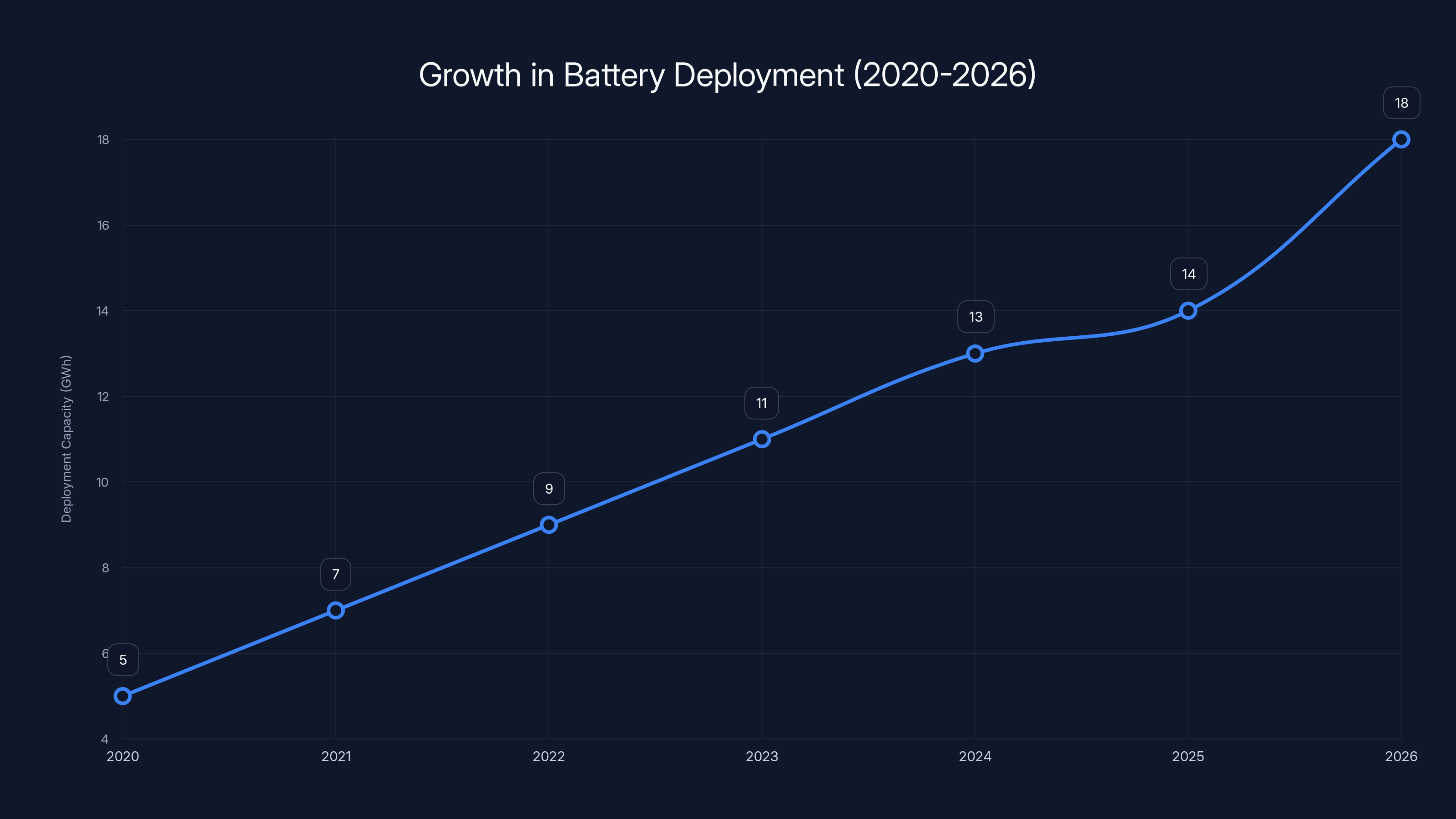

In 2025, battery deployment hit record levels. Grid-scale batteries added approximately 14 GWh of capacity just in the United States. That number continues accelerating.

Why? Because batteries solve a core problem: intermittency. Solar and wind are cheapest power sources, but they're not available 24/7. Batteries bridge that gap. A few hours of battery storage can turn variable renewable energy into firm power that grid operators trust.

Alternative chemistries are starting to matter too. Lithium-ion has dominated for years, but sodium-ion, zinc, iron-air, and other systems are approaching cost parity while potentially offering advantages like better cycle life, thermal stability, or availability of raw materials.

"We'll see growth in 2026 with new plays on battery chemistry and business models," Leo Banchik told me. "One of the key lessons from earlier failures was scaling gigafactories before you had demonstrated product-market fit. We're seeing more disciplined approaches now."

That's the lesson that took billions of dollars to learn, but it's being learned. Build evidence that your battery technology works and that there's genuine demand for it before you commit to gigafactory-scale capital. Use outsourced manufacturing to prove the case first.

Solar is in a similar position. The technology is mature and cheap. The opportunities are in deployment speed, permitting acceleration, and optimizing systems integration. Can you build solar farms faster? Can you navigate permitting quicker? Can you optimize the software that balances load across multiple renewable sources?

Those are software and operational questions, not physics questions. Venture capital thrives there.

In early 2024-2025, nuclear startups raised over $1 billion, signaling strong investor confidence in long-term electricity demand. (Estimated data)

The Reindustrialization Story

One conversation I had kept circling back to a topic that doesn't get enough attention: reindustrialization and supply chain decoupling.

Anil Achyuta, partner at Energy Impact Partners, brought it up directly: "Reindustrialization is going to take more of the spotlight in 2026. We need to rebuild supply chains for systems that require multiple components and complex flowsheets."

What does that actually mean?

For decades, Western industries—especially in the United States—have outsourced manufacturing to lower-cost countries, primarily China and Southeast Asia. That's been great for capital efficiency. It's also created massive fragility. Batteries need lithium, cobalt, nickel. Semiconductors need rare earth elements. Solar panels need silicon processing capacity. Wind turbines need specialized materials and assembly.

If your supply chain depends on one country, and that country restricts exports or gets caught in trade disputes, your entire business grinds to a halt.

The Biden administration tried to address this with industrial policy. Trump's administration is approaching it differently, through tariffs and trade restrictions. Either way, the underlying problem is the same: Western nations want to reduce dependence on China for critical materials and components.

That creates opportunities for companies that can:

- Extract and refine critical minerals domestically

- Build manufacturing capacity for battery components, semiconductors, or other inputs

- Design supply chain orchestration software

- Create closed-loop recycling systems

- Reduce the material intensity of production processes

This isn't sexy venture capital territory. It's not AI. It's not fusion reactors. But it's where serious economic value gets created, and it's where patient capital finds strong unit economics.

"Supply chain resilience is worth billions," Anil told me. "Companies that help hyperscalers or battery manufacturers reduce dependence on volatile supply chains will capture significant value."

Expect to see more venture capital flowing to companies in this space in 2026. Not hype-driven funding. Disciplined funding based on clear economics.

The Bubble Question Nobody Wants to Answer

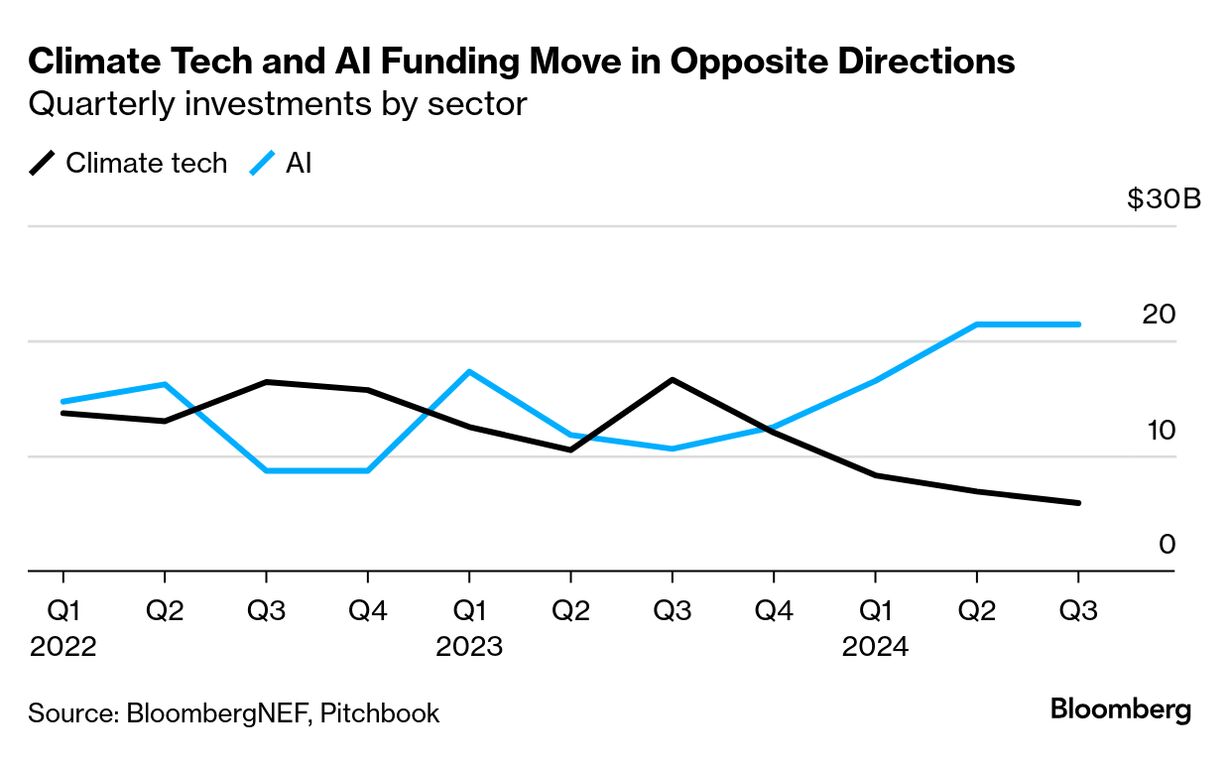

Every investor I spoke with danced around the same question, and most eventually addressed it directly: is the AI boom a bubble, and if so, what happens to clean energy investment when it pops?

The honest answer is: nobody knows.

There are plausible scenarios where AI spending contracts in 2026. The efficiency gains plateau. The killer app doesn't materialize. Hyperscalers overspent on capacity. Capital dries up.

There are also plausible scenarios where AI spending continues accelerating. New applications emerge. Model capabilities improve faster than expected. The current spend is just the beginning.

What the investors seemed confident about is this: even if AI spending decelerates, electricity demand doesn't collapse back to 2023 levels. It might not grow as fast as currently expected, but the baseline demand stays elevated.

"Could a bubble burst in 2026? Sure," Kyle Teamey told me. "But that doesn't mean the train stops. The power plant you built in 2025 is still generating electricity in 2026. The contracts you signed are still in effect. The batteries you deployed are still being used."

Andrew Beebe offered a nuanced take: "The data center bubble might burst in 2026 or early 2027. But there's no bubble in electricity generation. We still need a LOT more power."

The distinction matters. Data center construction could slow. Data center demand for power might moderate. But the infrastructure built to serve that demand doesn't disappear, and the underlying electricity needs don't go away.

What this means for venture capital: investors are being more disciplined about what they fund. Companies directly dependent on data center growth might face headwinds. But companies solving fundamental infrastructure problems—grid resilience, renewable energy deployment, battery storage—should be relatively insulated.

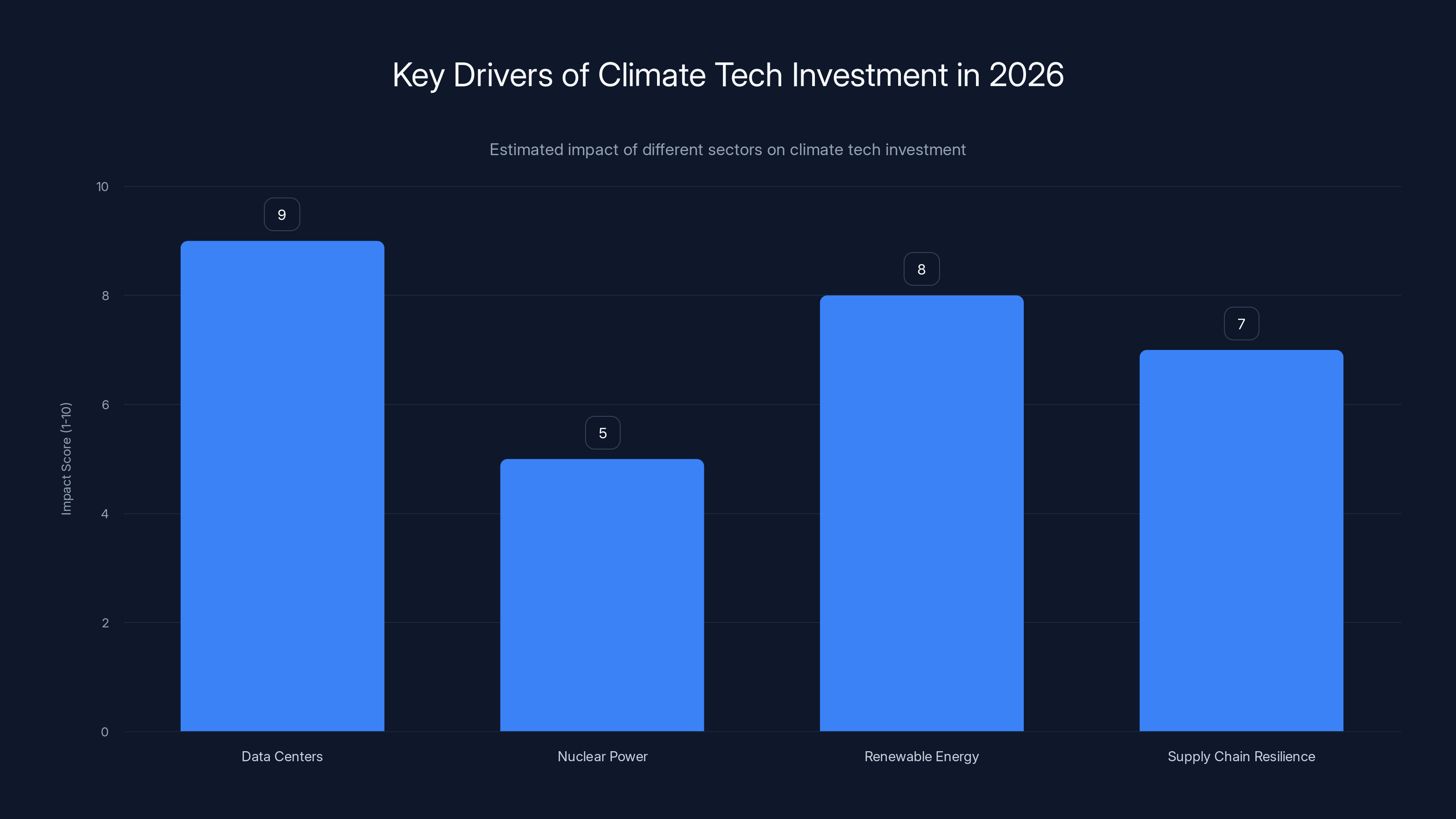

Data centers are the most significant driver of climate tech investment in 2026, followed by renewable energy and supply chain resilience. Nuclear power, while attracting funding, has a lower immediate impact. (Estimated data)

Geothermal: The Quiet Winner

Geothermal keeps appearing in investor conversations, but it's not getting the hype cycle attention that nuclear gets. That might be intentional.

Geothermal offers something unique: dispatchable, zero-carbon power that doesn't depend on weather or time of day. You drill down, tap into heat, generate electricity. It works in any weather, at any hour, with minimal land footprint.

The challenge has been cost and geography. Traditional geothermal (drilling deep, finding naturally hot areas) only works in specific locations. Enhanced Geothermal Systems (EGS), which create reservoirs in hot rock formations that don't naturally have water, could expand potential sites dramatically. But EGS is still experimental.

Why is this relevant in 2026? Because data centers care about dispatchability. Solar and wind are cheap, but they're variable. Geothermal offers a complement: consistent, reliable power that you can count on.

Daniel Goldman mentioned geothermal alongside nuclear and batteries as benefiting from the data center boom. That's worth paying attention to. If hyperscalers start incorporating geothermal into their power procurement strategies, the technology could scale faster than current timelines suggest.

Expect to hear more about geothermal startups in 2026. Not because the technology is new, but because the demand for reliable, dispatchable clean power is finally real.

Grid Resilience and Distributed Power

The grid, as currently structured in most developed countries, wasn't designed for the amount of distributed power generation we're starting to add.

When you have one massive central power plant, load flow is predictable. Power goes one direction: from the plant to consumers. When you have thousands of solar arrays, wind turbines, and batteries connected at distributed points, power flow becomes chaotic. Voltage varies. Frequency can destabilize. Blackouts propagate differently.

Grid operators are not happy about this. They want to understand and control their systems. That's hard when you have massive amounts of variable generation connected in ways that interact in complex ways.

This creates opportunities for companies that can:

- Forecast variable generation with high accuracy

- Dispatch flexible loads (EV chargers, batteries, water heaters) to balance load

- Optimize power flow across increasingly complex networks

- Detect and prevent cascading failures

- Enable microgrids that can island during grid instability

These are mostly software and controls problems. They require deep domain expertise, but they're not physics-limited the way advanced materials or reactor design can be.

In 2026, expect more venture capital flowing to grid software and controls companies. Not sexy capital. Necessary capital. And often, profitable capital pretty quickly.

Lisa Coca highlighted this: "Grid resilience and decoupling from the main grid will be increasingly important. Companies that solve those problems will attract significant investment."

Battery deployment has shown a steady increase, with a significant jump expected in 2026 due to advancements in alternative chemistries and business models. Estimated data.

Materials Science: The Long Game

Materials science doesn't move fast. But it moves powerfully.

The wind turbine blades you see today use composite materials (fiberglass or carbon fiber in epoxy resin) that were developed decades ago. They work well. But they have limits: they're heavy, they degrade over time, they're hard to recycle.

Better materials could enable lighter, more efficient turbines. Better battery materials could increase energy density, improve cycle life, and reduce costs further. Better thermal materials could improve power generation efficiency.

These aren't sexy venture bets. They take 10+ years to move from lab to commercial production. But they're foundational bets that enable everything else.

Don't expect flashy announcements about materials science companies in 2026. But do expect smart investors making patient bets on materials innovation. Some of those bets will become some of the most valuable climate tech companies of the 2030s.

The Investor Consensus That Actually Emerged

After talking to a dozen different venture capitalists with different strategies, geographies, and specializations, some clear themes emerged.

First, policy uncertainty is real but doesn't drive funding decisions the way it did in 2024. Companies are priced assuming subsidies disappear. If they don't, that's upside.

Second, data center power demand is the primary driver of near-term capital deployment. Not just in energy, but across climate tech. Any company that can help hyperscalers secure reliable, affordable power will capture significant capital and value.

Third, proven technologies at scale (solar, wind, batteries) are where most venture capital actually goes, even if nuclear and fusion get more attention. Boring economics beats speculative physics.

Fourth, grid resilience and supply chain decoupling are emerging opportunities that don't get enough attention. These are multi-billion-dollar problems with clear ROI.

Fifth, the venture market is being more disciplined. Companies need clear paths to profitability and genuine market demand. The days of funding on climate narrative alone are fading.

Sixth, if the AI boom does slow, electricity demand stays elevated. The concern isn't whether we'll need power. It's whether we can deploy it fast enough.

What This Means for Founders

If you're thinking about starting a climate tech company in 2026, here's what the investor conversations suggest:

First, nail the unit economics before you scale. Investors have learned expensive lessons about companies that burn capital faster than they can generate revenue. Prove that the core business model works at small scale.

Second, focus on problems with clear, large, near-term demand. Data center power, grid resilience, supply chain bottlenecks. These aren't speculative. Companies are writing checks for solutions today.

Third, don't lead with the climate narrative. Lead with the economic narrative. "We save data centers $50M per year on power costs" beats "We reduce carbon emissions by 10,000 tons per year" every single time. Climate is a nice-to-have. Economics is a need-to-have.

Fourth, understand your supply chain and your path to manufacturing. If you're not prepared to scale production, you'll eventually hit a ceiling. Don't be surprised when that ceiling appears.

Fifth, be prepared for a longer fundraising cycle and more due diligence around unit economics. The days of VCs writing checks on climate conviction alone are ending. They want to see a business model.

Looking Forward: The 2026 Landscape

The climate tech landscape in 2026 will look different from 2024.

Policy subsidies will be less reliable. That's not all bad—it forces companies to build real businesses with real economics, not subsidy-dependent models.

Data centers will be the primary demand driver. That creates focus. Instead of climate tech being ten different industries (energy, materials, agriculture, transportation, industrial heat, etc.), it becomes much more focused on power and resilience in the near term.

Tested technologies will dominate capital allocation. Solar, wind, batteries, geothermal. Not because they're exciting. Because they work and people want to buy them.

Supply chain resilience will emerge as a major investment theme. Companies helping hyperscalers, battery makers, and governments reduce dependence on vulnerable supply chains will attract serious capital.

Grid software and controls will become a visible category. These are often behind-the-scenes companies, but they solve critical problems that become more urgent as variable generation scales.

Nuclear will continue to attract headlines and capital, but commercial deployment will still be years away. The hype and reality will increasingly diverge.

Materials science and advanced technologies will keep getting funded, but with lower expectations and longer timelines. These are patience bets, not moonshot bets.

The venture market will be more selective. Fewer companies will raise massive rounds based on climate narrative alone. More companies will raise disciplined rounds based on proven business models.

None of this is a surprise to the investors I spoke with. They're already positioning for it.

The Bottom Line

Climate tech isn't dead. It's just getting real.

The narrative that sustained funding in 2022-2024—climate emergency, government subsidies, first-mover advantages—is fading. Being replaced by a more boring narrative: there's enormous demand for reliable, affordable clean power, and companies that supply it will make money.

That's actually healthier for the sector. Subsidy-dependent businesses are fragile. Economics-dependent businesses are resilient.

The investors I spoke with aren't worried about 2026. They're excited about it. Not because it will be easier. Because it will separate the real businesses from the narrative businesses.

If you've built something with genuine economics, genuine customer demand, and a clear path to profitability, 2026 is your year. Capital will flow to you.

If you've built something that only makes sense in a world with abundant government subsidies and unlimited venture patience, 2026 is going to be hard.

The barrier to entry for climate tech is rising. That's a feature, not a bug. It means the companies that do break through will be genuinely valuable.

FAQ

What is climate tech investing?

Climate tech investing refers to venture capital and private equity funding directed toward companies developing technologies that reduce greenhouse gas emissions, improve energy efficiency, or help society adapt to climate change. This includes renewable energy systems, battery storage, grid management software, carbon capture, sustainable agriculture, and supply chain innovation.

Why did climate tech funding remain flat in 2025 despite policy uncertainty?

Funding remained resilient because many climate technologies—particularly solar, wind, and batteries—have become economically competitive with fossil fuel alternatives, independent of government subsidies. Additionally, data center demand for reliable electricity created a genuine market pull for clean energy infrastructure that doesn't depend on policy incentives.

How are data centers driving climate tech investment in 2026?

Data centers require massive amounts of reliable electricity, making them the primary demand driver for clean energy infrastructure. This creates immediate market opportunities for companies solving power procurement, grid resilience, battery storage, and distributed energy management challenges. Investors are prioritizing companies that help hyperscalers secure cheap, clean, reliable power.

What role will nuclear power play in 2026?

While nuclear startups are attracting significant capital—over $1 billion in recent funding rounds—commercial nuclear reactors won't meaningfully contribute to the grid in 2026. The sector is experiencing funding and hype, but actual deployment is years away. Near-term energy demand will be met by solar, wind, batteries, and geothermal sources.

Why is supply chain resilience becoming important for climate tech investors?

As Western nations seek to reduce dependence on China for critical materials and components needed for renewable energy, batteries, and semiconductors, companies that can help establish domestic supply chains or improve supply chain resilience will capture significant value. This includes companies extracting minerals, building manufacturing capacity, optimizing supply chain logistics, and enabling recycling systems.

What types of companies will attract the most venture capital in 2026?

Investors are focusing on companies with proven technology, clear unit economics, genuine near-term customer demand, and realistic paths to profitability. Priority areas include: grid software and controls, battery storage and chemistry innovations, geothermal energy, data center energy solutions, supply chain resilience, and distributed power systems. Companies leading with climate narrative rather than economics face headwinds.

How should founders approach fundraising for climate tech in 2026?

Founders should emphasize unit economics and customer demand over climate impact. Focus on solving immediate problems for hyperscalers and utilities—not future problems for society. Develop disciplined capital deployment strategies, ensure supply chain viability before scaling, and be prepared for longer fundraising cycles with more rigorous due diligence. Lead with "how much money do customers save?" not "how much carbon do we eliminate?"

What happens to climate tech if the AI boom slows in 2026?

If AI spending moderates, data center construction might slow, but electricity demand doesn't disappear. The power infrastructure built in 2025 still generates electricity in 2026. Underlying demand from electrification, EVs, heat pumps, and industrial processes remains elevated. Companies solving fundamental power and resilience problems should be relatively insulated from an AI slowdown.

Are geothermal and nuclear the same thing?

No. Nuclear generates electricity through fission or fusion reactions. Geothermal taps into the Earth's internal heat. Both are dispatchable (available 24/7 without weather dependency), but geothermal can deploy in specific geographic locations today, while advanced nuclear designs are years from commercial viability. Investors see both as valuable, but with different timelines.

What is grid decoupling and why does it matter?

Grid decoupling means building power infrastructure that serves specific facilities (like data centers) independently of the main electricity grid. This reduces demand on congested grid systems and eliminates the risk that grid problems affect critical operations. Companies enabling faster decoupling—through distributed generation, battery systems, and microgrids—will attract significant capital as grid congestion becomes a real constraint.

What Venture Capitalists Are Actually Funding in 2026

The investor conversations revealed a clear pecking order of priority:

Tier 1 (Primary focus): Data center power solutions, grid-scale batteries, distributed renewable energy systems, grid software and controls, supply chain resilience for critical materials.

Tier 2 (Strong secondary focus): Geothermal energy, advanced battery chemistries, thermal storage, manufacturing capacity in North America, permitting and development acceleration tools.

Tier 3 (Patient capital): Nuclear and fusion research, materials science innovations, industrial decarbonization, carbon removal (if truly cost-effective).

Capital allocation roughly follows this hierarchy. Most deployment goes to Tier 1 because near-term demand is clear. Tier 2 gets solid funding based on strong economics. Tier 3 gets smaller allocations as patient, long-term bets.

As a founder, you want to be in Tier 1 or upper Tier 2. Tier 3 requires either exceptionally well-connected founders or the kind of narrative momentum that's become rare in this market.

The Hard Truth About 2026

Let me be direct about what the investors wouldn't say explicitly, but clearly believed: the golden age of climate tech venture capital based primarily on environmental impact is ending.

Not because climate change isn't real. Not because clean energy isn't important. But because venture capital is fundamentally disciplined by returns. When you can make exceptional returns funding climate tech because of genuine economics—not because of narrative or hope—capital flows freely. When you can't, capital goes elsewhere.

The good news? There actually are exceptional returns available in climate tech right now. Real businesses with real demand and real profit potential. The companies that capture those returns in 2026 will become the dominant players of the 2030s.

The bad news? The gravy train of capital chasing climate narrative is gone. You need a real business. A real customer. Real unit economics.

That sounds harsh. It's actually good news for the climate, though. Companies forced to be profitable become durable. And durable companies move markets.

Key Takeaways

- Climate tech funding remained flat in 2025 despite policy uncertainty, proving the sector's resilience is based on economics, not subsidies

- Data centers are the primary driver of clean energy investment in 2026, creating immediate demand for power solutions that don't exist elsewhere

- Solar, wind, and battery technologies have become cheaper than fossil fuels—this is an economics story, not an environmental narrative anymore

- Supply chain resilience and reindustrialization are emerging investment opportunities worth billions as companies reduce China dependence

- Even if AI spending slows, baseline electricity demand remains elevated, protecting clean energy infrastructure investment from a potential tech bubble burst

![Climate Tech Investing in 2026: What 12 Major VCs Predict [2025]](https://tryrunable.com/blog/climate-tech-investing-in-2026-what-12-major-vcs-predict-202/image-1-1767116152002.png)