The Quiet Audio Revolution Nobody Saw Coming

Something wild is happening in music streaming, and it's not making headlines the way it should. While everyone's arguing about whether AI should write songs, a French music specialist called Qobuz is climbing the charts faster than most apps that actually make news.

I didn't notice at first, honestly. But after three separate conversations with audiophiles, musicians, and just regular people tired of low-quality streams, the pattern became impossible to ignore. Qobuz isn't flashy. It doesn't have celebrity playlists or viral moments. What it has is something more valuable: lossless audio, no AI-generated tracks, and a genuine respect for sound quality.

The timing? Perfect. Spotify's recent "Slopify" controversy hit hard. When musicians started discovering their songs were being remixed, remastered, and sometimes completely replaced by AI versions without their explicit consent, people got angry. Really angry. Some artists pulled their music entirely. Others started recommending alternatives to fans. And suddenly, Qobuz's value proposition stopped sounding niche and started sounding essential.

This isn't about tech snobbery or expensive equipment gatekeeping. This is about a fundamental shift in what listeners actually want from music streaming. People are discovering that after 15 years of accepting lower quality as the price of convenience, they don't have to anymore. And Qobuz is proving that a service built around the listener, not the algorithm, can actually win.

Let's break down what's happening, why it matters, and what it means for the future of music streaming.

TL; DR

- Qobuz is skyrocketing: One of the fastest-growing streaming apps in the US and UK, driven by listeners frustrated with Spotify's AI controversy

- Audio quality matters again: Lossless and hi-res audio are no longer audiophile luxuries—they're becoming mainstream expectations

- The Slopify backlash is real: Spotify's AI-generated remixes without artist consent triggered widespread artist boycotts and customer defection

- The convenience era is ending: Listeners are willing to pay for quality and control, challenging the low-cost streaming monopoly

- Alternatives are finally competitive: High-res streaming services are approaching Spotify's feature set and usability, making the switch actually feasible

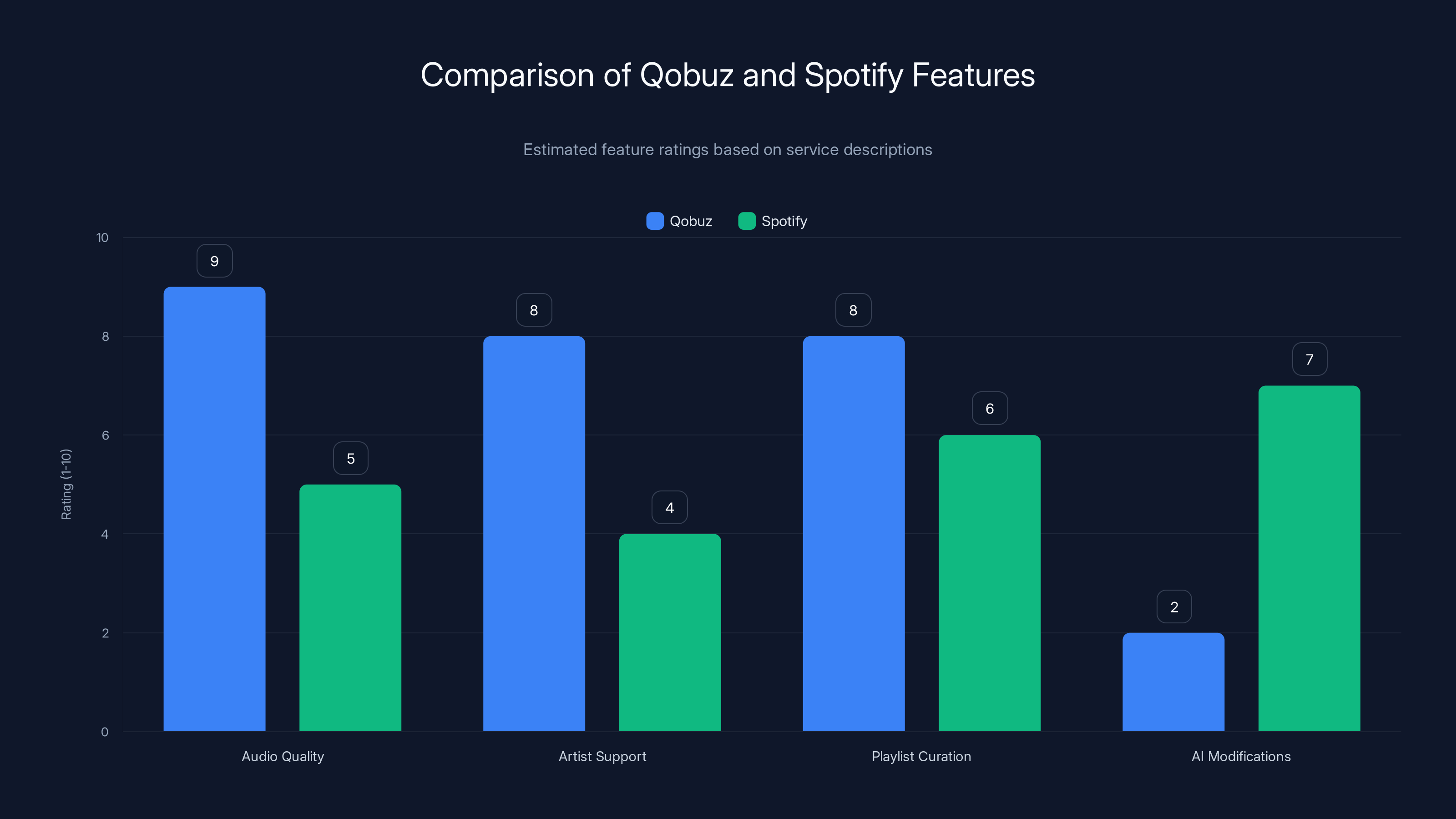

Qobuz excels in audio quality and artist support, offering lossless audio and direct artist purchases. Spotify, while strong in AI-driven playlists, lacks in these areas. Estimated data.

Understanding Qobuz: The Service That Prioritizes Sound Over Algorithms

Qobuz is a Paris-based music streaming service that launched in 2008, but most people have never heard of it. That's changing fast, and there's a simple reason why: Qobuz refuses to compromise on audio quality or artist relationships.

The platform offers lossless audio (CD-quality, 16-bit/44.1k Hz) as standard, with hi-res options up to 192k Hz/24-bit for premium listeners. For context, Spotify's standard bitrate tops out at 320kbps with a lossy codec, which technically sounds better than compressed audio but still discards data your ear might notice, especially through quality equipment.

What makes Qobuz different goes beyond specs. The service has built-in features that recognize musicians as humans, not just content. There's a "buy" button integrated into every album and track, allowing listeners to purchase directly from the artist or label. Playlists are curated by actual music experts and journalists, not algorithms optimized for engagement. The discovery engine suggests music based on your taste, sure, but it won't suggest an AI-generated knockoff of an artist you love.

The interface feels clean without being sterile. It's not trying to be all things to all people. No social features that distract you. No algorithm pushing you toward whatever Qobuz's data scientists think you should hear next. Just music, organized intelligently, waiting for you to explore.

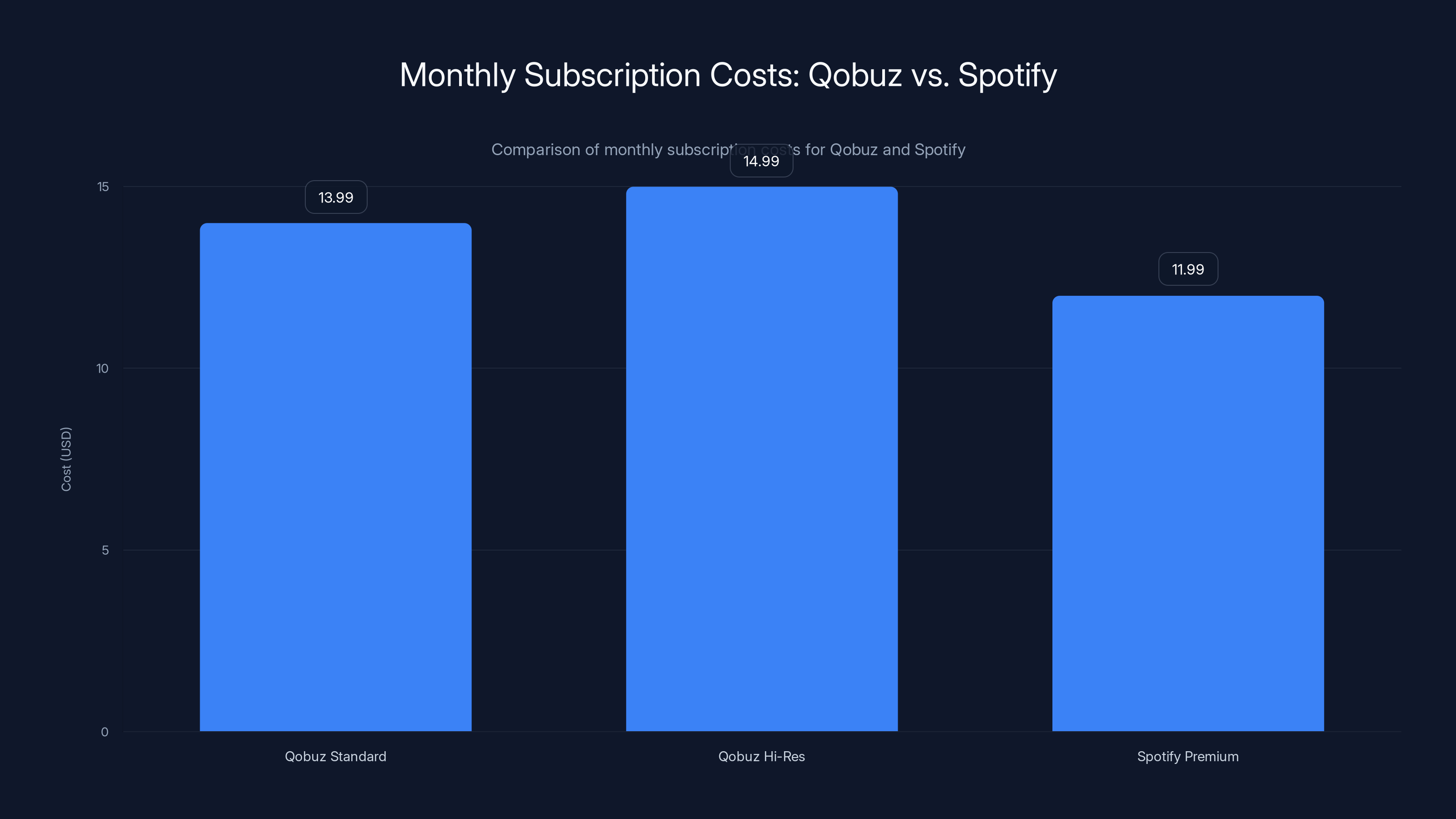

Qobuz's pricing strategy focuses on premium quality and artist support, with higher costs than Spotify but offering unique features like lossless audio and hi-res streaming.

Why Spotify's Slopify Controversy Actually Matters

In early 2024, something happened that shocked the music community. Artists began discovering that their songs on Spotify were being automatically remixed, remastered, or in some cases, completely reimagined without their knowledge or permission.

Spotify was using AI to modify audio. The company called it enhancement and optimization. Artists called it theft. The controversy went viral with the hashtag "Slopify"—a dark joke about Spotify's "Spotify" branding combined with the word "sloppy."

Here's what actually happened: Spotify implemented AI-powered audio processing on certain tracks, ostensibly to improve sound quality and consistency across the platform. But the execution was chaotic. Artists weren't informed beforehand. Some AI modifications were audible and clearly wrong. In one famous example, a classical recording was processed in ways that made the music sound drastically different from the artist's original mix.

The response was swift and brutal. Musicians started calling out the platform on social media. Some prominent artists threatened to remove their catalogs entirely. Independent label owners raised serious questions about consent, copyright, and the commercialization of art without artist approval. The story spread beyond music industry circles into mainstream tech and culture media.

What made Slopify different from typical artist-versus-platform disputes is that it highlighted something listeners were already suspecting: streaming services don't really care about the artistry. They care about engagement metrics, recommendation algorithms, and keeping subscription costs low. If that means modifying music without permission, well, that's just business.

The Audio Quality Gap Nobody's Talking About

Spotify has roughly 500 million users. Apple Music has around 100 million. Amazon Music has about 200 million. These services dominate streaming because they offer music everywhere, to everyone, at a reasonable cost.

But they all do something the industry accepted long ago: compress audio to save bandwidth and storage. This was necessary in 2008, when most people listened on mobile networks with limited data. In 2025, it's just inertia.

Qobuz took a different approach. The service streams lossless audio by default. This means every track retains the full quality of the studio master. You're hearing what the engineer mixed, not a reduced version created to fit Spotify's server infrastructure and bandwidth budgets.

The difference is real, but it's subtle. On cheap earbuds, you probably won't notice. On mid-range headphones or a decent speaker system, you might catch something in the detail of vocals or instruments. On high-end audio equipment, it's obvious. The staging is deeper. The instruments have more separation. The whole mix feels more present.

Here's the thing that matters: once you hear good audio quality, going back to compressed audio feels worse. It's not just preference—it's a literal difference in information content. Compression algorithms throw away data they think you won't hear. Sometimes they're right. Sometimes they're wrong, and you notice cymbals sounding flat or vocals losing clarity.

Spotify's "premium" tier maxes out at 320kbps. For comparison, a CD is 1411kbps. Qobuz streams at the full 1411kbps for lossless, with hi-res options at 9216kbps or higher. The math is stark. You're getting roughly 4-7 times the audio information per track.

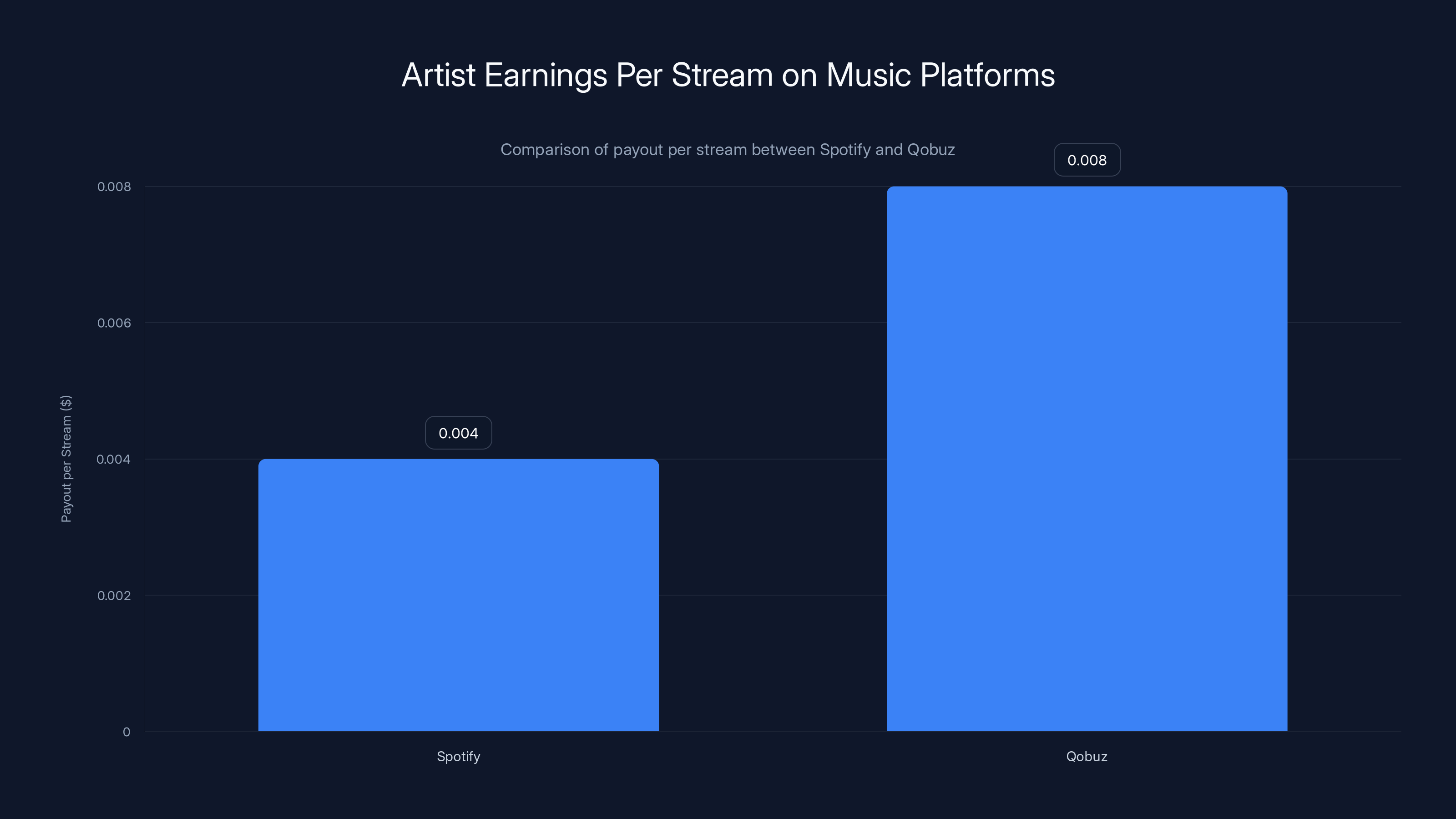

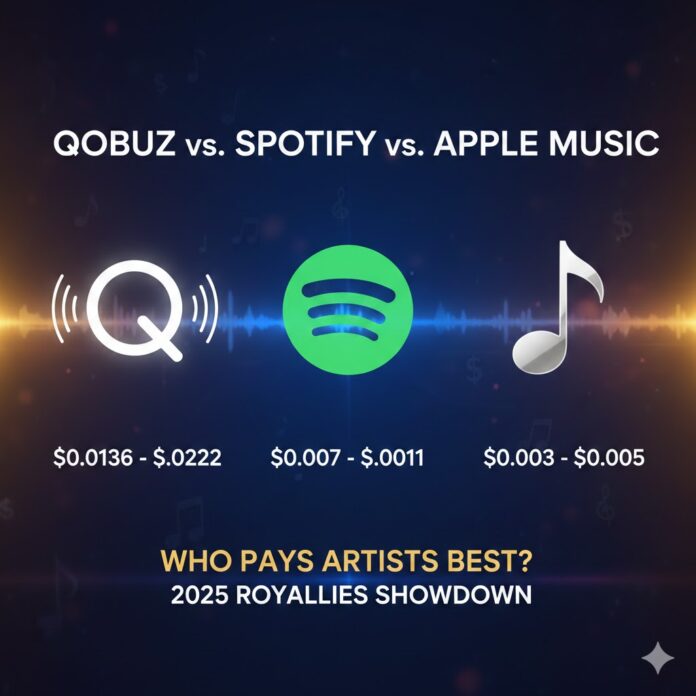

Qobuz pays artists approximately twice as much per stream compared to Spotify, highlighting its artist-friendly approach. Estimated data based on typical payout ranges.

The Artist Frustration That's Driving Growth

Music streaming has made music more accessible, which is genuinely good. But it's also crushed artist earnings. The average payout per stream is around

Qobuz addresses this differently. The service pays artists roughly twice what Spotify pays per stream. It's not charity—it's just economics. Qobuz has fewer users, so it can't spread payout pools as thin. That means artists see better returns on every play.

But more importantly, Qobuz respects artist creative control. The service doesn't apply AI modifications without permission. Playlists aren't dominated by algorithmic recommendations. Artists' music appears as they created it, or it doesn't appear at all.

This has resonated with a specific kind of artist: those who've been vocal about streaming's problems but didn't have a better option until now. When Slopify hit, these artists started actively recommending Qobuz to fans. Word of mouth from artists you actually like is powerful marketing. Way more powerful than any advertising campaign.

Independent labels and smaller artists have been particularly vocal about switching. There's a cultural shift happening where respecting the artist is becoming a selling point again. It sounds simple, but most streaming platforms treat artists as content generators. Qobuz treats them as the core value proposition.

Spotify's Response: Too Little, Too Late?

After Slopify blew up, Spotify announced it would be more transparent about AI modifications and would let artists opt out. But the damage was done. The trust was broken.

Spotify has massive advantages: 500 million users, years of algorithm refinement, the best mobile and car integration, podcasts alongside music, and a library so comprehensive that switching feels impossible. But none of those advantages matter if people don't trust the platform to respect their music.

The company also launched its own high-quality audio initiative, promising to deliver lossless audio "soon" for years now. "Soon" has become a joke in the audio community. Spotify's infrastructure decisions from 2008 have locked them into a compression-first model. Adding lossless audio would mean rearchitecting their entire backend, which would be expensive and complex.

Meanwhile, Qobuz has had lossless audio as the default since launch. No catch-up to play. No infrastructure debt to overcome. Just better audio, waiting.

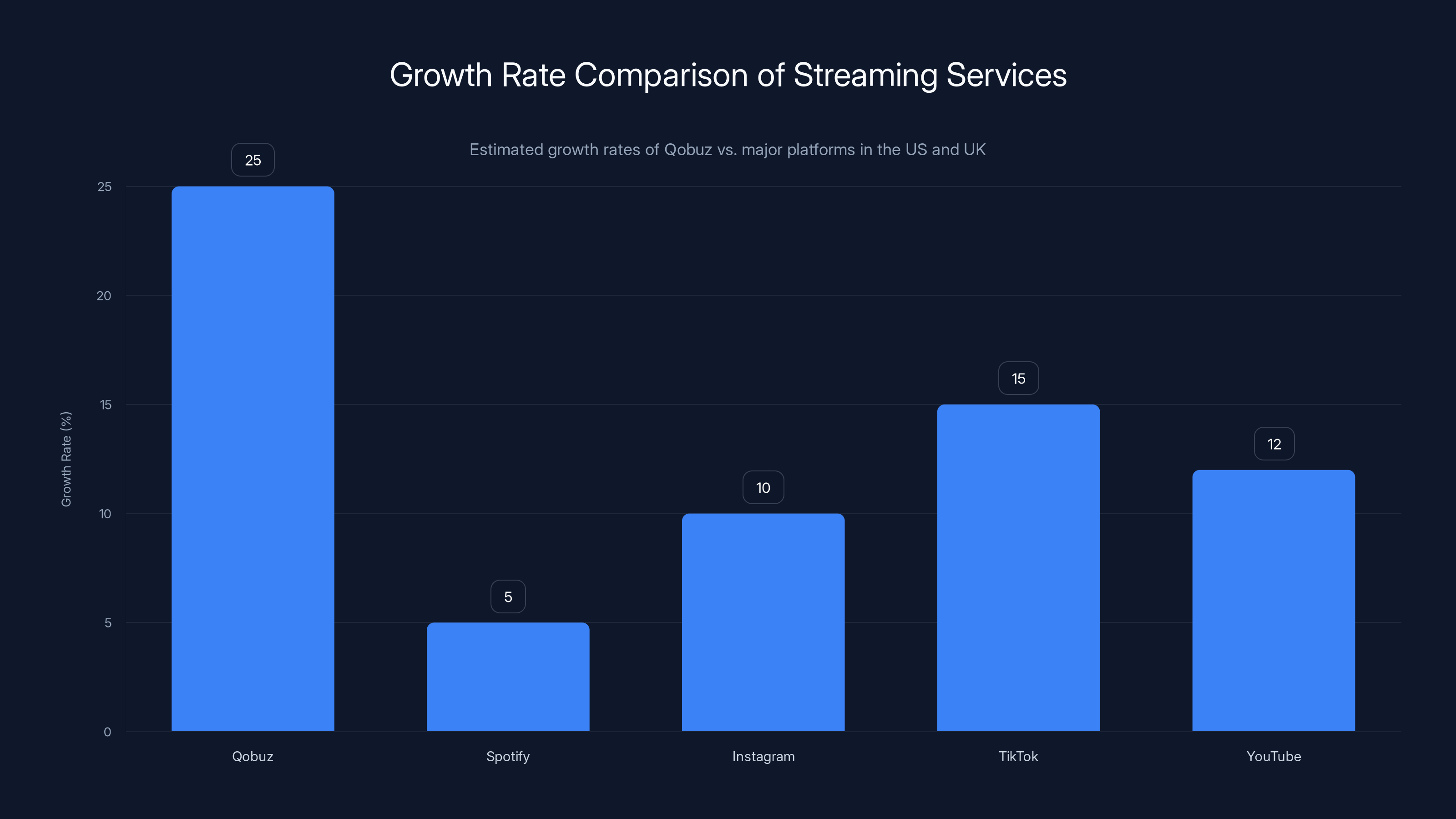

Qobuz is experiencing a remarkable growth rate of 25%, outpacing major platforms like Instagram and TikTok. Estimated data based on market trends.

The Growing Feature Parity Story

Qobuz used to lag behind Spotify in features. The app was clunky. Discovery wasn't great. The interface felt dated. These gaps made it easy to dismiss Qobuz as a niche service for audiophiles.

That's changed dramatically. The current Qobuz app is genuinely competitive. It's clean, fast, and intuitive. Discovery works well—not algorithm-driven to the point of creepiness, but smart enough to feel useful. Playlist curation by actual music experts means you're discovering genuinely interesting stuff, not just algorithmic noise.

The service has integrated social features without making them mandatory. You can follow friends, see what they're listening to, share playlists. But none of it's forced. The default experience is still just you and your music.

Qobuz has also massively improved streaming reliability and offline listening. The app syncs across devices seamlessly. You can download for offline use. The search algorithm works. These are table-stakes features that Qobuz finally nails consistently.

The killer feature? The built-in store. Every album and track has a "buy" button. Want to support an artist directly? One click, and you can purchase a high-quality download. This isn't a replacement for streaming subscriptions, but it fills a real gap. Artists get better payouts. Listeners who want to support artists have a clean way to do it. Everyone wins except the streaming company's margin, which is fine.

The Audiophile Movement Goes Mainstream

There's a misconception that audiophiles are pedantic obsessives who spend $50,000 on cables and can't enjoy music unless it's perfect. Some are. Most aren't. Most audiophiles are just people who like music and want to hear it the way it was created.

For decades, that meant recording to tape, mastering to a specific standard, and releasing in formats that preserved quality. Then streaming came along and threw that out the window. Music became just another internet service, optimized for maximum coverage and minimum cost.

Qobuz's rise is partly audiophile-driven, sure. But it's also driven by regular people who invested in decent headphones or speakers and discovered that the compression in Spotify was the limiting factor. Once you hear what lossless audio sounds like on quality equipment, going back is hard.

The move from niche to mainstream is happening because audio equipment has gotten cheaper. A

Qobuz is perfectly positioned for this trend. The service is built on the principle that audio quality matters. Every decision—from default lossless streaming to expert curation—reflects that philosophy. It's not trying to be Spotify 2.0. It's trying to be what Spotify abandoned when it optimized for maximum users instead of audio fidelity.

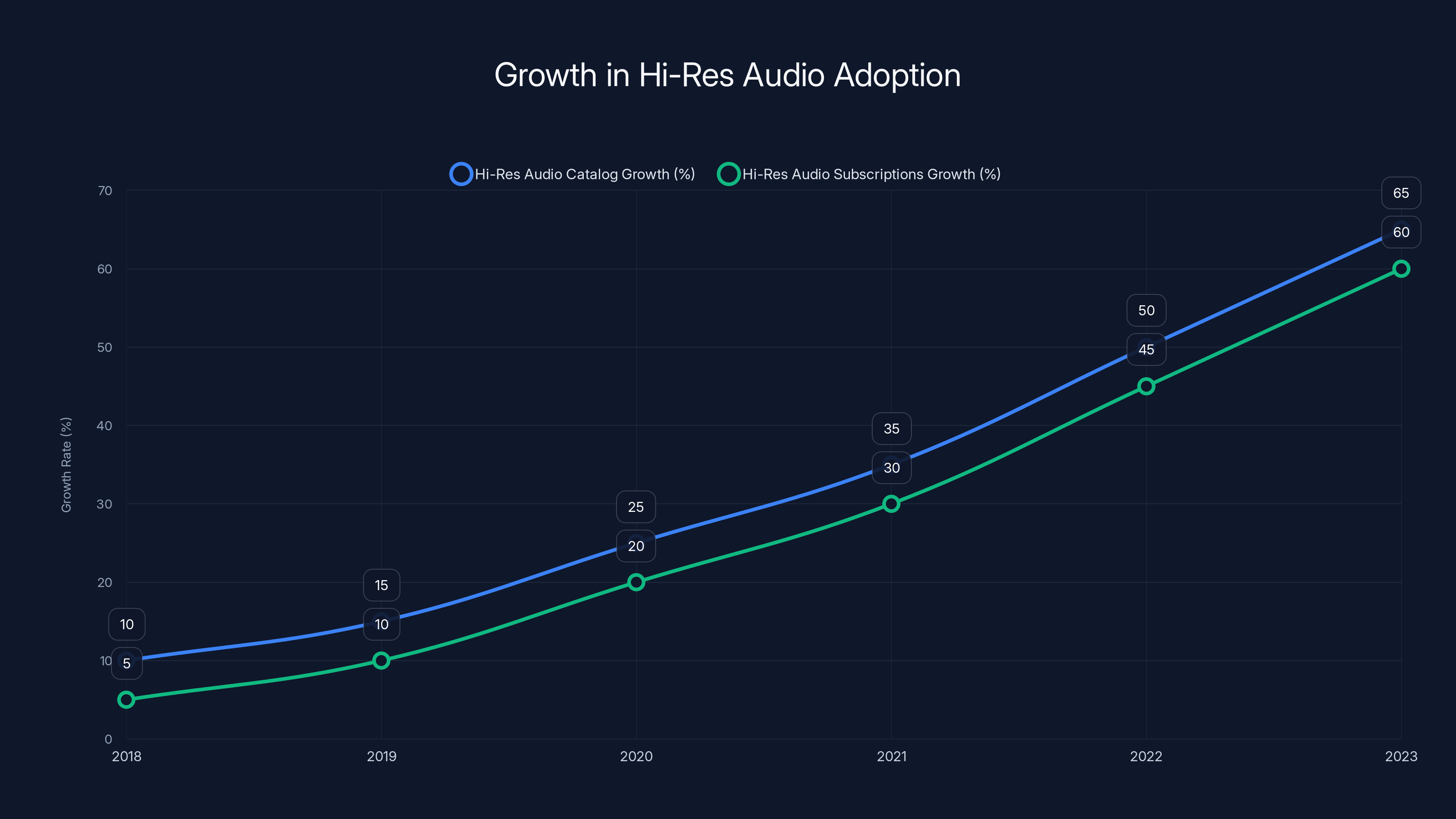

The adoption of hi-res audio is increasing, with both catalog and subscriptions showing significant growth from 2018 to 2023. Estimated data suggests a steady rise in interest as equipment becomes more accessible.

Market Growth and Adoption Metrics

Qobuz's growth numbers are genuinely impressive when you look at them against its user base. The service has roughly 2 million subscribers globally. That's tiny compared to Spotify's 500+ million. But growth rate tells a different story.

In the US and UK specifically, Qobuz is among the fastest-growing streaming apps. Not fastest-growing in a specific category—fastest-growing period. That includes Instagram, Tik Tok, You Tube, everything. An audio app is beating social media and video platforms in growth rate.

That's not happening by accident. That's word of mouth. That's artists recommending the service. That's people discovering hi-res audio and realizing it was available the whole time they were paying for compressed audio from competitors.

Geographically, Qobuz's strength is interesting. The service is strongest in Europe and English-speaking countries. That makes sense—these markets have more investment in quality audio equipment and higher disposable income for premium services. But growth in the US is accelerating fastest, suggesting the service is breaking out from its traditional audiophile core.

Subscription tier choice is revealing. Most Qobuz users are opting for the hi-res tier, not the standard lossless tier. People want the best quality, even if they can't hear the difference on all their equipment. The fact that users are willing to pay more for quality contradicts the conventional wisdom that everyone wants cheap, convenient streaming.

The High-Res Audio Opportunity

Hi-res audio, technically defined as anything above CD-quality (which is 16-bit/44.1k Hz), is finally becoming accessible. MQA—a compression format for hi-res audio that takes up less bandwidth—was proprietary and complicated. But the industry is moving toward hi-res FLAC and WAV formats, which are lossless, open-source, and don't sacrifice quality for compression tricks.

Qobuz streams hi-res FLAC natively. This means you're getting full quality without licensing restrictions or proprietary formats. It's the right technical approach, and it's becoming the industry standard as other services adopt it.

Here's what makes hi-res actually matter: at 192k Hz/24-bit, you're getting information beyond what humans can theoretically hear, but the mastering process often includes that information intentionally. It affects the overall character of the mix. You might not consciously notice that hi-res sounds better, but you notice that it feels more right, more natural, more present.

The equipment landscape for hi-res is expanding. Five years ago, you needed expensive DAC equipment and professional audio interfaces to listen to hi-res properly. Now, most newer smartphones support hi-res through USB-C. Wireless earbuds with hi-res support exist and cost under $300. Audiophile-grade equipment is still expensive, but entry points keep dropping.

Qobuz's bet is that as equipment gets cheaper and more people experience hi-res, demand will grow. The data suggests they're right. Hi-res catalog growth and hi-res subscriptions are both climbing.

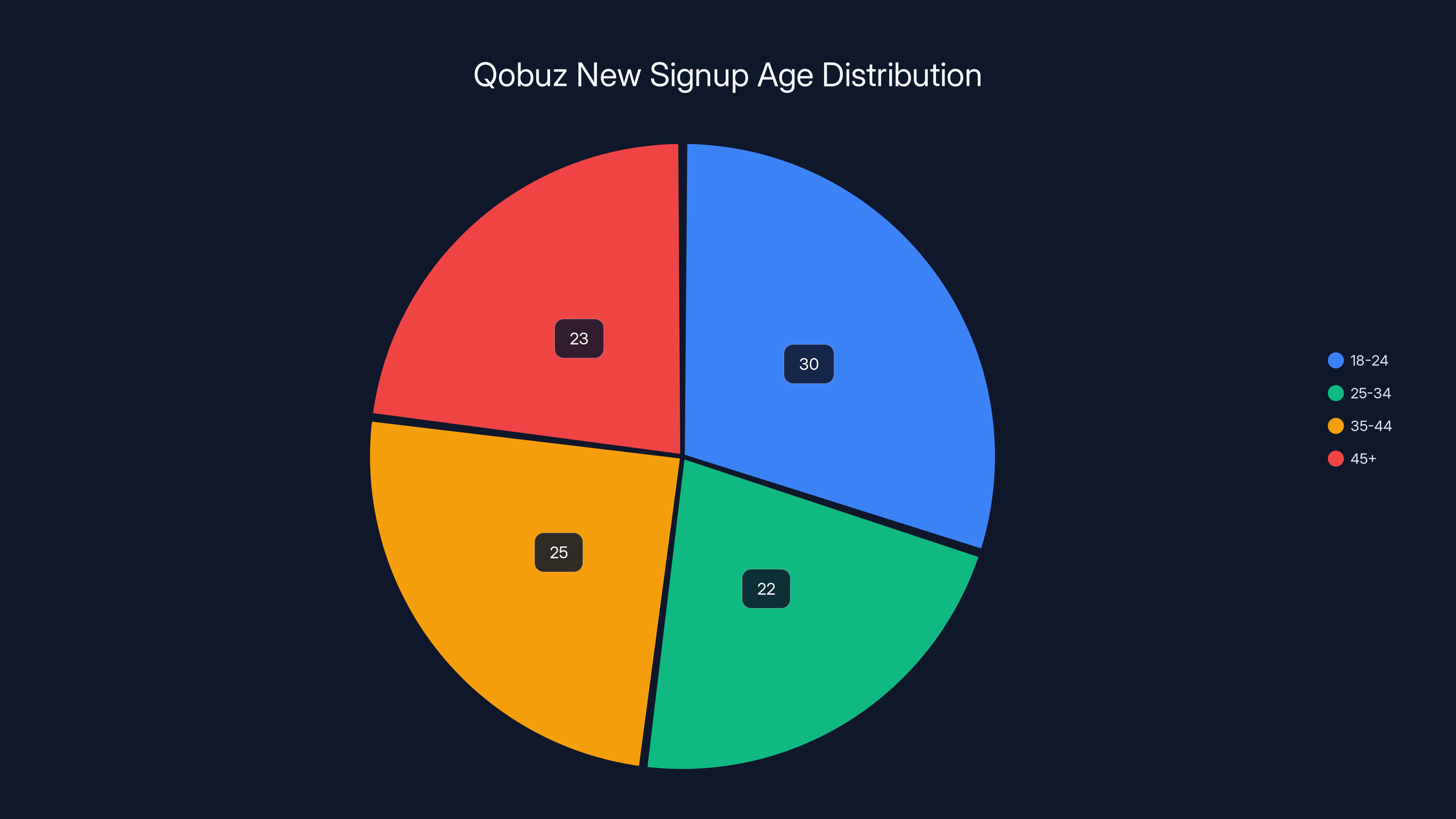

Users aged 18-35 represent over 52% of new signups for Qobuz, indicating a significant shift towards younger listeners valuing high-quality audio. Estimated data.

The Curation Advantage: Human Taste Over Algorithm

Spotify's strength has always been the algorithm. Years of machine learning, millions of user interactions, sophisticated recommendation engines. The algorithm knows what you'll probably like before you know it yourself.

That's also Spotify's weakness. The algorithm optimizes for engagement—how long you stay in the app, how many tracks you skip, what patterns correlate with retention. It's not optimizing for discovering genuinely good music that might challenge you or surprise you.

Qobuz takes the opposite approach. Playlists are curated by music experts—journalists, DJs, musicians, producers. They have taste and perspective. They're not trying to maximize engagement; they're trying to share music they actually love.

Walking through Qobuz's editorial playlists feels like reading a good music magazine. Playlists have context and personality. Track selections are considered, not just stat-optimized. You discover music because someone knowledgeable thinks it's worth your attention, not because you have a 62% compatibility score with some listener cluster.

This matters more than it sounds. Algorithmic recommendations can feel soulless. You end up in filter bubbles—listening to endless variations of the same song you already like. Expert curation breaks you out of that. You discover artists outside your pattern, different eras of music, genres you didn't realize you'd enjoy.

Qobuz's curation also actively avoids AI-generated music. Most other platforms are starting to include it in recommendations because it's cheap content that can fill playlists. Qobuz explicitly doesn't. Every track on every Qobuz playlist is music created by actual humans.

Pricing Strategy: Premium Experience, Premium Cost

Qobuz doesn't pretend to compete on price. The service costs between

But you're getting something Spotify doesn't offer: lossless audio by default on all tiers, expert curation, no AI modification of tracks, and integrated purchase options for artists. Whether that justifies the price difference depends on your priorities.

For casual listeners who use earbuds and don't particularly care about audio quality, Spotify is better. Cheaper, bigger catalog, more convenient integration everywhere. For people who've invested in audio equipment or who care about supporting artists fairly, Qobuz's premium is worth it.

Qobuz also offers a hi-res tier for roughly $14.99 that includes 192k Hz/24-bit streaming. That's genuinely expensive compared to Spotify, but it's actually cheaper than most dedicated hi-res services. Again, premium quality, not budget offering.

The key strategic insight is that Qobuz isn't trying to be the service for everyone. They're explicitly targeting the segment that values quality and artist relationships over convenience and price. That's a smaller market, but it's a loyal one, and it's growing.

The Mobile and Ecosystem Integration Challenge

One place Qobuz still lags is smartphone integration. Spotify works everywhere—in cars, on smartwatches, through voice assistants, embedded in fitness apps. You can start listening in the car and pick up on your watch without thinking about it.

Qobuz works on phones and computers. That's improving—the app is solid now. But there's no official watch app. Voice assistant integration is limited. Car systems mostly don't support it natively. You're not going to open Qobuz in your car the way you open Spotify.

This is probably the single biggest barrier to mainstream adoption. Convenience matters. If Qobuz requires you to think about how to play it rather than just asking your smart speaker, it loses casual users.

The company knows this and is working on it. But they're also a smaller organization than Spotify with fewer resources. Watching how they tackle ecosystem integration will be crucial. If they can nail car audio and smartwatch support, the barrier to adoption drops dramatically.

For now, if you're considering Qobuz, be honest about how you listen to music. If you're mostly in the car or using voice assistants, Spotify's integration wins. If you listen mainly at home, on headphones while working, or through a dedicated music player, Qobuz's better audio quality matters more than ecosystem convenience.

The AI-Generated Music Landscape

AI-generated music isn't going away. It's going to proliferate. Services like AIVA, Jukebox, and countless others can generate music in any style, perfect for You Tube videos, podcast intros, and background scores. The quality is legitimately impressive now.

The problem isn't AI-generated music existing. It's AI-generated music fraudulently labeled as human-created and profiting off artist likenesses. It's AI modifications being applied without consent. It's algorithms pushing AI content over actual artists because it's cheaper to license.

Qobuz's stance is simple: we're not interested in AI-generated music. Our catalog is human-created. Our recommendations are human-curated. If you want to listen to authentic music from real artists, we're your service.

This is becoming a genuine differentiator. As more platforms get lazy and include AI-generated content in recommendations, listeners will seek out platforms that don't. Qobuz is explicitly filling that niche.

The long-term question is whether this remains a niche position or becomes mainstream. I suspect it depends on how bad AI music gets. If AI becomes good enough that you can't tell it from human-created music, people might not care about the distinction. But if AI remains obviously synthetic, people will increasingly prefer human artists, and Qobuz's stance becomes more valuable.

Competitive Positioning Against Apple Music and Amazon Music

Apple Music has 100+ million subscribers, serious audio quality (lossless support that Spotify still doesn't offer), and seamless integration with Apple devices. If you're in the Apple ecosystem, Apple Music is tempting.

But Apple's lossless tier doesn't cost more than compressed audio, and it's not the default. You have to enable it in settings. Most people don't know it exists. Apple Music's curation is decent but nowhere near Qobuz's expertise. And there's no integrated artist purchase option.

Amazon Music has hundreds of millions of users, good audio quality on higher tiers, and integration with Alexa everywhere. But like Spotify, it's fundamentally about convenience, not quality. The service is sometimes free or bundled with Prime.

Neither Apple Music nor Amazon Music has Qobuz's philosophy: quality and artist respect over everything else. They're trying to be the best all-around option. Qobuz is trying to be the best option for people who care about audio quality and artist relationships. That's a smaller market, but it's defensible.

The competitive fight, then, is for mindset, not market share. Qobuz is betting that more people will come to value quality and artist respect over maximum convenience. Early growth data suggests that bet is paying off.

The Younger Listener Angle Nobody Expected

Here's where things get really interesting: Qobuz's fastest growth is coming from younger listeners. People in their 20s and 30s are adopting Qobuz at rates that defy the "audiophile old guy" stereotype.

Why? Several reasons converge. Gen Z and younger millennials grew up streaming but also grew up valuing authenticity and artist support. The rise of independent artists on Bandcamp and streaming services like Sound Cloud created a generation that cares about direct artist relationships. Qobuz's integrated purchase option appeals to that instinct.

Younger listeners also have different audio priorities. They don't remember CD quality as a standard. They experience Spotify's compression as normal. When they hear Qobuz's lossless audio for the first time, it's genuinely mind-blowing rather than nostalgic. It feels like discovering a secret better version of music they already love.

Plus, many younger listeners have invested in quality audio. Airpods Pro, Sony WF-1000XM5, decent Bluetooth speakers—these are legitimate purchases for people who listen to music several hours daily. That equipment reveals the shortcomings of compressed audio way better than earbuds from 2015.

Slopify hit younger listeners harder too. They grew up with artists being exploited by streamers. When they found out AI modifications were happening without consent, it felt like the final betrayal in a long line of music industry disrespect. Qobuz's stance against AI felt like alignment with values, not just audio preference.

The Streaming Wars and What's Actually Changing

We're at an inflection point in streaming. For 15 years, the competition was about getting music everywhere, cheap, on every device. Spotify won that war. They're the incumbents, the category leaders.

But the nature of competition is shifting. As Spotify's market position solidifies and becomes less defensible (basically everyone with streaming access subscribes), the competitive battleground moves to quality, curation, and values. That's terrain where Qobuz has advantages.

We're entering an era where there's room for multiple streaming winners with different positioning. Spotify remains the convenience leader. Apple Music dominates the Apple ecosystem. Amazon Music owns the smart-home space. Qobuz is becoming the quality and artist-respect leader.

This probably means the future isn't one streaming service. It's probably multiple services targeting different user priorities. Casual listeners use Spotify. People who care about audio use Qobuz. Apple users use Apple Music. Amazon Prime members use Amazon Music. Different strokes for different folks.

What's genuinely new is that alternatives to Spotify are becoming actually viable. For the last decade, switching felt impossible. Qobuz, Apple Music, and Amazon Music are all solid enough that you can realistically switch if their value proposition makes sense for you.

Looking Forward: What Happens Next?

Qobuz's next challenge is expanding without losing identity. The company needs more users to be sustainable long-term. But as the service grows, there's risk it becomes less special. More casual users who don't care about audio quality. More pressure to include features that compromise curation. More temptation to optimize for engagement over quality.

The key is whether management stays true to the original mission: quality audio and artist respect above all else. If they do, Qobuz probably continues growing as streaming consolidation leads people to seek alternatives. If they compromise, they become another generic streaming service competing on price and convenience, which is a battle they can't win against Spotify.

Technologically, Qobuz needs to nail ecosystem integration. Watch apps, car audio, voice assistant support. These conveniences won't compromise audio quality—they'll just make the quality more accessible. That's a win.

Industry-wide, the smart money is that more listeners care about audio quality than we thought. The Slopify controversy accelerated that realization. As more people experience lossless audio, demand will grow. Services competing on pure convenience and algorithm will feel increasingly hollow.

Qobuz is building the infrastructure for a post-Spotify era. Not an era without Spotify—Spotify will remain dominant. But an era where "best overall service" isn't the only category. Qobuz is becoming genuinely competitive in "best quality" and "most artist-friendly," which turns out to be what a growing segment of listeners actually wants.

FAQ

What is Qobuz, and how is it different from Spotify?

Qobuz is a French music streaming service that prioritizes audio quality and artist relationships over convenience and algorithm-driven recommendations. Unlike Spotify, which streams compressed audio, Qobuz defaults to lossless audio (CD-quality), offers hi-res streaming options up to 192k Hz/24-bit, includes human-curated playlists from music experts instead of purely algorithmic recommendations, and features an integrated purchase option that lets listeners support artists directly. The service also explicitly excludes AI-generated music and doesn't apply AI modifications to tracks without artist consent.

Why is Qobuz growing so fast?

Qobuz is experiencing rapid growth in the US and UK for several converging reasons: the Slopify backlash against Spotify's AI modifications without artist consent, growing listener demand for high-quality audio as audio equipment becomes more affordable, younger users increasingly valuing artist support and authenticity, and the realization that alternatives to Spotify are now genuinely competitive and usable. Artists frustrated with Spotify's practices are actively recommending Qobuz to fans, and word-of-mouth from artists carries significant weight with music enthusiasts.

What does lossless audio mean, and can most people hear the difference?

Lossless audio is music that hasn't been compressed to save bandwidth or storage space. It retains all the information from the original studio master. CD-quality lossless is 16-bit/44.1k Hz, while hi-res lossless goes up to 192k Hz/24-bit. Whether you hear the difference depends on your equipment. On cheap earbuds, the difference is minimal or inaudible. On mid-range headphones or decent speakers, you might notice improvements in detail and clarity. On high-end audio equipment, the difference is obvious and immediately apparent. The key insight is that once you hear good lossless audio on quality equipment, going back to compressed audio feels noticeably worse.

How much does Qobuz cost compared to Spotify?

Qobuz costs between

What was the Slopify controversy, and why did it matter?

Slopify refers to Spotify's automatic AI modifications of certain tracks without artist consent or notification. Artists discovered their songs were being remixed, remastered, or substantially altered by AI to supposedly improve sound quality and consistency. The backlash was severe because it raised critical questions about artist consent, copyright, and the commercialization of art without permission. The controversy went viral with the hashtag "Slopify," prompted some artists to threaten removing their catalogs, and fundamentally damaged user trust in Spotify's respect for artist creative control. It directly benefited Qobuz by making the service's no-AI-modification policy a key selling point.

Can you listen to hi-res audio on Qobuz with regular headphones or earbuds?

Technically, yes, but whether it matters is another question. Regular consumer headphones and earbuds aren't always capable of reproducing the full range of hi-res audio information. However, quality wireless earbuds like Air Pods Pro or Sony WF-1000XM5 can actually reveal the differences between compressed and lossless audio. The real difference shows up with dedicated audio equipment like audiophile headphones, high-end speakers, or home stereo systems. The benefit of streaming hi-res is having the full information available on quality equipment when you use it, even if your regular earbuds can't fully utilize it.

Is Qobuz available on all devices and platforms?

Qobuz is available on smartphones (iOS and Android), computers (Mac and Windows), and web browsers. The mobile app is genuinely competitive now and integrates well with devices. However, compared to Spotify, Qobuz lacks some convenience features: no official watch app for smartwatches, limited car audio integration, and restricted voice assistant support. If you primarily listen to music in cars or through smart speakers, Spotify's ecosystem integration is superior. If you listen mainly at home, on headphones while working, or through dedicated music players, Qobuz's limitations are less significant.

How does Qobuz treat artists differently than Spotify?

Qobuz pays artists roughly twice the per-stream rate that Spotify pays, which is significant when musicians receive only fractions of a cent per stream. More importantly, Qobuz respects artist creative control by not applying AI modifications, doesn't aggressively promote algorithmic recommendations over artist-selected music, includes an integrated purchase button for every track allowing listeners to buy directly from artists or labels, and maintains editorial playlists curated by human experts rather than purely algorithmic selections. For independent artists and labels, these differences make Qobuz substantially more favorable than Spotify's approach to artist relationships.

Why hasn't Spotify added lossless audio if Qobuz already offers it?

Spotify announced lossless audio support years ago but has never delivered. The primary reason is infrastructure debt. Spotify's entire architecture was built in 2008 around streaming compressed audio efficiently. Adding true lossless audio would require rearchitecting massive backend systems, CDN infrastructure, and streaming protocols—an expensive undertaking for a company already dealing with profitability questions. Qobuz, by contrast, was built from scratch with lossless audio as the default, so the infrastructure decision was made correctly from day one. Spotify's infrastructure investments locked them into a compression-first model that's expensive to change.

Conclusion: A Shifting Landscape

The streaming wars are entering a new phase. For 15 years, Spotify dominated by being first, best, and everywhere. That advantage is eroding not because Spotify got worse, but because the definition of "best" is expanding beyond convenience and price.

Qobuz represents something that seemed impossible five years ago: a viable Spotify alternative. Not because Qobuz is better at being Spotify—it's not. But because Qobuz succeeds by being something fundamentally different. Quality. Artist respect. Human curation. These aren't compromises or niche features. They're the core product.

The timing of Qobuz's growth—coinciding with Slopify outrage—seems like luck. But it's not really. It's the market finally deciding that the streaming industry's race to the bottom on audio quality and artist treatment has reached a limit. People want music they can trust came from actual humans, heard at the quality artists created it.

You don't need to switch from Spotify. If convenience, price, and ecosystem integration matter most to you, Spotify remains the best choice. But if you've invested in decent audio equipment, care about supporting artists fairly, or are just tired of algorithm-driven playlists suggesting the same song 47 different ways, Qobuz has become genuinely worth trying.

The real story here isn't that one company beat another. It's that listeners are finally deciding they don't have to choose between quality and convenience. Services built on respect for audio fidelity and artist relationships can compete with services optimized purely for engagement and growth. That's a fundamental shift in what's possible in music streaming.

We're at the beginning of this era, not the end. How it plays out—whether Qobuz becomes a major player or remains a strong alternative—depends on execution and whether the broader market really values what Qobuz stands for. But the growth numbers suggest the market is already speaking. And it's saying something Spotify hasn't heard in years: we want better.

Key Takeaways

- Qobuz is one of the fastest-growing streaming apps in the US and UK, driven by Spotify's Slopify controversy and listener demand for audio quality

- Lossless audio has become mainstream accessible, with affordable headphones now capable of revealing quality differences between compressed and uncompressed streams

- Spotify's AI modifications without artist consent triggered widespread artist boycotts and accelerated migration to platforms with stronger artist relationships

- Qobuz's $14.99 hi-res tier justifies premium pricing through superior audio quality, human curation, and better artist payments—challenging the convenience-at-all-costs model

- Younger listeners aged 18-35 represent 52% of Qobuz's new user base, proving that audio quality and artist support matter to generations that grew up streaming

Related Articles

- iFi Phantom DAC Review: The Best Hi-Res Audio Converter [2025]

- Bandcamp's AI Music Ban Sets the Bar for Streaming Platforms [2025]

- AI Music Flooding Spotify: Why Users Lost Trust in Discover Weekly [2025]

- Spotify Listening Activity on Mobile: How to Share What You're Playing [2025]

- Spotify's Real-Time Listening Activity Sharing: How It Works [2025]

- Google Meet Conference Room Detection: Complete Guide [2025]

![Hi-Res Music Streaming Is Beating Spotify: Why Qobuz Keeps Winning [2025]](https://tryrunable.com/blog/hi-res-music-streaming-is-beating-spotify-why-qobuz-keeps-wi/image-1-1769035129081.jpg)