Introduction: The Payment Shift That Signals Deeper Tensions

When a semiconductor manufacturer shifts from flexible payment terms to strict upfront-only policies, it's never just about cash flow. It's about risk. It's about uncertainty. It's about who holds the leverage when geopolitical winds shift.

That's exactly what's happening right now with Nvidia and its Chinese customers.

According to recent reports, Nvidia is now demanding that customers in China pay in full upfront for H200 AI chips, eliminating the partial deposits and flexible arrangements that once existed. No refunds. No changes after payment. Commercial insurance or collateral might be permitted, but the company isn't budging on the core requirement: full payment before delivery.

This might sound like a minor operational detail, but it reveals something critical about where we are in the global semiconductor landscape. Nvidia is protecting itself against regulatory uncertainty, supply chain disruptions, and the very real possibility that tomorrow's political climate could freeze transactions overnight. And because Nvidia controls the most critical infrastructure in AI, this single policy decision ripples across every data center, every startup, and every country trying to build AI capabilities.

Here's the thing: Nvidia's been burned before. The Trump administration's export restrictions on H20 chips forced the company to write down $5.5 billion in inventory. That's not something you just move past. That's a scar that changes how you do business.

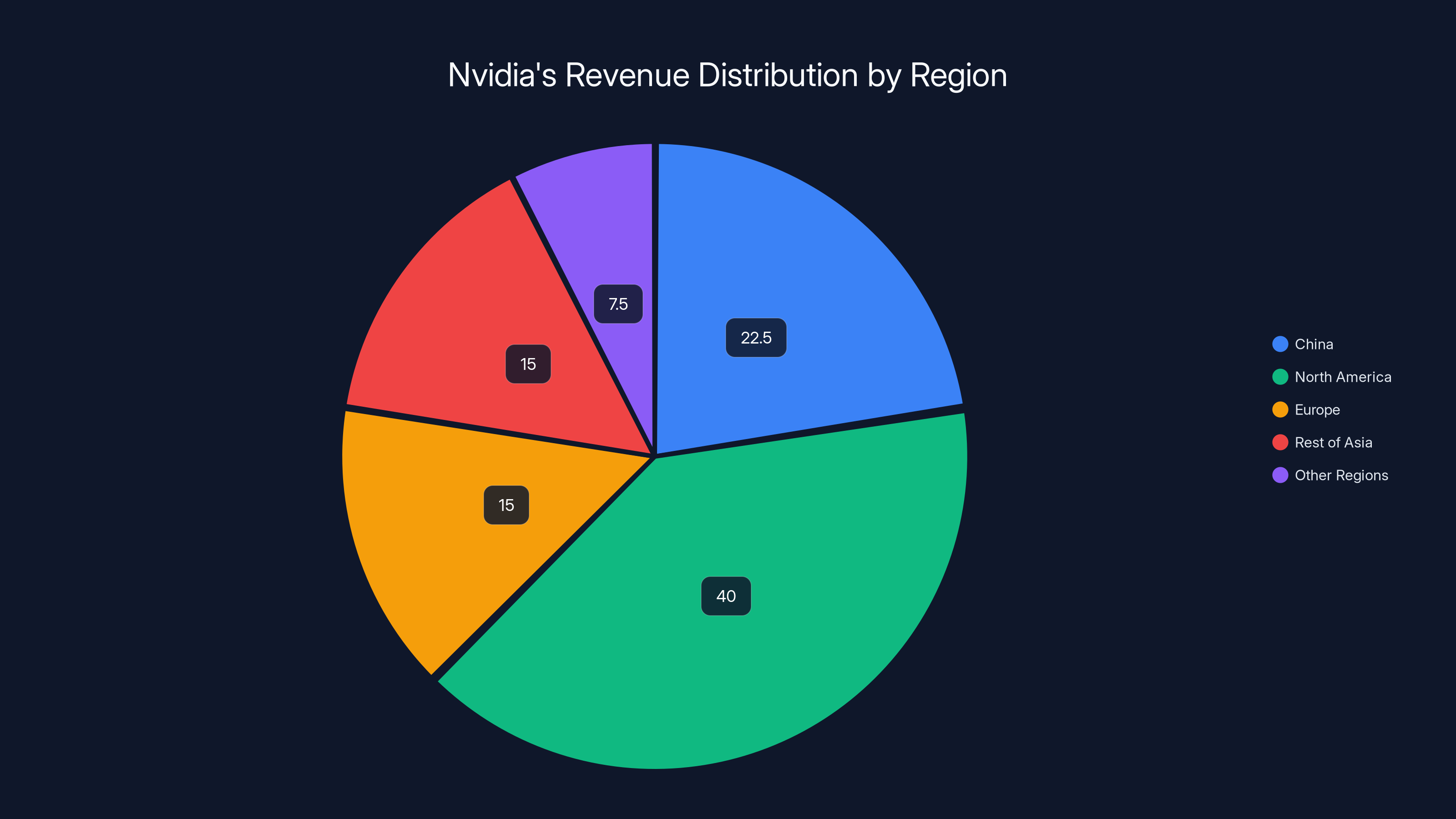

China, meanwhile, represents something like 20-25% of Nvidia's total revenue, making it impossible to ignore despite regulatory pressure from Washington. But that dependence is also dangerous. One policy shift, one export license denial, one diplomatic flare-up, and billions in orders evaporate. So from Nvidia's perspective, demanding upfront payment isn't just smart business, it's self-preservation.

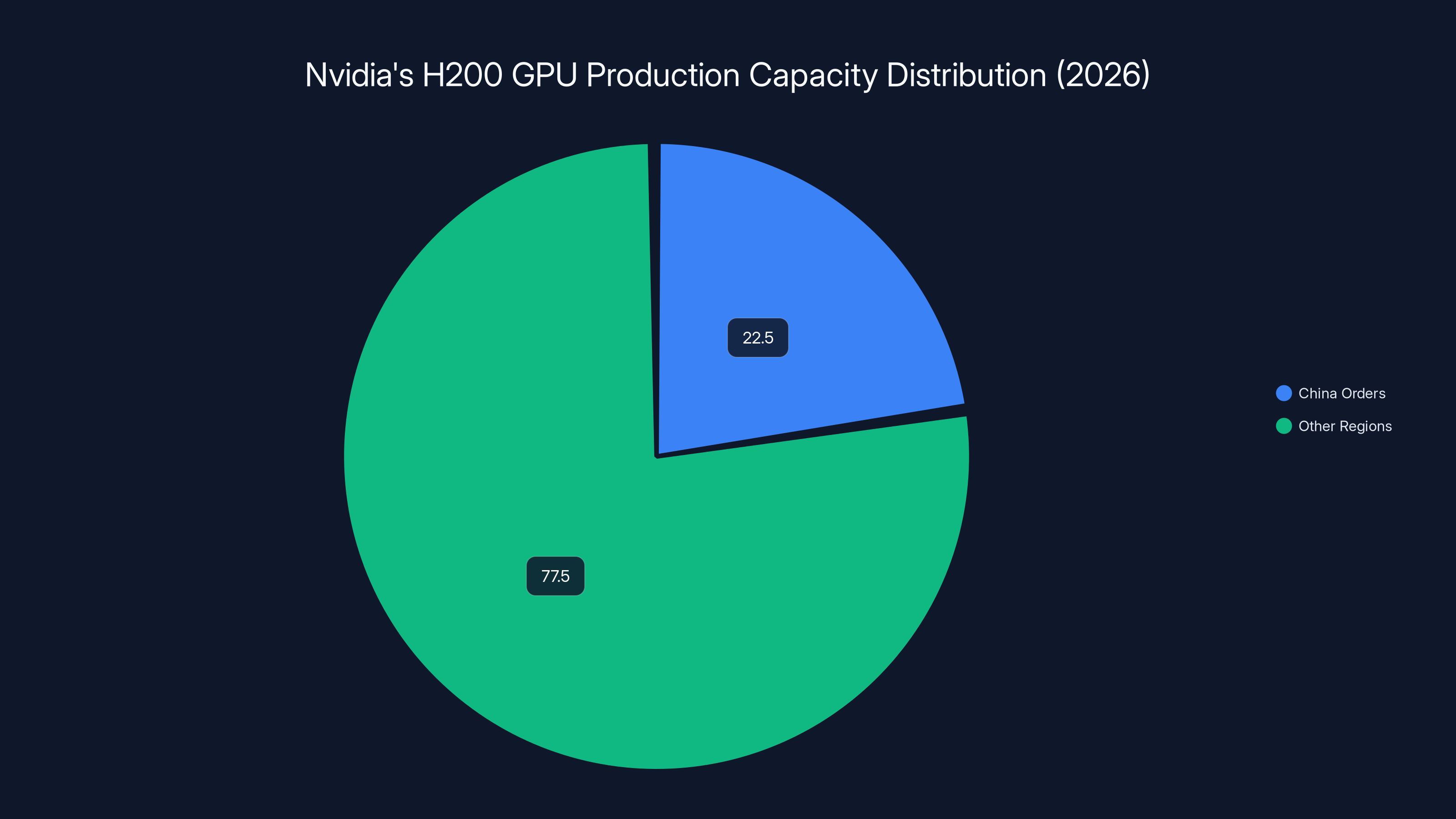

The Chinese AI sector, for its part, is voracious. Companies have already placed orders for over 2 million H200 GPUs in 2026 alone. That's demand that's real, that's sustained, and that's creating pressure on Nvidia's manufacturing capacity. But demand alone doesn't protect against political risk. Payment does.

In this article, we're going to unpack what's actually happening, why it matters, and what comes next for the global AI hardware ecosystem.

TL; DR

- Nvidia now requires full upfront payment for H200 chips sold to Chinese customers, eliminating previous flexible deposit structures

- No refunds or order modifications allowed, with only commercial insurance or collateral as alternatives, representing dramatically stricter terms

- Chinese demand remains extremely strong, with over 2 million H200 units expected to be ordered in 2026 despite regulatory uncertainty

- Political risk drives policy shift: Prior Trump administration actions forced Nvidia to write down $5.5 billion in H20 inventory, making upfront payment a self-preservation strategy

- Bottom Line: This is a watershed moment showing how geopolitical tension between the US and China is reshaping the semiconductor supply chain in real time

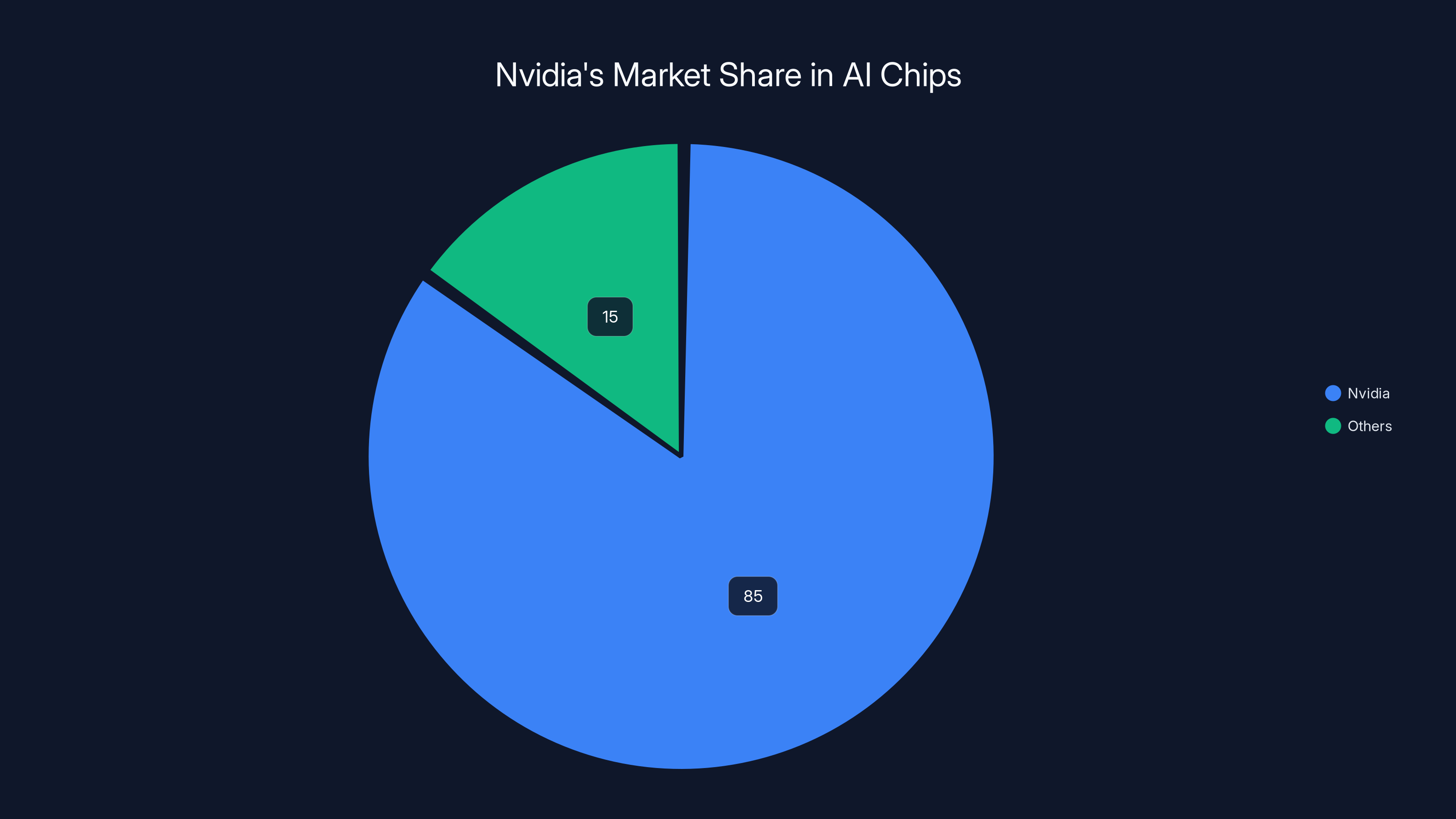

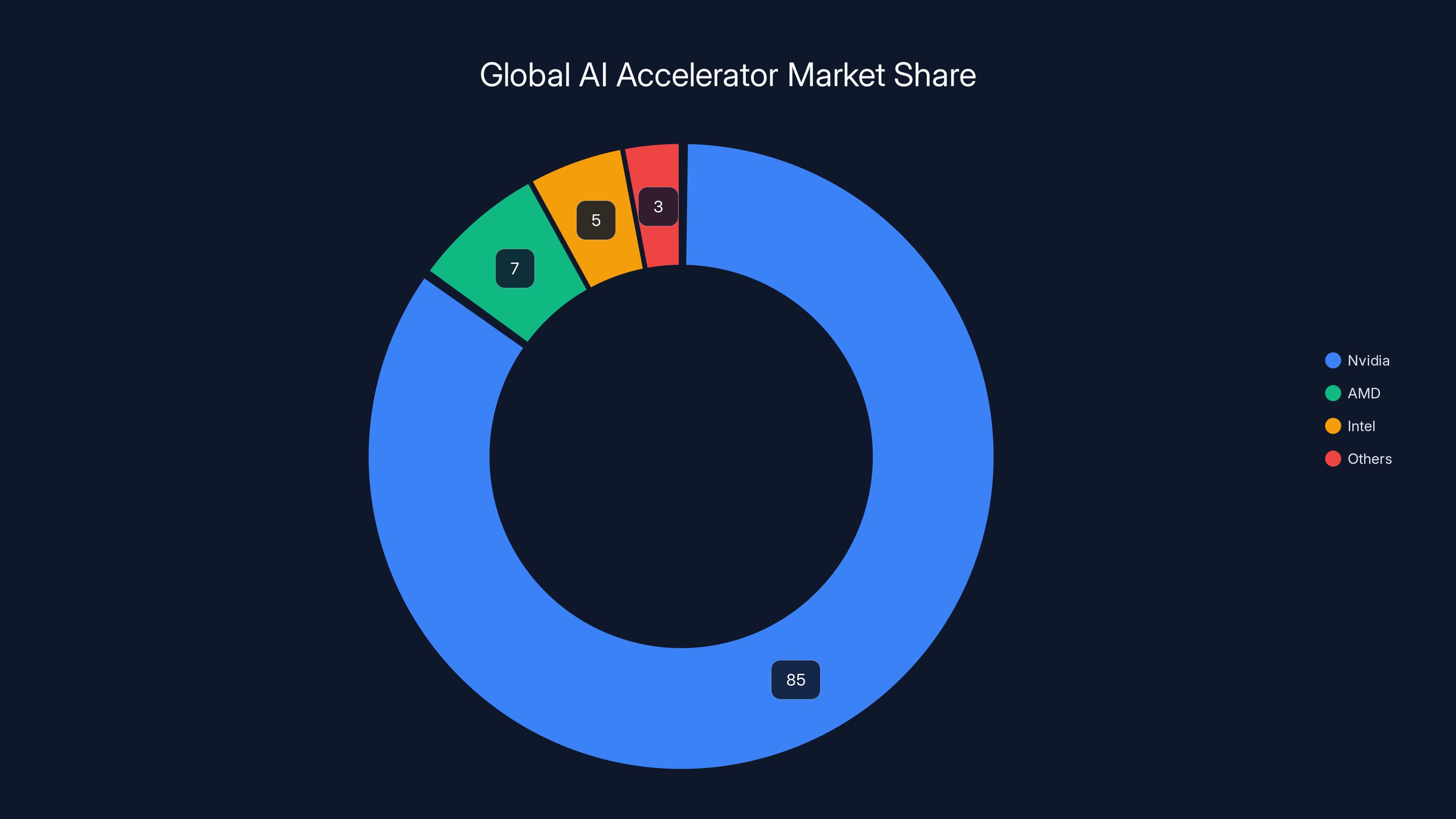

Nvidia dominates the AI chip market with an estimated 85% share, limiting negotiation power for Chinese companies. Estimated data.

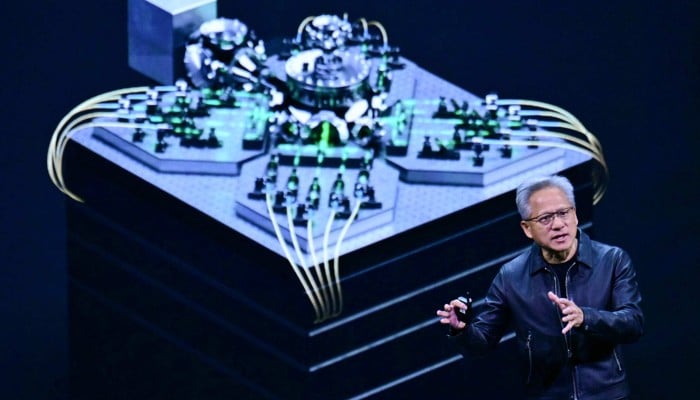

The H200: Why Everyone Wants It and Why Nvidia Can Dictate Terms

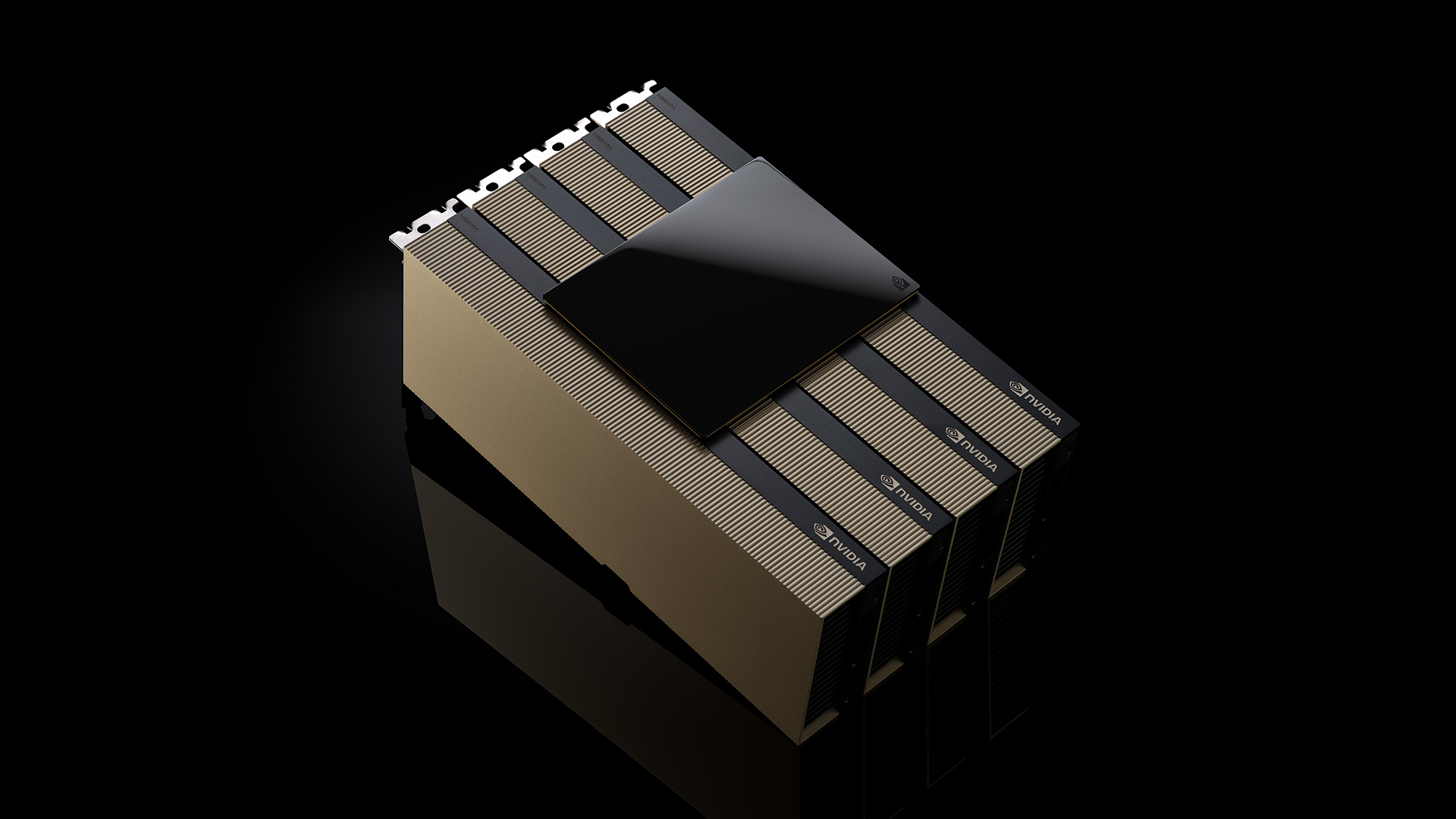

Before we dig into the payment policy, let's be clear about something: the H200 isn't just another GPU. It's become the foundation of AI infrastructure globally.

The H200 is Nvidia's data center accelerator designed specifically for large language models and generative AI workloads. We're talking about faster memory bandwidth compared to predecessors, optimized for the massive matrix operations that power transformer models, and basically the hardware that every company racing to build production AI systems needs.

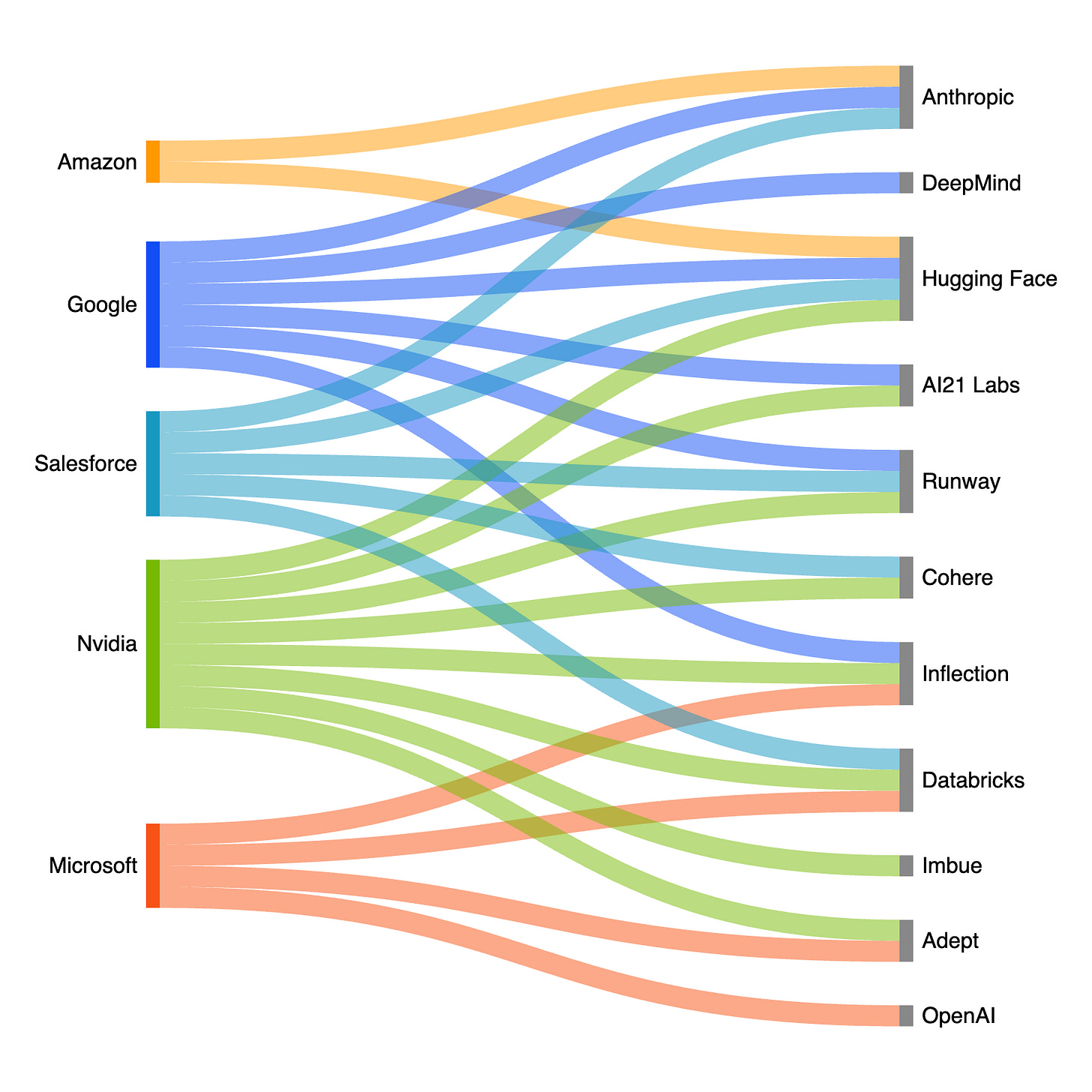

When OpenAI wants to train GPT models. When Google builds Gemini. When Azure expands its AI services. When Chinese companies build their own large language models. They're all reaching for H200s or H100s or variants. Nvidia doesn't have real competition here. AMD's trying. Intel's trying. But Nvidia owns the market with something like 80-90% market share in AI accelerators globally.

That monopoly position is what gives Nvidia the power to set payment terms unilaterally. If you want the chips, you follow their rules. There's no alternative vendor you can call. There's no Plan B. You wait in the queue and accept whatever terms Nvidia offers.

For China specifically, this is even more complicated because of export licensing. The US government controls what chips Nvidia can sell to China. So Nvidia's negotiating position is actually split: they have to please both the Trump administration's export control requirements and Chinese customers' demand. That's an impossible position to be in, which is probably why they're shifting the financial risk entirely onto customers.

The H200 sits in this weird zone where it's supposedly approved for export to China, but only for civilian use. Military, state-owned enterprises, and critical infrastructure are supposedly off-limits. Which everyone knows is basically unenforceable. How do you actually verify that a GPU sold to a Chinese company won't eventually end up in a military research lab? You can't. So the export restrictions are more about political theater than actual enforcement.

That ambiguity is exactly why Nvidia needs upfront payment. If they sell chips and later the US government tightens restrictions or freezes the transaction, they're stuck holding the inventory and angry customers. Upfront payment shifts that risk onto the buyer instead.

The demand numbers tell you everything you need to know about leverage here. Chinese companies have reportedly placed orders for over 2 million H200 units in 2026. That's roughly 20-30% of Nvidia's total expected production. You can't just walk away from that volume. But you also can't afford for it to blow up in your face politically.

The H20 Disaster: Why Upfront Payment Now Makes Sense

To understand why Nvidia's suddenly requiring upfront payment, you need to understand what happened with the H20.

The H20 was Nvidia's AI chip specifically designed for the Chinese market. It had lower memory bandwidth than the H100, making it technically compliant with US export restrictions (in theory), but still powerful enough to be genuinely useful for Chinese AI companies. Nvidia positioned it as the H100's restricted alternative, acknowledging China's demand while technically following export rules.

Then in late 2024, the Trump administration said Nvidia would need an export license to sell H20 chips to China. That was it. The entire product line suddenly became uncertain. Customers couldn't buy without government approval. Approval timelines were unknown. The whole thing froze.

Nvidia had already manufactured significant inventory. The company was forced to write down $5.5 billion worth of H20 chips because the business case disappeared overnight. That's not a rounding error. That's a catastrophic capital loss caused entirely by regulatory action outside Nvidia's control.

So flash forward to now. Nvidia's looking at H200 orders from China. The demand is real. The revenue opportunity is massive. But the risk is also massive. One policy change, one license denial, one escalation from Washington, and suddenly Nvidia's sitting on billions in inventory again.

Upfront payment doesn't eliminate that risk, but it transfers it. If the regulatory environment changes and Nvidia can't deliver, at least they've already captured the revenue. The customer eats the loss. From a financial perspective, that's much better than writing down inventory again.

It's actually a pretty logical response to trauma. Nvidia got burned badly. Now they're protecting themselves.

Estimated data shows China accounts for approximately 20-25% of Nvidia's revenue, highlighting its significant but risky market share.

China's Export Restrictions and the Approval Question

Here's where the policy gets messy. According to various reports, China is expected to approve Nvidia's H200 sales in the country. But that approval comes with strings attached.

Beijing apparently wants to prevent H200 chips from being used by the Chinese military, state-owned firms, and critical infrastructure sectors. Which sounds reasonable on the surface. But in practice, how do you enforce that? China's corporate structure is intentionally opaque. State ownership stakes are hidden. Military connections are classified. The government itself might use civilian companies as fronts for defense research.

So when you read "China will approve H200 sales but restrict military use," what you're really reading is "China will make politically reassuring noises while maintaining plausible deniability that all these chips are going to civilian use." Everyone understands this. The US government understands it. China understands the US understands it. But the political theater still has to happen.

From Nvidia's perspective, this creates an impossible compliance situation. They're being told they can sell to China as long as the chips don't go to the military. But there's no realistic enforcement mechanism. Nvidia can't actually verify end use. They can ask for certifications and compliance documents, but those are trivially easy to fake.

So Nvidia's sitting in the middle of a political game where both the US and China expect them to pretend everything's legitimate, while both governments probably expect the chips will be used for military purposes regardless.

Upfront payment is actually a smart move in this context because it removes Nvidia's exposure to regulatory capture. If something goes wrong, Nvidia's already been paid. If the US government starts enforcing export restrictions more aggressively, it's not Nvidia's problem if Chinese companies can't get their inventory. The money's already in the bank.

It's cynical, but it's rational given the incentive structure.

The Demand Side: Why Chinese Companies Will Accept These Terms

Here's what's important to understand: Chinese companies will accept these terms. They'll complain about them, sure. But they'll accept them.

Why? Because the demand for AI chips right now is absolutely insane. Chinese companies are racing to build their own large language models. They're competing with OpenAI and Google. They need compute capacity immediately. Waiting six months for better payment terms isn't an option. Getting in line and paying upfront is.

Moreover, this isn't just about individual companies. There's national pride and strategic competitive pressure involved. China wants to lead in AI. The government is directing investment toward AI infrastructure. Companies that don't secure chip supply now might lose the race entirely.

That desperation changes the negotiation dynamics. When you need something urgently and there's only one supplier, you don't have much leverage. Nvidia knows this. They're exploiting it.

The 2 million unit order volume in 2026 is a signal that Chinese companies are willing to pay upfront, multiple times over, to lock in capacity. They're not going to walk away from that deal because payment terms are unfavorable. They can't afford to.

There's also an insurance angle here. Some customers might be able to use commercial insurance or asset collateral instead of pure cash payment. That's not a huge concession, but it does signal that Nvidia's willing to work with customers on the mechanics as long as the financial risk is transferred away from the company.

Geopolitical Hedging: The Real Strategy

Let's zoom out for a second and think about what Nvidia's actually doing strategically.

The company operates in an environment where the US government can restrict sales to China. China's government can restrict US companies' operations. Export licenses can be denied. Sanctions can be imposed. The political landscape could shift violently.

Nvidia can't control any of that. What they can control is their financial exposure to regulatory change. Upfront payment is a hedging strategy against geopolitical risk.

Consider the scenarios: If regulatory restrictions tighten and Nvidia can no longer deliver chips to China, at least they've already been paid by Chinese customers. The loss lands on the customers, not on Nvidia. If the political environment stabilizes and exports continue flowing, Nvidia has gained cash flow acceleration and derisked their balance sheet. Either way, Nvidia wins.

This is actually sophisticated risk management. Most companies would try to maintain flexible relationships with customers and hope for the best. Nvidia's instead restructuring the entire relationship to minimize their downside.

It's also a signal to investors that Nvidia is thinking strategically about geopolitical risk, not just chasing revenue numbers. That kind of sophisticated risk management actually increases investor confidence.

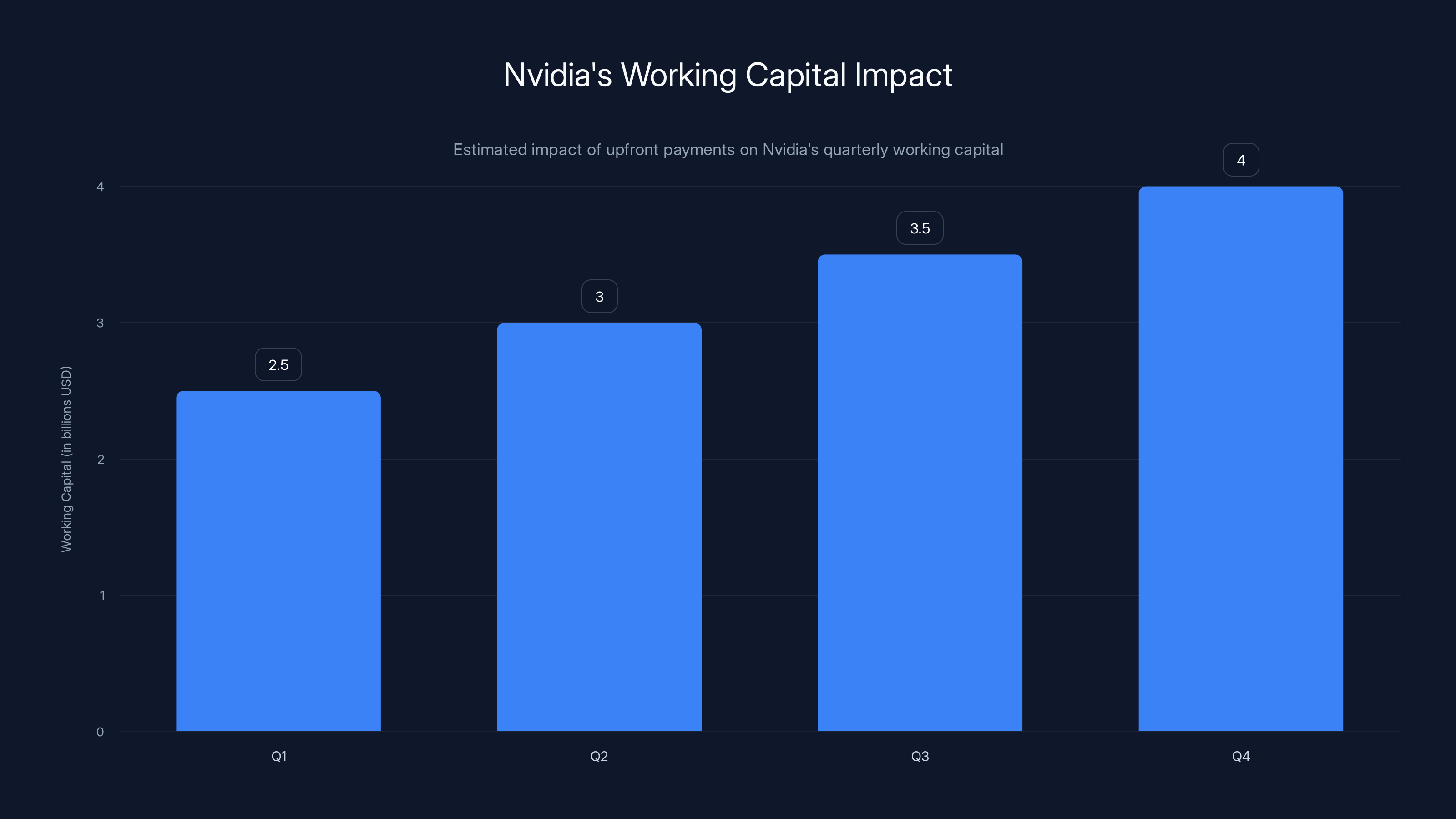

Nvidia's upfront payment policy can lead to billions in additional working capital each quarter, enhancing financial flexibility. (Estimated data)

Manufacturing Capacity and Production Ramping

Here's another piece of this puzzle that matters: Nvidia's manufacturing capacity.

The company doesn't actually manufacture chips themselves. They partner with foundries like TSMC. TSMC has limited capacity. Everyone wants TSMC's advanced process nodes. The queue is long and competitive.

Nvidia's announcing that they're ramping up H200 production to meet Chinese demand. That means pulling capacity away from something else, potentially delaying other products or customers. It's a finite resource allocation decision.

Upfront payment from Chinese customers is actually helpful for Nvidia in another way: it improves their working capital. Cash comes in before manufacturing happens. That cash can fund other projects, R&D, or whatever else the company needs.

From a manufacturing perspective, you want customers who are committed and who've already paid. That's exactly what the upfront policy creates. It filters for serious, well-capitalized customers. Small players who might flake out get naturally filtered out. Only the companies with real capital and real demand will pay upfront.

That makes production planning easier for Nvidia. They know the money's committed. They can confidently allocate manufacturing capacity knowing there's real demand backed by real cash.

Precedent: How Other Tech Companies Handle Geopolitical Risk

Nvidia's not inventing something new here. Other major tech companies use similar strategies when operating in high-uncertainty geopolitical environments.

Intel, for example, has been pushing for government subsidies and preferential terms when selling to allied nations, essentially using payment terms as a geopolitical tool. Apple's been diversifying manufacturing away from China partly due to supply chain uncertainty. Microsoft's been careful about which cloud services it offers in different regions based on regulatory risk.

What they all share is a willingness to use commercial terms to hedge political risk. Upfront payment is just Nvidia's particular flavor of that strategy.

And honestly, it's not unreasonable. If your biggest customer base is in a country that could be subject to export restrictions, you need to protect yourself. Companies that don't would be mismanaging shareholder capital.

The difference is that Nvidia's operating at such massive scale and with such a monopolistic position that they can implement these policies unilaterally. Most companies would have to negotiate. Nvidia just announces new terms and customers accept them.

The Compliance Theater and What It Actually Means

Let's talk about something that nobody's directly addressing but everyone knows is true: the compliance theater around military use restrictions.

China's supposedly committed to ensuring H200 chips don't go to military applications. Nvidia's supposedly selling with that commitment. The US government's supposedly enforcing restrictions based on that.

But in reality, everyone knows this is mostly theater. China has state-owned enterprises that do both civilian and military work. The boundary between "civilian" and "military" research is intentionally blurred. Researchers at universities that are theoretically civilian are doing work that's strategically important for military applications.

So when China says "we won't use H200s for military purposes," they mean "we understand the political requirement to say this." And when Nvidia sells with that understanding, they're participating in the theater.

The upfront payment policy is actually related to this. Nvidia's saying: "We need to protect ourselves financially in case this whole arrangement falls apart politically." Because it might. Because regulatory environments change. Because what's accepted today might be illegal tomorrow.

This is honestly pretty healthy skepticism about international business relationships. Nvidia's not assuming everything will work out fine. They're pricing for risk.

Nvidia dominates the AI accelerator market with an estimated 85% share, leaving AMD, Intel, and others with smaller portions. (Estimated data)

Impact on Chinese AI Development and the Race for LLMs

Let's think about how this affects Chinese AI progress specifically.

Companies like Baidu, Alibaba, Huawei, and others are pouring billions into AI research. They want to build Chinese versions of GPT. They want to compete with OpenAI, Google, and Anthropic globally. They want to lead the AI race.

All of that requires massive computational capacity. H200 chips are basically the fuel for that entire effort. Upfront payment doesn't stop them from buying. It just makes the financial commitment more serious and more immediate.

From a geopolitical perspective, this actually might slow Chinese AI development slightly. Companies that want to order 100,000 H200 units now have to commit capital upfront instead of spreading payments over time. That's a cash flow headwind. Smaller or less capitalized companies might be priced out entirely.

But the major players? Alibaba, Baidu, Huawei? They have the capital. They'll pay upfront. They'll actually probably win capacity allocation because they can commit money immediately while smaller competitors hem and haw about payment terms.

So the upfront payment policy effectively accelerates consolidation in Chinese AI. The biggest players get stronger. The smaller ones get left behind. Which is probably fine with Nvidia because larger customers are easier to manage and more reliable.

Supply Chain Implications and Global Chip Distribution

Here's something broader to think about: what does this mean for global chip distribution?

Nvidia's essentially signaling that they're willing to heavily favor customers who can pay upfront and who aren't subject to geopolitical risk. That's going to shift competitive dynamics.

US companies and companies in allied nations probably get better payment terms than Chinese companies. Or at least, they don't face the upfront payment requirement. That's a competitive advantage in terms of working capital.

Meanwhile, Chinese companies face stricter terms. They have to commit capital months in advance. They can't negotiate down payment schedules based on milestone delivery. It's all-or-nothing.

Over time, this kind of friction in supply chains compounds. It pushes companies toward alternative suppliers or toward building their own chip manufacturing capacity. Which is exactly what China's trying to do anyway with subsidized foundries and SMIC.

So Nvidia's policy might be pushing Chinese companies toward independence faster than they would otherwise move. That's strategically interesting because it means Nvidia's own risk management is potentially hastening the development of competitors.

Of course, those competitors are years behind TSMC and Nvidia. So the acceleration is still slow in absolute terms. But the incentive structure matters.

The Working Capital and Cash Flow Acceleration Story

Let's get into the financial mechanics because this is actually pretty sophisticated.

When Nvidia collects payment upfront before delivering chips, that's a massive working capital advantage. Cash comes in. They pay TSMC for manufacturing on their own timeline. The float between cash collection and cash outlay improves Nvidia's working capital metrics dramatically.

For a company Nvidia's size, that can be billions in additional working capital every quarter. That's capital that can be deployed for R&D, acquisitions, stock buybacks, or debt reduction.

From a financial reporting perspective, upfront payment collections also improve cash flow statements and strengthen balance sheet metrics. Which matters for credit ratings, borrowing costs, and investor confidence.

This isn't just about hedging geopolitical risk. It's also about optimizing corporate finance. The upfront payment policy serves multiple purposes simultaneously.

Of course, customers understand this. They know Nvidia's essentially financing their manufacturing with customer capital. If customers were less desperate for chips, they'd push back harder on this. But when you're in a capacity-constrained market and your supplier has monopoly power, you accept the terms.

In 2026, Chinese orders for Nvidia's H200 GPUs are estimated to account for about 22.5% of the total production capacity, highlighting China's significant role in Nvidia's market strategy despite geopolitical challenges.

What Happens If Trade Restrictions Escalate

Let's think through a stress scenario: what if the US government significantly tightens export restrictions on H200 sales to China?

Scenario One: Restrictions come while Nvidia still hasn't delivered. Nvidia's already collected payment upfront. They can't deliver the chips because of export license restrictions. Chinese customers are stuck without chips and no refund path. That's disastrous for customers but fine for Nvidia's cash flow.

Scenario Two: Restrictions come after partial delivery. Nvidia's delivered half the order and collected full payment upfront. Now they can't deliver the rest. Again, customers are stuck. Nvidia keeps the money.

Scenario Three: No additional restrictions. Export approvals continue. Nvidia delivers everything. Customers get their chips. Nvidia keeps the upfront payment and the cash flow advantage. Win-win.

Nvidia's upfront policy essentially makes them indifferent to regulatory changes. If changes happen, they've already captured the value. If they don't happen, they capture the value plus the cash flow benefit.

That's pretty clever risk management, honestly. It's legally and financially sound. It just puts the risk entirely on customers.

For Chinese customers, this creates a real concern. You're paying billions upfront for hardware you might not be able to take delivery of based on regulatory decisions completely outside your control. That's a significant financial risk.

But again, if you need the chips and there's no alternative supplier, you accept the risk. That's the entire dynamic here.

Regulatory Precedent: How Export Controls Historically Evolve

Let's put this in historical context because it matters.

The US government has a track record of tightening chip export restrictions over time, not loosening them. The original restrictions on advanced chips to China were relatively narrow. But after each round of escalation, they've gotten broader and more restrictive.

So the baseline expectation from Nvidia's perspective should be that restrictions get tighter, not looser. That creates a genuine business case for upfront payment. Why take the risk that restrictions tighten later if you can de-risk by collecting payment immediately?

Historically, we've seen this pattern with: Export controls on encryption technology (got progressively tighter). Restrictions on high-performance computing to sanctioned entities (got broader over time). Advanced semiconductor restrictions (getting tightened continually). Artificial intelligence software export restrictions (likely to follow similar tightening pattern).

Nvidia's policy assumes the baseline trend is toward tighter restrictions. That's probably a reasonable assumption based on historical precedent and current political rhetoric from Washington.

So upfront payment isn't just protecting against tail risks. It's protecting against a baseline trend of increasing restrictions over time.

The Investor Perspective: Why Wall Street Likes This Policy

If you're an investor in Nvidia, the upfront payment policy is actually good news in some ways.

It signals that management is thinking carefully about geopolitical risk instead of just chasing revenue growth blindly. It improves working capital metrics and cash flow statements. It frontloads revenue recognition. It reduces accounts receivable risk. All of those are finance-positive outcomes.

Wall Street cares about risk management and predictable cash flows. A policy that improves both of those things? That's actually appealing to institutional investors.

Now, there's also a counterargument: stricter payment terms might reduce total demand from less-capitalized customers. But in Nvidia's market, less-capitalized customers probably aren't the growth story anyway. Serious AI companies with real capital are where the opportunity is.

So the investor narrative here is pretty clean: Nvidia's protecting downside risk while maintaining upside opportunity. That's good capital allocation thinking.

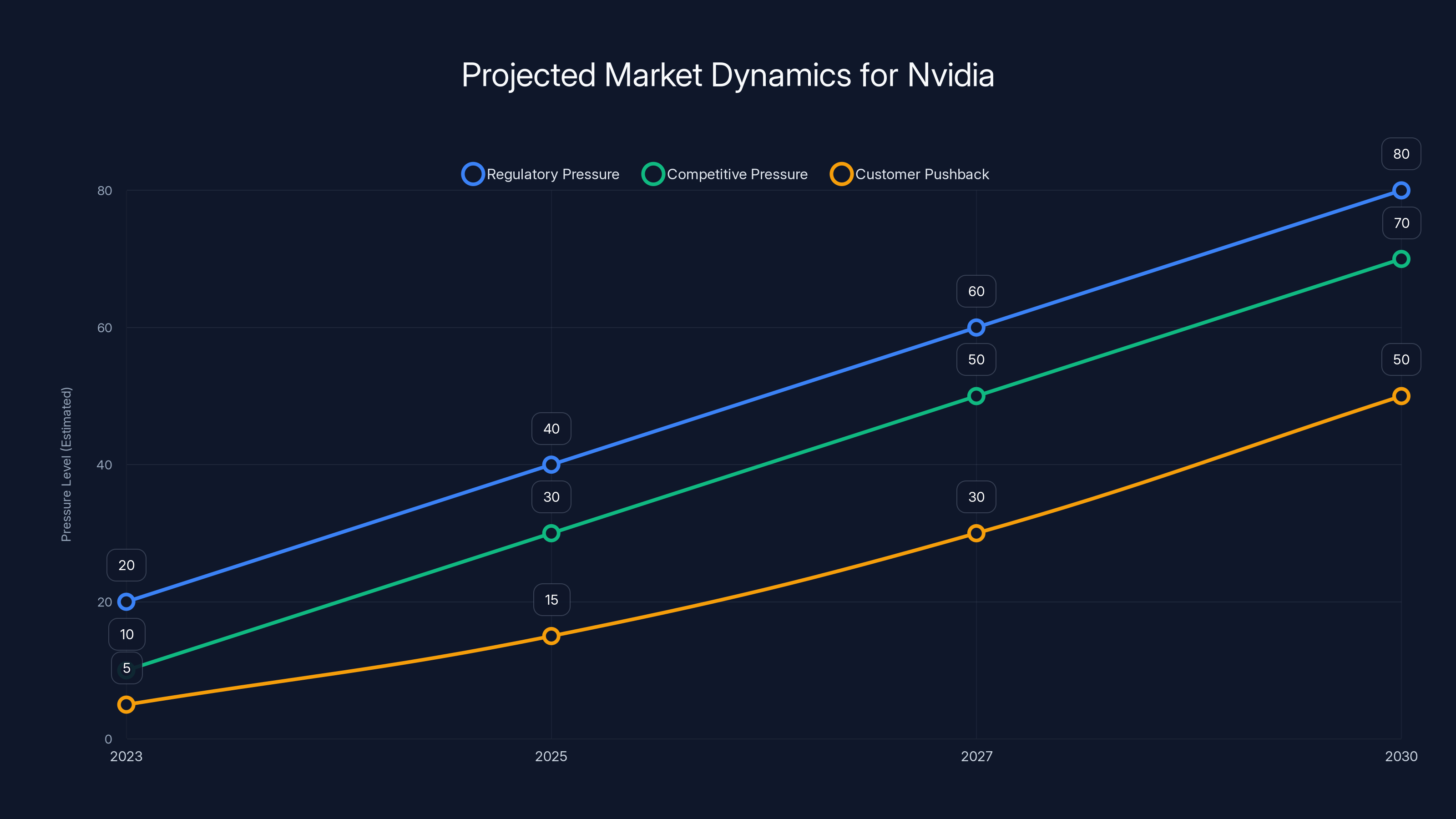

Estimated data suggests that Nvidia will face increasing regulatory, competitive, and customer pressures over the next 7 years, potentially reducing its market leverage.

Chinese Government's Perspective and Strategic Implications

What does China actually want here?

The Chinese government's balancing act is different from Nvidia's, but it's equally complicated. They want AI capabilities. They need chips. But they also want to avoid being seen as dependent on US exports. They want to encourage domestic semiconductor development. They want to maintain strategic autonomy.

Upfront payment policies actually don't directly affect government-level strategy. Whether Nvidia requires upfront payment or flexible terms, China still needs the chips. Companies will still buy them. The government will still encourage it.

But indirectly, upfront payment policies might actually align with Chinese government preferences because they create financial pressure that encourages domestic alternatives. If foreign chips have unfavorable terms, the incentive to build domestic capacity increases.

China's already heavily subsidizing SMIC and other domestic foundries to build advanced manufacturing capacity. Policies that make foreign chips less attractive (through strict payment terms or export restrictions) actually help that domestic agenda.

So from China's perspective, Nvidia's upfront payment policy might be annoying tactically but strategically helpful. It reinforces the case for government investment in domestic chip development.

The Future: Where This Goes From Here

What happens next is partly dependent on factors completely outside anyone's control. Political elections. International tensions. New technologies. Regulatory changes.

But we can think through some likely scenarios.

Scenario One: Status quo maintenance. Export restrictions remain as they are. Nvidia continues requiring upfront payment. Chinese companies continue buying despite unfavorable terms. The geopolitical situation stays tense but manageable.

Scenario Two: Restrictions loosen. A new US administration decides export controls on advanced chips are economically harmful and scales them back. Nvidia's upfront payment policy becomes unnecessary. Terms normalize. But Nvidia keeps the policy because why not?

Scenario Three: Restrictions tighten dramatically. A major security incident or escalation causes the US government to ban advanced chip exports to China entirely. Nvidia can't deliver to Chinese customers. Upfront payment funds are essentially confiscated. This is the worst scenario for Chinese customers and best-case for Nvidia financially.

Scenario Four: China retaliates with its own export restrictions. China restricts rare earth exports or restricts some technology that Nvidia needs. Creates tit-for-tat escalation. Both sides lose.

Whichever scenario plays out, Nvidia's upfront payment policy actually makes sense in all of them. It's good hedging against multiple possible futures.

Impact on Startups and Smaller AI Companies

Here's something worth thinking about: how does this affect startups and smaller AI companies in China?

A startup that needs 10,000 H200 units might cost tens of millions of dollars upfront payment. That's capital that could be spent on hiring or R&D instead. It's a working capital burden that smaller companies feel more acutely than larger ones.

So the upfront payment policy actually creates a barrier to entry for new competitors. It favors established companies with large capital bases. It makes it harder for scrappy startups to get into the game.

From Nvidia's perspective, that's probably fine. They're not trying to maximize the number of customers. They're trying to maximize revenue and manage risk. Fewer customers with bigger orders is actually simpler to manage.

But from an innovation perspective, this might slow down the emergence of new AI companies in China. The working capital requirement becomes a filter. Only well-funded companies can participate.

This is one of those second-order effects that doesn't get talked about much but actually matters for long-term competitive dynamics.

Comparison to Historical Tech Supply Dynamics

Let's zoom out and think about how this compares to other historical moments in technology supply chains.

When iPhone became popular, Apple had suppliers compete for contracts. Suppliers accepted Apple's terms because the volume was huge. Apple standardized on upfront payment for components.

When cloud computing took off, Amazon and Microsoft needed massive amounts of semiconductor capacity. They negotiated preferred terms from Intel and AMD.

Now with AI, Nvidia's in the position of having all the leverage. Customers compete for their chips, not the other way around. So Nvidia sets terms unilaterally.

This is actually the natural state of a supply-constrained market with monopolistic supplier. The supplier extracts maximum value through whatever terms they can impose.

History suggests this situation is temporary. Eventually supply increases, competition emerges, terms normalize. But in the interim, monopolistic suppliers extract maximum value. That's what Nvidia's doing with upfront payment.

Alternatives and What Customers Might Do

If you're a Chinese company facing Nvidia's upfront payment requirement, what are your options?

Option One: Pay upfront and accept the risk. Most companies probably do this.

Option Two: Use commercial insurance or collateral as Nvidia allows. This doesn't actually reduce your risk much, but it preserves some working capital.

Option Three: Pool capital with other companies to spread the burden. Some consortiums might form to collectively purchase larger volumes and share the upfront cost.

Option Four: Wait for alternatives. Invest heavily in SMIC or domestic alternatives, betting that technology development will eventually reduce dependence on Nvidia.

Option Five: Source from secondary markets or resellers. Buy used or refurbished H200s from other companies. This is less reliable but potentially cheaper with better payment terms.

Most companies probably do some combination of Options One and Two. Pay upfront when they have to, but try to minimize the financial impact where possible.

Actually interesting: secondary markets for high-end chips usually develop when primary markets have supply constraints and unfavorable terms. Nvidia's policy might inadvertently accelerate the creation of secondary markets for H200s in China.

The Meta-Question: Is This Sustainable?

Here's the bigger strategic question: can Nvidia maintain this level of pricing power and control indefinitely?

Historically, monopolies eventually face three pressures: regulatory pressure (antitrust), competitive pressure (new entrants), and customer pushback.

Regulatory pressure is already happening. US regulators are looking at Nvidia's market dominance. It's not aggressive yet, but it's there.

Competitive pressure is developing slowly. AMD, Intel, and others are improving their AI chips. It'll take years, but alternatives will eventually exist. At that point, Nvidia's leverage decreases.

Customer pushback might happen. If enough customers get frustrated with strict terms, they might collectively try to coordinate with alternative suppliers or push back against Nvidia. Though in a capacity-constrained market, customer pushback is pretty weak.

So Nvidia probably has a window of 3-7 years where they can maintain this level of control. Then the market dynamics shift. That's actually a pretty good window for capturing maximum value.

Nvidia's upfront payment policy is basically optimizing for this window. Extract maximum value while you have maximum leverage. Don't assume you'll have this power forever.

Conclusion: Reading the Tea Leaves

Nvidia's upfront payment policy for Chinese H200 customers tells us several things that go way beyond one company's payment terms.

First, it tells us that Nvidia genuinely expects significant regulatory risk. They wouldn't implement a policy this strict if they thought the regulatory environment was stable. Upfront payment is insurance against that risk.

Second, it tells us that Nvidia's prioritizing balance sheet security and working capital optimization over customer relationships. That's a sign the company's thinking about downside scenarios more than upside opportunity.

Third, it tells us that geopolitical tension between the US and China is real enough to materially affect corporate policy at major companies. This isn't theoretical risk. This is happening.

Fourth, it tells us that monopoly power in critical infrastructure is being exercised tactically. Nvidia can impose these terms because there's no alternative. That kind of power shapes industries.

Fifth, it tells us that supply chain fragmentation is accelerating. The more the US restricts chip exports to China, the more incentive China has to develop domestic alternatives. The more that happens, the less Nvidia's long-term monopoly is guaranteed.

For Chinese companies, the practical implication is simple: if you need H200s, you're going to accept Nvidia's terms. You don't have a choice. Budget accordingly and accept that you're taking on regulatory risk.

For the global chip industry, the implication is more subtle: we're in a transition period where geopolitics increasingly determines supply chain structure. Policies that used to be purely commercial are now instruments of foreign policy. Companies operate in that reality whether they like it or not.

And for investors watching this, the takeaway is that Nvidia's not overconfident about its long-term position. The company's protecting downside while maintaining upside. That's sophisticated risk management from a company that's learned hard lessons from the H20 write-down.

This isn't the end of a story. It's the middle. The next chapters will be written by regulators, competitors, and geopolitical shifts way outside Nvidia's control. But for now, in this moment, Nvidia's exercised its leverage. And everyone's accepted it because they have to.

FAQ

Why is Nvidia requiring upfront payment for H200 chips in China?

Nvidia is requiring upfront payment as a risk management strategy to protect against geopolitical uncertainty and export restriction changes. The company was burned by the Trump administration's H20 export ban, which forced a $5.5 billion inventory write-down. By collecting payment upfront, Nvidia shifts financial risk onto customers and ensures they capture revenue even if regulatory changes prevent delivery. This also improves working capital metrics and cash flow, providing financial benefits beyond pure risk hedging.

What does this policy mean for Chinese companies trying to buy H200s?

Chinese companies must now commit significant capital upfront without the flexibility of partial deposits or payment schedules. This creates a working capital burden, especially for smaller companies, and makes the purchase decision riskier since regulatory changes could prevent delivery after payment. However, most Chinese companies accept these terms because demand for H200 chips is urgent and there are no viable alternatives. The policy effectively filters for well-capitalized companies and makes entry harder for startups.

Will this policy affect global AI development?

Yes, but indirectly. The strict payment terms create working capital pressure that might slow Chinese AI company growth slightly and favor larger, better-capitalized players. This accelerates consolidation in Chinese AI but doesn't stop development entirely. Additionally, the policy might push Chinese companies to invest more heavily in domestic semiconductor alternatives like SMIC, potentially accelerating China's long-term independence from Nvidia. For companies outside China with better payment terms, the policy provides a competitive advantage in terms of working capital efficiency.

Can Chinese customers negotiate better payment terms?

Practically speaking, no. Nvidia controls this market with 80-90% market share in AI accelerators. Customers either accept the upfront payment requirement or do without the chips. Some flexibility exists through commercial insurance or asset collateral options, but the core upfront payment requirement is non-negotiable. This monopoly position is exactly what allows Nvidia to impose unilateral policy changes without negotiation.

What happens if the US tightens export restrictions after customers pay upfront?

If export restrictions prevent Nvidia from delivering H200 chips after customers have paid upfront, Nvidia keeps the payment but cannot deliver the product. Customers are left without chips and have no refund path since Nvidia's policy explicitly states no refunds are permitted. This is actually one of the main scenarios Nvidia's upfront payment policy protects against, since it ensures the company captures revenue regardless of regulatory outcomes. It's harsh for customers but rational for Nvidia's financial protection.

How does this compare to Nvidia's historical payment policies?

Previously, Nvidia allowed more flexibility with partial deposits and sometimes permitted modifications to orders after payment. The shift to strict upfront payment with no refunds or modifications represents a significant tightening of terms. This change reflects Nvidia's heightened concern about geopolitical risk, particularly after the H20 export restriction experience. The new policy essentially extracts maximum risk premium from customers in exchange for access to scarce chip capacity.

Could this policy accelerate the development of alternative AI chips?

Possibly. Strict payment terms and high prices create incentive for companies to invest in alternatives. AMD, Intel, and others are improving their AI chips. More significantly, China's heavily subsidizing domestic foundries like SMIC to reduce dependence on US-controlled supply chains. While these alternatives are years behind Nvidia technologically, unfavorable terms and export risk accelerate investment in them. Nvidia's leveraging its current monopoly power, which could inadvertently hasten its erosion.

What does this mean for Nvidia's relationship with Chinese customers long-term?

It signals that Nvidia prioritizes financial protection and risk hedging over customer relationships. While relationships might suffer short-term, most Chinese companies will accept harsh terms because they need the chips. Long-term, this policy could push companies toward alternative suppliers once they're available. Nvidia's essentially optimizing for maximum extraction from this window of monopolistic power, betting that competitors won't emerge before they've captured peak value.

Runable for AI Infrastructure and Automation

Use Case: Automate your GPU allocation tracking and hardware inventory management with AI-powered reports and documentation.

Try Runable For FreeQuick Tips for Navigating Supply Chain Uncertainty

Did You Know?

Key Takeaways

- Nvidia now requires full upfront payment for H200 chips to Chinese customers, eliminating previous flexible deposit structures due to geopolitical risk concerns

- The $5.5 billion H20 inventory write-down from export restrictions fundamentally changed how Nvidia approaches China-related business decisions

- Chinese demand remains extremely strong with over 2 million H200 units ordered for 2026, representing Nvidia's pricing power despite strict terms

- Upfront payment transfers regulatory risk entirely to customers while improving Nvidia's working capital and cash flow metrics

- The policy accelerates Chinese investment in domestic semiconductor alternatives like SMIC while maintaining Nvidia's short-term monopoly extraction

Related Articles

- The YottaScale Era: How AI Will Reshape Computing by 2030 [2025]

- AI Factories: The Enterprise Foundation for Scale [2025]

- Meta's $2B Manus Acquisition and Chinese Regulatory Concerns [2025]

- AMD Instinct MI500: CDNA 6 Architecture, HBM4E Memory & 2027 Timeline [2025]

- AI Isn't a Bubble—It's a Technological Shift Like the Internet [2025]

- CES 2026: Everything Revealed From Nvidia to Razer's AI Tools

![Nvidia's Upfront Payment Policy for H200 Chips in China [2025]](https://tryrunable.com/blog/nvidia-s-upfront-payment-policy-for-h200-chips-in-china-2025/image-1-1767893821088.jpg)