How AI Is Quietly Reshaping Pharmaceutical R&D Forever

Drug discovery used to work like this: chemists and biologists would run thousands of experiments, kill most ideas in the process, and occasionally stumble onto something that worked. The timeline was brutal. Ten to fifteen years. Three billion dollars. A 90% failure rate.

Then AI showed up and started breaking these assumptions.

Last week, Converge Bio announced a $25 million Series A round that signals something bigger than another biotech funding announcement. It's evidence that the drug discovery world is experiencing a genuine inflection point. The round was led by Bessemer Venture Partners, with participation from TLV Partners and Vintage Investment Partners, plus backing from unnamed executives at Meta, OpenAI, and Wiz. That executive backing matters. It means serious technologists are betting their own reputation and capital on the idea that AI-driven drug discovery isn't hype. It's the future.

The numbers back this up. Over 200 startups are now competing in the AI drug discovery space. Eli Lilly partnered with Nvidia to build a supercomputer specifically for drug discovery. DeepMind's AlphaFold team won a Nobel Prize in Chemistry in 2024 for predicting protein structures with AI. These aren't experiments anymore. They're investments.

Converge Bio's approach is particularly interesting because it doesn't rely on a single AI model. Instead, it builds integrated systems that tackle specific stages of drug development. An antibody design system. A protein yield optimizer. A biomarker discovery tool. Each one combines generative models with predictive filtering and physics-based validation. The company has already published case studies showing 4X to 4.5X improvements in protein yield and antibodies reaching single-nanomolar binding affinity.

Here's what makes this funding announcement worth paying attention to: it proves the market is moving past the "maybe this works" phase into "we need this to stay competitive." And that changes everything about the drug discovery industry.

The Converge Bio Story: From Skepticism to Credibility in 18 Months

When Converge Bio was founded eighteen months ago, the team faced a predictable obstacle. Skepticism. Not from investors, exactly. More like institutional doubt. Pharma companies had been burned before by AI hype. They'd heard promises about machine learning revolutionizing drug discovery. Most of those promises went nowhere.

Converge raised a seed round of $5.5 million in 2024 and started proving the skepticism wrong. The company grew from nine employees in November 2024 to thirty-four by the time this Series A closed. More importantly, it signed forty pharmaceutical and biotech partnerships. Forty. These aren't pilot deals with startup-friendly companies. These are partnerships with established pharma and biotech firms that have billion-dollar budgets and risk-averse cultures.

CEO and co-founder Dov Gertz described the shift perfectly in conversation: "A year and a half ago, when we founded the company, there was a lot of skepticism. That skepticism has vanished remarkably quickly." That speed of credibility shift is unusual in biotech. It suggests Converge hit on something genuinely useful rather than something that sounds good in pitch decks.

The proof points matter here. Converge published case studies showing concrete results. One partner saw protein yield improve by 4X to 4.5X in a single computational iteration. Another received antibodies with binding affinity in the single-nanomolar range. These aren't vague "improved efficiency" claims. They're specific, measurable outcomes that would make any pharma scientist pay attention.

The timing of this capital raise is strategic. Converge is currently running forty programs on its platform across customers in the US, Canada, Europe, and Israel. Now they're expanding into Asia. The $25 million funds three things: scaling the team, expanding the product to more stages of drug development, and building out infrastructure for that Asian expansion.

What's particularly notable is the composition of the round. Bessemer Venture Partners brought institutional heft and deep biotech experience. But the participation from unnamed executives at Meta, OpenAI, and Wiz signals something different. It means Converge attracted serious technologists who see the intersection of AI and drug discovery as a genuine strategic opportunity. When the VP of AI at Meta puts personal capital into a biotech startup, it's because they believe the tech is credible.

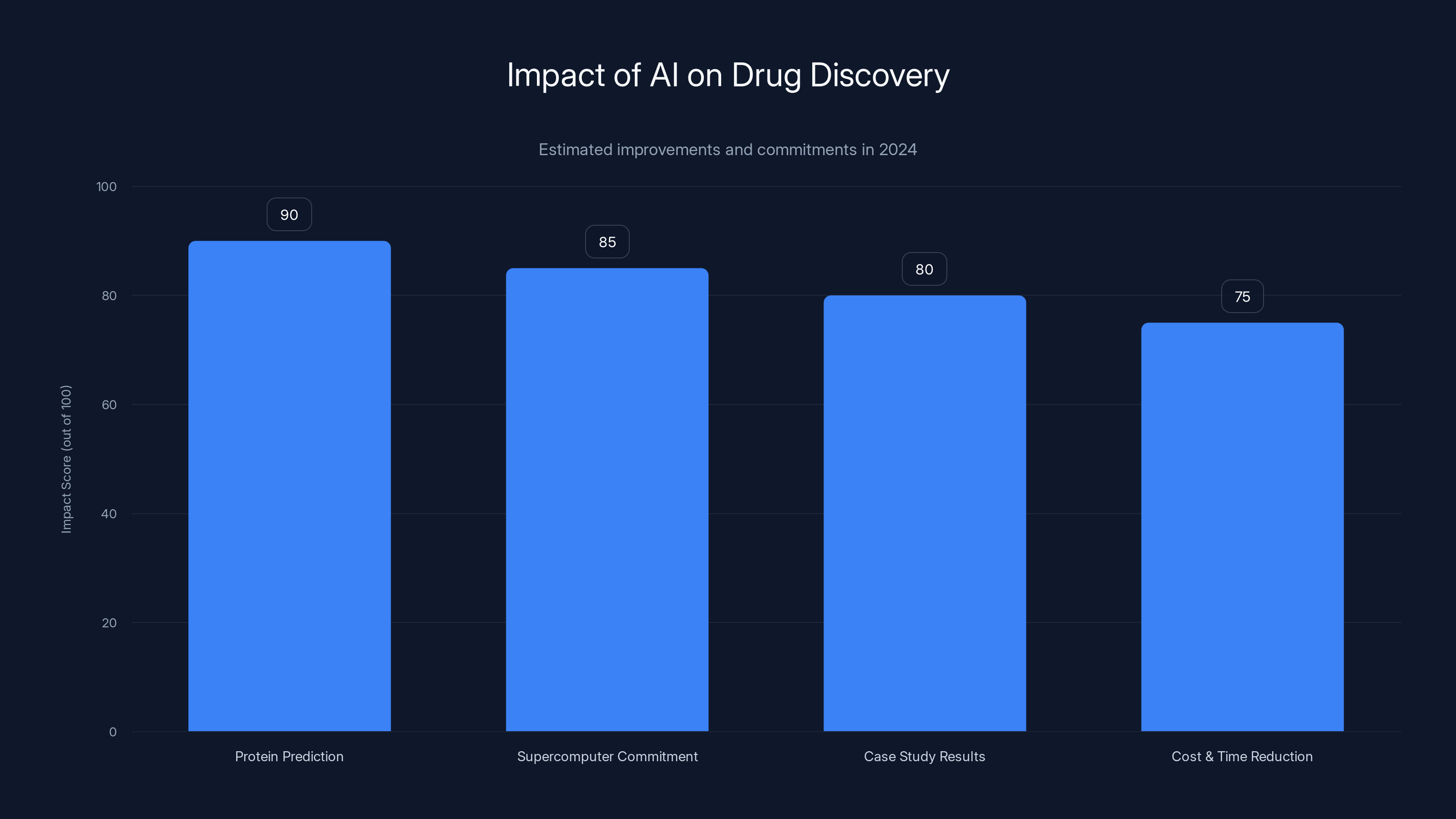

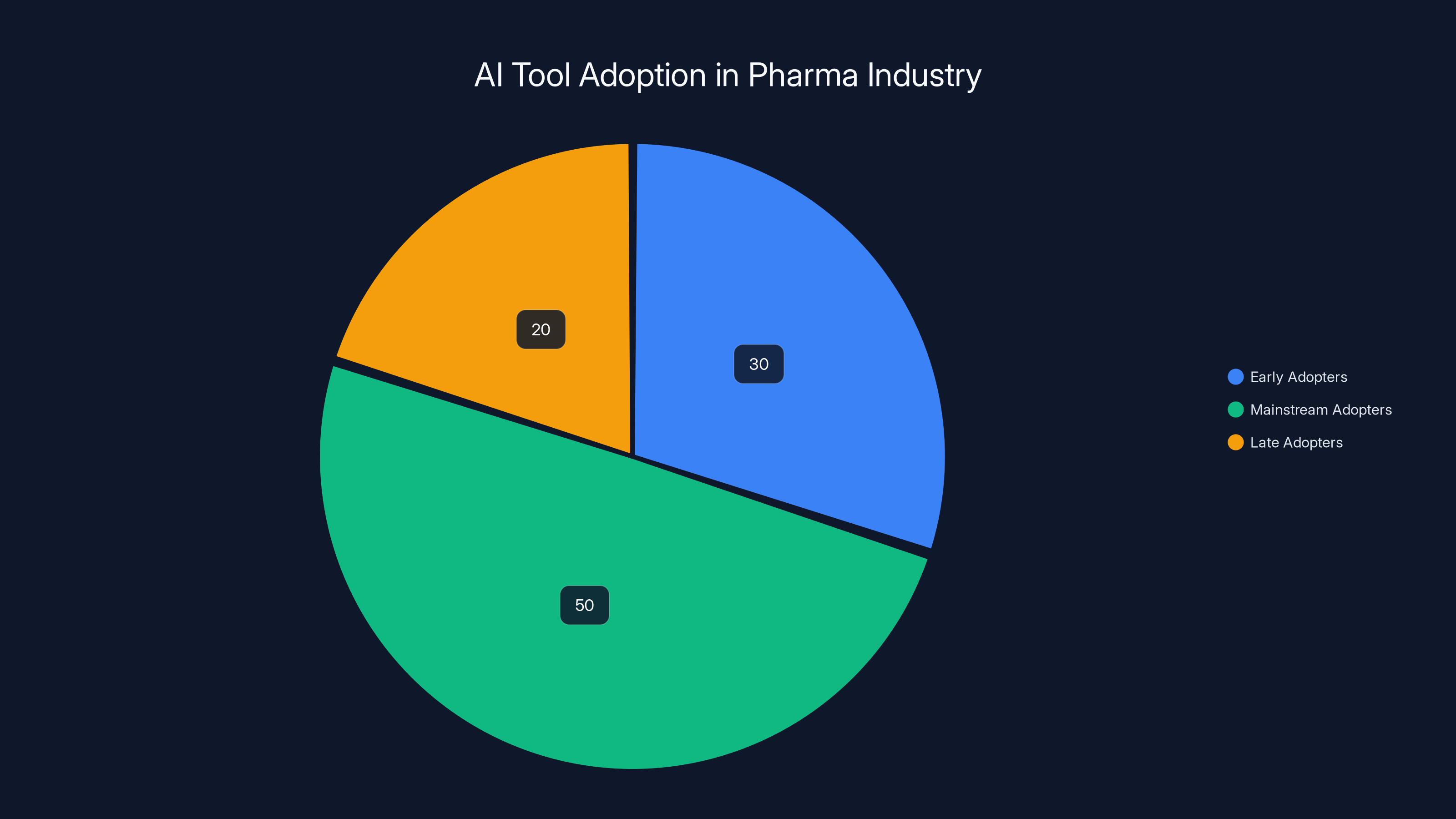

In 2024, AI significantly impacted drug discovery with breakthroughs in protein prediction, major commitments from pharma companies, and successful case studies. Estimated data.

Breaking Down the Technology Stack: How Converge Actually Works

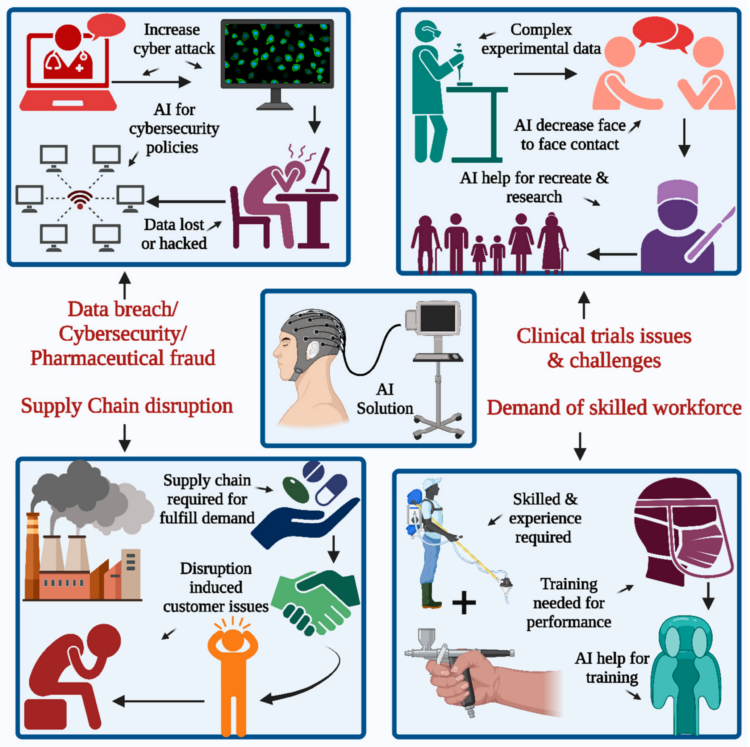

Converge's approach solves a specific problem that most single-model AI approaches fail to address: molecular hallucinations. When a large language model generates text, hallucinations are usually obvious. Wrong facts. Nonsensical sentences. A human reviewer catches them in seconds.

When an AI model generates a molecular structure, validation is completely different. Testing whether a novel compound actually works can take weeks or months. Running an experiment costs money. If the model confidently suggests something that doesn't work, the entire computational advantage disappears.

Converge solved this through architecture. They don't rely on a single generative model. Instead, they build integrated systems where multiple components work together to reduce risk. Here's how the antibody design system works as a concrete example:

First, a generative model creates novel antibodies. This is where raw AI creativity happens. The model uses patterns learned from DNA, RNA, and protein sequence data to suggest new antibody designs.

Second, predictive models filter those suggestions. Not all generated antibodies are equal. Some have properties that make them likely to work. Others have structural issues that predict failure. The predictive models evaluate each generated option and rank them by likelihood of success.

Third, a physics-based docking system simulates three-dimensional interactions. This is computational validation. Before a scientist ever touches a lab, the system models whether the antibody will actually bind to its target with sufficient affinity. The models are physics-informed, meaning they're grounded in what actually happens in molecular biology, not just pattern matching.

The key insight from Gertz: "The value lies in the system as a whole, not any single model." This is the opposite of how most AI companies market their technology. Most want to position a single model as revolutionary. Converge positions the workflow as revolutionary. Customers don't need to assemble models themselves. They get ready-to-use systems that integrate directly into existing pharma workflows.

This matters because pharma companies don't want to hire AI teams to string together experimental models. They want tools that work with their existing processes. Converge built specifically for that use case.

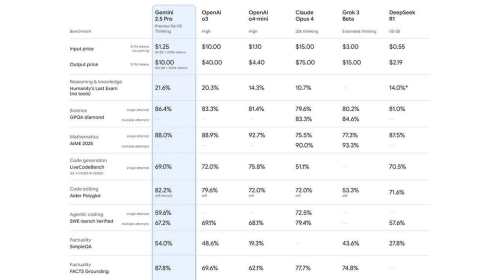

The company is deliberately not tied to a single AI architecture. They use large language models when appropriate. They use diffusion models for molecular generation in some contexts. They use traditional machine learning and statistical methods in others. Text-based LLMs are deliberately kept to supportive roles, like helping scientists understand literature on generated molecules. "They're not our core technology," Gertz emphasized. This architectural flexibility actually matters more than most people realize. As new AI techniques emerge, Converge isn't locked into defending an outdated approach.

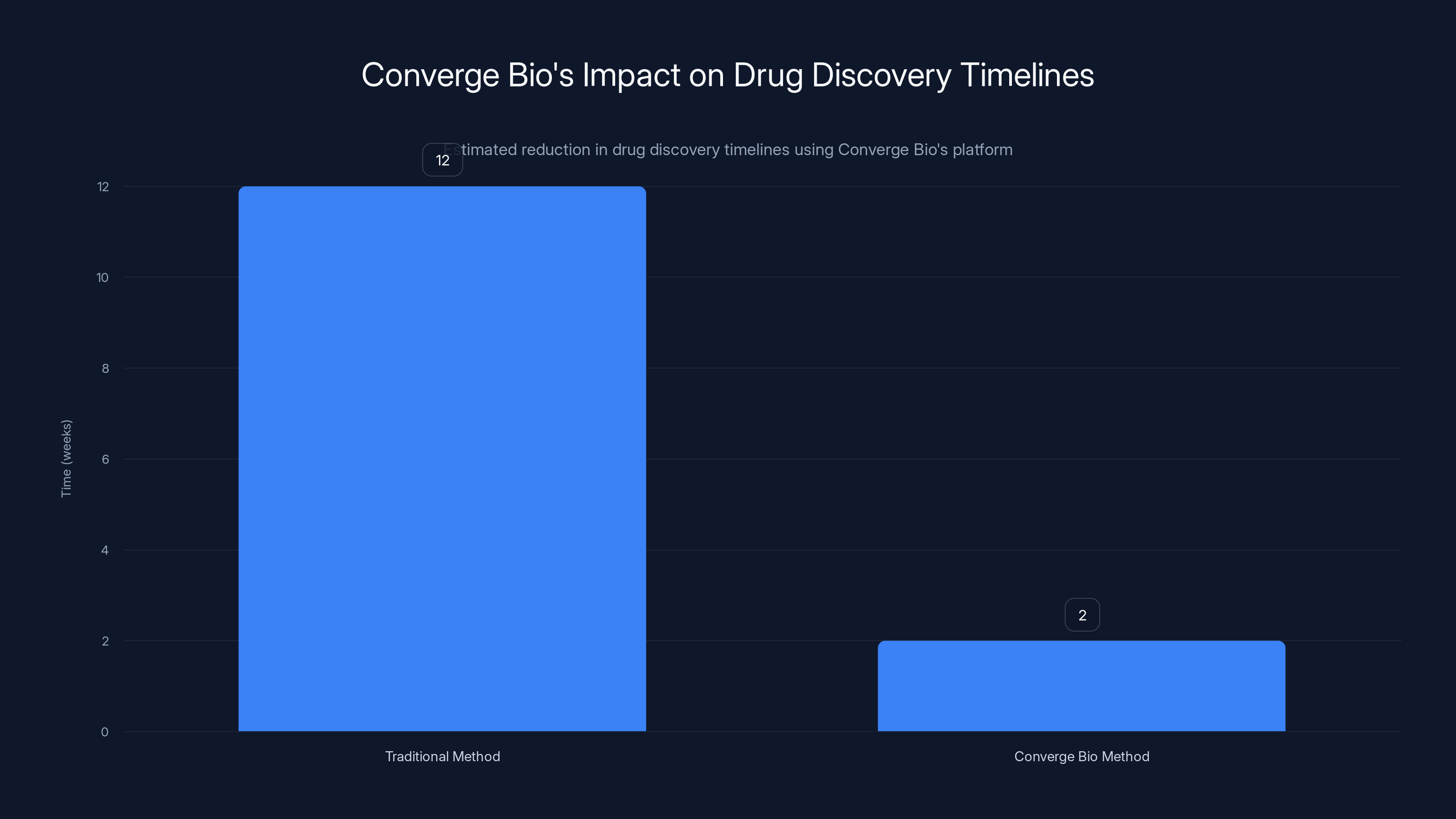

Converge Bio's platform significantly reduces drug discovery timelines from approximately 12 weeks to just 2 weeks by computationally narrowing the search space. Estimated data.

Why Pharma Companies Are Finally Taking AI Drug Discovery Seriously

For years, the drug discovery world treated AI as a nice-to-have. A research project. A proof of concept that might matter in five years.

That shifted dramatically in 2024. Several things happened simultaneously that created genuine momentum.

First, DeepMind's AlphaFold team won the Nobel Prize in Chemistry for protein structure prediction. This wasn't a startup getting acquired. This wasn't a venture-backed press release. This was the global scientific community formally recognizing that AI had solved a decades-old problem that traditional molecular biology couldn't crack. Protein structure prediction unlocks enormous downstream value in drug discovery because you can't design effective drugs without understanding the 3D structure of your target protein.

Second, Eli Lilly announced a partnership with Nvidia to build the "pharma industry's most powerful supercomputer for drug discovery." This came in 2024 and represented the first major pharmaceutical company making a massive institutional commitment to AI-driven discovery. When Eli Lilly moves, other big pharma companies notice. It signals that AI isn't experimental anymore. It's core infrastructure.

Third, successful case studies started accumulating. Companies like Converge published measurable results. Proteins improved 4X. Antibodies reached therapeutic binding affinities. These weren't theoretical improvements. They were operational wins that pharma scientists could understand and verify.

Fourth, the financial pressure on drug development became undeniable. The average drug costs $2.6 billion and takes 10-15 years to reach the market. A 90% failure rate means you're spending massive capital on compounds that ultimately don't work. Any technology that could cut years off timelines or improve success rates suddenly became worth serious investigation.

Converge is positioned right at the intersection of all these trends. They're not betting on AI becoming relevant to drug discovery. They're building for a world where AI is already considered essential and building products that integrate into existing workflows.

The Antibody Design System: A Case Study in Integrated AI

Antibody design is one of Converge's marquee products, and it's worth understanding in detail because it demonstrates how their integrated approach actually works versus theoretical AI drug discovery.

Antibodies are proteins that the immune system uses to identify and neutralize pathogens. They're also incredibly valuable as therapeutics. If you can design an antibody that specifically targets a cancer cell or a disease-related protein, you've got a potential drug. But antibody design is hard. The space of possible antibodies is incomprehensibly large. Traditional approaches rely on human intuition, experimentation, and luck.

The old workflow looked like this: immunologist thinks of a potential antibody design. Lab tests it. It doesn't work. Repeat hundreds of times. Maybe one design succeeds. Timelines measured in months or years for a single good candidate.

Converge's system compresses this workflow. The generative model suggests hundreds of potential antibodies informed by patterns in successful antibodies from natural and engineered sources. The predictive models immediately evaluate which suggestions are most likely to have the molecular properties needed for success. The physics-based docking system simulates binding interactions. The result is a ranked list of antibody candidates ordered by predicted likelihood of success.

Here's the thing that matters: a scientist can look at this ranked list and immediately see which candidates are worth physical testing. They don't have to test hundreds of candidates. They test twenty. Or ten. Or five. The AI hasn't solved antibody design. It's narrowed the search space dramatically, turning weeks of work into days.

One Converge customer got antibodies reaching single-nanomolar binding affinity. In practical terms, this means the antibody binds to its target extremely tightly. That's a therapeutic win. It's also a data point that Converge's filtering and prediction approach is finding genuinely useful candidates, not just theoretically interesting ones.

AI integration in pharmaceutical R&D is estimated to reduce timelines by 50%, costs by 30%, increase success rates by 10%, and improve protein yield by 400%. Estimated data based on industry trends.

The Business Model: Why 40 Partnerships in 18 Months Matters

Converge's growth narrative revolves around one number: forty partnerships with pharma and biotech companies in eighteen months. This is the proof point that the market actually wants this product.

In biotech, partnerships aren't easy to close. Pharma companies move slowly. They have compliance requirements. They have existing vendor relationships. They have internal risk mitigation processes. Closing forty partnerships in eighteen months suggests genuine market demand.

The partnerships are also geographically distributed. Converge works with customers across the US, Canada, Europe, and Israel. They're now expanding into Asia. This isn't a product being used by a handful of innovation labs. It's becoming infrastructure.

The forty programs running on the platform represent real workload. These aren't pilots that might never convert to sustained use. These are active programs where pharma scientists are using Converge tools in their drug discovery workflows. The company is essentially being paid to improve how these scientists work.

The business model is probably direct sales or usage-based pricing, though Converge hasn't publicly disclosed terms. Given the partner count and program volume, they're likely taking either a percentage of successful programs or a per-program fee. The faster drugs move through discovery, the more valuable Converge's technology becomes. The unit economics work out when you're saving customers weeks or months per program.

The Challenge That Most AI Drug Discovery Companies Miss: Hallucinations in Molecules

This is the part where most AI drug discovery discussions break down into hand-waving. Everyone acknowledges that LLMs hallucinate. Everyone agrees this is a problem in molecules where validation is expensive. But most companies don't actually solve it. They just warn about it.

Converge's solution is practical: pair generative models with predictive filtering and physics-based validation. Don't just trust the generated molecules. Test them computationally before committing resources to lab work.

Gertz was explicit about the limitation: "In text, hallucinations are usually easy to spot. In molecules, validating a novel compound can take weeks, so the cost is much higher." This is the core insight. The problem in drug discovery isn't hallucinations themselves. It's the cost of validating hallucinated molecules. In text-based applications, you catch errors immediately. In molecular biology, catching errors costs weeks and thousands of dollars.

The architectural response is sophisticated but not overcomplicated. Generative models create candidates. Predictive models filter ruthlessly. Physics-based validation simulates real molecular interactions. This layering reduces the number of bad candidates that reach lab testing. It's not perfect. No system is. But significantly reducing risk while improving outcomes is exactly what pharma companies need.

This approach also scales. As Converge adds new drug discovery stages to their platform, they're not starting from scratch with new models. They're applying the same integrated pattern: generate candidates, predict properties, validate with physics. The architecture is generalizable across different drug discovery problems.

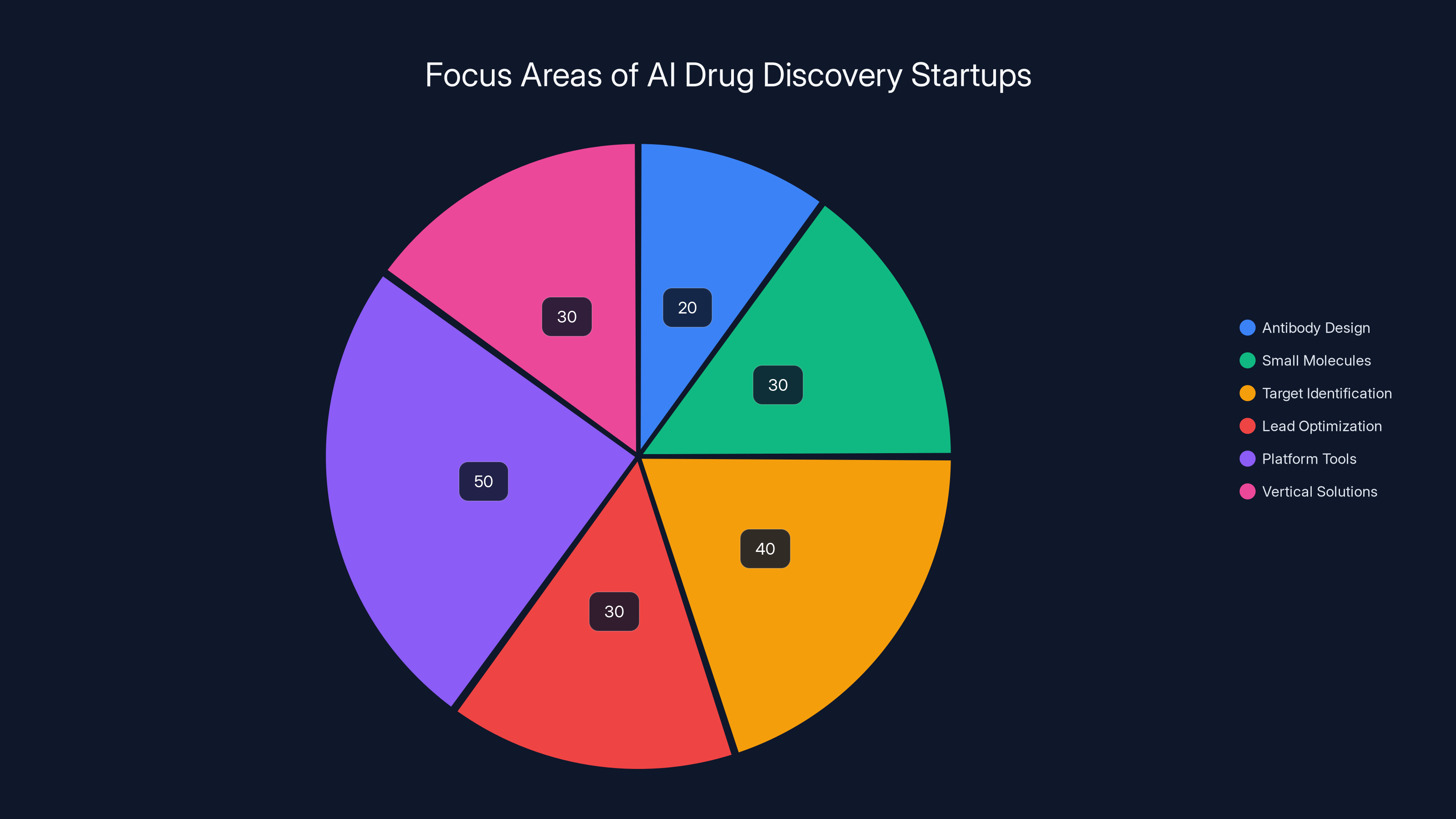

The AI drug discovery market is diverse, with startups focusing on various stages and types of drug discovery. Antibody design and platform tools are significant focus areas. (Estimated data)

Market Context: Why 200+ Startups Are Competing in AI Drug Discovery

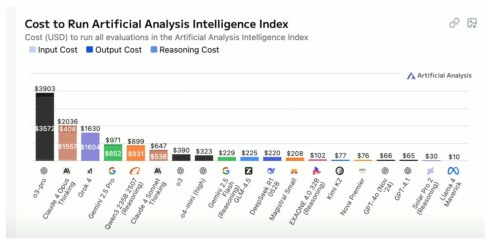

The $25 million funding for Converge is notable, but the broader context is even more important. Over 200 startups are now competing in this space. This isn't a category with one or two players. It's becoming crowded.

Why such density? Because the addressable market is enormous. Pharmaceuticals spend roughly $200 billion annually on research and development. Any technology that meaningfully improves that pipeline by 10-20% represents billions in value capture. The venture capital math is straightforward: put in hundreds of millions, capture a small percentage of a massive market, generate billion-dollar exits.

The distribution of these 200 startups is interesting. Some focus on specific drug types like antibodies or small molecules. Others focus on specific discovery stages like target identification or lead optimization. Some build platform tools. Others build vertical solutions. The diversity suggests the market hasn't yet consolidated around a single approach.

Converge's positioning within this landscape is clear: they're building integrated systems for specific drug discovery problems, starting with antibodies and protein optimization. They're not trying to be everything to everyone. They're solving specific pain points deeply.

This focus strategy is smart for a few reasons. First, it makes product development tractable. You can build exceptional systems for antibody design faster than you can build mediocre systems for all drug discovery stages. Second, it creates a beachhead in customer accounts. Pharma companies using Converge for antibodies become easier targets for selling protein optimization tools or biomarker discovery systems. Third, it reduces competition. While 200 startups exist in AI drug discovery, maybe twenty focus specifically on antibody design. That's a much smaller competitive set.

The broader movement toward AI in drug discovery is also driven by regulatory changes and industry standards. As more tools enter the market and more scientists get comfortable with AI-generated candidates, the regulatory and scientific frameworks are evolving to accommodate them. FDA processes for AI-assisted drug discovery are still forming, but the direction is clear: the regulator wants to encourage this innovation.

The Investors: What Bessemer, Meta, Open AI, and Wiz Tell You

Breaking down the investor lineup reveals what different capital sources believe about Converge and the AI drug discovery market.

Bessemer Venture Partners is a tier-one venture firm with deep biotech experience. They've backed numerous successful biotech companies. When they lead a round, they bring institutional credibility and a network that matters to pharma companies. Bessemer's involvement signals they've done diligence on the technology and the market and believe both are real.

TLV Partners is a Tel Aviv-based venture firm with focus on life sciences. Given that Converge has operations in Tel Aviv, this is a regional investor bringing local market knowledge and relationships. It also reflects the reality that Israel has become a significant hub for biotech innovation.

Vintage Investment Partners is another institutional voice, suggesting this wasn't a round built entirely on one VC's conviction. Multiple established firms participated, which typically indicates the opportunity passed skeptical investor scrutiny.

But the most interesting part of the round is the participation from unnamed executives at Meta, OpenAI, and Wiz. This signals something different than institutional venture capital. This is personal conviction capital. When a senior technologist at OpenAI puts personal money into a drug discovery startup, they're making a different bet than a VC fund makes. They're betting that the fundamental technology approach is sound and that the market will reward teams executing well on that technology.

This kind of executive backing has several implications. First, it brings credibility with other technologists. When AI researchers at major companies see that their peers are backing a biotech startup, it influences their perception of credibility. Second, it brings informal advisory relationships. The executive investors probably aren't formally on the board, but they're available for technical conversations. That advice is valuable for navigating architectural decisions. Third, it signals that the startup isn't just building biotech for biotech people. It's building technology that serious AI researchers think is worth backing.

The fact that these executives remained unnamed is also interesting. It suggests either corporate policy about outside investments or deliberate privacy on Converge's part. Either way, the existence of this backing matters more than the specific names.

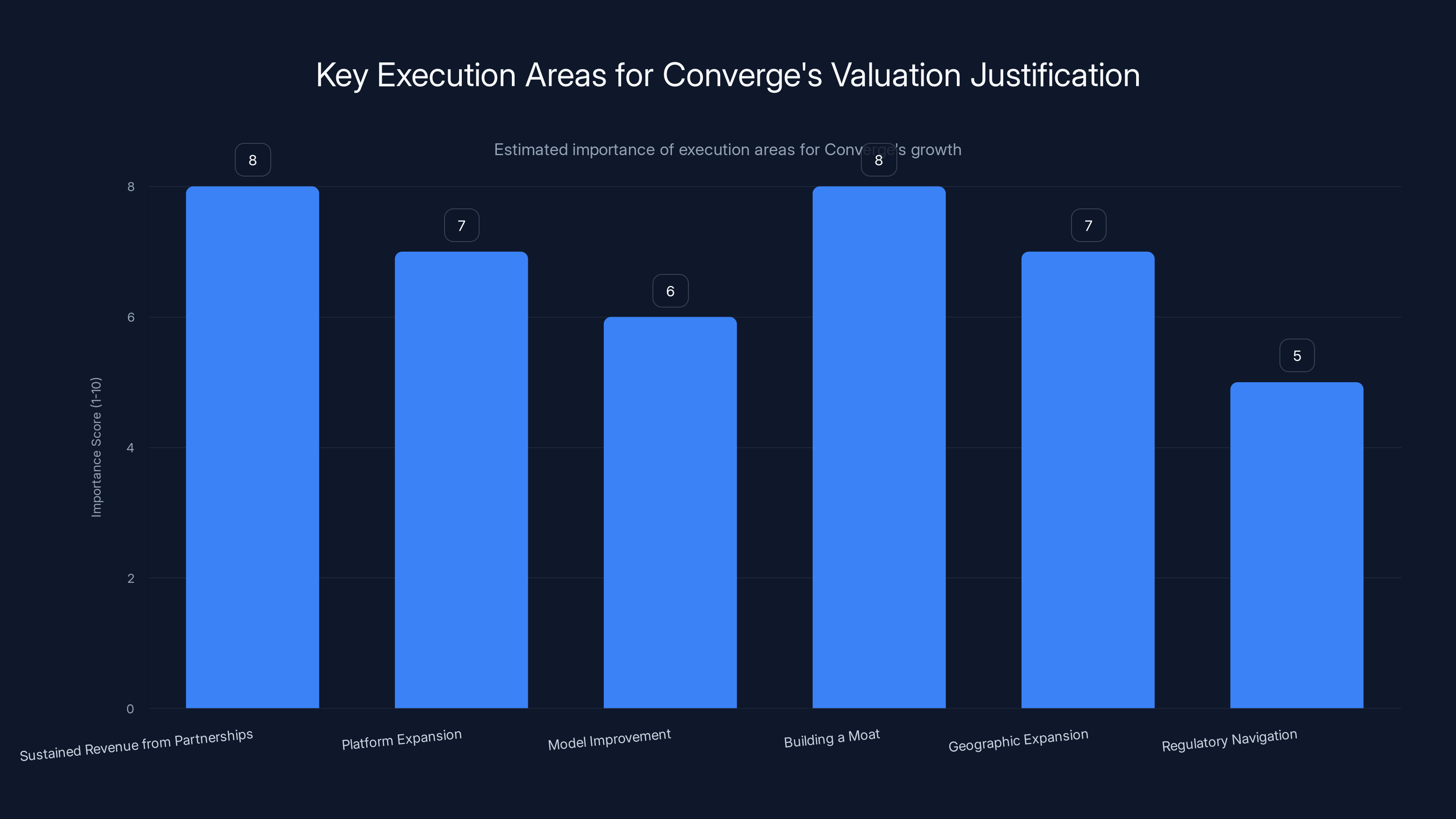

Converge's ability to justify its valuation hinges on executing key strategies like sustaining revenue from partnerships and building a competitive moat. Estimated data based on typical startup priorities.

How Converge's Platform Connects to Broader Drug Development Workflows

One risk with narrow AI tools is that they sit in isolation. A company builds an amazing molecule generator, but pharma companies can't easily integrate it into their existing processes. The tool becomes a research artifact rather than a workflow component.

Converge's platform is intentionally designed to avoid this. Gertz described the approach: "Our platform continues to expand across these stages, helping bring new drugs to market faster." The key word is "expand." They're not trying to rebuild the entire drug discovery process. They're systematically adding tools that integrate into the stages that already exist.

The drug development lifecycle has defined stages. Target identification and discovery. Candidate design. Preclinical testing. Clinical trials. Manufacturing. Regulatory approval. Converge is mapping their tools to these existing stages rather than trying to replace them wholesale.

This integration-first approach is actually the opposite of how many AI startups think about disruption. Most want to replace the entire workflow. Converge wants to improve specific parts of the workflow that pharma companies already use. This creates less resistance to adoption. The scientist's job description doesn't change. Their tools get better.

The expansion strategy is also revealing. Converge started with antibody design. They added protein yield optimization. They're now building biomarker and target discovery tools. This progression moves backward through the drug discovery pipeline. As they move upstream toward early-stage discovery, they're solving earlier problems that affect everything downstream. A better target identification process ripples through all subsequent stages.

Over the next two to three years, watch for Converge to either build or acquire tools that cover more of the pipeline. The $25 million funds product expansion. If they successfully integrate systems across four or five discovery stages, they become much stickier with customers. Pharma companies won't want to rip out tools that are deeply integrated into their workflows.

The Research Infrastructure Beneath the Product: Data as Moat

One thing Converge doesn't discuss publicly is the underlying research infrastructure that makes their models possible. But it's worth understanding because it's where sustainable competitive advantage actually lives in AI drug discovery.

Converge trains generative models on DNA, RNA, and protein sequences. That training data comes from somewhere. Public databases like GenBank contain millions of sequences. Proprietary data from pharma companies contains their internal discoveries. Academic research releases new sequences constantly. The question is: who has access to the most useful training data?

This is where partnerships become infrastructure. With forty pharma and biotech partnerships, Converge sees real experimental outcomes. When a model generates a candidate and the partner tests it in the lab, Converge learns whether the model's prediction was correct. This feedback loop is gold. It's how models improve from generation to generation. Companies that don't have these partnerships are training on static historical data. Converge is training on current, real-world outcomes.

Over time, this data advantage compounds. The more partnerships Converge adds, the more real-world validation data they accumulate, the better their models become, the more partnerships they can attract. This is a defensible moat that pure software companies struggle to replicate.

It's also why the partnership count matters so much. Forty partnerships isn't just revenue. It's forty sources of training data. It's forty feedback loops improving the models. It's forty relationships that make it harder for competitors to break in.

Estimated data shows that 30% of pharma companies are early adopters of AI tools, while 50% are in the mainstream adoption phase. Late adopters make up 20%. Early adoption can provide a competitive edge.

Competitive Dynamics: Who Else Is Building in This Space?

With 200+ startups competing in AI drug discovery, Converge isn't operating in a vacuum. Understanding who they're competing with illuminates their positioning.

The competitive landscape splits into a few categories. First, there are platform plays trying to cover the entire drug discovery pipeline. Companies like Schrödinger and Atomwise are trying to build end-to-end AI platforms. These are well-funded, but they're also trying to do everything, which makes execution harder.

Second, there are specialized point solutions. Some companies focus purely on small molecule design. Others focus on RNA therapeutics. Others focus on clinical trial optimization. Converge is somewhere in between. They're focused on specific areas like antibody design and protein optimization, but they're gradually expanding into adjacent areas.

Third, there are big pharma internal AI teams. Eli Lilly built systems in-house. Roche has AI research teams. These internal efforts aren't startups, but they're competitive in the sense that they reduce demand for external tools. However, big pharma internal teams tend to be slower and more conservative than startups. They're focused on the company's own pipeline, not building generalizable tools. This creates an opportunity for startups to offer better, faster solutions.

Converge's advantage in this landscape is execution speed and customer focus. They're moving faster than big pharma internal teams. They're more focused than platform plays trying to cover everything. They're more comprehensive than narrow point solutions. It's a positioning that makes sense for a thirty-four person company.

The risk is that this middle ground gets squeezed. If a platform company like Schrödinger gets materially better at antibodies, Converge loses differentiation. If pharma companies build internal capabilities at scale, they reduce demand for external tools. But neither of those outcomes is guaranteed. Converge has the partnership data and momentum to stay ahead of this squeeze.

How This Funding Affects the Broader AI Biotech Landscape

One Converge Bio funding round doesn't change the industry. But it's evidence of trends already underway.

First, it confirms that serious venture capital is moving into AI drug discovery as an established category. This isn't emerging anymore. It's established enough for later-stage capital rounds from credible firms. Bessemer leading a $25 million Series A signals that the category has matured past the experimental phase.

Second, it demonstrates that customers exist and can be converted at scale. Not forty pharma partnerships in five years. Forty in eighteen months. This velocity suggests demand is real and the sales process, while still challenging, is becoming more efficient. Pharma companies are now actively looking for AI drug discovery tools rather than requiring heavy evangelization.

Third, it validates the integrated systems approach over single-model approaches. If companies trying to build single revolutionary models were winning in the market, we'd see more announcements about teams doing that. Instead, we're seeing funding for companies like Converge that build careful workflows combining multiple AI techniques with domain expertise.

Fourth, it shows that executive backing from major tech companies is becoming a pattern in biotech funding. As AI expertise becomes more valuable in every industry, technologists from software companies are increasingly backing ventures in non-software sectors. This cross-pollination brings fresh perspectives and networks to biotech.

Looking at the next two to three years, expect more announcements like this. More companies in the AI drug discovery space will raise Series A and B rounds. Some will achieve scale. Others will get acquired by big pharma or larger biotech companies. The category that was theoretical five years ago is becoming routine industry infrastructure.

What This Means for Pharma Scientists and Industry Players

If you're a pharmaceutical scientist or industry executive, what does Converge's funding mean for your work?

First, it signals that the tools improving your discovery workflows are now backed by serious capital and serious companies. Tools that seemed experimental a year ago are becoming mature products with staying power. This matters for planning. You can commit to integrating these tools into your workflows without worrying they'll disappear.

Second, it suggests the market will increasingly separate winners from losers. Right now, there are 200 competitors in AI drug discovery. Not all survive. The companies that raise capital and hit growth milestones are becoming the ones scientists and pharma companies will use. This consolidation is coming.

Third, it implies that AI integration in drug discovery is no longer optional. If you're a pharma company and your competitors are using Converge or similar tools to accelerate discovery, you need comparable capabilities. The pressure to adopt these tools is increasing.

Fourth, it indicates that the scientists and companies best positioned to win in the next five years are those who learn to work effectively with AI-driven workflows. The future isn't chemists replacing computational scientists. It's chemists and computational scientists working together with AI tools that augment both.

The Role of Nobel Prize Recognition in Validating AI Drug Discovery

AlphaFold winning the 2024 Nobel Prize in Chemistry wasn't just an award. It was institutional validation of AI as a legitimate drug discovery tool.

When the Nobel Committee recognizes an AI system for solving a biological problem that had resisted solution for decades, it changes how the entire scientific and pharma community thinks about AI. This isn't a vendor claiming their tool works. This is the global scientific establishment saying AI solved something important.

AlphaFold predicted protein structures with accuracy that matched experimental determination. This was hard. Biochemists had been trying to solve this for fifty years. Structure prediction was one of the grand challenges in computational biology. Then DeepMind's team solved it with AI.

The ripple effects are still propagating. Protein structure prediction is foundational to drug discovery. If you understand structure, you can design better drugs. Before AlphaFold, getting a protein's 3D structure required experimental techniques like X-ray crystallography. Now you can predict it in seconds. This doesn't eliminate the need for experimentation, but it dramatically reduces computational uncertainty downstream.

Converge's tools build on this foundation. They can confidently design antibodies and optimize proteins because AlphaFold-like tools can accurately predict the three-dimensional interactions between molecules. The Nobel Prize for AlphaFold is indirectly a validation of what Converge is building.

This matters for sales conversations. When a Converge sales rep talks to a pharma company about using AI for drug discovery, they're not making a speculative pitch. They're pointing to a Nobel Prize and saying "this is proven technology." That changes the conversation from "should we take a chance on this?" to "which AI tools should we use?"

The Path Forward: What Converge Needs to Execute on to Justify This Valuation

A

Converge needs to execute on several things to justify this valuation and prove it's a durable company, not a momentary startup.

First, convert the forty partnerships into sustained revenue. Partnerships that are active and paying are great. Partnerships that are pilots that turn into nothing are less great. The company needs to demonstrate that these relationships are sticky and expand over time.

Second, expand the platform to cover more drug discovery stages. They've started with antibodies and protein optimization. The roadmap probably includes target identification, lead optimization, and eventually clinical trial optimization. Each new stage they address is a new revenue stream and a reason for existing customers to expand usage.

Third, improve the underlying models as more real-world data accumulates. The feedback loop from forty pharma partnerships should make the models demonstrably better year over year. They need to show that the data advantage compounds.

Fourth, build a sustainable moat. Right now, the moat is product quality and customer relationships. They need to extend that to data, technical talent, and network effects. The company that has the most partnerships in AI drug discovery has the best training data. That compounds over time.

Fifth, achieve geographic expansion successfully. They're expanding into Asia. Asia represents a huge pharmaceutical market. If they can replicate their success in the US and Europe in Asia, the market opportunity expands significantly.

Fifth, navigate regulatory complexity as it emerges. AI-assisted drug discovery is still establishing regulatory norms. Converge will need to work with regulators to ensure their tools are accepted in clinical workflows. Companies that build regulatory credibility early have an advantage.

If Converge executes on these points over the next two to three years, they have a path to becoming a substantial company. If they stumble on any of these, they become an acquihire or acquisition target. The $25 million funds the attempt to execute. The next funding round will validate whether they're actually pulling it off.

The Bigger Picture: AI Drug Discovery as an Industry Inflection

Zoom out from Converge Bio specifically, and what you see is an industry in the middle of a fundamental transformation. Drug discovery timelines are compressing. Success rates are improving. Costs per drug are potentially declining. These aren't small changes. They're industry-wide structural shifts.

The cause is clear: AI is enabling data-driven molecular design to replace trial-and-error approaches. The evidence is mounting. Case studies show measurable improvements. Nobel Prizes validate the approach. Capital is flowing in. Pharma companies are adopting tools. Scientists are getting comfortable with AI-assisted discovery. These are the early stages of a major shift.

Converge Bio is one company riding this shift. They're not unique in competing in this space. But their execution, their focus, and their capital validation suggest they're among the companies most likely to be meaningful beneficiaries of the transformation.

If you're in pharmaceutical or biotech, watching companies like Converge isn't optional anymore. These tools are becoming the infrastructure of modern drug discovery. The scientists and companies that learn to work effectively with them will discover drugs faster, more reliably, and more cheaply than those that don't. The competitive advantage is compounding.

The $25 million funding for Converge Bio isn't just a capital announcement. It's evidence of how seriously the industry is taking this shift. It's validation that the tools work. It's confirmation that the era of AI in drug discovery isn't coming. It's here.

FAQ

What exactly does Converge Bio do?

Converge Bio builds integrated AI systems for pharmaceutical and biotech companies to accelerate drug discovery. Rather than relying on single AI models, the company develops multi-component systems that combine generative models (which create new molecule candidates), predictive models (which filter candidates by likelihood of success), and physics-based validation (which simulates molecular interactions). Currently, they offer systems for antibody design, protein yield optimization, and biomarker discovery.

How does Converge Bio's platform reduce drug discovery timelines?

Traditional drug discovery relies heavily on trial-and-error experimentation. Scientists design candidates through intuition and experimentation, test them laboriously, and iterate. Converge's systems compress this cycle by computationally narrowing the search space before lab testing occurs. For example, their antibody design system generates hundreds of candidates, filters them to the most promising based on predicted properties, and simulates binding interactions. Scientists then test the top candidates rather than hundreds of options, converting weeks of work into days or hours.

What is binding affinity, and why did Converge's single-nanomolar achievement matter?

Binding affinity measures how tightly a molecule (like an antibody) attaches to its target. Single-nanomolar affinity means the antibody binds extremely tightly at concentrations measured in billionths of a mole. This is therapeutically significant because antibodies that bind weakly require higher doses and often fail in clinical trials. Achieving this level of affinity demonstrates that Converge's filtering and prediction systems are finding genuinely useful candidates, not just theoretically interesting ones.

Why did 40 pharma partnerships in 18 months signal genuine market demand?

Pharmaceutical companies move slowly due to compliance requirements, existing vendor relationships, and risk aversion. Closing forty partnerships in eighteen months suggests that Converge's product solves real problems that pharma companies actively want solved. These partnerships also represent actual usage and revenue, not theoretical interest. More importantly, these partnerships generate real-world validation data that improves Converge's models over time.

How does Converge avoid the AI hallucination problem that affects other generative AI tools?

AI models can generate molecules that sound plausible but don't actually work. In text applications, hallucinations are easy to spot. In molecular biology, validating whether a generated molecule works takes weeks and costs thousands of dollars. Converge solves this through architectural layering: generative models create candidates, predictive models immediately filter out candidates with problematic properties, and physics-based docking systems simulate molecular interactions before any lab testing occurs. This multi-step validation significantly reduces the number of bad candidates reaching expensive lab work.

What does AlphaFold's Nobel Prize have to do with Converge Bio's technology?

AlphaFold (developed by DeepMind) solved protein structure prediction, which had resisted solution for decades. Structure prediction is foundational to drug discovery because understanding a protein's 3D shape determines how to design molecules that interact with it effectively. When AlphaFold won the Nobel Prize in Chemistry in 2024, it provided global institutional validation that AI solves real biological problems. This shifts conversations about AI drug discovery from "should we try this?" to "which AI tools should we use?" Converge's tools build on the foundation AlphaFold created.

How sustainable is Converge Bio's competitive advantage?

Converge's moat has multiple layers. Short-term, it's product quality and customer relationships. Medium-term, it's data advantage from forty pharma partnerships—the more partnerships they have, the better their training data, the better their models, the more partnerships they can attract. Long-term, it's network effects and regulatory credibility. Companies that work with regulators earliest to establish norms around AI-assisted drug discovery will have advantages over latecomers. Converge has the partnership density and momentum to potentially establish this credibility first.

What needs to happen for Converge Bio to justify a $25 million Series A valuation?

Converge needs to execute on several fronts: convert the forty partnerships into sustained, expanding revenue; expand the platform to cover more drug discovery stages (targeting, lead optimization, clinical trials); demonstrate that underlying models improve measurably as more real-world data accumulates; build sustainable moats through data and regulatory credibility; achieve geographic expansion into Asia successfully; and navigate emerging regulatory frameworks for AI-assisted drug discovery. Essentially, they need to prove that partnerships are sticky, expansion is possible, and the data advantage compounds over time.

Are there competing companies with similar approaches?

Yes. Over 200 startups compete in AI drug discovery. The landscape splits into platform plays covering the entire pipeline (like Schrödinger), specialized point solutions focusing on specific drug types or discovery stages, and big pharma internal AI teams. Converge's positioning is somewhere in between: focused on specific areas like antibody design and protein optimization, gradually expanding into adjacent areas. This focus-and-expand strategy allows execution speed that platform plays struggle with, while remaining more comprehensive than narrow point solutions.

How will the outcome of Converge Bio's expansion into Asia affect the company's trajectory?

Asia represents enormous pharmaceutical market opportunity, particularly in China, India, and Japan where there's significant investment in drug discovery infrastructure. If Converge can replicate their partnership velocity and customer success in Asia that they achieved in North America and Europe, their addressable market and revenue runway expand significantly. Failure to execute internationally would suggest execution challenges and limit long-term growth potential. Success in Asia signals the company has genuinely useful technology that works across geographic and regulatory contexts.

Key Takeaways

- Converge Bio raised $25M Series A led by Bessemer VPs, with personal backing from executives at Meta, OpenAI, and Wiz, validating AI drug discovery as serious infrastructure

- The company grew from 9 to 34 employees and signed 40 pharma partnerships in just 18 months, demonstrating genuine market demand for AI-accelerated discovery

- Converge's integrated systems approach—combining generative models, predictive filtering, and physics-based validation—solves the hallucination problem that limits other AI drug discovery tools

- With 200+ startups competing in AI drug discovery and AlphaFold's 2024 Nobel Prize validating AI's role in drug development, the industry is undergoing a fundamental transformation from trial-and-error to data-driven molecular design

- The company's data advantage compounds over time: more partnerships provide training data, better models attract more partnerships, creating a defensible moat that pure software competitors struggle to replicate

![Converge Bio's $25M Funding: AI Drug Discovery's Inflection Point [2025]](https://tryrunable.com/blog/converge-bio-s-25m-funding-ai-drug-discovery-s-inflection-po/image-1-1768304273459.jpg)