The GPU Pricing Crisis That Nobody's Really Talking About

Last month, I got a text from a friend who builds gaming PCs. He was checking prices for a new RTX 4090 and thought his browser was broken. The markup from launch price to retail had somehow gotten worse, not better. He wasn't alone. A recent comprehensive global pricing analysis has pulled back the curtain on something that's been quietly infuriating everyone in the PC gaming and AI communities: graphics card prices aren't just expensive anymore. They're absurd.

Here's the thing. GPU pricing has always been weird. Cryptocurrency booms cause spikes. Launch shortages drive markups. Supply chain issues create chaos. But what we're seeing in 2025 is different. It's systematic. It's global. And it's hitting Nvidia's premium lineup harder than anything else.

The report analyzing current GPU pricing across major markets worldwide reveals a pattern that should concern anyone considering a graphics card upgrade. We're not talking about minor increases. We're talking about products selling for two, three, sometimes four times their suggested retail price in certain regions. The worst part? The higher the card, the worse the markup.

I've covered GPU pricing trends for years, and I'll be honest: this is the most aggressive pricing environment I've seen outside of the crypto boom days. Except this time, there's no clear expiration date. There's no "supply will catch up soon." It's just persistent, brutal margins that manufacturers and retailers seem comfortable maintaining.

So what's actually happening? Why are GPUs so expensive right now? And more importantly, what can you do about it?

TL; DR

- Global markups are severe: High-end Nvidia GPUs cost 80-150% more than suggested retail prices in most markets

- Premium cards hit hardest: The RTX 4090 and similar flagship models see the worst price inflation

- Regional variation is extreme: Certain European and Asian markets face even steeper markups than North America

- Supply constraints persist: Despite claims of abundance, premium GPU inventory remains limited

- This is strategic pricing: Manufacturers and retailers are comfortable with these margins, suggesting they'll stick around

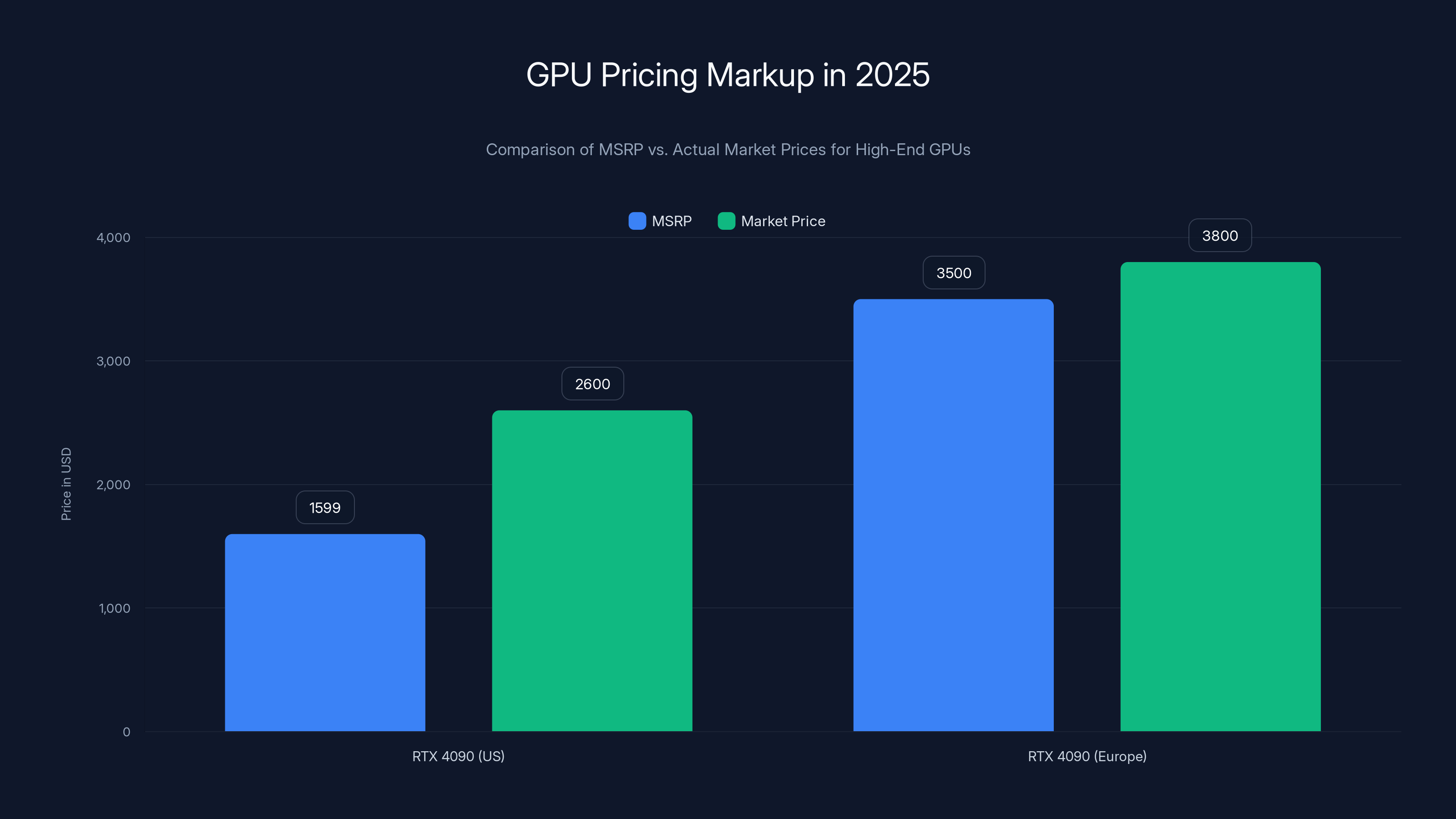

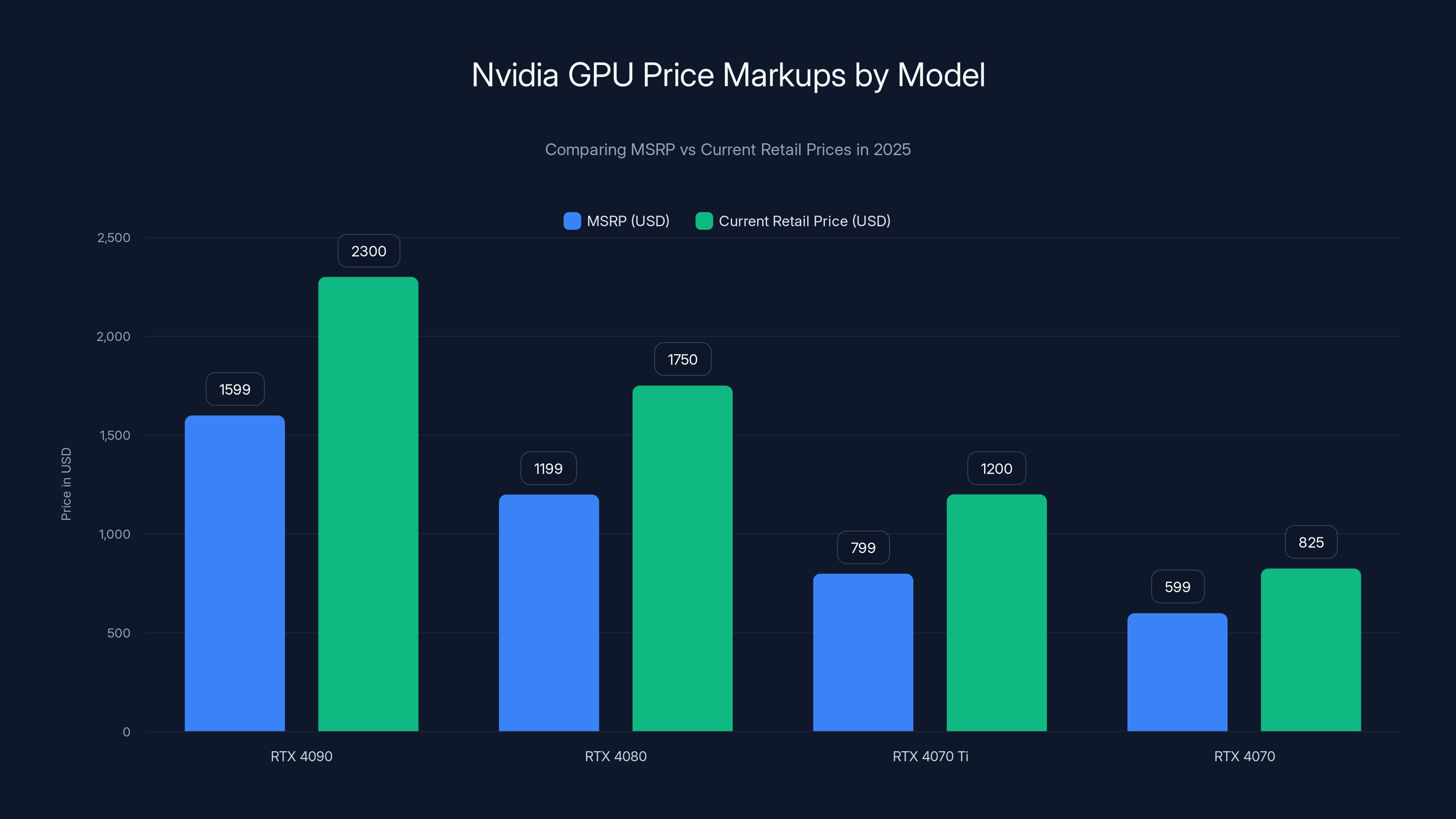

High-end GPUs like the RTX 4090 see significant markups in 2025, with US prices 50-75% above MSRP and European prices 120-150% higher, excluding VAT.

Understanding the GPU Pricing Landscape in 2025

The graphics card market in 2025 looks nothing like it did two years ago. Back in 2023, we were told prices would normalize. Supply chains would stabilize. Competition would drive prices down. Somehow, nearly all of that failed to materialize.

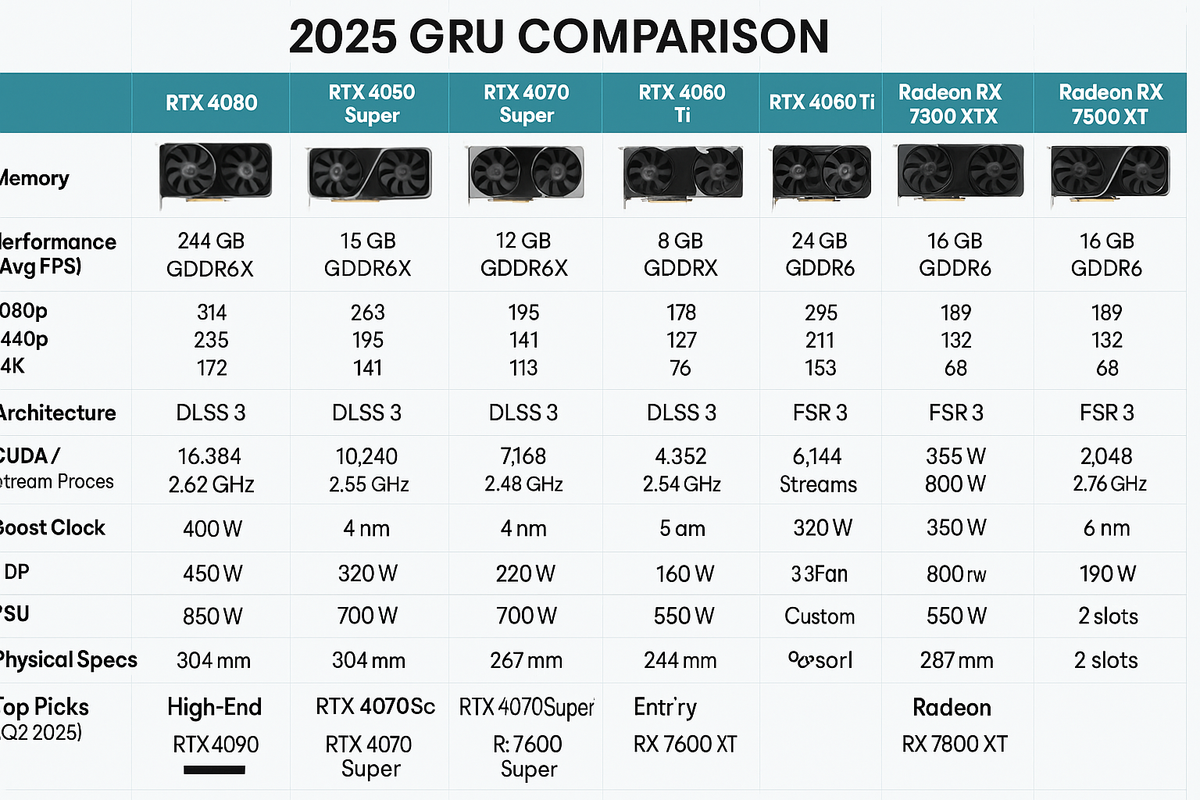

What we got instead was a strange hybrid market. Entry-level and mid-range cards (RTX 4060, RX 7600) are actually reasonably priced. Some are available at or near MSRP. But the moment you step into high-end territory (RTX 4080, RTX 4090, RTX 5090), prices spiral into another dimension entirely.

The global pricing report examined card pricing across dozens of markets and found consistent patterns. In the United States, an RTX 4090 with an MSRP of

Why is this happening? Several factors are colliding at once.

First, demand for high-end GPUs hasn't cooled off. If anything, it's accelerated. AI model training and inference workloads have exploded. Companies building AI applications desperately need compute power. Gamers pushing 4K gaming at high refresh rates still want the best cards available. Content creators working with video editing, 3D rendering, and machine learning haven't stopped needing performance.

Second, supply of premium cards is genuinely constrained. Nvidia has been strategic about manufacturing. They're not flooding the market. This keeps demand permanently ahead of supply, which means retailers and manufacturers have zero incentive to drop prices. Why would they? They'll sell every unit they have regardless.

Third, the market tier system has shifted. Nvidia's release strategy means there's a massive performance and price gap between the RTX 4080 and RTX 4090. If you want flagship performance, you're paying flagship prices. There's no middle ground anymore.

The Nvidia Markup Reality: How Bad Is It Really?

Nvidia cards are getting hit the hardest by global pricing markups, and the data backs this up clearly. Let's look at specific examples because abstract percentages don't hit the same way as concrete numbers.

The RTX 4090 launched at

The RTX 4080 faced similar pressure. With an MSRP of

But here's where it gets genuinely annoying. The RTX 4070 Ti, which should be a "more reasonable" option at

What makes this different from past GPU price spikes is the consistency. This isn't a temporary shortage situation. We're not in a panic-buying environment. These are just the prices. This is what these cards cost now. The market has reset at a higher equilibrium.

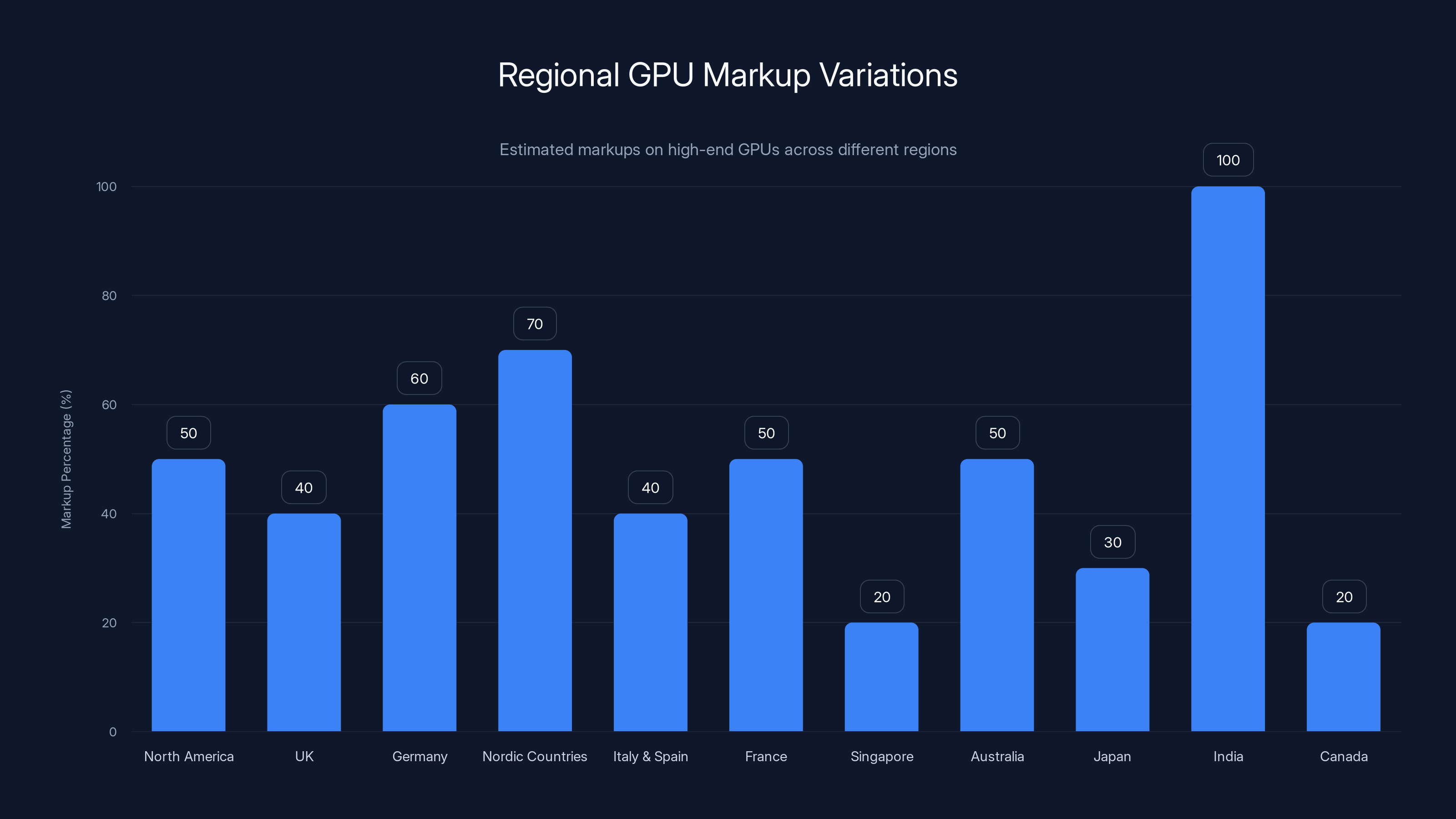

Regionally, the situation is even worse in some places. In the UK, the RTX 4090 consistently sells for £2,200 to £2,600, which is

India and Southeast Asia have it rough too. GPU prices in these regions are often higher than US prices even when adjusted for currency and purchasing power. An RTX 4090 in India might cost ₹400,000 to ₹500,000 (roughly

Why are Nvidia cards specifically being hit hardest? Because Nvidia controls 80-85% of the discrete GPU market. They have pricing power that AMD simply doesn't have. If you want high-end performance, you're buying Nvidia. Retailers know this. They price accordingly.

High-end Nvidia GPUs are selling at significant markups, with the RTX 4090 reaching up to 75% above MSRP in Europe. Estimated data.

Regional Pricing Variations: The Geography of GPU Markup Chaos

The global pricing report analyzed GPUs across 15+ major markets, and the variations are staggering. This isn't just about different currencies. It's about different supply chains, different retailer margins, and different levels of market power.

In North America, markups tend to run 40-60% above MSRP for high-end cards. This is frustrating but relatively consistent. Major US retailers like Newegg, Best Buy, and Amazon have standardized pricing, so you don't see massive variance between them. The problem is that even with competition, prices stay artificially high.

Europe tells a different story. UK prices are roughly 20-30% higher than US prices when you strip out VAT. That would make sense for logistics and taxes. But some cards show 50%+ premium even after VAT adjustment. Germany is particularly expensive. The RTX 4090 regularly costs €2,800 to €3,200 there, which after VAT removal still represents a huge markup.

Nordic countries (Denmark, Finland, Norway, Sweden) have even more aggressive markups. This might be due to smaller markets, less competition among retailers, and distribution constraints. An RTX 4090 in Copenhagen costs significantly more than the same card in Copenhagen, even accounting for regional price adjustments.

Italy and Spain show moderate markups, closer to UK levels. France pricing varies wildly depending on whether you buy from mainstream retailers or specialized PC builders.

In Asia-Pacific, Singapore has relatively competitive pricing, probably due to its regional hub status and strong electronics retail competition. Australia is expensive due to geographic isolation and higher operational costs. Japan is moderate. But India, Thailand, and Philippines see massive markups, sometimes 80-120% above US MSRP when you account for currency effects.

Canada sits between US and Europe pricing, typically 15-25% above comparable US prices.

What this tells us is that markup levels correlate with market size and retailer competition. Smaller markets with fewer competing retailers see worse prices. Markets dominated by one or two major electronics retailers show less price competition.

Why Are Nvidia Cards Getting Crushed More Than AMD?

AMD's RDNA 3 lineup (RX 7900 XTX, RX 7900 XT, RX 7800 XT) shows much more reasonable pricing than comparable Nvidia cards. The RX 7900 XTX, which competes with the RTX 4080, typically sells for

Why? Market position and demand dynamics.

Nvidia owns 80-85% of the discrete gaming GPU market. When you're the dominant player, you don't need to compete on price. You can maintain margins because customers have no alternative. If you want the best performance or the best driver support or CUDA compatibility, you're buying Nvidia. Retailers know this. They price accordingly.

AMD, meanwhile, is the challenger. They need volume to compete. They can't maintain high markups because people will just buy Nvidia instead. So AMD cards stay closer to MSRP as a competitive strategy.

This is classic monopolistic pricing. Nvidia isn't even competing on price anymore. They're just maintaining supply scarcity and letting retailers charge whatever the market will bear.

The CUDA ecosystem is part of this too. Developers, studios, and AI researchers have built their workflows around CUDA. Switching to AMD's ROCm is technically possible but painful. It requires rewriting code, retraining models, rebuilding pipelines. The switching cost is so high that Nvidia can charge premium prices and people still buy.

AI workloads have amplified this effect. A company training large language models doesn't care about the $400 price difference between an RTX 4090 and RX 7900 XTX. They care about compatibility with their existing infrastructure. CUDA is the standard. So they buy Nvidia at any price.

The Supply Constraint Myth: Are GPUs Actually Scarce?

Here's something that bothers me about the current narrative. Everyone keeps saying supply is constrained. But walk into a Micro Center or check Newegg, and you'll find most GPUs in stock. They're available. You can buy them today. So are they actually scarce?

The answer is nuanced. Entry-level and mid-range cards (RTX 4060, RTX 4070) have healthy inventory. Retailers maintain stock of these. Supply isn't tight.

But premium cards are different. RTX 4090, RTX 4080, RX 7900 XTX? These show limited inventory. Not zero inventory. Limited. You can find them, but quantities are low, and they're usually in stock for hours at a time before selling out again.

Nvidia is deliberately managing supply of high-end cards. They're not overproducing. This keeps demand permanently ahead of supply. With supply constraint, retailers don't need to compete on price. They can charge whatever they want because the next unit will sell at that price too.

It's a deliberate strategy. By maintaining artificial scarcity at the high end, Nvidia keeps margins healthy. If they flooded the market with RTX 4090s, prices would normalize in weeks. Instead, they trickle supply to selected partners and regions, keeping demand hot and prices elevated.

The curious thing is that this strategy works for both Nvidia and retailers. Nvidia gets to maintain premium pricing. Retailers get fat margins. Manufacturers in the AIB (add-in board) space like EVGA, MSI, and ASUS get steady (if limited) demand.

The only people who lose are customers.

Nvidia GPUs are experiencing significant price markups, with current retail prices far exceeding their original MSRPs. The RTX 4090, for example, now sells for an average of

Cryptocurrency's Ghost: Is This Another Mining Boom?

Some people wonder if we're in another cryptocurrency bubble that's driving GPU prices up. The answer is no, but it's not a clean answer.

Cryptocurrency mining has essentially stopped being GPU-profitable. Bitcoin mining moved to ASIC chips years ago. Ethereum moved to proof-of-stake and stopped being mineable. Most altcoins don't generate ROI for GPU miners anymore. The whole GPU mining ecosystem has largely dried up.

So GPU prices aren't being inflated by miners. This is actually worse because it means the pricing is just based on general demand and supply control. There's no external boom-bust cycle coming. This is the new normal.

The only exception is very new or very niche coins that still use GPU-friendly algorithms. But these represent a tiny fraction of demand. The main drivers are still gaming, AI, and content creation.

Interestingly, AI demand has somewhat replaced mining demand as a driver of high-end GPU scarcity. Both mining and AI training want massive amounts of compute and don't care about gaming-specific features. But AI is more economically viable, more persistent, and more widely distributed across companies and researchers. This makes AI demand more stable than mining demand.

The AI Factor: Why Demand Isn't Cooling

Here's what's changed since 2023. Back then, we thought the GPU market would normalize as AI hype cooled. It hasn't. If anything, AI demand has intensified.

Every major tech company (Open AI, Google, Meta, Microsoft, Anthropic, Mistral, etc.) is building AI infrastructure. Every one of them needs GPUs. Startups building AI applications need GPUs. Researchers need GPUs. Even small companies are experimenting with local AI models and fine-tuning.

AI model training demands are insane. Training a single large language model requires thousands of H100 or RTX 6000 GPUs running for weeks. Inference at scale requires even more infrastructure. Companies are spending millions on GPU infrastructure every year.

For consumer-grade cards like the RTX 4090, demand is split between gaming (still the majority), content creation (3D rendering, video work), and people experimenting with local AI models. All three segments want flagship performance. All three segments have budget to spend.

The AI factor has essentially locked in demand for premium GPUs. Gamers need them. AI researchers need them. Content creators need them. It's a trifecta of demand that all points toward scarcity and high prices.

Launch Pricing vs Reality: The MSRP Disconnect

There's this weird thing that happens with MSRP pricing in the GPU market. Nvidia announces a GPU at a certain price, and everyone assumes that's what it'll cost. Then reality hits and it doesn't.

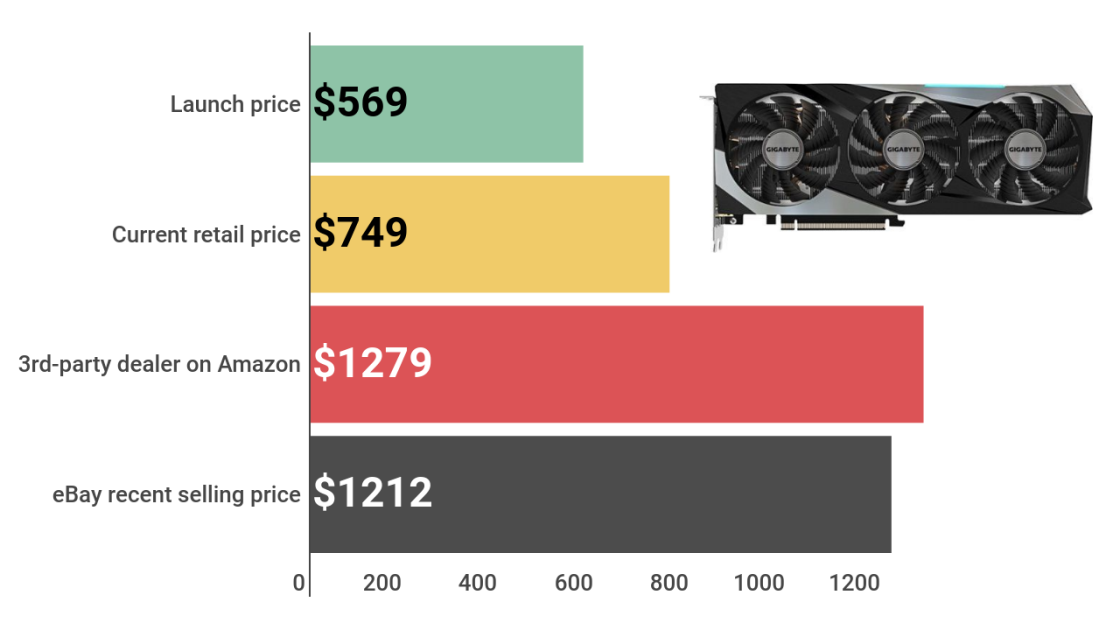

This has always happened to some degree, but the gap has widened. The problem is that MSRP is more of a suggested number than an actual floor. Nvidia sells some cards directly to OEMs and major partners at suggested pricing. Those cards never hit the retail market. Instead, AIB partners (third-party manufacturers) build custom versions with better coolers, higher clocks, and different designs, then set their own prices.

By the time cards reach retail channels (Newegg, Amazon, Best Buy, Micro Center), they're already marked up 20-30% by the AIB partners. Then retailers add their margin. You end up 40-60% above MSRP before anyone leaves the store.

What's changed is that this markup is becoming permanent. It's not a launch window thing. It's how the market operates now. The "actual" price of an RTX 4090 is

Some argue this is fine because MSRP is "just a suggestion." And technically, yes. But it's misleading. When Nvidia announces a new GPU at a price point, they're implicitly saying that's what customers should expect to pay. The reality is 40-60% higher. That's deceptive.

Estimated data shows significant regional variations in GPU markups, with India experiencing the highest markups at 100%, while Singapore maintains competitive pricing at 20%.

Manufacturer Positioning: Are AIB Partners Responsible?

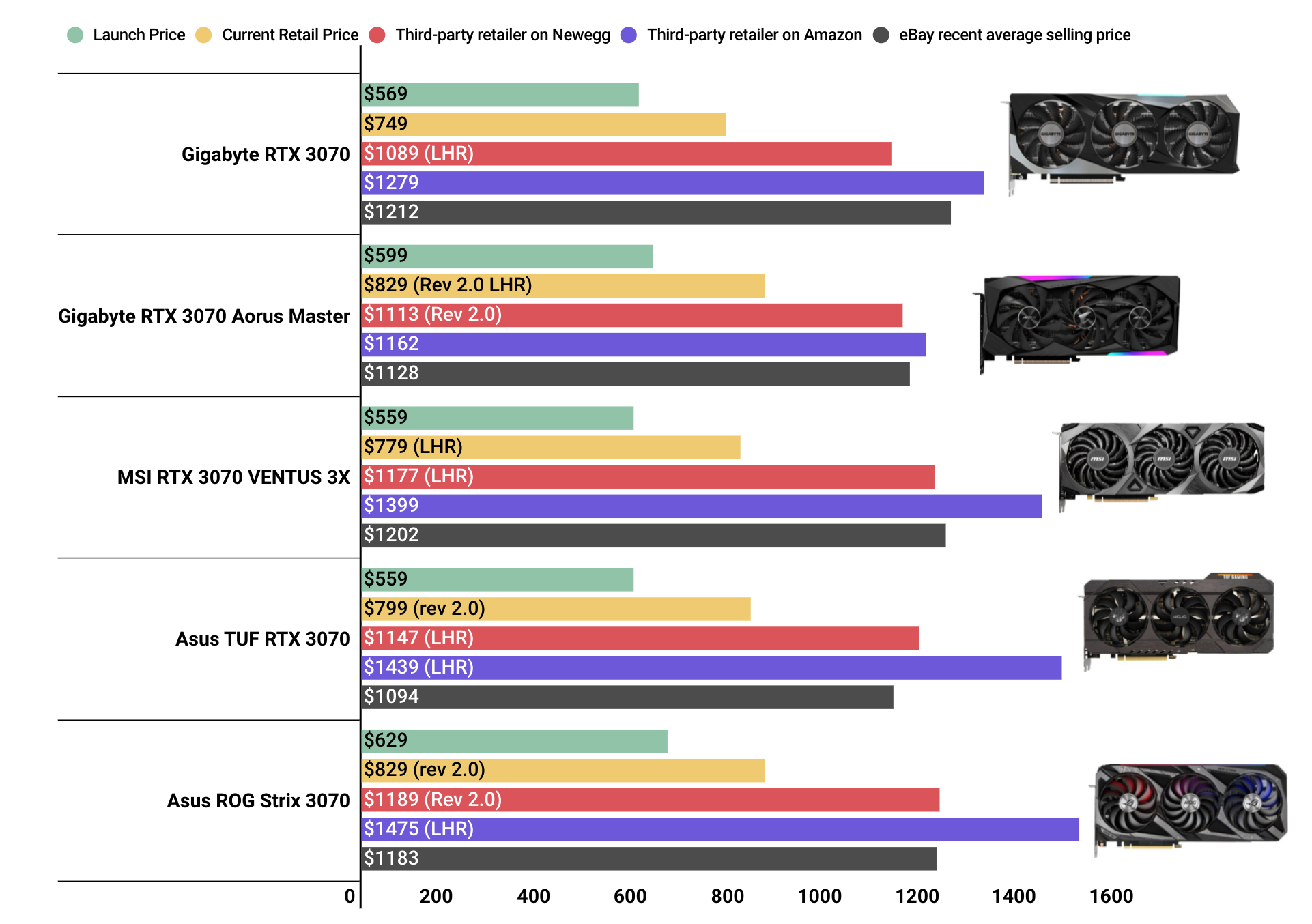

AIB partners (Asus, MSI, Gigabyte, EVGA, PNY, Zotac, etc.) get blamed a lot for high GPU prices. They're the ones doing the final pricing to retailers. But are they the real culprits?

Partially. AIB partners do add significant markups. A card that costs Asus

But here's the thing: Nvidia doesn't force this markup. They just provide the GPU chips. AIB partners decide their margins. If margins weren't profitable at

So AIB partners are complicit in high pricing, but they're not the primary driver. They're responding to market demand and supply constraints that Nvidia created.

The Retail Experience: Where Prices Get Really Messy

Retailers are the final link in the pricing chain, and they have more power over GPU prices than you'd think.

Major retailers like Newegg, Best Buy, and Amazon maintain relatively consistent pricing because they have warehouse operations and corporate structure. But boutique retailers, PC builders, and local computer shops? They have wildly different pricing.

Walk into a local PC building shop in a major city, and you might find RTX 4090s listed at

Online marketplaces like eBay, Amazon Marketplace (from third-party sellers), and local classified sites have even wider variation. Sometimes you find deals 10-15% below standard retail. Sometimes you find the same card 30-40% above retail from sellers trying to exploit demand.

International retailers operate differently too. If you're buying a GPU from a European retailer to import to the US, you might find better prices in some cases, worse in others. It depends on that country's tax structure and retailer competition.

Cryptocurrency Comparison: Why This Time Is Different

The last major GPU price spike was during the cryptocurrency mining boom (2017-2018, 2020-2021). Those spikes were brutal but temporary. Miners drove demand through the roof, then market crashes or mining difficulty increases made mining unprofitable, demand dropped, and prices normalized.

This situation is fundamentally different.

First, demand is more diversified. Gaming, AI, and content creation all drive demand independently. No single sector can crash and collapse the entire market.

Second, the underlying economic value is stronger. Companies training AI models are generating business value. The infrastructure investment makes sense. This isn't speculative mining. It's productive use.

Third, supply control is more intentional. During mining booms, manufacturers ramped production to capitalize on high prices. Then oversupply crashed prices. Nvidia has learned from this. They're deliberately managing supply to avoid oversupply.

Fourth, regulatory risk is lower. Cryptocurrency is regulatory minefield. AI is being regulated but not banned. The market feels safer.

What this means is that unlike crypto-driven spikes, GPU prices might stay elevated for years. There's no clear catalyst for normalization. Demand will only grow as AI adoption accelerates. Supply is being carefully managed. Pricing power is in the right hands.

The crypto boom was a temporary price fever. This feels permanent.

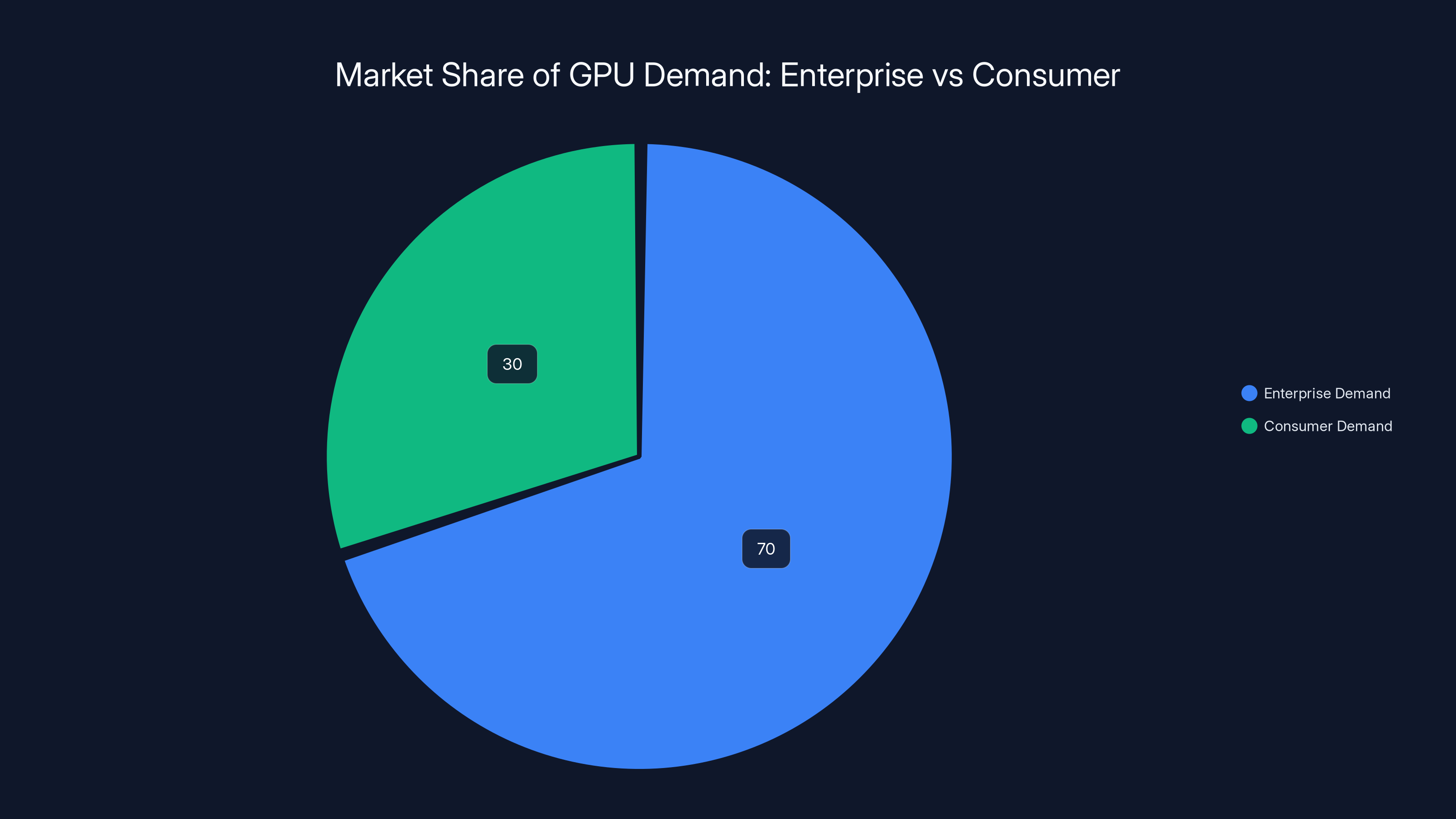

Enterprise demand dominates the GPU market with an estimated 70% share, significantly influencing pricing and availability for consumer GPUs. Estimated data.

Secondary Market Dynamics: Used GPU Pricing

One way to measure GPU price inflation is to look at the used market. If new cards are massively overpriced, used cards should offer good value. But the used GPU market is weird right now.

Used RTX 4090s are selling for

Why? Because even at those prices, used cards are cheaper than new. And buyers want flagship performance. So supply of used cards is limited. People aren't selling their RTX 4090s when they're still expensive and still functional.

The narrow gap between used and new prices tells you something important: the market believes these prices are sustainable. If retailers thought new card prices would drop soon, they'd liquidate inventory and prices would fall. Instead, they're holding inventory at high prices because they believe that's the market rate.

Interestingly, older high-end cards are holding value better than usual. A used RTX 3090 still commands $800-1,000 on the secondary market. Compare that to GPUs from previous generations that typically lose 40-50% of value after a year or two.

This is a healthy secondary market for resellers but bad news for people hoping prices will drop soon. Strong secondary market prices mean the primary market has no pressure to lower prices.

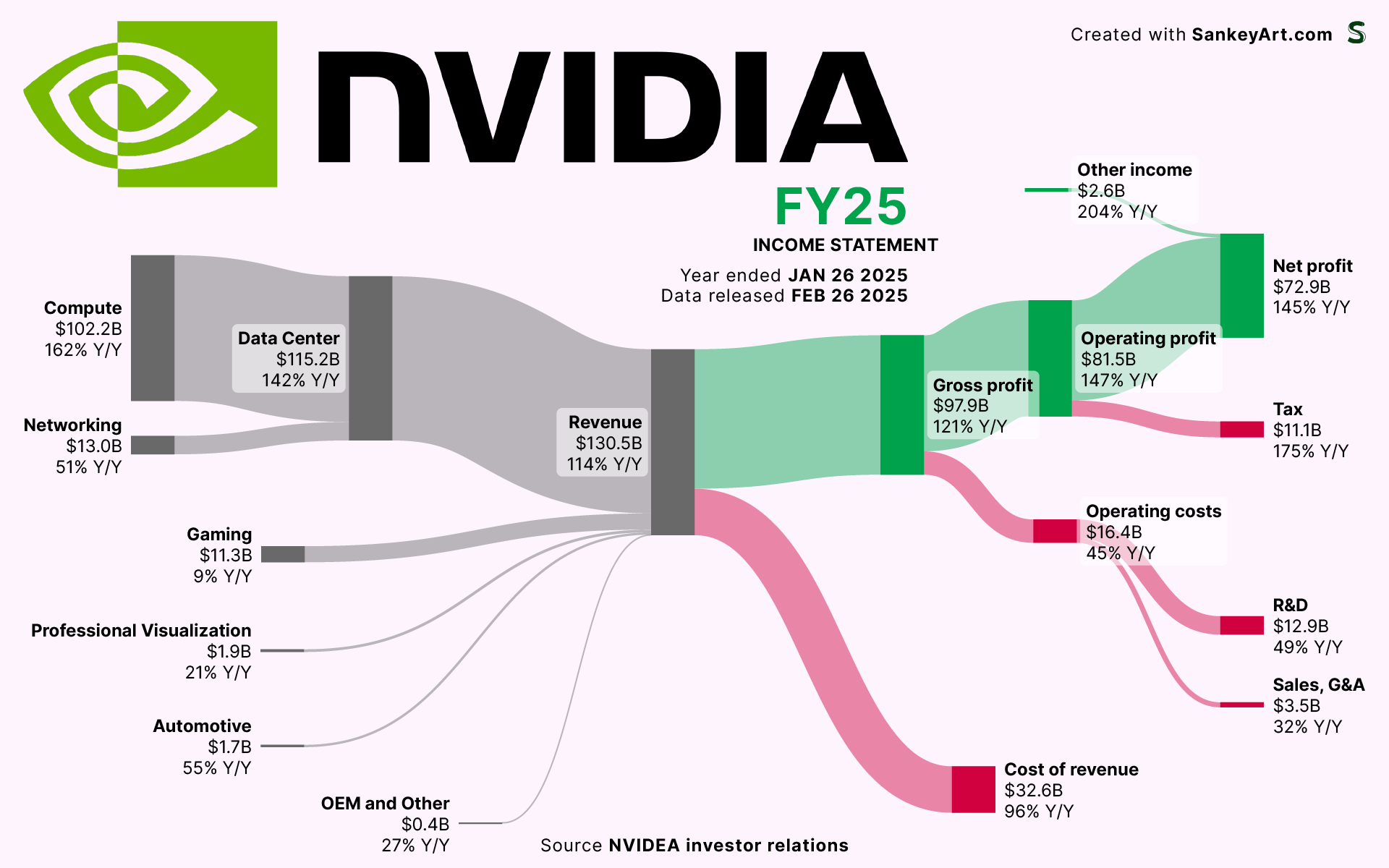

The Enterprise Factor: Data Centers Drive Demand

Consumer GPU pricing gets most of the attention, but enterprise GPU demand is actually moving markets more than gaming demand these days.

Data centers buy high-end Nvidia cards in bulk. The RTX 6000 Ada, H100, and even older H800 chips are enterprise products, but they influence consumer pricing by consuming manufacturing capacity.

When every major cloud provider (AWS, Google Cloud, Azure) is competing to build AI infrastructure, and every startup is desperate for GPU compute, the enterprise market gets priority allocation. This means consumer-grade cards get less manufacturing capacity.

More importantly, enterprise demand validates high GPU prices. If companies are paying

The enterprise GPU market is essentially unlimited in budget. A company can spend $100 million on GPU infrastructure and still want more. Consumer demand, while growing, is still constrained by individual budgets. So Nvidia naturally prioritizes enterprise.

This dynamic probably won't change soon. Enterprise demand for AI compute is still accelerating. Companies are building out infrastructure. The data center GPU market is supply-constrained too. Everything points toward continued pressure on consumer GPU availability and pricing.

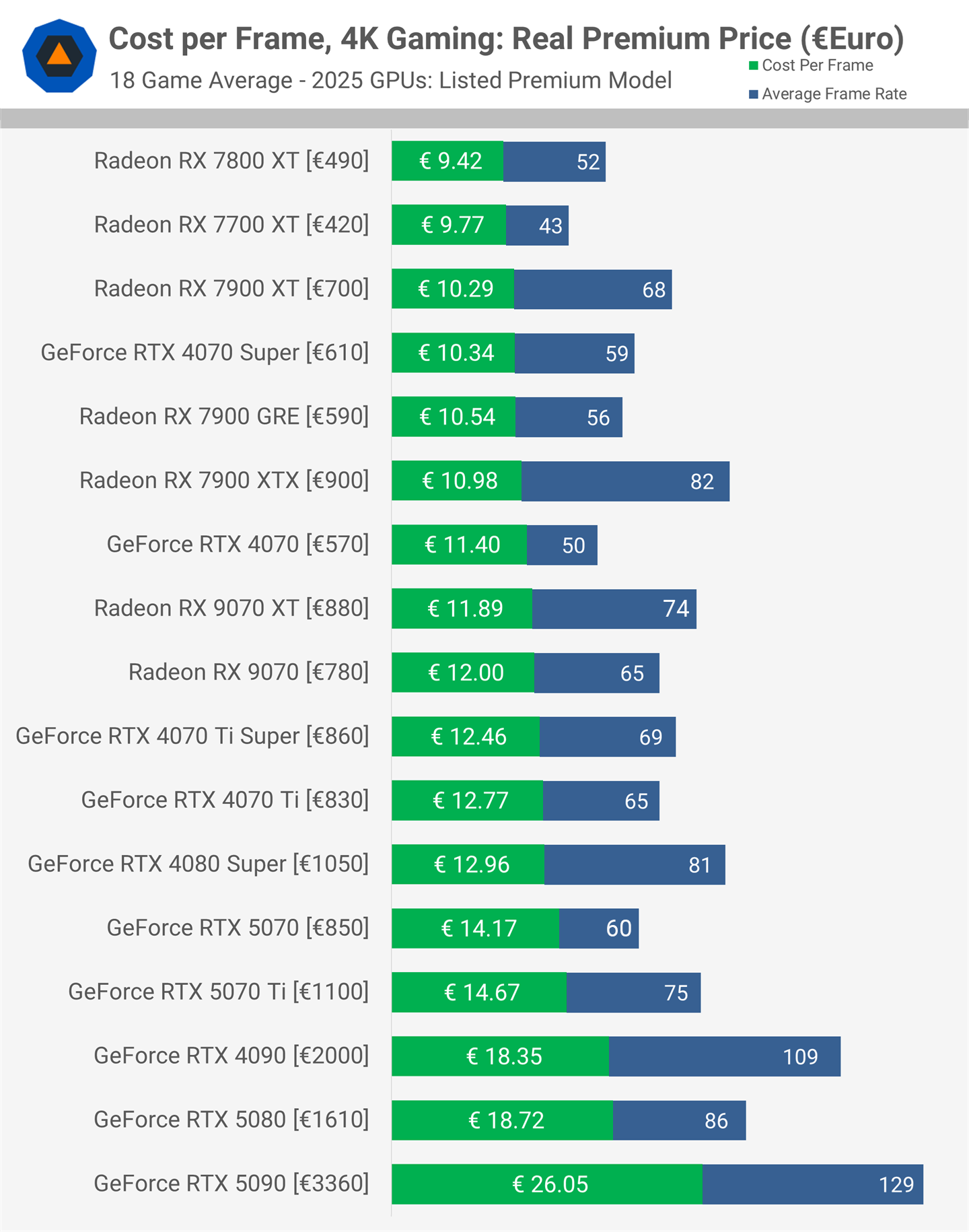

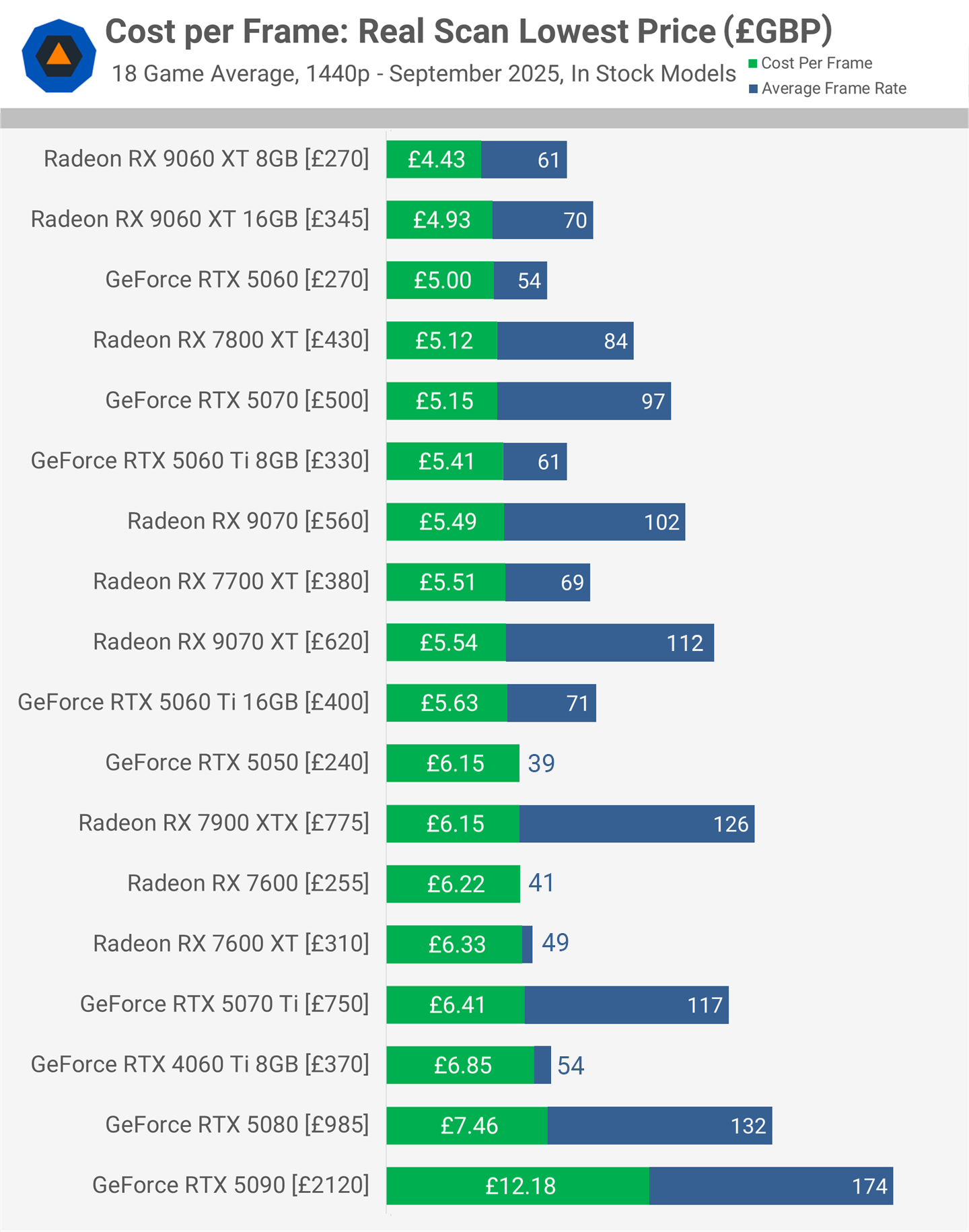

Gaming Performance vs Price: Is It Still Worth It?

Here's the hard question: at

For most gamers, the answer is no. Not because the RTX 4090 isn't an incredible card (it is), but because the performance gains don't justify the price anymore.

An RTX 4080 at (inflated)

An RTX 4070 at

AMD's RX 7900 XT at

What's happened is that the price-to-performance curve has bent. The RTX 4090 used to be expensive but justified. Now it's expensive and hard to justify unless you're a professional or serious enthusiast.

This might actually be healthy for the market. Extreme flagships shouldn't be accessible to everyone. But the problem is that pricing has increased across the entire stack, not just the top. Even the RTX 4070, which is supposed to be an accessible high-end card, is overpriced.

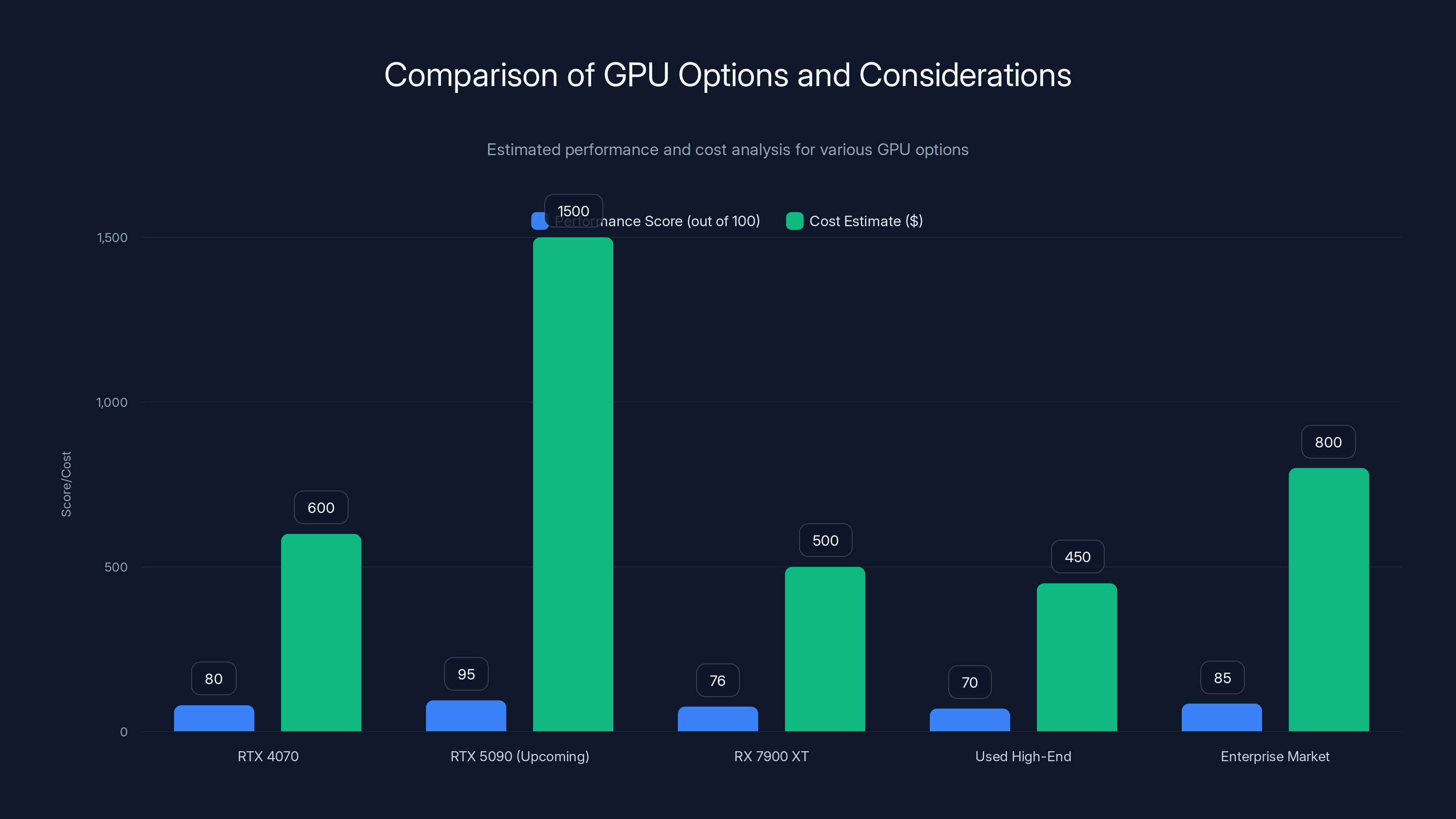

The RTX 4070 offers high performance for most games at a moderate cost. Upcoming models like the RTX 5090 promise higher performance but at a premium. The RX 7900 XT provides a cost-effective alternative with competitive performance. Estimated data.

Potential Disruption: Is Competition Coming?

Nvidia has dominated for so long that competition feels impossible. But there are a few scenarios where GPU pricing could reset.

Intel Arc, Nvidia's other main competitor, is still ramping. Arc Alchemist (RTX 40-series equivalent) had some issues, but Intel is committed to the space. If Arc generation two (Battlemage) delivers competitive performance at significantly lower prices, it could disrupt Nvidia's pricing power.

AMD's RDNA 4 is coming later in 2025. If RDNA 4 delivers strong gaming performance and competitive pricing, it could apply pressure to Nvidia's consumer lineup.

The real wild card is that software competition could reduce Nvidia's moat. If AMD's ROCm platform becomes easier to use and more developers build for it, CUDA's ecosystem advantage shrinks. That would make it easier to buy AMD.

But realistically, none of these feel like they'll cause dramatic repricing soon. Nvidia's lead is too large. The CUDA ecosystem is too entrenched. Even if competition improves, Nvidia probably maintains significant pricing power.

The only realistic scenario for rapid price normalization is a sudden surge in manufacturing that overwhelms demand. But Nvidia probably won't allow that. They'll keep supply controlled and let prices stay high.

What To Do If You Actually Need a GPU

So you're in the market for a graphics card. Prices are insane. What's the play?

First, define your actual needs. Do you need a flagship, or will a midrange card work? An RTX 4070 will game at 4K on high settings on 80% of games released. For most people, that's plenty. But if you're chasing absolute maximum performance or need professional capability, you're paying flagship prices no matter what.

Second, consider your alternatives. If you can wait 6-12 months, new card generations will arrive. The RTX 5090 is coming. RDNA 4 is coming. New products often reset pricing in their market segment. If you can defer your purchase, it might be worth it.

Third, evaluate used options carefully. Used high-end cards are holding value, but there's still a 15-25% discount to new. If you buy used, get a card from a reputable seller, look for one that's been kept cool (preferably from gaming use rather than mining), and verify it works before the return window closes.

Fourth, consider AMD. The RX 7900 XT is $150-200 cheaper than comparable Nvidia cards and delivers 95% of gaming performance. For gaming, that's a legitimate option. For CUDA-dependent work, it's not.

Fifth, check multiple retailers. Price variance between retailers is significant. Spending an hour comparing prices could save you $200-400.

Sixth, consider the used enterprise market. Sometimes companies upgrade their server GPUs and sell previous-generation professional cards. An RTX 6000 Ada might be more than you need but could be available at better prices than consumer cards.

Seventh, if you're doing AI work, consider cloud GPU rental. Renting compute time from cloud providers can sometimes be cheaper than buying hardware, especially if you don't need the GPU full-time.

The Margin Question: How Much Profit Are We Talking About?

Let's get specific about margins. What's actually happening financially here?

An RTX 4090 probably costs Nvidia

That's a rough breakdown for normal conditions. But at current prices?

Retailers are charging

Some of it is real: shipping costs more, storage in inventory costs more, customer service is more expensive. But most of it is profit. Retailers are capturing an extra $500+ per card in margin above normal.

AIB partners are probably also taking wider margins, not just absorbing retailer markups. They might be capturing an extra $100-200 per card.

Nvidia itself doesn't directly benefit from the $1,200+ markup, but they benefit from having GPUs maintain high market value, which keeps demand strong and CUDA ecosystem perception strong.

So the breakdown is probably something like: retailers get

This is why retailers can't compete each other on price. They're all making unprecedented margins. Lowering prices means cutting into profit margins that have become the norm.

Regional Government Intervention: Will Regulation Help?

Some governments have looked at GPU pricing and considered intervention. It seems absurd that a piece of hardware costs 2x what it should. Can regulation help?

Probably not much. Here's why.

GPU pricing isn't technically illegal. There's no price ceiling. Retailers are allowed to charge whatever they want. Nvidia is allowed to manage supply. There's no monopolistic behavior that clearly violates antitrust law in most jurisdictions.

The EU has antitrust concerns about Nvidia's market position generally, but not specifically about GPU pricing. Regulation could potentially force Nvidia to license CUDA or open the ecosystem, which would increase competition. But that would take years and might not even happen.

Price controls could theoretically be imposed, but most governments have learned that price controls cause bigger problems than they solve (shortages, reduced investment, black markets).

So realistically, regulation isn't coming to fix GPU pricing. The market will have to work it out itself, which means... waiting for competition or demand to cool. Neither seems imminent.

What might change is import policies. Some countries might reduce tariffs on imported electronics to make it easier to source GPUs from cheaper markets. But this would be a slow shift.

Predictions: Where Does This Go?

If I had to predict GPU pricing over the next 18-24 months, here's what I think happens.

Premium cards (RTX 4090, RTX 5090, RX 7900 XTX) stay expensive. The markups might vary between 40-80% MSRP, but prices don't normalize. Why? Enterprise demand remains strong. Gaming demand is robust. Supply is controlled. There's no pressure to drop.

Midrange cards (RTX 4080, RTX 4070) might see slight cooling as older inventory clears and new products launch. But we're talking 5-10% price movement, not 30-40%.

Entry-level and budget cards probably stay reasonable because they already have normal margins.

When new architectures launch (RTX 5090, Blackwell consumer variants, RDNA 4), there might be temporary price resets as older inventory clears. But new flagship prices will probably launch high and stay there.

AI demand probably keeps accelerating, which keeps enterprise GPUs expensive, which supports consumer GPU pricing.

The earliest we might see substantial repricing is 2026-2027 if competition improves dramatically or if AI demand suddenly evaporates. Neither seems likely soon.

The Broader Market Impact: What This Means for PC Gaming

High GPU prices have real impacts on the broader PC gaming market.

First, more people are staying on older GPUs longer. If an RTX 3080 or RTX 4070 is already pretty good, and upgrading costs $2,000+, you're probably keeping your current card. This extends upgrade cycles, which is bad for hardware makers but good for consumers in a weird way.

Second, pre-built systems are becoming more popular. Builders buying in bulk can secure cards at lower prices than individuals. Systems from companies like Alienware or NZXT often have better GPU pricing than buying standalone cards. This shifts power from the GPU market to the system integrator market.

Third, mobile gaming and console gaming become more attractive relative to PC gaming. If you can't afford to build a nice PC but you can afford a PS5 or gaming laptop, that's what you do.

Fourth, professional work that was traditionally done on desktop GPUs shifts to cloud solutions (AWS, Azure, Google Cloud). Why buy an expensive GPU when you can rent compute? This is actually happening.

Fifth, 1440p gaming becomes the "real" target for gaming-focused consumers, not 4K. A good 1440p system is actually affordable. A good 4K system requires premium GPUs.

Overall, high GPU prices are probably narrowing the PC gaming market slightly. Fewer people can afford enthusiast systems. This might be good news for console makers and bad news for Nvidia long-term, but that shift takes years.

Sustainability of High Pricing: How Long Can This Last?

The real question: is this pricing sustainable long-term, or will it eventually crash?

Market factors suggest sustainability:

- Demand from AI, gaming, and content creation is real and growing

- Supply control is intentional and manageable

- CUDA ecosystem creates artificial Nvidia moat

- Enterprise demand provides cushion even if gaming demand weakens

- No credible competition is arriving soon

Factors that could break the model:

- Sudden AI demand crash (seems unlikely)

- Major competition breakthrough (Intel, AMD doing much better)

- Manufacturing capacity surge (Nvidia allows supply to increase massively)

- Regulatory action (probably won't happen soon)

- Economic recession reducing demand (possible but would be a broad market thing)

My assessment: the current pricing is sustainable for 18-36 months minimum. After that, variables matter. If AI demand stays hot and competition doesn't improve, prices stay high. If either changes, pricing resets.

For practical purposes, assume GPU prices won't return to 2020 levels anytime soon. If you need a GPU, budget for 2025 prices, not launch prices.

FAQ

Why are GPU prices so high right now?

GPU prices are elevated due to a combination of factors: sustained high demand from AI model training, continued gaming demand, supply constraints that Nvidia deliberately maintains, and Nvidia's market dominance reducing price competition. Unlike previous price spikes driven by cryptocurrency mining, current pricing is driven by productive use cases (AI, gaming, content creation) that show no signs of cooling. Supply constraint is intentional, not accidental, which means retailers and manufacturers have no incentive to lower prices. The result is that high-end Nvidia GPUs consistently sell at 40-80% markups above suggested retail price globally.

How much more expensive are GPUs than they should be?

High-end Nvidia GPUs currently sell for 40-80% above their suggested retail price depending on region and specific model. The RTX 4090 with an MSRP of

Is this a temporary spike like cryptocurrency mining caused?

No, this pricing environment appears more permanent than previous GPU spikes. Cryptocurrency mining demand was boom-bust cyclical—when mining crashed, GPU prices normalized quickly. Current demand is diversified across AI model training, gaming, and professional content creation, making it more resilient. Supply constraints are being deliberately managed by Nvidia rather than being accidental shortages that will resolve with time. Enterprise data center demand creates a price floor that gaming demand alone wouldn't support. Collectively, these factors suggest elevated GPU pricing will persist for years rather than months, making this more of a market restructuring than a temporary spike.

Should I buy a GPU now or wait for prices to drop?

If you actually need a GPU for work or gaming, buying now makes sense because there's no clear timeline for price normalization. If you can wait 6-12 months, new GPU generations (RTX 5090, RDNA 4) will arrive and might reset pricing in their market segments. Consider whether you really need flagship performance or if a mid-range card (RTX 4070, RX 7900 XT) would meet your needs at better value. Shopping across retailers can save $200-400 on high-end cards, which is worth your time. Used GPUs offer 15-25% discounts to new prices, making them a reasonable option if you buy from reputable sellers and verify functionality.

Why is Nvidia hitting with more markup than AMD?

Nvidia holds 80-85% of the discrete GPU market, giving them pricing power that AMD lacks. When customers want the best performance or need CUDA compatibility, they must buy Nvidia regardless of price. AMD, as the challenger, cannot maintain high markups because people would just switch to Nvidia. The CUDA ecosystem creates an additional barrier because developers have built workflows around it, making switching costs high. This allows Nvidia to maintain premium pricing while AMD must stay closer to MSRP to compete on value. Enterprise AI demand specifically prefers Nvidia due to CUDA optimization and ecosystem maturity, further supporting Nvidia's pricing power.

Are there any good GPU alternatives to Nvidia right now?

AMD's RX 7900 XT offers excellent gaming performance (95% of RTX 4090 capability) at significantly lower prices (

What's happening with the used GPU market?

Used GPUs are holding value better than expected because the gap between used and new prices is only 15-25% instead of the typical 30-40%. This indicates the market believes current prices are sustainable rather than temporary. Older high-end cards (RTX 3090) are retaining value better than historical precedent. The strong used market means limited price leverage from used options and suggests the primary market doesn't expect prices to drop significantly soon. When shopping used, verify the card's history (gaming vs mining use), check return policies, and use trusted platforms like Swappa or eBay with buyer protection.

Will government regulation help lower GPU prices?

Government intervention on GPU pricing is unlikely in the near term. There's no illegal price fixing or clear antitrust violation specific to GPU pricing itself—retailers are allowed to charge what the market will bear. The EU is investigating Nvidia's broader market position and CUDA licensing, but specific pricing regulation is unlikely. Price controls typically create bigger problems (shortages, reduced investment) than they solve. Tariff reduction on imported electronics could marginally help pricing over years, but would be a slow change. The market will likely resolve pricing through competition or demand changes rather than regulation.

How long will GPU prices stay this high?

Based on current market fundamentals, expect elevated GPU pricing to persist for at least 18-36 months. AI demand shows no signs of weakening. Supply constraints are manageable and intentional. Competition isn't improving quickly enough to pressure prices. The only scenarios that would reset pricing soon are a sudden AI demand crash (unlikely), major competition breakthroughs (slow-moving), manufacturing capacity explosion (Nvidia won't allow), or recession (unpredictable). If you're planning a PC upgrade, assume 2025 pricing is the new normal rather than an anomaly that will reverse. New GPU generation launches might cause temporary ripples, but fundamental pricing levels will likely remain high.

Closing Thoughts: The New GPU Economy

The absurdity of GPU pricing in 2025 isn't actually absurd when you look at the economic fundamentals. Demand is genuinely strong across multiple sectors. Supply is deliberately constrained. Competition is weak. Market power is concentrated.

This is the market working exactly as economic theory predicts. When demand exceeds supply and one company controls the supply, prices rise. When prices rise and there's no viable alternative, they stay elevated. When they stay elevated long enough, they become normalized.

What's changed is that GPU pricing has normalized at a level that seemed crazy two years ago. The RTX 4090 at $2,200 is no longer news. It's just what the card costs. Retailers stock them at that price. Customers expect to pay that. The market has reset.

This isn't temporary. This is structural.

For gamers, creators, and researchers who actually need graphics cards, this means budgeting for premium pricing and shopping carefully. For the broader market, it probably means cooling growth in PC gaming and accelerating adoption of cloud-based GPU computing and console gaming.

Nvidia has managed to monetize their market position more effectively than nearly any tech company in recent memory. Whether that's good or bad depends on your perspective. For shareholders, it's great. For customers, it's brutal.

The question for the next two years is whether this pricing environment persists or breaks. My money is on it persisting. The fundamentals support it. Nothing credible is disrupting it soon. And Nvidia isn't giving this up voluntarily.

If you're in the market for a GPU, make peace with the prices. This is what graphics cards cost now. Plan accordingly.

Key Takeaways

- High-end Nvidia GPUs carry 50-150% markups above MSRP globally, with premium cards suffering worst inflation

- AMD cards remain closer to retail price due to competitive positioning, offering better value-per-performance

- Supply constraints are intentional strategy by Nvidia, not accidents, keeping demand perpetually ahead of supply

- Enterprise AI demand is now primary driver of GPU prices, replacing cryptocurrency mining as demand source

- Current pricing environment appears sustainable for 18-36+ months with no clear catalyst for normalization

![GPU Price Hikes Hit Hard: Nvidia Faces Brutal Global Markup Reality [2025]](https://tryrunable.com/blog/gpu-price-hikes-hit-hard-nvidia-faces-brutal-global-markup-r/image-1-1771429011329.jpg)