How Listen Labs Is Dismantling the $140 Billion Survey Industry

There's a moment that happens in every startup's journey where you realize the industry you're entering is fundamentally broken. For Alfred Wahlforss, the founder of Listen Labs, that moment came when he needed to hire 100 engineers but couldn't compete with the tech giants throwing money around like it grows on trees.

So instead of fighting that battle head-on, he did something genuinely weird. He spent $5,000 on a San Francisco billboard displaying what looked like random numbers. Not inspiring words about changing the world. Not even a company logo. Just five strings of cryptic AI tokens.

The genius part? The numbers were a puzzle. Decode them and you'd unlock a coding challenge inspired by Berghain, Berlin's most exclusive nightclub. Build an algorithm that acts as a digital bouncer—rejecting 99% of applicants and letting only the worthy through.

Thousands of engineers took the bait. Four hundred thirty cracked it. Some got hired. The winner got an all-expenses-paid trip to Berlin.

But this story isn't actually about recruiting. It's about what happened next. That unconventional hiring stunt caught the attention of the venture capital world. Last month, Listen Labs closed a

Here's the real kicker: Listen Labs has already generated eight figures in annualized revenue and conducted over one million AI-powered interviews. In the same nine-month window, revenue grew 15x.

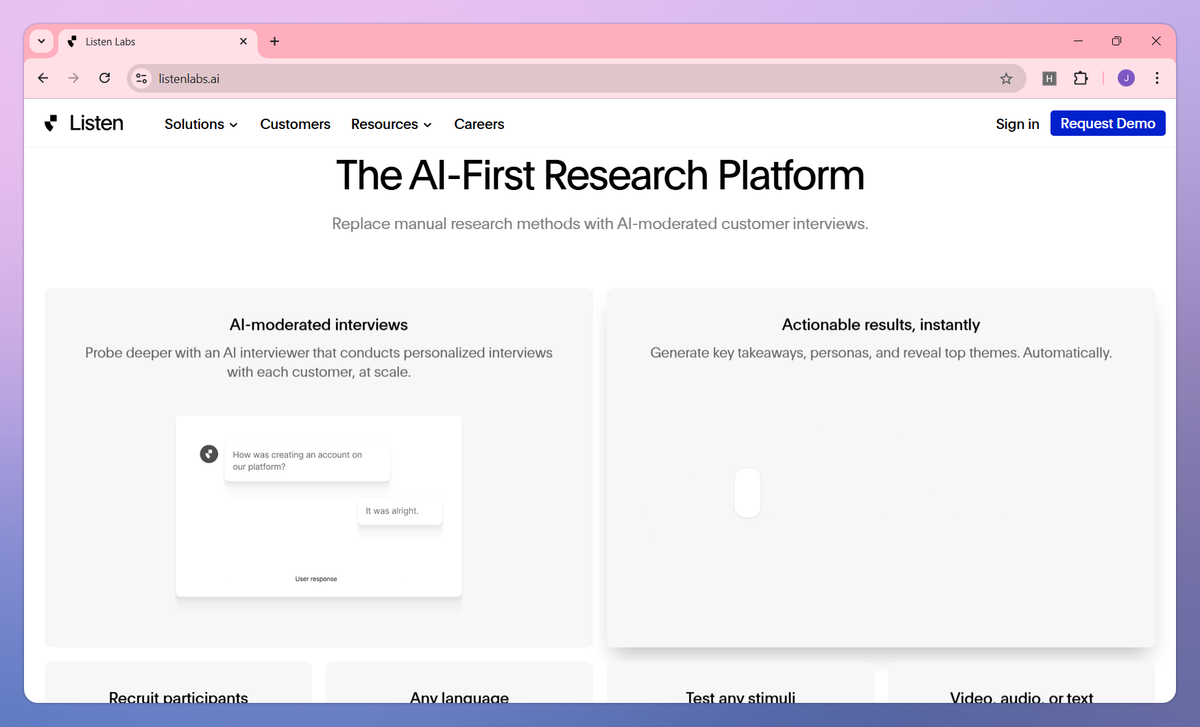

What are they selling? They're taking the oldest business process in market research—the customer interview—and replacing it with AI. Not surveys. Not focus groups. Actual conversations that last as long as you need them to, where follow-up questions happen in real time, and the answers you get are honest.

This matters because the global market research industry is worth $140 billion, and it's stuck in 1987. Companies are still choosing between two broken options: fast surveys that miss nuance, or deep interviews that don't scale. Listen Labs built something that does both. And the market is taking notice.

The Architecture of Traditional Market Research and Why It Fails

Let's be honest about how customer research actually works at most companies.

You start with surveys. They're fast. You can slap together a Typeform, distribute it to your email list, and have responses in 24 hours. The problem? People lie on surveys. Or worse, they answer the question they think you want answered, not the question you actually asked.

Wahlforss explained this perfectly in interviews with industry observers: "In a survey, you can kind of guess what you should answer, and you have four options. 'Oh, they probably want me to be a high income buyer. Let me click on that button.' Versus an open-ended response, which just generates much more honesty."

The math works like this. If your survey has multiple choice answers, respondents engage in what behavioral economists call "signaling." They're not answering based on their actual behavior or beliefs. They're answering based on what makes them look good to the researcher.

Then there's the outlier problem. Multiple choice surveys literally cannot capture outliers. If 95% of your users fit into one of four predefined categories, what happens to the 5% who don't? They get forced into the wrong box or they bounce. Either way, you lose the signal.

So companies move to the second option: human interviews. You hire a researcher, they create a discussion guide, they call customers one by one, and they dig into the "why" behind the behavior. This works beautifully. You get depth. You get context. You get to ask follow-up questions and catch people in contradictions.

The problem is obvious: it doesn't scale. A researcher might conduct 20 interviews per month. That's it. You want 500 interviews? That's two years of work.

Most enterprises end up with a hybrid approach. They run surveys for breadth and do selective deep interviews with key customer segments. The timeline? Four to six weeks if you're moving fast. Eight weeks if you're being thorough.

Microsoft is a perfect example. Before Listen Labs, their market research cycles ran four to six weeks. By the time insights landed on a product manager's desk, the decision had already been made, or the market opportunity had shifted. The research became historical, not strategic.

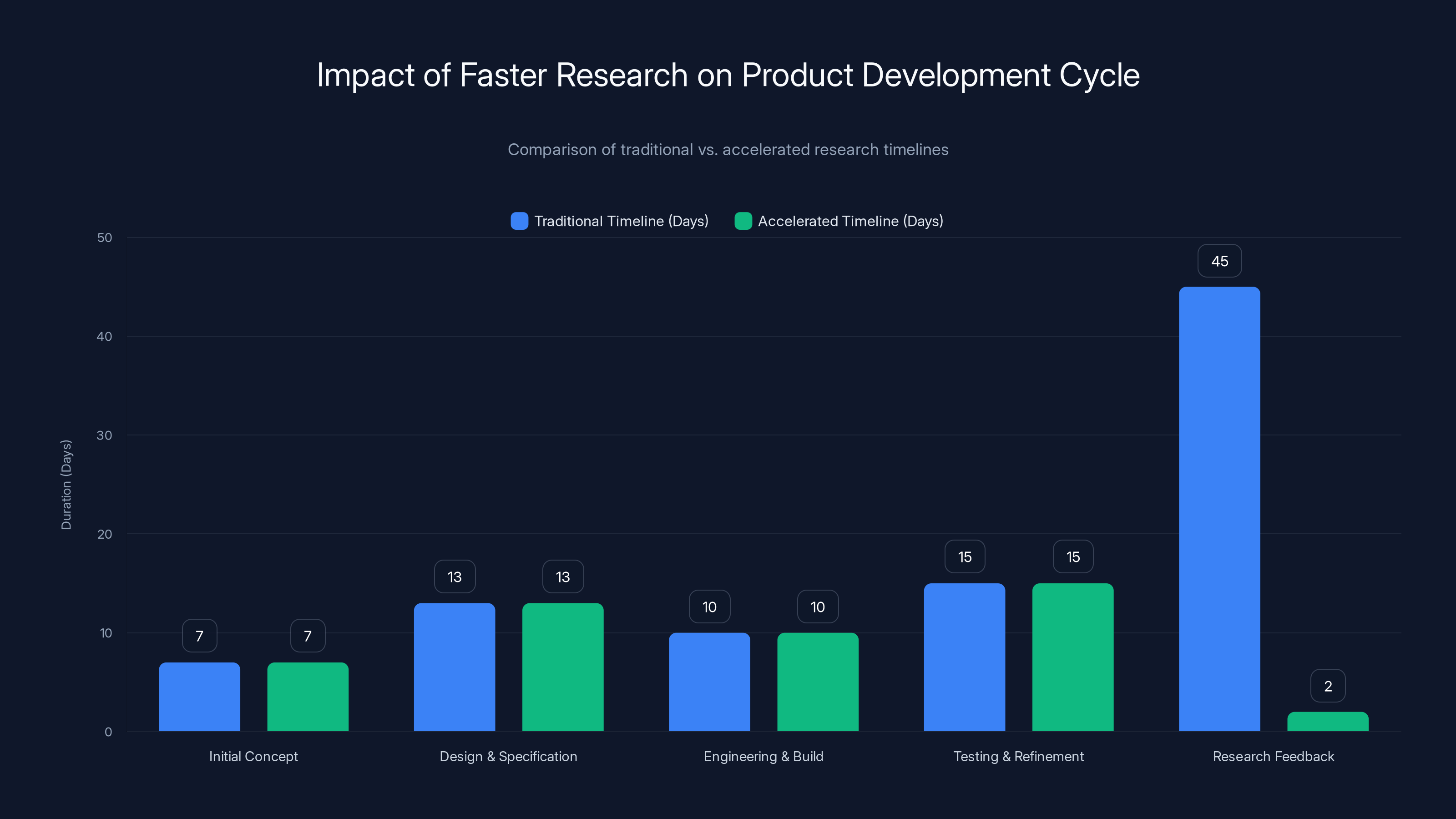

Accelerated research reduces feedback time from 45 days to 2 days, allowing integration of customer feedback much earlier in the product development cycle. Estimated data.

The Listen Labs Platform: How AI Conducts Interviews at Scale

Listen Labs solved this by building a platform that automates the parts of interviews that don't require human empathy, while preserving the parts that require real understanding.

The process has four steps, and each one is deceptively simple.

First, you create your study. You tell the platform what you want to learn. This used to require hiring a research consultant to build a 15-page discussion guide. Now? The platform has AI guidance built in. You can prompt it like you're talking to a colleague: "I want to understand why people abandon our checkout process." The AI suggests question frameworks and helps you refine them.

Second, Listen recruits participants. This is where the platform's 30 million person global network comes in. But recruitment isn't just about finding people who fit your demographic criteria. It's about finding the right people with the right contexts.

Third, the AI moderator conducts the interview. This is the surprising part. The interviews are video-based and open-ended. The AI asks your questions, listens to the answers, and generates follow-up questions in real time. If someone says "I stopped using your product because it was too complicated," the AI doesn't just move on to the next question. It asks why. It digs. It does what a good researcher does, which is listen and probe deeper.

Fourth, results get packaged into insights. The platform delivers executive summaries, key themes, highlight reels of video clips, and ready-to-present slide decks. You're not getting raw data. You're getting analysis.

The speed advantage is dramatic. Simple Modern, the Oklahoma-based drinkware company, needed to test a new product concept. The process took roughly one hour to write questions, one hour to launch the study, and 2.5 hours to receive feedback from 120 people. That's four hours from question to actionable insight. Traditional research would have taken three to four weeks.

Wahlforss said it this way: "We actually had some of the largest companies, some of them have billions in revenue, send us people and our system immediately detected fraud, fraud, fraud, fraud, fraud."

That detection happens through something Listen calls a "quality guard." The system cross-references Linked In profiles with video responses to verify identity. It checks consistency in how participants answer questions across the interview. It flags suspicious patterns like people who claim to be C-level executives but can't articulate basic knowledge about their industry.

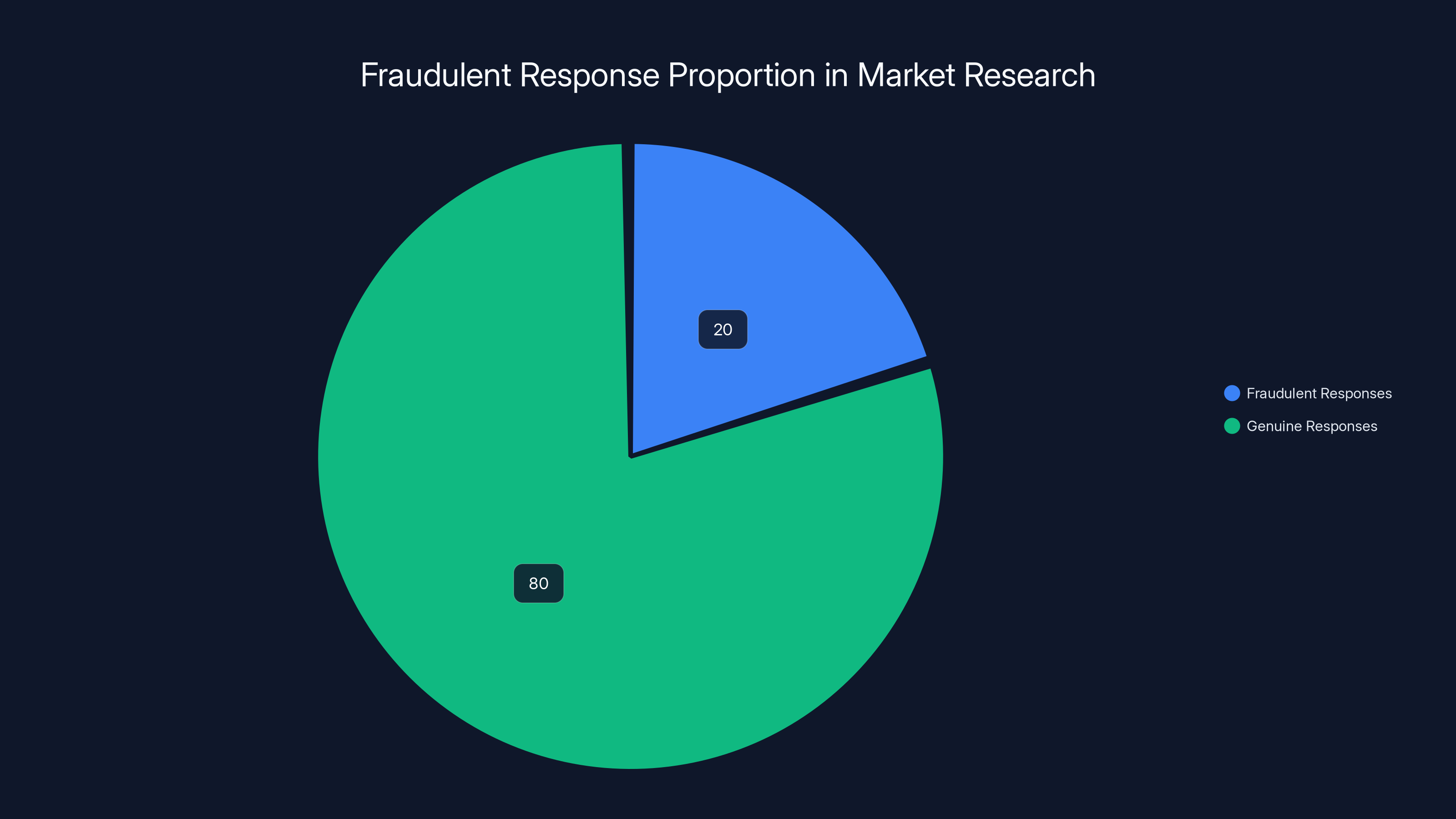

The result of that quality control? At Emeritus, an online education company, approximately 20% of survey responses previously fell into the fraudulent or low-quality category. With Listen? Almost zero.

Estimated data shows that 20% of responses in traditional market research surveys are fraudulent or low-quality, highlighting a significant issue in data reliability.

The Dark Side of Market Research: Fraud at Scale

Listen Labs stumbled onto something genuinely shocking when they entered the market research industry: it's corrupt. Not like, a little fraud here and there. Like, systemic, pervasive, billion-dollar fraud.

Here's how it works. Traditional market research companies maintain panels of respondents. These are people who've agreed to take surveys in exchange for small cash payments, usually

The moment money enters a transaction, bad actors follow. Respondents create multiple accounts. They impersonate professions they don't hold. They claim to be enterprise buyers when they're unemployed. They copy and paste responses. They spend 30 seconds on a survey designed to take five minutes.

The downstream effect is poisoned data. A company might run a survey asking "Do you currently use an enterprise CRM?" and get back a response from someone pretending to be a VP of Sales at a Fortune 500 company. They're not. But now that fake response is sitting in the dataset, skewing the results.

Wahlforss described discovering this as "one of the most shocking things we've learned when we entered this industry." The companies doing the fraud aren't small operations. "We actually had some of the largest companies, some of them have billions in revenue, send us people who claim to be kind of enterprise buyers to our platform and our system immediately detected, like, fraud, fraud, fraud, fraud, fraud."

Why does this matter? Because 20% of response data in some traditional surveys is fraudulent or low-quality. That means one in five data points you're building strategy on is noise. You're making business decisions on a foundation where the concrete is cracked.

Listen's solution is elegant. The video component makes fraud much harder. You can't easily create a fake video performance. The AI cross-references what you say in the video with your Linked In profile. It checks consistency across multiple questions. It watches for behavioral patterns that suggest someone is gaming the system.

Emeritus reported that they "did not have to replace any responses because of fraud or gibberish information." That's not a minor improvement. That's the difference between research you can trust and research that's partially garbage.

Real Companies, Real Results: How Listen Labs Changed Their Market Research

The best way to understand Listen Labs' impact is to look at how companies are actually using it. This isn't theoretical. This is what's happening in real product teams right now.

Microsoft's 50th Anniversary Customer Stories

Microsoft is the kind of company that can afford unlimited research budget. They have entire teams dedicated to user research. So when they used Listen Labs to collect customer stories for their 50th anniversary celebration, it wasn't because they couldn't afford traditional research. It was because they needed speed.

The goal was to collect video stories from customers around how Copilot—Microsoft's AI assistant—was empowering them. Romani Patel, Senior Research Manager at Microsoft, explained the alternative: "We wanted users to share how Copilot is empowering them to bring their best self forward, and we were able to collect those user video stories within a day."

Without Listen Labs, that project would have taken six to eight weeks. Not because the research is complicated, but because recruiting participants, scheduling interviews, conducting them, and editing the footage takes time. With the platform, Microsoft went from brief to video assets in 24 hours.

That's not just faster. That's a different category of fast.

Simple Modern's Product Testing

Simple Modern makes water bottles and drinkware. When they wanted to test a new product concept, they used Listen Labs. Here's the timeline:

- 1 hour to write the research questions

- 1 hour to launch the study

- 2.5 hours to receive feedback from 120 people across the country

Total: roughly four hours from question to actionable data.

Chris Hoyle, the company's Chief Marketing Officer, described the transformation: "We went from 'Should we even have this product?' to 'How should we launch it?'" In a single afternoon, they moved from validation questions to implementation questions.

Traditional market research would have taken three weeks minimum. They would have missed a market opportunity by that margin.

Chubbies and the Youth Market

Chubbies, the shorts brand that's become something of a cultural phenomenon among younger consumers, faced a specific challenge: recruiting young people for research is hard. Teenagers and 20-somethings don't respond well to traditional survey invitations. They're busy, skeptical, and not interested in unpaid research participation.

Using Listen Labs, Chubbies achieved a 24x increase in youth research participation—jumping from 5 to 120 participants. That's the difference between "We couldn't get enough young people to talk to us" and "We have a statistically significant sample."

The video format helped. Young people responded better to a conversational AI interview than to a survey. The immediacy helped too. Participants could participate on their own schedule, recorded on their phones, in their own environments.

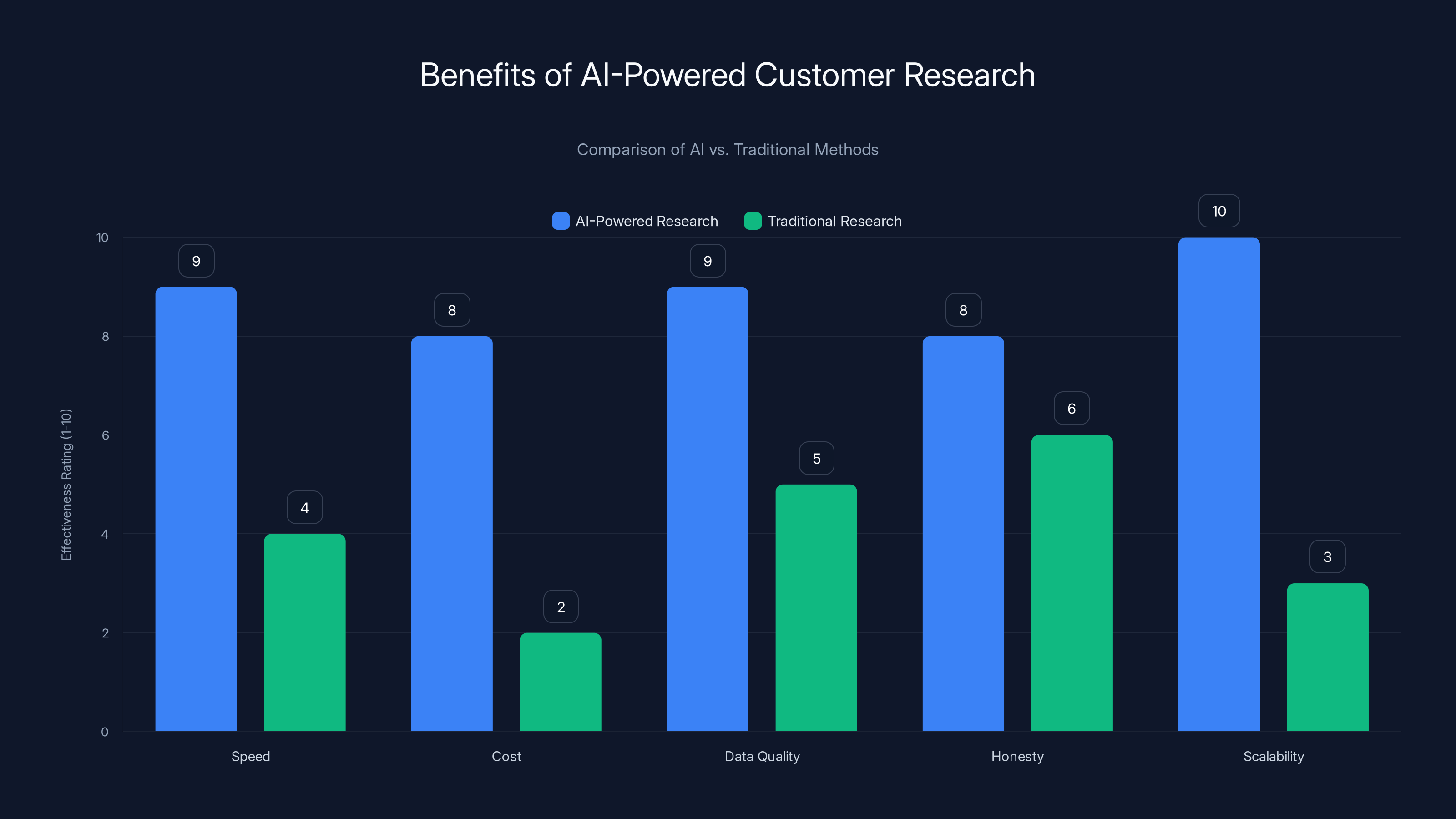

AI-powered research significantly outperforms traditional methods in speed, cost, data quality, respondent honesty, and scalability. Estimated data based on typical industry insights.

The Economics of Speed: Why Faster Research Changes Product Strategy

This is the hidden impact that most companies don't think about. It's not just that Listen Labs makes research faster. It's that faster research changes when research happens in the product development cycle.

Let's do some math. A traditional market research project takes 45 days. A product development cycle might look like this:

- Days 1-7: Initial concept, rough wireframes, hypothesis formation

- Days 8-20: Design and specification work

- Days 21-30: Engineering and build

- Days 31-45: Testing and refinement

If you want customer feedback, when do you actually run research? Usually around day 20-25, after you've locked in design direction but before you're fully committed to engineering. By the time results come back on day 65, you're already two weeks into production.

Now imagine research takes one to two days instead of 45. Suddenly you can run research on day 5. You get results by day 7. You incorporate feedback into the wireframe phase. You avoid building the wrong thing.

This is the real productivity gain. It's not about conducting research faster. It's about making better product decisions because feedback happens when it matters.

Wahlforss made this point repeatedly in explaining the company's pitch to enterprise customers: "When you obsess over customers, everything else follows. Teams that use Listen bring the customer into every decision, from marketing to product, and when the customer is delighted, everyone is."

That's not just marketing speak. It's a real shift in how research integrates into product development.

The math on cost is also interesting. Traditional market research for a significant project—something that requires 50 to 100 participants and multiple research questions—typically costs

Listen Labs pricing isn't fully public, but based on reports from users, it appears to be somewhere in the

The Viral Hiring Strategy That Actually Worked

Let's come back to that billboard for a second, because it deserves its own analysis. Not because it's clever marketing—though it is—but because it reveals something true about how Listen Labs actually operates.

The company needed 100 engineers. They had a limited marketing budget. They could compete on salary, but not on the $100 million Google and Meta budgets. So Wahlforss did something weird: he turned recruiting into a puzzle.

The execution was precise. Five strings of AI tokens displayed on a billboard. The cryptic design made people stop and look. Decoding the tokens led to a Git Hub link. Following that link revealed a coding challenge.

The challenge itself was interesting. It wasn't a basic leetcode problem. It was conceptually interesting: build an algorithm that acts as a bouncer for Berghain, one of the world's most exclusive nightclubs. Decode why 99% of people get rejected and 1% get in. Figure out the pattern.

This is a brilliant filter. It attracts the exact kind of engineers you want: people who are curious enough to follow a breadcrumb trail, smart enough to solve a conceptually interesting problem, and interesting enough that you'd want to work with them. It repels everyone else.

Thousands tried. 430 solved it. Some got hired. The winner got a trip to Berlin.

What's remarkable is that this approach worked at scale. It generated international press coverage. It created a moment of earned media in a world where attention is scarce. And it did something none of the traditional recruiting channels do: it pre-qualified candidates by inherent skill and curiosity.

But there's something deeper here. The billboard stunt reveals Listen Labs' core belief: the best insights come from creative, unconventional approaches to gathering information. That's not just their recruiting philosophy. It's their entire platform philosophy.

Traditional surveys are boring. People lie on boring surveys. Listen Labs built video conversations because conversations feel natural. They built the platform around open-ended questions because people are more honest when they're not picking from predefined boxes.

The billboard wasn't marketing theater. It was a proof of concept for the entire company philosophy.

Listen Labs has a 62x revenue multiple, justified by its 15x growth rate, compared to typical SaaS companies with 10-20x multiples and 1.5x growth. Estimated data.

The Competitive Landscape: Who Else Is Building This?

Listen Labs isn't operating in a vacuum. There are other companies trying to solve the "AI-powered interviews" problem. Understanding the competitive landscape helps explain why Listen Labs's

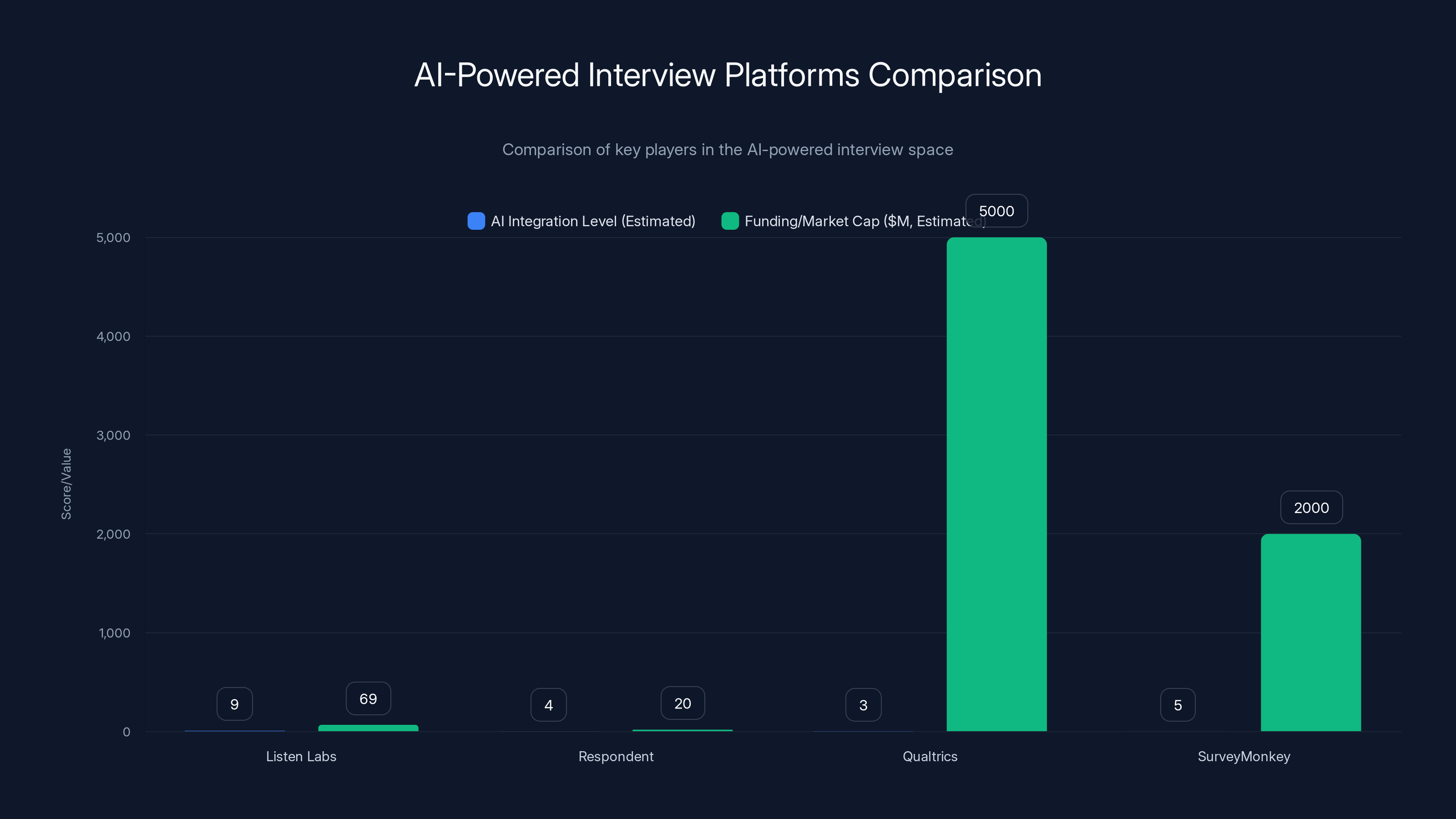

The closest competitor is probably Respondent, which has been around since 2014 and also operates a global panel of research participants. Respondent raises funding, but nothing close to Listen Labs' $69 million Series B. The core difference? Respondent still relies on surveys and traditional interviews. They haven't rebuilt the platform from scratch around conversational AI.

There's also Qualtrics, which is the enterprise leader in customer experience management and research. Qualtrics is much larger—it's public, with a $5 billion market cap—but it's still optimizing survey and feedback collection. It's not building AI-powered interviews.

Survey Monkey exists in this space too, though again, they're primarily survey-focused, with some interview capabilities. They're traditional software with AI features bolted on, rather than AI-first architecture.

What Listen Labs built that others haven't is a platform where AI is the fundamental architecture, not a feature. The moderator is AI. The recruitment is AI. The analysis is AI. The video interview format is the core, not an add-on.

That architectural difference matters because it creates a flywheel. More interviews mean more data for the AI models. Better models mean better interviews. Better interviews mean more customers. More customers mean more data.

Their funding validates that investors believe Listen Labs has structural advantages that competitors will struggle to replicate. You can't just add "AI interviewer" as a feature to an existing survey platform. You have to rebuild from the ground up.

The $500 Million Valuation: Is It Justified?

A $500 million valuation for a nine-month-old company generating eight figures in revenue sounds aggressive. Let's do the math to understand whether it's reasonable.

Listen Labs is valued at

Is that expensive? In absolute terms, yes. But context matters.

First, the company is growing at 15x year-over-year. That's the kind of growth rate that justifies high multiples. If they continue that trajectory, they'll hit $120 million in annual revenue within a few quarters.

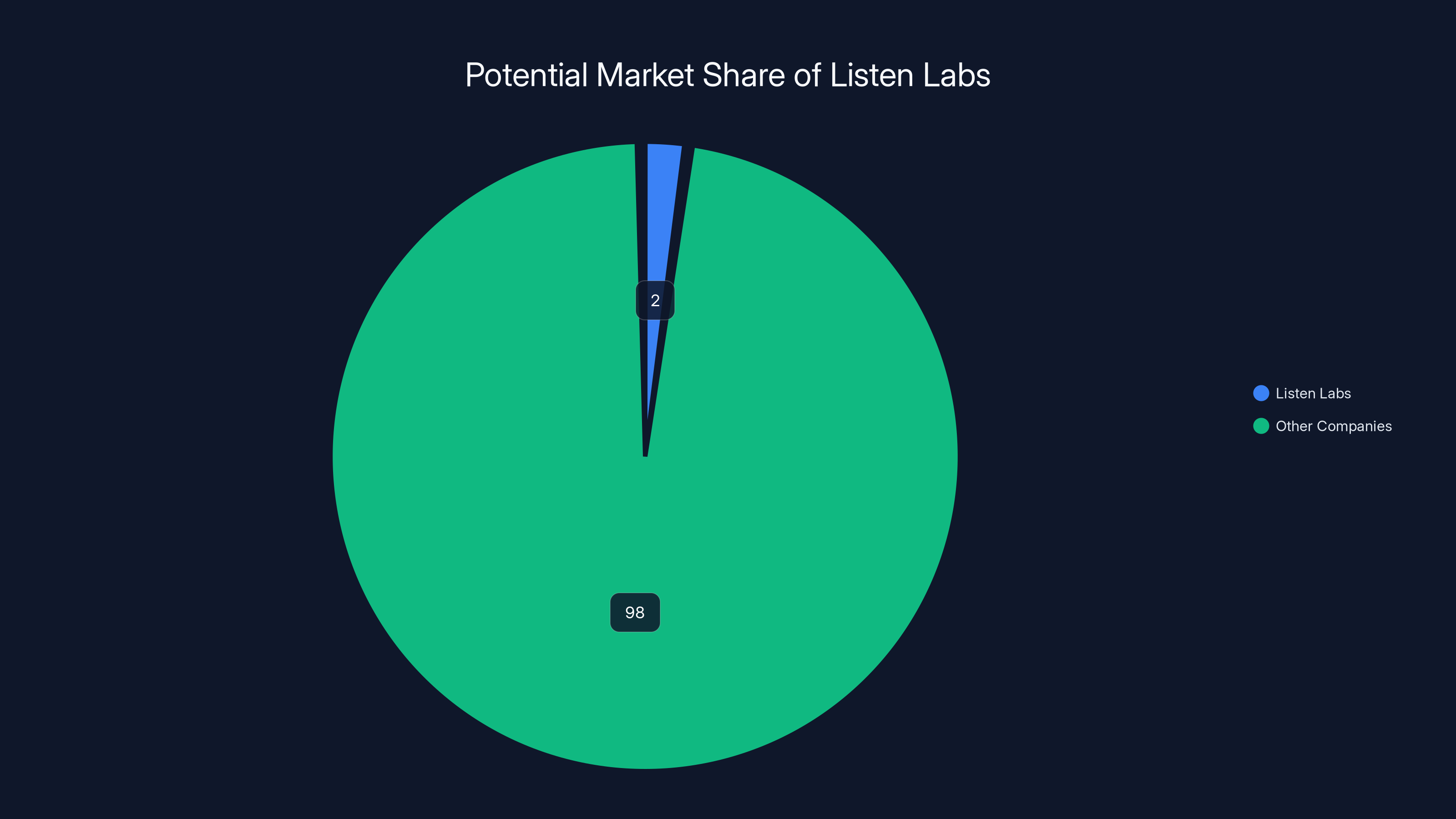

Second, the market they're attacking is massive. The global market research industry is worth

Third, this is a high-margin software business. Once the platform is built and the AI models are trained, the cost to serve additional customers is relatively low. Software multiples reflect that margin structure. Saa S companies with 80% gross margins and 15x+ growth historically trade at 10-20x revenue.

Fourth, the company has already achieved product-market fit. They have enterprise customers (Microsoft, Emeritus, Chubbies, Simple Modern). They're not speculating on whether the product works. It's demonstrably working.

That said, there's risk. Product-market fit in year one doesn't guarantee you'll maintain that trajectory. Execution risk is real. Competition from larger incumbents is possible.

But the valuation isn't crazy. It's consistent with how markets value high-growth, enterprise software companies at inflection points.

Listen Labs leads in AI integration with a score of 9, while Qualtrics has the highest market cap at $5 billion. Estimated data based on market insights.

What This Means for the Market Research Industry Long-Term

Listen Labs' $69 million funding round and the market's reception to it signals something important about where market research is heading. The industry is consolidating around AI-first approaches.

This has profound implications. If Listen Labs and competitors like them pull market share from traditional research agencies, those agencies either adapt or decline. The shift has already started. Gartner and other analyst firms have been talking about "automated insight generation" as a trend for three years. Listen Labs is the first company to really execute on it at scale.

For enterprise customers, the implications are clear: research is about to get much cheaper and much faster. That changes what research you do. If research costs one-tenth of the current price and takes one-tenth of the time, you run a lot more of it.

For research agencies, the implications are tougher. A research director at a large agency might generate $1 million in annual fees from a major enterprise customer. If that customer switches to Listen Labs at a fraction of the cost, the agency loses that revenue. Some agencies will integrate AI into their offerings. Others will shift upmarket to complex research problems that still require human judgment.

For participants in research panels, the implications are mixed. Video-based interviews are more engaging than surveys, so participation rates might increase. But the number of humans required for research decreases, so fewer people might actually get surveyed.

The overall effect is an industry in transition. And Listen Labs has positioned itself as the company leading that transition.

Building an AI That Can Actually Interview

Here's what most people don't realize about building an AI interviewer: it's harder than building a chatbot. Chatbots work if they can follow a script and retrieve information. Interviewers need to actually think.

An interviewer needs to listen to an answer and understand when to probe deeper. If someone says "I stopped using the product," a good interviewer doesn't move to the next question on the script. They ask why. And they need to ask why in a way that feels natural, not like you're talking to a robot.

Listen Labs solved this by building on large language models that can understand context and generate follow-up questions. But the real innovation is in the training data. They've trained their models on thousands of successful interviews from actual researchers.

The platform also uses what you might call "interview choreography." It knows when to go deeper, when to move on, when to circle back to something interesting. That comes from training data and from feedback loops where human researchers have validated the interview quality.

There's also the recruitment layer. Finding the right people to interview is half the challenge. Listen Labs' 30 million person network gives them scale. But matching people to studies requires understanding what makes a good participant. That's algorithmic work combined with domain expertise.

And then there's the fraud detection. As we discussed, traditional research panels are rotten with fraud. Listen Labs' approach to detecting and preventing fraud—cross-referencing video with Linked In, checking consistency across answers, flagging suspicious patterns—requires building a proprietary dataset of what fraud looks like.

All of this complexity is hidden from the user. They create a study, and the platform handles recruitment, interviewing, analysis, and reporting. That seamlessness comes from solving dozens of hard technical problems that competitors haven't even started on.

If Listen Labs captures 2% of the

The Venture Capital Narrative: Why Ribbit Capital Led This Round

Ribbit Capital led the Series B, which tells you something about how VCs are thinking about market research. Ribbit is a fintech-focused fund that has also backed companies like Plaid, Rippling, and Mercury. Their thesis is generally about automating back-office and operational work using software.

Market research isn't fintech, but it's in the same category: it's an industry that's been mostly unchanged for decades, it's expensive and slow, and AI can make it cheaper and faster. That's exactly the kind of thesis Ribbit invests in.

Sequoia Capital, which led the Series A, participated in the Series B. That's important. Sequoia rarely follows into later rounds unless they're genuinely impressed with the metrics and execution. The fact that they came back is a signal.

Conviction and Pear VC also participated, suggesting that the round was oversubscribed. When multiple top-tier VCs want into a round, it often means the company had to turn investors away.

The fact that Listen Labs closed $69 million in Series B—which is a large round for a company under a year old—suggests that VCs believe they've found a genuine inflection point. The company isn't speculative. It has customers, revenue, and traction.

How This Affects Everyday Product Teams

The impact of Listen Labs extends beyond enterprise research departments. If this technology becomes widespread, it changes how product teams do their work.

Imagine you're a product manager at a mid-market Saa S company. Right now, running customer research feels like a luxury. You have quarterly planning meetings, and someone mentions, "We should understand why customers churn." Everyone agrees. Six months later, you might get a research report.

With Listen Labs becoming standard, that calculus flips. Doing research becomes cheaper than guessing. You could run a quick study in a week. You could test assumptions before you build features. You could validate product directions with actual users instead of internal debate.

That doesn't guarantee better products. Plenty of teams run research and ignore the results. But it removes a structural barrier. Research stops being a strategic resource that requires budget negotiation and starts being a tactical tool you use whenever you're unsure about something.

This is similar to how Git Hub changed code sharing, or how Stripe changed payment infrastructure. The technology itself isn't revolutionary. But making something cheaper and faster removes structural barriers and enables new patterns.

For product teams, that pattern might be: weekly research instead of quarterly research. Monthly validation instead of yearly planning. Continuous learning instead of periodic input.

That's a significant shift in how product development works.

The Next Challenges: What Listen Labs Must Execute On

Funding, valuation, and traction are one thing. But Listen Labs has serious challenges ahead.

First, they need to maintain growth while expanding quality. It's easy to conduct a million interviews. It's harder to ensure all of them are insightful. As they scale, maintaining research quality becomes harder. If customer satisfaction drops because interview quality degrades, the business hits a wall.

Second, they need to navigate the sales motion with enterprises. Large companies move slowly. Microsoft using the platform is great for credibility, but converting enterprise sales at scale requires building a sales organization. That's expensive and slow.

Third, they need to build defensibility. Once Listen Labs proves the model works, bigger competitors will try to replicate it. Qualtrics could build an AI-first interview platform. Respondent could retool around conversational AI. Listen Labs needs to stay ahead of that competition through continuous improvement and product innovation.

Fourth, they need to handle the ethical questions around AI interviews. As AI interviewers become more sophisticated, regulators will eventually ask: Should customers know they're talking to AI? Are there privacy implications? What happens to the video data? These questions aren't immediate problems, but they'll become more important as the practice scales.

Fifth, they need to prove that the growth isn't dependent on novelty. Early adoption is exciting. Sustained adoption requires delivering real business value. Can customers prove that Listen Labs research actually improves their product decisions and business outcomes? If not, it's a nice tool that never becomes essential.

None of these challenges are insurmountable, but they're all real.

What This Means for Your Research Practice

If you run customer research, Listen Labs and companies like it should be on your radar. Not as a replacement for everything you do, but as a tool that changes what you can do.

For quick validation studies—"Do customers care about this feature?" "Why are we losing deals?" "How do people describe our product?"—AI-powered interviews are probably better than surveys and faster than traditional interviews.

For complex research that requires deep nuance and human judgment, you'll probably still want human researchers. But even there, Listen Labs could be a screening tool. Run an initial AI interview round to identify patterns, then follow up with human researchers on specific segments.

The key is recognizing that AI interviews are a new tool in your toolkit, not a replacement for your entire research practice.

The Broader Trend: AI Replacing Expensive, Slow Work

Listen Labs is part of a larger trend where AI is coming for industries that are expensive, slow, and haven't changed much in decades.

Legal research used to require expensive legal researchers reading thousands of cases. Now AI can do that in minutes. Customer support used to require humans handling simple questions. Now AI can do that. Content writing used to require hiring writers. Now AI can do that.

In each case, the pattern is the same: AI doesn't replace the human entirely, but it handles the routine parts, freeing humans to focus on what actually requires human judgment.

Listen Labs fits that pattern perfectly. AI doesn't replace the researcher who designs the study. But it does replace the months of recruiting, interviewing, and analysis.

That shift from "AI as replacement" to "AI as force multiplier" is happening across industries. Understanding how to integrate that into your work is becoming a key skill.

The Investment Thesis: Why VCs Are Excited About Listen Labs

Venture capital has a specific thesis about market research platforms. The industry is massive, incumbents are slow to innovate, and AI fundamentally changes the economics.

Here's how it breaks down:

The total addressable market is enormous.

The unit economics work. Video interviews are more expensive to conduct than surveys, but cheaper than human interviews. The platform can likely generate gross margins above 70%, which is typical for Saa S.

The competitive moat exists. Listen Labs has training data (thousands of quality interviews) that competitors can't easily replicate. They have customer relationships and usage data that inform product development. They have brand recognition from the viral billboard campaign.

The market is ready. Enterprise customers are tired of slow, expensive research. They're actively looking for alternatives.

All of that adds up to why Ribbit Capital and other VCs are excited. This isn't a speculative bet on unproven technology. It's a bet on a specific technology (AI interviews) applied to a specific market (enterprise research) where the timing is right.

What's Next: The Roadmap Everyone's Wondering About

No one from Listen Labs has publicly discussed their roadmap, but you can infer where they're probably going.

First, more languages and regions. They currently operate globally, but expanding to emerging markets with locally-trained AI models makes sense. That multiplies their addressable market.

Second, vertical-specific solutions. Right now, Listen Labs is horizontal—it works for any research need. But they could build healthcare-specific interview modules, fintech-specific interview modules, etc. That increases switching costs and customer lock-in.

Third, integration with analytics platforms. If they integrate with Amplitude, Mixpanel, or Tableau, they become part of the core product analytics workflow instead of a separate tool.

Fourth, predictive analytics. Once they have millions of interviews in their dataset, they can start predicting outcomes. "Based on how users answered these questions, we can predict with 75% accuracy whether they'll churn." That's valuable.

Fifth, white-label solutions. Some large enterprises might want to run Listen Labs internally, branded with their own logo. That's a different pricing model and a different market.

None of this is confirmed, but it's the natural progression for a platform company with good traction.

The Human Element: Why AI Interviews Actually Work Better

Here's something counterintuitive: in some cases, people are more honest with AI than with humans.

When you're on a video call with a human interviewer, you're aware of social dynamics. You're thinking about how you're presenting yourself. You might soften your criticism if you worry the interviewer will judge you. You might overstate your importance or knowledge.

With an AI interviewer, that social dynamic disappears. You're talking to a machine. You're less concerned with self-presentation. The result is more honest answers.

Wahlforss mentioned this in describing the quality improvements: "People talk three times more. They're much more honest when they talk about sensitive topics like politics and mental health."

That's a genuine insight about human psychology. People's default social behavior adjusts based on who they're talking to. Talk to a human and you perform. Talk to a machine and you're yourself.

There's irony in that. As we build better AI, we're discovering that people might actually prefer interacting with machines in certain contexts. That has implications for how we think about customer interactions, research, and even company culture.

Conclusion: The Market Research Industry Is Changing

Listen Labs'

The company isn't inventing customer research. People have been interviewing customers since businesses existed. What they're doing is making research cheaper and faster by automating the parts that don't require human judgment.

The impact ripples outward. Teams can run more research. Research happens earlier in product development. Decisions are more data-driven. And fraud-ridden survey panels become less relevant.

For your organization, the question isn't whether Listen Labs will matter. It's whether you'll integrate AI-powered customer research into how you make decisions.

The companies that do will have a genuine advantage: they'll learn faster, adapt quicker, and make better decisions because they're listening to customers more often.

The companies that don't will slowly fall behind as their competitors speed up.

That's the real story the billboard was telling. Not "we're hiring," but "the way you do research is about to change."

FAQ

What is AI-powered customer interview research?

AI-powered interview research uses artificial intelligence to conduct conversational interviews with participants at scale, replacing traditional surveys and manual interviews. The AI moderator asks open-ended questions, listens to responses, generates follow-up questions in real time, and then analyzes the data to produce actionable insights—all without direct human involvement during the interview phase. This approach combines the depth of traditional interviews with the scalability of surveys.

How do AI interviewers work differently from surveys and traditional interviews?

Surveys force respondents into predefined multiple-choice answers, which leads to inaccurate data because people game their responses or don't fit neatly into the options. Traditional interviews provide depth but don't scale beyond 20-30 interviews per month. AI interviewers conduct open-ended video conversations that feel natural, ask intelligent follow-up questions based on what respondents say, and can be scaled to hundreds or thousands of interviews in days. The result is both depth and scale—something previously impossible.

What are the main benefits of using AI for customer research?

The primary benefits include speed (insights in days instead of weeks), lower cost (typically 80% cheaper than traditional research), higher data quality through fraud detection, improved honesty from respondents (people are more honest with AI than surveys), and the ability to ask more follow-up questions. Teams can also run research more frequently, which means customer insights inform product decisions earlier in the development cycle when feedback actually matters.

Can AI interviews replace human market researchers entirely?

No. AI interviews excel at the operational parts of research—recruiting, moderating, analysis. What they can't replace is the strategic work: designing good research questions, interpreting nuance, understanding what insights actually mean for business decisions, and identifying when you need deeper human expertise. The future is AI handling the execution and humans handling the strategy. That's actually better for both sides.

How do companies ensure AI interview data is honest and not fraudulent?

Platforms like Listen Labs use a "quality guard" system that cross-references video responses with Linked In profiles, checks consistency across multiple questions, flags suspicious patterns, and monitors for behavioral red flags suggesting someone is gaming the system. Video interviews are inherently harder to fake than surveys, which makes fraud prevention more effective. Companies using these platforms report reducing fraudulent or low-quality responses from 20% down to near zero.

How much faster is AI-powered research compared to traditional research?

Traditional market research typically takes 45 days from brief to final report. AI-powered research can deliver results in 2-7 days depending on scope. Some companies have run initial studies in a single day. That speed difference—40 days faster—is enough to change when in the product development cycle research happens. Instead of research informing implementation decisions, it can inform design decisions or even concept validation decisions.

What types of companies benefit most from AI interview platforms?

Any company that makes regular product decisions based on customer feedback can benefit. Saa S companies, consumer brands, financial services firms, and healthcare companies are all early adopters. The biggest benefit goes to mid-market to enterprise companies with significant R&D budgets and product teams that move faster than traditional research could support. Startups can benefit too if they need quick validation of product-market fit assumptions.

Is talking to an AI interviewer weird or off-putting for respondents?

Initially, yes—some respondents find it unusual. But engagement and completion rates are typically high. People adapt quickly, and in some cases, they're actually more honest with AI than they would be with a human interviewer because there's no social judgment happening. Video interviews feel natural even when the moderator is AI, especially if the experience is designed well.

Key Takeaways

- Listen Labs raised 500M valuation by building AI-powered video interviews that compress 45-day research cycles into 2-7 days

- The platform's viral billboard hiring campaign wasn't just marketing—it was a proof-of-concept for their core technology of using creative approaches to gather honest information

- Traditional market research wastes 20% of data on fraudulent responses; video-based interviews with fraud detection reduce this to near-zero

- Companies like Microsoft, Simple Modern, and Chubbies are using Listen Labs to make faster product decisions, with some seeing 24x improvement in research participation

- The $140B market research industry is shifting toward AI-first platforms that automate recruitment, moderation, and analysis while preserving the strategic human elements

Related Articles

- Symbolic.ai & News Corp: How AI Is Reshaping Journalism [2025]

- AI Models Are Cracking High-Level Math Problems: Here's What's Happening [2025]

- Google Trends Explore Gets Gemini AI: What Changed [2025]

- VoiceRun's $5.5M Funding: Building the Voice Agent Factory [2025]

- Over 100 New Tech Unicorns in 2025: The Complete List [2025]

- Niko Bonatsos Launches New VC Firm After 15 Years at General Catalyst [2025]

![Listen Labs $69M Funding: How AI Replaced Customer Surveys [2025]](https://tryrunable.com/blog/listen-labs-69m-funding-how-ai-replaced-customer-surveys-202/image-1-1768574582872.webp)