Ford's AI Assistant and Blue Cruise 2.0: The Future of In-Car Intelligence

Ford just made one of the most significant announcements in automotive AI since Tesla started shipping Grok integration. And yet, it barely made a splash at CES 2026.

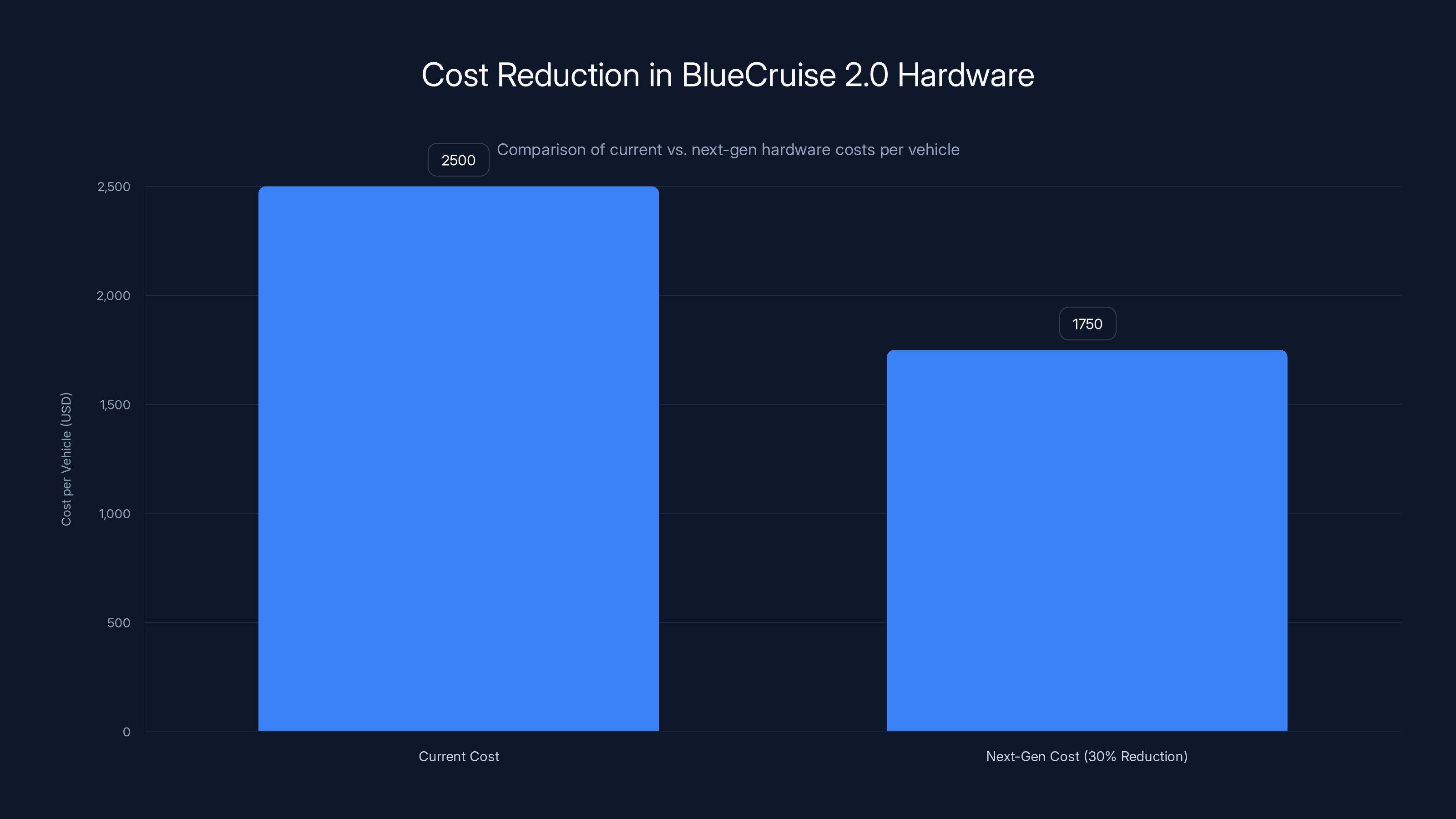

The Detroit automaker is launching a new AI assistant that will debut in its smartphone app before moving into vehicles by 2027. But here's what caught my attention: the next-generation Blue Cruise system arriving in 2027 is 30% cheaper to manufacture than current hardware, and it's promising something the industry has been chasing for years. Eyes-off driving capability in 2028.

That's not autonomous driving in the Tesla sense. It's hands-free, supervised autonomy where the car handles point-to-point navigation but requires you to stay alert and ready to intervene. It sits in this fascinating gray zone between advanced driver assistance and true self-driving.

Let me break down what Ford's actually building, why it matters, and what this means for the broader automotive industry.

The AI Assistant: Voice and Data, Together at Last

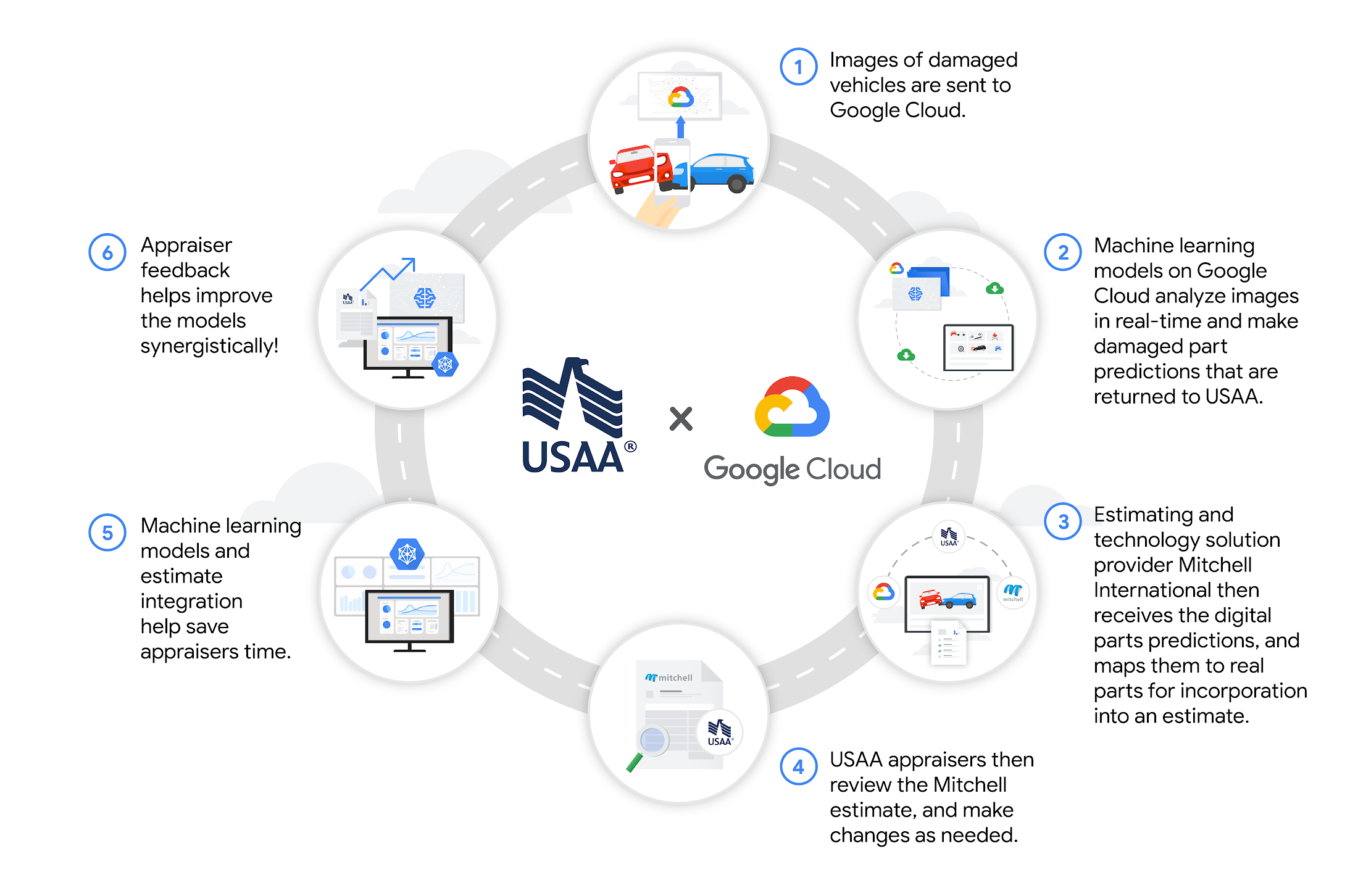

Ford's AI assistant is being hosted on Google Cloud infrastructure and built using off-the-shelf large language models. That's important context, because it means Ford isn't trying to reinvent the wheel. They're leveraging proven technology and focusing their engineering on the automotive-specific integration.

The assistant will have deep access to vehicle-specific data. Not just entertainment controls or climate settings, but real diagnostic and mechanical information about your specific truck or car. Ask it "how many bags of mulch can my truck bed support?" and it'll pull specs directly from your vehicle's documentation. Ask for your current oil life percentage, and it knows that in real time.

This is the kind of practical, contextual intelligence that separates a gimmick from a genuinely useful tool. Your smartphone's AI assistant can tell you general facts about truck bed capacity. Ford's assistant knows your specific truck, your specific configuration, your actual maintenance schedule.

The rollout timeline is methodical. Early 2026 gets the smartphone app integration first. That gives Ford a chance to test the underlying systems, gather user feedback, and identify edge cases before it arrives in the vehicle itself in 2027.

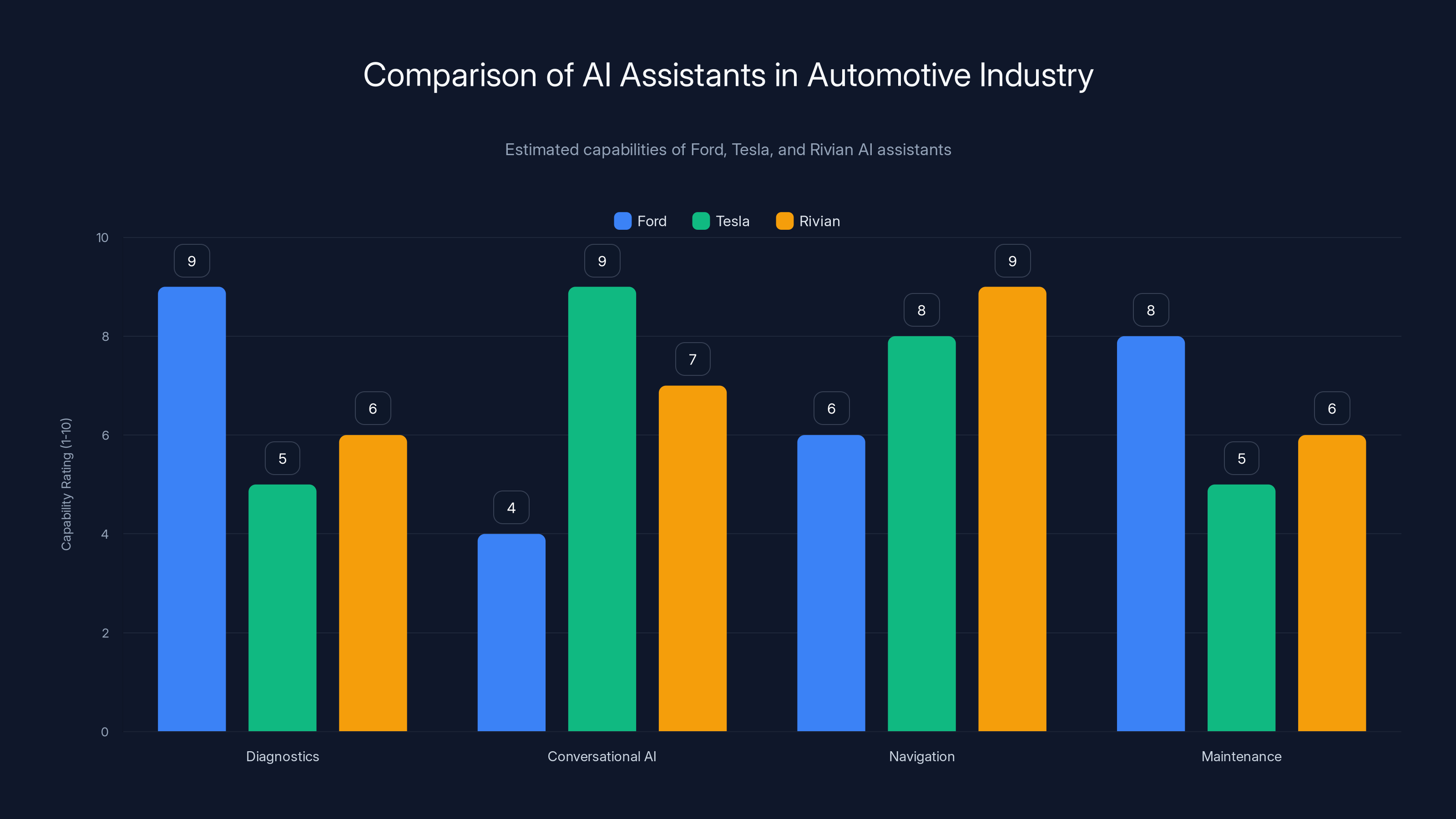

Ford's AI assistant excels in diagnostics and maintenance, while Tesla leads in conversational AI. Rivian shows strong navigation capabilities. Estimated data based on available descriptions.

Why Google Cloud Matters for Ford

Ford's partnership with Google Cloud isn't accidental. It's a strategic choice that reveals something about automotive industry trajectories.

Building and maintaining your own language model infrastructure at scale is phenomenally expensive. Google's already done that work. Microsoft's already done that work. Tesla tried, and now they're integrating Grok from x AI. For an automaker, the calculus is simple: licensing existing LLM capabilities lets you focus engineering resources on vehicle integration instead of model training.

Google Cloud also gives Ford access to Google's existing infrastructure for handling real-time data queries, managing vehicle telemetry at scale, and handling privacy concerns across millions of connected cars. That's not trivial. One bad privacy breach and your OTA update system becomes a regulatory nightmare.

The off-the-shelf LLM approach does have a tradeoff. Ford's assistant will likely be less specialized than a custom model trained on millions of Ford-specific conversations. But that's a fair exchange for a product that ships faster and costs less to operate.

Blue Cruise 2.0: 30% Cheaper, Eyes-Off Capable

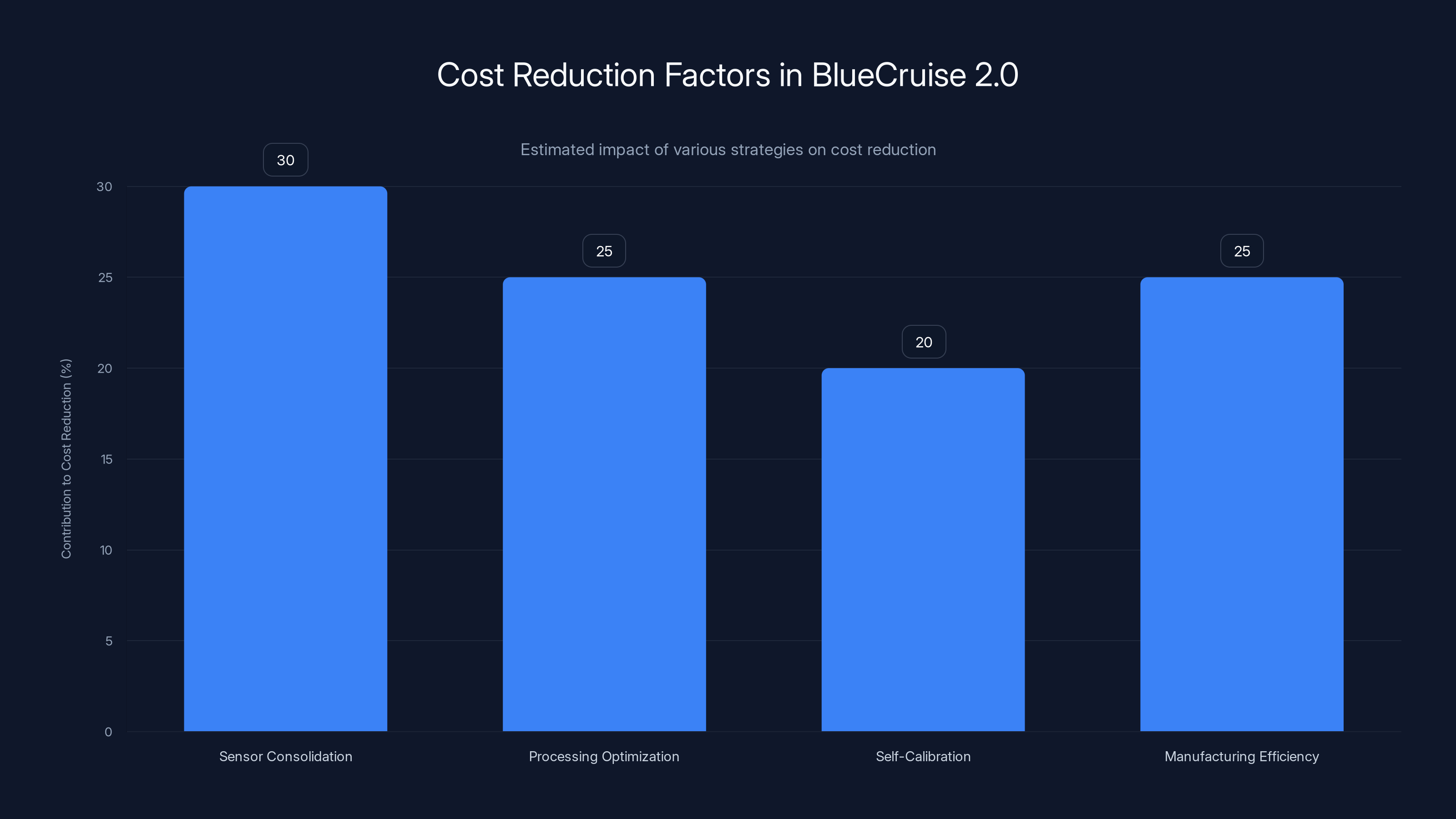

The real story is Blue Cruise's next generation. Ford claims it's 30% cheaper to build than current hardware. That's a massive cost reduction for a complex system, and it fundamentally changes the economics of advanced driver assistance.

Let's do some math. If current Blue Cruise hardware costs Ford roughly

The cost reduction is happening through a combination of factors. Better sensor integration means fewer separate hardware modules. Improved software means the processing can run on commodity hardware instead of custom silicon. Standardization across platforms means economies of scale.

Ford's also being smart about the rollout vehicle. The first next-gen Blue Cruise system is debuting on the company's new "Universal Electric Vehicle" platform, specifically a mid-sized pickup. That's a high-volume vehicle category. Every pickup sold with this system helps amortize R&D costs faster.

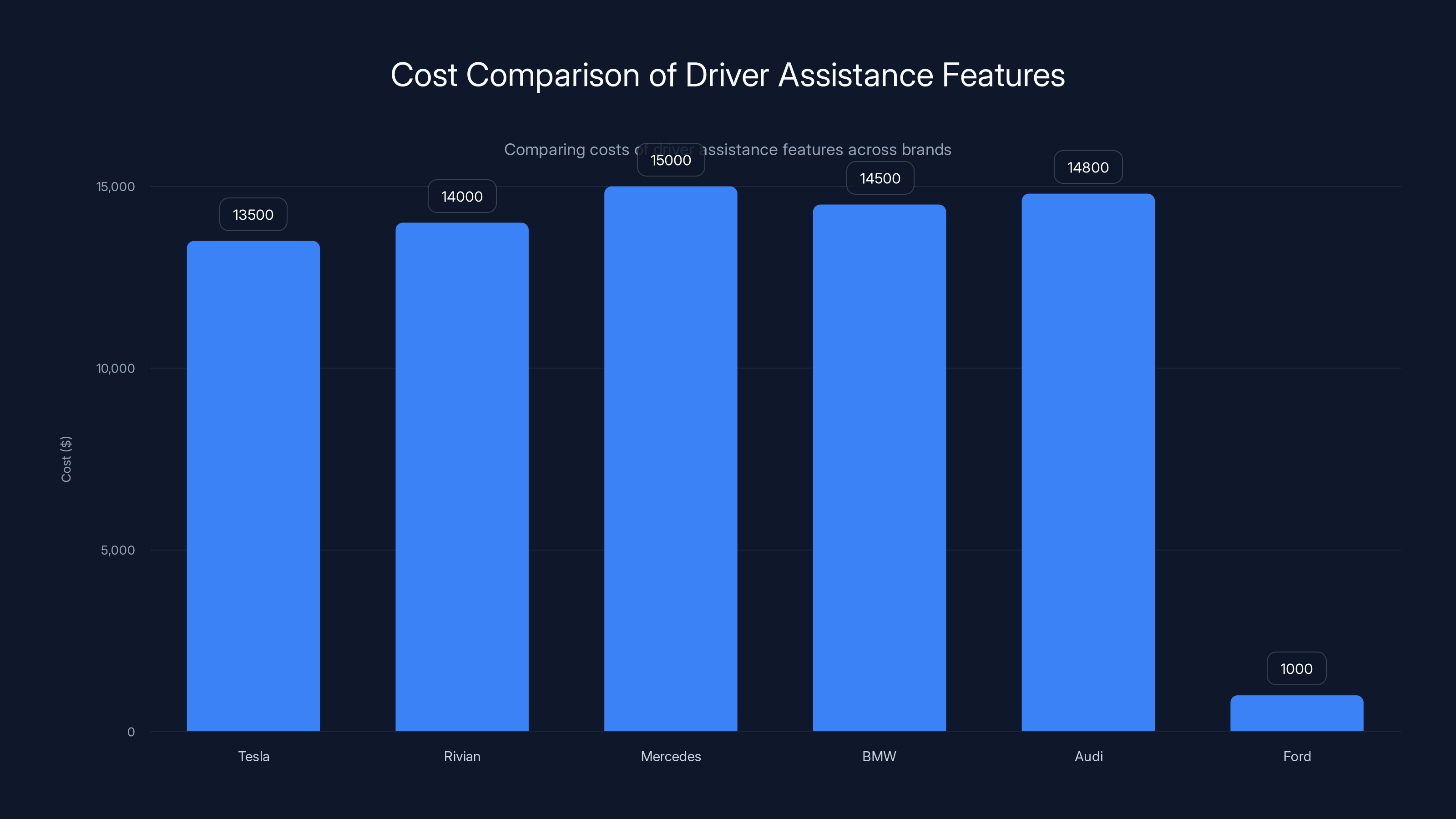

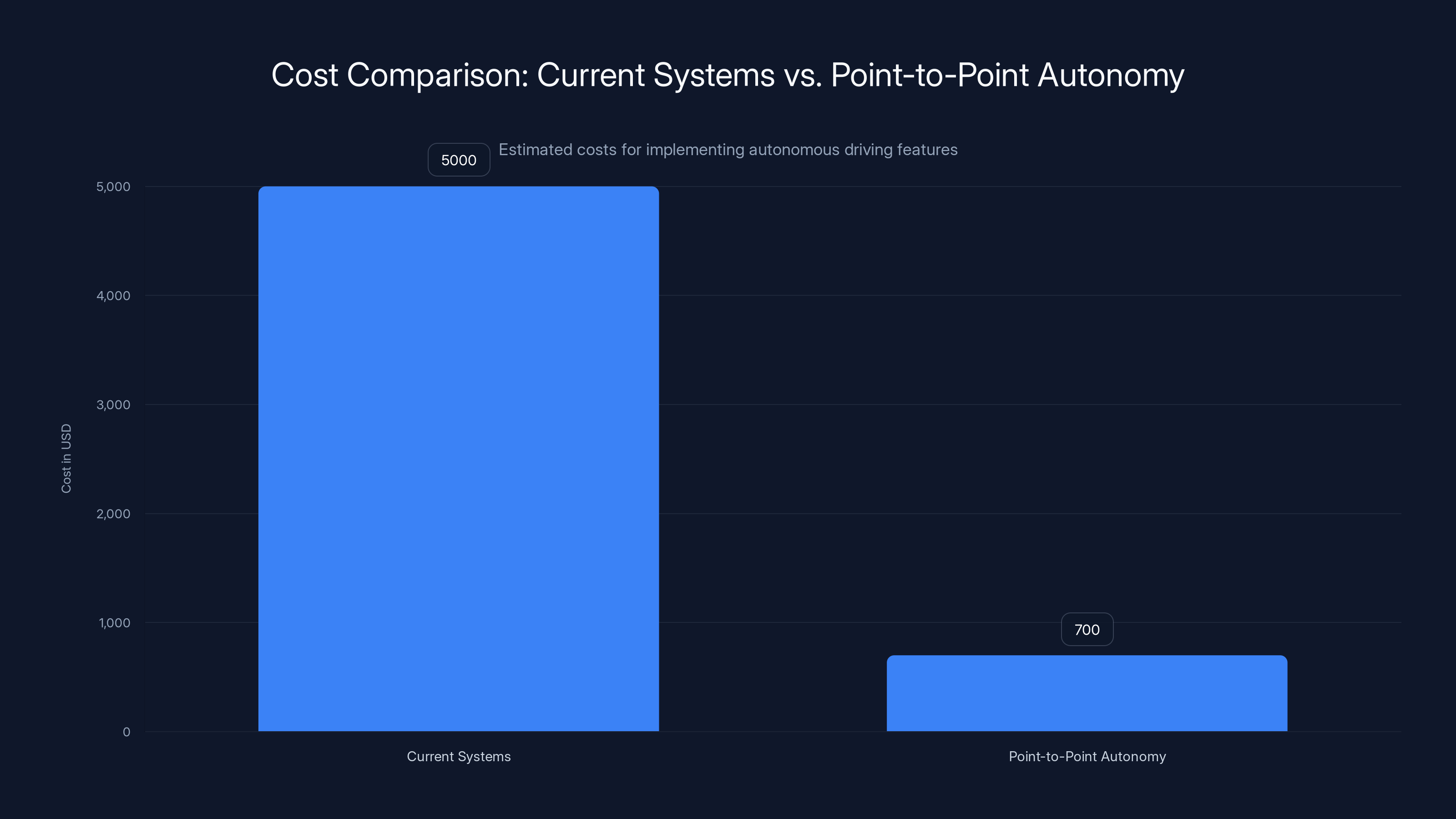

Ford's approach significantly reduces the cost of driver assistance features, making them more accessible compared to luxury automakers. Estimated data for Ford's cost.

Eyes-Off Driving: What It Actually Means

Ford's promising "eyes-off driving" capability with Blue Cruise 2.0 in 2028. That phrasing is important, and it's very different from "autonomous driving."

Eyes-off means the driver can look away from the road for extended periods. The car is actively steering, braking, and accelerating without continuous human input. But it's not autonomous in the way Waymo's robotaxis are autonomous. The driver must remain cognitively engaged and ready to take control immediately if the system encounters a situation it can't handle.

It's supervised autonomy, similar to what Tesla offers with Full Self-Driving (Supervised) and what Rivian is developing with its own advanced system. The legal framework around these systems is still being defined, which is why Ford is being careful with timelines.

The capability includes point-to-point autonomy, meaning the car can handle complex driving scenarios: highway merges, navigation through moderate traffic, lane changes, and route following without specific hand inputs. But it requires the driver to stay alert. Take your eyes off for five minutes and the system will prompt you to re-engage. Ignore those prompts and it disables the feature.

This is where the cost reduction becomes significant. Previous generations of hands-free systems required redundant hardware: dual processing units, multiple sensor sets, fault-tolerance architecture. Next-gen systems are consolidating that redundancy at the software level, meaning they can run on simpler hardware while maintaining the same safety margins.

The Competitive Landscape: Ford's Playing Catch-Up (Smartly)

Ford's announcement comes as the automotive industry is rapidly bifurcating. You've got Tesla pushing Full Self-Driving and rapidly integrating Grok for in-vehicle AI. Rivian just demonstrated its own digital assistant handling text messages, navigation, and climate control. Traditional automakers like GM and VW are developing their own systems. The pressure is immense.

But Ford's playing this differently. They're not trying to be first. They're trying to be smart. The Google Cloud partnership means they can move faster than trying to build infrastructure independently. The cost reduction for next-gen Blue Cruise means they can democratize the technology instead of keeping it exclusive to luxury vehicles.

Rivian's assistant can send texts and handle complex navigation. Tesla integrated Grok for creative conversations and itinerary planning. Ford's assistant focuses on vehicle-specific practical information: maintenance schedules, specifications, real-time diagnostics. These are different philosophies, but they're converging on the same destination: the car becoming an intelligent agent that understands the owner's needs.

The CES 2026 announcement was notably understated for something this significant. Ford didn't hold a keynote. They discussed it during a speaker session called "Great Minds" focused on "the intersection of technology and humanity." That's either modest product positioning or a sign that Ford's managing expectations while they work out the engineering challenges.

The Smartphone App First Strategy

Ford's decision to launch the AI assistant in the smartphone app before the vehicle is strategically brilliant. Here's why.

First, it's a massive testing ground. Millions of Ford owners already use the Ford app for remote locking, climate preconditioning, and trip data. A new AI assistant feature will reach millions of users immediately. That's real-world testing at scale. Every user interaction trains the system on actual Ford owner behavior, actual questions, and actual use cases.

Second, it reduces the risk of a bad in-vehicle experience. Smartphone AI assistants that are slightly imperfect or slow are annoying. In-vehicle assistants that are slow or unreliable are dangerous. Testing first on phones means Ford can iterate without safety implications.

Third, it keeps users engaged with Ford's ecosystem while engineering in-vehicle integration. A user discovers the app assistant, finds it useful, then expects the same experience in the car. That's brand loyalty through continuous improvement.

The 2027 in-vehicle integration will likely start with specific models. Ford probably isn't going to retrofit the feature across their entire lineup simultaneously. They'll pick one or two vehicles, gather data, refine the experience, then expand. That's how smart automotive rollouts work.

BlueCruise 2.0 hardware is 30% cheaper, reducing costs from an average of

Hardware Architecture: Sensors, Processing, Integration

The 30% cost reduction in Blue Cruise 2.0 hardware doesn't happen by accident. Ford's likely made significant changes to sensor strategy, processing architecture, and integration methodology.

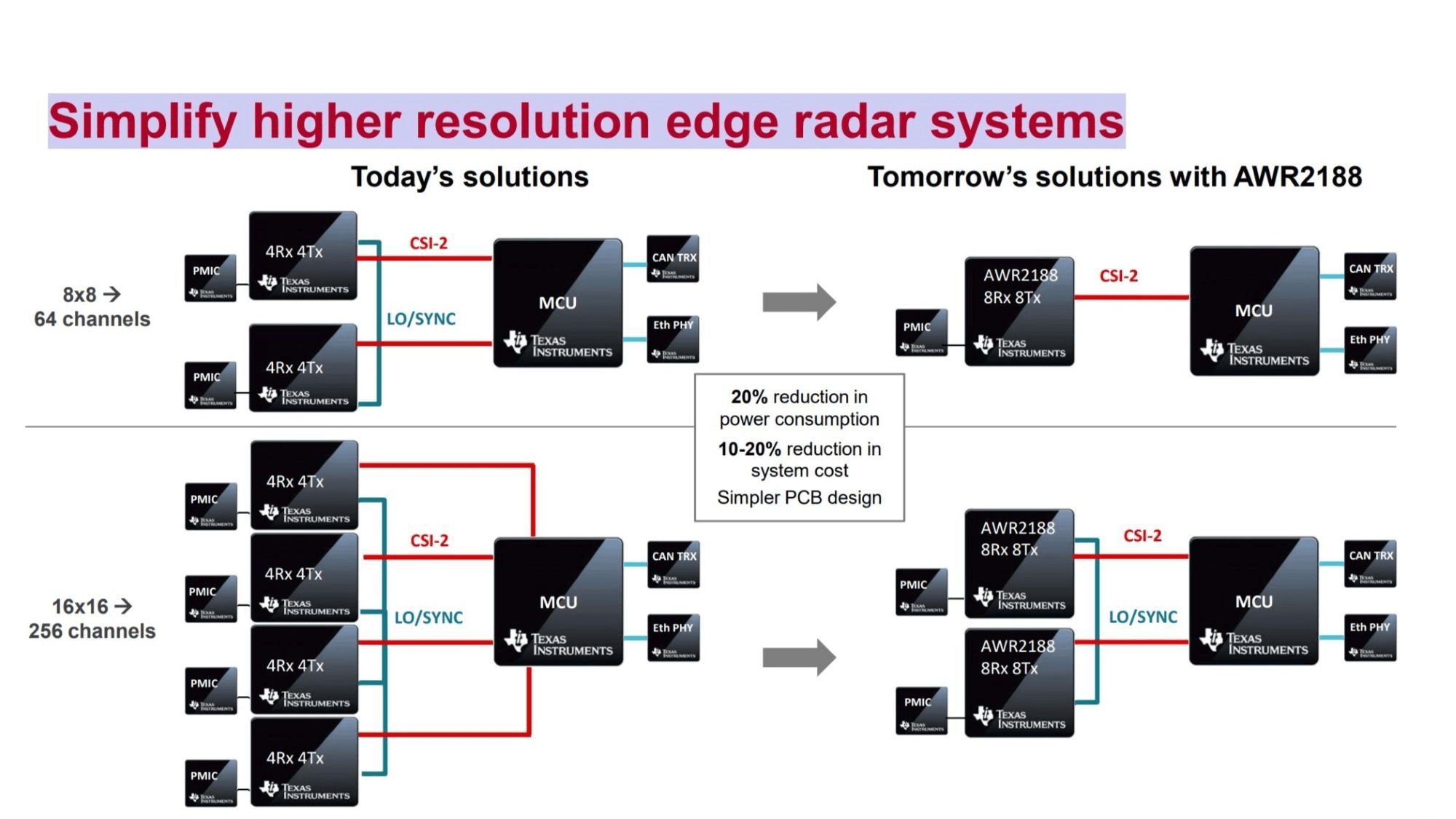

Previous Blue Cruise systems relied on multiple sensor types: cameras for lane detection and object recognition, radar for distance and velocity measurement, and sometimes lidar for 3D environmental mapping. That's redundancy for safety reasons, but it's also expensive. Different manufacturers, different calibration procedures, different integration points.

Next-gen systems are consolidating. Multi-modal sensors that combine radar and camera capabilities reduce the total sensor count. Neural processing engines that run on standard automotive processors instead of custom silicon reduce costs. Better software algorithms mean fewer sensors are needed to achieve the same safety level.

The processing power for Blue Cruise 2.0 is likely running on existing automotive computing platforms. Instead of adding specialized hardware, Ford's leveraging processors already in the vehicle for other functions. That's where the 30% savings come from: not reinventing hardware architecture, but optimizing software to run on existing infrastructure.

Calibration is another huge cost factor. Every sensor on a vehicle needs to be calibrated after installation. It's currently a manual, time-intensive process. Next-gen systems are moving toward automatic, self-calibrating approaches using computer vision and machine learning. That reduces assembly line time and field calibration costs.

Safety, Liability, and Regulatory Reality

Hands-free driving opens a regulatory minefield. Who's liable if the system fails? The driver or the manufacturer? What standards define safe eyes-off operation? How do you test these systems at scale?

Ford's cautious approach is appropriate. They're promising eyes-off capability in 2028, not next year. That gives regulators time to develop frameworks. It gives the insurance industry time to figure out liability models. It gives Ford time to test exhaustively without rushing.

The eyes-off feature will likely be geographically restricted initially. Maybe it works on specific highway segments that have been mapped and validated. Maybe it's restricted to certain weather conditions. Maybe it's limited to owners who've completed training. These aren't limitations of the technology; they're reasonable safety practices during rollout.

Liability is the real sticking point. Tesla handles it through aggressive waiver language: Full Self-Driving is beta software, and drivers accept full responsibility. Ford will probably take a different approach, emphasizing manufacturer responsibility for system performance within defined operating parameters.

The insurance implications are significant but still undefined. Does eyes-off driving increase insurance costs or decrease them? If the car is statistically safer than human driving (which it likely is), insurers should charge less. But that's not how the industry typically works. New technology usually means uncertainty, which means higher premiums initially.

The AI Assistant's Real-World Value Proposition

Let me be honest about what Ford's AI assistant actually does versus what it could do in theory.

Practical value: You can ask your vehicle detailed questions about maintenance schedules, specifications, current diagnostics, and operational parameters. That's genuinely useful. Most owners don't know their truck's bed capacity or towing limits without looking them up. Having the car answer that instantly, in context, adds real value.

Theoretical value: An intelligent assistant that understands your driving habits, predicts maintenance needs, suggests routes based on fuel efficiency, and proactively alerts you to issues. That's the vision.

The gap between those two is execution. Ford's launching with the practical stuff because it's proven and testable. The advanced capabilities will come later as they accumulate data.

Compared to Tesla's Grok integration or Rivian's texting-capable assistant, Ford's approach is more conservative. But conservation in automotive technology is often wisdom. Moving fast is fine until a system makes a mistake that costs lives.

Estimated data: Sensor consolidation, processing optimization, and self-calibration are key contributors to the 30% cost reduction in BlueCruise 2.0 hardware.

The Universal Electric Vehicle Platform and Market Implications

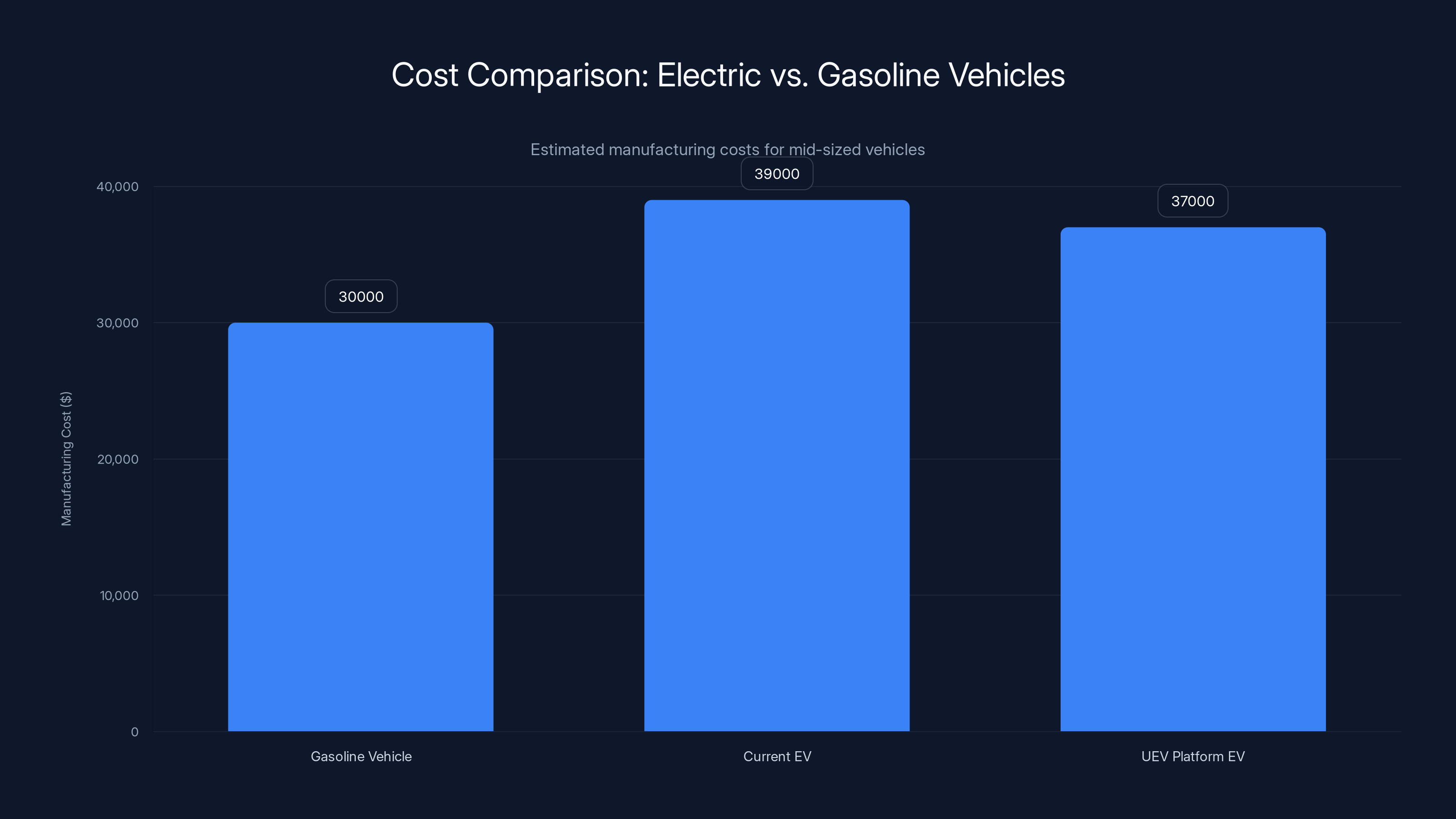

Ford's strategy makes much more sense when you understand the vehicle it's launching on. The UEV platform is specifically designed for cost-competitiveness in the mass market.

Electric vehicles are currently 20-30% more expensive to manufacture than gas equivalents, primarily due to battery costs and powertrain complexity. The UEV platform is cutting that differential. If Ford can deliver a mid-sized EV pickup at

Adding hands-free driving technology to an affordable vehicle is a game-changer. It's not exclusive anymore. It's standard or near-standard across the lineup. That changes customer expectations and competitive dynamics.

The mid-sized pickup segment is crucial for Ford. Trucks are their profit center. If they can deliver EVs with advanced driver assistance at competitive prices, they're protecting market share while transitioning to electrification. That's the real story.

The AI assistant becomes a feature that justifies the EV transition. "You get a better truck, lower fuel costs, and an intelligent assistant that understands your vehicle." That's a compelling narrative.

Timeline Analysis: What's Realistic

Ford's laid out a specific timeline. Let's assess whether it's realistic.

Early 2026: AI Assistant in smartphone app. This is happening. The infrastructure is already in place, the LLM is already available through Google Cloud, and testing with millions of users is incredibly valuable. Confidence: Very high.

2027: In-vehicle integration and next-gen Blue Cruise launch. This is ambitious but doable. The smartphone testing provides valuable data. One year to finalize in-vehicle implementation is tight but achievable for a phased rollout on specific models. Confidence: High, with caveats about which models and regions.

2028: Eyes-off driving capability. This is where uncertainty increases. Eyes-off driving requires regulatory clarity, extensive testing, and insurance industry cooperation. 2028 is possible, but delays wouldn't be shocking. Confidence: Moderate. Could easily slip to 2029 if regulatory questions aren't answered by late 2027.

Ford's generally conservative with timelines. When they commit to a feature with this level of specificity, they've usually already solved the hard problems. The fact that they're committing to eyes-off in 2028 suggests they've made real technical progress.

Point-to-Point Autonomy: What's Different From Current Systems

Point-to-point autonomy is a meaningful technical step beyond current advanced driver assistance. It means the car can navigate complex real-world scenarios without constant human input.

Current systems are task-focused. Lane-keeping assistance keeps you in your lane. Adaptive cruise control maintains distance. Traffic jam assist handles slow-speed congestion. Each feature is discrete.

Point-to-point autonomy integrates all of those into a unified system. You set a destination, and the car handles the entire journey: highway entry, merging through traffic, navigation at complex intersections, highway exit, surface street navigation. All without intervention (but with the driver ready to intervene).

This requires a completely different software architecture. Instead of discrete behavioral modules, you need a unified decision-making system that understands the overall driving context. That's exponentially more complex.

The cost reduction matters here too. Point-to-point autonomy becomes economically viable when you can implement it on affordable hardware. If it costs an additional

Ford's approach to handling complex scenarios is probably hierarchical: the system tries to navigate everything autonomously, falls back to supervised assistance if it's uncertain, and requests driver takeover if it's confused or approaching limits. That's the safety model that makes sense for eyes-off driving.

Point-to-point autonomy is projected to reduce costs by 86% compared to current systems, making it more economically viable. (Estimated data)

Competitive Responses and Industry Trends

Ford's announcement will trigger responses from GM, BMW, Mercedes, and traditional automakers competing for market share in advanced driver assistance.

Tesla's already ahead with Full Self-Driving, but Tesla's also not really competing in the mass market. A

Rivian's demonstrated more sophisticated AI capabilities, but Rivian's also a premium brand. Their assistant handling text messages is nice. Most buyers care more about whether their truck can safely merge on the highway.

GM's Cruise Origin is focused on robotaxi deployment, not consumer vehicles. They're playing a different game entirely.

Ford's positioned perfectly between the premium autonomous vehicle play (Tesla, Rivian) and the traditional assistance features (current Blue Cruise, GM's Super Cruise). They're offering next-generation capability at mainstream prices, which is where the actual automotive future lives.

Expect to see GM, Ford's traditional rival, announce something very similar within 12-18 months. They'll partner with another cloud provider (probably Microsoft Azure or Amazon AWS), integrate another LLM (probably Claude or a custom model), and launch on a similarly affordable vehicle. That's how the automotive industry works: innovation leapfrogs, then commoditizes.

.jpg)

The Real Value: Democratizing Driver Assistance

Here's what often gets lost in the technical discussion: Ford's actually trying to make hands-free driving affordable.

Tesla's Full Self-Driving is a

Ford's approach of embedding the technology in the base platform and reducing manufacturing costs by 30% is fundamentally different. It's trying to make this technology standard, not optional.

That's a harder business case to make. Luxury automakers make massive margins on advanced features. Adding an expensive option to a

Ford's betting they can hit that volume. The truck market is massive. If they can capture even 10% of new truck sales with this technology standard, that's hundreds of thousands of vehicles annually. At that scale, the economics work.

From a consumer perspective, this is the right direction. Hands-free driving technology that costs

Data and Privacy: The Elephant in the Room

An AI assistant with deep vehicle access and a cloud-connected system raises significant privacy questions that Ford's being quiet about.

What data is the assistant collecting? Real-time location? Driving patterns? Fuel consumption habits? Maintenance history? Diagnostic codes? All of those things are useful for the assistant to function effectively, and all of them are sensitive information.

Who owns that data? Ford? The customer? Some combination? Can Ford sell anonymized driving pattern data to insurance companies, city planners, or energy providers? Probably, unless they've committed otherwise, which we haven't seen stated explicitly.

How is data encrypted in transit and at rest? Google Cloud handles this, but what about Ford's own systems? Is there a clear data retention policy? Can customers delete their data?

These questions matter for adoption. A significant portion of Ford owners will be uncomfortable with a cloud-connected AI system that knows exactly how much their truck weighs and when it needs maintenance. Privacy concerns are not trivial in automotive.

Ford will probably address this eventually with explicit privacy policies and user controls. But it's notable they didn't mention it in the CES announcement. Privacy is usually something companies emphasize early if they've solved it properly.

The UEV platform reduces the cost differential between electric and gasoline vehicles, making EVs more competitive in the mass market. Estimated data.

Integration Challenges: The Hard Part

Everyone assumes that integrating an LLM into a vehicle is straightforward: just use the existing API. Reality is much messier.

Latency is the first problem. Cloud APIs have variable response times. Sometimes you get an answer in 200ms. Sometimes it's 2 seconds. In-vehicle, users expect responsiveness within 500ms. Anything slower feels broken. Ford needs to handle latency with intelligent caching, on-device fallbacks, and graceful degradation.

Connectivity is the second problem. Your phone might have LTE or 5G. Your car might be in a tunnel or rural area with spotty coverage. The assistant needs to work offline or with extremely limited bandwidth. That probably means running a lightweight model on-device for basic queries and falling back to cloud for complex ones.

Integration with vehicle systems is third. The assistant needs to know your navigation system, your climate controls, your infotainment system's capabilities. That's different integration work per vehicle model, per year, per market. It's not scalable without careful architecture.

Voice is fourth. Voice interaction in a moving vehicle is remarkably hard. Road noise, accents, speech patterns, background conversations. The voice recognition system needs to be better than smartphone versions because the stakes are higher.

These challenges are solvable, but they require serious engineering. Ford's had years to work on them, which is why the timeline seems realistic.

Future Roadmap: Where This Heads

If Ford executes on this roadmap, they're positioning for the next decade of automotive technology.

The AI assistant is a customer engagement tool. It keeps people interacting with Ford's ecosystem. That data becomes valuable: understanding what customers want, how they use their vehicles, what features matter.

Next-gen Blue Cruise with eyes-off driving is a technical achievement, but more importantly, it's a safety achievement. If the system works reliably, Ford proves that hands-free driving is viable on affordable vehicles. That changes industry expectations.

The combination of both is a platform: Ford vehicles become intelligent, connected systems that understand their owners and handle driving intelligently. That's how premium cars work today. Making it accessible at Ford's price points changes everything.

Longer term, Ford's clearly preparing for higher levels of autonomy. Eyes-off in 2028 is probably not the end state. It's likely a stepping stone to conditional autonomy (handling specific defined scenarios completely) and eventually higher autonomy levels.

The UEV platform is designed for this too. It's architected to support increasingly sophisticated autonomous capabilities without major hardware redesigns. That's how you amortize R&D costs: build the right platform, then layer on increasing capability over multiple generations.

What This Means for Ford Owners

If you're a Ford owner or considering one, what does this announcement actually mean for you?

In 2026: Access to an AI assistant in the smartphone app that can answer vehicle-specific questions. This is nice-to-have, not need-to-have. It solves problems you probably don't have unless you really don't know your truck.

In 2027: In-vehicle integration of the assistant and availability of next-gen Blue Cruise (probably on new models first). Blue Cruise 1.0 was hands-off but not eyes-off. Version 2.0 will be more capable and cheaper, meaning more models will have it as standard or cheap option.

In 2028: Eyes-off driving capability, probably rolled out initially to specific highway segments and models. This is genuinely transformative if it works. Reclaiming attention for 30 minutes on a highway commute is valuable time.

The progression is thoughtful. Ford's not overpromising. They're being specific about timing and capability. That builds confidence, assuming they execute.

Manufacturing and Supply Chain Implications

The 30% cost reduction for Blue Cruise 2.0 has massive supply chain implications.

Ford's not just reducing costs through optimization. They're probably consolidating suppliers. Instead of separate contracts for cameras, radar, and processing units, they might be negotiating with fewer suppliers for integrated systems.

They're probably also changing manufacturing processes. Maybe the new system doesn't require the same in-line calibration procedures. Maybe assembly time drops from 45 minutes to 30 minutes. Those savings compound across millions of vehicles.

For Ford's suppliers, this is both opportunity and threat. Suppliers who adapt their products to Ford's new architecture win contracts. Suppliers who can't adapt get replaced.

For Ford's manufacturing facilities, this is an upgrade opportunity. The company can retrain assembly line workers on new calibration procedures. New equipment can reduce assembly time per vehicle. Lower costs per vehicle means they can cut prices and still maintain margins.

This is why automotive timelines matter. Ford's not just developing new technology. They're redesigning supply chains, retraining manufacturing, and negotiating new contracts. That's why 2027 for availability is realistic but tight.

Investment and Business Case Analysis

Why is Ford investing heavily in AI assistants and advanced driver assistance if margins are being cut?

Volume. If hands-free driving is standard on 500,000 vehicles instead of optional on 50,000 vehicles, even at lower margins per unit, total profit increases dramatically.

Customer loyalty. Owners who experience hands-free driving in a Ford are more likely to buy another Ford. That's lifetime value thinking.

Brand positioning. Ford's competing against Tesla for "technology leader" perception. Announcing AI and hands-free driving signals that Ford isn't a legacy automaker stuck in the past.

Regulatory optionality. The company's building capability that might become mandatory. Having it ready first gives them advantage.

The business case assumes successful execution. If the technology doesn't work well, if it frustrates owners, if it's buggy, the investment becomes a cost center rather than profit generator. Ford's banking on nailing the execution.

FAQ

What is Ford's AI assistant and how does it work?

Ford's developing an artificial intelligence assistant hosted on Google Cloud infrastructure that will debut in the Ford smartphone app in early 2026 before moving into vehicles in 2027. The assistant is built using off-the-shelf large language models and has deep access to vehicle-specific data, allowing it to answer detailed questions about your truck or car like maintenance schedules, bed capacity, oil life, and other specifications.

How is Ford's approach different from Tesla and Rivian's AI assistants?

Tesla integrated Grok from x AI for creative conversations and itinerary planning, while Rivian demonstrated capabilities like sending text messages and handling complex navigation requests. Ford's assistant is more focused on practical, vehicle-specific information: diagnostics, specifications, maintenance details, and operational parameters. This represents a different philosophy emphasizing utility over conversational AI, though all three systems are moving toward the same destination of intelligent, context-aware vehicle assistants.

What is Blue Cruise 2.0 and when will it be available?

Blue Cruise 2.0 is Ford's next-generation hands-free driving system that's 30% cheaper to manufacture than current Blue Cruise technology. It will debut in 2027 on vehicles built on Ford's Universal Electric Vehicle platform, specifically a mid-sized pickup. The system enables point-to-point autonomy where the car handles complex driving tasks, and Ford promises eyes-off driving capability by 2028, meaning drivers can look away from the road for extended periods while remaining cognitively engaged and ready to intervene.

What does eyes-off driving actually mean and how is it different from hands-free?

Hands-free means you're not touching the steering wheel, but you're still watching the road. Eyes-off means you can look away from the road for extended periods while the vehicle handles steering, braking, and acceleration autonomously. Eyes-off requires hands-free driving but is a more advanced capability. It's different from full autonomous driving because the driver must remain alert and ready to take control immediately if the system encounters scenarios it can't handle.

How much will the new AI assistant and Blue Cruise features cost?

Ford hasn't released specific pricing for the AI assistant, though it will be included free with the smartphone app rollout in early 2026. Blue Cruise 2.0 pricing hasn't been officially stated, but the 30% reduction in manufacturing costs suggests it will be significantly cheaper than current Blue Cruise, likely making it standard or near-standard rather than a premium option on new vehicles.

What are the privacy implications of a cloud-connected AI assistant with vehicle access?

A cloud-connected system collecting vehicle data raises legitimate privacy questions about data ownership, usage rights, encryption, and retention policies. Ford's handling these details through Google Cloud infrastructure, but details about user privacy controls, data deletion options, and Ford's own data practices haven't been extensively detailed in public announcements. These concerns are typical for new connected vehicle features and usually addressed through explicit privacy policies as rollout approaches.

When will the AI assistant and Blue Cruise features be available in my Ford?

The timeline is phased: AI assistant launches in the Ford smartphone app in early 2026, in-vehicle integration arrives in 2027 (initially on specific new models), and eyes-off driving capability is promised for 2028. The in-vehicle rollout will likely begin with Ford's newly launched vehicles on the Universal Electric Vehicle platform and gradually expand to other models. Existing Ford owners will need to upgrade to newer vehicles to access these features.

How does the 30% cost reduction in Blue Cruise 2.0 change the automotive industry?

A 30% manufacturing cost reduction makes hands-free driving technology economically viable for mainstream, affordable vehicles rather than just premium models. If current hardware costs approximately

Is Ford's eyes-off driving as advanced as Tesla's Full Self-Driving?

No. Tesla's Full Self-Driving is positioned as more advanced, handling broader scenarios and requiring less driver attention in some cases. Ford's eyes-off driving is supervised autonomy where drivers must remain cognitively engaged and ready to intervene. Both systems are advancing rapidly, and the actual capability gap depends on real-world testing and execution. They're targeting different customer bases: Tesla at premium buyers, Ford at mainstream buyers seeking affordable capability.

What could delay the announced timeline?

Regulatory clarity around eyes-off driving is the biggest uncertainty. Liability questions, safety standards, and insurance industry cooperation need resolution before widespread rollout. A shift in regulatory stance could delay the 2028 eyes-off launch to 2029 or later. Technical challenges with in-vehicle integration, supply chain disruptions, or quality issues could also push timelines. Ford's historically conservative with announcements, suggesting they've built in buffer, but automotive projects frequently slip.

Conclusion: Ford's Bet on Practical Automotive AI

Ford's not trying to be flashy. They're not promising fully autonomous robotaxis or driverless delivery fleets. They're announcing something more pragmatic: an AI assistant that helps you understand your vehicle better, and hands-free driving technology that's actually affordable.

That pragmatism is probably the right strategy for the current moment. The automotive industry is bifurcating: premium brands chasing autonomy bragging rights, traditional brands fighting for profitability and market share. Ford's clearly chosen the latter path, and they're executing intelligently.

The smartphone-first approach for the AI assistant is smart testing strategy. The 30% cost reduction for Blue Cruise 2.0 is real engineering progress. The timeline is ambitious but defensible. The bet on affordable hands-free driving is the right bet for a mainstream automaker.

Will it work? That depends entirely on execution. The technology is probably sound. The strategy is solid. The market timing is right. But automotive history is littered with well-intentioned features that shipped broken or never shipped at all.

Ford's got until 2028 to prove this works. That's enough time to iterate, test, and refine. If they execute well, they fundamentally change customer expectations about what hands-free driving should cost. If they slip or ship broken features, they're just another automaker overpromising on technology.

I'm betting they pull it off. The announcement was careful, specific, and realistic. The timelines have buffer. The cost reduction is meaningful. The market demand is obvious.

Watch for the smartphone app launch in early 2026. That's the real test. If Ford nails that experience and it's genuinely useful, the in-vehicle rollout in 2027 becomes credible. And if that works, 2028's eyes-off driving becomes something we'll be actually discussing, not theoretically debating.

The automotive future doesn't belong exclusively to Tesla or Waymo or luxury brands. Ford's reminding us that the volume players, the mass-market brands, are equally capable of innovation. They're just doing it in ways that make economic sense for real customers buying real vehicles.

That's honest automotive progress. Watch for it.

Key Takeaways

- Ford's AI assistant launches in smartphone app early 2026, then in vehicles 2027, providing vehicle-specific diagnostic and specification information through Google Cloud infrastructure

- BlueCruise 2.0 achieves 30% manufacturing cost reduction, making hands-free driving technology accessible on affordable vehicles instead of just premium models

- Eyes-off driving capability (drivers can look away from road) promised for 2028 on the Universal Electric Vehicle platform mid-sized pickup first

- Point-to-point autonomy enables seamless navigation from highway to destination without constant intervention, requiring unified decision-making versus discrete task-focused modules

- Ford's approach prioritizes practical vehicle utility over conversational AI, differentiating from Tesla's Grok integration and Rivian's multi-modal assistant features

Related Articles

- Sony Honda's Afeela 1 EV: Why It Feels Outdated at CES 2026 [Review]

- Mobileye Acquires Mentee Robotics: $900M Bet on Humanoid AI [2025]

- CES 2026: Why EVs Lost to Robotaxis & AI – Industry Shift Explained

- Hyundai CES 2026 Live Presentation: Holographic Windshield & Atlas Robot [2025]

- Sony Honda Afeela CES 2026 Press Conference: Complete Guide [2025]

![Ford's AI Assistant and BlueCruise 2.0: The Future of In-Car Intelligence [2025]](https://tryrunable.com/blog/ford-s-ai-assistant-and-bluecruise-2-0-the-future-of-in-car-/image-1-1767832608657.jpg)