Meta Acquires Manus: The AI Agent Revolution Explained

When Meta announced its acquisition of Manus in late 2024, the tech world collectively paused. This wasn't just another startup swallowed by a big tech company. This was Meta making a decisive bet on the future of AI, and frankly, it changes everything we thought we knew about where artificial intelligence is heading.

Let me be straight with you. For the past year, AI has been dominated by one conversation: large language models. Chat GPT, Claude, Gemini. The chatbots. Everyone's been focused on what these models can talk about, not what they can do. But Manus represented something different. A Singapore-based startup that quietly emerged in early 2024 and immediately captured the imagination of engineers, operators, and business leaders alike. Manus built AI agents that don't just chat. They act. They navigate interfaces, complete tasks, make decisions autonomously across systems.

Then Meta pulled the trigger and bought them.

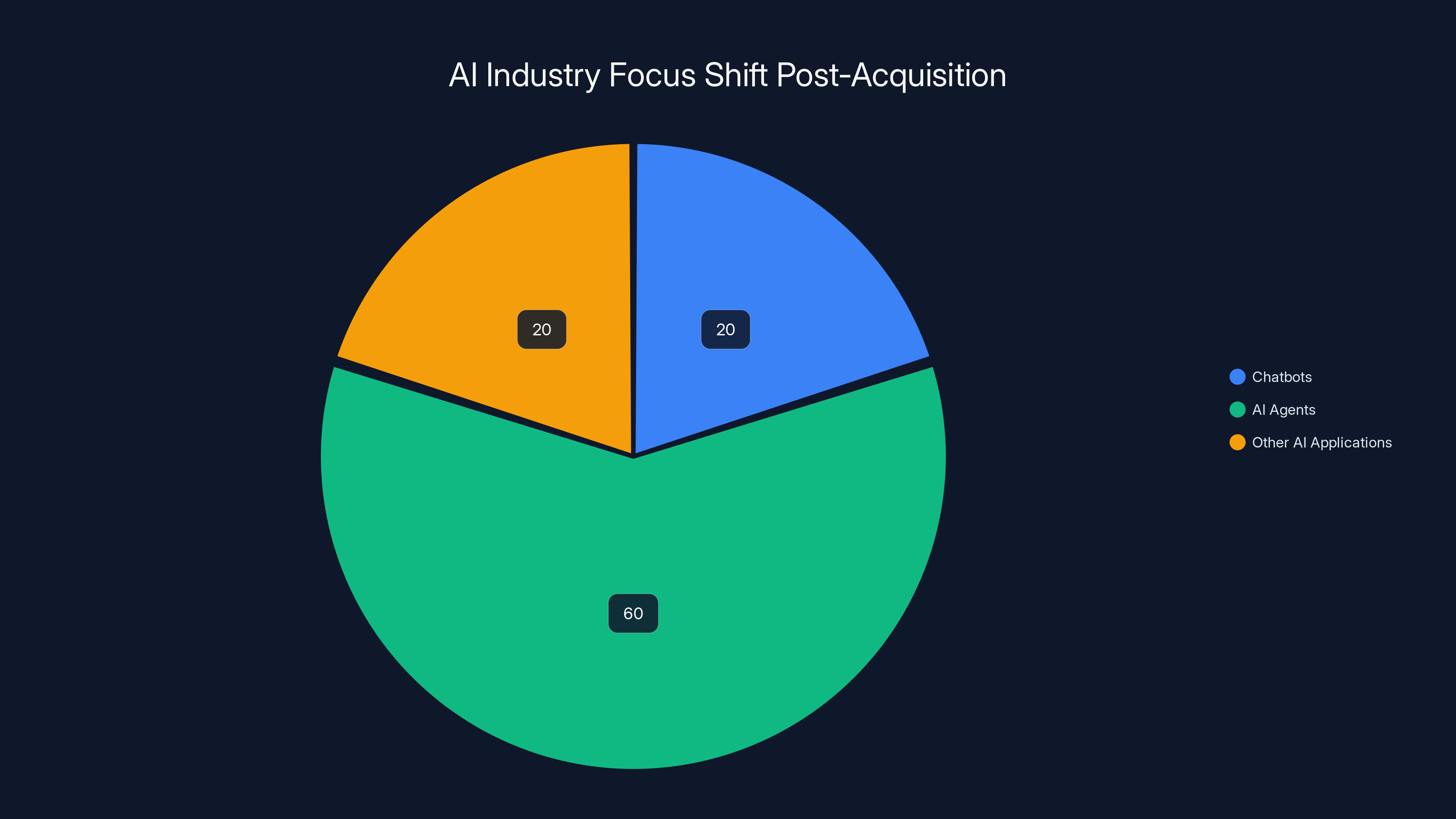

Why does this matter? Because it signals that the era of interactive chatbots is ending. The next era belongs to agents that work for you while you do something else. Agents that manage your calendar, automate your workflows, handle customer support, generate reports, coordinate between systems. Autonomous, capable, tireless.

This isn't speculation or hype. This is a major technology company betting billions of dollars that this is the direction the industry is moving. And when Meta moves, everyone watches.

Understanding the Manus Acquisition: What Actually Happened

Let's establish the facts first, because there's been a lot of noise around this deal. Meta acquired Manus, a startup founded by exceptionally talented engineers and focused on building AI agents that could perform complex tasks autonomously. The deal, while not publicly disclosed in terms of valuation (though estimates circled in the hundreds of millions), represented a significant commitment to a very specific vision of AI's future.

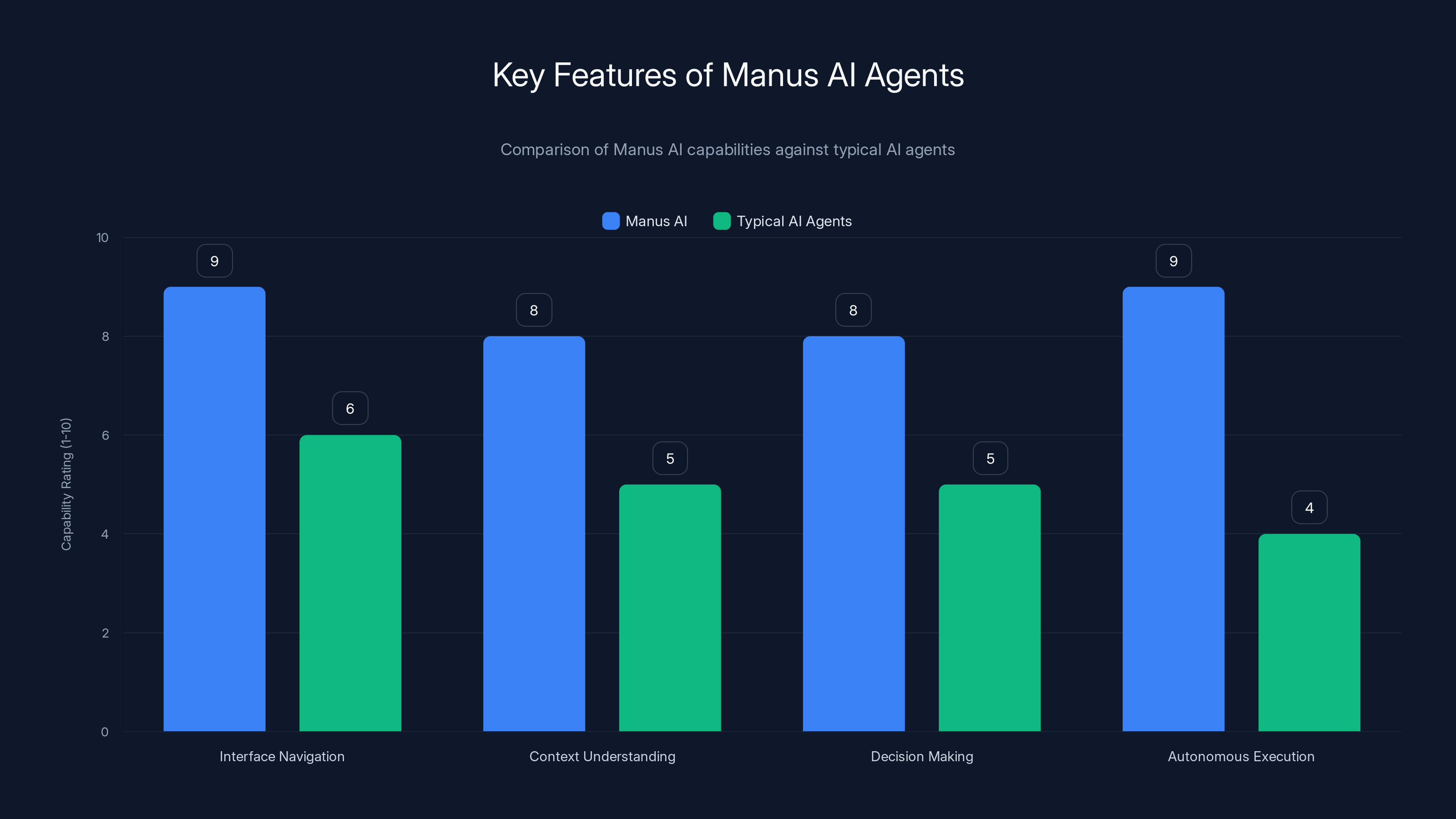

Here's what made Manus special compared to dozens of other AI startups pitching agents at the time. Manus had actually built something that worked. Their agents could navigate complex user interfaces, understand context across multiple systems, make intelligent decisions about what to do next, and execute tasks without constant human intervention. They weren't perfect. No AI system is. But they demonstrated genuine autonomy in ways that felt different from the chatbot paradigm everyone was obsessed with.

The acquisition announcement came with a commitment from Meta to maintain Manus's existing services while accelerating product development under Meta's infrastructure. This is important. Meta didn't kill Manus. They absorbed it. They wanted the team, the technology, and the vision.

Why would Meta care so much about autonomous agents right now? Because they're looking at the same future everyone else is: a world where AI systems work independently, without needing human prompts and responses every few seconds. A world where you give your AI agent a goal and it figures out the steps, interacts with the systems needed, and reports back when it's done. This is the holy grail of AI application, and it's significantly more valuable than a chatbot.

The timing also matters. Meta's been under pressure from investors and users to demonstrate that AI integration means something more than "we added a chatbot." Acquiring Manus let them say, "No, we're building infrastructure for autonomous agents at scale." That's a much more compelling story for both enterprise customers and venture capital.

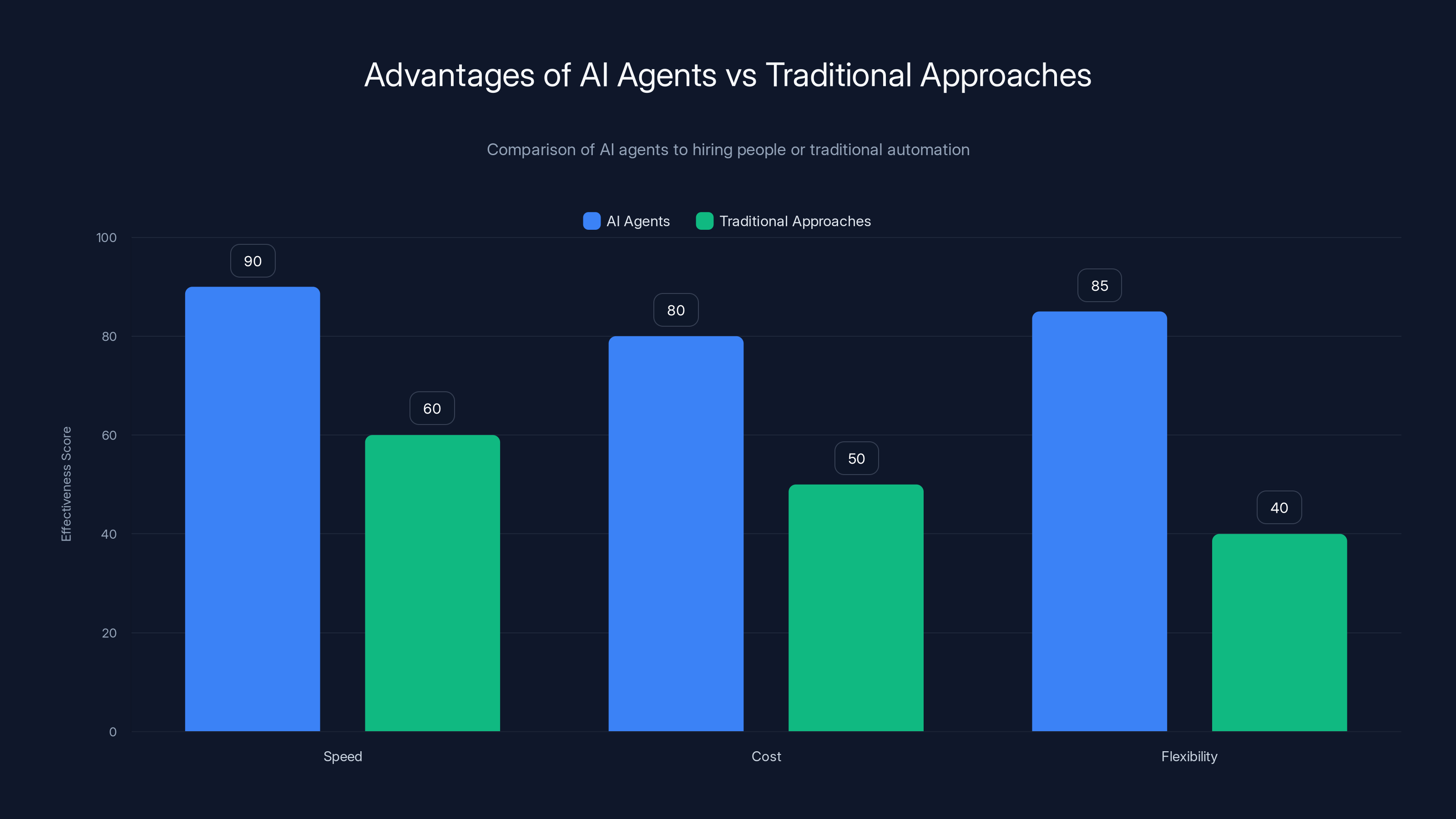

AI agents outperform traditional approaches in speed, cost efficiency, and flexibility, with significant improvements in each area. Estimated data based on typical benefits.

The State of AI Agents Before Meta's Move

To understand why this acquisition was significant, you need to understand the landscape of AI agents in 2024. The space was fractured and experimental. You had research papers describing theoretical agent architectures. You had startups building specialized agents for specific tasks. You had open-source projects attempting to create general-purpose agent frameworks. But very few companies had actually built working agents that could handle real, complex tasks in production environments.

Most AI companies in 2024 were still thinking in terms of the Open AI model: you prompt, the AI responds, you prompt again. Iterative interaction between human and machine. It works great for some use cases. Writing assistance, code generation, brainstorming. But for automation? For handling multi-step workflows that span different systems and require decision-making? That paradigm breaks down.

What Manus understood, and what they built toward, was something different. An agent needed to be able to see a screen (or understand an API), decide what action to take next based on what it was seeing, execute that action, observe the result, and iterate. Autonomously. Without waiting for a human to read a response and decide what to do next.

This requires several things to come together. First, multimodal understanding. The agent needs to process text, images, data, and understand how they relate. Second, planning capabilities. The agent needs to break down a complex goal into sub-goals and figure out the sequence of actions. Third, tool use. The agent needs to be able to interact with external systems, APIs, and interfaces. Fourth, error handling and recovery. When things go wrong (and they will), the agent needs to understand what went wrong and either fix it or escalate appropriately.

Manus had built all of this. And they'd done it in a way that actually worked reliably enough for real businesses to use. That's rare. Most agent projects in 2024 still needed significant human oversight. Manus's agents could operate with much less.

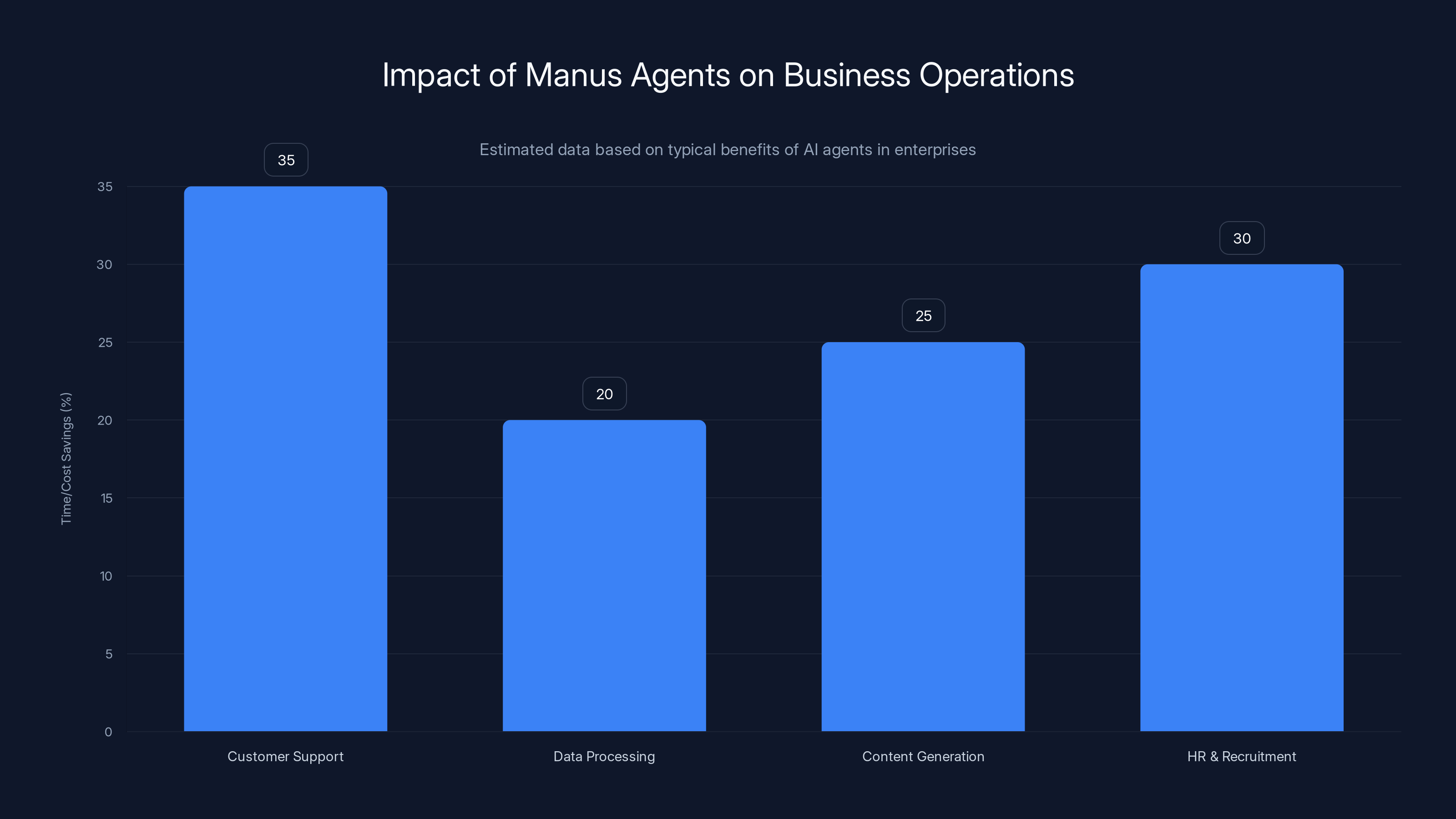

Manus agents significantly reduce time and costs across various business functions, with customer support seeing up to 35% savings. Estimated data based on typical benefits.

Why Meta Needed This Acquisition

Meta's been in a weird position in AI. They have world-class researchers and engineers. They've contributed significantly to open-source AI development with models like Llama. But their AI products for end-users have been... underwhelming. A chatbot in your Messages app isn't moving the needle. Generative AI features in creative apps don't change the business model. Meta needed something that would make people actually care about AI as an agent, not just as a tool you interact with occasionally.

Broadly, Meta faces three strategic imperatives that Manus solves for. First, enterprise revenue. Consumer AI is a commodity right now. Every major tech company has a chatbot. But enterprise customers will pay significantly for AI agents that actually automate their operations. That's a real business. Second, defensibility. An LLM-only strategy is defensible for only so long. Everyone's building better models. But an agent platform with specialized knowledge, good tooling, and deep system integration is much harder to copy. Third, future positioning. If agents become the dominant form of AI interaction (which seems likely), Meta needs to be a player in that world or they're relegated to being an LLM provider like everyone else.

Acquiring Manus solved all three problems at once. Manus had demonstrated that general agents were possible. Their team had the expertise to scale them. And their roadmap showed a path toward real enterprise value. From Meta's perspective, this was a no-brainer acquisition that positioned them in the center of where AI is actually headed.

There's also the timing element. In late 2024, the AI world was starting to ask harder questions about what comes after chat. Anthropic was researching computer use capabilities. Open AI was exploring agents. Google was integrating agents into their business tools. Meta couldn't afford to be left behind in that conversation. Manus gave them a credible seat at the table.

The Technology Behind Manus Agents

Understanding what makes Manus different requires understanding how their agents actually work. This isn't magic, but it's sophisticated engineering that took significant time to develop correctly.

At the core, Manus agents operate on what's sometimes called a "see-think-act" loop. An agent observes its environment (a screenshot, an interface state, current data), processes that observation through AI models, thinks about what action to take next based on the goal it's been given, and executes that action. Then it loops back and observes the result.

Here's a concrete example. Imagine you give a Manus agent this task: "Schedule a meeting with the marketing team for next Tuesday at 2 PM to discuss Q1 campaign strategy." The agent needs to do several things. First, understand the goal (schedule a meeting). Second, figure out what systems are available (calendar system, contact system, email). Third, access those systems (usually through APIs or interface automation). Fourth, search for available times next Tuesday. Fifth, check the calendar for the team members. Sixth, send calendar invites. Seventh, potentially send a follow-up email with context.

A chatbot can describe how to do this. Manus agents can actually do it.

The technical architecture supporting this is what Meta really acquired. Manus had built systems for reliable agent execution, error detection, recovery mechanisms, and optimization. They'd solved problems around token efficiency (agents that use too many tokens become expensive). They'd engineered solutions for maintaining context across long operation sequences. They'd developed methods for letting agents learn from failures and improve their strategies.

One particularly important technical challenge Manus solved was the integration problem. Most real-world tasks don't happen in one system. They require moving between different applications, APIs, and interfaces. Some of those are well-documented with clean APIs. Others are legacy systems with limited interfaces. Manus built abstraction layers that let agents work across this fragmented landscape without needing custom engineering for every single integration.

Another critical piece is safety and control. An autonomous agent that can take actions in your systems is powerful but also potentially dangerous. Manus built in safeguards. Agents don't have unlimited capabilities. They operate within defined boundaries. They escalate to humans when decisions get sufficiently important. They maintain audit trails so you can always see what they did and why. This is table-stakes for any agent system that actually operates on real businesses.

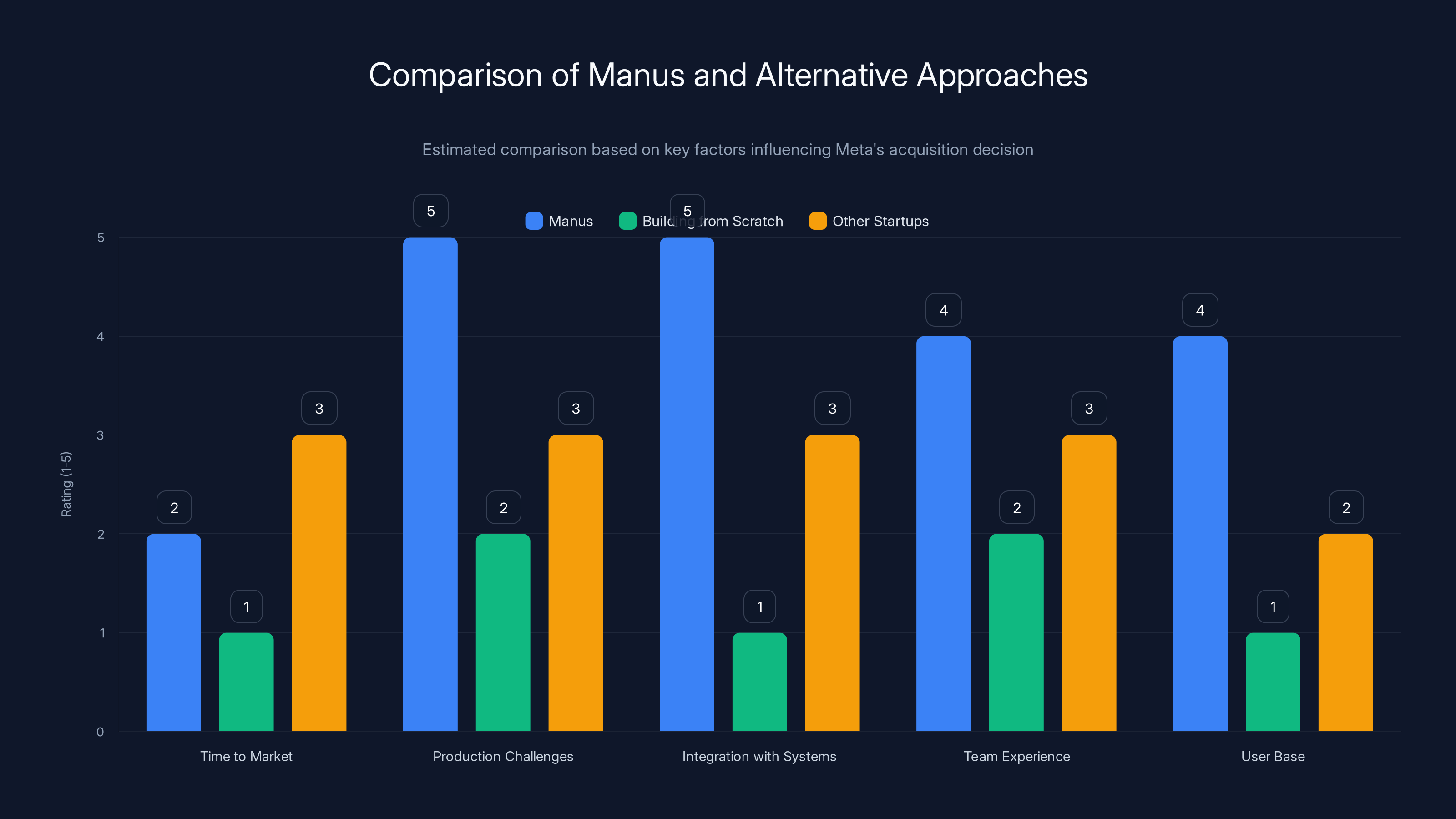

Manus outperforms other approaches in production challenges and integration, making it an attractive acquisition for Meta. Estimated data.

Market Impact: What This Acquisition Signals

When Meta acquires a company the size and strategic importance of Manus, it sends shockwaves through the industry. Investors immediately start re-evaluating their bets. Companies re-examine their roadmaps. Startups either celebrate if they're similar (investors will fund more like this) or panic if they're in a different direction (investors will pressure them to pivot or get acquired).

The immediate market impact was clear. Every investor who'd been funding chatbot companies immediately asked themselves, "Do we need to shift to agents?" Agent-focused startups suddenly became attractive acquisition targets. Companies like Anthropic, already thinking about agents, doubled down on those research efforts. Open AI, which had been more chatbot-focused, started increasing investment in agent capabilities. The whole industry felt a nudge in a particular direction.

But there's a broader signal here too. The acquisition of Manus by Meta, combined with similar moves by other major tech companies, signals that we're moving from an era where AI is something you interact with, to an era where AI is something that works for you. This is a fundamental shift in how AI gets applied to real-world problems.

In the era of chatbots, AI adoption meant: you have a problem, you ask the AI, the AI gives you an answer, you figure out what to do with it. In the era of agents, AI adoption means: you have a problem, you give it to your AI agent, the agent solves it and comes back with the result. Simpler for the user. More valuable from a business perspective. Much harder to build correctly.

This shift has implications for every industry. Customer service teams will have AI agents handling entire conversations and transactions autonomously. Finance departments will have agents reconciling accounts, processing transactions, and generating reports. Software development teams will have agents that can actually write code, run tests, and deploy changes. Marketing teams will have agents creating content, managing campaigns, and optimizing ad spend.

Meta acquiring Manus was a signal that this future is imminent and that major technology companies are taking it seriously. Not eventually. Not in some theoretical timeframe. Now.

Integration Into Meta's AI Strategy

Understanding how Manus fits into Meta's broader AI strategy requires looking at Meta's existing infrastructure and commitments. Meta has been investing heavily in AI infrastructure, particularly around their Llama language models and their underlying AI compute capabilities.

Manus fills a specific gap in Meta's stack. While Meta has strong language models and computational infrastructure, they'd been missing a high-quality agent execution platform. By acquiring Manus, Meta gets the engineering expertise, the battle-tested architecture, and the proven ability to run agents in production at scale.

The integration happened in a thoughtful way. Meta didn't immediately shut down Manus or force it onto Meta's infrastructure. Instead, Meta let Manus continue operating as a product while accelerating development under Meta's resources. This is smart because it allows Manus to maintain its user base and continue generating revenue while being rebuilt and enhanced with Meta's engineering horsepower.

Over time, we'll likely see Manus technology increasingly integrated into Meta's broader offerings. Manus agents might power more sophisticated AI features in WhatsApp, Instagram, and Facebook. Manus technology might form the foundation for AI agent offerings in Meta's workplace products. Manus infrastructure might support new applications entirely that Meta hasn't announced yet.

The key insight is that Meta didn't acquire Manus to kill it. They acquired Manus because they believe autonomous agents are genuinely important to their future and they needed the team and technology to compete in that space. This is a long-term strategic investment, not a short-term financial play.

Manus AI agents excel in autonomy and decision-making compared to typical AI agents, making them a valuable acquisition for Meta. Estimated data based on industry insights.

Enterprise Applications: Where Manus Agents Create Real Value

Talking about agent technology in the abstract is fine, but what actually matters is real-world application. Where do businesses use AI agents and what value do they generate?

Customer support is perhaps the most obvious application. A Manus agent can handle customer inquiries by accessing your ticketing system, checking your knowledge base, looking up customer history, and either solving the problem or routing it to a human with full context. This works 24/7, doesn't get tired or cranky, and handles routine issues while humans focus on complex problems. The result is faster resolution times, better customer satisfaction, and lower support costs. We're talking 30-40% reduction in support ticket volume in many cases, with most of the remaining tickets being routed directly to humans who can solve them because the agent already did all the research.

Data processing and analysis is another massive area. Finance teams spend hours pulling data from multiple systems, cleaning it, creating reports, and distributing them. A Manus agent can do all of this autonomously. Extract data from your ERP system, validate it, run calculations, create visualizations, and email the report to stakeholders every Friday morning. No human intervention needed. This saves finance teams 10-15 hours per week for smaller companies, potentially hundreds of hours for larger organizations.

Content generation at scale is becoming feasible with agents. A Manus agent could monitor your product database, customer feedback channels, and current events, then automatically generate blog posts, social media content, and marketing emails. This isn't just templating. With proper configuration, agents can create genuinely useful content that requires minimal human review before publishing.

Human resources and recruitment benefit significantly from agents. Resume screening, initial candidate assessment, interview scheduling, offer letter generation, onboarding checklist execution. All of this can be automated. An HR agent could handle 80% of recruitment workflow without human involvement, escalating only the most promising candidates or the most complex situations to actual people.

Operations and logistics involves constant coordination between systems. A Manus agent can monitor inventory, check demand forecasts, coordinate with suppliers, manage shipping logistics, and optimize routes. The result is faster delivery times, lower inventory holding costs, and better utilization of resources.

The common thread here is that agents create value not by replacing humans, but by handling the routine, automatable parts of complex processes so humans can focus on the parts that require judgment, creativity, or personal interaction. The math on this is compelling for businesses, which is why enterprise adoption of agents will likely accelerate significantly now that Meta is backing the space.

Competition and Market Positioning

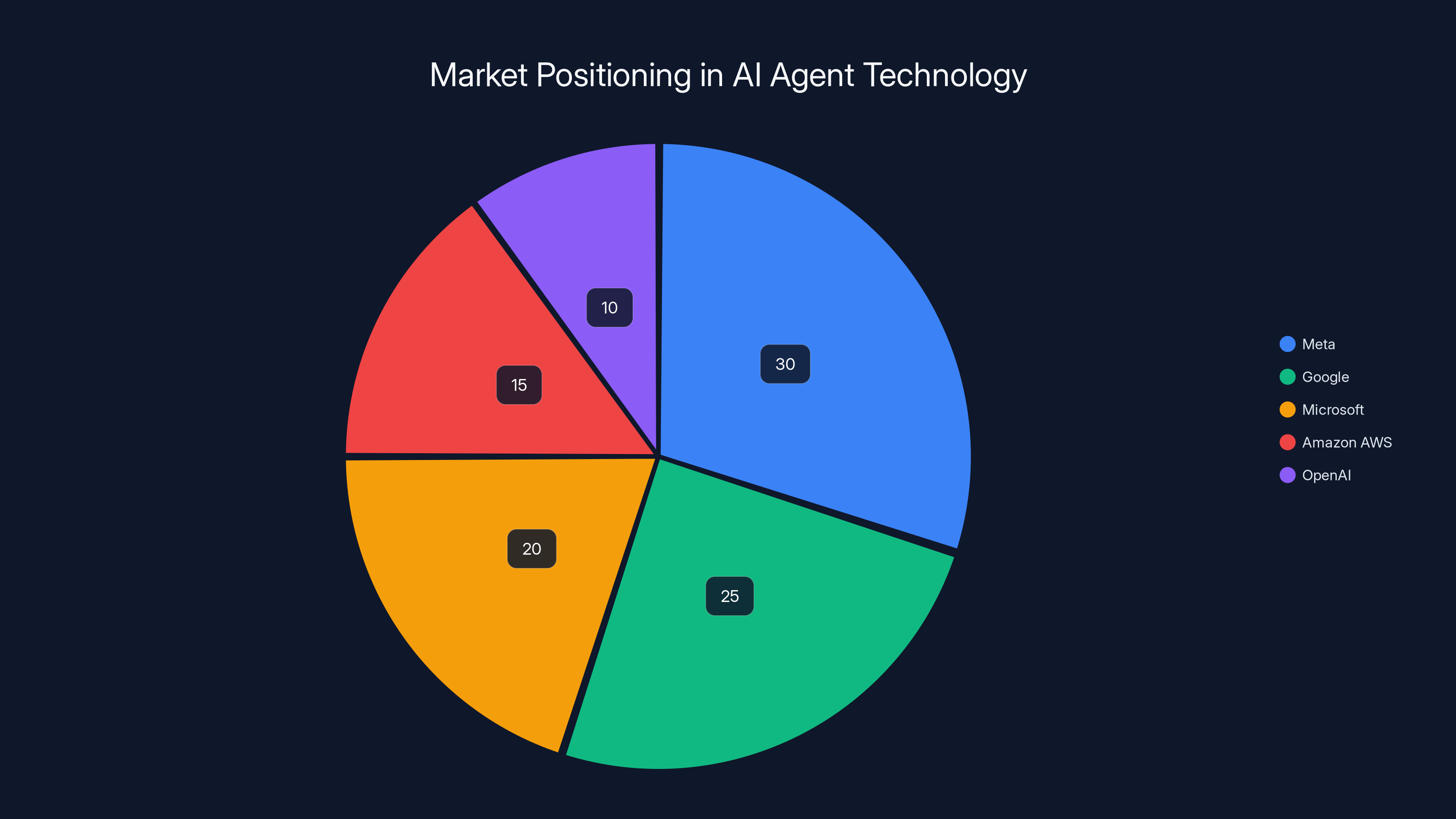

Meta's acquisition of Manus immediately raised a question for everyone else: "How do we compete?" The answer isn't trivial because Manus had already solved a lot of hard problems and had significant momentum.

For established companies, the response was generally to accelerate existing agent roadmaps. Google had already been integrating agents into their enterprise products like Workspace. They doubled down on that. Microsoft was embedding AI capabilities into their Office suite. They expanded that vision to include more agent-like functionality. Amazon AWS, which has been relatively quiet on consumer AI, started making more noise about agents for enterprise customers.

For other startups, the acquisition was both a threat and an opportunity. A threat because some of the talented people working on agents would now be at Meta. An opportunity because investor appetite for agent technology increased dramatically. Several other agent-focused startups saw funding rounds increase or received acquisition offers from other major tech companies.

Open AI's response was particularly interesting. Open AI has always been cautious about positioning themselves as a platform company rather than a product company. But the success of Manus and Meta's investment in agents pushed Open AI to lean harder into their API and developer platform strategy, positioning their language models as the foundation for other companies' agent systems.

But here's the crucial thing: this isn't winner-take-all territory. The market is large enough for multiple successful approaches. Meta doesn't need to be the only company building agents. They just need to be a credible player and to integrate agent capabilities into their existing products in ways that generate value for users and revenue for Meta.

The competitive dynamics here will play out over the next 2-3 years. Companies that move fast, integrate agents into real products, and demonstrate genuine business value will win. Companies that move slowly or talk about agent technology without shipping anything real will lose. Meta, with their resources and Manus's expertise, is in a strong position. But they're not running unopposed.

The acquisition of Manus by Meta is estimated to shift the AI industry focus towards AI agents (60%), reducing emphasis on chatbots (20%) and maintaining other AI applications (20%). Estimated data.

The Broader Implications for AI Development

The Manus acquisition sits within a broader trend in AI development that's worth understanding. For the past two years, the narrative around AI has been increasingly dominated by the idea that bigger models with more parameters would automatically solve more problems. Bigger models do solve some problems. But the Manus success suggests that execution and integration might matter just as much as raw model capacity.

Manus didn't build the best language model in the world. They built great agent architecture and integration capabilities on top of existing models. This is a meaningful shift in how people think about AI advancement. It's not all about the next breakthrough in model architecture. Sometimes it's about solving engineering challenges, building good abstractions, and creating systems that reliably work in the real world.

This has implications for how AI development will progress. You're going to see more specialization. Fewer companies trying to do everything (build models and applications and infrastructure and sales) and more companies focused on specific layers (infrastructure, tooling, applications, integration). This is healthy because it allows each company to focus on what they're best at.

The Manus acquisition also signals that research breakthroughs matter less than product execution for many AI applications. This might sound heretical if you've been following AI news for the past year. But think about it realistically. In most business contexts, a system that works reliably and integrates well with existing tools will generate more value than a cutting-edge model that's harder to deploy and doesn't integrate with anything. Meta betting on Manus is Meta betting that integration and reliability matter more than bleeding-edge research for enterprise applications.

This doesn't mean research stops being important. It means the calculus around what kind of research gets funded and developed is shifting. Research that creates better tools for builders becomes more valuable. Research on better alignment and safety of agents becomes critical because autonomous systems that make mistakes are worse than interactive systems. Research on efficient inference and optimization becomes crucial because agent operations can be expensive if not done efficiently.

Practical Implications for Businesses

Let's talk about what this means if you're running a business. The Manus acquisition and Meta's movement toward agents creates both opportunities and pressures.

Opportunities: Agent technology is becoming more sophisticated and more accessible. In 18 months, businesses that currently rely on expensive custom automation (RPA, custom scripts, consultants) might be able to accomplish similar things with an agent system that's easier to update and more flexible. If you have repetitive workflows, they're about to become automatable in new ways.

Pressures: Your competitors are watching this space too. If your industry has competitors using agents to automate customer service, outbound sales, or content creation before you do, they gain an advantage. Early adopters of agent technology will likely capture meaningful advantages in efficiency and capability for the next 2-3 years before the technology commoditizes.

Practically, what should you be thinking about? First, audit your current operations for tasks that are repetitive, rule-based, and span multiple systems. Those are the tasks agents will be best at. Second, think about your integration landscape. Agents work best in environments with good APIs and clear system boundaries. If your tech stack is fragmented and hard to integrate, that's a limiting factor. Third, consider the business case. Where would 5-10 hours per person per week of recovered time create the most value?

Most importantly, you probably want to start experimenting now rather than waiting. Agent technology is moving quickly. By the time you're convinced it's real, your competitors will already be ahead. Spending a few weeks in 2025 exploring agent capabilities seems much smarter than spending those weeks in 2026 trying to catch up.

Estimated data shows Meta leading in AI agent technology focus post-Manus acquisition, with Google and Microsoft also significantly invested. Estimated data.

Technical Challenges Still Remaining

Let's be honest about what hasn't been solved yet, because it matters. Manus has solved many important problems, but agent technology still has significant challenges.

Cost is one. Autonomous agents can be computationally expensive. An agent that needs to examine a screenshot, think about what to do, take an action, and repeat this cycle hundreds of times for a complex task can run up an API bill pretty quickly if you're using premium language models. This is improving as models get more efficient, but it's still a real constraint.

Reliability and consistency are another challenge. Agents sometimes get confused. They sometimes take actions that seem logical but are actually wrong. They sometimes get stuck in loops. These problems are less severe than they used to be, but they're not solved. Any serious agent deployment needs human monitoring and the ability to intervene when things go wrong.

Safety and control is a third major area. An agent that operates across your business systems needs safeguards. It shouldn't be able to delete critical data. It shouldn't be able to make unauthorized commitments. It shouldn't be able to access information it shouldn't. Building these safeguards right is hard and easy to get wrong.

Integration with legacy systems remains a challenge. Modern SaaS products often have good APIs. Legacy enterprise systems sometimes don't. Manus has solved this in some cases, but it's still an area where custom engineering might be required for older systems.

Transparency and auditability are important for business contexts. When an agent does something, you need to understand why it did it and be able to explain it to others. This is getting better but still isn't where it needs to be for many regulated industries.

These challenges are all solvable. They're not fundamental limitations that make agents impossible. But they are real practical constraints that matter if you're trying to deploy agent technology in a business.

The Future After This Acquisition

Looking forward, the Manus acquisition sets up several likely scenarios for how agent technology evolves.

Scenario one: Rapid adoption by large enterprises. Companies with the resources to integrate new technology quickly and the problems that agents solve well will adopt agents aggressively. This will create visible success stories, which will drive further adoption. Within 3 years, most Fortune 500 companies will have at least one agent system in production. Within 5 years, it will be unusual for a large company not to be using agents for significant portions of their workflow.

Scenario two: Agent technology commoditizes partially but not completely. The core agent execution framework becomes standardized and widely available. But specialized agents for specific domains (healthcare, finance, legal) remain valuable and command premium pricing. Think of how cloud computing commoditized infrastructure but specialized cloud services still capture significant value.

Scenario three: Integration with other AI technologies creates compounding value. Agents that can use multimodal models (image, video, audio, text) will be more capable than agents limited to text. Agents that can use specialized models for specific tasks will outperform general-purpose agents. The most valuable systems will likely combine multiple AI technologies elegantly.

Scenario four: Regulation becomes an issue. As agents operate more autonomously in business-critical processes, regulators will care more about how they work, what safeguards are in place, and how errors are handled. This creates complexity but also creates defensible moats for companies that get ahead of regulation and build compliant systems.

Scenario five: A new category of jobs emerges. "Agent operator" or "agent architect" becomes a common job title. These people configure agents, train them on company-specific knowledge, monitor their behavior, and intervene when necessary. They're not technically programmers, but they require significant technical skills.

All five of these scenarios are plausible and might be happening in parallel in different industries and companies. The point is that the Manus acquisition isn't just a financial transaction. It's a signal about the direction of AI development and the direction of business automation. Ignoring it would be unwise.

Comparing Manus to Alternative Approaches

It's worth understanding why Meta chose Manus specifically rather than building agents entirely from scratch or acquiring different technology.

Building from scratch would have taken 3-5 years, even for Meta with their resources. They would have needed to hire a lot of experienced people in agent research and engineering. They would have made mistakes and had to recover from them. Meanwhile, competitors would have moved ahead. Acquisition compressed that timeline significantly.

Manus specifically was valuable because they'd already solved production challenges, not just research challenges. Many universities and research labs are doing amazing work on agent architectures. But running agents reliably at scale, integrating with real business systems, and maintaining service uptime at customer expectations is a different challenge. Manus had solved that.

Alternative acquisitions might have been possible (other agent-focused startups existed), but Manus had several advantages. Their team included people who'd worked at major tech companies and understood scale. Their product had real users and revenue. Their research was strong without being theoretical-only. They'd already integrated with meaningful business systems. All of this made them an attractive acquisition target for someone like Meta.

This comparison also reveals something about AI startup strategy. If you're building an AI company in 2025, the question isn't just "do we have good research?" It's "can we execute in production? Can we integrate with real systems? Can we generate real business value?" Companies that focus on these questions alongside research are much more likely to end up acquired or successful than companies that only focus on cutting-edge research.

Organizational and Cultural Implications

There's something interesting about how Meta handled the Manus acquisition that's worth noting. They didn't immediately fold Manus into an existing Meta division. They maintained Manus as a distinct product team while providing resources and infrastructure support. This is smart for several reasons.

First, it preserves the existing Manus user base and product momentum. If Meta had immediately shut down Manus and tried to rebuild it from scratch, they would have lost customers and momentum. Keeping Manus running as a product maintains continuity.

Second, it allows the Manus team to stay focused. Large organizations like Meta are complex. If you immediately immerse a startup team in Meta's culture, processes, and organizational structure, you slow them down significantly. By giving them the resources and support they need while letting them maintain some independence, Meta gets the benefit of their energy and focus.

Third, it creates a model for how acquisitions should work. Not all acquisitions need to be full integrations. Sometimes the acquiring company is smarter to act as a supportive parent rather than trying to absorb the acquisition completely.

This approach has implications for how AI development will happen in the future. We might see a model where large companies like Meta, Google, Amazon, and Microsoft maintain portfolios of semi-independent product teams that operate under their umbrella but maintain distinct identities. Think of how Google Ventures operates, but with product teams instead of just investments.

This is actually healthy for innovation because it allows smaller, more focused teams to do work that might not fit within the cultural norms or processes of the larger parent. A startup culture operating under the resources of a mega-corporation is a powerful combination.

Investing and Funding Implications

The Manus acquisition has significant implications for how venture capital approaches AI investment going forward.

Firstly, it validates the agent approach to AI monetization. Before Manus's acquisition, there was some skepticism about whether agents could be a business. Manus proved that yes, people would pay for agent capabilities. This opened investor appetite for other agent-focused startups and prompted existing AI companies to expand their agent offerings.

Secondly, it highlights the value of execution over pure research. Manus wasn't publishing groundbreaking papers. They were building working systems. Yet they commanded a significant acquisition price. This sends a signal to the startup ecosystem: if you want to succeed in AI, focus on building things people actually use, not just on research publications. This is a subtle but important shift in the AI startup landscape.

Thirdly, it increases the bar for AI startups in some ways and lowers it in others. It lowers the bar if you're focused on building applications on top of existing models. Manus didn't build their own language model. They built agent infrastructure on top of existing models. This is a more achievable goal for startups. But it raises the bar in other ways because now you're competing against major tech companies that are aggressively investing in agent technology. You need a real differentiation and a real product, not just a cool idea.

Financially, the Manus acquisition will probably prove to be a fantastic investment for Meta. If agents become as important as I expect, the value Meta gets from owning core agent infrastructure will be enormous. They're not just getting a product. They're getting a strategic position in a major new category of AI application.

Practical Guidance for 2025 and Beyond

If you're running a business, working in tech, or thinking about the future of AI, here's what you should be paying attention to.

First, track how major tech companies integrate agent technology into their products. When Google releases new agent features in Workspace, when Microsoft releases new autonomous capabilities in Office, when Meta releases new agent features in their products, these are signals about where the industry is moving. Companies that move early to integrate agents will have advantages. Companies that wait will have to catch up.

Second, evaluate your own systems and workflows for automation opportunities. Which of your processes are repetitive, rule-based, and span multiple systems? Those are candidates for agent automation. You don't need to build the agent yourself (you can use platforms like Manus or competitors), but you should identify opportunities now.

Third, start thinking about how agents change your business model and competitive dynamics. If your advantage currently comes from operational efficiency or managing complex workflows, agent technology might threaten that advantage. Better to be proactive about how you adapt than reactive when competitors deploy agents before you do.

Fourth, invest in education and understanding. Spend time actually using agent systems. See what they can do. Understand their limitations. This will help you make better decisions about how and when to use them in your business.

Fifth, consider the talent implications. People who understand how to build, manage, and optimize autonomous systems will be in high demand. If you're early in your career, these are valuable skills to develop.

Long-Term Vision: Where This Is Heading

Let me zoom out and talk about the longer-term trajectory here. The Manus acquisition is a data point in a longer story about where AI is heading.

Over the next 5-10 years, I believe autonomous agents will become the primary way that humans and organizations interact with digital systems. Not through typing prompts into a chatbot. Not through clicking through interfaces. But through giving high-level instructions to an agent that figures out the rest.

This changes everything about how software is built, how businesses operate, and what skills matter. Software interfaces designed for human interaction will become less important. APIs and system integration will become more important. The ability to specify what you want an agent to do will become more important than the ability to use a user interface.

Businesses will reorganize around agent capabilities. Instead of hiring three people to handle customer support, you hire one person to manage the customer support agent and handle escalations. Instead of a team of analysts building reports, you have an analyst who configures the report-generation agent and reviews what it produces.

This transition will create disruption. Some jobs will be eliminated. Other jobs will be created. Broadly, the jobs that remain will be the ones that require human judgment, creativity, or emotional intelligence. The jobs that go away will be the ones that are primarily execution of defined processes.

This is happening whether we like it or not. The Manus acquisition signals that major technology companies are betting heavily on this direction. They wouldn't make that bet unless they believed it was where the future was heading. So adapting to this future now, rather than being forced to adapt when it arrives, seems like the wise play.

FAQ

What exactly did Meta acquire when they bought Manus?

Meta acquired Manus, a startup that built AI agents capable of autonomously completing complex tasks across multiple systems without constant human intervention. This included their team of engineers, their proprietary agent technology and architecture, their existing customer relationships, and their product roadmap. The acquisition didn't include Manus becoming a separate Meta division, but rather Manus continues operating as a product while gaining access to Meta's infrastructure, resources, and expertise.

How do Manus agents actually work compared to regular chatbots?

Manus agents operate through an autonomous see-think-act loop. An agent observes its current environment (a screen, interface state, or data), processes that information through AI models to understand what's happening, determines what action to take next based on the goal it's been given, executes that action, and repeats. Unlike chatbots that require humans to prompt them repeatedly and decide what to do with the response, Manus agents can work continuously and independently toward a goal. For example, a chatbot can tell you how to schedule a meeting, but a Manus agent can actually schedule the meeting by accessing your calendar system, checking availability, and sending invites without human intervention.

Why would a business want to use AI agents instead of hiring people or using traditional automation?

AI agents offer advantages across three dimensions compared to traditional approaches. Speed: agents work 24/7 and complete tasks in minutes that might take humans hours. Cost: one agent handling routine tasks lets you redeploy humans to higher-value work, reducing labor costs significantly. Flexibility: unlike traditional automation that requires custom programming for each workflow, agents can be reconfigured for new tasks relatively easily. A study by McKinsey estimated that AI automation could recover 30-40% of worker time spent on routine tasks. Businesses using agent technology report 30-50% reductions in time spent on administrative workflows, 40-60% improvement in process accuracy, and faster turnaround times for customer requests.

What are the main risks or challenges with deploying autonomous agents in business?

Three primary challenges exist with agent deployment. Reliability: agents sometimes make mistakes or get confused, especially with ambiguous instructions or unexpected situations. This requires human monitoring and the ability to intervene. Cost: running agents at scale can be computationally expensive, particularly if using premium language models for decision-making. Control and safety: you need safeguards ensuring agents operate within defined boundaries and can't access or modify sensitive data. Agents in business contexts must also maintain audit trails so you can understand why they took particular actions, which is critical for compliance and trust. Getting these aspects right requires careful planning and ongoing oversight rather than simple deployment.

How does Meta's acquisition of Manus compare to competitors like Open AI or Google building their own agent capabilities?

Meta chose acquisition over internal development to accelerate their timeline significantly. Building agent infrastructure from scratch would take 3-5 years even for Meta, while acquisition compressed that timeline to immediate access. Open AI has focused on improving their model capabilities and providing APIs for others to build agents on top of, rather than building a complete agent platform themselves. Google integrated agents into their existing enterprise products like Workspace rather than acquiring a dedicated agent startup. Amazon Web Services has been slower to move but is investing in agent capabilities through multiple approaches. All three approaches have merit. Acquisition (Meta's path) is fastest but relies on external teams. Internal development (Open AI's path) maintains control and alignment. Integration into existing products (Google's path) leverages distribution advantages. The market is large enough for all three approaches to succeed.

When will AI agents become mainstream enough for smaller businesses to use easily?

Agent technology accessibility is improving rapidly. Many smaller businesses already use simpler forms of autonomous systems through platforms like Zapier or Make, which automate workflows without agents. True agent capabilities from platforms like Manus are currently most accessible to mid-market and enterprise companies, but this is changing. In 6-12 months, expect to see agent capabilities becoming available through mainstream platforms that smaller businesses use. Within 18-24 months, I'd expect most business software platforms to have some agent capabilities built in or easily accessible. For true accessibility (where a non-technical small business owner can set up a meaningful agent in 30 minutes), that's probably 2-3 years away. However, working with consultants or agencies to implement agents is already feasible for smaller businesses if the ROI makes sense.

What should businesses do right now to prepare for agent technology?

Three concrete actions make sense. First, audit your workflows for automation opportunities. Look for tasks that are repetitive, rule-based, and span multiple systems. Those are ideal for agent automation. Document how many hours per week these tasks take. Second, evaluate your technical integration landscape. Agents work best in environments with good APIs and clear system boundaries. If your current systems integrate poorly, that limits where you can deploy agents. Third, experiment with simpler automation first. Start with basic workflow automation through platforms your team already uses. This builds skills and familiarity that transfer to more sophisticated agent deployment later. You don't need to wait for the perfect moment to start learning about agents. Starting small and building expertise now positions you well for when agent technology becomes truly mainstream.

Could agents eventually replace most human workers in business operations?

In theory, agents capable enough could handle most routine business operations. In practice, this won't happen for 10+ years and even then, the economics and human preferences will prevent full replacement. Agents will absolutely eliminate large categories of routine administrative and operational jobs. This is real and should be taken seriously. But humans remain valuable for work requiring judgment, creativity, ethical decision-making, complex problem-solving, and interpersonal interaction. The more realistic scenario is that the nature of work changes fundamentally. Humans spend less time on routine execution and more time on judgment and strategy. Businesses that plan for this transition now (upskilling workers, reorganizing around agent capabilities, rethinking job design) will be better positioned than those that ignore it until forced to react.

Final Thoughts: Why This Moment Matters

The Manus acquisition represents something important that extends beyond Meta's corporate strategy. It's a visible acknowledgment that the AI industry is maturing beyond the research phase and moving into the application and execution phase. Manus wasn't the most cutting-edge AI research. They were the best execution of agent technology at the time of acquisition.

This signals a shift in how AI creates value. For the past couple of years, value in AI came from who built the best model. Bigger models, better training data, more sophisticated architectures. Those things still matter. But increasingly, value comes from who builds the best applications, the best integrations, the best solutions to real problems. Companies that understand this shift and focus on execution alongside research will thrive. Companies that stay focused on research alone will become components in other companies' systems.

For individuals watching this space, the practical implications are clear. If you want to work in AI in a way that generates value and creates impact, focus on understanding how to build real things that solve real problems. Learn to execute. Learn to integrate systems. Learn to work with customers and iterate based on feedback. These skills matter as much as understanding the latest research paper.

For businesses, the implications are equally clear. The tools you use to automate your operations are about to change. The people you hire are about to operate in a different context. The competitive dynamics in your industry are about to shift toward those who adopt agent capabilities faster. Starting to think about these changes now rather than in two years puts you in a vastly better position.

The Manus acquisition is not just a transaction. It's a signpost pointing toward the future. If you're not noticing where it's pointing, you should be.

Key Takeaways

- Meta's acquisition of Manus signals that autonomous AI agents are becoming a strategic priority for major tech companies and will reshape business automation over the next 3-5 years

- Unlike chatbots that require constant human interaction, Manus agents operate autonomously through a see-think-act loop, handling complex multi-system workflows without human prompts

- Agent technology creates immediate business value through customer support automation (30-50% cost reduction), data processing (10-15 hours/week saved), and workflow optimization across enterprise systems

- Businesses should audit their workflows for automation opportunities now because early adopters of agent technology will gain competitive advantages before the technology commoditizes

- The shift from interactive AI to autonomous agents represents a fundamental change in how AI creates value, prioritizing execution and real-world application over research innovation

Related Articles

- Meta Acquires Manus: The $2 Billion AI Agent Deal Explained [2025]

- 5 AI Trends That Changed My Life [2025]

- The 32 Top Enterprise Tech Startups from TechCrunch Disrupt [2025]

- Google Photos on Samsung TVs 2026: Features, Timeline & Alternatives

- Tech Resolutions for 2026: 7 Ways to Upgrade Your Life [2025]

- The Highs and Lows of AI in 2025: What Actually Mattered [2025]

![Meta Acquires Manus: The AI Agent Revolution Explained [2025]](https://tryrunable.com/blog/meta-acquires-manus-the-ai-agent-revolution-explained-2025/image-1-1767075618246.webp)