Mobileye's $900 Million Humanoid Robot Gamble: Why This Deal Matters

When Intel's Mobileye announced it was acquiring Mentee Robotics for $900 million, the tech world collectively shrugged. Another robotics deal. Another founder making a bet on humanoid robots becoming the next big thing.

But here's what makes this different: Amnon Shashua, Mobileye's president and co-founder, is the same person who co-founded Mentee Robotics in 2022. So this isn't just a strategic acquisition. It's a deliberate move by one of the most successful autonomous vehicle engineers to pivot Mobileye toward what he's calling "Mobileye 3.0"—a company that applies decades of automotive AI expertise to physical robots that can understand, learn, and act in the real world.

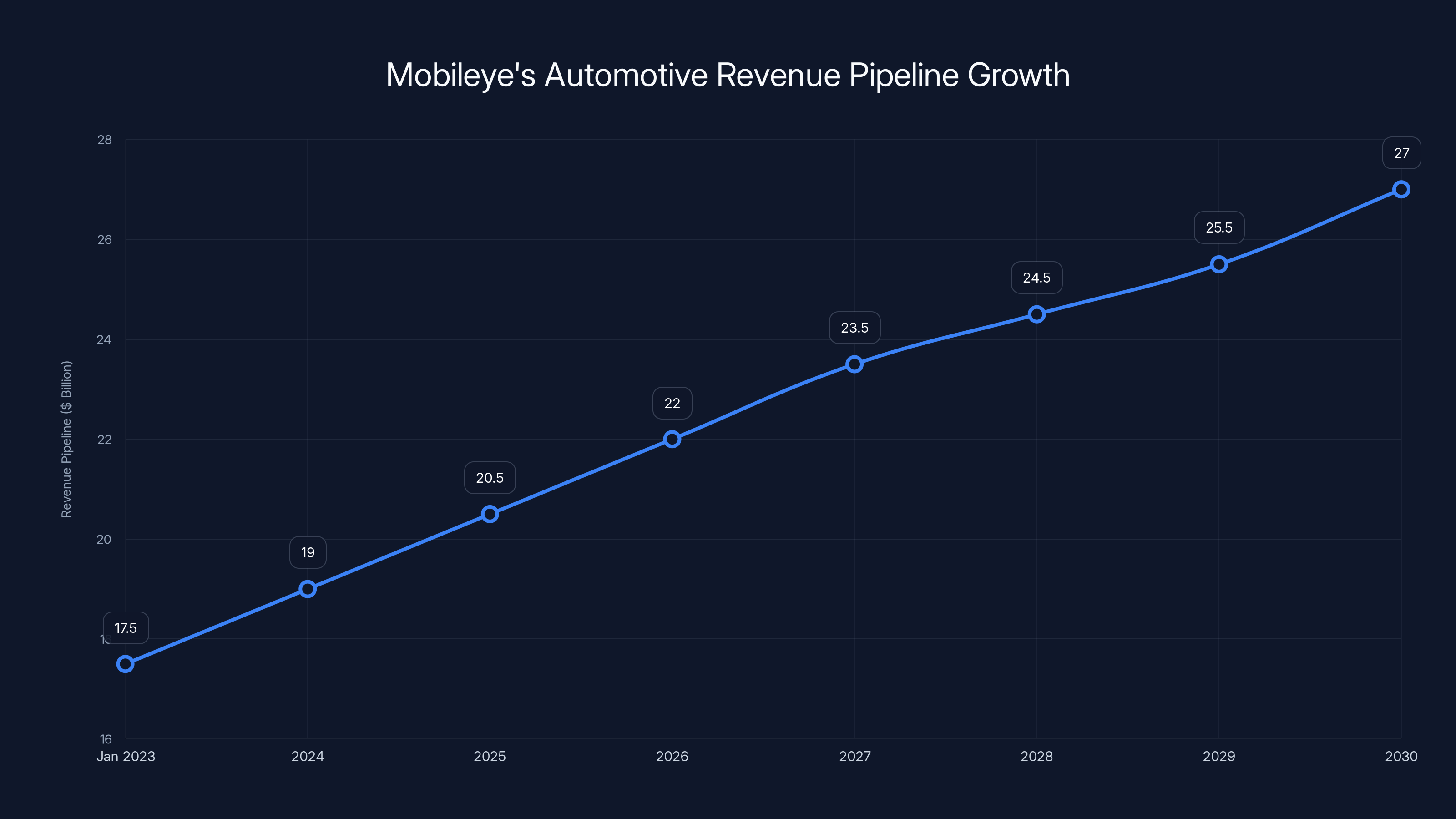

The implications are massive. Mobileye currently supplies advanced driver assistance systems (ADAS) and autonomous driving chips to major automakers. Their revenue pipeline hit $24.5 billion over the next eight years as of early 2025. Now, they're betting that the same computer vision, spatial reasoning, and AI systems that let cars navigate highways can teach robots how to work alongside humans.

This isn't a distraction from autonomous vehicles. It's an extension of it. And it reveals something important about where AI is actually heading: from screens to the physical world.

Let's break down what happened, why it matters, and what it means for the future of robotics, autonomous vehicles, and the $900 million question of whether humanoid robots are actually going to matter.

TL; DR

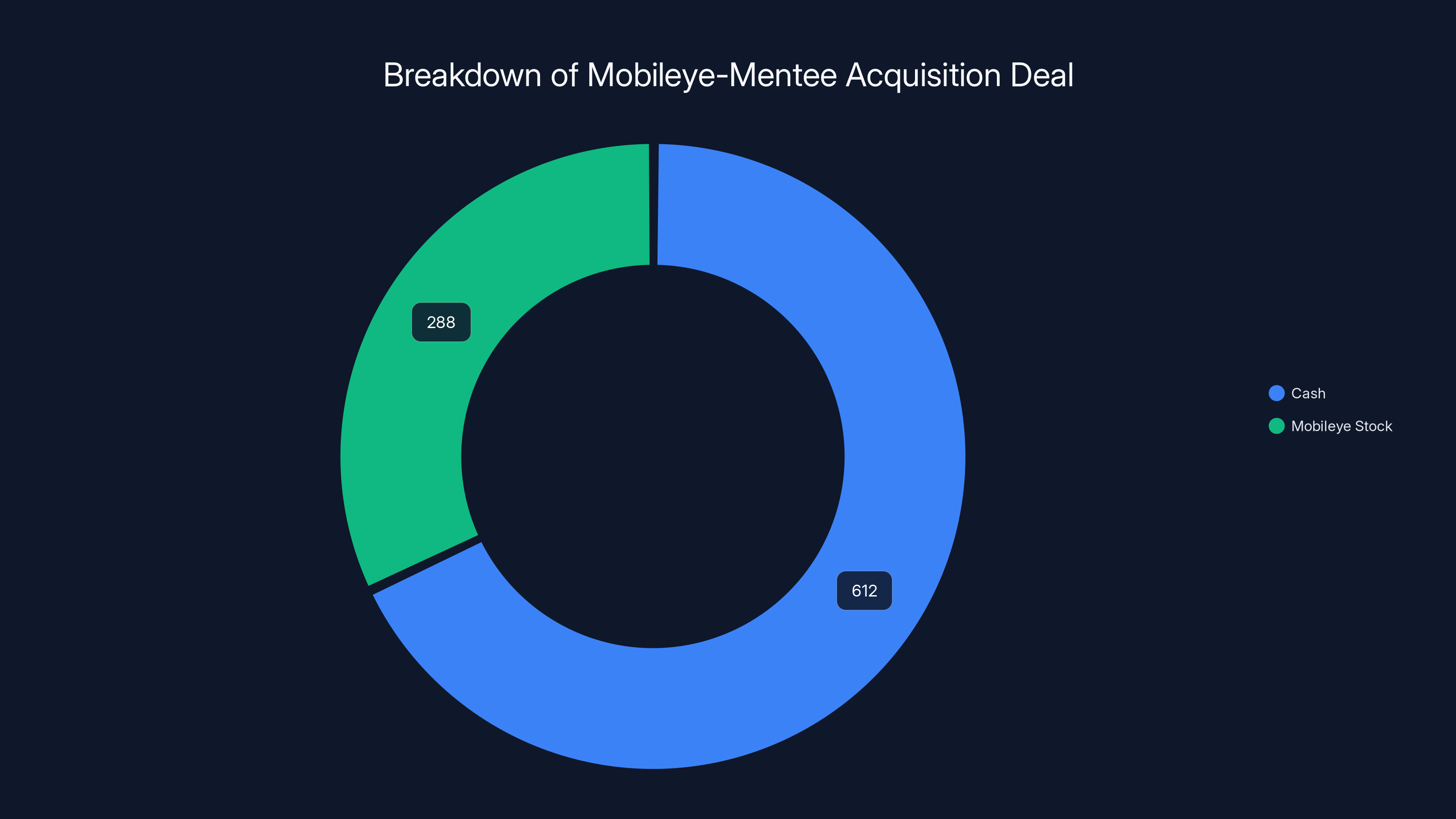

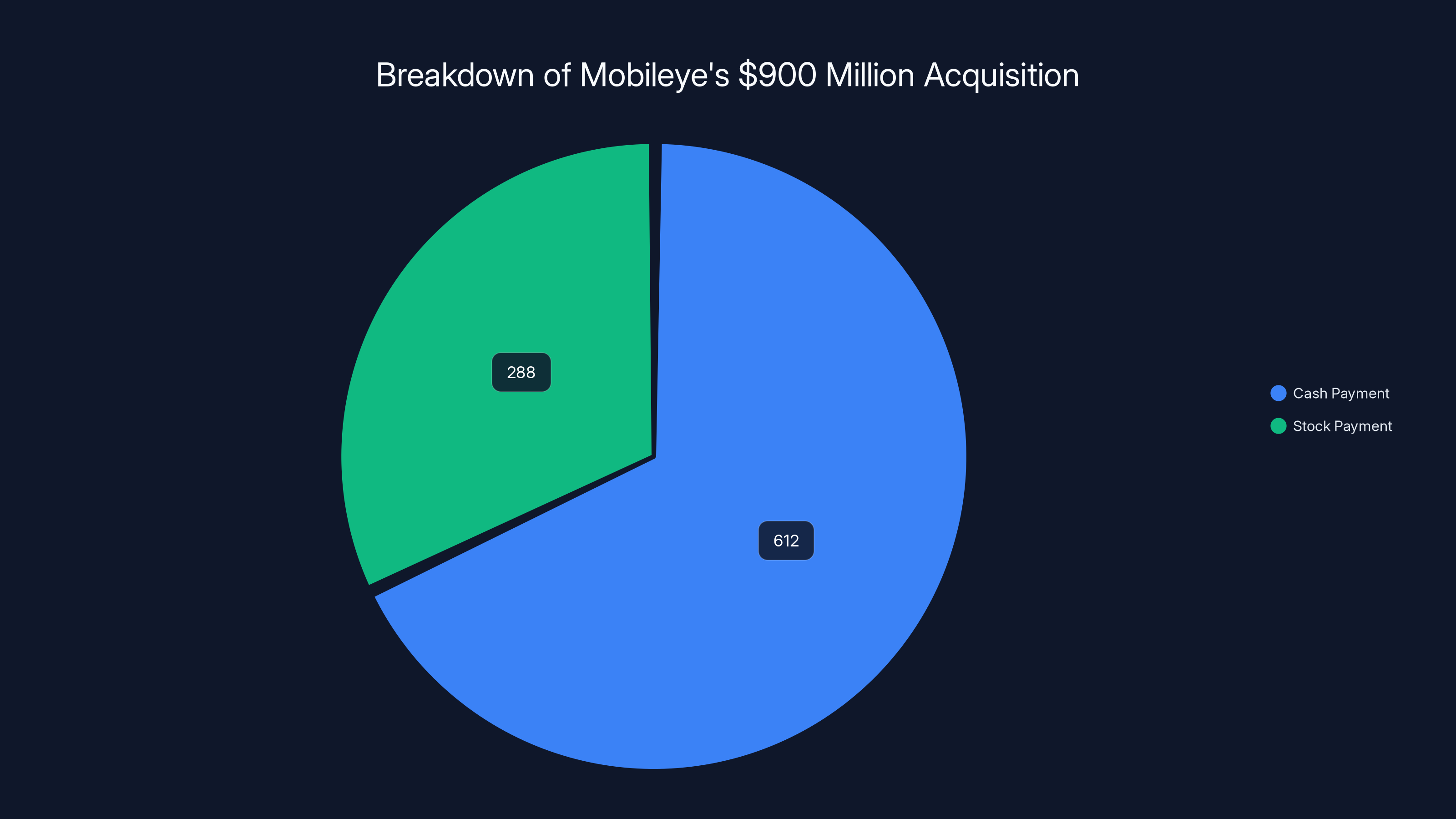

- **612 million in cash plus 26.2 million shares of stock, announced at CES 2025.

- Strategic pivot: The deal signals Mobileye's shift from pure autonomous vehicle chips toward "physical AI" and humanoid robotics applications.

- Founder connection: Amnon Shashua co-founded both companies, providing direct continuity and vision alignment between the two organizations.

- Proven infrastructure: Mobileye brings a $24.5 billion automotive revenue pipeline, advanced AI training compute, and productization expertise to Mentee's robotics research.

- Market timing: The acquisition reflects broader industry momentum toward humanoid robots as both Tesla and other major tech companies race to commercialize physical AI.

The Mobileye-Mentee acquisition deal is valued at

Understanding Mobileye: The Company Behind the Windshield

Mobileye didn't become a publicly traded billion-dollar subsidiary by accident. Amnon Shashua founded the company in 1999 with a simple but revolutionary idea: use cameras and computer vision to give cars the ability to "see" the road the way humans do.

For two decades, Mobileye dominated a very specific problem: how to extract actionable information from video feeds mounted on vehicles. Their Eye Q chips became the standard in advanced driver assistance systems. If a car could detect a pedestrian about to walk into traffic, warn the driver of lane drift, or predict collision risk, there was probably a Mobileye chip doing the heavy lifting.

Intel acquired Mobileye in 2017 for $15.3 billion. At the time, it seemed like Intel was betting everything on autonomous vehicles becoming a massive market. And they were right to be interested. But Intel also acquired a company that had something even more valuable: twenty years of experience building AI systems that operate in the chaotic, unpredictable real world.

Because here's the thing about training AI on video data from billions of hours of driving: you learn a lot about how the world actually works. Computer vision isn't just about recognizing objects. It's about understanding context, predicting intent, and making decisions in real time with incomplete information. That's the kind of AI that actually transfers to robots.

Mobileye went public in 2023, separate from Intel, even though Intel remains the largest shareholder. The company reported $1.93 billion in revenue for 2024, with gross margins above 75%. That's the kind of profitability that gives you resources to make expensive bets on the future.

So when Shashua made the announcement at CES 2025, he wasn't making this up. He had the cash, the talent, and twenty-five years of successful experience building AI systems that work in the real world.

The Mentee Robotics Story: What Shashua Built Before This Deal

Mentee Robotics is a three-year-old startup working on humanoid robots. Three years old. That's not a lot of time to accomplish much in robotics, which is a field where even the best-funded companies spend years iterating on basic mechanics, control systems, and learning algorithms.

Shashua co-founded Mentee in 2022, which means he was building it at the same time he was running Mobileye as president. That's either audacious or delusional. The market will decide which one.

The startup focuses specifically on humanoid robots—robots that roughly look like humans and are designed to operate in human environments. Not factory robots. Not drones. Actual bipedal machines that can walk into a warehouse, understand what humans are asking them to do, and perform tasks.

This is harder than it sounds. Humanoid robots have been the dream of robotics researchers for decades. Honda's Asimo is probably the most famous example—beautiful engineering, limited practical application. Boston Dynamics' Atlas is arguably the most impressive robot ever built, but it's still a research project, not a shipping product.

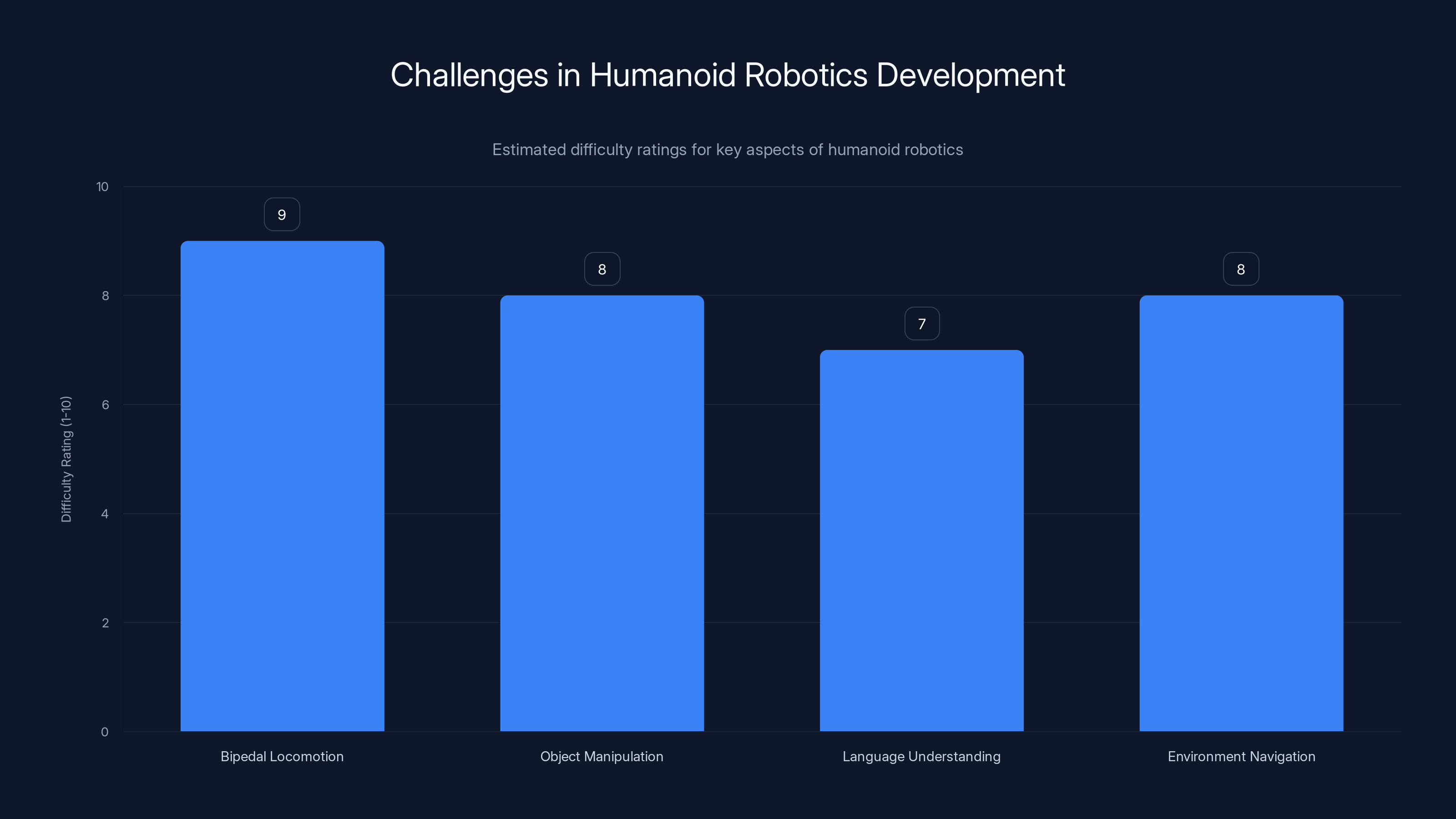

Why are humanoid robots so difficult? Because bipedal locomotion is unstable. It requires constant balance adjustments. Add in the requirement to manipulate objects, understand language, navigate unpredictable environments, and you've got a problem space that needs breakthroughs in multiple areas simultaneously.

Mentee's approach—and this is where Shashua's vision becomes important—is to combine motor control (the robotics part) with advanced AI perception (the Mobileye expertise). In other words, don't try to build a perfect physical robot that can do anything. Build a robot that can see, understand, and learn from humans what it's supposed to do.

That's a fundamentally different approach than most robotics companies take. And it's the reason why Mobileye acquiring Mentee makes sense, even if the reasoning isn't obvious on the surface.

Mobileye's acquisition of Mentee was split into

Physical AI: The Concept That Justifies the Price Tag

Shashua is pushing a term that you're going to hear more often: "Physical AI." It's not a new concept—researchers have been talking about embodied AI for decades—but it's become the hot catchphrase for companies trying to explain why they're building robots.

Physical AI means artificial intelligence that understands the real world—not just language or images, but physics. Gravity. Friction. Inertia. How objects behave when you touch them. How humans react to different stimuli. The knowledge that if you pick something up too fast, it falls, and if a human is standing in a doorway, you can't move through it without changing your behavior.

This is different from Chat GPT or image generation models. Those are pattern-matching systems trained on text and images. They can tell you how to solve a problem, but they can't actually perform the solution. Physical AI needs to bridge that gap—to translate understanding into action in environments with constraints and consequences.

Why would Mobileye care about this? Because they've been solving a related problem for twenty years: training AI systems to understand real-world complexity and make safety-critical decisions based on incomplete information.

When a Mobileye chip detects a pedestrian stepping into the road, it's not just recognizing a human shape. It's understanding context: traffic conditions, weather, road surface, the speed of the vehicle, the typical behavior of pedestrians, and the consequences of a wrong decision. That's physical understanding applied to a very specific domain.

Humanoid robots need the same capability, but applied to different domains. Understanding that a human is angry versus happy isn't about recognizing a smile. It's about understanding context—body posture, speech patterns, the situation the human is in. A robot that can do that could actually work alongside humans in environments like warehouses, manufacturing, or construction sites.

Mobileye's $24.5 billion revenue pipeline gives them the resources to invest in this problem space. And more importantly, it gives them computing infrastructure, training data, and expertise that most robotics companies don't have access to.

The calculation is simple: apply twenty-five years of automotive AI expertise to a new domain. If it works, the market could be enormous. If it doesn't, they've spent

The Amnon Shashua Factor: One Man, Two Companies

When Mobileye's board approved this acquisition, Amnon Shashua recused himself because he's a significant shareholder in Mentee Robotics and chairman and co-founder of the company. This is important to understand because it tells you something about how this deal actually works: Shashua has already committed to this vision.

He's not buying a company as an experiment. He's integrating a company he founded with a company he runs. From a governance perspective, this creates obvious conflicts of interest. From a strategic perspective, it creates clarity: Shashua is personally betting his reputation, his shares, and his time on the idea that humanoid robots powered by automotive-grade AI can become a massive market.

Consider what Shashua has already accomplished: he took Mobileye from a startup to a

The counterargument is obvious: founder enthusiasm is a terrible predictor of market success. There are dozens of examples of brilliant engineers who bet everything on a technology that didn't work out. The humanoid robot market is unproven. The regulatory environment is unclear. The economics are uncertain.

But Shashua has one advantage most robotics founders don't: he's already built a billion-dollar business by solving hard AI problems in the real world. He knows how to take research breakthroughs and turn them into products that actually ship at scale. That's rarer than you'd think.

Why Humanoid Robots Matter (Or Might Not)

Let's address the obvious question: why are tech companies suddenly obsessed with humanoid robots?

The simple answer is that robots optimized for human environments are more useful than robots optimized for specific tasks. A factory robot that can only weld is useless in a warehouse. A humanoid robot that can learn tasks might be useful everywhere.

The harder answer is that we're reaching a point where robot hardware is cheap enough and AI is good enough that building a robot that can work alongside humans is starting to look feasible. Not easy. But feasible.

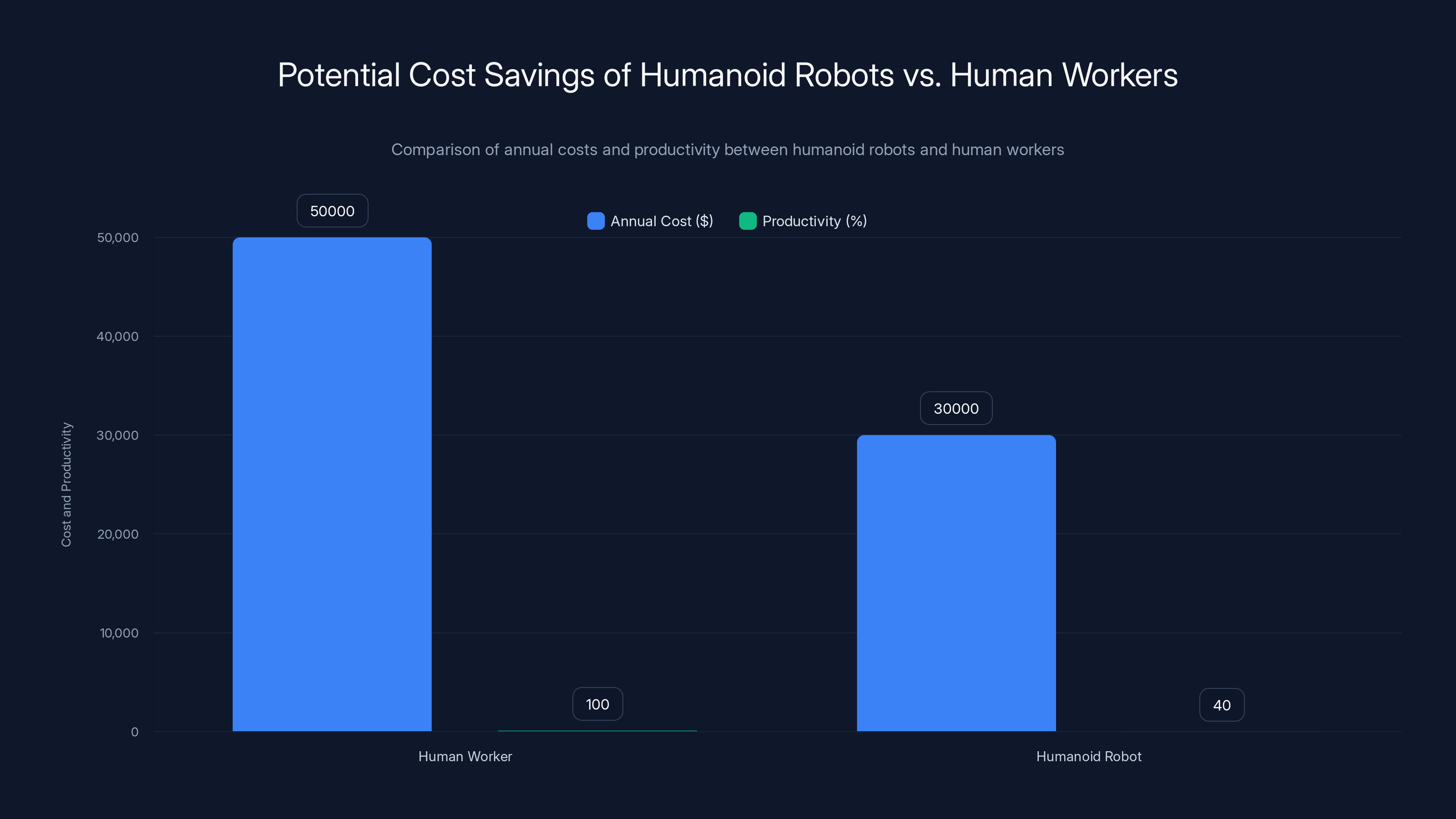

Consider the economic argument: a human warehouse worker costs about

But the bar is high. The robot needs to:

- Understand instructions with minimal training

- Handle unexpected situations without human intervention

- Work safely around humans

- Not require constant maintenance and repair

- Continuously improve as it performs tasks

Mobileye's expertise addresses points 1, 3, and 5. Their computer vision and AI systems are built to understand humans, predict behavior, and improve over time. That's directly applicable to humanoid robotics.

The market opportunity is enormous. Warehousing is a

But "enormous potential" is not the same as "guaranteed success." There are still massive problems to solve: mechanical reliability, power systems, learning algorithms that work in the real world, regulatory frameworks, worker displacement, and the basic question of whether humans actually want to work next to robots.

Humanoid robots, despite lower productivity, can offer cost savings over time due to lower annual costs and 24/7 operation. Estimated data based on typical costs and productivity.

The Competitive Landscape: Tesla, Boston Dynamics, and Everyone Else

Mobileye is entering a crowded field. Tesla is building Optimus. Boston Dynamics is working on commercial applications for Atlas. Figure AI is building humanoid robots with Amazon backing. Every AI company from Google to Microsoft is exploring robotics applications.

What gives Mobileye an advantage?

First, scale. Mobileye already has relationships with major automakers. Those relationships come with trust, technical standards, and distribution channels. If Mobileye can build a robot that works in logistics or manufacturing environments, they can reach customers faster than a pure robotics startup.

Second, expertise in real-world AI. Building autonomous vehicle systems teaches you how to handle edge cases, failure modes, and the thousand small problems that come up when you're deploying AI in unpredictable environments. That experience is incredibly valuable in robotics.

Third, capital. Mobileye has proven they can execute and scale. They have the cash and the organizational capability to invest heavily in robotics for years without needing to show short-term returns.

What are the risks?

First, Mobileye's expertise is domain-specific. Autonomous vehicle AI doesn't automatically transfer to general-purpose robotics. The problems are similar, but not identical.

Second, Mobileye is primarily a B2B company selling to automakers. Robotics markets might require different go-to-market approaches, different partnerships, and different sales cycles. There's no guarantee Mobileye's organizational culture is suited to this.

Third, the humanoid robot market hasn't proven itself yet. Tesla's Optimus is a prototype. Boston Dynamics has been working on robots for fifteen years with limited commercial success. Figure AI is still in early stages. This isn't a market with established players and proven unit economics. It's a bet on a future market that might not develop the way people expect.

Financial Analysis: $900 Million and What It Buys

So what exactly did Mobileye pay $900 million for?

Officially, Mobileye paid approximately

Fundamentally, Mobileye bought:

- Intellectual property: Mentee's patents, algorithms, and engineering know-how related to humanoid robotics.

- Engineering talent: The team that founded and built Mentee.

- First-mover advantage: An existing head start in a market that could be enormous.

- Strategic optionality: The ability to learn whether humanoid robots are actually viable at scale.

In the context of Mobileye's financials, this is manageable. Mobileye reported revenues of

Mobileye estimated the acquisition would increase operating expenses by a low-single-digit percentage in 2026. That's the cost of integrating the team, setting up manufacturing facilities, and beginning the long process of bringing a humanoid robot to market.

The real question isn't whether Mobileye can afford this. They can. The question is whether the return justifies the investment. If Mentee produces a commercially viable humanoid robot that captures even 5% of the logistics robotics market in the next decade, this deal will look like a steal. If humanoid robots remain a niche product for specialized applications, this will look like an expensive experiment.

Historically, when large successful companies make acquisitions of startups in adjacent markets, the success rate is mixed. Sometimes you get value creation. Sometimes you get organizational integration problems and culture clashes.

But Shashua has already built one of the most successful AI companies in the world. He's not new to scaling organizations. That has to count for something.

Integration Strategy: How Mentee Will Operate Within Mobileye

Formally, Mentee Robotics will continue as an independent unit within Mobileye. This is a smart approach. Robotics requires different engineering practices than automotive systems. Different hiring. Different partnerships. Different go-to-market strategies.

Keeping Mentee independent preserves that flexibility while still giving the company access to Mobileye's resources.

Where integration makes sense:

- AI training infrastructure: Mobileye has state-of-the-art compute infrastructure for training computer vision models. That becomes available to Mentee's engineers immediately.

- Chip design: Mobileye's Eye Q chip family could potentially be adapted for robotics applications or serve as a baseline for robot-specific processors.

- Safety standards and testing: Mobileye has decades of experience building safety-critical AI systems. That expertise directly applies to humanoid robots operating around humans.

- Supply chain and manufacturing: Mobileye works with the world's largest automakers and their suppliers. Those relationships and expertise apply to scaling robot production.

- Customer relationships: Mobileye's relationships with logistics companies, retailers, and manufacturers could create distribution channels for Mentee robots.

Where independence helps:

- Engineering culture: Robotics teams often work differently than automotive teams. Maintaining some separation allows different workflows.

- Decision-making speed: Independent units can move faster on decisions that don't affect other parts of the company.

- Talent acquisition: The robotics job market is different. Promising autonomy helps recruit top talent.

- External partnerships: Robotics requires partnerships with research institutions, component suppliers, and integration partners that might be different from Mobileye's current ecosystem.

This is a common approach for large companies acquiring startups—maintain independence while creating value through resource sharing and strategic alignment. It works when there's clear vision alignment, which Shashua's dual role guarantees.

Mobileye's revenue pipeline is projected to grow from

The Autonomous Vehicle Connection: From Cars to Robots

Let's be clear about what's really happening here: Mobileye is taking two decades of expertise in autonomous vehicles and applying it to humanoid robots.

Why does that make sense?

Autonomous vehicle technology solves several problems that are directly relevant to robots:

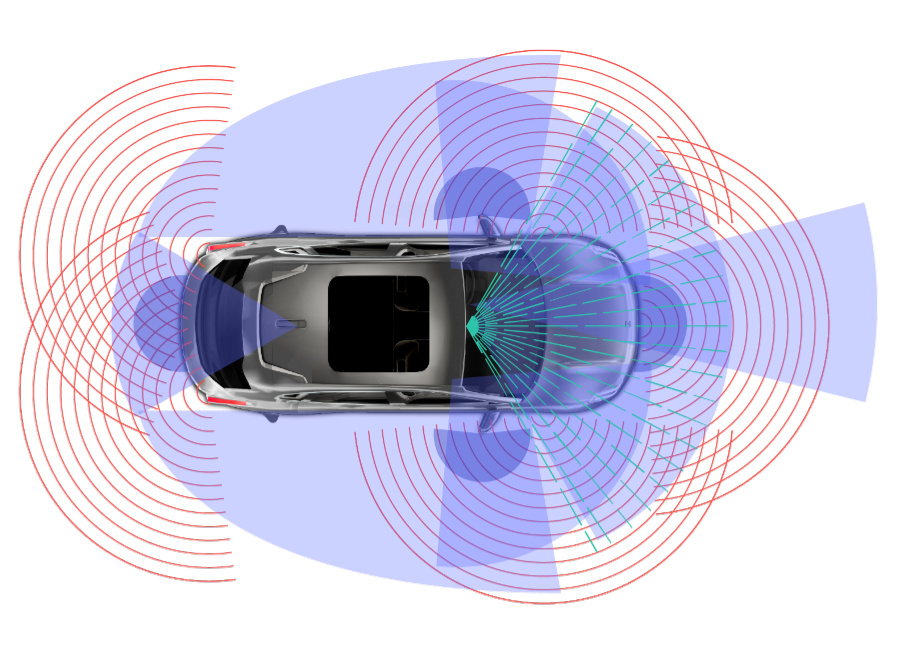

Perception and understanding: Autonomous vehicles need to understand their environment in real time. They use cameras, radar, and lidar to build a three-dimensional understanding of what's around them. They need to recognize objects (cars, pedestrians, cyclists), understand their behavior (will that pedestrian cross the street?), and predict future states (where will that car be in 2 seconds?).

Humanoid robots need the same capabilities. They need to understand what's in front of them, what objects are, how humans behave, and what's likely to happen next.

Decision-making under uncertainty: Autonomous vehicles operate in unpredictable environments. A pedestrian might make an unexpected move. A traffic light might malfunction. Weather conditions might obscure sensors. The AI system needs to make decisions despite uncertainty and potential failure modes.

Robots face the same problem. You can't write a complete rulebook for every situation a robot might encounter. Instead, you need an AI system that understands the world well enough to handle novel situations.

Safety and reliability: Autonomous vehicles have to be extremely reliable because failures have consequences. A system crash in an autonomous vehicle could cause a collision. The industry has developed rigorous testing frameworks, failure mode analysis, and safety standards.

Robots need the same rigor. If a humanoid robot in a warehouse fails, it could hurt someone or damage equipment. The reliability standards need to be comparable to autonomous vehicles.

Continuous learning and improvement: Autonomous vehicles improve over time as they encounter new situations. The AI system learns from edge cases and unusual scenarios. This learning loop is critical for robots to improve their capabilities over time.

Mobileye has built systems to handle all of these problems. The transfer isn't automatic—robots are different from vehicles in important ways—but the underlying technical problems are similar enough that there's real value in the transfer.

Revenue Pipeline and Economic Scale: The $24.5 Billion Question

Mobileye estimates its current automotive revenue pipeline at $24.5 billion over the next eight years. This number is important because it tells you the scale of Mobileye's existing business and provides context for the Mentee acquisition.

Where does this $24.5 billion come from?

Primarily from automotive ADAS and autonomous driving systems sold to major automakers. The company announced just before the Mentee acquisition that a "top 10 automaker" struck a deal to purchase 9 million Eye Q6H-based Surround ADAS systems. Earlier, Volkswagen Group announced plans to use the Eye Q6H chip in its vehicle platforms.

With more than 19 million Eye Q6H-based Surround units projected for future delivery, Mobileye is essentially betting that the automotive AI market is expanding significantly.

How does the Mentee acquisition fit into this picture?

In the short term, it doesn't. Humanoid robots won't generate automotive revenue. But in the medium term, Shashua is betting that the same customers—major automakers and their partners—will want humanoid robots for logistics, manufacturing, and supply chain operations.

Think about a typical car manufacturer. They operate massive manufacturing facilities. They have suppliers spread across continents. They move parts, finished vehicles, and materials. A lot of that work is done by humans in roles that could potentially be filled by robots.

If Mobileye can build humanoid robots that work in these environments, the same sales team that sells ADAS systems could sell robots to the same customers. That's not a coincidence. That's the strategy.

Mobileye also noted that this pipeline represents more than a 40% increase compared to January 2023. That growth suggests the market for automotive AI is accelerating, which creates tailwinds for the company as a whole.

Competitive Advantages: What Mobileye Brings to Mentee

Let's think about what advantages Mobileye brings to Mentee beyond just cash:

1. Compute infrastructure: Training large AI models requires enormous computational resources. Mobileye has built the infrastructure to train computer vision models on billions of hours of driving data. That infrastructure immediately becomes available to Mentee's robotics team.

2. Data: Twenty-five years of automotive data. Video feeds from millions of vehicles. Information about edge cases, failure modes, and unusual situations. This data is incredibly valuable for training robotics systems because it teaches the AI how the world actually works in complicated, messy real environments.

3. Chip design expertise: Mobileye has been designing and optimizing computer vision chips for two decades. The Eye Q family of chips represents years of optimization for specific workloads. That expertise could accelerate Mentee's ability to develop efficient robot processors.

4. Safety and reliability frameworks: Autonomous vehicles operate in safety-critical environments. The industry has developed rigorous standards for testing, validation, and failure analysis. Mobileye understands these standards and can apply them to robotics.

5. Supply chain and manufacturing: Scaling automotive products to millions of units per year requires dealing with suppliers, managing manufacturing complexity, and ensuring quality at scale. Mobileye has experience doing all of this. Mentee probably doesn't.

6. Regulatory expertise: The automotive industry is heavily regulated. Mobileye has spent decades navigating regulatory frameworks across different countries. Robotics will eventually face similar regulation, and Mobileye's experience will be valuable.

7. Customer relationships: Mobileye already works with the world's largest automotive manufacturers. These are exactly the kinds of large organizations that might deploy humanoid robots in their operations. Mobileye's existing relationships and credibility with these customers could accelerate Mentee's go-to-market strategy.

These aren't small advantages. They're the kinds of structural benefits that could accelerate Mentee's development timeline by years.

Mobileye's revenue has shown significant growth since its founding, reaching $1.93 billion in 2024. Estimated data for early years.

The Broader Physical AI Movement: Why This Matters Beyond Mobileye

Mobileye's acquisition of Mentee isn't happening in isolation. It's part of a broader industry movement toward what Shashua calls "Physical AI."

What's driving this movement?

-

AI is getting better at understanding the world: Large language models, vision transformers, and multimodal AI systems are reaching capability levels that make it plausible to control robots with these systems.

-

Hardware is getting cheaper: Robotic actuators, sensors, compute, and batteries have all gotten significantly cheaper in the last five years. This changes the unit economics of robot development.

-

The market is pushing in this direction: Logistics, manufacturing, and construction are all facing labor shortages. The economic incentive to deploy robots is stronger than it's ever been.

-

Major tech companies are betting on it: Tesla is building Optimus. Google is working on robotics. Microsoft has partnerships in the space. When major tech companies bet on something, capital flows in that direction.

-

We're reaching inflection points in AI capabilities: The jump from GPT-3 to GPT-4 was dramatic. Similar jumps are happening in robotics AI. At some point, incremental improvements in AI capability translate to step-function improvements in robot capability.

Mobileye's move is both a bet on this broader movement and an attempt to position itself as a leader in the space. If humanoid robots do become a major market, Mobileye wants to be one of the companies that shaped that outcome.

The risk, of course, is that this is hype. Humanoid robots have been "the next big thing" for decades. The failures and disappointments outnumber the successes. Boston Dynamics has been working on robots for years with limited commercial success. Tesla's Optimus is still in prototype stages.

But Shashua's track record suggests he doesn't make bets lightly. If he's willing to put $900 million and significant organizational effort into this, it's worth paying attention to.

Challenges Ahead: The Realities of Humanoid Robotics

Let's not oversell this. There are massive challenges ahead:

Hardware challenges: Building humanoid robots that are reliable, safe, and reasonably cost-effective is extraordinarily difficult. The mechanics of bipedal locomotion, dexterous manipulation, and safe operation around humans are unsolved problems at scale.

AI challenges: Even if the hardware works, the AI needs to understand context, learn quickly, handle novel situations, and work safely with minimal human supervision. Current AI systems are getting better at these things, but we're not there yet.

Manufacturing challenges: Scaling production of complex mechanical systems is hard. Automotive companies have spent decades optimizing manufacturing processes. Mobileye has some experience here, but robotics manufacturing is fundamentally different from chip manufacturing or vehicle production.

Market development challenges: Even if Mobileye builds a great humanoid robot, they need to convince customers to deploy it. That requires proving reliability, demonstrating ROI, managing integration into existing facilities, and handling worker concerns about job displacement.

Regulatory challenges: As robots become more common, regulation will follow. Questions about safety standards, liability, data privacy, and worker protections will all need to be addressed.

Competition challenges: Every major tech company is working on robots. The competitive landscape is getting crowded. If humanoid robots do become a huge market, margins will compress as more players enter.

Mobileye is entering this space with significant advantages, but the challenges are real and shouldn't be underestimated.

Timeline and Expectations: What to Watch

The acquisition closed in Q1 2025. Here are the key milestones to watch:

2025: Integration of Mentee into Mobileye. Continuation of prototype development. First hints about commercial applications and target markets.

2026-2027: Development of production-ready humanoid robot designs. First customer pilots in controlled environments. Refinement of manufacturing processes.

2028-2029: Initial commercial deployments. Probably small scale at first, likely in partnerships with major customers. Focus on specific use cases where robots provide clear value.

2030 and beyond: Scale if deployments succeed. Major expansion if unit economics work out. Potential for multiple robot product lines targeting different market segments.

That's an aggressive timeline. Most robotics companies take longer. But Mobileye isn't a typical robotics company. They have resources and expertise that most startups lack.

The market will provide feedback quickly. If Mentee's designs don't work at scale, that will become obvious in 2-3 years. If they do work, we could see rapid expansion.

Bipedal locomotion is rated as the most challenging aspect of humanoid robotics, requiring constant balance adjustments. Estimated data.

The Investor Perspective: How Markets Viewed the Deal

When Mobileye announced the Mentee acquisition at CES 2025, the reaction from investors was cautious optimism. The market didn't tank on the news. Mobileye's stock didn't collapse. That suggests investors thought the price was reasonable relative to potential upside.

Investors understand that Shashua is a serious person who doesn't make random bets. They also understand that humanoid robots could represent an enormous market. Even if the probability of success is moderate (say 30-40%), the expected value of a successful humanoid robot company is so large that $900 million is a reasonable bet.

The key metric investors will watch is Mentee's ability to produce a robot that works in real-world environments. Everything else—manufacturing scale, market adoption, competitive advantage—flows from that fundamental technical achievement.

If Mentee can demonstrate a humanoid robot that reliably performs tasks in a warehouse, manufacturing facility, or logistics center, the valuation becomes a no-brainer. If they struggle to get basic mechanics working at scale, this will look like an expensive mistake.

Mobileye's existing business is strong enough that one failed acquisition won't derail the company. But the success or failure of this bet could significantly impact the company's long-term trajectory and valuation multiple.

Strategic Implications: What This Means for the Industry

Mobileye's move signals something important: the era of pure autonomous vehicle companies is ending. Or more accurately, it's expanding. Companies that started in autonomous vehicles are now branching into adjacent markets.

Mobileye started as an autonomous vehicle company. Now it's becoming a physical AI company. Tesla started as an electric vehicle company and is now building factories, energy systems, and robots. Amazon started as a retailer and is now heavily invested in robotics and logistics automation.

This convergence makes sense: the underlying technologies (AI, computer vision, robotics) apply across multiple domains. A company that gets good at building AI systems that work in autonomous vehicles has solved most of the hard problems needed for humanoid robots.

For the robotics industry, this is positive news. When major tech companies get serious about robotics, it accelerates the entire field. Capital flows in. Talent migrates. Supply chains get built. Standards get established. Regulation gets developed.

For pure robotics startups, this is a mixed signal. On one hand, a larger market for robotics means more opportunities. On the other hand, competition from well-funded tech companies is brutal. A startup trying to build humanoid robots against Mobileye, Tesla, Google, and Boston Dynamics faces an uphill battle.

For customers and workers, the implications are complex. Humanoid robots could improve safety, increase productivity, and handle dangerous work. They could also displace workers and concentrate value in a small number of dominant companies. Both outcomes are likely to some degree.

Future Possibilities: Where This Could Go

Assuming Mentee successfully develops a commercially viable humanoid robot, what could Mobileye eventually do with the technology?

Scenario 1: Focused niche player: Mentee robots become specialized tools for specific industries (logistics, manufacturing, construction). Mobileye captures 5-10% of these markets and generates billions in revenue. This is a good outcome, but not revolutionary.

Scenario 2: Broader industrial robotics: Mentee robots become standard equipment in industrial settings. They're deployed at scale across manufacturing, warehousing, and logistics. Revenue scales to tens of billions. This is the "home run" scenario.

Scenario 3: Expansion into consumer/service markets: Humanoid robots eventually work in retail, hospitality, healthcare, and other service industries. The market becomes enormous, potentially exceeding the industrial robotics market.

Scenario 4: Integration with autonomous vehicles: Mobileye develops robots that work together with autonomous vehicles. An autonomous vehicle shows up at a distribution center, a robot loads it, another robot unloads it at the destination. Fully automated logistics. This is the mega-scenario where robotics and autonomous vehicles become a unified system.

Scenario 5: The tech giant plays hardball: Tesla, Google, or another company with massive resources develops superior robots and dominates the market. Mobileye's first-mover advantage proves insufficient. The $900 million acquisition becomes a learning experience.

Any of these outcomes is possible. The trajectory will depend on Mentee's technical execution, market adoption, competitive pressure, and regulatory environment.

But what's clear is that Mobileye is making a serious bet that the future of AI isn't just autonomous vehicles. It's physical systems that understand and work in the real world.

Conclusion: The Next Chapter of Autonomous AI

Mobileye's acquisition of Mentee Robotics for $900 million is more significant than it initially appears. On the surface, it's a tech company making a strategic bet on humanoid robots. Below the surface, it's one of the most successful autonomous vehicle companies pivoting toward a much larger vision: physical AI systems that operate across multiple domains.

Amnon Shashua isn't reinventing himself. He's expanding. For twenty-five years, he's been building AI systems that understand the real world and make critical decisions. First in the form of ADAS systems that prevent collisions. Now in the form of humanoid robots that work alongside humans.

The acquisition makes sense strategically. Mobileye brings resources, expertise, infrastructure, and customer relationships that most robotics startups could only dream of. Mentee brings focus, specialization, and the concentrated effort of a team working on one hard problem.

Will it work? That's unknowable. Humanoid robots are extremely difficult. The market is uncertain. Competition is fierce. But the downside is manageable—Mobileye can afford a $900 million experiment. And the upside is enormous—physical AI could be the most important technology development of the next decade.

For investors, customers, and anyone watching the AI industry, this acquisition is worth paying attention to. Not because it's guaranteed to succeed, but because it signals where serious people with serious resources think the future is going.

The Mobileye 3.0 chapter has begun. Whether it becomes a huge success or an interesting detour will tell us a lot about the future of robotics, autonomous systems, and AI at scale.

FAQ

What is Mentee Robotics?

Mentee Robotics is a startup founded in 2022 by Amnon Shashua that specializes in developing humanoid robots designed to operate in human environments. The company focuses on combining motor control and advanced AI perception to build robots that can understand instructions, navigate unpredictable environments, and learn from human feedback.

Why did Mobileye acquire Mentee Robotics?

Mobileye acquired Mentee Robotics for $900 million to expand into physical AI and humanoid robotics. The acquisition allows Mobileye to apply its decades of expertise in autonomous vehicle AI to a new domain—building robots that understand context, predict human behavior, and operate safely alongside humans. The deal also provides Mentee access to Mobileye's advanced compute infrastructure, safety expertise, and customer relationships with major manufacturers.

What is Physical AI?

Physical AI refers to artificial intelligence systems that understand and operate in the real, physical world. Unlike language models or image generation systems that work with text and images, physical AI systems need to understand physics, gravity, object behavior, and human intentions to control robots that interact with physical environments. This requires the kind of real-world understanding that Mobileye has developed through decades of autonomous vehicle work.

How much is the Mobileye-Mentee deal worth?

The acquisition is valued at approximately

What advantages does Mobileye bring to Mentee?

Mobileye brings several significant advantages to Mentee, including advanced AI training infrastructure, access to decades of automotive sensor data, expertise in building safety-critical AI systems, supply chain and manufacturing experience for scaling production, established relationships with major manufacturers, and regulatory knowledge from operating in the highly regulated automotive industry. These resources could accelerate Mentee's development timeline by years.

Will Mentee Robotics operate as an independent company?

Yes, Mentee Robotics will continue to operate as an independent unit within Mobileye after the acquisition. This structure allows the robotics division to maintain its own engineering culture and decision-making speed while benefiting from Mobileye's resources, infrastructure, and strategic guidance. Amnon Shashua maintains his role connecting both organizations and driving the overall vision for physical AI.

What is Mobileye's current business and revenue?

Mobileye is an Intel subsidiary and publicly traded company that supplies advanced driver assistance systems (ADAS) and autonomous driving chips to major automakers. The company reported

How does this acquisition fit with Mobileye's autonomous vehicle business?

The acquisition represents an expansion of Mobileye's domain, not a replacement of its core business. Many of Mobileye's existing customers (large automotive manufacturers) operate massive logistics and manufacturing operations where humanoid robots could provide value. The same AI expertise used to build autonomous vehicle systems applies to robotics—both require understanding the physical world, predicting behavior, and making safety-critical decisions.

What competition does Mentee face in humanoid robotics?

Mentee faces competition from several major players, including Tesla's Optimus project, Boston Dynamics' Atlas robot, and Figure AI. Every major tech company from Google to Microsoft is exploring robotics applications. However, Mobileye's resources, existing relationships with manufacturers, and 25 years of real-world AI expertise provide significant competitive advantages that most pure robotics startups don't possess.

What timeline should we expect for Mentee robots to reach the market?

Based on typical robotics development timelines and Mobileye's aggressive approach, initial commercial pilots could begin in 2026-2027, with first production units potentially arriving in 2028-2029. However, these timelines are speculative and depend heavily on technical progress. Humanoid robotics is inherently unpredictable, and projects frequently take longer than expected to reach commercial viability.

How big could the humanoid robot market become?

The potential market for humanoid robots is enormous. Logistics alone is a

What happens to Mobileye if humanoid robots don't work out?

Mobileye's core business remains strong. The company has a proven, profitable automotive AI business with a

Understanding the Technology Behind the Deal

The technical foundation of this acquisition is worth understanding. Mobileye's expertise in computer vision and real-world AI comes from two decades of building automotive systems that need to understand complex environments.

When a Mobileye chip analyzes a video feed from a vehicle, it's doing several things simultaneously: detecting objects (pedestrians, cyclists, vehicles, obstacles), classifying them (what type of object is this?), predicting their behavior (what will this person do next?), and recommending actions (should the vehicle brake, steer, or accelerate?).

All of this happens in real time, with incomplete information, in unpredictable environments, and with safety-critical consequences if the system fails. That's incredibly hard to do well.

Humanoid robots need similar capabilities. A robot in a warehouse needs to detect obstacles, understand what humans want, predict potential hazards, and move safely through the environment. The technical problems are different in the details, but the fundamental challenges are similar.

Mobileye's advantage is that they've spent twenty-five years solving these problems in the automotive domain. The algorithms, training pipelines, safety frameworks, and computational approaches transfer reasonably well to robotics. Not automatically—robotics is different in important ways—but well enough that Mobileye starts with significant technical advantages.

Mentee brings focus and specialization. A dedicated team working on one hard problem often produces better results than a general team trying to solve multiple problems. Mentee's entire engineering effort is focused on humanoid robots, which allows for the kind of deep specialization that breakthrough technologies require.

Combining Mobileye's broad AI expertise with Mentee's focused robotics specialization creates something that neither organization could achieve independently. That's the real value of this acquisition.

The Broader AI Industry Implications

This acquisition also signals something important about where the AI industry is heading. For the last few years, everyone's attention has been on large language models—Chat GPT, Claude, Gemini, and similar systems. These are fascinating technologies that can generate text, code, and creative content.

But there's a subtle shift happening: serious technologists and companies with resources are increasingly focused on AI systems that interact with the physical world. Robots, autonomous vehicles, industrial automation, medical devices—these are the applications where AI moves from generating information to actually doing things in the real world.

That shift matters because it's where most of the economic value actually is. A chatbot is useful, but a robot that can work in a warehouse creates direct economic value by replacing human labor or handling unsafe tasks. The addressable market for physical AI applications is dramatically larger than the market for language model applications.

Mobileye's pivot toward humanoid robots is part of this broader industry trend. If we're entering an era of physical AI, Mobileye wants to be a major player. The $900 million acquisition is essentially a bet that this trend is real and will accelerate.

For the AI industry as a whole, this is healthy. It pushes AI development away from pure software systems toward integrated systems that understand and manipulate the physical world. It creates demand for different kinds of engineering talent. It drives innovation in robotics, control systems, and real-time AI. It forces companies to grapple with safety, reliability, and the practical challenges of deploying AI in high-stakes environments.

Whether Mobileye's specific bet on humanoid robots works out, the broader trend toward physical AI is almost certainly going to accelerate. And that's the story that really matters.

Key Takeaways

- Mobileye's $900 million acquisition of Mentee Robotics represents a strategic pivot toward physical AI and humanoid robotics applications, not a distraction from its core automotive business.

- Amnon Shashua's simultaneous roles as Mobileye president and Mentee co-founder create direct alignment and suggest serious long-term commitment to the humanoid robot market.

- Mobileye's $24.5 billion automotive revenue pipeline provides substantial resources and cash flow to fund Mentee's expensive robot development without impacting core business operations.

- Computer vision, safety-critical AI decision-making, and real-world learning systems developed for autonomous vehicles directly transfer to humanoid robot development, creating significant technical advantages.

- The humanoid robotics market addresses $4.9 trillion in addressable industries (logistics, manufacturing, construction), making even small market penetration worth billions in revenue.

Related Articles

- AI Companion Robots and Pets: The Real-World Shift [2025]

- CES 2026: Why EVs Lost to Robotaxis & AI – Industry Shift Explained

- Narwal's AI Robot Vacuums: Pet Monitoring, Jewelry Detection & Smart Cleaning [2025]

- Home Robots in 2026: Why Specialized Bots Beat the Robot Butler Dream [2026]

- CES 2026: Every Major Tech Announcement & What It Means [2026]

- Nvidia Cosmos Reason 2: Physical AI Reasoning Models [2025]

![Mobileye Acquires Mentee Robotics: $900M Bet on Humanoid AI [2025]](https://tryrunable.com/blog/mobileye-acquires-mentee-robotics-900m-bet-on-humanoid-ai-20/image-1-1767735556042.jpg)