European Commission Probes Shein's Addictive App Design and Illegal Product Sales [2025]

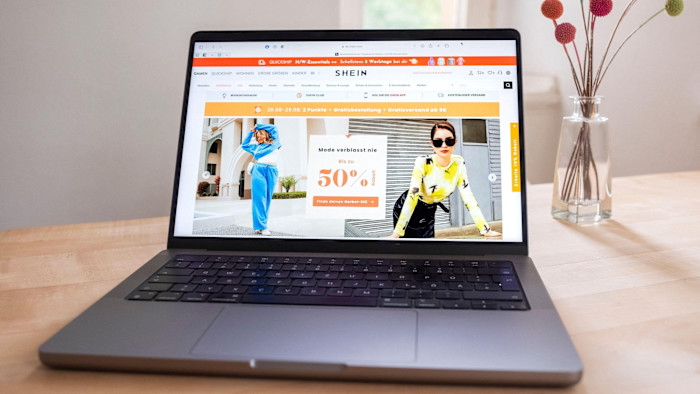

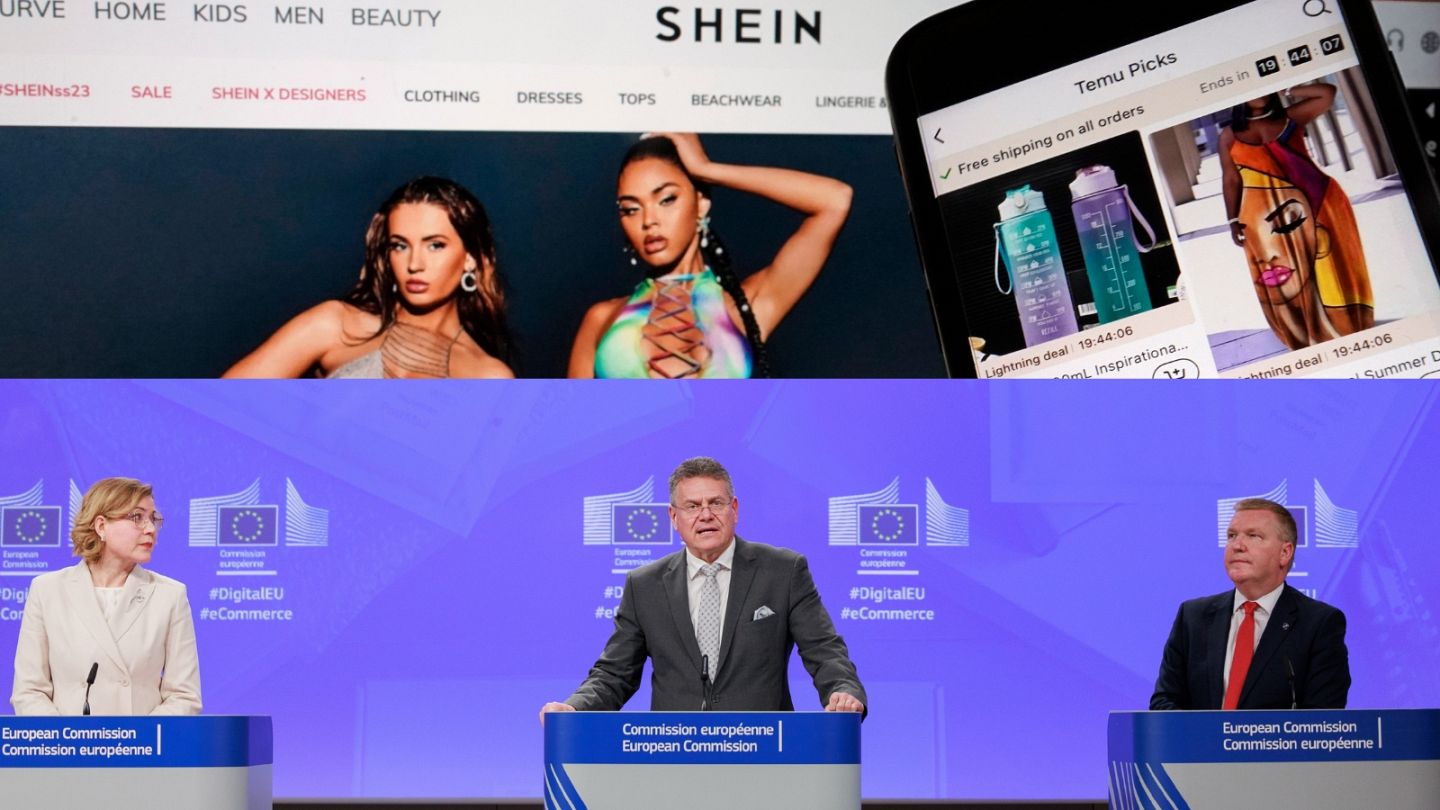

The European Commission just opened a formal investigation into Shein, the fast-fashion giant that's quietly become a $66 billion empire. What started as a whisper about cheap clothes has turned into something far more serious: regulators are now scrutinizing whether the company deliberately engineers addictive shopping experiences while turning a blind eye to illegal products, including child sexual abuse material.

This isn't just another regulatory probe. It's a signal that Europe's patience with big tech and e-commerce companies is running out. The Commission has already fined Temu for similar violations. They're currently investigating TikTok's addictive design patterns. And now Shein finds itself in the crosshairs during a moment when the EU's Digital Services Act is becoming the most consequential tech regulation on the planet.

Let's break down what's actually happening here, why it matters, and what this means for Shein, consumers, and the broader future of online retail.

What the European Commission Actually Found

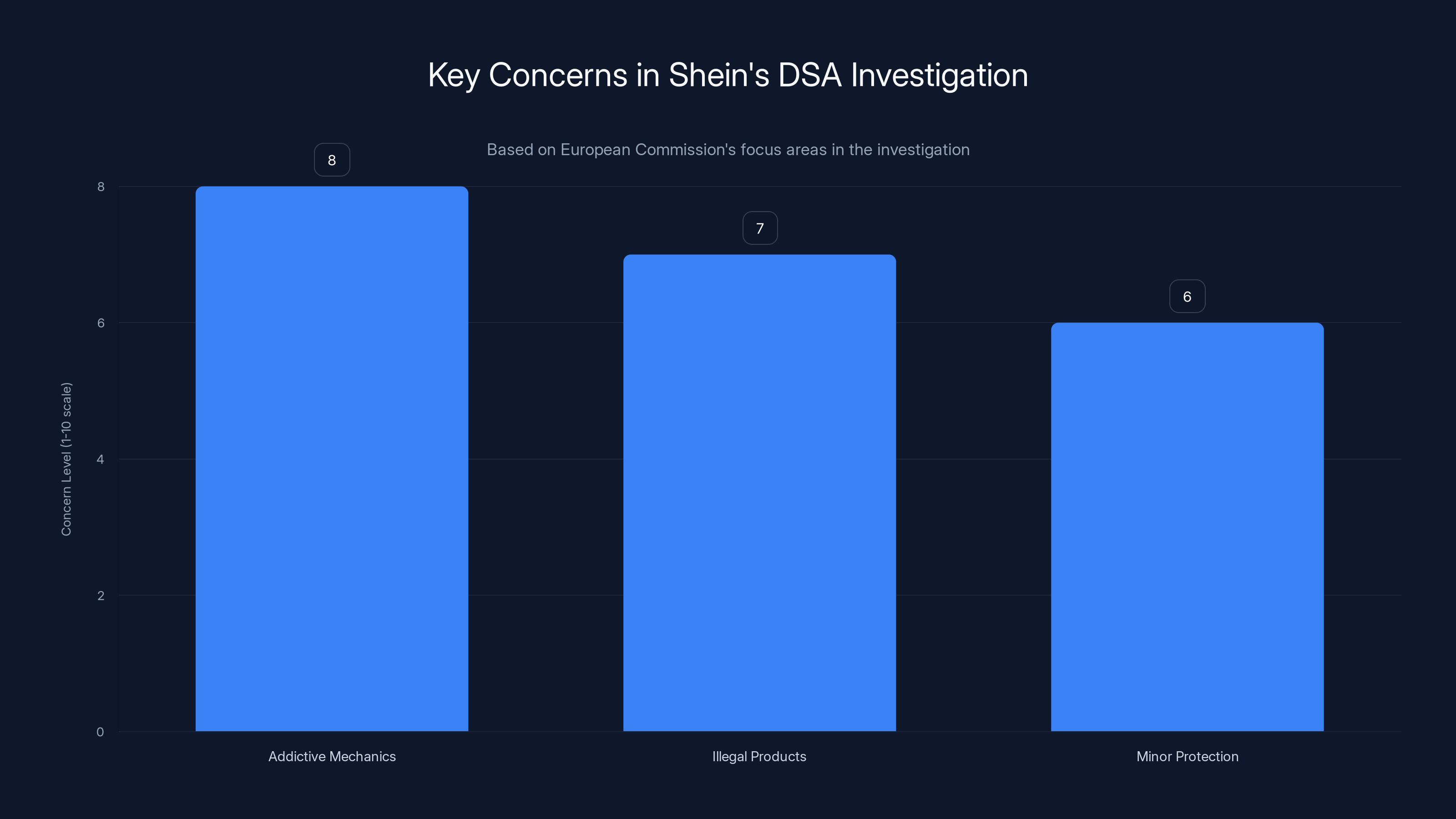

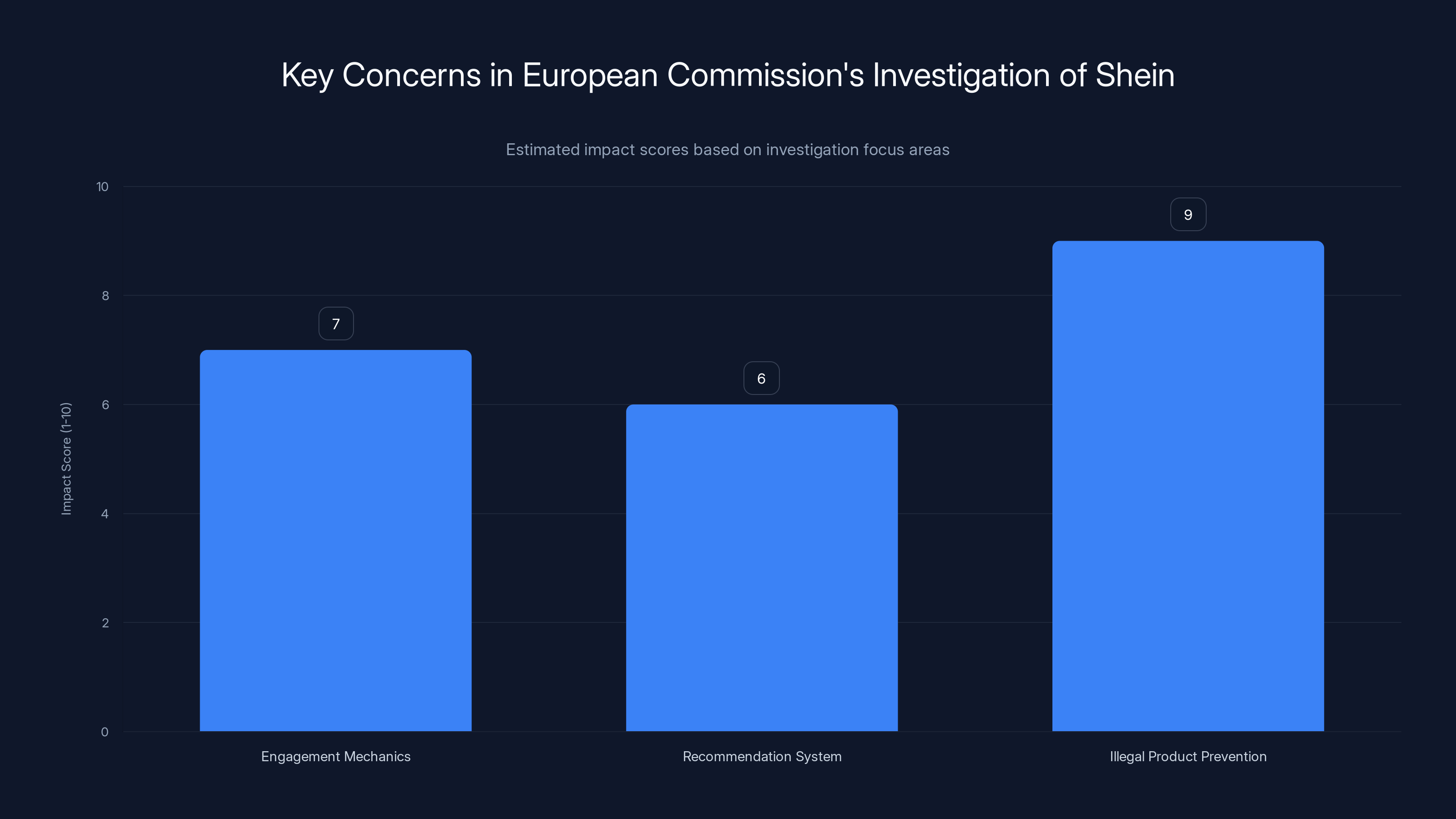

The European Commission isn't operating on hunches. The investigation centers on two major concerns that regulators can point to with specificity: the deliberate use of engagement mechanics that appear designed to create compulsive shopping behavior, and the systemic failure to prevent illegal products from being sold on the platform.

On the addictive design side, the Commission is looking at Shein's points and rewards system. You know the one: earn points with every purchase, get bonuses for inviting friends, unlock exclusive discounts. These mechanics aren't accidental. They're borrowed directly from the playbook that keeps people scrolling on TikTok and Instagram. The difference is that Shein's rewards are pushing people toward spending money, not just time.

The algorithmic recommendation system is another focal point. Shein's AI learns what you're interested in and serves up endless variations. A dress you clicked on yesterday becomes fifty dresses tomorrow, each one slightly different enough to feel novel, but similar enough that you're already mentally committed to the category. This is profiling taken to an extreme, and the Commission wants to know if Shein is deliberately exploiting psychological vulnerabilities.

But the points and rewards system pales in comparison to the second accusation: Shein's alleged inability or unwillingness to prevent child sexual abuse material from being sold on its platform. This isn't about borderline products. This is about one of the most serious crimes imaginable being facilitated by inadequate safety systems. The fact that this material exists on the platform at all suggests either incompetence at scale or a deliberate decision to prioritize growth over safety.

The European Commission's investigation into Shein focuses on addictive mechanics, illegal products, and minor protection, with addictive mechanics being the highest concern. Estimated data.

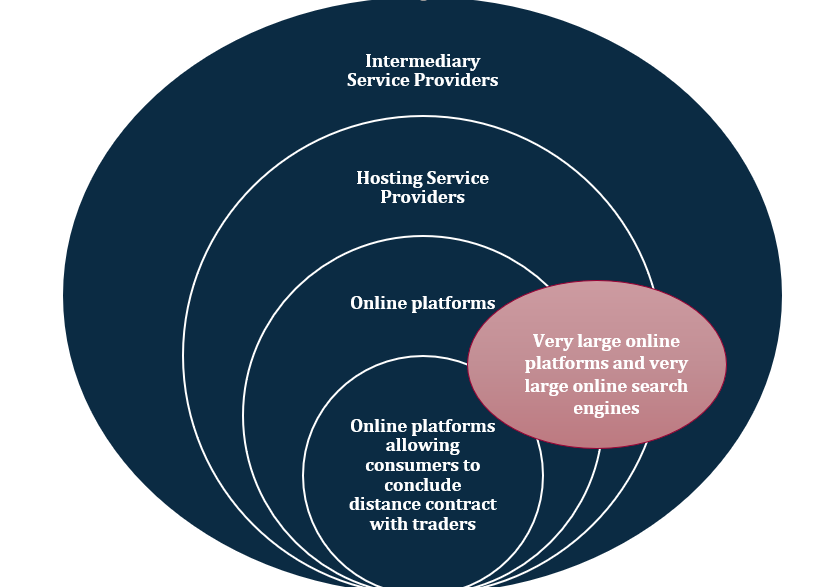

The Digital Services Act: Europe's Most Powerful Tech Regulation

Understanding this investigation requires understanding the Digital Services Act (DSA). It's not a small regulation with loopholes. It's a comprehensive framework that essentially says: if your platform hosts user-generated content or facilitates transactions, you're responsible for what happens on it.

The DSA came into force in August 2024, and it fundamentally changed the relationship between platforms and regulators. Companies can no longer hide behind "we're just a marketplace" arguments. They have to actively prevent illegal content, particularly content that harms children. They have to be transparent about their algorithms. And they have to design their platforms in ways that don't exploit user psychology.

When the European Commission investigated Temu last year under these same rules, they found multiple violations. Temu was using similar engagement mechanics, had inadequate protections against counterfeit goods, and failed to implement age verification systems. The investigation resulted in Temu being formally notified of violations and given a timeline to change their practices.

Shein's investigation follows the same pattern, but with added urgency because of the child safety component. This makes it a higher-priority case for regulators who are trying to send a message that child safety violations will be treated differently than just having addictive UI design.

The Commission has specific legal powers here. They can demand that Shein prove how their systems work. They can require real-time audits. They can impose interim remedial measures before the investigation is even complete. And if Shein refuses to cooperate, the fines compound.

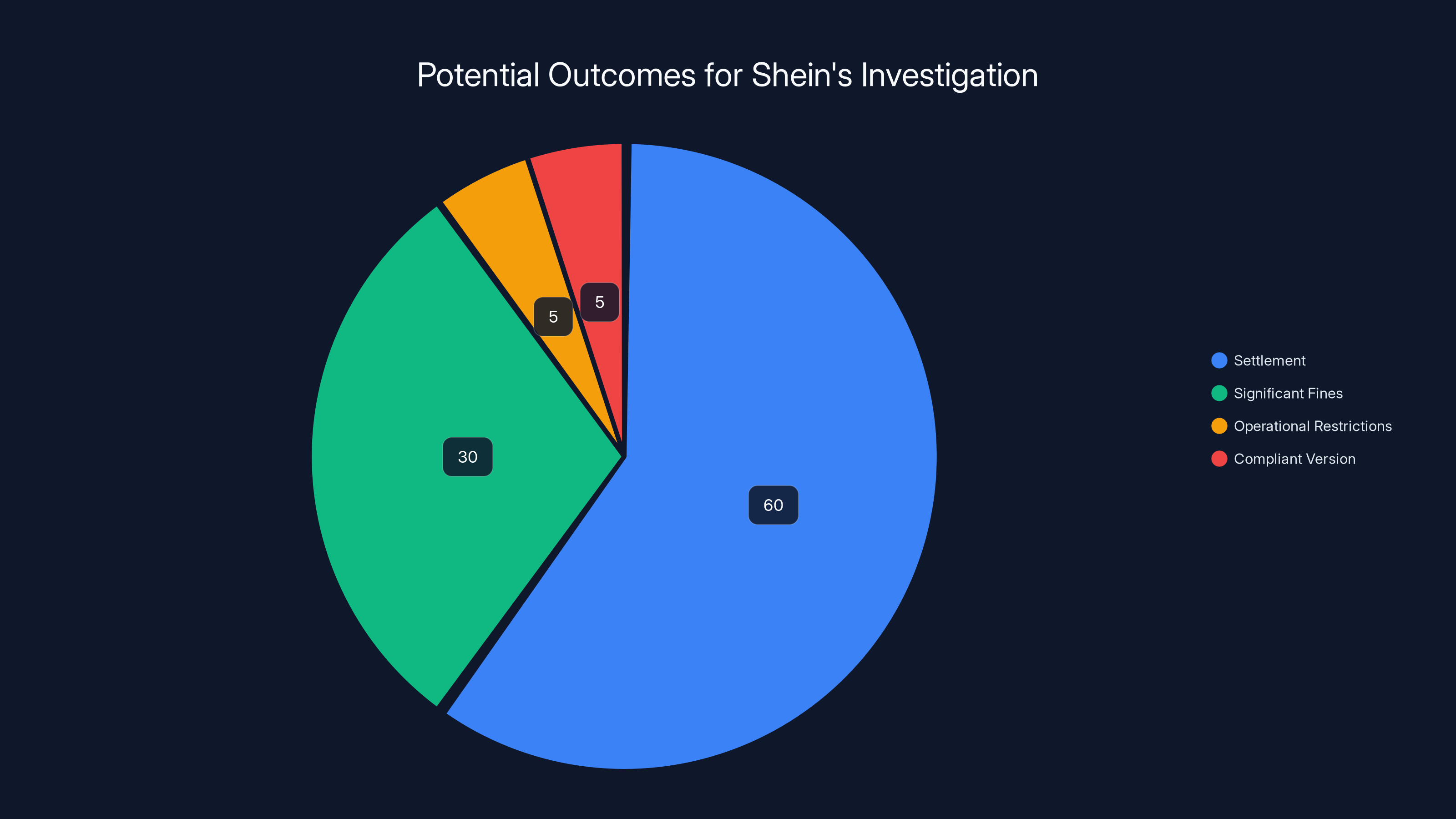

The most likely outcome is a settlement with a 60% probability, while operational restrictions and launching a compliant version each have a 5% chance. Estimated data.

Addictive Design: The Psychology Behind Shein's Business Model

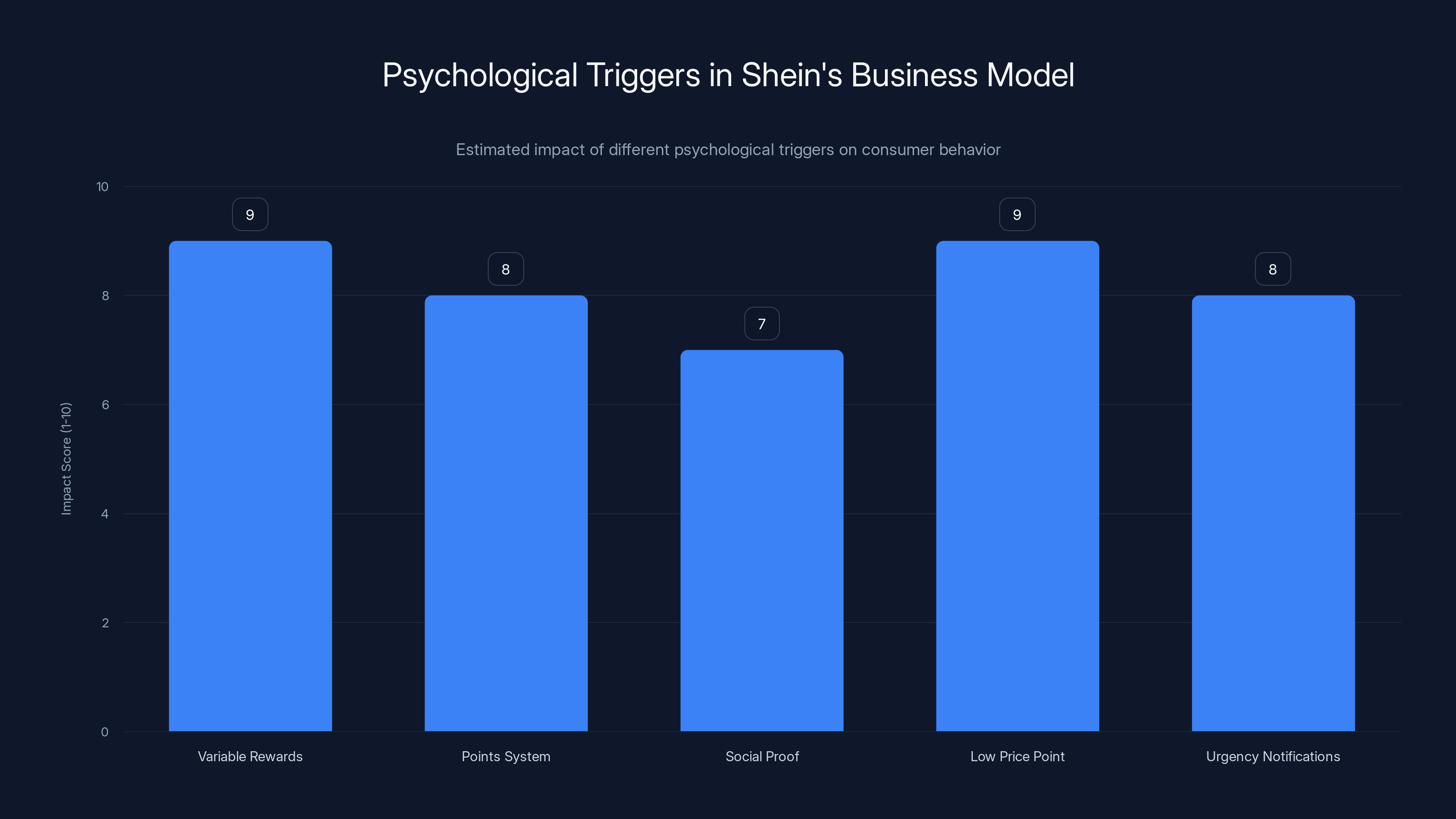

Shein didn't invent addictive design, but they've weaponized it better than most. Understanding how this works requires understanding behavioral psychology and the specific mechanics that trigger compulsive behavior.

Variable rewards are the foundation. Every time you open the Shein app, something slightly different greets you. A flash sale on items you viewed yesterday. A new item in your size. A notification that you're close to earning a reward tier. Your brain doesn't know what to expect, and that uncertainty is powerful. Neuroscience research shows that variable reward schedules trigger stronger dopamine responses than predictable ones.

The points system layered on top of this creates what psychologists call a "variable ratio schedule." You don't know when your next purchase will unlock a meaningful reward, so you keep shopping. One more item. Just one more checkout. Maybe this one will push you over the threshold.

Shein also leverages social proof aggressively. The app displays "trending now" items with real-time purchase counts. You see that 3,200 people bought this exact dress in the last 24 hours. Fear of missing out kicks in. The item might disappear. The stock might run out. Now it's not just about whether you want the item—it's about whether you can afford to not buy it.

Then there's the price point itself. Shein's stuff is so cheap that the friction of purchase is essentially zero. A t-shirt for

The company also uses push notifications and email in ways that feel designed to interrupt whatever you're doing. "Exclusive offer expires in 2 hours." "New styles just added in your favorite category." "Earn double points today." These notifications are timed to create urgency without being so aggressive that users immediately uninstall.

What makes all of this particularly concerning to regulators is that Shein's primary user base skews young. The app appeals heavily to Gen Z users, particularly teenage girls and young women who are still developing impulse control and are particularly vulnerable to social comparison and FOMO tactics.

The Illegal Products Problem: A Systemic Failure

The addictive design stuff is concerning. The illegal products issue is alarming. Shein operates a marketplace model where third-party sellers can list products. This is how Amazon operates, how eBay operates. But unlike those companies, Shein appears to have minimal quality control.

Counterfeit goods are the least serious problem. Shein has been called out repeatedly for selling counterfeit designer items, knockoff logos, and products with intellectual property violations. Fashion brands have been suing Shein for years over this. But counterfeit Gucci bags, while illegal, don't hurt people directly.

The child sexual abuse material allegations are different. If CSAM is appearing on Shein's platform, that suggests the company isn't doing basic keyword filtering, content moderation, or age verification. It suggests that a predator could, in theory, list illegal images on the platform and find buyers. The fact that this is happening on a shopping app makes it worse because it suggests the safeguards that other platforms have implemented are absent.

European regulators have been particularly aggressive about CSAM in recent years. The Online Safety Directive, which preceded the DSA, specifically required platforms to have systems in place to detect and remove this content. Shein appears to have failed these requirements.

Beyond CSAM, there are reports of Shein selling counterfeit pharmaceutical products, fake cosmetics containing dangerous chemicals, and products manufactured using child labor. None of these are accidents. They're inevitable consequences of a marketplace model that prioritizes volume and speed over verification.

The Commission will likely ask Shein to prove they have adequate systems to detect these products. They'll want to see proof of content moderation. They'll demand to know what happens when reports come in. And they'll probably find that Shein's approach is to delete individual listings without fixing the underlying system that allows them to appear in the first place.

The European Commission's investigation into Shein highlights three major concerns, with illegal product prevention scoring the highest impact due to its severe implications. Estimated data.

Why This Investigation Matters: Setting Precedent for Tech Regulation

This isn't just about Shein. This investigation is about establishing what the Digital Services Act actually means in practice. The EU is essentially answering the question: "What happens to a platform if they violate these rules?"

The stakes matter because Shein is a different type of company than Temu or Meta. Shein is a retailer. They're not a social media platform. If regulators can compel a retailer to redesign their app's engagement mechanics, that sets a precedent that any business model involving user interaction is subject to scrutiny.

This also signals how seriously Europe is taking the algorithmic recommendation problem. The Commission's investigation into the X algorithm earlier this year was about transparency. This Shein investigation is about demanding that platforms use their algorithms responsibly. The Commission will likely demand that Shein offer a non-personalized recommendation system as an alternative.

For TikTok, which is also under investigation for addictive design, this Shein case becomes even more important. If the Commission successfully argues that Shein violated the DSA by using variable reward mechanics and algorithmic recommendations, that same logic applies to TikTok's for-you page, which is essentially a variable reward system disguised as a feed.

The precedent being set is: you can still make engaging products, but you can't deliberately engineer addiction. You can use algorithms, but users must be able to opt out of algorithmic recommendations. You can operate a marketplace, but you're responsible for what's being sold.

The Global Implications: Will This Spread Beyond Europe?

Here's the question that keeps Shein's leadership up at night: does this regulation stay in Europe, or does it become the template everywhere?

Historically, European regulations have spread globally because compliance is expensive. When Europe passed GDPR in 2018, companies didn't create a GDPR-compliant Europe and then maintain separate systems elsewhere. They usually just implemented GDPR globally because it's simpler than managing multiple compliance frameworks.

This Shein investigation could follow the same pattern. If Europe forces Shein to implement age verification systems, redesign their rewards program, and overhaul their content moderation, Shein will likely do all of that globally. It makes no sense to maintain multiple versions of the app based on geography.

Other countries are watching this closely. The UK already left the EU but is largely mirroring DSA regulations with their Online Safety Bill. Brazil, Australia, and several other countries are considering similar frameworks. If Europe's approach works, others will likely follow.

For Shein, this investigation could be the moment where their growth trajectory changes. If Europe forces them to redesign core mechanics that drive engagement, that could impact user retention globally. If they're forced to implement serious content moderation, costs rise. If they have to verify user ages, friction increases.

The company has already been controversial on multiple fronts. Labor practices. Environmental impact. Data privacy. Now they're facing the one issue that governments won't overlook: child safety.

Variable rewards and low price points are the most impactful psychological triggers in Shein's business model, driving compulsive shopping behavior. (Estimated data)

Shein's Response and Likely Defense Strategy

Shein will argue they're complying with regulations and that they're investing in safety. They'll point to their trust and safety team. They'll highlight their cooperation with law enforcement. They'll argue that third-party marketplace models inherently have challenges and that they're doing better than most.

None of this will probably work. The Commission's investigation isn't interested in whether Shein is trying hard. It's interested in whether they've violated the law. And if CSAM appeared on their platform, trying hard doesn't matter. The requirement is to prevent it, not to have the best intentions.

Shein might argue that the rewards system isn't designed to be addictive, just engaging. This is a weaker argument because "engaging" and "addictive" are on a spectrum, and the Commission has already established through the Temu case that certain mechanics cross the line.

The company might also argue that they can't possibly moderate everything on a marketplace with millions of sellers. This argument has some merit, but it's also why the Commission is likely to demand technical solutions like automated screening, not just manual review.

Ultimately, Shein's best defense is speed. If they can show that they're making real changes before the Commission formally concludes that violations occurred, they might negotiate a reduced penalty. But if they fight this or drag their feet, the fines could be substantial.

The Broader Battle: Addictive Design vs. Innovation

This investigation touches on a fundamental tension in tech regulation. How do you prevent addictive design without killing innovation and user engagement?

No one wants boring apps. Engagement is what makes products valuable. The question is whether you achieve engagement through understanding user needs or through exploiting psychological vulnerabilities.

The Commission is essentially arguing that there's a difference. You can make an engaging shopping app without using variable reward schedules. You can have recommendations without using dark patterns. You can build a successful platform without manipulating people's dopamine systems.

Shein's entire business model depends on the opposite assumption: that user engagement, measured in purchases, requires psychological exploitation. Their UI is deliberately designed to minimize friction. Their rewards are designed to create compulsion. Their recommendations are designed to maximize time spent and items viewed.

This is a philosophical difference that will play out in the regulatory space for years. Europe is taking the position that business success and psychological manipulation aren't the same thing. The US is still figuring out whether it agrees.

For Shein specifically, this means they'll need to think about what their business looks like if they can't use these tactics. Can they still be attractive to users? Can they still compete with other fashion retailers? The answer is probably yes, but with lower margins and slower growth.

The investigation into Shein by the European Commission could span 18 to 24 months, with each phase taking several months. Estimated data.

Timeline: What Happens Next

The European Commission's investigation will proceed in stages. First, they collect evidence. They demand that Shein provide information about how their systems work. They analyze the data. They look for patterns that indicate violations.

This phase can take several months. The Commission will want to understand the technical architecture behind the rewards system. They'll want user data that shows addiction patterns. They'll want logs of how the recommendation algorithm works. Shein will resist some of this, and there will be legal arguments about scope and relevance.

Once the Commission has enough evidence, they'll issue a preliminary assessment. This is essentially a draft finding of violations. Shein gets a chance to respond, to argue their case, to propose remedies. This phase typically takes a few months.

If the Commission's preliminary assessment holds up, they issue a final decision. This is binding. It states what violations occurred and what the company must do to fix them. Fines are specified. Timelines for compliance are set.

Shein can appeal to the European Court of Justice, but that appeals process is years long and Shein would still be required to comply with the original decision while the appeal is pending.

The whole thing, from investigation to final decision, could take 18 months to two years. In the interim, Shein continues operating, but under increasing pressure to make changes.

Precedent from the Temu Investigation

Understanding what happened with Temu gives us a roadmap for what might happen with Shein. The Temu investigation focused on similar issues: addictive design, lack of consumer protection, inadequate age verification, and failure to remove illegal products.

The Commission found that Temu was using gamification and reward mechanics in ways that violated the DSA. They also found that Temu wasn't doing enough to protect minors. The company agreed to make changes, including redesigning their interface, implementing age verification, and improving content moderation.

What's interesting is that Temu's changes didn't destroy their user base. They're still wildly popular. But compliance did mean slower feature rollouts and higher operational costs. Temu had to hire more people for content moderation. They had to license and implement age verification technology. They had to redo the user interface.

For Shein, the Temu precedent suggests that compliance is possible but expensive. The precedent also shows that the Commission is willing to use its authority. They didn't just warn Temu. They formally found violations and demanded remedies.

Another interesting aspect of the Temu case is that it happened relatively quickly. The investigation was initiated and concluded within about a year. This suggests that the Shein investigation might also move faster than traditional regulatory processes because the Commission has already worked through the legal arguments with Temu.

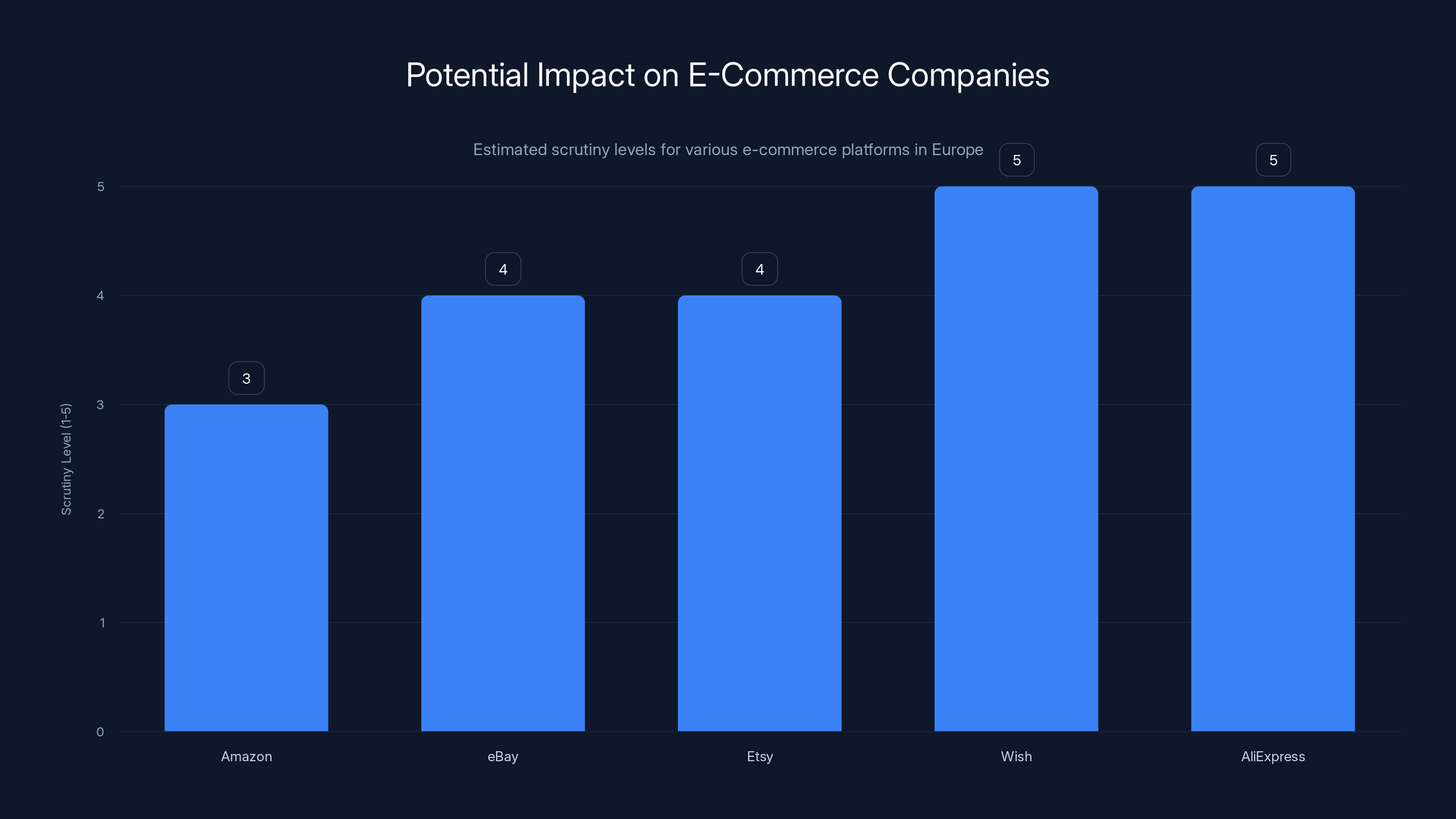

Estimated scrutiny levels show that platforms like Wish and AliExpress may face higher regulatory attention due to their engagement tactics. Estimated data.

What This Means for Consumers

For people who shop on Shein, this investigation could actually be good news. If the Commission succeeds in forcing design changes, the app might become less manipulative. You might spend less money. You might encounter fewer questionable products.

But there are also risks. If Shein is forced to increase prices to cover the cost of compliance, that

Consumers might also see reduced personalization. If Shein can't use algorithmic recommendations, the experience becomes more like a traditional catalog. Everything is visible, but nothing is tailored to you. For some people, this is better. For others, it's worse.

The child safety angle is important here. If Shein is forced to implement better content moderation, that reduces the risk that your purchases support CSAM. It's hard to put a value on that, but it matters.

One consequence that won't happen: Shein won't just disappear. Even if the Commission wins decisively, Shein continues operating in Europe. They'll just do it in a more compliant way. For casual users, the shopping experience will probably stay similar. For power users who've trained themselves on Shein's addictive mechanics, the changes will be more noticeable.

The Broader Context: Why Europe is Being So Aggressive

Europe didn't wake up one day and decide to regulate everything. This aggressive stance comes from specific historical lessons and current frustrations.

Europe learned from watching Facebook/Meta grow unchecked that light-touch regulation leads to massive societal problems. Cambridge Analytica. Election interference. Mental health impacts on children. By the time evidence of these harms became clear, Facebook was too big to effectively regulate.

Europe decided not to make that mistake again. When the opportunity came to pass the DSA, they designed it with teeth. They gave themselves the authority to actually make companies change their behavior before the harm gets out of hand.

The other factor is that tech companies have a complicated relationship with Europe. For years, American tech companies treated Europe as a secondary market and expected that European regulations would eventually align with US norms. That's not happening. Europe is becoming more regulatory, not less.

Shein is particularly problematic to Europe because it represents a new generation of tech-enabled companies that are learning from Meta, TikTok, and others about how to exploit psychology. If Europe doesn't act now, while Shein is still growing, the company could become massive and equally difficult to regulate.

There's also a protectionist element here that's worth acknowledging. European fashion companies don't appreciate Shein's ability to undercut their prices. European regulators probably don't mind using the DSA as a way to make Shein's business model less competitive. But the fact that there's a protectionist motivation doesn't mean the concerns about addictive design and child safety are illegitimate.

Implications for Other E-Commerce Companies

This investigation sends clear signals to Amazon, eBay, Etsy, and other e-commerce companies operating in Europe. The Commission is watching. If you use addictive engagement mechanics, you're on notice. If you don't have adequate content moderation, you're on notice. If minors can access adult products on your platform, you're on notice.

The most immediate impact will probably be on other fast-fashion retailers that mimic Shein's model. Companies like Wish, AliExpress, and others that use similar engagement tactics should expect increased scrutiny.

Bigger players like Amazon are probably less concerned because they already have massive compliance infrastructure. But even Amazon might see pressure to change recommendation algorithms or reduce certain types of gamification.

The takeaway for e-commerce companies is: what works in terms of user engagement and addiction isn't necessarily what's legal in Europe. If you're relying on psychological manipulation to drive growth, the Shein investigation should be a wake-up call.

Why Child Sexual Abuse Material is the Inflection Point

Of all the issues in this investigation, the CSAM allegation is the one that changes everything. Addictive design is controversial but debatable. Counterfeit products are common across e-commerce. But CSAM is the absolute red line.

European regulators have made child safety their top priority for tech regulation. The reason is straightforward: children are particularly vulnerable, and the internet has created unprecedented opportunities for predators. When a platform fails to prevent CSAM, it's not a design flaw or a business model issue. It's a failure to protect the most vulnerable.

This issue also transcends the typical EU vs. US regulatory divide. American regulators and international law enforcement agencies also care deeply about CSAM. Shein's failure here isn't just a European problem.

The practical implication is that the CSAM issue will probably accelerate the investigation. The Commission might not wait for a full multi-year process before demanding interim measures. If they can demonstrate that CSAM is appearing on the platform with sufficient frequency, they might impose restrictions on Shein's ability to operate in the EU while the investigation is ongoing.

This is also the issue that makes Shein's defense most difficult. You can argue about reward systems and algorithmic recommendations. But you can't argue about CSAM. Either you have systems in place to prevent it, or you don't. Either you're cooperating with law enforcement to identify sellers of illegal material, or you're not.

For Shein's leadership, this part of the investigation is probably the most concerning. Even if they win on the addictive design allegations, losing on the CSAM issue could be catastrophic for the company's reputation and its ability to operate in Europe.

Potential Outcomes and What They Mean

Let's walk through the likely scenarios for how this investigation concludes.

Scenario 1: Shein Reaches a Settlement

This is the most likely outcome. Shein agrees to make changes, pay a modest fine, and move on. The precedent has been set with Temu, so both sides know roughly what compliance looks like. Shein redesigns the app, implements age verification, and improves content moderation. Life continues.

Odds: 60%

Impact: Moderate disruption to Shein's growth trajectory, but the company continues operating.

Scenario 2: Commission Finds Violations, Imposes Significant Fines

The Commission formally concludes that Shein violated the DSA. They issue fines, potentially in the

Odds: 30%

Impact: Serious financial impact but manageable for a $66 billion company. Reputational damage.

Scenario 3: Commission Restricts Shein's Operations

If the Commission determines that Shein poses an imminent risk of harm (particularly around CSAM), they could temporarily restrict the company's ability to operate in the EU while the investigation continues. This would be unprecedented under the DSA, but legally possible.

Odds: 5%

Impact: Devastating for Shein's European operations and precedent-setting for aggressive regulation.

Scenario 4: Shein Launches Compliant Version and Moves On

Shein decides that fighting the Commission is more expensive than just building a new, fully compliant app for Europe. They launch a separate European version with none of the addictive mechanics, significantly different recommendations, and serious content moderation. It's less profitable but keeps them in the market.

Odds: 5%

Impact: Shein continues operating but with reduced growth and profitability in Europe.

Each of these scenarios is interesting because they all lead to a similar conclusion: Shein's growth in Europe will slow. Whether it's through direct regulation, reputational damage, or self-imposed compliance, the company faces headwinds that didn't exist before this investigation.

The Bigger Picture: How Regulation is Changing Tech

This Shein investigation is part of a larger shift in how the world is regulating technology. For twenty years, the narrative was "move fast and break things." Break regulations, break social norms, break psychological boundaries. Growth was the only metric that mattered.

That era is ending. Governments worldwide are deciding that unfettered tech growth comes with too many costs. Europe is leading this change, but others will follow.

The Shein investigation tells us several things about where regulation is heading:

First, regulators are getting more sophisticated. They understand how addictive design works. They understand algorithmic manipulation. The Commission isn't relying on complaints from users. They're doing technical analysis.

Second, regulators are willing to use their power. The DSA isn't just a law on the books. It's actually being enforced. Companies are being investigated. Violations are being found. This isn't theoretical regulation.

Third, child safety is becoming the ultimate trump card. Any issue involving minors gets accelerated treatment and harsher penalties. This is true across regulatory agencies and countries.

Fourth, no company is too big or too cool to regulate. Shein is a darling of Gen Z. They're the fashion app everyone uses. None of that matters if you violate regulations.

For tech entrepreneurs and companies, the takeaway is clear: the regulatory environment is harder and more complex than it was five years ago. What would have been accepted in 2020 isn't acceptable in 2025. You need to think about compliance from day one, not as an afterthought.

Looking Forward: What Comes After the Investigation

Regardless of how the Shein investigation concludes, it won't be the last one. The Commission is settling into a pattern of investigating major platforms for DSA violations. They're building expertise. They're establishing precedent. Future investigations will move faster and be better informed.

We should expect investigations of other fast-fashion retailers. We should expect continued scrutiny of TikTok and Instagram's addictive mechanics. We should expect new investigations into emerging platforms that use similar tactics.

The precedent established by the Shein case will influence how companies operate globally. If Europe forces Shein to implement age verification, that's a standard that other companies will need to meet to be competitive.

For consumers, this shift toward aggressive regulation is a mixed bag. On one hand, you get more protection from exploitation and illegal products. On the other hand, apps become less engaging and companies might charge more to cover compliance costs.

The real question is whether tech companies can innovate and grow within regulatory constraints, or whether regulation inevitably kills innovation and entrepreneurship. Europe is essentially betting that these aren't mutually exclusive. Time will tell if they're right.

FAQ

What is the Digital Services Act and how does it apply to Shein?

The Digital Services Act is European legislation that governs how online platforms operate and the responsibilities they have for content moderation, algorithmic transparency, and user protection. It applies to Shein because the company operates as an online marketplace within the EU, even though it's Singapore-based. Under the DSA, Shein must prevent illegal products from being sold, disclose how their algorithms work, and avoid deliberately designing addictive features. The law gives the European Commission authority to investigate violations, issue fines up to 6% of global revenue, and mandate changes to how the platform operates.

Why is the European Commission investigating Shein specifically?

The Commission is investigating Shein based on concerns about three main issues: the use of addictive engagement mechanics like points systems and algorithmic recommendations; the appearance of illegal products on the platform, including counterfeit goods and child sexual abuse material; and inadequate protections for minors. The investigation follows a similar probe into Temu that found DSA violations, suggesting that the Commission is taking a broader look at fast-fashion e-commerce platforms that use engagement tactics borrowed from social media.

What are addictive design patterns and how does Shein use them?

Addictive design patterns are intentional features in apps and websites designed to keep users coming back and spending more. Shein uses several tactics: variable reward schedules through their points system, where you don't know when your purchase will unlock a reward; algorithmic recommendations that show endless variations of products you've shown interest in; push notifications and emails creating artificial urgency; pricing so low that purchase friction is minimal; and social proof displays showing real-time purchase counts. These are borrowed from social media platforms but weaponized for shopping, where the goal is not just engagement but actual spending.

What could happen if the Commission finds that Shein violated the Digital Services Act?

If violations are confirmed, the Commission can impose fines ranging from 4% to 6% of Shein's annual global revenue, which could amount to hundreds of millions of dollars. The Commission can also mandate specific changes to how Shein's app operates, such as redesigning the rewards system, implementing age verification, improving content moderation, and providing non-algorithmic recommendation options. Shein would have a timeline to implement these changes, and failure to comply would result in additional penalties. The company can appeal any decision to the European Court of Justice, but must comply with the original decision while the appeal is pending.

How does child sexual abuse material appearing on Shein make this investigation more serious?

The appearance of CSAM on Shein's platform transforms this from a regulatory investigation about design practices into a child safety emergency. Unlike disputes about rewards systems or algorithmic transparency, CSAM isn't debatable or subject to interpretation. The DSA requires platforms to have systems in place to detect and remove such content. If Shein failed to prevent or detect CSAM, that's an unambiguous violation that transcends the usual EU regulatory discussions. This issue also makes the investigation more urgent because it involves actual harm to real children, not just questionable business practices.

Could this investigation affect Shein's ability to operate outside of Europe?

Possibly, though not directly through legal channels. Most companies facing significant European regulation implement compliance globally because it's simpler than maintaining multiple versions of their product. If Shein is forced to redesign their app, improve content moderation, or implement age verification in Europe, they'll likely do the same worldwide. Additionally, if the investigation damages Shein's reputation, that impacts their global user base, not just European users. The app store policies in Apple and Google also respond to regulatory pressure, so an app flagged by European regulators might face scrutiny from platform operators globally.

How is the Shein investigation different from the Temu investigation?

While both investigations target similar issues like addictive design and inadequate content moderation, the Shein investigation appears more serious because of the CSAM allegations. Temu's investigation didn't prominently feature illegal products of that severity. Additionally, Shein is more established and has been under scrutiny longer than Temu, giving the Commission more background evidence to work with. The Shein investigation is also building on the precedent established by Temu, meaning the Commission knows what compliance looks like and can potentially move faster. However, the core legal issues are similar, and the precedent from Temu will likely influence the Shein outcome.

What timeline should we expect for this investigation to conclude?

Based on the Temu investigation and typical EU regulatory processes, the Shein investigation could take anywhere from 12 to 24 months from start to finish. The Commission typically begins by gathering evidence and technical information from the company, which can take several months. Then comes a preliminary assessment phase where Shein has a chance to respond. Finally, the Commission issues a formal decision. Throughout this period, Shein would be under pressure to make voluntary changes to demonstrate good faith compliance, even before any formal decision is reached. If the Commission determines there's immediate risk, they could accelerate the timeline or impose interim measures while the full investigation continues.

Could the Shein investigation lead to restrictions on the company's operations in the EU?

Yes, though it would be unprecedented. The DSA gives the Commission authority to impose interim remedial measures if they determine there's imminent risk of harm. For CSAM issues specifically, there's a strong case that imminent harm exists. However, the Commission has never fully restricted a major platform's operations under the DSA, so it would be a dramatic step. More likely is that Shein is forced to implement changes and faces fines, but remains operating in the EU. A full operational restriction would be considered only if the Commission believed Shein was deliberately non-compliant and posed severe ongoing risks.

What should consumers know about Shein in light of this investigation?

Consumers should understand that Shein's business model relies on engagement tactics that regulators believe cross ethical lines. The app is deliberately designed to encourage spending, and the marketplace features inadequate protections against illegal products. If you're shopping on Shein, you're accepting risks around counterfeit goods, product quality, and potentially supporting the distribution of illegal materials. The investigation might ultimately make Shein a safer platform if the Commission wins and forces compliance, but in the meantime, caveat emptor. Consider whether the price savings justify supporting a company facing serious regulatory challenges.

The European Commission's investigation into Shein represents a pivotal moment in how governments regulate online commerce and addictive design. Whether Shein emerges from this investigation largely unchanged or fundamentally transformed, one thing is certain: the era of unfettered e-commerce growth without regulatory oversight is ending. For consumers, that might mean safer platforms and better protections. For companies, it means adapting business models to survive in an increasingly regulated world.

Key Takeaways

- The European Commission opened a formal investigation into Shein's addictive app design mechanics, including points systems and algorithmic recommendations that may deliberately exploit user psychology

- Child sexual abuse material appearing on Shein's platform represents the most serious allegation and could accelerate regulatory action, potentially leading to operational restrictions

- The Digital Services Act allows the Commission to impose fines up to 6% of global revenue (potentially $1+ billion for Shein) and mandate fundamental changes to how the platform operates

- The Shein investigation sets a precedent that e-commerce companies can't hide behind marketplace models to avoid responsibility for illegal products and that engagement mechanics borrowed from social media face regulatory scrutiny

- Global tech companies operating in Europe will likely adopt the same compliance measures worldwide, making this EU investigation consequential for how platforms operate globally beyond just the European market

Related Articles

- Deezer's Bold Stand Against AI Slop: Why Spotify Users Are Finally Switching [2025]

- Airbnb's AI Search Revolution: What You Need to Know [2025]

- Verizon's 35-Day Phone Unlock Delay: What You Need to Know [2025]

- Meta's 'Dear Algo' Feature: How Threads Turned User Complaints Into Official Features [2025]

- NordVPN & CrowdStrike Partnership: Enterprise Security for Everyone [2025]

- Discord's Age Verification Disaster: How a Privacy Policy Sparked Mass Exodus [2025]