India's Zero-Tax Cloud Policy Until 2047: The Game-Changer for Global Data Center Investment

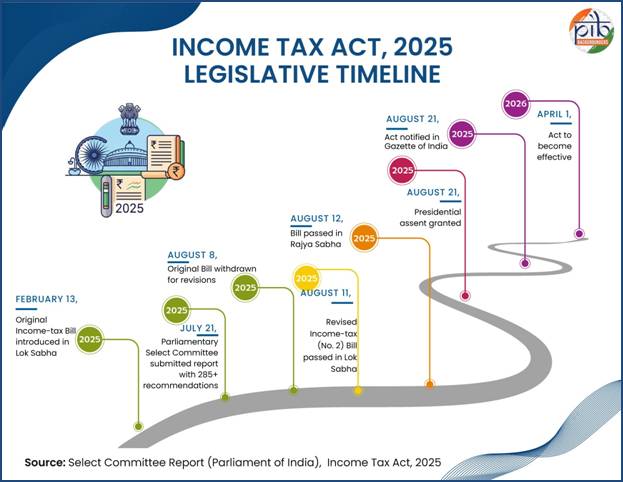

India just made a move that could reshape the global cloud infrastructure landscape. The country's government announced something that sounds too good to be true: zero taxes on cloud service revenues until 2047, but with one condition—your data centers have to run from Indian soil. According to CNBC, this policy aims to attract significant foreign investment in India's cloud infrastructure.

Let me be honest. At first glance, this looks like India throwing money at tech companies. But it's actually a calculated, strategic play. The government isn't just handing out tax breaks. It's positioning India as a serious player in the global AI and cloud infrastructure race, timing everything to align with Prime Minister Narendra Modi's vision for India to become a developed nation by 2047, as detailed in CantonRep.

Here's what's actually happening, why it matters, and what it means for cloud providers, tech companies, and the broader ecosystem.

The Core Policy: What India Is Actually Offering

India's Finance Minister Nirmala Sitharaman announced a targeted tax incentive designed to attract foreign cloud infrastructure investment. The headline is simple: zero corporate tax on cloud service revenues generated outside India, valid through 2047. But the fine print reveals the strategy, as reported by TechCrunch.

The incentive applies to foreign companies operating cloud data centers within India. If you're Google, Microsoft, or Amazon, you can process workloads in India and sell those services globally without paying Indian corporate tax on those revenues. That's a massive financial advantage over operating data centers in most other countries, according to TechBuzz.

However, there's a critical caveat. Domestic sales—services sold to Indian customers—must flow through locally incorporated resellers who face standard Indian taxation. This isn't a blanket tax holiday. It's a targeted incentive for export-oriented cloud services.

Why the 2047 timeline? That's the government's target year for India to achieve developed-nation status under its Viksit Bharat (Developed India) initiative. The tax break essentially says: we're betting on this infrastructure creating jobs and economic growth over the next two decades, as noted by W.Media.

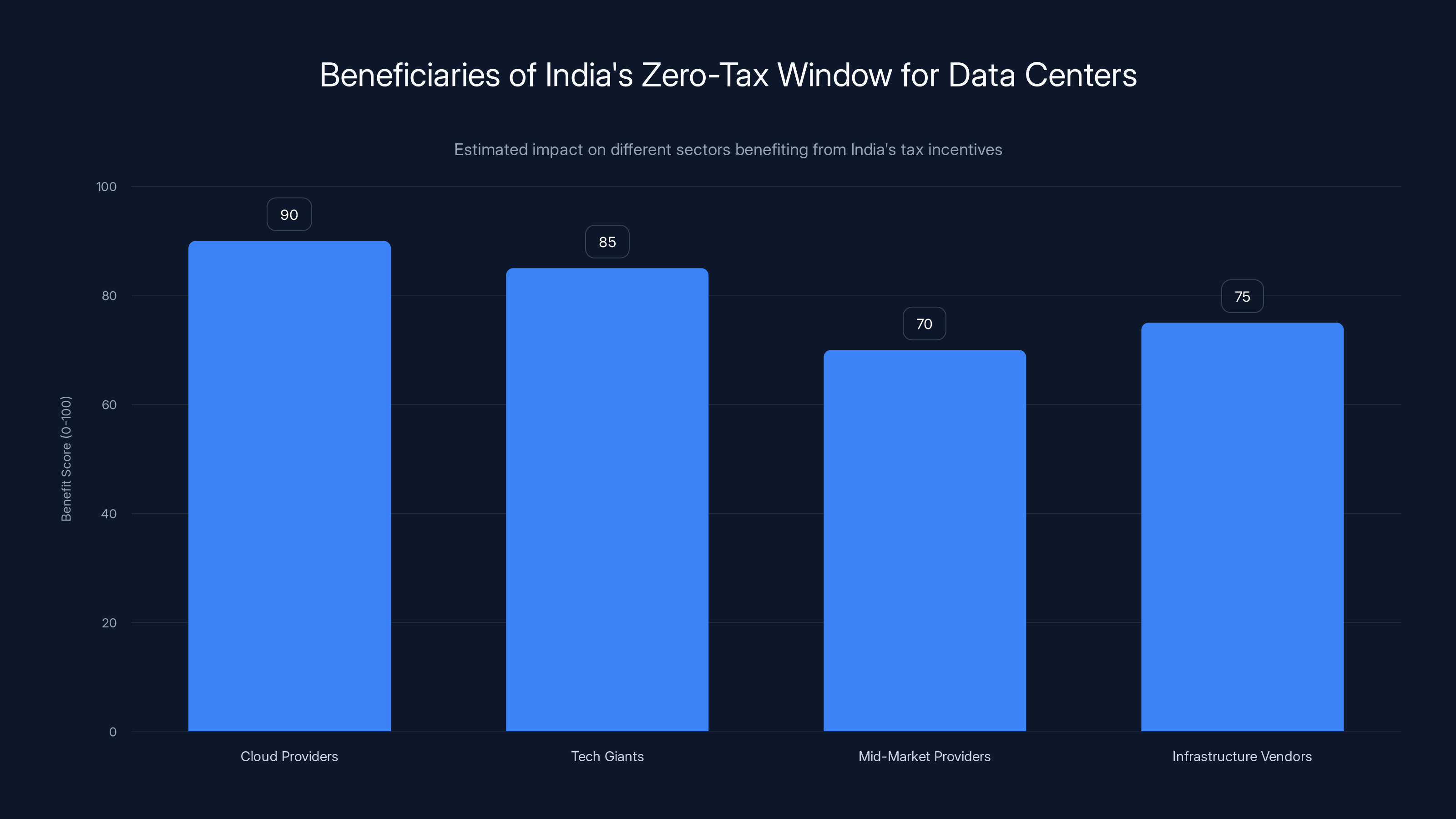

Cloud providers and tech giants are the primary beneficiaries of India's zero-tax window, with significant cost savings and increased investment potential. Estimated data based on potential tax savings and market impact.

Why This Matters: The Race for Data Center Dominance

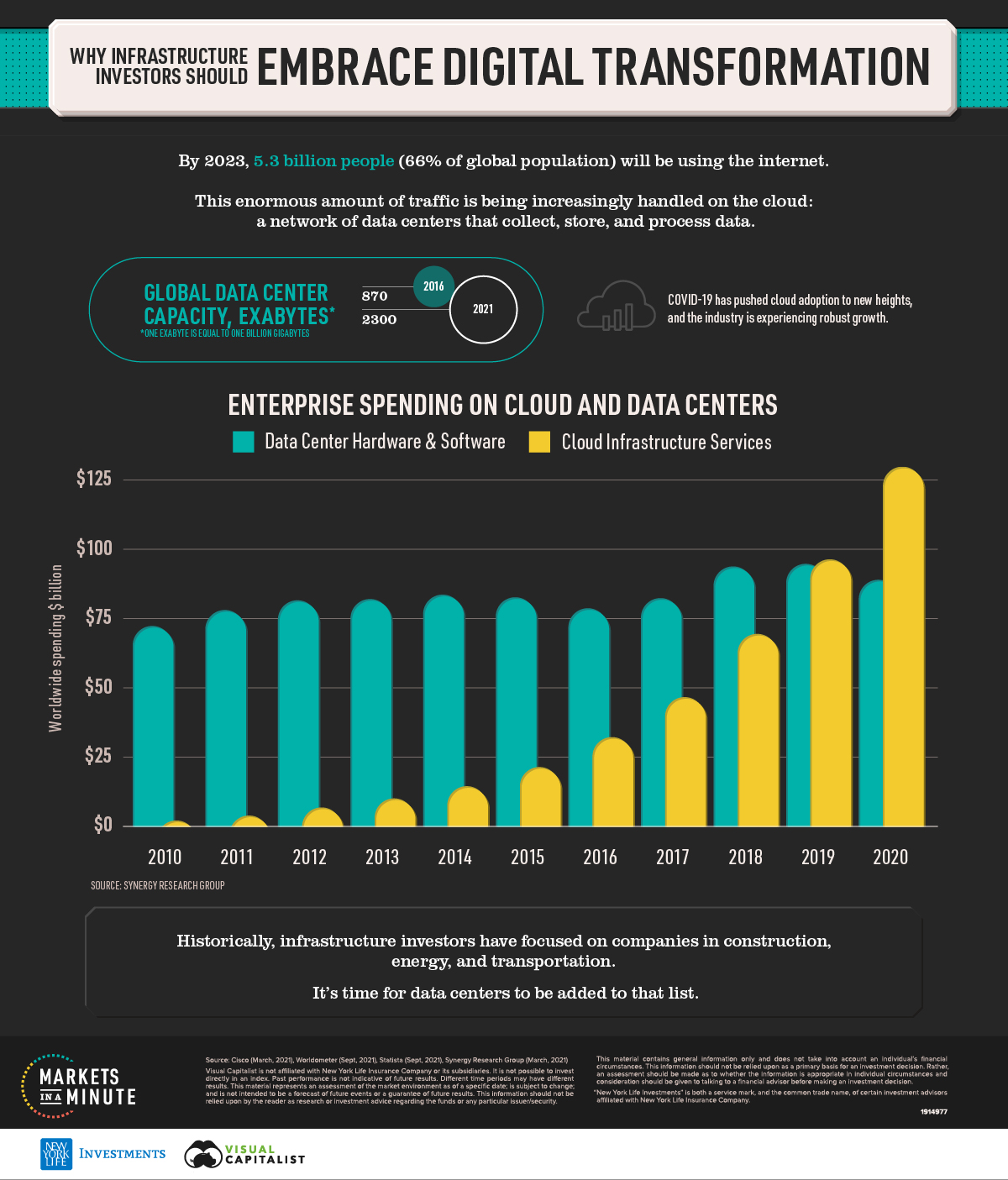

Data centers aren't boring infrastructure anymore. They're strategic assets. AI workloads demand proximity to processing power. Regulatory compliance increasingly requires local data residency. And geopolitics matters—countries want control over where their data sits, as highlighted by Data Center Knowledge.

India recognized this. While other countries were debating data sovereignty rules, India decided to make itself attractive. The math is simple: offer tax incentives, attract investment, build world-class infrastructure, and watch the economic multiplier effect unfold.

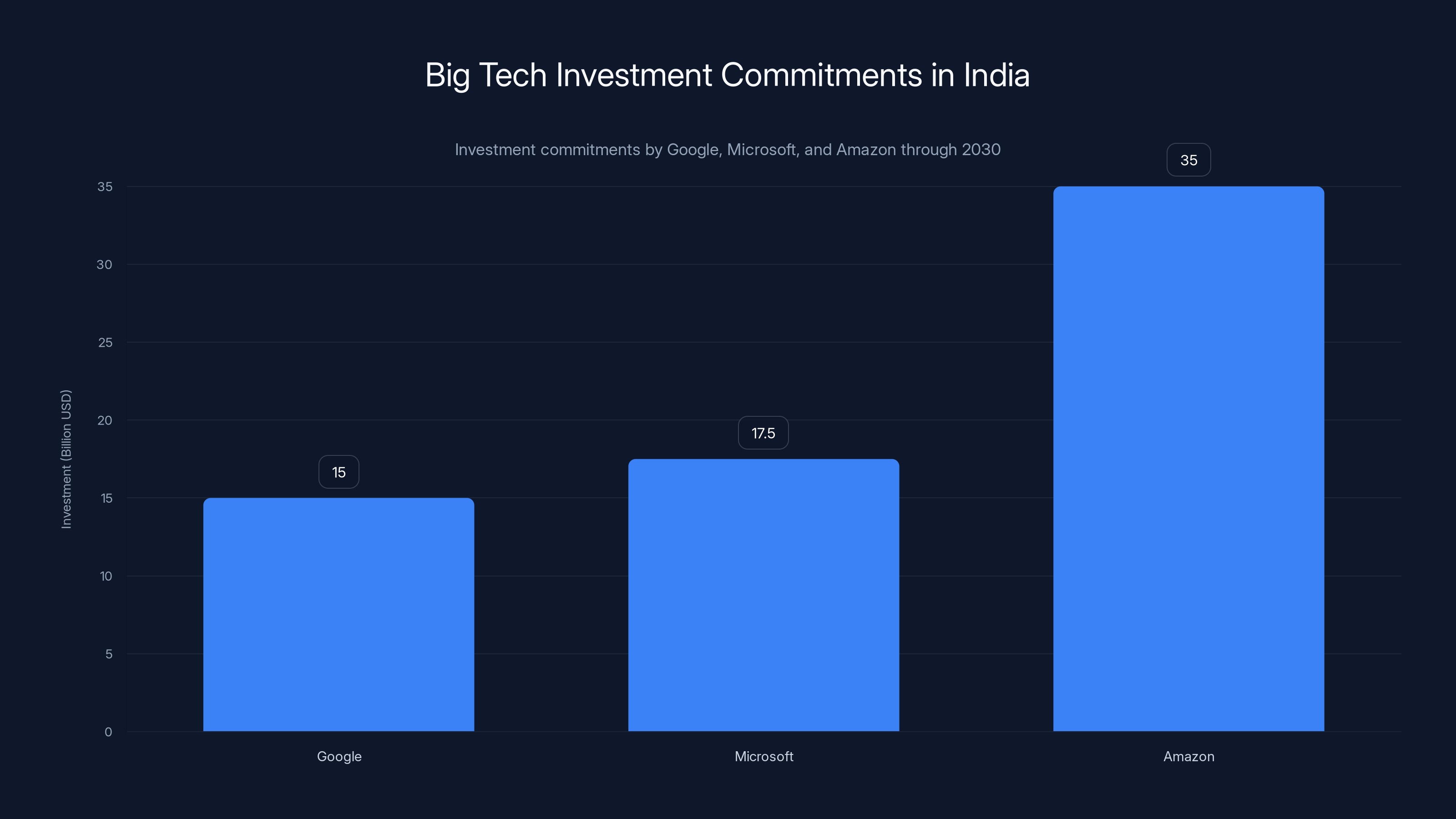

The policy directly addresses a problem tech giants already know exists. Google committed

Before this announcement, these companies faced typical Indian corporate tax rates on profits. Now they face zero tax on overseas revenues. That changes the unit economics entirely.

The Economic Logic: Why Countries Are Fighting Over Data Centers

Data centers create jobs. Lots of them. You need engineers to build and maintain infrastructure, network specialists, security personnel, and support staff. You also need electricity generation, real estate development, and supply chain services.

For every data center job, studies suggest multiplier effects generate additional economic activity. When Google or Microsoft builds a campus, local businesses benefit. Real estate values increase. Tax revenues flow to local governments, as noted by Bloomberg Law.

India's government is playing long-term. A 21-year tax incentive is expensive. But if it attracts $100 billion in data center investment over the next decade, the employment and tax revenue from supporting services could pay for the incentive many times over.

There's another dimension. Data sovereignty is increasingly non-negotiable. Companies serving Indian customers often must store data in India. Companies serving Southeast Asian markets want low-latency infrastructure in the region. India's geographic position, massive talent pool, and growing tech ecosystem make it ideal.

The competitive pressure is real. Singapore, the UAE, and other regional competitors offer their own incentives. Ireland has become a European data center hub through favorable tax treatment. India is essentially saying: we'll match that aggression and raise the stakes.

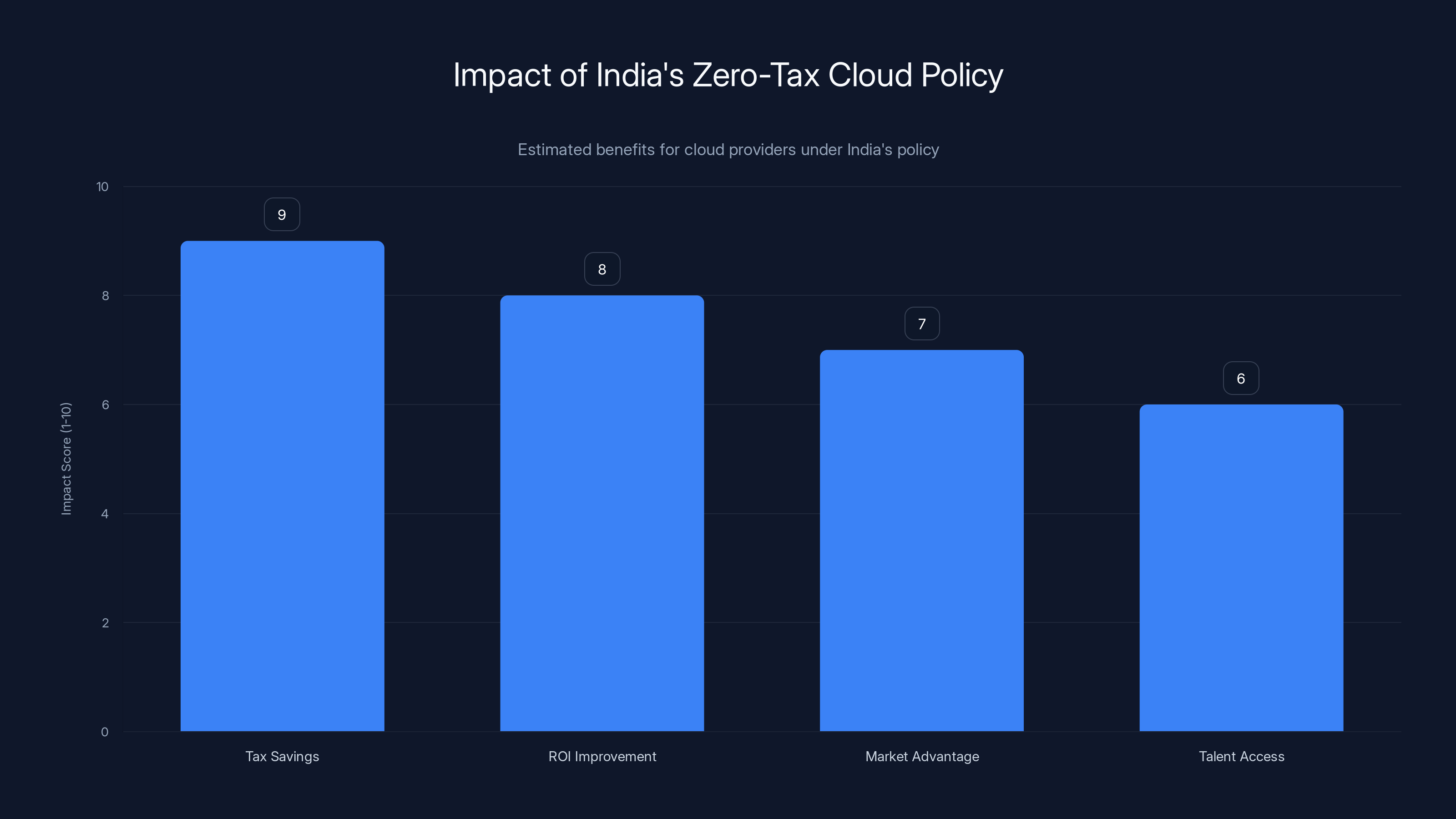

India's zero-tax cloud policy offers significant tax savings and ROI improvements for cloud providers, enhancing their market position and access to talent. (Estimated data)

Who Benefits: Cloud Providers, Tech Giants, and Infrastructure Players

The direct beneficiaries are cloud providers with global operations. If you're selling compute, storage, or AI services globally and processing them from Indian data centers, this eliminates a significant cost structure.

Let's do the math on a practical example. Suppose a cloud provider processes

Big Tech firms benefit most. Google, Microsoft, and Amazon have the scale to build campuses, hire teams, and invest in supporting infrastructure. They also have the global customer bases to generate massive export revenues that qualify for the tax break.

But mid-market and smaller cloud providers also benefit. A startup offering specialized AI services or edge computing can build in India and scale globally without tax drag. That changes whether building in India is competitive versus, say, building in Virginia or Northern Europe.

Infrastructure vendors win too. Power companies, telecom providers, real estate developers, and construction firms all see increased demand.

The Challenges: Why This Isn't a Done Deal

Here's where it gets complicated. India has world-class engineers and competitive labor costs. But data centers aren't just about people. They demand reliable power, water, cooling infrastructure, and connectivity.

India faces real challenges on all these fronts. Power supply reliability varies significantly by region. Electricity costs are rising. Water scarcity is a serious concern—data centers consume enormous amounts of water for cooling. And in some areas, infrastructure constraints mean building new facilities takes longer than in developed nations, as discussed in WebProNews.

Gordon Gekko would call this "friction." Businesses hate friction. Even with zero taxes, if power cuts go offline 5% of the time, that damages reliability. If water availability becomes uncertain, data center operations suffer. If permitting delays add six months to a project, that changes ROI calculations.

Critics also worry about the environmental and social impacts. Data centers consume massive amounts of electricity. As India builds more, the demand for renewable versus fossil-fuel power becomes critical. Water scarcity in agricultural regions raises questions about prioritizing data centers over farming.

There's also a skills consideration. India has excellent engineers, but absorbing the talent demands of multiple major data center builds simultaneously will be competitive. Microsoft, Google, and Amazon all hiring from the same talent pool will drive compensation increases.

Regulatory uncertainty remains. The tax incentive is set through 2047, but India's government could change policies. Political shifts, trade disputes, or international pressure could alter the arrangement. Companies making multi-billion-dollar investments want stability.

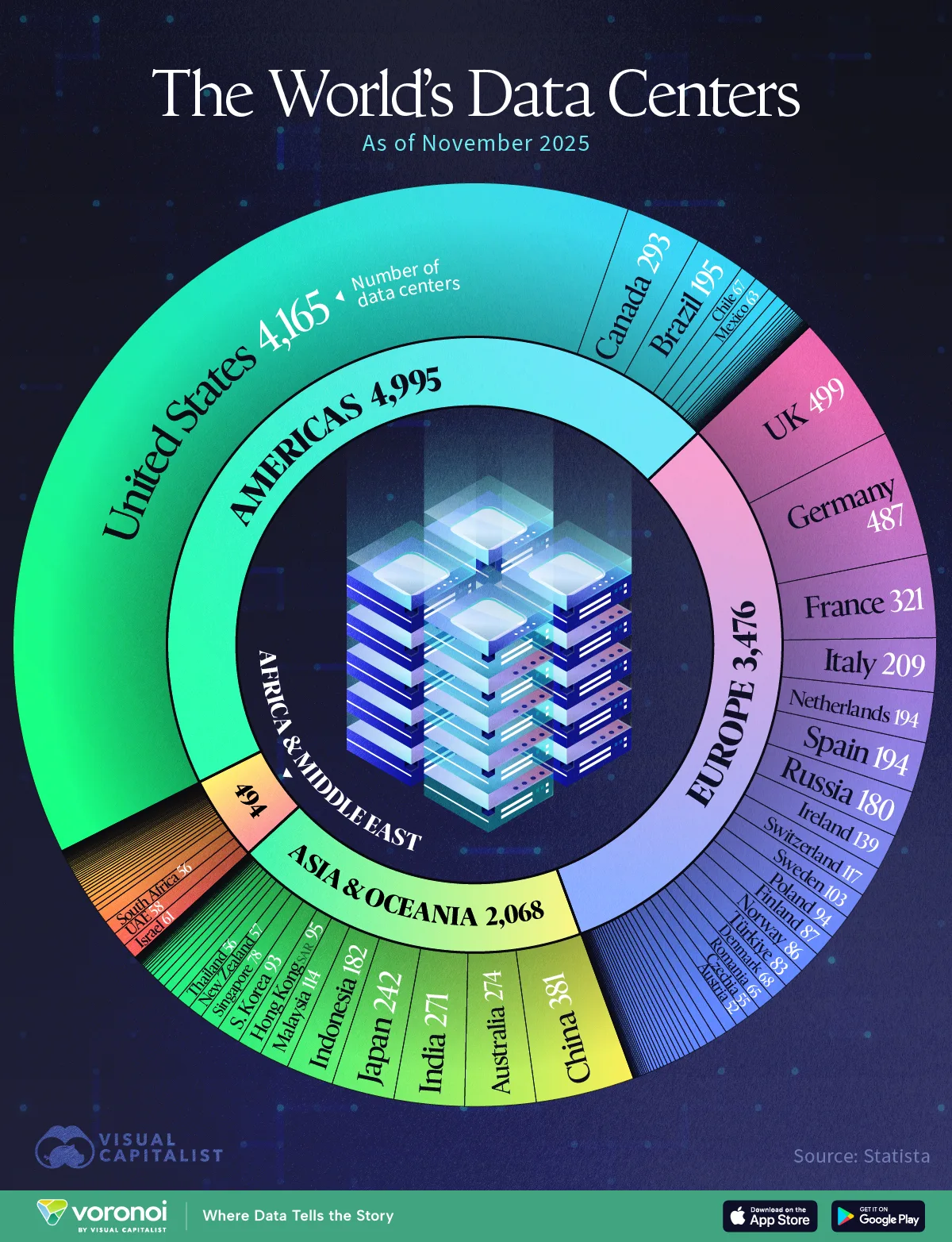

Regional Competition: How India Fits Into the Global Data Center Map

India doesn't exist in a vacuum. It's competing with Singapore, the UAE, Australia, and Japan for regional dominance.

Singapore has advantages: political stability, excellent infrastructure, world-class connectivity, and a highly developed regulatory environment. But it's expensive and space-constrained. India offers scale and cost advantages Singapore can't match.

The UAE is aggressive on incentives too, positioning itself as a Middle East and Africa hub. Dubai's data center ecosystem is growing fast. But India has something the UAE can't easily replicate: a massive domestic tech talent pool and a booming startup ecosystem.

Japan and South Korea have excellent infrastructure and stability but face demographic challenges and higher operational costs. Australia offers reliability and growth but is geographically isolated.

India's play is smart positioning: "We're cheaper than developed nations, more stable than developing ones, and we have the talent and scale nobody else can match." The tax incentive is just financial juice on top of those fundamentals.

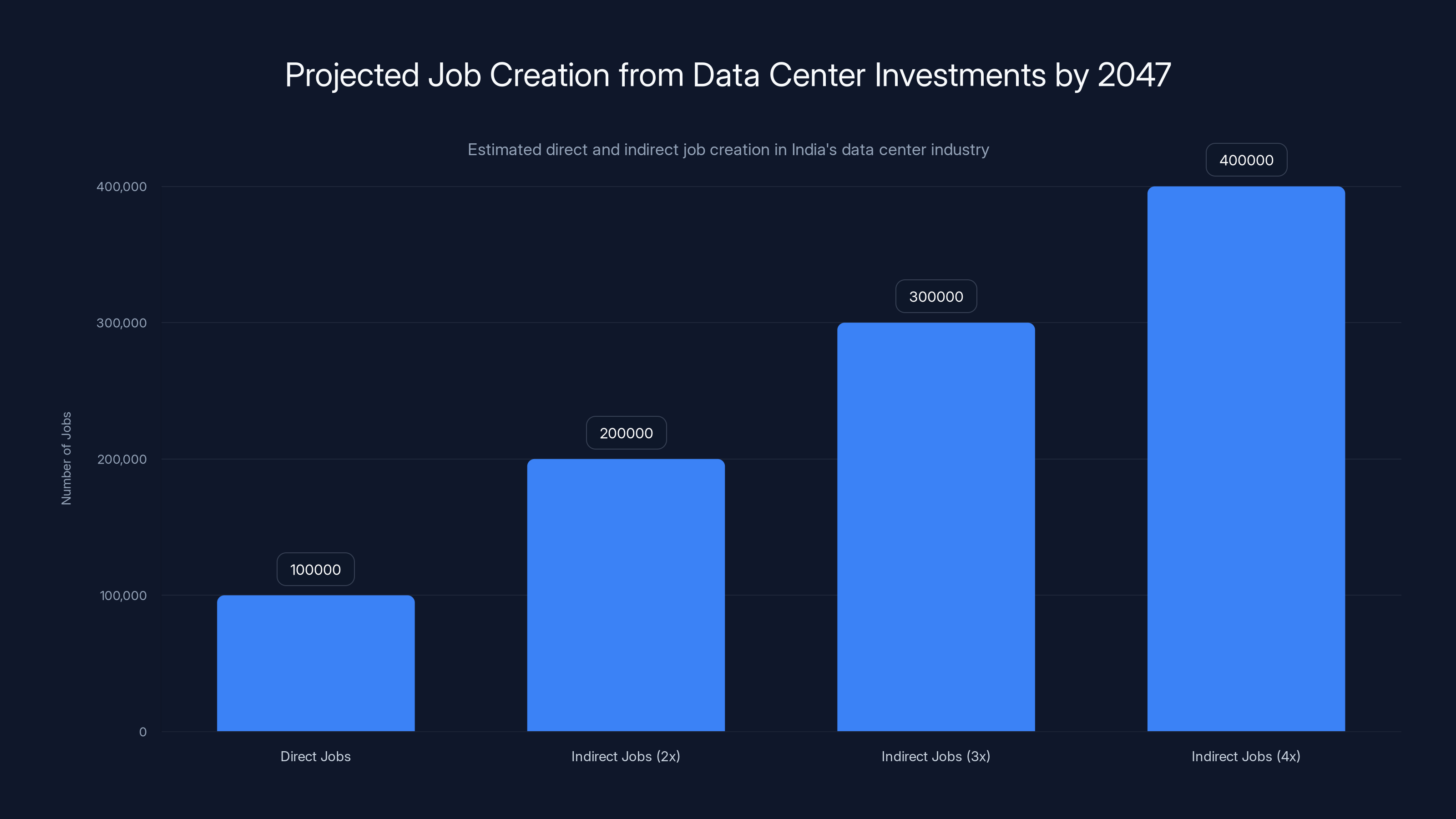

By 2047, India's data center investments could create over 100,000 direct jobs and up to 400,000 indirect jobs, depending on the multiplier effect. (Estimated data)

The Big Tech Commitments: What This Means for Google, Microsoft, and Amazon

Google's $15 billion commitment through 2030 makes sense now. That's not just about building data centers. It's about capturing the economics of the tax incentive. If those investments generate annual operating margins, the zero-tax window dramatically improves returns, as analyzed by TechBuzz.

Microsoft's $17.5 billion through 2029 is similarly strategic. Microsoft is aggressive on sovereignty—helping customers keep data in-country. India's incentive supports that strategy while improving unit economics.

Amazon's $35 billion through 2030 is the biggest bet. Amazon is betting on both AWS infrastructure and broader economic presence in India. The tax incentive makes that math work better.

But here's the nuance. These companies aren't just thinking about tax rates. They're thinking about:

- Customer demand: Indian companies need local cloud infrastructure. These investments enable serving that market.

- Regional expansion: Processing workloads in India serves Southeast Asia with lower latency than processing from the US or Europe.

- Geopolitical hedging: Avoiding concentration in any single geography reduces political risk.

- Talent access: Proximity to India's tech talent helps recruiting and operations.

The tax incentive sweetens the deal, but it's not the only reason these companies are investing heavily in India.

Implementation Challenges: How This Actually Gets Built

Talking about policy is easy. Implementation is hard.

First, there's the physical infrastructure challenge. India needs reliable power grids in data center locations. That means investing in renewable energy, upgrading transmission infrastructure, and managing grid stability. Some regions are ready. Others need significant work.

Second, there's the water challenge. Data centers need cooling. In water-scarce regions, this creates competition with agriculture and domestic use. Operators will need to invest in recycling, alternative cooling technologies, and possibly develop new water sources.

Third, there's the connectivity question. Data centers need low-latency connectivity to customer bases and upstream infrastructure. India's international bandwidth has grown, but connecting data center regions to global networks requires continued investment.

Fourth, there's the permitting and regulatory environment. While India has streamlined some processes, building massive infrastructure facilities still involves coordination across multiple government levels, environmental reviews, and community engagement.

The timeline matters. If Google, Microsoft, and Amazon all start major campus builds simultaneously, they'll compete for everything: land, power, skilled labor, construction expertise, and regulatory attention. That competition will increase costs and timelines.

Estimates suggest major data center campuses take 18-36 months to build, depending on complexity and site readiness. Some will be faster. Others will hit delays.

The Domestic Market Play: Local Resellers and Indian Tax Strategy

The policy is clever because it distinguishes between export and domestic sales. Cloud services sold to Indian customers still go through local resellers, who pay standard Indian corporate taxes.

This serves multiple purposes. First, it protects India's domestic tax base. Foreign companies can't simply establish operations in India and avoid all taxes. Second, it creates opportunities for Indian companies. Local resellers become intermediaries, capturing margin and growing Indian-controlled tech businesses.

Think of it like this: Google provides cloud infrastructure from an Indian data center. A local reseller like TCS or Infosys (hypothetically) acts as the sales and support entity for Indian customers. The reseller pays taxes. Google's revenues from exports are tax-free.

This model also protects domestic Indian cloud providers. If foreign companies could offer services tax-free directly to Indian customers, they'd have unfair competitive advantage against Indian cloud companies. The reseller model ensures Indian providers aren't undercut.

It's strategic industrial policy: attract foreign investment and expertise, but structure it to benefit Indian businesses and tax base.

Estimated data suggests economic downturn and political risk have the highest potential impact on investment decisions, with scores of 9 and 8 respectively.

Broader Economic Impact: Jobs, Growth, and Development Goals

Fast-forward to 2047. If this policy works as intended, India will have invested hundreds of billions in data center infrastructure. That creates:

Direct jobs: Engineers, network specialists, security personnel, operations teams. Estimates suggest 100,000+ direct jobs from major data center campuses.

Indirect jobs: Power generation and distribution, construction, real estate services, supply chain, hospitality, and supporting services. Multiplier effects typically range from 2-4x direct employment.

Skills development: Workers trained in world-class infrastructure operations bring expertise that elevates India's entire tech ecosystem.

Regional development: Data center locations attract supporting industries. Real estate values increase. Local businesses benefit. Tax revenues flow to state and local governments.

Export capability: Data center revenues generate hard currency. Cloud services delivered globally represent India's intellectual property and infrastructure being monetized internationally.

The Modi government's Viksit Bharat 2047 vision aims to move India from developing nation to developed nation status. Data infrastructure is foundational to that vision. You can't build modern digital services, fintech, AI research, or software exports without reliable infrastructure.

India's reasoning: "If we can attract global cloud providers and build world-class infrastructure, that infrastructure becomes the foundation for our own tech industry to thrive."

Regulatory and Compliance Considerations: The Fine Print

Companies evaluating the incentive need to understand the actual regulatory framework. Tax incentives only matter if you can reliably access them.

Key questions every company should ask:

- What constitutes "cloud services sold outside India"? Does it include API revenue, licensing, managed services, or just compute and storage?

- How is profit allocation determined? If a company has global revenues and India operations, how does tax authority determine what percentage qualifies for the incentive?

- What documentation is required? Companies need to demonstrate that services were rendered from Indian data centers and sold to overseas customers.

- What happens if the government changes rules? Is the incentive locked in, or can policy change mid-stream?

- What about international tax treaties? How does the Indian incentive interact with home country tax obligations for US, EU, or other companies?

These aren't theoretical questions. Transfer pricing and profit allocation are complex. A company making billions in revenue needs certainty about how taxes are calculated.

Reputable tax advisors will be crucial. Companies will likely negotiate Advance Pricing Agreements (APAs) with Indian tax authorities to lock in how profit allocation works.

Competitive Positioning: How This Reshapes Cloud Economics

Let's think about regional cloud market share. If you're building cloud infrastructure in Asia, you're choosing between:

- India: Large market, massive talent pool, growing demand, now with zero-tax export incentive

- Singapore: Excellent infrastructure, political stability, but expensive and space-constrained

- UAE: Aggressive incentives, Middle East and Africa access, but smaller tech ecosystem

- Japan/South Korea: Stability and advanced infrastructure, but high costs

The zero-tax incentive gives India a meaningful edge. Over a 21-year horizon, tax savings compound. A company that might have split investment between India and Singapore now concentrates in India.

This likely increases the pace of investment. Companies want to start capturing the incentive immediately. Projects planned for 2027 might accelerate to 2025 to begin generating tax-free revenues sooner.

For Indian cloud providers, this is a mixed picture. The incentive helps them compete against foreign providers by reducing their tax drag on exports. But foreign competitors with global scale will still be formidable.

The strategic bet India is making: "If we build the infrastructure, the companies will come. If the companies come, the ecosystem grows. If the ecosystem grows, India's own companies can compete effectively."

It's a rising-tide-lifts-all-boats play.

Amazon leads with a

Environmental and Sustainability Concerns: The Real Friction

Data centers consume enormous amounts of electricity. The Uptime Institute estimates modern data centers use 500-1,500 k W per cabinet, depending on density and workload.

If India builds significant data center capacity, electricity demand increases dramatically. India's power generation mix includes significant fossil fuels. Data center expansion could increase carbon emissions unless paired with renewable energy investment.

Water consumption is equally important. Data centers use water for cooling. In water-scarce regions, this becomes a hard constraint. India faces monsoon variability and aquifer depletion in many regions.

Savvy operators are investing in:

- Liquid cooling: More efficient than air cooling, reduces water consumption

- Renewable energy: On-site solar and wind power reduces grid demand

- Water recycling: Closed-loop systems minimize consumption

- Waste heat capture: Using data center heat for district heating or other purposes

But these solutions add cost. Companies will push back on expensive environmental requirements if they reduce competitiveness.

The government needs to balance incentives with environmental responsibility. Too permissive, and you risk water depletion and carbon emissions. Too restrictive, and companies build in competing countries instead.

Timeline and Milestones: When Does This Actually Happen?

The policy was announced in early 2024. Here's a realistic timeline:

2024-2025: Companies finalize commitments, negotiate regulatory frameworks, and begin land acquisition. Major announcements of specific data center locations and timelines.

2025-2027: Construction begins on first-generation facilities. Companies establish operations, hire teams, and build supporting infrastructure.

2027-2030: First campuses come online and generate revenue. Multiplier effects become visible. Second-generation facilities begin planning.

2030-2035: Mature ecosystem emerges. Supporting industries (power generation, telecom, real estate) operate at scale. Skills availability increases.

2035-2047: Broader economic impacts materialize. Regional cloud ecosystem becomes competitive globally. India's own cloud providers potentially emerge as global players.

This isn't immediate. Major infrastructure takes years to build. But the incentive is long enough (21 years) to capture full value.

How This Affects International Tech Governance

India's move has downstream effects on global tech policy.

First, it intensifies the competition for infrastructure investment. Every country offering data center incentives faces pressure to match or exceed India's generosity. Tax rates and incentive structures become competitive battlegrounds.

Second, it raises questions about fair competition. If India's zero-tax window gives foreign providers unfair advantage over domestic competitors, what does that mean for "national champions" strategies pursued by other countries?

Third, it highlights the strategic importance of data. Countries increasingly see data infrastructure as national security issue. Incentivizing foreign providers to operate locally is a compromise: you get investment and expertise while maintaining some control.

Fourth, it demonstrates that developing nations can successfully compete for high-value infrastructure investment by combining incentives with fundamental advantages (talent, market size, geography).

Other countries are watching. If India's experiment succeeds, expect similar plays from countries across Southeast Asia, Africa, and Latin America.

The Talent Multiplier: Why India's Workforce Is Critical

Here's a fact that rarely gets emphasized: India's success with data center expansion will depend on talent availability.

Data centers need skilled engineers. Not just operators—people who can architect resilient systems, troubleshoot complex problems, and optimize performance. India has this talent. But absorbing the scale of hiring from Google, Microsoft, and Amazon simultaneously will be competitive.

Expect wage inflation. Companies competing for the same talent will drive salaries up. This is healthy economic equilibrium, but it increases operating costs. Companies will need to account for rising labor costs in their India unit economics.

There's also a knowledge-transfer opportunity. As foreign companies build and operate in India, local engineers gain expertise. Over time, Indian companies can leverage that experience to build competing services.

This is why the policy is genuinely strategic—it's not just about tax revenue. It's about building human capital and institutional knowledge that persists for decades.

Risk Factors: What Could Go Wrong

Let's be honest about downside scenarios.

Political risk: The incentive runs through 2047 under current government. If administrations change, policy could shift. Companies want stability; uncertainty increases risk premium on investment.

Infrastructure constraints: If power, water, or connectivity aren't available when companies want to build, projects delay. Delayed projects erode tax incentive value.

Geopolitical tensions: US-China tensions could affect cloud provider decisions. If India becomes seen as aligned with either side, it could complicate operations.

Economic downturn: If global cloud demand softens, companies might delay data center expansion regardless of tax incentives. Recessions don't care about tax policy.

Technology evolution: If AI workloads shift to edge computing or distributed models, centralized data centers become less critical. The policy optimizes for a specific technology paradigm.

Competition from other countries: If another country offers even more attractive incentives, India's advantage erodes.

No policy is risk-free. Companies will price in these risks when making investment decisions.

How Runable Can Help Organizations Navigate Cloud Infrastructure Decisions

As companies evaluate whether to build cloud infrastructure in India or elsewhere, they need tools to manage complexity. Organizations are increasingly using AI-powered platforms to automate decision-making and documentation processes.

For infrastructure planning, teams need to document assumptions, create scenario models, and present findings to executives. Runable enables teams to generate automated presentations from data and assumptions, making it easier to present complex infrastructure decisions to leadership. With AI-powered document and presentation generation, teams can create polished materials in minutes rather than days.

When evaluating data center locations, organizations create detailed reports comparing costs, risks, and timelines across regions. Runable's AI reports feature can synthesize complex analysis into clear, visual reports that stakeholders understand.

For ongoing operations, teams need to maintain documentation about regulatory status, incentive tracking, and compliance requirements. Runable helps automate these documents, keeping infrastructure teams organized without manual overhead.

Use Case: Generate automated infrastructure decision documents and executive presentations comparing India versus other data center locations, with real-time updates as analysis changes.

Try Runable For FreeLooking Forward: What This Means for the Next 23 Years

We're at an inflection point. Data center investment is flowing to India. Companies are making multi-billion-dollar commitments. The ecosystem is beginning to form.

Over the next two decades, India's strategy will either succeed brilliantly or face significant challenges. Most likely, it's somewhere in between—substantial success in some regions, disappointment in others.

The broader pattern is clear: countries are increasingly competing aggressively for infrastructure investment. Tax incentives are becoming standard. The question isn't whether you get incentives, it's how large they need to be to attract investment relative to other locations.

For global tech companies, India becomes a non-optional presence. Not as an afterthought or secondary market, but as a core infrastructure hub. Companies serving Asian customers, processing workloads with local data residency requirements, or optimizing cost structures will have major operations in India.

For Indian companies, the opportunity is different. The infrastructure gets built by foreigners. But that infrastructure becomes the foundation for Indian tech innovation. If managed correctly, India's own cloud providers, AI companies, and digital services firms can leverage that infrastructure to compete globally.

The 21-year window through 2047 is intentional. It's long enough to see real transformation. It's also short enough that the policy is meaningful—if you're deciding on infrastructure investment now, you're betting on a two-decade window of certain tax treatment.

India is betting that 21 years is enough time to build world-class infrastructure, develop supporting industries, create jobs, and position itself as a genuine developed nation. History suggests that's a reasonable bet.

FAQ

What is India's zero-tax cloud policy?

India's zero-tax cloud policy is a government incentive offering zero corporate tax on cloud service revenues generated outside India until 2047, provided that the data centers and workloads are operated from within Indian territory. The policy targets foreign cloud providers like Google, Microsoft, and Amazon to incentivize infrastructure investment and position India as a global data center hub.

How does the zero-tax incentive apply to domestic versus international sales?

The incentive applies exclusively to cloud services sold outside India. For cloud services sold to Indian domestic customers, the tax incentive does not apply, and sales must flow through locally incorporated resellers who are taxed according to standard Indian corporate tax law. This structure protects India's domestic tax base while allowing foreign providers to benefit from export-oriented cloud services.

Why did India set the incentive timeline through 2047?

The 21-year timeline aligns with the Indian government's Viksit Bharat (Developed India) initiative, which aims to transform India into a developed nation by 2047. The policy is designed to build foundational digital infrastructure that supports broader economic development goals, job creation, and positioning India as a global technology and infrastructure leader.

What are the main benefits of this policy for cloud providers?

Cloud providers benefit from eliminated corporate tax on export revenues, improved return on investment for data center infrastructure, competitive advantage in regional and global markets, access to a massive talent pool, and the ability to serve Asian customers with local low-latency infrastructure. The 21-year certainty also allows companies to plan long-term capital investments with confidence in tax treatment.

What challenges does India face in implementing this policy?

Implementation challenges include ensuring reliable power infrastructure, managing water scarcity for data center cooling, upgrading international connectivity, streamlining permitting and regulatory processes, competing for skilled talent across multiple simultaneous major projects, and balancing economic incentives with environmental sustainability concerns around electricity consumption and water usage.

How does this policy compare to data center incentives in other countries?

India's zero-tax window is among the most aggressive globally, comparable to or exceeding incentive structures in Singapore, the UAE, and some European countries. However, India distinguishes itself through lower operational costs, access to large talent pools, and geographic positioning for serving Asian markets. Competitors like Singapore offer superior infrastructure maturity and regulatory stability, while the UAE focuses on Middle East and Africa markets.

What is the timeline for actual data center construction and revenue generation?

Based on typical infrastructure development cycles, significant data center construction is expected 2024-2027, with first facilities coming online and generating revenue 2025-2028. Large-scale ecosystem maturity with supporting industries operating at scale is projected 2030-2035. The full economic impacts across job creation, skills development, and broader regional effects will unfold across the full 21-year window.

How will the policy affect cloud pricing and competition in Asia?

The policy will likely increase cloud provider investment in India, potentially resulting in competitive pricing for services delivered from Indian data centers. Over time, increased capacity and competition among global providers operating in India could drive regional cloud pricing down, benefiting enterprises and developers across Asia while strengthening India's position as a regional tech hub.

What regulatory risks should companies consider before investing in India data centers?

Key regulatory risks include potential policy changes if government administrations shift priorities, ambiguity around profit allocation and transfer pricing for companies with global operations, definitional clarity on what constitutes "cloud services sold outside India," and international tax treaty interactions with home country tax obligations. Companies should engage experienced tax advisors and potentially negotiate Advance Pricing Agreements with Indian authorities.

How does this policy support India's broader development and innovation goals?

The policy generates direct employment in high-skill sectors, creates multiplier effects through supporting industries, develops human capital and technical expertise, generates export revenue and hard currency, builds infrastructure that enables Indian companies to compete globally, and creates the foundational digital ecosystem necessary for fintech, AI research, and software innovation to flourish as India progresses toward developed-nation status.

Key Takeaways

- India offers zero corporate tax on cloud service revenues generated outside the country until 2047, provided data centers operate within India

- Google (17.5B), and Amazon ($35B) have committed major investments through 2030, betting on infrastructure and tax advantages

- The incentive applies only to export revenues; domestic cloud services must flow through locally taxed resellers, protecting India's tax base

- India faces real implementation challenges including power reliability, water scarcity, and talent competition across simultaneous major projects

- The policy is part of India's Viksit Bharat 2047 vision to achieve developed-nation status through infrastructure and skills development

Related Articles

- Nvidia's $2B CoreWeave Bet: Vera Rubin CPUs & AI Factories Explained [2025]

- Nvidia's $100B OpenAI Investment: Reality vs. Reports [2025]

- Nvidia's $2B CoreWeave Investment: AI Infrastructure Strategy Explained

- China's AI Boom: Inside the Government Registry Tracking Thousands of Companies

- AI Companies & US Military: How Corporate Values Shifted [2025]

- Bank of England's Oracle Migration Cost Triples to £21.5M [2025]

![India's Zero-Tax Cloud Policy Until 2047: What It Means [2025]](https://tryrunable.com/blog/india-s-zero-tax-cloud-policy-until-2047-what-it-means-2025/image-1-1770035893310.jpg)