The Solid-State Battery Revolution Is Happening Right Now

Here's the thing about the electric vehicle industry: everyone's waiting for that one breakthrough that makes everything make sense. The range anxiety disappears. The charging times become ridiculous. The cost drops below gas cars. For the last decade, that breakthrough was always "five years away."

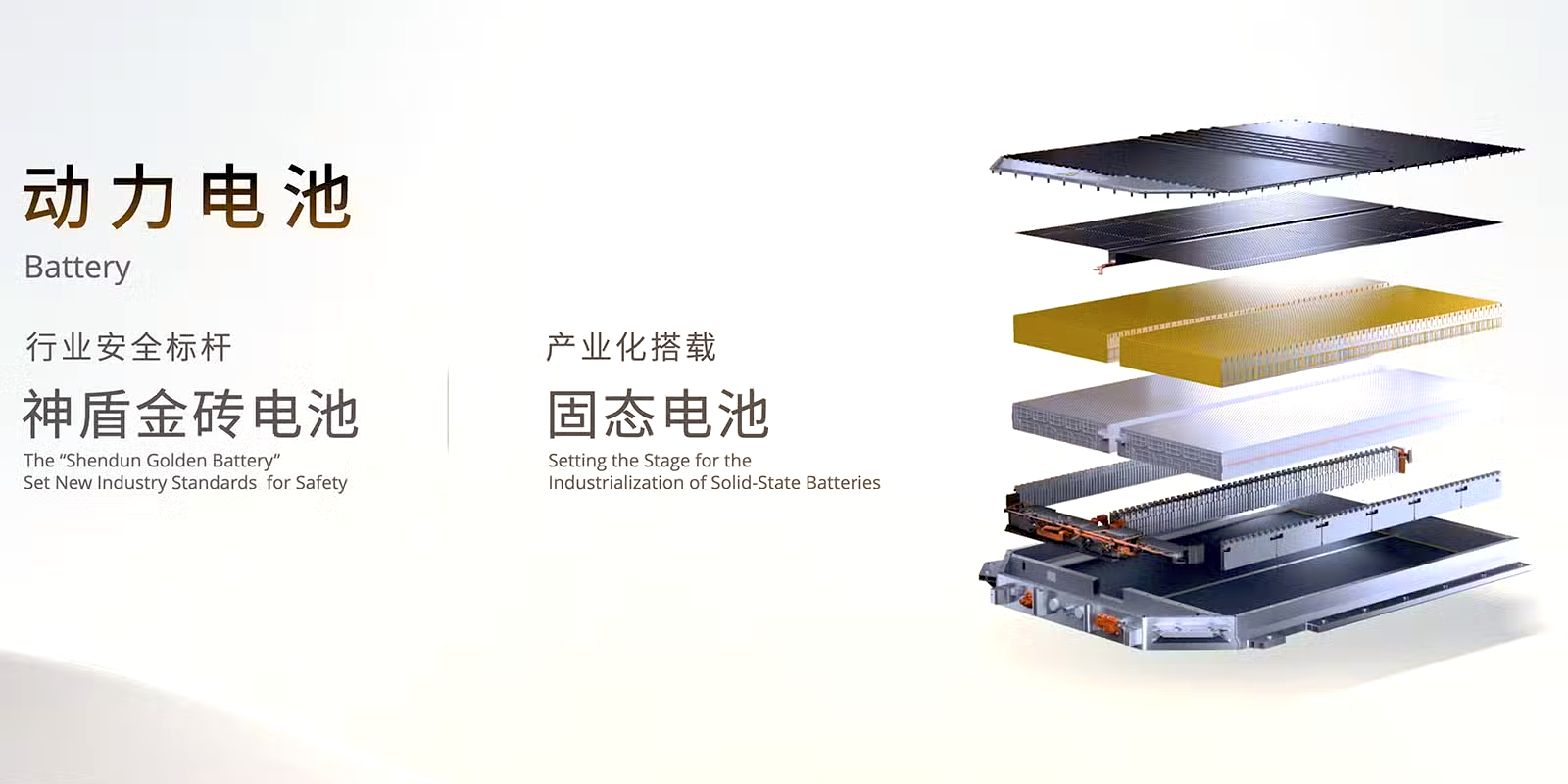

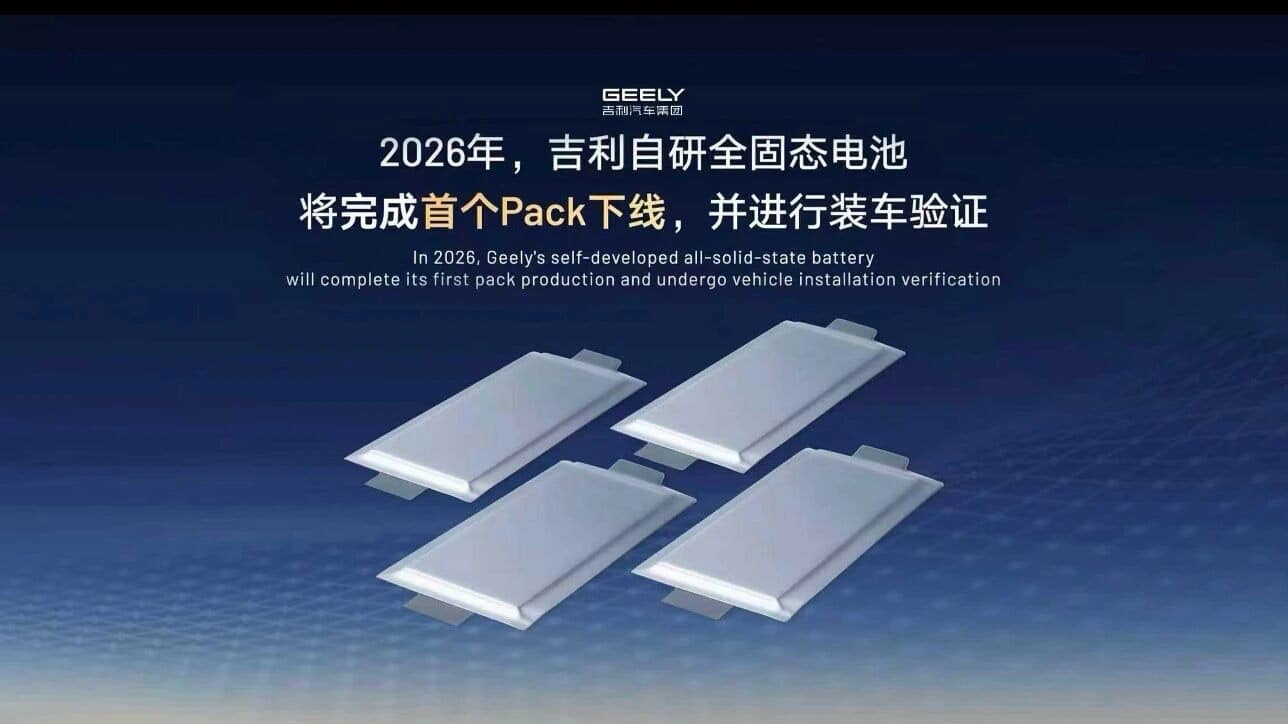

Then Geely, the Chinese automotive giant that owns Volvo Cars and Polestar, announced something different. They're not talking about future timelines anymore. They're finishing production of actual, real solid-state battery packs this year, as reported by Electrek.

I'll be honest: this matters more than most people realize.

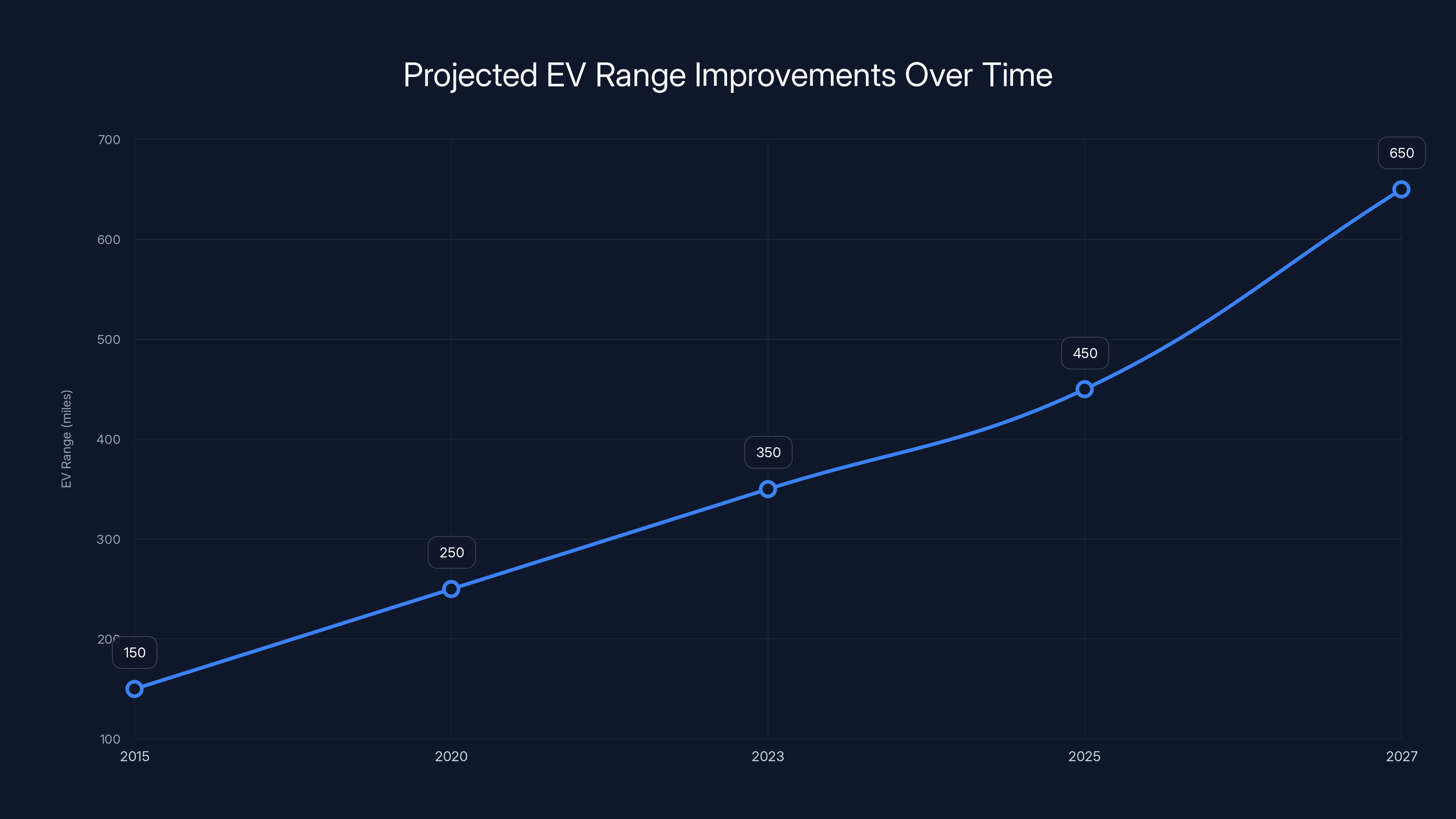

We're talking about 650 miles per single charge. That's not a lab number. That's not a theoretical maximum under perfect conditions. That's a production-ready battery pack built in a real factory by a real automaker. It's the kind of achievement that changes how we talk about electric vehicles entirely.

So what's happening here, and why should you care? Let's break it down.

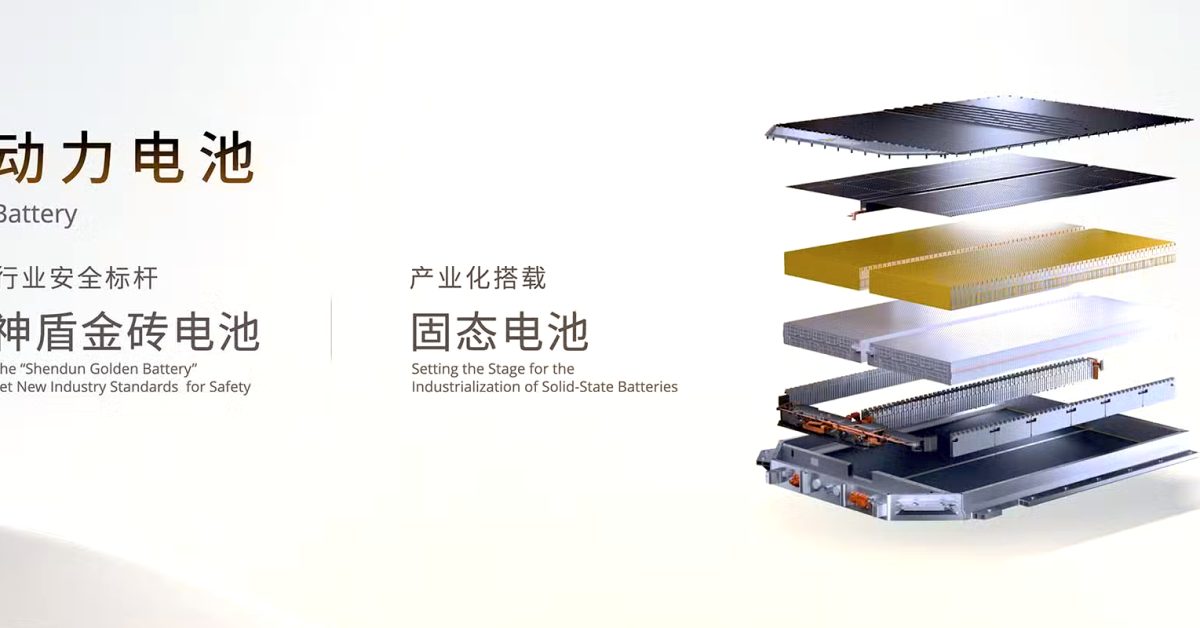

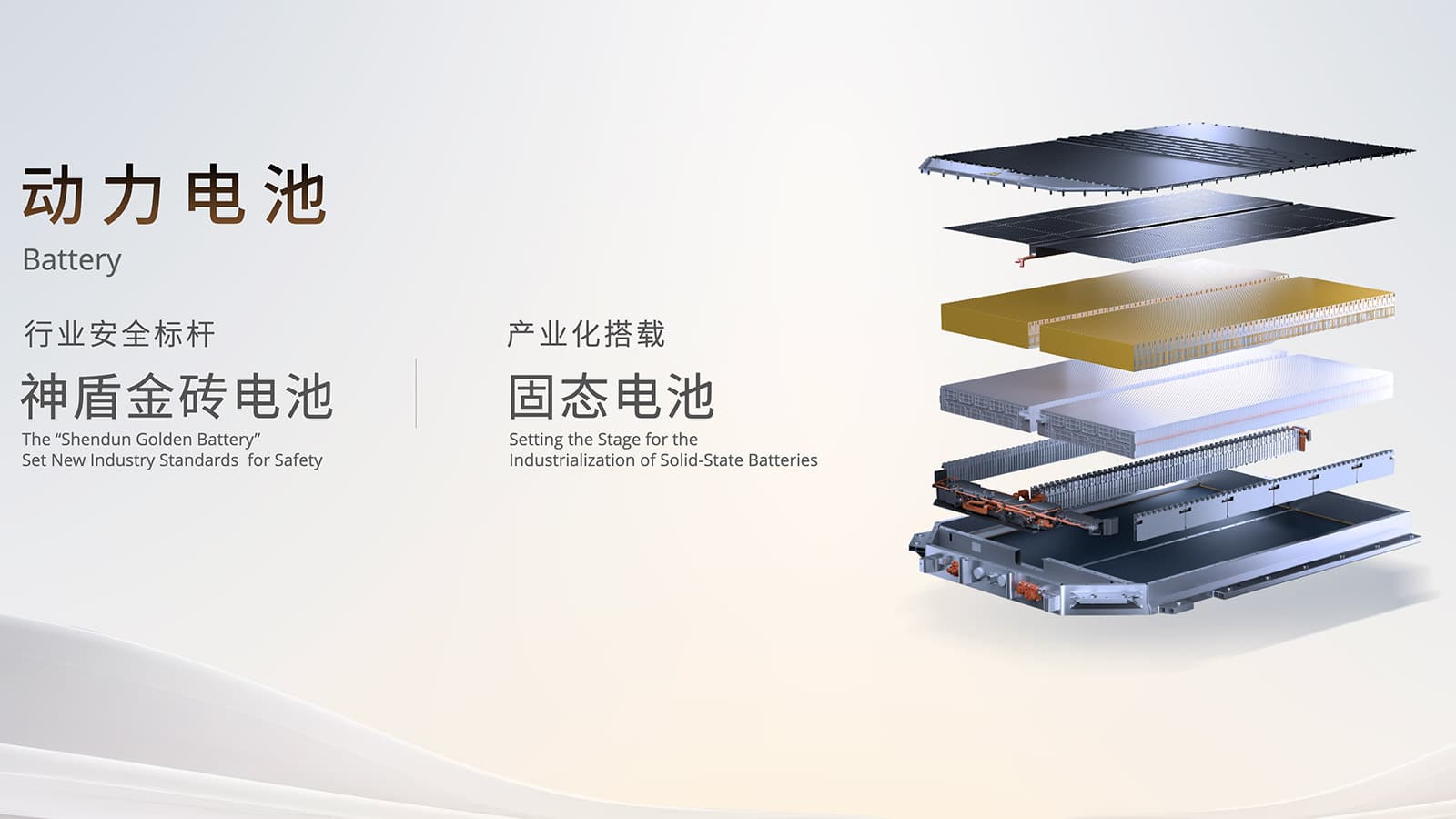

Understanding Solid-State Battery Technology

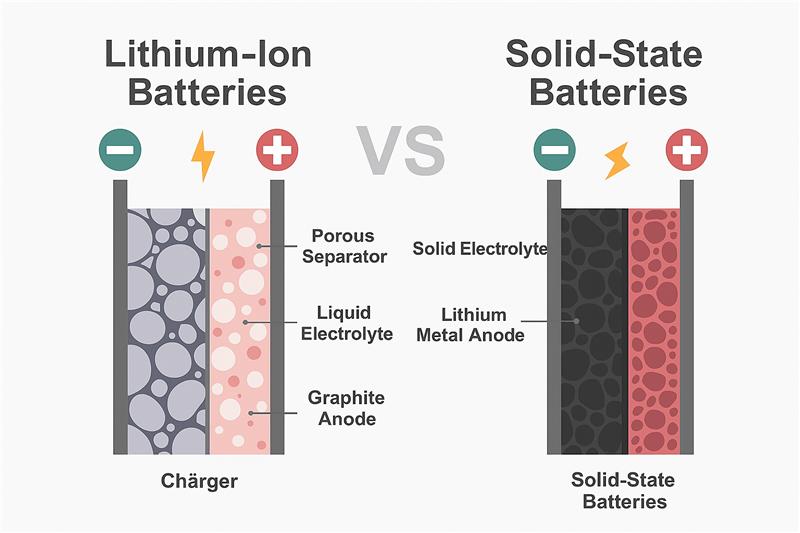

To get why this is such a big deal, you need to understand what's wrong with the lithium-ion batteries currently in every EV on the road today.

Lithium-ion batteries work. They're proven. Tesla proved that. But they have hard limits. The electrolyte inside them is liquid, which sounds fine until you realize that liquids expand, degrade, and create dendrites (tiny crystals that can short-circuit the whole thing). This is why EV batteries gradually lose capacity over time. It's also why they're bulky, why they take forever to charge, and why there's a thermal ceiling to how much energy they can safely hold.

A solid-state battery throws that whole design in the trash. Instead of a liquid electrolyte, you use a solid material—usually a ceramic or polymer. Think of it like replacing water with a block of glass inside the battery.

The advantages are immediate:

- Energy density skyrockets. You can pack more energy into the same physical space. That's why Geely's getting 650 miles. Traditional lithium-ion would need a much larger, heavier pack.

- Charging becomes absurdly fast. Without the liquid limitations, you can push more current through without heat damage. Real 10-minute charges aren't fantasy anymore.

- Battery lifespan extends dramatically. Those solid materials don't degrade like liquids do. You're looking at the battery outlasting the car in many cases.

- Safety improves. No liquid means no flammability risk. No thermal runaway. This is why Toyota and others are betting on this technology.

The catch? Actually manufacturing these things at scale is brutally hard. You need precision down to the nanometer. You need materials that don't crack during assembly. You need production lines that don't exist yet. Every company that tried moved their timelines back. And back again.

Until now.

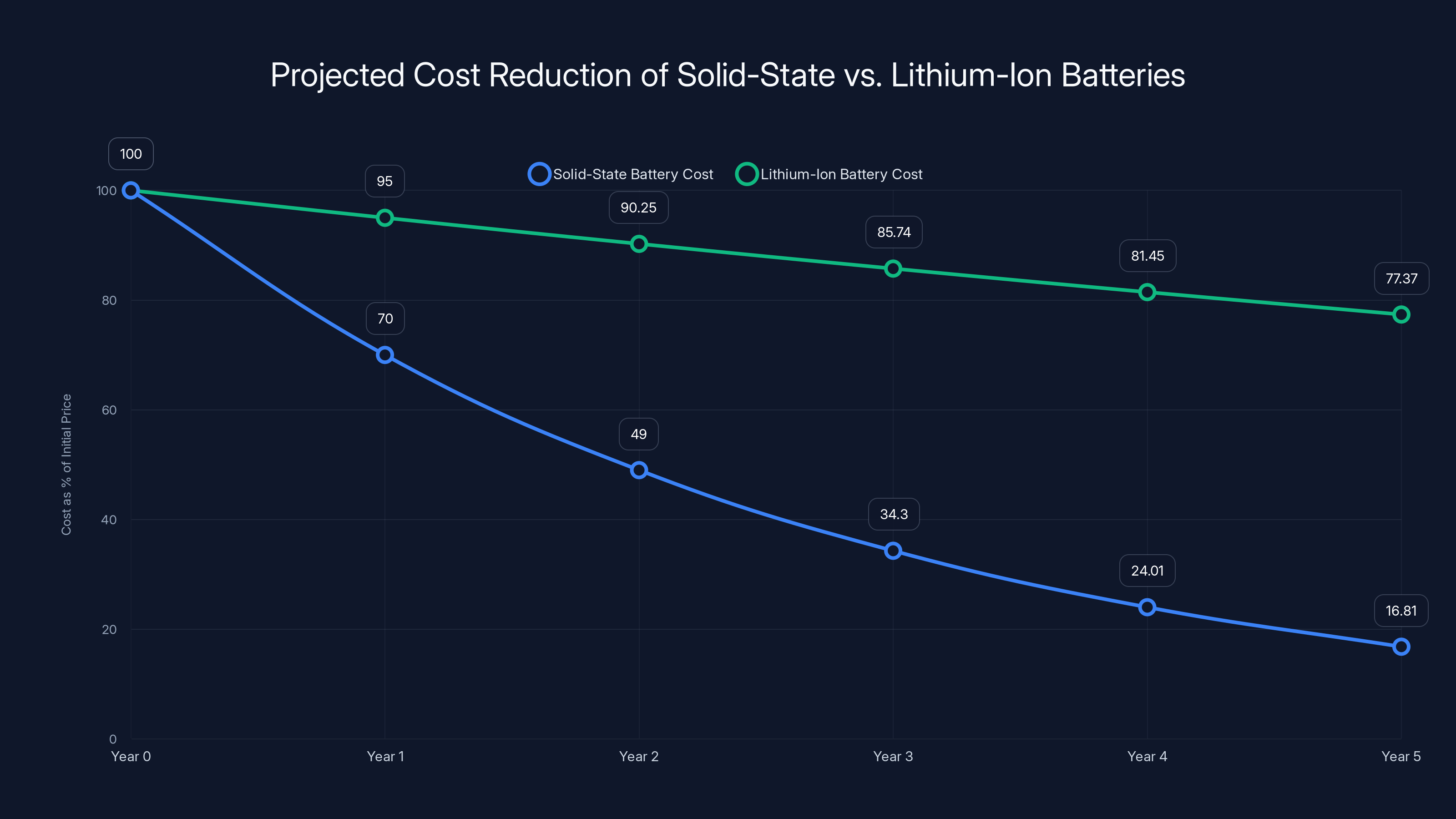

Estimated data shows solid-state battery costs dropping significantly faster than lithium-ion, achieving cost parity in 4 years and becoming cheaper by year 5.

Why Geely's Achievement Matters More Than You Think

Geely isn't Tesla. Most people don't know they exist. But that's exactly what makes this significant.

Tesla's been promising better batteries for years. Elon Musk talks about it constantly. They've hired solid-state experts, invested in research, made bold claims about timelines. And yet, we're still waiting. Tesla's cars still use conventional lithium-ion batteries. The improvements have been incremental, not revolutionary.

Geely, meanwhile, has been working quietly with solid-state specialists. They're not the flashiest company. They're not pumping out PR announcements every month. But they're actually building the thing.

This is significant because it means:

The technology works outside the lab. This isn't theoretical physics anymore. Real people at a real factory figured out how to manufacture a solid-state battery pack at production scale. They solved problems that engineers thought were unsolvable just two years ago.

The supply chain is being established. Once you move from "prototype" to "production," you need reliable suppliers for materials, components, and processes. That supply chain doesn't build itself. The fact that Geely can complete production means they've already solved these problems.

The cost curve is starting. Solid-state batteries are expensive right now. But manufacturing experience drops costs fast. Every unit built teaches engineers how to build cheaper ones. By the time these cars hit the market in 2025-2026, the cost premium will be smaller than people expect.

Competitors are genuinely panicked. When BMW, Mercedes, Ford, and others announced their solid-state timelines, they were gambling that it wouldn't happen for another 5-7 years. Geely just proved that's not true. Now those timelines look like excuses.

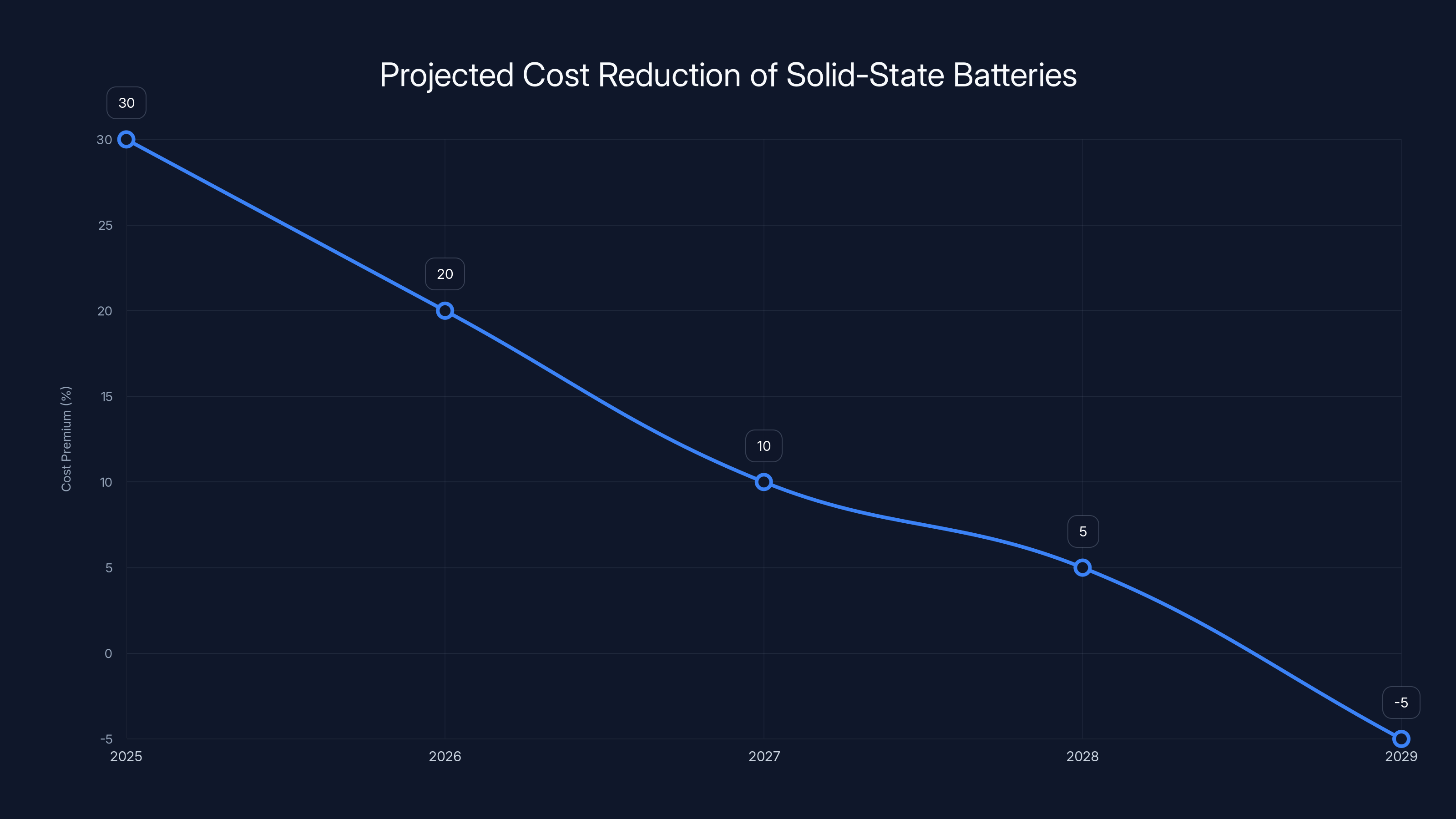

Estimated data shows a significant reduction in the cost premium of solid-state EVs over five years, potentially becoming cheaper than lithium-ion EVs by 2029.

The 650-Mile Range: What It Actually Means

Six hundred and fifty miles sounds absurd. Let's put it in perspective.

A Tesla Model Long Range gets around 350 miles. Most modern EVs range from 200-400 miles. The best-case scenarios you see in reviews are often 450 miles under ideal conditions. Now imagine a battery that reliably delivers 650 miles in normal driving.

Math-wise, that's almost 2x the range of a mid-tier EV. It's more range than most gas cars get per tank. It means:

Road trips become trivial. You can drive from New York to Washington DC without charging. You can cross entire states. You can actually live a normal life without planning your routes around charging stations.

Charging infrastructure becomes optional. Right now, EVs depend on public chargers. With 650 miles, most people might charge at home once a week. The entire "charging anxiety" argument collapses.

The used car market changes. Current EVs lose range as batteries degrade. That's a real concern when buying used. With 650-mile packs that hold capacity for 300,000 miles, used EVs suddenly make sense at any age.

Fleet electrification becomes viable. Logistics companies have been hesitant about EVs because range limits service areas. Geely's battery changes that equation. A delivery truck with 650 miles? That covers a massive territory.

But here's what matters most: the range ceiling gets reset. Right now, there's a psychological limit. People think "EVs max out at 400 miles, so I'll never leave home." Geely proves that's wrong. That perception shift matters more than the actual number. Once one manufacturer has 650 miles, everyone else needs it too. The baseline moves. The whole industry shifts.

How Geely Solved Manufacturing (And Why Tesla Couldn't)

Let's talk about why this is hard. Because it IS hard. If it were easy, someone would've done it already.

Manufacturing a solid-state battery requires solving multiple engineering nightmares simultaneously:

Material compatibility issues. The solid electrolyte, the electrodes, the current collectors, the packaging—they all need to work together without chemical reactions or mechanical failures. Get one interface wrong and the whole battery is dead weight.

Thermal management during assembly. Solid-state batteries are sensitive to temperature. You can't just heat them up or cool them down carelessly. The manufacturing process has to maintain tight temperature ranges throughout. This requires equipment that most factories don't have.

Mechanical stress distribution. Solid materials are brittle. When you assemble the battery, you're essentially stacking ceramics with incredible precision. Any crack or misalignment ruins it. The manufacturing tolerances are tighter than semiconductor production.

Quality control at scale. Testing for defects in solid-state batteries is harder than lithium-ion. You can't just charge and discharge them to see if they work. You need spectroscopy, impedance testing, and other sophisticated analysis. This all has to happen in a real factory, in real time, on every single unit.

Geely's achievement suggests they didn't solve these perfectly. They solved them practically. That's actually more impressive.

There's a difference between "perfect in the lab" and "good enough in the factory." Labs produce one unit at a time with unlimited budget and time. Factories produce thousands per day with real constraints. Geely clearly moved past lab work into factory reality.

Why couldn't Tesla do this first? Several reasons:

Tesla's existing investments. They've poured billions into lithium-ion optimization. Their factories are optimized for that chemistry. Shifting to solid-state means abandoning those investments and starting over. That's a decision Elon Musk never committed to.

Production obsession. Tesla's focused on making cars. Batteries are secondary. Geely, as an automaker first, made batteries the primary project. Different priorities lead to different timelines.

Capital and patience. Geely's backed by Chinese investors who take a 10-year view. Tesla's pressured to show quarterly profits. That financial reality shapes which R&D projects get resources.

Partnership approach. Geely partnered with battery specialists. Tesla wanted to do it in-house. In-house sounds better until you realize you don't have all the expertise.

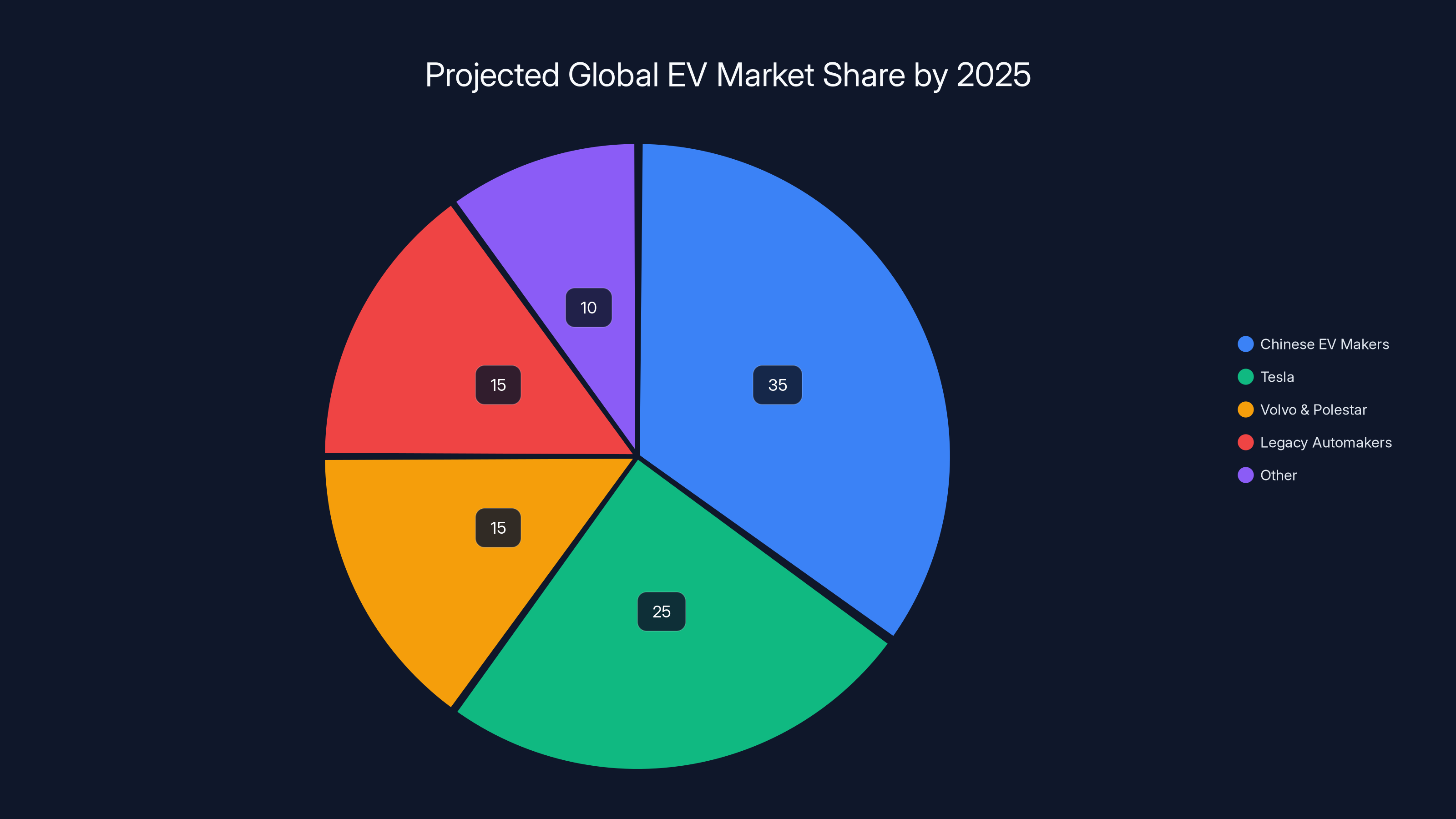

Chinese EV makers are projected to lead the global market by 2025, driven by strategic R&D and manufacturing focus. Estimated data based on current trends.

The Timeline: When You'll Actually Buy One

Geely completing production this year doesn't mean solid-state EVs appear at your local dealership tomorrow.

There's still a process:

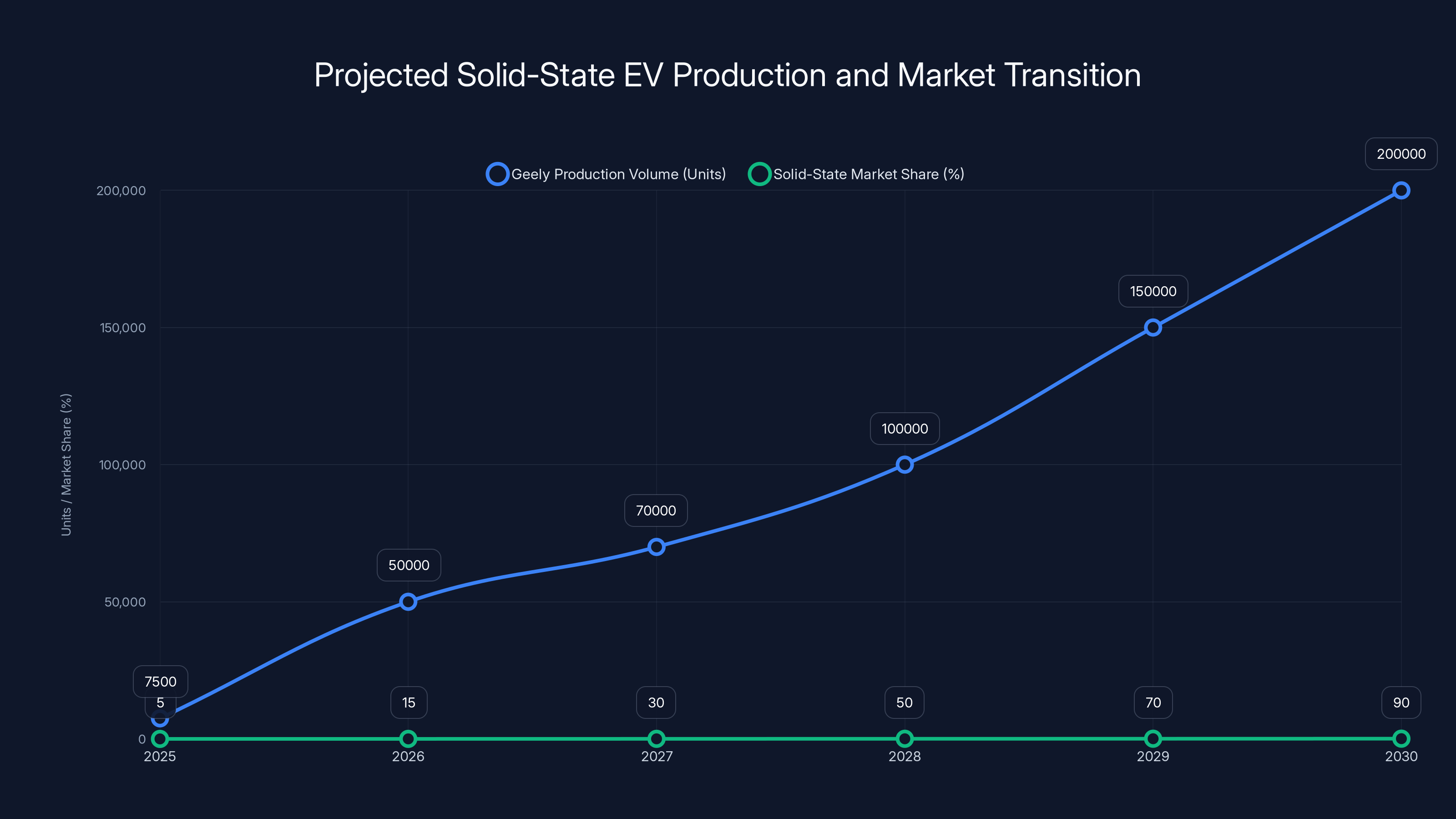

Phase 1: Limited production (2025). Geely builds a few thousand units, probably in existing Volvo or Polestar models. These are sold in select markets, probably China first, then Europe. Prices are high because manufacturing costs are still high.

Phase 2: Ramping volume (2026-2027). Production increases. Prices drop. You see solid-state options in multiple Geely brands and models. Competitors finally launch their own versions.

Phase 3: Mainstream adoption (2028+). Solid-state becomes standard, not premium. Prices normalize. Every manufacturer has versions. The transition is essentially complete.

Why does it take so long? Because manufacturing expertise compounds slowly. You can't jump from 5,000 units per year to 500,000 overnight. Each increase requires new factory lines, new training, new supply chains. It's a multi-year process.

But here's what's different from previous battery breakthroughs: the proof already exists. Geely's not promising this will work someday. They've already made it work. The timeline now is about scaling, not about achieving feasibility. That changes everything.

For consumers, this means: if you're buying an EV in 2025, you might wait for solid-state options. If you're buying in 2026-2027, you'll have real choices. By 2028, solid-state is the obvious pick.

How This Affects Every Major Automaker

Geely's announcement doesn't just matter for Geely. It matters for everyone.

BMW promised solid-state by 2026. Now they're behind schedule. They need to accelerate or admit they were overpromising.

Toyota showed solid-state prototypes with claims of 700-mile range. But they haven't announced production. Are they being cautious, or are they further behind than Geely?

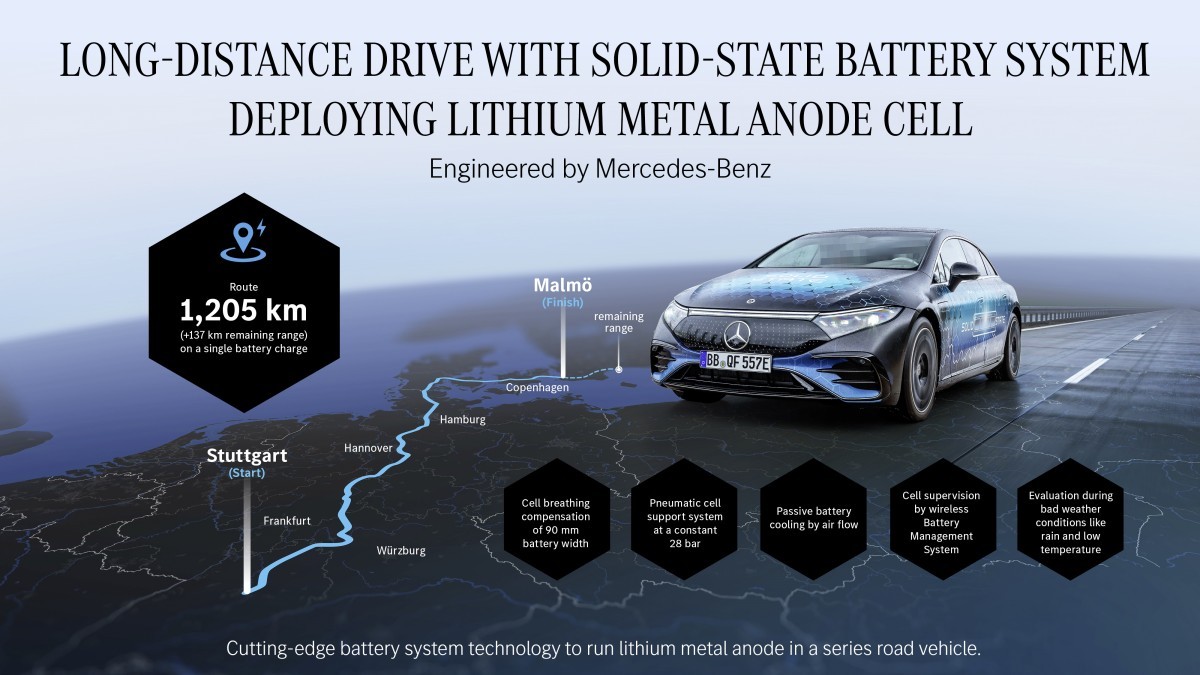

Mercedes and Audi have roadmaps that now look questionable. If a Chinese automaker beat them to production, what does that say about their R&D?

Ford and General Motors are even further behind. Their solid-state timelines are vague, probably because they know they're not ready.

What we're seeing is a competence reveal. Companies that claimed to be leading the EV revolution suddenly look slower than a Chinese automaker working quietly. That changes investor confidence, market positioning, and hiring. Engineers at Tesla are probably updating their LinkedIn profiles right now.

The market response will be significant. Geely and Volvo will attract premium pricing power they've never had. Investors will pour money into Geely's battery division. Competitors will either accelerate timelines (probably impossible) or announce partnerships with solid-state specialists (the smart move).

Within 18 months, expect at least two major partnerships: a German automaker with a battery company, and a Japanese manufacturer with a Korean specialist. That's how industries respond to being outpaced.

Geely's innovation significantly accelerates EV range improvements, setting a new baseline of 650 miles by 2027. Estimated data.

The Cost Advantage: Why Solid-State Wins on Price

Everyone assumes solid-state batteries are expensive. They're right. For now.

But here's the economic math: solid-state batteries use less material to achieve better performance.

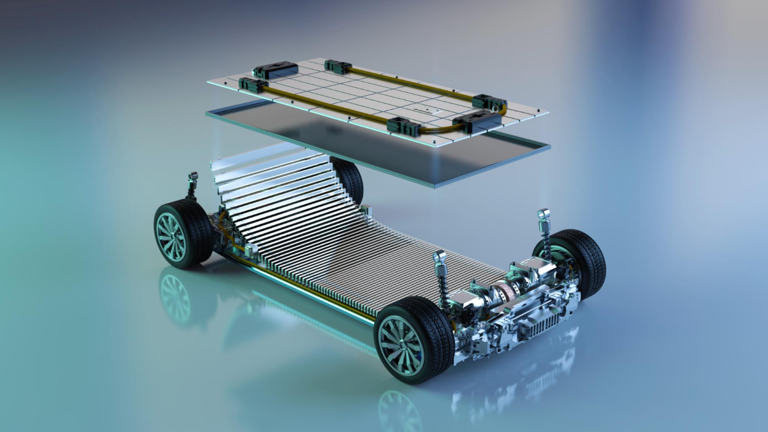

A 650-mile solid-state pack might weigh 200 kg. A 650-mile lithium-ion pack would weigh 400 kg or more. That's 100 kg less weight that the car has to carry around. That requires less energy to move. That means smaller motors, smaller cooling systems, lighter structural requirements.

The cost comparison:

- Lithium-ion 650-mile pack: Doesn't exist practically, but cost would be astronomical due to weight and heat issues

- Solid-state 650-mile pack: Premium today, but includes material savings elsewhere

Once manufacturing experience kicks in, the solid-state cost drops 30-40% per year for the first 3-4 years. That's industry standard. Meanwhile, lithium-ion costs drop 5-8% annually. The curves cross faster than people expect.

Geely's moving down the cost curve right now. In two years, their solid-state packs might cost only 20% more than lithium-ion for the same range capacity. In four years, they might cost the same. In five years, they're cheaper because they last longer and need less supporting infrastructure.

This is why Geely's timeline matters for consumers. They're not just building a better battery. They're starting the cost-reduction machine that makes EVs genuinely cheaper to own than gas cars. That's the real revolution.

Environmental Impact: The Neglected Story

Everyone focuses on range and charging. Nobody talks about the environmental benefits of solid-state batteries. That's a mistake.

Lithium mining is destructive. Cobalt mining is exploitative. Nickel refining consumes enormous energy. Every EV battery requires raw materials that damage ecosystems and communities.

Solid-state batteries reduce the material requirement. Less lithium, less cobalt, less nickel. That means fewer mines, smaller environmental footprint, fewer ethical complications.

The manufacturing process is cleaner too. Solid-state batteries run cooler during charging and discharging. That means less cooling infrastructure, less energy waste, less heat pollution from charging stations.

Over a vehicle's lifetime, a solid-state battery in a 650-mile vehicle generates less cumulative emissions than two lithium-ion batteries in conventional EVs. You're not just driving electric—you're driving electric with a smaller supply chain.

This should be Geely's marketing angle. It's not. But it should be. Because the environmental story is actually stronger than the range story. We don't just need longer-range EVs. We need ethically-sourced, environmentally-responsible EVs. Solid-state achieves both.

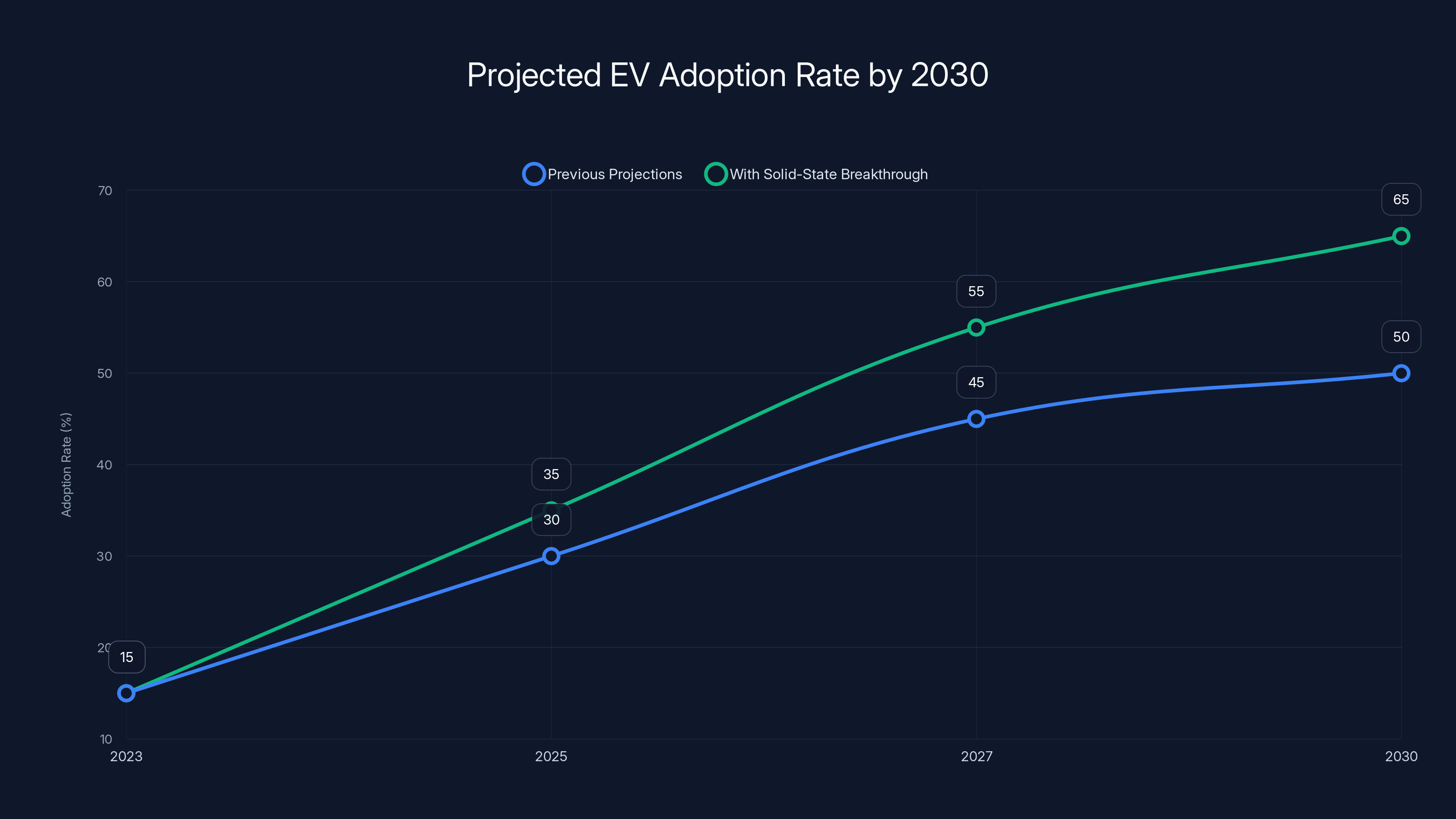

Solid-state battery technology could accelerate EV adoption to 65% by 2030, 15 percentage points faster than previous projections. Estimated data.

The Supply Chain Revolution

Solid-state batteries require different materials than lithium-ion. That reshapes global supply chains.

Lithium comes from Argentina, Chile, Australia. Cobalt comes from Congo. Nickel comes from Indonesia. These supply chains are mature, consolidated, and increasingly expensive.

Solid-state electrolytes require specialty ceramics and polymers. Those come from a different set of suppliers. China and Japan dominate this space. That's part of why Geely succeeded—they're positioned in the right geography with access to the right specialists.

What emerges is a geopolitical reset. Battery supply chains shift. Dependencies change. Europe and the US lose some leverage. China consolidates more. Korea becomes more critical.

For consumers, this matters because it affects pricing, availability, and geopolitical stability. A battery revolution that moves supply chains to China isn't a pure win for everyone. It's a trade-off.

But practically speaking, it's an unavoidable one. The technology is moving in this direction. Supply chains will follow. Understanding this is important for appreciating why Geely, not a Western company, led the breakthrough.

How Geely's Innovation Changes Consumer Expectations

For decades, EV ranges increased incrementally. 150 miles became 200. Then 250. Then 350. Each generation brought modest improvements. Charging speeds improved slowly. Battery longevity improved marginally.

Geely just skipped forward 200 miles in one jump. That's not incremental. That's disruptive.

Consumer expectations shift immediately. Nobody gets excited about a 400-mile EV anymore when a 650-mile option exists. That becomes the new baseline for "serious" range.

This creates pressure throughout the industry. A car company that launches with 400-mile range now looks behind the curve, even if it's state-of-the-art lithium-ion. Customers ask: "Why is this not solid-state?" Salespeople stammer about timelines. The deal dies.

Within 18 months, you'll see manufacturers marketing against their own lithium-ion battery as if it's a downgrade. "Why settle for 400 miles?" That messaging starts immediately, probably from BMW or Audi as they rush to announce solid-state timelines.

The practical effect: the EV market polarizes. Premium vehicles get solid-state quickly. Budget vehicles stick with lithium-ion longer. That creates a strange market where a

For consumers, this is good and bad. Good because innovation accelerates. Bad because it might push prices up faster than expected. The 2025-2027 period could see EV prices increase as manufacturers transition to higher-cost solid-state technology, even as long-term costs decline. Time the market right, and you save money. Time it wrong, and you pay premium prices.

Geely's production of solid-state EVs is expected to grow significantly from 2025 to 2030, with market share reaching 90% by 2030. Estimated data based on industry trends.

Challenges Ahead: This Isn't Over

Geely's achievement is real, but the journey from production to ubiquity is still long.

Battery degradation is still theoretical. Geely's pack probably has excellent lab results showing 300,000+ mile lifespan. Real-world data will come slowly. If degradation appears after 200,000 miles, that changes the narrative. Geely's betting they won't see this. Probably they won't. But it's not certain.

Repairs might be impossible. Lithium-ion batteries can be disassembled and repaired. Solid-state packs might need complete replacement. That could make insurance more expensive. Repair shops might refuse to work on them. The user experience gets more complicated.

Thermal management is still unsolved. Solid-state batteries run cooler than lithium-ion. That's good. But fast charging generates heat. Extreme temperatures affect performance. What happens in Arizona summers? That real-world stress testing hasn't happened yet.

Competing solid-state approaches exist. Geely's using one approach. Toyota's researching another. Quantum Scape (partnered with Volkswagen) is using a different path. One technology winning doesn't mean Geely's approach becomes the standard. There might be a decade of competing standards, which slows adoption.

Manufacturing scale could stall. Moving from 5,000 units to 50,000 is hard. Moving from 50,000 to 500,000 is much harder. Something could break. Supply chains could fail. Geely's proven concept. They haven't proven they can manufacture competitively at massive scale.

These aren't reasons to dismiss Geely's achievement. They're reasons to stay realistic about timelines and expectations. This is progress, not the finish line.

The Competitive Response: Who's Next

Geely just forced everyone's hand. Let's predict the cascade:

BMW announces partnership with a Korean solid-state specialist (probably Samsung). Timeline: early 2026. They need to show progress immediately.

Volkswagen accelerates the Quantum Scape timeline. They've been cautious. Now they're panicked. Expect a working prototype by late 2025.

Toyota quietly reveals they were further along than anyone thought. They announce 2026 production for a limited solid-state model. This stuns the market because nobody expected Toyota to move this fast.

Ford and GM admit they're not ready and partner with established battery companies or Chinese manufacturers. This is a humbling moment for American EV leadership.

Hyundai-Kia, already strong in batteries, announces their own solid-state roadmap with credible timelines. They probably can deliver on a 2027-2028 timeline genuinely.

Luxury brands (Ferrari, Lamborghini, Porsche) announce premium solid-state models with 500+ mile range and 15-minute charging. These cost $200K+. They're halo products meant to prove capability, not volume plays.

The net effect: solid-state becomes mainstream faster than expected, but fragmented across different approaches and quality levels. By 2028, every major manufacturer has solid-state options. By 2030, it's standard.

The Investment Implications

If you're looking at EV stocks, this matters.

Geely's parent companies gain credibility. Linker Group's Geely division is now proven as a technology leader, not just a manufacturer. That's a narrative shift worth billions in valuation.

Volvo and Polestar become premium plays. Solid-state batteries let them justify higher pricing. A solid-state Volvo S90 competes with Tesla Model S on range and price, but with Volvo's luxury positioning. That's valuable.

Tesla's valuation might compress slightly. The narrative of Tesla as the EV technology leader becomes harder to sustain. They're still a great company, but they're not ahead of the curve anymore. They're defending past positioning.

Chinese EV makers become even stronger. Geely's success validates the Chinese approach to EVs: patient capital, long R&D timelines, manufacturing focus. Expect Chinese market share to increase globally.

Legacy automakers face a credibility test. If BMW, Mercedes, and others miss their solid-state timelines, investors lose faith in their EV strategies. That affects stock prices materially.

Battery specialists (non-integrated) like Samsung, Panasonic, and LG Energy Solution need to accelerate their own solid-state programs or face obsolescence. This is their last competitive window.

For individual investors: this announcement changes nothing about your portfolio tomorrow. But over the next 24 months, it reshapes EV sector dynamics significantly. Track announcements from major manufacturers about solid-state partnerships and timelines. When the first Western automaker hits production, that's the real inflection point.

The Real Winner: EV Adoption Itself

Zoom out and ignore the corporate drama for a moment.

Geely's solid-state breakthrough is genuinely good for EV adoption. Here's why:

Range anxiety evaporates. 650 miles is enough that most people stop worrying about charging. That removes the biggest psychological barrier to EV adoption. Studies show range is the #1 concern for non-EV owners. Solve range, and adoption accelerates rapidly.

Charging infrastructure becomes less critical. Today's charging networks are being built in panic because current EVs need them. With 650-mile packs, people charge at home 95% of the time. Public chargers are occasional, not essential. That reduces infrastructure investment needs and speeds adoption.

Used EVs become actually viable. A solid-state battery lasting 300,000 miles means a used EV at 100,000 miles still has 200,000 miles of life. That makes the used EV market realistic for normal people. Right now, used EVs are still risky. Solid-state changes that.

The TCO math flips. Total cost of ownership for an EV versus gas becomes obviously favorable. Shorter battery payback period, longer useful life, lower per-mile energy cost. The financial incentive becomes real without subsidies. That's when adoption explodes.

Fleet adoption becomes standard. Delivery companies, taxi services, rental fleets can operate on solid-state EVs without operational compromise. That's when transportation becomes fundamentally electric, not just enthusiast vehicles.

Geely's announcement means that by 2030, EV adoption probably reaches 60-70% of new vehicles in developed markets. That's 15-20 percentage points faster than previous projections. That's massive.

For society, that means less oil consumption, less carbon emissions, less air pollution. The energy transition actually accelerates. That's the real victory, beyond any corporate narrative.

Looking Forward: What's Next

Geely's completing production this year. That's 2025. Here's what to watch:

Q1-Q2 2025: First solid-state vehicles roll off the line. They'll probably be Volvo S90 or Polestar 2-based models. Production volume is low, probably 5,000-10,000 units. Prices are premium, maybe

Q3-Q4 2025: Competitors respond aggressively. BMW, Audi, and others announce real partnerships and timelines. The vague "someday" messaging becomes concrete "2026-2027" roadmaps.

2026: Production ramps; competition emerges. Geely increases output to 50,000+ units. First competitors' solid-state prototypes hit the road. Prices for Geely's models drop 10-15% due to manufacturing experience.

2027-2028: Inflection point. Multiple manufacturers have solid-state vehicles. Prices approach lithium-ion parity. The market shifts decisively. By late 2028, solid-state is expected, not surprising.

2029-2030: Solid-state becomes standard. Most new premium and mid-range EVs use solid-state. Legacy lithium-ion is budget tier. The technology transition completes.

For the average person deciding what car to buy: 2025-2026 is the transition window. If you need an EV now, a good lithium-ion vehicle works fine. If you can wait 18-24 months, solid-state options give you better value. If you're buying in 2027 or later, solid-state is the obvious choice.

Geely didn't just announce a new battery. They announced the shape of the next decade of transportation.

FAQ

What exactly is a solid-state battery?

A solid-state battery replaces the liquid electrolyte found in traditional lithium-ion batteries with a solid material, typically ceramic or polymer. This solid electrolyte enables higher energy density, faster charging, improved safety, and longer lifespan compared to conventional liquid-based batteries. The technology has been researched for decades but remained difficult to manufacture at scale until recently.

How does Geely's solid-state battery achieve 650 miles of range?

Geely's solid-state battery achieves 650 miles through a combination of higher energy density and better efficiency. The solid electrolyte allows for more energy storage in the same physical space compared to liquid-based batteries. Additionally, because solid-state batteries operate at cooler temperatures and with less mechanical stress, they waste less energy as heat, allowing more of the stored energy to be converted into vehicle movement.

When will solid-state EVs actually be available for purchase?

Geely plans to complete production of solid-state battery packs in 2025, with the first vehicles likely arriving in late 2025 or early 2026. However, initial production will be limited to high-end Volvo and Polestar models with premium pricing, likely

How much more expensive will solid-state vehicles be compared to current EVs?

Initially, solid-state vehicles will carry a premium of 20-40% above equivalent lithium-ion models. However, this cost advantage narrows rapidly as manufacturing experience increases. Industry standards suggest battery manufacturing costs drop 30-40% annually in early production phases. Within 3-4 years, the cost premium should shrink to 5-10%, and within 5 years, solid-state may actually cost less due to material savings elsewhere in the vehicle.

Why is Geely's announcement significant when Tesla and other major companies haven't delivered solid-state batteries yet?

Geely's announcement is significant because they've moved beyond research and prototypes into actual production manufacturing. This proves the technology can be manufactured reliably at real factory scale, not just in laboratories. Most competitors have been promising solid-state vehicles but missing timelines repeatedly. Geely's concrete production timeline forces the entire industry to acknowledge the technology is real and accelerate their own programs accordingly.

How does a 650-mile range change the EV ownership experience?

A 650-mile range eliminates the most significant barrier to EV adoption: range anxiety. With current EVs at 300-400 miles, owners must plan around charging infrastructure. With 650 miles, most people charge only at home, probably once weekly. This makes EVs functionally equivalent to gas cars for daily driving and roadtrips, while retaining all the economic and environmental advantages of electric power.

Will solid-state technology make current EV models obsolete?

Solid-state won't immediately make current EVs obsolete, but it will reshape market perception. In 2025-2026, expecting premium pricing advantages for solid-state vehicles. By 2027-2028, as competition increases and manufacturing scales, lithium-ion vehicles will be positioned as budget alternatives. Used EV values might drop faster as solid-state options become available. However, existing EVs remain functional and valuable for their entire lifespan; the transition is market-driven, not technical.

What does this mean for battery recycling and environmental impact?

Solid-state batteries require less raw material per unit of energy capacity, reducing mining impacts for lithium, cobalt, and nickel. The manufacturing process generates less heat and requires less cooling infrastructure, reducing manufacturing energy consumption. Longer battery lifespan means fewer replacements over a vehicle's lifetime. These factors combine to significantly reduce the total environmental footprint of EV battery production and use compared to current lithium-ion technology.

How will traditional automakers respond to Geely's achievement?

Traditional automakers will likely accelerate their solid-state timelines and announce strategic partnerships with battery specialists. BMW, Mercedes, and Audi will probably announce concrete solid-state roadmaps within 12 months. Companies that miss these windows face credibility damage and market share loss. This creates competitive pressure that accelerates the entire industry's transition to solid-state technology.

What could go wrong with Geely's solid-state battery program?

Potential challenges include manufacturing scale-up difficulties, thermal management issues in real-world conditions, unexpected battery degradation patterns, competing solid-state technology standards fragmenting the market, and supply chain disruptions for specialized materials. Additionally, real-world data from 200,000+ miles of driving might reveal issues not apparent in laboratory testing. However, Geely's achievement of production readiness suggests they've solved most critical technical problems.

Conclusion

Geely's announcement that they're completing production of solid-state battery packs in 2025 isn't just an incremental upgrade. It's a fundamental reset of the EV industry.

For years, solid-state batteries lived in the "coming soon" category alongside flying cars and fusion energy. Everyone believed in them. Nobody could make them work at scale. The narrative was always: five more years, maybe a decade.

Geely proved that narrative wrong. They moved the technology from "theoretical breakthrough" to "production ready" in a timeframe that shocked the entire industry. That's a massive achievement, and it deserves recognition beyond the tech press.

What happens next matters for everyone:

If you're shopping for an EV right now, you're in a window of decision. A solid lithium-ion vehicle handles 95% of driving needs. But if you can wait 18-24 months, the solid-state option gives you better range, faster charging, and better long-term value. That's not a trivial difference.

If you're following the auto industry, this is the inflection point. For the next 24 months, watch how competitors respond. When BMW, Mercedes, and Toyota hit production milestones, that's when you know the transition is real. When prices start dropping below the premium zone, that's when adoption accelerates.

If you care about climate and energy, Geely's achievement accelerates the timeline for transportation electrification by 5-10 years. That's significant for carbon reduction and energy independence.

The solid-state battery isn't coming sometime in the future. It's here now. Geely proved it. The next decade of EVs just started.

Key Takeaways

- Geely's solid-state battery achieves 650-mile range in production vehicles arriving 2025-2026, proving the technology works at manufacturing scale unlike Tesla's delayed promises

- Solid-state batteries use 50% less material than lithium-ion while delivering 2x the range, eliminating range anxiety and making EV ownership as practical as gas vehicles

- Manufacturing costs drop 30-40% annually in early production phases, meaning initial $70K-90K premium vehicles reach price parity with lithium-ion by 2028-2030

- Geely's breakthrough forces industry-wide acceleration: BMW, Mercedes, Toyota, and others must demonstrate solid-state progress or lose credibility and market share to Chinese competitors

- Supply chains shift from lithium-cobalt dependency to specialty ceramics sourced primarily from China and Korea, reshaping geopolitical leverage in battery manufacturing

Related Articles

- Volvo EX60 Software Revolution: How Volvo Solved EV Infotainment [2025]

- Volvo EX60: The Electric Crossover Game-Changer [2025]

- How BYD Beat Tesla: The EV Revolution [2025]

- Next-Gen Battery Tech Beyond Silicon-Carbon [2025]

- Nissan Qi2 Magnetic Wireless Chargers: The Future of Car Tech [2025]

- Elon Musk's Tesla Roadster Safety Warning: Why Rocket Boosters Don't Mix With Cars [2025]