Introduction: The Subscription Pivot Nobody Saw Coming (Well, Kind Of)

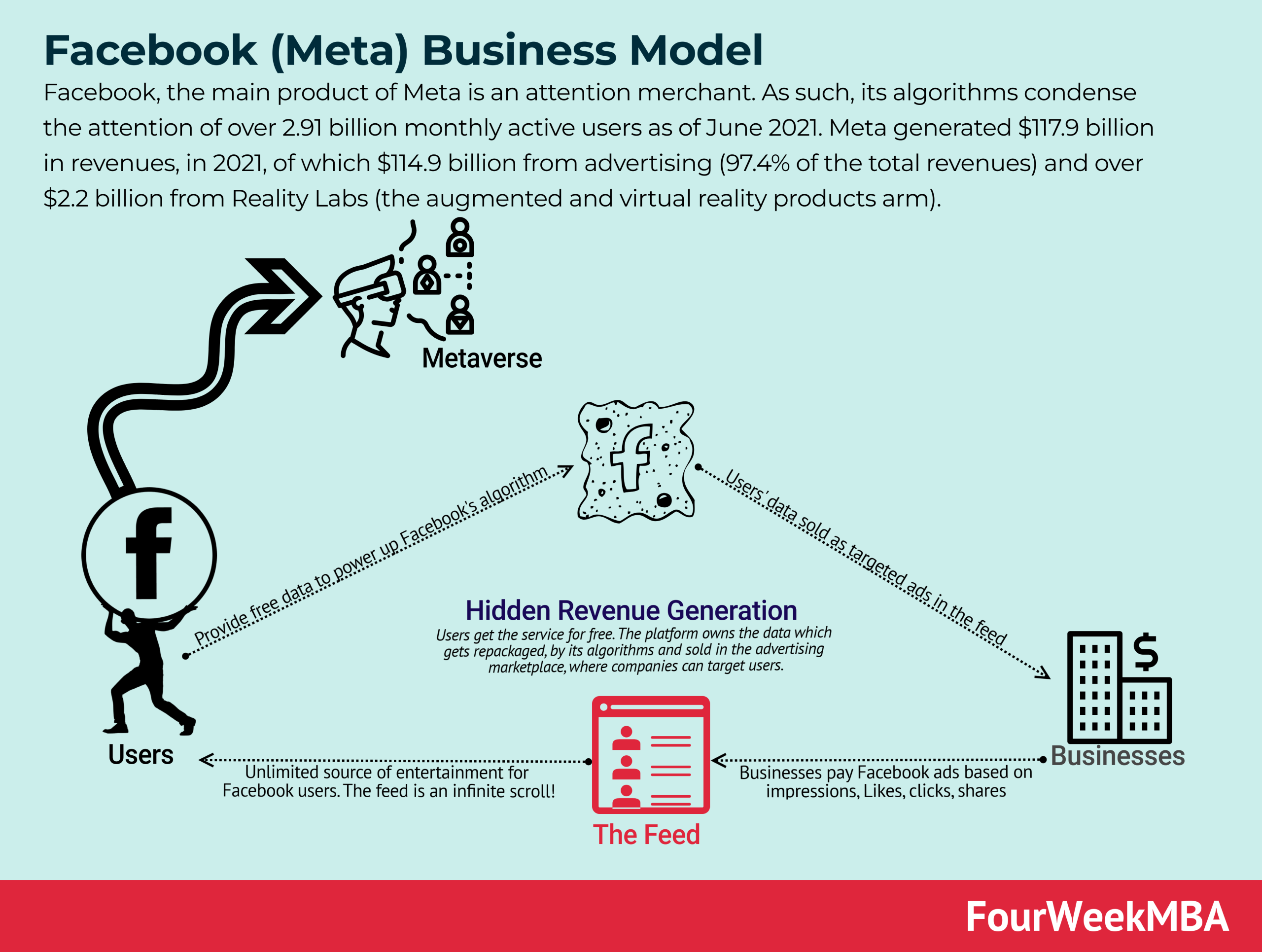

Remember when social media was entirely free? Yeah, those days are mostly gone. Meta's latest move marks a significant shift in how the company plans to monetize its massive user base. While Instagram ads and Facebook ads have generated hundreds of billions in revenue over the past decade, the company is now testing a completely different model: making users pay directly for premium experiences.

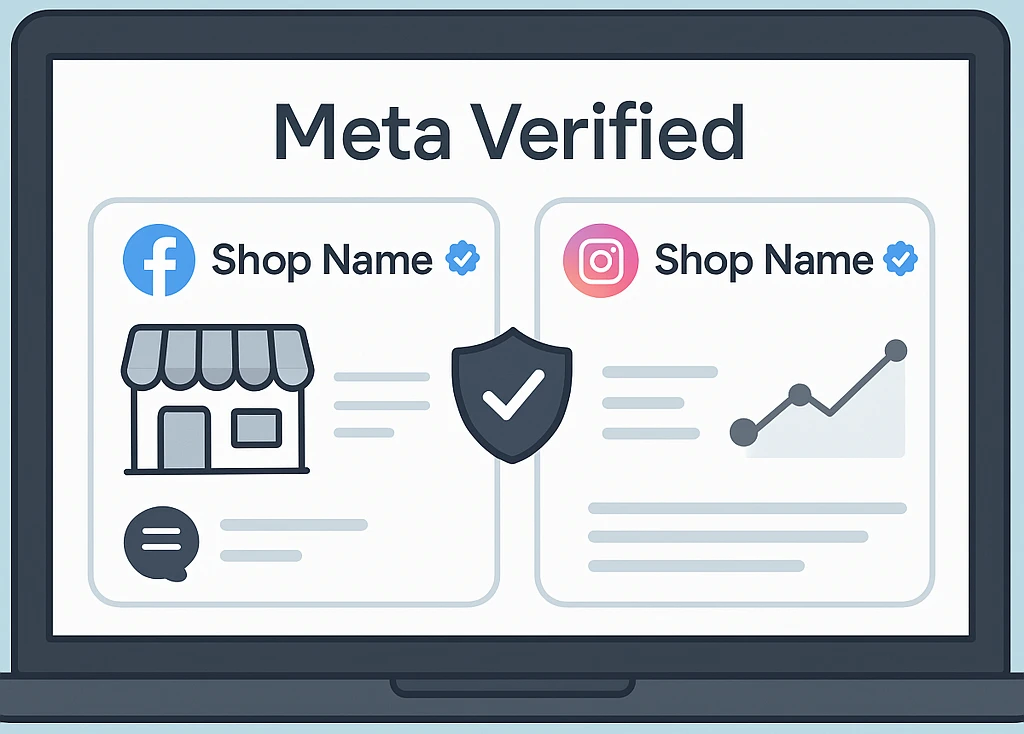

This isn't Meta's first rodeo with paid tiers. Meta Verified launched a few years back, giving creators and businesses a blue checkmark and some handy features like direct support and impersonation protections. But that was designed for influencers and brands. What Meta is testing now is fundamentally different. It's targeting everyday users, not just creators or businesses.

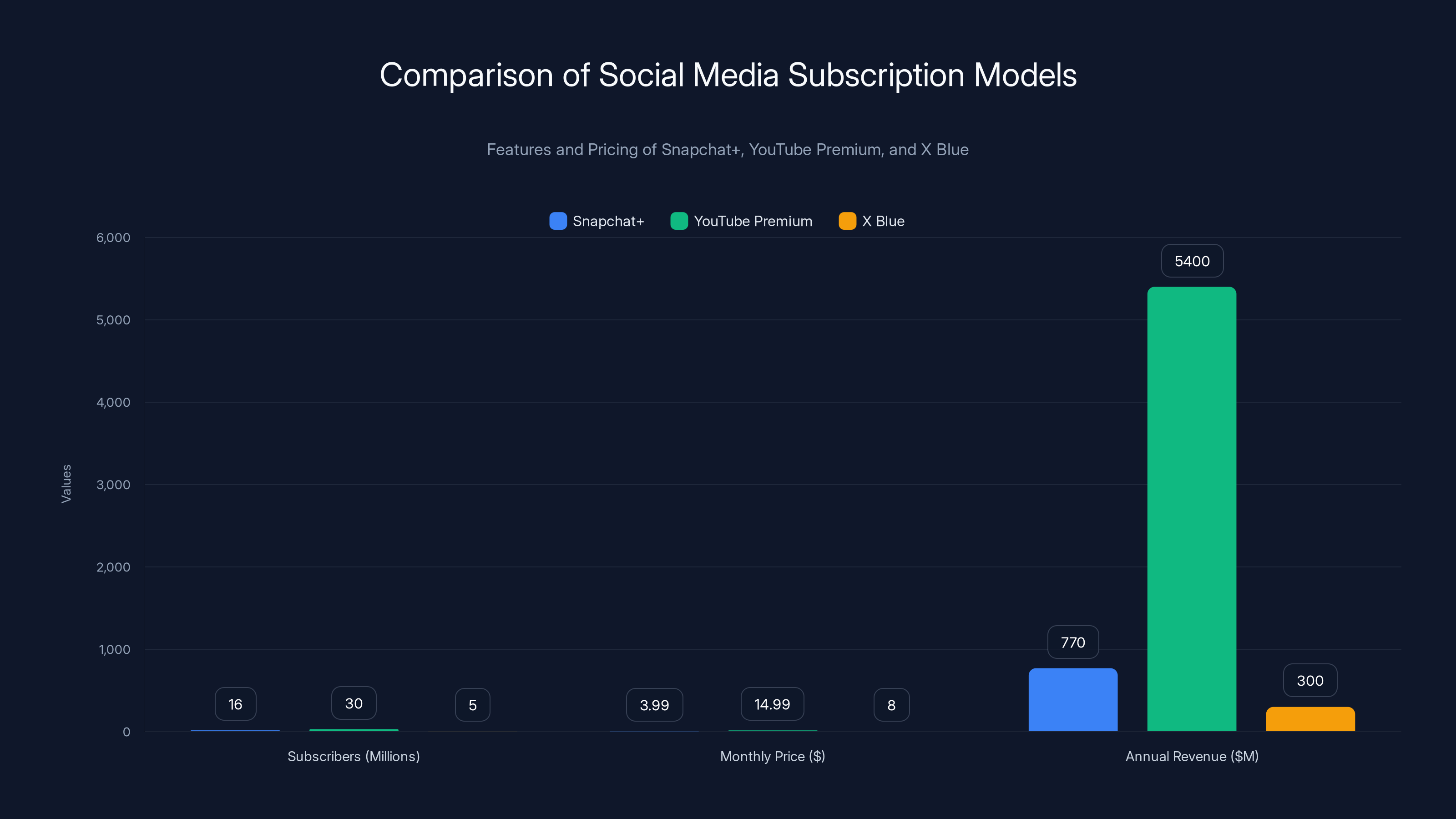

The move reflects a broader industry trend. Snapchat proved the market exists for social media subscriptions with Snapchat+, which has grown to over 16 million subscribers and continues to climb. YouTube Premium offers ad-free viewing and exclusive content. Even X (formerly Twitter) has explored subscription tiers. So why shouldn't Meta capitalize on this opportunity?

But here's what makes Meta's approach interesting: they're not locking essential features behind paywalls. Instead, they're adding special features, enhanced AI capabilities, and more granular control over how users share and connect. The free experience stays intact. The paid tier is for people who want more.

In this article, we're diving deep into Meta's premium subscription strategy. We'll explore what features are being tested, how it compares to competitors, what it means for advertisers, creators, and everyday users, and what the potential impact could be on the broader social media landscape. By the end, you'll understand not just what Meta is doing, but why it matters and what to expect in the coming months.

TL; DR

- Meta is testing paid subscriptions across Instagram, Facebook, and WhatsApp in the coming months

- Premium features will be unique per app, including exclusive AI capabilities and enhanced controls

- Manus AI integration will be a major selling point for subscribers, with standalone business subscriptions continuing

- Free experience remains unchanged, with paid tiers targeting those wanting more productivity and creativity tools

- Early Instagram features include unlimited audience lists, follower insights, and Story view privacy

- Snapchat+ success proves the market, with 16 million+ subscribers generating meaningful revenue

- Meta Verified stays separate, targeting creators and businesses rather than mainstream users

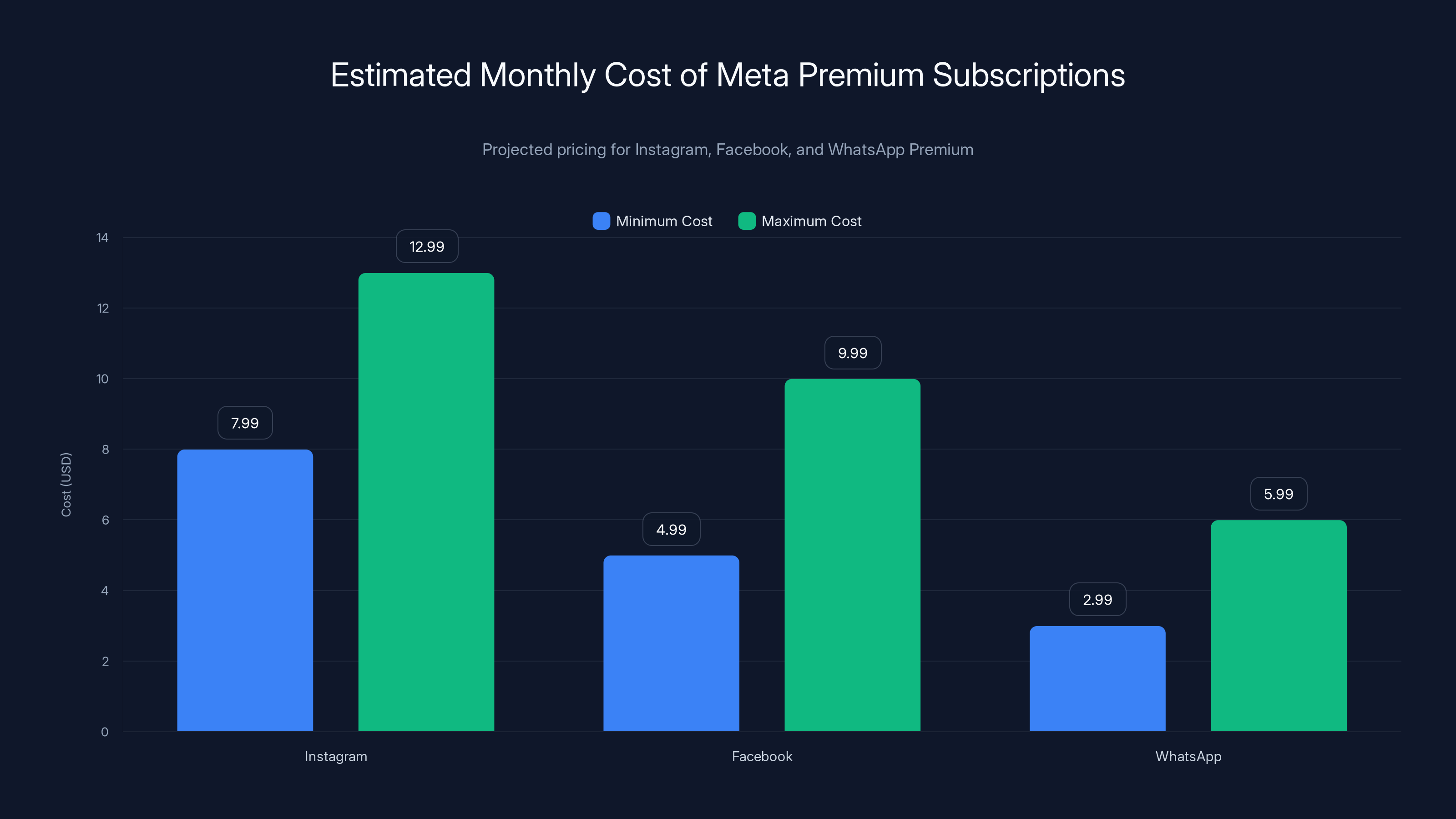

Estimated monthly costs for Meta premium subscriptions range from

Why Meta Is Betting Big on Subscriptions Now

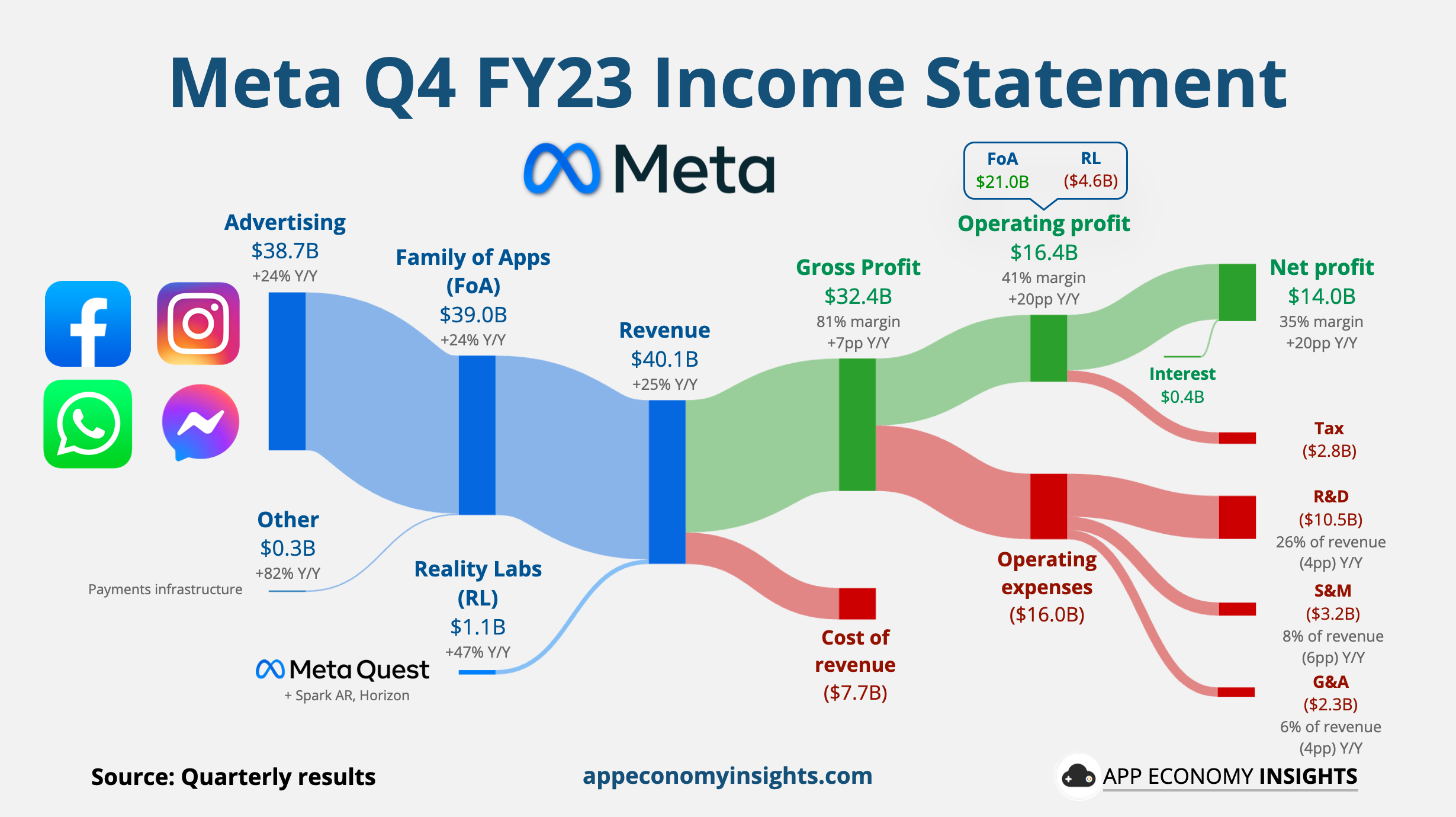

Meta has been the subscription skeptic for years. Why charge users when you can make billions from advertising? The math seemed simple: 3 billion monthly active users across all platforms multiplied by sophisticated ad targeting equals an endless revenue stream.

But the math changed. Advertising, while still incredibly profitable, faces headwinds. Apple's privacy changes made tracking and targeting less effective. Regulators globally are tightening rules around data collection. Advertisers are getting pickier about where their money goes. The growth curve that seemed infinite ten years ago has started to plateau.

Enter artificial intelligence. Meta has invested heavily in AI, acquiring companies like Manus for a reported $2 billion. The company sees AI as the next frontier, and they're betting that users will pay for advanced AI capabilities. This isn't about forcing existing features behind a paywall. It's about offering genuinely new value that didn't exist before.

The subscription model also diversifies revenue. One user with a $10 monthly subscription generates more predictable revenue than that same user clicking on an occasional ad. Subscriptions create a direct relationship with users, which reduces reliance on the ad market and gives Meta more control over its business destiny.

Another factor: shareholder pressure. Meta's stock price has recovered impressively, but investors always want growth. Subscriptions signal a new growth vector that doesn't require acquiring more users (which is nearly impossible at Meta's scale). Instead, it extracts more value from existing users. Wall Street loves that story.

The timing is also strategic. Meta faces increasing criticism about data privacy, content moderation, and the addictive nature of its apps. A premium, paid tier creates a tier of users who might expect higher privacy standards, better content moderation, and a less ad-heavy experience. This subtly addresses criticism while creating a revenue opportunity.

Understanding Meta's Multi-App Strategy

Meta didn't announce one universal subscription covering all apps. Instead, each app—Instagram, Facebook, and WhatsApp—will have its own distinct premium tier with unique features. This segmented approach reveals a lot about Meta's thinking.

Instagram and Facebook serve different user bases and purposes. Instagram is primarily visual, built around images and short-form video. Facebook is conversation-heavy, built around groups, events, and family connections. WhatsApp is messaging-focused and heavily used in markets like India and Brazil where the other apps are less dominant. It makes sense to offer different premium features tailored to how each platform is actually used.

The multi-app strategy also lets Meta test different pricing and features without needing a single company-wide rollout. Instagram might charge

For developers and businesses, this creates both opportunity and complexity. If you're building tools that integrate with Meta's platforms, you'll need to understand how premium features affect your integrations. Some API endpoints might have different rate limits for premium subscribers. Authentication flows might differ. The landscape gets messier, but also more interesting.

Meta's decision to keep premium subscriptions separate from Meta Verified is also telling. Verified remains the creator and business tier. These new subscriptions target average users. That's a different demographic with different needs and price sensitivity. By keeping them separate, Meta avoids confusing messaging and can optimize each tier independently.

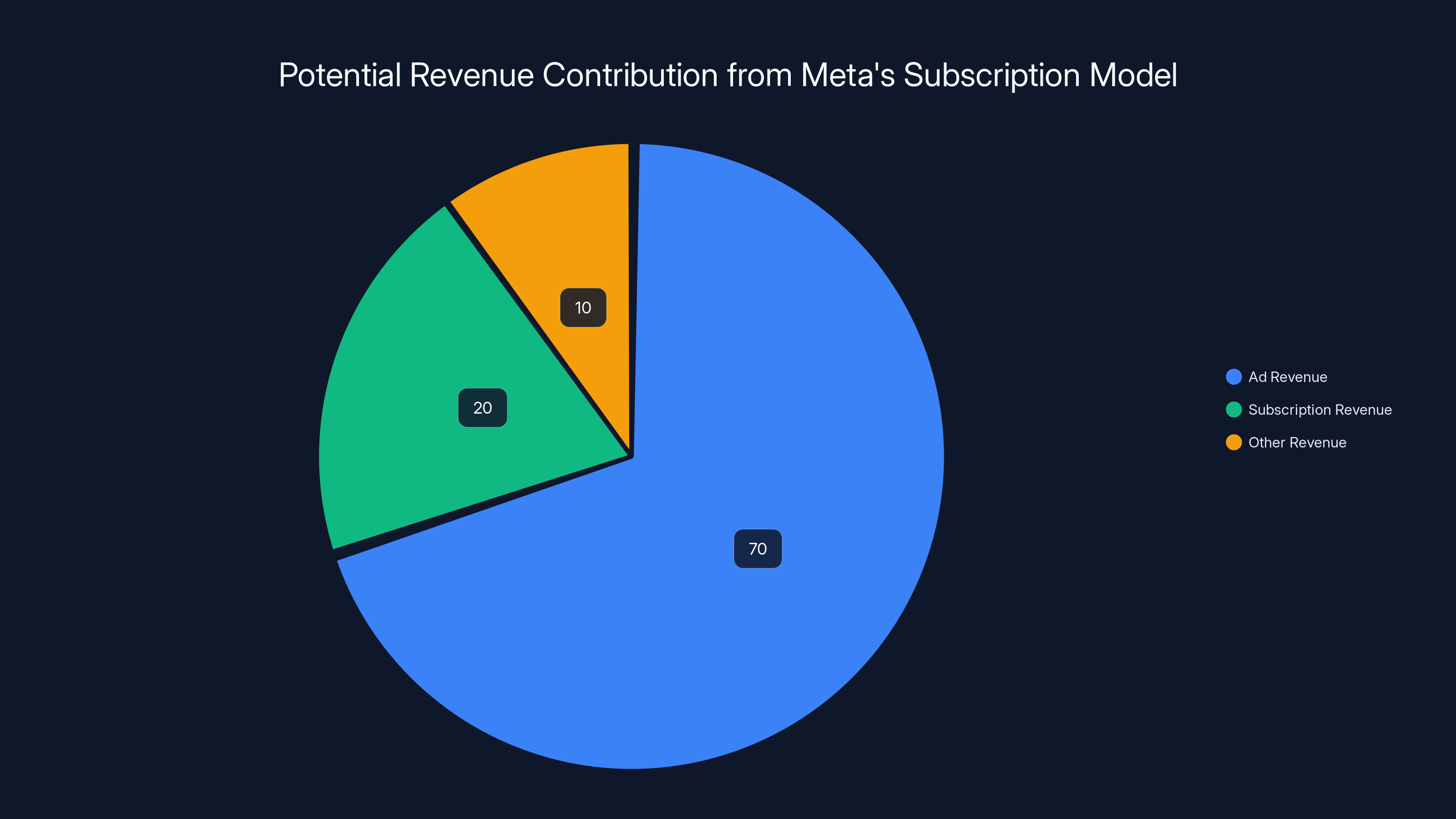

Estimated data suggests that if 5-10% of Meta's users adopt subscriptions, it could contribute significantly to the company's revenue, alongside traditional ad revenue.

What Instagram Premium Actually Looks Like (So Far)

Meta hasn't officially announced Instagram Premium's full feature set, but thanks to reverse engineers who find unreleased features in code, we have a pretty good picture of what's coming.

The biggest feature is unlimited audience lists. For context, regular Instagram users can create follower lists and organize them, but with limitations. Premium users get unlimited lists, making it easier to segment audiences and understand follower composition. This might sound minor, but for creators and small business owners, audience segmentation is crucial for targeting.

The second announced feature is the ability to see followers who don't follow you back. This is pure engagement intelligence. Right now, if you want to know which followers are one-way relationships, you need third-party tools. Instagram Premium will build this in natively. For creators trying to optimize their following, this is valuable.

The third feature is Story view privacy. Normally, when you view someone's Story, they see your name in the viewer list. Instagram Premium subscribers will be able to view Stories without the poster knowing. This is the privacy angle, and it's interesting because it's not about additional features—it's about control and privacy.

There are likely more features being tested that haven't been discovered yet. Meta mentioned premium subscribers get access to enhanced AI capabilities. On Instagram, this could mean AI-powered caption suggestions, better content recommendations, or AI tools for editing images and videos. The company is clearly positioning AI as a major premium selling point.

Pricing hasn't been officially announced, but expect Instagram Premium to fall in the

The rollout will be gradual. Meta says it's testing these features in coming months, not launching them globally tomorrow. Expect slow regional rollouts, probably starting in wealthy markets like the United States, Canada, and Western Europe where users are most likely to pay.

The Role of Manus AI: Meta's $2 Billion Bet

Meta acquired Manus AI for $2 billion, a significant investment that signals serious commitment to AI capabilities. But what is Manus, and why does it matter for subscriptions?

Manus is an AI agent company. Think of AI agents as software that can take actions on your behalf based on instructions. Unlike Chat GPT, which responds to prompts, AI agents can integrate with other tools and systems to accomplish multi-step tasks. Manus was built with business applications in mind, helping companies automate workflows and customer service.

Meta's strategy with Manus is two-pronged. First, it's integrating Manus directly into Meta's consumer apps like Instagram, Facebook, and WhatsApp. When you're a premium subscriber, you'll have access to these AI agent capabilities for personal use. Second, Meta continues selling Manus separately to businesses as a B2B product. Both revenue streams contribute to justifying the $2 billion acquisition price.

What does this mean in practical terms? Imagine you're an Instagram creator. Premium features might include an AI assistant that helps you schedule posts, suggests optimal posting times based on your followers' activity, generates caption ideas, and even responds to common comments. That's the kind of productivity boost Manus could provide.

For Facebook users, AI agents could help manage events, moderate group discussions, or organize neighborhood safety discussions. WhatsApp users might get AI that helps organize group messages or provides smart replies.

The genius of this strategy is that Manus enhances each app's core functionality without requiring massive engineering efforts. Manus is already trained to understand AI tasks. Meta just needs to tailor the interface and capabilities to each app's use case.

Reverse engineers have already found evidence of Manus shortcuts being added to Instagram. These would give users quick access to AI-powered features. As development progresses, expect these to expand significantly.

Facebook Premium: What Everyday Users Actually Want

Facebook is a different beast than Instagram. It's older, more diverse, and serves more varied purposes: staying connected with distant relatives, joining groups around shared interests, event planning, local community discussions, and yes, some marketplace transactions.

Facebook Premium will likely focus on features that enhance these core use cases. Facebook hasn't publicly described Facebook Premium features yet, but we can make educated guesses based on what users complain about most.

One possibility: reduced ad frequency. Facebook ads are everywhere. You scroll through your feed and see ads mixed in with organic content from friends. A premium tier might offer fewer ads or an ad-free experience. This would be similar to YouTube Premium offering ad-free watching. For a platform that users often find overstuffed with ads, this would be genuinely valuable.

Another possibility: enhanced group moderation tools. Thousands of users manage Facebook groups. A premium tier might offer advanced moderation capabilities like AI-assisted spam detection, better member management tools, or analytics for group engagement. This would target the power users who dedicate significant time to managing communities.

A third possibility: improved event management. Facebook Events is still a major feature, especially for local businesses and community organizers. Premium could offer better event analytics, more customization options, or improved guest communication tools.

For older users specifically (Facebook skews older than Instagram), Meta might include features like easier privacy controls, larger text options, or simplified interfaces. Facebook Premium could offer genuinely better usability for less tech-savvy users.

The challenge with Facebook Premium is pricing sensitivity. Facebook's demographic is older, more diverse economically, and less likely to subscribe to app premium tiers compared to younger Instagram users. Meta will need to offer clear, obvious value to make subscription stick on Facebook.

Snapchat+ has a significant subscriber base at a lower cost, generating substantial revenue. YouTube Premium, despite higher pricing, attracts many users due to its ad-free experience. X Blue struggles with lower adoption. Estimated data for YouTube Premium and X Blue.

WhatsApp Premium: The Messaging Anomaly

WhatsApp is the strangest addition to Meta's subscription plans because WhatsApp is primarily a messaging app, and people don't typically pay for messaging. Yet WhatsApp is huge: over 2 billion users globally, especially dominant in emerging markets where it's the de facto messaging standard.

The challenge: WhatsApp has never been ad-supported. There are no ads in WhatsApp. It's always been the privacy-first option, which is partly why it's so popular in markets with government surveillance concerns. How do you monetize WhatsApp without breaking what makes it valuable?

Subscriptions might be the answer. WhatsApp Premium could include features that justify payment:

Business features: WhatsApp has been pushing WhatsApp Business for years. Premium could offer enhanced business messaging capabilities like customer service tools, automated responses, or integration with CRM systems. Small businesses might happily pay $5 monthly for better customer communication tools.

Media storage and backup: WhatsApp stores media in cloud backups. Premium could offer more cloud storage specifically for WhatsApp backups, or better backup and recovery tools.

Group management: WhatsApp group chats can get chaotic. Premium might offer admin tools for larger group management, better organization features, or advanced privacy controls for who can add you to groups.

Status and customization: WhatsApp Status is the Stories feature. Premium could offer more customization, stickers, fonts, or animation options.

The key insight: WhatsApp's monetization challenge is different from Instagram and Facebook because there's no existing ad ecosystem. Subscriptions are basically the only option. For Meta, this is an opportunity. Global messaging is a massive market. If even 5% of WhatsApp's 2 billion users subscribe at

Geographically, WhatsApp Premium could be priced differently in different regions. It might be

Comparison with Competitors: Snapchat+, YouTube Premium, and X Blue

Meta isn't inventing the social media subscription model. Let's see how its approach compares to what's already working in the market.

Snapchat+ is the success story. Launched in 2022, it's grown to over 16 million subscribers in just a couple of years. The price is $3.99 monthly. Features include exclusive filters, custom stories, the ability to pin friends, and extended search history. The genius of Snapchat+ is that it's not mandatory for the core experience. Everything still works for free users. The paid tier is genuinely optional.

Snapchat+ proves the market exists and that users will pay. It generates an estimated $770 million annually in subscription revenue for Snap. That's not huge compared to Snap's ad revenue, but it's a new revenue stream on a platform with stagnant user growth.

YouTube Premium is the oldest player here, having launched in 2015 (originally as YouTube Red). It costs

YouTube Premium works because it offers genuine convenience. Ads on YouTube are intrusive. Removing them is worth money. The service also bundles YouTube Music, which has value on its own.

X Blue (formerly Twitter Premium/Blue) is the cautionary tale. Elon Musk aggressively pushed Blue subscriptions post-acquisition, but adoption has been limited. Early estimates suggested around 5% of X users paid for Blue. The issue: X's free experience is still functional, and the paid features (priority support, verification) don't seem essential to most users.

Meta's approach seems thoughtfully positioned between these examples. It's offering more meaningful features than X Blue (which felt more like a cash grab), but at a lower price point than YouTube Premium. The company is positioning AI capabilities as premium features, which could resonate if the AI tools are genuinely useful.

The Advertiser Angle: What Changes for Marketing

Meta's subscription strategy has major implications for advertisers and marketers. Let's think through this.

First, the good news: free users still exist. The free experience isn't going away. Meta still has 3 billion potential audience members to serve ads to. Advertising isn't being killed. It's being supplemented.

But there are complications. If a meaningful percentage of users subscribe to premium tiers, advertisers face questions:

Do ads reach premium users differently? If Instagram Premium includes a less ad-heavy experience, premium users will see fewer ads. This could theoretically improve ad effectiveness (less clutter), but reach decreases proportionally. Advertisers might need to adjust budgets or targeting to account for this.

How does premium status affect ad targeting? If premium subscribers opt out of aggressive tracking to support the privacy angle, advertisers lose targeting data. Meta might offer premium subscriber data as a premium advertising product (which would be ironic), or advertisers might simply have less accurate targeting for these users.

What about creators with premium audiences? If you're an influencer whose followers are disproportionately premium subscribers, you need to understand how that affects engagement rates, reach, and brand safety.

Meta will likely take a measured approach. Premium features might not dramatically reduce ad frequency or targeting. The company makes too much money from advertising to sabotage it. Instead, premium might mean cleaner ad formatting, fewer irrelevant ads, or optional ad features (like seeing the full advertiser information before clicking).

For small businesses, there's another angle: WhatsApp Premium and Facebook Premium could actually be advertising products. A small retailer might pay $5 monthly to access better customer service tools on WhatsApp, or to get better business analytics on Facebook. Meta essentially gets these users to pay for better ad tools, which makes sense.

Large advertisers probably won't care much. They'll adjust their strategies based on actual performance data once premium tiers launch. Smaller advertisers and creators might feel more impact initially, but will adapt as they understand the new dynamics.

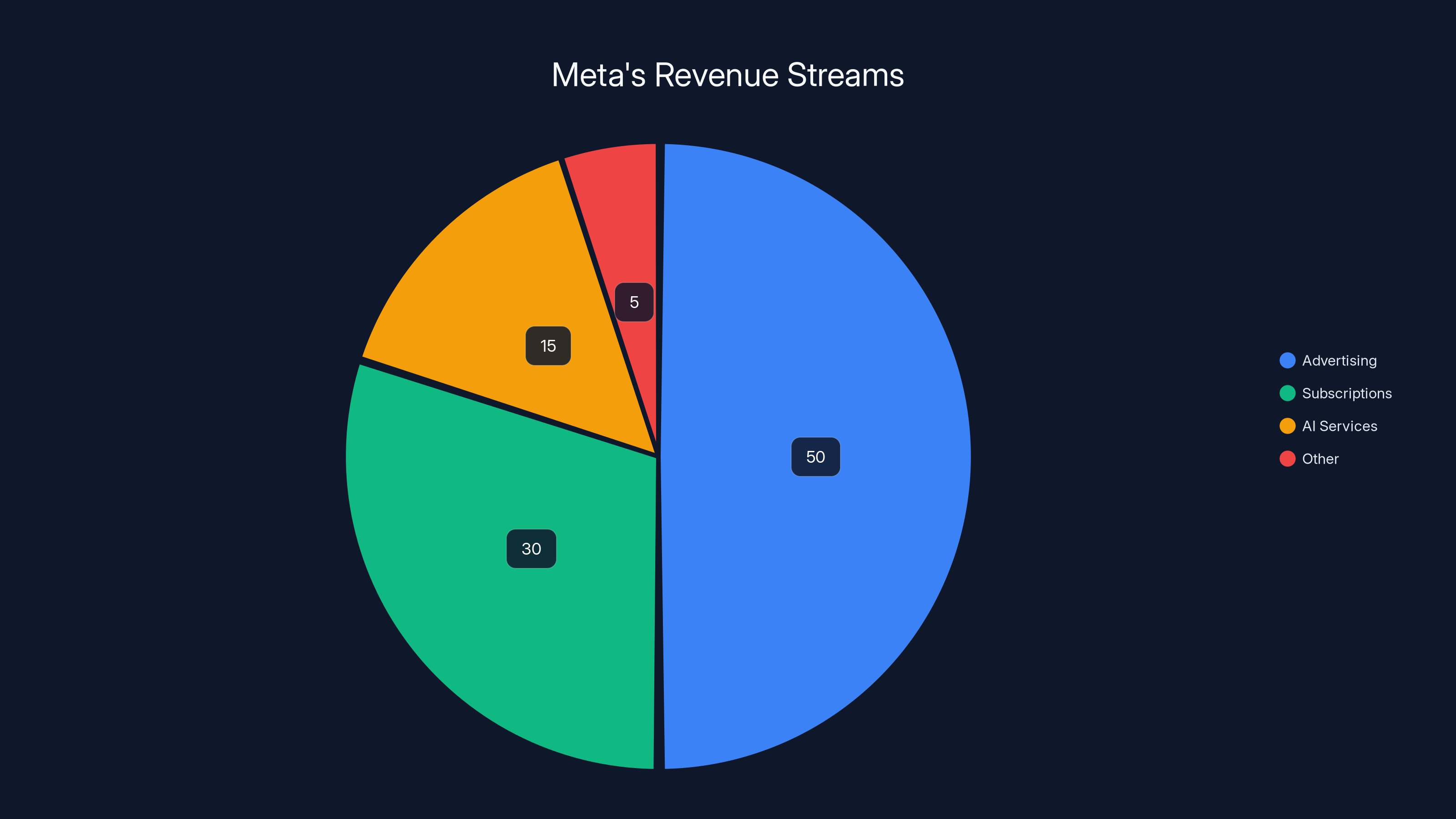

As Meta shifts focus, subscriptions and AI services are estimated to comprise 45% of future revenue, diversifying away from traditional advertising. Estimated data.

Revenue Potential: The Math That Justifies This Strategy

Let's do some math to understand why Meta is bothering with subscriptions.

Meta has approximately 3 billion monthly active users across all platforms. Not all of these users are addressable for subscriptions. Users in developing countries have lower purchasing power. Teenagers (some of Meta's biggest users) can't easily pay for subscriptions. Casual users might not see value.

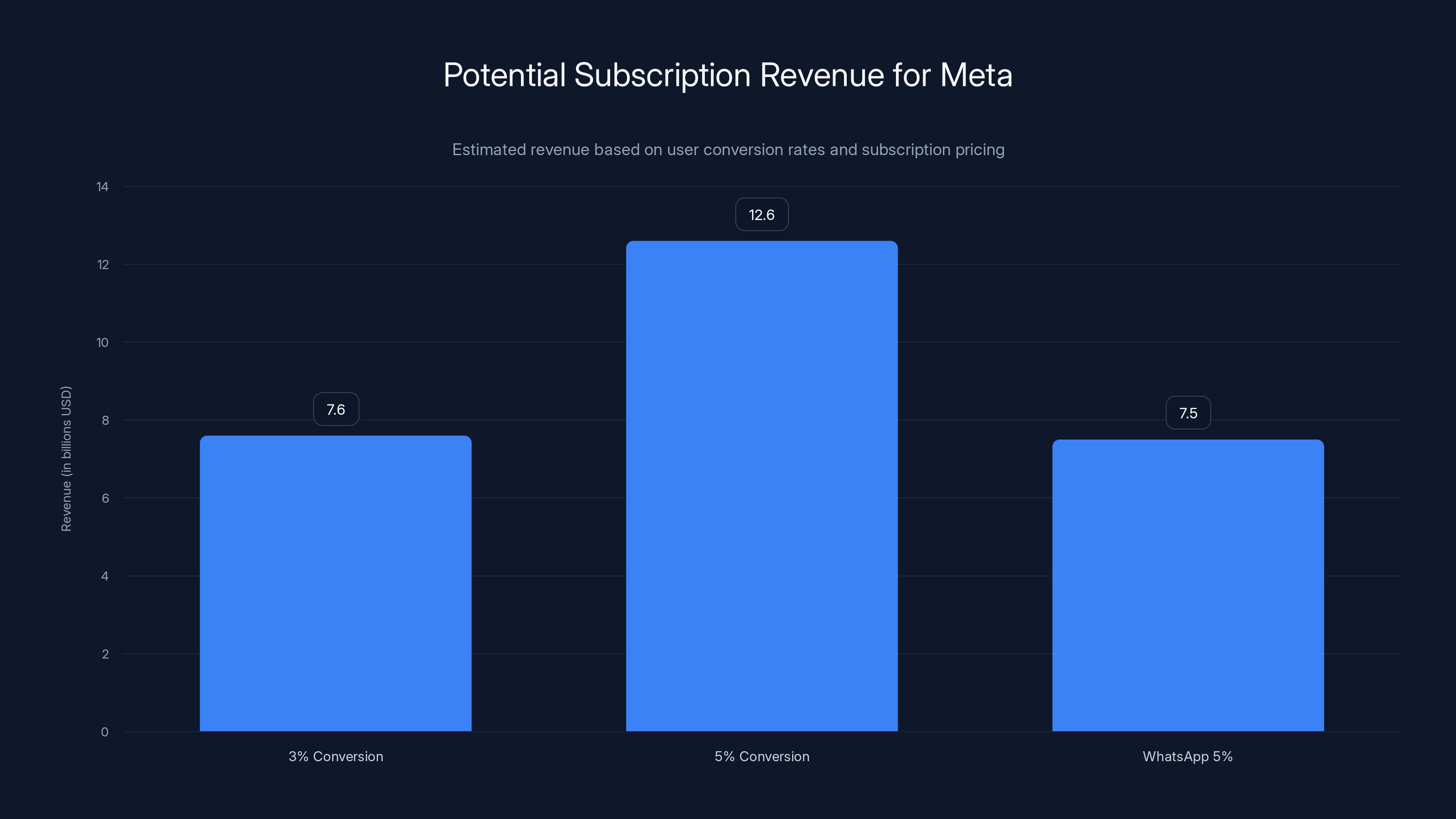

But let's assume a conservative 5% conversion rate for subscriptions across Meta's platforms. That's 150 million subscribers. If the average subscription price is $7 monthly (with regional variations), that's:

Or **

Even if Meta achieves only a 3% conversion rate, that's $7.6 billion annually. The math is compelling enough to justify investing in this strategy.

The revenue quality is also important. Subscription revenue is predictable and recurring. Advertising revenue can fluctuate based on economic conditions. Advertisers can reduce spending during recessions. Subscribers tend to stay longer. This smooths revenue and makes financial forecasting more reliable.

Beyond revenue, subscriptions create psychological effects. Users who pay for something value it more and use it more. This increases engagement metrics, which looks good to investors and advertisers. Engaged users are worth more to advertisers, so premium subscriptions could indirectly increase ad revenue per free user.

Pricing Strategy: How Meta Will Price These Tiers

Meta hasn't announced official pricing, but we can make educated guesses based on market conditions and competitive offerings.

Instagram Premium: Expect

Facebook Premium: Expect $4.99-9.99 monthly. Facebook's user base is older and more price-sensitive. They're less likely to pay for premium features. Meta will need to offer genuine value at an attractive price. Comparatively lower pricing makes sense here.

WhatsApp Premium: Expect $2.99-5.99 monthly. WhatsApp is dominant in price-sensitive markets like India, Brazil, and Southeast Asia. Global pricing will need to account for this. Regional variations (pricing higher in wealthy markets, lower in emerging markets) are likely.

Meta might also experiment with bundled pricing: pay $9.99 monthly to get Instagram Premium + Facebook Premium, for example. This increases the perceived value and improves conversion rates.

Annual subscription options will likely include a discount. A typical pattern is 20% off yearly pricing: instead of

Geographic pricing variations are almost certain. A premium tier that costs

Meta might also offer regional bundles or local payment methods to improve conversion. In many Asian markets, users prefer mobile payment methods over credit cards. Meta will need to support this.

The Free Experience Stays Free (For Now)

One of Meta's smartest messaging around these subscriptions is the guarantee that core experiences remain free. You'll still be able to use Instagram, Facebook, and WhatsApp without paying. The free experience isn't disappearing.

This is important for several reasons. First, it maintains the scale that makes Meta valuable. If you started charging for basic Instagram access, users would flee to alternatives. The free tier remains the primary user acquisition and engagement mechanism.

Second, it avoids the perception of paywalling essential features, which would generate significant backlash. Users are okay with optional premium features. They're not okay with essentials being locked behind paywalls. Meta understands this.

Third, the free experience subsidizes the entire platform. Free users generate engagement, network effects, and data. They're monetized through advertising. Premium users represent a delta revenue opportunity—additional value extracted from people willing to pay for more.

However, there's a risk hiding here. Over time, Meta might gradually push more features into the premium tier, subtly degrading the free experience. This is a gradual process called "feature creep into premium." It's been done before by other companies. Users might not revolt at any single change, but over years, the free experience could feel increasingly crippled.

Meta likely won't do this overtly because it would trigger regulatory scrutiny and user backlash. But the temptation to gradually improve premium relative to free is real. Users should watch for this.

The alternative is that Meta commits fully to robust free experiences forever. Some companies do this—Discord, for example, keeps core features free and robust while charging for cosmetics and premium services. If Meta follows this model, subscriptions become genuinely optional rather than gradually becoming mandatory.

Meta's premium tiers are expected to be priced based on user demographics and market conditions, with Instagram Premium potentially ranging from

Privacy, Control, and the Premium Angle

Several of the announced premium features relate to privacy and control: hiding Story views, seeing who doesn't follow you back, unlimited audience lists. This suggests Meta is positioning premium partly as a privacy-conscious tier.

This is strategic positioning. Users increasingly care about privacy. A premium tier that offers more privacy controls sounds appealing. But there's an implicit message: if you don't pay, your privacy defaults are less protective. This could be uncomfortable philosophically.

How will Meta handle this? The company could position privacy features as genuinely premium upgrades that require engineering investment. Better tracking controls, more granular privacy settings, and end-to-end encryption for certain features could legitimately be premium-only.

Alternatively, Meta might make basic privacy tools free (to avoid regulatory backlash and because privacy is increasingly expected) while premium gets advanced privacy features. This seems more likely.

The wildcard: regulated industries might require certain privacy features to be free. Regulators could mandate that users have the right to hide Story views without paying, for example. Meta will need to navigate this carefully.

For users, the message is: don't assume premium is the privacy-forward option by default. Use free tier privacy settings effectively first. Premium should enhance privacy, not be the only way to access privacy.

How Creators and Influencers Should Prepare

If you're a creator or influencer relying on Meta platforms for income, these subscription changes matter. Here's what you need to think about.

First, understand that Meta Verified remains separate from these new consumer subscriptions. If you're verified, that doesn't change. Meta Verified continues to target creators and brands.

Second, consider how premium features affect your audience. If Instagram Premium's unlimited audience lists feature becomes popular, your followers might be better organized and segmented. This could theoretically improve engagement if they use your content more intentionally.

Third, think about your own subscription strategy. Should you create a premium tier for your audience (like Patreon, Substack, or a Discord community)? If Meta Premium includes premium audience management features, Meta is making it easier to monetize your audience directly on their platform. This is competitive pressure on third-party creator platforms.

Fourth, watch analytics carefully. When premium features launch, you'll want to track whether premium vs. free user engagement differs. Do premium users engage differently with creator content? Are they more or less likely to follow new creators? This data will inform your strategy.

Finally, consider diversification. If you rely entirely on Meta platforms for income, these changes increase your dependence on Meta's strategy decisions. Building audiences on other platforms, or direct relationships with fans (email lists, Discord communities) reduces risk.

Meta might also offer creators a revenue share from subscription revenue. If premium subscribers generate more engagement, creators could earn more. The company hasn't announced this, but it would be smart incentive design. Creators would become advocates for the premium tier if it meant more income.

Timeline and Rollout Expectations

Meta said subscriptions are coming "in the coming months," which is vague but suggests a 2025 timeline for the first tests. Here's what we might expect:

Q1 2025: Early testing likely begins in limited geographies. Instagram Premium might launch first in the United States, Canada, and a few European countries. Small percentage of users get access. This is the "early adopter" phase where Meta gathers feedback and tweaks features.

Q2-Q3 2025: Broader rollout if early tests succeed. Instagram Premium expands to more countries. Facebook Premium testing might begin. Meta refines pricing based on early adoption rates.

Q4 2025: WhatsApp Premium possibly launches later than the other two, since it's more complex (no existing monetization strategy). Alternatively, WhatsApp Premium might be a 2026 launch.

2026: Full scale rollout. All premium tiers available globally (with regional pricing variations). Meta begins integrating Manus AI more deeply into premium experiences based on user feedback.

The exact timeline depends on a few variables:

Regulatory approval: Meta needs to ensure subscriptions don't violate regulations in major markets. This review could slow launches in regions with stricter tech regulation (like the EU).

Competitive response: If the market reacts negatively or if competitors launch competing offerings, Meta might accelerate or decelerate its rollout.

Technical readiness: Building premium features, payment systems, and subscriber management across billions of users is complex. Technical challenges could delay launches.

For users, the realistic expectation is that premium features won't be widely available until mid-to-late 2025. Early adopters in specific regions will see them first. Global availability probably comes in 2026.

Estimated data shows that even with a conservative 3% conversion rate, Meta could generate

Regulatory and Antitrust Considerations

Meta operates at a scale that attracts regulatory scrutiny. The FTC has been investigating Meta. The EU has been regulating Meta aggressively. Subscriptions will create new regulatory questions.

The FTC might question whether premium tiers are an attempt to create tiered access that benefits wealthy users over poor users, raising fairness questions. The EU might question whether subscription revenue is being used to fund aggressive behavior that harms competitors.

Specifically, Meta could theoretically use subscription revenue to fund aggressive competitive moves against other social media companies or to buy out competitors. This would trigger antitrust review.

Meta will likely be careful to frame subscriptions as optional enhancements rather than core functionality. This messaging helps defensively position against regulatory concern.

Privacy regulators might also scrutinize whether premium subscribers get better privacy defaults or data handling, and whether this constitutes two-tier privacy access (where richer users get better privacy).

Meta has legal and regulatory teams thinking about these issues. But the regulatory environment remains uncertain. Major regulatory changes could affect the subscription rollout.

For users, this means: regulatory approval isn't guaranteed, and subscriptions might not launch in some regions if regulators block them. But given the low-risk nature of optional subscription features, regulatory intervention is unlikely.

The Bigger Picture: What This Means for Social Media's Future

Meta's subscription strategy signals a shift in how social media platforms think about monetization. Instead of maximizing advertising revenue, they're building subscription revenue as an alternative revenue stream.

This has implications:

User power increases slightly. If users can pay to reduce ads, they gain leverage over platforms. Platforms need to keep free users happy (for network effects and ad revenue) while also keeping paid users happy (for subscription revenue). This is actually more balanced than pure ad-supported models.

Quality might improve selectively. Premium tiers incentivize building genuinely useful features. If Meta can monetize premium features directly, it has reason to invest in their quality. Free tiers might get less investment over time, but premium tiers should be competitive.

Privacy becomes a stratification issue. If premium tiers offer better privacy, wealthy users get privacy while poor users give up data. This is philosophically uncomfortable but probably inevitable as platforms mature.

Creator economics get complicated. Platforms now compete for creator attention while also competing with creators for user money. This creates tensions that will need to be resolved.

Advertising remains central. Despite subscriptions, advertising will continue to be the primary revenue source for social media platforms. Subscriptions represent incremental revenue, not replacement revenue.

The broader trend: social media is maturing. The growth phase where user count increases rapidly is ending. Mature platforms monetize more intensively by extracting more value from existing users. Subscriptions are part of this evolution.

Common Questions and Concerns

As Meta tests subscriptions, users have legitimate questions and concerns. Let's address the main ones:

"Will premium become mandatory eventually?" Unlikely in the foreseeable future. Network effects require a massive free user base. Making subscriptions mandatory would shrink the network and reduce value for everyone. Meta has a stronger incentive to keep subscriptions optional.

"Will my data be safer with premium?" Not necessarily. Premium features might include enhanced privacy controls (like hiding Story views), but your data is still Meta's business. Premium doesn't mean Meta stops collecting data.

"Can I share a subscription with family members?" Meta hasn't announced this. Different platforms handle it differently. Facebook has household sharing. YouTube Premium requires individual subscriptions. Expect clarification when subscriptions launch.

"Is this worth paying for?" Depends on your use case. If the features save you time or money, yes. If they're nice-to-haves, probably not. Wait for official launches and user reviews before deciding.

"Will ad quality improve for free users?" Not because of subscriptions, but possibly due to general improvements. Meta might improve ad targeting regardless of subscriptions.

"How does this affect WhatsApp's business messaging plans?" WhatsApp Business might become a paid-first model. Small businesses might need to pay for advanced features. This could be a change from the current free model.

Competitive Threats and Opportunities

Meta's subscription strategy creates opportunities for competitors and threats if Meta executes well.

For TikTok: TikTok hasn't offered paid premium features yet. This is an opportunity to differentiate. TikTok could launch a premium tier with exclusive creators, better recommendations, or creator fund access for subscribers. The young, engaged TikTok audience might be more receptive to premium features than Instagram's aging user base.

For Discord: Discord has been ruthlessly focused on free core features with optional cosmetic paid items. If Meta Premium is attractive, Discord faces competitive pressure. However, Discord's community-focused positioning is different enough that direct competition might be limited.

For Reddit: Reddit is increasingly focusing on monetization. Premium features could compete with Reddit Premium. Both platforms could succeed with different user segments.

For YouTube: YouTube Premium is already established. Meta's subscriptions could validate the subscription model for YouTube, potentially driving YouTube Premium adoption higher. Meta and YouTube could benefit from raising subscription awareness together.

For Be Real, Threads, Bluesky: Newer platforms could position subscriptions as optional from day one, rather than adding them later. Users often resent subscriptions added after launch. Newer platforms could frame paid options as optional features supporting indie platforms.

The strategic opportunity: as Meta gets more aggressive with monetization, it creates space for competitors to position themselves as "ad-free alternatives" or "privacy-focused alternatives." Users unhappy with Meta's subscription and ad strategy could migrate to platforms explicitly choosing different models.

What Users Should Actually Do

If you're a regular Instagram, Facebook, or WhatsApp user, here's practical advice:

Wait and see: Don't pre-commit to subscriptions. Once they launch, evaluate actual features against the price. Some tiers might be genuinely useful for your workflow. Others might be nice-to-haves.

Track your usage: Before premium launches, spend two weeks tracking how you actually use these apps. Are you using features that premium would enhance? How much time would premium features save you? This baseline helps evaluate the value proposition.

Explore free tier limits: Understand what the free tier includes and what its limitations are. Premium features should address actual frustrations, not create new wants.

Use trial periods: When premium launches, take advantage of free trial periods (usually 7-14 days). Actual experience beats marketing promises.

Consider alternatives: Are there other apps or tools that solve the problem premium features address? Sometimes a third-party tool might be better value than a Meta subscription.

Reassess annually: If you subscribe, revisit your subscription decision yearly. Needs change. What made sense in 2025 might not make sense in 2026.

Ultimately, subscriptions should make your life demonstrably better. If they don't, skip them. There's no shame in using the free tier.

The Manus Integration Deep Dive

We touched on Manus earlier, but it deserves deeper exploration because it's central to Meta's premium vision.

Manus is an AI agent platform built for business automation. Meta acquired it to accelerate AI capabilities across its products. But what does "AI agent" actually mean for average users?

Think of an AI agent as a smart assistant that can accomplish multi-step tasks. You tell the agent what you want, and it breaks down the task into steps, executes those steps, and reports results. Unlike Chat GPT (which responds to prompts), agents can integrate with other systems and services.

In the context of Instagram Premium, a Manus agent could:

- Analyze your recent posts and follower engagement

- Identify your best-performing content types

- Suggest optimal posting times based on your audience's activity

- Draft captions tailored to your audience

- Identify trending topics relevant to your niche

- Suggest hashtag strategies

This is genuinely useful for creators. It saves hours of manual analysis and planning.

For Facebook Premium, agents could:

- Manage group moderation (identifying spam, inappropriate content)

- Suggest relevant events based on community interests

- Help organize marketplace listings

- Draft and schedule group announcements

For WhatsApp Premium, agents could:

- Manage customer service conversations (responding to common questions)

- Route messages to appropriate team members

- Summarize long conversation threads

- Schedule messages

The challenge: AI agents require significant computing power. Manus agents will require backend infrastructure. Meta is fine with this cost for premium tier users, but it's why premium features exist—they require more server resources than the free tier.

As Manus integration deepens through 2025 and 2026, expect premium features to become increasingly agent-powered. Agents will be the flagship premium value proposition.

International Markets and Localization Challenges

Meta operates globally, so subscriptions will need to work globally. This creates complexity.

Payment methods vary by region. In India, users prefer mobile wallets. In parts of Africa, they prefer carrier billing. In developed markets, credit cards dominate. Meta's payment infrastructure needs to support all of these.

Price sensitivity varies wildly. $10 monthly for Instagram Premium is nothing in San Francisco. It's significant in Manila. Meta will need to price regionally, which adds operational complexity.

Regulatory requirements differ. The EU has different digital service requirements than the US. India has data localization requirements. China doesn't allow foreign app subscriptions. Meta's lawyers will have a nightmare.

Cultural expectations differ. In some cultures, paying for apps is normal. In others, software is expected to be free. Marketing and positioning will need to account for this.

Currency exchange volatility: Meta will need policies for handling currency fluctuations. If Meta prices Instagram Premium at $9.99 USD, what happens if local currency collapses or appreciates? Most platforms handle this by re-pricing quarterly or using local currency amounts.

Piracy and fraud: With payment systems come fraud, chargebacks, and piracy. Small subscription amounts are particularly vulnerable to fraud. Meta will need robust fraud detection and dispute systems.

For international users, expect regional pricing, delayed launches in some regions, and possibly different feature sets by region as Meta optimizes for local markets.

Potential Pitfalls and How Meta Might Avoid Them

Subscription initiatives have failed before. Meta has a real risk of botching this. Here are the main pitfalls and how Meta might avoid them:

Pitfall 1: Pricing too high, adoption fails Solution: Meta has the data to understand price elasticity. The company likely tested various price points with user surveys and focus groups. Expect smart, data-driven pricing rather than guesses.

Pitfall 2: Premium features feel like basic features should be free Solution: Meta will carefully segment features to avoid this perception. Features locked in premium should feel genuinely new or advanced, not essential. The company understands this distinction because it's made money from optional features for years.

Pitfall 3: Premium tiers fragment the user experience Solution: Meta has experience managing multiple user tiers through Meta Verified and Facebook Gifts. The company understands how to build features that coexist peacefully across tiers. Users with and without premium should have largely compatible experiences.

Pitfall 4: Subscription support quality is poor Solution: Customer support is expensive, which is why Meta wants subscriptions. But poor support would kill subscriptions. Meta will likely offer subscription support through automated systems (AI agents, naturally) and reserve human support for major issues.

Pitfall 5: Competitor exclusivity Solution: Meta might be tempted to offer exclusive features that competitors can't match. But exclusivity that frustrates non-paying users could backfire. Meta will likely balance exclusivity with perceived fairness.

Pitfall 6: Cannibalization of ad revenue Solution: Meta's biggest risk is that subscription revenue cannibalizes ad revenue (if ads are reduced for subscribers, but paid subscribers generate lower lifetime ad value). Meta will price subscriptions to overcome this risk. The company won't sacrifice a dollar of ad revenue for a dollar of subscription revenue if it can avoid it.

The Bigger Story: Monetization Maturity

Meta's subscription push reflects a broader industry shift from growth-focused (acquiring users) to monetization-focused (extracting value from users). This is normal as platforms mature.

Social media platforms in 2015: focused on user growth, engagement, and network effects. Monetization was secondary.

Social media platforms in 2025: growth has slowed. Engagement is stable. Now the focus shifts to revenue per user.

Meta has effectively maxed out user growth (3 billion users is 40% of the world's population and probably represents saturation in accessible markets). The only way to increase revenue now is to monetize existing users more intensively.

Subscriptions are one lever. Advertising improvements are another (better targeting, new ad formats). Data licensing could be another (selling anonymized data, though this is risky politically). Creator fund programs are another.

Meta is pulling all these levers simultaneously. Subscriptions are just the most visible part.

For users, this means expectations should reset. Social media is no longer a growth-stage service where the primary goal is user acquisition. It's a mature service focused on sustainable revenue and profitability. This affects product decisions, feature priorities, and user experience design.

FAQ

What is a Meta premium subscription?

A Meta premium subscription is an optional paid tier that gives users access to exclusive features and enhanced capabilities on Instagram, Facebook, or WhatsApp. Each app has distinct premium features tailored to its use case. Premium subscribers still get the core free experience plus additional features like unlimited audience lists on Instagram, enhanced AI capabilities, and better privacy controls. The free experience remains unchanged for non-subscribers.

How much will Meta premium subscriptions cost?

Meta hasn't announced official pricing yet, but based on competitive benchmarks, expect Instagram Premium around

When will Meta premium subscriptions launch?

Meta said subscriptions will be tested "in the coming months," indicating a 2025 timeline for initial tests. Realistic expectation is early-to-mid 2025 for limited regional testing in the United States, Canada, and some European countries. Broader rollout would likely occur in Q2-Q3 2025 if early tests succeed. WhatsApp Premium might launch later, potentially in late 2025 or 2026. Full global availability with regional pricing variations probably comes in 2026. Regulatory approval and technical readiness could affect exact timelines.

Are Meta premium subscriptions mandatory?

No, premium subscriptions will remain completely optional. Meta has emphasized that core experiences on Instagram, Facebook, and WhatsApp will stay free. The free tier includes all essential features and functions. Premium subscriptions add optional features for users willing to pay for enhanced productivity, creativity, or privacy controls. Meta's business model depends on a massive free user base for advertising and network effects, so mandatory subscriptions would be counterproductive. The company benefits from keeping most users on the free tier while capturing incremental revenue from those willing to pay.

What features will Instagram Premium include?

Official features haven't been announced, but reverse engineers have found evidence of unlimited audience lists, the ability to see followers who don't follow you back, and the ability to view Stories without the poster seeing you viewed it. Additional features likely include enhanced AI capabilities powered by Manus, AI-assisted caption generation, improved content recommendations, and possibly advanced analytics for engagement. Instagram Premium will probably include productivity tools for creators and power users. The features appear designed for people who use Instagram seriously (creators, business owners) rather than casual users.

What will Facebook Premium offer?

Meta hasn't officially described Facebook Premium features, but likely offerings include reduced ad frequency or a less ad-heavy feed, enhanced group moderation tools for group administrators, improved event management features, better analytics for page owners, and enhanced AI capabilities. Facebook Premium might target power users who spend significant time managing groups, organizing events, or running local businesses. Privacy control improvements are also possible. The challenge is convincing Facebook's older, more price-sensitive user base that premium features provide genuine value worth paying for monthly.

How does Manus AI integrate with premium subscriptions?

Manus is an AI agent platform Meta acquired for $2 billion. The company plans to integrate Manus into Meta products, making advanced AI capabilities available to premium subscribers. For Instagram, this could mean AI assistants helping with scheduling, caption generation, and follower analysis. For Facebook, agents could help moderate groups and suggest relevant content. For WhatsApp, agents could provide customer service automation and message organization. Meta will also continue selling Manus separately to businesses. Essentially, premium subscribers get access to AI agent capabilities for personal and creative use, while businesses access Manus as a separate product for automation needs.

How will premium subscriptions affect advertisers?

Advertisers will face some changes. If premium subscribers see fewer ads, advertiser reach decreases proportionally. Advertisers might need to adjust budgets or targeting for premium subscribers who see ads differently. If premium subscribers opt out of aggressive tracking to support privacy, advertisers lose targeting data for these users. However, Meta will likely maintain substantial advertising on the free tier where the vast majority of users remain. The net effect is probably modest for most advertisers unless a very high percentage of users convert to premium, which is unlikely.

Should I subscribe to Meta premium if it launches?

Wait for official launches and try free trial periods before committing. Evaluate whether premium features actually save you time or provide genuine value for your specific use case. If you're a casual user, the free tier probably suffices. If you're a creator, business owner, or power user who uses these apps extensively, premium might provide meaningful value. Use your baseline usage data (how you actually use the app today) to evaluate whether premium addresses real frustrations or just creates new wants. Don't subscribe based on marketing promises; base decisions on actual experience during trial periods.

How does Meta premium compare to YouTube Premium and Snapchat+?

Snapchat+ (

Will premium users get better privacy and data protection?

Premium features will likely include enhanced privacy controls (like hiding Story views), but this doesn't mean Meta stops collecting data from premium users. Premium probably doesn't change Meta's underlying data practices, just what features you can control. Premium might offer better visibility into data collection, but the collection itself continues. Users shouldn't assume premium equals privacy-first. Use free tier privacy controls effectively first, then premium for additional control options.

What are the risks of Meta premium subscriptions?

Key risks include: (1) premium features becoming gradually essential, degrading the free experience over time; (2) privacy controls being paywalled while free users lose privacy; (3) pricing higher than perceived value, limiting adoption; (4) poor customer support for subscription issues; (5) subscription revenue cannibalizing advertising revenue; (6) regulatory issues in certain jurisdictions blocking launches. For users, the main risk is discovering premium features aren't valuable after purchase. For Meta, the main risk is poor execution damaging user sentiment and adoption rates.

Conclusion: The Future of Social Media Monetization

Meta's premium subscription strategy represents a fundamental shift in how the company thinks about its business. For the past 15 years, Meta's strategy was simple: acquire users, engage them, and monetize through advertising. That strategy worked brilliantly and made the company one of the most valuable in the world.

But that strategy has limits. User growth has plateaued. Advertising markets are increasingly competitive. Regulatory pressure is mounting. The cost of maintaining and improving platforms continues rising while traditional revenue streams face headwinds. Enter subscriptions.

Subscriptions represent Meta's bet that users will pay directly for features that make their social media experience better. It's not a crazy bet. Snapchat proved demand exists. YouTube Premium has been successful. Consumers pay subscriptions for hundreds of apps and services. Why not social media?

The execution matters enormously. If Meta prices aggressively but features don't deliver value, adoption will be low. If the free tier becomes increasingly degraded to push people to premium, backlash will be significant. If privacy controls are paywalled while free users lose privacy, regulatory agencies will react sharply.

But if Meta executes smartly—offering genuine value in premium features, maintaining robust free experiences, and pricing competitively—subscriptions could add billions to annual revenue while keeping users happy. The company's massive scale means even 5-10% subscription adoption would generate enormous revenue.

For users, the takeaway is clear: premium subscriptions are coming, but they're optional. Evaluate them carefully based on actual features and your real needs. Don't feel pressured to subscribe. The free tier will remain functional and complete. Premium is for people who genuinely want the extra features and are willing to pay for them.

For creators, this is an inflection point. Meta is moving toward more direct monetization. This creates both opportunities (premium tools that make creation easier) and competitive pressure (Meta features that might replicate what third-party creator platforms offer). Smart creators will diversify their monetization beyond Meta while leveraging Meta premium features when they provide clear value.

For advertisers, watch the early adoption data. How many users subscribe? What's the overlap between premium subscribers and your target audience? Are engaged premium users more or less likely to convert? The answers will inform your strategy.

The bigger story is about platform maturity. Social media is no longer a growth business. It's a mature, profitable business focused on sustainable revenue and shareholder returns. This affects everything from feature priorities to privacy standards to user experience design. Users should expect platforms to monetize more intensively and pull more levers for revenue. Subscriptions are just the most visible lever.

What's uncertain is whether users accept this evolution or migrate to alternatives promising different models. Threads, Bluesky, and other platforms explicitly position themselves against Meta's aggressive monetization. If Meta's subscription push and advertising intensity increase significantly, these alternatives could gain traction among users frustrated with Meta's direction.

The next 12 months will be critical. Early subscription adoption rates will signal whether Meta's strategy works. If 10-15% of users subscribe, the strategy is validation and Meta accelerates. If adoption is below 5%, Meta might reconsider. Your actual behavior as an early adopter will help determine Meta's trajectory.

For now, the smart approach is patience. Wait for official launches. Try free trials. Evaluate against your actual needs. Don't subscribe based on hype. Subscribe based on value. And remain aware that this is Meta's strategic pivot toward squeezing more revenue from the platforms you use. Whether that's good or bad for users is a question you'll answer through your subscription choices.

Use Case: Need to automate creating presentations or reports about new social media strategies? Generate them in minutes instead of hours.

Try Runable For FreeKey Takeaways

- Meta is testing optional premium subscriptions on Instagram, Facebook, and WhatsApp with app-specific features starting mid-2025

- Instagram Premium will likely cost $7.99-12.99 monthly and include unlimited audience lists, follower insights, and Story view privacy

- Manus AI integration ($2 billion acquisition) powers premium AI capabilities including content scheduling, caption generation, and analytics

- Even conservative 5% adoption could generate $12.6 billion annually, justifying Meta's investment in subscription infrastructure

- Free tiers remain completely functional and unchanged, with premium as optional enhancement for power users and creators

- Snapchat+ (16 million subscribers) proved market demand; Meta is positioning between Snapchat+ (14.99)

- Regional pricing variations likely, with higher prices in wealthy markets and lower prices in emerging markets with different purchasing power

Related Articles

- UpScrolled Surges as TikTok Alternative After US Takeover [2025]

- Threads Algorithm Guide: How It Works & How to Win [2025]

- TikTok's First Weekend Meltdown: What Actually Happened [2025]

- TikTok's Trump Deal: What ByteDance Control Means for Users [2025]

- TikTok US Deal Finalized: 5 Critical Things You Need to Know [2025]

- TikTok's US Deal Finalized: What the ByteDance Divestment Means [2025]

![Meta's Premium Subscriptions Strategy: What It Means for You [2025]](https://tryrunable.com/blog/meta-s-premium-subscriptions-strategy-what-it-means-for-you-/image-1-1769470684441.jpg)