Microsoft Killing One Drive and Share Point Plans: What You Need to Know [2025]

Last January, Microsoft dropped a bombshell that barely made headlines. The company announced it was axing four standalone cloud storage plans: Share Point Online Plan 1 & 2, plus One Drive for Business Plan 1 & 2. If you're using these, you need to pay attention. The phaseout timeline spans until December 2029, but the window to act is closing fast.

Here's the thing: this isn't just about removing unpopular products. It's a calculated business move to funnel millions of users into more expensive Microsoft 365 subscriptions. For some users, the cost is about to jump significantly. For others, it's a wake-up call that even cloud storage isn't truly standalone anymore.

I've been following Microsoft's consolidation strategy for years, and this one feels different. It's aggressive. It's designed to remove choice. And it's coming with a tight deadline that catches most organizations off guard.

TL; DR

- Microsoft is discontinuing four standalone One Drive and Share Point plans by December 2029, starting with new sales in June 2026

- Cost impact varies dramatically depending on your current plan and usage patterns, potentially doubling expenses for some users

- Migration paths exist but require planning: Microsoft 365 Business, E3/E5 plans, or pay-as-you-go storage options

- Timeline is compressed with only a few months before new sales stop, so migration decisions need to happen soon

- Alternatives worth exploring include third-party cloud providers, open-source solutions, and hybrid architectures

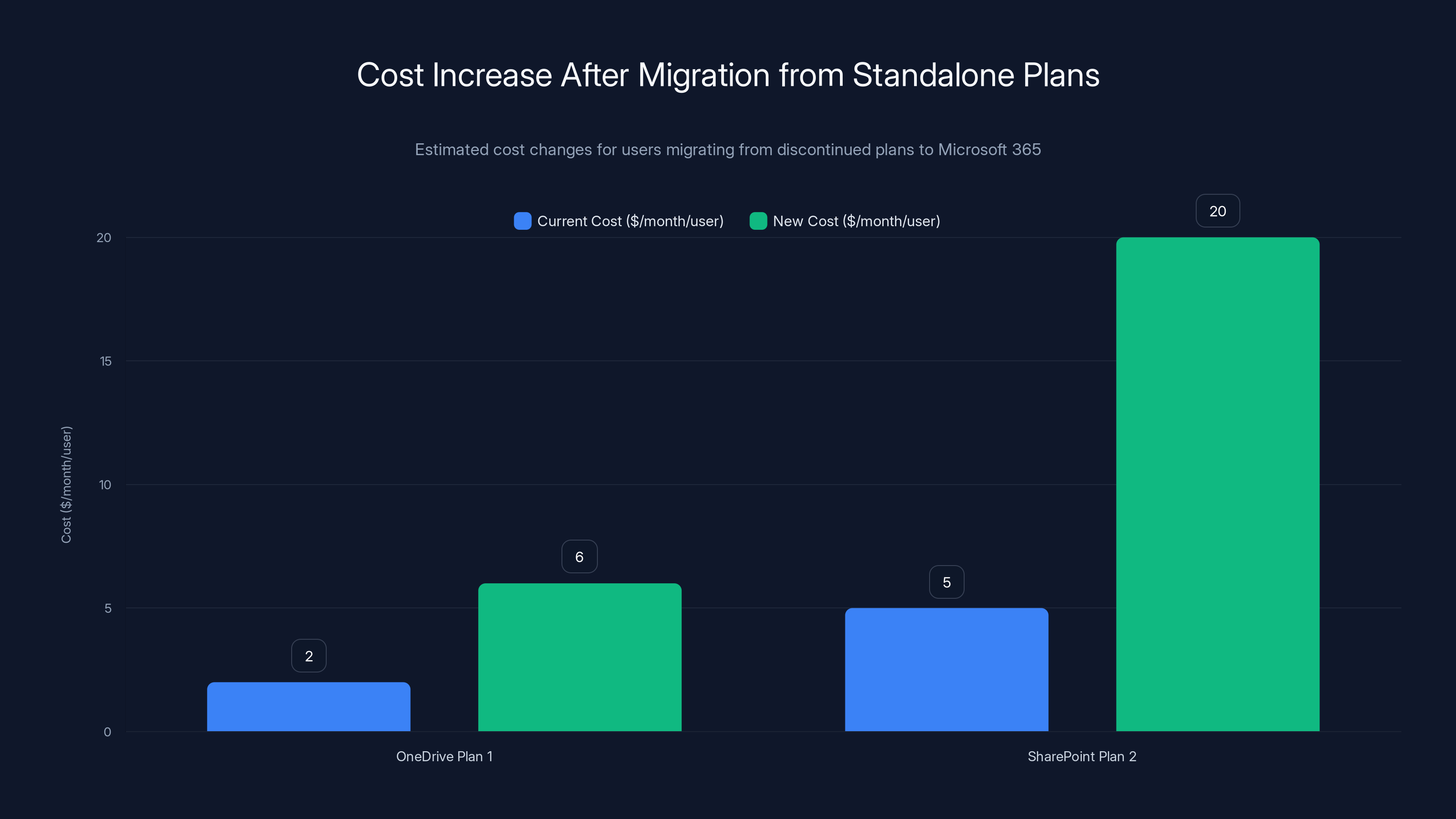

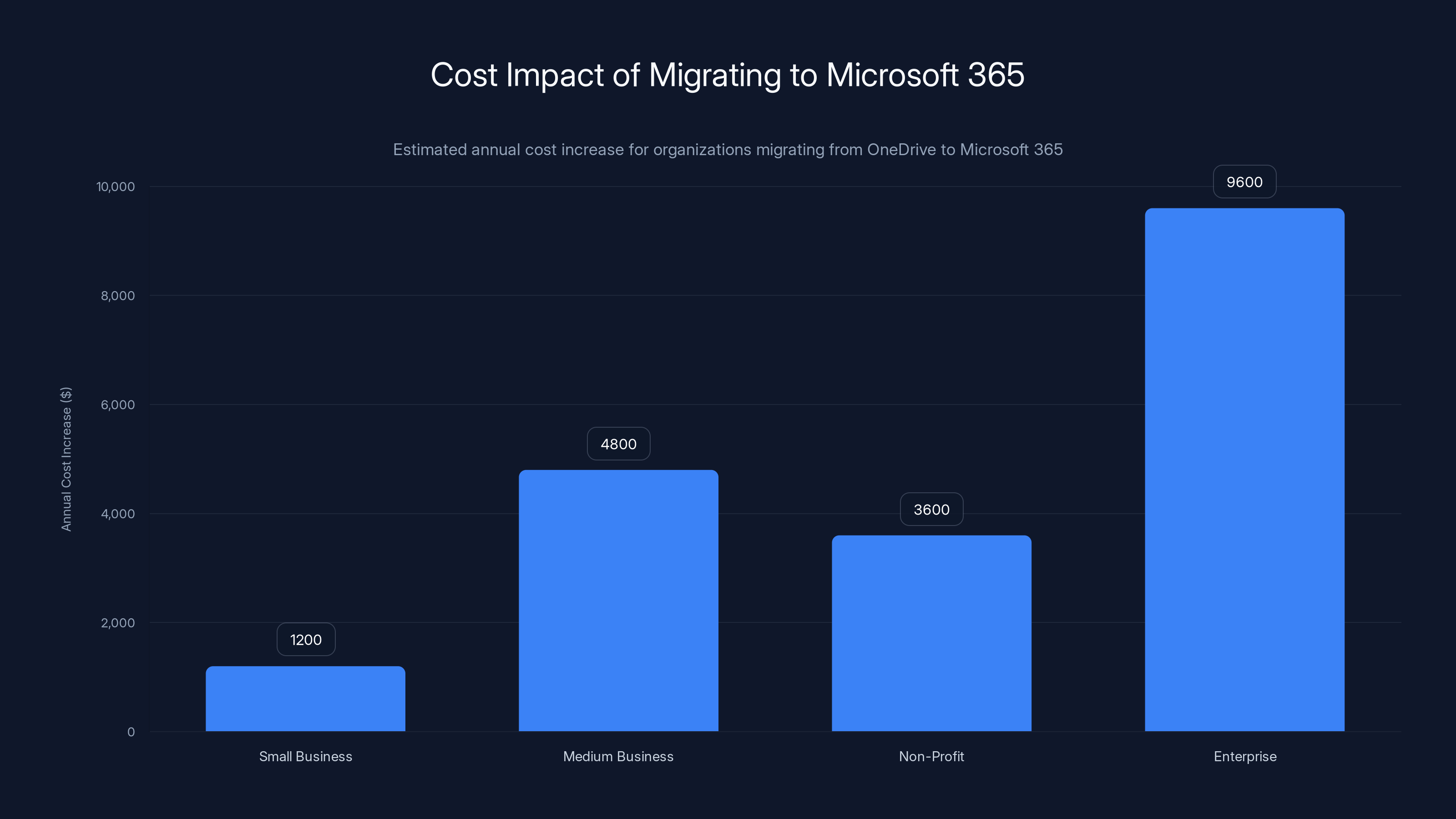

Users migrating from OneDrive Plan 1 to Microsoft 365 Business Basic may see costs triple, while SharePoint Plan 2 users could face a 4x increase. Estimated data based on typical plan costs.

The Plans Getting Axed: What's Actually Disappearing

Microsoft is retiring four specific plans. Let's break down exactly what you lose.

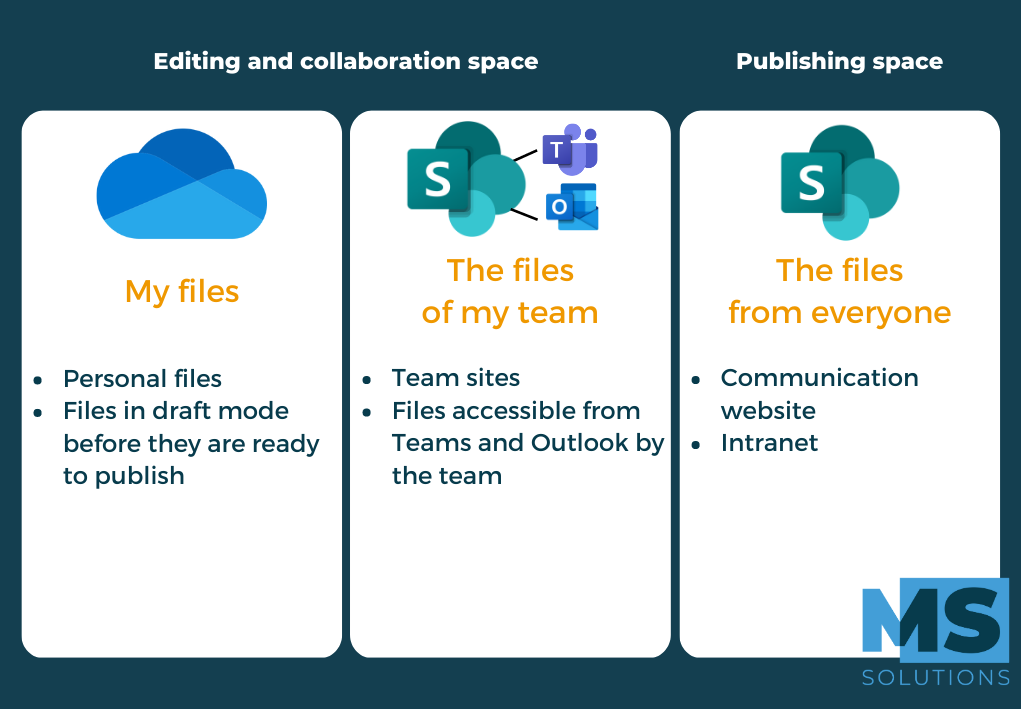

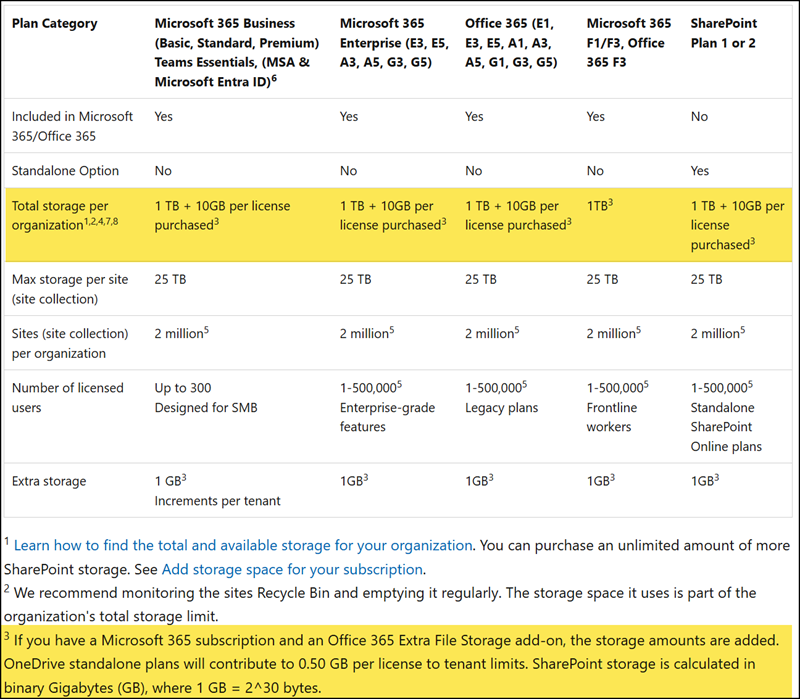

Share Point Online Plan 1 was the entry-level option for small teams needing basic document management and team collaboration. It included 1TB of storage per site, basic version control, and access to the Share Point ecosystem. No advanced governance, no sophisticated workflows. Just the essentials.

Share Point Online Plan 2 stepped up the game slightly. You got 25TB of site collection storage, more sophisticated search capabilities, and better integration with Microsoft Teams. Mid-market organizations often picked this for department-level deployments.

One Drive for Business Plan 1 was the budget option for individual cloud storage. It provided 1TB of personal cloud storage, basic file sharing, and integration with Office 365. Perfect for solo contractors or small businesses that didn't need enterprise features.

One Drive for Business Plan 2 doubled the storage to 2TB and added more sophisticated sharing controls plus advanced recovery options. Teams with sensitive data often preferred this tier over Plan 1.

Here's what made these plans attractive: they were genuinely standalone. You didn't need a full Microsoft 365 subscription to use them. You could buy One Drive storage without touching Teams, Share Point without buying Exchange, or any combination that made sense for your business. That flexibility is what Microsoft is eliminating.

The company characterized these plans as suffering from "low customer demand" and "higher operational costs." But the real story? These cheap options were cannibalizing Microsoft 365 adoption. Why spend

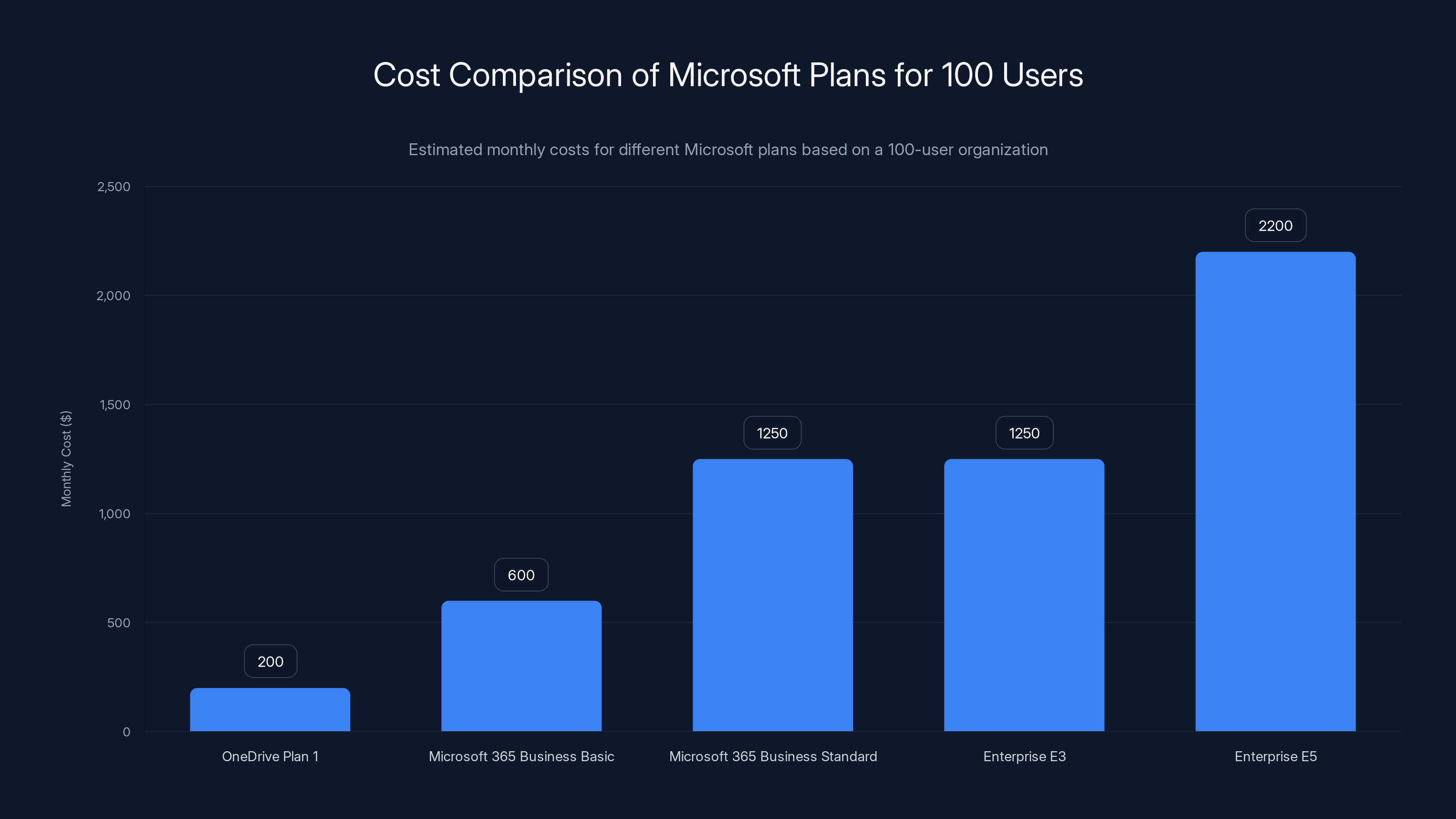

For a 100-user organization, upgrading from OneDrive Plan 1 to Microsoft 365 Business Basic results in a 200% cost increase, while the Business Standard and Enterprise plans further increase costs significantly. Estimated data.

The Real Reason: It's About Revenue, Not Retirement

Let's be direct. Microsoft isn't killing these plans because they're unpopular. They're killing them because they want to push users into bigger, pricier packages.

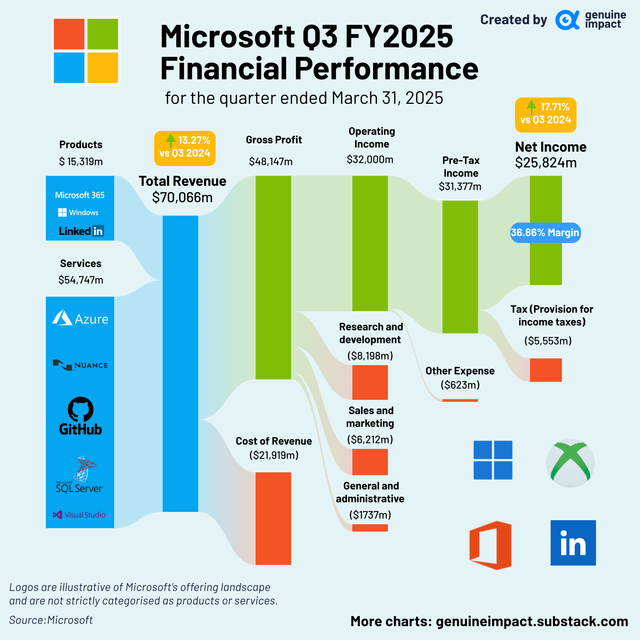

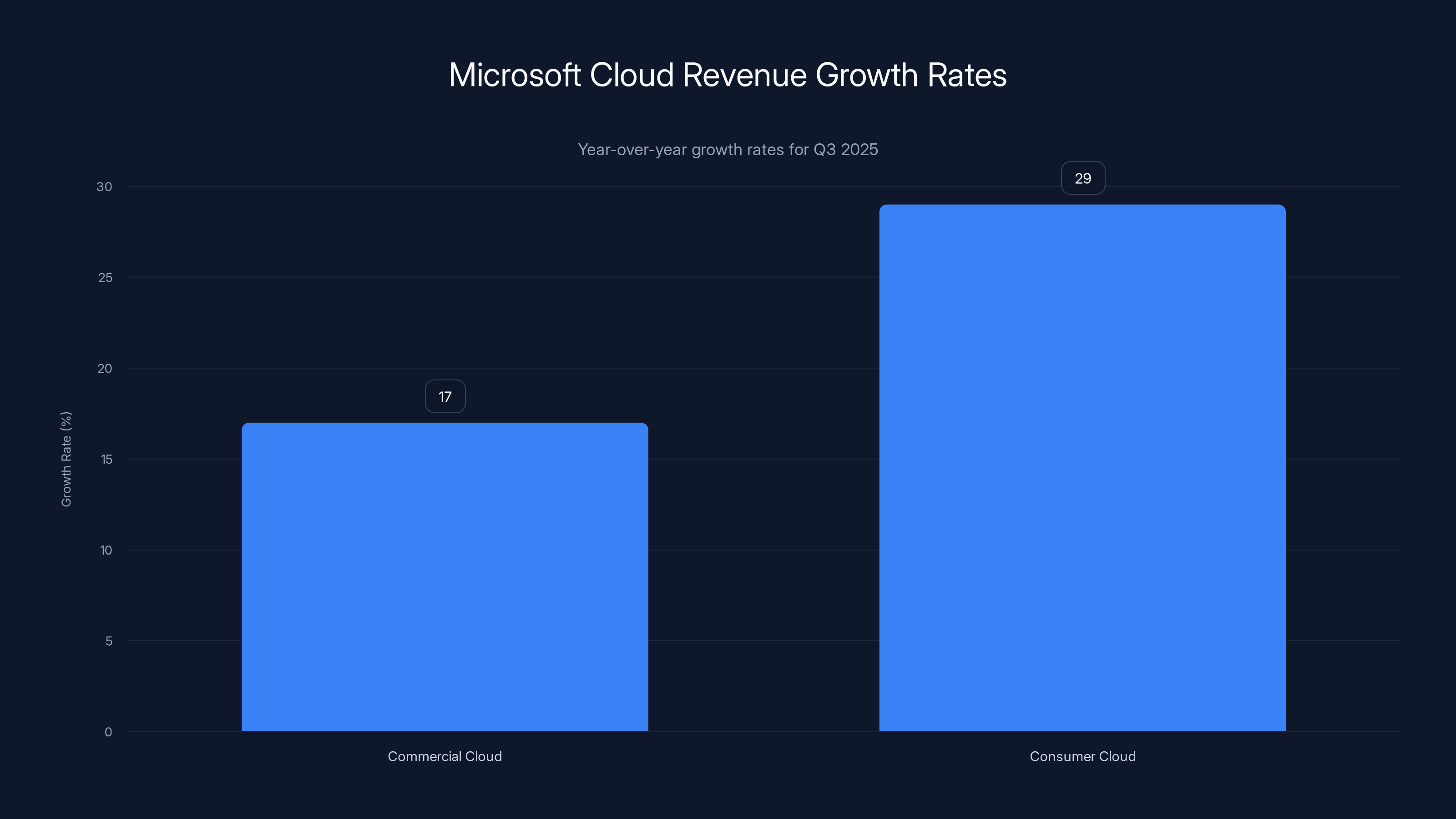

Microsoft's cloud business is printing money. In Q3 2025 (calendar Q4), Microsoft 365 Commercial cloud revenue jumped 17% year-over-year. But here's the kicker: Microsoft 365 Consumer cloud revenue grew a staggering 29%. That's the growth rate the company wants to replicate across every segment.

Standalone plans prevent that growth. When you can buy just One Drive storage for

The company's announcement specifically mentions "unintended or nonstandard usage" of these plans. Translation: people were using them for bulk storage at a discount. Archive large datasets on One Drive for Business? Cheaper than enterprise storage solutions. Store backups on Share Point? Fraction of the cost of dedicated backup tools. Microsoft's infrastructure costs are real, sure, but the operational cost argument is partially cover for a revenue optimization strategy.

This is standard practice for SaaS companies. Adobe did it with Creative Cloud, forcing creative professionals into subscription models. Autodesk did it with AutoCAD, eliminating perpetual licenses. Now Microsoft's doing it with cloud storage. Remove the cheap entry point, and users graduate to premium tiers.

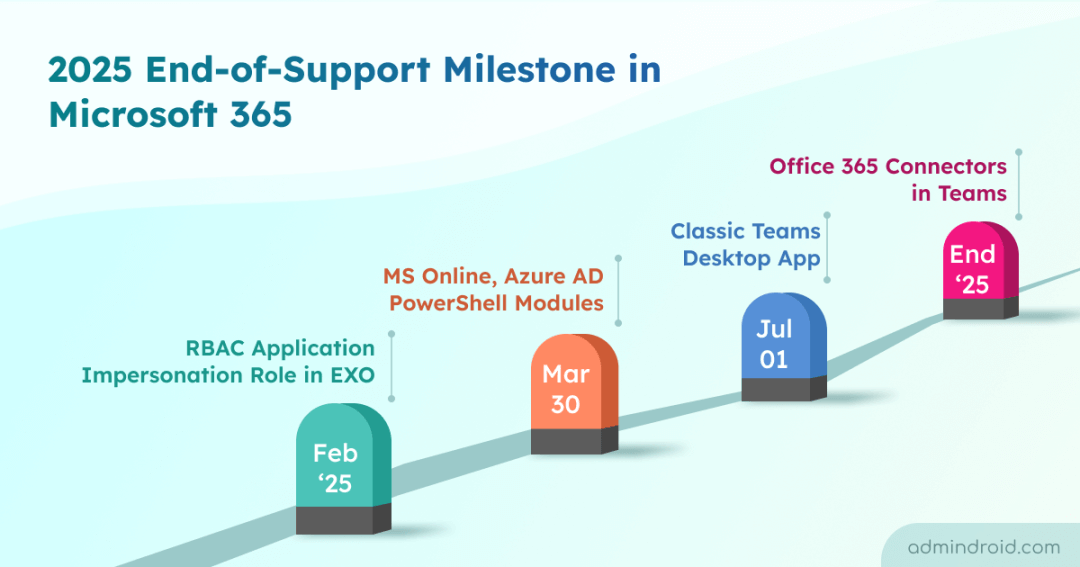

Timeline Breakdown: When Everything Happens

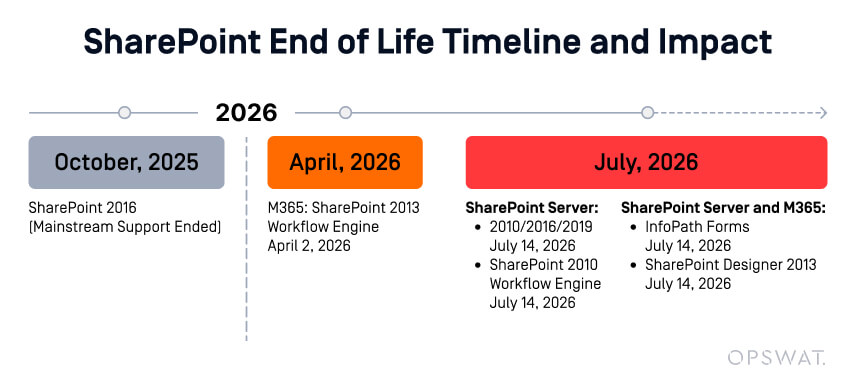

Microsoft announced this shift in late January 2026. That's your warning period. Here's how the phaseout actually unfolds.

June 2026: End of Sales to New Customers

This is the first hard deadline. Starting June 2026, you cannot purchase any of these four plans as a new customer. You can't migrate to them, you can't sign up for them fresh, you can't shift to them from another provider. The door closes.

If you're currently on a standalone plan, this doesn't immediately affect you. Existing customers get a reprieve. But here's where it gets tricky: if your license expires before renewal, you'll be forced into a Microsoft 365 suite. This matters for organizations with staggered renewal dates.

January 2027: Renewal Phaseout Begins

Starting January 2027, existing customer renewals on these plans will begin transitioning. When your license is up for renewal, Microsoft won't let you renew the old plan. You'll have to pick a new option.

For some organizations, this is manageable. For others, it's a massive disruption. If your enterprise license renewal happens in February 2027, you're dealing with this immediately. If it's in October 2027, you've got more breathing room.

Ongoing Through 2027 and 2028: Contract Retirement

Multi-year contracts get hit differently. If you signed a three-year agreement for One Drive for Business Plan 2 in 2024, your contract probably runs through 2027. Microsoft will honor that agreement, but won't let you renew on the same terms when it expires.

December 2029: Service Entirely Ended

Final deadline. Any remaining customer on these plans gets fully migrated or service ends. This is the hard stop. No more extensions, no more negotiation.

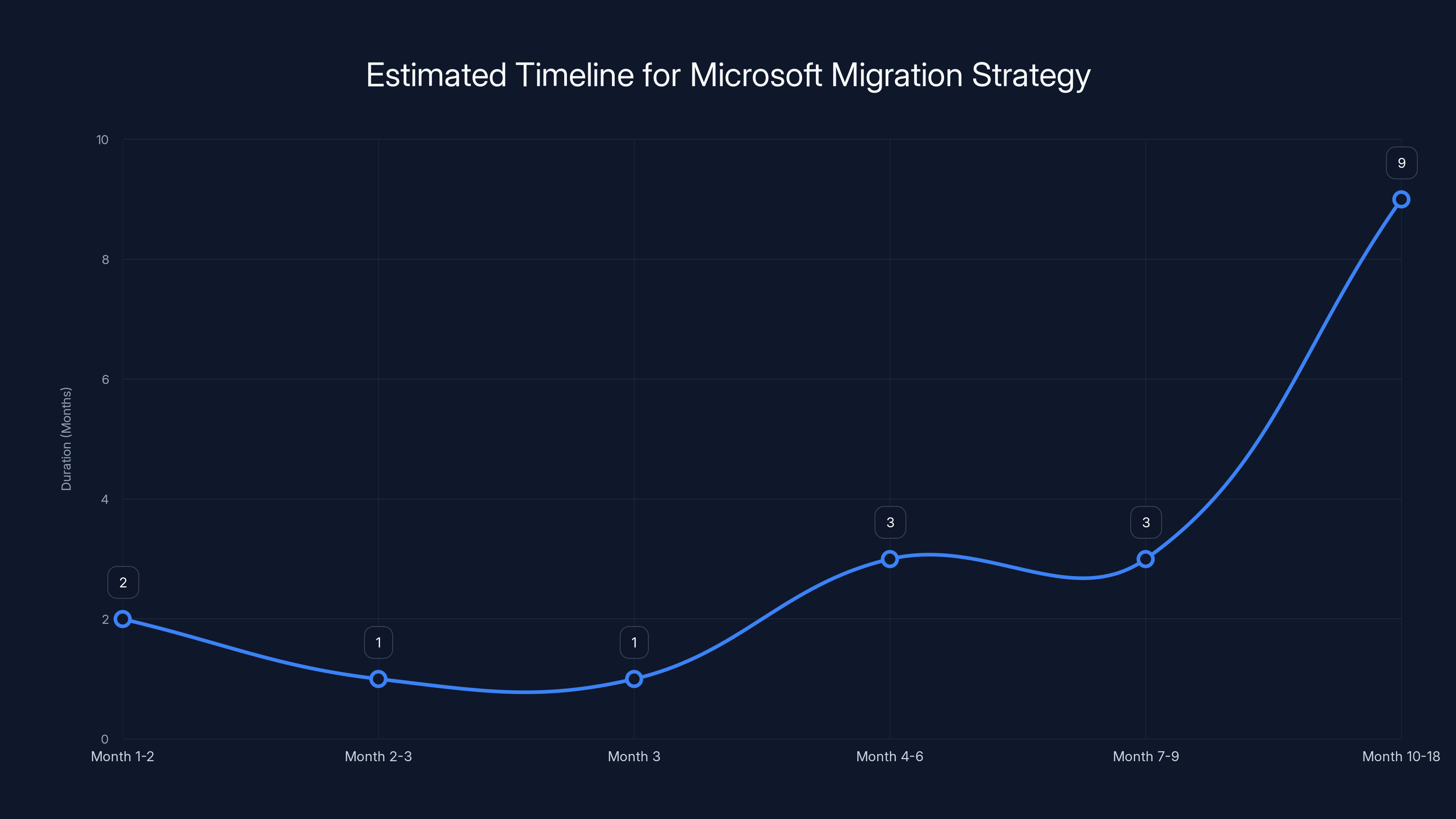

The timeline is actually tighter than it sounds. You have roughly six months from announcement until new sales stop. For large organizations with procurement cycles and budget planning, that's incredibly compressed. Most enterprises plan IT changes 12-18 months out. This timeline doesn't respect that.

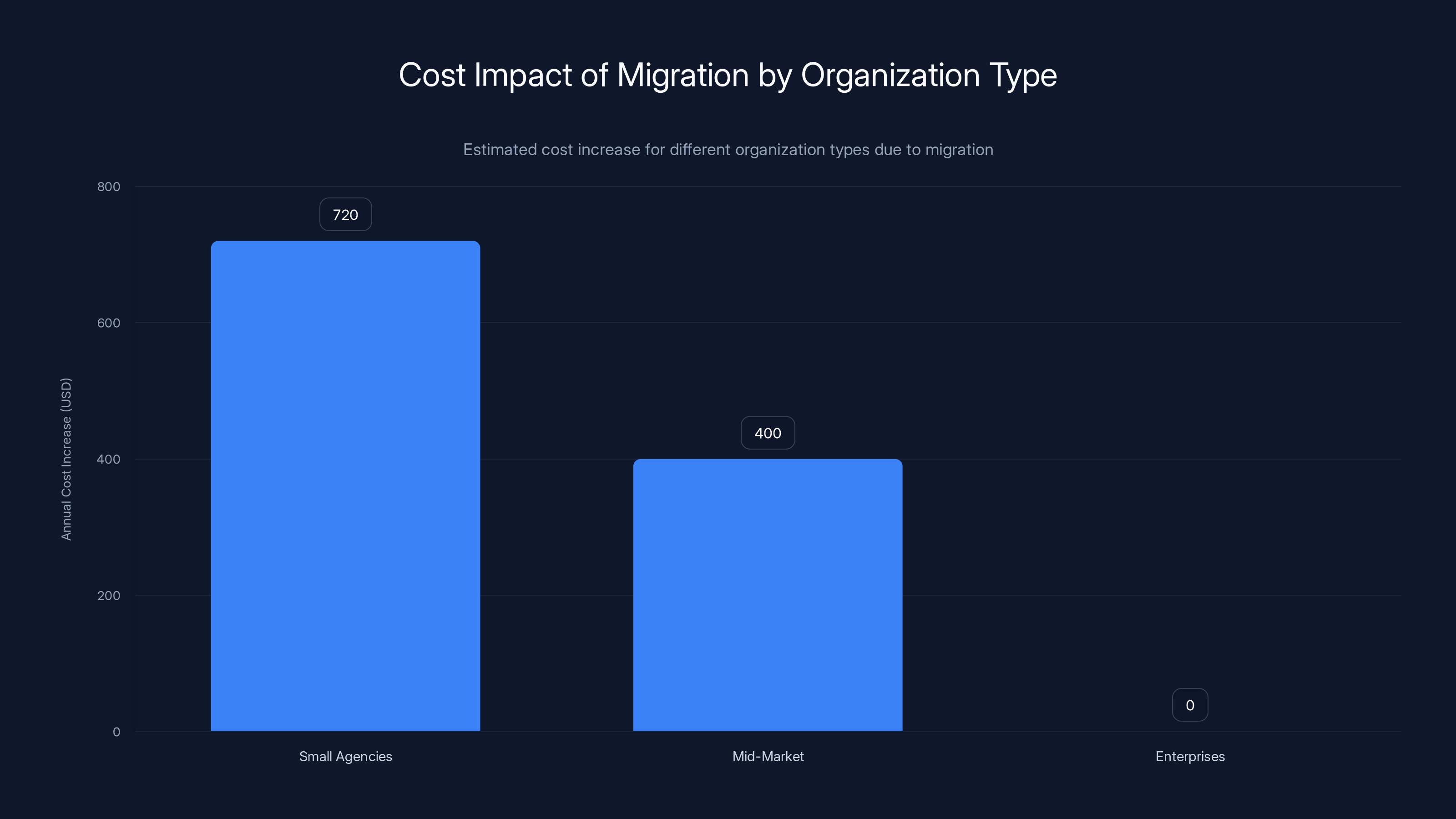

Small agencies face the highest cost increase per person due to migration, while enterprises experience negligible financial impact. (Estimated data)

The Cost Impact: What You'll Actually Pay

Here's where things get painful for many organizations.

If you're currently on One Drive for Business Plan 1 at roughly $2/user/month, your migration options are:

Option 1: Microsoft 365 Business Basic ($6/user/month) gets you One Drive + Outlook + Microsoft Teams + Office web apps. That's a 3x cost increase if you only need One Drive. But you're forced to pay for services you don't use.

Option 2: Microsoft 365 Business Standard ($12.50/user/month) adds full Office desktop applications. Five times the cost.

Option 3: Enterprise plans (E3 at

Microsoft's "pay-as-you-go storage" option (100GB for roughly $2/month through One Drive consumer) exists, but it's genuinely for consumer use. It lacks the admin controls, compliance features, and business-grade security enterprises need.

For a 100-person organization on One Drive Plan 1:

- Current cost: $200/month

- Microsoft 365 Business Basic: $600/month

- Cost increase: 200%

That's a $4,800 annual increase for the same storage capability.

Now consider Share Point Online Plan 1 users. The economics get worse. Enterprise search, governance, information architecture - these features aren't cheap in any solution. Migration to Microsoft 365 Business or E3 plans is basically required. There's no cheaper option that preserves functionality.

This is where Microsoft's strategy reveals itself completely. The company knows that migrating to full Microsoft 365 suites locks in long-term contracts and increases customer lifetime value. Even if you only need 20% of the features in Microsoft 365 Business, you're paying for 100% of the suite.

Migration Paths: Your Actual Options

Microsoft officially recommends three migration paths. Understanding each one matters.

Path 1: Microsoft 365 Business Plans (Basic, Standard, Premium)

This is what Microsoft wants you to choose. You get a complete productivity suite: Office desktop apps, Teams, Outlook, Sharepoint, One Drive, and cloud security features.

Costs range from

For larger organizations, the calculus changes. A 500-person company paying

Path 2: Microsoft 365 Enterprise Plans (E3, E5)

These are designed for organizations with more than 300 employees. E3 is

But here's the catch: to qualify for E3/E5 licensing, most organizations need to move their entire user base onto enterprise plans. You can't have 200 people on E3 and 100 people on Business Basic. Licensing rules force consolidation.

For enterprise customers currently on standalone plans, moving to E3 across the board could mean tripling licensing costs. That's a conversation that requires CFO approval and usually takes months to negotiate.

Path 3: Pay-As-You-Go Storage Solutions

Microsoft's own pay-as-you-go One Drive option charges roughly

This option works for individuals or tiny teams with basic needs. For any organization with compliance requirements or governance policies, it's inadequate.

Path 4: The Unspoken Option - Diversification

Some organizations are using this as a forcing function to reevaluate their cloud strategy entirely. If you're already paying for Microsoft 365 E3 across your user base, One Drive migration is cheap. You just enable it. But if you're on standalone plans and facing a tripling of costs, suddenly alternative platforms look interesting.

Google Drive, Nextcloud, Dropbox for Business, Box - these become viable during migration decisions. Organizations are discovering that consolidating everything into Microsoft 365 isn't always the right answer.

Estimated data shows significant cost increases for organizations migrating to Microsoft 365, with non-profits facing substantial financial challenges.

Who Gets Hurt Most: Impact by Organization Type

This retirement impacts different types of organizations very differently.

Small Agencies and Consultancies

These organizations often licensed One Drive for Business Plan 1 for each contractor and employee. Cheap, simple, no extra features needed. Migration to Microsoft 365 Business Basic immediately doubles or triples their per-person cost.

A 15-person consulting firm on One Drive Plan 1 is paying roughly

The real hurt comes from being forced into the full suite. They need cloud storage. They don't need Teams, they don't need Outlook (many use Gmail), and they don't need Office web apps. But they're paying for all of it.

Mid-Market Organizations with Hybrid Cloud

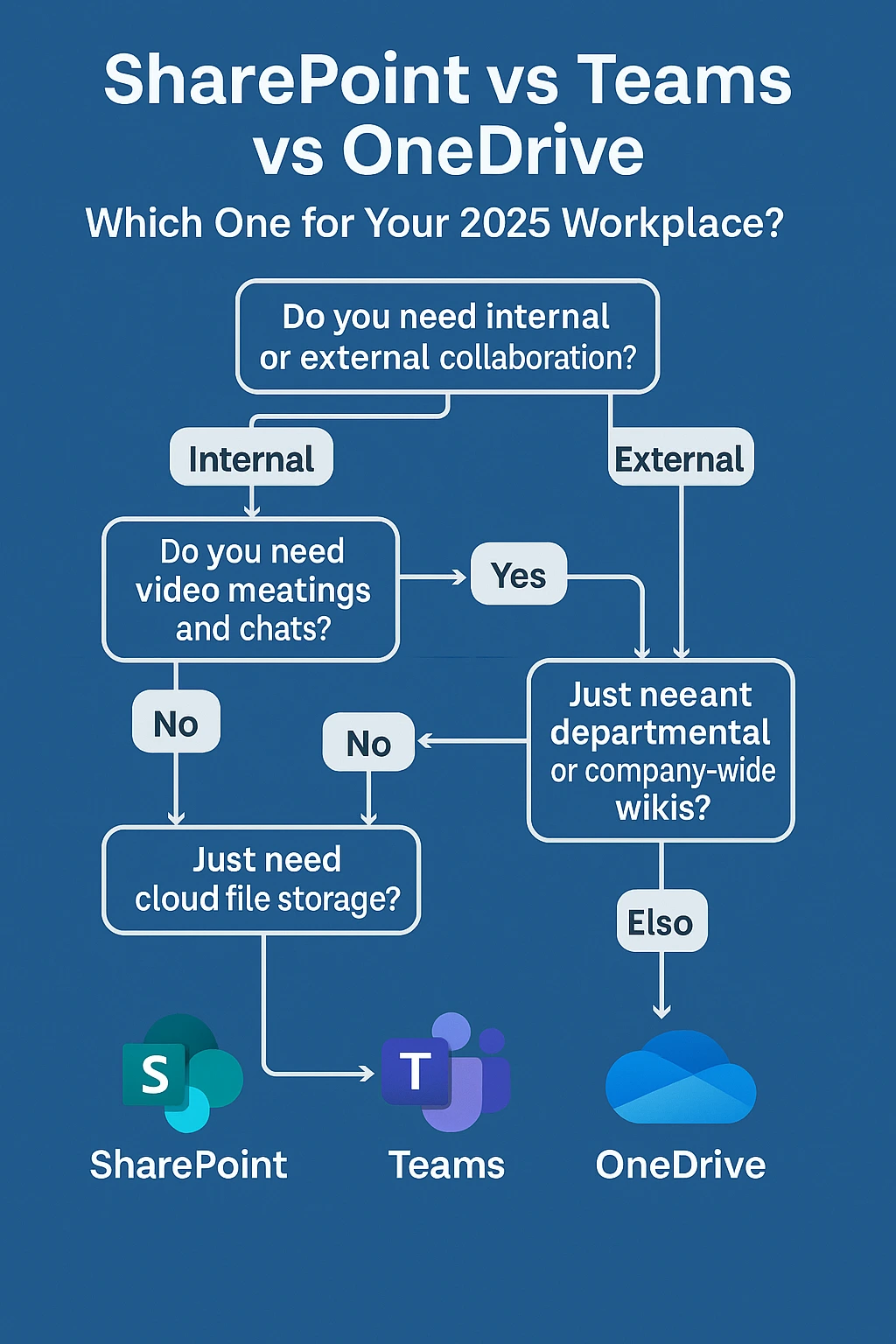

These companies often have Salesforce, Slack, Google Workspace for email, but use One Drive/Share Point for document management. It's a best-of-breed approach.

Migration forces them to either consolidate into Microsoft 365 (which means abandoning other platforms) or maintain expensive redundancy. Some choose to migrate entirely to Google Workspace to avoid Microsoft's ecosystem lock-in. Others bite the bullet and move to Microsoft 365 E3, then realize they're duplicating functionality across email, productivity, and chat platforms.

The cost multiplier is real. Add Microsoft 365 E3 on top of Slack subscriptions, and you're looking at

Enterprises Already on Microsoft 365

Interestingly, large enterprises on E3/E5 contracts barely feel this change. Their One Drive/Share Point migrations are essentially free (just an enablement question). The real impact is political: IT departments have to justify why they've been licensing these expensive plans when they could have included One Drive/Share Point all along.

For enterprises not on full Microsoft 365 licensing, the options are brutal. Move 500 people from standalone plans to E3 licensing? That's a

Non-Profit Organizations

Non-profits get some relief through Microsoft's non-profit program (free Microsoft 365 for certain qualifying organizations). But smaller non-profits that don't qualify face the same math as small businesses. They get squeezed out.

Global Organizations with Data Residency Requirements

Some organizations in specific countries (especially EU organizations dealing with GDPR requirements) have been using standalone Share Point/One Drive for data residency purposes. Full Microsoft 365 suite licensing sometimes comes with less flexibility on data center placement.

This creates an unexpected administrative burden during migration.

The Business Logic Behind the Move

Let's think like a Microsoft executive for a moment. Why make this decision?

First: Revenue Predictability

Microsoft 365 subscriptions generate predictable, recurring revenue. You sign a customer to E3 licensing, and you know roughly what they'll pay monthly for three years. That's easier to forecast than managing fragmented purchases.

Standalone plans are unpredictable. A customer might buy One Drive storage and keep it at the same level for five years. Or they might cancel it unexpectedly. Or they might abuse it for cheap bulk storage. The revenue is lumpy.

Enterprise subscriptions smooth out that lumpiness. Better for earnings predictability, which makes the stock price happy.

Second: Cross-Sell Opportunities

Once you have someone on Microsoft 365 Business Basic, you can upsell them to Standard, then Premium. Then suggest E3 when they grow. Each step increases lifetime customer value.

A customer on standalone One Drive? There's limited upsell path. They either need more storage (commoditized) or they need business features (and then they upgrade to a suite).

But if they're already in the Microsoft 365 ecosystem, adding compliance features, security features, or administrative tools is a natural next step.

Third: Feature Leverage

Microsoft spent billions developing Teams, advanced search, governance tools, and compliance features. These are embedded in Microsoft 365 suites. They want to drive adoption of these features because they provide competitive moats.

Give someone One Drive standalone, and they're one Google Drive campaign away from switching. Give them Microsoft 365 with Teams, Outlook, Office desktop apps, and One Drive tightly integrated, and they're much stickier.

The integration story is real. Teams + Share Point + One Drive together are genuinely more powerful than One Drive alone. Microsoft's betting that forcing people to use Teams and Share Point together will make them realize the value and lock them in.

Fourth: Cost Reduction

There's also a real operational efficiency play. Supporting four separate product SKUs costs more than supporting one integrated suite. Fewer testing scenarios, fewer support paths, fewer licensing variations.

Microsoft's operational costs probably did increase for these plans. But calling it the primary reason is disingenuous. The revenue opportunity is the driver.

Microsoft's Consumer Cloud revenue grew by 29%, outpacing the 17% growth in Commercial Cloud. Estimated data.

What Alternatives Actually Exist

Let's be real: if you're leaving Microsoft's ecosystem, you need solid options.

Google Workspace ($6-18/user/month depending on tier) includes Gmail, Drive, Docs, Meet, and Sheets. The storage model is more generous (Drive for Work includes unlimited storage for most plans). Integration with third-party tools is straightforward because Google's ecosystem is more open.

For organizations already using Gmail and Google services, this is the natural migration. You gain advanced admin controls while keeping costs stable.

Nextcloud (self-hosted or commercial plans) gives you full control over your data. You can run it on your own servers or purchase managed hosting starting around $10-20/user/month. It's open-source, so no vendor lock-in. Sync works great, sharing controls are granular, and integration with other tools is excellent.

The tradeoff: you're responsible for updates, security patches, and availability. Or you're paying a managed hosting provider. For organizations with IT staff, this is attractive. For organizations without, it's risky.

Dropbox for Business ($18-22/user/month) is older but still solid. Integration with Slack is native. Advanced sharing controls are built-in. The user experience is known and trusted by millions.

Dropbox is more expensive than alternatives, but it excels at selective sync and mobile experience. For organizations where file access on mobile matters, it's worth considering.

Box ($10-55/user/month depending on tier) is enterprise-focused. It's commonly paired with Slack, Salesforce, and other enterprise tools. Content management is more sophisticated than One Drive. Compliance features rival Microsoft 365.

Box is probably too expensive for small organizations but worth evaluating for enterprises.

Hybrid Approach

Many organizations are discovering that splitting cloud platforms is cheaper than consolidating everything into Microsoft 365. For example:

- Google Workspace for email and docs (better UI, cheaper)

- Nextcloud for sensitive data (privacy, control)

- Slack for team communication (better than Teams)

- Salesforce for CRM (better than Dynamics)

With proper integration (Zapier, Make, native APIs), this setup can be cheaper than Microsoft 365 Enterprise and often provides better individual feature sets.

The downside is complexity. You're managing five separate vendors instead of one. But for organizations that don't want all their eggs in Microsoft's basket, that complexity is worth it.

Migration Strategy: How to Actually Do This

If you're staying with Microsoft, here's how to execute the migration smoothly.

Step 1: Audit Everything (Month 1-2)

Before you do anything, understand what you're actually using. Not what you think you're using. What you're actually using.

Run reports on Share Point storage consumption. Check One Drive adoption rates. Identify unused document libraries. This usually reveals that 30-40% of your data is dead weight.

Clean house before migration. Migrate only what matters. This reduces your Microsoft 365 licensing requirements and saves money.

Step 2: Calculate True Cost (Month 2-3)

For your organization size, calculate costs under each Microsoft 365 tier. Get quotes from your account manager. Understand the per-user cost and total budget impact.

Don't let Microsoft's account team guide you toward the most expensive tier. You know your organization. Push back on enterprise licensing if you don't need it.

Step 3: Plan Renewal Timing (Month 3)

If your contracts expire before June 2026, you're dealing with this sooner. If they expire after, you have more breathing room.

Work backward from your renewal date to determine when you need to make licensing decisions. Involve procurement, IT, and finance early.

Step 4: Pilot Groups (Month 4-6)

Migrate a pilot group of 50-100 users onto the new license tier. Run for 30 days. Identify issues. Adjust.

Issues will emerge. Users will discover missing features. Your Teams adoption will surprise you. Better to discover this in month 5 than month 13.

Step 5: Training and Change Management (Month 7-9)

Teams is more complex than One Drive. Share Point has more features than users expect. You'll need training.

Plan for change management. Identify super-users who become advocates. Create documentation. Budget time for support tickets.

Step 6: Phased Migration (Month 10-18)

Roll out in waves. Don't flip 500 people at once. Do it in groups of 50-100. This spreads the support load and lets you iterate on processes.

End-user support costs are real. Budget for them.

Step 7: Decommissioning Legacy Plans (Ongoing)

Once users are on new licenses, decommission old licenses. Don't let them run in parallel longer than necessary. That's waste.

But timing matters. Make sure migrations actually completed before you cancel old licenses. Data loss is catastrophic.

The migration strategy spans approximately 18 months, with significant time allocated to phased migration and training. Estimated data.

The Ecosystem Shift: What Microsoft 365 Bundling Means

This retirement signals something broader about Microsoft's strategy.

The company is moving aggressively toward bundling. Sell you a suite of integrated tools rather than point solutions. Teams gets bundled with One Drive with Share Point with Office. You can't opt out of any single component.

There's genuine value in that integration. Teams + One Drive + Share Point is better together than separately. File collaboration in Teams is better because it's integrated with Share Point. Search is better because it spans all three products.

But there's also strategic value for Microsoft. Bundling increases switching costs. Once Teams, One Drive, Share Point, and Outlook are all intertwined, replacing one becomes nearly impossible. Replace Outlook with Gmail? You lose the integration. Replace Teams with Slack? File collaboration breaks.

This is why the stand-alone plan retirement matters beyond just cost. It's about ecosystem lock-in.

For enterprises, this creates pressure to rationalize vendors. If you're paying for Microsoft 365 E3 anyway, using all the bundled services makes sense. Paying for Microsoft 365 plus Google Workspace plus Slack plus Salesforce becomes harder to justify financially.

Microsoft knows this. And they're betting on it.

Compliance and Governance Considerations

One angle that gets overlooked: compliance and data residency.

Some organizations choose standalone plans specifically for compliance reasons. EU organizations dealing with GDPR requirements might want data to stay in EU data centers. Standalone licensing sometimes offers more flexibility on data center selection than bundled suites.

When you migrate to Microsoft 365, you inherit the broader licensing terms. Data residency options might be more constrained. This is worth auditing before migration.

Similarly, organizations in highly regulated industries (financial services, healthcare, government) might have specific requirements for data handling, backup, and disaster recovery that standalone plans met but Microsoft 365 suites don't fully address without purchasing additional services.

Migration conversations should include your compliance and legal teams, not just IT and finance.

The Broader SaaS Consolidation Trend

Microsoft isn't alone in this strategy. It's industry-wide.

Adobe killed Creative Cloud standalone and Creative Cloud Photography plans, forcing users into the full suite. Autodesk eliminated perpetual licenses for AutoCAD, forcing subscription adoption. Atlassian simplified their product portfolio, discontinuing older, cheaper tiers.

The pattern is consistent: successful SaaS companies eventually consolidate offerings to maximize revenue per customer. It's rational business strategy. It's also unpopular with customers who don't need the bundled features.

This trend suggests that the era of best-of-breed cloud solutions might be ending. As platforms become more integrated and bundled, organizations increasingly choose between a few large ecosystem players (Microsoft, Google, Amazon) rather than mixing and matching point solutions.

For organizations that valued flexibility and choice, this is disappointing. For large enterprises, it's forcing hard decisions about ecosystem commitment.

Preparing for the Inevitable: Future-Proofing Your Cloud Strategy

Assuming Microsoft continues this consolidation pattern, how do you future-proof?

First: Diversify Your Vendor Risk

Don't put everything into one vendor's ecosystem. If Microsoft owns email, chat, documents, and storage, you've eliminated your options for most cloud needs.

Consider deliberately choosing different vendors for different functions. Email from Google, documents from Nextcloud, chat from Slack. This is more complex operationally but maintains flexibility.

Second: Invest in Integration Layers

If you're using multiple vendors, integration becomes critical. Zapier, Make, or custom APIs let you connect systems together without vendor dependency.

Think of your tech stack as modular. Core vendors can change, but the integration layer keeps systems talking.

Third: Understand Real Costs

When evaluating platforms, look at total cost of ownership. Don't just compare the headline monthly rate. Include training, integration, migration, and support costs.

Often the expensive point solution is actually cheaper when you account for everything.

Fourth: Plan for Migrations

Accept that you'll migrate eventually. Instead of treating migrations as one-time traumatic events, build organizational muscle for regular migrations.

Keep data portable. Avoid custom configurations. Make decisions that assume you might change vendors in five years.

What Microsoft's Timeline Actually Means

Let's decode the announcement more carefully.

Microsoft is being generous with enterprise customers but aggressive with everyone else. If you have a large contract up for renewal in 2027, Microsoft's account team will negotiate aggressively. You'll face pressure to move to E3/E5 licensing for your entire organization.

But if you're a small business on a month-to-month contract, the pressure is even higher. You get no negotiating leverage. It's E3 or goodbye.

The December 2029 endpoint is also strategic. It's far enough away that it sounds manageable but close enough that you can't delay indefinitely. Most organizations will wait until 2027-2028 to act, then realize they're in a rush.

This timeline is designed to minimize Microsoft's support burden for legacy products while maximizing migration conversions.

The Open Question: Is This Sustainable?

There's a deeper question underneath all of this: is Microsoft's bundling strategy sustainable?

For enterprise customers, maybe. Large organizations with 500+ employees benefit from integration and simplify IT operations with consolidated licensing.

But for small businesses, consultancies, and non-profits? The cost pressure is real. Some will switch to Google Workspace. Some will adopt open-source solutions like Nextcloud. Some will maintain expensive redundancy by keeping multiple platforms.

Microsoft's betting that the value of integration outweighs the cost increase. For some customers, that bet is right. For others, it's pushing them toward competitors.

The true test will be adoption rates over the next 24 months. If organizations migrate smoothly to Microsoft 365, the strategy works. If significant numbers migrate to alternatives instead, Microsoft overplayed its hand.

Historically, customers being forced into expensive bundled products doesn't end well. It creates frustration, opens the door to competitors, and eventually forces corrections. But in the near term, Microsoft will see revenue increases.

FAQ

What exactly is Microsoft discontinuing?

Microsoft is retiring four standalone cloud storage and collaboration plans: Share Point Online Plan 1 & 2, and One Drive for Business Plan 1 & 2. These were entry-level plans that could be purchased independently from Microsoft 365 suites. New sales stopped in June 2026, existing renewals phase out starting January 2027, and service entirely ends by December 2029.

Why is Microsoft making this change?

Microsoft cites low customer demand and higher operational costs, but the strategic driver is revenue. Standalone plans were too cheap and prevented customers from upgrading to more expensive Microsoft 365 suites. By forcing consolidation, Microsoft increases average revenue per user and creates stronger ecosystem lock-in through integrated features like Teams, Outlook, and advanced Share Point.

How much will my costs increase after migration?

Costs increase dramatically depending on your current plan. One Drive for Business Plan 1 users migrating to Microsoft 365 Business Basic face a 3x cost increase (from ~

What are my migration options?

You have three main paths: migrate to Microsoft 365 Business plans (Basic, Standard, or Premium), upgrade to enterprise plans (E3 or E5), or move to Microsoft's pay-as-you-go storage option. Beyond Microsoft, you can migrate to Google Workspace, Nextcloud, Dropbox, Box, or adopt a hybrid approach using multiple vendors. Each option has different cost and feature implications.

Can I delay migration until the final 2029 deadline?

Not easily. The hard deadlines are June 2026 (no new sales) and January 2027 (renewals phase out). If your license renewal happens between January 2027 and December 2029, you'll be forced to choose a new plan at renewal. Organizations on staggered renewal schedules face forced migrations on different timelines. Delaying until 2029 isn't really an option unless your contract runs that long.

Is there a way to avoid the cost increase?

Yes, if you're willing to change vendors. Google Workspace offers comparable features at similar or lower cost. Nextcloud provides self-hosted alternatives with no per-user licensing. For organizations already using multiple platforms, consolidating around Google rather than Microsoft is sometimes cheaper. However, Microsoft's ecosystem integration is genuinely valuable, so the tradeoff is feature loss plus migration complexity.

What should I do right now?

Immediate actions: (1) Audit which plans your organization uses and how many users per plan, (2) pull reports on actual storage consumption and feature usage, (3) calculate total cost under Microsoft 365 Business or E3 licensing, (4) determine your contract renewal dates, (5) involve procurement, IT, and finance in planning, (6) if budget is constrained, evaluate alternative vendors before making a decision.

Will Microsoft enforce this timeline strictly?

Likely yes for new customer acquisition (no flexibility starting June 2026). For renewals, there's slightly more room for negotiation with enterprise accounts, but account managers will push aggressively toward E3/E5 licensing. Organizations that don't renew until 2028-2029 might have limited negotiation leverage since they're at the tail end of the phaseout period.

Are there compliance risks in the migration?

Yes, particularly for EU organizations with GDPR requirements and organizations in regulated industries. Data residency options, compliance reporting, and e Discovery capabilities may differ between standalone plans and Microsoft 365 suites. Before migrating, consult compliance and legal teams to ensure Microsoft 365 meets regulatory requirements. Some organizations may need to purchase additional add-ons (Advanced Compliance, e Discovery) that don't come standard.

How long does a typical migration take?

For small organizations (under 100 users): 2-4 months with minimal disruption. For mid-market organizations (100-500 users): 4-8 months with phased rollouts. For enterprises (500+ users): 8-18 months with multiple pilot phases and extensive training. Budget time for user training, support, and unexpected issues. Migrations that appear complete often surface data sync or permission problems weeks later.

Conclusion: Adapting to Microsoft's New Cloud Reality

Microsoft's decision to retire standalone One Drive and Share Point plans isn't really about low demand or operational costs. It's a strategic move to force millions of users into more expensive, bundled Microsoft 365 subscriptions. And honestly, it's working.

The cost impact is real. A 100-person organization on One Drive for Business Plan 1 faces a $4,800+ annual increase when forced to migrate to Microsoft 365 Business Basic. For budget-constrained organizations, that's material. For cash-poor non-profits, it's devastating.

But the broader implication matters more. Microsoft is signaling that the era of picking and choosing individual cloud services is ending. The future, in their vision, is consolidated ecosystems. If you want One Drive, you get Teams, Outlook, and Share Point whether you need them or not.

For enterprise customers, this consolidation creates real value. Teams and One Drive integration is genuinely powerful. Advanced governance features in Share Point rival expensive content management systems. The ecosystem argument is legitimate.

For smaller organizations, it's less clear. You're paying for features you don't need. Your flexibility evaporates. Your switching costs rise. And your annual cloud bill potentially doubles overnight.

The timeline is compressed enough that procrastination isn't an option. You need to decide by mid-2026 at the latest. Migrate to Microsoft 365? Evaluate alternatives? Maintain expensive redundancy? These decisions require months of planning.

My advice: don't panic, but do act. Audit your actual usage immediately. Calculate true costs under Microsoft 365 licensing. If the numbers work, migration is manageable. If the costs are crushing, explore alternatives. Google Workspace, Nextcloud, or hybrid approaches genuinely offer better value for organizations that don't need Microsoft's full ecosystem.

The cloud marketplace is more competitive today than it's ever been. Microsoft's consolidation strategy only works if the value proposition justifies the cost. Make Microsoft prove the value rather than assuming it.

Need help automating your cloud migration workflows, creating compliance documentation, or managing the transition process? Tools like Runable can help teams create automated workflows, generate reports on data migration status, and build presentations for stakeholder buy-in without manual work. These operational tools become invaluable during large-scale migrations, especially when timelines are compressed.

Key Takeaways

- Microsoft is discontinuing four standalone cloud plans (SharePoint Online 1&2, OneDrive for Business 1&2) by December 2029 to push users toward Microsoft 365 suites

- Cost impact is dramatic: organizations face 3-6x price increases when forced to migrate from cheap standalone plans to bundled Microsoft 365 subscriptions

- Timeline is compressed: new sales end June 2026, renewals phase out January 2027, creating urgency for organizations that delayed migration planning

- Alternative platforms (Google Workspace, Nextcloud, Dropbox, Box) offer viable migration options and sometimes lower total cost of ownership than Microsoft 365

- This move reflects broader SaaS industry trend toward bundling and consolidation, reducing customer choice and increasing vendor lock-in across cloud services

Related Articles

- Microsoft Teams People Skills Profile: How to Showcase Your Work Talents [2025]

- Palantir's £240 Million UK MoD Contract: What It Means for Defense Tech [2025]

- Microsoft's Example.com Routing Anomaly: What Went Wrong [2025]

- Edit Password-Protected Office Files in Google Workspace [2025]

- Rackspace Email Hosting Price Hike: What It Means for Businesses [2026]

![Microsoft Killing OneDrive and SharePoint Plans: What You Need to Know [2025]](https://tryrunable.com/blog/microsoft-killing-onedrive-and-sharepoint-plans-what-you-nee/image-1-1770136895210.jpg)