Tik Tok's Trump Deal: What Byte Dance Control Means for Users [2025]

It's January 2026, and Tik Tok is still here. But nothing feels quite the same.

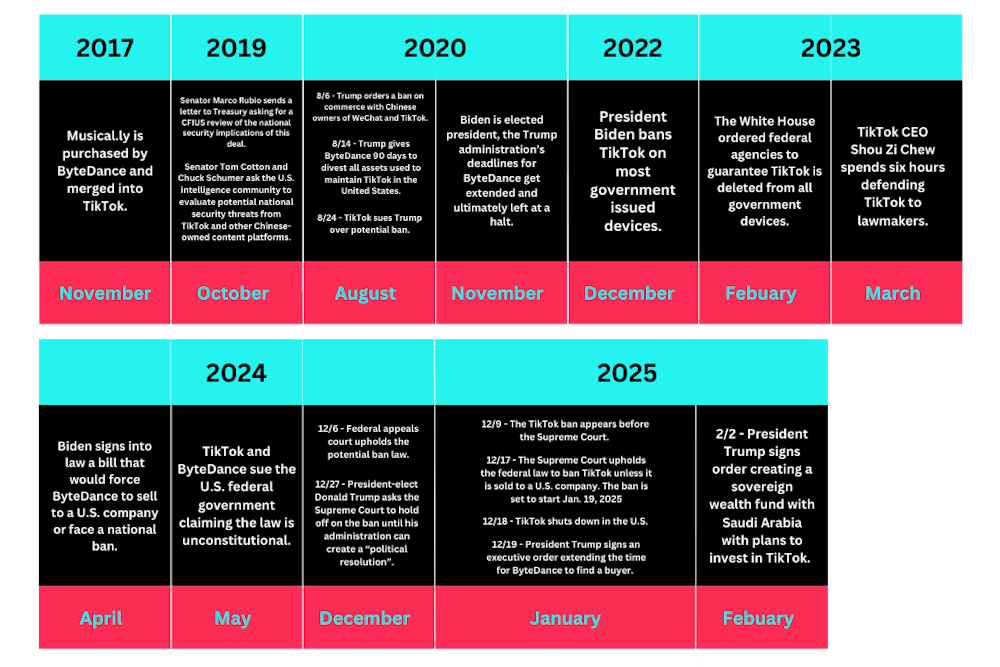

For months, the app existed in limbo. Congress had passed a law requiring Tik Tok to divest from its Chinese parent company Byte Dance or face a complete ban in the United States. The deadline came and went. Trump issued executive orders. Negotiations dragged on. Hundreds of millions of American users refreshed the app wondering if today would be the day it disappeared.

Then, just as suddenly as the crisis arrived, the Trump administration announced a deal. The app would stay. Byte Dance wouldn't lose it entirely. Instead, a new joint venture would take control, with American investors holding the majority stake. Trump celebrated on Truth Social. Byte Dance released a statement. Tik Tok's leadership reassured employees.

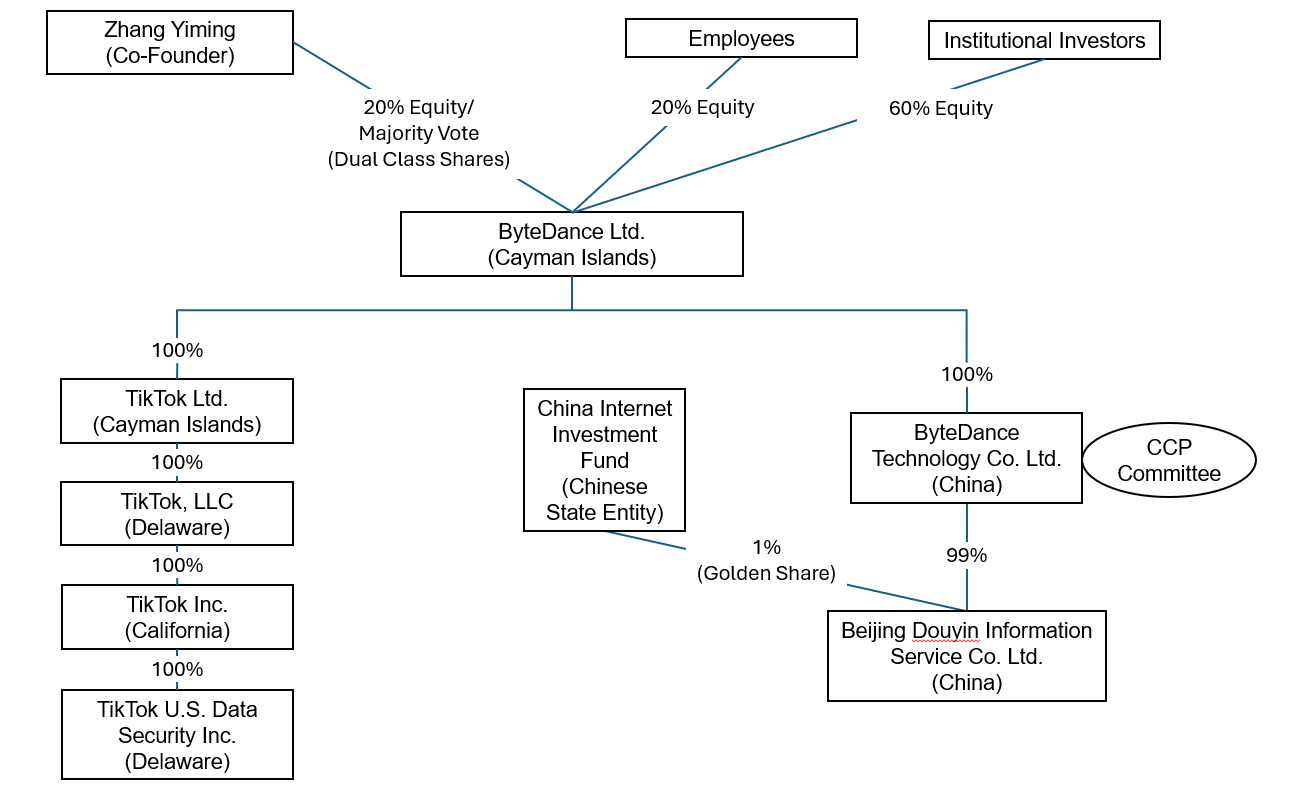

But if you've paid attention to how these deals actually work, you already know something doesn't add up. Byte Dance retains nearly 20 percent ownership. The company still controls the algorithm. And the Trump allies now running Tik Tok have openly discussed wanting to reshape the platform's content in their political favor. The national security concerns that sparked the ban are still there. The political implications are worse.

This isn't just about whether an app survives. It's about control over one of the most influential media platforms in America, what happens when political allies gain operational authority over a major social network, and whether the deal actually resolves anything at all.

Let's break down what actually happened, why it matters, and what comes next.

TL; DR

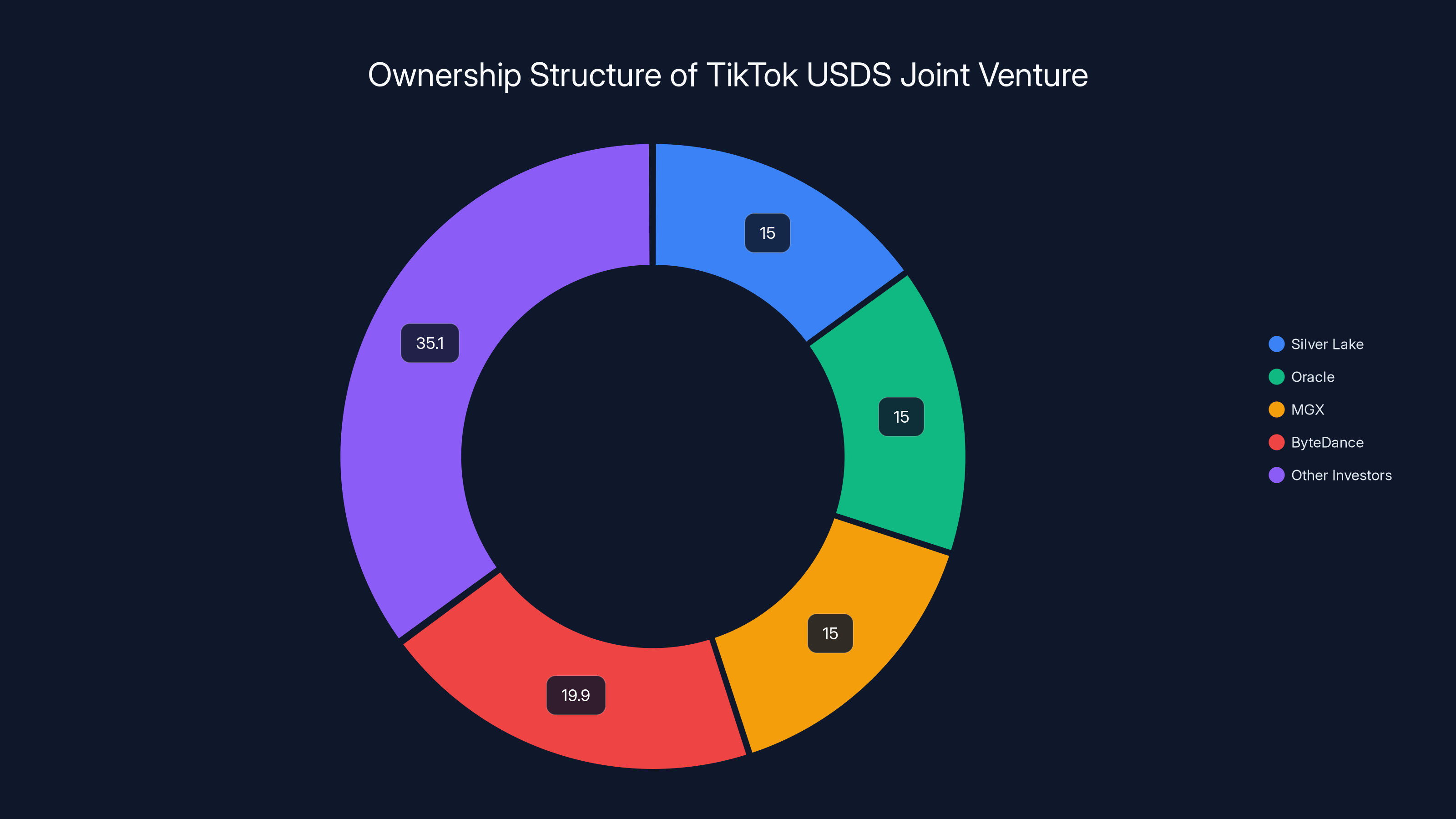

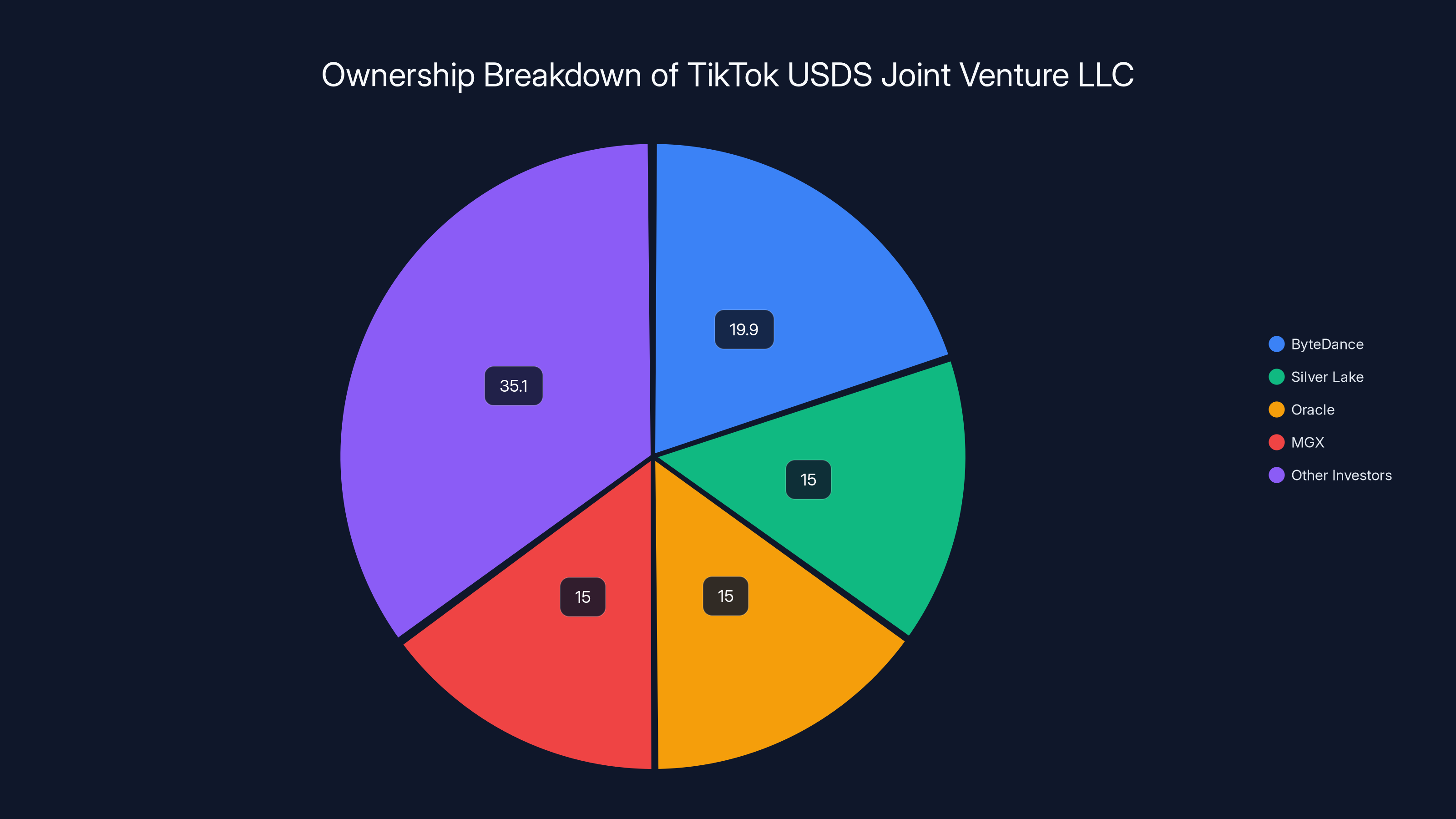

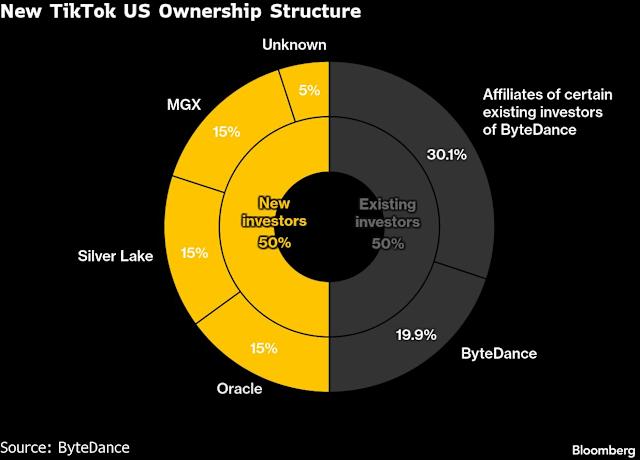

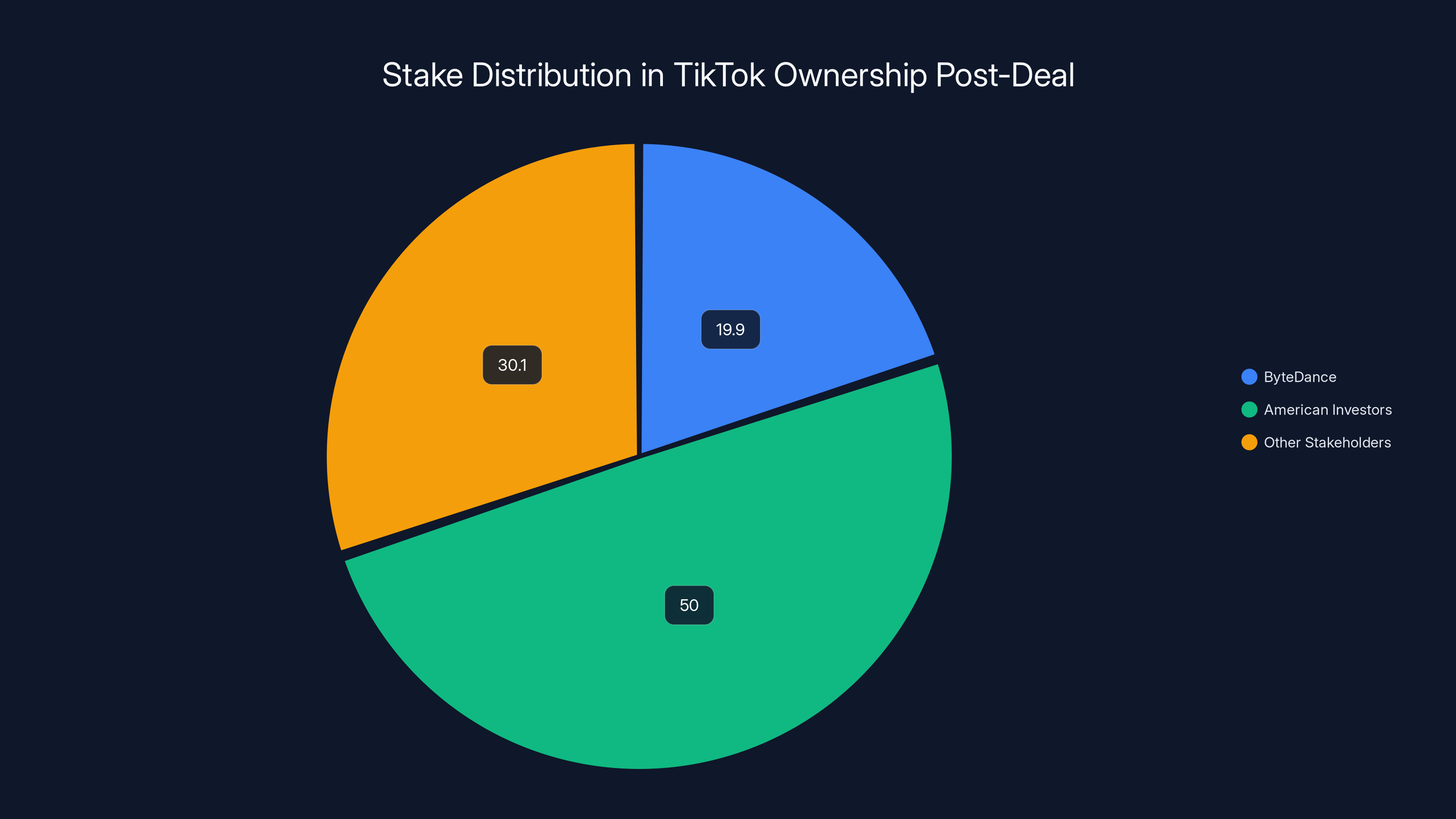

- New joint venture structure: Tik Tok USDS Joint Venture LLC keeps the app running with American majority ownership, but Byte Dance retains 19.9% stake and algorithm control, as reported by CNN.

- Trump administration approval: The deal allows Trump allies through Silver Lake, Oracle, and MGX to take operational control of the platform, raising concerns about political bias, according to Politico.

- National security unresolved: Byte Dance still manages "global product interoperability and certain commercial activities," meaning continued operational ties to the Chinese parent company, as noted by Reuters.

- Algorithm concerns: Questions remain whether the algorithm can truly be decoupled from Chinese government influence when Byte Dance still owns the underlying technology, as discussed in Tech Policy Press.

- Policy shifts ahead: Trump officials have indicated Tik Tok will become more favorable to conservative content, reversing years of perceived political moderation concerns, according to The New York Times.

The TikTok USDS Joint Venture is structured with American investors holding majority stakes, each at 15%, while ByteDance retains a 19.9% stake. Estimated data.

The Deal Structure: Who Owns What

The Tik Tok USDS Joint Venture LLC is a carefully constructed compromise that looks like a divestiture on paper but functions more like a partnership restructuring in practice. Understanding the actual ownership breakdown matters because percentages don't tell the full story when it comes to operational control.

Byte Dance took the 19.9 percent stake, which puts it just below the 20 percent threshold that might trigger additional regulatory scrutiny. The company maintains this position despite months of political pressure to completely divest. This wasn't an accident. The Trump administration explicitly agreed to these terms, understanding that they provided Byte Dance with meaningful influence while allowing the deal to move forward, as explained by USA Today.

The three major American investors each hold 15 percent. Silver Lake, a prominent venture capital firm that specializes in technology deals, brought both capital and operational expertise. Oracle, the database giant, stepped in to handle data security and infrastructure requirements. MGX, a UAE-based sovereign wealth fund, rounded out the primary ownership group. Together, these three entities control 45 percent of the joint venture, as noted by Investing Live.

Other investors, including Michael Dell's family office, hold smaller undisclosed stakes that probably don't exceed 5 percent each. This fragmentation matters because it means no single American investor has the kind of controlling stake you might expect from a forced divestiture. Instead, influence is distributed across multiple players, each with their own agenda.

The board structure reinforces this distributed authority. Seven seats total, with Americans holding the majority (exactly how many depends on the specific composition, though Tik Tok's official statements confirm American dominance). Byte Dance holds one seat, occupied by Tik Tok CEO Shou Chew. This single board seat gives Byte Dance formal representation at strategic decision-making meetings, as highlighted by BBC News.

What makes the structure even more nuanced is the distinction between ownership, board control, and operational authority. You can own a business without controlling day-to-day operations. You can sit on a board without making hiring decisions. The deal divides these powers in ways that technically satisfy the divestiture requirement while practically maintaining Byte Dance's influence.

The valuation sits at $14 billion, which is substantially lower than pre-ban estimates of Tik Tok's worth. That discount reflects the risk premium investors pay for an asset surrounded by geopolitical uncertainty and regulatory ambiguity. Silver Lake and Oracle likely negotiated hard to justify this investment to their boards and limited partners, as reported by NPR.

The pie chart shows ByteDance holding a 19.9% stake, while three major American investors each hold 15%, and other investors collectively hold 35.1%. This distribution indicates a balanced control structure.

What Byte Dance Actually Retains

Here's where the deal gets genuinely complicated and why national security experts remain concerned. Byte Dance didn't just keep a minority stake. The company retained control over the actual technology that makes Tik Tok work, as detailed by American Progress.

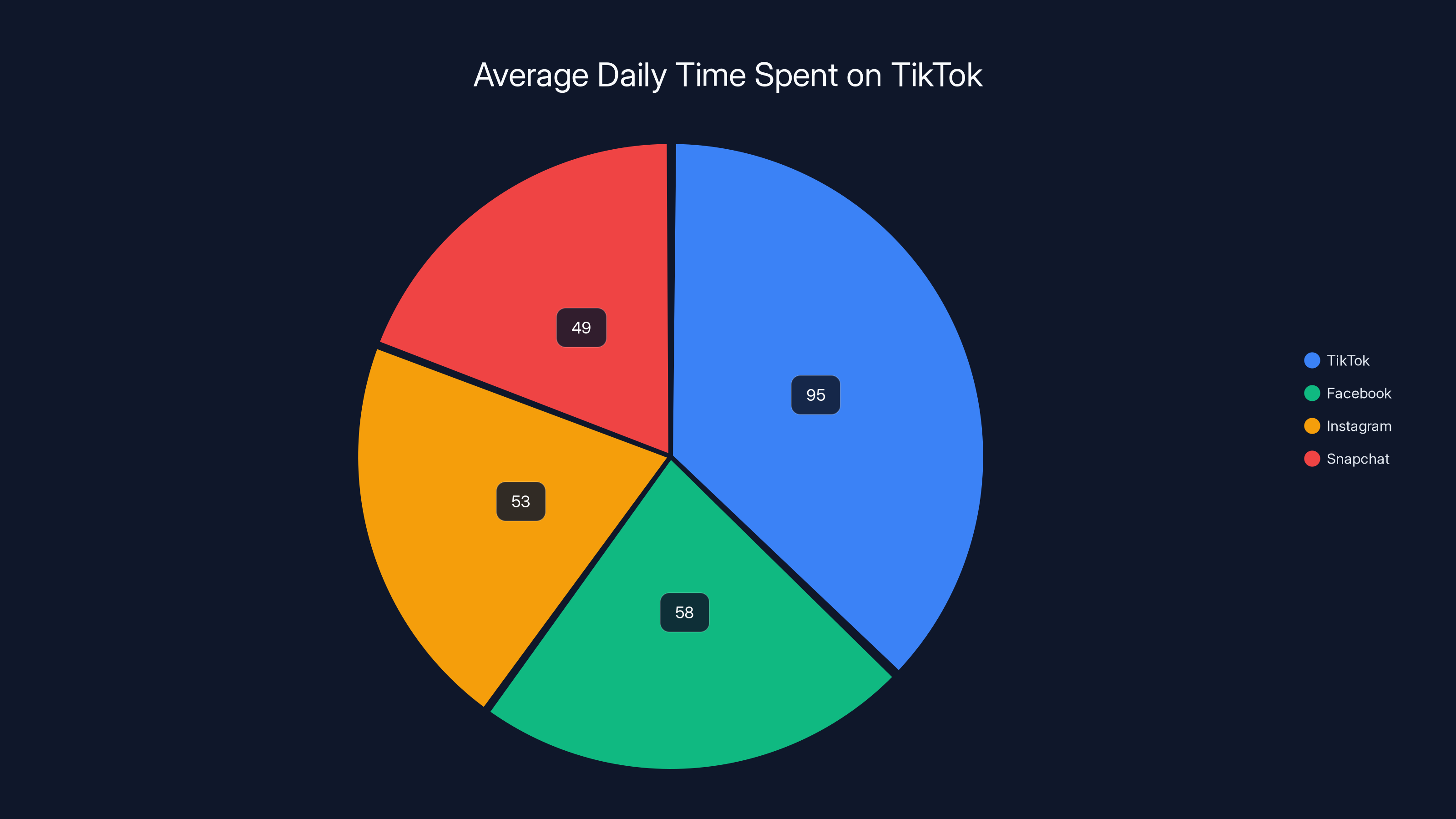

Most importantly, Byte Dance owns the recommendation algorithm. This is the system that decides which videos you see, in what order, with what priority. The algorithm is the soul of Tik Tok. It's why users spend 95 minutes per day on average scrolling through an endless stream of hyper-optimized content. Facebook's algorithm changed how billions consume information. Tik Tok's algorithm is even more powerful because it operates without the friction of social connections. You don't follow accounts on Tik Tok the same way you follow people on Facebook. Instead, the algorithm directly places content in front of you based on what it thinks you want to see.

Byte Dance licensed this algorithm to the joint venture. The joint venture will retrain it on American user data and retain control over deployment. That sounds like decoupling until you realize that Byte Dance still owns the underlying technology architecture. If the joint venture wants to make a significant change, it still requires Byte Dance's permission. If the algorithm has structural components designed to prioritize content in certain ways, those design choices originated with Byte Dance's engineers, as noted by Politico.

This matters because the core concern about Tik Tok has always been the algorithm's potential to favor content aligned with Chinese government interests. Critics worried that Byte Dance could use the algorithm to promote propaganda, suppress dissent, or manipulate American public opinion in ways favorable to Beijing. The deal doesn't eliminate this possibility. It just moves the responsibility for activating it from Byte Dance directly to a Byte Dance-controlled technology.

Byte Dance also retained control over "global product interoperability and certain commercial activities, including e-commerce, advertising, and marketing." Translation: the company still manages how Tik Tok integrates with Byte Dance's other products globally. Byte Dance owns Douyin (Tik Tok's Chinese version), Byte Dance Now (social media), and numerous other platforms. Keeping "interoperability" under Byte Dance control means Tik Tok users could theoretically be connected to these other ecosystems, and data could flow between them, as explained by Tik Tok Newsroom.

The e-commerce component is especially important because Tik Tok Shop, which lets creators and businesses sell directly through the app, falls under this umbrella. Byte Dance still manages the commercial infrastructure. This creates another potential pressure point. If the Chinese government wanted to access information about American commerce or creator networks, the infrastructure exists.

Oracle provides the security infrastructure. Third-party auditors will regularly review the data environment. These are meaningful controls, and Oracle is a serious company with something to lose if they oversee a breach. But the controls sit on top of technology infrastructure that Byte Dance ultimately owns. It's like hiring the best security company in the world to protect a building while still letting the original architect maintain access to the blueprints, as highlighted by The New York Times.

The National Security Question Nobody Really Answered

Congress passed the Protecting Americans from Foreign Adversary Controlled Applications Act specifically to address national security concerns about Tik Tok. The law requires complete divestiture that "ends any 'operational relationship' between Byte Dance and Tik Tok in the United States."

Does this deal satisfy that requirement? That's the central question that Trump administration officials claim is settled while lawmakers and security experts say remains unresolved, as discussed in BBC News.

The technical argument in favor goes like this. Byte Dance no longer operates Tik Tok in the US. American investors do. American executives make decisions about content moderation, creator policies, and platform features. American data infrastructure handles user information. The algorithm gets retrained on American data. From an operational standpoint, Tik Tok US operates independently.

The technical argument against goes like this. Byte Dance still owns the algorithm, the underlying technology, the e-commerce infrastructure, and the global integration layers. The company maintains a board seat. Byte Dance retains a minority stake large enough to monitor decisions. The "operational relationship" isn't eliminated. It's just restructured into a licensing arrangement where Byte Dance provides the core technology while American partners handle deployment.

The law's framers probably intended the former. The deal as written enables the latter. This is a meaningful gap.

Consider a parallel. Imagine a foreign government owned the core algorithms behind Google Search but licensed them to an American company. The American company hires American engineers, makes American decisions about content moderation, and ensures American data protection. Is Google now American-controlled? Technically American entities operate it. Strategically, the foreign power still controls the fundamental technology that shapes what billions of people see.

Senator Edward Markey raised exactly this concern in a statement released the day the deal closed. He noted that the White House provided "virtually no details about this agreement, including whether Tik Tok's algorithm is truly free of Chinese influence." He called for Congressional investigation and transparency. Representative John Moolenaar, chair of the House Select Committee on China, posed two specific questions: First, can Americans ensure the algorithm isn't influenced by the Chinese Communist Party? Second, can Americans ensure that user data is secure? These concerns were echoed in The New York Times.

Both are reasonable questions. Both remain incompletely answered. The Trump administration and Tik Tok's new management claim the answers are yes. But the architecture of the deal creates structures where both could theoretically be compromised if Byte Dance chose to exercise its leverage.

This isn't speculation. It's how technology licensing agreements typically work. If you license core technology to someone, you maintain certain rights and leverage points. Byte Dance negotiated to retain this leverage.

The Trump administration apparently decided that these concerns were acceptable risks. Vice President JD Vance confirmed that the joint venture "will have control over how the algorithm pushes content to users." That's a meaningful commitment. But control over deployment and ownership of underlying technology remain different things. The deal provides the former while Byte Dance retains the latter, as noted by CNN.

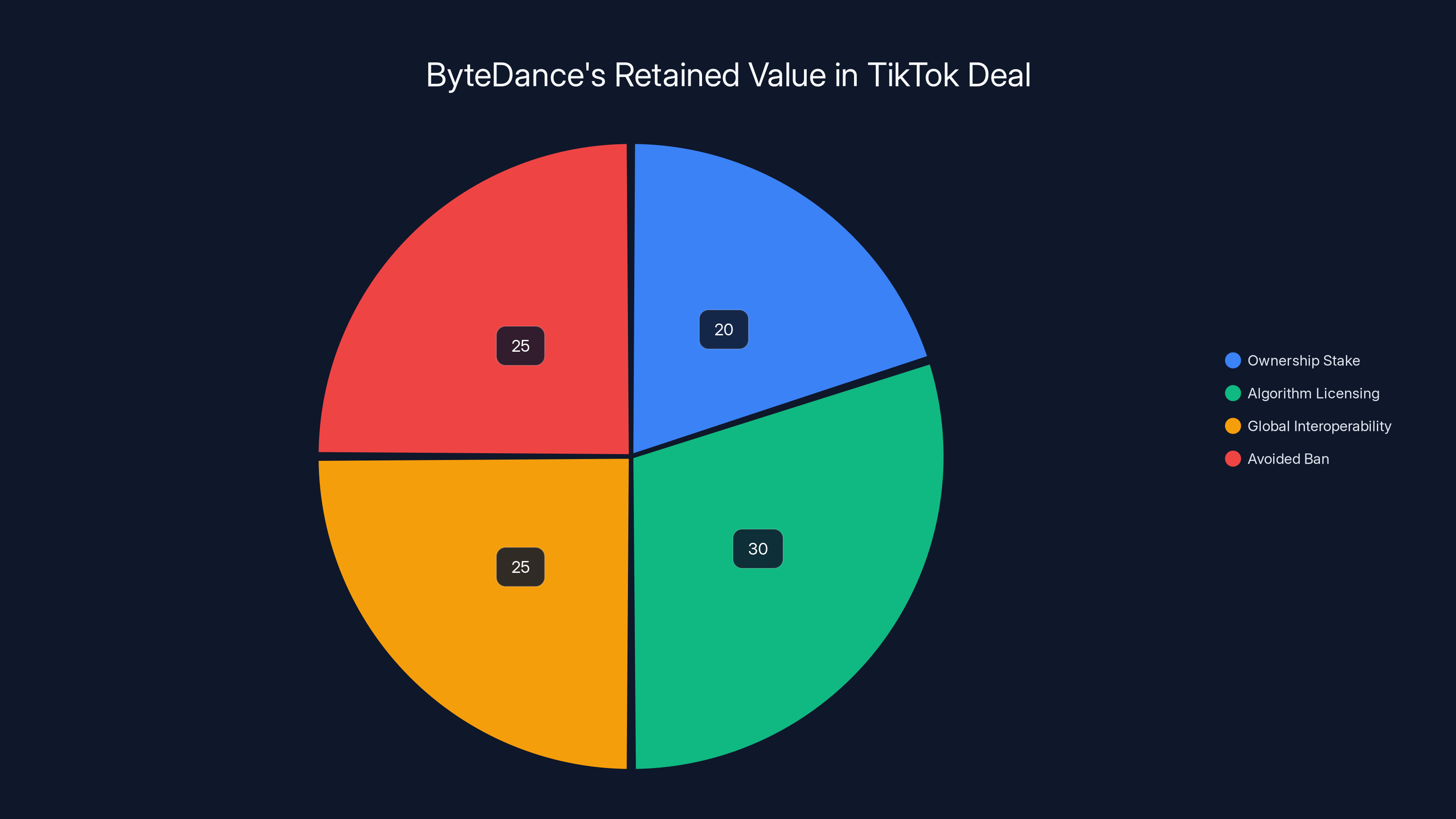

ByteDance retained value through ownership stake, algorithm licensing, global interoperability, and avoiding a complete ban. Estimated data.

Who's Running Tik Tok Now

Two former Tik Tok employees now lead the joint venture, which matters more than you might initially think. These are the people making daily decisions about what content thrives, which creators get promoted, and how the platform evolves.

Adam Presser, the new CEO, previously ran Operations and Trust & Safety at Tik Tok. That's an important background because Trust & Safety touches everything from content moderation policy to creator relationships to policy enforcement. Will Farrell, the new Chief Security Officer, previously handled Business Operations Protection. Both rose through Tik Tok's internal ranks, which means they understand the platform at a deep technical level. Both also have institutional memory of how Byte Dance made decisions historically.

What makes their appointment interesting is that both are Americans taking over a platform from American (nominally) ownership. But they're not external operators brought in to radically reshape the company. They're Tik Tok people who understand the current culture and operations. This means continuity for users even as control shifts.

But here's the catch. Presser and Farrell now work for the American board, which is controlled by Silver Lake, Oracle, MGX, and various other investors. Some of these investors have political leanings. Some have business interests that might align with Trump administration priorities. The new leadership answers to a different boss than the old Byte Dance-controlled management did, as highlighted by NPR.

In a hypothetical scenario, if the new board decided Tik Tok should feature more conservative political content or suppress progressive creators, Presser and Farrell would be expected to implement those decisions. They'd face pressure from investor shareholders to generate returns and meet political expectations. This is true for any corporate leadership. But it becomes especially relevant when your new board includes Trump allies who've explicitly discussed wanting to reshape the platform's content.

Trump himself gave a sense of where this might go when he said Tik Tok should go "100 percent MAGA." The New York Times noted that this comment suggested Trump and his allies wanted to directly influence "which posts to leave up and which to take down." That's not normal social media governance. That's politically directed content control, as reported by The New York Times.

Presser and Farrell are professional operators who presumably understand platform governance principles. But they now work in an environment where their board includes major Trump donors and allies who see the platform as an opportunity for political influence.

The Algorithm Retrain: What Changes

One genuine technical advance in the deal is that Tik Tok's algorithm will be "retrained" on American user data. This sounds simple. It's actually complex and has meaningful implications.

When machine learning algorithms train on data, they learn patterns embedded in that data. Tik Tok's recommendation algorithm was trained on billions of global user interactions. It learned what content drives engagement across China, Southeast Asia, Europe, and the US. That training data likely reflects global preferences and probably carries some signal of Chinese government preferences (since part of the data comes from Douyin, the Chinese version where the government has far more control).

Retraining on American data only means the algorithm learns patterns specific to American users. It forgets patterns from other markets. It might recommend different things because American users have different tastes, different sensitivities, and different engagement patterns than global users.

This could theoretically reduce any algorithmic bias introduced by Chinese government influence, since that influence was encoded in the global training data. But retraining on American data doesn't eliminate bias entirely. It just changes whose biases the algorithm reflects. If the American training team has certain assumptions about what content should succeed, those assumptions get embedded in the new algorithm, as noted by Tech Policy Press.

The humans who design the training process, who choose what data to include, who set the optimization targets, still have enormous influence. If you train an algorithm to maximize engagement above all else, it'll optimize for engagement (which helped Tik Tok become wildly popular). If you train it to maximize engagement while penalizing certain types of content, it'll do that instead.

Oracle and the joint venture haven't announced the specific retraining approach. They haven't said whether they're optimizing for pure engagement or for engagement plus other factors like "healthy discourse" or "diverse viewpoints" or "politically balanced content." Different optimization targets could produce very different recommendations.

The retrain also affects the algorithm's understanding of what users want to see. The current algorithm probably overrepresents certain content types that Chinese users engage with heavily. Retraining could shift recommendations toward content that American users prefer. This could mean more political content, more lifestyle content, more local culture. It could also mean different algorithms for different user demographics, optimizing for what each age group or interest category engages with most.

All of this is probably positive in some ways. It reduces the direct connection to Chinese user behavior and preferences. But it's important to be realistic about what "retraining" actually means. It's not magic. It doesn't eliminate algorithmic bias. It replaces one set of biases (global, potentially influenced by Chinese government) with another set (American market-driven, potentially influenced by new board members).

TikTok's algorithm drives higher user engagement, with an average of 95 minutes spent daily, surpassing other platforms like Facebook, Instagram, and Snapchat. Estimated data.

Trump Allies Now Control a Major Platform

This is where the deal moves from technical governance into genuinely concerning political territory.

Silver Lake, one of the three major 15-percent investors, is a firm that manages billions in assets. The firm's founder and key executives have donated to Republican candidates. Satya Nadella, CEO of Microsoft (another major tech investor), is personally apolitical but Microsoft has increasingly aligned with Trump administration interests. Oracle founder Larry Ellison is a vocal Trump supporter who has funded his campaigns, as reported by The New York Times.

These aren't neutral investors. They're people with political preferences who now control a platform used by nearly 200 million Americans. Tik Tok's influence on American culture, politics, and youth engagement is enormous. The app has shaped everything from music discovery to political activism to how Gen Z understands current events.

In 2024, there was a noticeable pattern where Tik Tok suppressed certain types of content, and critics accused the platform of anti-Trump bias. The New York Times ran multiple stories about creators claiming Tik Tok's algorithm wasn't promoting their content if they posted politically right-leaning material. These allegations were never conclusively proven, but they created a narrative that Tik Tok was biased against conservatives.

Now that Trump allies control the platform, there's a legitimate concern that the reverse could happen. Progressive creators could find their content deprioritized. Political content supporting Democratic candidates could get suppressed. Climate change content could be deemphasized. LGBTQ+ creators could face algorithmic headwinds.

Trump's statement that Tik Tok should go "100 percent MAGA" suggests he's thinking about it exactly this way. He views the platform as having been biased against him. Now that he has influence over it, he wants to reshape it to reflect his political perspective, as noted by The New York Times.

This is different from Byte Dance's concerns, which were about whether a foreign government could use the platform for propaganda. Now the concern is whether the Trump administration and its allies could use the platform for domestic propaganda. Both are legitimate concerns. Both involve using algorithmic influence to shape what Americans see and how they think about politics.

The irony is that the deal was supposed to prevent foreign government influence on American media. But it may have created conditions for different governmental influence, just from a different direction.

Data Security and the Oracle Infrastructure

One area where the deal provides genuine technical safeguards is data security. Oracle is handling the infrastructure, which is a meaningful choice. Oracle understands enterprise-grade security because it serves banks, governments, and major corporations. The company has serious expertise, as highlighted by BBC News.

The specific arrangement places American user data in a secure cloud environment. This presumably means data physically stored on servers in the United States, managed by American infrastructure, under American legal jurisdiction. Third-party cybersecurity experts will audit the system regularly. If a breach happens, Oracle bears direct liability.

This structure does reduce the risk that user data gets exfiltrated to Chinese government agencies. It doesn't eliminate that risk entirely (no data system is perfectly secure), but it substantially reduces it. American courts can compel data access, but the Chinese government cannot directly force Byte Dance to hand over the data because Byte Dance wouldn't have it.

Compare this to the pre-deal situation where Tik Tok operated under complete Byte Dance control, with data theoretically accessible to Chinese authorities under Chinese law. The move to American infrastructure and American data custody is a genuine improvement, as noted by Reuters.

But it's worth noting that data security and algorithm control are separate things. Protecting data from government access doesn't solve the algorithmic bias problem. You can have perfectly secure data that gets fed into an algorithm that's been designed to suppress certain types of content. The two issues address different aspects of national security concern.

Oracle's involvement also gives the company significant commercial leverage. They're now embedded in one of the most powerful media platforms in America. Their infrastructure decision directly affects how Tik Tok operates. This means Oracle has negotiating power with other companies, governments, and regulatory bodies. That's not necessarily bad, but it means Oracle's interests now align with Tik Tok's success, as reported by Investing Live.

Estimated data shows ByteDance retains 19.9% ownership, while American investors hold a significant stake, illustrating compromise in international tech negotiations.

The Congressional Investigation That Hasn't Really Started

Momentum Moolenaar has promised to hold hearings with Tik Tok's new American leadership to examine whether the deal actually addresses national security concerns. But as of late January 2026, those hearings haven't happened. Congress has accepted the Trump administration's assertion that the deal is legitimate without really independently evaluating it, as noted by Politico.

This represents a significant departure from how Congress typically handles major tech regulatory issues. Usually, there's extensive debate, testimony from multiple perspectives, and detailed analysis of proposed solutions. With Tik Tok, Congress essentially outsourced the decision to the Trump administration and then waited to see what deal emerged.

Senator Markey's complaint about lack of transparency is justified. The public doesn't know the specific terms of the deal beyond what Tik Tok released in a press statement. The actual legal documents, the specific technical requirements, the audit arrangements, and the governance procedures are not public. Congress hasn't seen full details either, based on Markey's statement that the White House denied repeated requests for information, as reported by American Progress.

This lack of transparency makes proper oversight impossible. How can legislators determine whether a deal truly addresses national security concerns if they don't know the actual terms? How can the public trust the arrangement if the details are hidden? And how can independent security experts assess the technical sufficiency of the arrangement without seeing the underlying agreement?

The Trump administration seems to have decided that speed was more important than transparency. They wanted to announce a deal before the political window closed. They wanted to show Trump a win on Tik Tok preservation. Getting approval from the new ownership group was straightforward because they negotiated the terms directly. Getting Congressional approval was unnecessary because Congress had already expressed opposition to a ban, making most legislators open to accepting any alternative.

But this creates a situation where a major media platform serving 200 million Americans was essentially privatized through back-channel negotiations rather than through formal legislative or regulatory process. That's not inherently illegal or wrong, but it's unusual and opens the door to future problems, as discussed in Tech Policy Press.

What Creators and Users Should Expect

For Tik Tok users, the deal probably means the app continues to look and function mostly the same. The interface won't dramatically change overnight. The core recommendation algorithm will probably work similarly in most ways. Your For You Page will still serve an endless stream of optimized content.

But subtle shifts could happen gradually over months. If the new board wants more conservative political content, creators might notice that political videos get different algorithmic treatment. Progressive creators might find fewer people seeing their content. Conservative creators might see unprecedented reach. These shifts wouldn't be sudden or obvious. They'd be gradual changes in algorithmic promotion, as noted by The New York Times.

Creators could also face new content policies. The new leadership might deprioritize content about climate change, abortion, gun control, or other politically charged topics. Or they might actively promote such content if it aligns with the Trump administration's messaging. The specific policies will emerge from decisions made by Presser, Farrell, and the board over the next few months.

For regular users, the most noticeable change might be advertising. Byte Dance historically ran Tik Tok as a platform play, accepting lower profitability in exchange for user growth. American investors are more focused on monetization and profitability. That probably means more ads, more promoted content, and more aggressive commercial features, as discussed in CNN.

The e-commerce features will likely expand significantly. Byte Dance had been cautious about monetization in the US to avoid regulatory criticism. American investors see the e-commerce opportunity as a major revenue stream. Expect more product placements, more seller storefronts, and more shopping-focused content.

For child safety, content moderation, and creator welfare, the new American management team will probably implement more robust policies than Byte Dance did. American labor law, consumer protection law, and child safety regulations have force behind them. Chinese Byte Dance management sometimes treated these areas as obstacles to overcome. American management will treat them as legal requirements. This could mean better protections for kids using the app and better working conditions for creators, though it could also mean more content removals and stricter enforcement, as highlighted by USA Today.

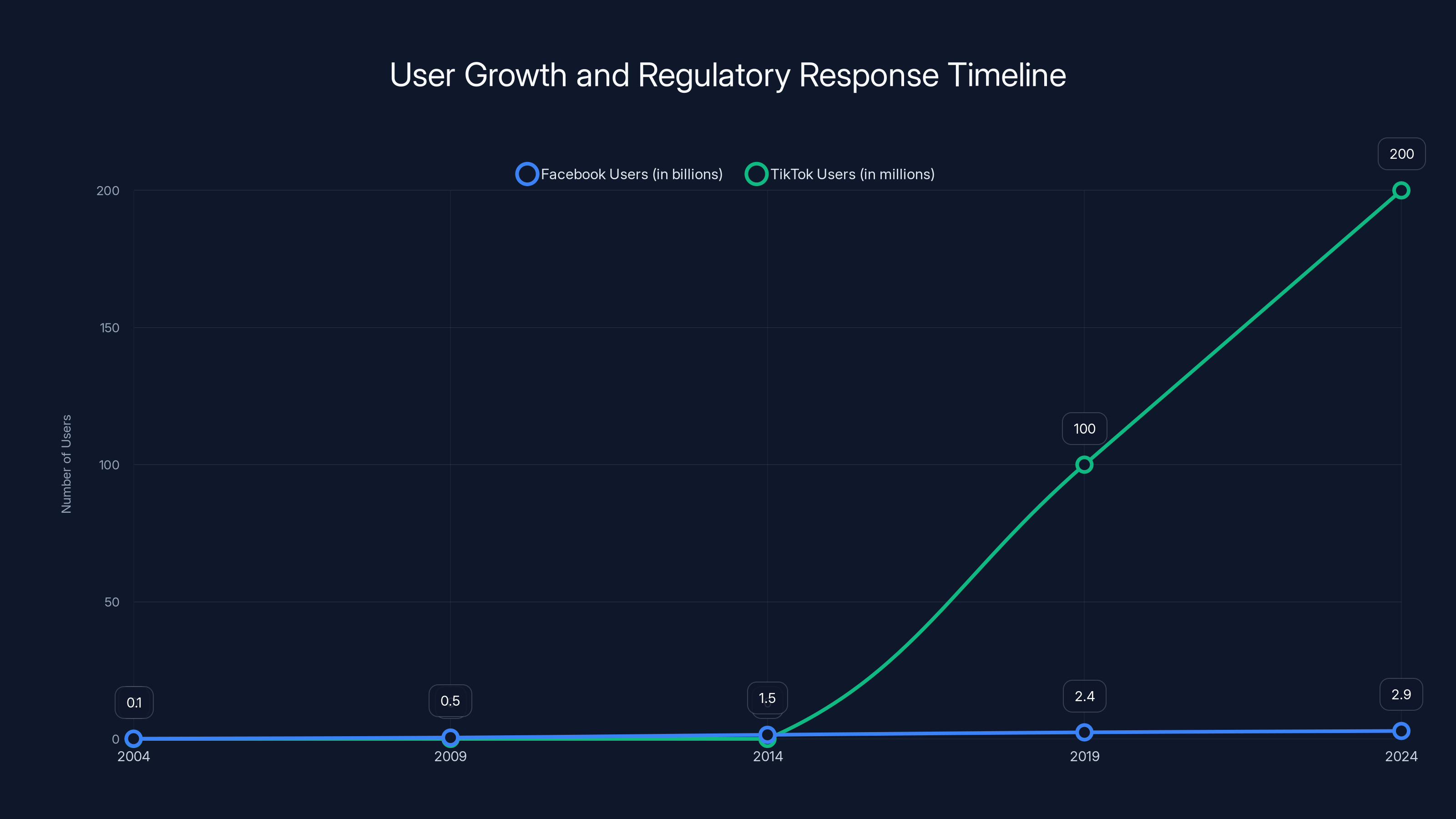

Estimated data shows Facebook's user growth over 20 years and TikTok's rapid rise in just 6 years, highlighting the accelerated regulatory response for TikTok.

The International Implications

This deal has consequences far beyond Tik Tok specifically. It signals how the Trump administration will handle Chinese technology companies operating in the United States. It shows what's possible when political pressure meets corporate negotiation. And it demonstrates that complete divestiture isn't actually required if a company agrees to a restructured ownership arrangement, as reported by Reuters.

For other Chinese tech companies, the message is that staying invested in America is possible if you're willing to compromise on operational control and bring in American investors. That makes future dealings with Chinese firms easier in some ways (they know what negotiation looks like) and harder in others (they know divestiture requirements can be negotiated if you're willing to compromise enough).

For China, the deal is a loss but not a total loss. Byte Dance retains a valuable asset, maintains some influence, and avoids a complete ban on its most powerful Western product. From Beijing's perspective, keeping 19.9 percent and algorithm control is better than losing 100 percent and having the app disappear entirely. But it's certainly not the outcome China would have preferred, as noted by CNN.

For Europe, the deal raises questions about how American regulatory authority effectively extends to Chinese companies. The US essentially forced a restructuring of a global Chinese platform through threat of ban. The EU might follow a similar playbook with other Chinese tech companies, using regulation as leverage to demand more control or data access.

For broader US-China tech competition, the deal represents an acknowledgment that some Chinese tech products are so embedded in American culture that banning them creates more problems than it solves. Tik Tok was going to be too disruptive to American social media and culture if it disappeared. Better to restructure it than to ban it entirely. That's a more nuanced China policy than simple isolationism, as discussed in Politico.

Potential Legal Challenges Ahead

Despite Trump's claim that the deal is final and done, there are several reasons this arrangement might face legal challenges that could unspool the entire compromise.

First, the fundamental question remains: Does this deal actually satisfy the statutory requirement for complete divestiture and ending the "operational relationship" between Byte Dance and Tik Tok US? Multiple legal scholars and Congressional critics have suggested it doesn't. If they're right, challenges in federal court could force a complete restructuring or actual ban, as noted by American Progress.

Second, the deal might face challenges from China or Byte Dance if they feel the terms are unfair or if the Chinese government decides to block the arrangement. Byte Dance operates under Chinese law and needs government approval for major deals involving foreign investment and technology licensing. If Beijing decides the deal undermines Chinese tech sovereignty, they could prevent implementation.

Third, new Congressional majorities or administrations could decide the deal doesn't adequately protect national security and push for genuine complete divestiture. A future Democratic Congress or a future administration that takes a harder line on China could revisit the issue.

Fourth, Byte Dance could sue if it believes the deal violates its property rights or if it disagrees with how the technology licensing agreement is being implemented. Corporate disputes over licensing terms can become lengthy and complicated.

And fifth, the public interest groups or foreign policy experts could mount challenges arguing that allowing this arrangement violates Congressional intent and creates security risks. These would be less likely to succeed legally but could create political pressure, as discussed in Tech Policy Press.

For now, the deal stands, and Tik Tok remains operational under this new structure. But nothing is truly final when it comes to major tech policy disputes.

What Byte Dance Negotiated For

It's easy to look at the deal as a loss for Byte Dance. The company lost operational control, lost majority ownership, and lost the American market to a restructured entity. But Byte Dance negotiated meaningful value into this arrangement.

First, the company retained 19.9 percent ownership in a platform worth

Second, Byte Dance retains algorithm ownership and licensing revenue. Every time the joint venture uses Byte Dance's algorithm technology, it's a licensing arrangement that generates revenue back to Byte Dance. If Tik Tok scales further under American investment, that licensing arrangement becomes more valuable.

Third, Byte Dance maintains global interoperability connections and the ability to integrate Tik Tok with its other products. This creates ongoing technical coordination between Byte Dance and Tik Tok US, which could be valuable for business purposes even if it complicates the national security picture.

Fourth, Byte Dance avoids the complete ban scenario that would have resulted if negotiations failed. The company's employees in the US would have lost their jobs. The platform that invented the globally dominant recommendation algorithm architecture would have been inaccessible to Byte Dance. That complete loss is worse than the partial loss represented by this deal.

Byte Dance's negotiating position was actually weaker than it might have seemed. Congress had passed a law with Congressional mandate to divest. Trump had issued executive orders. The political momentum was all in one direction. Byte Dance couldn't negotiate from strength. It negotiated from the position of either taking this deal or losing everything. In that context, retaining a stake, maintaining some operational influence, and preserving algorithm ownership represents a skilled negotiation, as discussed in The New York Times.

The Broader Media Consolidation Story

This deal is part of a much larger story about media consolidation and control that extends far beyond Tik Tok. The pattern is clear: platforms that accumulate massive audiences become too powerful and too politically important for government to ignore.

Facebook went through a similar arc. Twenty years ago, it was a startup. Within fifteen years, it accumulated nearly 3 billion users and became too significant for government to leave alone. Congress and regulators began investigations. Mark Zuckerberg faced Congressional testimony. The FTC sued to break up the company. Eventually, Facebook adapted its business practices to accommodate regulatory pressure, but the platform's power over American discourse became undeniable.

Tik Tok followed a similar trajectory but faster. Launched in the US in 2018, it reached 200 million American users by 2024. That speed of adoption triggered faster regulatory response. Lawmakers couldn't slowly investigate Tik Tok the way they did Facebook because Tik Tok's market position became critical faster.

What Tik Tok's restructuring demonstrates is that when a platform becomes politically important enough, existing governance structures break down, and new arrangements get negotiated behind closed doors by political insiders. The public gets to see the outcome but not the negotiating process. Congress gets to criticize but doesn't actually make the decision. Companies scramble to accommodate political pressure.

This suggests that future tech platforms will face similar pressures the moment they reach mass cultural significance. The question isn't whether regulatory intervention will happen. The question is what form that intervention will take and who will benefit from the restructuring, as highlighted by Politico.

For Tik Tok users and creators, understanding this broader context helps explain why the platform's future is fundamentally political. It's not purely a commercial question of what makes good product. It's also a political question of which Americans are allowed to control a platform that shapes how 200 million people see the world.

The Creator Economy Under New Ownership

Tik Tok created the modern creator economy. Millions of people make money as content creators because Tik Tok's algorithm gives unknowns the ability to reach massive audiences without prior fame or connections. That's extraordinarily powerful for individual creators but concerning for platforms that want to maintain editorial control.

The new American management team will face a core tension. Do you want to maximize creator freedom and algorithmic openness (which made Tik Tok powerful but creates moderation headaches)? Or do you want to implement stricter editorial control (which reduces brand risk but might reduce the authentic creativity that makes Tik Tok special)?

Byte Dance erred on the side of creator freedom and algorithmic openness. The company rarely removed content unless legally required or advertiser-sensitive. It let the algorithm run fairly openly, which created space for weird, niche, unfiltered content that became culturally significant.

American investors might choose differently. They might implement more editorial control. They might remove content more aggressively. They might restrict which creators can monetize. They might promote creators who align with the platform's new direction.

If that happens, Tik Tok becomes more like YouTube or Instagram, where the algorithm increasingly serves the platform's commercial interests rather than pure engagement maximization. That's probably better for advertisers and brand safety. It's probably worse for the authentic creator ecosystem that made Tik Tok culturally significant.

For creators, the smart move is to treat Tik Tok as one distribution channel among many and develop audiences on multiple platforms simultaneously. The best creators are doing this already. They understand that algorithm dependence is dangerous. The new Tik Tok ownership should accelerate that trend, as noted by The New York Times.

What Happens to the Divestiture Promise

The original law required Byte Dance to divest from Tik Tok completely. The Trump administration essentially amended that requirement through negotiation rather than formal legislative change. Depending on how you interpret the deal, either the requirement has been satisfied or it has been fundamentally violated.

That might seem like a technical legal question, but it has huge practical implications. If Congressional critics argue the requirement wasn't satisfied and push for enforcement, the deal could unravel. Courts might order complete divestiture. The new joint venture could be forced to fully separate from Byte Dance.

Conversely, if Congress accepts the deal as satisfying the statutory requirement, then future Chinese companies know that "divestiture" can mean something less than complete separation. It can mean bringing in American investors, having them hold majority ownership, restructuring governance, but still maintaining minority stakes and technology control. That becomes a template for future deals, as discussed in American Progress.

The Trump administration clearly decided the second interpretation was more practical. Getting Chinese companies to agree to complete divestiture is nearly impossible in modern tech. But getting them to agree to American-majority restructuring is more achievable. So the administration changed what "divestiture" means without going back to Congress to formally amend the statute.

That's a power play. It suggests executive interpretation of Congressional intent supersedes the literal text of the law when political necessity demands it. Future administrations will likely remember this precedent and apply similar logic to different situations.

The Automation and AI Question

One aspect of the deal that received less attention than it should is how artificial intelligence and automation factors into the platform's future. Tik Tok's algorithm is fundamentally a machine learning system. As AI improves, the algorithm could become more powerful, more predictive, and more effective at influencing what humans see and do.

The deal doesn't explicitly address how the joint venture will use advanced AI. It doesn't specify limitations on algorithmic training, automated content generation, or AI-driven recommendation systems. That's a gap because the next five years will bring enormous advances in AI capabilities, and Tik Tok will inevitably incorporate those advances, as noted by BBC News.

Running on top of advanced language models could detect political leanings in comments and predict which creators' content aligns with specific viewpoints. Computer vision improvements could analyze video content to identify political messaging. Recommendation algorithms trained on behavioral data could become increasingly effective at pushing certain kinds of content.

The American management team could use these capabilities for good purposes, like better content moderation or helping creators reach appropriate audiences. Or they could use them for problematic purposes, like algorithmic suppression of certain viewpoints or AI-driven manipulation of public discourse.

The deal doesn't preclude either scenario. It just transfers control from Chinese management to American management. That's potentially better for national security (if the American managers act in good faith) and potentially worse for platform integrity (if they don't).

What's clear is that AI capabilities will continue advancing, and platforms like Tik Tok will continue integrating those capabilities. The question is whether there will be adequate oversight and transparency around how those capabilities get used. The current deal doesn't require it, as highlighted by Politico.

Looking Six Months Forward

By July 2026, we should have a much better sense of whether this deal is actually working or whether it's creating new problems.

First, we'll see if the Congressional investigation actually happens. Moolenaar promised hearings. Will he follow through? Will the new Republican Congress have appetite for scrutinizing a deal that Trump championed? Or will partisan loyalty supersede security concerns?

Second, we'll see how algorithmic behavior shifts. Will creator content discovery change significantly? Will certain types of content get promoted more or less? Will the platform start looking noticeably different in terms of what content succeeds? These changes would be gradual but detectable, as discussed in CNN.

Third, we'll see how the new leadership implements content moderation and creator policies. Will they impose stricter controls? Will they promote certain political perspectives? Will the platform become noticeably less permissive about controversial content?

Fourth, we'll see how Byte Dance actually behaves as a minority shareholder. Does the company attempt to exercise influence? Does it quietly accept the restructuring? Do conflicts emerge between the minority holder and the majority management?

Fifth, we'll see if legal challenges materialize. Do civil rights groups sue arguing the algorithm promotes certain political viewpoints? Do former creators sue arguing algorithmic discrimination? Does Congress push for more aggressive enforcement of divestiture requirements?

All of these will indicate whether the deal represents a genuine resolution of the Tik Tok problem or just a temporary reprieve before the real conflict emerges.

FAQ

What is the Tik Tok USDS Joint Venture?

The Tik Tok USDS Joint Venture LLC is the new entity created to operate Tik Tok in the United States following Trump's deal with Byte Dance. It's structured as a publicly-owned company with American investors holding majority stakes (including Silver Lake, Oracle, and MGX each at 15%), while Byte Dance retains 19.9%. The joint venture took over from Byte Dance's direct control of the platform to satisfy statutory divestiture requirements, though Byte Dance maintains ownership of core technology like the recommendation algorithm, as reported by The New York Times.

How does the algorithm retrain work and why does it matter?

The joint venture will retrain Tik Tok's recommendation algorithm on data specific to American users rather than global users, meaning it will learn new patterns about what content drives engagement for US audiences rather than inheriting patterns learned from global usage including Chinese users. This matters because it could theoretically reduce any algorithmic bias influenced by Chinese government preferences, though it introduces new potential biases based on how the retraining process is conducted and what optimization targets are prioritized by American management, as discussed in Tech Policy Press.

Does Byte Dance actually lose control of Tik Tok with this deal?

Byte Dance loses operational control of day-to-day Tik Tok US decisions, but retains meaningful influence through minority ownership, exclusive algorithm licensing, and control over global integration features. The company no longer decides what content succeeds on the American version of the platform, but it still owns the underlying technology that powers recommendations and maintains board representation through CEO Shou Chew, as detailed in reporting from the New York Times on the deal structure.

What are the national security implications of Byte Dance retaining algorithm control?

National security experts worry that Byte Dance maintaining ownership of the recommendation algorithm could theoretically allow the Chinese government to influence what Americans see on the platform, since the algorithm is the core technology determining content distribution. While the joint venture retrains it on American data and deploys it independently, critics like Senator Edward Markey argue that the underlying technology relationship means the "operational relationship" that the law intended to eliminate hasn't truly ended, according to statements from Markey's office.

Who will actually make decisions about what content Tik Tok promotes?

Adam Presser, the new CEO, and the board composed of American investors will make strategic decisions, while Tik Tok's algorithm and engineering teams will implement those decisions through the recommendation system. However, Trump and his allies have indicated they want the platform to feature more conservative content and be "100 percent MAGA," suggesting that algorithmic decisions could shift to reflect political preferences rather than pure engagement optimization, which would represent a significant departure from Byte Dance's historically neutral approach to content promotion, as noted by The New York Times.

Will Tik Tok be more expensive or change its features for users?

Tik Tok's core service will likely remain free for users, but the platform is expected to increase advertising and expand e-commerce features under American investment, which prioritizes monetization differently than Byte Dance's strategy of maximizing user growth first. Content moderation may become stricter, and the platform might remove or deprioritize certain types of content that falls outside new guidelines, though the full extent of feature changes won't be clear until several months of operation under new management, as reported by CNN.

What happens if Congress decides the deal doesn't satisfy divestiture requirements?

If Congress or courts determine the deal fails to meet the statutory requirement of ending the operational relationship between Byte Dance and Tik Tok, legal challenges could force complete divestiture where Byte Dance has zero ownership, or potentially trigger the original ban if restructuring attempts fail. Representative John Moolenaar has promised Congressional hearings to investigate whether the deal genuinely addresses national security concerns, though as of early 2026 those hearings had not yet occurred, according to Moolenaar's official statements.

How could algorithmic changes affect creators?

Creators may experience shifts in algorithmic promotion if the new management team decides to optimize for different outcomes than pure engagement maximization. If Trump administration preferences influence content promotion, creators working in progressive or controversial spaces could find their content reaching smaller audiences, while conservative creators might gain unprecedented reach. This represents a fundamental shift from Byte Dance's approach of algorithmic neutrality focused purely on engagement, as discussed in Tech Policy Press.

Can Byte Dance influence the joint venture from its minority position?

Byte Dance can exercise some influence through its minority ownership stake, its exclusive hold on algorithm technology, its board seat occupied by CEO Shou Chew, and its control over global integration features, but it cannot unilaterally make major decisions since American investors hold majority voting power. The actual extent of influence depends on whether other board members and investors have conflicting interests and whether Byte Dance chooses to exercise its leverage through the algorithm licensing agreement or other contractual terms not publicly disclosed, as noted by The New York Times.

What does "interoperability" mean in the deal and why does it matter?

Byte Dance maintaining control over "global interoperability" means the company manages how Tik Tok US integrates with other products in the Byte Dance ecosystem globally, essentially keeping technical connections open between the American version and Byte Dance's other platforms. This matters because it allows data flow between systems and creates ongoing technical coordination that complicates the claim that Byte Dance has truly divested, since Tik Tok's official statements specifically call out that Byte Dance retains this responsibility along with e-commerce and advertising management.

How does Oracle's role as data custodian affect security?

Oracle handling American user data in secure US cloud infrastructure reduces the risk of Chinese government access compared to Byte Dance's previous direct control, and third-party audits provide oversight. However, Oracle's involvement means another corporation has detailed access to Tik Tok's user data and becomes embedded in the platform's infrastructure, creating a new potential leverage point where Oracle's commercial interests could conflict with user privacy or security priorities, as highlighted by BBC News.

The Bottom Line

Tik Tok survives, but it doesn't come out of the Trump deal unscathed. The restructuring resolves the immediate crisis of a potential ban, but it creates new questions about algorithmic bias, political control, and whether the deal actually addresses the national security concerns that prompted Congressional action in the first place.

For users, the app probably continues to work the way it does now, with gradual shifts toward more aggressive monetization and potentially different content promotion. For creators, diversification across multiple platforms becomes even more important given the uncertainty about algorithmic priorities under new management. For policymakers, the deal represents a template for how future tech company divestitures might work, through restructuring and American investor control rather than complete ownership transfer.

The core tension remains unresolved. Can you have an American-owned platform that uses Chinese-owned core technology and still claim national security is protected? Different people will answer that question differently. Congress hasn't definitively answered it. The courts haven't tested it. And the future will reveal whether the Trump administration's confidence in this arrangement was justified or misplaced.

What's certain is that Tik Tok's future will be shaped more by political considerations than by technical merit or user interest. The platform was too influential, too culturally significant, and too strategically important for that not to be true. The deal doesn't change that reality. It just determines who gets to decide Tik Tok's direction going forward.

Key Takeaways

- ByteDance retains 19.9% ownership and exclusive algorithm control despite structural divestiture, maintaining meaningful influence over platform technology, as reported by The New York Times.

- Trump administration prioritized speed of deal over transparency, with Congressional oversight and public disclosure still pending months after announcement, as noted by American Progress.

- Algorithm retraining on American data represents real technical progress but doesn't eliminate bias concerns if new American management has political agendas, as discussed in Tech Policy Press.

- National security gap remains unresolved: statute requires ending operational relationship between ByteDance and TikTok US, but licensing arrangements maintain ongoing technical coordination, as highlighted by BBC News.

- Trump allies' involvement in deal raises concerns that algorithmic changes will reflect political preferences rather than user engagement or platform integrity, as noted by The New York Times.

Related Articles

- TikTok US Deal Finalized: 5 Critical Things You Need to Know [2025]

- TikTok's US Entity Deal Explained: How ByteDance Avoided Ban [2025]

- TikTok's US Future Settled: What the $5B Joint Venture Deal Really Means [2025]

- The TikTok U.S. Deal Explained: What Happens Now [2025]

- TikTok's US Deal Finalized: What the ByteDance Divestment Means [2025]

- Age Verification & Social Media: TikTok's Privacy Trade-Off [2025]

![TikTok's Trump Deal: What ByteDance Control Means for Users [2025]](https://tryrunable.com/blog/tiktok-s-trump-deal-what-bytedance-control-means-for-users-2/image-1-1769189887776.jpg)