Introduction: The Long Road From Hype to Hardware

When Lucid Motors went public via a $4 billion reverse merger in 2021, the company promised a revolution. The projections were audacious, almost reckless in their optimism. Management claimed they'd deliver 135,000 vehicles by 2025, with 86,000 being the new Gravity SUV, 42,000 being the Air sedan, and 7,000 coming from an unfinished mid-sized platform. Wall Street ate it up. Investors saw a sleek Saudi-backed competitor to Tesla with the technology and design chops to compete.

Then reality hit.

Production delays, supply chain nightmares, software bugs, demand fluctuations, and a pandemic-ravaged automotive market turned those rosy projections into cautionary tales. By early 2025, Lucid was still struggling. The Gravity SUV, supposed to be the company's salvation, launched with quality issues that frustrated customers and embarrassed management. In December, interim CEO Marc Winterhoff sent a customer email essentially admitting the company had messed up. "Lingering software problems have unfortunately affected our customers' experience and satisfaction," he wrote.

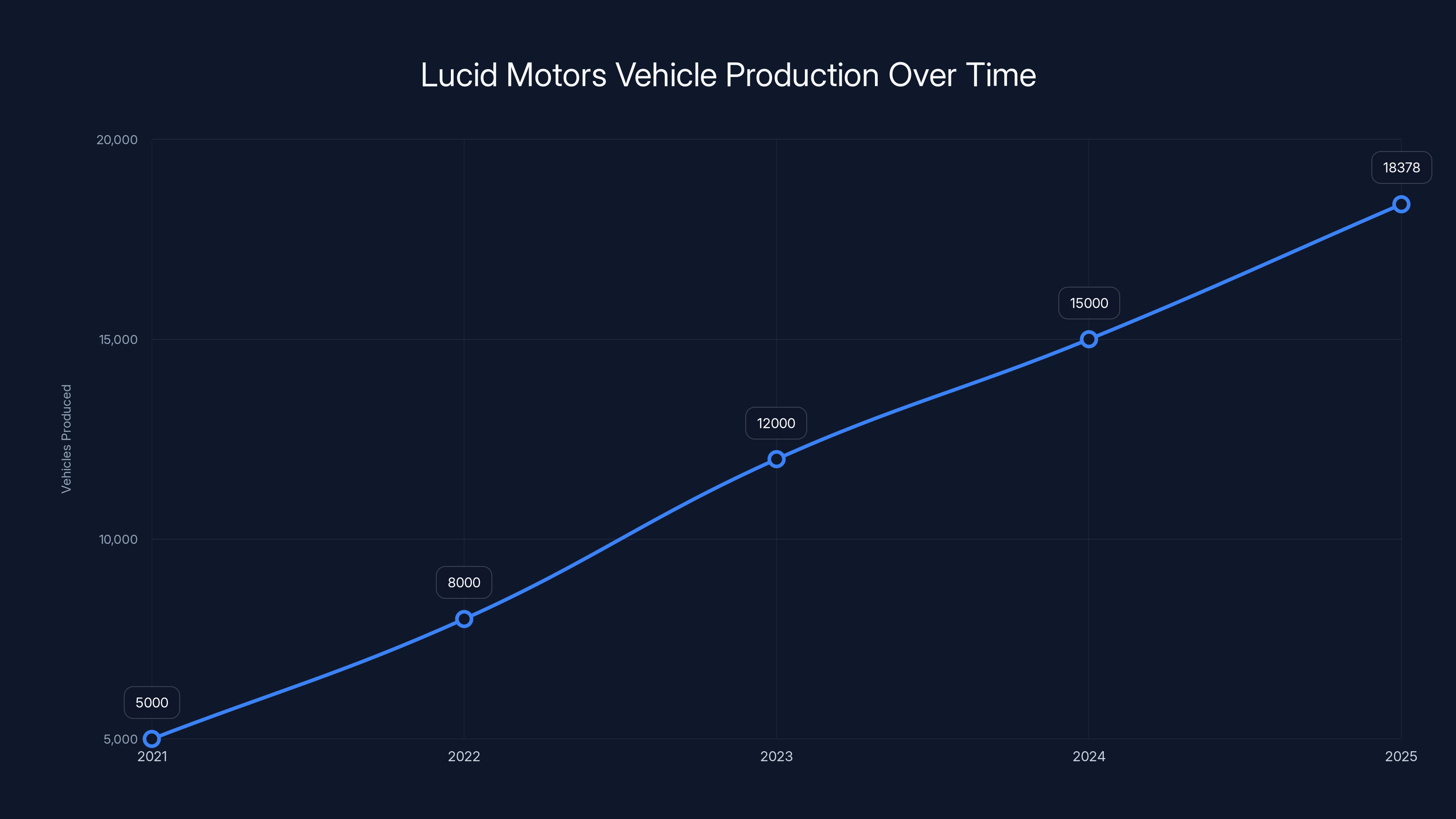

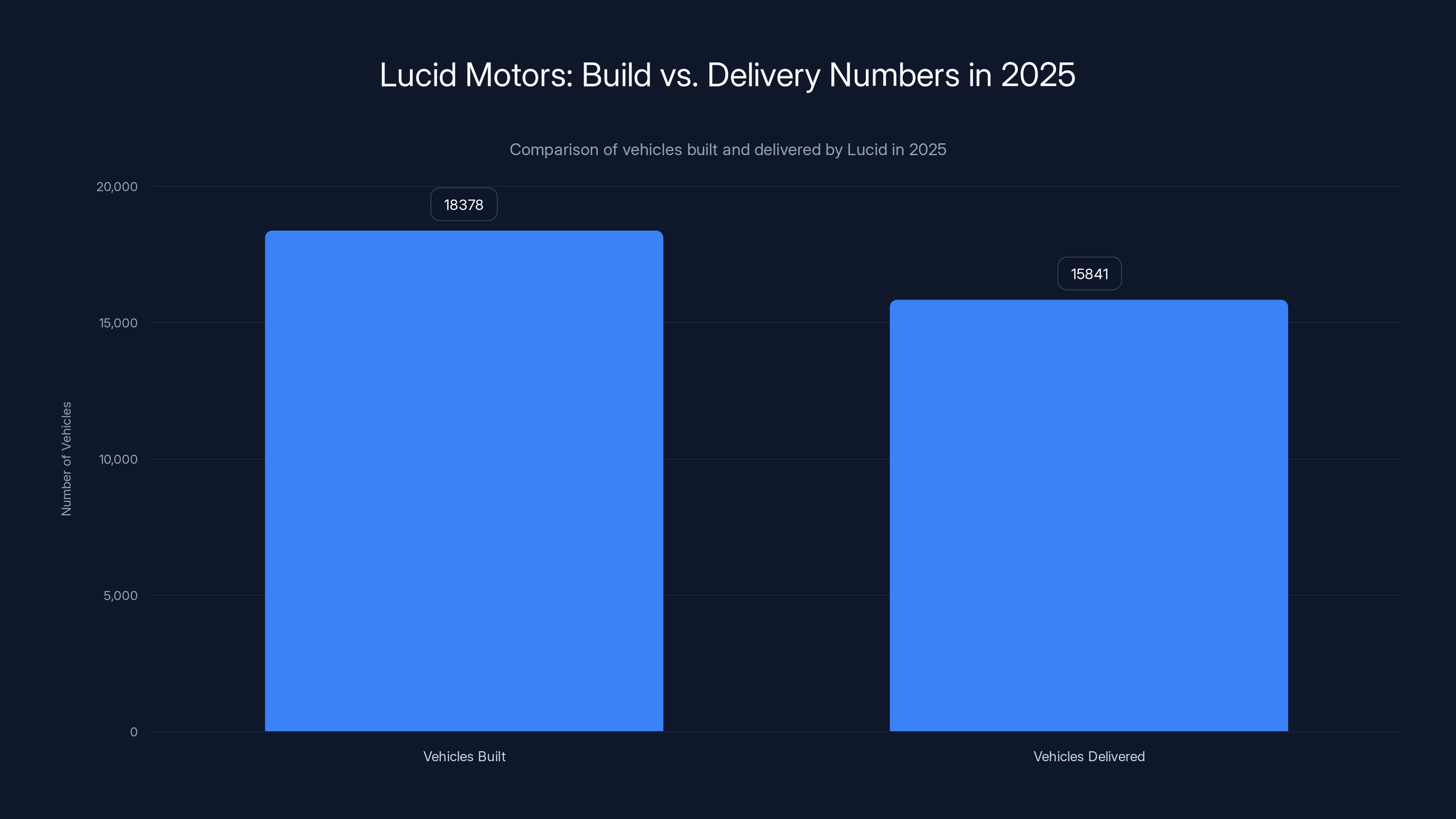

But here's where the story gets interesting. Lucid didn't collapse. Instead, the company methodically fixed problems, ramped production, and by the end of 2025, had built more cars than in any previous year. The company announced it built 18,378 EVs in 2025, with an impressive 8,412 rolling off the Arizona assembly line in Q4 alone. Deliveries hit 15,841 vehicles, a 55% jump from 2024.

This isn't a comeback story yet. The numbers still pale against the 2021 promises. But it's a story about survival, about learning from mistakes, and about what it actually takes to build cars at scale. It's also a story that matters beyond just Lucid. The EV industry is learning hard lessons about production, quality, and customer expectations. Lucid's struggles and recovery offer a roadmap of what to avoid.

Let's dig into what happened, why it happened, and what comes next.

TL; DR

- Production more than doubled: Lucid built 18,378 EVs in 2025, with Q4 producing 8,412 vehicles, showing dramatic improvement from early-year struggles

- Delivery surge: The company delivered 15,841 vehicles, representing a 55% increase over 2024's figures

- The comeback had limits: Despite this progress, 2025 delivery fell 88% short of 2021 projections (15,841 vs. 135,000 promised)

- 2026 will be critical: The company's mid-sized EV platform launch, targeting the $50,000 price point, will determine if Lucid can compete with Tesla and Rivian

- Quality remains fragile: Early 2025 was marked by Gravity SUV software issues that required management intervention to address customer frustration

Lucid Motors showed significant growth in vehicle production, reaching 18,378 units in 2025 after overcoming early challenges. Estimated data.

The 2021 Hype Machine: When Projections Met Delusion

In 2021, Lucid Motors wasn't just confident. The company was euphoric. The Saudi Public Investment Fund had backed them to the tune of billions. The company had production facilities. It had the Air, a luxury sedan that automotive journalists genuinely praised. And management had plans for an entire fleet.

Let's break down what they promised. For 2025, Lucid claimed it would deliver 135,000 vehicles total. That's a specific, audacious number. Not 100,000. Not 150,000. One hundred and thirty-five thousand. The breakdown was equally specific: 86,000 Gravity SUVs, 42,000 Air sedans, and 7,000 from the mid-sized EV platform. Those numbers weren't casual estimates. They were in investor decks, regulatory filings, and press releases. Management staked their credibility on them.

Why were these projections so wildly off? Several factors contributed. First, Lucid underestimated the complexity of scaling production. Going from hand-built prototypes to tens of thousands of vehicles per year isn't a linear process. Every bottleneck in manufacturing compounds. A supplier falls behind, and suddenly you're missing components for 500 cars. A quality issue emerges, and you need to halt production to investigate.

Second, the company didn't anticipate the demand challenges. Luxury EVs, especially from a brand consumers had barely heard of, turned out to have a smaller addressable market than projections suggested. The Air is an incredible sedan, but it costs over $70,000. That limits your buyer pool dramatically.

Third, supply chain disruptions from the pandemic hit harder and lasted longer than anyone expected in 2021. Semiconductor shortages became the automotive industry's nightmare. Lucid, as a smaller player without the leverage of Toyota or Volkswagen, got squeezed.

Finally, and this matters, Lucid ran into serious execution challenges. The company needed to ramp the Gravity simultaneously, which is incredibly hard. You can't just copy what worked for the Air. New production lines, new supply chains, new quality control procedures. Everything is new. Mistakes compound.

By 2022, it was clear these projections wouldn't materialize. By 2023, investors had largely priced in the reality. But the damage to Lucid's credibility was already done. Trust is the hardest thing to rebuild in public markets.

The Gravity SUV: From Savior to Headache to Qualified Success

The Gravity SUV was supposed to fix everything. Sedans are niche. SUVs are mainstream. The global market demands SUVs. Americans buy SUVs. Europeans are buying SUVs. The Gravity was Lucid's bet that they could scale.

When Lucid launched the Gravity in 2024, the timing was both necessary and risky. The company needed to launch a volume product. The risk was that ramping a new model while still trying to hit Air production targets would strain everything. And that's exactly what happened.

Early 2025 revealed significant problems. Software issues plagued early Gravity deliveries. Customers reported glitchy infotainment systems, unexpected shutdowns, and frustrating user experience problems. These aren't just inconveniences. In a $80,000 vehicle, they're dealbreakers. One software glitch that requires a service appointment can generate three hours of customer frustration. Multiply that by hundreds of early buyers, and you have a public relations crisis.

Marc Winterhoff's December email acknowledging these problems wasn't just an apology. It was a signal that Lucid was taking the issue seriously. The company implemented software updates, worked with customers individually, and apparently fixed many of the issues by year's end. The Q4 production surge suggests that quality problems were largely resolved, allowing the company to ramp without fear of churning out defective vehicles.

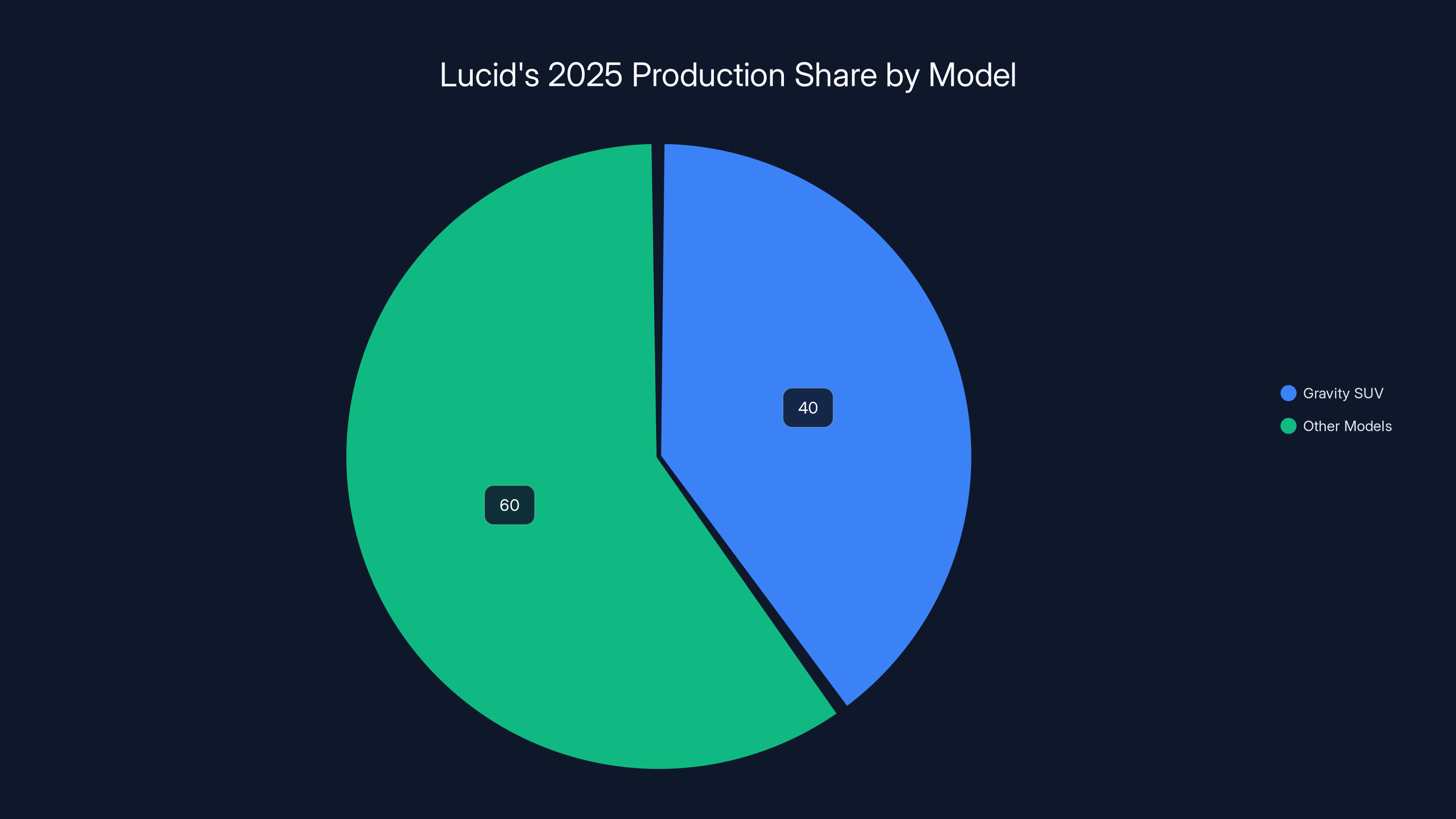

By the numbers, the Gravity is now crucial to Lucid's business. The company doesn't break out production by model, but industry analysts estimate the Gravity accounted for a significant portion of 2025 build volume, likely over 40% of the total.

The Gravity starts at around

The real test comes in 2026. Lucid needs to maintain Gravity production momentum while launching the mid-sized EV platform. If the company can execute on both fronts without sacrificing quality, the Gravity SUV will be remembered as the turning point that saved the company. If not, it'll be another failure added to an increasingly long list.

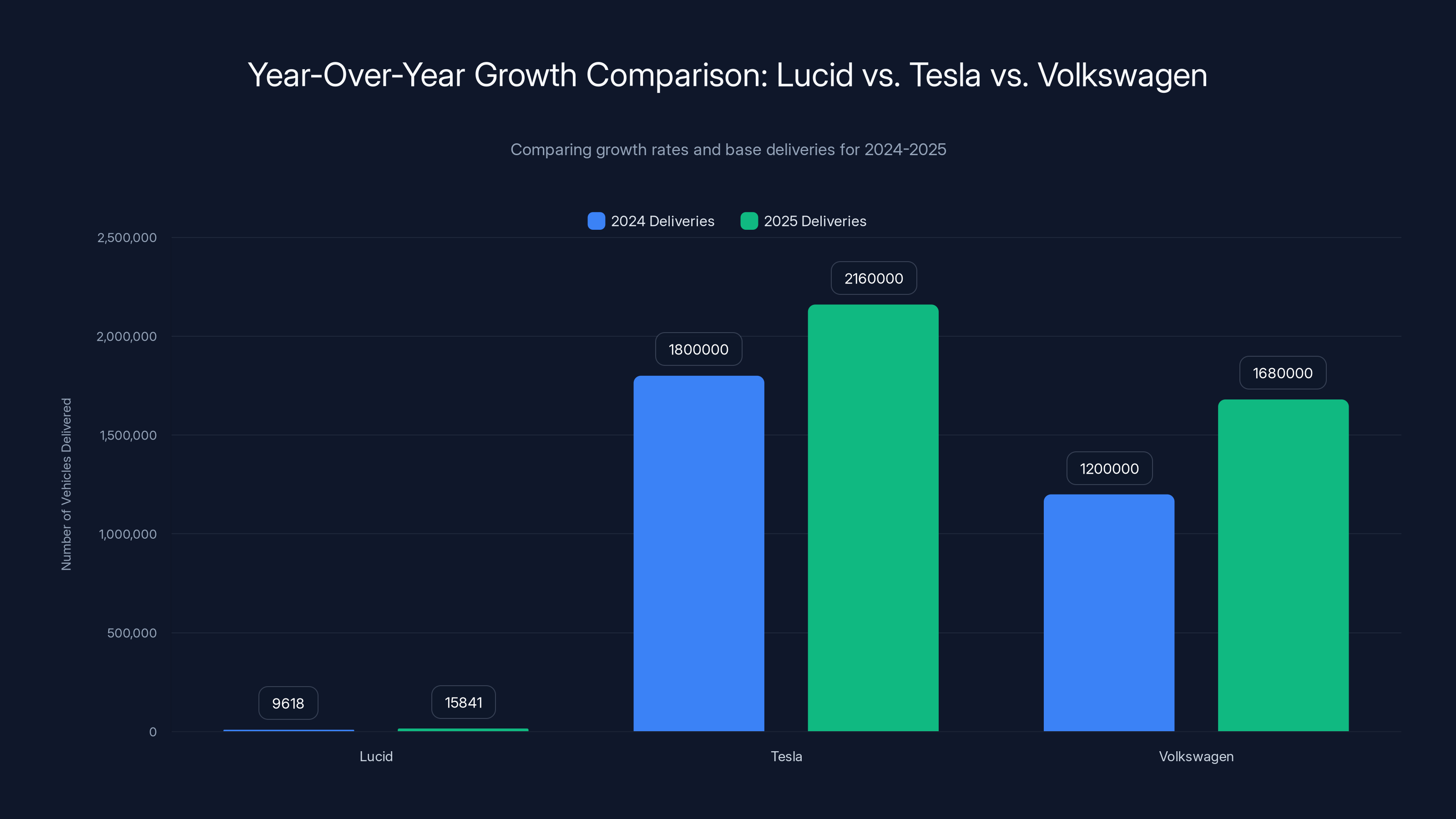

Lucid's 55% growth from a small base contrasts with Tesla's 20% and Volkswagen's 40% growth from larger bases. Estimated data.

Production Ramp: From Desert Capacity to Actual Output

Lucid's Casa Grande, Arizona facility is the company's sole production plant. The building was originally developed for another project and acquired by Lucid years ago. It's not a traditional automotive factory with the efficiency of German manufacturing plants or the automation of Tesla's factories.

When Lucid designed the Casa Grande facility, the company was optimistic about scaling. The plant had theoretical capacity for around 400,000 vehicles annually at full utilization. But getting there is exponentially harder than the engineering blueprints suggest.

In 2024, Lucid produced approximately 9,000 vehicles for the full year. The Casa Grande facility was nowhere near capacity. Why? Multiple reasons. First, ramp is slow. You can't just turn on production like flipping a light switch. You have to train workers, validate processes, solve unexpected problems, and gradually increase line speed. The first vehicles might take 40 hours of labor. After optimization, maybe they take 20. That improvement doesn't happen overnight.

Second, supply chains were still strained in early 2025. Batteries are the biggest bottleneck for any EV maker. Lucid uses battery cells from external suppliers, which limits flexibility. If your supplier has a problem, you're stuck waiting.

Third, the introduction of the Gravity meant splitting factory floor space and management attention. You can't run the Air and Gravity on the same production line efficiently. The cars have different dimensions, different battery pack sizes, different component layouts. So Lucid essentially stood up two parallel production lines in the same factory.

By Q4 2025, the ramp had worked. The factory built 8,412 vehicles in the final quarter, which annualizes to over 33,000 vehicles. That's still a fraction of theoretical capacity, but it shows real progress. More importantly, it shows that Lucid can actually scale production without imploding operationally.

One metric to watch is factory utilization. If Lucid can maintain 8,400+ quarterly production without quality degradation, the company might be approaching sustainable operations. But there's a long way between quarterly success and annual consistency.

Delivery Numbers vs. Build Numbers: Why There's a Gap

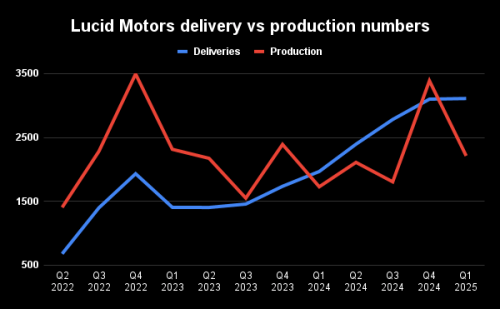

Lucid built 18,378 vehicles in 2025 but delivered only 15,841. That's a gap of 2,537 vehicles, or about 13.8% between production and delivery.

This gap isn't unusual. Most automakers build cars that aren't immediately delivered. Some cars go to dealerships before sale. Some are in transit. Some are held for inventory. But the gap does tell a story.

First, it shows that Lucid is being conservative with inventory. The company isn't flooding the market with vehicles it can't sell. Instead, it's building to match real demand more closely. That's actually a sign of maturity. In 2022-2023, Lucid had excess inventory problems. Dealer lots filled up with unsold vehicles, which meant the company had to offer discounts and incentives.

Second, the gap suggests that Lucid is still ramping. If the company was operating at steady state, the gap would be minimal. The fact that there's a 2,500+ car gap suggests the factory is still increasing production, and some vehicles built at the end of the quarter haven't been delivered yet. Those will likely count toward 2026 delivery numbers.

Third, some vehicles in that gap are likely held for logistics reasons. Lucid delivers to international markets, which adds complexity. A car built in Arizona in December might not ship and deliver until January.

The 15,841 delivery number is important for Lucid's financial results. Revenue recognition happens at delivery, not production. So the company's 2025 revenue is based on the 15,841 vehicles, not the 18,378 built.

Assuming an average selling price of around

The 55% Year-Over-Year Growth: Progress or Marketing

Lucid's 15,841 deliveries in 2025 represented a 55% increase over 2024's deliveries, which the company reported as around 10,000 vehicles (actually 9,618 if you calculate backward from the percentage).

A 55% growth rate sounds impressive. It is impressive, relatively speaking. But context matters. Lucid is growing from a tiny base. If you're making 10,000 cars and you grow 55%, you're making 15,500 cars. That's meaningful, but it doesn't mean the company is suddenly healthy.

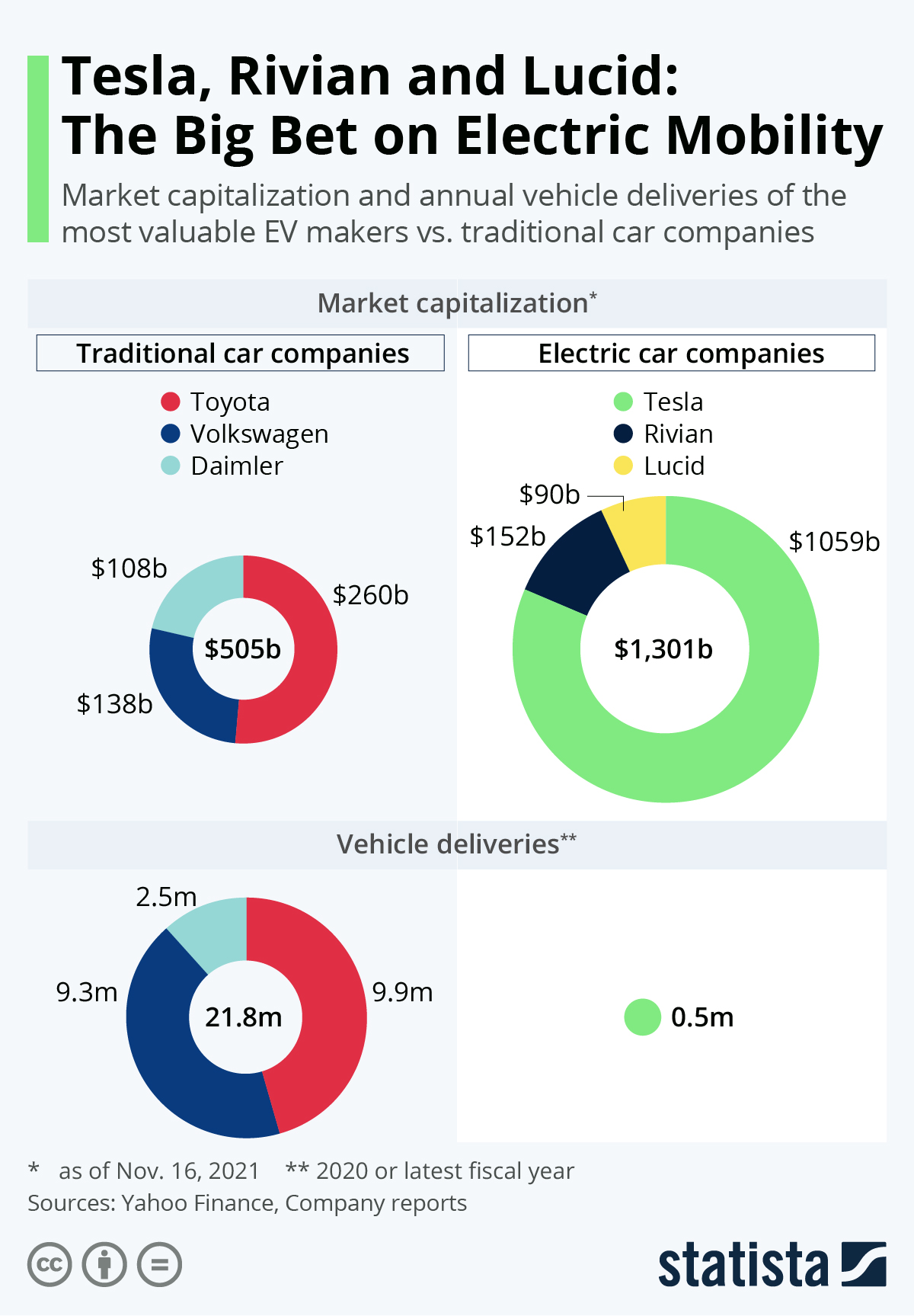

For comparison, Tesla's growth from 2023 to 2024 was about 20%, but Tesla was growing from a base of 1.8 million vehicles. Volkswagen's EV deliveries grew 40% in 2024, but from a base of 1.2 million vehicles. Lucid's growth rate is high because the denominator is so small.

That said, the trajectory is encouraging. If Lucid can maintain even 30-40% annual growth from here, the company could be at 50,000+ vehicles annually within 3-4 years. That would be a meaningful scale, though still tiny compared to traditional automakers.

The real test isn't the percentage growth. It's whether Lucid can grow delivery numbers while maintaining profitability or at least reducing losses. In 2024, Lucid burned enormous amounts of cash. The company's net loss exceeded

If the 2025 net loss is, say,

Lucid needs to reach around 150,000 annual deliveries to approach break-even at current pricing and cost structure. That's still years away.

Estimated data suggests that the Gravity SUV accounted for over 40% of Lucid's total production volume in 2025, highlighting its crucial role in the company's lineup.

The Mid-Sized EV Platform: The Real Bet for Survival

Lucid's future doesn't depend on the Air or the Gravity. It depends on the mid-sized EV platform, codenamed "Project MID" internally.

This vehicle is scheduled to launch in late 2026 or early 2027. Lucid has stated the price point will be around

This is where Lucid either makes or breaks. The luxury EV market is niche. The mass-market EV segment is where volume happens. Every major automaker is launching something in this space. Volkswagen has the ID.4. BMW has the i4. Hyundai has the Ioniq 5. Mercedes has the EQE. The competition is ferocious.

Lucid's claim to differentiation is that it will offer better range, faster charging, and premium interior design at competitive pricing. That's ambitious. It's also possible. The company has demonstrated real technical competency in battery efficiency and thermal management.

But here's the challenge. Building a

Lucid will also need to scale production dramatically. The company can't launch the mid-sized EV with the same constrained production volumes as the Air and Gravity. It needs to be able to build tens of thousands per year, potentially 100,000+ annually within five years of launch.

This requires more than just ramping the Arizona facility. Lucid needs new factory capacity. The company has announced plans for a second facility in Mexico and possibly a third in Saudi Arabia. Those are years away from production.

The mid-sized EV is also where Lucid needs to prove it understands mass-market consumers. The company's original brand identity was luxury. Consumers buying Air and Gravity vehicles expect premium experiences. Consumers buying a $50,000 Lucid want a great car at a fair price. Different psychology entirely.

Quality Control and Customer Experience: The Winterhoff Factor

Marc Winterhoff took over as interim CEO in late 2024, replacing Peter Rawlinson. Winterhoff came from the traditional automotive industry, bringing decades of manufacturing and quality experience from major OEMs.

His December email to customers was notable for several reasons. First, it was honest. Rather than minimize the software problems, he acknowledged them. Second, it was personal. He took responsibility, not hiding behind generic corporate speak. Third, it outlined a plan. The company wasn't just acknowledging problems; it was committed to fixing them.

The Gravity software issues in early 2025 were serious but ultimately survivable. They affected customer satisfaction and generated negative press, but they didn't destroy the product. The issues were fixable, and Lucid fixed them.

What matters now is whether Lucid has learned. The company needs to avoid similar quality issues with the mid-sized EV. First impressions matter more for a new model than they do for an established one.

Winterhoff's background suggests the company is taking quality seriously. Traditional automakers have brutal quality control standards. If Lucid can import that discipline into its operations, the company will be better positioned to scale.

But here's the risk. Traditional automotive culture often conflicts with startup culture. Lucid was founded by people who wanted to disrupt the auto industry. That entrepreneurial energy is part of the company's DNA. Bringing in more traditional automotive executives could slow innovation or create cultural friction.

The ideal balance is combining Lucid's technical innovation with traditional automotive quality discipline. Whether management can achieve that balance is an open question.

Market Position: Luxury EV Segment Dynamics

The luxury EV market is changing rapidly. In 2021, when Lucid went public, competition was limited. Tesla dominated. European luxury brands like BMW and Mercedes were just beginning their EV transitions. Porsche had the Taycan, but it was niche.

Now, the competitive landscape is crowded. Porsche has expanded its EV lineup. BMW is serious about electric vehicles. Mercedes has multiple EV options. Audi is pushing the e-tron. Bentley is going electric.

Even more challenging, Tesla has proven that luxury EV customers will accept minimalist interiors, sparse options, and direct-to-consumer sales models. That's different from traditional luxury buyers' expectations. Tesla customers buy minimalism as a feature. They see it as honest, futuristic, and efficient.

Lucid's positioning is more traditional. The Air and Gravity both emphasize hand-crafted details, premium materials, and curated customization options. That appeals to luxury buyers, but it's harder to scale than Tesla's approach.

Geographically, Lucid has a unique advantage. The Saudi Public Investment Fund's backing gives Lucid real interest in the Middle Eastern market, where there's enormous demand for luxury vehicles. The company is also building manufacturing capacity in Saudi Arabia, which could eventually serve that region directly.

But globally, Lucid's market share remains tiny. The company delivered 15,841 vehicles in 2025 in a global EV market exceeding 15 million vehicles. That's 0.1% market share. Even in the luxury segment, Lucid is a footnote.

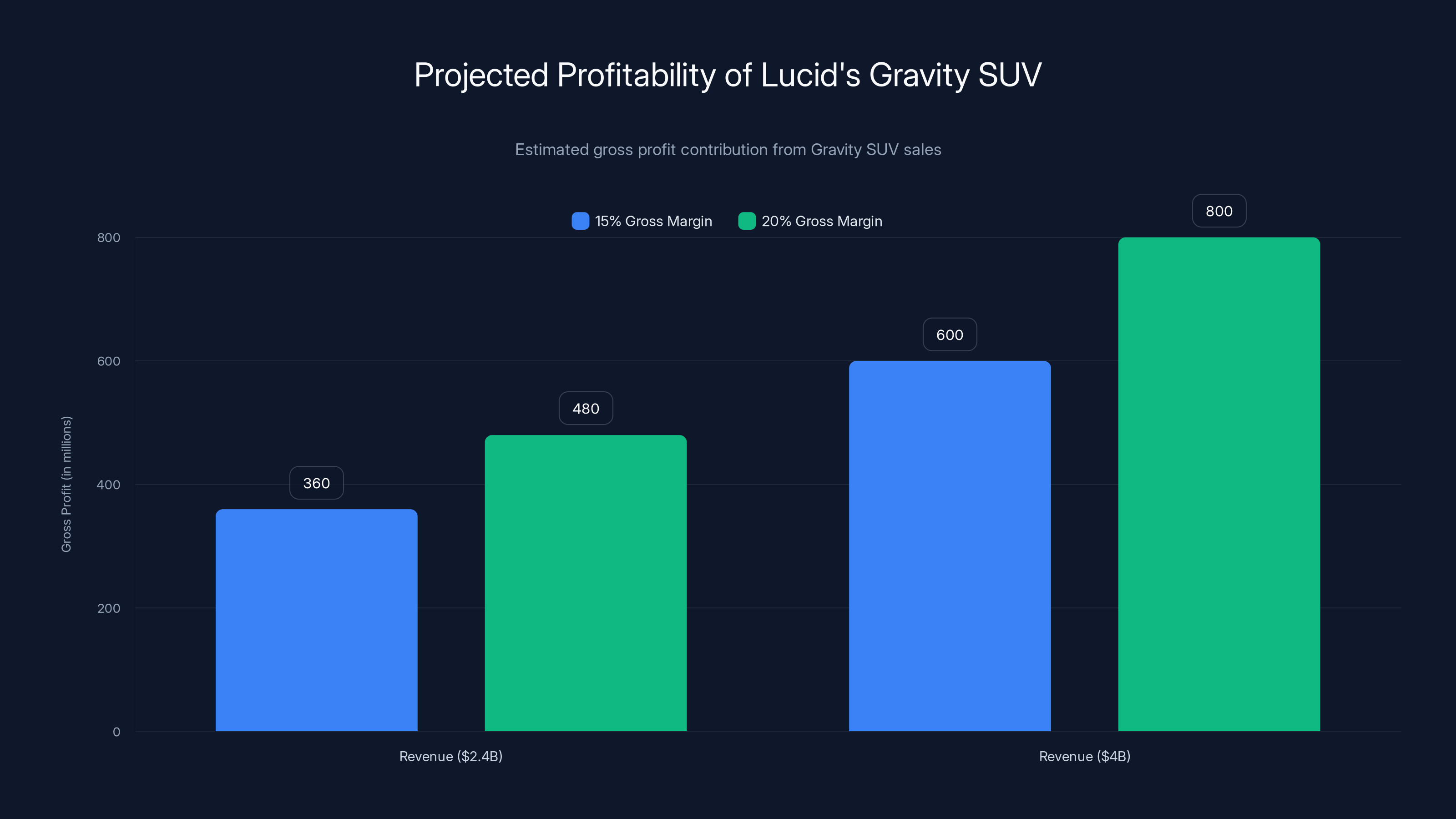

Estimated data shows that with a 15-20% gross margin, Lucid's Gravity SUV could contribute

Cash Burn and Financial Runway: The Looming Question

Lucid's fundamental problem isn't production or product. It's financial. The company is hemorrhaging cash.

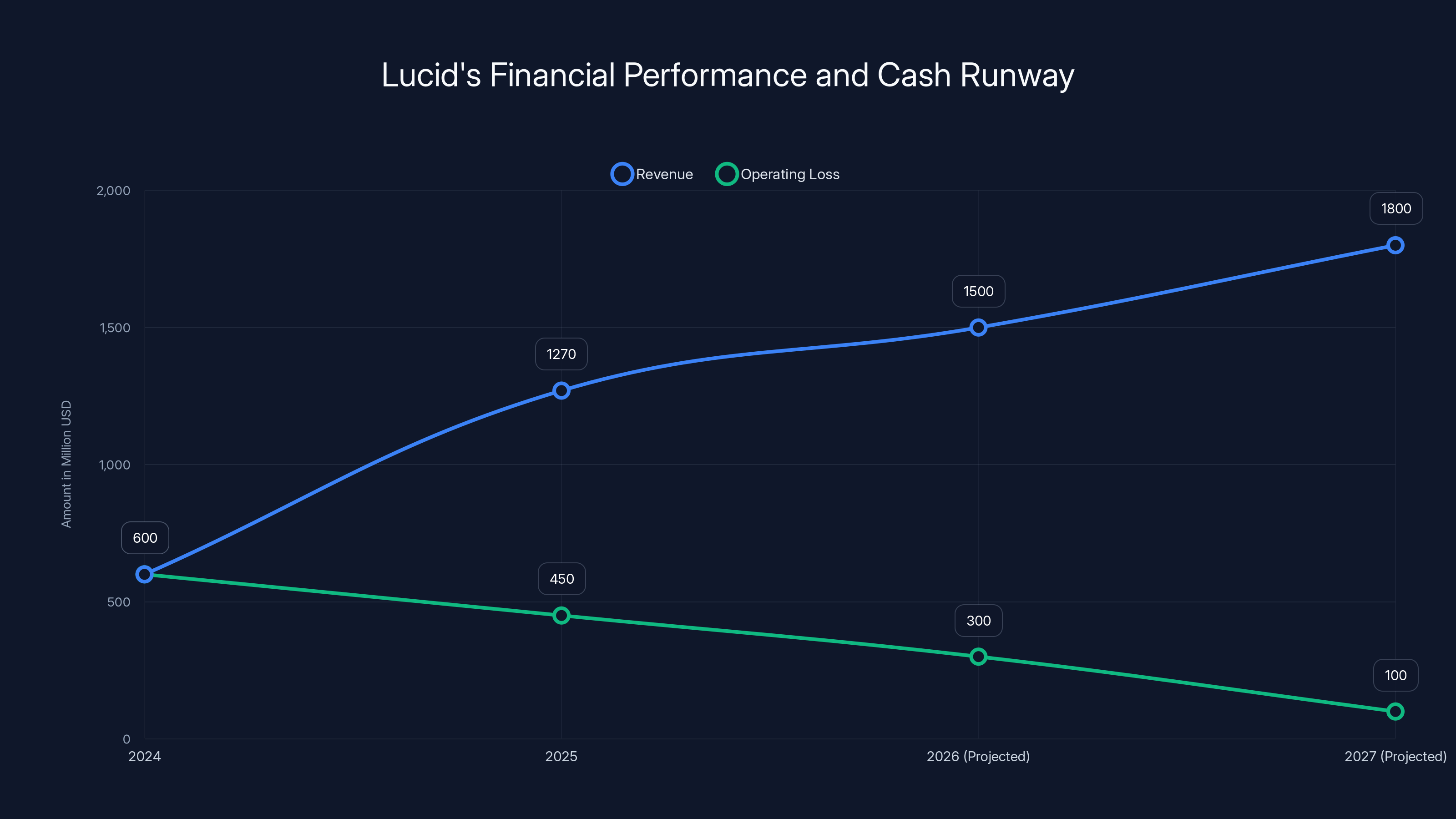

In 2024, Lucid's operating loss exceeded

In 2025, with roughly

Lucid has substantial backing from Saudi Arabia's PIF, which has provided over $5 billion in funding so far. That's a war chest, but even that money runs out. At current burn rates, Lucid might have 2-3 years of cash runway, depending on the company's Q1 2026 financial results.

The company needs to reach profitability or near-breakeven within a few years. That requires several things: continued production ramp, pricing discipline (which might be hard given competition), successful launch of the mid-sized EV (which should carry lower unit costs), and operational efficiency improvements.

One wildcard is whether Lucid might take additional capital infusions from PIF or other investors. Saudi Arabia's sovereign wealth fund has shown commitment to Lucid, possibly because of strategic interests (developing the auto industry, promoting Saudi Arabia's Vision 2030 agenda). If PIF decides to invest another $5 billion, Lucid's runway extends dramatically.

But relying on speculative future funding is risky. Lucid needs a clear path to profitability based on actual operations.

The Gravity's Unexpected Role in Profitability

Here's something that doesn't get discussed enough. The Gravity SUV, despite its early quality issues, might be Lucid's path to profitability.

The Air starts at over

First, larger vehicles generally have higher margins. You can charge more for an SUV than a sedan with comparable features. Consumers expect SUVs to cost more, so pricing power is higher.

Second, the Gravity is likely cheaper to produce than the Air in unit terms. SUVs are simpler architecturally. They don't require the same kind of ultra-low drag coefficient optimization. They can use simpler interior designs while still feeling luxurious.

Third, the Gravity addresses a larger addressable market. More consumers want SUVs than sedans. That higher demand should translate to higher production volume, which spreads fixed costs.

If Lucid can get Gravity production to 30,000-40,000 vehicles annually at

At that scale, if the company can achieve a 15-20% gross margin on Gravity vehicles (which is realistic for high-volume luxury vehicles), Gravity gross profit alone would cover a significant chunk of corporate overhead.

This is why Q4 2025's production surge to 8,412 vehicles matters. If that pace continues, Lucid could build 30,000-35,000 vehicles in 2026. Some will be Air, some Gravity, with an increasing share from the mid-sized EV platform later in the year.

Competitive Pressure: Tesla, Rivian, and Traditional Automakers

Lucid isn't just competing against other EV startups. The competitive environment includes Tesla, Rivian, and every traditional automaker that's investing billions in electric vehicles.

Tesla remains the elephant in the room. The Model S and Model X are proven products with massive installed bases. Tesla's brand loyalty is strong, and the company continues to innovate. Tesla can also adjust pricing aggressively to defend market share, something Lucid can't do without destroying its already-tight unit economics.

Rivian is in a similar position to Lucid: a well-funded EV startup trying to build volume while managing cash burn. The difference is that Rivian has Amazon as a major shareholder and customer, providing some revenue stability. Rivian also launched two vehicle categories (R1T pickup and R1S SUV) simultaneously, which is why the company is also struggling with profitability.

Traditional automakers like BMW, Mercedes, and Volkswagen have scale advantages. They can build EVs across multiple price points and still achieve economies of scale. They have established dealership networks, brand loyalty, and access to capital.

Lucid's advantages are technical expertise, brand prestige in certain segments, and sovereign wealth backing. That's not nothing, but it's not necessarily enough to guarantee success.

The real risk for Lucid is that it could get squeezed from both directions. Tesla could move downmarket with the mid-sized platform and undercut Lucid on price. Traditional luxury brands could fully transition to EV and leverage their brand heritage. Lucid would be caught in the middle.

Lucid's only real defense is differentiation through innovation. The company needs to offer features, performance, or efficiency that competitors can't match. The mid-sized EV's rumored 500+ mile range would be such a feature. If Lucid can deliver that at $50,000, it's genuinely competitive.

In 2025, Lucid built 18,378 vehicles but delivered only 15,841, showing a 13.8% gap. This indicates a strategic approach to inventory and production ramping.

Supply Chain Vulnerabilities and Battery Dependencies

Lucid's production is constrained by its battery suppliers. The company doesn't manufacture its own battery cells; it sources them from external suppliers, primarily Samsung and likely others through partnership agreements.

This is both a blessing and a curse. Not manufacturing batteries saves Lucid billions in capital expenditure and sidesteps the complexity of battery chemistry, manufacturing processes, and recycling. But it means Lucid is dependent on suppliers' production capacity and quality.

If Samsung's EV battery production faces delays, Lucid's production is impacted. If there's a defect in battery cells, Lucid has recall risk. If battery prices rise, Lucid's margins compress.

For the mid-sized EV platform, this supply chain risk is critical. The company needs hundreds of thousands of battery cells annually by 2028-2030. That requires either very long-term contracts with existing suppliers or securing supplies from new sources.

One possibility is that Lucid could eventually move toward cell manufacturing, either by building its own facility or through a joint venture with a supplier. That's expensive and takes years to implement, but it gives the company more control over supply and costs.

For now, Lucid is optimizing what it can control: production efficiency, assembly quality, and thermal management systems that make its vehicles more efficient, reducing per-vehicle battery demand compared to competitors.

International Expansion and Saudi Arabia's Role

The Saudi Public Investment Fund's involvement in Lucid is more than just financial backing. Saudi Arabia has strategic interests in developing domestic manufacturing and positioning itself as an EV powerhouse.

Lucid's announced plans include building manufacturing facilities in Saudi Arabia, potentially in the Neom megacity project. This isn't just about moving production overseas. It's about building regional capacity to serve Middle Eastern markets and positioning Saudi Arabia as an automotive hub.

This has implications for Lucid's long-term strategy. The company could eventually operate three manufacturing hubs: Arizona (North America), Saudi Arabia (Middle East and potentially Europe), and Mexico (likely for North America cost reduction).

International expansion also matters for brand positioning. Lucid in Saudi Arabia isn't just another American startup. It's a global brand with commitments to multiple regions. That lends credibility.

But international expansion also increases complexity. Currency fluctuations, regulatory differences, supply chain fragmentation, and geopolitical risks all come into play. Lucid needs to manage these carefully.

2026 Outlook: The Decisive Year

2026 will define Lucid's trajectory. The company is at an inflection point. Current trends suggest production will continue ramping, possibly to 25,000-30,000 vehicles for the year.

But several things need to happen. First, the company needs to avoid another Gravity-like quality crisis. One more product launch with significant issues could irreparably damage Lucid's brand.

Second, the mid-sized EV platform needs to launch on schedule with compelling product-market fit. If the vehicle is delayed or underwhelming, Lucid's growth story stalls.

Third, profitability or near-profitability needs to be visible on the horizon. Lucid can't be a perpetually cash-burning startup. Investors and stakeholders need evidence that the company can eventually operate sustainably.

Fourth, management stability matters. Marc Winterhoff has been positive for quality and discipline. Lucid needs continuity in leadership to execute the 2026 plan.

If these things happen, Lucid could emerge as a genuine competitor in the luxury EV space, with a path to scaled production. If they don't, the company could face existential challenges within 18-24 months.

Lucid's revenue is projected to increase from

Lessons for the EV Industry

Lucid's journey offers lessons that extend beyond the company itself. The broader EV industry is learning that scaling production is exponentially harder than designing great vehicles.

First, wildly optimistic projections destroy credibility. Lucid's 2021 promises set expectations that were never realistic. Every automotive company now makes conservative projections, essentially baking in a safety margin. This makes growth announcements less exciting but more believable.

Second, quality issues at scale are amplified in the social media age. The Gravity's early software problems were serious but fixable. But they generated negative press that took months to overcome. Traditional automakers built quality buffer into their reputations; startup EV makers don't have that buffer.

Third, the path from prototype to volume production requires different expertise. Lucid brought in traditional automotive executives like Winterhoff because startup founders and engineers don't naturally optimize for scaled manufacturing. The company needed that expertise.

Fourth, battery supply chains are the real constraint. Every EV maker is bottlenecked by battery availability and cost. Companies that can optimize battery efficiency (vehicles that go further on the same battery) gain a competitive advantage.

Fifth, capital efficiency matters enormously. Lucid has spent over $5 billion to reach 15,000 annual production. For comparison, Tesla spent roughly that amount to reach 1.8 million annual production. Lucid's capital efficiency is far worse, which limits how many years the company can sustain operations.

Financial Model and Path to Break-Even

To understand Lucid's future, we need to model when the company reaches profitability.

Assume the following:

- 2026 deliveries: 25,000 vehicles

- Average selling price: $75,000 (weighted average of Air, Gravity, and some MID)

- Gross margin: 12% (improving from current negative territory)

- Operating expenses: $600 million annually (fixed costs)

Using this model:

Revenue: 25,000 ×

Lucid would still be losing money, but the loss would be shrinking. To reach break-even at $600 million fixed costs with a 12% gross margin, the company would need:

So Lucid needs to deliver approximately 67,000 vehicles annually at current ASP and gross margin to break even. That's achievable if the company can ramp to that level by 2027-2028.

The variable that matters most is gross margin. As production volume increases, fixed manufacturing costs are spread across more vehicles, improving margins. Additionally, supply chain optimization and process improvements will reduce per-vehicle costs.

If Lucid can achieve a 15-18% gross margin by 2028 (realistic for luxury manufacturers at scale), the break-even point drops to around 35,000-40,000 vehicles annually, which is achievable.

The PIF Wildcard: How Saudi Arabia Could Change the Outcome

The Saudi Public Investment Fund has already committed over

Additional capital would provide several benefits. First, extended runway to profitability without forced asset sales or desperation moves. Second, ability to invest in manufacturing facilities more aggressively. Third, capital to expand into adjacent markets (software, autonomous driving, charging infrastructure).

The risk is that massive capital infusion could blunt management's incentive to become profitable. If PIF will keep funding losses indefinitely, management might lose urgency about unit economics. That would be unhealthy.

But PIF is a sophisticated investor. It likely has demanding governance provisions and clear milestones that Lucid must hit to receive additional funding. That discipline could actually force the company to execute.

Conclusion: Lucid's Survival Is Likely; Success Is Uncertain

Lucid Motors survived 2025. The company didn't collapse, didn't run out of cash, and didn't get acquired at a distressed price. That alone is an achievement in the brutal world of automotive manufacturing.

The company doubled production, improved quality, and positioned the launch of the mid-sized EV platform. If Lucid can execute on that launch in 2026-2027, the company has a legitimate path to scaled production and eventual profitability.

But legitimate path doesn't equal certainty. Lucid is still a risky investment. The company is capital-intensive, capital-constrained, and operating in an increasingly competitive market. Management execution matters enormously, and there's limited margin for error.

For investors and industry observers, Lucid is the middle-ground case: neither Tesla-like success nor outright failure. The company has real technology, real backing, and real momentum. But it also has real constraints, real competition, and real execution risks.

The next 18 months will be decisive. If Lucid launches the mid-sized EV platform successfully and continues production ramp without major quality issues, the company could achieve genuine scale by 2028-2030. If either of those things fails, Lucid could face existential challenges.

The luxury EV market proved that consumers will buy premium electric vehicles. Lucid's Air demonstrated that. But the mass-market EV segment is where fortunes are made and broken. Lucid's mid-sized platform will determine if the company is capable of competing at scale. Based on 2025 progress, the odds are better than they were. But they're still uncertain.

Lucid went from a company making audacious promises in 2021 to a company learning to execute in 2025. That's progress. Whether it's enough progress depends on what happens next.

FAQ

What is Lucid Motors and why is the company important?

Lucid Motors is an American luxury electric vehicle manufacturer founded in 2007 and taken public via a $4 billion reverse merger in 2021. The company is important because it represents one of the few well-funded EV startups attempting to compete with Tesla in the luxury segment while eventually targeting the mass market. With backing from Saudi Arabia's Public Investment Fund, Lucid's success or failure has implications for the EV startup ecosystem and the competitive landscape against both Tesla and traditional automotive manufacturers.

How did Lucid achieve 18,378 vehicles built in 2025 after early struggles?

Lucid doubled production through several factors: addressing Gravity SUV software issues through targeted updates and customer service, optimizing the Casa Grande Arizona facility's production processes, and ramping manufacturing capability across both the Air and Gravity platforms. Management changes, including hiring automotive veteran Marc Winterhoff as interim CEO, brought disciplined manufacturing expertise that improved production scheduling and quality control, allowing the company to achieve its strongest quarterly output of 8,412 vehicles in Q4 2025.

Why did Lucid's 2025 projections fall so far short of 2021 promises?

The 2021 projections of 135,000 deliveries proved unrealistic due to multiple compounding factors: supply chain disruptions from the pandemic limited battery availability, consumer demand for luxury EVs proved smaller than initially estimated, manufacturing complexity increased during the Gravity platform launch, and production scaling proved slower than anticipated. Additionally, software quality issues in early 2025 required remediation resources that limited production ramp speed, though these were substantially resolved by year-end.

What is the Gravity SUV and why is it important to Lucid's future?

The Gravity is Lucid's luxury three-row SUV starting at approximately $80,000, representing the company's entry into the high-volume SUV segment where consumer demand is significantly larger than the luxury sedan market. The Gravity is critical to Lucid's future because SUVs offer better scaling potential, higher profit margins, and access to a broader addressable market than the Air sedan. Despite early software issues, the Gravity's increasing production volume contributed substantially to 2025 results and will be essential for achieving profitability.

When will Lucid launch its mid-sized EV platform and who will it compete with?

Lucid plans to launch its mid-sized EV platform in late 2026 or early 2027, with pricing targeted at approximately

What are Lucid's cash burn rate and profitability timeline?

Lucid's cash burn in 2024 exceeded

How does the Saudi Public Investment Fund's involvement impact Lucid's prospects?

The Saudi PIF has already committed over $5 billion to Lucid and has demonstrated continued backing despite the company's challenges, providing a financial runway that most EV startups lack. The PIF's involvement also positions Lucid as a strategically important company for Saudi Arabia's Vision 2030 diversification goals and future manufacturing plans. However, while PIF backing improves Lucid's survival probability, it doesn't guarantee success—additional capital infusions may be needed to reach profitability, and they're contingent on the company meeting specified operational milestones.

What quality and software challenges did Lucid face with the Gravity SUV?

Early 2025 Gravity deliveries experienced lingering software problems that affected customer experience, including infotainment glitches, unexpected system shutdowns, and various reliability issues. CEO Marc Winterhoff publicly acknowledged these problems in a December 2024 customer email, committing the company to rapid resolution. By mid-2025, the company had deployed software updates and quality improvements that resolved most issues, enabling the significant production ramp in Q4 without quality degradation, demonstrating that the problems were addressable rather than fundamental design flaws.

What is Lucid's current market share in the global EV market?

Lucid delivered 15,841 vehicles in 2025 in a global EV market exceeding 15 million vehicles, representing approximately 0.1% market share. Even within the luxury EV segment, Lucid's share is minimal compared to Tesla, traditional luxury manufacturers like BMW and Mercedes, and competitors like Rivian. However, this small base combined with 55% year-over-year growth from 2024 suggests the company is gaining momentum in its niche.

What competitive advantages does Lucid have against Tesla and traditional automakers?

Lucid's competitive advantages include technical expertise in battery efficiency and thermal management, a luxury brand identity that appeals to premium consumers, sovereign wealth backing that provides capital stability, and design differentiation through premium interior materials and curated customization options. However, these advantages are offset by Tesla's manufacturing scale and cost advantages, traditional manufacturers' brand heritage and distribution networks, and the broader competitive pressure across all price segments as the EV market matures and becomes increasingly crowded.

Key Takeaways

Lucid Motors doubled production to 18,378 vehicles in 2025, with 15,841 deliveries representing a 55% increase over 2024, demonstrating meaningful operational progress after early-year Gravity SUV quality issues that management successfully resolved through software updates and quality improvements. Despite this improvement, 2025 deliveries fell 88% short of Lucid's 2021 projection of 135,000 vehicles, highlighting the gap between startup optimism and manufacturing reality in the automotive industry. The company's path forward depends critically on successful launch of its mid-sized EV platform at the

Related Articles

- Sony Honda Afeela CES 2026: How to Watch & What to Expect [2025]

- Sony Honda Afeela CES 2026 Press Conference: Complete Guide [2025]

- Tesla Loses EV Crown to BYD: Market Shift Explained [2025]

- Tesla Q4 2025 Sales Collapse: Why the EV Leader Lost Its Edge [2025]

- How to Watch Hyundai's CES 2026 Presentation Live [2025]

- Sony Honda Afeela CES 2026 Press Conference: Complete Watch Guide [2025]

![Lucid Motors Production 2025: From Crisis to 18K EVs [2026]](https://tryrunable.com/blog/lucid-motors-production-2025-from-crisis-to-18k-evs-2026/image-1-1767632932295.jpg)