Nvidia's Big GPU Delay: What's Actually Happening With RTX 50 Super and RTX 60

Last month, everyone was waiting for the RTX 50 Super to show up at CES. It didn't. Now we know why, and the answer reveals something bigger about where Nvidia's priorities actually are these days.

The company canceled the RTX 50 Super refresh that was supposed to launch in January 2026. No announcement, no official statement. Just gone. And if you're thinking that's bad news, you should know it gets worse. The next generation after that, the RTX 60-series, might not hit shelves until 2028 instead of late 2027 like originally planned, as reported by Tom's Hardware.

This isn't a random slip-up or a minor manufacturing hiccup. This is Nvidia making a deliberate choice about what matters most to its business right now. And that choice is clear: AI chips are more important than gaming GPUs. The company looked at its limited supply of high-bandwidth memory (HBM) and decided that data center processors for artificial intelligence deserve the resources instead of consumer graphics cards, according to TechPowerUp.

So what does this actually mean if you're a gamer waiting for new hardware? What does it say about the state of the GPU market? And why is RAM of all things the thing holding everything back? Let's dig into what's happening and why it matters more than you might think.

The RTX 50 Super That Never Was

Nvidia has a pretty reliable pattern with its GPU launches. The company releases flagship cards, then rolls out a "Super" refresh six to twelve months later with modest improvements. It's the silicon version of a seasonal menu update. Slightly better, slightly faster, slightly more efficient.

The RTX 50 series arrived roughly on schedule last year. Gaming benchmarks looked solid. Reviews were positive. Stock evaporated from shelves almost immediately. Gamers and miners fought over limited inventory while prices climbed. For Nvidia, this is basically the ideal scenario.

Then came the plan for RTX 50 Super. This is where the story gets interesting. The Information, which has been reliably reporting on Nvidia's internal decisions, published a report saying Nvidia's management made the call in December to kill the Super refresh entirely. Not delay it. Not push it back. Straight cancel it, as noted by TweakTown.

The reasoning was straightforward, if brutal: RAM supply is the bottleneck. Nvidia needs more HBM than it can currently get. The company has to choose where to allocate that precious memory supply. Data center AI chips generate exponentially more revenue than gaming GPUs. The math on that decision is simple.

Here's the thing that really matters: Nvidia isn't just deprioritizing the Super refresh. The company is also cutting production of the current RTX 50-series to funnel more memory toward AI chips. These cards are already impossible to find at MSRP. They're being scalped at markups. Cutting production even further is basically ensuring the shortage only gets worse, as highlighted by Tom's Guide.

Gamers were already frustrated. Now Nvidia's effectively saying: "You know what? We don't have new cards for you this year. And we're actually making fewer of the existing ones. Sorry about that."

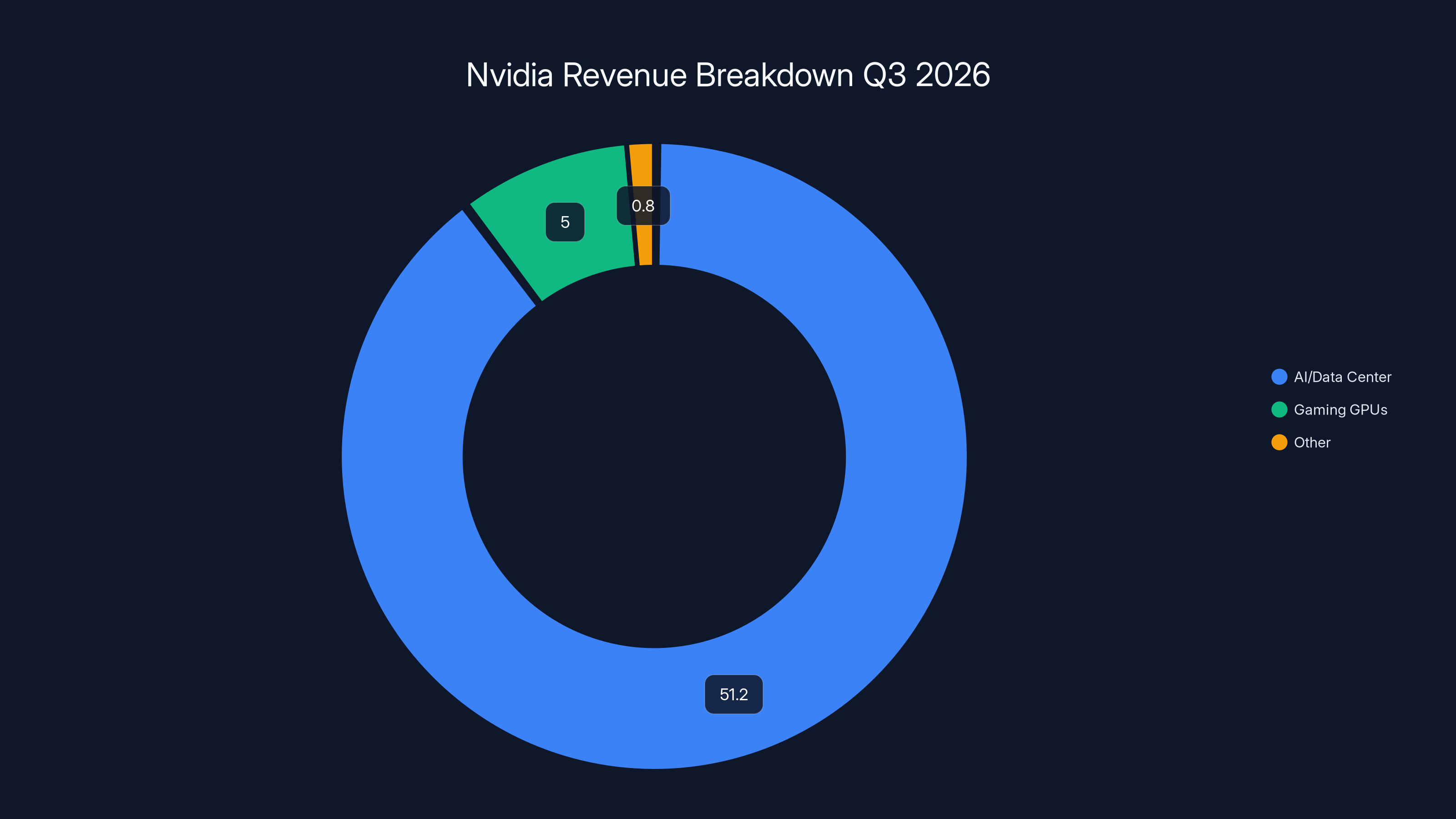

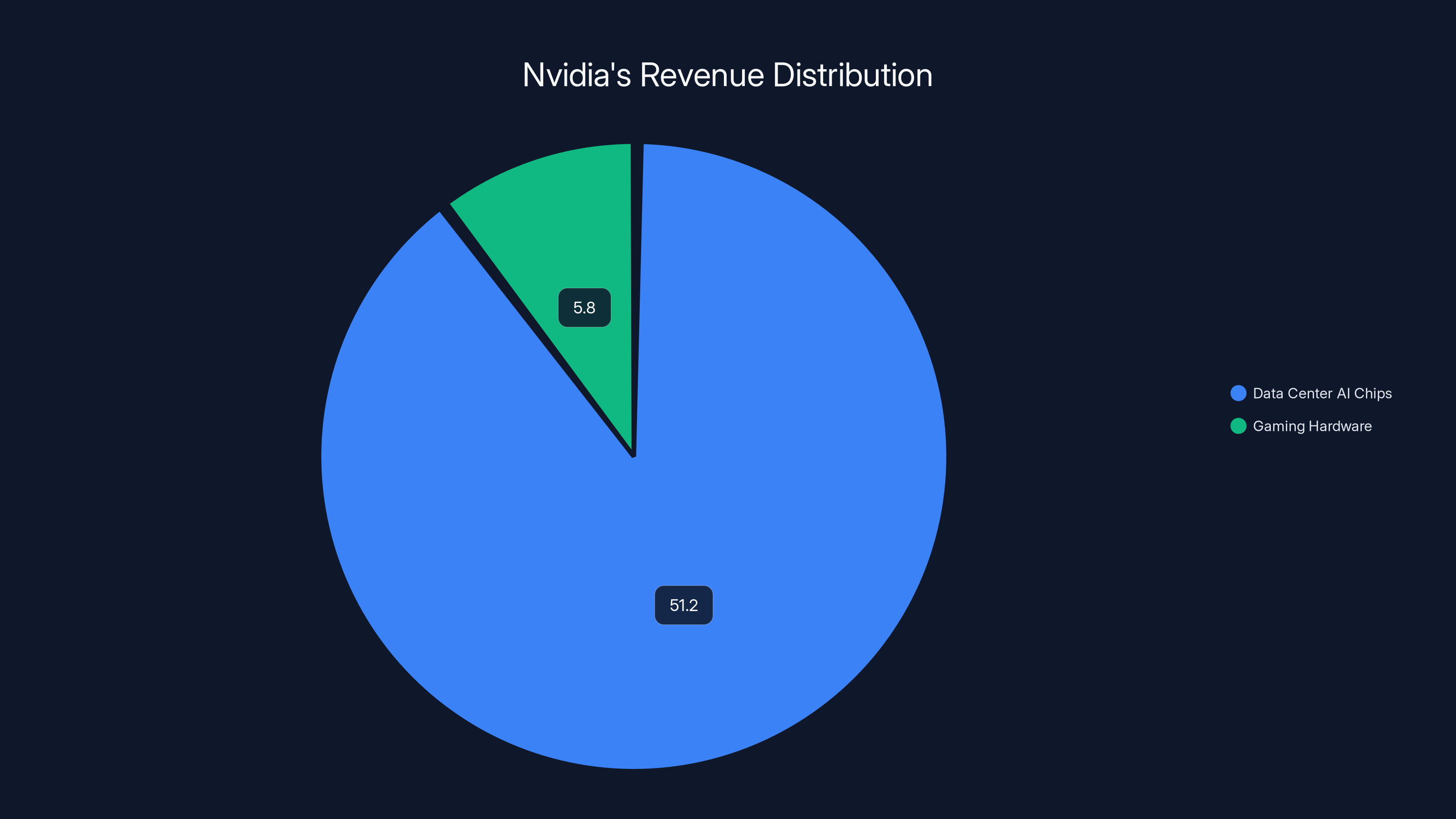

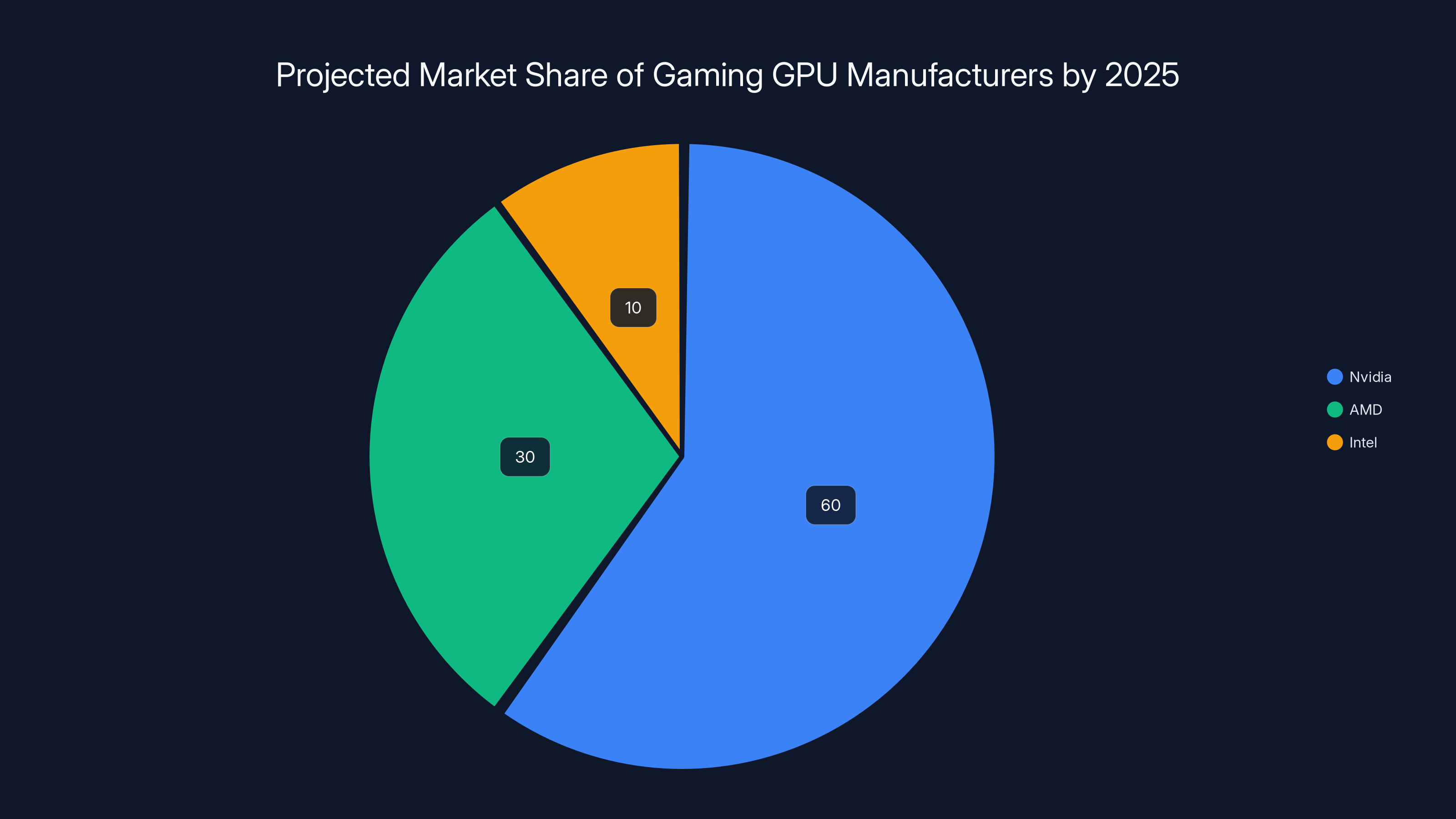

In Q3 2026, Nvidia's revenue from AI and data centers was over 10 times that of gaming GPUs, highlighting the strategic shift towards AI. Estimated data for 'Other' category.

Why AI Chips Matter More Than Gaming GPUs (And The Numbers Prove It)

Let's talk about the actual business reality here, because it's striking. In Nvidia's most recent quarterly earnings report covering Q3 2026, the company reported total revenue of approximately

Gaming GPUs? They generated revenue increases of about 30 percent year-over-year, which sounds great until you realize gaming made up less than $5 billion of the total. The growth rate is healthy, but the absolute size is almost an afterthought compared to the AI juggernaut.

This is the shift that's happening in real time. Five years ago, Nvidia's business was more balanced between gaming and professional markets. Now it's completely lopsided toward AI and data centers. When you control for memory supply constraints, the decision becomes mathematically obvious. You serve the market that's generating 10 times the revenue.

The demand side is similarly extreme. Every cloud provider on the planet wants more H100 and H200 GPUs than Nvidia can manufacture. Microsoft, Amazon, Google, Meta—they're all building out massive data centers and they need more processing power than currently exists. The waiting list for enterprise AI GPUs is measured in quarters, not weeks.

Meanwhile, a gamer who wants an RTX 5090 might have to wait a few months and pay a premium. From a revenue per unit perspective, selling that one data center GPU is worth dozens of consumer cards. So the opportunity cost of making gaming GPUs is enormous.

Nvidia's executives looked at this situation and probably had the easiest decision they'll make all year. "Shift the memory. Cancel the gaming refresh. Keep the AI lines running hot." Done.

The RAM Shortage That Nobody Saw Coming (But Should Have)

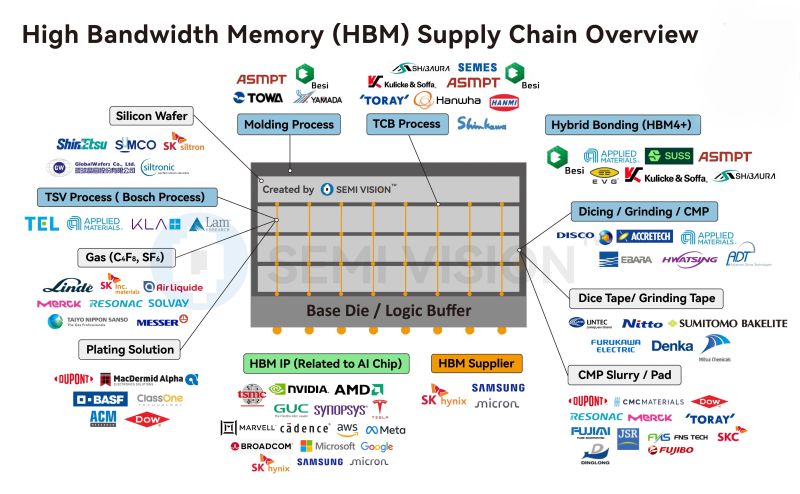

The root cause of all of this is something that most tech news coverage glosses over way too quickly: the global shortage of high-bandwidth memory. This isn't theoretical or projected. It's happening right now, and it's cascading across the entire technology supply chain.

High-bandwidth memory is the specialized RAM that powers GPUs and AI accelerators. It's different from the DRAM in your PC or phone. It's faster, more expensive, and way harder to manufacture at scale. There are only a few companies on the planet that make it. JEDEC, SK Hynix, and Samsung dominate the market. When supply doesn't meet demand, there's no quick workaround.

The semiconductor industry is still working through the aftermath of the pandemic-era chip shortage. Many manufacturers never quite ramped production back up to optimal levels. Then the AI boom hit, and suddenly every major cloud provider wanted to buy tens of thousands of GPUs. Demand skyrocketed. Supply couldn't keep up, as noted by Carbon Credits.

Nvidia's HBM supply became the constraint. The company could design faster GPUs, could allocate wafer capacity, could handle the manufacturing logistics. But it couldn't magically create more memory from thin air. HBM production takes years to scale up. New fabrication plants are enormously expensive. Building out manufacturing capacity isn't a quarter-to-quarter decision. It's a multi-year, multi-billion dollar bet.

So Nvidia's sitting there with limited memory, unlimited demand for AI chips, and some consumer demand for gaming GPUs that's real but secondary. When you're rationing a scarce resource, you serve your most profitable customers first. That's just business.

But here's the secondary impact that's important: this shortage is affecting way more than just Nvidia's gaming lineup. iPhone production is being constrained by memory availability. Samsung's phone manufacturing has been impacted. Even companies building specialized hardware for things like AR glasses and automotive systems are dealing with HBM scarcity. The entire tech industry is feeling this squeeze, as reported by TechSpot.

Nvidia generates approximately

RTX 60-Series Getting Pushed Into 2028

Now here's where the long-term implications get gnarly. The RTX 50 Super might have been disappointing news, but the real story is what happens next.

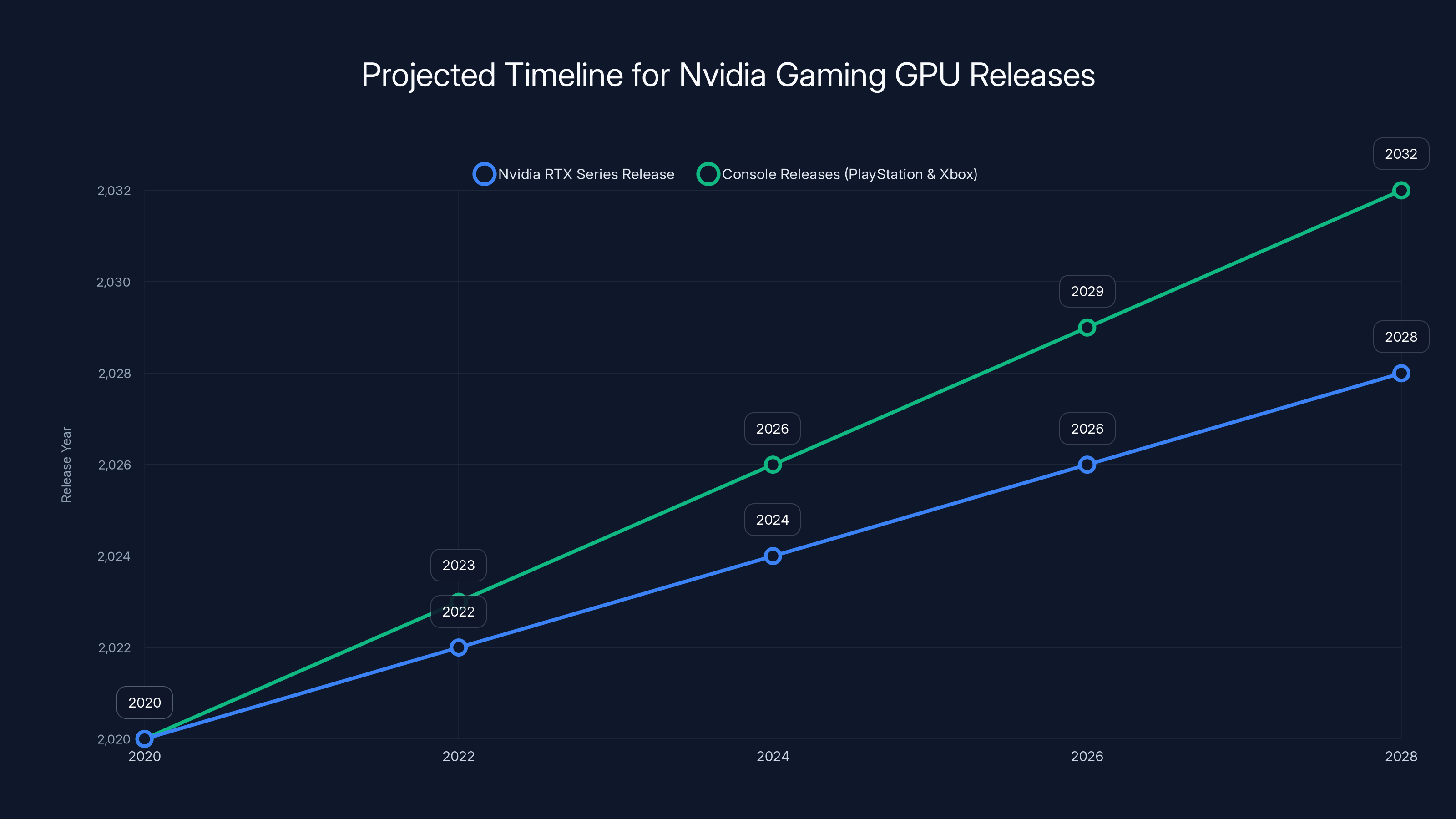

According to the sources who spoke with The Information, the RTX 60-series was originally supposed to begin mass production at the end of 2027. That timeline was already aggressive. Consumer GPU generations typically take 18-24 months from initial design to widespread availability. Having the 60-series hit mass production in late 2027 would mean the 50-series had a relatively short reign.

Now, though, that mass production start date is in jeopardy. Pushing it back even a few months could easily slide the consumer launch into 2028. And if the memory shortage persists, the delay could stretch even longer, as indicated by TweakTown.

Let's think about what this timeline actually means. If RTX 60 doesn't hit shelves until mid-to-late 2028, that's more than two years between the RTX 50's late-2024 launch and the next generation arriving. In the GPU market, that's an eternity. Two years is enough time for competitors to catch up. AMD's RDNA line gets better. Intel Arc potentially becomes competitive. The window where Nvidia has overwhelming dominance in consumer gaming GPUs gets narrower.

For gamers, this is rough. If you're running an RTX 4090 and waiting to upgrade, you're looking at either buying aging RTX 50-series hardware at inflated prices, or waiting for next-generation cards that won't arrive for another 24 months. It's not a great choice either way.

The timeline slipping also raises questions about architectural decisions. Nvidia's been on a roughly 18-month cadence for major GPU architecture updates. Blackwell came out, then the expectation was Rubin, then the next generation. If RTX 60 gets pushed to 2028, does that change the architecture roadmap? Are future generations compressed together? Does Nvidia stick with Rubin longer?

These questions matter because they affect what the actual hardware capabilities will be. A one-year delay in a new architecture means one year more of using the previous generation's fundamental design. That compounds over time.

The Cascade Effect: How This Impacts Every Part of the Industry

Here's something that doesn't get discussed enough: when Nvidia makes decisions about GPU production and supply, it ripples through the entire ecosystem. Nvidia controls something like 85-90 percent of the discrete gaming GPU market. When Nvidia shifts priorities, essentially everyone downstream feels it, as discussed by The Motley Fool.

Consider the PC builder community. Boutique manufacturers who assemble high-end gaming systems were already struggling to get RTX 50-series cards at reasonable prices. Now production's getting cut further. Their ability to source GPUs for custom builds just got worse. They either pass the cost to customers or they slow down production themselves.

The peripherals market gets affected too. Monitor manufacturers, RAM vendors, power supply makers—they all assume a certain cadence of GPU releases and production volumes. When Nvidia changes those expectations, their inventory planning falls apart. A monitor maker might have overproduced high-refresh panels in anticipation of RTX 60 launches. Now they're stuck with excess inventory.

Streaming services and content creators are impacted as well. A lot of content creation workloads still rely on consumer GPUs or professional variants built on the same architecture. If professionals are using RTX 5090 cards and gaming doesn't get access to RTX 60 for another year, there's a mismatch in feature parity and performance that makes content creation harder.

Even esports organizations feel this. Tournament operators want standardized hardware for fair competition. If new generation cards are delayed, you're stuck running tournaments on aging hardware for longer. That affects game optimization, competitive balance, and the overall production quality of esports events.

The memory shortage itself creates secondary markets. Scalpers and resellers know that cards are scarce. They buy up inventory when it hits retail and mark it up 20-30 percent. This creates an artificial barrier for price-sensitive gamers. The only people who can afford RTX 50-series cards at current prices are either enthusiasts with deep pockets or professionals who need the performance enough to justify the premium.

What This Means For Gaming Hardware Roadmaps

There's a bigger strategic question here that Nvidia probably isn't thinking about in a way that prioritizes gaming. When you delay consumer GPU refreshes, you're also making a statement about gaming's importance to your overall strategy.

Nvidia built its reputation in part on the gaming market. GeForce has been synonymous with high-performance gaming for twenty years. The RTX brand carries enormous prestige with gamers. But when you start treating gaming as secondary to data center operations, you signal that gaming isn't core to your identity anymore.

There are real consequences to that messaging. Gamers have long memories. They remember when manufacturers prioritized their market and when they didn't. AMD learned this lesson during the mining boom a few years ago. When AMD ramped GPU production to serve cryptocurrency miners and left gaming supply deprioritized, gamers remembered. Even now, AMD's still rebuilding that relationship.

For Nvidia, the RTX 50 Super cancellation and RTX 60 delay send a signal: "If you want new gaming GPUs, you're waiting." Gamers will start looking at alternatives. They'll consider AMD's RDNA cards more seriously. They'll look at Intel Arc and think about whether it's worth trying something different. Some will stay loyal and just wait. Others will jump ship.

Now, will any of this meaningfully hurt Nvidia's market share in gaming? Probably not in the short term. Nvidia's margin of superiority is still substantial. But it erodes the goodwill and enthusiasm that's been part of Nvidia's competitive moat. You can't take your customers for granted in technology. They have options.

From a strategic standpoint, Nvidia's probably betting that this delay is temporary. They're betting that HBM supply will improve. They're betting that the AI boom will eventually normalize and the memory constraints will ease. They're betting that by 2027 or 2028, they'll have enough HBM to serve both markets adequately.

That's a reasonable bet, but it's not guaranteed. If HBM supply remains constrained, Nvidia might have to make this same choice next generation. And at some point, consistent deprioritization of gaming becomes a self-fulfilling prophecy. You stop investing in gaming features. Your gaming reputation declines. You lose market share.

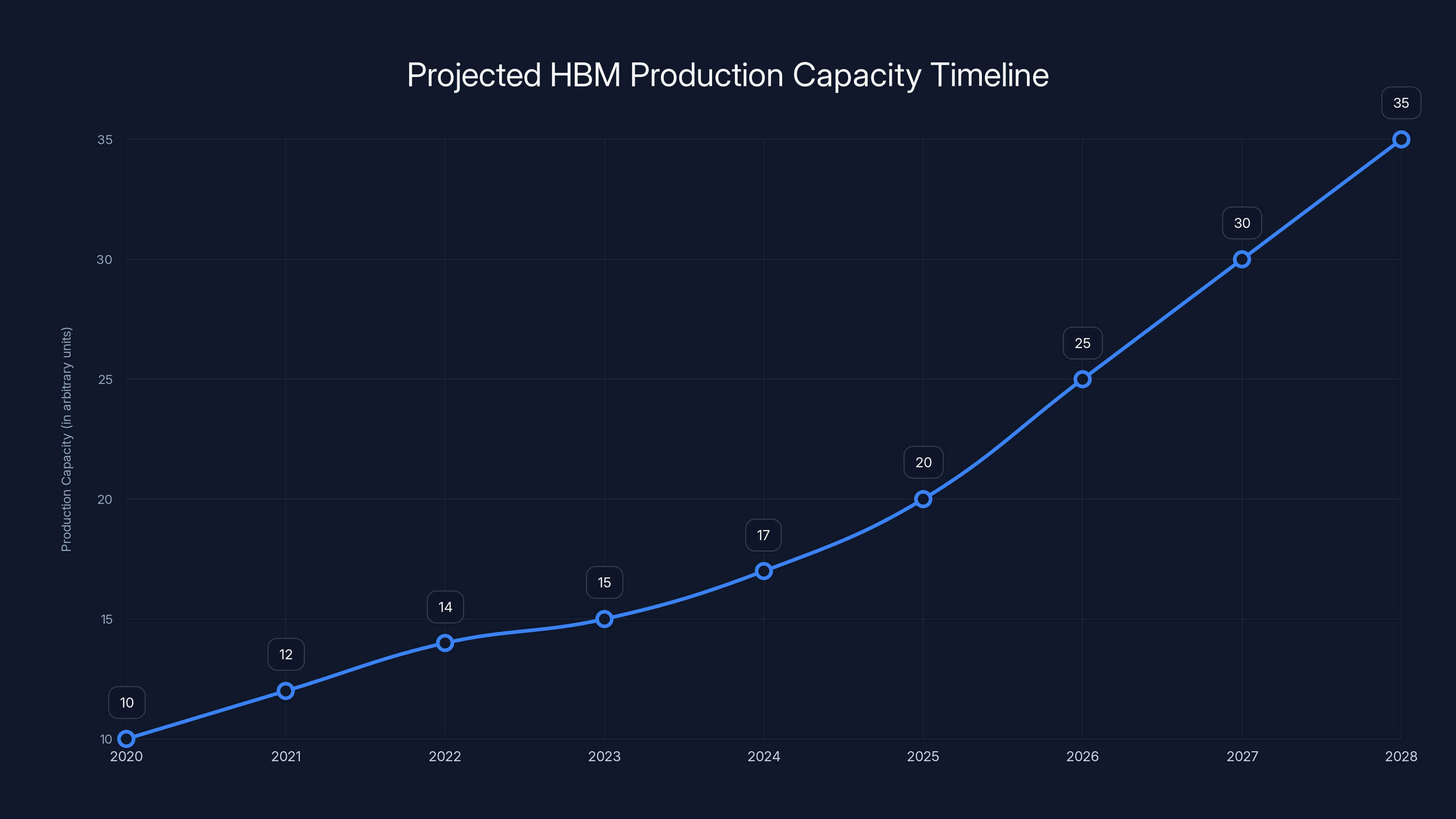

Estimated data shows gradual increase in HBM production capacity, with significant growth expected by 2026-2028 to meet AI and gaming demands.

The Broader Memory Supply Crisis

The HBM shortage isn't something Nvidia created. It's an industry problem. But Nvidia's decisions about how to allocate its limited HBM supply have outsized impact because Nvidia's so dominant.

SK Hynix and Samsung have been trying to increase HBM production capacity. It's just not fast enough. Building a new fabrication plant costs

What we're seeing now is the result of a decision made around 2020-2021 that nobody fully anticipated the demand for. Back then, AI wasn't nearly as urgent as it is now. Cloud providers weren't building data centers at this scale. Nvidia was still a diversified company with gaming and professional markets in better balance.

Now the decisions from five years ago look inadequate. Everyone's scrambling to increase capacity. But capacity doesn't increase overnight. You're looking at 2026, 2027, maybe 2028 before there's enough HBM production to supply both the AI explosion and normal gaming/professional demand.

That timeline explains Nvidia's decision-making perfectly. The company's looking at its crystal ball and seeing continued memory constraints for the next two years. So it's rationing supply toward the most profitable uses. That's just rational business management under scarcity.

Samsung and SK Hynix are incentivized to expand, but they're also cautious. If they massively expand HBM capacity and then demand softens, they're stuck with expensive plants that aren't running at full utilization. So they expand slowly, watching demand signals carefully. It's a classic chicken-and-egg problem. Nvidia and the cloud providers want more HBM. The memory makers want to build it. But both sides are playing it somewhat cautiously.

Implications for Gaming's Future in the Nvidia Ecosystem

This situation forces an uncomfortable question: is gaming still important to Nvidia as a market, or is it just a legacy business that generates some revenue but doesn't drive strategic decisions?

The facts suggest the latter. Gaming revenue is growing, but it's not driving innovation. It's not getting the memory allocation. It's not getting the attention from management. Gaming's becoming like the appendix of Nvidia's business model. It's there, it works fine, but it's not getting surgery or upgrades.

For gamers, this should prompt some thinking about alternatives. AMD's RDNA architecture has closed the gap significantly in the last generation. The differences in raw performance aren't as severe as they used to be. Intel Arc is still maturing, but it's getting better. Nvidia's dominance is built partly on engineering excellence and partly on market inertia. When you start deprioritizing the market, inertia is all you've got left.

Will gamers actually switch en masse? Probably not immediately. Nvidia's still the best option for most gaming workloads. But the margin is eroding, and the time between generations is growing. That's a formula for slowly losing market position over time.

From a hardware roadmap perspective, expect the console cycle to matter more. PlayStation 6 and Xbox Series X2 will both launch before RTX 60 hits mass market. Those consoles will set the performance baseline for games. PC games will be optimized for console hardware first, then scaled up for high-end PC GPUs. That's already happening, but it'll accelerate if high-end gaming GPU updates get spaced two years apart.

Content creators and developers are also paying attention to this timeline. If RTX 60 doesn't show up until 2028, then game developers can't rely on requiring RTX 60 hardware until 2029 or later. That means design decisions get locked to RTX 50-level capabilities for longer. Innovation in gaming features tied to GPU hardware gets slower.

The RAM Shortage's Impact on Other Hardware

The HBM shortage isn't isolated to GPUs. It's affecting all kinds of hardware that needs high-performance memory.

Apple's been dealing with memory supply constraints for iPhone production. The Memory system on Chip (SoC) in iPhones relies on high-bandwidth memory for graphics and machine learning tasks. When HBM supply is constrained, Apple's iPhone manufacturing gets squeezed. This isn't speculation. It's been reported multiple times, as noted by Tom's Guide.

Automotive suppliers building autonomous driving systems depend on similar memory technology. The lidar and camera processing requires fast memory. When supply is tight, automotive production slows down. We've seen this happen with tier-one automotive suppliers having to cut production orders or delay launches.

Even AI accelerator startups are dealing with this. Any company building a competing AI chip needs HBM. If the HBM makers are prioritizing Nvidia's enormous orders, smaller players get starved. That's an anti-competitive advantage for Nvidia almost by default. Nvidia doesn't have to beat competitors on price or performance. Nvidia just has to lock up the memory supply.

This raises some interesting antitrust questions that have been largely overlooked. Nvidia's dominance in GPU design is one thing. Nvidia's control over memory supply allocation is another. When one company can essentially gatekeep what gets built by controlling access to memory, that's a different kind of competitive advantage. It's not about being better. It's about controlling the supply chain.

None of this is necessarily illegal. Nvidia isn't forcing SK Hynix or Samsung to prioritize its orders unfairly. Those companies are making commercial decisions to sell to whoever pays the most. Nvidia's just able to pay more because it's more profitable. But the cascading effects on the whole industry are worth noting.

Estimated data suggests Nvidia will maintain a significant lead in the gaming GPU market by 2025, but AMD and Intel may gain ground due to strategic shifts in Nvidia's focus.

Timeline Considerations and What Gamers Should Do

Let's be concrete about what the next couple years probably look like for gaming GPU supply.

Right now through mid-2026: RTX 50-series is current. Supply is limited. Prices are inflated. This is the worst time to upgrade unless you absolutely need new hardware. If you're thinking about buying, wait.

Late 2026 through 2027: Rumors will start circulating about RTX 50 Super and RTX 60. Hype will build. And then... probably nothing. The RTX 50 Super isn't happening. RTX 60 still isn't ready. Nvidia might release some minor updates or refreshes, but nothing major. This is the waiting period.

Late 2027 through 2028: RTX 60 development heads toward completion. Maybe announcements start appearing. Maybe pre-orders open. But actual retail availability is probably still 3-6 months away. Prices at launch will be premium because demand will be enormous.

2028 and beyond: RTX 60 actually becomes available in volume. Prices start to normalize. This is when gamers can actually upgrade to something meaningfully better than RTX 50.

So if you're asking yourself what to do right now, here's the realistic advice: if your current GPU is handling your workloads adequately, don't upgrade. The value proposition is terrible. You're paying inflated prices for aging hardware with a two-year-old architecture. Wait it out.

If you absolutely need to upgrade because your current GPU can't handle what you're doing, then you have to buy RTX 50-series and accept the premium pricing. That's a cost of business. But if you can wait, waiting is the smart financial choice.

For content creators and professionals, this timeline is less forgiving. If your workflow requires the latest GPU architecture for competitive reasons, you might have to buy RTX 50-series even though it's old by the time you need it. That's a professional cost. But you should at least go in with eyes open about the supply situation.

Nvidia's Broader Strategic Shift

This GPU delay story is really a symptom of a much bigger strategic shift happening at Nvidia. The company's transitioning from being a gaming and professional GPU manufacturer with a data center business on the side to being a data center AI company that happens to also make gaming GPUs.

That's not necessarily bad from Nvidia's perspective. The data center market is enormous and growing faster than gaming. AI accelerators probably do have longer product lifespans and higher margins than gaming GPUs. From a pure business optimization standpoint, focusing on the more profitable market makes sense.

But it's a strategic pivot that Nvidia's not talking about explicitly. The company still presents itself as a gaming technology leader. Nvidia still sponsors esports events and gaming conferences. Nvidia still builds features into GeForce drivers for gamers. But when the resource allocation shows that gaming is secondary, that messaging rings hollow.

Intel went through something similar. Intel dominated PC processors for decades, then mobile and cloud data centers became more important, and Intel couldn't adjust its strategy quickly enough. Now Intel's a secondary player in mobile and cloud. It's taking years to rebuild. Nvidia's hopefully learning from that playbook and not making Intel's mistakes. But you have to actually invest in your markets. You have to make them a priority. If you don't, competitors will eventually take them over.

The next two years will tell us a lot about whether Nvidia's treating gaming as a genuine market or as a legacy business that exists only for historical reasons. If RTX 60 launches on schedule in 2028 with robust production and innovative features, then gaming was just temporarily deprioritized. If RTX 60 launches late with limited supply and incremental improvements, then we'll know gaming's becoming less central to Nvidia's identity.

What Competitors Should Be Doing Right Now

If you're AMD, Intel, or any other GPU maker, this is the opportunity you've been waiting for. Nvidia just announced that gaming's not a priority. That's your opening.

AMD's RDNA architecture is solid. It's not as efficient as Nvidia's architecture, and it doesn't have as large a driver ecosystem. But the gap has narrowed. If AMD could actually get competitive supply of good cards at reasonable prices right now, while Nvidia's prioritizing AI, AMD could make meaningful gains in market share.

The challenge is that AMD has its own supply constraints. The company can't magically produce massive quantities of cards overnight. But this is the window. This is when AMD should be going all-in on gaming supply. Not waiting for RTX 60. Not hedging bets. Just flooding the market with good cards at good prices. Make it impossible for gamers to choose anything but AMD.

Intel's situation is different. Arc is still maturing. The drivers are getting better. Performance is improving. But Intel hasn't reached parity with Nvidia yet. By the time Intel's competitive enough, it might be too late. But Intel should be thinking about this window too. If Intel can get Arc to competitiveness faster, this could be the timing that makes Intel viable.

The memory shortage actually works against competitors too, though. If AMD and Intel are also fighting for HBM supply, and SK Hynix and Samsung are prioritizing Nvidia's orders because Nvidia buys in massive volume, then competitors are also memory-constrained. That's actually to Nvidia's benefit. It means Nvidia's competition can't take advantage of this moment even if they wanted to.

Projected release timeline shows Nvidia's potential delay in gaming GPU updates, with consoles potentially setting performance baselines. Estimated data based on industry trends.

The Broader Implications for Hardware Release Cadences

One thing that's worth considering: could this be the beginning of longer cadences for GPU generations in general?

Traditionally, GPU generations come every 18-24 months. But maybe that cycle is broken. If memory supply is the constraint, and memory supply takes years to scale, then maybe GPU generations need to stretch out to 24-36 months or longer. The architecture gets more mature. The drivers get better. The games get fully optimized. Instead of rushing out new hardware, you optimize the existing hardware.

That's not unprecedented. Intel's done this with CPU generations in recent years. AMD's done this too. Sometimes the best strategy is to evolve the existing generation rather than rushing out a new one.

For gamers, longer cadences mean your investment in a GPU lasts longer before it becomes obsolete. That's actually not bad. It means fewer upgrade cycles. It means the value proposition gets better over time. Games get more optimized. Drivers improve. Your GPU gets faster through software optimization.

But it also means longer periods of waiting for new technology. If you buy RTX 50 now, you're potentially stuck with it until 2028. That's a long time in technology terms. A lot could change.

Questions About Supply Chain Flexibility

This whole situation raises questions about supply chain flexibility in semiconductors. The industry's learned from the pandemic-era chip shortage that having single points of failure is dangerous. But HBM supply is still concentrated with a handful of manufacturers.

What if there was another disruption? What if SK Hynix or Samsung had a manufacturing problem? What if geopolitical tensions affected supply? These aren't theoretical questions. They're real risks. And Nvidia's dependent on uninterrupted HBM supply to maintain this allocation strategy.

This is probably why both SK Hynix and Samsung are being cautious about expansion. They know there are risks. They're not going to build massive capacity only to have it underutilized if something disrupts supply chains.

From a strategic diversification perspective, Nvidia should probably be exploring alternative memory types or pushing for multiple suppliers of HBM technology. Being dependent on two companies for a critical input is risky. But that's a long-term problem. For now, Nvidia's dealing with supply constraints as they are.

The Professional GPU Market Implications

Nvidia's professional GPU line—the data center products for AI and machine learning—uses a lot of the same HBM supply. So the gaming delay is partially a consequence of professional GPU demand being so high.

This actually benefits professional users. You're getting cutting-edge hardware faster because Nvidia's prioritizing your market. But it creates a two-tier system where professionals get latest hardware at premium prices and gamers get aging hardware at premium prices. That's Nvidia optimizing for profit, which makes business sense but creates frustration.

Content creation workloads that use professional cards are minimally affected. Machine learning researchers at universities and companies get what they need. But gaming performance stagnates. The gap between gaming and professional hardware widens. Eventually, professional hardware gets so specialized that it's not useful for gaming anymore. We might already be there.

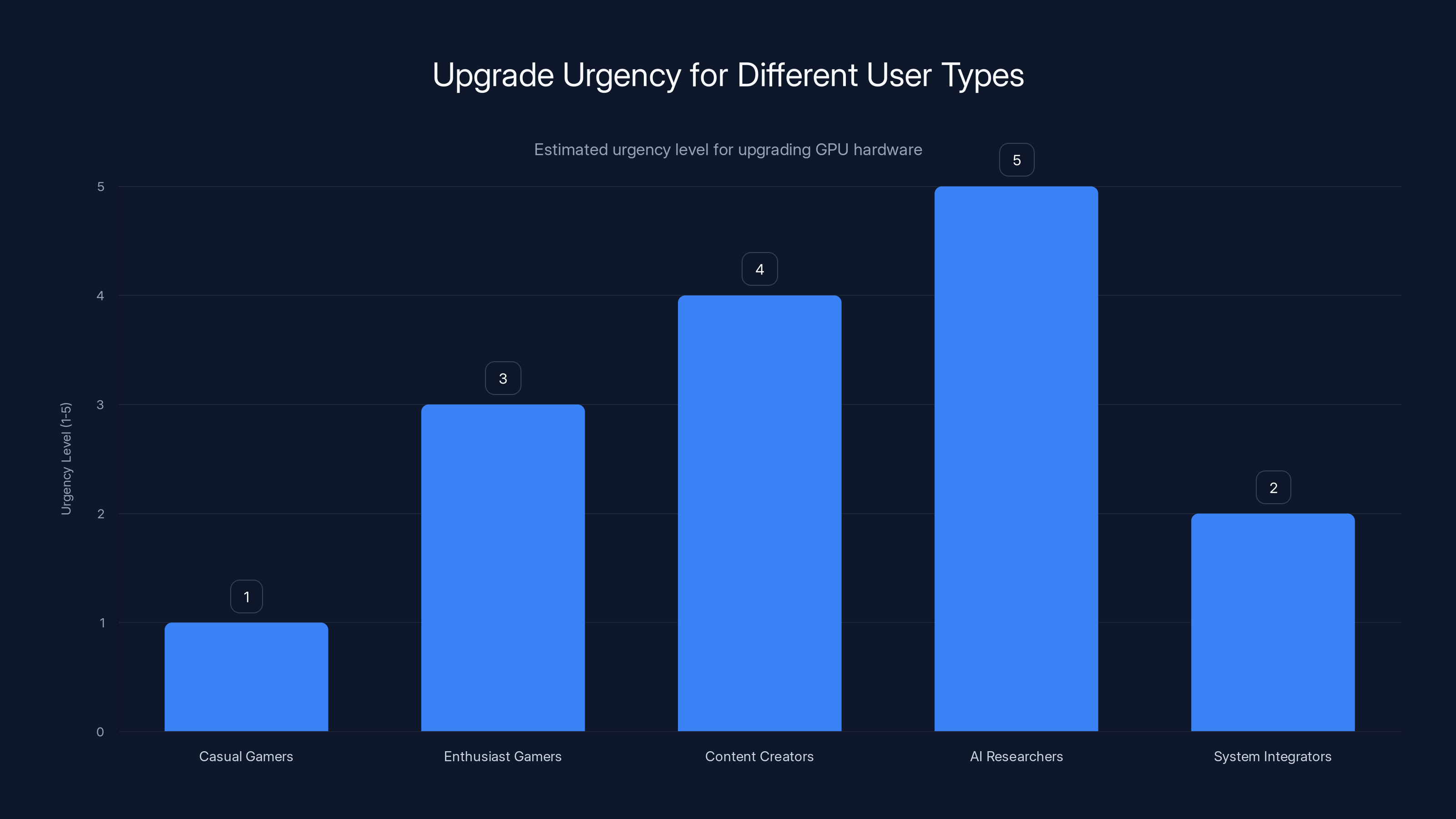

Content creators and AI researchers face the highest urgency for GPU upgrades due to performance needs, while casual gamers can delay upgrades. Estimated data.

Market Speculation and the Waiting Game

One interesting angle that deserves mention: speculative behavior and market psychology around GPU availability.

When supply is constrained and demand is high, speculators and resellers thrive. They buy cards at launch, hold them, and sell at higher prices. This exacerbates supply constraints for actual users. You can't get a card at MSRP because scalpers bought inventory.

Nvidia's aware of this problem. The company's implemented some anti-scalping measures in the past. But those measures are never fully effective. There's always a secondary market. As long as supply is tight and demand is high, resellers will profit.

The psychological effect is also worth noting. When cards are scarce and expensive, the prestige of owning one goes up. Your RTX 5090 becomes a status symbol. That's good for Nvidia's brand in some ways but bad for accessibility. Gaming becomes more exclusive. That erodes the mass market appeal.

Over a multi-year delay, this could shift gaming's demographic. More hardcore enthusiasts with deep pockets upgrade. Price-sensitive casual gamers stop upgrading and either stick with older hardware or move to other platforms. That changes the makeup of the gaming market.

Looking Ahead: When Will Things Normalize?

The key question is: when does the HBM supply situation actually improve?

Industry analysts are predicting that meaningful capacity increases will start coming online around 2027-2028. SK Hynix is investing heavily. Samsung's investing. New competitors might enter the market. The capacity pipeline should improve.

But that's just capacity coming online. It doesn't mean immediate availability. New fab plants run at reduced capacity for the first few quarters while processes are optimized. Yield rates start low and improve over time. So even when new capacity technically exists, it takes time to actually generate usable output.

Add to that the reality that AI demand might still be outpacing supply even after new capacity comes online. If AI adoption continues accelerating, demand could stay ahead of supply. We could be in a memory-constrained environment for multiple years.

Gamers should probably prepare themselves psychologically for 2028-2029 being when things normalize. That's the timeline to think in. Not 2026. Not 2027. 2028 or later. That sounds pessimistic, but it's the realistic timeline based on fab capacity announcements and demand trends.

AMD and Intel's Potential Windows

Even though AMD and Intel face some of the same memory constraints, they might have opportunities to take share if they play it right.

AMD's main advantage is that gaming's always been important to AMD as a market. When AMD gets memory supply, it can allocate it to gaming without the data center competition that's crushing Nvidia's gaming division. AMD should be going all-in on this messaging. "Nvidia's ignoring gamers. We're not."

Intel's advantage is that Intel's not memory-constrained in the same way because Intel isn't targeting the data center market as aggressively. Intel Arc can focus on gaming with less competition from Intel's own data center division. That's an underutilized advantage.

Neither company is going to suddenly become better than Nvidia's GPUs overnight. But they could become "good enough and actually available" and that might be enough to move some percentage of the market. Market share doesn't always go to the technical leader. Sometimes it goes to whoever's actually available.

The Bigger Picture: Technology Cycles and Market Evolution

Zoom out from the immediate GPU situation and you're looking at a broader technology cycle. AI's in a hype phase right now. Companies are investing aggressively. Growth is exponential. But eventually, AI adoption will plateau. New applications will slow. The sense of urgency will decrease.

When that happens, the HBM supply constraints will ease. Nvidia might even face overcapacity in AI GPUs. Then the company would want to pivot back to gaming. But that's a couple years away at minimum.

The gaming market will have evolved by then. Games will be optimized for whatever hardware's current at that time. Gamers will have made choices about alternative platforms or competitors. The market dynamics won't be the same.

Nvidia's betting that it can build enormous profits in the AI window and then seamlessly transition back to gaming when the opportunity makes sense. That's a risky bet. Markets don't usually forgive you for ignoring them, even when you have good reasons.

What This Means for the Future of Gaming Hardware

If Nvidia's strategy works—if HBM supply improves, if AI demand normalizes, if the company can launch RTX 60 with good supply in late 2028—then everything's fine. Gaming gets new hardware with a slight delay.

If Nvidia's strategy doesn't work—if memory remains constrained, if RTX 60 launches with supply issues, if competitors have closed the gap—then gaming's going to be in a tougher position. You'll have fewer upgrade options. You'll have longer times between generations. That's not catastrophic, but it's real.

For developers and game designers, the implication is to optimize aggressively for the hardware that exists rather than expecting rapid hardware improvements. That's actually healthy. It encourages efficiency. It encourages creativity within constraints.

For PC builders and system integrators, this means being more conservative with inventory planning. You can't rely on a steady cadence of GPU releases anymore. Build systems based on what exists, not what's coming.

For the esports scene and competitive gaming, this could mean longer periods where tournament hardware doesn't change. That's stability in some ways but stagnation in others.

The Antitrust Angle

There's a regulatory question lurking in the background here. Nvidia's market dominance is now affecting the entire GPU market's evolution. When one company controls 85-90 percent of discrete gaming GPU market share and can make resource allocation decisions that affect every other segment of computing, that's a lot of power.

The FTC and other regulatory bodies are watching Nvidia carefully. There have been some investigations and inquiries, though nothing major has happened yet. But decisions like the RTX 50 Super cancellation are exactly the kind of thing that raises regulatory eyebrows.

Nvidia's not technically doing anything illegal. The company isn't forcing suppliers to discriminate against competitors. But the downstream effect is that competitors can't get memory supply fast enough to compete effectively. That's anticompetitive in practice even if it's not anticompetitive in intent.

This could become more of an issue if the pattern continues. If three years from now, Nvidia's still constraining gaming GPU supply and competitors still can't get enough memory, that's a clearer picture of market manipulation. Not now, but potentially down the road.

Practical Advice for Different Types of Users

Let's be practical about what different groups should do given this situation.

Casual gamers playing esports titles and older games: Your current GPU is probably fine. Games like Valorant, CS2, League of Legends don't need the latest hardware. Don't upgrade. Wait until 2028 at earliest.

Enthusiast gamers playing demanding AAA games: If your current GPU can handle what you play at acceptable frame rates, wait. If it can't, buy the best RTX 50-series card you can afford now knowing you're paying a premium for aging hardware.

Content creators using GPUs for rendering or video work: You might need to upgrade sooner because performance directly affects productivity. Evaluate whether the productivity gains justify the cost. They might. But go in knowing you're buying premium-priced hardware.

Machine learning developers and AI researchers: You probably need the latest data center GPUs, so supply constraints are hitting you directly. This is frustrating but unavoidable. Work with what you can get. Consider whether other AI accelerators or cloud services might be more cost-effective than buying your own hardware.

System integrators and builders: Plan conservatively. Don't assume RTX 60 will launch on time with good supply. Plan systems around current hardware and adjust as you get more certainty.

The Role of Software Optimization

One silver lining in this hardware delay is that software optimization becomes more important. If new hardware isn't coming for a couple years, then driver improvements and software optimizations are how you get performance gains.

Nvidia's already aggressive with driver updates and features. AMD should match that aggressiveness. It's an opportunity to show that you're committed to gaming even if hardware supply is constrained. Better drivers and features cost less than new silicon.

Game developers also have incentive to optimize more aggressively when hardware isn't advancing quickly. Optimization becomes competitive advantage. Publishers can brag about how their game runs better on older hardware.

This could actually be beneficial in the long run. Bloated software and wasteful optimization are often enabled by the assumption that hardware will keep getting better. If hardware gains slow down, you have to be smarter with what you have.

Final Thoughts: Nvidia's Gamble

Ultimately, Nvidia's betting on a few key assumptions:

- HBM supply will improve enough by 2027-2028 that the company can serve both AI and gaming markets adequately.

- Gaming's profitability will remain strong enough to justify eventual investment even after multi-year deprioritization.

- Competitors won't use this window to take meaningful market share.

- Gamers will accept delays and constraints as temporary rather than permanent.

- The AI boom will justify the short-term costs of abandoning gaming's traditional cadence.

These are reasonable bets. But they're bets. And if any of them don't work out, the consequences could be significant. Nvidia's not infallible. The company's made strategic mistakes before. This RTX 50 Super cancellation is a big bet on AI's continued dominance and memory constraints lasting longer.

For everyone else—gamers, developers, competitors, regulators—it's worth watching closely. The next two years will tell us a lot about where the GPU market's actually heading and whether Nvidia's strategy works or backfires.

FAQ

Why is Nvidia canceling the RTX 50 Super?

Nvidia is canceling the RTX 50 Super because the company faces limited supplies of high-bandwidth memory (HBM), and management decided to allocate available memory to data center AI chips instead of consumer gaming GPUs. Data center operations generate approximately

When will the RTX 60-series actually launch?

The original plan called for RTX 60-series mass production to begin at the end of 2027, with consumer availability following several months later. However, the memory shortage could push that timeline back significantly. Based on current reports, RTX 60 might not become widely available until 2028 or later. If you need a new GPU before then, you're looking at purchasing RTX 50-series hardware at current inflated prices.

How bad is the HBM shortage really?

The high-bandwidth memory shortage is genuinely constraining the entire technology industry. SK Hynix and Samsung, which dominate HBM manufacturing, can't expand production fast enough to meet skyrocketing demand from AI accelerator sales. The shortage is affecting iPhone production, automotive suppliers building autonomous driving systems, and every company trying to build AI-competitive hardware. New manufacturing capacity won't come online meaningfully until 2027-2028.

Will AMD or Intel benefit from Nvidia's GPU delays?

AMD and Intel have opportunities to gain market share because Nvidia is deprioritizing gaming, but both face their own memory supply constraints. AMD's RDNA architecture is competitive with Nvidia's technology, and Intel's Arc is improving. However, they're also fighting for limited HBM supply. AMD would benefit most because gaming has historically been more central to AMD's strategy, and the company could position itself as the gamer-focused alternative to Nvidia's data center priorities.

Should I buy an RTX 50-series card now or wait for RTX 60?

This depends entirely on your needs. If your current GPU handles your workloads adequately, wait absolutely wait until 2028 when RTX 60 actually launches. You're paying inflated prices for a two-year-old architecture. If you need new hardware now because your current GPU isn't adequate, buy the best RTX 50-series card you can afford knowing you're paying a premium for aging hardware. Content creators and professionals have to weigh productivity gains against premium pricing.

What does this mean for gaming's future with Nvidia?

This signals that gaming is no longer Nvidia's priority. The company has shifted to focus on data center and AI applications, which are more profitable. For gamers, this means longer waits between new GPU generations, continued supply constraints, and deprioritized innovation in gaming-focused features. Over time, if this pattern continues, competitors like AMD or Intel could take gaming market share by positioning themselves as the gamer-first alternative.

How does the memory shortage affect other tech companies?

The HBM shortage is a bottleneck across the entire industry. Apple's iPhone production has been constrained. Automotive suppliers building autonomous vehicles can't get enough memory. Any company trying to build AI accelerators competes with Nvidia for limited memory supply. Basically, Nvidia's enormous purchasing power lets the company lock up memory that competitors need, creating an anti-competitive dynamic even though it's technically legal.

Could Nvidia's RTX 60 launch timeline slip again?

Yes, it could. If HBM supply remains as constrained as it is now, the RTX 60 launch could slip beyond 2028. Even after new manufacturing capacity comes online, it takes time for yields to improve and for full production capacity to materialize. Nvidia might push the timeline back again if memory supply doesn't improve. Gamers should plan conservatively and assume RTX 60 won't be readily available until 2029 at the earliest.

Is Nvidia's strategy of prioritizing AI sustainable?

For the short term, yes. The AI market is growing exponentially and more profitable than gaming. But long term, this strategy is risky. Gaming is foundational to Nvidia's brand and reputation. By deprioritizing gaming for multiple years, Nvidia risks losing goodwill and giving competitors time to close the gap. Intel learned this lesson with mobile processors—ignoring a market doesn't prevent competitors from taking it over.

What should PC gamers do right now?

If you don't need to upgrade immediately, hold your current GPU and wait. Prices are inflated and hardware is aged. Wait until at least 2028 when RTX 60 actually has a chance of launching with reasonable supply. If you absolutely need to upgrade, buy used RTX 50-series cards if possible to avoid paying new card markups, or consider AMD's RDNA alternatives which might offer better value and availability. Don't pay premium prices for aging hardware unless you truly need the performance.

Conclusion: The New Reality of GPU Supply

The cancellation of the RTX 50 Super and the delay of RTX 60 to potentially 2028 isn't just a scheduling inconvenience. It's a fundamental signal about where Nvidia's priorities lie and how the GPU market's going to evolve over the next few years.

Nvidia's made a rational business decision. Data center AI chips are exponentially more profitable than gaming GPUs. The company has limited memory supply and unlimited demand for both. It chose to serve the highest-value market. That's not surprising or even wrong from a business perspective.

But it's consequential. It means gamers are going to be stuck with aging hardware for longer. It means upgrade cycles are stretching out. It means the time between meaningful performance improvements is extending. It means competitive opportunities for AMD and Intel that they need to capitalize on.

For the broader technology industry, this reveals how concentrated the supply chains for critical components have become. When one company's purchasing decisions affect the entire market's evolution, and when that company's prioritizing one market over others based on profitability, you have structural market dynamics that should worry people.

The next 18-24 months will be interesting to watch. If HBM supply improves faster than expected and Nvidia successfully launches RTX 60 with good availability, then this delay is just a temporary hiccup. If supply stays constrained and gaming continues to be deprioritized, then we're looking at a fundamental shift in GPU market evolution and maybe in gaming's role within Nvidia's broader strategy.

Either way, the days of predictable GPU upgrade cycles and consistent performance improvements every 18 months are probably over. The hardware market's evolving based on supply chain constraints and profit incentives. Gamers and developers need to adjust expectations and plan accordingly. The future of gaming GPUs is being determined by decisions made in data center boardrooms, not by gamer enthusiasm or technical requirements. That's the new reality.

Key Takeaways

- Nvidia canceled the RTX 50 Super refresh and is cutting production of current RTX 50-series to prioritize AI chips

- RTX 60-series mass production has been pushed from late 2027 to potentially 2028 or later due to HBM memory constraints

- Data center operations generate 57 billion quarterly revenue, explaining the strategic shift away from gaming

- The HBM shortage is an industry-wide problem affecting iPhone production, automotive suppliers, and all GPU manufacturers

- Gamers should expect a 2+ year wait for meaningful GPU upgrades and should avoid buying RTX 50-series at inflated current prices

Related Articles

- Steam Machine Delayed: RAM Crisis & Price Shock [2025]

- Raspberry Pi Price Hikes: The RAM Crisis Explained [2025]

- Raspberry Pi Price Increases 2025: Impact of Global Memory Shortage

- China Approves Nvidia H200 Imports: What It Means for AI [2025]

- AI Infrastructure Boom: Why Semiconductor Demand Keeps Accelerating [2025]

- GPU Memory Crisis: Why Graphics Card Makers Face Potential Collapse [2025]

![Nvidia RTX 50 Super Delayed: RTX 60 Series May Miss 2027 [2025]](https://tryrunable.com/blog/nvidia-rtx-50-super-delayed-rtx-60-series-may-miss-2027-2025/image-1-1770311495927.jpg)