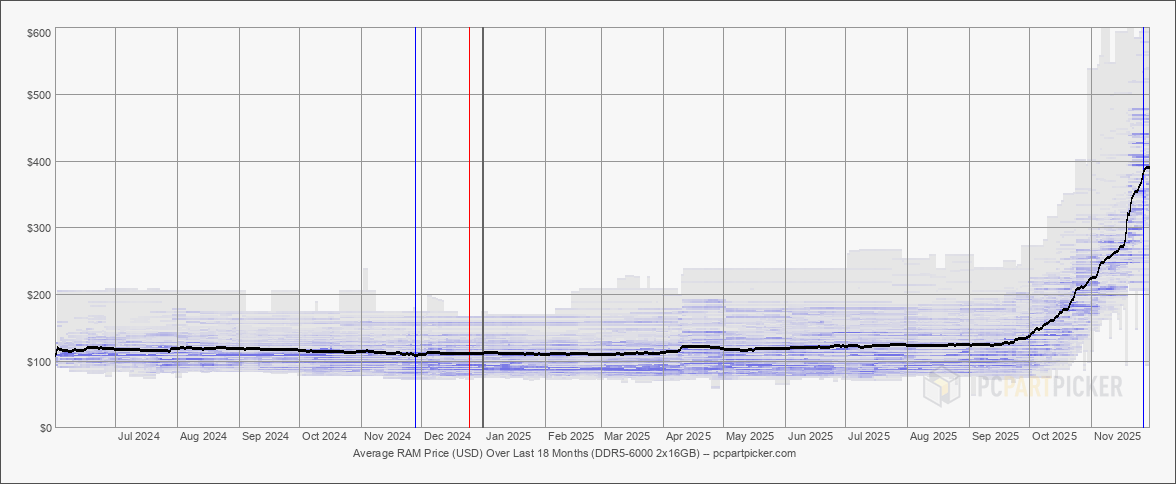

The Perfect Storm: Why DDR5 Prices Are About to Explode

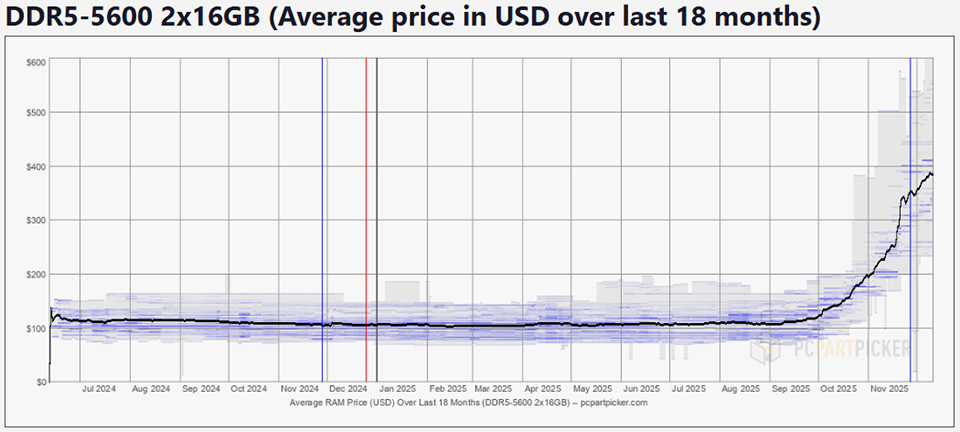

Remember when DDR5 was the exciting new thing? Fast, efficient, future-proof. Now it's become the technology equivalent of a luxury car that only billionaires can afford. And if industry analysts are right, 2026 is going to make today's prices look like a bargain basement sale.

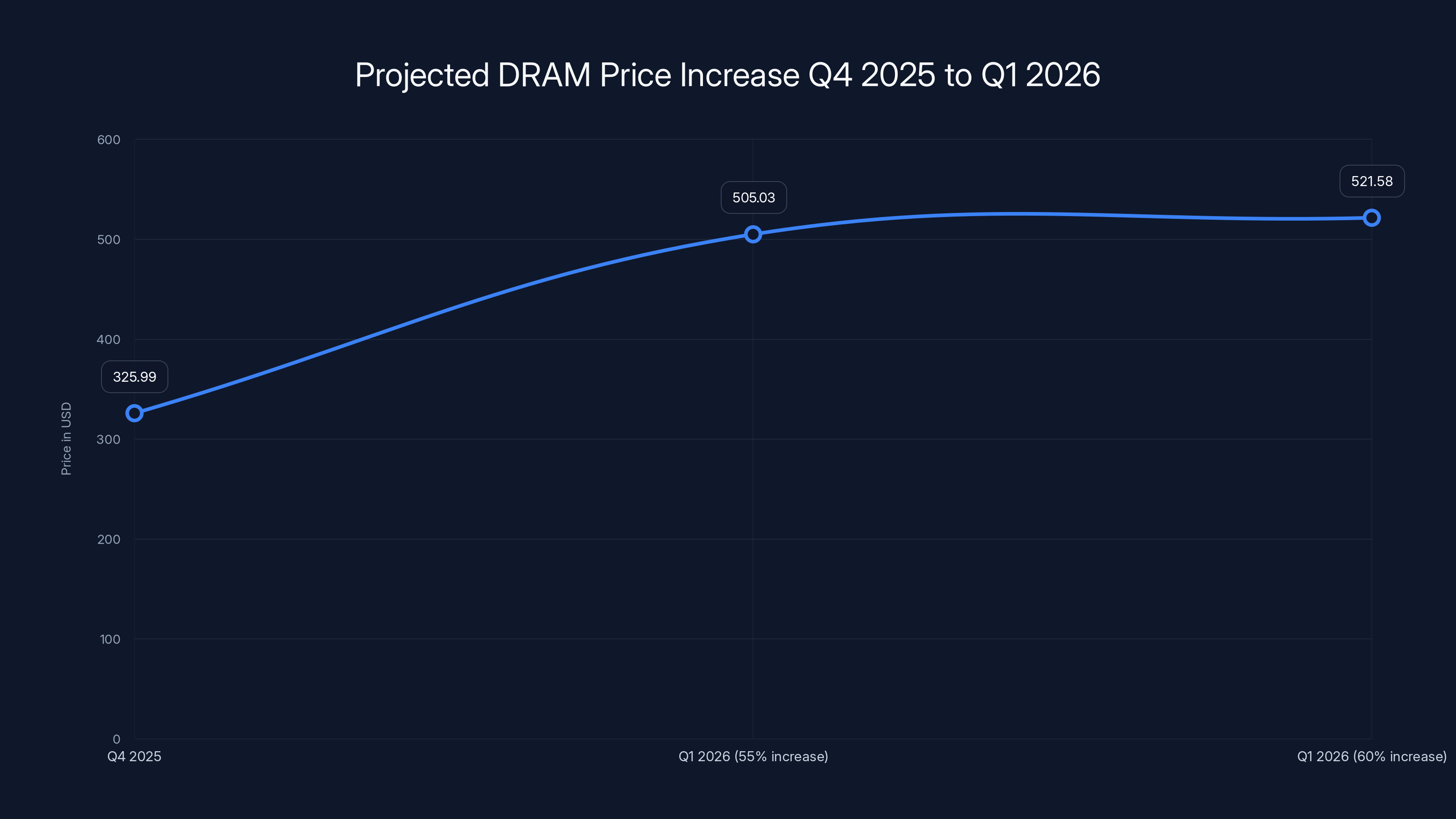

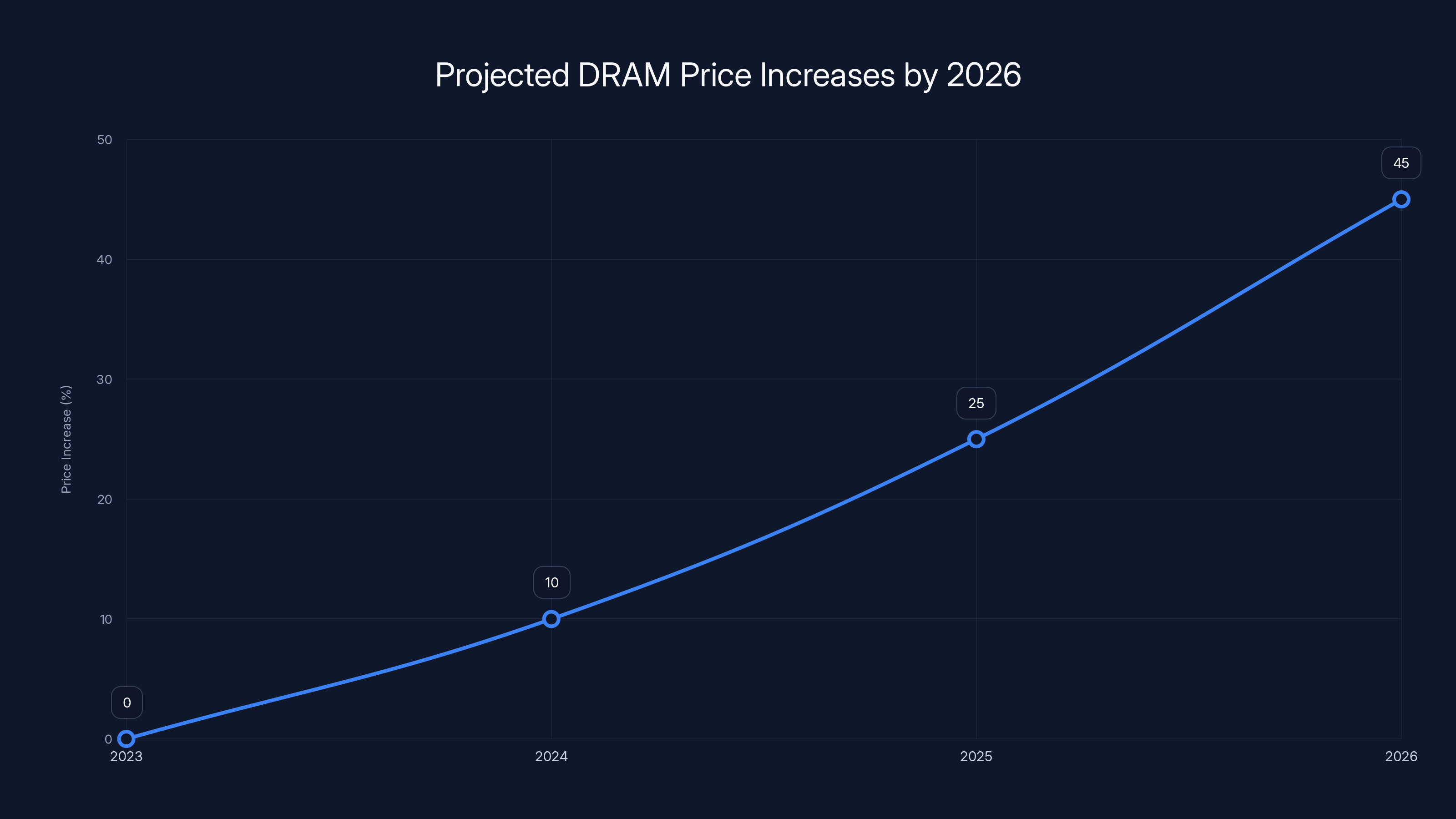

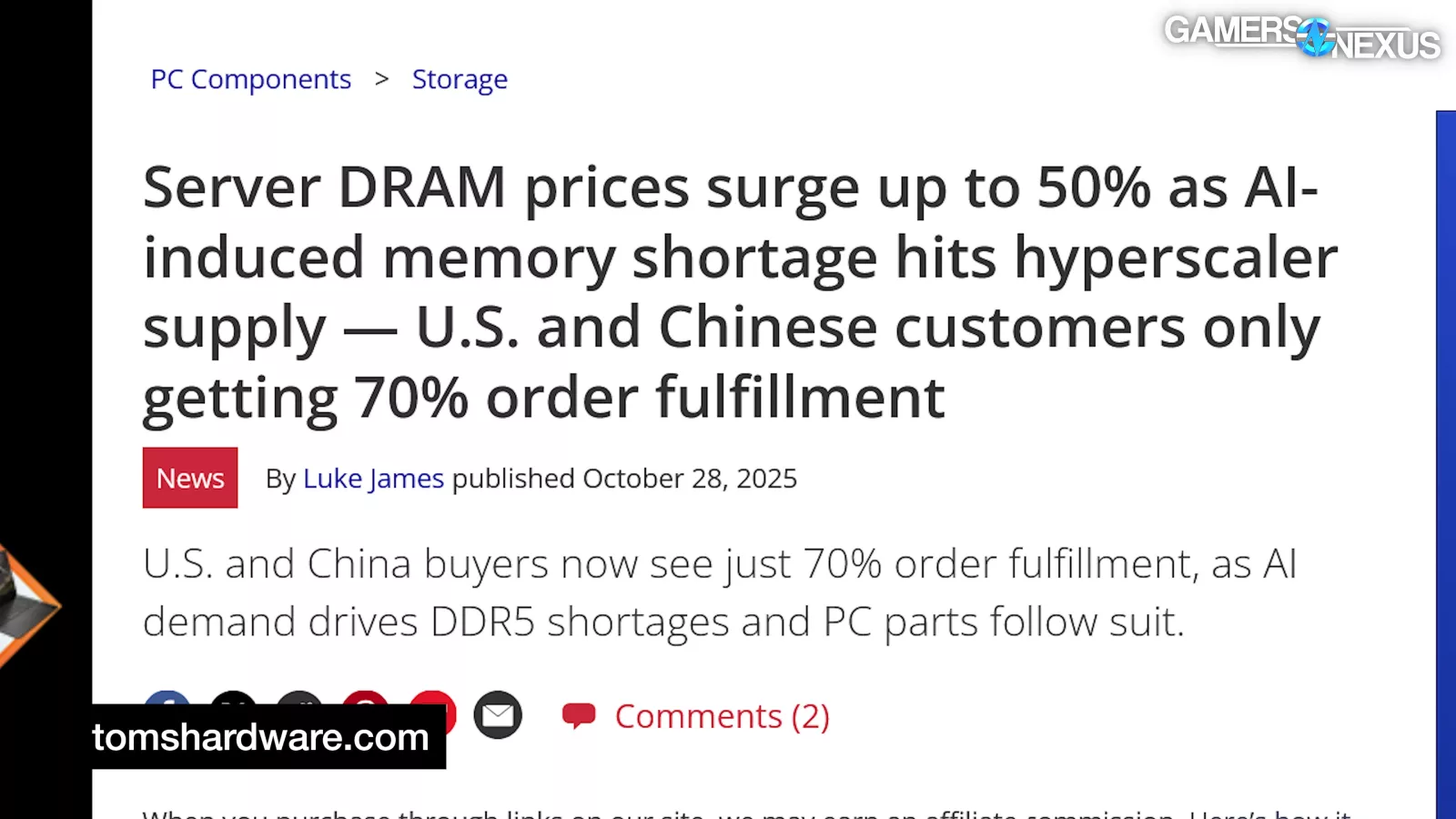

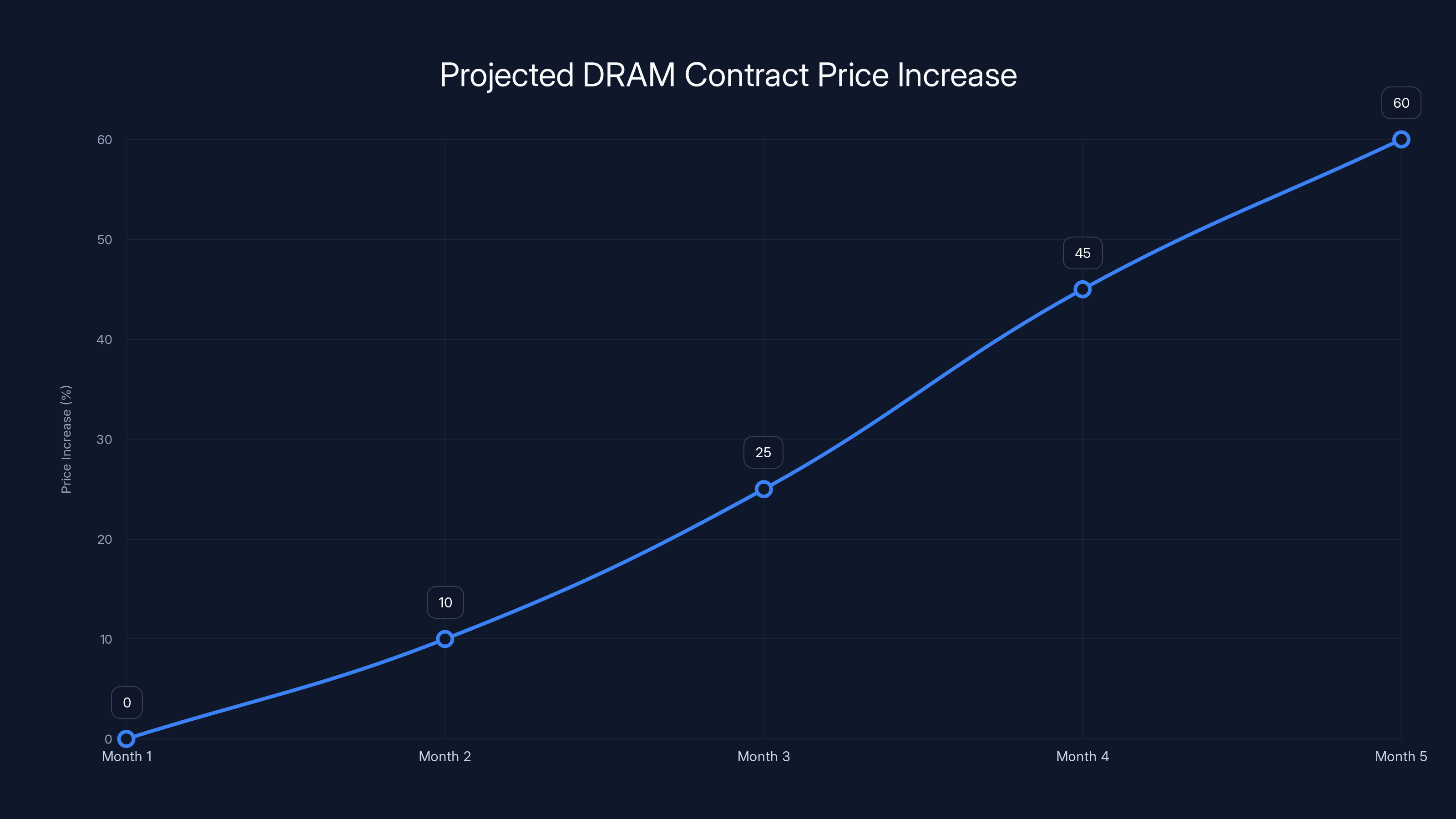

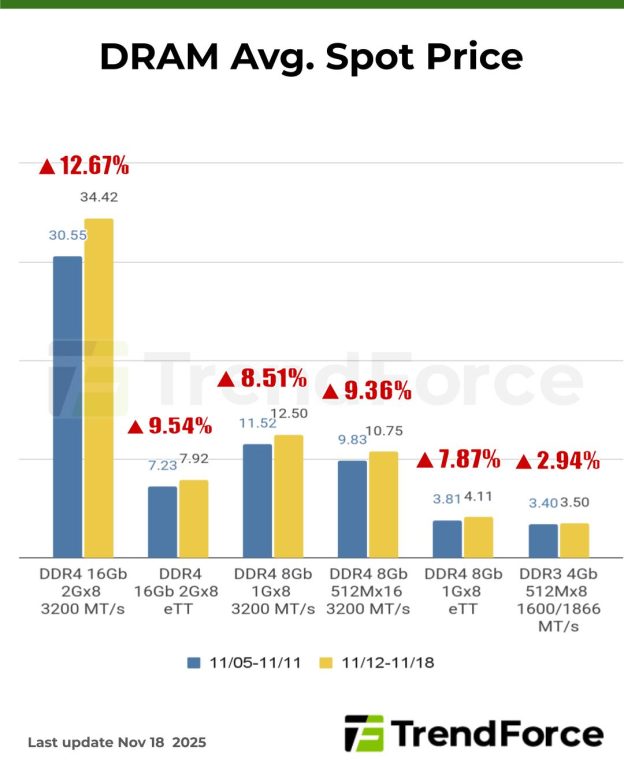

Here's the situation: DRAM memory is getting expensive, and it's about to get a lot worse. We're not talking about a gradual 5-10% increase. Industry analysts at TrendForce are predicting a 55-60% price jump in the first quarter of 2026 alone. That's not a normal market fluctuation. That's a supply shock.

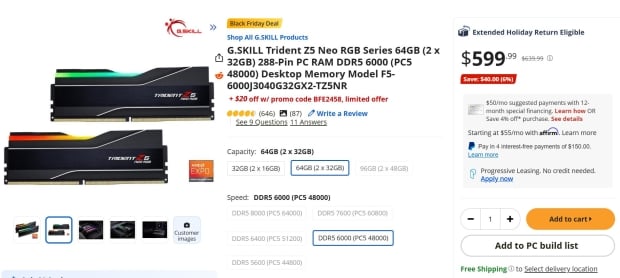

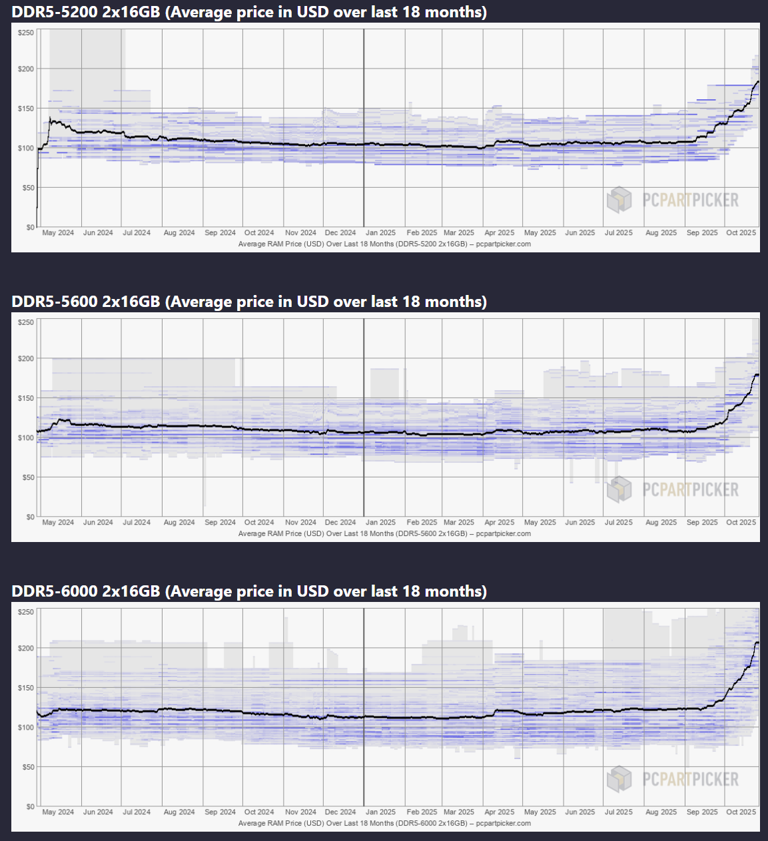

To put this in perspective, a single 32GB DDR5-5200 module currently costs around

The culprit? It's not one thing. It's several things converging at exactly the wrong time. Server manufacturers are vacuuming up available DRAM supply. AI companies are demanding specialized memory faster than chip makers can produce it. Memory manufacturers are pivoting toward high-margin server products, which means consumer RAM takes a back seat. And the production facilities themselves can only make so much memory, regardless of demand.

What makes this situation particularly painful is that DDR5 shares production capacity with server memory and HBM (High Bandwidth Memory) products. When demand for those skyrockets, consumer DDR5 supply tightens immediately. This isn't speculation or doom-saying—it's basic supply chain economics. When premium products command higher margins, manufacturers follow the money.

The real question isn't whether prices will rise. They will. The question is how much this affects you, how long it lasts, and what you can actually do about it. Let's break it down.

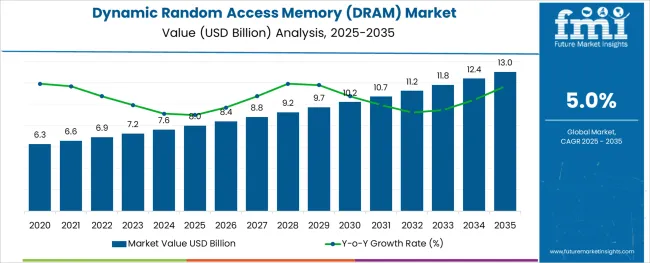

Understanding the DRAM Market Dynamics: It's More Complex Than You Think

DRAM pricing isn't straightforward. It's not like buying a cup of coffee, where price = supply divided by demand. The memory market operates on contract pricing, spot pricing, and speculative inventory movements. It's messy, interconnected, and heavily influenced by decisions made thousands of miles away in fabs you've never heard of.

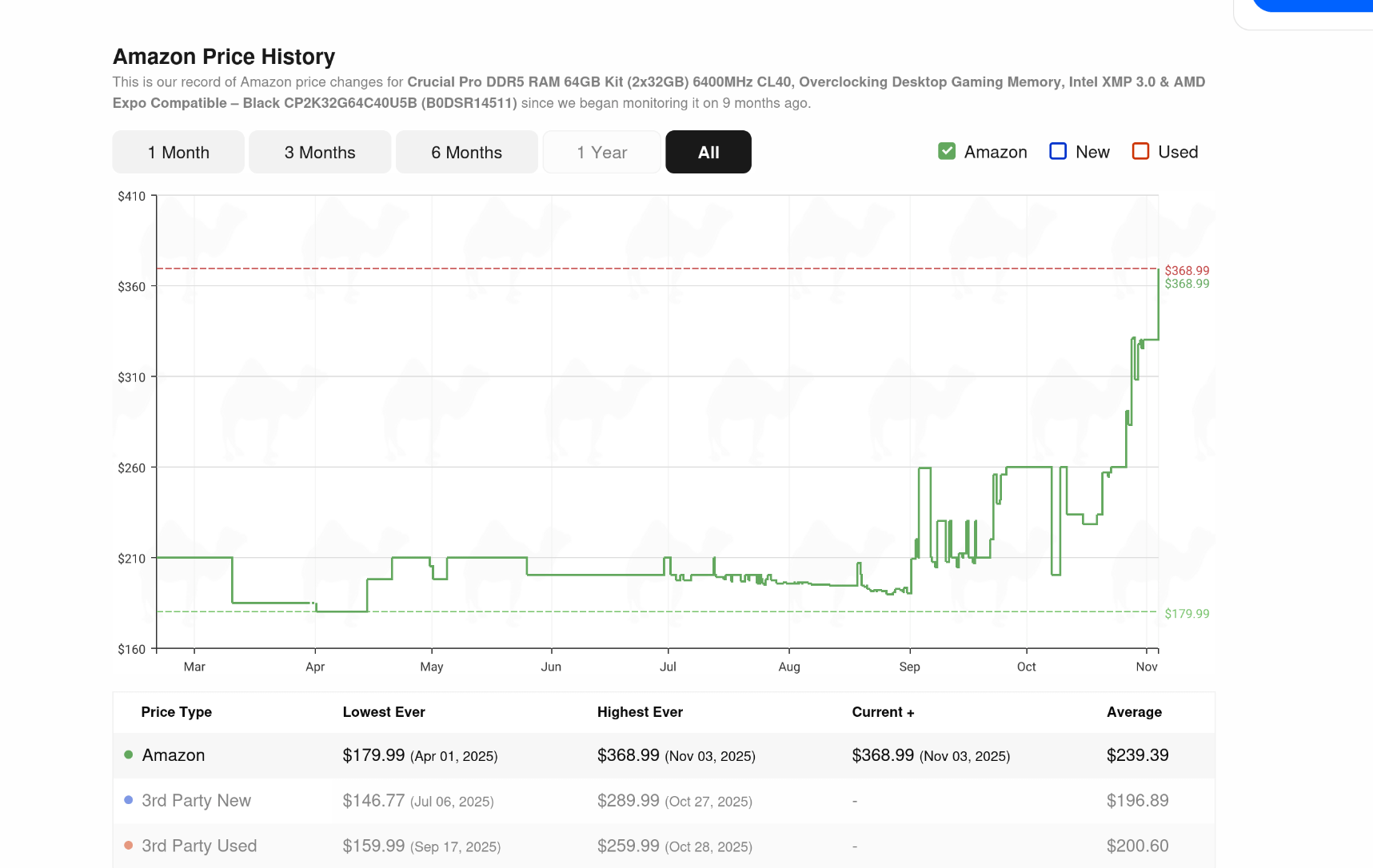

When TrendForce predicts a 55-60% increase in contract pricing, they're talking about the wholesale prices that memory manufacturers charge to system builders, OEMs, and distributors. These aren't retail prices. But here's the thing: retail prices follow contract prices. Maybe not immediately, maybe not perfectly, but they follow.

Think of contract pricing as the wholesale market. It's where the real transactions happen. OEM partners who buy in massive volumes negotiate bulk rates. Once those negotiations conclude and contracts lock in at higher prices, you start seeing retail prices climb within a few weeks.

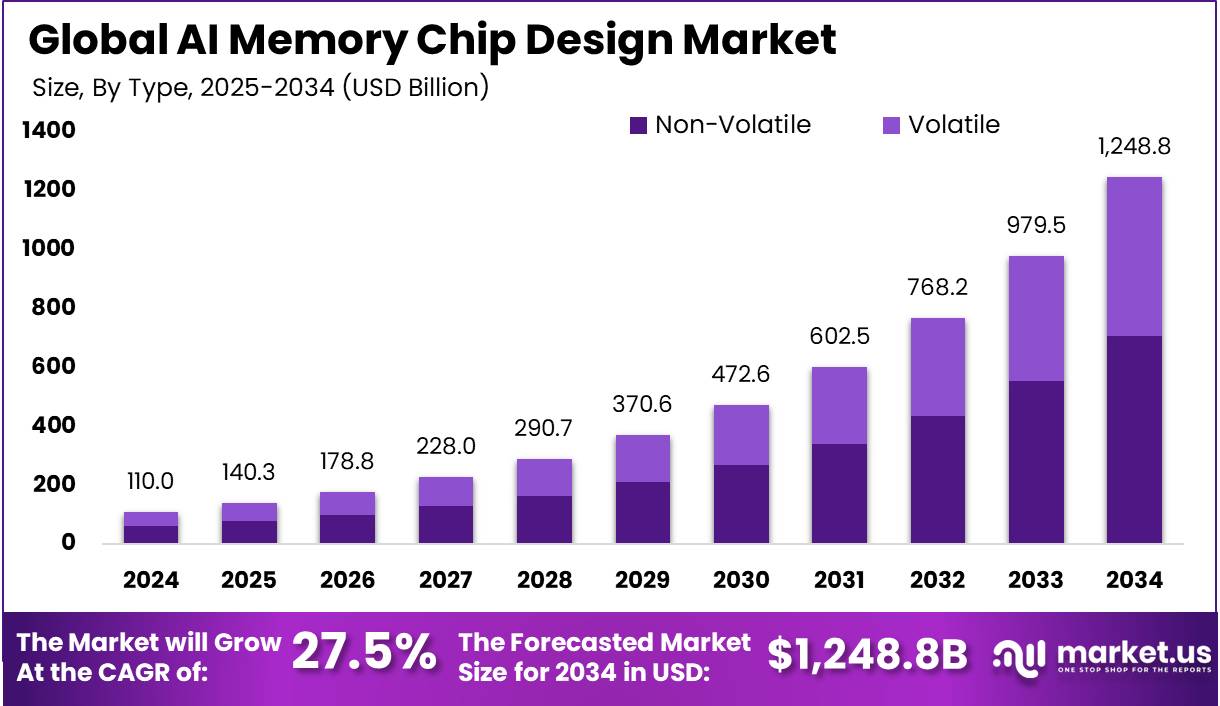

The server market is the primary driver here. Data centers around the world are expanding like never before. Cloud providers are building out capacity to handle artificial intelligence workloads, which require enormous amounts of memory. A single AI training cluster might consume terabytes of DDR5. One. Single. Project. Multiply that across dozens of major projects at Meta, Google, OpenAI, Anthropic, and countless other companies, and you understand why server memory demand is through the roof.

But here's where it gets weird: even in sectors where server demand has softened, supply constraints are still pushing prices upward. It's a cascading effect. When the premium segment (servers, HBM, AI accelerators) absorbs most available capacity, the lower-margin consumer segment loses out. Not because demand for consumer RAM exploded, but because the supply pipeline was diverted upstream.

And manufacturers aren't going to maintain low prices on consumer DDR5 just because. If they can sell every chip they produce to server OEMs at premium prices, that's where the profit is. Consumer DDR5 becomes secondary.

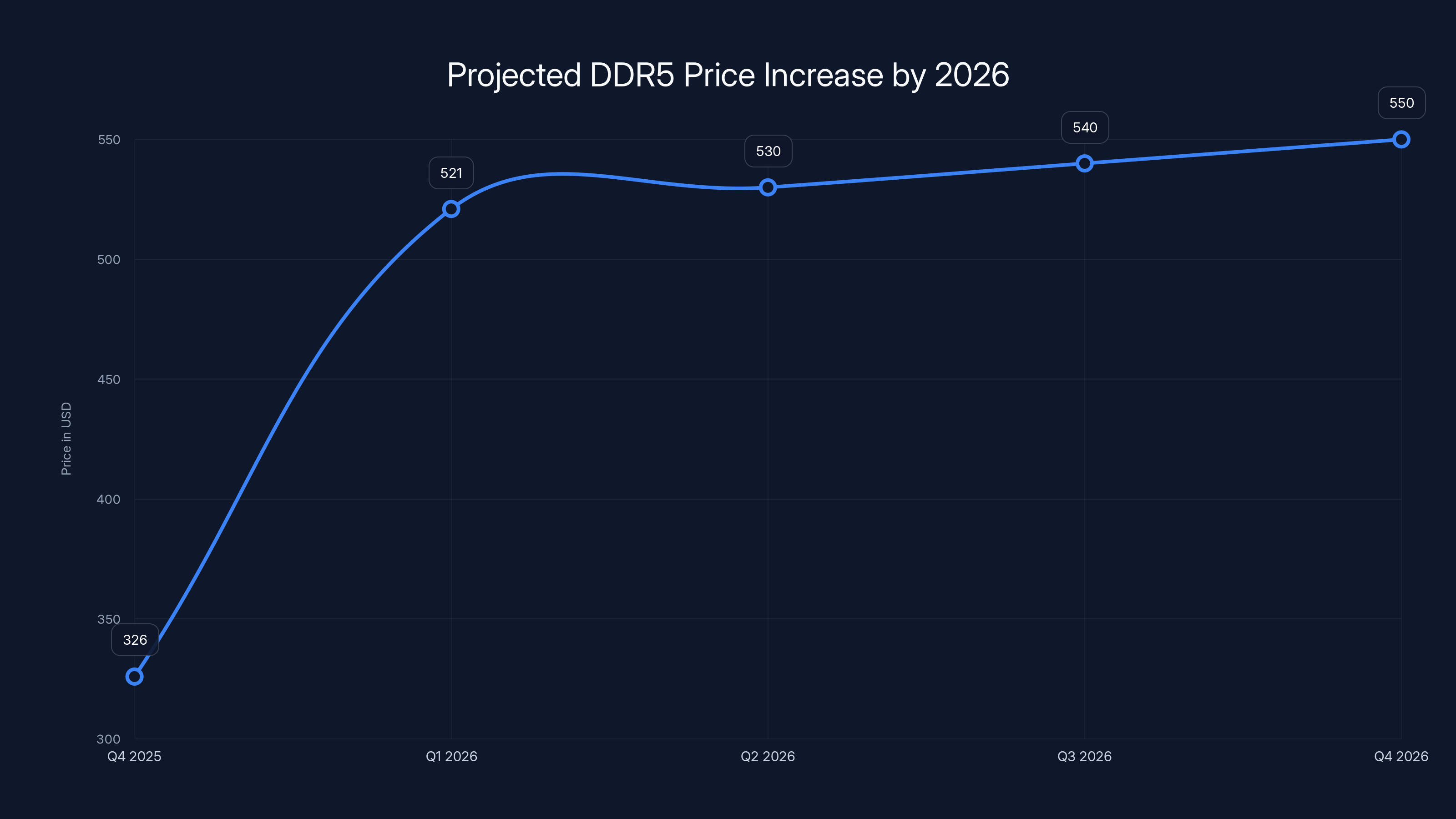

TrendForce predicts a significant 55-60% increase in DRAM contract prices from Q4 2025 to Q1 2026. This translates to retail prices exceeding $500 for a 32GB module.

The Server Memory Takeover: Why AI Changed Everything

Five years ago, server memory demand was stable and predictable. Data centers refreshed on cycles. Cloud providers planned capacity months or years ahead. It was boring, reliable, and profitable in a steady-state way.

Then artificial intelligence exploded.

Suddenly, data centers needed more memory than anyone anticipated. Training large language models, running inference clusters, building embeddings databases—all of this is memory-intensive in ways traditional workloads aren't. A traditional database server might use 256GB of DDR4. An AI training cluster might use 2TB. Per server. There are hundreds of servers in a single cluster.

This created an absolute avalanche of demand. Manufacturers couldn't have predicted this. They ramped up production, but fabs take years to build and billions of dollars to construct. You can't just flip a switch and increase DRAM output by 40% overnight.

Meanwhile, HBM (High Bandwidth Memory) demand exploded even faster. This is specialized memory used in AI accelerators like NVIDIA's flagship GPUs. HBM is high-margin, high-demand, and uses some of the same production facilities as DDR5. When HBM needs capacity, DDR5 production suffers.

Memory manufacturers face a simple calculation: produce DDR5 for consumer builds and earn modest margins, or pivot capacity toward server DDR5, HBM, and specialized memory products and earn 2-3x the margin. Every single manufacturer chose the second option. And they're right to do so from a business perspective.

Consumer DDR5 demand hasn't actually skyrocketed. PC sales are steady or declining in many markets. Gaming hasn't surged. Professional workstations haven't multiplied. The demand for consumer DDR5 is actually reasonable. The problem is that supply has been diverted away from the consumer segment toward more profitable server applications.

This is critical to understand: the price increase you're seeing isn't driven by soaring consumer demand. It's driven by supply constraints caused by manufacturer prioritization of higher-margin products. If consumer demand had exploded, at least you could argue that was justified. But this is artificial scarcity, created by rational business decisions that happen to hurt consumers.

The Math Behind the Prediction: Breaking Down TrendForce's Forecast

Let's look at the actual numbers. TrendForce, a reputable Taiwan-based market research firm, predicted that DRAM contract prices would rise 55-60% in Q1 2026 compared to Q4 2025. That's not a typo. That's not speculation. That's their formal market forecast.

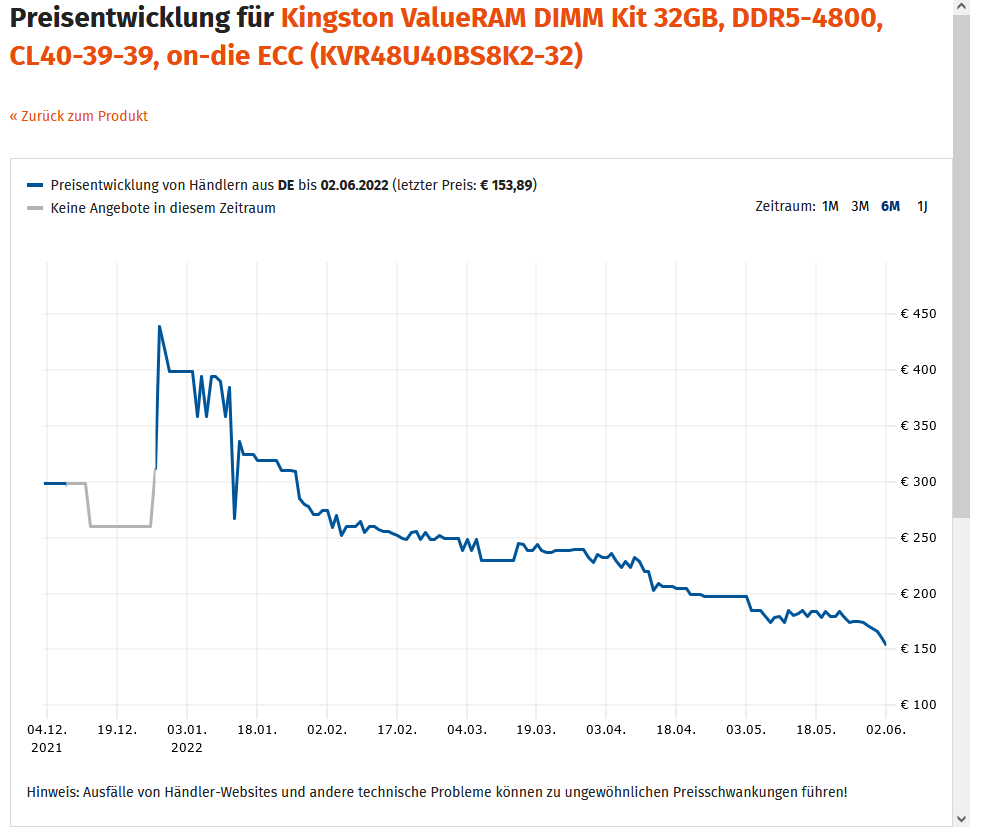

To understand whether this is reasonable, we need to look at historical context. DRAM prices do fluctuate. In 2018, DRAM prices fell 50% year-over-year as supply caught up with demand. In other years, prices rose 30-40%. A 55-60% jump in a single quarter is extreme but not unprecedented in DRAM history.

Here's the math for retail pricing. Using the Patriot Viper Venom 32GB DDR5-5200 as a baseline at $325.99:

Scenario 1: Conservative 55% increase

Scenario 2: Upper range 60% increase

These are the ballpark figures we're discussing. Not

Now, here's the critical caveat that everyone needs to understand: TrendForce's forecast is about contract pricing. The actual retail increase might be somewhat lower. Memory module makers might absorb some costs, or they might try to avoid total sticker shock by spreading increases over time. But the direction is clear, and the magnitude will be significant.

Why would manufacturers not immediately pass along every cent of the price increase? Mostly because of competitive pressure. If Kingston raises prices 60% but Crucial only raises 50%, consumers buy Crucial. So there's a race to the bottom where manufacturers try to balance cost recovery with market share maintenance.

But there's only so much margin to absorb. At some point, if wholesale costs rise dramatically, retail prices have to follow. And we're talking about a point where wholesale costs are rising by more than half in a quarter.

DDR5 prices are projected to increase by 55-60% by the end of 2026 due to supply-demand imbalances driven by server and AI infrastructure demand. Estimated data.

What About DDR4? Why That's Getting Expensive Too

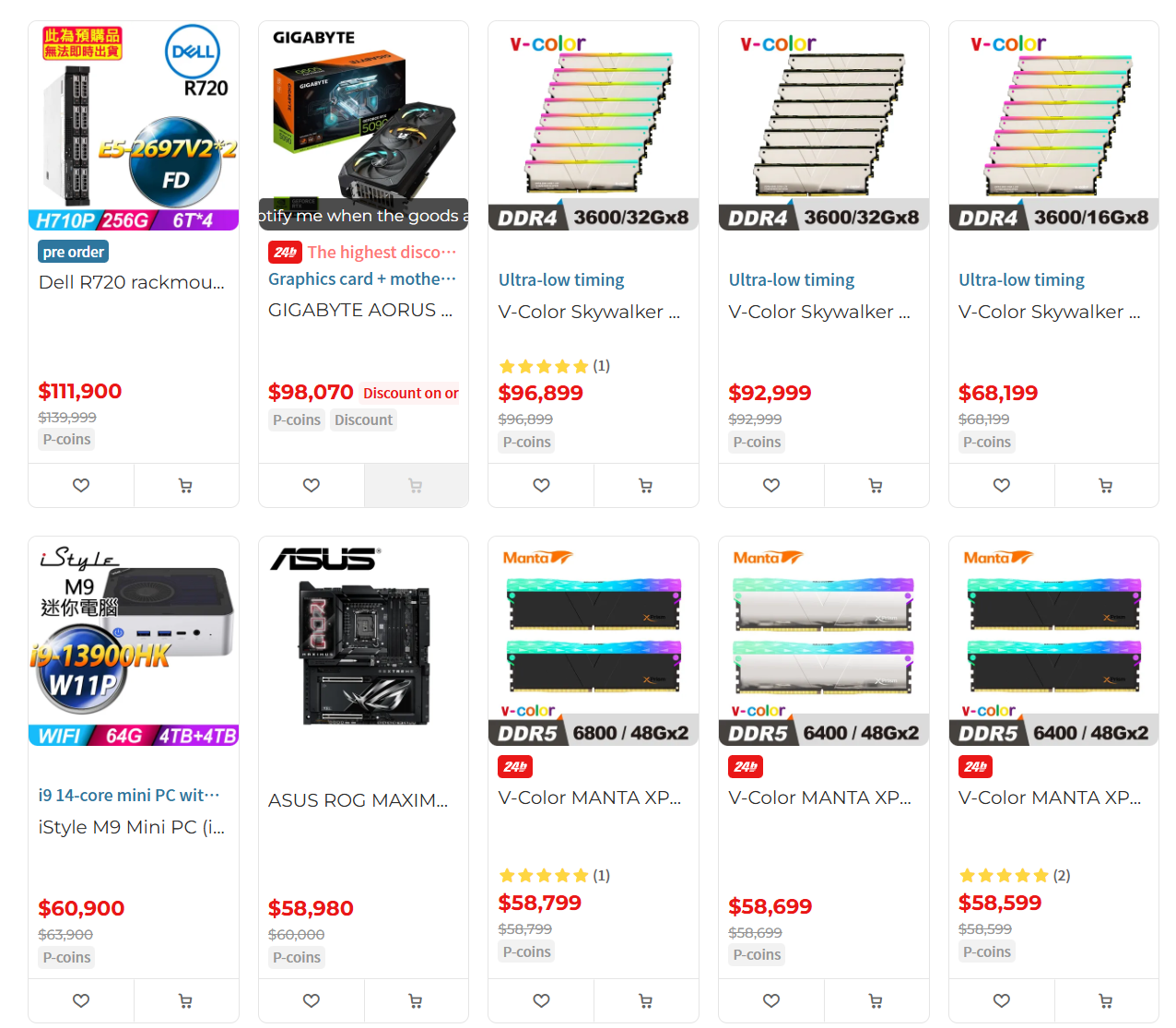

You might be thinking: "Okay, I'll just stick with DDR4." Good news: DDR4 is cheaper than DDR5. Bad news: DDR4 is also getting expensive.

Why? Because some of the same factories produce both DDR4 and DDR5. Server demand for DDR4 is still substantial (lots of older systems, lots of specialized applications that prefer mature nodes). So DDR4 supply is also being constrained.

Additionally, DDR4 inventory levels are lower than they used to be. Manufacturers stopped producing it at high volumes about two years ago, assuming everyone would migrate to DDR5. That was a miscalculation. Turns out, lots of builders prefer DDR4 because it's cheaper and compatible with older hardware. Now supply is tight.

Expect DDR4 prices to rise too, maybe not as dramatically as DDR5, but noticeably. The "just buy DDR4" workaround is less of a workaround and more of a tactical retreat.

NAND Flash: The Secondary Shock

While the DDR5 story dominates, there's another memory crisis developing in parallel: NAND flash pricing. This affects SSDs, and if you're building a PC, SSDs are kind of essential.

TrendForce forecasts client SSD prices climbing 40% quarter-over-quarter. That's not as severe as DRAM, but it's still significant. A 2TB SSD that costs

The dynamics are slightly different. NAND flash prices are driven more by actual supply-demand balance than DRAM prices are. The difference is that storage demand isn't growing as fast as memory demand. SSDs are mature products. Most people have enough storage. But supply is tightening anyway.

Why? Manufacturing constraints. Fab capacity is being allocated toward products with better margins. And like DRAM, manufacturers are shifting toward server-grade storage products that have higher price points.

So if you're building a system in 2026, you're not just looking at expensive RAM. You're also looking at expensive storage. CPU and GPU prices might be reasonable, but the memory subsystem is going to hurt.

Historical Context: Have We Seen This Before?

This isn't the first DRAM crisis. Memory markets are cyclical. We've had shortage cycles, glut cycles, and everything in between.

In 2017-2018, DRAM prices surged. A 16GB DDR4 kit that cost

But this situation is different. Previous surges were often driven by miscalculations in supply planning or cyclical demand changes. This surge is structural. It's not a temporary blip. It's driven by a fundamental shift in computing architecture toward AI workloads that require enormous amounts of memory, and those workloads aren't going away.

When AI demand diminishes, DRAM prices might stabilize. But AI demand isn't diminishing. It's accelerating. Every major tech company is doubling down on AI infrastructure. This suggests the memory shortage could persist for longer than previous cycles.

DRAM prices are projected to increase significantly by 2026, with retail prices for 32GB DDR5 kits expected to rise by 40-50%. Estimated data.

GPU Prices vs. RAM Prices: A Fascinating Comparison

Here's something that should blow your mind. Right now, a high-end RTX 5090 costs around

Traditionally, GPUs are the expensive part. RAM is the cheap part. If your GPU costs

This creates interesting build constraints. Builders will have to budget more carefully. A balanced system that cost

For professional workstations and servers, the math gets even worse. A workstation with 256GB of RAM could cost tens of thousands of dollars just for the memory alone. That's genuinely impactful for companies making infrastructure decisions.

Supply Chain Responses: Are Manufacturers Doing Anything?

Memory manufacturers aren't stupid. They see the same demand signals everyone else does. The question is: what are they doing about it?

The answer is: what they can. Samsung, SK Hynix, and Micron (the three major DRAM makers) are all increasing production. But increasing fab capacity takes time. A new DRAM fab costs $10-20 billion and takes 3-5 years to build and ramp up to full production. You can't solve a 2026 shortage with 2026 investment. You needed to invest in 2021 or 2022, and honestly, nobody predicted AI would explode quite this hard.

What they're doing instead is optimizing existing capacity. Running more shifts, increasing yields, streamlining processes. But there's a limit to how much you can squeeze from existing fabs without compromising quality or reliability.

Some manufacturers are also shifting their product mix. Instead of making lots of standard DDR5, they're making higher-margin specialty products. This exacerbates the consumer DDR5 shortage, but it's the profitable choice.

The industry response is basically: "We'll make more, but it'll take a couple years. In the meantime, prices are going up." That's honest, and it's also unhelpful if you need to build a PC in 2026.

What This Means for PC Builders: The Real Impact

Let's talk about what this actually means for you if you're building or upgrading a PC.

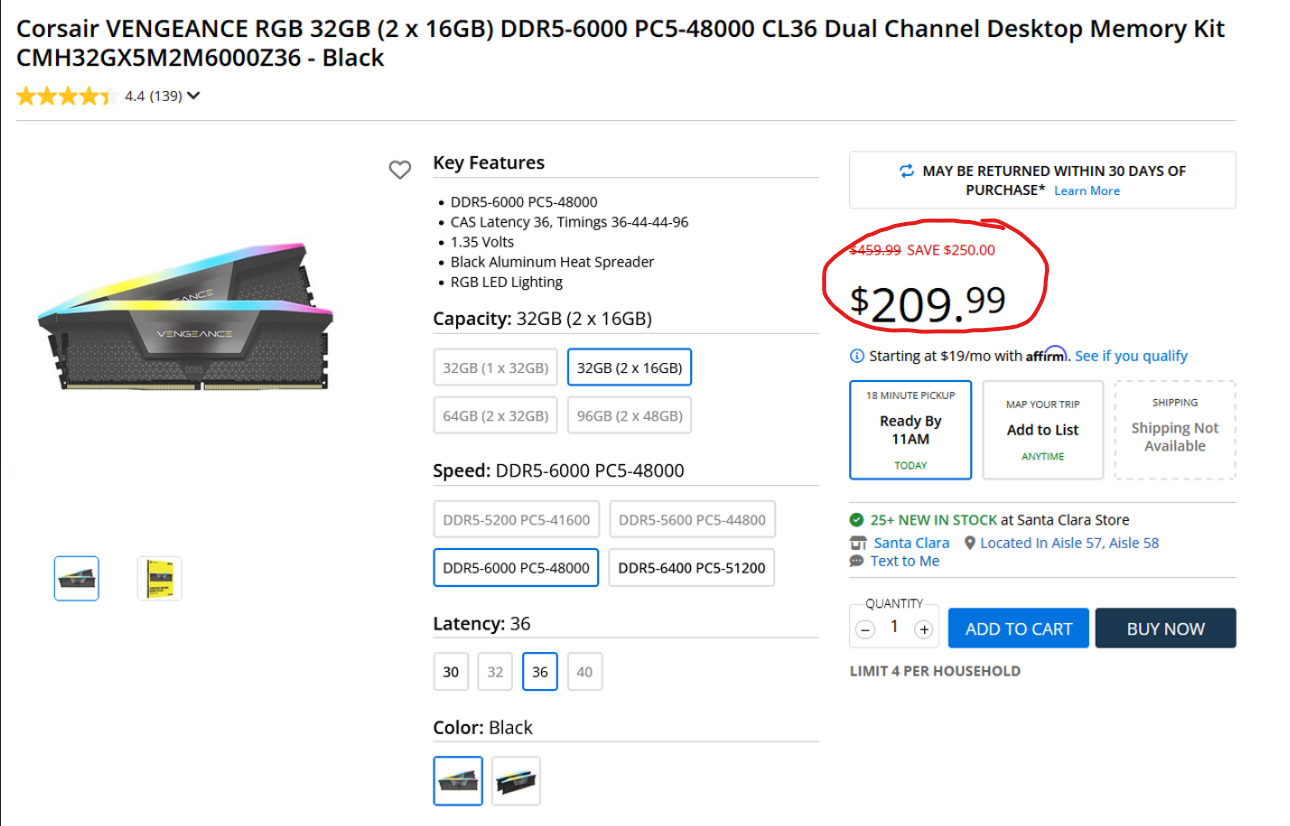

First, timing matters enormously. If you can build in late 2025, do it. Prices might be high, but they'll be higher in 2026. This is one of those rare situations where "buy now" is actually the right financial decision, even if the prices seem inflated.

Second, configuration matters. Instead of a balanced, overkill system, consider a more constrained build. Maybe 32GB instead of 64GB. Maybe a 1TB SSD instead of 2TB. DDR5 prices hit different. Every extra 16GB is another $250-300 in Q1 2026.

Third, DDR4 alternatives might make sense. If you can use an older motherboard or a last-gen CPU that supports DDR4, you might save money overall. The motherboard might be cheaper, the CPU might be cheaper, and the RAM will definitely be cheaper. For budget builds, this could be the smarter move.

Fourth, laptops and pre-built systems become more attractive. Manufacturers might eat some of the memory cost increases to stay competitive with consumers. If you buy a pre-built system in early 2026, you might get a better deal than if you build it yourself, which would be unusual.

DDR5 prices are expected to surge by 55-60% in Q1 2026, with a 32GB module potentially reaching $521. Estimated data shows continued price growth throughout 2026.

Workstation and Server Impact: Where It Really Hurts

PC gamers will feel the pinch. But professionals are going to feel genuine pain.

For workstations—think video editing, 3D rendering, data science, machine learning—more RAM is always better. A workstation that had 128GB of DDR4 might upgrade to 256GB of DDR5 for performance and future-proofing. That's now going to cost an additional $3,000-4,000 just for the memory.

For servers and data centers, the situation is different but equally painful. Enterprises have committed to expansion plans. They've budgeted for certain memory costs. Now those costs are going up 60%. That's not something IT departments can just absorb.

Budget lines that expected

For GPU-heavy server farms (common for AI workloads), this is particularly brutal. You're already spending millions on GPUs. Now the memory that goes with them is also becoming expensive. The total cost of ownership for AI infrastructure is rising sharply.

What About Second-Hand Market Dynamics?

Here's a thought: if new DDR5 gets insanely expensive, won't used DDR5 become more valuable?

Possibly. The second-hand memory market could see interesting dynamics. Old DDR5 chips that were headed for e-waste might suddenly have value. People upgrading might decide to sell their existing RAM instead of recycling it.

But this creates a problem: used memory is risky. It might be degraded, unstable, or near end-of-life. Warranty is zero. One failing chip ruins an entire kit. Most builders avoid used RAM because the risk-reward doesn't make sense at normal pricing. At inflated pricing, maybe it does.

This could create a bifurcated market: new RAM at premium prices and used RAM at mid-range prices, with a gap in between. That's not good for the industry or consumers.

The AI Infrastructure Question: Is This Sustainable?

Here's the bigger question: is current AI infrastructure spending sustainable? Or is this a bubble?

Companies are spending tens of billions on AI infrastructure. But returns are unclear. Chat GPT generates some revenue, but nowhere near the amount being invested. The same for other AI products. There's hype, there's hope, but there's not clear unit economics.

If AI spending moderates, memory demand moderates. Prices drop. Crisis averted.

If AI spending continues to accelerate, memory demand doesn't moderate. Prices stay elevated. New fabs come online in 2027-2028, eventually prices normalize. But for 2026, the crunch is real.

My take: AI infrastructure investment will continue. It might slow a bit if returns don't materialize, but it won't collapse. That suggests elevated memory prices persist through 2026 and into 2027.

TrendForce predicts a 55-60% increase in DRAM contract prices over the next few months, driven by high demand from data centers and AI workloads. Estimated data.

Mitigation Strategies: What You Can Actually Do

If you're facing a 2026 build or upgrade, here are practical strategies:

Build Early, Build Now: This is the most direct option. Building in November or December 2025 is almost certainly cheaper than building in March 2026. Even if you don't need the system yet, the arbitrage is worth considering.

Constrain Your Config: Don't overbuild. 32GB DDR5 is usable for almost everything in 2025-2026. 64GB is only necessary for specific workloads. Save the extra $300 and upgrade later when prices normalize.

Consider DDR4 Systems: Last-generation platforms like Ryzen 5000/Intel 12th/13th gen are mature, well-supported, and cheap. DDR4 kits will be cheaper than DDR5. Performance trade-offs are minimal for most use cases.

Laptop or Pre-Built: Instead of building yourself, buy a pre-built system. Manufacturers might absorb some costs. You get a warranty. You save the hassle.

Plan for Upgrades Later: Build a system that's serviceable. Don't max out RAM today. Plan to upgrade in 2028 when prices are normal. This is the long-game approach.

Monitor Spot Pricing: DRAM contracts lock in quarterly. But spot prices fluctuate. Watching memory retailers might reveal periodic deals. Not guaranteed, but possible.

Enterprise Response: How Companies Are Planning

Enterprise customers are responding proactively. Some are accelerating purchases before Q1 2026 increases hit. Others are renegotiating contracts with OEMs to lock in current pricing.

The smart enterprises are also exploring alternatives. Some are looking at different architectures or technologies that use less memory. Others are spreading purchases across multiple quarters to smooth out the price impact.

There's also a conversation happening about whether certain AI workloads are worth the cost. Some companies might shift to smaller models or lighter inference techniques that require less memory infrastructure. Others might switch to cloud providers who absorb the memory costs as part of their pricing model.

For service providers (AWS, Google Cloud, Azure), these price increases directly impact their margins. They have some ability to pass costs to customers, but excessive price increases might push customers toward self-hosted or competing solutions. It's a delicate balance.

Timeline: When This Gets Better

Here's the timeline based on current manufacturing plans:

Q1 2026: Price peak. This is when the worst of the increases hit.

Q2-Q3 2026: Prices might stabilize if new fab capacity comes online. But don't expect dramatic drops.

Q4 2026: Modest relief as capacity increases and some demand moderates.

2027: Gradual normalization. New fabs are running at higher capacity. Prices start declining toward more reasonable levels.

2028: If memory fabs operate at normal utilization, prices should be closer to historical norms.

This is optimistic. It assumes: fab expansions happen on schedule (often they don't), demand moderates (might not happen), and no new geopolitical issues disrupt supply (always possible).

Pessimistic scenario: prices stay elevated through 2027 because demand doesn't slow and fab expansion lags. This is possible but less likely.

Most likely: 2026 is painful, 2027 is improving, 2028 is back to normal. That's roughly a 3-year cycle, consistent with previous memory shortage cycles.

The Bigger Picture: What This Says About Tech Markets

This DRAM situation is a microcosm of larger technology market dynamics. A few takeaways:

Infrastructure spending is real and has consequences: When the entire industry pivots toward AI infrastructure, it affects commodity markets in unexpected ways. DRAM shortages cascade into higher PC costs, which affects consumer adoption, which affects everything downstream.

Efficiency matters more than raw specs: In a constrained market, 128GB of efficient DDR5 beats 256GB of inefficient DDR4. Architects and builders will focus on getting more from less. That's healthy, actually.

Supply chains are fragile: We have three DRAM manufacturers. Three. Samsung, SK Hynix, Micron. If any of them have a fab issue, prices spike across the market. We should probably diversify that.

Hype has real costs: AI infrastructure spending is driving these shortages. Much of that spending is speculative, based on hope that AI will generate returns. If that doesn't pan out, we've distorted entire supply chains for nothing. That's worth thinking about.

Overall, this DRAM situation highlights how interconnected modern tech is. One market segment (server/AI) explodes, and consumer markets feel the pressure immediately. That's efficiency from a manufacturing perspective, but fragility from a resilience perspective.

Conclusion: Plan Ahead, Build Smart

Here's the bottom line: DRAM prices are going to rise significantly in 2026. A 55-60% increase in contract pricing will likely translate to 40-50% retail price increases, pushing 32GB DDR5 kits past $500. This is driven by structural supply constraints, not temporary disruptions.

If you need a PC in 2026, start planning now. Decide what you actually need (32GB is probably enough). Determine your timeline (building earlier is cheaper). Explore alternatives (DDR4, laptops, pre-builts).

For professionals and enterprises, the impact is real but manageable. Lock in quotes now, spread purchases across quarters, and explore architectural alternatives where possible.

For the industry, this is a wake-up call. Fab capacity is constrained. Supply chain diversification is necessary. And perhaps most importantly, not every speculative investment in AI infrastructure is worth the collateral damage to commodity markets.

The PC market has weathered memory shortages before. It will weather this one. But 2026 builds are going to feel expensive, and that's just the reality of how markets work when demand far exceeds supply.

FAQ

What is driving DDR5 price increases in 2026?

The primary driver is a supply-demand imbalance caused by server and AI infrastructure demand consuming available DRAM production capacity. Memory manufacturers are prioritizing higher-margin server products and HBM (High Bandwidth Memory) over consumer DDR5, tightening consumer supply while demand remains steady. This diversion of capacity, combined with physical fab constraints, creates the projected 55-60% contract price increase.

How are TrendForce's predictions calculated?

TrendForce analyzes DRAM contract pricing trends, supply chain reports from major manufacturers (Samsung, SK Hynix, Micron), demand signals from data center buildouts and AI infrastructure expansion, fab utilization rates, and inventory levels at distributors and OEMs. Their forecast reflects wholesale contract pricing that manufacturers charge to bulk buyers, which historically translates to retail price increases within 4-12 weeks of contract price changes.

Can I avoid high prices by waiting for DDR6 in 2026?

No. DDR6 won't be available in quantity until 2027 or later. Even then, early DDR6 modules will be expensive as they come online. Additionally, DDR6 motherboards and CPUs will also be premium products initially. If you need a system in 2026, DDR5 or DDR4 are your realistic options.

Should I build my PC now or wait until 2026?

Building before Q1 2026 is financially smarter. Prices are elevated now but will be higher in early 2026. If you don't need the system until summer 2026, waiting might be reasonable hoping for price stabilization by then. But if you can build in late 2025, the savings will likely exceed the cost of having the hardware sit unused for a few months.

Will DDR4 also become expensive?

Yes, though not as severely as DDR5. DDR4 supply is also constrained because some of the same fab capacity produces both DDR4 and DDR5, and server demand for DDR4 is still substantial. Expect DDR4 prices to rise 25-35% in the same period, making it a less dramatic but still noticeable increase. Overall, DDR4 systems will remain cheaper than DDR5 systems.

How does this affect gaming and consumer use cases?

For gaming, 32GB DDR5 is sufficient through 2026 and beyond. The performance difference between 32GB and 64GB is minimal for gaming. Builders should stick with 32GB and reinvest savings elsewhere (GPU, CPU, storage). For productivity work (video editing, 3D rendering), the impact is more severe. Professional users might need to upgrade to 64-128GB, which becomes expensive.

Are used or refurbished DDR5 modules a viable alternative?

Used DDR5 modules might be attractive at inflated new prices, but carry risks including potential degradation, limited or no warranty, and stability issues. Most builders avoid used RAM unless they can test it thoroughly. Refurbished modules from reputable sellers offer slightly better assurance but are rarer and might not offer significant savings over new modules during shortages.

What happens after 2026? Will prices normalize?

Yes, gradually. As new DRAM fab capacity comes online in 2027-2028 and AI infrastructure spending moderates (or at least stabilizes), supply should improve. Prices typically normalize within 18-24 months of a shortage peak. Expect 2027 to show gradual improvement and 2028 to return closer to historical pricing levels, assuming no new supply disruptions occur.

How does this compare to previous DRAM shortage cycles?

Previous shortages (2017-2018, 2000-2001) were typically driven by cyclical demand swings or manufacturing oversights. This shortage is more structural, driven by a fundamental architectural shift toward memory-intensive AI workloads. That suggests it could persist longer than historical cycles unless either fab capacity expands faster than expected or AI demand moderates more than anticipated.

What should enterprise buyers do to prepare?

Enterprises should lock in current quotes with OEMs and distributors immediately, accelerate purchases where feasible to capture pre-Q1 2026 pricing, explore volume discounts or multi-year contracts that might protect from future increases, and evaluate architectural alternatives that achieve similar performance with less memory (where possible). Some enterprises are also shifting to cloud providers to outsource memory infrastructure costs.

Key Takeaways

- DRAM contract prices are forecast to increase 55-60% in Q1 2026, potentially pushing 32GB DDR5 modules past $500 retail

- Server and AI infrastructure demand is consuming production capacity, creating structural supply constraints that differ from previous cyclical shortages

- DDR4 prices will also rise 25-35%, making DDR4-based systems the more budget-friendly alternative for 2026 builds

- Builders should plan to construct systems before Q1 2026 or constrain configurations to 32GB instead of 64GB to minimize memory costs

- Price normalization is expected by 2028 as new fab capacity comes online, but 2026-2027 will remain elevated

Related Articles

- Nvidia's Upfront Payment Policy for H200 Chips in China [2025]

- Why RAM Prices Are Skyrocketing: AI Demand Reshapes Memory Markets [2025]

- Best Tech of CES 2026: 15 Innovations That Matter [2025]

- Best 4K TV Deals January 2026: Complete Guide & Buying Strategy

- AirPods Pro 3 Hit Record-Low Price: Save $50 on Apple's Best [2025]

- AI Factories: The Enterprise Foundation for Scale [2025]

![DDR5 Memory Prices Could Hit $500 by 2026: What You Need to Know [2025]](https://tryrunable.com/blog/ddr5-memory-prices-could-hit-500-by-2026-what-you-need-to-kn/image-1-1767908140319.png)