The Unicorn Explosion of 2025: What It Means for Tech

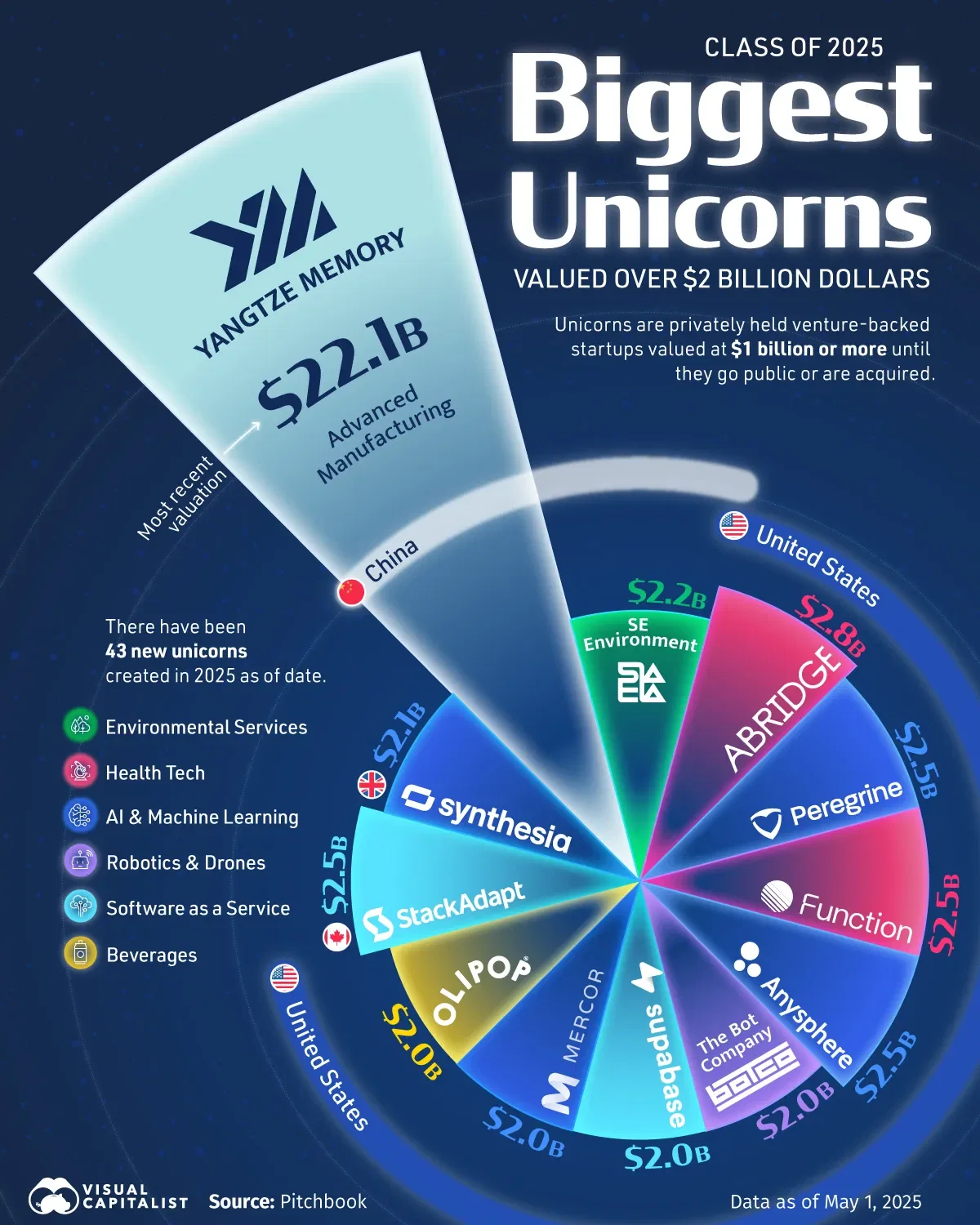

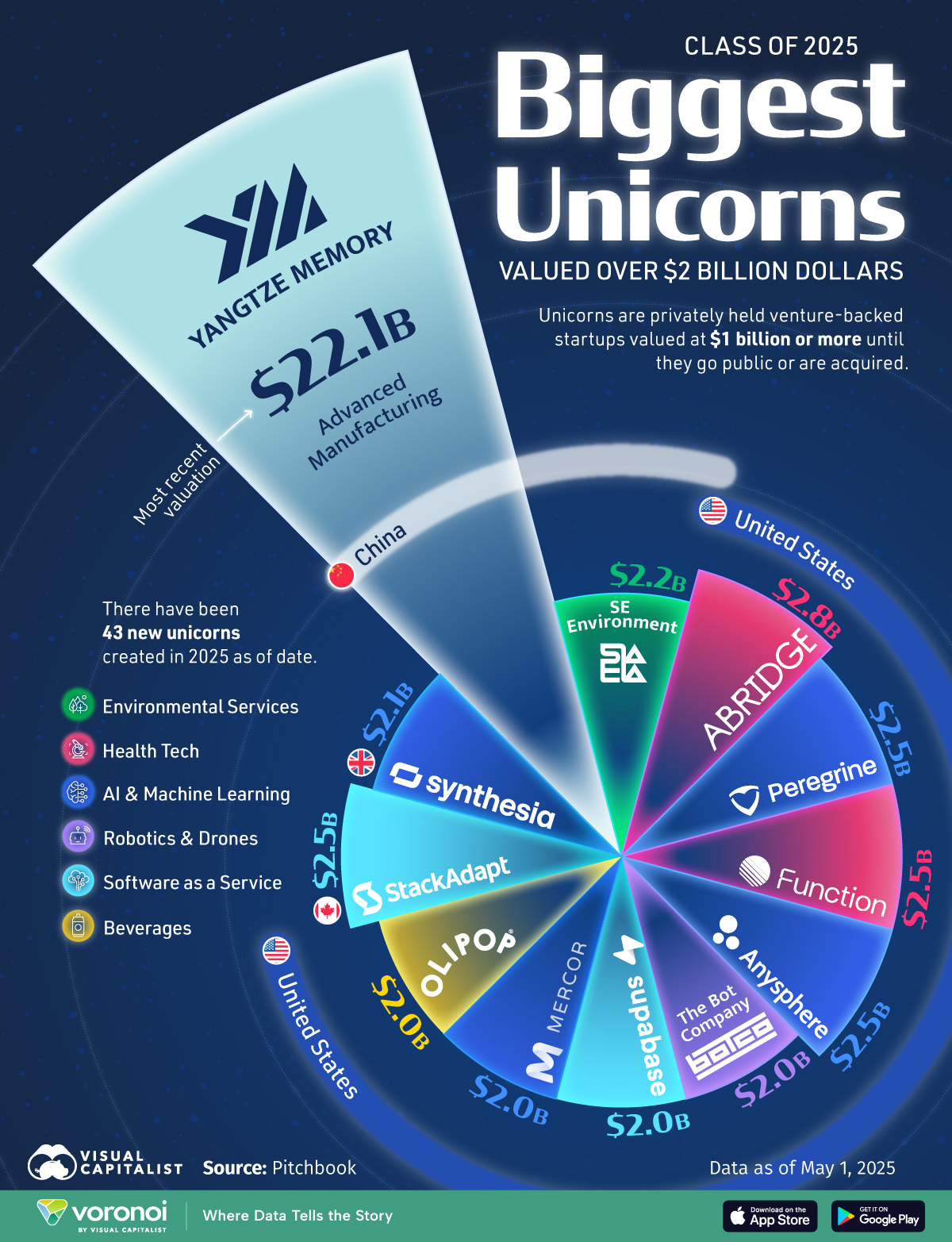

Something wild happened in 2025. We didn't just see a few startups cross the $1 billion valuation mark. We saw over 100 of them reach unicorn status in a single year. If that number sounds insane, that's because it kind of is.

For context, the entire venture capital ecosystem spent years celebrating when ten unicorns were minted in a single year. That was considered a boom. Now? We're talking triple digits, and honestly, it's reshaping how we think about startup valuations, investor behavior, and what "unicorn" even means anymore.

The 2025 unicorn wave tells us something crucial about where capital is flowing and what founders are building. It's not just about AI, though AI dominates the headlines. Hydrogen drones, nuclear energy, vertical farming, crypto banks, drone operators, AI music generators, AI video creators, mathematical reasoning engines, defense tech, identity management security platforms, customer analytics tools, payment processors, health insurance startups, and even satellite companies are all reaching billion-dollar valuations.

This article breaks down the most significant unicorns of 2025, analyzes the trends driving these valuations, and explores what this surge means for the startup ecosystem going forward. We'll look at the AI startups reshaping how we work, the deep tech companies solving hard problems, and the fintech innovations that are changing how money moves.

The unicorn market in 2025 is fundamentally different from previous years. Investors are moving faster. Funding rounds are getting bigger. And the companies reaching billion-dollar status are increasingly diverse in their markets and approaches. Let's dig into what's really happening.

TL; DR

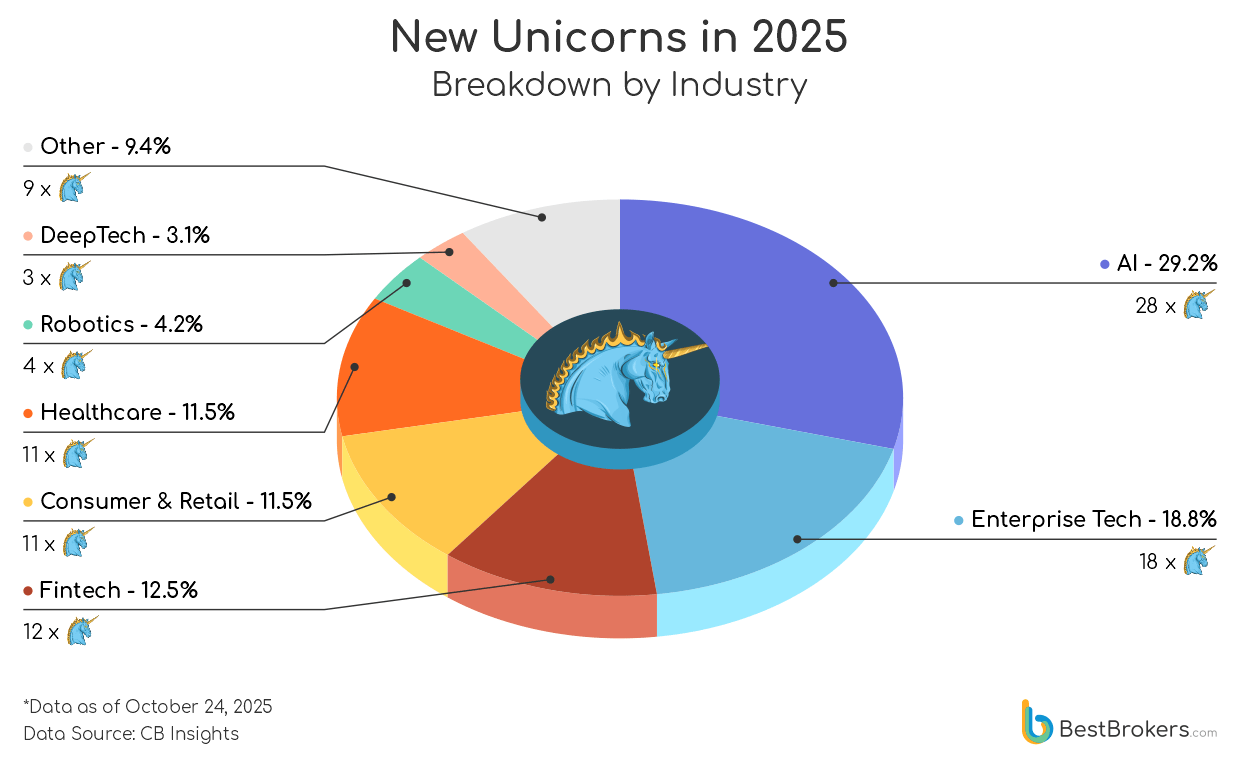

- Over 100 startups reached unicorn status in 2025, driven primarily by investor appetite for AI solutions and infrastructure

- AI dominates the list, but companies in energy, defense, fintech, and biotech are also crossing the $1 billion threshold

- Funding rounds are significantly larger, with Series B and C rounds regularly exceeding $200 million

- The definition of "unicorn" is becoming less exclusive, with more startups achieving the milestone than ever before

- Mega-unicorns are emerging, with several startups valued at $4 billion or higher in their first rounds

Luma leads with a

AI-Powered Automation: The Core of 2025's Unicorn Boom

If you're looking for the single biggest driver of unicorn creation in 2025, it's AI automation. Specifically, companies building AI agents that help knowledge workers move faster, smarter, and more efficiently.

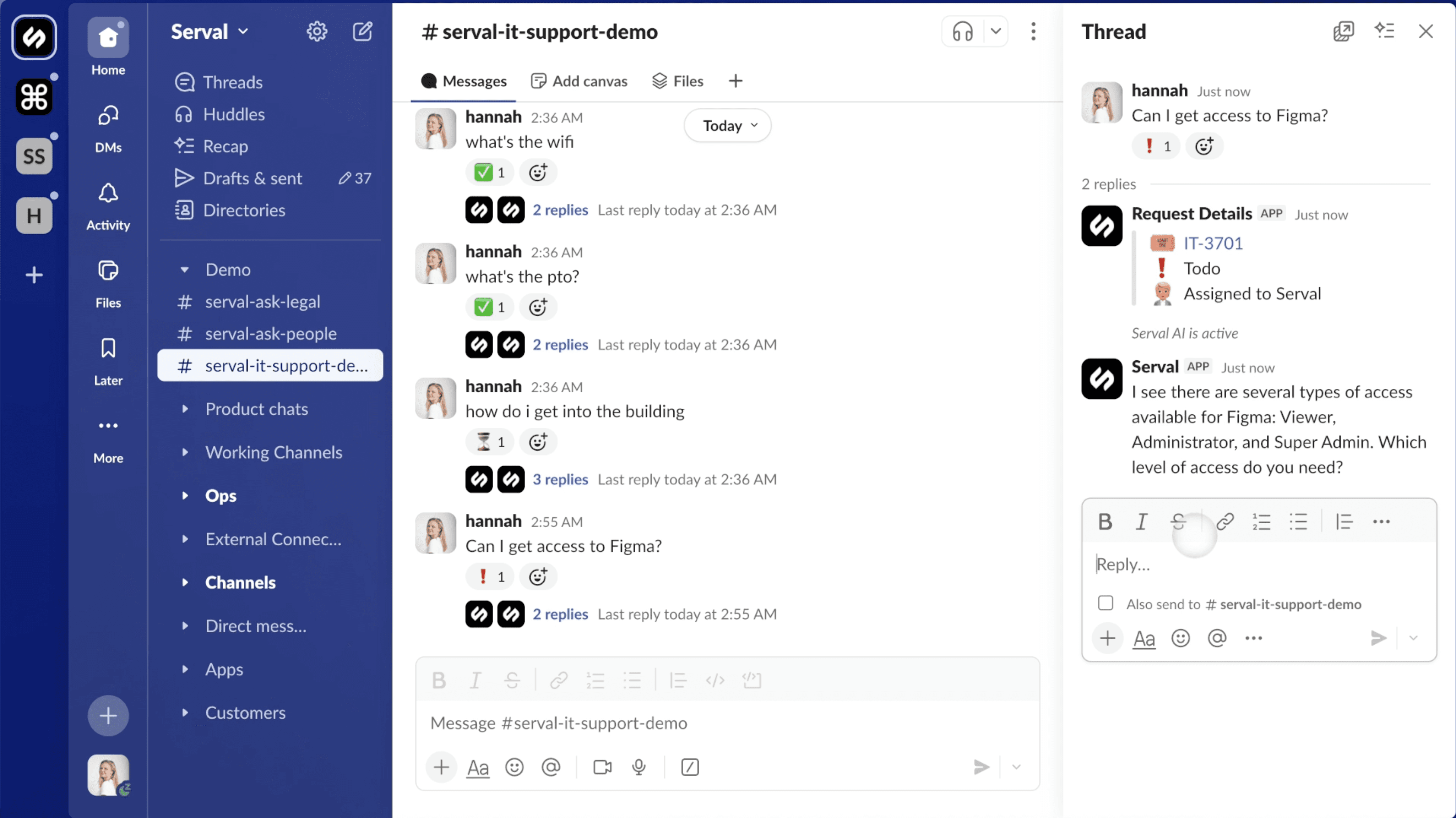

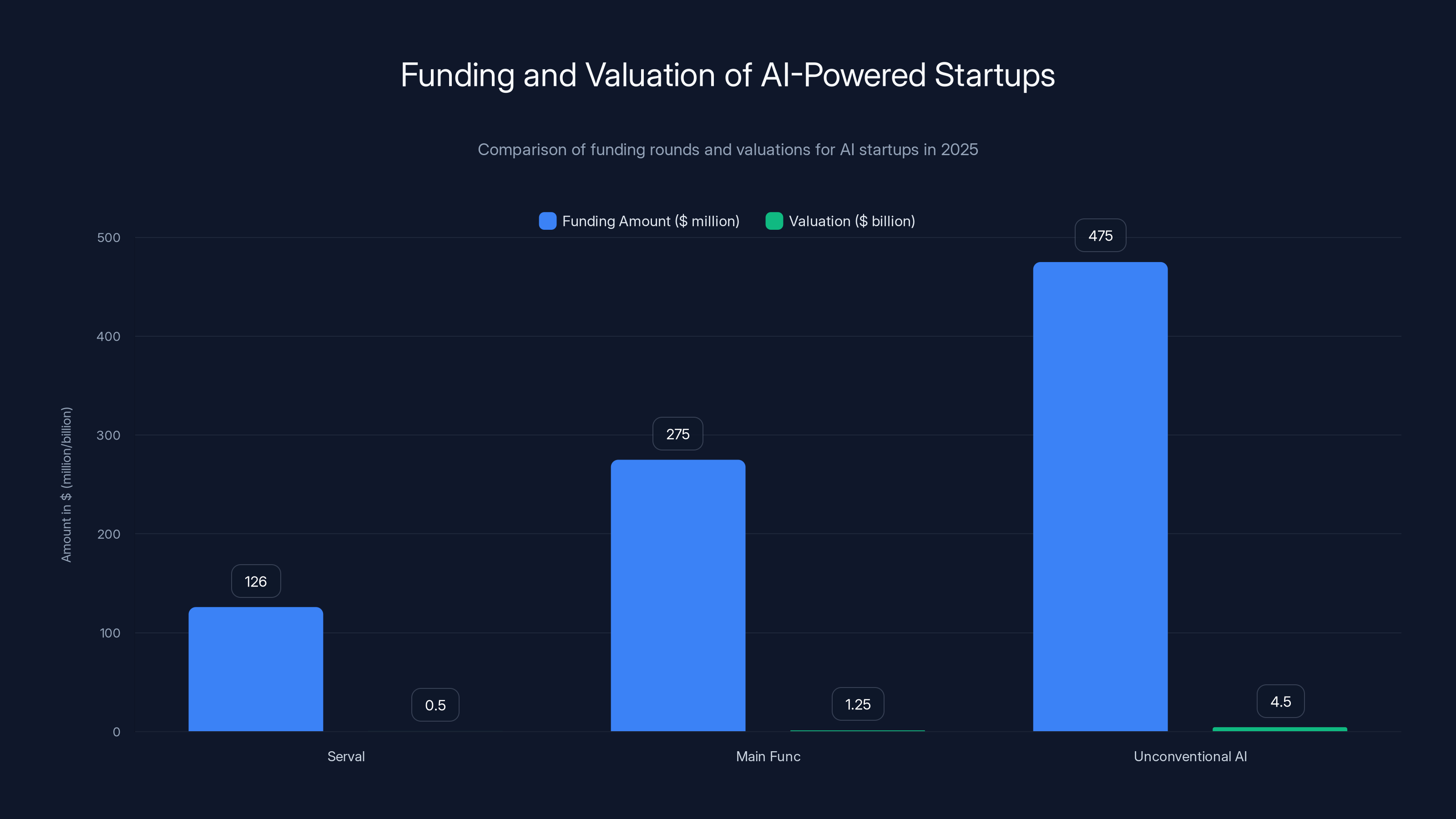

Serval exemplifies this trend perfectly. Founded in 2024, this startup built AI agents designed to help IT professionals complete complex tasks without manually executing every step. That's it. That's the pitch. And it worked spectacularly. The company raised a

Why would top-tier venture capitalists pour that much money into a two-year-old startup? Because IT operations is broken. IT professionals spend their days toggling between ten different tools, running the same commands repeatedly, troubleshooting the same issues. If AI can automate even 30% of that work, the ROI is massive. Companies save money, employees focus on strategic work, and Serval captures a meaningful percentage of that savings.

Main Func follows a similar playbook but targets white-collar workers more broadly. Founded in 2023, the company is building AI agents that automate the repetitive, bureaucratic tasks that plague most office workers. Main Func raised a

Then there's Unconventional AI, which takes a different approach. Instead of building software agents, this startup is creating energy-efficient hardware designed specifically for running AI workloads. Founded in 2025 by Naveen Rao, the former head of AI at Databricks, Unconventional AI raised a

This is the current market dynamic: venture capitalists are betting enormous sums on companies that haven't yet proven their business model, based solely on the massive potential of the AI market. The calculus is simple: if the TAM (total addressable market) is large enough, and the founding team is credible enough, the risk of moving fast outweighs the risk of missing out.

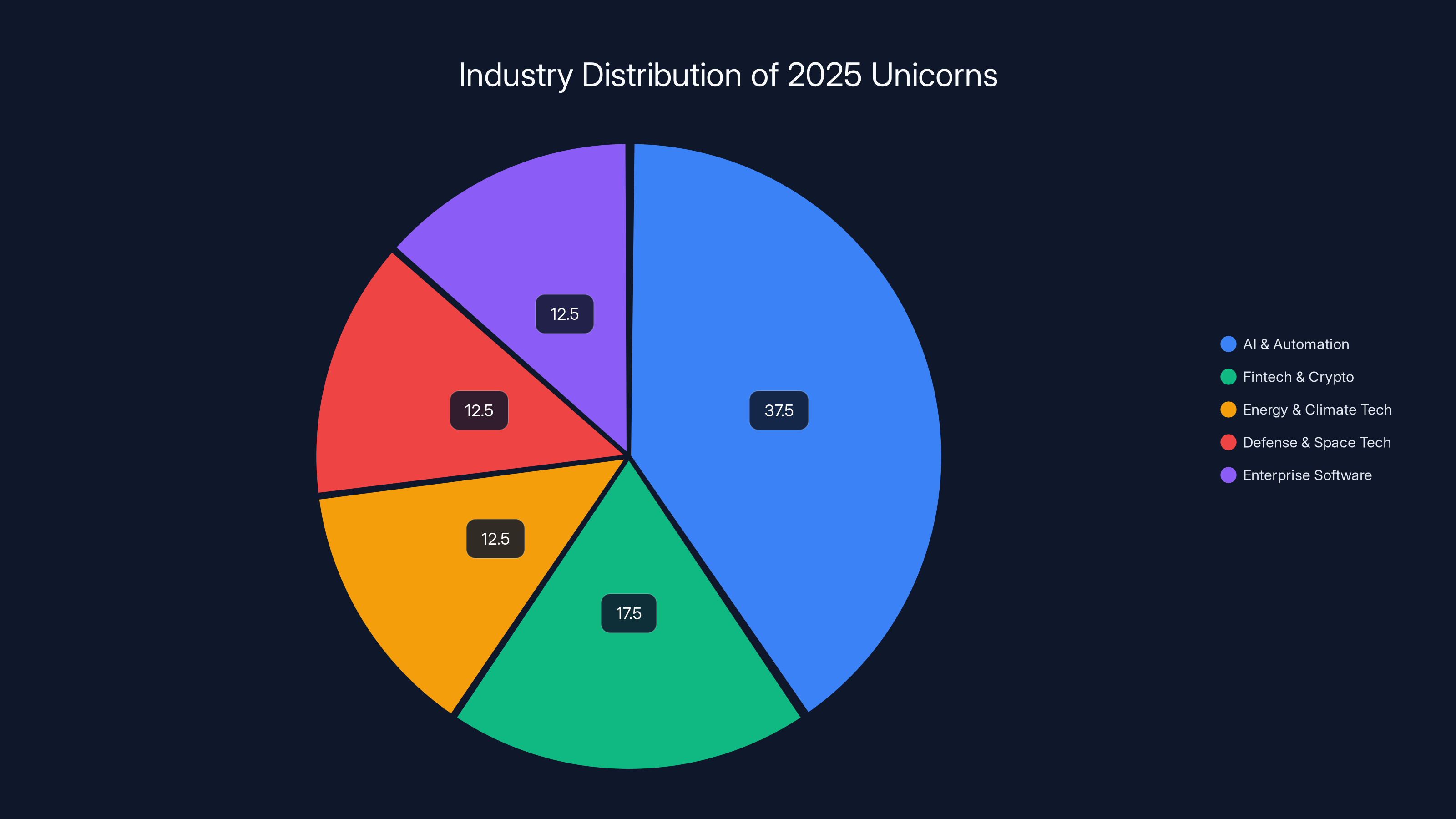

In 2025, AI and Automation lead the unicorn landscape, comprising approximately 37.5% of new unicorns, followed by fintech and crypto at 17.5%. Estimated data.

Creative AI: Video, Music, and Visual Generation Take Off

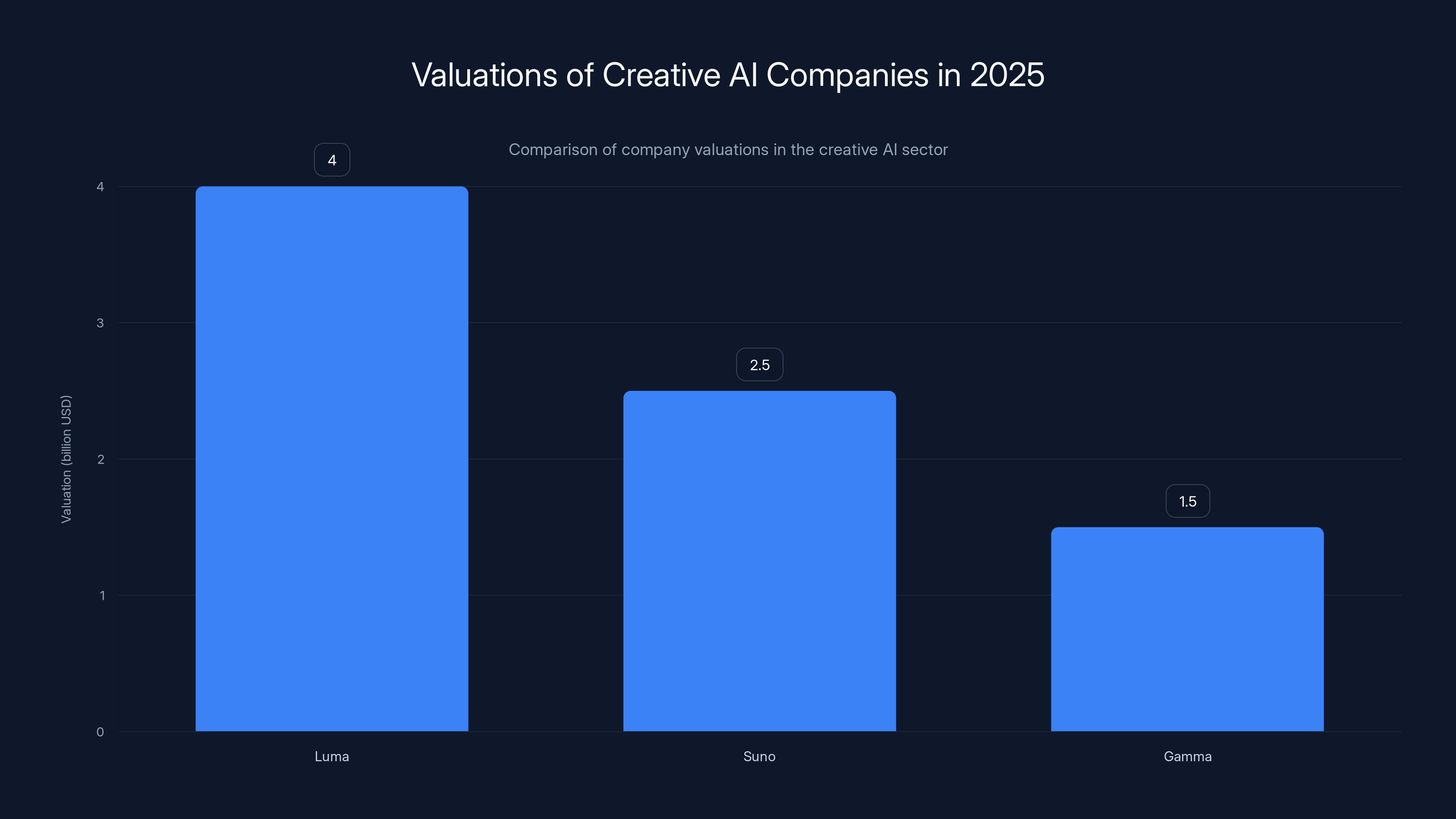

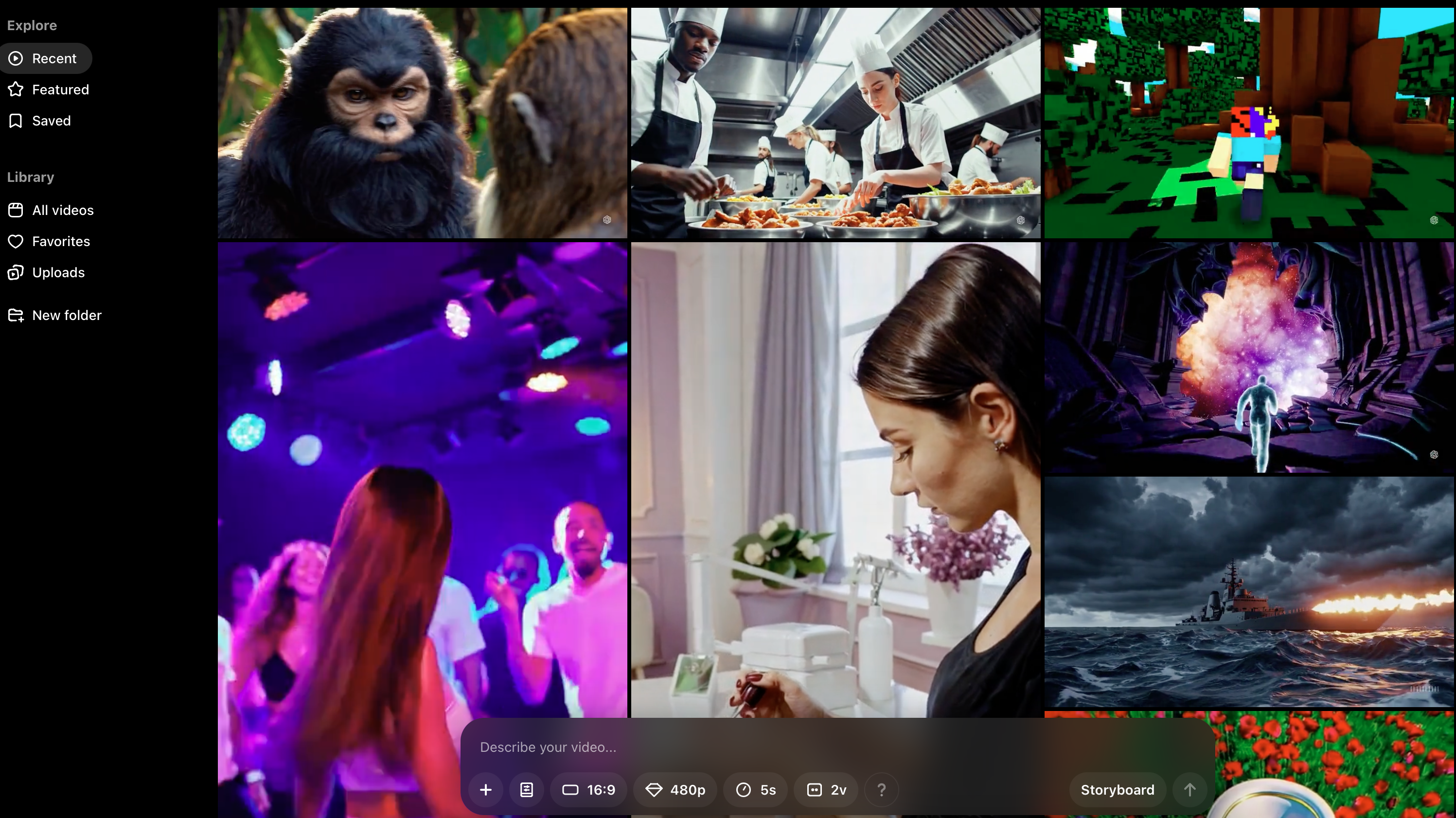

While automation-focused AI companies are attracting capital, creative AI is creating equally stunning valuations.

Luma is building an AI video generation platform that converts text prompts into realistic videos. Founded in 2021, the company has been iterating quietly while the market caught up to what's possible. In 2025, Luma raised a

The video generation market is competitive. Open AI's Sora, Google's Veo, and a handful of other competitors are building similar capabilities. But Luma has something special: early traction and a user community that genuinely uses the product. That community signal matters. When a tool reaches critical mass, switching costs increase and network effects kick in. Luma's valuation reflects confidence in that network.

Suno approached the creative AI space differently. Instead of generating videos, Suno generates music. Founded in 2022, the company built an AI that can compose original music based on a text description. A founder describes wanting an "upbeat electronic track," and Suno generates it. The company raised a

The music generation market is smaller than video, but it's more defensible. Music rights are complex, and Suno has navigated licensing challenges that would sink most startups. The company has partnerships with labels and payment systems in place. That operational excellence is reflected in its valuation.

Gamma takes a different approach to creative AI. Instead of generating videos or music, Gamma generates visual designs: websites, presentations, graphics. Founded in 2022, the company launched its first product in 2022 and quickly became a user favorite. The interface is clean. The results are usable. The company raised a

What's interesting about Gamma is that it solved a specific problem beautifully. Designers were using Gamma to generate rough drafts. Marketers were using it to create social media graphics. Product teams were using it to prototype interfaces. The use cases kept multiplying, but the core value proposition remained consistent: high-quality visual generation in seconds.

Deep Tech & Infrastructure: The Unsexy Unicorns Attracting Serious Money

While creative AI makes headlines, some of the most interesting unicorns of 2025 are in boring, essential infrastructure categories.

Chai Discovery is a biochemistry company. Founded in 2024, it built AI models that predict the structure of biochemical molecular structures. This is pure science fiction stuff: you input a molecule description, the model predicts its 3D structure, and suddenly you can design drugs faster. The company raised a

What makes Chai Discovery remarkable is how niche it is. It's not solving a consumer problem. It's not automating knowledge work. It's solving a decades-old scientific problem using modern AI. That specificity attracted sophisticated investors who understand the pharma industry and the value of accurate molecular prediction.

Harmonic takes a different deep tech approach. This company built a mathematical reasoning engine: AI that can understand and solve complex mathematical problems. Founded in 2023, the company raised a

Mathematical reasoning is genuinely hard for AI models. Most large language models can solve basic algebra but struggle with complex proofs and novel problems. Harmonic's breakthrough is in that gap. Companies in finance, engineering, and research immediately saw value.

Saviynt is a cybersecurity company focused on identity management. Founded in 2010, the company has been quietly building sophisticated tools for enterprise access control. In 2025, the company raised a

What's remarkable about Saviynt is its age. Most unicorns are young companies riding recent trends. Saviynt has been around for 15 years. The company succeeded because identity management is a constant problem, regulatory requirements keep expanding, and enterprises have massive budgets for security. The 2025 valuation reflects recognition that Saviynt owns a critical infrastructure category.

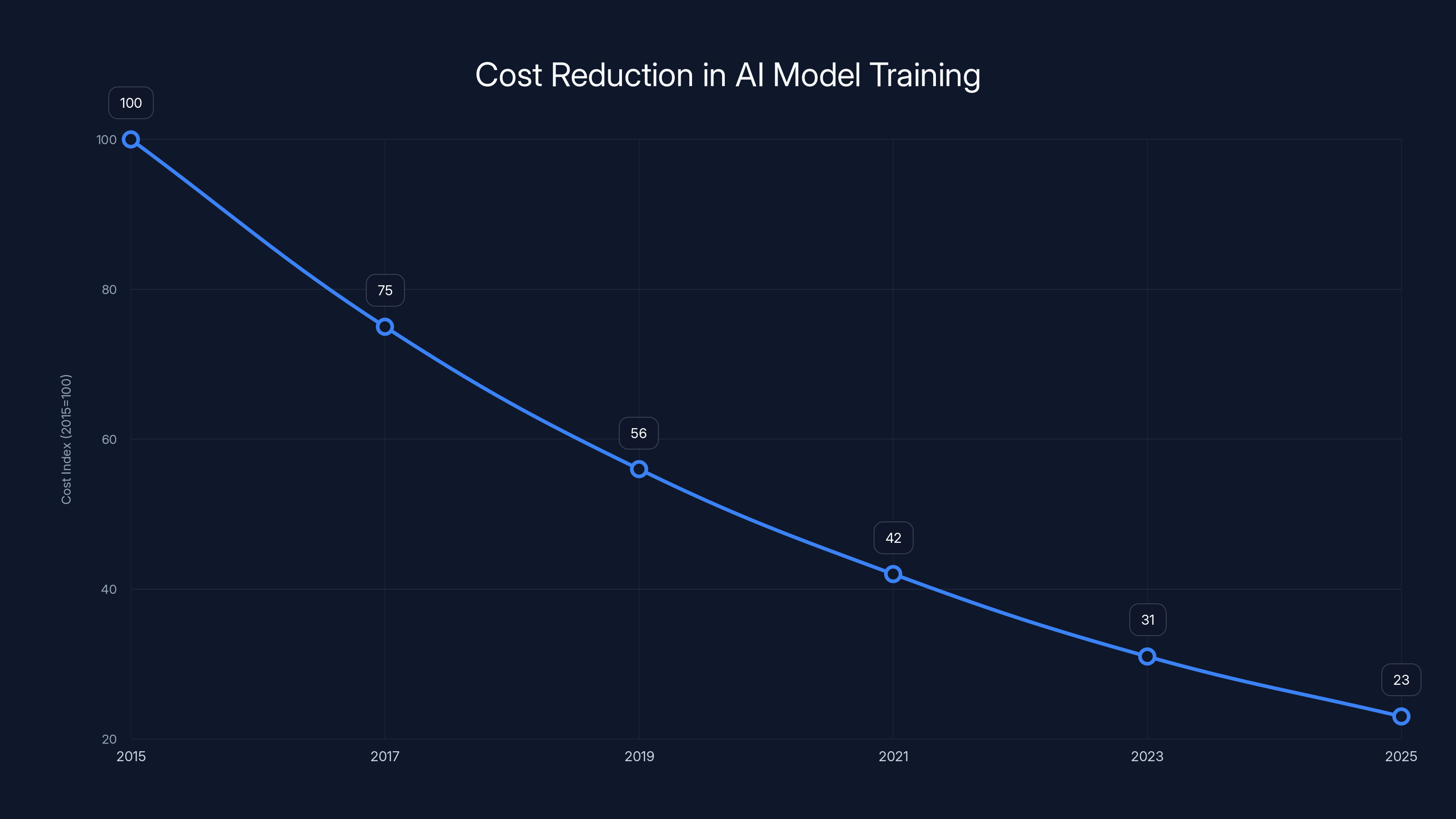

The cost of training large AI models has decreased by approximately 50% every 18 months, enabling more startups to build AI products and contributing to the unicorn boom. Estimated data.

Energy & Climate Tech: Hydrogen Drones and Nuclear Power

Climate change is attracting serious venture capital, and 2025 saw several energy startups cross the unicorn threshold.

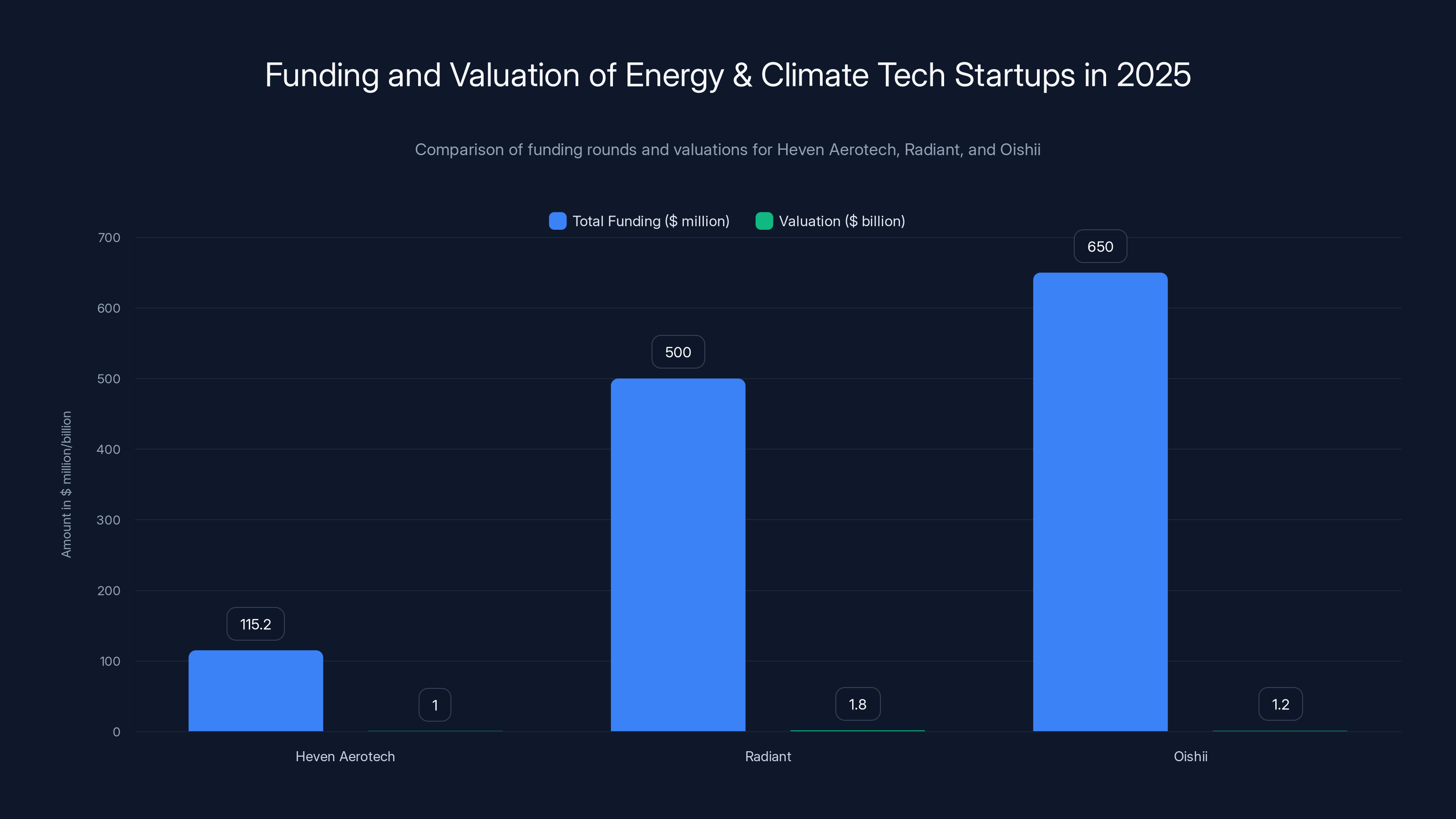

Heven Aerotech is building hydrogen-powered drones. Founded in 2019, the company recognized a fundamental limitation of electric drones: battery energy density limits flight time. Hydrogen offers significantly higher energy density, enabling drones to fly longer without refueling. Heven raised a

The hydrogen drone market is early but growing. Delivery companies, inspection services, and government agencies all have interest in longer-flying drones. Heven's approach is grounded in real thermodynamic advantages. This isn't vaporware; it's a physics-based solution to a real problem.

Radiant is taking a different approach to energy: nuclear power. Founded in 2019, the company is building next-generation nuclear reactors designed to provide reliable, carbon-free power. The company raised a

Nuclear energy is experiencing a cultural renaissance. As climate concerns intensify and renewable energy limitations become apparent (solar and wind need storage, battery production creates environmental costs), nuclear is being reconsidered. Radiant's valuation reflects investor confidence that next-generation nuclear will play a central role in future energy infrastructure.

Oishii operates in vertical farming, growing fresh produce in controlled indoor environments. Founded in 2016, the company has been iterating on growing techniques, crop selection, and supply chain logistics. In 2025, Oishii raised a

Vertical farming sounds futuristic, but Oishii has cracked something important: profitability and scale. Most vertical farming companies burn money. Oishii is actually profitable at scale. That operational capability justified the billion-dollar valuation.

Fintech Innovation: Payments, Banking, and Trading Platforms

Financial technology continued its explosive growth in 2025, with several startups reaching unicorn status.

Imprint is a payment processing platform founded in 2020. The company built a system that makes accepting payments simpler and more flexible for businesses. In 2025, Imprint raised a

Payment processing might sound commoditized. Square, Stripe, and Pay Pal dominate the space. But Imprint found gaps in the market: developers who need lower fees, businesses that want more flexibility, merchants who are underserved by incumbents. By focusing on those segments, Imprint built a valuable company.

Erebor took a completely different approach to fintech: crypto banking. Founded in 2025 (yes, just created in 2025), Erebor is building a bank specifically designed for crypto clients. The company raised a

A seed-stage company valued at $4.3 billion with no revenue history. This is what venture capital looks like in 2025. The bet: crypto adoption will accelerate, crypto-native financial services will be essential, and the first mover with proper banking infrastructure and compliance will own a massive market. It's a high-risk bet, but the TAM (if it works out) justifies the valuation.

Kalshi is a blockchain-based trading platform that allows users to trade prediction contracts on real-world events. The company bridges prediction markets and blockchain technology. While specific 2025 funding details aren't fully disclosed, Kalshi has been recognized as achieving unicorn status in 2025, reflecting investor confidence in prediction market infrastructure.

Unconventional AI leads with a

Defense & Space Tech: The Unsexy Categories Attracting Big Money

Defense and space technology are experiencing a renaissance in venture capital. 2025 saw multiple companies in these categories cross the unicorn threshold.

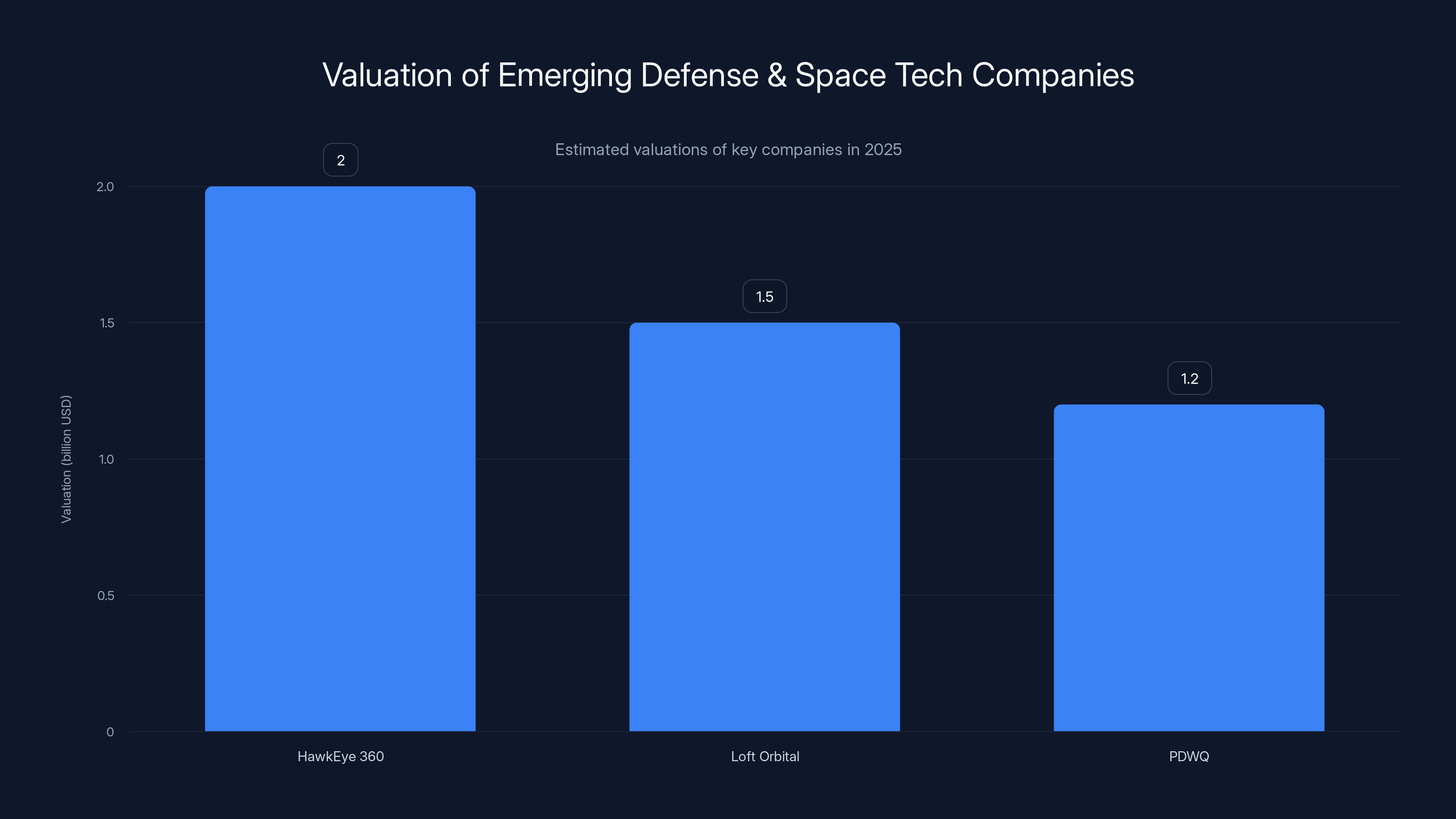

Hawk Eye 360 is a defense-tech company founded in 2015. The company built a constellation of satellites that detect radio frequency signals from anywhere on Earth. This capability is useful for everything from tracking illegal fishing vessels to monitoring military communications. In 2025, Hawk Eye raised a

What's interesting about Hawk Eye 360 is its path to unicorn status. The company was founded in 2015 and quietly built its satellite constellation for ten years. Suddenly, as geopolitical tensions increased and the government recognized the need for commercial space capabilities, investor interest accelerated. The valuation spike reflects changing government priorities and real revenue growth.

Loft Orbital is another space company mentioned in the original unicorn data. Loft Orbital builds platforms for sending satellite payloads to space. Instead of building their own satellite, customers can rent space on Loft's satellites. It's the cloud computing model applied to space. The company has achieved unicorn status and is attracting serious government and commercial contracts.

PDWQ (specific company name may vary in actual records) is using AI to create and operate drones. Founded in 2019, the company raised a

Drone technology is advancing rapidly. Autonomous drones, drone swarms, and AI-powered navigation are all real capabilities now. PDWQ's valuation reflects the commercial and government demand for drone technology.

The defense and space categories are attractive to investors because they have specific characteristics:

- Large addressable markets: Government spending on defense and space is enormous and growing

- High barriers to entry: Building satellites or developing advanced defense tech requires significant capital and expertise

- Predictable revenue: Government contracts, while competitive, offer stable long-term revenue

- Regulatory moats: Once you're approved to work with government agencies, competitors face the same approval gauntlet

The Role of AI Infrastructure in Fueling the Unicorn Boom

The explosion of unicorns in 2025 can't be separated from AI infrastructure investments. Without the underlying capability to build and train powerful AI models, most of these startups wouldn't exist.

When Unconventional AI raises a $475 million seed round, it's because investors believe that energy-efficient AI hardware will become essential infrastructure. As data centers grow and AI models become more compute-intensive, the cost of running AI workloads escalates. A company that can reduce those costs by 30% or 40% suddenly has a massive market.

Similarly, companies like Chai Discovery, Harmonic, and Serval all depend on advances in AI and machine learning. They're not inventing new ML techniques; they're applying existing techniques to domain-specific problems. That application layer is where the immediate commercial value lies.

The infrastructure layer itself is less visible but equally important. Cloud providers like Amazon, Google, and Microsoft have essentially bankrolled the AI infrastructure that makes these startups possible. By making GPU access cheap and reliable, by offering pre-trained models through APIs, they've lowered the bar for starting an AI company from "need a Ph D and

In 2025, Heven Aerotech, Radiant, and Oishii secured significant funding, reflecting their innovative approaches in hydrogen drones, nuclear power, and vertical farming, respectively. Estimated data.

Founder Quality and Team Composition in 2025's Unicorns

One overlooked factor in the unicorn explosion is founder quality. The startups reaching unicorn status in 2025 tend to have either:

- Seasoned founders with previous exits or successful companies (like Naveen Rao at Unconventional AI, previously at Databricks)

- Deep domain expertise (like the biochemists at Chai Discovery or the defense engineers at Hawk Eye 360)

- Very recent funding with no revenue history but strong team credentials

This tells us something important about the 2025 venture market: investors are betting on people, not ideas. The idea of an AI agent for IT professionals (Serval) is not particularly novel. But the Serval team executed better than competitors, attracted investor confidence, and raised more capital at a higher valuation.

The founder quality bar has also shifted. Five years ago, many unicorns were founded by first-time founders with raw talent. Today, most unicorns have at least one founder with previous startup experience or deep industry expertise. This suggests that the venture market is being more selective about founder quality, even as it's being more generous about valuations.

Timing and Market Readiness also play crucial roles. A company like Gamma (AI-powered visual design) would have struggled to raise serious capital in 2021 because the AI models weren't good enough and the market wasn't ready. By 2025, the models were good enough, design tools market was mature, and investors were hungry for AI design startups. Gamma succeeded because it was founded at exactly the right moment.

The Unicorn Valuation Question: Are We in a Bubble?

Here's the uncomfortable question that everyone's thinking: are these valuations justified, or is this a bubble?

The data suggests something more nuanced than a simple "bubble" or "sustainable boom." Let's break down the evidence:

Arguments for Reasonable Valuations:

- AI is a genuine technological shift with massive market implications

- Companies like Serval and Chai Discovery solve real problems that have specific, quantifiable value

- Funding rounds include major institutional investors (Sequoia, Andreessen Horowitz, Kleiner Perkins) who presumably do diligence

- Several companies (Saviynt, Radiant, Imprint) have demonstrated ability to generate revenue

- Government contracts for defense and space tech are relatively predictable

Arguments for Concern:

- Seed-stage companies (Erebor, Unconventional AI) with no revenue are hitting $4+ billion valuations

- Many companies have been operating for only 1-3 years with minimal proof of business model

- Venture capital has dramatically more funds to deploy than it did 5 years ago, creating pressure to deploy capital at higher valuations

- The definition of "unicorn" matters less when 100+ companies achieve it annually

- Downstream financing (Series B, C, D) may struggle if late-stage investors don't share early investors' optimism

The honest answer: some of these companies are reasonably valued, some are significantly overvalued, and it's impossible to know which is which without inside knowledge of their revenue and growth.

What we can say: founders and investors are moving faster, taking bigger bets, and accepting higher risk. This creates both opportunity and danger. The companies that deliver on their promises will create enormous value. The companies that don't will collapse, taking investor money with them.

HawkEye 360 leads with a $2 billion valuation, reflecting its strategic importance in defense tech. Estimated data for Loft Orbital and PDWQ shows significant growth in the space and drone sectors.

Market Consolidation: The Unicorn Economy's Next Phase

One significant implication of the unicorn boom is consolidation. When 100+ companies achieve billion-dollar valuations, the market becomes crowded. Most of these companies will face competition from:

- Other well-funded startups in the same category

- Big tech incumbents (Google, Microsoft, Amazon, Meta) who are aggressively building in similar areas

- Open-source alternatives built by the community and maintained for free

Take AI agents, for example. Serval, Main Func, and dozens of other companies are all building AI agents for knowledge workers. Google has Google Tasks, Microsoft has Copilot, Salesforce has Einstein. The market will consolidate. Some startups will be acquihires. Some will become profitable but non-unicorn-sized businesses. A few will emerge as category leaders.

Consolidation also means that later-stage rounds will be harder. Series C and D investors will be more selective, asking harder questions about unit economics, customer acquisition costs, and path to profitability. The founders and investors who celebrate unicorn status today may struggle to raise Series C at a higher valuation in 2026 or 2027.

History suggests that only 10-20% of unicorns created in any boom year actually deliver on their promise. The rest either consolidate, stagnate, or fail. That's not criticism; it's just how venture capital works. The role of venture is to fund many bets, knowing that most will lose, but the winners will be massive.

Geographic Distribution of 2025 Unicorns

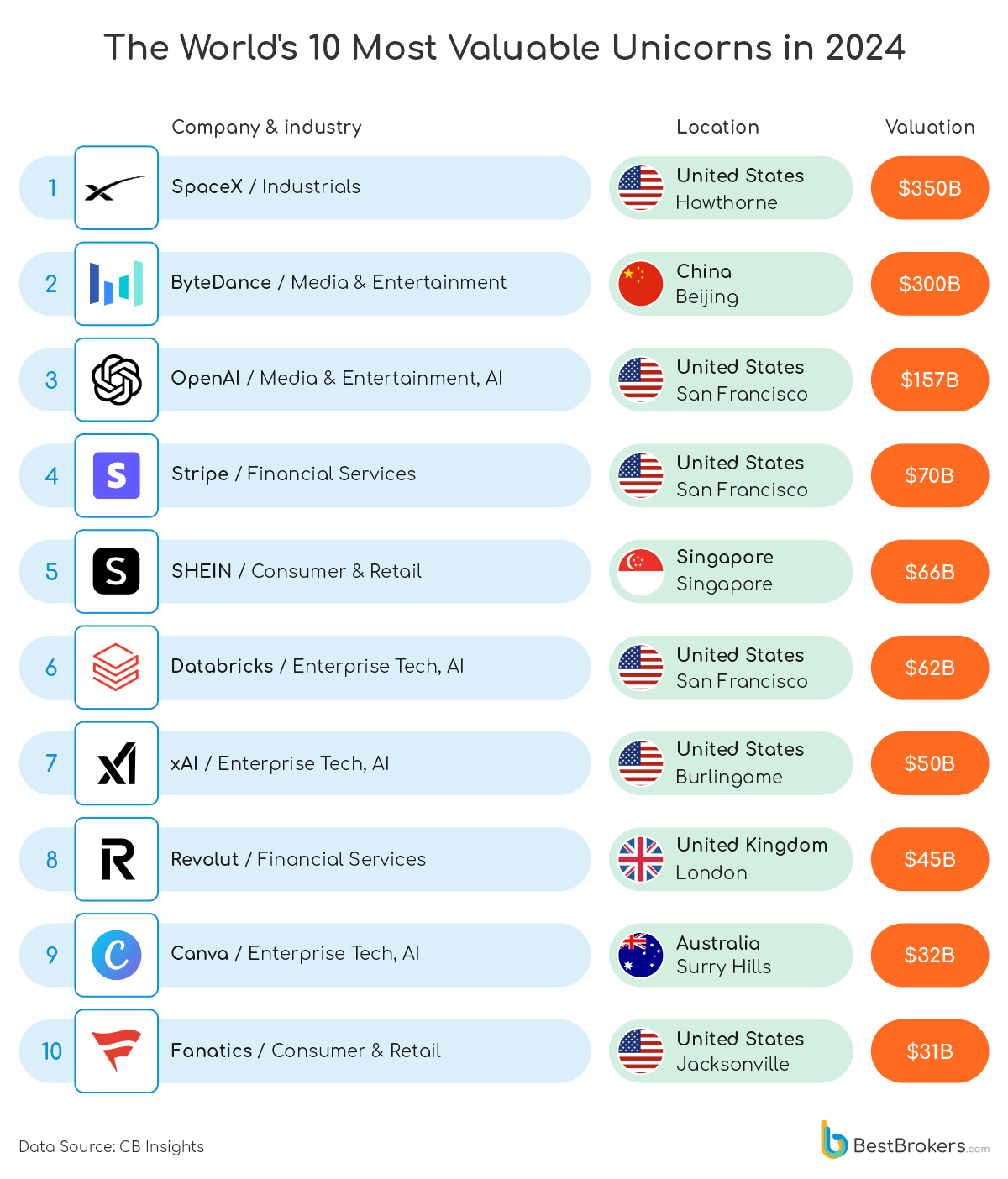

The 2025 unicorn list shows interesting geographic distribution. While many companies are based in the United States (Silicon Valley, New York, and emerging hubs like Austin and Boulder), international unicorns are increasingly represented.

This reflects a fundamental shift in global startup ecosystems. Venture capital has become more distributed. Founders no longer need to move to the Bay Area to raise money and build massive companies. Strong internet connectivity, global talent pools, and remote work have enabled companies to be built and scaled from anywhere.

Companies like Mo Engage (customer analytics platform) and others are being valued as global leaders even if they're based outside the traditional tech hubs. This geographic distribution will likely continue accelerating.

Sector Breakdown: Where the Money Is Really Going

Let's analyze the 2025 unicorn list by sector:

AI & Automation: Serval, Main Func, Unconventional AI, Luma, Suno, Gamma, Harmonic - approximately 35-40% of unicorns

Biotech & Chemistry: Chai Discovery - represents the growing venture interest in AI for science

Energy & Climate: Heven Aerotech, Radiant, Oishii - approximately 10-15% reflecting climate tech investment

Fintech & Crypto: Imprint, Erebor, Kalshi, Mo Engage (adjacent) - approximately 15-20%

Defense & Space: Hawk Eye 360, Loft Orbital, PDWQ - approximately 10-15%

Enterprise Software: Saviynt, Curative, Mo Engage - approximately 10-15%

The sector breakdown reveals where investor capital is concentrated and where they believe the largest opportunities exist. AI dominates, which makes sense. But the diversity of sectors represented shows that unicorns are being minted across the full startup landscape, not just in one hot category.

The Role of Mega-Funds in Unicorn Proliferation

Another factor driving the unicorn boom: mega-funds. In recent years, venture capital mega-funds have raised $100+ billion to deploy. These funds are managed by titans like Andreessen Horowitz, Sequoia, and others.

Mega-funds have two structural incentives:

- Larger check sizes: A $50 billion fund needs to write large checks to deploy capital effectively. This pushes up valuations and check sizes at every stage.

- Broader mandate: Mega-funds invest across sectors and stages, increasing the number of unicorns in their portfolio.

When Sequoia participates in a

This dynamic is self-reinforcing. As mega-funds deploy larger checks, founders expect larger checks. As valuations increase, companies that previously would be valued at

What 2025 Unicorns Tell Us About 2026 and Beyond

If we extrapolate from the 2025 unicorn list, several trends seem clear for the coming years:

AI Will Remain Central: Unless there's a dramatic shift in investor sentiment or fundamental limitations emerge in AI capabilities, AI-powered companies will continue to dominate unicorn creation. The market is betting that AI will be as transformative as the internet, and that bet seems reasonable.

Domain-Specific AI Will Outperform: Companies that apply AI to specific, complex problems (drug discovery, molecular prediction, IT operations) will succeed faster than companies building generic AI tools. The specificity creates defensibility and clear ROI.

Infrastructure Bets Will Grow: As AI demands more compute, more energy, more specialized hardware, infrastructure companies will attract massive funding. We should expect more unicorns in AI chips, cloud infrastructure, and energy.

Consolidation Is Coming: The 100+ unicorns created in 2025 can't all succeed independently. Expect significant M&A activity in 2026-2027 as later-stage investors become more selective and market consolidation accelerates.

Government Becomes a Major Customer: Defense and space tech are showing that government contracts can be a path to profitability and growth. More startups will pursue government relationships, creating new unicorns in categories like cybersecurity, defense tech, and space infrastructure.

Practical Implications for Founders, Investors, and Employees

For Founders: The 2025 unicorn boom shows that it's possible to raise enormous capital at high valuations if your team is credible and your market is large. But unicorn status is just a milestone. The real challenge is surviving the transition from being a well-funded startup to being a profitable, sustainable company.

For Investors: Be selective. The unicorn category has become so broad that it's almost meaningless. Focus on unit economics, founder quality, and market size rather than the binary question of "will this be a unicorn?" Most unicorns will not deliver returns worthy of their valuation.

For Employees: Joining a newly-minted unicorn is exciting but risky. The stock option is worth more, but the company also has higher burn rate and faces higher expectations. Strong employees should consider: will this company survive to IPO, or will it be acquired, putting your options underwater? Will I actually want to work here for the 4-year cliff period? These questions matter more than the headline valuation.

Learning From the Companies That Stuck Around

Not every unicorn from 2015 became a major company. Some IPO'd successfully (Slack, Airbnb, Uber). Some plateaued (We Work). Some became lifestyle businesses rather than explosive growth engines.

The companies most likely to become truly transformative seem to share several characteristics:

- Clear unit economics: Customers clearly pay for value. The company knows its CAC (customer acquisition cost) and LTV (lifetime value).

- Founder persistence: The founding team stays long-term and keeps iterating rather than cashing out early.

- Market timing: The company arrives at exactly the right moment when the market is ready for its solution.

- Product quality: The core product is genuinely better than alternatives, not just funded better.

- Adaptability: As markets shift, the company pivots rather than doubling down on a failing strategy.

The 2025 unicorns will be filtered through these criteria over the next 3-5 years. The ones that stick around will likely do so because they met most of these conditions.

The Bigger Picture: What the Unicorn Boom Means for Society

Zooming out from the specific startups and valuations, the unicorn boom of 2025 tells us something important about how capital flows in modern society.

Venture capital has become the primary mechanism for funding innovation. Instead of large corporations funding innovation internally or governments funding research directly, we've shifted toward a model where venture capital deploys capital to founders with ideas, accepting high failure rates in exchange for potentially massive returns.

This system has produced extraordinary innovations: the smartphone, social networks, cloud computing, and now AI. It's also produced spectacular failures, environmental problems (crypto), regulatory nightmares (some fintech), and an increasingly unequal society where founders and early investors accumulate wealth while later investors and employees often lose.

The 2025 unicorn boom reflects confidence in this model. Investors believe that more startups, more capital, and more risk-taking will lead to more innovations. That's probably true. Whether those innovations create broad-based prosperity or concentrate wealth further remains to be seen.

FAQ

What is a unicorn in the startup world?

A unicorn is a privately-held startup company valued at $1 billion or more. The term was coined by venture capitalist Aileen Lee in 2013 as a humorous reference to the rarity of such valuable private companies. In 2025, the term has become less exclusive as over 100 companies achieved unicorn status in a single year.

How do startups achieve unicorn valuation?

Startups reach unicorn valuations through venture capital funding rounds. When investors purchase equity in a company, they agree upon a valuation at which that purchase occurs. As companies demonstrate growth, solve real problems, and attract more capital, their valuations increase. A company becomes a unicorn when its valuation reaches $1 billion during a funding round, even if the company has no revenue or is unprofitable.

What are the most common industries for 2025 unicorns?

Artificial intelligence and automation dominate the 2025 unicorn list, representing approximately 35-40% of all new unicorns. Other major sectors include fintech and crypto (15-20%), energy and climate tech (10-15%), defense and space technology (10-15%), and enterprise software (10-15%). The diversity of sectors shows that venture capital is investing across multiple categories, not concentrated in a single area.

Is being a unicorn profitable?

No, unicorn status does not mean profitability. Many 2025 unicorns have never generated revenue or have negative unit economics. Valuation and profitability are separate metrics. A company can be valued at

Why are AI companies getting such high valuations in 2025?

AI companies are receiving high valuations because investors believe the AI market will be massive, comparable to the internet revolution. Companies solving specific problems with AI (drug discovery, IT operations, visual design) are positioned to capture significant value from their respective markets. Additionally, mega-venture funds have enormous capital to deploy and larger check sizes increase valuations across the board.

Should I join a newly-minted unicorn?

Joining a newly-minted unicorn has both advantages and risks. The advantages include higher stock option potential, resources to build products, and access to talented colleagues. The risks include higher burn rate, aggressive growth expectations, possibility of acquihire or failure before IPO, and potentially unrealistic team dynamics driven by rapid growth. Evaluate the specific company's runway, unit economics, and market opportunity before deciding.

What percentage of unicorns actually become successful public companies?

Historically, only 10-20% of unicorns created in any given boom year become genuinely successful public companies or achieve their projected valuations. The majority either consolidate through acquisition, stagnate as profitable but non-explosive businesses, or fail entirely. This is why venture capital is a numbers game: funds must make many bets knowing that most will lose but a few will be enormous winners.

How do mega-funds like Andreessen Horowitz influence unicorn creation?

Mega-funds with

Conclusion: The Unicorn Moment and What Comes Next

The minting of over 100 unicorns in 2025 is a remarkable moment in startup history. It reflects confidence in innovation, abundance of capital, and the transformative potential of artificial intelligence. But it also raises important questions about sustainability, market consolidation, and whether these valuations represent genuine value or speculative excess.

The startups in this list represent humanity's genuine attempt to solve hard problems: drug discovery through AI, autonomous systems, renewable energy, financial infrastructure, and space access. Some will succeed spectacularly. Many will fail or be absorbed into larger companies. A few will become the iconic companies of their era.

What's clear is that the venture capital model is optimized for creating these moments of explosive valuation growth. Whether that model is optimized for creating broadly beneficial innovation is a different question entirely.

For founders, the 2025 unicorn moment represents opportunity. Capital is abundant, investors are hungry for AI companies, and market windows exist in multiple categories. But opportunity comes with risk. The companies built in this moment will be tested by market realities, consolidation, and competition from well-funded incumbents.

For investors, the unicorn boom is both alluring and dangerous. The potential returns are enormous, but so are the risks. Mega-funds have deployed capital at scales that will make it harder for them to generate returns. Smaller, more focused funds may outperform by being more selective and patient.

For employees and the broader public, the 2025 unicorn boom matters because it determines what gets built, who builds it, and who benefits from the innovations. The companies reaching unicorn status are the ones attracting the brightest talent and the most capital. Their choices ripple through the broader economy.

The unicorn boom of 2025 won't continue at this pace forever. Market corrections, failures, and consolidation will slow the creation of new unicorns. But the companies created during this moment of abundance will shape the next decade. Their success or failure will determine whether this capital abundance was well-deployed or wasted.

One thing is certain: we've entered a new era where unicorn status is no longer exceptional. Instead, it's becoming a standard milestone for well-funded startups in hot categories. The real question isn't whether a company reaches unicorn status, but whether it survives, scales, and becomes a genuinely transformative force. For founders, investors, and society, that's where the real challenge lies.

Key Takeaways

- Over 100 startups reached unicorn status in 2025, with AI companies representing 35-40% of new billion-dollar valuations

- Mega-funds with $50+ billion in capital are writing larger checks and increasing valuations across all funding stages

- AI automation (Serval, Main Func), creative AI (Luma, Suno, Gamma), and deep tech (Chai Discovery, Harmonic) are dominating the unicorn landscape

- Seed-stage companies like Erebor and Unconventional AI are hitting $4+ billion valuations with zero revenue, reflecting extreme investor optimism

- Only 10-20% of unicorns historically deliver returns proportional to their valuations, making future consolidation and M&A activity likely

Related Articles

- European Deep Tech Spinouts: How 76 University Companies Became Unicorns [2025]

- Harmattan AI Defense Unicorn: $200M Series B, Dassault Aviation [2025]

- SandboxAQ Executive Lawsuit: Inside the Extortion Claims & Allegations [2025]

- Niko Bonatsos Launches New VC Firm After 15 Years at General Catalyst [2025]

- Where AI Startups Win Against OpenAI: VC Insights 2025

- Articul8 Series B: Intel Spinoff's $70M Funding & Enterprise AI Strategy

![Over 100 New Tech Unicorns in 2025: The Complete List [2025]](https://tryrunable.com/blog/over-100-new-tech-unicorns-in-2025-the-complete-list-2025/image-1-1768266714506.jpg)