Josh D'Amaro Becomes Disney's New CEO: What It Means for the Entertainment Giant [2025]

Disney just made its second swing at replacing Bob Iger as CEO, and this time they're banking on Josh D'Amaro to steer the ship. The announcement in October 2025 marks another major inflection point for the company that's dominated entertainment for nearly a century. But here's the thing: this isn't just about one person stepping into a corner office. It's about Disney wrestling with a fundamental question about who should lead a media empire in the streaming age.

D'Amaro, who currently leads Disney Experiences, has spent 28 years at the company building everything from theme parks to consumer products. He's not a Hollywood newcomer or a tech industry transplant. He's a lifer. And that tells you something important about where Disney thinks its future lies.

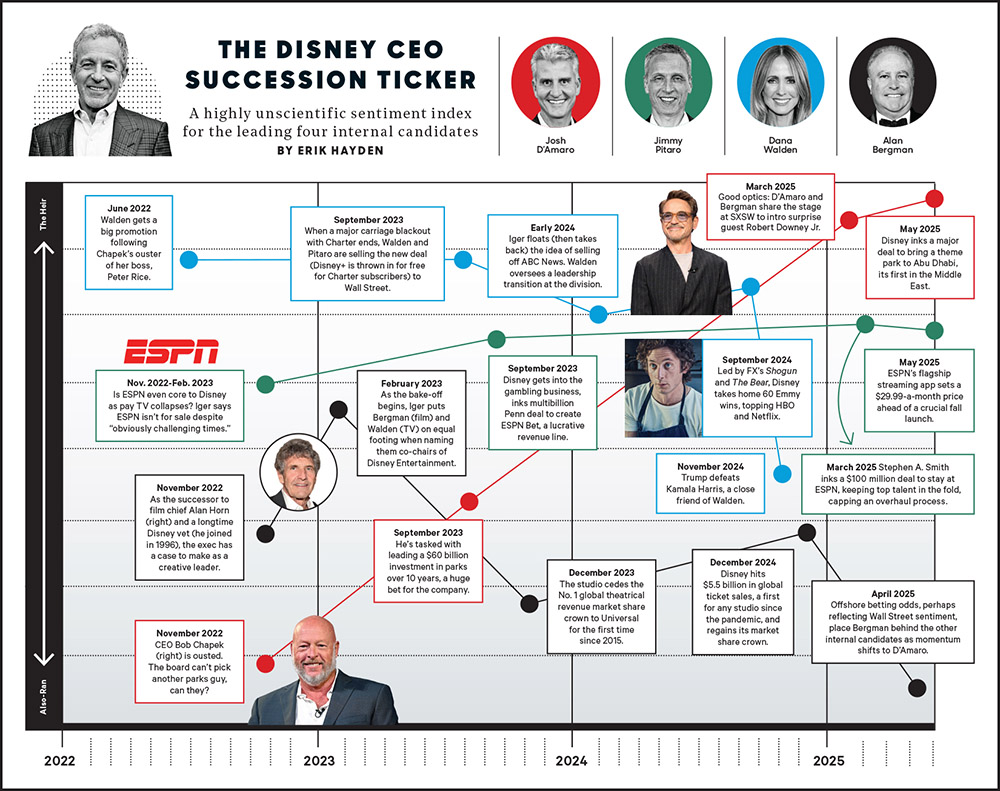

The board voted unanimously to make D'Amaro the next CEO, effective March 2025. That's the kind of endorsement that sounds good on paper. But context matters. This is the second time Disney's board has had to appoint an Iger successor. The first attempt, with Bob Chapek in 2020, lasted just two years before Iger came back. That failure still casts a shadow over this decision.

Why does this matter to you? Because Disney's leadership chaos directly affects the products you use, the prices you pay, and the streaming services you subscribe to. When Disney struggles with CEO transitions, it trickles down to everything from Disney Plus pricing to the quality of content being produced. This article digs into what D'Amaro's appointment means, why his background makes him different from previous leaders, and what happens to Disney's streaming, theme parks, and film divisions under new leadership.

Let's break down the narrative everyone's missing.

TL; DR

- Josh D'Amaro, who led Disney Experiences, was unanimously appointed as the next Disney CEO in October 2025, effective March 2025

- This is Disney's second succession attempt after Bob Chapek's tenure ended in 2022 when founder-led Iger returned

- D'Amaro brings 28 years of Disney experience, particularly in high-margin, physical businesses like theme parks and cruises

- The transition signals Disney's potential shift from streaming-first strategy to leveraging its experience-driven portfolio

- Bob Iger will remain as board member and senior advisor until end of year, mentoring the transition

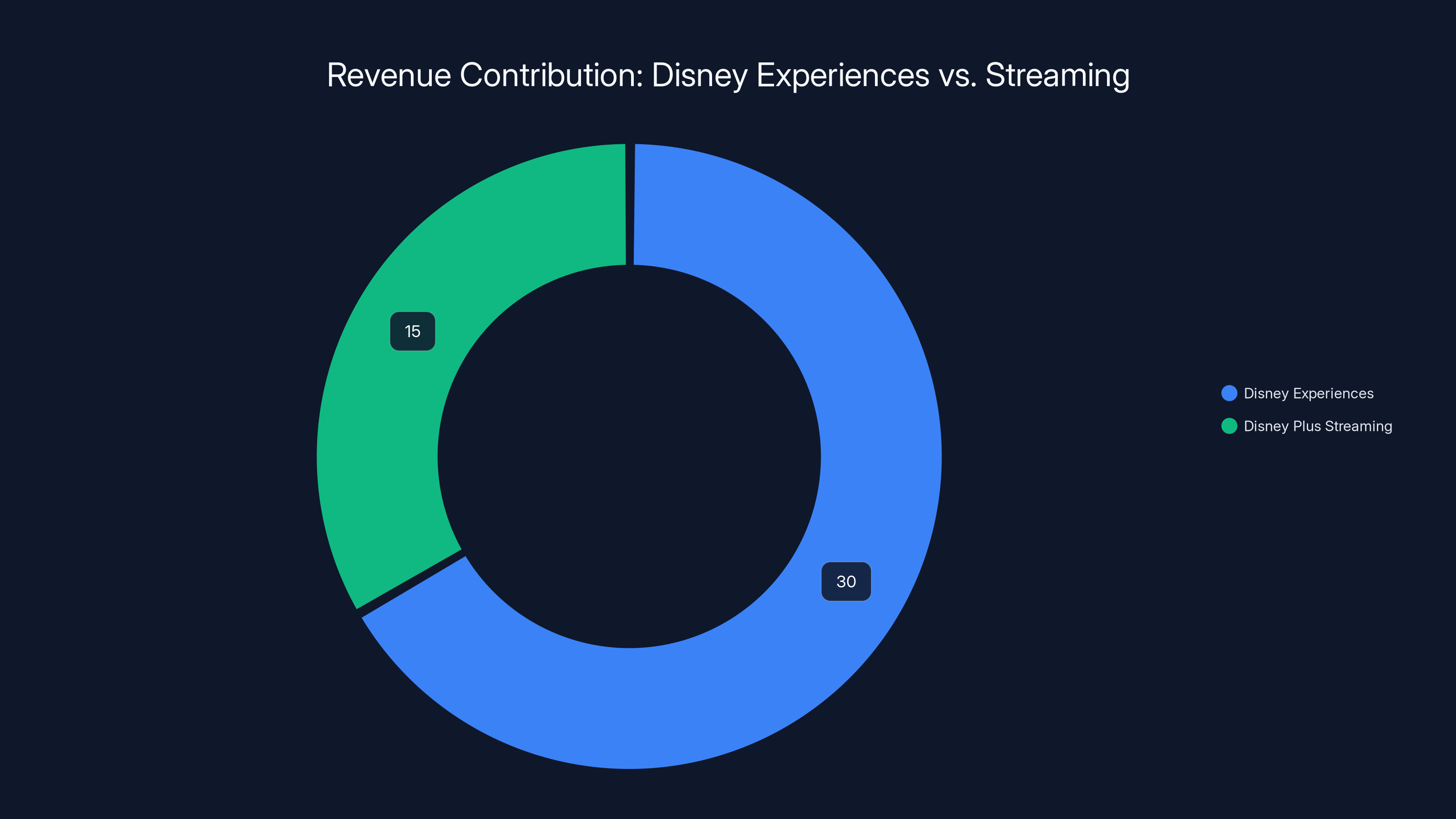

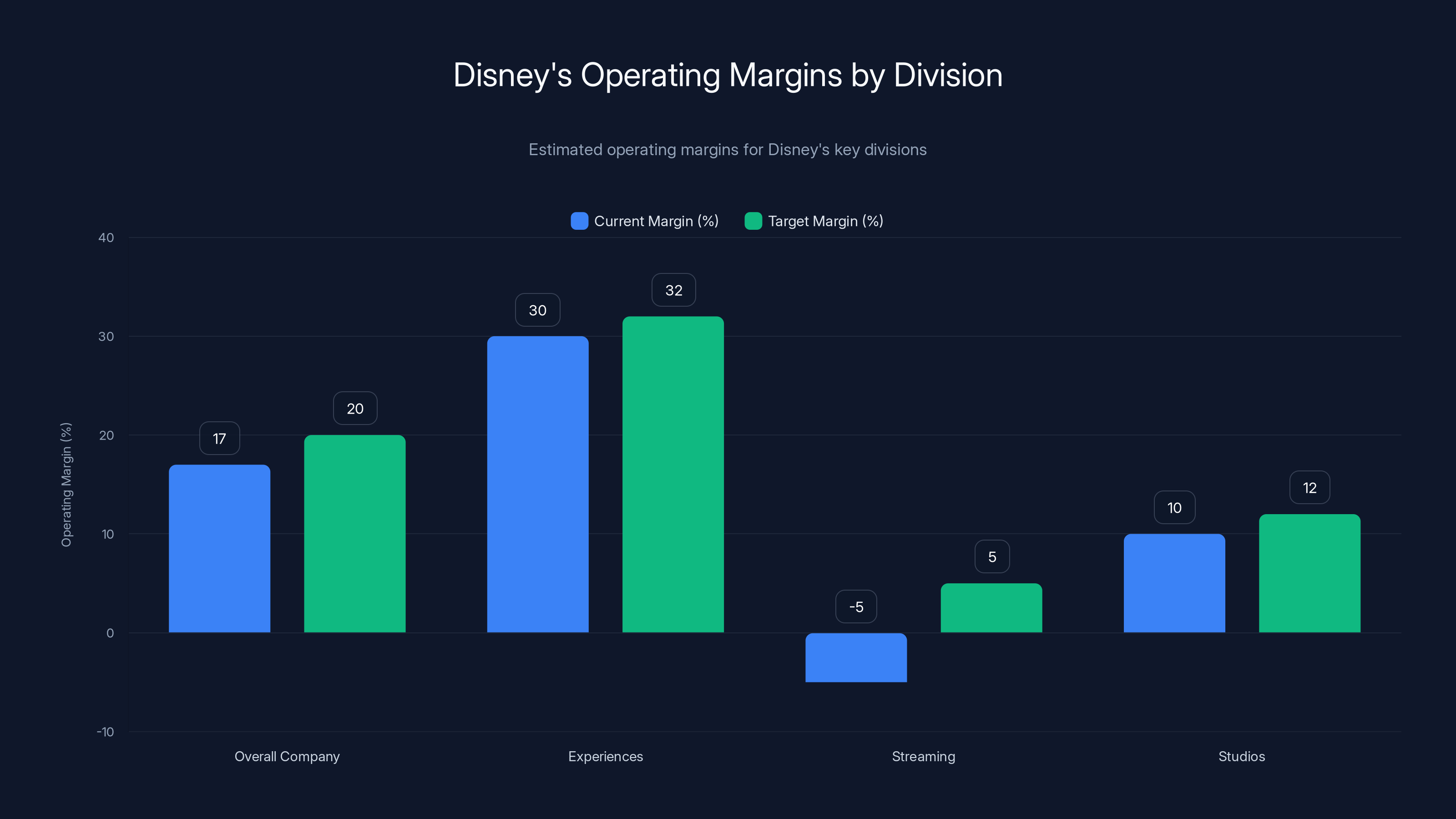

Disney Experiences generates significantly higher revenue and operating margins compared to Disney Plus Streaming, highlighting its strategic importance. Estimated data based on typical industry figures.

The Second CEO Succession in Five Years: Why This Time Is Different

Let's be straight about this: Disney naming a new CEO isn't unusual. Companies do it all the time. But doing it twice in five years? That's a red flag that something went sideways.

In 2020, the board appointed Bob Chapek, who was running Disney Parks at the time. Iger was stepping back after 15 years as CEO, feeling like he'd accomplished his major objectives. Chapek took over during a uniquely terrible moment: the pandemic was shutting down theme parks, Disney Plus was burning cash trying to compete with Netflix, and the theatrical business was imploding. The guy inherited a nightmare.

But here's what actually happened. Chapek made decisions that alienated both creatives and investors. He started charging premium prices for everything, cut spending on content, and generally managed the company in a way that felt... corporate. Two years in, with Disney's stock down and morale cratering, the board decided to bring Iger back. Even though he'd supposedly retired. Even though he'd built the system Chapek was dismantling.

That vote of no confidence in Chapek matters because it shows the board's actual priorities. They didn't want a steady hand managing decline. They wanted Iger's vision back, even though Iger himself had decided he was done.

Now, with Iger actually leaving for real, they're trying something different. D'Amaro is neither Iger nor Chapek. He's not a media guy obsessed with content libraries. He's a parks guy who understands recurring revenue, customer experience, and physical spaces. The choice reveals something crucial: Disney's board might be pivoting away from the streaming obsession that defined the last five years.

The timing matters too. D'Amaro takes over in March 2025, giving the company a smooth transition. Iger stays on as advisor and board member through the end of the year, mentoring D'Amaro through the handoff. This is the kind of measured approach that was missing when Chapek took over. Back then, Iger just vanished. This time, there's continuity.

What's interesting is that D'Amaro's entire career has been tied to Disney's most profitable businesses. Theme parks generate obscene margins. Disney World's operating margins are estimated at 30-35% before corporate allocation. Cruises also print money. Consumer products, when done right, are licensing revenue with minimal risk. These aren't exciting tech plays, but they're reliable, predictable profit engines.

Compare that to streaming. Disney Plus still isn't profitable, despite nearly 150 million subscribers. The company's spent over $50 billion building the streaming wars, and the returns haven't justified the investment. A CEO who made his career in high-margin physical experiences is going to naturally look at that pile of cash and ask hard questions.

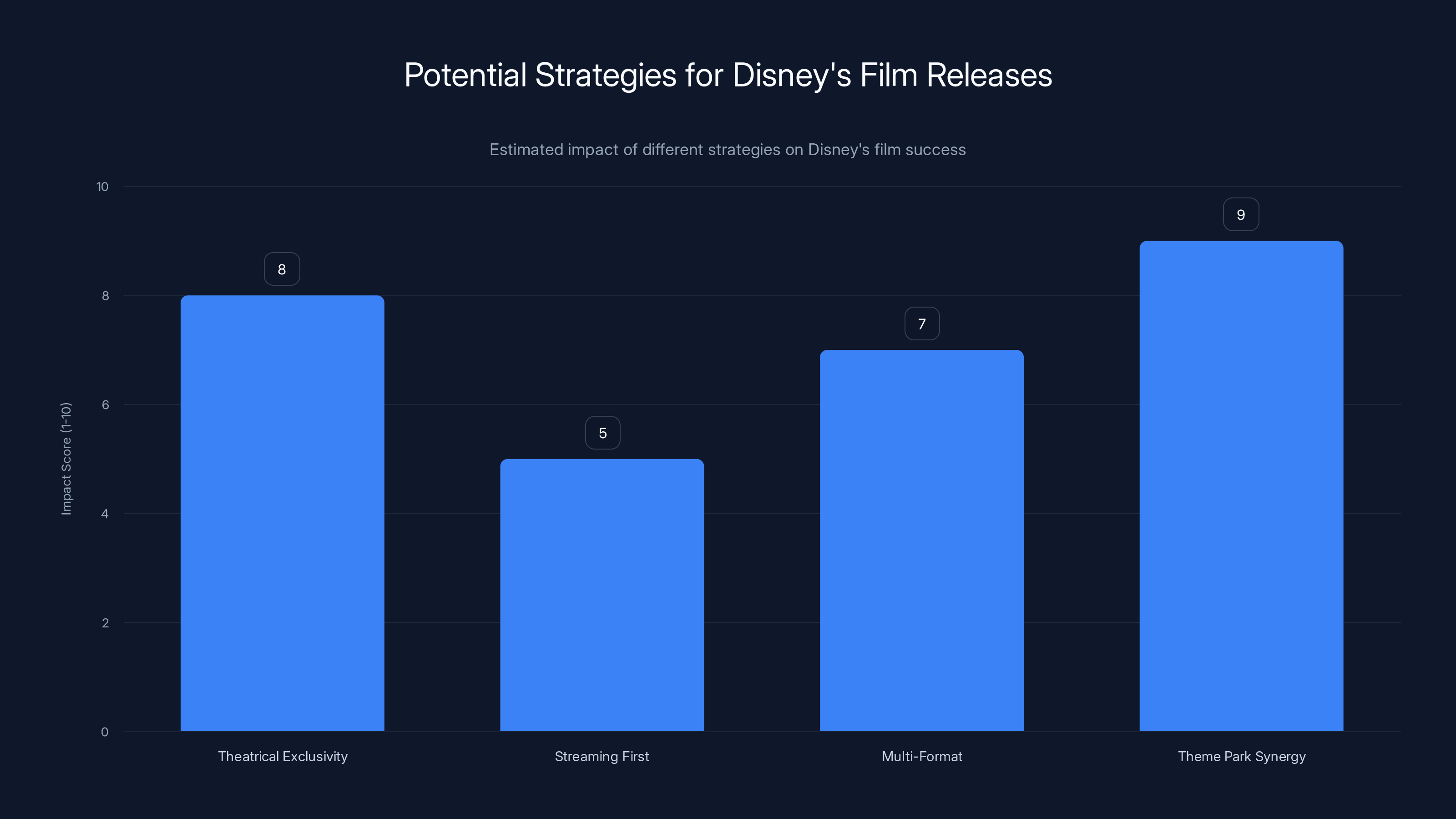

Estimated data suggests that focusing on theatrical exclusivity and theme park synergy could have the highest positive impact on Disney's film success.

Understanding D'Amaro's Background and Experience

Josh D'Amaro didn't just show up at Disney yesterday. He's been there for 28 years, which means he was working at the company when it was still figuring out how to make DVDs profitable.

He started in operations, the unglamorous side of Disney where you optimize labor scheduling, manage supply chains, and make sure things actually run. Operations is where you learn how to handle massive complexity at scale. Disney's theme parks aren't just businesses; they're small cities. Magic Kingdom alone handles roughly 58,000 visitors per day during peak seasons. That's a logistical nightmare. Food, bathrooms, security, emergency services, ride capacity, crowd flow, employee scheduling—it all has to work perfectly, or the whole thing collapses.

D'Amaro worked his way up through that machine. He became a park president, then expanded to overseeing all Disney Parks. But here's where it gets interesting: he also took over Disney Consumer Products, which includes video games and merchandise. That's not theme parks. That's completely different business models. D'Amaro had to learn how licensing works, how retail partnerships function, and how to build intellectual property into consumer goods.

Then there are Disney Cruises. Cruises are the weirdest business in Disney's portfolio. They're hospitality, entertainment, logistics, and international operations all wrapped together. If you can run Disney Cruises successfully, you've solved problems most people never encounter. Smooth sailing from port to port requires coordination across multiple countries, complex international maritime law, supply chain management for floating hotels, and the ability to handle crises (medical emergencies, weather, mechanical failures) completely isolated from shore support.

When D'Amaro moved to oversee Disney Experiences in 2022, he consolidated all of this under one umbrella. Parks, cruises, consumer products, online gaming—all reporting to him. That's roughly 200,000 employees across dozens of countries. It's not just an operations job; it's a genuine P&L responsibility with significant budget authority.

Here's what this background tells you about how D'Amaro will likely run Disney. He understands operations at scale. He won't be impressed by theoretical strategies; he'll want to see execution. He knows how to manage complex, international operations. He understands both high-margin physical experiences and digital products. Most importantly, he's proven he can run profitable businesses in the face of market headwinds.

During COVID, when every theme park in the world closed, D'Amaro had to figure out how to keep Disney Experiences alive. He pivoted to merchandise, leaned into consumer products, and prepared the parks to reopen safely. When they did reopen, demand was insane. Prices went up, capacity management became crucial, and the margins actually improved. That's not luck. That's execution under pressure.

The creative side of Disney? He's spent his entire career working with the Imagineers and storytellers who design attractions. He's not some operations autocrat who doesn't get it. He understands that Disney's experiences have to tell stories and create emotional connections. But he also knows how much those stories cost to build and how to maximize their profitability.

Compare that to Chapek, who came from theater operations and had to learn everything about Disney on the fly. D'Amaro's already learned it. He's debugged it. He knows where it breaks.

Why Bob Chapek's CEO Tenure Failed So Publicly

Understanding D'Amaro requires understanding why Chapek flopped. This isn't just internal drama; it reveals what Disney's board values and doesn't value in a leader.

Bob Chapek wasn't a bad executive. He was competent at running Disney Parks before he became CEO. But he was the wrong person at the wrong time making the wrong decisions in the wrong way.

The timing issue was brutal. Chapek took over in February 2020, literally weeks before everything shut down. He had no runway to establish credibility. Investors and employees hadn't bought in, so when the crisis hit, nobody gave him the benefit of the doubt. Every decision was scrutinized. Every move felt wrong because nobody trusted him yet.

Then Chapek made specific choices that alienated key constituencies. He cut spending on content aggressively, trying to preserve cash during the pandemic. That made sense financially but killed morale in creative departments. Hollywood creators didn't trust him. They'd worked for years with Iger building Disney's creative powerhouse, and Chapek was slashing budgets.

He also centralized decision-making in a way that frustrated park operators and regional leaders. D'Amaro, by contrast, understood that you can't run 12 different theme parks across the globe from a single Manhattan office. You need regional autonomy with corporate guardrails. Chapek was too top-down.

Most critically, Chapek misread the moment on streaming. He got religiously committed to the streaming wars, pivoting huge theatrical releases to Disney Plus without understanding the downstream effects. Black Widow's theatrical release got delayed, then it went straight to streaming. That decision cost the studio hundreds of millions and poisoned relationships with theatrical partners and major talent.

When Iger came back, the first thing he did was moderate that strategy. He acknowledged that theatrical releases matter, that partners matter, and that balance matters. Chapek had been so fixated on the streaming war that he'd lost sight of Disney's entire ecosystem.

The other issue? Chapek had never been CEO before. He was competent as a parks executive, but the CEO job at a

One more thing that's important: Chapek and Iger had fundamentally different philosophies about Disney's DNA. Iger believed Disney's strength was intellectual property and storytelling. Every major decision he made—acquiring Marvel, buying Lucasfilm, buying Fox's studios—was about building IP libraries. Chapek saw those libraries as digital goods to maximize through Disney Plus. Iger saw them as the beating heart of the company's entire ecosystem.

D'Amaro, interestingly, sees IP differently. Theme parks are the ultimate expression of IP. You're literally putting people inside a story. You're selling $15 hamburgers because you've created an emotional connection to that brand so powerful that people pay premium prices to be immersed in it. That's not digital thinking. That's narrative thinking, but applied to physical experiences.

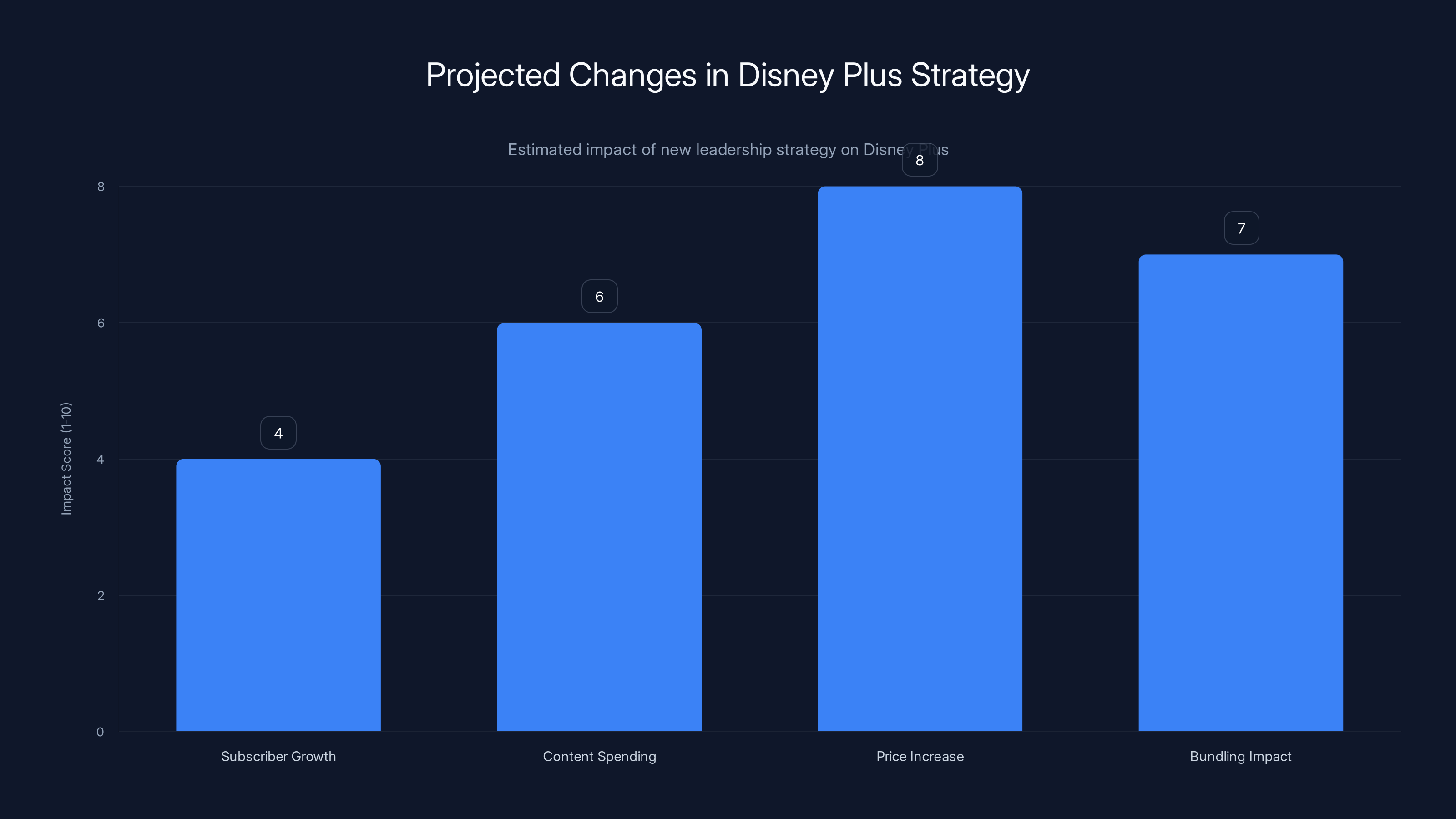

Under new leadership, Disney Plus is expected to focus more on profitability through price increases and bundling, rather than aggressive subscriber growth. Estimated data.

The Rise of Disney Experiences as a Strategic Priority

For years, Disney's board and investors were obsessed with streaming. Netflix was the enemy. Disney Plus was going to save the company. Every quarter, earnings calls focused on subscriber growth and streaming losses.

But something shifted. Quietly, without fanfare, Disney's Experiences division started outperforming streaming. The math is brutal: Disney Plus has 150+ million subscribers but barely breaks even. Disney Parks and Experiences generates $30+ billion in annual revenue with operating margins around 30%. One division is the future; the other is the present.

This isn't accidental. D'Amaro realized that experiences are actually where the money is. A streaming subscription costs $15-20/month and generates thin margins once you account for content costs. A Disney World trip costs a family thousands of dollars and happens maybe once per year. The lifetime value of a Disney theme park customer is orders of magnitude higher than a streaming subscriber.

So D'Amaro's team pivoted. They invested in new lands (Pandora, Galaxy's Edge), new attractions, new entertainment shows. They raised prices aggressively, knowing demand would sustain higher price points. They diversified beyond theme parks: cruises, vacation clubs, Disney Springs experiences, virtual reality parks in Asia.

They also figured out how to use IP to drive experiences. The idea isn't that you watch the Marvel movie, then you go to the theme park. The idea is that IP lives across multiple formats, and experiences are the highest-value format. A Marvel fan watches the show on Disney Plus (cheap), follows it on social media (free marketing), buys merchandise (higher margin), then goes to the theme park for the ultimate experience.

That's different from Iger's playbook. Iger built IP libraries first and figured out distribution later. D'Amaro builds distribution and pulls IP through it. The philosophy creates different incentive structures and different business priorities.

Under D'Amaro's leadership, Disney also realized that experiences work globally in ways that streaming doesn't. Disney Plus has to compete with Netflix everywhere. But there's no competing with Disney Parks as an experience. You can't get that from a subscriber base. So the company started building experiences everywhere: theme parks in Tokyo, Shanghai, Hong Kong, and smaller experiences in other regions.

This international focus matters because it suggests D'Amaro will continue pushing Disney toward experiential, location-based revenue rather than streaming. That's not guaranteed, but his entire career points that direction.

Bob Iger's Legacy and the Expectations Around His Successor

Bob Iger is one of the most successful CEOs in history. Period. He took over Disney in 2005 when the company was in transition and built it into the most powerful entertainment company on Earth. His major moves: buying Pixar for

Those acquisitions look brilliant in hindsight. They've generated trillions in value across movies, merchandise, streaming, and experiences. But at the time, they were controversial. Pixar wasn't owned by Disney yet; partnering with them seemed risky. Marvel wasn't cool; it was a struggling comic book company with rights scattered everywhere. Lucasfilm was valuable, but $4 billion seemed steep.

Iger's genius was seeing potential where others saw risk. He combined those acquisitions with operational excellence and creative respect. He hired great leaders, then got out of their way while providing strategic direction. He understood both the business and the art.

Iger also understood Disney's DNA in a way few people do. Disney's core strength isn't any single product or service. It's the ability to take intellectual property and express it across every conceivable format. A character can be a movie, a TV show, a comic book, a theme park attraction, a piece of merchandise, a restaurant experience, a video game. Disney's magic is that it does all of those things really well.

By contrast, most media companies are excellent at one or two formats. Netflix does streaming. Sony does movies and games. Universal is great at theme parks and film, but their TV content is weaker. Disney's comprehensive excellence is rare.

Iger's expectation for his successor? Keep that system running. Don't dismantle it. Don't get so focused on one format (streaming, for instance) that you weaken the others. The board clearly knew this. When Chapek got too focused on streaming and lost the plot, they brought Iger back to rebalance.

D'Amaro's appointment suggests the board wants to avoid that trap again. Instead of replacing an Iger-like figure with a specialist, they're promoting someone who's proven he can manage multiple formats and business models. D'Amaro won't be another Iger, but he's not supposed to be. He's supposed to be someone who maintains the system while focusing on what's actually profitable right now.

There's also pressure to perform financially. Disney's stock hasn't grown dramatically in recent years. Streaming losses, content spending, and general market conditions have weighed on the stock price. Investors expect D'Amaro to find efficiencies, improve profitability, and maybe actually make streaming profitable or acknowledge that it won't be.

That's a different challenge than Iger faced. Iger was building for growth at any cost. D'Amaro's inheriting a company that needs to optimize its existing portfolio. That's harder in some ways because there's less exciting visionary stuff. But it's also more achievable. You don't need to make a $70 billion acquisition to create value. You just need to run the existing business smarter.

Disney's Experiences division leads with a 30%+ margin, while Streaming struggles at negative margins. Target improvements aim for a 5% margin in Streaming and overall company margin growth. Estimated data.

Streaming Strategy Under New Leadership: Profitability Over Growth

Here's the central question everyone's asking: Is D'Amaro going to kill Disney Plus, or is he going to fix it?

The answer is probably neither. He's going to continue running it, but with different priorities than the streaming-at-all-costs approach of the last few years.

Disney Plus has been burning cash because it was built to win the streaming wars. The company threw money at content, offering low prices to build subscriber numbers, accepting massive losses in pursuit of market share. It's the Netflix playbook, except Netflix invented it and has 10 years of head start.

The problem is that playbook only works if you can eventually make streaming profitable. Netflix did it. Disney is struggling. Disney Plus has 150+ million subscribers, which is enormous, but the content spending required to maintain that subscriber base is brutal. They're not breaking even.

D'Amaro will likely take a different approach. Instead of trying to beat Netflix at Netflix's game, he'll optimize Disney Plus as one piece of a larger ecosystem. That means:

Higher prices. Disney Plus will probably increase prices more aggressively. They've already moved to a

More bundling. Disney Plus, Hulu, ESPN Plus bundled together makes more sense than pricing them separately. It increases perceived value and makes churn less likely. Expect the bundle to become the focus, not individual services.

Different content strategy. D'Amaro understands that not every piece of content needs to be a prestige award-winner. Some of it can be good, profitable entertainment that doesn't cost $300 million per season. That sounds obvious, but it's a shift from the mindset of the last few years where every Marvel and Star Wars show had to be a prestige event.

Leveraging experiences. Here's where D'Amaro's background matters. Streaming can drive people to experiences. A new Marvel show doesn't just generate streaming revenue; it drives visits to the Disney Parks' Marvel lands. A new Star Wars series gets people excited to visit Galaxy's Edge. Under D'Amaro, expect more explicit integration between streaming content and physical experiences.

Selective growth. Disney probably won't try to win every market with streaming. Markets where experiences are more profitable will get more attention. The US and Europe are saturated with streaming services anyway. What about markets where Disney Parks are growing? Asia, for instance. Expect more localized content and more aggressive bundling with experiences in those regions.

The bigger shift is strategic philosophy. Streaming was supposed to be the future. Under D'Amaro, it's probably going to be treated as an important part of the ecosystem, not the central pillar. That might actually make it more profitable, ironically, because you stop chasing Netflix-sized subscriber bases and start optimizing for profitability and integration.

One thing to watch: D'Amaro will have to manage expectations carefully. Wall Street expects streaming growth to continue. If he pivots too aggressively, investors might panic. But he's got some runway because Iger is staying on as advisor. If Iger publicly supports the strategy, the board is probably on board too.

How D'Amaro Might Reshape Disney's Film and Television Studios

Disney's film and TV studios are in a weird place. The theatrical business is recovering from pandemic lows, but it's not healthy. Studio films don't dominate at the box office the way they used to. Superhero fatigue is real. Audiences are fragmented across so many platforms.

Chapek's solution was to pump theatrical releases straight to Disney Plus. That made sense for maximizing streaming subscriber numbers but destroyed relationships with theater owners and alienated creators who want their work seen on the big screen.

Iger reversed that when he came back. He acknowledged that theatrical releases matter, that they generate prestige and marketing value, and that abandoning the theatrical model was a mistake.

D'Amaro will probably continue that approach, but with tweaks. The question isn't whether to make theatrical films. The question is which films go theatrical, how they're positioned, and how they're monetized across platforms.

Expect D'Amaro to be more disciplined about theatrical releases. Not every IP should get a theatrical film. Some work better as streaming content, some work better as theme park attractions, and some work better across multiple formats simultaneously. The key is optimizing each title for what it does best.

There's also Marvel to consider. Marvel movies have been underperforming lately by Marvel standards. Recent releases haven't been the $1+ billion blockbusters they used to be. That's partly market saturation, partly creative issues, and partly the fact that Marvel fans can get their content on Disney Plus instead of going to theaters.

D'Amaro will probably work to refocus Marvel as a theatrical experience. That means higher budgets for fewer films, more theatrical exclusivity, and more coordination with Disney Parks to create synergies. A new Spider-Man film isn't just box office revenue; it's also a new land at the theme parks and a massive merchandising opportunity.

The TV side is more complicated. Disney's streaming ambitions meant spending billions on original TV content. Some of it's been great. Some of it has been expensive and not particularly successful. Under D'Amaro, expect a more pragmatic approach: fewer prestige shows, more cost-conscious production, and more focus on content that drives multiple revenue streams (streaming + merchandising + experiences).

One more thing: D'Amaro will inherit responsibility for Hulu, which is a profitable streaming service. The company already owns 100% of Hulu (after buying out Comcast's stake). Unlike Disney Plus, Hulu is actually profitable. It carries general entertainment and adult-oriented content. Expect D'Amaro to lean into that, because it demonstrates that Disney can run profitable streaming businesses. They just need the right strategy.

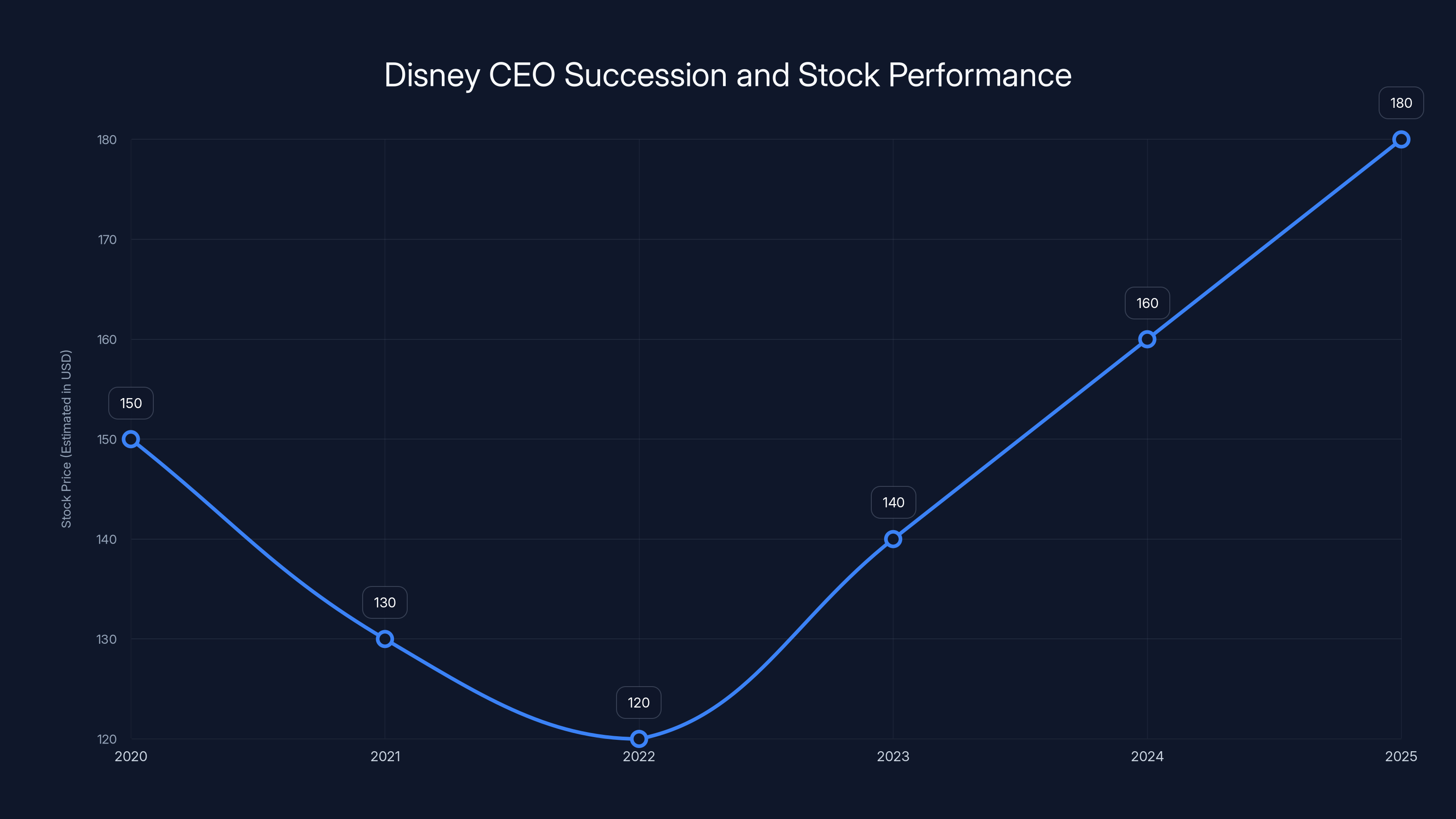

Estimated data shows Disney's stock performance fluctuating during CEO transitions, with a projected recovery under new leadership by 2025.

The Theme Parks Division: Expansion and Innovation Under New Leadership

Disney Parks and Experiences is the crown jewel of Disney's portfolio. Under D'Amaro, expect continued expansion and innovation, but with more discipline around spending and more focus on profitability.

The parks have already undergone massive innovation. Galaxy's Edge in both California and Florida is a technological and design marvel. Pandora is arguably the most immersive land Disney's ever built. New attractions across all parks have raised the bar for theme park engineering. But all of that innovation costs money. Lots of money.

D'Amaro has proven he'll invest in innovation, but he'll demand returns. A new land doesn't just have to be beautiful; it has to drive attendance, increase average spending per guest, extend visit length, and justify its construction costs within a reasonable timeframe.

Expect this to accelerate D'Amaro's focus on international parks. The US parks are mature and probably can't grow attendance much more. But there's enormous potential in Asia, the Middle East, and other regions. Disney is already planning parks in these regions. Under D'Amaro, those projects will probably move faster.

There's also the cruise line, which is expanding rapidly. Disney Cruise Line is one of the most profitable hospitality businesses in the world. Guests pay premium prices for a Disney experience at sea, and Disney controls all of the economics. New ships are under construction. Expect D'Amaro to push for more cruise capacity because it's basically free money (once you've built the ship).

Price increases will probably continue, maybe even accelerate. Disney Parks have gotten extremely expensive, and that's a feature, not a bug. Higher prices drive higher margins and reduce crowd congestion. But there's a ceiling. Go too high, and you price out families. D'Amaro will have to balance profit maximization with maintaining Disney's image as an accessible, family-oriented brand.

One wildcard: Virtual reality and immersive technologies. Disney's invested in VR experiences at parks. The technology keeps improving. At some point, VR experiences might become attractions in their own right. They're cheaper to build than traditional attractions and can be updated constantly. D'Amaro, who's shown willingness to embrace new technologies, might push this harder than previous leaders.

Also watch for better integration between streaming and experiences. When a new Marvel show comes to Disney Plus, you'll probably see coinciding updates to Marvel-themed attractions at parks. When a new Star Wars series launches, Galaxy's Edge probably gets new content. This kind of coordination maximizes the value of the IP investment across multiple formats.

International Expansion and Global Market Strategy

Disney's theme parks in Asia are absolute powerhouses. Tokyo Disney Resort is the most visited theme park complex in the world (by most metrics). Shanghai Disneyland is booming. Hong Kong Disneyland is ramping up after years of COVID and political uncertainty.

These parks generate enormous revenue and operate at margins that dwarf the US parks. Labor costs are lower (in some cases), real estate is comparatively cheap, and the willingness to pay is actually higher than in the US in some segments.

Under D'Amaro, expect more aggressive expansion in Asia. This is where he'll probably focus his biggest bets. New parks, new attractions, new experiences—all aimed at capturing the growing middle class in countries with billions of people.

There's also the Middle East. Saudi Arabia has been investing in massive entertainment experiences. Disney is probably an obvious partner, though the relationship is complex (Disney's LGBTQ+-friendly corporate culture vs. Saudi Arabia's cultural norms). Still, that market represents enormous potential.

Europe is more mature, but there's room for growth. European parks have different operating models and different challenges than US parks, and D'Amaro has international experience managing these differences.

The international strategy will also influence streaming. Content that works in Western markets doesn't always work in Asia. Disney will probably invest more in localized content, localized experiences, and localized partnerships. That's different from the current approach, which is somewhat one-size-fits-all.

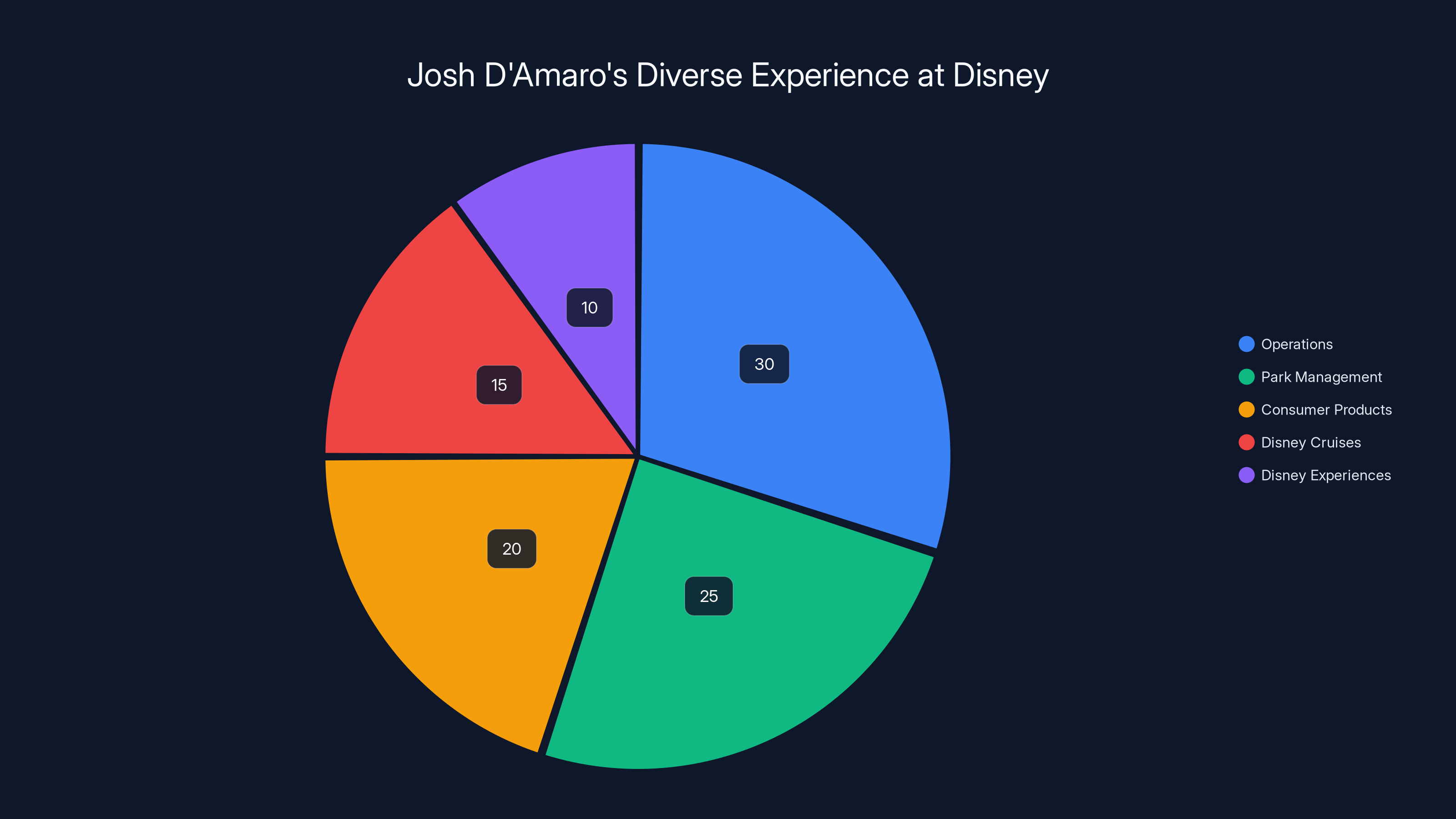

Estimated data shows D'Amaro's career distribution, highlighting his extensive experience across various Disney sectors.

Strategic Implications of Experience-First Leadership

Okay, let's connect the dots. What does it mean for Disney's strategy that they've promoted a parks guy instead of a studio guy or a tech guy?

It means several things:

First, the streaming war is effectively over for Disney. Not over in the sense that Disney won. Over in the sense that Disney's no longer trying to win it. They have Disney Plus, it exists, it'll be profitable eventually, but it's not the central strategic priority anymore. Netflix already won that war. Disney's pivoting to what it does better than anyone else: experiences.

Second, profitability matters more than growth. Iger's era was about building for the future. Spend billions acquiring studios, accept streaming losses, invest heavily in IP development. D'Amaro's era is about optimizing existing assets. Make the parks more profitable. Make streaming profitable. Make the studios more efficient. It's a different mentality.

Third, intellectual property gets expressed primarily through experiences, not content. This is subtle but important. The old Disney model: build the IP (movies, shows), then merchandise it and create theme park attractions from it. The new model: experiences are the highest-value expression of IP, and content is secondary. You build IP that works as experiences first, then you make content that drives people to those experiences.

Fourth, international growth is the priority. The US market is mature. Growth comes from Asia, the Middle East, and eventually Africa. D'Amaro's best opportunities are in building experiences in markets where nobody's doing it as well as Disney.

Fifth, integration between business units matters more than keeping them siloed. Under Iger, Studios made films, Parks made attractions, Streaming made content. Under D'Amaro, all of that probably gets tightly integrated. A new Marvel release is coordinated with Parks attractions, merchandise, and streaming rollouts. Nothing exists in isolation.

These strategic implications matter because they're going to shape what Disney does for the next decade. They'll influence which projects get greenlit, how much money gets spent, which markets get attention, and how success is measured.

Financial Implications and Investor Expectations

Wall Street is going to be very interested in whether D'Amaro can improve Disney's financial performance. The stock hasn't been thrilling lately. Investor expectations are mixed.

Here's the math that matters: Disney's operating margin across the whole company is somewhere around 15-20%, depending on how you calculate it. But the Experiences division operates at 30%+ margins. Streaming is negative or barely breakeven. Studios vary wildly.

If D'Amaro can shift the company's revenue mix to be more heavily weighted toward high-margin experiences, he can improve overall profitability without cutting costs everywhere. That's the key: growth through margin optimization, not cost-cutting.

The challenge is that experiences are geographically limited. You can only have so many theme parks. Cruises can expand, but they're capital intensive. So growth from experiences has physical limits.

That's why streaming matters even under D'Amaro. Streaming is scalable without physical limits. The question is whether it can be made profitable, and whether it serves the broader experience strategy by driving people to parks and merchandise.

Investors will want to see:

- Disney Plus achieving profitability within the next 2-3 years

- Parks margin remaining strong despite competition and inflation

- Content spending stabilizing and becoming more efficient

- The overall company operating margin improving

- Successful expansion into new markets

D'Amaro has a track record of delivering on these kinds of metrics in the Experiences division. The question is whether he can do it at the company-wide level.

Leadership Style and Management Philosophy

We don't know as much about D'Amaro's leadership philosophy as we do about Iger or Chapek because he's been running a division, not the whole company. But we can infer some things from his 28-year track record.

First, he's patient. A 28-year career at one company suggests someone who's not in a hurry and trusts the system. He's climbed the ladder through competence, not empire-building. That's different from Chapek, who seemed always trying to prove something, and different from Iger, who had the advantage of a clean slate and could make bold moves.

Second, he's operationally rigorous. Everything we know about his work in Parks and Experiences suggests someone who cares deeply about execution. Things have to work. People have to perform. Systems have to function. That's not glamorous, but it's what separates successful operations from failures.

Third, he understands people. Running 200,000 employees across multiple countries requires emotional intelligence. You can't just mandate things and expect compliance. You have to build culture, earn trust, and make people believe in the mission. D'Amaro seems to have done that in his division.

Fourth, he's probably not a visionary risk-taker. Iger would make a $70 billion acquisition and hope it works out. D'Amaro will probably make smaller bets and expect them to pay off. That's not adventurous, but it's also not reckless.

One thing that might matter: D'Amaro's age. He was born in 1971, making him 53 or 54 at the time of his appointment. That's young enough to lead for potentially 15 years, but old enough to be taken seriously. It's different from promoting someone in their 30s or early 40s who might need 10 years to figure things out.

Competitive Landscape: How Disney Faces New Challenges

Disney's not facing competition the way it did 10 years ago. Back then, Netflix was the threat. Now, Netflix is just another service, and Disney Plus is trying to compete on Netflix's terms. That's not where Disney should be competing.

The real competition now is for experience and attention. Disney's theme parks compete with other theme parks, other vacations, other ways families spend discretionary income. Disney's streaming competes with every other service for screen time. Disney's merchandise competes with every other brand.

Under D'Amaro, Disney's probably going to lean into what it actually wins at: experiences that nothing else can match. Universal has theme parks, but they're not as immersive or as well-designed as Disney's. Nobody else has parks that operate at Disney's level of quality and scale.

Streaming is different. Disney can't beat Netflix because Netflix is Netflix. But Disney doesn't need to. It just needs Disney Plus to be profitable and serve the broader ecosystem. That's a different game than streaming wars.

One competitive threat that's emerging: other companies building experiences. Saudi Arabia's building the NEOM entertainment complex. China's building massive entertainment facilities. Europe's investing heavily. Disney doesn't have a monopoly on experiences anymore.

But Disney has a 70+ year head start, an unmatched talent pool, and proven execution. Those advantages are real.

D'Amaro will probably focus on defending Disney's position in experiences while letting streaming be a support function rather than the centerpiece. That's a strategic choice that allows Disney to compete in areas where it has genuine advantage.

The Transition Plan and What Success Looks Like

D'Amaro takes over effective March 2025. Iger stays on as advisor and board member through the end of the year. That gives them nine months of overlap, which is actually quite generous in CEO transitions.

The transition plan seems purposeful. It's not a clean handoff like Iger's original transition to Chapek, where Iger just left. This time, there's mentoring, guidance, and continuity. That suggests the board learned from Chapek's failure and wants to do this right.

What counts as success for D'Amaro?

Year one would be about stabilization and demonstrating continuity. Keep the parks running, keep streaming on track, keep the studio pipeline moving. Don't do anything crazy. Build credibility with employees, investors, and partners.

Year two would be about optimization. Implement new strategies in streaming, improve operational efficiency, maybe announce new parks or expansions. Start showing the kind of financial improvements that justify the confidence the board showed in appointing him.

Years three and beyond would be about transformation. Once D'Amaro's established himself, he can start making bigger bets. New markets, new business models, new expressions of the IP. That's when you'd see the real D'Amaro strategy play out.

One wildcard: activist investors. If Disney's stock underperforms significantly, activist investors might agitate for changes. That could accelerate D'Amaro's timeline or constrain his options. You have to be mindful of shareholder pressure.

FAQs About Disney's Leadership Transition

The announcement of D'Amaro's appointment raised a bunch of questions. Here are the ones that matter most.

What makes Josh D'Amaro different from Bob Chapek?

D'Amaro has 28 years of Disney experience and a proven track record running Disney's most profitable divisions. Chapek was brought in from outside with less Disney background. D'Amaro also built his career in high-margin, customer-focused businesses (parks and cruises), while Chapek had more of a theater operations background. The key difference is that D'Amaro understands Disney's entire ecosystem and has managed complex global operations at scale.

Will Disney Plus shut down under D'Amaro's leadership?

No. Disney Plus will continue operating, but probably with different strategic priorities. Expect higher prices, more bundling with other services, more selective content investment, and tighter integration with the broader Disney ecosystem. The focus will shift from streaming growth at any cost toward streaming profitability and its role in driving other business units.

How will D'Amaro handle Disney's film and television studios?

D'Amaro will likely continue Iger's approach of respecting theatrical releases, but with more discipline. Expect fewer theatrical films overall but higher budgets for those that do get theatrical releases. Studios will probably be asked to show how their content drives streaming subscribers and theme park visits, creating more integration across the company.

What does D'Amaro's appointment mean for the Disney Parks?

It probably means continued expansion, particularly internationally. Parks will remain the company's profit engine, and D'Amaro will keep investing in innovation and new experiences. Expect new lands, new attractions, and aggressive expansion in Asia and other high-growth markets. Prices will probably keep increasing, but so will the quality and appeal of experiences.

Why did Bob Iger stay on as an advisor if he was retiring?

Iger staying on suggests the board wanted continuity and mentorship, which makes sense given Chapek's failure. Having Iger available for guidance during the transition reduces risk. Iger gets a graceful exit and continued influence; the company gets stability. It's a win-win that protects the company from another abrupt transition failure.

Will D'Amaro make big acquisitions like Iger did?

Probably not at the same scale. Iger made billion-dollar acquisitions (Marvel, Lucasfilm, Fox) because Disney needed intellectual property. D'Amaro inherits a company that already has enormous IP. His focus will probably be on optimizing existing assets rather than making massive bets on new ones. Smaller acquisitions that fill specific needs are more likely than another Fox-sized deal.

How long is D'Amaro expected to serve as CEO?

Under typical corporate governance, D'Amaro could serve for 10-15 years. He was born in 1971, so he'd be in his mid-60s at the end of that tenure. The board probably expects at least 5-10 years of stable leadership before needing to think about succession planning again.

What's the biggest risk for D'Amaro's tenure?

That streaming never becomes profitable, and Disney's margin story doesn't improve. If Disney Plus continues burning cash and the company's overall margins compress, investors will lose faith quickly. D'Amaro's credibility depends on delivering financial results within 2-3 years. That's a reasonable timeline, but it's not unlimited.

Will D'Amaro pursue the company's original streaming ambitions?

No. The streaming ambitions of 5-6 years ago were about beating Netflix and achieving streaming dominance. That era is over. D'Amaro will pursue profitable streaming that serves the broader Disney ecosystem. That's a fundamentally different goal with different metrics for success.

How does D'Amaro's appointment affect creators and talent at Disney?

For studio creators, it's mixed. D'Amaro will demand efficiency and profitability, which might mean tighter budgets and fewer projects greenlit. But he also respects creative excellence when it makes business sense. For parks and experiences talent, it's probably positive. D'Amaro built his career in that space and understands the people and the work.

Conclusion: A New Era Begins

Josh D'Amaro's appointment as Disney's next CEO marks a strategic pivot that's been coming for years. The era of streaming-first strategy is over. The era of experience-first strategy is beginning.

Disney didn't need another visionary IP builder. It has 70+ years of the world's greatest IP already. It needs someone who can optimize that IP across multiple formats while defending Disney's position as the world's premier entertainment and experience company.

D'Amaro brings exactly that. Twenty-eight years at Disney, proven execution in the company's most profitable divisions, international experience, and a leadership style grounded in operational excellence rather than bold bets. He's not Iger, but he was never supposed to be. He's something different for a different moment.

The risk is real. Running a

But the board seemed to have learned from that mistake. They're giving D'Amaro a smooth transition, Iger's mentorship, and clear expectations: stabilize the company, improve profitability, and keep Disney relevant in a rapidly changing media landscape.

Will he succeed? The next 18-24 months will tell you. If Disney's margins improve, streaming losses narrow, and investor confidence returns, D'Amaro will have validated the board's decision. If the company continues struggling, you'll hear about a successor pretty quickly.

The thing about CEO transitions is that they're both intensely personal and entirely impersonal. It's one person stepping into a role, but that role is defined by forces way bigger than any individual. D'Amaro will have to navigate shifting media consumption patterns, international competition, streaming economics, and shareholder expectations while somehow keeping the magic alive.

That's the job he signed up for. The company he's inheriting is vastly more complex than the one Iger took over in 2005. But it's also vastly more valuable, and the playbook is proven. Execute better, make experiences unforgettable, and let the IP do the talking.

If D'Amaro can do that, Disney's next chapter could be its best. If he can't, well, we'll be writing about his successor before we know it.

Watch the first nine months. That's when you'll know whether this transition is different from the Chapek disaster or just another stumble on the way to finding Disney's true successor to Bob Iger's legacy.

Key Takeaways

- Josh D'Amaro, who spent 28 years building Disney's highest-margin divisions, was unanimously appointed CEO effective March 2025, representing a strategic shift from streaming-focused leadership

- The appointment marks the second CEO succession in five years following Bob Chapek's failed tenure, suggesting the board learned from previous transition mistakes by providing structured mentorship

- D'Amaro's background in theme parks and experiences (30%+ operating margins) compared to streaming losses indicates Disney is deprioritizing streaming wars and refocusing on profitable, customer-experience-driven businesses

- Disney Plus strategy will likely shift from growth-at-any-cost toward sustainable profitability through bundling, higher prices, and tighter integration with the broader Disney ecosystem

- International expansion, particularly in Asia, will become a central strategic priority under D'Amaro's leadership, with accelerated investment in new parks, cruise experiences, and localized content

Related Articles

- PayPal's Enrique Lores Appointment: A Strategic Overhaul in Digital Payments [2025]

- Amazon's Fallout Season 1 Free on YouTube: What You Need to Know [2025]

- Melania Documentary Cost Controversy: What the $75M Price Tag Really Reveals [2025]

- Tech CEOs on ICE Violence, Democracy, and Trump [2025]

- Prime Video's The Wrecking Crew: How Amazon Toned Down Violence [2025]

- Disney+ and Hulu Bundle Deal: Complete 2025 Guide [Save $3/Month]

![Josh D'Amaro Becomes Disney's New CEO: What It Means [2025]](https://tryrunable.com/blog/josh-d-amaro-becomes-disney-s-new-ceo-what-it-means-2025/image-1-1770136895213.jpg)