Introduction: When Pivots Actually Work

Most startup pivots are desperate last stands. A founder realizes their original idea isn't working, so they scramble to find anything that gains traction. The result? Usually a half-baked product caught between two markets, satisfying neither.

Then there's Hupo.

In 2022, Justin Kim launched what seemed like a straightforward wellness startup called Ami. The premise was solid: use technology to help people manage stress, build habits, and improve their mental resilience. Meta saw potential and backed the seed round. For a moment, it looked like another pandemic-era wellness play.

Four years later, the company is now called Hupo, it's raising millions from serious institutional investors, and it's selling AI-powered sales coaching to some of the world's largest banks and insurance companies. HSBC, Prudential, AXA, Manulife, Bank of Ireland—these aren't startups throwing money at experimental tech. These are enterprises with byzantine approval processes, compliance teams that exist solely to say no, and a historical track record of rejecting innovation.

Yet Hupo got through. More than that, it scaled.

The company just secured a

Here's what makes Hupo's story worth understanding: it's not about luck or market timing. It's about recognizing that the problem you're solving isn't what you thought you were solving, it's why you were solving it. Kim's obsession with human performance didn't change. The venue did.

This article breaks down how a wellness startup became a banking software company, why the pivot actually made sense, and what it reveals about building enterprise AI products in heavily regulated industries.

TL; DR

- The Pivot: Hupo shifted from mental wellness platform Ami to AI-powered sales coaching for banking, finance, and insurance

- The Funding: 15M since 2022

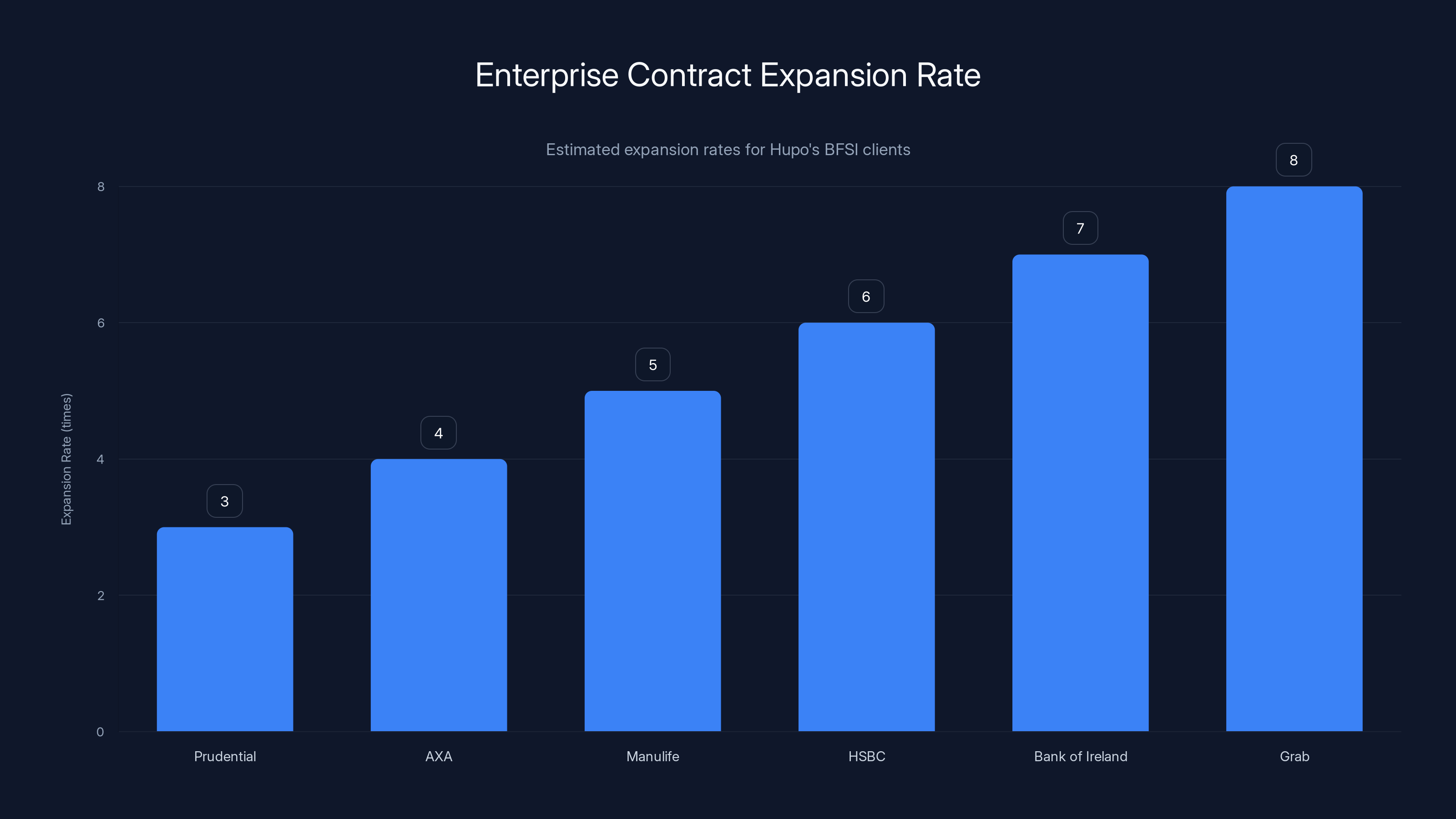

- The Traction: Serving dozens of enterprise clients including HSBC, Prudential, AXA, and Manulife with 3-8x contract expansion in first six months

- The Strategy: Built AI models specifically trained on financial products, regulatory requirements, and real client objections instead of generic sales coaching

- The Expansion: Now scaling from APAC/Europe into US market where distribution-heavy models create strong demand for scalable coaching

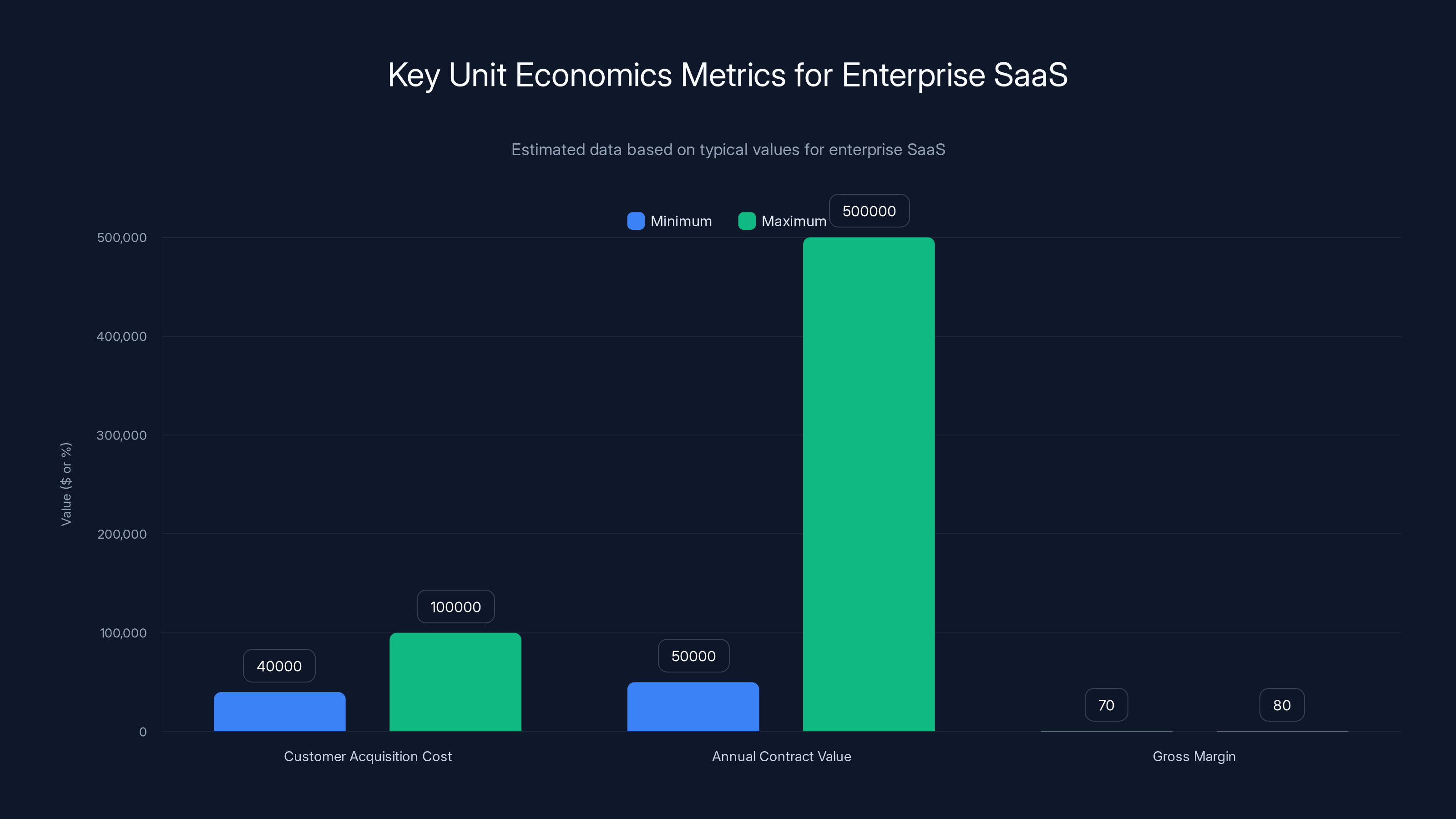

Estimated data shows that enterprise SaaS companies typically have customer acquisition costs between

The Original Vision: Performance Through Mental Wellness

Justin Kim's career path reads like someone methodically gathering puzzle pieces for a startup he hadn't launched yet. Before founding anything, he spent years at Bloomberg selling enterprise software to banks, asset managers, and insurers. That's not a typo. The CEO of an AI sales coaching company literally started by selling complex enterprise software to the exact customers he now serves.

The Bloomberg years taught him something critical: enterprise sales in regulated industries is a human game played on inhuman terms. Inconsistency kills you. When you're selling financial products, results don't vary because of motivation. They vary because some reps got trained properly and others didn't. Some got confidence-building feedback and others got silence. Some had managers who cared about their development and others had managers focused on quota.

After Bloomberg, Kim moved to South Korea to work on product development at Viva Republica, the company behind Toss. This was a different kind of education. Instead of selling to financial institutions, he was now building for them. He watched how technology could reshape traditional financial services when designed around real user behavior instead of top-down requirements.

But his intellectual curiosity pulled him somewhere else first. Kim has always been obsessed with performance. He'll talk for hours about sports—basketball, Formula One, MMA—because they're living laboratories of human performance. In sports, patterns emerge. Teams with better coaching beat teams with similar talent. Individual athletes with the same genetics diverge wildly based on mentorship. The variables are isolated enough that you can actually see what works.

That curiosity led him to a question: if performance patterns are so clear in sports, what about in work?

One theme kept surfacing: mental resilience. Not motivation. Not talent. Resilience. The ability to handle pressure, adapt to setbacks, maintain clarity under stress. Kim realized this wasn't an individual problem. It was an organizational problem. Companies have thousands of employees. Traditional coaching can't reach everyone. You can't afford a sports psychologist for every person.

So he founded Ami in 2022. The idea was elegant: use technology to deliver performance coaching at scale. Help people manage pressure, form better habits, change behavior over time. Meta backed it in the seed round. The product made sense. The problem was real.

But something wasn't clicking.

The Mental Wellness Reality: Where Software Met Adoption

Here's what Kim learned that a lot of founders only discover through painful failure: knowing the problem exists and having people use your solution are different things.

The wellness space is littered with apps that understand human behavior perfectly on a theoretical level and fail spectacularly on a practical one. Build a tool that tells someone they're anxious and need to meditate? That tool is judgmental, abstract, and disconnected from their actual work. Nobody opens that app at 2 PM when they're spiraling in an important client call.

Kim watched Meta's feedback on Ami shape his thinking. The company wasn't saying the problem was fake. It was saying: software only works when it fits into daily behavior, when it's woven into how people already live and work.

That's not a rejection of Ami's thesis. That's a recognition that the delivery mechanism was wrong. You can't fix enterprise problems with consumer mental health tech.

But the core insight remained true: at scale, results vary because of training, feedback, and confidence, not because of intrinsic motivation or talent. That problem didn't disappear when you moved from general workforce to banking and insurance reps. It got worse. In highly regulated financial services, compliance teams watch every conversation. Managers can't sit in on every call. Inconsistency creates liability.

What if AI could provide real-time coaching embedded in the work itself?

That question didn't require a pivot. It required a reframing. Same problem. Different context.

Hupo's clients in the BFSI sector typically expand their contracts by 3 to 8 times within the first six months, indicating strong product performance and customer satisfaction. (Estimated data)

Why Regulated Financial Services, Not Another Industry?

Kim had to make a choice. The performance problem existed everywhere. Why focus on banking and insurance?

The answer is almost embarrassingly practical: he understood the buyer, the end-user, and the operational reality. He'd sold to these companies. He'd built with these companies. He knew their workflows, their pain points, their compliance nightmares, their regulatory constraints. Most importantly, he knew what they actually paid for.

Financial services has a specific inefficiency that most other industries lack. The sales function in banking, insurance, and wealth management is heavily reliant on human judgment in high-stakes moments. A rep's ability to handle objections, navigate regulatory constraints, and maintain confidence in complex conversations directly affects revenue. These aren't discretionary coaching problems. They're core business problems.

Second, financial services companies have exceptional distribution channels. Banks and insurance companies have massive sales forces. A solution that works for one rep scales to hundreds or thousands within the same organization. That's not true in most industries.

Third, and this matters for early-stage companies, financial services has genuine budget allocation for training and development. When you pitch to tech companies, you're competing with Slack, GitHub, Figma. When you pitch to financial services, you're competing with traditional external coaching vendors that charge $300 per hour and deliver inconsistent results across a team of 200 reps. You're also not a luxury. You're a solution to a compliance problem.

Finally, the regulatory constraints that seem like friction are actually moats. Building an AI coaching tool is easy. Building one that actually understands regulatory requirements, common objections in regulated sales, product features that matter in banking, and compliance language? That requires domain expertise. Most AI startups avoid regulated industries for a reason. That's exactly why a well-executed solution in banking and insurance is defensible.

The Technology Approach: Training Models on Reality

This is where Hupo's strategy diverges from every other AI sales coaching startup. Most competitors launched with generic AI models. They trained on general sales conversations, applied a large language model, and figured the model would learn the specifics through integration.

Hupo did the opposite. From the start, the company trained its models on real financial products, common objections in banking and insurance, client types specific to regulated markets, and regulatory language that actually matters in these conversations.

That's not a difference that shows up in a demo. It shows up in accuracy. When an AI model has seen 10,000 real mortgage sales conversations, it understands the pressure points. It knows why a client might object. It understands what a compliant response sounds like.

When a generic AI model tries to coach on the same conversation, it's operating on educated guesses.

Kim is explicit about this: "One of the biggest lessons I've learned is that, especially with large enterprises, you have to understand their business and industry in detail. You can't just apply a generic tool and hope it works."

That philosophy shaped product development from day one. Instead of starting with AI capabilities and asking how to apply them to sales, Hupo asked: what do sales reps in banking and insurance actually need to hear in real-time? What would make them more confident? What would reduce compliance mistakes? What would help managers coach more effectively?

Then they built AI to solve those specific problems.

The result is a system that doesn't try to replace manager judgment. It augments it. Real-time coaching that understands context. Post-call analysis that identifies specific moments where a rep could improve. Training that's tied to actual performance patterns instead of generic best practices.

Real-Time Coaching: The Technical Challenge Most Startups Skip

People often assume AI sales coaching is just call recording plus transcription plus language model. Ship it, make millions.

Reality is messier.

Real-time coaching means processing audio while the conversation is happening. It means recognizing when a sales rep is veering into risky territory before they commit the error. It means suggesting responses that sound natural, respect the regulatory environment, and actually address the client's concern.

That's computationally expensive. It's also legally complex. Financial institutions don't want AI that's sometimes right. They want AI that's right 99% of the time because the cost of error is measured in compliance violations and lawsuits.

Hupo's approach accounts for this. Instead of making AI suggestions that override human judgment, the system provides context and guidance that human reps can evaluate. A red flag appears when regulatory language isn't being used correctly. A suggestion appears when a common objection could be addressed more effectively. But the rep makes the final decision.

That's not a limitation of the technology. It's a feature. Enterprise customers in regulated industries don't want AI making decisions. They want AI making managers' jobs possible at scale.

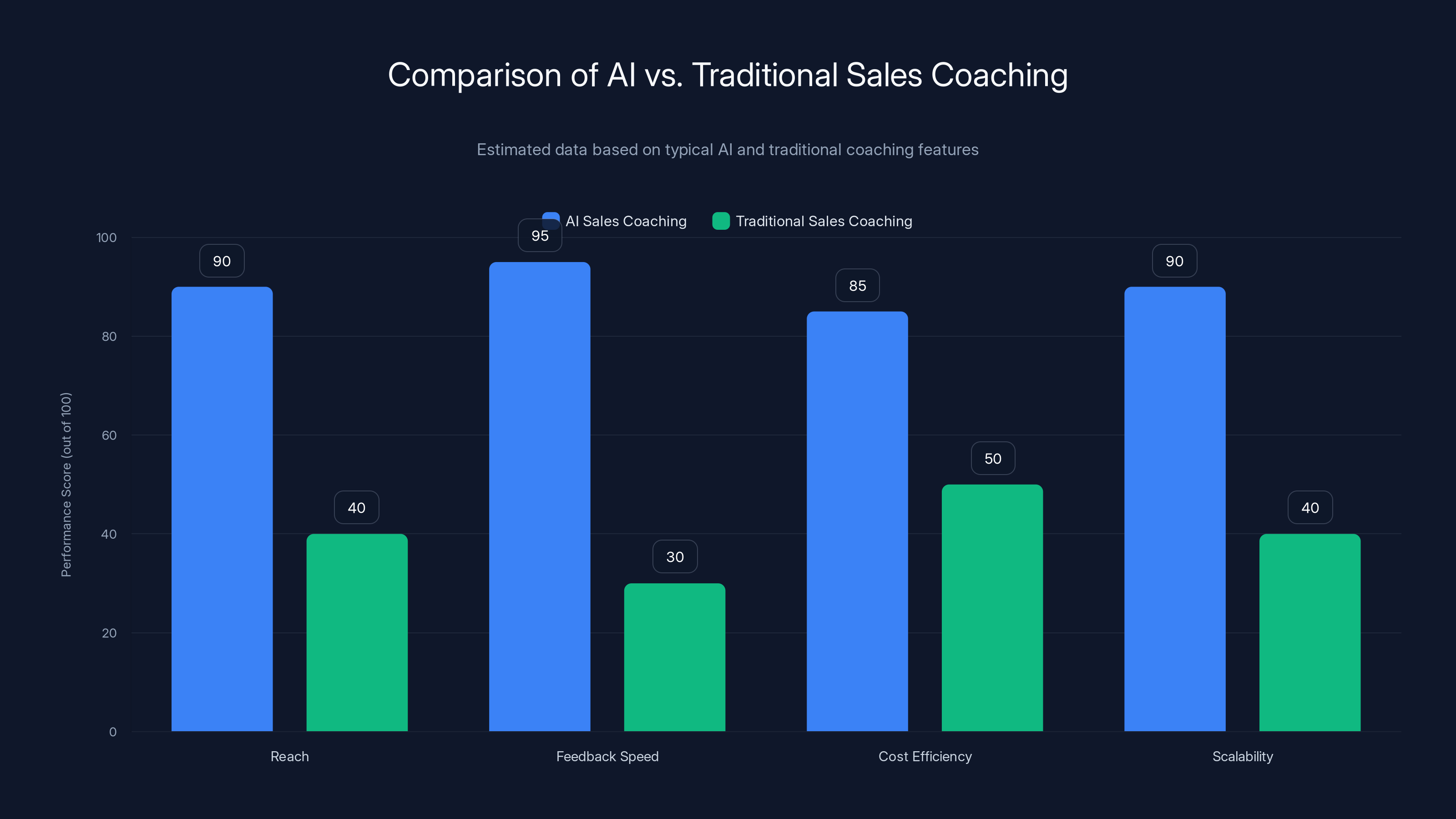

AI sales coaching significantly outperforms traditional methods in reach, feedback speed, cost efficiency, and scalability. Estimated data.

Enterprise Adoption: How Hupo Got Into HSBC and Prudential

Entering the BFSI (Banking, Financial Services, Insurance) vertical is notoriously hard for early-stage companies. The sales cycle is long. The decision-making process is Byzantine. One compliance objection kills months of work.

Hupo didn't solve this through clever sales tactics. It solved it by building a product that works.

The traction speaks for itself: Hupo now serves dozens of customers including Prudential, AXA, Manulife, HSBC, Bank of Ireland, and Grab. These aren't experimental pilots where the startup gets $50K to prove the concept. These are production deployments.

More telling than the company names is the expansion metric: customers typically expand contracts 3-8x within the first six months. That means the initial pilot works. Managers see their teams improve. Compliance sees fewer errors. Revenue sees better conversion rates. Then customers expand to more teams, more markets, more product lines.

That kind of expansion ratio in enterprise is a superpower. It means the solution isn't theoretical. It actually moves the needle on something the customer cares about deeply.

How did Hupo get past the initial objection? By understanding the buyer's actual problem. Banks and insurance companies have sales forces. They want those sales forces to be more effective. They also want them to be consistent, compliant, and manageable.

A traditional external coaching firm might improve performance 5% and cost $500K annually. But coverage is inconsistent. Only high-potential reps get intensive coaching. A software solution that improves performance 10%, costs less, and reaches everyone? That's an easy financial argument.

Expansion Into New Markets: Why the US Plays Different

For two years, Hupo focused on APAC and Europe. That's where the company built its initial playbook, proved its model, and generated the revenue to fund growth. These regions offered dense markets, financial institutions with strong international sales forces, and distribution partners who already understood the value proposition.

But the US market is different, and not just in size. American financial services have heavier reliance on distribution partners. Banks have networks of affiliated brokers and advisors who operate with significant autonomy. Insurance companies rely on agents who are often independent. Wealth management firms employ thousands of advisors across different offices.

These distribution models create a specific pain point: consistency is nearly impossible. You can't control every conversation. You can't train every rep the same way. But you're liable for every rep's behavior.

That's where AI coaching becomes essential, not optional. Hupo's expansion into the US in 2025 isn't just market growth. It's attacking a problem that US financial institutions have been unable to solve for decades.

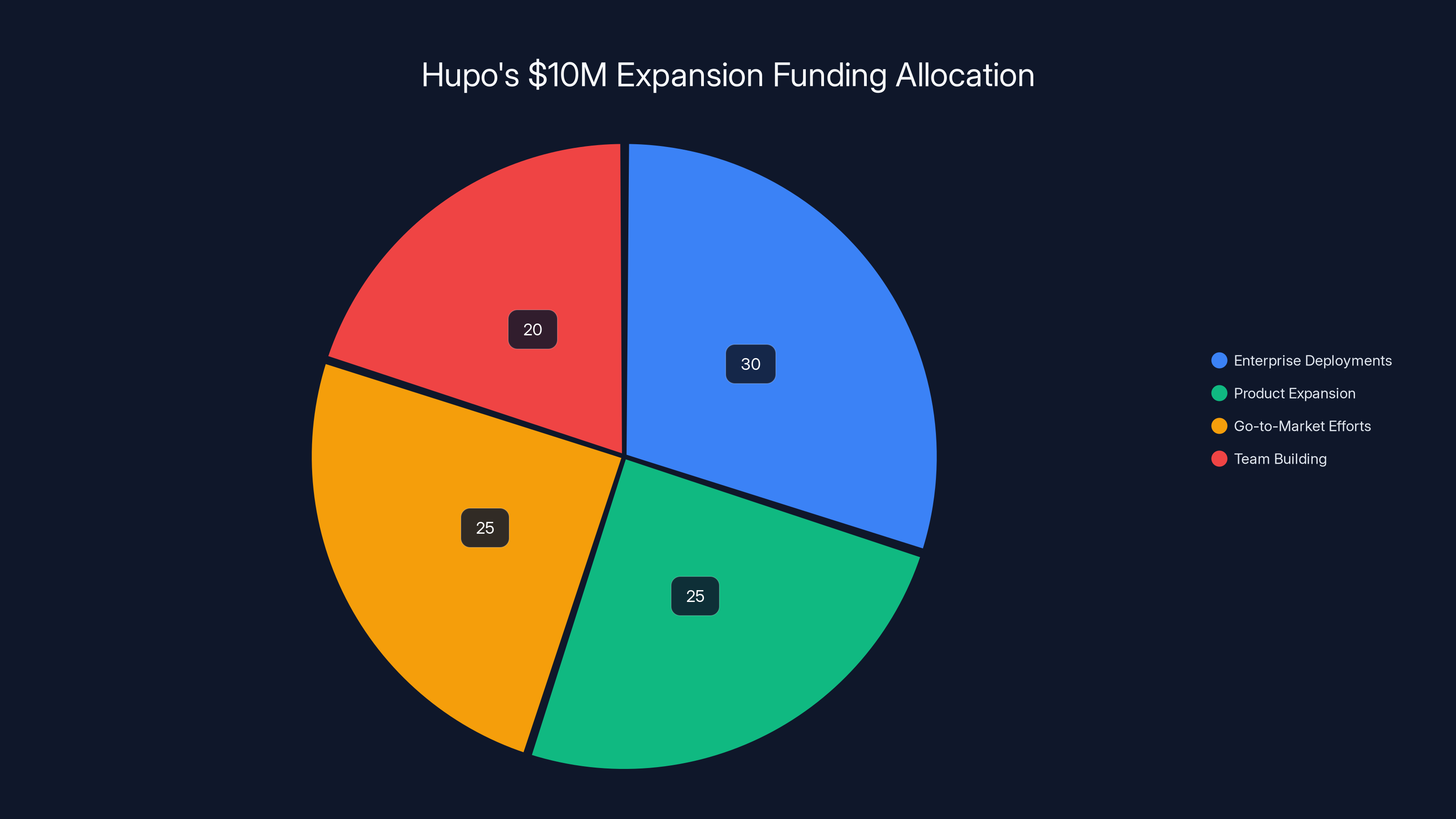

The company raised $10M specifically to fund this expansion. That capital will go toward scaling enterprise deployments, expanding the product with new features, growing go-to-market efforts in banking and insurance, and building out the team.

The Funding: Why DST Global Led This Round

DST Global Partners is an unusual lead investor for an AI sales coaching startup. The firm specializes in global technology platforms with durable business models and strong unit economics. DST doesn't lead Series A rounds for experimental products. It leads them for companies that have already proven they work.

Hupo's metrics supported that narrative. Dozens of enterprise customers in APAC and Europe. Contract expansion ratios that indicate real product-market fit. A founder who understood the industry deeply and had executed a strategic pivot. Funding from prior investors like Collaborative Fund and Goodwater Capital signaling belief in the trajectory.

DST's involvement signals something else: this is a platform-sized problem. The firm invests in companies that can become category leaders. A moderately successful sales coaching tool doesn't interest DST. But a platform that could reshape how large financial institutions approach rep development and management? That's worth $10M in Series A funding.

The round also included participation from Collaborative Fund, Goodwater Capital, January Capital, and Strong Ventures. That's a coalition of investors with deep expertise in enterprise software, fintech, and marketplace dynamics. They're not betting on a trend. They're betting on a founder and a proven product in a massive market.

Estimated data shows Hupo's $10M funding will be primarily allocated to enterprise deployments and product expansion, crucial for addressing US market challenges.

Product Vision: Beyond Sales Coaching

Kim's long-term vision for Hupo extends beyond coaching individual sales reps. In five years, he wants the company to help large teams perform at scale, giving managers and employees clearer insights and practical guidance, even across tens of thousands of people.

That's not a vague mission statement. It's a specific architectural direction. The underlying technology—understanding conversations, identifying performance gaps, providing real-time guidance—works for sales coaching. But the same tools could work for customer service, client management, internal communication, training delivery, and dozens of other scenarios where human performance matters.

The defensibility of that vision is worth noting. Most AI startups are playing a feature game. They build tools that existing software vendors can eventually incorporate. Hupo is building a foundation. The company understands performance in regulated financial services at a level that pure AI companies don't. That understanding is hard to acquire if you're starting from zero.

The vision also reveals Kim's thinking about the market. He's not trying to replace managers. He's trying to make managers' jobs possible at scale. That's a product positioning that actually appeals to enterprises because it doesn't threaten the existing management structure. It enhances it.

The Competitive Landscape: Why Timing Matters

AI sales coaching isn't a new category. The space includes established players, well-funded startups, and tools bolted onto existing CRM platforms. So why did Hupo gain traction while others struggled?

Partially, it's timing. The technology to understand financial language in real-time, provide regulatory-compliant coaching, and integrate seamlessly with banking workflows didn't exist five years ago. It barely exists today. But it exists enough that a focused team with domain expertise can build something that works.

Partially, it's the customer being ready. Financial institutions in APAC and Europe have been digitizing their operations rapidly. They're more willing to experiment with new software than US banks. They also have specific pressure to improve sales force effectiveness. That combination created a market window.

Partially, it's the founder. Kim isn't a generic AI entrepreneur or a sales expert who learned to code. He's someone who spent years in the industry, understood the problem from multiple angles, and recognized when the technology could finally address it.

That founder-market fit is underrated in venture investing. A great product built by someone who doesn't understand the industry often fails. A mediocre product built by someone who knows the customer, the buyer, and the regulatory environment often succeeds. Hupo got both.

Regulatory Compliance: Building for Constraints

Most AI companies treat regulatory requirements as friction. Hupo treats them as features.

In banking and insurance, regulatory requirements aren't optional considerations. They're core business requirements. A coaching tool that ignores compliance is a tool that no enterprise will deploy at scale. A coaching tool that understands compliance and actively helps reps stay compliant is a tool that reduces liability.

Hupo's models are trained on regulatory language and requirements specific to different financial products. The system understands what constitutes compliant communication in different contexts. It can flag language that might be risky. It can suggest reframes that address client concerns while maintaining regulatory safety.

That's not a competitive advantage that competitors can easily copy. It requires domain expertise in financial regulation, deep understanding of compliance frameworks, and the ability to translate that into AI coaching.

It also means the product is more defensible. A competitor could launch with a faster model or cheaper pricing. But they'd need to rebuild the regulatory knowledge from scratch. For enterprise financial services, that knowledge gap is significant.

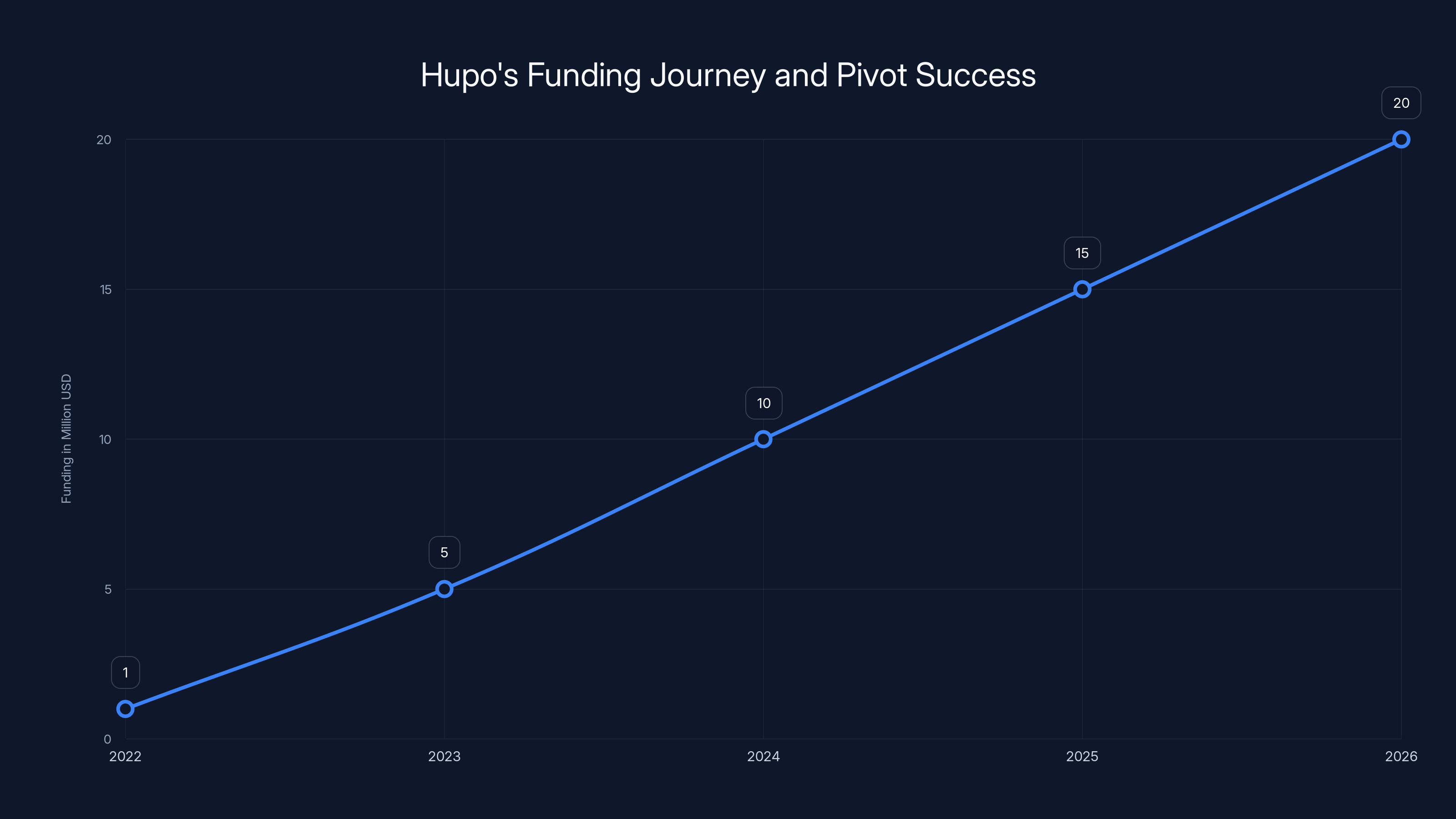

Hupo's strategic pivot from wellness to AI-powered sales coaching led to a significant increase in funding, reaching $15 million by 2026. Estimated data.

Building for Manager Workflows: The Adoption Secret

Most AI coaching tools focus on the rep. That's the person actually talking to the customer. Hupo focuses equally on the manager.

Reps won't use a tool if their manager doesn't support it. But managers won't support a tool if it doesn't make their job easier. The product had to work for both.

For reps, it's real-time coaching in moments that matter. For managers, it's insights and data that let them understand what's happening across their team, identify gaps, and coach more effectively.

That dual focus required specific product decisions. The system captures more data than a typical sales tool. It provides more insights than a typical coaching tool. But all of that data flows to managers in forms that actually help them. Dashboards that show which reps struggle with specific objections. Reports that identify training gaps. Alerts that help managers know when to jump in and coach directly.

That's a harder product to build than simple rep-focused coaching. It's also more valuable to the customer. Managers are the ultimate customer. Reps are users. When you align incentives around the manager, adoption follows.

The Competitive Moat: What Hupo Has That's Hard to Replicate

Assuming the product works—and the traction indicates it does—what prevents well-funded competitors from entering and crushing this startup?

Data. Hupo has trained its models on thousands of real financial services conversations. That's a resource most competitors don't have. A well-capitalized startup could theoretically build the same product, but they'd need access to the same training data. Banks aren't going to share call recordings with a random startup.

Domain expertise. Building an AI system that understands banking products, financial compliance, and regulatory language requires people who actually know banking. Those people are expensive, and they're not sitting around waiting to join a startup.

Customer relationships. Hupo has embedded itself in enterprise financial institutions. Those relationships create switching costs and ongoing revenue. A new competitor would need to convince existing Hupo customers to rip-and-replace, which is expensive and risky.

Product knowledge. The company now understands what actually works in financial services. That knowledge—what messaging resonates, what compliance issues matter most, what managers actually care about—isn't in a documentation system. It's in the product and the team's heads.

None of these moats are absolute. But together, they create a defensible position in a specific vertical. Hupo isn't trying to win the entire AI sales coaching market. It's trying to own banking, finance, and insurance. That's a narrower target but a much more defensible one.

Financial Metrics: The Unit Economics Nobody Talks About

Venture investors often focus on funding amounts and valuations. The actual number that matters for long-term success is unit economics. Does the product make money when you account for sales, implementation, support, and ongoing development costs?

For enterprise Saa S, typical unit economics look like this: customer acquisition cost around

Hupo's expansion ratio—3-8x contract growth in the first six months—suggests healthy unit economics. If a customer signs a contract for

That unit economics indicate the product isn't just theoretically valuable. It's creating measurable ROI for customers. Banks wouldn't expand contracts otherwise.

The Series A funding—

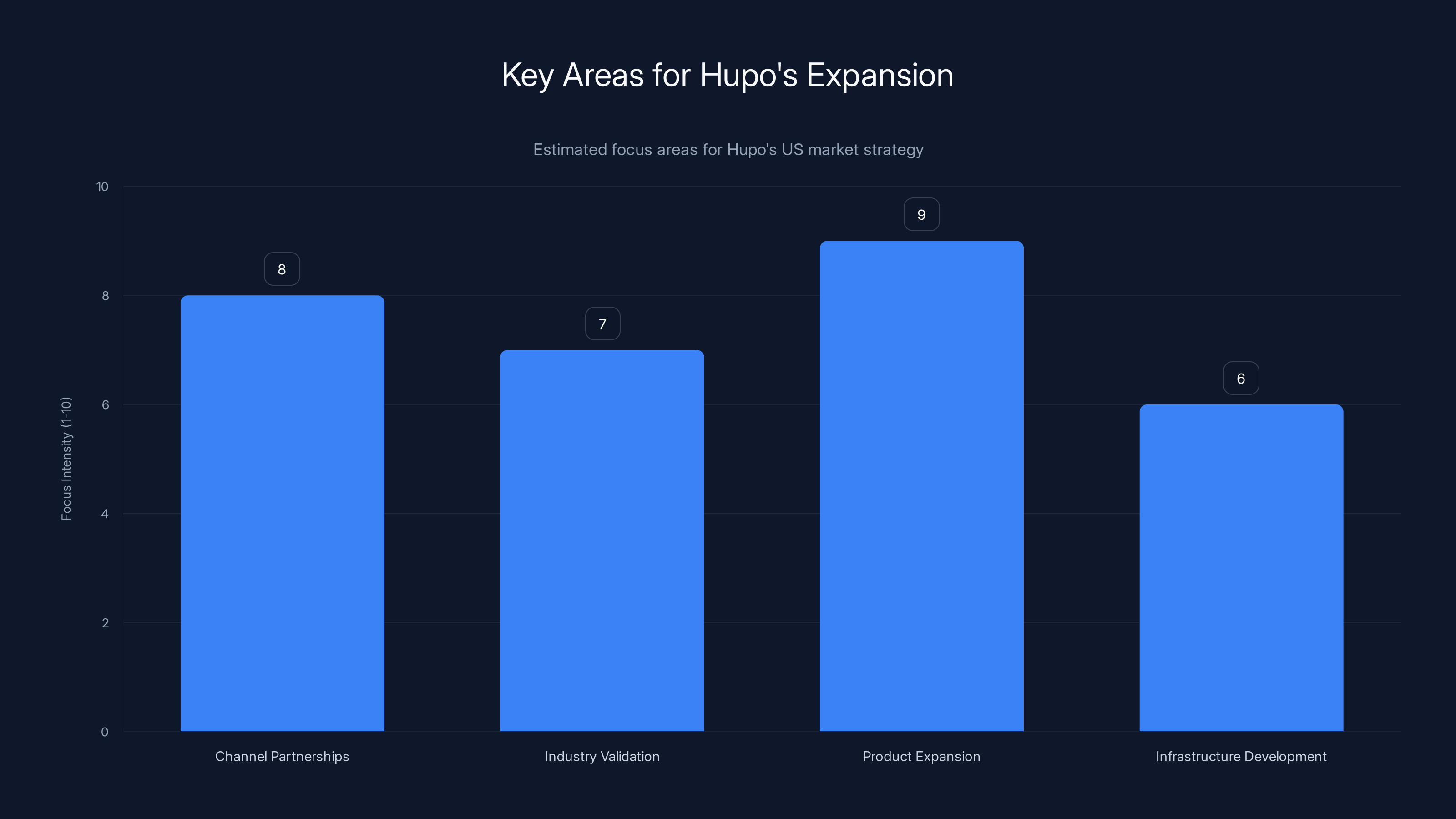

Hupo's expansion into the US market will likely focus heavily on product expansion and channel partnerships, with significant emphasis on industry validation and infrastructure development. Estimated data.

Operational Reality: Building in Singapore, Selling Globally

Hupo is headquartered in Singapore, which is significant. Asia is where the company found its first market. The region's rapid financial digitization, openness to new technology, and large banking sector made it a perfect proving ground.

Singapore specifically is a financial hub. The city-state punches far above its population weight in global finance. It's also a place where fintech is welcomed by regulators. That combination of regulatory support and financial density made it a logical choice for the company's base.

Building in APAC but selling globally requires different infrastructure than a US-centric startup needs. You're managing across time zones, different regulatory frameworks, and diverse financial systems. But you also get earlier exposure to markets that will eventually become as important as the US.

The strategy to expand into the US in the first half of 2025 is a natural progression. Build the product with APAC and European customers. Prove it works across regulatory frameworks. Then attack the largest market with a product that's already been stress-tested in multiple environments.

The Founder Effect: Why Kim's Background Matters

This article repeatedly emphasizes Kim's background because it actually matters. A founder with deep industry experience who understands the customer, the end-user, and the regulatory environment has a massive advantage over a founder who needs to learn those things.

Kim's path—Bloomberg selling to financial services, Viva Republica building with financial services, extensive thinking about human performance—is almost perfectly optimized for building Hupo. He didn't need to hire a VP of Enterprise Sales with banking experience. He had that experience. He didn't need consultants to explain financial regulation. He understood it.

That founder advantage shows up in product development speed, customer understanding, and strategic pivoting. When the company realized Ami wasn't working, Kim could immediately see where the real value was. A founder without that context would need to hire consultants or iterate for months.

The founder effect also shows up in investor confidence. DST Global doesn't lead Series A rounds for teams with weak founder-market fit. The fact that serious institutional investors backed this round suggests they saw a founder who could execute.

What This Means for the AI Startup Category

Hupo's story reveals something important about AI startups in 2025: the winners won't be the companies with the best AI models. They'll be the companies with the best understanding of customer problems and the discipline to focus on specific verticals.

Generic AI is becoming commoditized. Chat GPT, Claude, Gemini—these models are available to anyone with a credit card. The differentiation isn't in the underlying AI anymore. It's in vertical application, regulatory understanding, and customer focus.

Hupo proves that thesis. The company isn't doing anything AI researchers haven't figured out. It's applying known technology to a specific problem in a specific industry with discipline and depth.

That's a different path than many AI startups are taking. The narrative-driven approach is to raise money, hire ML researchers, build features fast, and find customers later. Hupo's approach is to deeply understand customers, build for them with focus, and scale methodically.

Those paths will produce different winners. The fast-moving generalist approach might produce higher valuations short-term. The focused vertical approach produces companies that actually sustain and grow long-term.

The Pivot Lesson: Knowing When to Change Direction

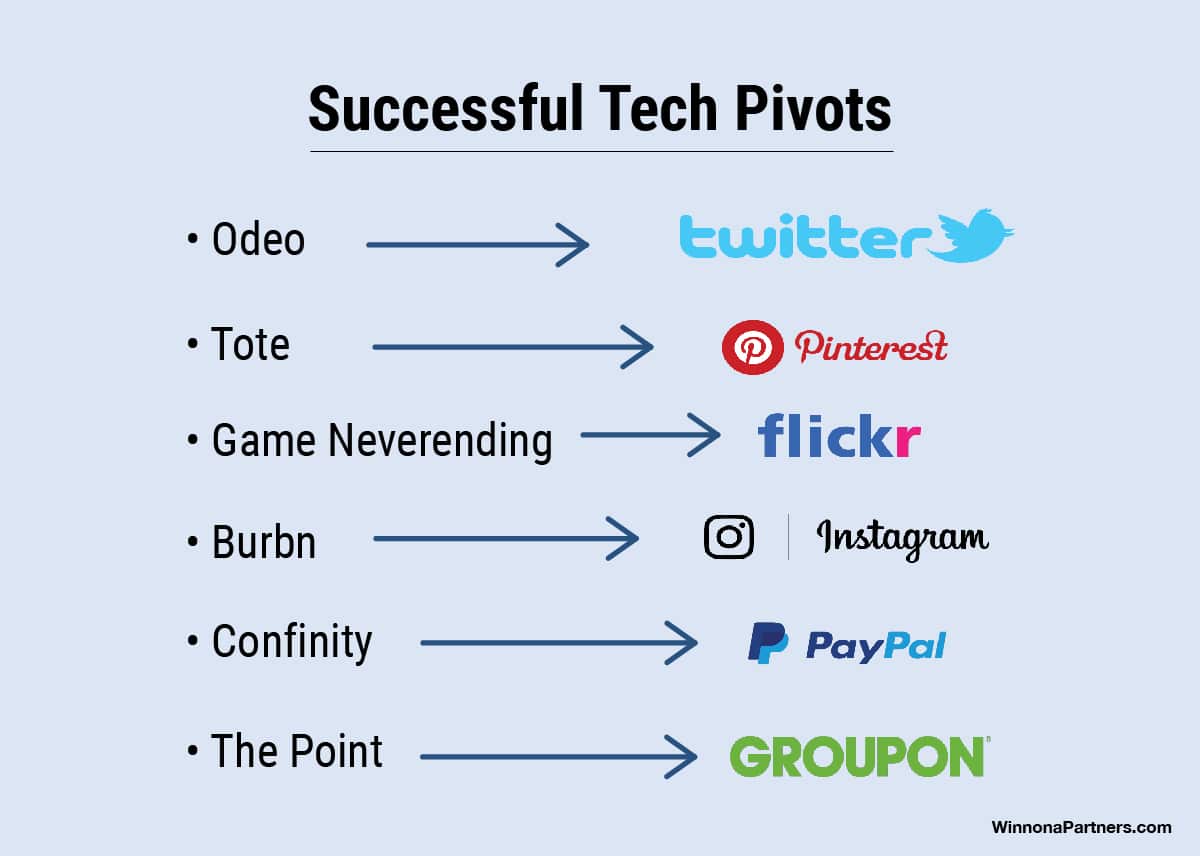

Most startup advice treats pivots as failures. You built the wrong thing, so you're changing course. Hupo's story reframes that narrative.

The company didn't fail with Ami. It succeeded in understanding the core problem—performance at scale—and recognizing that the delivery mechanism needed to change. That's not a failure. That's learning.

The lesson for founders is subtle but important: the problem you're solving and the customer you're solving it for don't always align on your first try. The successful move isn't to defend your original hypothesis. It's to quickly test whether you've actually found product-market fit, and if you haven't, to look at the data and change direction.

Kim did that. He watched Ami's adoption metrics, listened to Meta's feedback about how software actually gets used, and asked the honest question: where is this problem actually acute enough that customers will pay?

Financial services was the answer. Not because it's the only place where the problem exists. But because it's a place where the problem is painful enough to overcome adoption inertia and compliance concerns.

For founders reading this: your first idea probably isn't your best idea. But your observation about what drives human behavior is probably correct. The pivot is finding the right context for that observation.

Looking Forward: What's Next for Hupo

The Series A funding and US expansion launch Hupo into a new phase. The company moves from proving the model works to proving it scales. That's where many startups falter.

Scaling enterprise software into the US requires different go-to-market strategy. European and APAC customers might develop relationships through regional partners or direct outreach. US customers expect channel partnerships, industry analyst validation, and visibility in vendor comparison discussions.

Hupo will need to build that infrastructure. It will also need to expand its product to serve more use cases within banking and insurance. The company started with sales coaching. What about customer service interactions? What about advisor conversations in wealth management? What about compliance training?

The five-year vision of helping large teams perform at scale suggests the company isn't thinking narrowly about one feature set. It's thinking about a platform for performance at scale across regulated industries.

That's where the real value emerges. A tool for sales rep coaching is valuable but limited. A platform that understands regulatory constraints, provides real-time guidance across different role types, and helps managers scale coaching across tens of thousands of people? That's a category-defining company.

Conclusion: The Pivot That Worked Because It Was Honest

Hupo's story matters because it shows that successful pivots aren't desperate last stands. They're strategic refinements of the same core insight when market reality demands it.

Justin Kim founded a company to solve a real problem: human performance doesn't scale. Four years and one pivot later, he's built a company that's proving that insight in the most challenging possible market: regulated financial services.

The journey from Ami to Hupo wasn't about abandoning the original thesis. It was about recognizing that the thesis applied most acutely in a specific vertical where customers would pay for the solution, where the pain was acute, and where domain expertise created defensibility.

That honesty—about what was working, what wasn't, and where the real value lay—is why the company secured $15M in funding, why major financial institutions are trusting the system with sensitive conversations, and why the Series A lead investor is a firm that invests in platform-sized businesses.

As AI matures from a novelty into a utility, the companies that win will be those built on this same foundation: deep understanding of customer problems, discipline in vertical focus, and honest assessment of what's actually working. Hupo got those right. That's why the pivot worked.

FAQ

What is AI sales coaching and how does it differ from traditional coaching methods?

AI sales coaching uses artificial intelligence to provide real-time guidance to sales representatives during customer conversations, analyzing language patterns, objection handling, and regulatory compliance. Unlike traditional external coaching that might work with a few high-potential reps annually, AI coaching reaches entire sales teams consistently, provides immediate feedback when it matters most, and operates at a fraction of the cost of human coaches. Traditional coaching is reactive and selective. AI coaching is proactive and scalable.

How does Hupo's product actually work in banking and insurance environments?

Hupo embeds AI coaching into the sales workflow by processing conversations in real-time, flagging potential compliance issues, suggesting improved responses to common objections, and providing managers with data about performance patterns across their teams. The system doesn't replace human judgment. It augments it by providing context, suggesting alternatives, and alerting managers to moments where additional coaching might help. The technology is trained specifically on financial products, regulatory language, and client objections common in banking and insurance so that the suggestions are relevant and compliant.

Why did Hupo focus on banking and insurance instead of pursuing a broader market?

Financial services faced a specific convergence of pain points: sales teams are geographically dispersed, regulatory requirements demand consistency, customer expectations are high, and traditional coaching couldn't scale. Additionally, Kim's previous experience at Bloomberg and Viva Republica gave him deep understanding of how these institutions operate, what their budgets prioritize, and what compliance actually requires. Building for a specific vertical created defensibility, enabled faster implementation, and aligned with where the problem was most acute.

What does the 3-8x contract expansion metric actually mean for enterprise Saa S success?

When customers expand contracts 3-8x within six months, it demonstrates that the initial solution created measurable value. In enterprise Saa S, this kind of expansion indicates healthy unit economics, strong product-market fit, and customer willingness to invest more money because they're seeing real ROI. Businesses don't expand spending on solutions that don't work. This metric is a proxy for customer satisfaction and business impact that's more reliable than customer count alone.

How does Hupo protect customer data and maintain compliance with financial regulations?

Regulatory compliance is built into the system architecture from the ground up, not added later. Hupo's models are trained on financial regulation and understand compliance requirements in different contexts. The system can flag language that might violate regulations, help reps maintain compliant communication, and maintain audit trails for compliance verification. Data handling follows financial services standards for encryption, access control, and retention. The product is designed with regulatory requirements in mind rather than despite them.

What does the future vision of helping teams "perform at scale" across tens of thousands of people entail?

Kim's vision extends beyond individual sales rep coaching to a platform that helps large organizations improve performance across different roles and contexts. This could include customer service interactions, advisor conversations in wealth management, training delivery, internal communication, or compliance processes. The underlying technology—understanding conversations, identifying performance gaps, providing real-time guidance—works across these scenarios if trained appropriately. The vision is about becoming a performance platform for regulated industries rather than a single-feature sales coaching tool.

Why did DST Global Partners lead the Series A round, and what does that signal about Hupo's trajectory?

DST Global invests in global technology platforms with durable business models and strong unit economics, not experimental products. The firm's decision to lead the round signals investor confidence that Hupo has achieved product-market fit, has proven unit economics that can support scale, and operates in a large addressable market. DST's involvement also suggests the firm believes Hupo can become a category leader in AI coaching for regulated industries, not just a moderately successful tool.

How does being headquartered in Singapore affect Hupo's business model and go-to-market strategy?

Singapore is a global financial hub with strong regulatory support for fintech innovation, making it an ideal base for a financial services software company. Building in APAC allowed Hupo to test its product in multiple regulatory environments before scaling globally. The region also has high digital adoption in financial services, which accelerated customer willingness to experiment with new tools. The strategy to expand to the US in 2025 builds on the foundation of proven products and operational understanding developed in APAC and Europe.

What competitive advantages would prevent other well-funded startups from entering and dominating the AI sales coaching market?

Hupo has built several defensible moats: trained AI models based on thousands of real financial services conversations that competitors can't easily replicate, deep domain expertise in banking and insurance that requires specialized hiring, embedded customer relationships in major financial institutions that create switching costs, and proprietary product knowledge about what actually works in this vertical. These advantages compound—more customers mean more training data, which means better models, which means easier customer acquisition. A competitor could theoretically build similar technology but would need to recreate all these advantages simultaneously, which is expensive and time-consuming.

How does Hupo's approach to building for manager workflows rather than just rep workflows improve adoption rates?

Most sales tools focus on frontline reps because they're the users. But managers are the ultimate customers who approve spending, mandate adoption, and determine whether a tool gets deployed across teams. Hupo built equal focus on manager functionality: dashboards showing which reps struggle with specific objections, reports identifying training gaps, and alerts helping managers know when to coach directly. When the tool makes managers' jobs easier and helps them lead more effectively, they enthusiastically adopt it. That adoption support cascades to reps, who use the system more fully.

Key Takeaways

- Hupo pivoted from mental wellness platform Ami to AI sales coaching for financial services after recognizing the performance problem was more acute in banking and insurance

- The company secured 15M funding) with enterprise customers achieving 3-8x contract expansion within six months

- Founder Justin Kim's background spanning Bloomberg enterprise sales, Viva Republica fintech product, and performance psychology created ideal founder-market fit

- Hupo differentiates by training AI models specifically on financial products, regulatory requirements, and banking-specific objections rather than using generic sales coaching

- The expansion strategy builds in APAC/Europe first to prove the model, then enters US market where distribution-heavy financial models create urgent demand for scalable coaching

Related Articles

- AI Factories: The Enterprise Foundation for Scale [2025]

- Articul8 Series B: Intel Spinoff's $70M Funding & Enterprise AI Strategy

- Nvidia Cosmos Reason 2: Physical AI Reasoning Models [2025]

- Nvidia Vera Rubin AI Computing Platform at CES 2026 [2025]

- How Much Equity to Give First Employees: Real Data & Framework [2025]

- Qwen-Image-2512 vs Google Nano Banana Pro: Open Source AI Image Generation [2025]

![Hupo's AI Sales Coaching Pivot: From Mental Wellness to $15M Startup [2025]](https://tryrunable.com/blog/hupo-s-ai-sales-coaching-pivot-from-mental-wellness-to-15m-s/image-1-1768278966685.jpg)