How BYD Beat Tesla: The Chinese EV Revolution Reshaping Global Markets [2025]

There's a moment every industry has. That moment when the market leader realizes it's not the leader anymore. For Tesla, that moment came quietly in 2024 when BYD, a company that barely registers in American consciousness, sold more electric vehicles than Elon Musk's empire.

Not close. Dominantly.

Let me set the scene. You're scrolling through Tik Tok or Instagram, and suddenly there's a sleek sedan or a quirky hatchback with a name like "Dolphin Surf" or "Qin." It's Chinese. It's gorgeous. It costs a third of what you'd pay for a comparable Tesla. The comments explode: "Why can't we get this in America?" Welcome to the BYD phenomenon.

This isn't a story about a single company winning. It's a story about how China's manufacturing prowess, battery innovation, and aggressive pricing have fundamentally disrupted an industry that many thought Tesla had permanently conquered. It's about how the rules of competition changed while the West wasn't looking.

Here's the thing: understanding BYD's rise isn't just about cars. It's about supply chains, battery technology, government policy, and the future of transportation. It's about how American consumers might soon be driving Chinese EVs without even realizing it. It's about what happens when innovation meets infrastructure meets industrial strategy.

And yes, there's a Dolphin Surf involved.

TL; DR

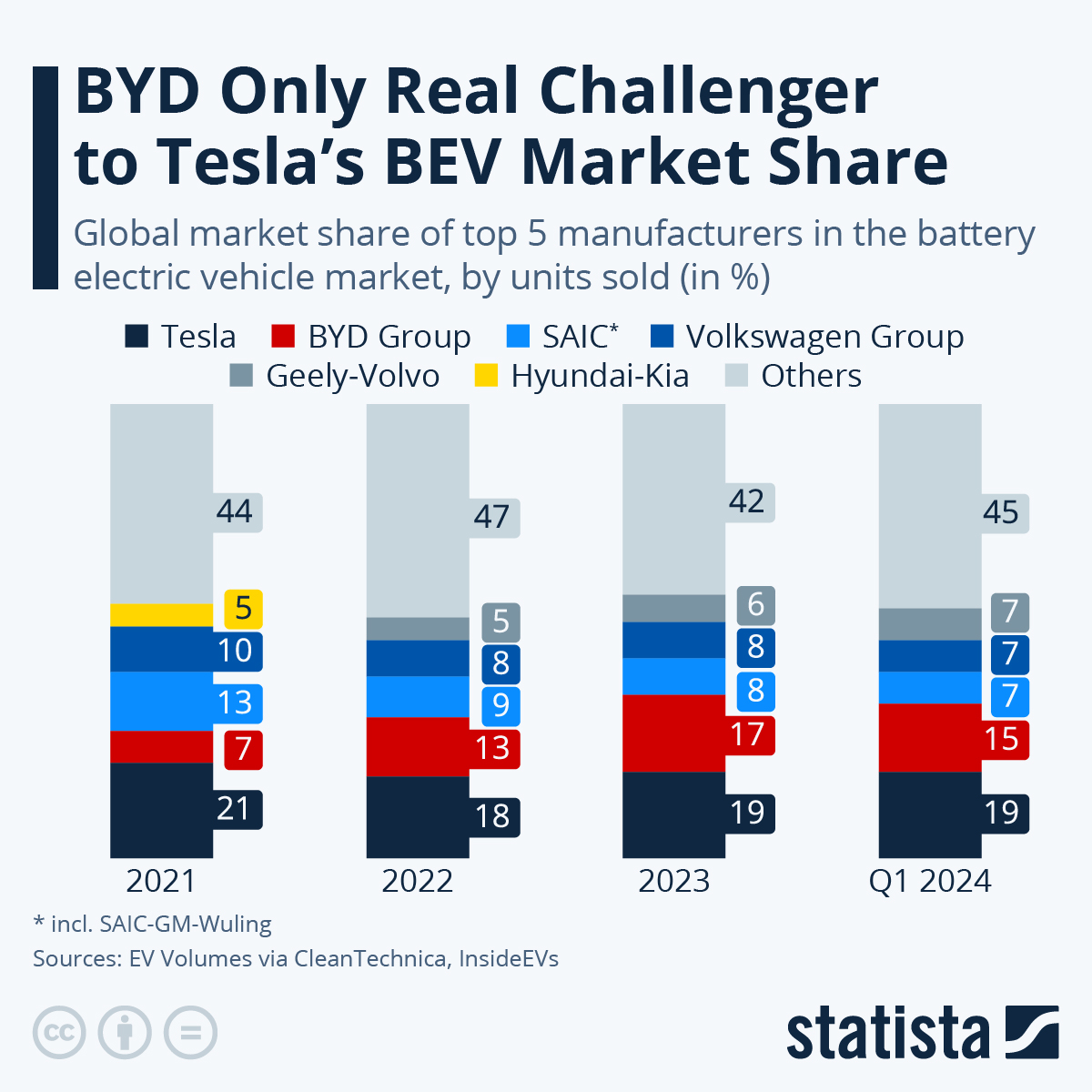

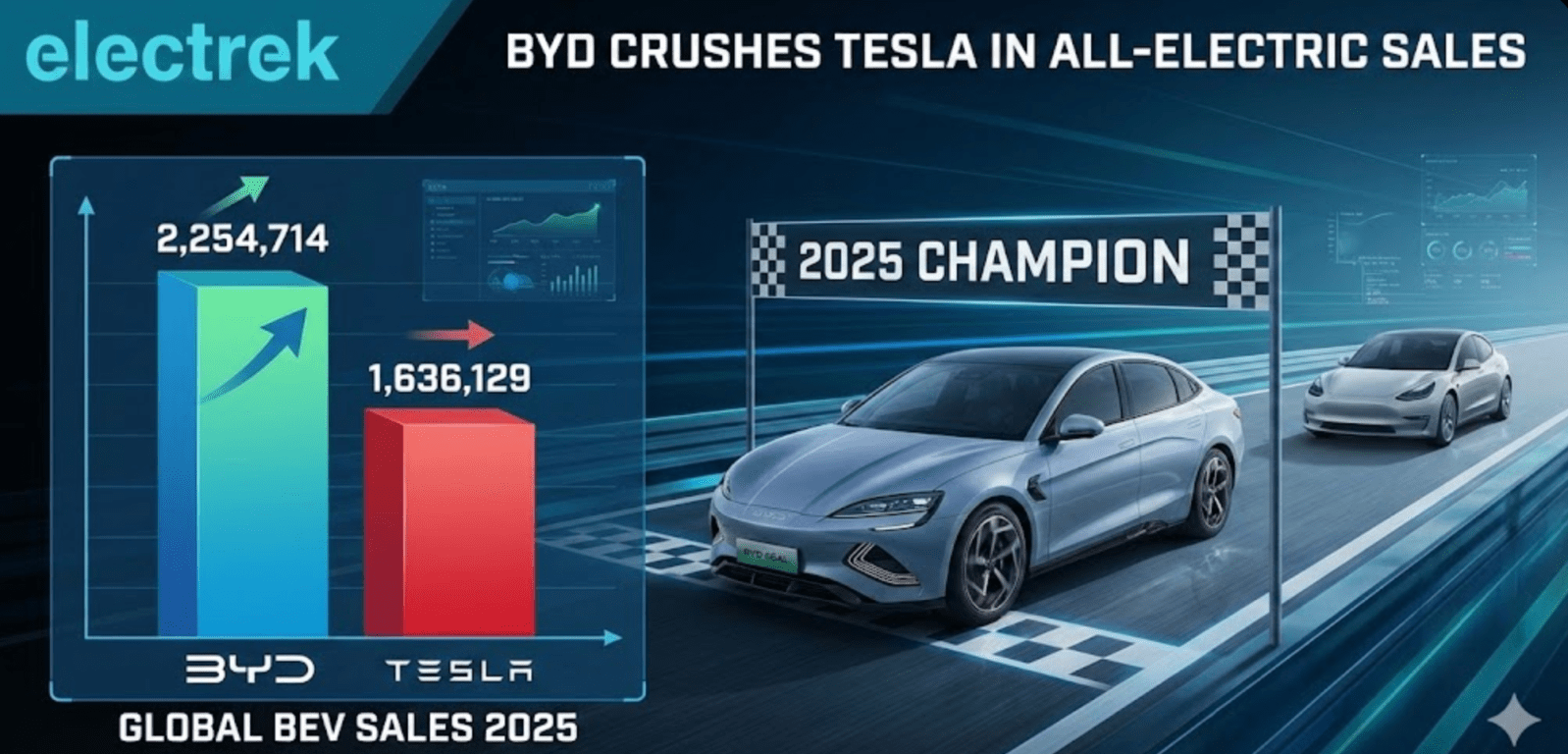

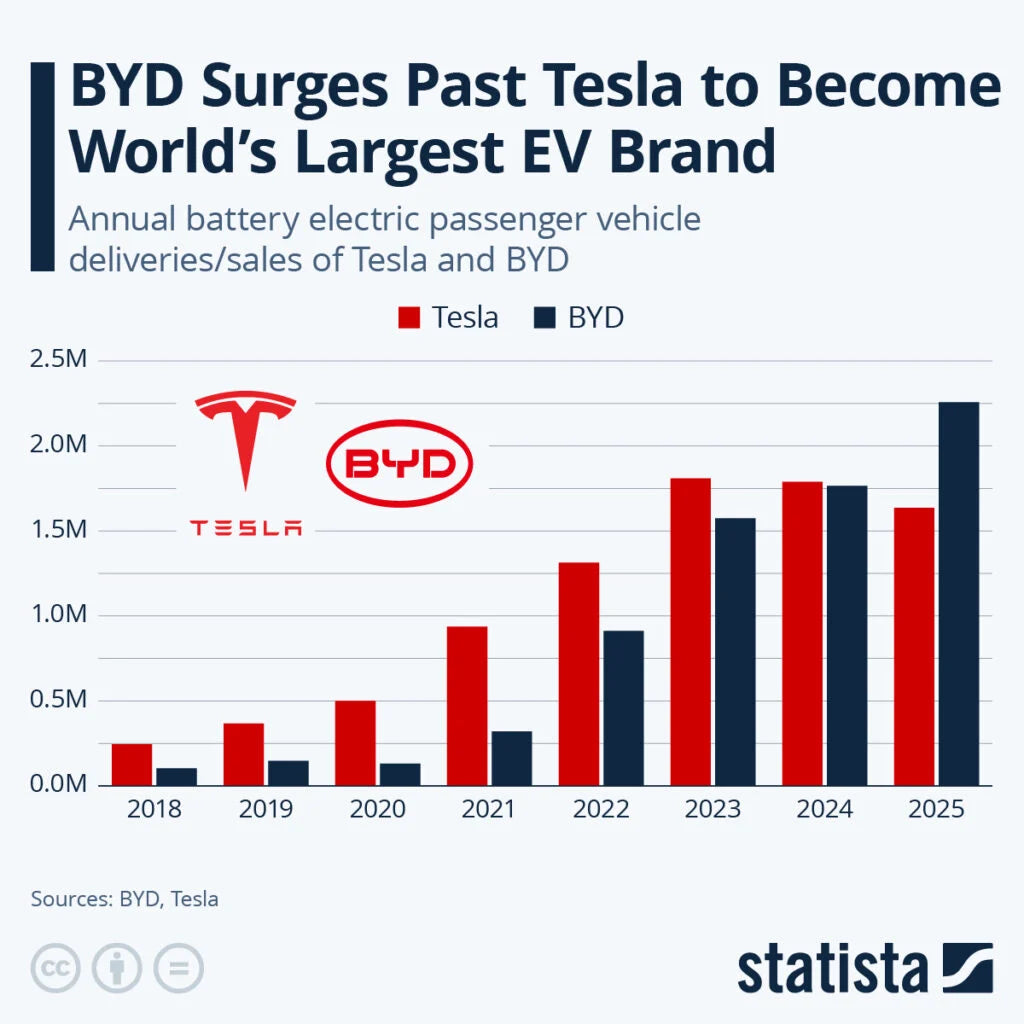

- BYD overtook Tesla in 2024, selling more electric vehicles globally despite lower brand recognition in Western markets

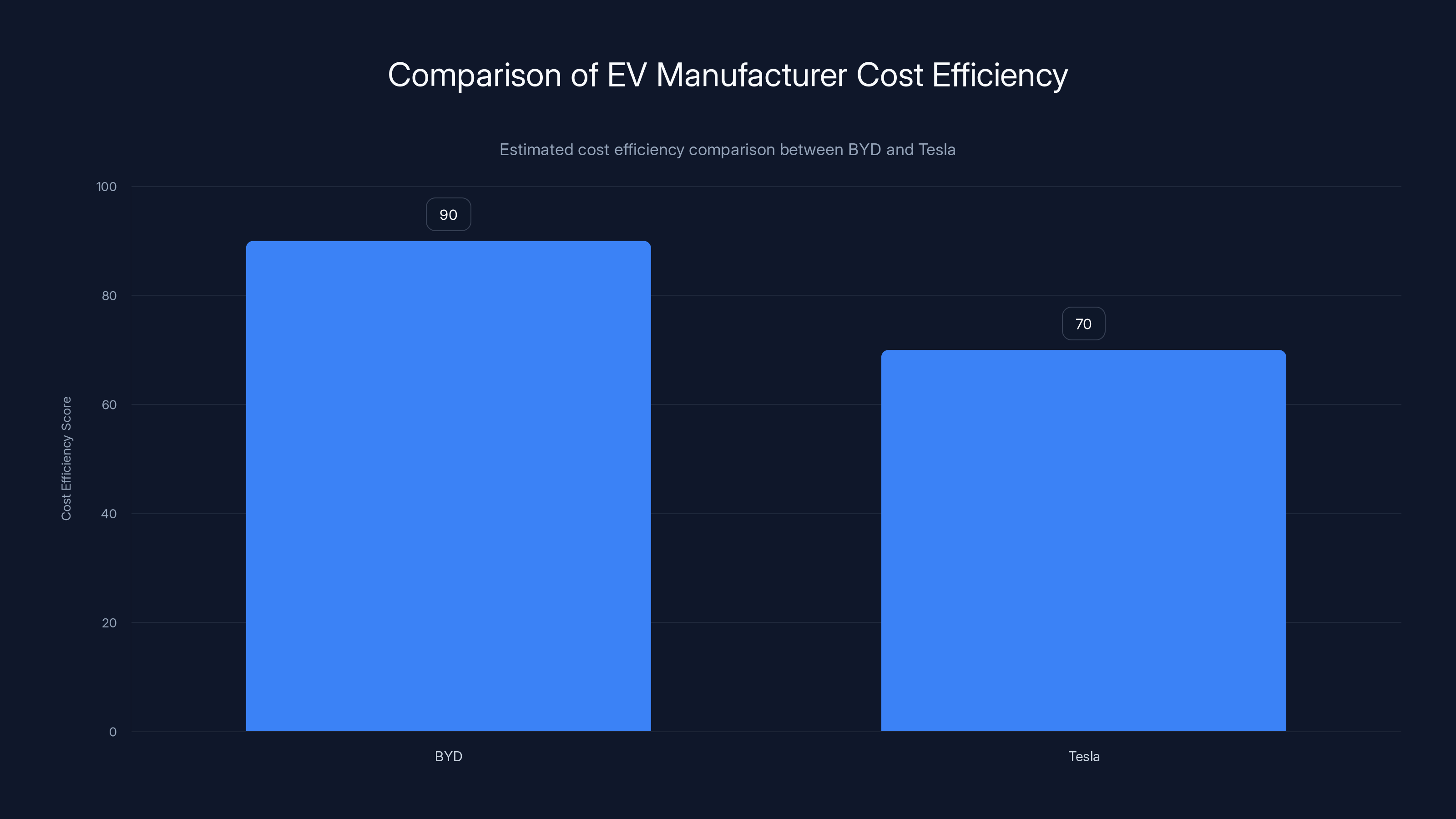

- Vertical integration dominates: BYD manufactures its own batteries, giving it 30-40% cost advantages over competitors reliant on external suppliers

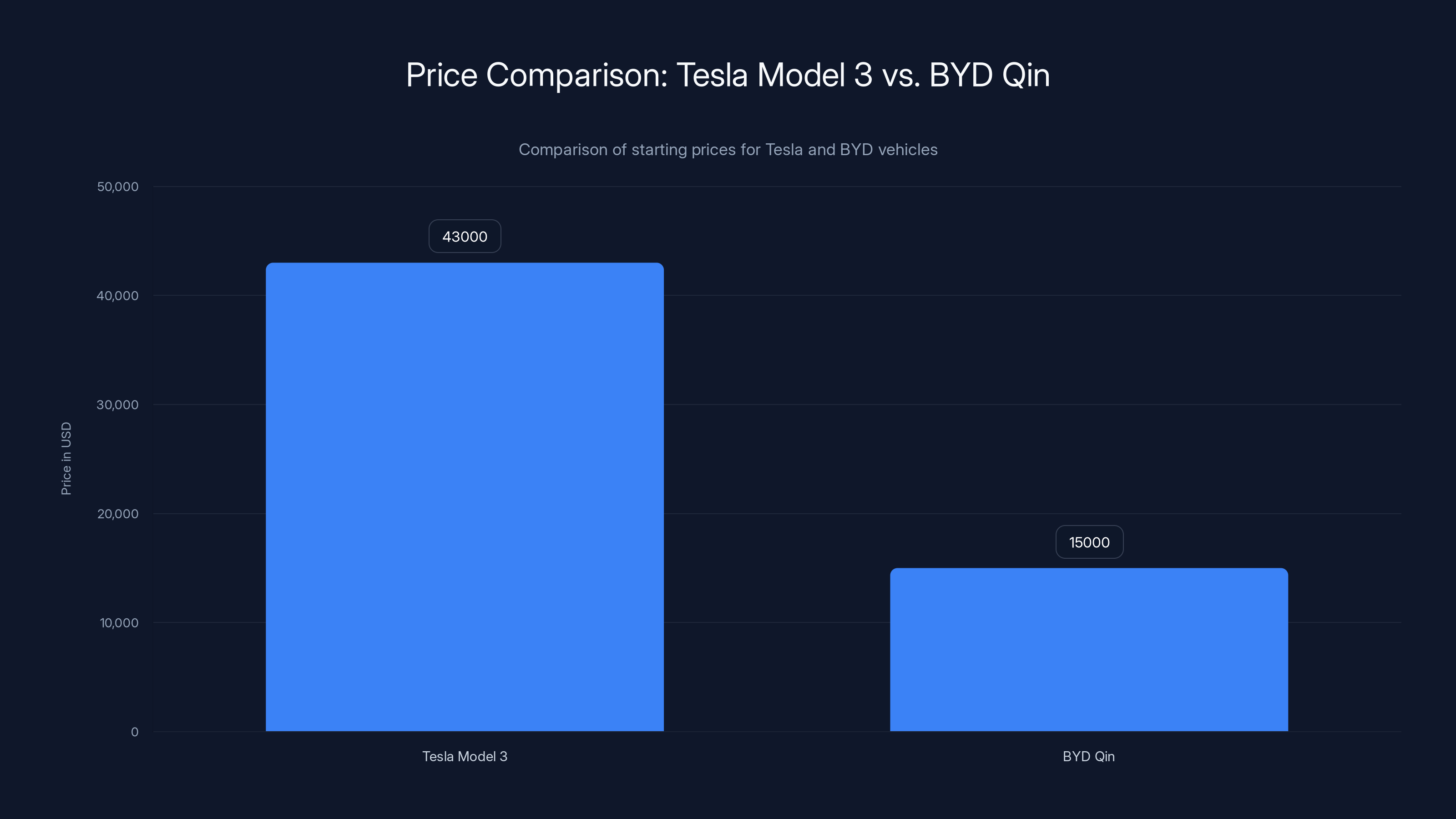

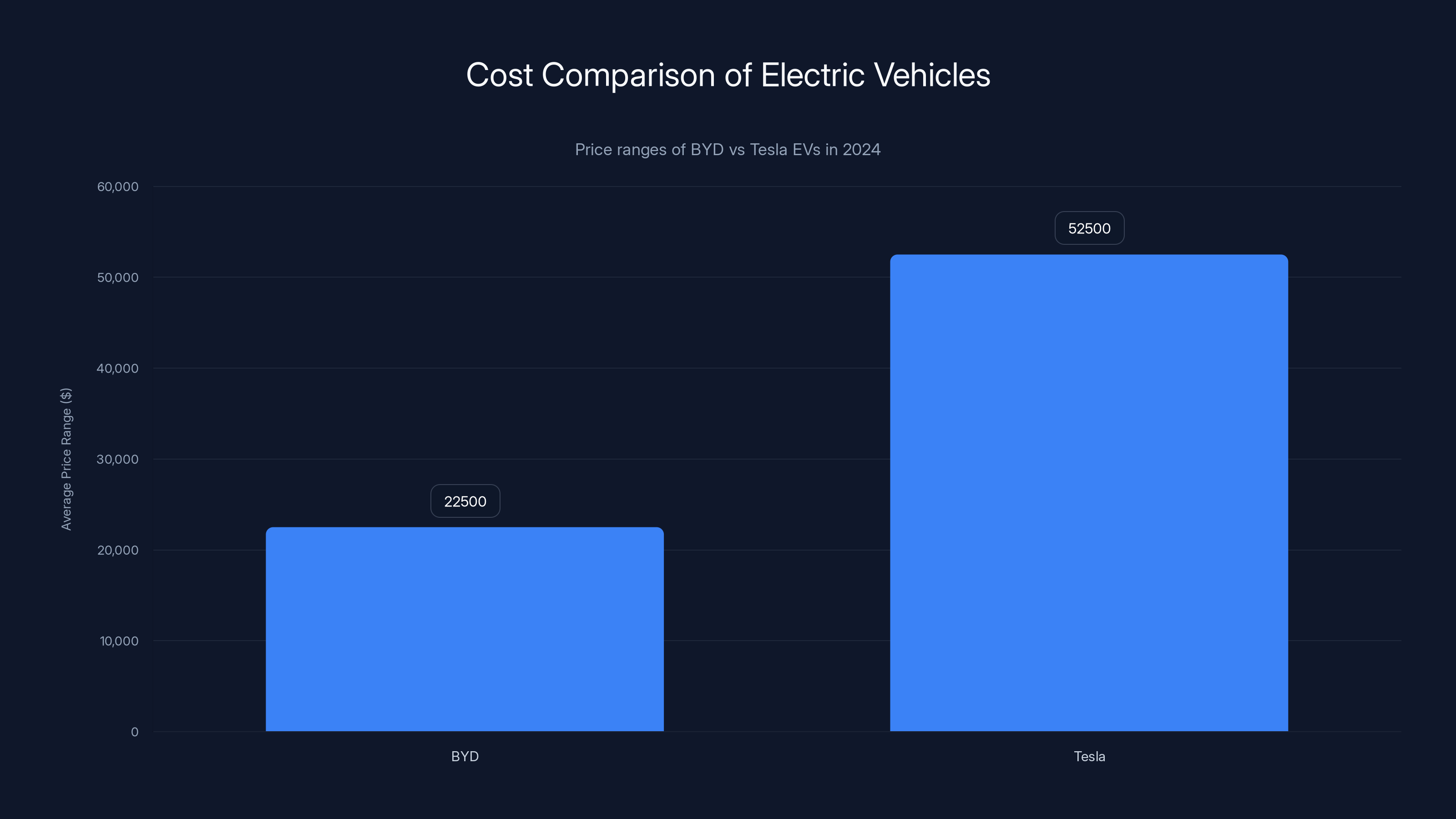

- Pricing revolution: BYD EVs cost 30,000, versus Tesla's70,000+, capturing price-sensitive markets worldwide

- Chinese government support: Subsidies, infrastructure investment, and domestic demand created perfect conditions for rapid scaling

- US market uncertainty: Tariffs and regulatory barriers currently prevent BYD from entering America, but this won't last forever

- Bottom Line: The EV market is no longer about innovation—it's about manufacturing efficiency, and China has mastered it

BYD's vertical integration and scale provide a significant cost efficiency advantage over Tesla, estimated at a 20-point difference in cost efficiency score.

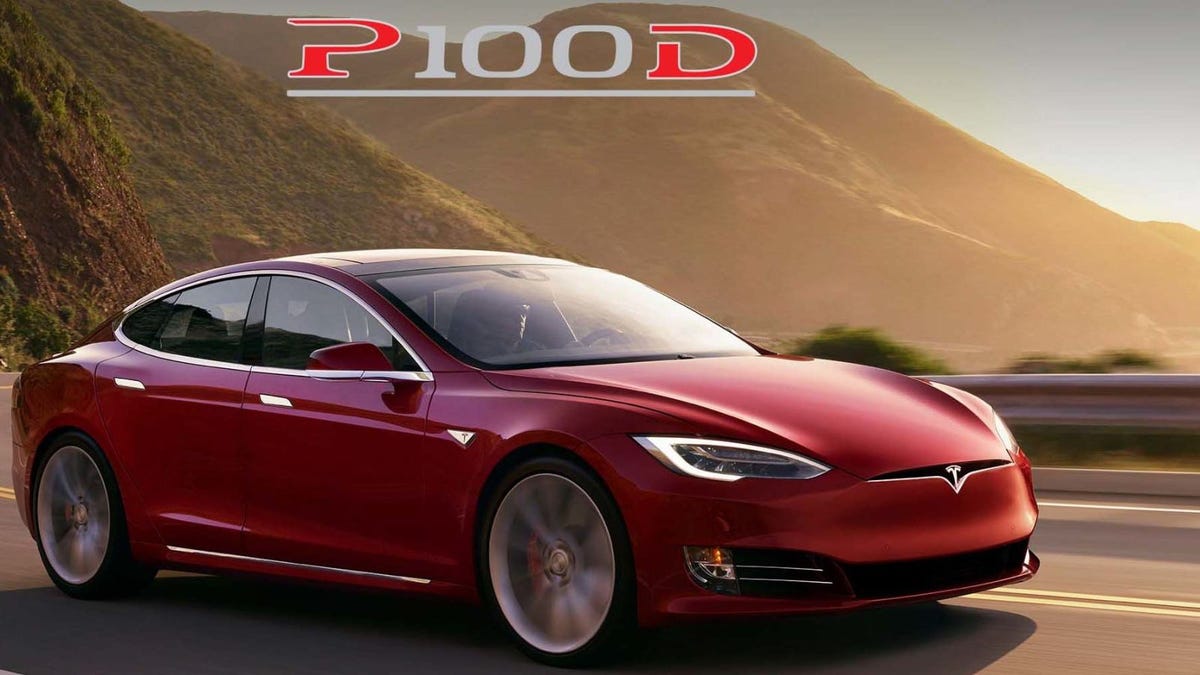

The Tesla Era and How It Ended

Tesla's dominance was total. It wasn't just about selling cars—it was about defining what an electric car could be. When Elon Musk launched the Model S in 2012, electric vehicles were punchlines. Glorified golf carts. Environmentalist fantasies with 200-mile ranges and 8-hour charging times.

Then Tesla happened. The Model S was fast. Really fast. Ludicrous Mode wasn't just marketing; it was a legitimate flex. Zero to 60 in 2.5 seconds. The range was real. Supercharging worked. Suddenly, EVs weren't a compromise—they were a status symbol.

Tesla capitalized on this perfectly. It became synonymous with electric vehicles. Search "best EV" in 2020, and Tesla owned the conversation. Model 3, Model Y, the Roadster—each one reinforced Tesla's position as the category king. The stock soared. The brand reached near-religious fervor among enthusiasts.

But here's where the story gets interesting. Tesla's success created a massive market. Suddenly, every automaker wanted in. Every government wanted to subsidize EVs. Every battery maker wanted to scale production. The barriers to entry, which Tesla had exploited so brilliantly, started crumbling.

This is where most people miss the plot. They assume Tesla lost because it got complacent. Wrong. Tesla didn't lose—the game changed. Manufacturing efficiency, battery supply, and pricing became more important than being first or being cool. Those are competitive advantages BYD owns.

Tesla is still an incredible company. Still profitable. Still innovative. But the industry no longer revolves around innovation—it revolves around execution. And execution is China's native language.

Who Is BYD, Anyway?

BYD's origin story is hilarious if you're into business history. The company started in 1995 as a battery manufacturer. Not an automaker. A battery company. The founder, Wang Chuanfu, built rechargeable batteries for mobile phones when that was an actual market. Phones with good batteries were luxury items.

Fast forward to the 2000s. The Chinese government realized something: the future was electric. Not because of environmental concerns (though those existed), but because of energy independence and geopolitical strategy. China imports oil. It doesn't import electrons. Electric vehicles meant energy autonomy.

So the government threw resources at EV development. Subsidies. Tax breaks. Manufacturing zones. Grid infrastructure investment. The works. BYD, already a battery powerhouse, saw the opportunity and pivoted.

In 2003, BYD acquired a failing automaker. That's it. One acquisition. Suddenly, BYD had manufacturing facilities, automotive expertise, and a pathway to scale. This is the move everyone forgets when they discuss "garage startup" mythology. Sometimes the best shortcut is acquisition.

BYD spent the next decade building. Quietly. While Tesla was dominating headlines, BYD was optimizing processes, building scale, and capturing the Chinese market. By 2020, when the global EV market started accelerating, BYD was ready. Not scrambling. Ready.

Today, BYD is essentially two companies in one: a battery manufacturer that supplies everyone (including Tesla, ironically), and an automaker selling under multiple brands. BYD's vehicle lineup includes affordable hatchbacks, sedans, SUVs, and luxury vehicles. Some cost

The Tesla Model 3 starts at

The Battery Advantage: Why BYD's Costs Are Impossibly Low

Let's talk about the thing that actually matters in the EV business: batteries. They're 40-60% of an EV's total cost. Get batteries wrong, and your entire business model collapses. Get them right, and you own the market.

Here's Tesla's supply chain: It needs batteries. It buys them from Panasonic, LG Chem, and increasingly, third-party suppliers. Each supplier has profit margins. Logistics costs. Negotiation leverage. Tesla pays list price, ships components, and assembles.

Here's BYD's supply chain: It manufactures its own batteries. In its own factories. At massive scale. No middleman. No profit margin for someone else. Just cost.

The math is staggering. In 2023, BYD manufactured over 150 gigawatt-hours (GWh) of battery capacity annually. Tesla? Around 40 GWh. That's not a difference—that's dominance. At BYD's scale, every penny of manufacturing cost compounds across millions of units.

When you manufacture batteries at that scale, something magical happens: cost curves flatten. You invest in automation. You optimize chemistry. You squeeze logistics. You negotiate raw material prices (lithium, cobalt, nickel) with the power of three million unit orders. Suppliers listen.

A Tesla Model 3's battery might cost Tesla

Then there's the technology angle. BYD pioneered Blade Battery technology—batteries with longer, blade-like cells that pack more density into the same space. Fewer cells mean simpler assembly. Simpler assembly means lower labor costs. Lower costs mean better margins or lower prices (BYD chose lower prices).

It's not that BYD's batteries are revolutionary in a "never-before-seen" way. They're better in boring ways: they're cheaper to make, they're reliable, they charge reasonably fast, and they hold their value. In manufacturing, boring beats flashy every single time.

This is where the Western obsession with "innovation" becomes a liability. American companies obsess over the next breakthrough: solid-state batteries, 1,000-mile range, 5-minute charging. BYD obsesses over making current technology 1% better and 5% cheaper every quarter. Compounded over years, 1% becomes everything.

The Pricing Strategy: Dominance Through Affordability

Let's compare cars directly. A Tesla Model 3 starts around

Different cars? Sort of. Similar performance, range, and features? Yes.

BYD's strategy is deceptively simple: capture the customer who would have bought a gas car but is considering electric. That's not Tesla's market. Tesla owns the "I want a premium EV" segment. BYD owns the "I want any EV and I have a budget" segment.

In developed markets (Europe, China, parts of Asia), that second segment is massive. Maybe even bigger than the first. A buyer in Mexico City doesn't need Ludicrous Mode. They need 200 miles of range, reliability, and a monthly payment they can afford. A buyer in Southeast Asia wants a car that lasts 10 years, has a good warranty, and costs less than a year's salary. BYD delivers.

The pricing also creates a flywheel. Lower prices drive volume. Volume drives manufacturing efficiency. Efficiency drives lower prices. Tesla can't compete in that race because it's a different race entirely. Tesla competes on brand, performance, and autonomous tech (theoretically). BYD competes on value.

What's wild is that BYD's cars aren't cheap junk. They're genuinely good. You see Chinese EV influencers (and yes, that's a category now) praising BYD's build quality, interior design, and software. These aren't grudging endorsements—they're enthusiastic.

Meanwhile, Tesla's cheapest new car is the Model 3 at

Tesla could theoretically compete on price, but then it destroys its profit margins and brand positioning. It's locked in. BYD isn't. BYD sells expensive luxury models AND cheap mass-market vehicles under different brands. Portfolio diversity is strategic advantage.

Government Policy and the Infrastructure Edge

Here's something American business media rarely discusses: government policy matters a lot. China doesn't just support EVs rhetorically—it reorganized entire supply chains around them.

China banned fossil fuel vehicle sales planning. That's not a suggestion—that's industrial policy. It means every major Chinese automaker is preparing for an EV-only future. Urgency changes everything.

The government also invested insanely in charging infrastructure. If you drive an EV in China, you find chargers everywhere. Highway rest stops have them. Shopping malls have them. Apartment buildings have them. Not all functional, not all fast, but they're there. When charging infrastructure exists, EV adoption accelerates naturally.

Subsidies also matter. China subsidized EV purchases directly (though it's reducing this now). When you're deciding between a

The US did something similar with the Inflation Reduction Act, offering tax credits up to $7,500. But the difference: the credits are available to buyers, not manufacturers, and they're limited to US-built vehicles. China's approach was "build the industry from the ground up." America's approach was "incentivize purchases." Both work, but China's creates more competitive advantage.

These aren't accidental differences. They're deliberate industrial policy. China treats EVs as a strategic priority. America treats them as one option among many.

Europe tried a hybrid approach—regulation (demanding EVs) plus infrastructure investment. Results: Europe has a strong EV market, but it's fragmented across multiple countries and manufacturers. No single company dominates. China has one king (BYD) and a few challengers (NIO, XPeng, Li Auto). Consolidated power, consolidated advantage.

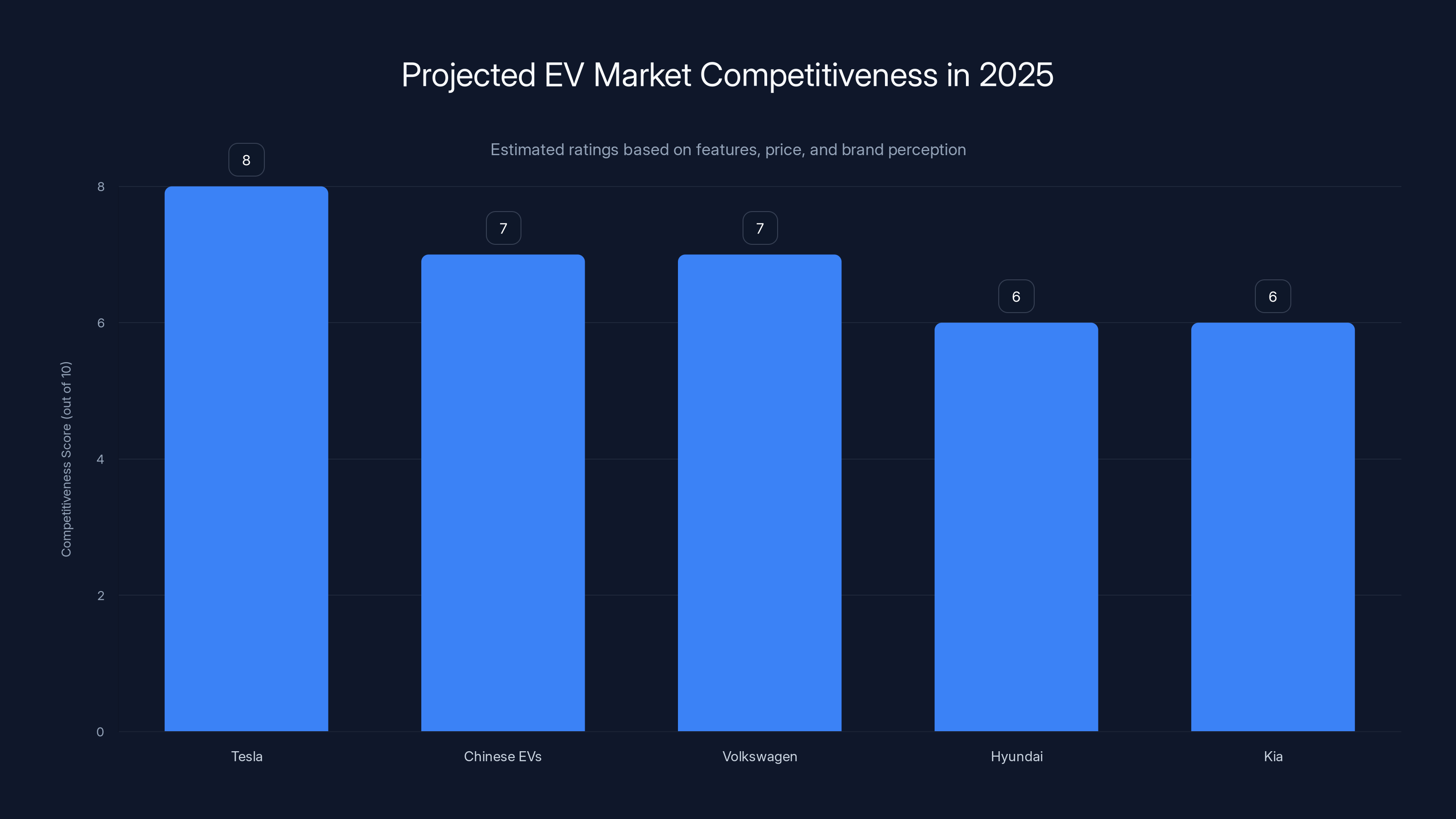

Tesla remains a strong player in the EV market, but Chinese EVs and legacy OEMs like Volkswagen, Hyundai, and Kia are becoming increasingly competitive. Estimated data.

BYD's Diverse Lineup: A Strategy Tesla Never Adopted

Tesla makes Teslas. Model S, Model 3, Model Y, Model X, Roadster, Cybertruck, Semi. Different price points, same brand. Same design language. Same everything-plus-or-minus.

BYD makes BYDs, but also Denzas, Yangwangs, and sells under Li Auto branding in some contexts. The company essentially runs multiple automotive brands under one corporate umbrella. Some focus on budget vehicles. Some focus on luxury. Some focus on specific demographics.

This is actually genius and something Tesla could never do without destroying its brand. You can't have a $15K Tesla—it would cannibalize the brand. You can't have a cheap Roadster. The brand wouldn't survive.

BYD has no such constraints. It's not trying to be Apple (one premium ecosystem). It's trying to be Volkswagen Group (multiple brands covering every market segment). This means BYD can chase every customer, not just the wealthy ones.

The Yangwang brand, for instance, positions as ultra-luxury. Yangwang vehicles compete with luxury brands, not with Tesla. The Denza brand targets premium-but-not-crazy buyers. The BYD brand itself covers everything from budget hatchbacks to mid-range family cars.

This portfolio approach means BYD captures customers at every decision point. If you want a

It's boring corporate strategy, but boring wins wars.

The Chinese Market as Practice Ground

Before BYD conquered global markets, it dominated China. That's where the real magic happened.

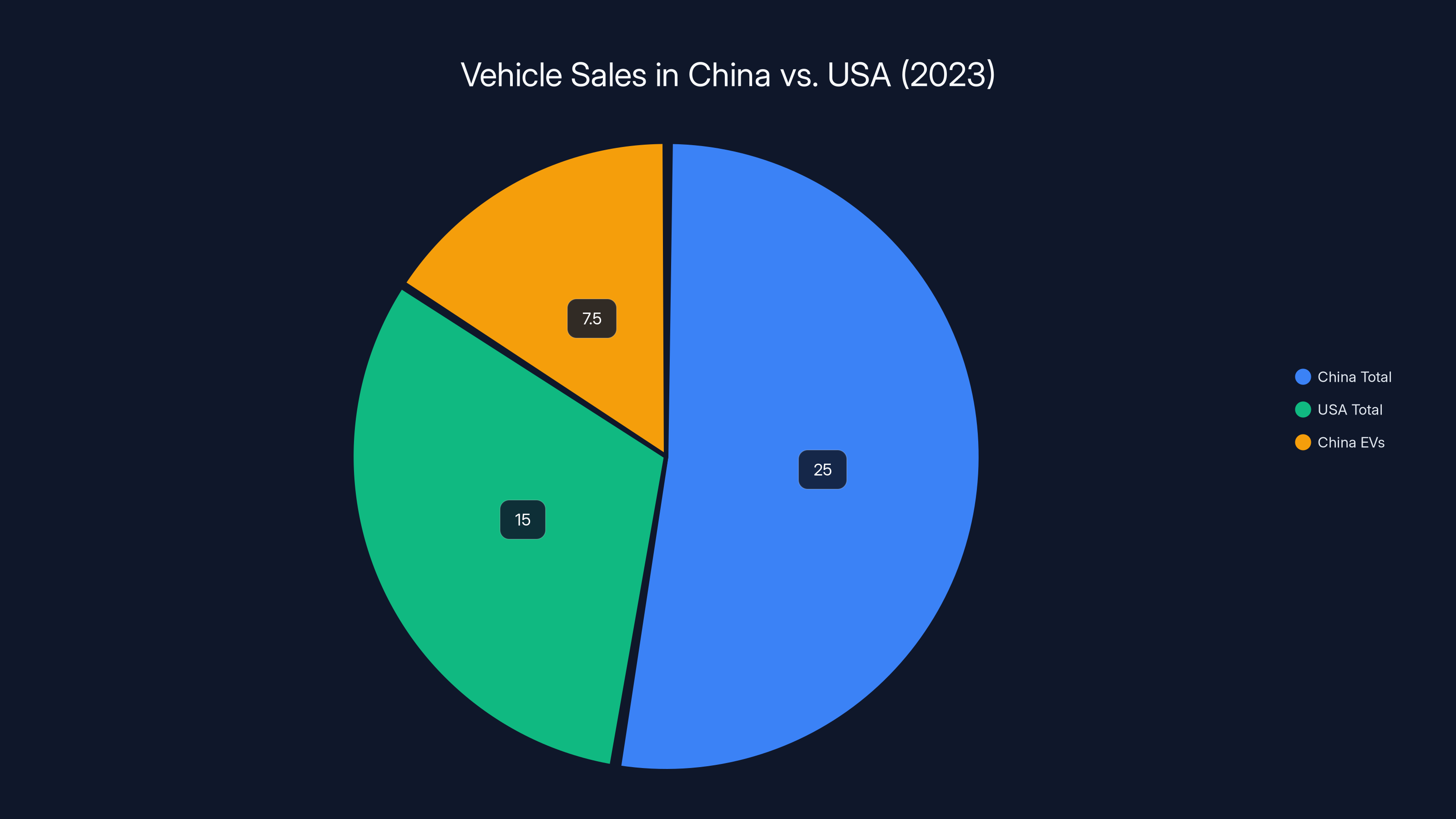

China's EV market was already massive by 2020. Millions of vehicles annually. That's not a niche—that's the entire US car market size. For context, Americans bought about 15 million vehicles total in 2023. China bought about 25 million. And of those, EVs are now over 30% in some regions.

When you have a market that large, you can experiment relentlessly. You can test product concepts, marketing strategies, manufacturing optimizations, software features. You can fail cheaply. You can scale winners.

BYD did all of this. The company wasn't trying to predict what global customers wanted—it was testing with actual Chinese customers, learning what worked, and then exporting the playbook.

The Dolphin, for instance, became a hit in China before it had any global presence. The company knew it resonated with a specific demographic: young, urban, budget-conscious buyers. Then BYD exported the Dolphin to Southeast Asia, where it found similar customers. Then Latin America. Each market got a vehicle already proven in a huge domestic market.

Tesla's approach was different: design for global markets, assume all customers want the same thing, iterate based on feedback. BYD's approach: dominate the largest market first, prove the product-market fit, then expand.

The Chinese market also taught BYD something critical: software matters enormously. Chinese consumers care about in-vehicle tech, over-the-air updates, integration with their phones, and ecosystem lock-in. BYD invested heavily in software. The vehicles get regular updates. They connect with everything. They feel modern.

This is where you see the real gap: a BYD vehicle from 2024 feels tech-forward. Software doesn't feel dated. The infotainment system is responsive. Over-the-air updates are common. For a budget vehicle, this is remarkable. American manufacturers still struggle with this. BYD built it in from the start.

Global Expansion: Southeast Asia and Latin America

Once BYD dominated China, expansion was logical. But the company didn't try to enter the US or Western Europe immediately. Too much regulatory friction. Too much brand skepticism. Instead, BYD expanded to regions where American and European brands were weak: Southeast Asia and Latin America.

Think about it. In Brazil, a $20K electric vehicle with 300-mile range and a 5-year warranty is an incredible deal. Most Brazilians have never sat in a BYD, but they've heard great things from influencers and online reviews. Price + specs + social proof = conversion.

Same dynamic in Thailand, Vietnam, Philippines, Indonesia. These markets have millions of buyers who want EVs but can't afford Tesla prices. BYD walks in, offers the exact product they need at the exact price point they can afford, and wins.

The company also understood logistics. Instead of shipping cars directly from China, BYD invested in regional warehouses and distribution centers. Shorter delivery times. Local customer support. Regional marketing. This is boring, but boring sells.

In 18 months, BYD went from unknown to dominant in multiple Southeast Asian markets. Not through acquisition. Not through partnerships. Through straightforward execution: good product, good price, good service.

The company is now planning expansion into Africa, South America, and potentially Eastern Europe. Each region has millions of potential customers who want EVs but can't access them. BYD sees that gap and fills it.

In 2023, China sold about 25 million vehicles, significantly more than the USA's 15 million. Notably, over 30% of China's sales were EVs, highlighting the country's advanced adoption of electric vehicles.

The Technology Stack: Software, Hardware, and Integration

BYD's advantage isn't just batteries and price. It's also architecture.

BYD built an integrated platform: battery management software, vehicle OS, charging system software, cloud connectivity, and mobile app all talk to each other seamlessly. When you own every component, you can optimize the whole system instead of optimizing each part in isolation.

Compare this to Tesla. Tesla builds much of its stack in-house too, but it's more vertically integrated in software than in manufacturing. Tesla buys many battery cells from suppliers. BYD manufactures its own.

Then there's the autonomous driving situation. Tesla makes a big deal about Autopilot and Full Self-Driving. BYD's autonomous features are less hyped but equally sophisticated. The company is investing heavily in LIDAR, vision systems, and AI training. Not to beat Tesla, but to match it.

What's interesting is that BYD doesn't advertise autonomous driving as aggressively. The company knows most buyers, especially in emerging markets, don't prioritize it. They prioritize reliability, value, and build quality. Autonomous features are secondary.

This is actually strategic. Tesla built the hype around autonomous driving, which drove brand perception and stock price. But it also created unrealistic expectations. Buyers wait years for FSD that doesn't fully work. Frustration builds. BYD avoids this by under-promising on autonomy and over-delivering on reliability.

In the long term, autonomy will matter. But today, it doesn't determine market share. Reliability and price do. BYD optimized for today's market, not tomorrow's promise.

Why BYD Hasn't Entered the US Market (Yet)

This is the question everyone asks: why no BYD cars in American dealerships?

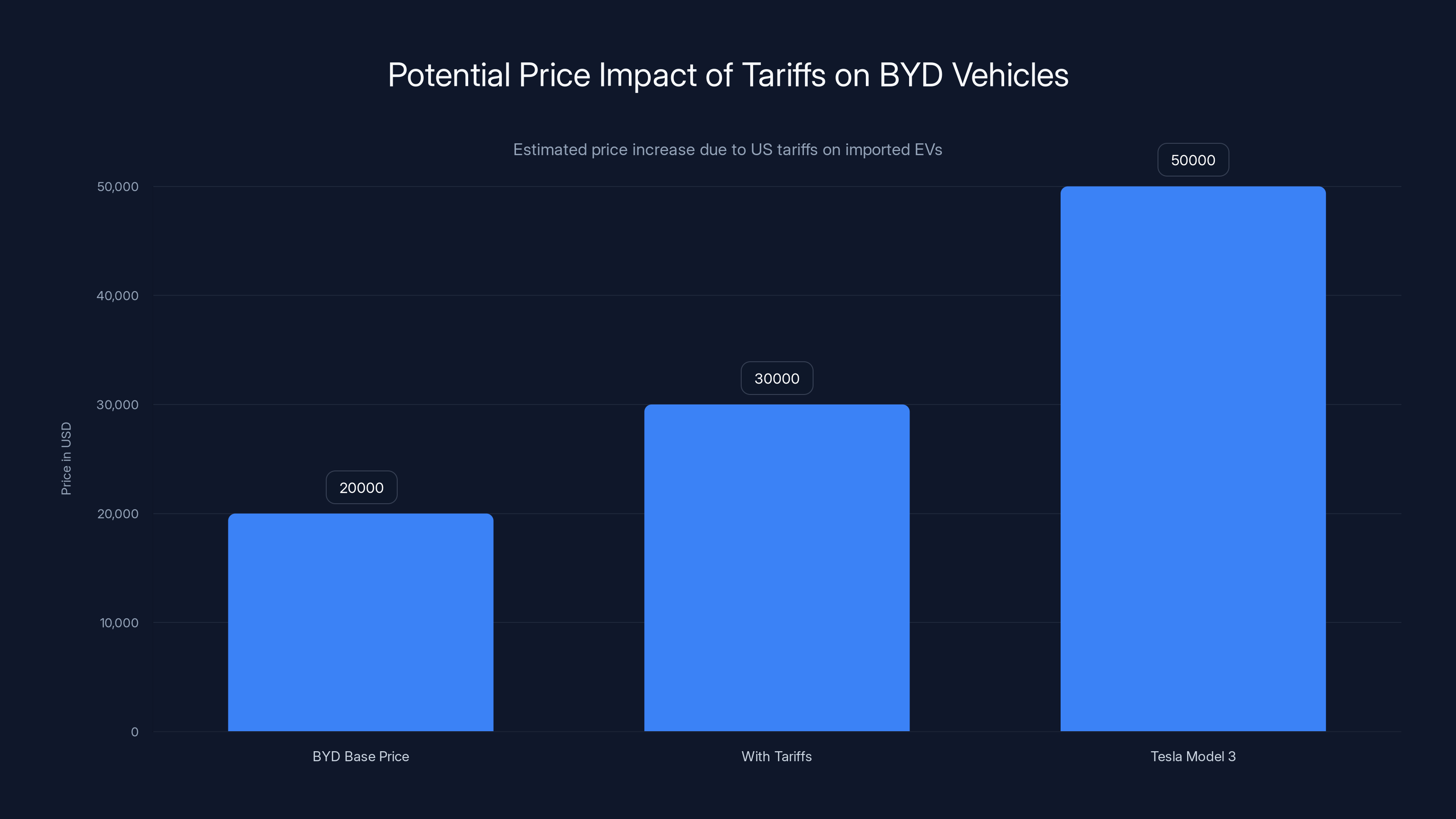

The answer is multifaceted. First, tariffs. The US implements steep tariffs on imported vehicles, especially EVs. If BYD tried to export its

Second, perception. American consumers don't trust Chinese automotive brands yet. Tesla built the "cool factor." BYD would need to build cultural acceptance first, then price competitiveness. That's a longer journey.

Third, regulation. American safety and environmental standards are different from Chinese standards. BYD vehicles meet global standards, but certification takes time and money. It's not insurmountable, but it's a barrier.

Fourth, distribution. BYD would need to build a dealer network or direct-to-consumer sales infrastructure. That requires investment and market infrastructure that barely exists yet for Chinese brands.

But here's the key: none of these are permanent barriers. Tariffs can change with administration shifts. Perception can shift with time and good vehicles. Regulation can be navigated. Distribution can be built.

Some analysts predict BYD entering the US market through partnerships or acquisitions rather than direct sales. Imagine: BYD buys a struggling American EV startup or partners with an established OEM. Suddenly, a "foreign" vehicle becomes a "US" vehicle (assembled here, partly). The dynamics shift.

It's not a question of if BYD enters America, but when. And when it does, it will fundamentally disrupt pricing expectations.

The Impact on Tesla's Strategy

Tesla is responding, but carefully. The company can't cut prices too aggressively without destroying margins and signaling weakness. It can't compromise on brand or quality to chase volume. It's in a constrained position.

What Tesla is doing instead: doubling down on autonomous driving, performance, and brand lifestyle. If you can't compete on price, you compete on capability and identity. Tesla is leaning into the identity—charging more for the experience, not just the car.

The company is also accelerating factory automation and cost reduction, but these gains are marginal compared to BYD's structural advantages. Tesla would need to fundamentally reorganize to match BYD's cost structure, and that's not feasible without huge disruption.

So Tesla will likely settle into a "premium EV" position. Smaller market share than it enjoys today, but higher margins, higher brand value, and strong profitability. It's actually a defensible position, just not the market dominance Elon Musk has been promising.

For Tesla investors, this is a wake-up call. The narrative of inevitable dominance is over. Tesla is an excellent car company with strong technology. It's not an inevitable monopoly.

Estimated data shows that US tariffs could increase BYD vehicle prices by $10,000, reducing their competitive edge against Tesla's Model 3.

The Broader Industry Implications

BYD's rise signals the end of the American and European auto industry's comfortable position. For decades, legacy OEMs competed among themselves: Ford, GM, BMW, Mercedes, Volkswagen, Toyota. Regional competitors mostly. One American company (Tesla) disrupted, but another American company.

Now Chinese companies are winning on price, quality, and manufacturing. This forces a reckoning.

Legacy OEMs face a choice: compete directly on price (suicide for margins), or retreat upmarket (limiting growth). Some will do the first, some the second, some will fail.

European manufacturers like Volkswagen and BMW are accelerating EV development and ramping factories. They're trying to compete on both price and quality. It's possible, but it requires brutal efficiency and margin discipline.

American manufacturers like Ford and GM are slower. They're still profitable on gas vehicles, so the incentive to transform urgently isn't there. But it will be soon. When Chinese EVs start undercutting their budget vehicle lines by

The industry will eventually consolidate around maybe 5-7 global EV manufacturers: Tesla (premium), BYD (mass market), Volkswagen (premium and mass market), maybe NIO (premium), Li Auto (mass market), and a few others. Legacy OEMs that don't adapt will disappear.

This is actually good for consumers. Competition drives innovation and price reduction. Bad for incumbent profits, good for buyer wallets.

The Battery Supply Chain and Raw Materials

One often-overlooked aspect: batteries require raw materials. Lithium, cobalt, nickel, manganese. These are finite, geographically concentrated resources.

China doesn't have vast lithium reserves, but it controls the refining and processing of lithium globally. Same with cobalt processing. This gives China enormous leverage over the supply chain, regardless of where raw materials come from.

BYD's advantage extends to this level too. The company has long-term contracts with mines and processors. It has refineries. It has processing capacity. When lithium prices spike, BYD feels the pain but has mitigation strategies. Smaller competitors get squeezed.

This is industrial policy at work. China ensures its battery manufacturers have secure supply chains because batteries are strategically important. The US and Europe are trying to replicate this (building US and European battery factories, securing long-term contracts), but they're years behind.

For BYD, this means cost stability. For competitors, this means perpetual risk. Lithium prices fluctuate based on China's control of processing. If China tightens supply, only Chinese manufacturers have alternative sources. Everyone else suffers.

The Cultural and Market Differences That Matter

Here's something the business world underestimates: culture shapes markets.

American consumers, especially wealthy ones (Tesla's core market), care about brand identity. Tesla is aspirational. It's the iPhone of EVs. Buying a Tesla is a statement. Buying a BYD is practical.

Chinese consumers care about value and reliability first, brand second. They'll switch vehicles if a better option comes along. Loyalty is transactional, not emotional. This mindset accelerates disruption.

In emerging markets (Southeast Asia, Latin America, Africa), buyers are even more price-sensitive. They compare spreadsheets, not philosophies. If a BYD and a Tesla have the same range and features, the BYD wins on price. Done.

European consumers are somewhere in the middle: they care about environmental impact, value, and design. BYD appeals to them increasingly, especially as the brand becomes known.

Understanding these cultural differences explains why BYD's strategy varies by region. In China, it emphasizes technology and features. In Southeast Asia, it emphasizes price and reliability. In Europe, it emphasizes environmental credentials and design.

Tesla, by contrast, uses the same messaging globally. That works in wealthy markets. It fails in price-sensitive markets.

BYD offers a significant pricing advantage with EVs ranging from

Future Scenarios: What Happens Next?

Let's extrapolate. If current trends continue, here are plausible futures:

Scenario 1: The Duopoly – BYD and Tesla split the global EV market. Tesla owns premium (15-20% market share), BYD owns mass market (35-45% market share). Legacy OEMs get 30-40%. This is the most likely outcome.

Scenario 2: Chinese Dominance – BYD, NIO, XPeng, and Li Auto collectively capture 60%+ of global EV sales. American and European brands shrink to regional players. Less likely but possible if Western OEMs stumble.

Scenario 3: The Consolidation – Major OEMs (VW, BMW, etc.) aggressively cut costs and acquire EV startups to stay competitive. A few survive with niche positions. Tesla remains premium. BYD remains mass market. This feels like the real-world outcome.

Scenario 4: The Tariff Wall – The US and Europe implement aggressive trade policies that block Chinese vehicles. Regional markets fragment. BYD dominates Asia, Africa, Latin America. Tesla dominates North America and Western Europe. VW dominates Europe. Less connected global market emerges.

Most likely? Some blend of Scenarios 1 and 3. BYD doesn't need to conquer America to win globally. It already owns the fast-growing markets. America becomes one region among many, not the center of the universe.

For consumers, this is actually great. More competition means more choices, lower prices, faster innovation. The era of one company defining an entire category is over.

Lessons for American and European Manufacturers

If you're an incumbent OEM trying to compete with BYD, what do you do?

Option 1: Vertical integration. Build your own batteries instead of buying from suppliers. Cuts costs by 30-40%. Takes years and billions to implement. VW is attempting this.

Option 2: Scale relentlessly. Move production to low-cost regions. Accept lower margins. Compete on volume. This destroys profitability.

Option 3: Retreat upmarket. Cede mass market to BYD. Focus on premium vehicles where brand matters. This limits growth but protects margins.

Option 4: Partner with Chinese manufacturers. License technology. Share supply chains. This sacrifices control but speeds time-to-market.

Option 5: Acquire capacity or expertise. Buy EV startups. Buy battery companies. Buy software firms. This costs billions but creates capabilities faster.

Most successful companies are doing combinations of 1, 3, and 5. BMW is focusing on premium. Volkswagen is building batteries and scaling mass market aggressively. Ford is doing a hybrid.

The lesson for Western businesses is humbling: first-mover advantage doesn't guarantee permanent dominance. Tesla moved first in EVs and won globally. But sustainable dominance requires continuous cost optimization, not innovation alone. BYD understood this. Tesla is learning.

The Technology Innovation Question

One argument you'll hear: "BYD is winning on price, but innovation will eventually favor Western companies."

Maybe. But let's examine this. What's the innovation that matters most in EVs?

Battery chemistry: Improvements happen incrementally. Lithium, then LFP (safer, cheaper), then eventual solid-state (maybe in 10+ years). BYD is research-active in all of these. The company isn't behind.

Autonomous driving: Everyone's working on this. Tesla has Autopilot/FSD. BYD has its own autonomous stack. Neither is "level 5" yet. Both claim to be close. Neither has a meaningful advantage currently.

Charging speed: 350 kW charging exists. It's not revolutionarily better than 250 kW. BYD supports modern charging standards.

Software: In-vehicle software is where things are exciting. BYD's software is genuinely modern and updates frequently. Tesla's software is good but proprietary. Neither has a knockout advantage.

So what's the innovation advantage? There isn't one, really. BYD keeps pace. It's not revolutionary. It's just... there.

This is actually the real story: BYD proved you don't need revolutionary innovation to win. You need good execution, cost control, and customer understanding. That's boring. That's also why most established companies miss it.

Western businesses obsess over the next disruption. "What's the next iPhone? The next Tesla?" China focuses on optimization. "How do we make 1% better vehicles at 5% lower cost every year?" Compounded over time, the second approach wins.

The Global Trade and Geopolitics Angle

Here's where it gets complicated: BYD's rise is geopolitically significant.

The US has been the automotive superpower for a century. American companies made cars the world wanted. American brands were synonymous with automobiles. This wasn't just economic—it was soft power.

BYD's rise means Chinese manufacturing can compete globally on quality. This shifts perceptions. It strengthens China's economic influence. It redistributes power.

The US response: tariffs, regulations, and messaging about "made in America." The EU response: similar but with sustainability focus. Both are trying to protect incumbent industries.

This likely leads to more regionalization. Chinese EVs dominate China and adjacent markets. American vehicles dominate America. European vehicles dominate Europe. Less of a truly global market, more of regional markets with some overlap.

For consumers, less trade friction is better (more choice, lower prices). But geopolitics might override economics. It often does.

BYD's own position is interesting here. The company is Chinese, but increasingly international. It's not an arm of the Chinese government (though the government is a shareholder). It's a private company with global ambitions. Unlike Huawei, which faced US sanctions, BYD doesn't have a direct geopolitical target on its back—yet.

But watch closely. As BYD expands globally, geopolitical pressure might increase. The US might restrict Chinese vehicle imports more aggressively. Europe might follow. This would limit BYD's options, but wouldn't stop BYD from dominating the rest of the world.

Lessons for Startups and New Entrants

If you're a startup trying to compete in the EV space, BYD's playbook offers lessons:

-

Start with the right market. BYD didn't try to compete with Tesla in America. It dominated China first. Choose a market where you have advantages (manufacturing cost, supply chain, local knowledge), not where you'll be glamorous.

-

Vertical integration compounds. Control your supply chain. It's expensive initially but creates moats over time. Half-measures don't work.

-

Price matters more than specs. A vehicle at half the price with 90% of the specs wins over 100% of the specs at 2x the price. Know your customer.

-

Portfolio diversity is strategic. Serve multiple market segments with different brands or sub-brands. Doesn't destroy margins, increases addressable market.

-

Software is an ongoing investment. Don't treat software as an afterthought. Make it foundational. Update it continuously.

-

Execution beats innovation. Being 80% as innovative as competitors while 20% more efficient wins. Keep that ratio.

-

Build in boring markets first. Hype attracts competition. Focus where profit margins are real and customers are price-sensitive.

BYD basically followed all seven. Tesla followed maybe three. Established OEMs follow one or two. Guess who's winning?

What American Consumers Should Know

If you're considering an EV in 2025:

-

Tesla is still excellent. Model 3 is great. Model Y is great. They're just not the only good option anymore, and they're not the cheapest. Consider them for premium features and brand, not as the default.

-

Chinese EVs are coming. Maybe not to your local dealership yet, but they're coming. When they arrive, they'll be cheaper and competitive on features. This will force price reductions across the industry. Be patient or buy now.

-

Legacy OEMs are improving. Volkswagen ID.4, Hyundai Ioniq, Kia EV6—these are genuinely good vehicles. Competitive with Tesla on features, sometimes cheaper. Consider them.

-

The market is consolidating. In 5 years, you'll have more EV choices, better prices, and more competition. Waiting a year or two for options might be smarter than buying today, unless you need a vehicle immediately.

-

Total cost of ownership matters. An EV that's $5K cheaper but has worse reliability might cost you more long-term. Research carefully. Look at ownership reports, not just specs.

The Emerging Challenge: Competition From Multiple Angles

What's fascinating is that BYD isn't the only Chinese company winning. NIO is selling luxury EVs. Xiaomi just entered the EV market (yes, the phone company). XPeng is making affordable EVs with advanced features. Li Auto is doing extended-range EVs.

Instead of one company threatening Tesla, there's an entire ecosystem. It's like the smartphone market in 2015—suddenly there are dozens of good options at different price points.

This is actually healthy for the industry. Competition drives innovation. It drives costs down. Consumers win.

But it also means consolidation is inevitable. Not all Chinese EV startups will survive. Some will fail. Others will merge. Eventually, you'll have maybe 5-6 strong Chinese brands competing globally, plus Tesla, plus the legacy OEMs.

That's probably a healthy endpoint.

FAQ

What is BYD and why did it beat Tesla?

BYD is a Chinese company that started as a battery manufacturer and became the world's largest electric vehicle manufacturer by sales volume. It beat Tesla primarily through superior cost efficiency (especially in battery manufacturing where it has complete vertical integration), aggressive pricing (

How does BYD maintain such low costs compared to competitors?

BYD controls every stage of its supply chain. It manufactures its own batteries (150+ GWh annually), sources raw materials, runs assembly plants, and develops software in-house. This eliminates middlemen and profit margins that competitors face when buying from external suppliers. At BYD's scale, even 1% manufacturing improvements compound into massive cost savings across millions of vehicles annually. Additionally, China's lower labor costs and the company's vertical integration of battery production (which is 40-60% of vehicle cost) creates a structural 30-40% cost advantage over competitors reliant on external suppliers.

What are the benefits of BYD's strategy for global EV markets?

BYD's strategy has several positive effects on global EV markets. First, aggressive pricing accelerates EV adoption globally—customers who couldn't afford Tesla can now afford BYD, expanding the addressable market. Second, competition forces price reductions across the entire industry, benefiting all consumers. Third, BYD's success proves that profitably manufacturing EVs at scale is possible, giving confidence to investors and governments. Fourth, the company's portfolio approach (multiple brands at different price points) demonstrates that one company can serve diverse market segments, increasing options for consumers. Finally, BYD's global expansion brings modern EV technology and manufacturing expertise to emerging markets where it didn't exist before, accelerating clean transportation adoption.

When will BYD cars be available in the United States?

Currently, BYD vehicles aren't sold in US dealerships, primarily due to tariffs, regulatory barriers, and market strategy rather than technical limitations. US import tariffs on vehicles make Chinese EVs significantly more expensive upon entry, eliminating BYD's primary competitive advantage (price). Additionally, American consumers lack familiarity with Chinese automotive brands, requiring investment in brand building. However, these barriers aren't permanent. Tariff policy could change with administration shifts. BYD might enter through partnerships, acquisitions of US companies, or manufacturing facilities in the US. Industry analysts predict BYD will enter North American markets within 5-10 years, likely disrupting price expectations when it does. The company is currently focused on dominating Asia, Africa, and Latin America where regulatory barriers are lower and price sensitivity is higher.

How does BYD's technology compare to Tesla's?

On battery chemistry, both companies use modern lithium-based and LFP (lithium iron phosphate) technologies, with BYD leading on cost and Tesla on energy density. For autonomous driving, both have sophisticated systems (BYD's autonomous stack is competitive with Tesla's Autopilot/FSD, though neither has achieved full level 5 autonomy yet). On software, BYD offers modern, regularly updated in-vehicle software with cloud connectivity, comparable to Tesla's approach. On charging speed, both support current fast-charging standards (350 kW+). The key difference isn't technological capability—it's integration and optimization. BYD optimizes its entire ecosystem for cost and reliability. Tesla optimizes for performance and brand experience. Both strategies work; they target different markets. BYD isn't technologically behind; it's strategically different.

What does BYD's success mean for Tesla shareholders?

BYD's dominance means Tesla's market share will decrease, but not necessarily its profitability. Tesla will likely retreat to the premium EV segment (15-20% global market share) where it can command higher prices and margins based on brand, performance, and technology leadership. This is actually a defensible position—the premium car market is smaller but more profitable than mass market. For investors, Tesla shifts from "inevitable global monopoly" narrative to "strong premium player with solid fundamentals." Stock valuation might compress since growth expectations decrease, but Tesla's profitability and return on equity could remain strong. The real risk for Tesla isn't BYD's competition; it's failure to maintain technological leadership in autonomous driving or battery efficiency. If Tesla falls behind on core technology, the premium positioning fails.

Can legacy automakers compete with BYD?

Yes, but they must transform their cost structures. VW, BMW, Ford, GM, and others can compete through vertical integration (building batteries in-house), aggressive manufacturing optimization, or retreating to premium segments. Some are attempting this—VW is building 6 new battery factories, GM is partnering with LG and other suppliers. However, they face structural disadvantages: legacy manufacturing plants, labor contracts, and organizational inertia. Their most likely path isn't beating BYD on cost but differentiating on design, brand, technology, or serving specific niches. In practice, you'll probably see a market where BYD dominates mass market (40%+), Tesla owns premium (15%), and legacy OEMs split the remainder (30-40%) with regional strengths. That's a realistic outcome by 2030.

What happens to oil companies and gas stations if BYD and other Chinese EVs accelerate adoption?

This is a long-term disruption. If BYD successfully captures 40-50% of global vehicle sales within 10 years, oil demand from transportation declines significantly. Major oil companies are aware and investing in energy transition (renewable, EV charging infrastructure, etc.). The most vulnerable are companies dependent solely on transportation fuel. However, aviation and shipping will likely remain petroleum-based for decades, maintaining some demand. Gas stations will increasingly diversify to EV charging, convenience retail, and other services. The transition won't eliminate oil demand but will substantially reduce it, creating a significant but manageable challenge for the energy sector. Developing countries might retain internal combustion vehicles longer, extending the timeline, but the trajectory is clear.

How does Chinese government policy support BYD versus American or European policy?

China's approach is comprehensive industrial policy: subsidized EV purchases (historically), massive investment in charging infrastructure, dedicated manufacturing zones, technical standards favoring local companies, and strategic support for battery supply chains. The US approach through the Inflation Reduction Act provides tax credits to buyers and incentives for US manufacturing, but doesn't mandate EV adoption or direct government investment in manufacturing the way China does. Europe combines regulation (demanding EV adoption) with infrastructure investment and subsidies, creating a stronger push than the US but less focused industrial policy than China. The difference: China treats EVs as strategic national priority and organizes industrial policy accordingly. The US treats EVs as one technology option among many. This difference explains much of China's manufacturing edge—BYD didn't just win on corporate strategy; it benefited from decades of coordinated government policy.

Are Chinese EV batteries reliable and do they have good warranties?

Yes. Chinese EV batteries, particularly BYD's LFP batteries, have demonstrated strong reliability in millions of deployed vehicles. LFP chemistry is actually more stable than traditional lithium batteries, with lower fire risk. BYD batteries are now used in Tesla vehicles (Tesla sources from BYD), a strong signal of quality. Warranties are typically 5-8 years or 100K-150K miles for BYD vehicles, comparable to industry standards. Real-world data from millions of Chinese vehicles shows battery degradation is gradual (typically 2-3% annually) rather than sudden failure. The early concern about Chinese EV quality has largely been resolved by real-world performance. However, battery degradation varies by chemistry (LFP is more durable; NCA/NCM batteries degrade faster) and environmental conditions (heat accelerates degradation). For buyers, BYD's warranty and proven track record make reliability comparable to Western EV manufacturers.

What's the timeline for global EV market consolidation around BYD, Tesla, and legacy OEMs?

Based on current trajectories, expect major consolidation by 2030-2035. By then, BYD will likely have 35-45% global market share (including all regions where it operates). Tesla maintains 12-18% (premium segment). Legacy OEMs collectively hold 30-40% with regional strength. Smaller EV startups and secondary Chinese brands merge or fail. By 2040, you'll probably see the market dominated by 5-8 global companies plus regional players. This isn't different from traditional auto markets (Toyota, VW, GM, Ford, Geely/Volvo, BMW, Mercedes, BYD). The transition will be painful for incumbents but healthy for competition and consumers. The key question isn't whether consolidation happens, but whether American and European manufacturers can survive it.

Trying Runable For Free today won't help you understand EV market dynamics, but automating your market research reports with AI? That's where BYD's competitive advantage becomes personal. Runable helps teams generate research documents, presentations, and reports automatically—the same efficiency gains that gave BYD its edge. When you're tracking global EV trends, competitive positioning, or supply chain data, having an AI platform that turns raw data into polished reports in minutes saves your team hours every week. Start automating your workflow at Runable.com for just $9/month.

Conclusion: The New Order of Electric Vehicles

BYD beat Tesla not through magic or luck, but through relentless focus on the fundamentals that matter: cost, quality, scale, and customer understanding.

The story is simultaneously simple and complex. Simple: a company optimized manufacturing better than competitors and captured market share. Complex: decades of Chinese industrial policy, geopolitical positioning, supply chain strategy, and market segmentation created conditions where BYD could win.

The implications ripple through industries and geopolitics. For consumers, BYD's rise is genuinely positive—it means more choices, lower prices, and faster adoption of clean technology. For manufacturers, it means the era of comfortable oligopoly is over. For policy makers, it raises questions about how industrial policy works in a globalized world.

Tesla remains an exceptional company. But Tesla is no longer inevitable. BYD is.

The question now isn't whether Chinese EVs will dominate global markets. They will. The question is whether Western manufacturers can stake out defensible positions in the segments where competition is less price-based and more differentiation-based. Tesla can. Many legacy OEMs probably can't without radical transformation.

For the automotive industry, 2024 marks a turning point. The past 15 years belonged to Tesla—the innovator who saw electric vehicles first and moved boldest. The next 15 years belong to optimization and scale. BYD's game.

The Dolphin Surf won't be cruising down American highways anytime soon. But that's not really the point. BYD doesn't need America. It's already won everywhere else. America will eventually follow when tariffs drop or BYD builds factories locally.

When that happens, when Chinese EVs finally break through American tariff walls and consumer skepticism, the automotive landscape will shift again. Prices will drop. Options will multiply. Consumer choice will expand.

For now, the story is still being written. But the author has already been decided.

BYD wrote it.

Key Takeaways

- BYD sold 67% more electric vehicles than Tesla in 2024, becoming the world's largest EV manufacturer by volume through vertical integration and cost optimization, not innovation alone.

- Vertical integration of battery manufacturing gives BYD 30-40% structural cost advantages, allowing pricing at 30,000 versus Tesla's70,000 range.

- China's comprehensive government policy—infrastructure investment, subsidies, and manufacturing zones—created competitive advantages that Western policy approaches haven't matched in scale or focus.

- BYD's multi-brand portfolio strategy captures customers across every price segment and demographic, while Tesla's single-brand approach limits addressable market.

- Strategic geographic expansion to China first, then Southeast Asia and Latin America, allowed BYD to prove models and scale efficiently before attempting Western market entry.

Related Articles

- How Chinese EV Batteries Conquered the World [2025]

- Kia EV2: The Compact EV That's Shaking Up Europe [2025]

- Sony's TV Business Takeover: Why TCL's Partnership Changes Everything [2025]

- Best Gear & Tech Releases This Week [2025]

- Netflix's $82B Warner Bros Deal: What It Means for Movie Theaters [2025]

- Next-Gen Battery Tech Beyond Silicon-Carbon [2025]

![How BYD Beat Tesla: The EV Revolution [2025]](https://tryrunable.com/blog/how-byd-beat-tesla-the-ev-revolution-2025/image-1-1768918086603.jpg)