The Unlikely Intersection of Crime, Corporate Finance, and the World's Richest Man

When the U.S. Department of Justice released over 3 million pages of documents related to investigations into Jeffrey Epstein in late 2024, most of the attention focused on the predictable outrage: emails showing Elon Musk asking the convicted sex offender about "the wildest party on your island," details that contradicted years of public denials about how well they actually knew each other. According to NBC News, these revelations were part of a broader investigation into Epstein's connections with high-profile individuals.

But buried deeper in those files was something far stranger than a billionaire's tone-deaf party invitations. There was evidence of a high-level financial operation happening in real time, orchestrated by one of Musk's closest advisors, who had spent weeks in direct contact with Epstein seeking guidance on how to take Tesla private. The emails revealed not just casual acquaintance, but an active attempt to leverage a convicted sex offender's connections and financial expertise for one of the most consequential corporate deals in modern business history.

This wasn't ancient history. This was 2018. This was happening while Musk was posting about smoking weed on Joe Rogan's podcast, while he was feuding with the SEC, while he was calling a cave rescue diver a pedophile on Twitter. In the midst of all that chaos, someone very close to him was quietly reaching out to one of the world's most notorious criminals for business advice.

The story that emerges from these newly declassified documents is a masterclass in how power operates in the shadows, how desperation can override judgment, and how even when operating at the highest levels of corporate finance, people sometimes make decisions so baffling they seem almost fictional. It's a tale that raises uncomfortable questions about who advises billionaires, what lengths they'll go to make deals happen, and whether the rules that apply to ordinary people actually apply to the extraordinarily wealthy.

TL; DR

- A Musk associate secretly consulted Jeffrey Epstein about financing Tesla's controversial 2018 take-private deal, seeking his connections to Saudi Arabia's sovereign wealth fund

- Epstein suggested Margaret Thatcher for Tesla's board despite her having been dead for five years, revealing troubling gaps in his understanding of the company

- The Saudi connection was the real prize: Musk had already discussed the deal with Saudi Arabia's Public Investment Fund (PIF), and the consultant believed Epstein was close to Crown Prince Mohammed bin Salman

- The entire operation happened without Musk's explicit knowledge, though his behavior and leadership style were central topics of discussion between Epstein and the consultant

- The $420 tweet that started it all was reckless: Musk had not actually secured funding, leading to SEC charges and his forced stepping down as Tesla's chairman

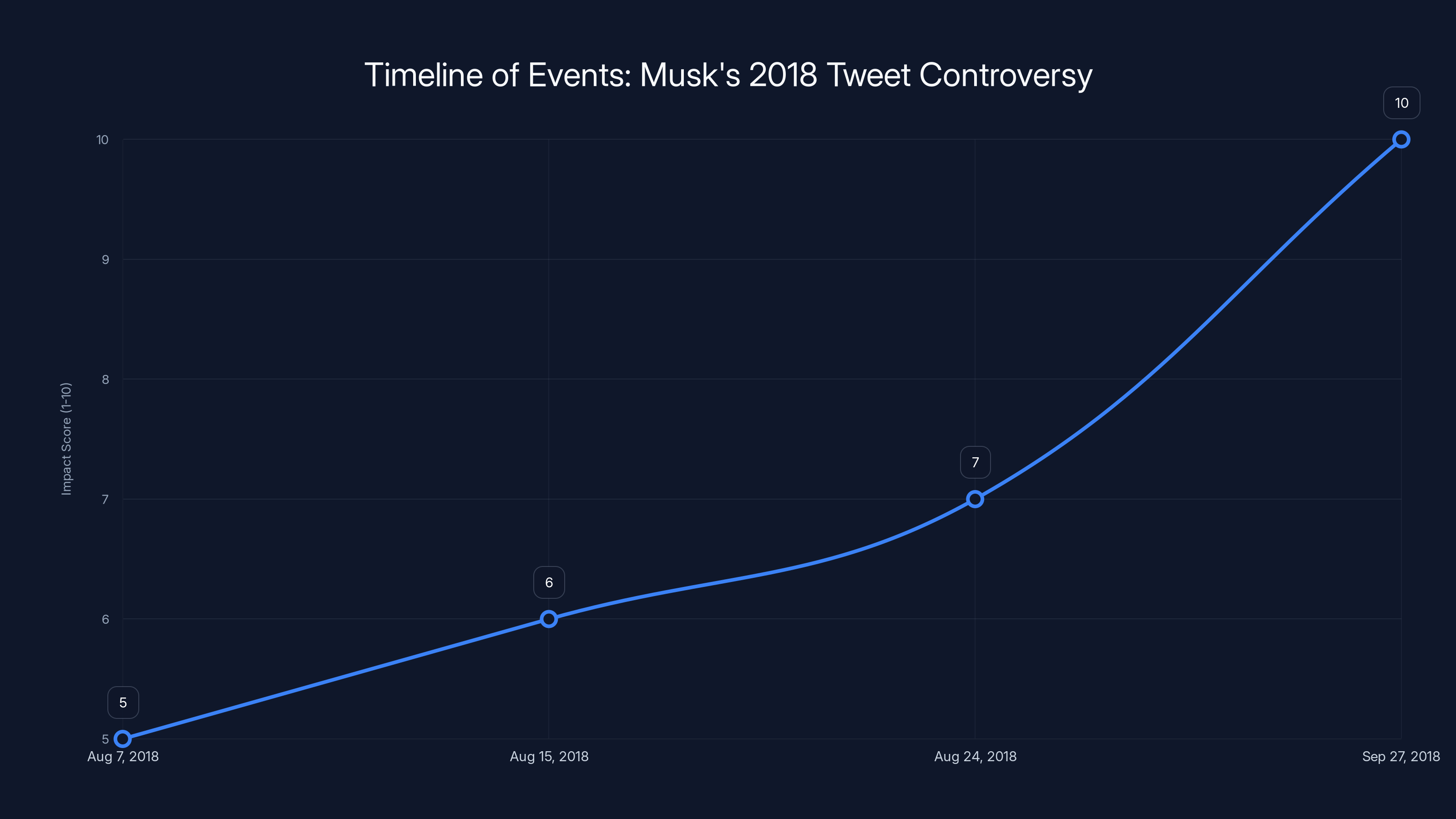

The timeline highlights key events from Musk's tweet on August 7, 2018, to the SEC charges on September 27, 2018. The impact score reflects the increasing severity and public attention of the controversy.

How One Tweet Spiraled Into One of Tech's Biggest Controversies

Elon Musk had a problem in August 2018, and it wasn't the one everyone thought. On the surface, the problem was that he was unhappy running a public company. The constant scrutiny from the SEC, the quarterly earnings calls, the endless stream of activist investors demanding quarterly profit growth instead of long-term thinking. All of it felt suffocating to someone who'd just acquired Solar City, who had dreams of colonizing Mars, who saw himself as building the future rather than answering to shareholders about the past.

But there was a deeper problem underneath. His companies were under enormous pressure. Tesla was burning cash. Production of the Model 3 had fallen short of his infamous "production hell" projections. The stock price was volatile. Investors were nervous. And Musk himself was becoming increasingly erratic in public.

Then, on August 7, 2018, he did what he always does when facing constraints: he tweeted his way out of the problem. "Am considering taking Tesla private at $420," he wrote. "Funding secured."

The tweet was breezy, almost cavalier. The $420 price point was intentional (a marijuana reference, because Musk). The claim about funding was definitive. But here's the thing that nobody knew at the time: the funding wasn't actually secured. Musk had spoken with Saudi Arabia's Public Investment Fund about the possibility, but nothing had been finalized. No commitments. No signed agreements. Just conversations.

What came next was inevitable in retrospect. The SEC launched an investigation. On September 27, 2018, they filed fraud charges against Musk personally, alleging securities fraud for "a series of false and misleading tweets." The punishment was swift and humiliating: a

But between that initial tweet on August 7 and the SEC charges on September 27, something urgent was happening behind closed doors. Musk and his team were actually trying to make the deal real. Because if they could make it real, if they could actually secure the funding, then Musk's tweets wouldn't have been a lie. They would have been prescient. They would have been visionary.

That's where the Epstein connection becomes relevant. And that's where things get truly bizarre.

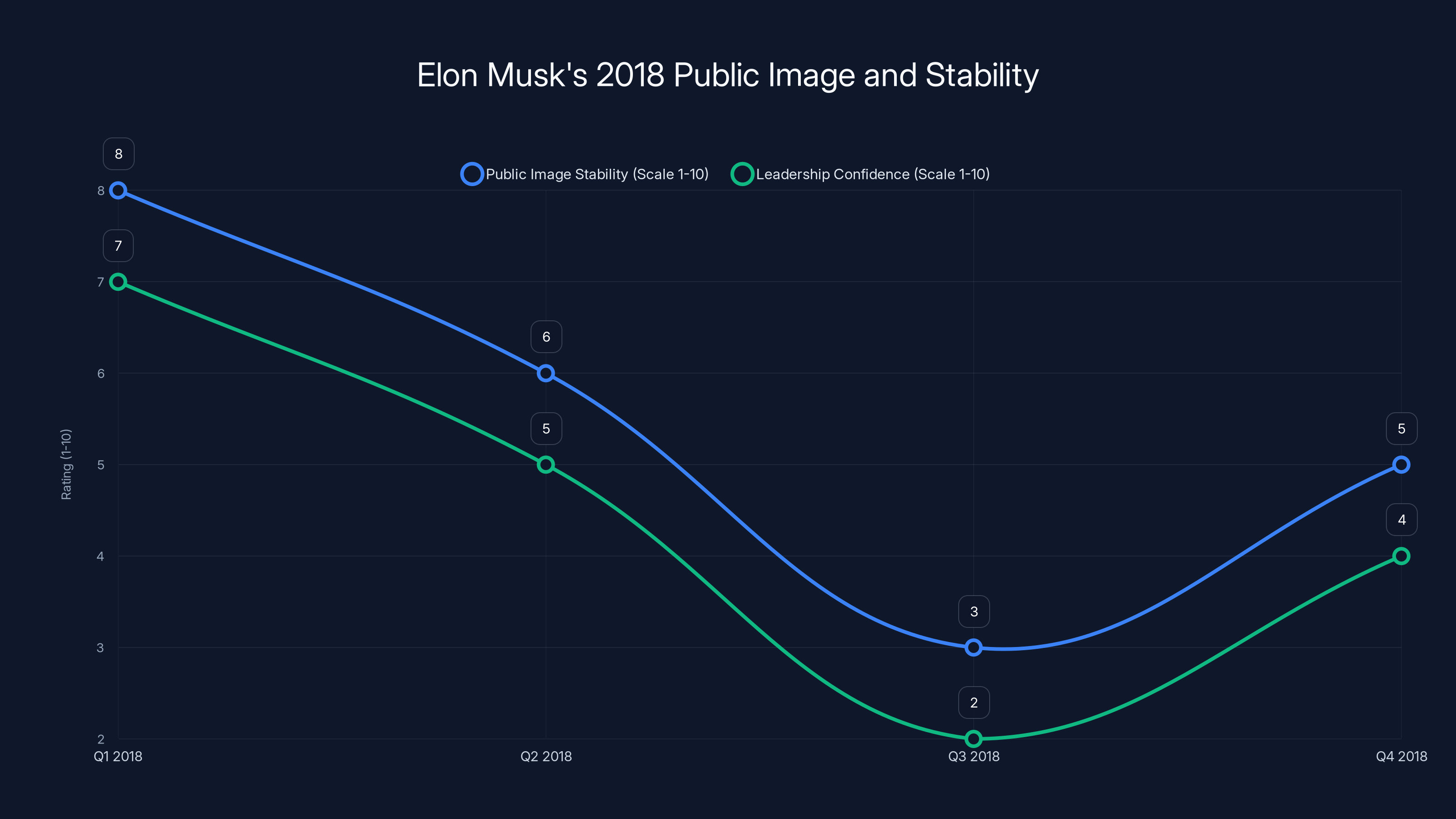

Estimated data shows a decline in Musk's public image stability and leadership confidence throughout 2018, highlighting the challenges he faced during this tumultuous period.

The Secret Consultant: Juleanna Glover and Her Unusual Rolodex

Juleanna Glover is a professional fixer. She's a high-powered lobbyist and consultant who has worked on campaigns, advised major corporations, and operated in the highest circles of Washington power. She's the kind of person who knows people, who makes calls, who gets things done. More importantly, she was someone Musk trusted.

After Musk's "pedo guy" tweet incident with the cave diver (and the subsequent Twitter meltdown and the lawsuit threats), Musk turned to Glover for damage control. She was brought in to help manage the PR fallout, to strategize about how to limit the blowback to Musk's reputation during one of his most publicly erratic moments.

But once she was in the room with Musk and his team, the conversation evolved. They started talking about the take-private deal. They started strategizing about how to actually make it happen. And Glover started thinking about who she knew who could help.

Someone told her (Glover later said she "heard") that Jeffrey Epstein was close to Saudi Crown Prince Mohammed bin Salman. That connection was the key. If Epstein could help her reach MBS, if she could leverage Epstein's access to convince the Saudis to commit the money, then Musk's impossible tweet could become reality.

So on August 12, 2018, five days after Musk's initial tweet, Glover sent Epstein a carefully worded email. "If you are advising re: sovereign funds looking to help a prominent company go private, let me know if I can help w any approp additional information," she wrote. The message was vague enough for plausible deniability, but clear enough that Epstein would understand she was asking for help.

Epstein's response was immediate: "Clever."

That single word opened the door. Over the following weeks, Glover and Epstein would exchange dozens of emails. She would brief him on Tesla's financial position, its growth prospects, its energy business, its Autopilot technology. She would defend Musk's leadership style and vision. Epstein would raise concerns about cash flows and stability. They would discuss sovereign wealth, private equity financing structures, and the Saudi connection.

And according to Glover's later statements, Musk never knew any of this was happening.

The Technical Financier: What Epstein Actually Brought to the Table

This is where the story gets uncomfortable. Because for all of his crimes, for all of his depravity, Jeffrey Epstein was genuinely knowledgeable about finance. He wasn't just a wealthy predator. He was a financier who had successfully navigated complex deals, who understood wealth management, who had connections to billionaires and sovereign wealth funds around the world.

That's actually why Glover thought he could help. It's not like she was reaching out to a random criminal for no reason. She was reaching out to someone who had concrete experience with exactly the kind of deal structure they were trying to execute.

In their correspondence, Epstein focused on the fundamentals. He wanted to understand Tesla's cash flows. He wanted to know about the company's stability. He raised red flags about Musk's recent erratic behavior. He pointed out that taking the company private would be a massive undertaking, and that the leadership needed to be rock-solid.

"Bottom line is at the core," he wrote to Glover, reducing the entire complex financial question down to its essential components. It's actually not bad advice. And in a different context, in a world where this advice was coming from someone other than a registered sex offender who was actively under investigation, it would be unremarkable business wisdom.

But Epstein's emails also contained something that revealed just how little he actually understood about Tesla, despite his financial sophistication. At one point, he suggested adding Margaret Thatcher to Tesla's board. The problem with this suggestion wasn't philosophical or strategic. It was temporal: Margaret Thatcher had been dead for five years.

She passed away in April 2013. By 2018, when Epstein was suggesting her for Tesla's board, she had been a historical figure for half a decade. The suggestion was so divorced from reality that it raises serious questions about whether Epstein was actually engaged with the material at hand, or whether he was just going through the motions while trying to maintain his appearance of financial wizardry.

Still, he assured Glover, "I only say great things about your boy." He was onboard. Or at least, he was willing to pretend to be onboard.

Tesla's market value has significantly increased from 2018 to 2023, reflecting its growth and dominance in the electric vehicle market. (Estimated data)

The Saudi Connection: Why MBS and His Wealth Fund Actually Mattered

To understand why Glover thought Epstein was valuable enough to contact, you need to understand what Saudi Arabia's Public Investment Fund (PIF) actually represented in 2018. The fund was sitting on approximately $250 billion in assets. It was the investment vehicle through which Saudi Arabia was trying to transform itself from an oil-dependent economy into something more diversified. And it was increasingly willing to make bold, high-profile investments that other funds might shy away from.

Musk had already been in discussions with PIF representatives about the take-private deal. This wasn't coming out of nowhere. The Saudis were genuinely interested. They saw Tesla as a transformative technology play. They understood electric vehicles and renewable energy as part of their economic future. And they had the capital to make it happen.

But there was a catch: PIF needed political cover. They needed to know that this investment had the blessing of the crown. And in Saudi Arabia's political structure, that meant getting closer to Crown Prince Mohammed bin Salman. MBS wasn't just another wealthy investor. He was the de facto ruler of the country. His approval mattered in ways that an American CEO might not fully appreciate.

Glover believed (or had been told, or had heard) that Epstein was close to MBS. The nature of that closeness was never specified in the emails. But the implication was clear: Epstein supposedly had the kind of access that could make things happen at the highest levels of Saudi power.

Looking back at this now, it raises uncomfortable questions. How close was Epstein to the crown prince? What was the nature of that relationship? Why would someone involved in the highest circles of Saudi power be maintaining contact with a registered sex offender? These are questions that the declassified documents don't fully answer, and they may never be answered if the interactions happened on channels that weren't captured in the DOJ's investigation.

What we do know is that Glover clearly believed the connection existed. And she believed it strongly enough to take the extraordinary step of reaching out to Epstein, to brief him on one of the most sensitive financial deals in technology, and to try to leverage him as an intermediary to the most powerful person in one of the world's most consequential countries.

Musk's 2018 Chaos and Why Epstein Thought It Might Fail

By late summer 2018, Elon Musk was having what might generously be described as a difficult period. He'd gone on Joe Rogan's podcast and smoked weed. He'd called a cave rescue diver a pedophile on Twitter, then doubled down on it in emails to journalists. He'd been subpoenaed over the $420 tweet. He was constantly fighting with the SEC. He was doing interviews where he described himself as working 120-hour weeks and expressing suicidal ideation. His Twitter presence was erratic, sometimes brilliant, sometimes unhinged, often both at the same time.

This was all immediately relevant to the take-private deal. Because taking a public company private is a massive undertaking. It requires institutional investors to have confidence in the person leading the company. It requires stability. It requires a leader who doesn't make reckless financial claims on social media. It requires someone who doesn't call people pedophiles without consequences.

And Musk, at that moment, was none of those things.

Epstein picked up on this immediately. In one particularly damning email, he wrote: "concern over the recent strings of outbursts. earnings call etc. Thailand. emotional performance."

The "Thailand" reference was his way of mentioning the cave diver incident. The "earnings call" reference suggested Epstein had been paying attention to Musk's increasingly heated interactions with analysts and journalists. The "emotional performance" phrase was a polite way of saying that Musk seemed unstable.

And Epstein wasn't wrong. By any objective measure, Musk was not in an optimal position to lead a company through a complex take-private transaction. His judgment was questionable. His emotional state was volatile. His public image was damaged. His legal situation was worsening.

What's fascinating is that despite these very legitimate concerns, Epstein didn't use them as a reason to disengage. Instead, he suggested that Glover work harder to convince him that Musk was the right person for this massive deal. He wanted her to make the case for Musk's leadership, to convince him that the CEO's flaws were actually strengths, that his erratic behavior was just transparency and passion for justice.

Glover took the bait. She wrote back defending Musk's leadership style in terms that are, in retrospect, almost comical. "Interesting fact about leader is that those around him accomplish the impossible because they witness his ethics and drive," she wrote. "Yes sometimes also too transparent and without artifice, but that is always as a reaction to a perceived injustice or malfeasance."

In other words: sure, he's erratic and unfiltered, but that's actually a sign of his integrity. Sure, he calls people pedophiles on Twitter, but he's just responding to perceived injustice. Sure, he smokes weed on podcasts and makes reckless financial claims, but he's doing it all for noble reasons.

Epstein seemed to accept this argument, at least on the surface. But he remained skeptical about whether the deal was actually viable given Musk's recent troubles.

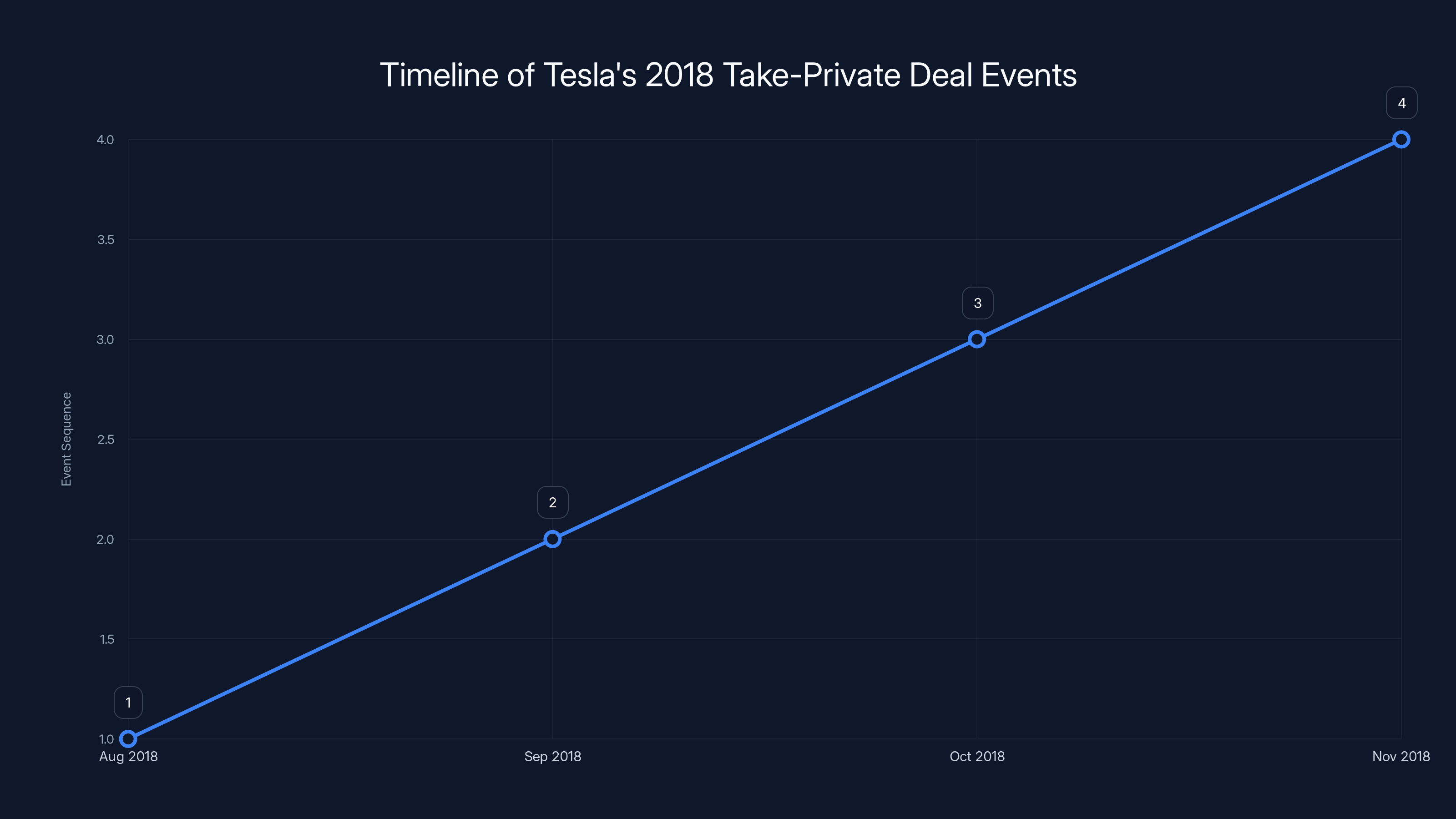

The timeline illustrates the sequence of events in Tesla's take-private deal in 2018, starting with Musk's tweet and ending with the settlement of SEC charges. (Estimated data)

The Autopilot Ambition: The Feature Epstein Called "the Elephant in the Room"

In one of her emails to Epstein, Glover made a cryptic reference to Tesla's Autopilot technology. She called it "the elephant in the room all see but don't comprehend." The phrase was meant to convey that Autopilot represented enormous untapped value. Everyone could see that it existed, but few people truly understood its potential. If investors could really grasp what Autopilot meant for Tesla's future, they would understand why the company was worth the asking price.

This was an interesting sales pitch because it was simultaneously true and misleading. Autopilot is genuinely transformative technology. It represents billions of dollars in potential value. But at that time in 2018, Autopilot was also massively overpromised and underdelivered. Musk had made bold claims about full self-driving that hadn't materialized. The technology was powerful but incomplete. It could handle certain driving tasks, but it required constant human oversight. It was nowhere near the "full self-driving" that Musk had promised.

So when Glover was pitching Autopilot to Epstein as a core reason to invest, she was banking on his financial sophistication. She was betting that he would understand that Autopilot's potential value might be worth more than its current performance justified. She was asking him to look past the gap between the promise and the reality, and to see the future value instead.

Epstein's response to this pitch is not recorded in the available emails. But his general approach to the Tesla deal was to focus on the fundamentals: cash flows, stability, and the quality of the leadership. And by those measures, Autopilot, however exciting, didn't change the underlying concerns.

The Sovereign Wealth Fund Gambit: Why Saudi Arabia Was the Key

The reason Glover was spending so much time trying to convince Epstein that Tesla was a good investment wasn't just about his personal wealth. It was about his supposed connections. The specific goal was to reach Saudi Arabia's PIF and, more importantly, to reach Crown Prince Mohammed bin Salman.

This is where understanding the geopolitical and financial context becomes crucial. In 2018, Saudi Arabia was in a period of economic transformation. The Vision 2030 initiative was supposed to diversify the kingdom's economy away from oil dependence. Renewable energy, technology, and innovation were supposed to be pillar industries. Electric vehicles fit perfectly into this narrative.

But there was another reason the Saudis were relevant. They had money, vast amounts of it, and they were willing to deploy it in ways that traditional Western institutional investors might not be. If the Saudis committed to funding a Tesla take-private deal, it would be a massive vote of confidence. It would signal to the market that this wasn't just Musk's crazy idea, but something backed by serious international money.

Glover even discussed the financing structure in her emails. She outlined how this could work, how the deal could be assembled, what the capital requirements would be. This wasn't amateur stuff. This was the kind of sophisticated financial thinking that would be appropriate for someone seriously considering a multi-billion-dollar investment.

But there's a critical detail that never fully emerges from the emails: did Epstein actually have the kind of access to MBS that Glover believed he had? Or was this based on rumors, on assumptions, on the kind of gossip that travels through wealthy circles without necessarily being grounded in reality?

The emails don't provide definitive answers. What they do show is that Glover believed in the connection strongly enough to stake the entire strategy on it. She was so convinced that Epstein could deliver access to Saudi power that she was willing to brief him on confidential information about Tesla's financials and strategic direction.

Estimated data suggests the Epstein connection had the highest negative impact on public perception of Elon Musk in 2018.

The Ethics and Legal Implications: Why This Matters Beyond Gossip

Now, it would be easy to dismiss this entire story as salacious gossip about powerful people doing silly things. Billionaire's advisor talks to famous criminal about business deals, sound the alarm, clutch the pearls, move on.

But there are actually serious ethical and legal questions embedded in this narrative.

First, there's the question of informed consent. Major investors in a company have a right to know who is advising management on strategic decisions. Tesla's shareholders didn't know that Musk's advisors were taking counsel from a registered sex offender. They didn't know that decisions about the future of the company were being influenced by someone with serious credibility and judgment issues.

Second, there's the question of due diligence. When sovereign wealth funds are evaluating investments, they do deep background checks on the people involved. If a SWF discovered that an advisor to the company was consulting with a convicted predator, that would likely be a deal-breaker. The fact that the Saudis may not have known about this arrangement raises questions about whether anyone involved was properly disclosing their information sources.

Third, there's the question of judgment and values. Even if what happened was technically legal, it raises profound questions about the kind of people a billionaire chooses to trust, and the kind of operations he allows to happen in his name. If you claim to be building the future, if you claim to be advancing humanity, if you present yourself as visionary and principled, then secretly consulting with a convicted sex offender about your business strategy is a serious credibility issue.

Fourth, there's a question about Epstein's own agenda. What did he get out of this arrangement? Was it simply the opportunity to feel important and influential? Was he trying to build relationships with Musk that might be useful later? Was he trying to position himself as an important intermediary to power? These questions don't have clear answers from the declassified documents.

The Take-Private Deal That Never Happened: Why This Entire Effort Failed

Despite all of Glover's efforts, despite all of Epstein's advice, despite the apparent interest from Saudi Arabia's PIF, the take-private deal never happened. Musk's tweet proved to be what it seemed: a reckless claim made without the proper groundwork.

The SEC charges came swiftly. Musk was forced to settle, to pay fines, and to step down as chairman. The pressure to actually execute the deal evaporated. The Saudis, facing reputational questions of their own (this was only months after the Jamal Khashoggi assassination), apparently decided that the risk-reward calculation had changed. The deal, which had once seemed like a genuine possibility, became a historical curiosity.

What's interesting is that the collapse of the deal didn't seem to significantly impact Musk's standing with his core group of supporters and advisors. He remained CEO of Tesla. He retained enormous influence over the company's direction. He continued to make major strategic decisions. The SEC settlement was a slap on the wrist for someone of his resources and power. Stepping down as chairman meant he still controlled the company, just without the formal title.

In the end, the entire elaborate effort to take Tesla private—the social media posting, the behind-the-scenes financial maneuvering, the consultation with a convicted sex offender—all of it amounted to nothing. The company remained public. Musk remained in control. The Saudis didn't invest at the level they had supposedly discussed. Everything returned to the status quo, except that now there was a documented record of just how far some people were willing to go to make an impossible deal happen.

Estimated data shows that time pressure and desperation significantly influence decision-making, often leading to consulting unusual advisors.

The Musk-Epstein Relationship: How Well Did They Actually Know Each Other?

The declassified DOJ documents were supposed to settle the question of how well Musk and Epstein knew each other. For years, Musk had insisted it was a casual acquaintance, that Epstein was just one of many wealthy people trying to get close to him. The 2012 email asking about "the wildest party on your island" seemed to contradict that narrative.

But even after seeing that email and the news of Glover's behind-the-scenes communications, the relationship remains somewhat ambiguous. Musk and Epstein weren't business partners. They weren't close friends (as far as the available evidence suggests). But they clearly moved in overlapping social circles. They attended some of the same events. They had mutual acquaintances. And at least on Musk's part, there seemed to be some level of interest in Epstein's party scene.

What's not clear from the documents is whether Musk knew about Glover's outreach to Epstein. Glover later said he didn't know, and there's no evidence in the emails suggesting that she was acting at his direct instruction. But in a large organization with a strong CEO, the question of "knowing" becomes murky. Did Musk explicitly ask Glover to reach out to Epstein? No. But was the broader goal of finding a way to finance the take-private deal something that Musk wanted accomplished? Almost certainly yes.

So while Musk may not have directed Glover to Epstein specifically, he may have set the parameters for her problem-solving that naturally led her to consider unconventional solutions.

The Epstein Prison Perspective: What His Lawyers Claimed He Was Offering

One of the most bizarre elements of this story is that by 2018, when Glover was reaching out to Epstein, he was not in prison. He had been convicted of solicitation of prostitution and procurement of minors to engage in prostitution in Florida back in 2008. He had pled guilty. He had registered as a sex offender. But he had received a sweetheart deal that allowed him to serve time in the local jail rather than prison, and he had been released relatively quickly.

The question of why Epstein received such a lenient sentence has been the subject of extensive investigation and debate. It involved decisions by prosecutors, decisions by judges, decisions by lawyers. But the end result was that by 2018, Epstein was back in polite society, living on his island, maintaining relationships with wealthy and powerful people, and apparently still positioning himself as a sophisticated financial advisor.

This context is important because it means that when Glover reached out to Epstein, she wasn't consulting with someone who was locked away from the world. She was consulting with someone who had successfully navigated the legal system, who had emerged on the other side with his wealth and connections largely intact, and who was still being treated by some parts of the wealthy elite as a valuable advisor.

The fact that this was possible—that Epstein could serve a sentence that was widely viewed as inadequate, and then re-emerge into high society and be trusted with sensitive information about billion-dollar deals—tells us something uncomfortable about how the system works for the extraordinarily wealthy.

What We Learned About Decision-Making Under Pressure

The entire Tesla take-private saga, and Glover's outreach to Epstein in particular, is instructive about how intelligent people make poor decisions when facing time pressure and impossible odds.

Glover wasn't a stupid person. She was a sophisticated Washington operator who understood power and how to navigate complex situations. But she was also facing an seemingly impossible problem: Musk had made a reckless claim that he couldn't back up, and she had been asked (implicitly or explicitly) to find a way to make it real.

When facing an impossible task, the temptation is to use every tool at your disposal. And if Epstein could provide access to Saudi wealth, if he could smooth the path to capital, if he could make something that seemed impossible become possible, then reaching out to him made a certain kind of sense. It was a high-risk, high-reward play made by someone under pressure.

But that calculation was flawed in ways that should have been obvious. Consulting with a convicted sex offender about a major corporate financing deal isn't just ethically fraught, it's also practically unwise. It increases risk. It creates exposure. It generates liability if anything goes wrong. And in this case, things did go wrong, because the deal fell apart and the SEC investigation intensified.

The lesson here isn't that Glover is a bad person or that Musk is evil (though reasonable people can differ on both those points). The lesson is that when people are desperate enough, when they're facing sufficient pressure, when they believe the stakes are high enough, they will consider options they would normally rule out. They will rationalize consulting with inappropriate advisors. They will convince themselves that the unusual is actually necessary.

The Saudi Arabia Angle: Crown Prince Mohammed bin Salman's Relationship to Epstein

One of the most important pieces of this puzzle remains partially obscure: the nature and extent of Epstein's relationship with Saudi Crown Prince Mohammed bin Salman. Glover believed Epstein had access. But how real was that access?

MBS, by all accounts, was eager to invest in technology and position Saudi Arabia as a forward-thinking kingdom. He visited Silicon Valley. He met with tech leaders. He was building relationships with people in the innovation ecosystem. It's entirely plausible that he would have met Epstein at some high-profile gathering, or that they would have mutual connections.

But the jump from knowing someone at a party to having the kind of access that would be useful for brokering a billion-dollar deal is substantial. Did Epstein really have MBS on speed-dial? Or was the relationship more distant, more superficial, more based on rumor than reality?

The declassified documents don't definitively answer this question. And it may be that the documents never will, because if Epstein and MBS were in contact about sensitive matters, that communication probably happened through channels that weren't captured by the FBI's Epstein investigation.

What we can say is that Glover believed in the connection enough to build her entire strategy around it. And that belief, whether it was based on reality or on optimistic assumptions, drove her to reach out to Epstein and brief him on confidential information about Tesla.

The Ripple Effects: How This Damaged the Companies and People Involved

The immediate effect of the take-private saga was visible and dramatic: Musk was forced to step down as chairman, the company remained public, the Saudis didn't commit the funding they had discussed, the SEC fined both Musk and Tesla, and the whole situation became a regulatory nightmare.

But the ripple effects extended further. Tesla's investors had to grapple with the reality that their CEO made reckless financial claims on social media. Employees had to work for a company whose future seemed uncertain. The company's reputation in certain circles was damaged. The relationship between Musk and the SEC became more adversarial. And regulators were put on notice that they needed to monitor Musk's Twitter activity more carefully.

For Glover, the situation was awkward. Her role in the behind-the-scenes efforts remained largely confidential until the DOJ released the documents. But for Epstein, the revelation that he was still trying to position himself as a valuable advisor to the wealthy and powerful—that he was using whatever remaining credibility he had to insert himself into billion-dollar deals—added to the growing evidence that he was far from a reformed figure.

Within a few years, Epstein would be arrested again (in 2019), and he would die in jail under circumstances that remain controversial. But in 2018, he was still alive, still wealthy, still connected, still trying to leverage whatever influence he had retained.

Lessons About Corporate Governance and Due Diligence

The Tesla take-private episode offers several important lessons about corporate governance that remain relevant today.

First, it demonstrates the risks of allowing a single individual to have unchecked decision-making authority. Musk's power was such that he could post a tweet claiming to have secured funding for a take-private deal that hadn't actually been secured. By the time the company's board or legal team could verify the claim, the tweet had already been sent, the market had already reacted, and the SEC was already investigating.

Second, it shows the importance of having advisors who are willing to say no. In theory, Glover was hired to help manage the PR fallout from Musk's various controversies. But instead of telling him that consulting with a convicted sex offender about corporate finance was a bad idea, she went ahead and did it, trying to solve Musk's impossible problem by any means necessary.

Third, it highlights the need for better background check procedures in corporate advisory roles. Reaching out to Epstein should have been flagged as inappropriate at multiple levels, but instead it was allowed to proceed without serious challenge.

Fourth, it demonstrates how legal and reputational risk can intersect. Even if the Tesla take-private deal had succeeded, the revelation that it was facilitated through counsel from a convicted sex offender would have been a catastrophic reputational liability.

The Bigger Picture: How the Wealthy Navigate Different Rules

When you step back and look at the entire episode holistically, what emerges is a picture of how the extraordinarily wealthy and powerful operate according to different rules than the rest of us.

A typical person cannot post on social media claiming to have secured funding for a major transaction, then face SEC fraud charges, then pay a fine and move on as if nothing happened. A typical person cannot have their company pay an equal fine as a form of cover. A typical person cannot step down from one title while retaining real power.

But Musk could. And did.

Similarly, most people would find themselves in serious legal jeopardy if they knowingly consulted with a convicted sex offender about a major financial deal. But Glover never faced criminal charges. She wasn't investigated. The revelation was handled as gossip rather than as a serious ethical or legal breach.

And Epstein, despite his conviction and registration as a sex offender, remained a functioning member of the wealthy elite in 2018. He was still receiving credible requests for advice. He was still being consulted on major financial matters. He was still being treated as if his past crimes were a curiosity rather than a disqualifying factor.

This pattern suggests something uncomfortable about how power works: that it creates different rules for different people, that it allows certain individuals to navigate situations that would be catastrophic for others, and that it permits past wrongs to be overlooked if the person is sufficiently wealthy or connected.

The Aftermath and Remaining Questions

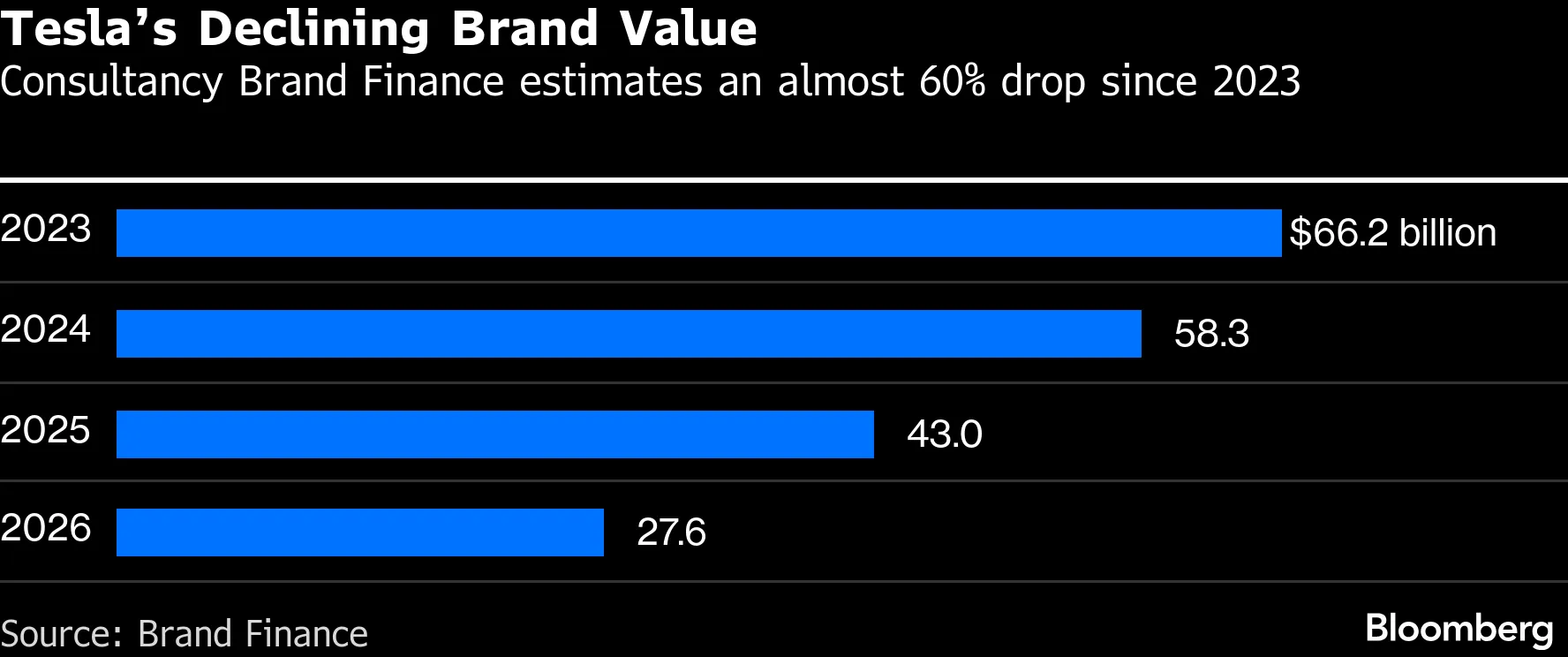

Years have passed since the 2018 take-private saga. Tesla is now worth far more than even the $420 price point that Musk joked about. The company has continued to grow, to succeed, to cement its position as the leading electric vehicle manufacturer in the world.

Musk has moved on to other controversies, other Twitter feuds, other business challenges. His estrangement from the SEC has evolved. His relationship with regulators has shifted. But the fundamental question of how much accountability he faces for his actions remains unresolved.

Epstein's story ended tragically and controversially in a jail cell in 2019. But before that, there are still unanswered questions about his contacts, his influence, and the extent of his access to the highest levels of power. The declassified documents provide some answers, but they also reveal how much remains obscure.

And Glover, despite her role in one of the more unusual episodes of modern corporate history, has largely disappeared from public view. She hasn't been held accountable in any formal sense. She hasn't faced serious professional consequences. She was just a fixer doing what fixers do: trying to make impossible things possible.

Which brings us to the final observation: sometimes the most important stories aren't about what happened, but about what it reveals about the system that allowed it to happen in the first place.

FAQ

What was the Tesla take-private deal in 2018?

In August 2018, Elon Musk tweeted that he was "considering taking Tesla private at $420" and that "funding secured." The deal would have involved converting Tesla from a publicly traded company to a privately held one. However, Musk had not actually secured the funding at the time of the tweet, which led to SEC fraud charges and Musk being forced to settle and step down as chairman.

Who was Juleanna Glover and what was her role?

Juleanna Glover is a high-powered lobbyist and consultant who was brought in to help manage the PR fallout from Musk's public controversies in 2018. She then took on a behind-the-scenes role trying to make the take-private deal happen by reaching out to potentially interested parties, including Jeffrey Epstein, to explore financing options.

Why did Glover contact Jeffrey Epstein about the Tesla deal?

Glover believed that Epstein had connections to Saudi Arabia's Crown Prince Mohammed bin Salman, and she was trying to leverage those connections to persuade Saudi Arabia's Public Investment Fund (PIF) to commit financing for the take-private deal. Musk had already been in preliminary discussions with the Saudis about the possibility.

Did Elon Musk know that Glover was consulting with Epstein?

According to Glover's later statements, Musk was never aware of her communications with Epstein. There is no evidence in the declassified documents that Musk directly instructed her to reach out to Epstein. However, Musk had set the goal of finding financing for the take-private deal, which created the context for Glover's decision-making.

What absurd suggestions did Epstein make about Tesla?

Epstein suggested adding Margaret Thatcher to Tesla's board, despite the fact that Thatcher had died in 2013, five years before his suggestion. This raised questions about whether Epstein was genuinely engaged with understanding Tesla's needs and structure, or whether he was simply going through the motions to appear helpful.

What happened to the Tesla take-private deal?

The deal never happened. The SEC filed fraud charges against Musk for the misleading tweets, Musk was forced to settle by paying fines and stepping down as chairman, and the pressure to actually execute the deal collapsed. Saudi Arabia's PIF ultimately did not commit the funding that had been discussed.

How did these documents become public?

The U.S. Department of Justice released over 3 million pages of documents related to investigations into Jeffrey Epstein in late 2024. These documents, which were previously sealed, contained the emails between Glover and Epstein, revealing the behind-the-scenes effort to use Epstein's connections for the Tesla deal.

What does this reveal about corporate decision-making under pressure?

The episode demonstrates how intelligent, sophisticated people can make questionable decisions when facing seemingly impossible problems and time pressure. Glover's decision to consult with a convicted sex offender was a high-risk, high-reward calculation made by someone trying to solve an urgent, high-stakes problem. It highlights how pressure can override normal judgment and caution.

What were the SEC charges against Musk, and what happened?

The SEC charged Musk with securities fraud for making false and misleading tweets about securing funding for the take-private deal. Musk settled the charges by paying a

What is the significance of the Saudi Arabia connection?

Saudi Arabia's Public Investment Fund had approximately $250 billion in assets and was actively seeking transformative technology investments. For Musk's take-private deal to work, he needed their capital commitment. Glover believed that Epstein's supposed connections to Crown Prince Mohammed bin Salman could help facilitate this crucial investment, which is why she was willing to brief Epstein on confidential Tesla information.

Conclusion: Power, Desperation, and the Rules That Don't Apply

The story of how Jeffrey Epstein found himself advising a Musk associate on taking Tesla private is, at its core, a story about how power and desperation intersect. It's a story about what happens when someone faces an impossible problem and decides that the normal rules don't apply. It's a story about how the extraordinarily wealthy and connected operate in a system with different standards than everyone else.

But it's also a story with a lesson that extends far beyond Silicon Valley, beyond corporate finance, beyond the quirks of billionaire behavior. It's a story about how institutions fail, how oversight breaks down, how people convince themselves that the inappropriate is actually necessary.

When Glover made the decision to reach out to Epstein, she probably told herself that she was just trying to make something happen. She was trying to solve an impossible problem. She was trying to help. She probably didn't spend much time thinking about the ethics or the risks or the fundamental unsuitability of consulting with a convicted sex offender about a multi-billion-dollar corporate deal.

But that's precisely the problem. That's how systems fail. That's how bad things happen: one decision at a time, each made by someone who convinced themselves that their particular situation was special, that the rules didn't quite apply, that the ends justified the means.

The Tesla take-private deal never happened. Musk's reckless tweet never became reality. The Saudis didn't commit the money. Epstein didn't broker the deal. The entire elaborate scheme collapsed under the weight of its own impossibility.

But the revelation of what happened behind the scenes tells us something important about how power actually works, how decisions actually get made, and what people are actually willing to do when the stakes feel high enough. And that's a story worth understanding, regardless of what you think about Musk, or Epstein, or any of the other characters in this increasingly strange Silicon Valley saga.

The take-private deal failed not because of legal constraints or moral objections, but because the underlying premise was flawed. Musk had made a claim he couldn't back up. You can't make a public company private without actual capital. No amount of consulting with well-connected criminals can change that fundamental reality.

But that didn't stop people from trying. And that's the most revealing detail of all.

Key Takeaways

- A Musk advisor secretly consulted with Jeffrey Epstein about financing Tesla's 2018 take-private deal, seeking connections to Saudi Arabia's sovereign wealth fund

- Epstein suggested adding the deceased Margaret Thatcher to Tesla's board, revealing gaps in his understanding of the company

- The entire operation happened without Musk's explicit knowledge, though he had set the goal of finding financing

- Musk's reckless $420 tweet was made without actually securing funding, leading to SEC fraud charges and his forced resignation as chairman

- The deal ultimately failed because the underlying premise was impossible: you cannot take a public company private without actual capital and proper planning

Related Articles

- How Elon Musk Is Rewriting Founder Power in 2025 [Strategy]

- Tech Elites in the Epstein Files: What the 3.5M Documents Reveal [2025]

- Epstein Files: The Tim Cook Meeting That Exposed Silicon Valley's Hidden Networks [2025]

- xAI Engineer Exodus: Inside the Mass Departures Shaking Musk's AI Company [2025]

- Tech Elites in the Epstein Files: What the Documents Reveal [2025]

- Tesla Electronic Door Handles: Deaths, Lawsuits, and Safety Concerns [2025]

![Epstein's Secret Role in Musk's Tesla Private Deal [2025]](https://tryrunable.com/blog/epstein-s-secret-role-in-musk-s-tesla-private-deal-2025/image-1-1770835137030.jpg)