The Marketing Automation Revolution Nobody Expected

Marketing teams are drowning. Not in leads or conversions—in tools. Facebook has AI suggestions. Instagram pushes machine learning. TikTok's algorithm is basically a sentient black box at this point. Then you've got Google, Microsoft, and a thousand startups (Jasper, Copy.ai, and whatever launched this week) all screaming about their AI marketing superpowers.

So when another marketing AI startup walks out of stealth, your first instinct is fair: "Here we go again."

But Kana is different. And I don't say that lightly.

The San Francisco-based startup just raised

And they're convinced that AI marketing tools have been solving the wrong problem.

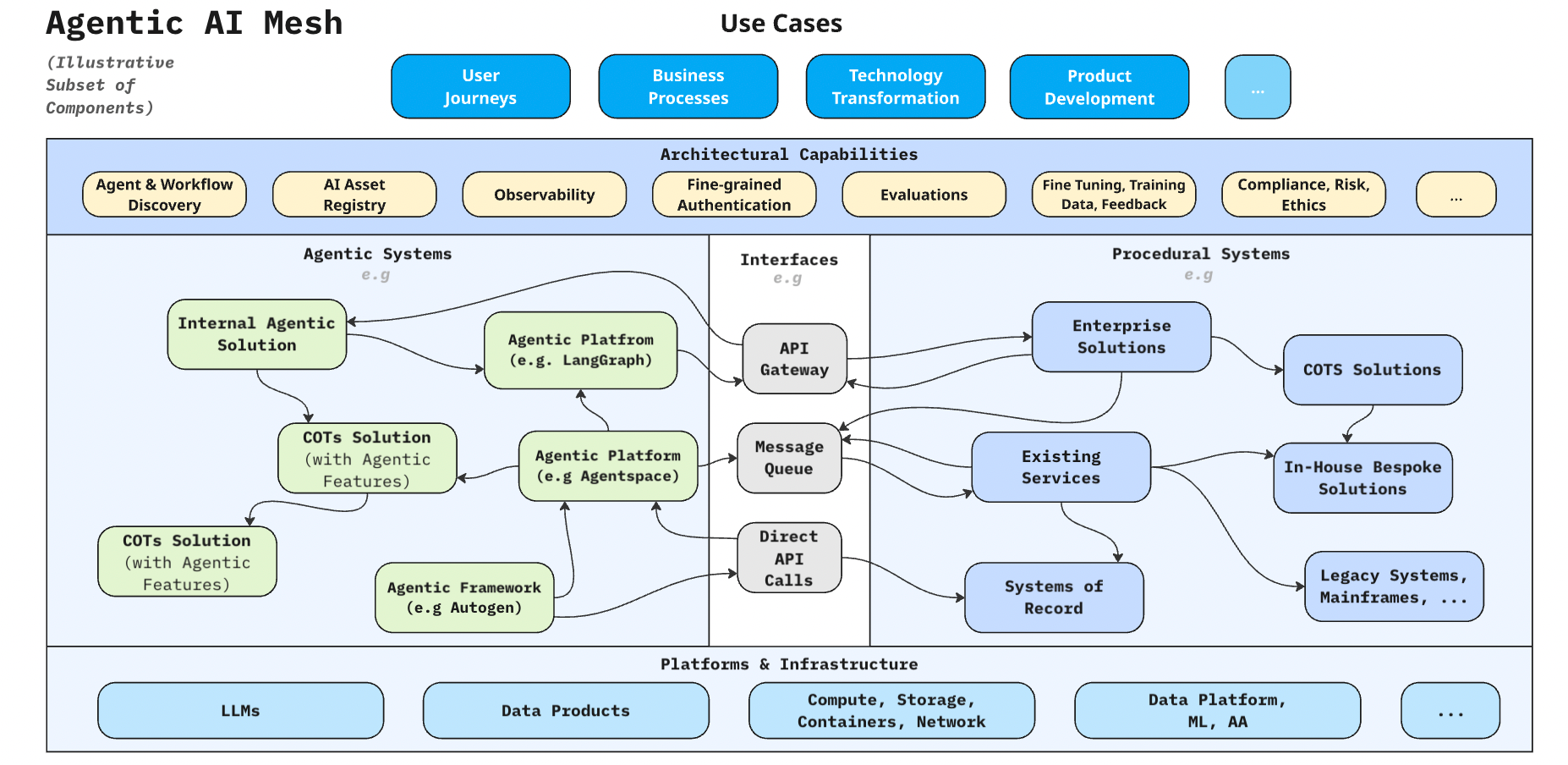

Instead of building another monolithic platform or bolting AI onto existing software, Kana is architecting something fundamentally different: loosely coupled AI agents that work like specialized contractors. You give them a job—analyze this campaign, target this audience, generate these reports—and they handle it. But here's the thing that separates this from the hype: the agents are flexible. You can customize them on the fly. Swap them in and out of your existing marketing stack. Let them work autonomously while keeping humans in the loop for final approval.

This is the first deep dive into what Kana is actually building, why the timing matters, and whether this startup can cut through an impossibly crowded market.

TL; DR

- Kana raised $15M in seed funding to build customizable AI agents for marketing automation

- Founders have 25+ years in marketing tech experience (built Rapt, Krux, and earlier ventures)

- The product differs from incumbents by offering loosely coupled, real-time customizable agents instead of monolithic platforms

- Key features include autonomous campaign optimization, synthetic data generation, audience targeting, and media planning

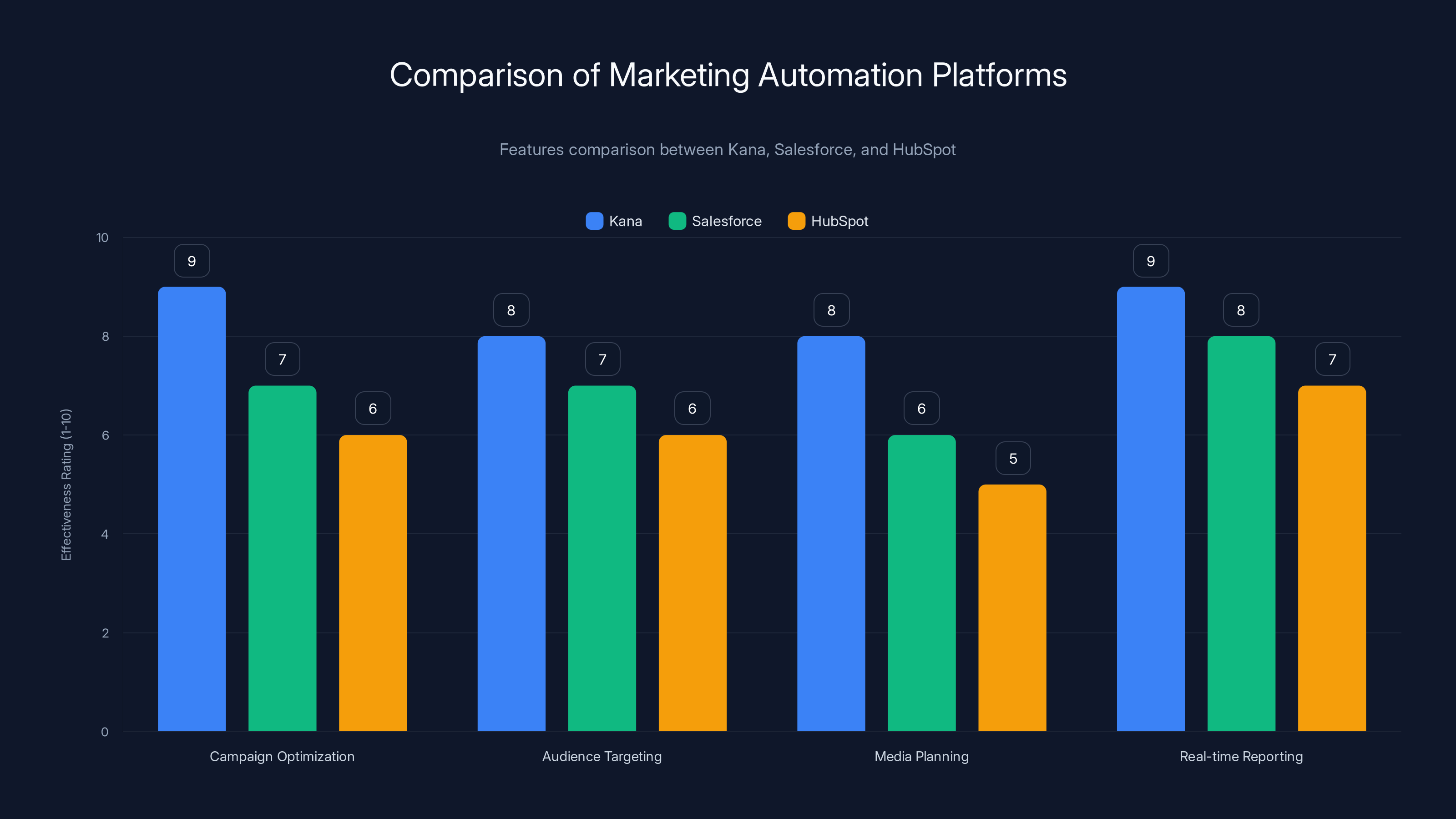

- The competitive edge is flexibility and speed to deploy versus enterprise software like Salesforce or HubSpot

- Target market is mid-market to enterprise marketing teams frustrated with legacy platform constraints

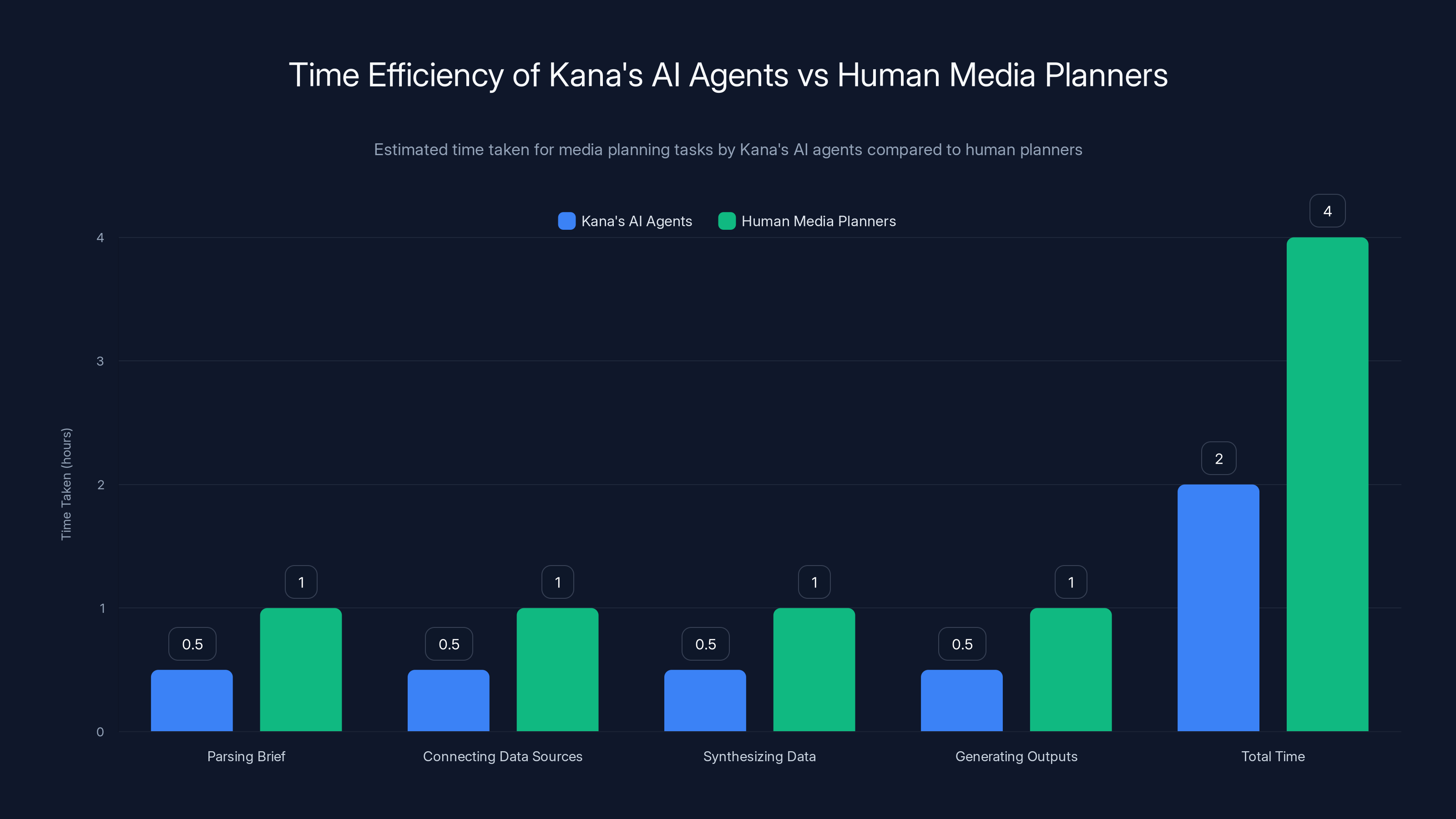

Kana's AI agents significantly reduce the time required for media planning tasks, completing them in approximately half the time compared to human planners. (Estimated data)

Understanding the Kana Moment: Why Now?

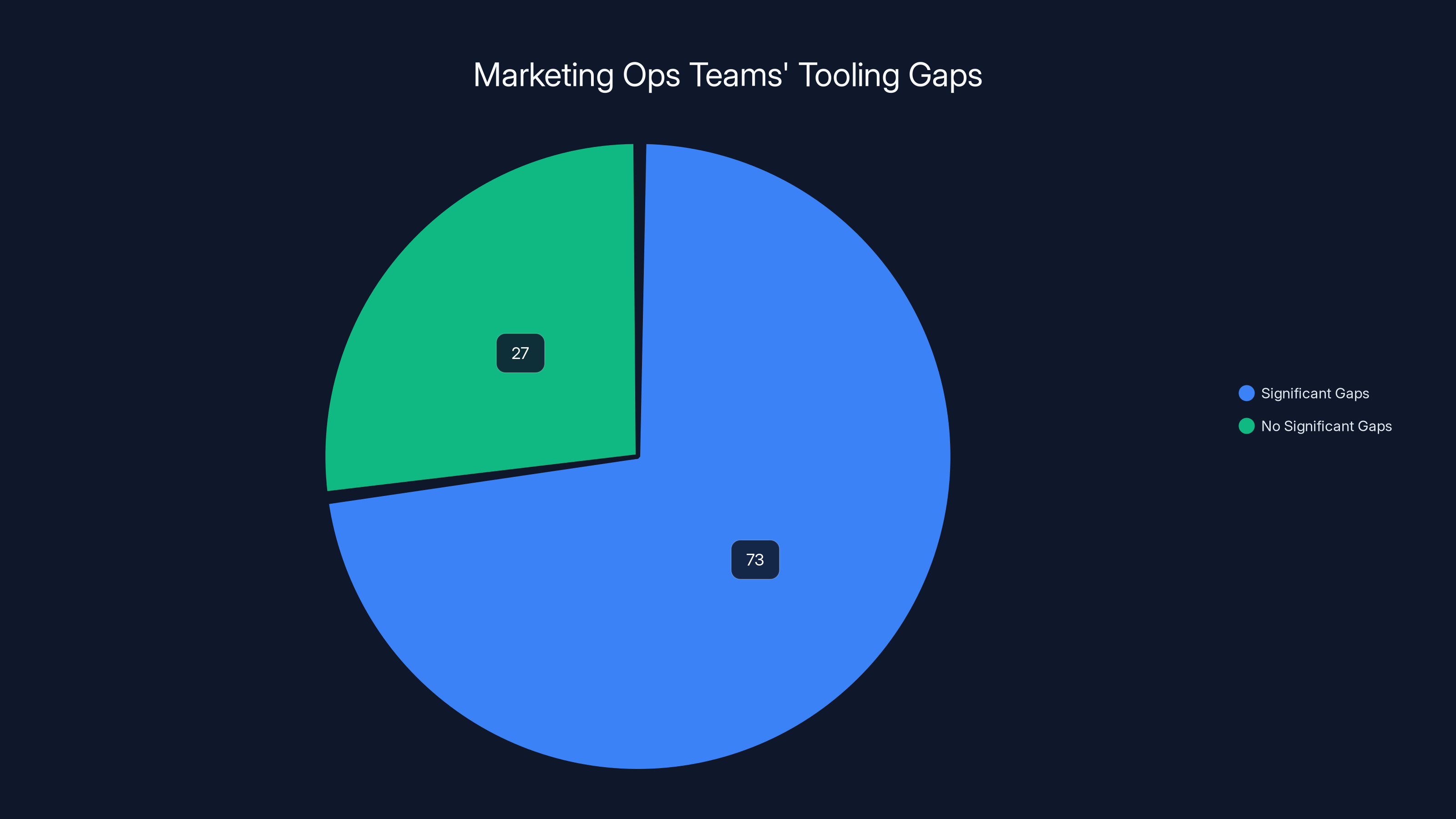

Marketing operations have fundamentally changed in the last three years, and most tools haven't caught up. A 2024 survey from the Marketing Operations Professionals Organization found that 73% of marketing ops teams report significant gaps between their current tooling and their actual needs. Think about that number. Nearly three-quarters of marketing organizations are running on infrastructure that doesn't fit what they're trying to do.

Why? Legacy platforms like Salesforce, HubSpot, and Adobe Experience Cloud were built in a different era. They optimize for consolidation—pulling everything under one roof. But modern marketing doesn't work that way anymore. Brands use TikTok, Pinterest, Snapchat, YouTube, Google Ads, Facebook, LinkedIn, email, SMS, push notifications, retargeting pixels, DCM, and seventeen other channels simultaneously. Each channel has its own data structure, its own API, its own quirks. Trying to manage all of that through a single enterprise platform creates what system architects call "impedance mismatch." Everything bends to fit the platform's model instead of the platform bending to fit how you actually work.

That's where AI changes the equation.

Instead of manually integrating a new channel or waiting for your platform vendor to build a connector (which might take 6 months if they even care), you could deploy an AI agent that understands the channel, pulls the data, understands your business context, and does the work. And crucially, you could do that without ripping out your existing infrastructure.

Chavez and Vaidya saw this gap coming. When they were running Krux before Salesforce bought it, they watched the entire martech landscape fracture into specialized tools. The consolidation story that Salesforce, HubSpot, and others had been selling was increasingly out of step with how actual marketing teams operated. Marketers didn't want everything bolted together. They wanted best-of-breed tools that actually talked to each other.

AI agents solve that differently. Instead of forcing integration at the product level, you integrate at the data level. The agent understands the data, understands the task, and acts.

Chavez put it simply in our conversation: "We see a market that's crying out for solutions that meet this moment. We understand the space deeply, having wallowed in it arguably a little too long; having really stood in our customers' pain."

What he's really saying is this: most AI marketing startups are outsiders trying to crack a problem they've observed from the outside. Kana's founders aren't guessing. They've lived inside marketing operations long enough to know exactly where it's broken.

The Founders' Track Record: Why Experience Matters

Two tech exits shouldn't automatically make someone successful in a third venture. Plenty of serial entrepreneurs have one good idea and spend the next decade failing quietly. But Chavez and Vaidya's specific track record matters here because they've exited in the right way, at the right times, for the right reasons.

Rapt (2008, acquired by Microsoft): Rapt was behavioral targeting and audience segmentation software in the mid-2000s. This was the era when cookie-based tracking was ascendant and first-party data was basically the entire game. Rapt helped advertisers and marketers build sophisticated audiences from behavioral signals. When Microsoft bought it, they integrated it into the Advertising Exchange and later into their broader ad platform. This teaches you something crucial: data structures for audience understanding.

Krux (2016, acquired by Salesforce for $700M+): Krux was Chavez and Vaidya's masterwork. It was a data management platform—essentially a place where marketers could bring in all their first-party data, third-party data, and create a unified customer understanding. Krux succeeded because it solved a real problem: fragmented data. In 2016, the big platforms (Google Analytics, Facebook, Adobe) were starting to fight for dominance, and marketers needed a Switzerland—a neutral place to unify everything. Salesforce bought Krux not just for the technology but because they recognized it solved a positioning problem for them in the data space.

What you learn from selling Krux: integrated data infrastructure is valuable, but only if it actually scales across different systems. Salesforce has spent the last eight years trying to turn Krux into something it was never designed to be—a core part of the CDP (Customer Data Platform) story. And they've struggled. Why? Because martech fragmentation has only gotten worse. The more consolidated Salesforce tried to make the Krux experience, the less useful it became.

Super{Set}: After exiting Krux, Chavez and Vaidya launched a startup studio called super{set}. This is the underrated part of their background. Instead of just working at a company, they built a company factory. A startup studio teaches you something specific: how to spot problems, quickly validate them, iterate rapidly, and scale without the overhead of a typical startup. Over nine months, they incubated Kana inside super{set}, testing core assumptions before taking outside funding.

This is important because it means the founding team came to Kana with an already-validated idea. They weren't pitching Mayfield on a vision. They were pitching on proof of concept.

According to data from the Founder Institute, startups that validate ideas before raising institutional capital are 3.2x more likely to reach profitability and 2.8x more likely to avoid catastrophic pivots. Kana had that advantage.

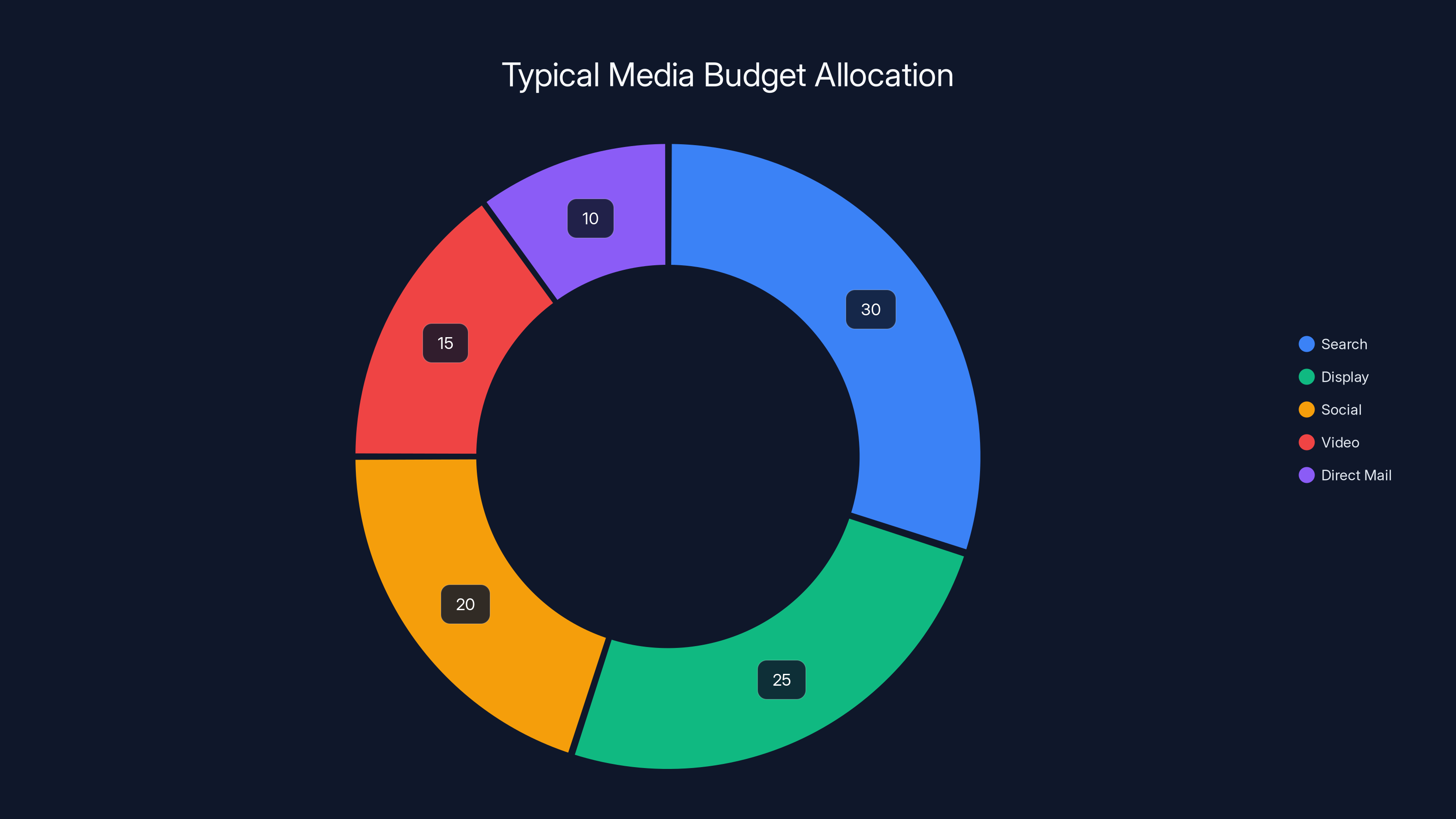

Typical media budget allocation shows a diverse strategy with search and display channels receiving the largest shares. Estimated data based on common practices.

How Kana's AI Agents Actually Work

Let's get concrete about what Kana is actually building, because the term "AI agents" means different things depending on who's using it.

At a technical level, an AI agent is a software system that perceives its environment (receives input), reasons about that input (applies logic), and takes actions. In Kana's case, the agents are specialized for marketing tasks. But the word "specialized" is doing heavy lifting here. They're not just LLM wrappers. They're built with domain-specific logic for marketing operations.

Consider this workflow that Chavez described: A marketer uploads a media brief. This is typically a 10-50 page document with campaign objectives, target audience descriptions, budget constraints, channel preferences, and performance benchmarks. A human media planner would spend two to four hours reading this, understanding the strategic goals, then building out a recommendation.

Kana's agent does something similar, but differently. It:

-

Parses the brief to extract structured data: What are the KPIs? Who's the target audience (described in natural language)? What's the budget? What channels are we using?

-

Connects to your data sources to pull in historical performance data, inventory availability, market research, and third-party audience data. This isn't just grabbing pre-built reports. It's executing queries against multiple systems simultaneously.

-

Synthesizes the data with the brief's objectives to create a recommendation. The agent understands that if your KPI is "maximize click-through rate at a $4 cost-per-action cap," that's different from "maximize brand awareness." Different objectives require different tactics.

-

Generates outputs: A recommended media plan broken down by channel, expected performance, and reasoning for the recommendations.

-

Waits for approval or feedback: This is the "human-in-the-loop" piece. The marketer reviews the recommendation, might adjust the budget allocation, change the target audience, or add constraints. The agent learns from that feedback.

Vaidya was explicit about this: "We can move with insane speed that these big companies just cannot. And that's our advantage."

But speed requires something else: loosely coupled architecture. In traditional enterprise software, everything is integrated through a central data model. Make a change in one place and dependencies ripple everywhere. Kana decouples this. Each agent is somewhat autonomous. It has access to data it needs, understands its specific task, but doesn't need to coordinate with other agents at a deep architectural level.

This is similar to a microservices approach in software engineering. Instead of one monolithic Salesforce org, you have specialized agents for audience targeting, campaign optimization, reporting, bid management, and so on. Each can be deployed, updated, and customized independently.

Kana targets 70-80% agent autonomy on routine tasks, with the remaining 20-30% requiring human review or exception handling. This is higher than most marketing automation platforms (which are closer to 30-40% for equivalent complexity) but lower than fully autonomous systems (which would hit 95%+ but introduce unacceptable risk in marketing spend).

The Synthetic Data Piece: A Quiet Differentiator

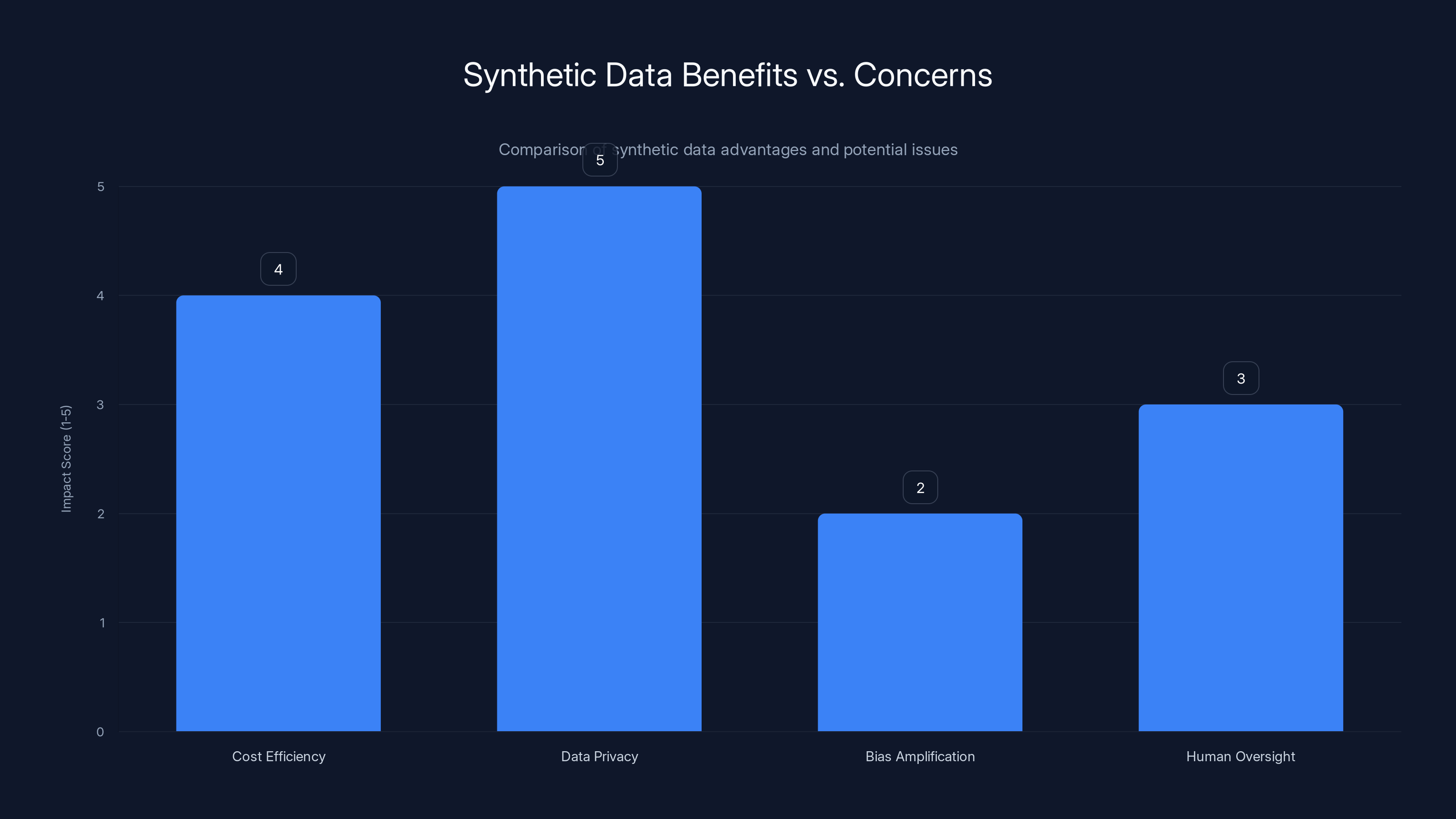

One feature of Kana gets glossed over in most coverage but might be their most interesting innovation: synthetic data generation.

Here's the problem it solves: third-party data has become expensive and constrained. Apple's privacy changes decimated cookie-based tracking. Google is sunsetting third-party cookies. Privacy regulations (GDPR, CCPA, LGPD) have made data collection harder. So if you're a marketer and you need audience data, you're paying premium prices to data brokers, and even then, the data is degraded compared to what you could access five years ago.

Synthetic data is an alternative. Using machine learning, you can take patterns from your existing first-party data and generate realistic but artificial audience profiles that match your customer segments. For example, if your customer database shows that "tech-savvy parents aged 30-45 who earn $100K+" are your core audience, synthetic data generation can create hundreds of additional profiles that fit that pattern without violating anyone's privacy.

The benefit: you can test audience strategies faster, fill gaps in your data, and reduce reliance on expensive third-party sources.

But there are legit concerns too. Synthetic data can accidentally bake in biases from your training data. If your existing customer base is homogeneous, synthetic data will amplify that. If you're using it to fuel targeting, you risk creating narrow, discriminatory audiences.

Chavez acknowledged this indirectly: Kana's agents are designed to "keep humans in the loop." For synthetic data specifically, that means a marketer reviews and approves the synthetic profiles before they're used in actual campaigns.

This matters because it's not a novel technical idea—synthetic data has been used in marketing and ad tech for years. What's novel is integrating it into an agent-based workflow where it's part of a bigger decision-making process, not a standalone feature.

Campaign Optimization and Autonomous Tracking

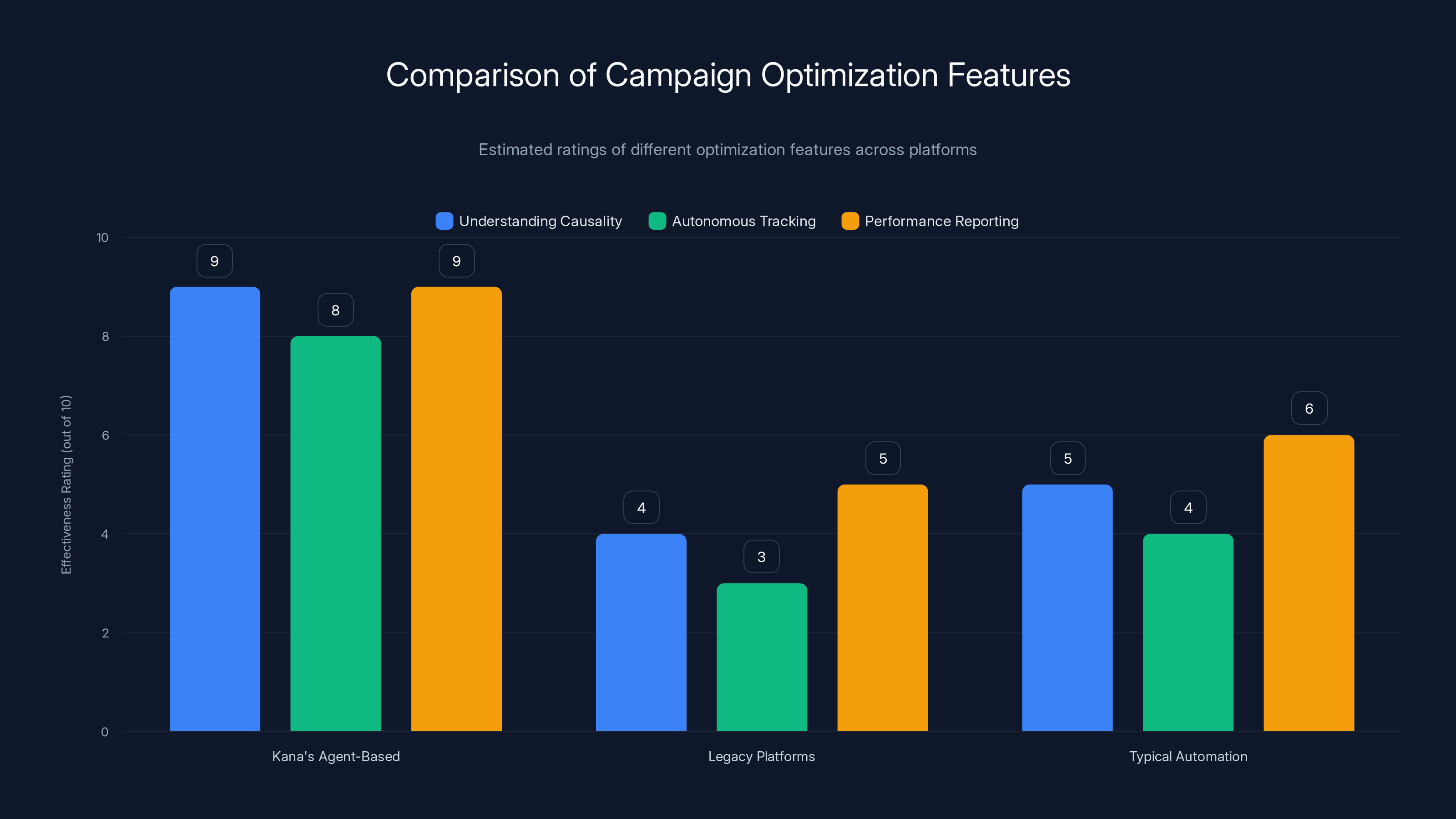

Campaign optimization is the bread and butter of marketing automation. Almost every platform claims to do it. But there's a massive gap between what platforms claim and what they actually deliver.

Most "optimization" is really just automated rule-based adjustments: "If CTR drops below X%, bid less on that placement." Or: "If cost-per-lead exceeds $Y, reduce daily budget."

That's not optimization. That's reaction.

Real optimization understands causality. Why did CTR drop? Was it the creative? The audience targeting? The time of day? The external environment (news cycle, competitor activity, seasonality)? A system that optimizes without understanding causality is just flailing.

Kana's agent-based approach allows for deeper analysis. The campaign optimization agent has access to:

- Performance data (impressions, clicks, conversions, costs)

- Creative assets (images, copy, video)

- Audience data (who the ads are reaching)

- Contextual data (what's happening in the news, on social media, in the market)

- Historical patterns (how this campaign performed in the past, how similar campaigns performed)

Given all that input, the agent can make more nuanced recommendations. "Conversions dropped 12% this week because the target audience shifted to mobile-only due to iOS updates. Recommend: (A) reallocate budget to mobile creative, or (B) shift audience to desktop-heavy segments."

Autonomous tracking—the ability to automatically measure and report campaign performance—is where this becomes operationally valuable. In legacy platforms, building a custom campaign report requires marketing ops to manually configure dashboards, often using tools like Looker or Tableau. It's slow and error-prone.

Kana's agents can autonomously generate weekly performance reports, track progress against KPIs, flag anomalies, and suggest corrective action. For a typical marketing team, this eliminates maybe four to six hours of weekly dashboard creation and analysis.

Let me put that in terms of impact:

Typical marketing ops team size: 8-12 people

Hours spent on weekly reporting: 32-72 hours

Cost of that labor (fully loaded):

Annual cost:

If Kana's agents can eliminate even 50% of that work, we're talking about

Kana's platform excels in campaign optimization and real-time reporting compared to traditional platforms like Salesforce and HubSpot. Estimated data based on typical feature effectiveness.

Audience Targeting and Segmentation

Audience targeting is where Kana's founders have the deepest experience. Rapt was an audience targeting company. Krux was an audience data company.

The insight they learned: targeting is only as good as your data, and most teams' data is terrible.

A typical marketer has:

- Customer data from their CRM (usually clean and accurate)

- Website data from Google Analytics (usually incomplete and siloed)

- Ad platform data from Facebook, Google, LinkedIn (siloed within each platform)

- Third-party data from data brokers (expensive, decaying in quality, full of gaps)

- Maybe first-party data from email (if they have a decent email program)

There's no unified view. Stitching this together is painful. Most teams just accept the fragmentation and work within it.

Kana's agents can work across this fragmented landscape. An agent can pull customer definitions from your CRM, enhance with website behavioral data, fill in third-party data sources, validate quality, and then create targeting segments that your ad platforms understand natively.

This is where the "loosely coupled" architecture becomes operationally important. Instead of forcing you to centralize all data in Salesforce or HubSpot (which is what those platforms want), Kana's agents leave your data where it is but act as a coordination layer.

Vaidya emphasized this: "We can be configured to meet customers where they are. Larger companies just are never going to get there."

What he means is that Salesforce, HubSpot, and Adobe all want to be the center of your universe. If you use other tools, they grudgingly support them through integrations. But those integrations are always secondary—the platform is optimized for its own data model.

Kana inverts this. The agents are optimized to work across whatever tools you're already using. This is a fundamental architectural choice that gives them competitive flexibility.

There's a risk though: if you're not using good data governance practices, loosely coupled agents can make that worse. You end up with different agents making different assumptions about what data means, leading to contradictory recommendations. But Kana has incentive to solve for this because it's existential to their platform reliability.

Media Planning and Budget Allocation

Media planning is one of the few areas of marketing that has genuinely stalled for the last 20 years.

The process looks like this:

- Marketing leadership sets a budget

- Media planner does research on channel performance

- Media planner builds a multi-channel allocation ("30% search, 25% display, 20% social, 15% video, 10% direct mail")

- Channels are booked

- Campaign runs

- Post-analysis happens (usually a month later)

- Learnings inform next quarter's plan

There's a two-month feedback loop baked in. That's absurdly slow.

Kana's agents collapse this timeline. A media planning agent has access to real-time performance data, market conditions, inventory availability, and budget constraints. It can recommend reallocation weekly instead of quarterly.

Better: it can run scenario analyses. "If we shift $50K from display to YouTube, what's the expected impact on our KPIs?" That's not just running a forecast. That's running multiple forecasts simultaneously against different allocation scenarios and recommending the one most likely to hit your targets.

Budget allocation becomes dynamic instead of static.

The complexity here is that you need historical data to forecast accurately. A startup running its first campaign has no baseline. A mature brand running a campaign it's run for three years has rich historical data. Kana's agents get smarter the more data you feed them, which creates switching costs. After six months of data, the system becomes more valuable because it understands your specific business patterns.

This is a moat—if you switch away from Kana after six months of data accumulation, you're starting from zero with a competitor.

Chatbot Optimization: A Growing Category

One use case Kana mentioned is optimizing chatbots. This might sound niche, but it's actually pointing toward something important.

Chatbots have become core to customer engagement. E-commerce sites use them for product recommendations. SaaS products use them for onboarding. Service organizations use them to qualify leads. But most chatbots are dumb. They're rule-based or barely-LLM-powered. They don't learn. They don't optimize for what users actually want.

A Kana agent could monitor chatbot interactions, identify where users are dropping off, surface common questions that the bot can't answer, and recommend improvements to the bot's response patterns.

More ambitiously, the agent could act as a continuous optimization loop: measure which bot responses lead to conversions, recommend response rewrites, test them, measure impact, rinse, repeat.

This is a smaller market than email or paid social, but it's growing. Every company is deploying chatbots, and almost none of them have good optimization frameworks. Kana's agents could own that category.

A 2024 survey reveals that 73% of marketing operations teams report significant gaps between their current tools and actual needs, highlighting a critical need for modern solutions.

Competitive Landscape: Who Else Is Building This?

Kana isn't the only company thinking about AI-powered marketing automation. But most competitors are coming from a different angle.

Existing incumbents like Salesforce, HubSpot, and Adobe are bolting AI onto their platforms. Salesforce has Einstein, HubSpot has AI features, Adobe has its Firefly integration. But they're constrained by their legacy architecture. Adding new agents or customizing existing ones requires development resources. The process is slow.

Specialized AI startups like Jasper and Copy.ai are focused on content generation—writing emails, ad copy, social posts. They're not solving campaign management, optimization, or audience targeting. They're one tool in the martech stack.

Agent-focused platforms like Anthropic and other AI-first companies are building general-purpose agents. But they're not specialized for marketing. A general-purpose agent might be able to help with marketing tasks, but it won't have domain-specific knowledge about media planning, audience segmentation, or campaign optimization.

Kana is positioned at an intersection: marketing domain expertise + agent-based architecture + flexibility for real-time customization.

Their competitive moat is threefold:

-

Domain expertise from founders: Chavez and Vaidya have been in marketing tech for 25 years. They understand the real constraints, the real pain points, not academic or theoretical versions of them.

-

Loosely coupled architecture: Instead of forcing consolidation, they enable orchestration across your existing stack. That's architecturally smarter than trying to be the single platform.

-

Speed of customization: Because agents are loosely coupled and designed to be configured, Kana can customize the platform for specific customers much faster than traditional enterprise software. A Salesforce implementation takes 6-12 months. A Kana implementation could be 6-8 weeks.

The question is whether they can convert that positioning into market share.

Funding and Go-to-Market Strategy

The

The investment suggests Mayfield sees Kana as a promising AI company, not a get-rich-quick marketing automation play. That's probably correct.

Kana's stated use of funds is hiring across engineering, product, and go-to-market. This is the right distribution for a B2B SaaS startup that needs to:

- Engineering (40-50% of budget): Build and expand the agent platform, improve reliability, add new agent types.

- Product (15-20% of budget): Define the roadmap, work with early customers, understand where to focus.

- Go-to-market (30-40% of budget): Sales, marketing, partnerships. This is crucial because martech is crowded and noisy.

Their board now includes Navin Chaddha, the Mayfield managing partner. This is typical and signals that Mayfield wants more involvement than just capital.

Go-to-market strategy for Kana is probably similar to what Krux did: land with mid-market companies (the sweet spot for agile adoption), prove value, then move upmarket to enterprise as the product matures.

They might also consider partnerships. Integrating with Salesforce, HubSpot, or advertising platforms as a plugin could accelerate adoption. Early-stage, that's probably too much distraction. But by year two, partnership strategy becomes critical.

The "Build With" Philosophy vs. Traditional Approaches

Vaidya articulated a philosophy that deserves deeper exploration: "We live in a world which allows us to explore a third option [with customers]: not build, not buy, but build with—build with in a way which is supported."

This is interesting because it's explicitly anti-consolidation.

Traditional enterprise software sells "build vs. buy":

- Build: You hire engineers, build custom software, own the entire stack, but spend millions and it takes forever.

- Buy: You buy a platform, implement it, it solves 70% of your problems and leaves 30% unsolved, but it's fast and cheaper.

Most enterprise customers choose "buy" because "build" is usually prohibitively expensive and slow.

Kana is proposing something different: "Build with"—the platform is flexible enough that you and Kana are partners in the customization. You're not buying a fixed product and living with its constraints. You're not building everything from scratch. You're collaborating on a solution that evolves with your needs.

This is operationally harder than traditional SaaS (which wants to sell the same thing to 10,000 customers). But it could be a competitive advantage if executed well.

The risk is that "build with" can easily devolve into "build for each customer." At that point, you've essentially taken on professional services costs, and your unit economics collapse. Successful "build with" platforms (like Shopify for e-commerce) manage this by having predefined customization paths. You can customize, but within defined boundaries.

Kana needs to avoid the trap of custom development for each customer. They need modular customization. This is where the agent-based architecture helps—each agent is a customization point, but you're not rewriting the entire system for each customer.

Kana's agent-based approach significantly outperforms legacy platforms and typical automation in understanding causality, autonomous tracking, and performance reporting. Estimated data.

The Challenges Ahead

Kana faces several non-trivial challenges:

Challenge 1: Adoption inertia in martech

Marketing teams have invested heavily in their current stack. Switching costs are real—training, integration, risk of errors during transition. Kana has to overcome that inertia with clear, quantifiable ROI. "Saves four hours of reporting per week" is concrete. "More flexible AI agents" is not.

Challenge 2: Data quality and governance

Kana's agents are only as good as the data they operate on. If a customer has fragmented, poorly governed data, Kana's agents will amplify the problems, not solve them. Kana will need to invest heavily in data quality tooling and education. This is unsexy but essential.

Challenge 3: Liability and risk

Marketing spend is real money. If a Kana agent makes a bad optimization decision and wastes budget, the customer will have a claim. Kana needs rock-solid explainability (why did the agent make that recommendation?) and safeguards (limits on autonomous actions without human approval).

Challenge 4: Competition from incumbents

Salesforce and HubSpot will not sit idle. They'll invest in their own agent-based systems. They have advantages: existing installed base, broader feature sets, enterprise relationships. Kana has to move faster than they can, which is theoretically possible but operationally hard.

Challenge 5: Integration complexity

Kana's strength (works across your existing stack) is also a weakness (needs to integrate with lots of systems, each with different APIs and data models). As Kana adds more integrations, technical debt can compound. They need disciplined engineering practices.

Financial Projections and Timeline to Growth

Based on comparable startups (Krux before acquisition, Rapt's trajectory), Kana's likely path:

Year 1 (2025): Focus on product-market fit with 10-15 early customers. Revenue likely in the

Year 2 (2026): Expand to 50-75 customers, expand into adjacent use cases (creative optimization, audience intelligence). Revenue potentially $10-15M ARR. This is when they'd likely raise Series A.

Year 3+ (2027): If they nail the product and GTM, scale to 200+ customers and $50M+ ARR. At that point, they're an acquisition target for a Salesforce, HubSpot, or Marketo.

These are rough estimates, but they give you a sense of the cadence.

The breakeven timeline for a SaaS startup with $15M seed is typically 5-7 years. Kana probably targets breakeven by end of year 3 or beginning of year 4, assuming successful fundraising at each milestone.

The Broader Trend: AI Agents Are Becoming Real

Kana is one data point in a larger trend: AI agents are moving from hype to implementation.

For years, the agent narrative was "They're coming!" But building working agents is hard. They need:

- Clear task definitions

- Access to reliable data and systems

- Well-defined success metrics

- Guardrails against catastrophic failure

- Human oversight mechanisms

Marketing is uniquely suited for agents because marketing tasks are:

- Well-defined: "Optimize this campaign for this KPI" is clear. It's not ambiguous like "improve employee engagement."

- Data-rich: Marketing generates tons of data—impression data, click data, conversion data, audience data.

- High-frequency: Marketing optimizations happen weekly or daily, not yearly. That fast feedback loop is where agents thrive.

- Have clear ROI: If an agent saves you money or makes you money, you can measure it directly.

Other agent-focused startups in different verticals (engineering, sales, legal) are trying to solve harder problems. Kana picked the right domain to demonstrate agent value.

Synthetic data offers significant cost efficiency and privacy benefits, but risks bias amplification, highlighting the need for human oversight. Estimated data.

What Success Looks Like

For Kana to be a success (a meaningful company, not necessarily IPO-size), they need to:

- Land 50+ customers with marketing teams at mid-market to enterprise scale within 18 months.

- Achieve 80%+ net revenue retention, meaning existing customers expand their usage as they discover value.

- Build a recognizable brand in martech—not household name, but respected by marketing ops professionals.

- Maintain product velocity by shipping meaningful features every 4-6 weeks.

- Raise a strong Series A from a top-tier venture firm within 18-24 months, suggesting strong early traction.

If Kana achieves all of that, they're on track to become a $1B+ valuation company (through acquisition or IPO) by 2030.

Does the founding team have the chops? The historical track record suggests yes. But track record doesn't predict the future. Martech is brutal, and many smart founders have been crushed by changing market dynamics.

Practical Takeaways for Marketing Leaders

If you're a marketing leader evaluating whether Kana (or tools like it) make sense for your organization, here's what to consider:

When Kana could be valuable:

- You have a fragmented martech stack and your marketing ops team spends more than 30% of time integrating and reporting.

- You need faster campaign optimization cycles (currently quarterly, want monthly or weekly).

- You have multiple channels and want coordinated strategy instead of siloed optimization.

- Your data governance is reasonably mature (if not, you'll have bigger problems than agent-based platforms).

When Kana might not be right yet:

- You're in year 1-2 of your marketing tech journey and still figuring out fundamentals.

- Your current platform (Salesforce, HubSpot) is still meeting your core needs and you don't have integration pain.

- You have limited budget and need to prioritize headcount over software.

- Your marketing team lacks ops expertise to manage an agent-based system (these require more operational discipline, not less).

The Bigger Picture: Why Timing Matters

One more layer of context: Kana's emergence in early 2025 is no accident.

We're at an inflection point where:

-

AI models are good enough: ChatGPT, Claude, Gemini have reached a level of capability where you can build reliable systems on top of them. Five years ago, you couldn't. Five years from now, they'll be better, but the improvement curve is flattening.

-

Martech incumbents are slow to move: Salesforce's last major product innovation was Einstein (2016-2017). HubSpot's AI features are incremental. They're optimizing for existing customers, not jumping at new paradigms.

-

Martech stack fragmentation is at peak pain: As I mentioned earlier, the average marketing team uses 91 tools. That's not sustainable. Organizations are looking for relief.

-

Autonomous systems have proven value in adjacent categories: Shopify's automation, Stripe's machine learning, Notion AI all demonstrated that AI-powered automation could create real customer value.

Kana is surfing a wave of all these factors coming together simultaneously. The wave has a limited window—in two years, either they've proven the concept and become valuable, or incumbents have copied them and the window closes.

FAQ

What is Kana and what does it do?

Kana is an AI marketing automation platform founded by Tom Chavez and Vivek Vaidya, the former leaders of marketing tech companies Rapt and Krux. The platform uses loosely coupled AI agents to automate marketing tasks like campaign optimization, audience targeting, media planning, and reporting. Unlike traditional marketing platforms that force consolidation, Kana's agents work across your existing marketing technology stack, allowing customization on the fly without ripping out your current infrastructure.

How do Kana's AI agents differ from traditional marketing automation?

Traditional marketing automation platforms like Salesforce and HubSpot use monolithic architectures where everything is connected through a central data model. Kana's agents are loosely coupled, meaning each agent is somewhat autonomous and can be deployed, customized, and updated independently without affecting the entire system. This allows marketers to tailor agents to their specific needs, swap them in and out of workflows, and deploy new capabilities much faster than traditional platforms.

What funding has Kana raised?

Kana raised $15 million in seed funding led by Mayfield Ventures. The investment will fund hiring across engineering, product, and go-to-market operations. Mayfield managing partner Navin Chaddha joined Kana's board. For context, this positions Kana to operate for approximately 15 months with their current burn rate, after which they'll need to show progress toward profitability or raise additional capital.

What are the key features of Kana's platform?

Kana's core features include autonomous campaign optimization and tracking, synthetic data generation for audience augmentation, audience targeting and segmentation across fragmented data sources, media planning and budget allocation recommendations, chatbot optimization, and real-time campaign reporting. The platform emphasizes keeping humans in the loop, allowing marketers to review and approve the agents' recommendations before implementation.

Who are the founders of Kana and what's their background?

Co-founders Tom Chavez (CEO) and Vivek Vaidya (CTO) have 25+ years of experience in marketing technology. Chavez and Vaidya previously founded Rapt, which was acquired by Microsoft in 2008, and Krux, a data management platform that Salesforce acquired in 2016 for over $700 million. Before launching Kana, they ran a startup studio called super{set}, where they incubated Kana for nine months before seeking institutional funding.

How does Kana integrate with existing marketing tools?

Rather than forcing consolidation into a single platform, Kana's agents work with your existing martech stack. This means you can keep using your current CRM, email platform, ad platforms, analytics tools, and other software. Kana's agents connect to these systems' APIs and data sources to pull information, analyze it, and provide recommendations or take autonomous actions (depending on your configured guardrails). This approach is fundamentally different from platforms like Salesforce that want to be the center of your marketing universe.

What does "build with" mean in Kana's philosophy?

Vaidya described a "build with" philosophy that contrasts with traditional "build vs. buy" software decisions. Rather than either building custom software (expensive and slow) or buying a fixed platform (fast but limited), Kana positions itself as a partner in customization. You and Kana collaborate on configuring the agents and workflows to match your specific business needs. This requires more operational discipline from customers but allows faster iteration and more tailored solutions than traditional SaaS platforms.

How does synthetic data generation work in Kana's platform?

Kana can generate synthetic audience profiles based on patterns from your existing first-party customer data. If your database shows your typical customer is a tech-savvy parent aged 30-45 earning $100K+, Kana's system can create additional realistic but artificial profiles matching that pattern. This helps fill gaps in your audience data and reduces reliance on expensive third-party data sources. However, all synthetic profiles must be reviewed and approved by humans before use in actual campaigns to prevent bias and ensure quality.

What competitive advantages does Kana have against incumbents like Salesforce and HubSpot?

Kana's competitive advantages include: (1) Specialized domain expertise from founders with 25+ years in marketing technology; (2) A loosely coupled, agent-based architecture that allows flexibility and real-time customization without ripping out existing systems; (3) Speed of implementation (Kana aims for 6-8 weeks versus 6-12 months for traditional enterprise software); (4) The ability to deploy new agents and capabilities rapidly without waiting for slow-moving platform vendors. However, incumbents have advantages including existing customer bases, broader feature sets, and established enterprise relationships.

What is the target market for Kana?

Kana's primary target is mid-market to enterprise marketing teams (typically 8-12+ people) that have fragmented martech stacks and spend significant time (30%+ of ops hours) on integration and manual optimization. Secondary targets include marketing leaders frustrated with their current platform's inflexibility, teams managing multiple channels that require coordinated strategy, and organizations with maturing data governance who need faster optimization cycles. Early-stage startups with simple marketing operations are not ideal customers yet.

When might Kana not be the right fit for an organization?

Kana might not be appropriate if: (1) You're in your first one to two years of marketing tech adoption and still figuring out fundamentals; (2) Your current platform (Salesforce, HubSpot) is still meeting core needs and you don't have integration pain; (3) Your marketing operations team lacks the sophistication to manage an agent-based system (these require more operational discipline and data governance rigor, not less); (4) Your budget is constrained and you need to prioritize headcount over software; (5) Your data quality and governance practices are immature (agents amplify data quality problems rather than solve them).

Conclusion: The Next Wave of Marketing Automation

Kana represents something genuinely interesting in a market saturated with incremental improvements.

It's not revolutionary in the way the word gets thrown around in tech. But it's thoughtful. The founding team spent 25 years learning what actually breaks about marketing operations, and they're building specifically to address those breaks.

AI agents are real now. They're not perfect, they're not autonomous replacements for human judgment, but they're useful enough to create genuine value. The question is whether Kana can translate that value into a defensible company.

They have advantages: experienced founders, a good problem space, reasonable timing, and a clear differentiation strategy. They have challenges: a crowded market, powerful incumbents, and the operational complexity of managing a system designed for customization.

If I had to bet, I'd say Kana hits product-market fit within 18 months. Whether they scale to a

They're solving real problems for real people.

In martech, that's actually pretty rare.

Watch this space.

Key Takeaways

- Kana emerged from stealth in early 2025 with $15M in seed funding to build flexible AI agents for marketing automation

- The founding team (Chavez and Vaidya) has unmatched domain expertise, having previously built and exited Rapt and Krux

- Kana's architecture is fundamentally different from incumbents by using loosely coupled agents instead of monolithic platforms

- Key features include autonomous campaign optimization, synthetic data generation, and real-time customization without requiring platform replacement

- The competitive moat is speed of customization and flexibility, not feature breadth

- The target market is mid-market to enterprise marketing teams struggling with fragmented martech stacks

- Timing is favorable due to peak martech stack fragmentation and AI model maturity

- Success requires landing 50+ customers and achieving 80%+ net retention within 18 months

- Risks include adoption inertia, data quality challenges, and competition from incumbents investing in their own agent platforms

- The broader trend is that AI agents are moving from hype to implementation in domains with clear task definitions and fast feedback loops

Related Articles

- The AI Agent 90/10 Rule: When to Build vs Buy SaaS [2025]

- RentAHuman: How AI Agents Are Hiring Humans [2025]

- SurrealDB 3.0: One Database to Replace Your Entire RAG Stack [2025]

- Infosys and Anthropic Partner to Build Enterprise AI Agents [2025]

- Peter Steinberger Joins OpenAI: The Future of Personal AI Agents [2025]

- OpenAI Hires OpenClaw Developer Peter Steinberger: The Future of Personal AI Agents [2025]

![Kana AI Agents for Marketing: The $15M Startup Reshaping Campaign Automation [2025]](https://tryrunable.com/blog/kana-ai-agents-for-marketing-the-15m-startup-reshaping-campa/image-1-1771429126658.jpg)