Rackspace Email Hosting Price Hike: What It Means for Businesses

Imagine waking up one morning to find out your largest operational expense just increased sevenfold. That's not a hypothetical scenario for thousands of businesses. It's exactly what happened to Rackspace customers in early 2026 when the cloud services provider announced a staggering price increase for email hosting services.

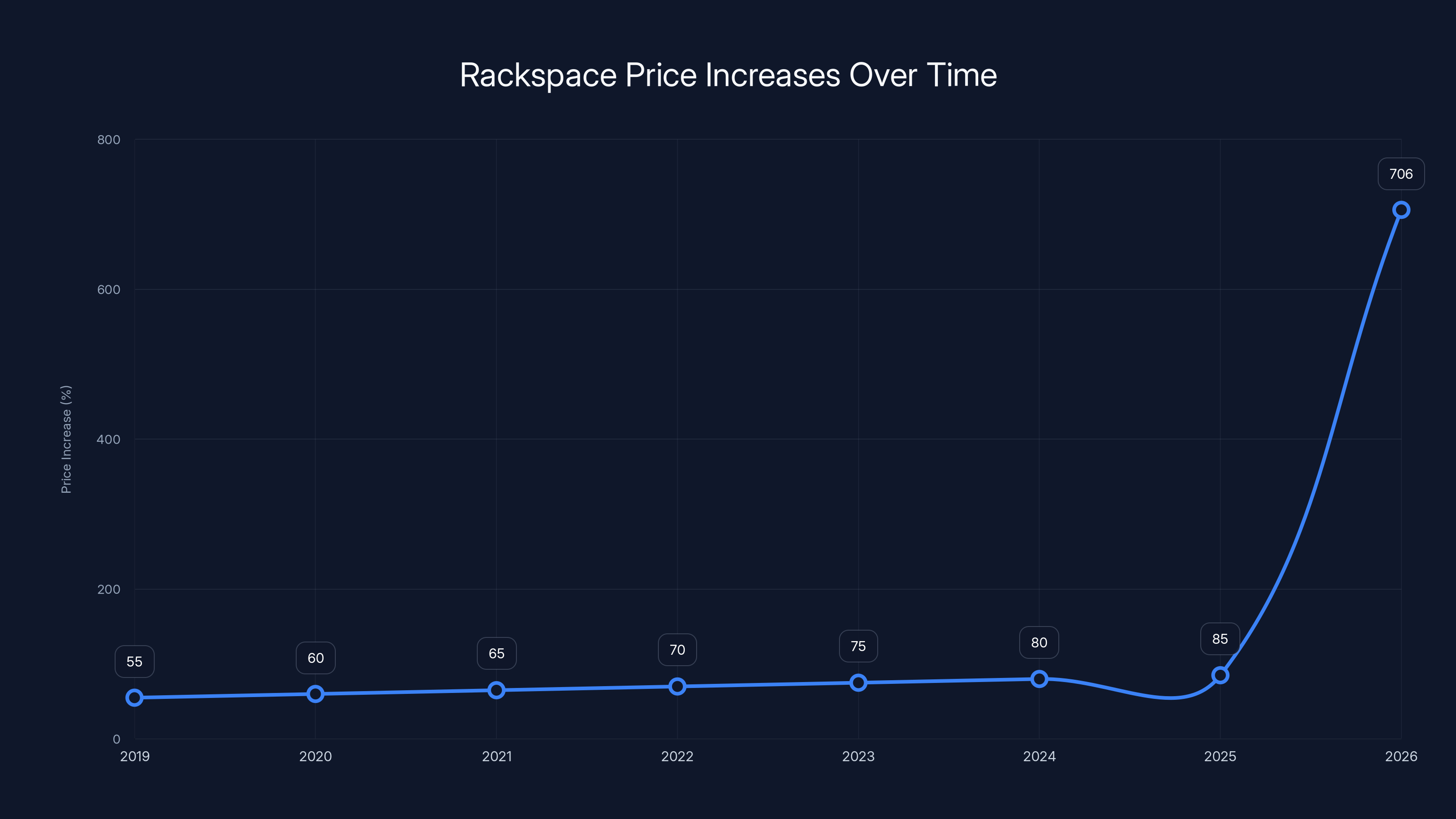

Laughing Squid, a web hosting service provider and long-time Rackspace partner that's been using the company since 1999, received notice that Rackspace planned to increase their email pricing by 706 percent. Other resellers reported increases ranging from 110 percent to nearly 500 percent. With only a month and a half notice before the March 2026 effective date, thousands of businesses suddenly faced a choice: absorb the crushing cost or migrate to a completely different email provider.

This wasn't a modest adjustment. This wasn't a 10 or 15 percent increase justified by inflation or operational costs. This was a wholesale restructuring of Rackspace's email business model, and it's forced the entire hosting industry to reckon with fundamental questions about cloud service reliability, pricing transparency, and customer loyalty.

Understanding the Magnitude of the Price Increase

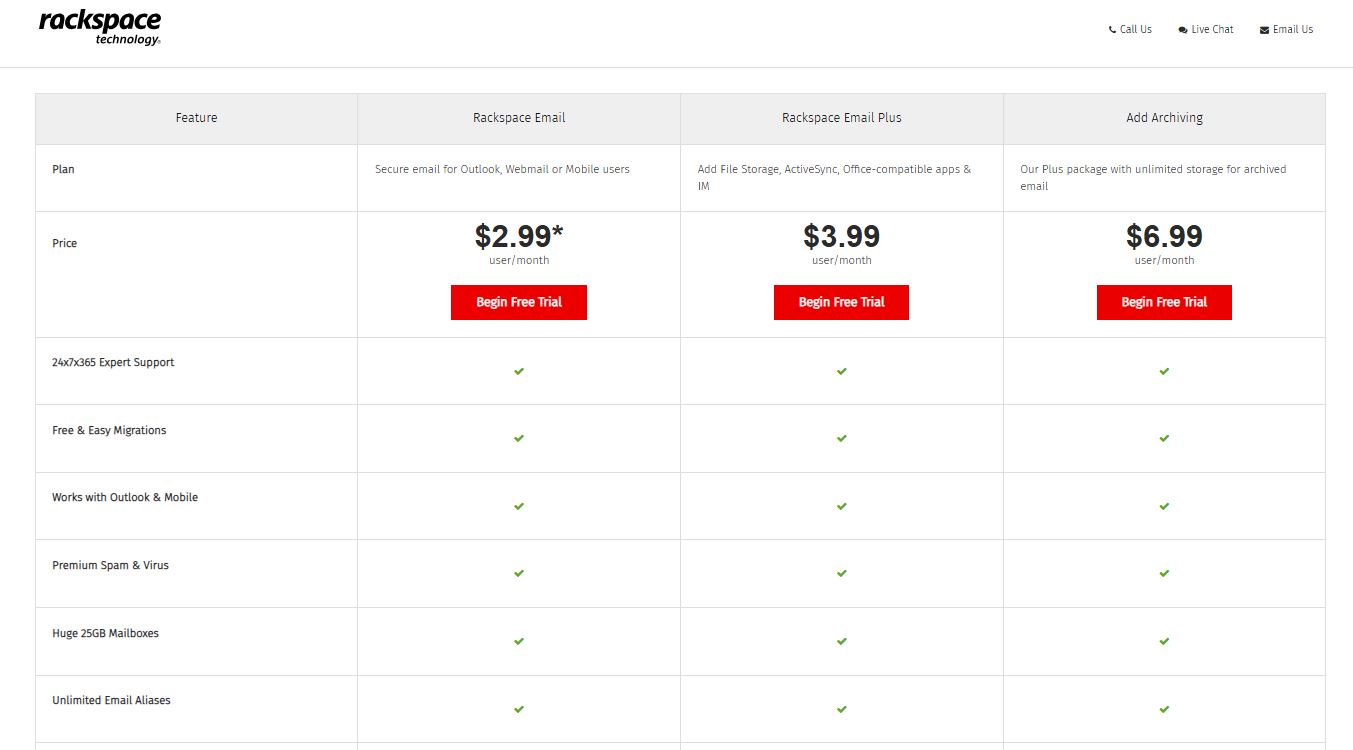

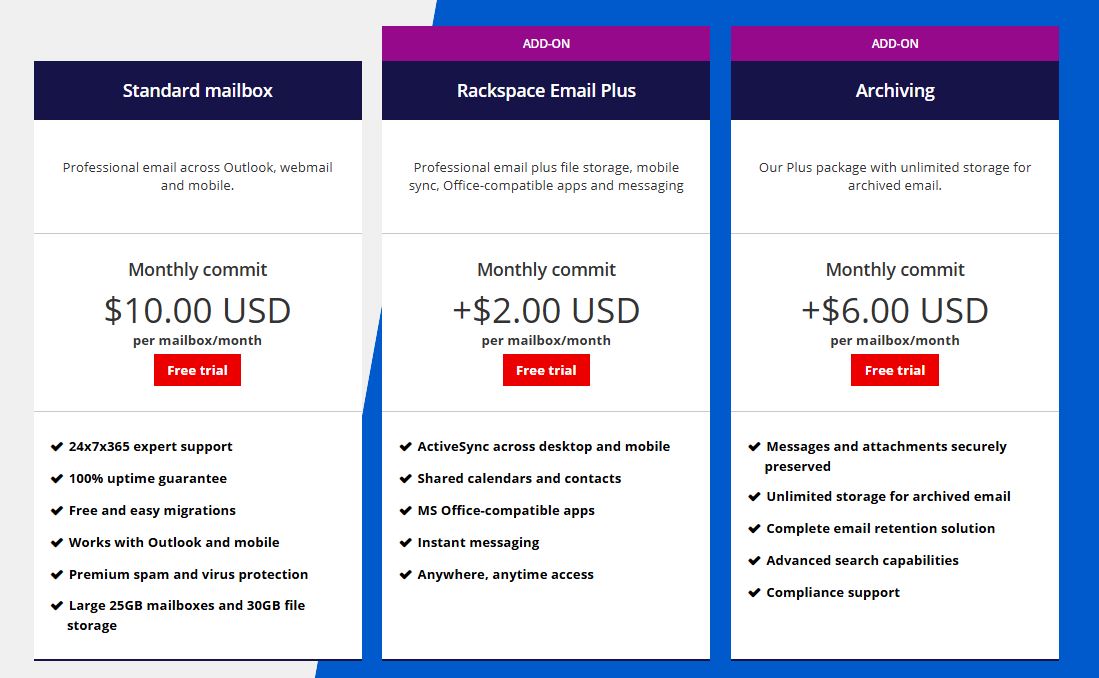

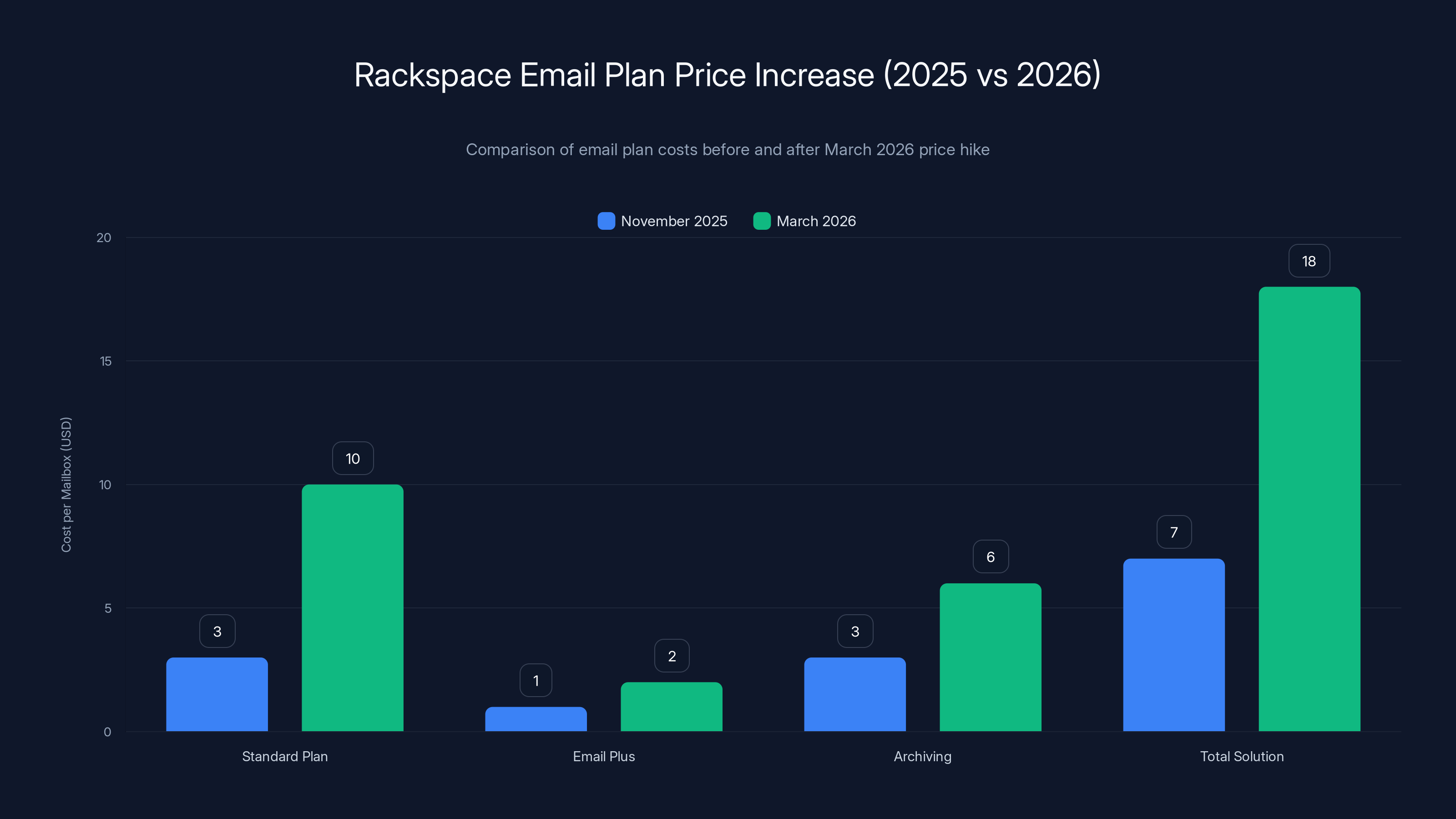

To understand just how devastating this increase truly is, let's look at the actual numbers. In November 2025, Rackspace's Standard email plan cost

Effective March 2026, those prices jumped dramatically. The Standard plan alone became

But Laughing Squid's 706 percent increase tells an even more troubling story. Scott Beale, the company's founder, revealed that his organization had negotiated volume discounts over their 25-plus years as a Rackspace customer. These negotiated rates had essentially vanished in the new pricing structure. The new quotes didn't include any volume discounts at all.

This matters because it suggests Rackspace didn't just adjust prices upward. They fundamentally restructured how they calculate pricing for reseller partners, eliminating loyalty-based discounts that had been built up over decades. For Laughing Squid, which had worked with Rackspace since the late 1990s, this felt like a betrayal.

Beale told journalists that email had become Laughing Squid's largest expense after the increase. When your largest expense suddenly jumps by more than 700 percent, your entire business economics change overnight. You can't just absorb that cost. You have to pass it along to customers, and customers don't want to pay seven times more for email.

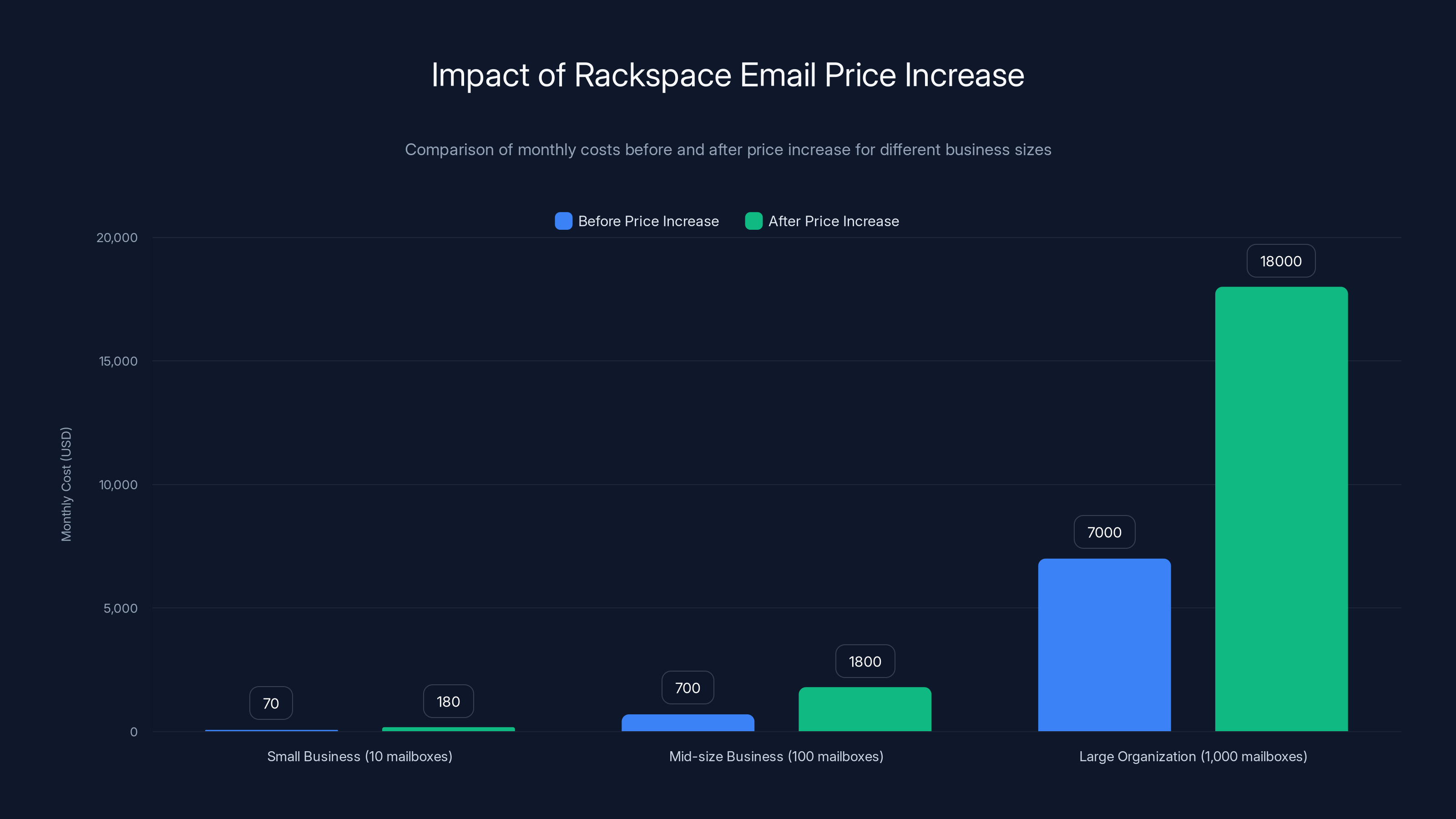

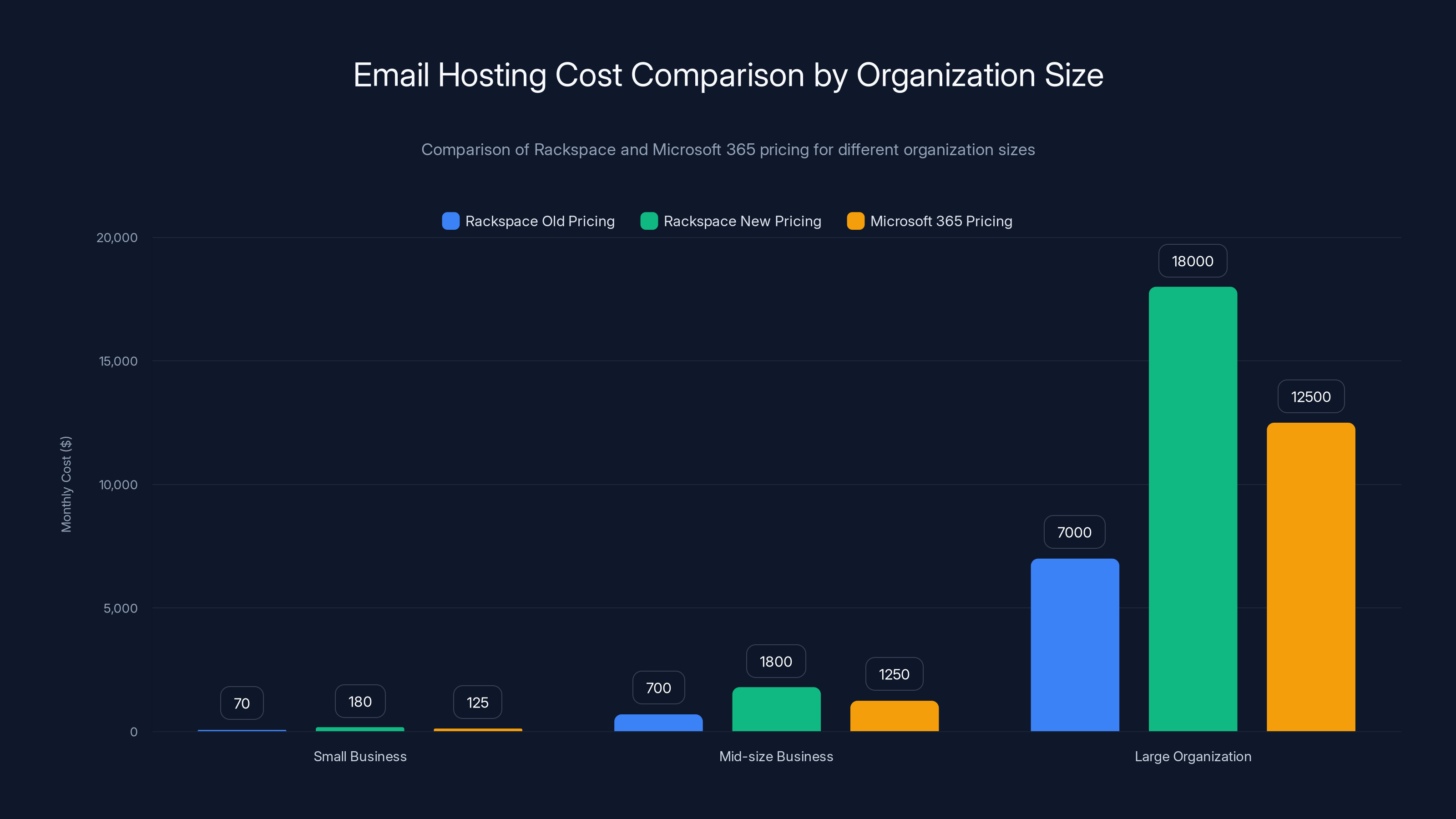

The price increase significantly impacts businesses of all sizes, with small businesses seeing a

Why Email Hosting Has Become Such a Tough Business

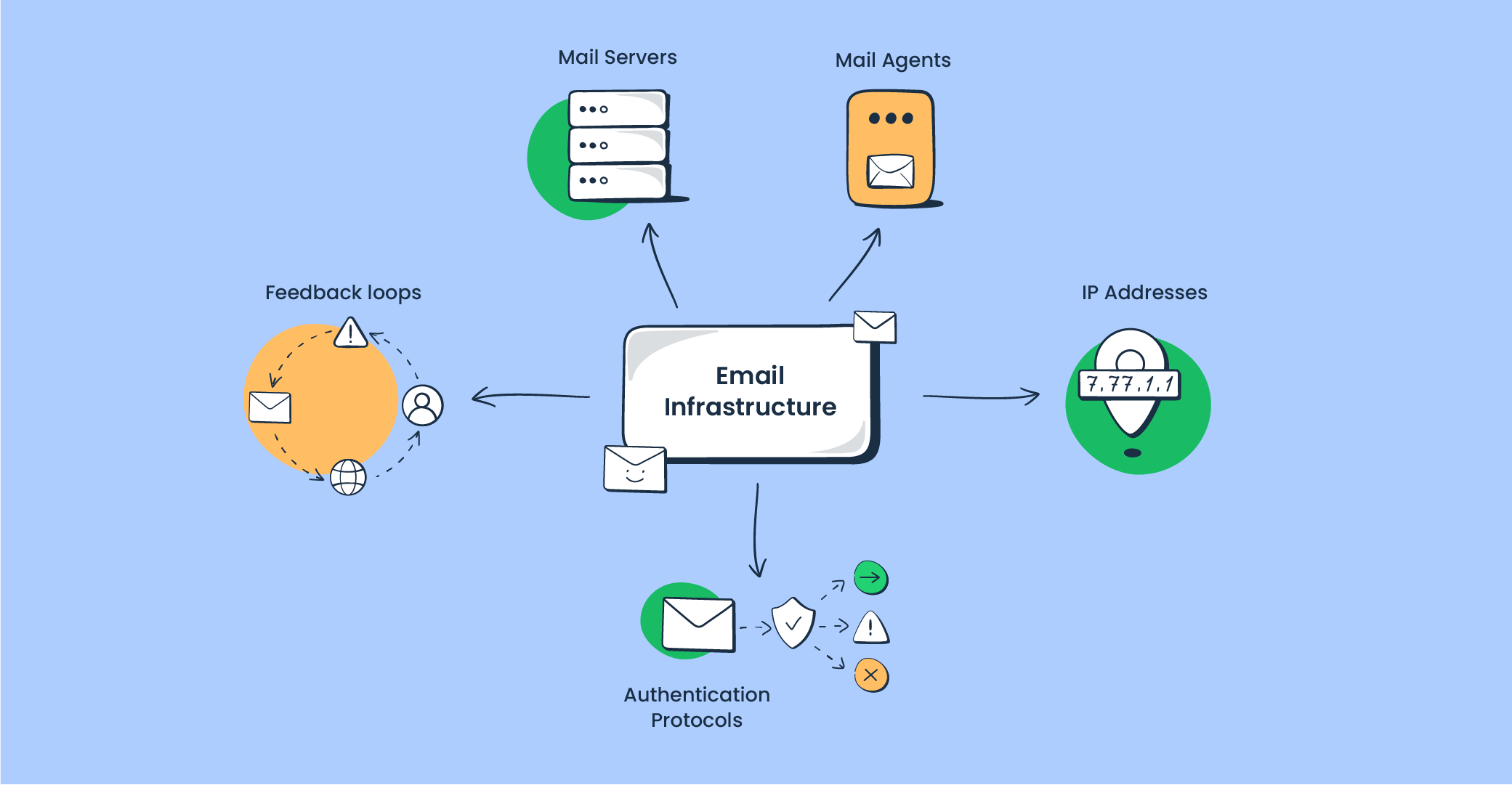

Understanding Rackspace's decision requires understanding why email hosting has become increasingly challenging for large cloud providers. On the surface, email seems like a commodity service. But running reliable, secure email at scale is actually remarkably complex.

Email infrastructure requires constant vigilance against threats. Spam filtering, security scanning, malware detection, and phishing prevention all demand ongoing investment. A single security breach can devastate a hosting provider's reputation. Rackspace learned this the hard way in 2022 when a ransomware attack hit their infrastructure and forced them to completely exit Microsoft Exchange hosting.

Beyond security, email requires expertise in areas that most modern cloud companies would rather avoid. Managing servers that handle SMTP, IMAP, and POP protocols. Ensuring uptime across geographically distributed infrastructure. Handling the complexities of email authentication protocols like SPF, DKIM, and DMARC. Managing storage for decades-old email archives that customers refuse to delete. All of this requires specialists, and specialists are expensive.

The industry has noticed this challenge. Large cloud providers increasingly prefer to resell Microsoft 365 and Google Workspace rather than maintaining proprietary email infrastructure. Microsoft has more resources to handle email security. Google has more infrastructure to scale. Both companies have invested billions in email technology. For a company like Rackspace, maintaining a competitive email service while competing against these giants requires either massive investment or accepting lower margins.

Rackspace also stopped hosting Microsoft Exchange following their 2022 ransomware attack. This was a significant shift. Many Rackspace customers relied on Exchange for advanced features like shared calendars, meeting room reservations, and complex delegation rules. Losing Exchange meant Rackspace's email offering became less competitive for enterprise customers.

Additionally, 2026 brought an AI-driven RAM shortage that impacted computing component availability and affordability. Storage, a critical component for email systems, became more expensive. Running email infrastructure at a lower margin became even less viable.

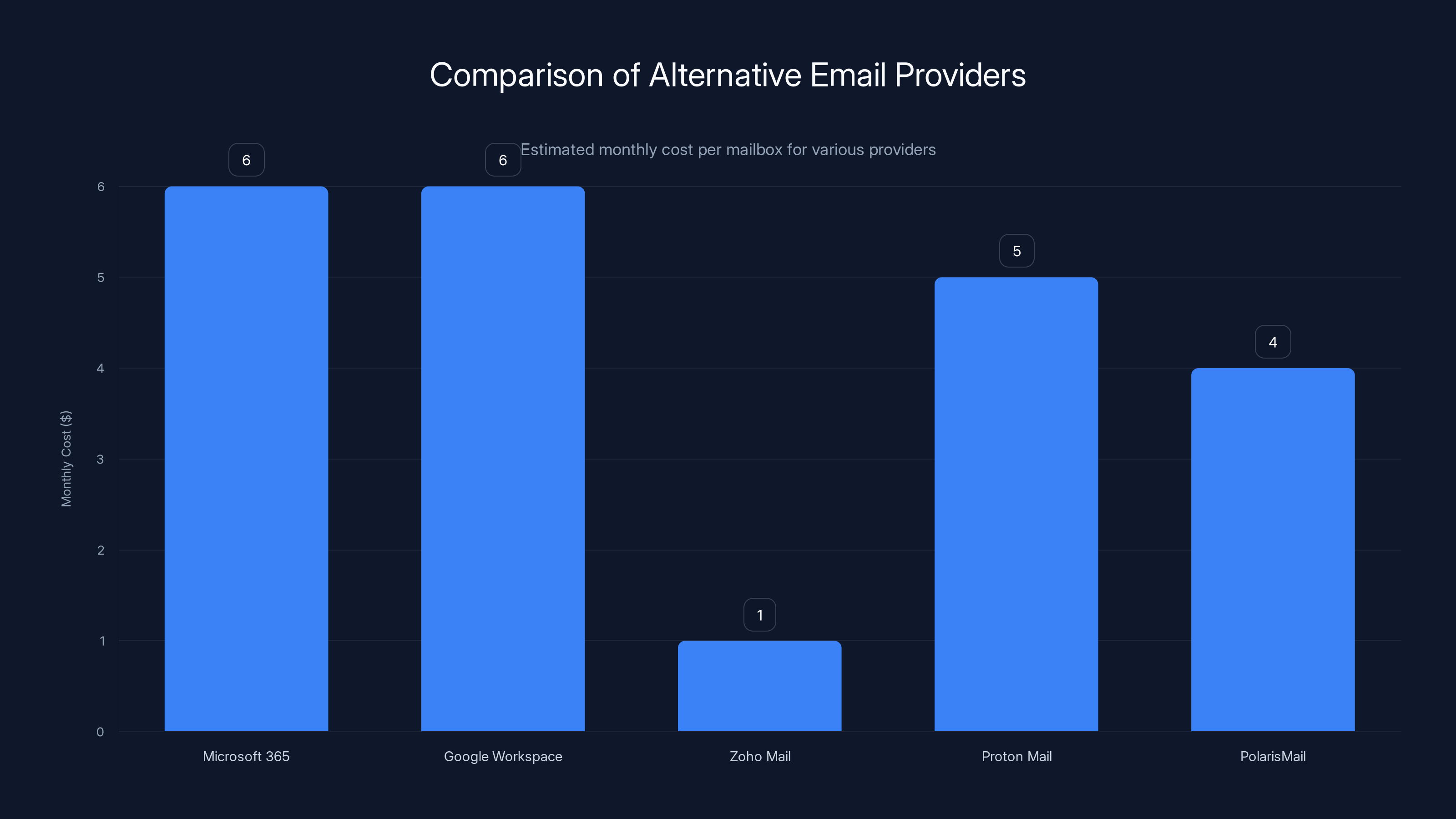

This chart compares the starting monthly cost per mailbox for various alternative email providers. Zoho Mail offers the lowest starting price, while Microsoft 365 and Google Workspace are priced similarly.

The Customer Impact: A Cascading Effect

The price increase doesn't just impact Rackspace customers directly. It cascades through the entire reseller ecosystem. When Laughing Squid's costs increased by 706 percent, they faced three choices: absorb the loss, pass the increase to their own customers, or migrate to a different provider.

Absorbing the cost was impossible. A single large customer could have destroyed their margins. Passing the increase to customers would have meant telling clients that their email costs increased sevenfold overnight—a conversation that would lead most to shop around.

So Laughing Squid chose option three: migrate to a different provider. They began offering email services through Polaris Mail at significantly lower prices than what Rackspace's new pricing would have required. This meant finding a new provider, testing their infrastructure, ensuring data could migrate without loss, and rebuilding customer trust in a different email platform.

This scenario repeated across Rackspace's entire reseller network. Partners who had spent years building customer relationships on Rackspace's email infrastructure suddenly had to either raise prices dramatically or switch providers. Many chose to switch.

Rackspace's Explanation: Managing Expectations

When asked by journalists about the massive price increase, Rackspace provided a brief statement. The company said that Rackspace Email is a reliable and secure business-class email solution for small businesses. To continue delivering the service levels customers expect, effective March 2026, they were increasing prices. The company also noted they have a support team available to discuss options.

That's it. No detailed explanation of why prices increased by such an enormous margin. No breakdown of cost drivers. No acknowledgment of the dramatic nature of the increase. No transition period for existing customers. Just a terse statement about continuing to deliver service levels.

This response reveals something important about how large cloud providers sometimes view their customer relationships. Rackspace essentially told customers "take it or leave it." There was no negotiation, no grandfather clause for long-term customers, no phased implementation. Just a price increase so large that it forced a fundamental decision point.

Compare this to how other companies communicate price changes. When most services raise prices, they provide context. They explain what drove the increase. They often grandfather existing customers or provide extended notice periods. Rackspace did none of these things.

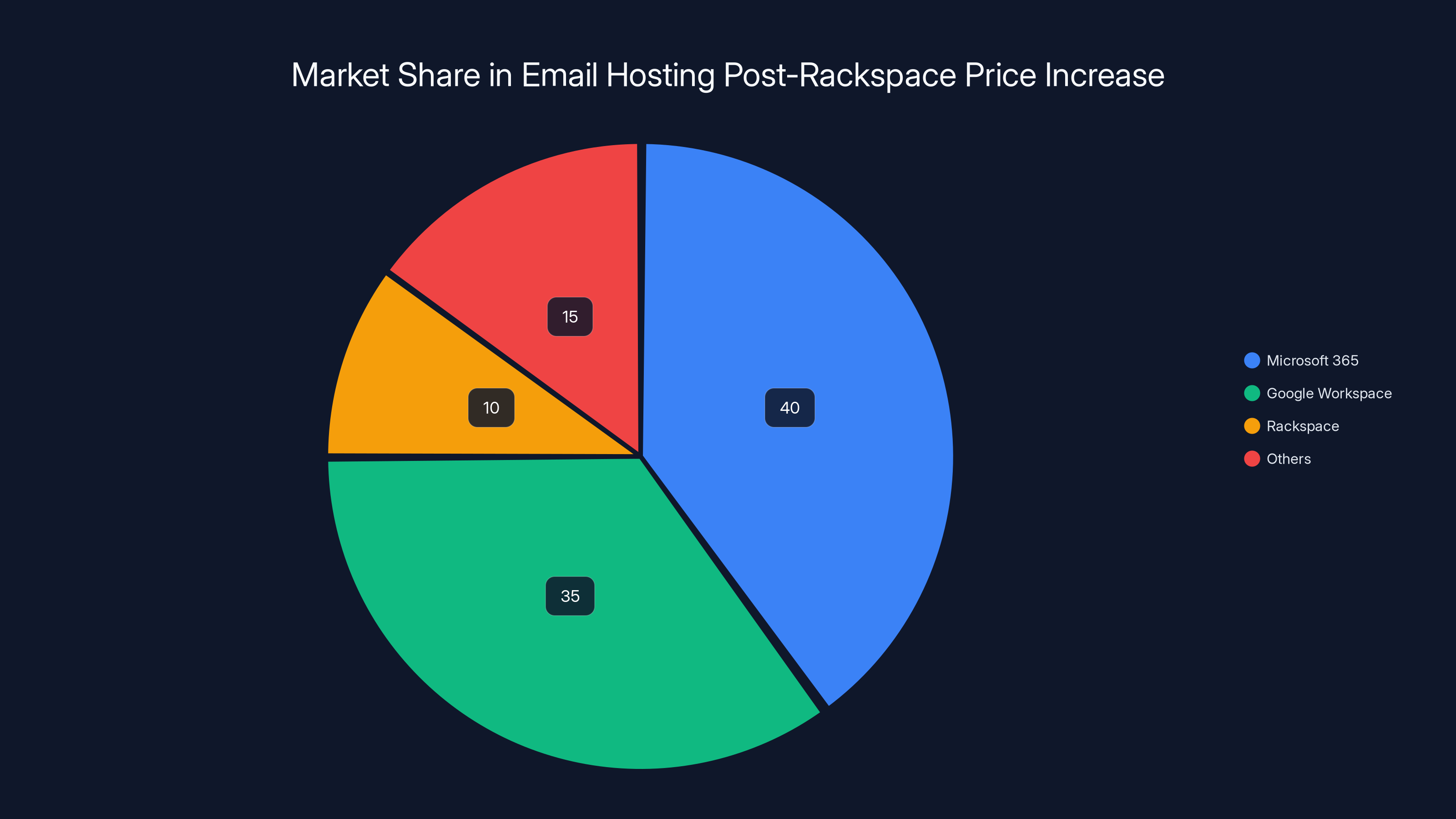

Estimated data shows Microsoft 365 and Google Workspace leading the email hosting market, with Rackspace losing share post-price increase.

The Timing: Why 2026?

The decision to implement this increase in 2026 likely reflects several converging factors. First, Rackspace went public in 2020, making them accountable to shareholders. Public companies face pressure to improve margins and profitability. Email hosting has historically been a low-margin business, so increasing prices is attractive to investors.

Second, the 2022 ransomware attack forced Rackspace to exit Microsoft Exchange hosting. This represented a loss of revenue and customers. When you lose a major service line, you need to compensate elsewhere. Email hosting, while challenging, still generates recurring revenue.

Third, the competitive landscape shifted. Microsoft 365 and Google Workspace have become the de facto standards for business email. Smaller providers like Rackspace struggle to compete on features and price. Rather than invest billions to catch up, raising prices for existing customers seems more attractive to management.

Fourth, the broader cloud infrastructure market saw consolidation and margin pressure. Companies like Amazon, Microsoft, and Google have such massive scale that they can operate services at lower margins. Smaller players like Rackspace need higher margins to remain profitable.

Comparing Email Hosting Alternatives

For businesses suddenly facing massive price increases, understanding alternatives is critical. The email hosting market includes several categories of providers, each with different strengths.

Managed Exchange Providers: Companies like Microsoft, Google, and various third-party managers still offer Exchange hosting. These tend to be more expensive than basic email but offer advanced features like shared calendars and meeting room reservations.

Cloud-First Email Services: Providers like Zoho Mail, Proton Mail, and others built cloud-native email from scratch. These often undercut traditional Exchange providers on price while offering modern features.

Open-Source Solutions: Companies willing to manage their own infrastructure can run Postfix, Dovecot, and other open-source email software. This requires technical expertise but offers maximum control and lowest cost.

Alternative Hosting Providers: Competitors to Rackspace like Liquid Web, Kinsta, and others offer email hosting at various price points. Many specifically position themselves as alternatives to Rackspace for customers affected by price increases.

Hybrid Approaches: Many businesses now run email through Microsoft 365 or Google Workspace while maintaining legacy Exchange servers for compliance or specific features.

The key is understanding your actual email requirements. Do you need advanced features like shared calendars and meeting room reservations? Do you need to maintain compliance with specific data residency requirements? Do you need maximum control over your infrastructure? Your answers to these questions determine which alternative makes most sense.

Rackspace's new pricing significantly increases costs across all organization sizes compared to their old pricing. Microsoft 365 offers a more cost-effective solution with additional features.

The Reseller Impact: Navigating the Crisis

Resellers occupy a peculiar position in the hosting ecosystem. They purchase services from larger providers like Rackspace and resell them to smaller customers. When their costs increase, they face margin compression. When they pass costs to customers, they risk losing those customers to competitors.

For Laughing Squid specifically, the 706 percent increase was particularly harsh because of their long history with Rackspace. The company had built their customer relationships partly on Rackspace's reputation and stability. Suddenly having to explain that email costs increased sevenfold and they're switching providers created a difficult customer service situation.

Other resellers across Rackspace's network faced similar situations. Some attempted to negotiate with Rackspace for transition periods or modifications to pricing. Most found Rackspace inflexible. The company's position appeared to be "here's the new pricing, effective in six weeks, take it or make other arrangements."

This approach destroyed customer goodwill at scale. Resellers who had been loyal to Rackspace for decades suddenly found their largest provider unresponsive and uncaring about the disruption the price increase created. Many began evaluating whether they wanted to continue recommending Rackspace services to new customers.

Industry Implications: The Broader Pattern

Rackspace's price increase isn't unique. It's part of a broader pattern in cloud services where companies raise prices after gaining market share. This is a common playbook: gain customers with competitive pricing, then increase prices once customers are locked in.

What makes Rackspace's approach notable is the magnitude of the increase and the lack of notice. A 55 percent increase in 2019 was already substantial. A 706 percent increase in 2026 is extraordinary. With only 6 weeks notice, customers had almost no time to evaluate alternatives and plan migrations.

This raises important questions about cloud service sustainability. If providers depend on dramatic price increases to remain profitable, what does that say about their business models? If these businesses can only increase margins by forcing customers to migrate, how long can they maintain customer relationships?

The email hosting space specifically seems to be consolidating around a few large providers. Microsoft 365 and Google Workspace have achieved such scale that they can operate at margins smaller companies can't match. Specialized providers like Rackspace, which don't have that scale, seem to be either exiting email hosting entirely or raising prices dramatically to reduce customer bases to levels they can profitably serve.

Rackspace's price increase pattern shows a dramatic spike in 2026 with a 706% increase, highlighting significant pricing strategy shifts. Estimated data for years without explicit values.

Migration Strategies: How to Switch Email Providers

For businesses deciding to leave Rackspace or any other provider increasing prices, the migration process requires careful planning. Email migration is notoriously delicate because email is critical infrastructure that can't have downtime.

The first step is choosing your target provider. This involves evaluating features, pricing, reliability, and integration requirements. Once you've identified the new provider, you'll need to understand their migration process. Most offer guided migrations that preserve email history, contacts, and calendars.

Before beginning migration, back up all your email data. Use your provider's export tools to create local copies of important email. This ensures you have a safety net if migration goes wrong.

During migration, you'll typically use a staged approach. Start with non-critical mailboxes, verify everything works, then migrate critical mailboxes. Use MX record forwarding to gradually shift mail flow from the old provider to the new one. This allows you to validate the new system is receiving mail correctly before fully committing.

After migration, test critical integrations. If your CRM connects to email, verify the connection still works with the new provider. If your compliance system archives email, ensure that continues working. Many failed migrations result from broken integrations that nobody tested until after the switch.

The entire process typically takes 2-8 weeks depending on your email volume, number of mailboxes, and complexity of your email integrations.

Cost Analysis: The Real Financial Impact

To understand the financial impact of Rackspace's price increase, let's work through the math for different organization sizes.

For a small business with 10 mailboxes, old pricing was

For a mid-size business with 100 mailboxes, old pricing was

For a large organization with 1,000 mailboxes, old pricing was

These increases are substantial enough that they often trigger budget reviews and force reallocation from other areas. A business spending an additional

Many businesses respond by consolidating to Microsoft 365 or Google Workspace, which offer predictable pricing at scale. A Microsoft 365 Business Standard subscription costs $12.50 per mailbox per month, including not just email but also Office applications, cloud storage, and other productivity tools. This is cheaper than Rackspace's new pricing and includes additional value.

Rackspace's email plan costs increased significantly in March 2026, with the total solution cost rising from

The Trust Factor: Reputation Damage

Beyond the financial impact, Rackspace's price increase damages something harder to quantify: customer trust. Customers who had been with Rackspace for 10, 20, or 25 years suddenly learned that loyalty didn't provide any protection from dramatic price increases.

When you've used a service for decades, you develop an assumption that the vendor cares about your business. You assume that loyalty will be rewarded with stable pricing or at least notice and respect for long-term relationships. Rackspace's approach contradicted these assumptions.

Once trust is broken, it's difficult to rebuild. Even if Rackspace offered to negotiate or provided transition discounts now, customers would remember that the company was willing to exploit its customer base for financial gain. This memory persists.

For Rackspace's sales team, this creates a significant challenge. If you're trying to sell new services to prospects, explaining that your company dramatically increased prices on long-term customers doesn't help your pitch. Prospects wonder if they'll face similar treatment after a few years.

This is why some companies provide explicit pricing guarantees. They commit to not increasing prices beyond a certain threshold for a certain period, or they commit to giving 12 months notice before any significant price change. Rackspace could have managed this situation very differently by providing transition options and showing respect for long-term customer relationships.

What Rackspace Could Have Done Differently

While we can't know Rackspace's internal decision-making, there were clearly better approaches to managing this situation.

Grandfather Pricing: Offer existing customers lower pricing than new customers, with pricing increases tied to inflation or specific cost drivers. This rewards loyalty and maintains customer relationships.

Phased Implementation: Rather than implementing the increase all at once, implement it gradually over 12-18 months. This gives customers time to adjust budgets and evaluate alternatives without disruption.

Transparency: Explain specifically what drove the price increase. Share metrics about infrastructure costs, security investments, and market changes. Transparency builds trust even when delivering bad news.

Negotiation: For high-value customers, especially those with decades-long relationships, offer to negotiate pricing rather than applying a one-size-fits-all increase. Most customers would accept moderate increases if they felt their history was respected.

Alternative Migration: Offer to help customers migrate to Microsoft 365 or Google Workspace at a discounted rate, positioning this as a service rather than a forced exodus.

Extended Notice: Six weeks notice is insufficient for business email migration. A company that cared about customer relationships would have provided 6 months notice, giving customers ample time to plan.

None of these approaches were taken. Instead, Rackspace chose to maximize short-term revenue by extracting as much as possible from customers before they left.

Industry Standards for Price Increases

To understand how unusual Rackspace's approach was, consider how other service providers handle price increases.

Most SaaS companies provide 30-90 days notice before price increases. Tier-one cloud providers like AWS, Azure, and Google Cloud provide 30 days notice. Traditional telecommunications companies are required by regulation to provide 30 days notice for rate changes.

For price increase magnitude, most companies increase by 5-15 percent annually. Even aggressive companies limit increases to 20-25 percent. A 55 percent increase, which Rackspace implemented in 2019, was already outside typical industry norms. A 706 percent increase is truly extreme.

Rackspace's approach violates industry norms in both notice period and magnitude. This suggests the increase wasn't a carefully planned business decision based on market conditions. It looks more like an opportunistic grab for revenue, betting that enough customers would accept the increase without leaving.

Future Outlook: What Comes Next

Rackspace likely faces customer attrition related to this price increase. Existing customers will migrate to Microsoft 365, Google Workspace, or competitors. Resellers will shift their recommendations to alternative providers. The question is how severe the impact will be.

Some customers will migrate quickly. Others, particularly larger organizations with complex deployments, will take longer. A few will begrudgingly accept the higher pricing because migration costs and risks aren't worth the savings.

Long-term, Rackspace's email hosting business will likely shrink as a percentage of their overall business. They may eventually exit email hosting entirely, similar to how they exited Microsoft Exchange after the 2022 ransomware attack. This would allow the company to focus on higher-margin services like managed cloud infrastructure, where they can compete with AWS and Azure more directly.

Alternatively, Rackspace could reverse course, apologize for the price increase, and offer discounts to retain customers. This would be expensive and admit that the original pricing strategy was a mistake. But it's possible if the customer attrition becomes severe enough to impact revenue projections.

The most likely scenario is that Rackspace accepts significant customer loss, uses the increased revenue from remaining customers to fund other business initiatives, and gradually shrinks their email hosting business to a small managed service for customers unwilling to migrate.

Lessons for Business Leaders

Rackspace's price increase offers important lessons for any organization evaluating cloud services.

Vendor Lock-In Is Real: Switching services is possible but difficult, especially with email which integrates deeply into business operations. Recognize this risk when selecting providers and negotiate terms that protect you if pricing becomes unacceptable.

Evaluate Total Cost of Ownership: Don't choose a provider based on advertised price alone. Consider switching costs, integration costs, and total cost of ownership over the likely lifetime of the relationship.

Maintain Exit Plans: Even if you're satisfied with your current provider, develop plans for how you'd migrate to alternatives if pricing, quality, or other factors became unacceptable. This maintains optionality.

Negotiate Long-Term Agreements: If your usage is substantial, negotiate multi-year agreements with defined pricing. This protects you from unilateral price increases.

Diversify Critical Services: Don't concentrate all critical business functions with a single provider. If email is critical to your business, maintain relationships with multiple email providers or hybrid approaches.

Monitor Vendor Financial Health: Companies facing financial pressure are more likely to raise prices. Monitor your vendor's financial health and market position to anticipate price increases before they arrive.

Rackspace's Statement and Response

Rackspace's brief statement that they're committed to reliability and service levels, with a support team available to discuss options, essentially deflected the core issue. Customers didn't need to hear about reliability. They needed to understand why prices more than tripled overnight and what the company would do to mitigate the impact.

Since Beale stated he reached out to Rackspace about the new pricing without receiving responses, it appears the company is taking a hands-off approach. Rather than engaging with affected customers to discuss options, Rackspace seems content to let customers vote with their feet by migrating.

This approach makes financial sense in the short term. Every customer who stays at the higher price generates more revenue. Every customer who leaves to a competitor is no longer a customer. From Rackspace's perspective, this binary outcome is preferable to negotiating with hundreds of customers about pricing adjustments.

But from a long-term customer relationship perspective, this approach is devastating. It signals that Rackspace doesn't value long-term customer relationships, doesn't respect customer loyalty, and is willing to exploit its market position to extract maximum revenue regardless of consequences.

Alternative Email Providers Worth Considering

For organizations leaving Rackspace, several alternatives deserve evaluation.

Microsoft 365: The market leader, offering Exchange Online integrated with Office applications and collaboration tools. Pricing starts at $6 per mailbox monthly. Enterprise support and advanced security features available at higher tiers.

Google Workspace: Includes Gmail with 30GB of storage, Google Drive, Docs, Sheets, Meet, and more. Pricing starts at $6 per mailbox monthly. Excellent for organizations already in the Google ecosystem.

Zoho Mail: An underrated option offering email with custom domains starting at $1 per mailbox monthly. Includes limited collaboration features and integrates with Zoho's broader business software suite.

Proton Mail: Privacy-focused email with end-to-end encryption. Pricing starts at $5 per mailbox monthly for businesses. Best for organizations with strong privacy requirements.

Polaris Mail: The alternative that Laughing Squid migrated to, positioning itself specifically as a Rackspace alternative with competitive pricing and reliable infrastructure.

Open Source Options: Organizations with technical teams can run Postfix, Dovecot, and other open-source email software on their own infrastructure. Lowest cost but highest operational complexity.

Each option has different strengths depending on your specific requirements, existing infrastructure, and technical capabilities.

The Broader Cloud Services Pricing Picture

Rackspace's price increase reflects a broader trend in cloud services. Companies often use aggressive pricing to gain market share, then increase prices once they have a substantial customer base. This isn't unique to Rackspace.

We've seen similar patterns with:

- Twitter rate-limiting its API after acquiring substantial developer usage

- Stripe increasing processing fees for card-not-present transactions

- GitHub implementing storage limits that require paid upgrades

- Atlassian discontinuing perpetual licenses to force cloud transitions

The pattern is consistent: gain market share with attractive pricing, then increase prices once customers are sufficiently dependent.

This raises a fundamental question about cloud service sustainability. If providers depend on price increases to remain profitable, are their initial pricing models sustainable? Or are they intentionally aggressive to gain customers, knowing prices will rise later?

For customers, the lesson is clear: never assume current pricing will remain stable indefinitely. Always evaluate the long-term total cost of ownership, including anticipated price increases. Always maintain alternatives that you could switch to if pricing becomes unacceptable.

Conclusion: What Rackspace's Price Increase Reveals About Cloud Services

Rackspace's email hosting price increase is more than just bad news for customers. It's a window into how large cloud service providers think about customer relationships, profitability, and market dynamics.

The increase reveals that Rackspace viewed email hosting as a low-priority service that wasn't generating sufficient margins. Rather than invest in the technology to make it competitive with Microsoft and Google, the company chose to extract maximum revenue from remaining customers while expecting most to migrate to competitors.

This approach is financially rational in the short term. But it's strategically damaging long-term. Customers who experience this kind of treatment become skeptical of other Rackspace services. Resellers who felt betrayed become less enthusiastic recommending Rackspace to new customers. And prospects evaluating Rackspace for the first time hear stories about 706 percent price increases and look elsewhere.

For Rackspace, the price increase probably generates short-term revenue gains before customer attrition becomes severe. But the long-term consequences are real. Once a vendor demonstrates it's willing to exploit customers for financial gain, trust is broken. And without trust, long-term customer relationships aren't possible.

For customers of any cloud service provider, Rackspace's approach should serve as a cautionary tale. It highlights the importance of maintaining alternatives, negotiating long-term agreements with pricing protections, and never assuming vendor goodwill will protect you from business decisions driven by financial pressures.

The email hosting space will continue consolidating around providers with enough scale to operate at competitive margins. Microsoft 365 and Google Workspace will continue gaining market share. Smaller providers will either specialize in specific niches or exit email hosting entirely.

Rackspace's future in email hosting looks bleak. But the company's approach offers valuable lessons for any organization dependent on cloud services: understand your dependencies, maintain alternatives, and recognize that vendor interests don't always align with customer interests. When those interests diverge, as they did in January 2026, customers need to be prepared to act quickly.

FAQ

What caused Rackspace to increase email hosting prices so dramatically?

Rackspace faced several converging pressures that made email hosting unprofitable at previous pricing levels. The 2022 ransomware attack forced the company to exit Microsoft Exchange hosting, representing a loss of revenue. Additionally, email infrastructure has become increasingly complex to manage securely at scale, requiring substantial ongoing investment. The company also faced pressure from public shareholders to improve margins in lower-margin business lines. Rather than invest significantly in competing with Microsoft 365 and Google Workspace, Rackspace chose to increase prices on existing customers.

How much will the price increase impact a typical business?

The impact varies by organization size and current service tier. A small business with 10 mailboxes would see monthly costs increase from

What are my best options for switching email providers?

Microsoft 365 and Google Workspace are the most popular alternatives, offering email integrated with productivity applications at comparable or lower pricing than Rackspace's new rates. For organizations requiring higher privacy, Proton Mail offers end-to-end encrypted email. Zoho Mail provides affordable email with reasonable features. Polaris Mail specifically positions itself as a Rackspace alternative. The best choice depends on your existing infrastructure, required features, and integration needs. Most migrations take 2-8 weeks depending on complexity.

How much notice should I expect before a major price increase?

Industry standards typically provide 30-90 days notice for price increases. Tier-one cloud providers like AWS provide 30 days notice. Traditional telecommunications providers are regulated to provide 30 days notice. Rackspace provided only 6 weeks notice for a change taking effect March 2026, falling below best practices. When evaluating cloud providers, prioritize those offering longer notice periods and more transparent communication about pricing changes.

Should I trust other Rackspace services given their email hosting price increase?

The price increase suggests that Rackspace prioritizes short-term revenue extraction over long-term customer relationships. This doesn't necessarily mean other Rackspace services will experience similar price increases, but it does highlight the importance of negotiating long-term pricing agreements for any Rackspace services you depend on. Consider diversifying critical services across multiple providers to reduce dependence on any single vendor.

What should I do if my email provider raises prices?

First, evaluate whether the new pricing remains reasonable compared to alternatives. If it doesn't, initiate evaluation of competing providers. Create a migration plan that includes data backup, testing with non-critical mailboxes, and validation of integrations with other business systems. Conduct the migration during low-usage periods if possible. Before fully committing to a new provider, verify that all critical integrations work correctly and that email is flowing properly. The migration process typically requires 2-8 weeks but is worth the investment if it significantly reduces costs.

Could Rackspace reverse this price increase?

Reversing the price increase would require the company to acknowledge the original pricing strategy was a mistake and absorb significant lost revenue. This is unlikely unless customer attrition becomes severe enough to threaten the company's financial performance. More likely, Rackspace will accept customer loss and use increased revenue from remaining customers to fund other business priorities. The company could mitigate damage by offering transition discounts to customers evaluating alternatives, but this seems inconsistent with their current approach.

How can I evaluate the true cost of an email provider?

Calculate total cost of ownership including the email service price, migration costs, integration costs, training costs, and support costs. Factor in the cost of systems you might retire by switching to a more integrated platform like Microsoft 365. Consider switching costs if you need to migrate again in the future. Evaluate whether the provider includes features you currently use elsewhere, potentially reducing total tools required. This comprehensive analysis often reveals that slightly more expensive providers offer better total value.

What does this mean for Rackspace's future as an email provider?

Rackspace's email hosting business will likely decline substantially as customers migrate to alternatives. The company may eventually exit email hosting entirely, similar to their exit from Microsoft Exchange after the 2022 ransomware attack. This would allow Rackspace to focus on higher-margin services like managed cloud infrastructure where they can better compete with AWS and Azure. For customers, this means evaluating your long-term email strategy independently of Rackspace's plans.

How can I prevent being surprised by price increases in the future?

Negotiate multi-year agreements with defined pricing for critical services. Monitor your vendor's financial performance and market position to anticipate pressures that might drive price increases. Maintain relationships with alternative providers so you have options if pricing becomes unacceptable. Include pricing guarantees in your contracts specifying maximum annual increases or notice periods required before changes. Regularly evaluate competitive offerings to stay aware of market pricing trends. These steps don't prevent price increases but give you information and options to respond effectively when they occur.

Key Takeaways

- Rackspace increased email hosting prices from 18 per mailbox monthly in March 2026, with some resellers facing 706% increases

- The price increase reflects structural challenges in email hosting: complexity, security requirements, and inability to compete with Microsoft 365 and Google Workspace

- Resellers faced only 6 weeks notice to either absorb costs, raise customer prices, or migrate to alternative providers like PolarisMail

- Microsoft 365 (6-18/month depending on tier) offer competitive alternatives with integrated productivity tools

- Email migration takes 2-8 weeks and requires careful planning, testing, and validation of integrations to prevent data loss or service disruption

- The price increase demonstrates why businesses should maintain alternative vendor relationships and negotiate long-term pricing agreements

Related Articles

- X Platform Outage January 2025: Complete Breakdown [2025]

- MSI's AI and Business Focus at CES 2026 [2025]

- AI PCs Are Reshaping Enterprise Work: Here's What You Need to Know [2025]

- AI Operating Systems: The Next Platform Battle & App Ecosystem

- Google's $32B Wiz Acquisition: EU Antitrust Decision [2025]

- Data Sovereignty for SMEs: Control, Compliance, and Resilience [2025]

![Rackspace Email Hosting Price Hike: What It Means for Businesses [2026]](https://tryrunable.com/blog/rackspace-email-hosting-price-hike-what-it-means-for-busines/image-1-1768606557493.jpg)