DDR5 RAM Prices Finally Stop Rising, But the News Isn't Great

Something weird happened in the RAM market over the past few months. After prices quadrupled in a matter of weeks during late 2025, they suddenly stopped climbing. On the surface, that sounds like good news. Stabilization sounds like relief. Stability sounds like normalcy returning.

Except it doesn't mean any of that.

The prices stabilized at around $900 per 64GB kit. That's not stabilization due to increased supply or manufacturing efficiency. That's stabilization because buyers essentially gave up. The market hit a ceiling not because sellers reached their limit, but because buyers reached theirs, as highlighted in a TechRadar report.

Let me explain what actually happened, why it matters, and what it means for your PC upgrade plans heading into 2026.

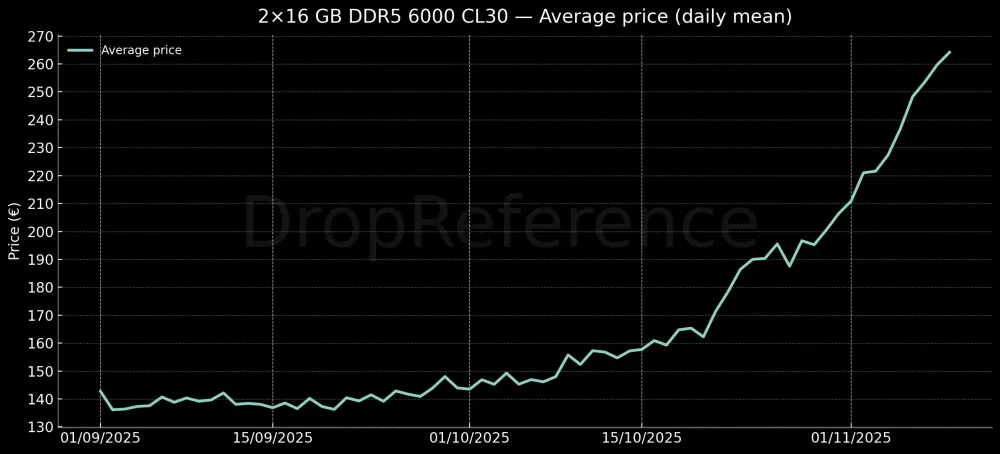

The Shocking Price Explosion That Triggered the Market Reset

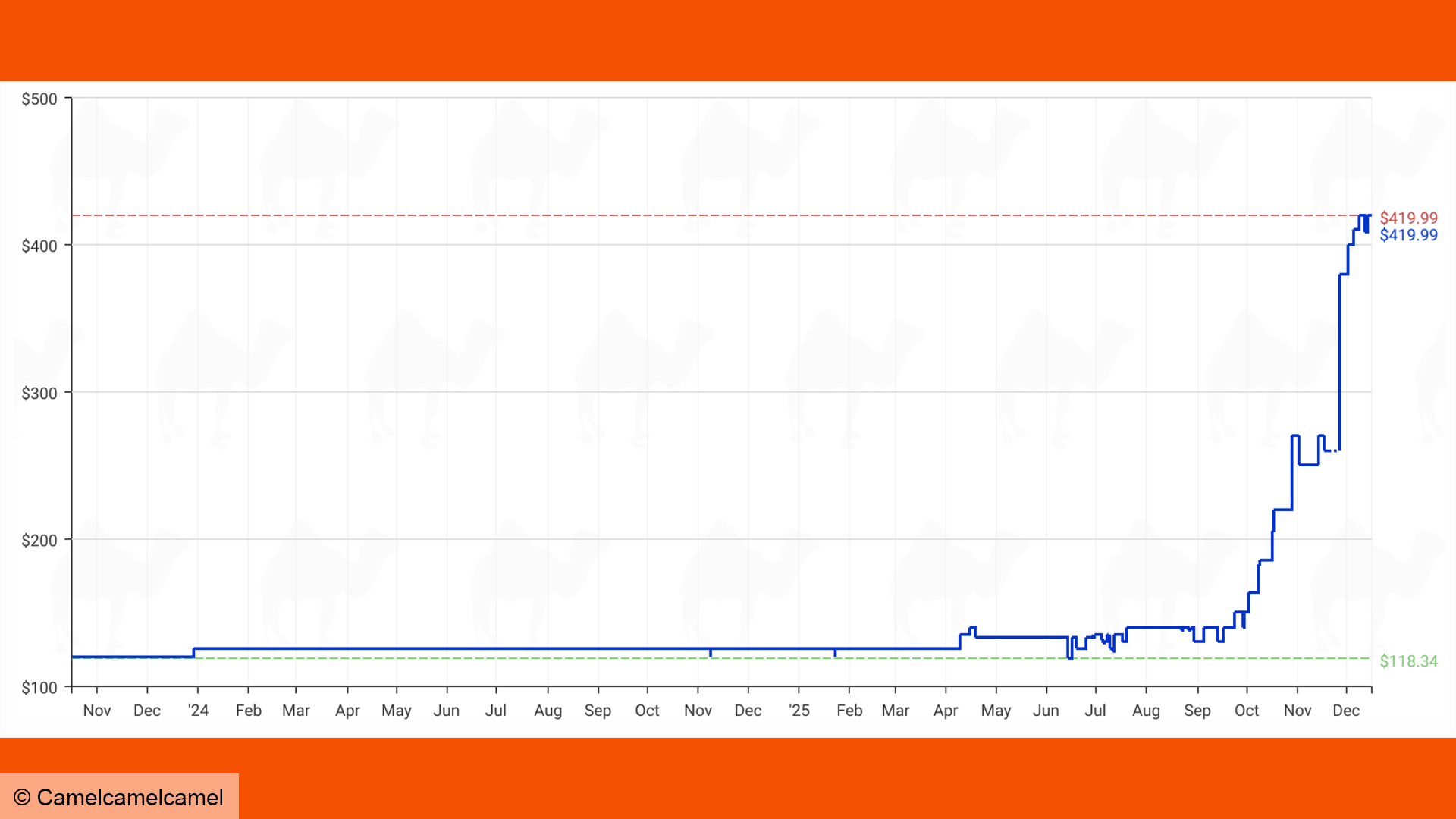

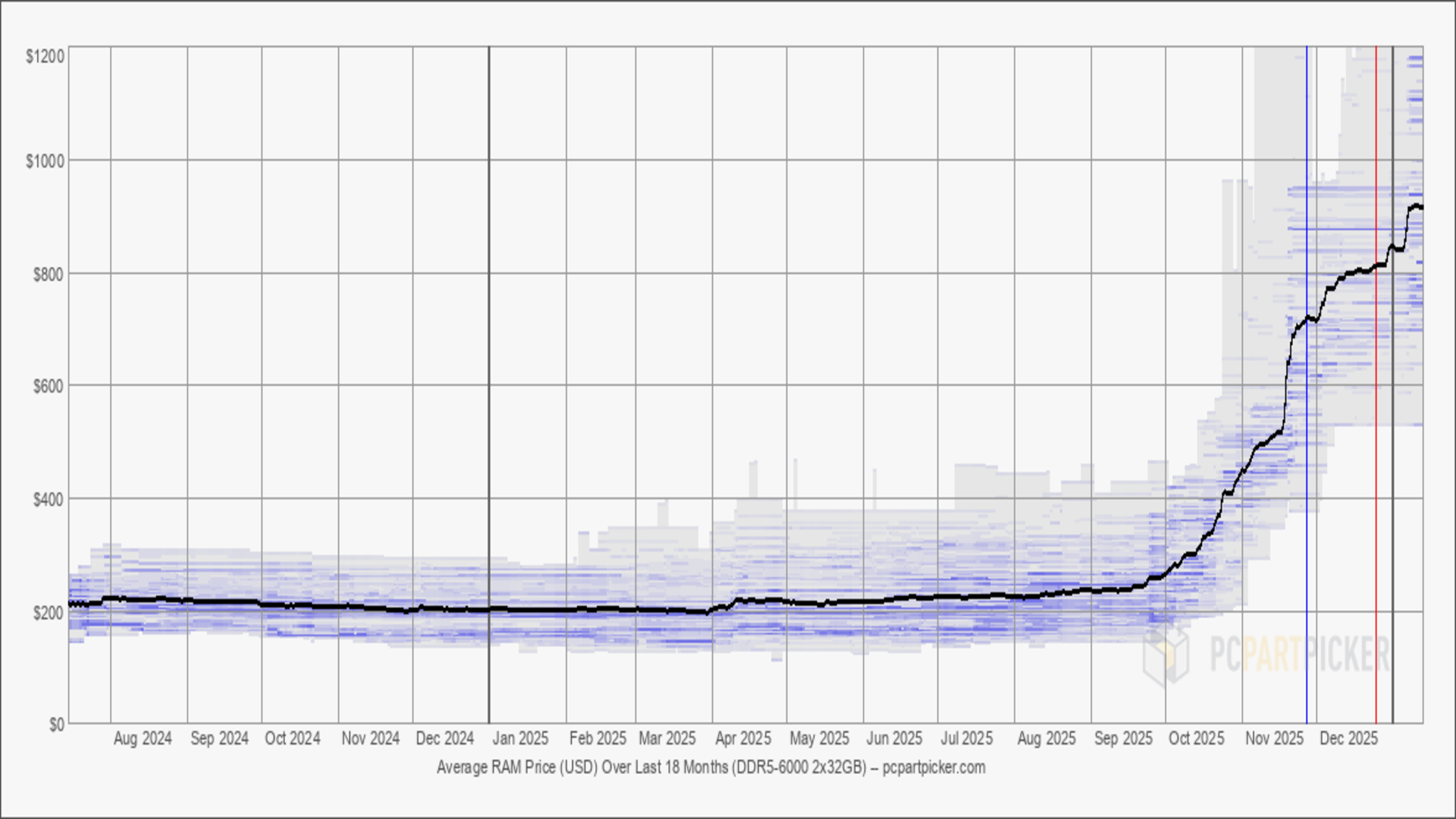

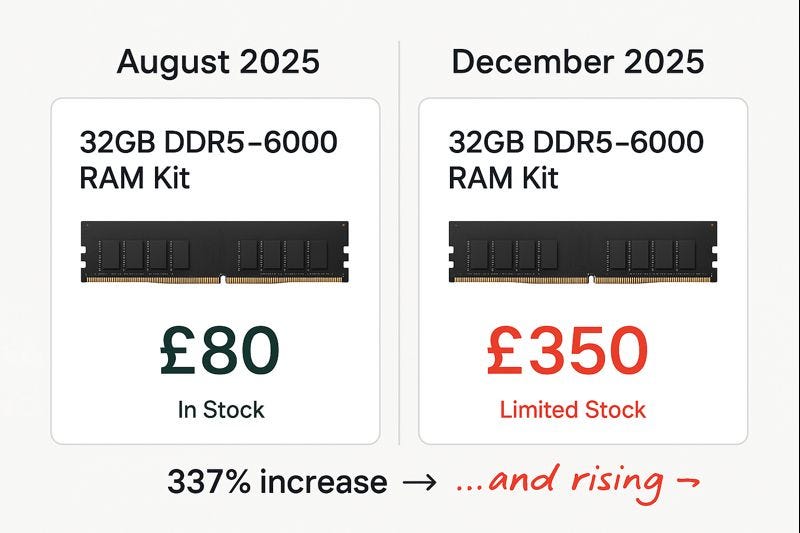

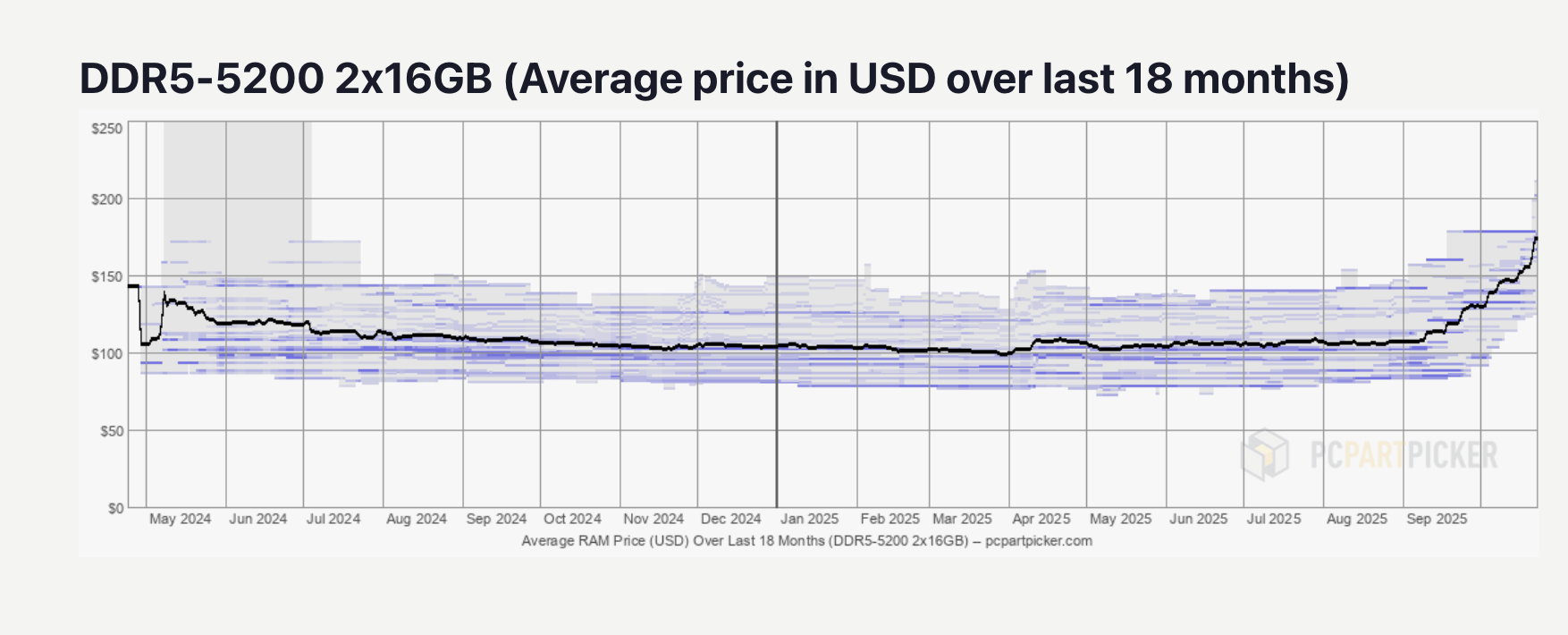

High-capacity DDR5 memory spent most of 2024 and early 2025 in a surprisingly predictable range. A 2x 32GB DDR5-5600 kit hung around the

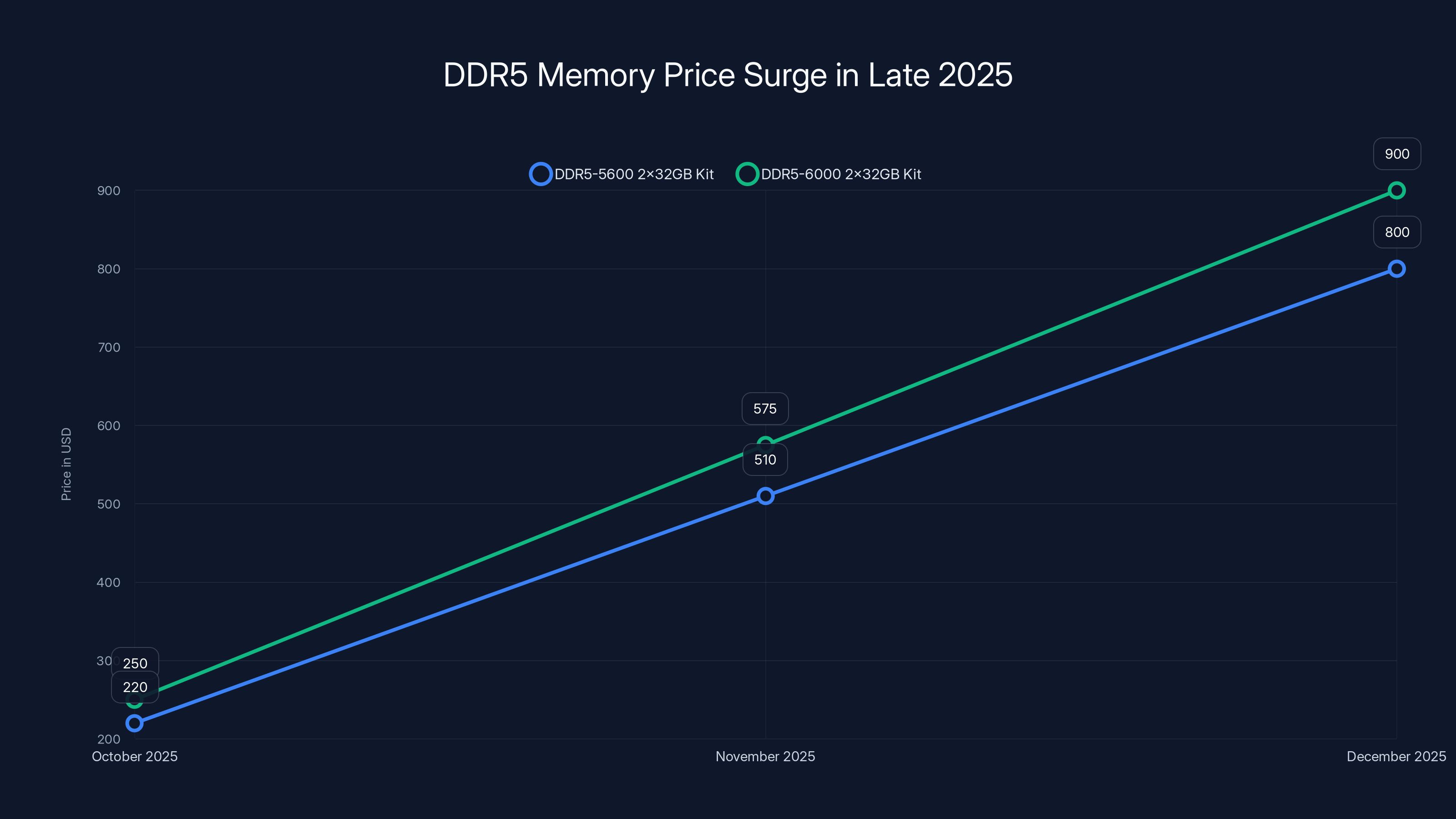

Then October 2025 hit, and everything broke.

Within a span of roughly twelve weeks, DDR5-5600 2x 32GB kits went from approximately

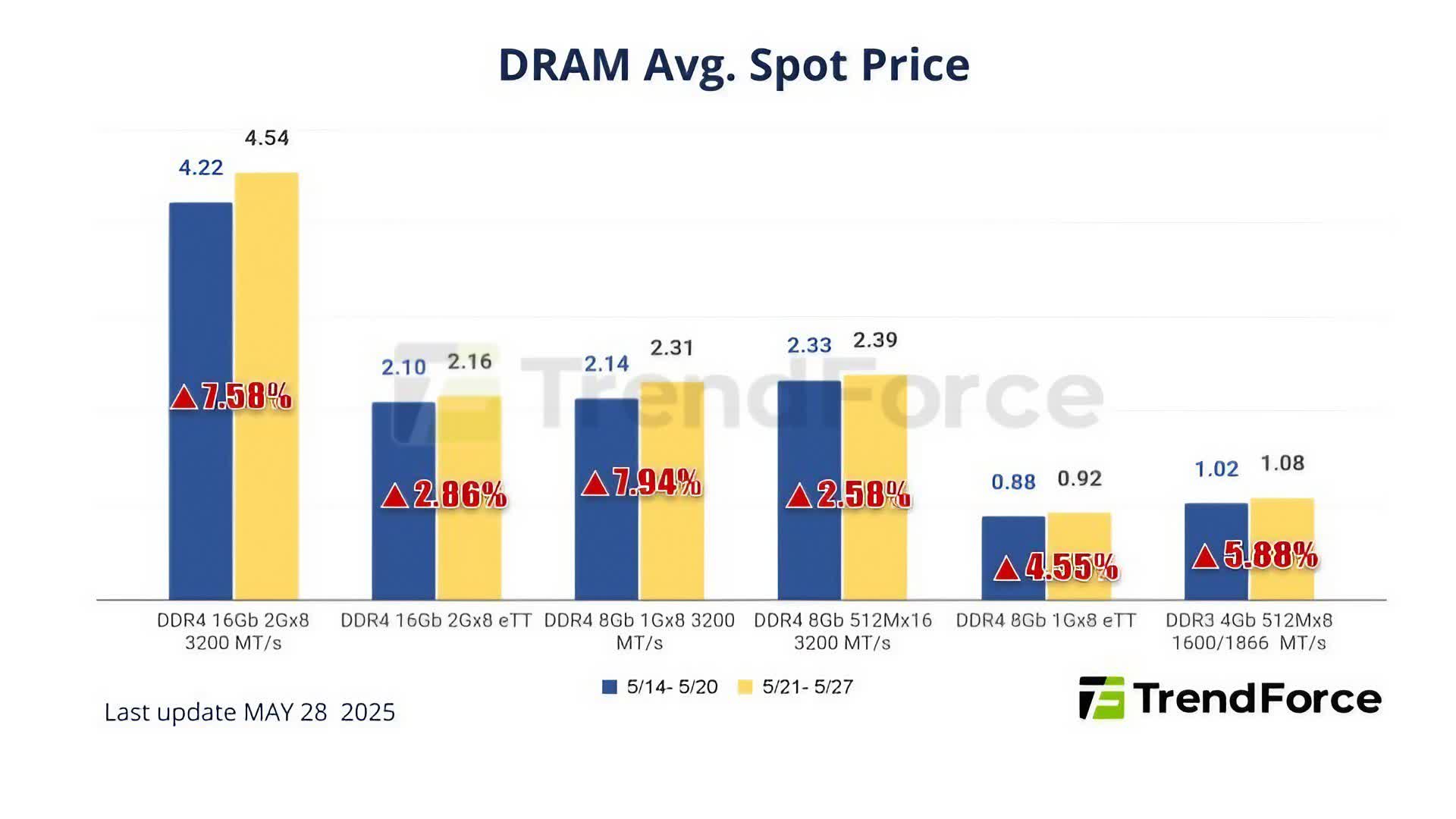

What made this price explosion particularly jarring was how synchronous it was. Normally, different memory speeds would track independently. A faster bin like DDR5-6000 might drift differently than DDR5-5600 based on demand, production yields, or chipset adoption. But these two configurations moved in near-perfect lockstep, rising by virtually identical percentages week after week. That suggests something structural shifted in the market, not random supply-demand fluctuations.

The reason? Contract pricing. Manufacturers like Samsung, SK Hynix, and Micron operate on multi-tiered pricing structures. Enterprise customers lock in quarterly rates. Retailers and distributors negotiate bulk contracts. When upstream suppliers increase contract prices dramatically, those increases cascade downstream within weeks. By December 2025, essentially every retailer and marketplace reflected the same inflated pricing because they were all buying from the same contracted inventory at the same elevated rates, as noted in Resell Calendar's analysis.

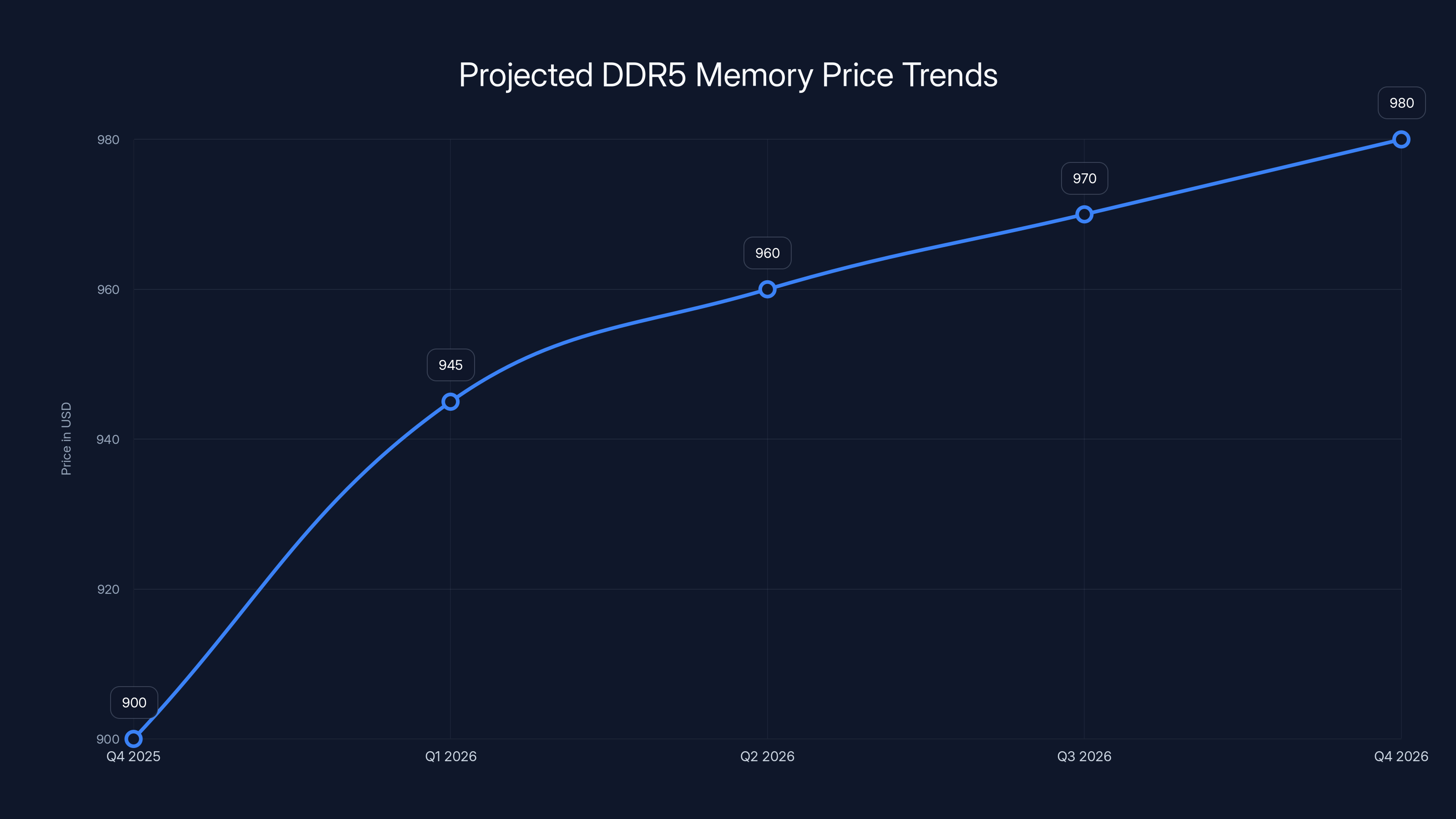

DDR5 prices are projected to remain high through 2026, with a peak in Q1 2026 due to continued supply constraints and demand pressures. Estimated data based on market forecasts.

Why Both DDR5-5600 and DDR5-6000 Rose Together

This is the part that confused a lot of people. If prices are driven by supply and demand, why would two different products with different performance levels move identically?

The answer lies in how memory manufacturing works. DDR5-6000 isn't actually a fundamentally different product from DDR5-5600. It's the same silicon, rated for higher frequency. Manufacturers can produce a batch of memory chips and bin them based on quality. The best-performing chips get labeled DDR5-6000. The next tier becomes DDR5-5600. It's the same production line, the same yields, the same marginal cost.

When contract prices surge, they don't surge differently for each speed tier. The base pricing goes up across the board. A manufacturer signing a new contract in Q4 2025 would have quoted similar per-gigabyte rates for all their DDR5 offerings. Retailers then mark up based on what they paid, maintaining their margin percentages, as explained in TechRadar's detailed analysis.

This is actually important to understand. It means the price explosion wasn't driven by consumers suddenly demanding faster memory or by production constraints on high-speed bins. It was a wholesale repricing event triggered at the source. The manufacturer level changed the fundamental cost basis, and everything else adjusted to compensate.

The False Stability We're Experiencing Now

Here's where things get interesting, and a little depressing.

Starting around early January 2026, the trajectory changed. Instead of continuing to climb, prices started holding steady. Weekly data showed little movement. The average price for a 64GB DDR5 kit lingered around

But dig into what stabilization actually means in this context, and the picture becomes murkier.

Price stabilization in a market typically happens when supply equals demand at a given price point. Sellers have enough inventory to meet buyer requests without scrambling. Buyers can find products readily without bidding prices up. It's a natural equilibrium. That's not what's happening here.

Instead, the market stabilized because demand collapsed at the $800+ price point. Retailers still have inventory. They're willing to sell. But customers have largely stopped buying. Walk into any PC building community, and you'll see the same refrain repeated constantly: "I'll wait." "These prices are insane." "I'm sticking with DDR4 for now." "I'll upgrade when this cools down."

That's not equilibrium. That's rejection. The market cleared at an artificially high price point because buyers simply withdrew from the market rather than pay it. Stabilization in this case means "nobody's buying, so we're just leaving prices where they are and hoping someone cracks." It's a standoff between suppliers hoping for breakthrough demand and consumers hoping for a price collapse, as highlighted in TechRadar's report.

Projected data shows a significant price increase for DDR5 kits by Q1 2026, with potential prices reaching up to $1,500 for high-end configurations. Estimated data.

What Contract Pricing Actually Tells Us

Looking ahead, the picture gets cloudier. Industry analysts and suppliers have indicated that Q1 2026 contract pricing could increase another 55 to 60% compared to late 2025 rates. If that materializes, we're not looking at stabilization continuing. We're looking at another explosive phase, as predicted by Seeking Alpha.

Let's do the math. If a 64GB DDR5 kit sits at roughly

That's not a sustainable market state. At those prices, the only buyers would be data center operators with massive budgets and enterprises that can't avoid the purchase. The consumer market effectively exits. The gaming market vanishes. The content creator market consolidates around DDR4 or waits out the cycle.

Manufacturers know this. They know there's a price ceiling beyond which demand becomes essentially zero. So why would they push pricing there?

The answer involves multiple factors. First, tight supply constraints mean even reduced demand at high prices generates acceptable revenue. Second, contract negotiations happen in bulk, with average pricing across their entire product portfolio. If mobile DRAM surges but high-end desktop memory stays tight, they still push up the overall contract rates. Third, geopolitical factors, tariff concerns, and supply chain consolidation create artificial scarcity psychology that justifies price increases to suppliers' corporate boards, as discussed in Discovery Alert.

The Supply Chain Tension Nobody's Talking About

Underneath all of this sits a supply chain that remains strained. Some of the biggest memory manufacturers have consolidated significantly over the past decade. Samsung, SK Hynix, and Micron now account for roughly 95% of global DRAM production. That's not a competitive market. That's an oligopoly.

In an oligopoly, pricing decisions become synchronized without explicit collusion. When one major player signals that contract pricing is going up, the others follow. It's not because they're colluding in a conference room. It's because they're all responding to the same market signals and incentives. And individual players know that if they don't raise prices when their competitors do, they leave money on the table, as analyzed by IDC.

This dynamic is particularly pronounced in memory because customers can't easily switch suppliers. A PC builder can't decide "I'm buying Intel CPUs instead of Ryzen today." But they can also can't buy from a fourth major memory manufacturer that doesn't exist. They either buy DRAM at current prices, or they don't buy DRAM at all.

That asymmetry gives the three major players significant pricing power, especially when supply is tight. And right now, supply is absolutely tight. Capacity additions take years and billions in capital investment. A manufacturer can't just decide to triple production next quarter. They have to plan years in advance.

Why Demand Destruction Matters More Than You Think

When buyers withdraw from a market en masse, it sends a signal. It tells manufacturers and suppliers that they've priced out the viable customer base. It's different from a supply crunch, where high prices incentivize increased production. Demand destruction means higher prices actually reduce the total market size.

This is crucial for understanding where we go from here. If Q1 2026 sees another 55% price increase and demand stays flat or drops further, we could hit an inflection point. Manufacturers might realize they've pushed too hard. Retailers holding massive inventory at high prices that aren't moving start cutting into margins. The incentive structure changes.

Alternatively, we could see a bifurcation in the market. Premium configurations targeting data centers and enterprises move higher in price and lower in volume. Consumer-oriented configurations get delisted or discontinued because they're not profitable at scale. The market fragments into "enterprise at any price" and "consumer offerings disappear for 12-18 months."

Historically, memory markets have experienced both scenarios. The 2018 DRAM shortage saw price spikes followed by overcorrection when manufacturers added capacity and demand collapsed. Prices crashed harder than they'd risen. The 2011 flooding in Thailand disrupted memory supply for months but didn't create permanent shortage pricing. Eventually, equilibrium returned.

The question now is which pattern we're heading toward.

DDR5-5600 and DDR5-6000 memory kits saw a dramatic price increase of over 260% from October to December 2025, driven by structural shifts in contract pricing. Estimated data.

The Role of Data Centers in Driving Prices

One factor complicating the picture is data center demand. Enterprise memory demand is significantly less elastic than consumer demand. When a cloud provider needs to deploy new servers, they're buying memory regardless of price. The total addressable market for cloud infrastructure continues expanding as AI workloads, streaming services, and business applications scale.

This means data center buyers are absorbing a disproportionate share of available supply at premium prices. That inventory doesn't flow down to retail channels. The consumer market essentially becomes a secondary market consuming what's leftover after enterprise allocations, as noted by Wccftech.

Manufacturers know this. They can guarantee high-margin sales to enterprises with committed budgets. Taking those deals means less supply for the retail channel, which supports the high pricing we're seeing. From a manufacturer's profit perspective, selling 50% less volume at 3x the price is substantially better than maintaining market share at lower prices.

This dynamic has shifted the fundamental economics of memory manufacturing away from volume-based models toward margin-based models. It's a structural change with long-lasting implications.

When Will Prices Actually Come Down?

This is the question everyone asks. The honest answer is: we don't know, and the timeline could be unexpectedly long.

Historically, memory prices have followed boom-bust cycles tied to manufacturing capacity additions. Suppliers expand production in response to shortages. Expanded production eventually floods the market. Prices collapse. But that's a multi-year process. Building a new memory fabrication plant takes three to four years and costs

So we're likely looking at a sustained high-price environment extending into 2026, possibly into 2027, until either demand recovers and absorbs available supply at current prices, or until some external shock disrupts the market dynamics.

What could trigger relief? A few scenarios: First, if enterprise demand softens and data center buildouts slow, inventory could flow back to retail channels. Second, if geopolitical tensions ease and supply chain anxiety decreases, some of the artificial scarcity premium could evaporate. Third, if an unexpected new supplier enters the market or existing suppliers announce significant capacity additions, that could shift pricing expectations long before capacity comes online.

None of those scenarios look imminent as of early 2026.

How High Could Prices Realistically Go?

Let's do some scenario planning. If contract pricing increases 55-60% and that flows through to retail with normal markups, we're looking at

Is that sustainable? Probably not indefinitely. At those prices, the addressable market shrinks dramatically. Gaming PC builds become prohibitively expensive. Content creator workstations become uneconomical. Even small and medium businesses reconsider upgrade cycles. Only enterprises with hard requirements and unlimited budgets sustain purchases.

Manufacturers understand this. They'll push pricing to maximize short-term profit margin, but they won't necessarily maintain that pricing if volume collapses too severely. There's a threshold where they'd rather take lower margins and higher volume than squeeze too hard.

The challenge is that threshold is harder to identify in advance. Manufacturers have incomplete information about total market demand elasticity. They're making educated guesses about where that threshold sits. And when you're competing in an oligopoly against two other sophisticated competitors, you tend to push pricing until you get clear market feedback that you've gone too far.

DDR5 memory prices are projected to rise moderately through 2026, with a potential increase of 55-60% in contract pricing by Q1 2026. Estimated data.

DDR5 Adoption and the Timing Problem

One complicating factor is that DDR5 adoption is still incomplete. Millions of systems worldwide still run DDR4. The installed base of DDR4 is enormous. As long as DDR4 remains available at reasonable prices, consumers have a viable alternative.

This is actually good news buried in a frustrating situation. It means the DDR5 market doesn't have a complete monopoly on buyer options. If DDR5 prices stay above psychological thresholds, buyers can stick with DDR4 for longer than they normally would in a typical upgrade cycle. This lengthens the timeline before DDR5 becomes truly mainstream and potentially moderates eventual demand for DDR5 when it does arrive.

But it also creates a risk: if DDR5 prices stay too high too long, some portion of the market might skip DDR5 entirely and migrate directly to whatever comes next. If DDR6 launches while DDR5 is still expensive and supply-constrained, buyers might wait for DDR6 rather than pay a premium for DDR5 that they view as "between generations."

That would be catastrophic for DDR5 market penetration.

What This Means for Your PC Upgrade Plans

Here's the practical advice: if you need a new system right now, you're in a difficult spot. Paying $900 for a 64GB DDR5 kit is genuinely expensive, but if your existing system is limiting you professionally, the cost might be unavoidable.

If you can wait, waiting is the smarter play. Even if prices don't collapse, Q2 or Q3 2026 might bring some relief. Market dynamics could shift. Enterprise demand might soften. Unexpected supply might materialize. Waiting reduces downside risk with limited upside cost.

If you're building or upgrading now, consider right-sizing your memory capacity. Do you actually need 96GB or 128GB, or do you need 64GB? Can you start with 64GB and upgrade later if necessary? Spreading the purchase across time reduces the immediate price shock and lets you benefit from any price movements that materialize.

For professionals with hard requirements, this is simply a cost of doing business right now. Data scientists, 3D artists, video editors, and developers working on memory-intensive applications sometimes can't wait out market cycles. The work requires the hardware. In those cases, the premium you're paying now is unfortunately necessary.

The Historical Parallel That Should Worry You

Memory markets have experienced price shocks before, but the 2025-2026 cycle has a different character than historical precedents. Previous shortages were typically driven by unexpected disruptions: natural disasters, manufacturing accidents, or sudden demand spikes. Those created temporary supply crunches that eventually resolved as production normalized.

This cycle appears to involve structural changes in the supply chain, consolidated ownership among manufacturers, and shifting demand dynamics with data centers absorbing premium-priced inventory. That's a different animal. It suggests the high-price regime might persist longer than historical precedent suggests.

Look back at the 2018 DRAM shortage. Prices peaked and then crashed hard. But that crash took two years to materialize. From 2016 to 2018, prices climbed. Then from 2018 to 2020, prices fell. But the collapse was sudden and severe. Manufacturers who'd added capacity to capitalize on high prices found themselves stuck with excess inventory in a collapsing market.

We could see a similar pattern unfold here. Optimistic manufacturers might commit to capacity additions expecting sustained high prices. If that happens, we're looking at a 2027-2028 scenario where supply floods the market and prices crater. But that's years away. For anyone buying in 2026, that's cold comfort.

Estimated data shows potential price increases for memory kits, with mainstream 64GB kits reaching

What Retailers Are Doing Right Now

If you check retail inventories right now, you'll notice something interesting: stock levels are varied. Some retailers have deep inventory of high-capacity kits at elevated prices. Others have limited stock. Some have shifted their focus away from high-capacity DDR5 toward DDR4 alternatives. This fragmentation suggests different retailers have different margin strategies and inventory philosophies.

Some retailers betting that prices will fall further are holding inventory and accepting lower margins, hoping to sell at slightly better prices later. Others are aggressively pricing to move inventory and lock in sales. This creates price variation between retailers that can span 10% to 15% on identical products.

If you're shopping now, that variation matters. Spend time comparing prices across multiple retailers. The best deal might not be at the obvious big-name sellers. Regional retailers and online specialists sometimes undercut major chains significantly.

The Future Market Structure

Looking ahead, we might see a market segmentation that persists even after prices normalize. Premium memory for workstations and servers might maintain higher pricing, reflecting that market segment's lower price sensitivity. Consumer memory might stabilize at lower price points. The market divergence that began during the shortage might become permanent.

Manufacturers would actually prefer this outcome. Segmented markets let them maintain margins across different customer bases without direct competition. Enterprise buyers get premium options at premium prices. Consumers get acceptable options at moderate prices. Neither segment undercuts the other because they're not really competing in the same market.

This would represent a shift from how the memory market has worked historically, where there were fewer distinct tiers and prices converged across categories. But it's a natural evolution as the market matures and consolidates.

What We're Actually Learning About the Market

The stabilization at

That $900 ceiling is roughly 4x what DDR5 prices were three years ago. It's genuinely expensive. But it's also apparently not so expensive that it produces panic buying or hoarding behavior. Buyers aren't rushing. The stabilization suggests acceptance of a new price regime, not temporary shock.

That acceptance actually removes some upside pressure on prices. If buyers are accepting $900, manufacturers can raise prices further, but the benefit of doing so diminishes because they're already past the psychological shock threshold. Further increases might trigger demand destruction without proportional revenue gains.

We might actually be seeing the ceiling that stabilizes the market for the next 12 to 18 months. That's not good news, but it's not the worst news either. It means we probably won't see another shock like we saw in Q4 2025. We'll probably see modest increases as contract pricing rises, but nothing catastrophic.

Alternative Strategies You Should Know About

Some buyers are getting creative to work around high memory prices. Building with older-generation platforms like AM4 Ryzen or 12th-gen Intel, which support DDR4, lets you skip DDR5 entirely. You lose some performance, but DDR4 prices remain reasonable. It's a legitimate strategy if you can tolerate the generational performance compromise.

Others are buying used or refurbished memory. This is risky and not generally recommended, but used memory from trusted sellers occasionally surfaces at prices significantly below new retail. The risk is that memory failure can be catastrophic. But if you're comfortable with that risk, it's an option.

Some professionals are considering workstation-class systems from vendors who might offer fleet pricing. If you're buying multiple systems, corporate purchasing might yield better per-unit costs than retail consumer pricing.

None of these strategies are ideal, but they exist on the margins for buyers who can't or won't accept current retail pricing.

The Psychological Impact We're Not Discussing

There's an interesting second-order effect happening in tech communities right now. These extreme prices are creating psychological exhaustion. Buyers are fatigued from constantly checking prices, waiting for drops that don't materialize, and making upgrade decisions based on budget constraints rather than technical requirements.

This fatigue itself becomes a market dynamic. It reinforces demand destruction because buyers simply stop paying attention. They stop shopping. They stop researching. They postpone decision-making. That behavioral shift persists even after prices normalize because the trust has been broken.

Manufacturers and retailers need to understand that extreme pricing cycles create long-term market damage beyond just the immediate sales impact. Buyer goodwill erodes. When prices do eventually normalize, demand might recover slower than supply suggests it should because buyers are still emotionally adjusting to the trauma of the previous cycle.

This might actually be a moderating factor on future pricing. Retailers who recognize that extreme markup squeezing creates brand damage might voluntarily moderate margins to maintain customer relationships. It's a long-term strategy over short-term extraction. How many retailers actually make that choice remains to be seen.

Planning for 2026 and Beyond

If you're making infrastructure decisions for 2026, assume high memory prices as a given. Don't plan around normalization that might not happen. Right-size your systems for current pricing conditions. If you're deploying new servers, calculate ROI based on expensive memory. If you're upgrading workstations, budget accordingly.

This hardnosed approach prevents disappointment. If prices do fall, great, you've budgeted more conservatively than necessary. If prices stay high or go higher, you're not shocked because you were already planning for that scenario.

For manufacturers and systems integrators, the challenge is communicating value at premium price points. You can't sell

Transparency in that messaging matters. Customers who understand the market dynamics are more likely to make purchase decisions than customers who think they're being price-gouged.

What We're Missing in This Conversation

One thing that doesn't get discussed enough is the role of market sentiment and psychology in creating self-fulfilling prophecies. When everyone believes prices will stay high, buying behavior changes. Fewer buyers compete for inventory, which reduces pressure on retailers to lower prices. Lower pricing pressure supports the belief that prices will stay high. It's a feedback loop.

Breaking that loop requires something unexpected: better news than anticipated, an external market shock, or enough time passing that the high-price era becomes normalized and less psychologically threatening.

Alternatively, if one major retailer or integrator decided to absorb margin pressure and aggressively discount memory to move volume and grab market share, it could create a downward price pressure cascade. But that requires a player willing to sacrifice short-term margin for long-term market position. In the current environment, most players are optimizing for short-term returns.

The Bottom Line for Buyers Right Now

High-capacity DDR5 memory stabilized at around $900 per 64GB kit because buyers essentially stopped bidding higher. That's not equilibrium. That's standoff. Manufacturers are content holding inventory at current prices because the margins are excellent. Buyers are content staying out of the market because they won't pay current prices.

Prices probably won't collapse anytime soon. Contract pricing increases of 55-60% predicted for Q1 2026 might push retail prices higher. But demand destruction has probably peaked too, which might limit how much higher prices actually go.

If you need memory now, shop carefully across multiple retailers and expect to pay premium prices. If you can wait, waiting is the smarter strategic move. The next 12-18 months will likely see continued elevated pricing, but not necessarily the explosive growth we saw in Q4 2025. The market has likely found its new rough equilibrium, even if that equilibrium is uncomfortably high.

For planning purposes, assume memory remains expensive through 2026. Build systems around that assumption. If prices fall, that's a bonus. If they don't, you're not surprised.

FAQ

Why did DDR5 prices quadruple in late 2025?

Contract pricing at the manufacturer level surged dramatically in Q4 2025, driven by supply constraints, data center demand absorption, and oligopolistic market dynamics among the three dominant DRAM manufacturers. These increased wholesale costs cascaded immediately into retail pricing, reflecting contract price increases that retailers couldn't absorb without destroying margins. The simultaneity of the increase across different DDR5 speed tiers indicates a source-level pricing change rather than demand-driven differentiation, as reported by Resell Calendar.

How is memory price stabilization different from normal market equilibrium?

True market equilibrium occurs when supply and demand balance at a price point where both buyers and sellers find the terms acceptable. Current stabilization reflects demand destruction rather than equilibrium, meaning buyers have largely withdrawn from the market at current prices rather than accepting them as reasonable. Retailers and manufacturers hold inventory they're willing to sell, but insufficient buyer interest exists to create genuine equilibrium. This is more accurately described as a standoff than a balanced market, as explained by TechRadar.

Will DDR5 prices fall significantly in 2026?

Significant price declines appear unlikely in the near term, particularly given analyst forecasts suggesting another 55-60% increase in Q1 2026 contract pricing. Historical memory market cycles typically require 2-3 years to fully resolve from peak shortage to price normalization. Relief would likely emerge only from unexpected events like sudden demand collapse, geopolitical changes easing supply chain anxiety, or manufacturer announcements of significant capacity additions. Most realistic scenarios point to sustained elevated pricing through 2026, as analyzed by Seeking Alpha.

Should I upgrade to DDR5 now or wait for prices to improve?

If you can wait without performance impact to your current work, waiting is strategically superior. Current pricing at $900 per 64GB represents a consumption price that most buyers consider prohibitive. If your existing system adequately meets your needs, postponing the upgrade 6-12 months carries limited downside while preserving optionality if market conditions improve. However, professionals with genuine memory bottlenecks limiting productivity should prioritize functionality over waiting for price decreases that may not materialize.

Why do DDR5-5600 and DDR5-6000 cost nearly the same if they have different performance?

Both speed tiers come from the same manufacturing process and binning strategy, where higher-performing chips are classified as DDR5-6000 while slightly lower performers become DDR5-5600. When wholesale contract pricing increases, manufacturers apply similar per-gigabyte cost increases across speed tiers, resulting in similar retail price adjustments. Performance differentiation matters less during shortage pricing because the marginal manufacturing cost between tiers is minimal compared to the wholesale pricing increases driving overall costs, as explained by TechRadar.

How do data center purchases affect consumer memory prices?

Data center builders absorb supply at premium prices and have relatively inelastic demand because infrastructure requirements take precedence over cost considerations. This inventory absorption from data center allocations reduces supply reaching the retail consumer market while supporting high pricing across the industry. Manufacturers prioritize data center contracts because they guarantee volume at premium margins, leaving less inventory for consumer channels and supporting the high-price regime consumers experience at retail, as noted by Wccftech.

What price point would trigger renewed consumer demand for DDR5?

Market psychology suggests renewed consumer interest likely emerges below

Are there viable alternatives to buying expensive DDR5 right now?

Building with DDR4-compatible platforms like AM4 Ryzen or 12th-generation Intel provides generational performance compromise but avoids DDR5 premium pricing. Used memory from trusted sellers occasionally surfaces at discounts, though carries replacement risk. Fleet or corporate purchasing might yield better pricing than retail consumer channels. Right-sizing memory capacity toward actual requirements rather than maximum capacity reduces the immediate purchase impact. Each strategy involves different trade-offs depending on your specific constraints and risk tolerance.

Key Takeaways

- DDR5 memory prices quadrupled from 900 per 64GB kit in Q4 2025, driven by contract pricing increases cascading from manufacturers.

- Current price stabilization reflects demand destruction rather than market equilibrium, with buyers simply withdrawing rather than accepting premium pricing, as noted by TechRadar.

- Q1 2026 forecasts predict another 55-60% increase in contract pricing, potentially pushing retail prices to $1,400-1,550 per kit, as analyzed by Seeking Alpha.

- Three manufacturers control 95% of global DRAM supply, creating oligopolistic pricing dynamics where coordinated increases occur without explicit collusion, as discussed by IDC.

- Data center buyers absorb most inventory at premium prices, limiting supply to retail channels and supporting sustained high-price regime, as noted by Wccftech.

- Historical memory market cycles suggest 2-3 years from price peaks to normalization, indicating elevated pricing will likely persist through late 2026, as analyzed by Resell Calendar.

- Strategic alternatives include sticking with DDR4 platforms, right-sizing memory capacity, or delaying upgrades to avoid buying into peak pricing.

Related Articles

- RAM Price Hikes & Global Memory Shortage [2025]

- Why AI PCs Failed (And the RAM Shortage Might Be a Blessing) [2025]

- DDR5 Memory Prices Could Hit $500 by 2026: What You Need to Know [2025]

- PC Prices Set to Soar in 2026: RAM Shortage & AI Demand Explained [2025]

- PC Market Downturn: How AI's Memory Crunch Will Impact 2026 [2025]

![DDR5 RAM Prices Stabilize at $900: What It Means [2025]](https://tryrunable.com/blog/ddr5-ram-prices-stabilize-at-900-what-it-means-2025/image-1-1768599378129.png)