Palantir's Latest UK Defense Win: A £240 Million Contract That Raises Real Questions

In late 2024, Palantir Technologies secured something most companies can only dream about: a three-year, £240.6 million contract with the UK Ministry of Defence, awarded without a competitive procurement process. That part matters more than you might think.

For those not deeply embedded in defense tech, Palantir is a Denver-based company that specializes in data integration and analytics. The firm has built its entire business around taking messy, fragmented data from different sources and making it intelligible. For military and government agencies, that's gold. But here's where the story gets complicated.

The contract renewal wasn't the result of an open bidding process. Instead, the Mo D used what's called a "defense and security exemption" to skip the whole competitive tendering thing and hand the work directly to Palantir. That decision sparked immediate scrutiny from transparency advocates, civil rights organizations, and even some UK lawmakers who wondered why public money was being spent without any real competition for the work.

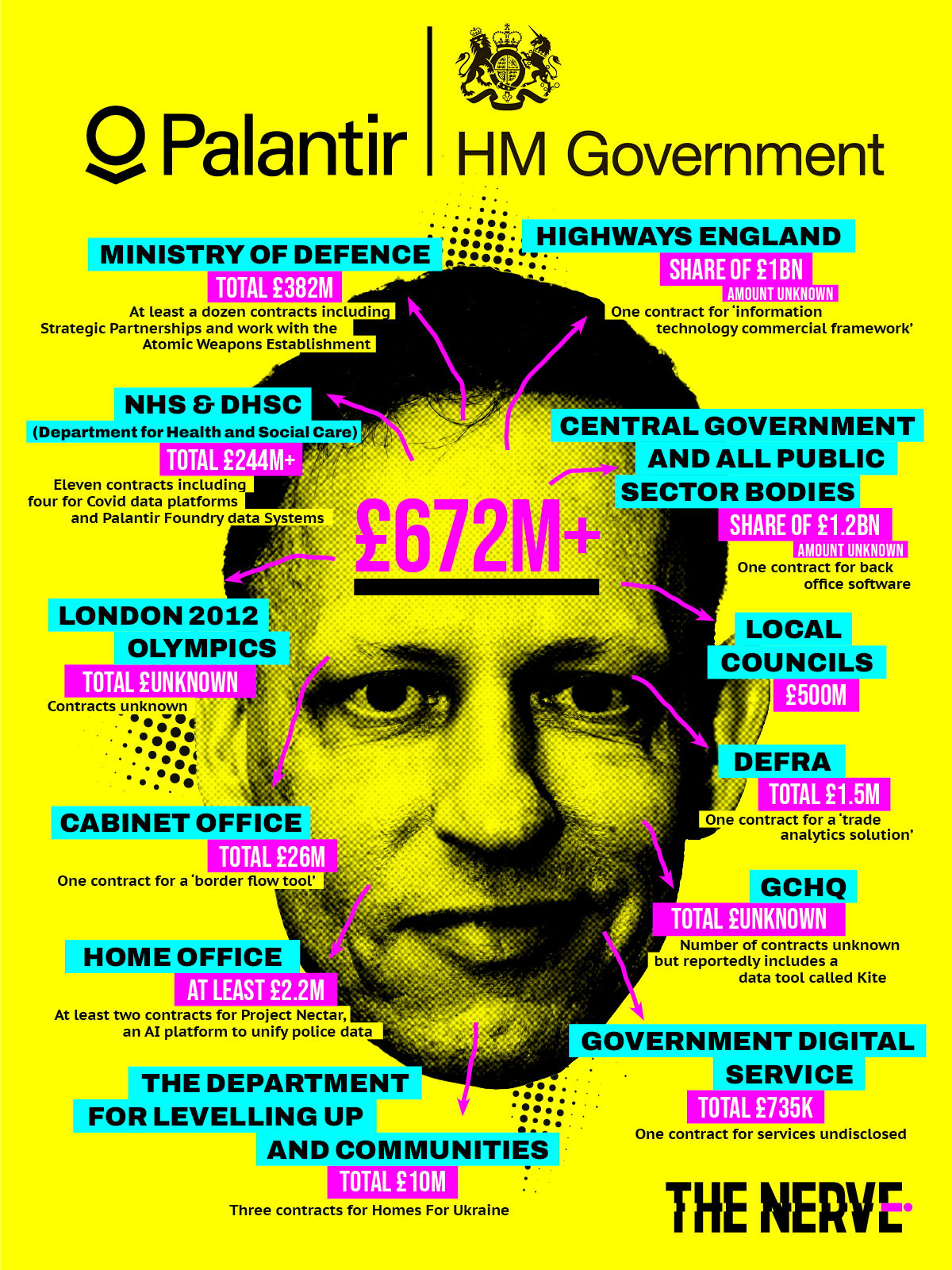

This wasn't Palantir's first major win in the UK. The company already operates extensively with British military and intelligence agencies. But this new contract signals something deeper: Palantir is becoming increasingly embedded in core UK defense infrastructure, and the way it got this deal tells you a lot about how government procurement actually works versus how most people assume it should work.

Let's break down what happened, why it matters, and what it reveals about the intersection of defense spending, data analytics, and government accountability.

The Numbers Behind the Deal

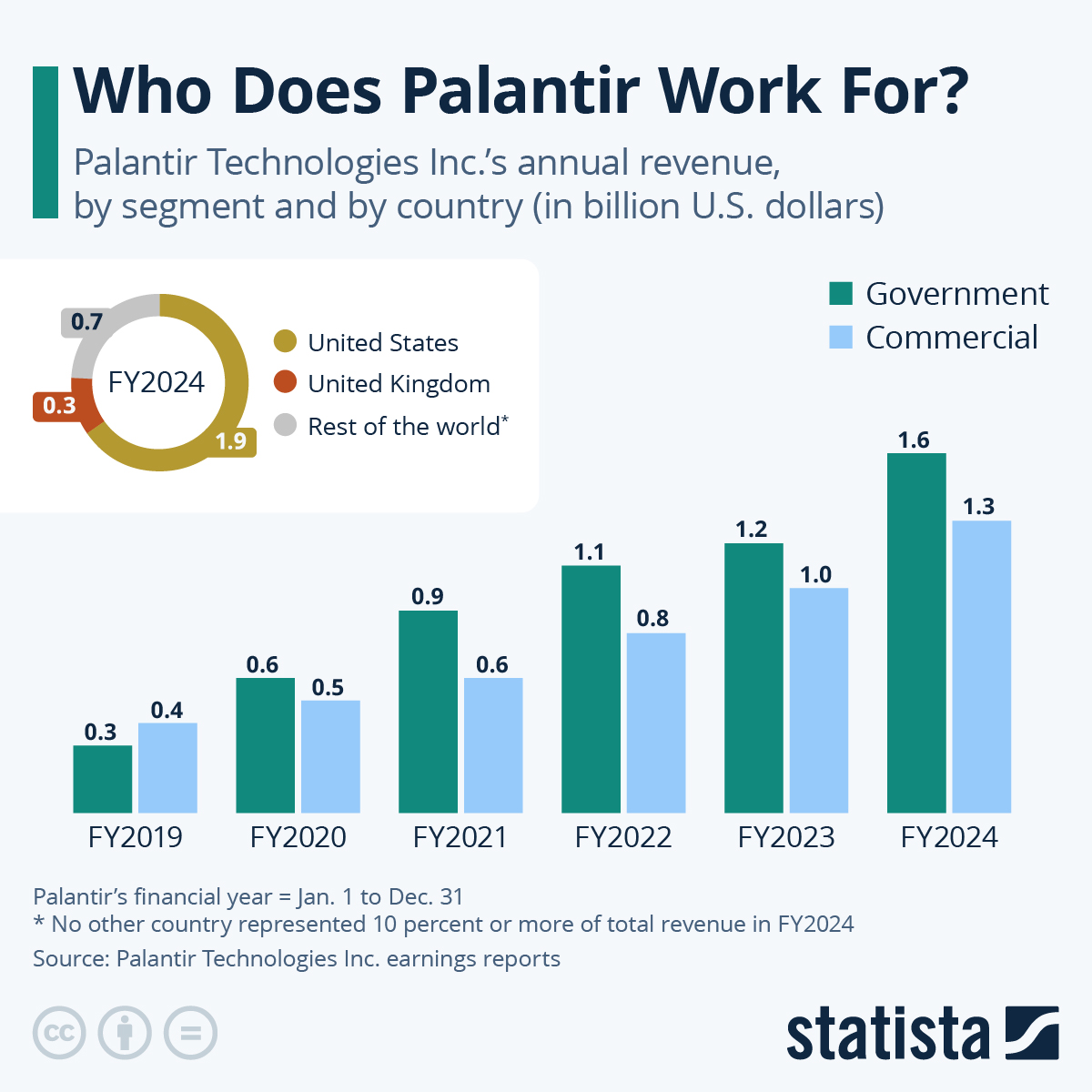

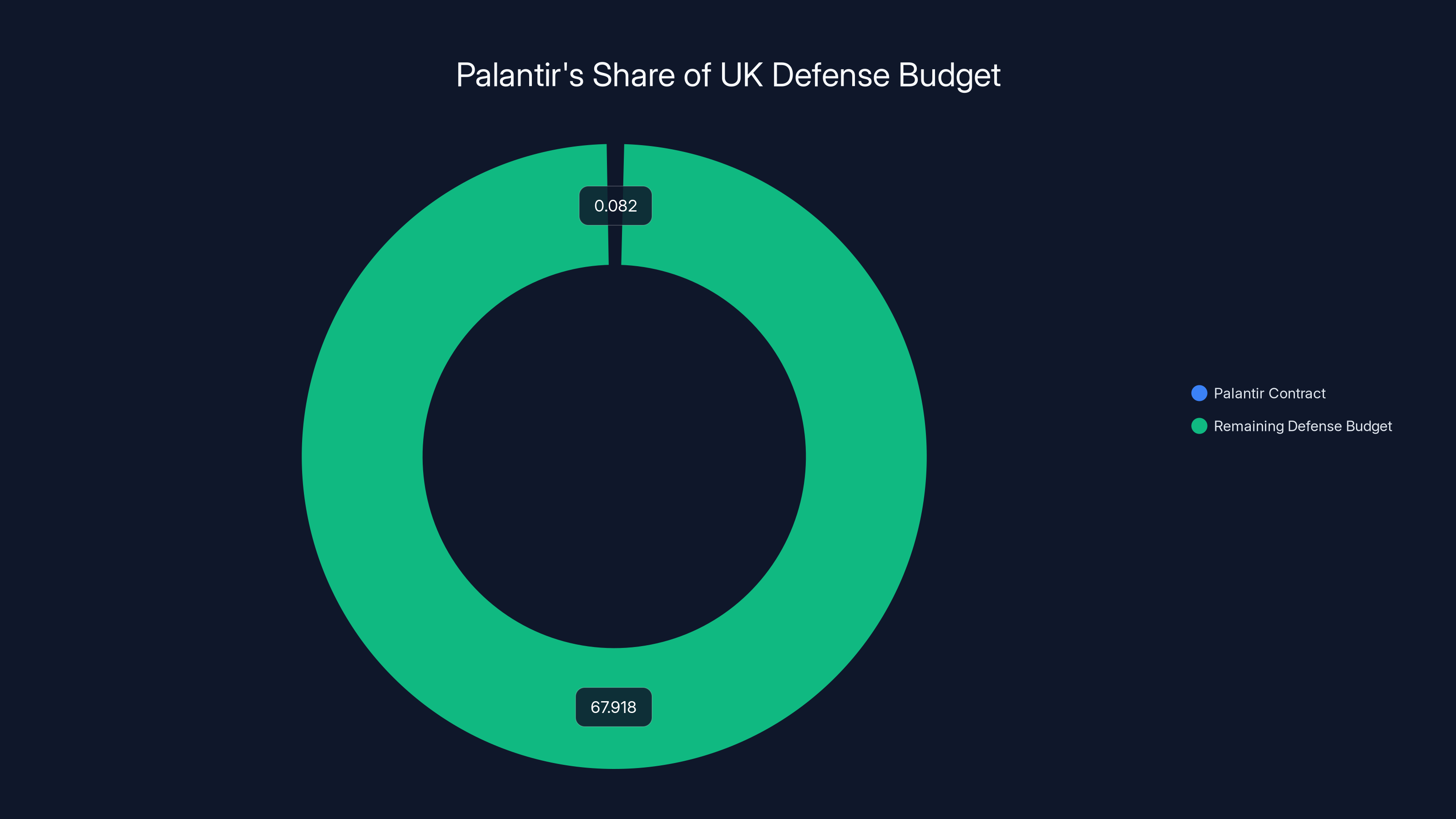

A £240.6 million contract over three years breaks down to roughly £80.2 million annually. That's significant spending, but it's worth context: the UK's total defense budget for 2024-2025 sits at approximately £68 billion. Palantir's share is about 0.12% of the total defense spending, which seems small in absolute terms. But in the specific universe of data analytics contracts, it's enormous.

To put it another way, Palantir is getting paid roughly the same amount annually as the entire operational budget for some NATO countries. The spending isn't trivial, and neither are the implications.

The three-year term matters because it represents continuity. Palantir doesn't need to prove its value again or compete with newer entrants. The company gets guaranteed funding, stability, and deeper integration into Mo D systems. From a business perspective, it's ideal. From a government accountability perspective, it raises questions about whether the Mo D explored alternatives or simply defaulted to the incumbent vendor.

One interesting detail: this contract came roughly two months after the UK government reached a separate deal allowing Palantir to establish a European operations center on British soil. In September 2025, Palantir announced it would create a UK-based hub to handle its European defense work. The combination of those two moves suggests Palantir is positioning itself as a long-term strategic partner to the British government, not just a temporary vendor.

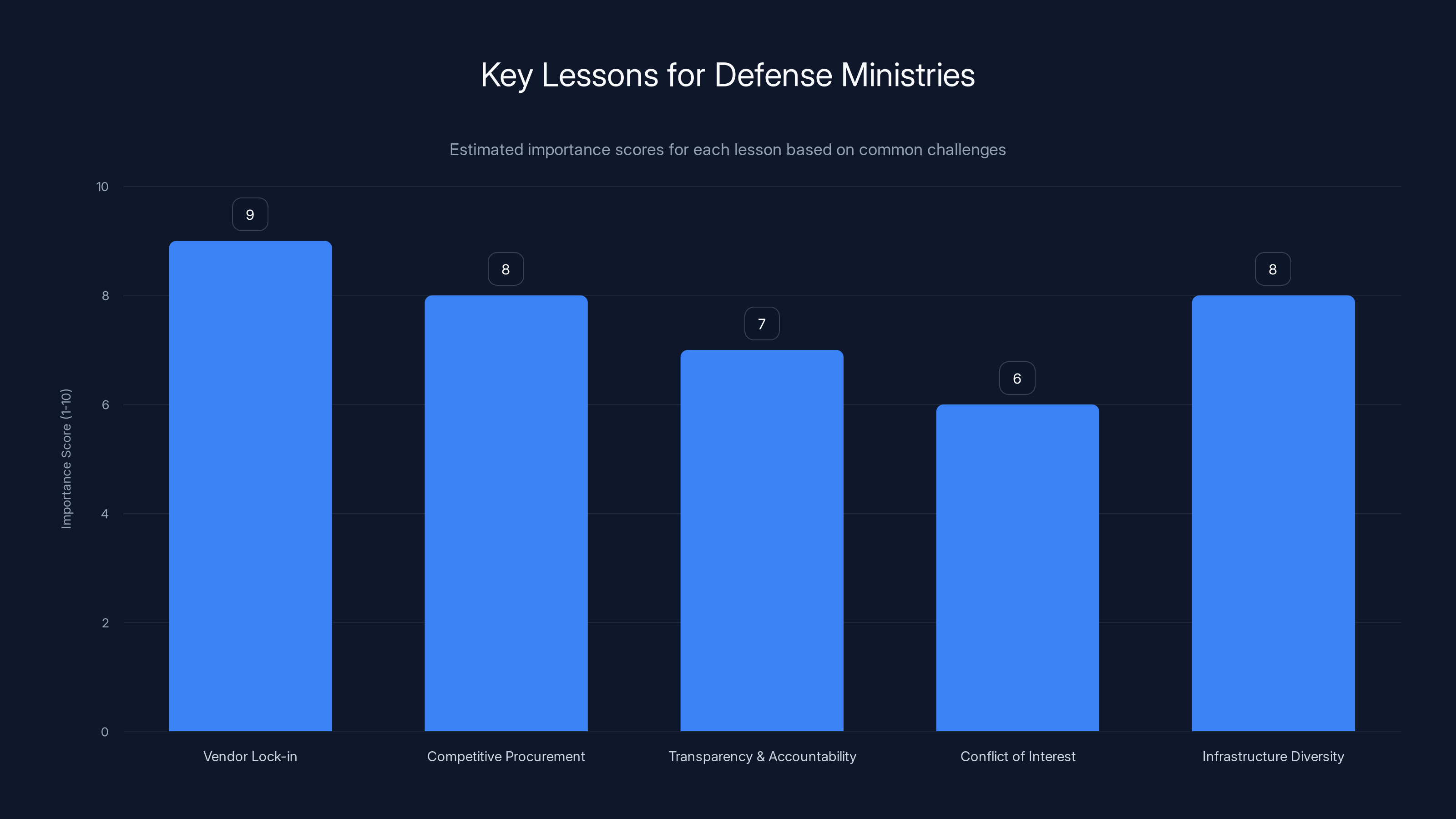

Vendor lock-in and infrastructure diversity are critical lessons for defense ministries, with high importance scores. Estimated data based on common challenges.

How Palantir Got Here: The Path to Defense Dominance

Palantir didn't start as a military contractor. The company was founded in 2003 by Peter Thiel and others, initially focused on fighting terrorism and financial crime. The firm's core product, Palantir Gotham, was built to handle intelligence analysis: taking disparate datasets and finding patterns humans might miss.

For the first decade, Palantir was almost entirely dependent on US government contracts. The company worked heavily with agencies like the CIA, the NSA, and the Department of Homeland Security. But Palantir's real growth came when it expanded into the commercial sector and, crucially, when it started winning contracts internationally.

The UK was a natural expansion point. British intelligence agencies like GCHQ (Government Communications Headquarters) and the Security Service (MI5) operate in similar intelligence ecosystems as American agencies. NATO interoperability requirements mean that tools used by the US military often need to work seamlessly with British and European forces. Palantir's systems were designed with that integration in mind.

By 2022, Palantir had already established itself within the Mo D and British defense ecosystem. Contracts with intelligence agencies and the military had created institutional knowledge, trained users, and data pipelines that would be expensive and time-consuming to replace. That's called vendor lock-in, and it's one of the reasons why defense contracts, once awarded, tend to stay with the same vendor.

Palantir's expansion from US government contracts to international markets like the UK and NATO has significantly contributed to its dominance in the defense sector. Estimated data based on historical growth trends.

The Defense and Security Exemption: Skipping the Competitive Bid

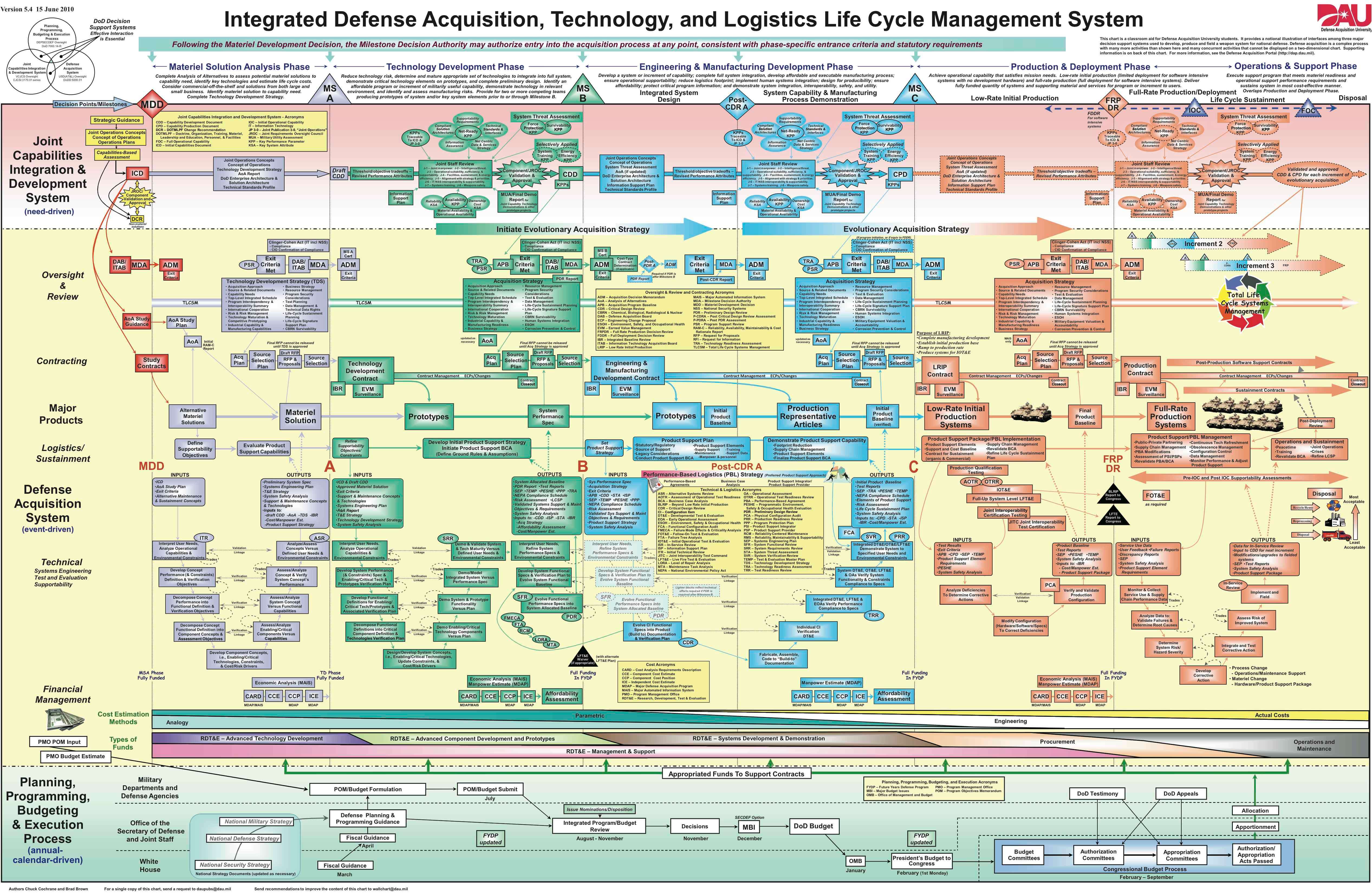

Here's where the controversy kicks in. The Mo D awarded this contract using what's called a "defense and security exemption" under UK procurement law. This exemption exists to allow government agencies to award contracts without competitive bidding when national security interests are at stake.

The logic makes sense in theory. If you're procuring classified intelligence systems or defense equipment that requires extreme secrecy, you can't exactly hold an open bidding process. Competitors might leak specifications. Foreign adversaries might discover procurement details. So governments maintain exemptions for these kinds of acquisitions.

But exemptions can be abused, or at least used loosely. The Mo D's justification for skipping competition with Palantir? The contract would provide "continued licensing and support to data analytics capabilities supporting critical strategic, tactical and live operational decision making across classifications across defense and interoperable with NATO and other allied nations Palantir systems."

Translate that to plain English: Palantir's systems are already integrated into Mo D operations, and switching vendors would disrupt critical military functions. That's technically true, but it's also a self-reinforcing argument. If you keep awarding contracts to the incumbent vendor without competition, they become more embedded, making it even harder to replace them next time.

Some transparency advocates questioned whether the exemption was really necessary. The contract appears to be for continued support and licensing of existing systems, not for something so classified that it required secrecy. A restricted tender (open only to cleared vendors) might have been possible, though it would have been more cumbersome.

The UK government's decision to use the exemption without exploring alternatives reflects a broader pattern in defense procurement: once a vendor is embedded, they're very hard to dislodge.

The Revolving Door: Ex-Mo D Officials Joining Palantir

Another aspect that drew scrutiny was the influx of ex-Mo D officials joining Palantir in 2025. According to reporting by Open Democracy, a total of five former Ministry of Defence employees moved to Palantir roles that year. Most notably, Barnaby Kistruck, who served as the Director of Policy at the Mo D, joined Palantir very shortly after leaving the government.

This created an obvious conflict-of-interest concern. If a senior government official with detailed knowledge of Mo D strategy and procurement processes moves directly to the company bidding for Mo D contracts, it raises questions about fairness and whether that knowledge was leveraged inappropriately.

The Mo D's response was to place restrictions on Kistruck's new role. An Mo D spokesperson stated: "We conduct comprehensive due diligence on any business appointments that may lead to concern. We work diligently to enforce any conditions placed on individuals, fully investigating instances raised of breached policy and, if found valid, take appropriate action."

But the restrictions don't erase the underlying concern. Kistruck presumably knows how the Mo D thinks about problems, what its technical requirements are, and how procurement decisions get made. That knowledge, even if he's not technically prohibited from using it, creates an advantage that competitors don't have.

This pattern isn't unique to Palantir. The "revolving door" between government and defense contractors is well-documented. But it does suggest that the relationship between Palantir and the Mo D is closer and more entangled than a typical vendor-customer arrangement. It's the kind of relationship that makes competitive procurement harder to justify, even as it makes the case for competitive procurement stronger.

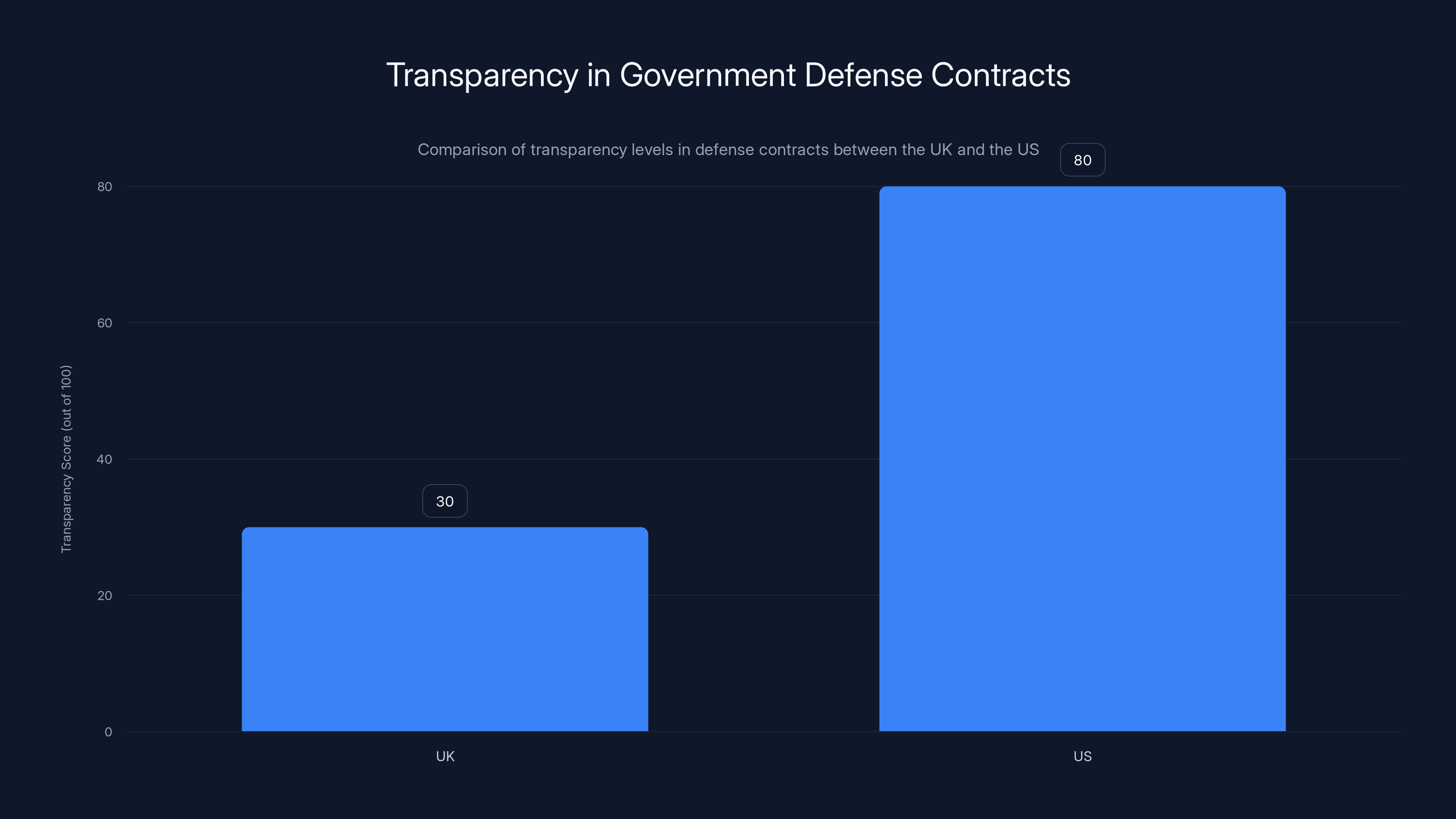

The US exhibits a higher transparency score in defense contracts compared to the UK, reflecting more public accountability. Estimated data based on available public information.

Palantir's Broader UK and European Footprint

The Mo D contract isn't Palantir's only major UK government work. In November 2023, the National Health Service awarded Palantir a £330 million, seven-year contract to create a Federated Data Platform for handling patient data across the NHS. That deal was even more controversial than the Mo D contract.

The NHS contract faced significant backlash from the British Medical Association, the Doctors' Association UK, and numerous cybersecurity professionals. The concerns centered on patient privacy, data security, and the lack of transparency in the procurement process. The NHS didn't disclose why Palantir was chosen, and critics argued that the company's history with intelligence agencies and surveillance tools raised questions about whether patient data would be adequately protected.

That context matters when assessing the Mo D deal. Palantir is rapidly becoming one of the largest processors of sensitive British government data. Between the NHS work and the defense contracts, the company has access to healthcare information for tens of millions of Britons and classified military and intelligence data. That's a massive concentration of power in the hands of a single private vendor.

Meanwhile, in September 2025, Palantir announced it would establish a European operations center in the UK, specifically to handle its growing European defense work. The UK government gave the company space and resources to expand this hub. That decision signals confidence in the partnership and probably makes future UK contracts even more likely. Why would the government invest in infrastructure to help Palantir operate from the UK if it was considering switching vendors down the line?

Palantir also holds major contracts with other UK and European defense agencies. The company has expanded beyond the US military ecosystem into NATO-wide procurement. Every contract won makes the next one easier to justify, because the systems become more integrated and switching costs increase.

How Palantir's Data Platform Actually Works

To understand why Palantir has become so central to defense operations, you need to grasp what the company's core product actually does. Palantir Gotham (their defense and intelligence focused platform) and Palantir Foundry (their broader data integration product) are data integration and analysis tools. They're not AI in the sense of running large language models. They're more fundamental: they take data from hundreds of different sources and make it queryable and analyzable.

In a military context, that's powerful. The Mo D operates systems from dozens of vendors: radar systems, communications networks, logistics databases, satellite feeds, personnel records, financial systems. Each one generates data in different formats, at different cadences, with different classification levels. If you want to run a military operation, you need to correlate that data: which units are deployed where, what supplies are available, what's the enemy doing according to intelligence feeds, who's available to execute a mission.

Palantir's systems make that correlation possible. A military commander can query across all those sources simultaneously and get a unified picture. That's not trivial. Before such tools existed, military operations depended on analysts manually cross-referencing data and writing reports. Palantir automates that process and makes it real-time.

The platform uses what Palantir calls "ontologies": structured ways of describing relationships between data elements. If you have personnel records and deployment records and casualty records, the ontology tells the system how they relate. It allows the platform to understand that a person with ID 12345 in the personnel database is the same person deployed to location X in the deployment database.

For intelligence work, that's enormously valuable. Intelligence agencies deal with the same challenge: connecting dots across different data sources to identify threats, understand terrorist networks, track criminal organizations, or detect fraud.

Palantir's contracts with the UK government include a £240.6 million MoD contract and a £330 million NHS contract, highlighting its significant role in UK public sector data management.

The Expansion into Commercial and Non-Military Sectors

Interestingly, Palantir's growth strategy has been shifting. While the company still generates substantial revenue from defense and intelligence contracts, it's increasingly focusing on commercial clients. Major banks, healthcare systems, manufacturers, and retailers all use Palantir's data platforms.

That shift matters because it raises questions about data governance and dual-use concerns. When Palantir builds infrastructure for the NHS, it's doing commercial healthcare work. When it builds infrastructure for the Mo D, it's doing defense work. But the underlying data platform is similar. That creates interesting questions about whether techniques developed for military intelligence could be applied to healthcare data, or vice versa.

Palantir's commercial expansion also explains why the company is investing in a UK operations center. The European market is growing, and Palantir wants to position itself as a European company, not just an American defense contractor. That positioning helps with contracts, regulations, and hiring. It also helps assuage concerns about American government surveillance by creating a legal and operational separation between US and European operations.

But the separation is mostly superficial. Palantir remains a US-based company owned by American investors and subject to US law. Data processed by the UK operations center could theoretically be accessed by US authorities under national security agreements or legal process. That's not unique to Palantir, but it's worth noting when evaluating the company's role in critical British infrastructure.

Concerns About Surveillance and Data Privacy

Let's address the elephant in the room: Palantir's history with surveillance and its cultural associations with the surveillance-industrial complex.

Palantir was born from intelligence work. The company's founder, Peter Thiel, has deep ties to the US intelligence community. The company's early revenue came almost entirely from CIA, NSA, and military contracts. To many civil liberties advocates, Palantir is fundamentally a surveillance company, regardless of how it markets itself today.

The company's work with US Immigration and Customs Enforcement (ICE) reinforced that perception. Palantir supplied ICE with ELITE (Enhanced Leads Identification and Targeting for Enforcement) software, which ICE uses to identify targets for deportation. Immigration activists and civil rights organizations have protested Palantir's work with ICE, arguing that the company is profiting from enforcement activities they see as unjust.

Palantir's response has been to argue that they're not responsible for how governments use their tools. Data integration software is neutral, they'd argue. The choice of how to use it is the government's. That's a coherent position, but it doesn't really address the underlying concern: if you build tools specifically optimized for finding and tracking people, you're implicitly enabling surveillance, whether or not that's your intention.

In the UK context, there are similar concerns. British civil liberties organizations have questioned whether Palantir's data platform could be used to track and monitor citizens in ways that violate privacy expectations. The NHS contract sparked particular concern because healthcare data is some of the most sensitive information a government holds. If that data gets integrated into a surveillance-optimized platform, privacy advocates worry that the line between healthcare management and population surveillance could blur.

Palantir has argued that its UK operations are governed by UK privacy law and that proper safeguards are in place. But critics note that when government agencies have powerful surveillance tools at their disposal, the temptation to use them broadly tends to overcome initial privacy commitments. Once the infrastructure is built, it's easy to expand its use.

Palantir's £80.2 million annual contract represents only 0.12% of the UK's £68 billion defense budget, highlighting its small relative size but significant impact in the data analytics sector.

The Bigger Picture: Government Vendor Lock-In and Procurement Risk

The Palantir contract illustrates a structural problem in government procurement: once a vendor becomes embedded in a government system, it's nearly impossible to replace them without disrupting critical functions. This is true not just for defense, but for healthcare, transportation, and every other domain where governments depend on complex software systems.

Vendor lock-in happens in the private sector too. If you build your company on top of AWS, switching to Google Cloud is expensive and disruptive. But in government, the stakes are higher, the switching costs are larger, and the consequences of disruption are more serious. You can't just take down a military system for a few weeks while you migrate to a new vendor. That's not acceptable when national security is at stake.

So governments face a choice: they can insist on competitive procurement for every contract renewal, which is slower and more expensive but maintains vendor competition and keeps any single vendor from becoming too entrenched. Or they can use efficiency exemptions and award contracts to incumbent vendors, which is faster and cheaper but progressively reduces competition and increases long-term risk if the incumbent vendor becomes complacent or untrustworthy.

Most governments have drifted toward the second approach because the first is administratively expensive and politically difficult. A Defense Secretary who insists on rebidding every contract faces pressure from colleagues who want faster procurement. Military commanders don't want to wait for lengthy bidding processes. Commercial imperatives push toward consolidated vendors.

But that approach creates strategic risks. What if Palantir goes out of business? What if the company makes an error that corrupts critical military data? What if the geopolitical situation changes and the UK decides it doesn't want to depend on an American company for defense data integration? Once Palantir has become indispensable, these questions are very hard to address.

Some advanced economies are starting to recognize this risk and pushing for "cloud exit" or "vendor exit" strategies: architectural approaches that allow rapid switching between vendors without losing functionality or data. But implementing those strategies is expensive and technically complex, and they require planning that most governments aren't doing.

Transparency and Accountability Questions

One thing that's notable about the Palantir contract is how little public information there is about it. The government announced the deal, but there's no detailed breakdown of what the money is being spent on. There's no explanation of what alternatives were considered or why the competitive exemption was necessary. There's no public assessment of whether the contract represents good value for money.

That lack of transparency is partly justified: military and defense operations need secrecy. But it also means there's no public accountability mechanism. Taxpayers are spending £80 million per year on Palantir services, but they have no way to assess whether that's appropriate.

In some cases, government procurement transparency goes further. Some countries publish redacted versions of contract terms, allowing public review of pricing and scope while protecting genuinely sensitive information. That approach would be possible here: the government could publish pricing terms without revealing classified details about how Palantir's systems support specific military operations.

The lack of transparency is also partly a cultural choice. UK government procurement traditionally operates behind closed doors, with detailed decisions kept confidential. Some argue that's necessary for security. Others argue it enables waste and corruption.

Compare the UK approach to, say, the US military's approach with the USA Spending database, which publishes detailed information about government contracts including defense contracts. The US reveals far more about defense spending than the UK does. That doesn't make US procurement perfect, but it does create more public accountability.

Estimated data shows that Palantir's NHS contract forms the largest portion of its UK engagements, highlighting its significant role in healthcare data management.

What This Means for Competition and Innovation

When large government contracts get awarded without competitive bidding, it inevitably affects the broader market for those services. Smaller competitors, or vendors from other countries, can't effectively compete. Over time, that reduces innovation because vendors don't feel competitive pressure to improve their offerings.

Palantir's track record illustrates this. The company has grown fat on government contracts without serious competition. Its technology is solid, but there are other vendors offering similar data integration capabilities. Some are arguably more innovative. But because Palantir got there first and locked in government customers, competitors find it hard to gain footholds.

This creates a strange market dynamic: Palantir can charge premium prices because switching costs are high, even if better alternatives exist. Meanwhile, innovative startups with better technology can't compete because they don't have the customer relationships or the embedded status.

For a technology sector trying to maintain innovation and competitiveness, that's not ideal. The UK government pays more for less innovative solutions because of vendor lock-in. And the market for data integration technology becomes less competitive, which stifles innovation across the industry.

There are ways to address this. Governments can implement deliberate vendor rotation: award a contract to vendor A for five years, then rebid it competitively, knowing that vendor B might win. Or they can architect systems with vendor-neutral interfaces, making it easier to swap out data integration providers without disrupting everything else. But those approaches require planning and commitment, and they're not how most governments currently operate.

The NATO and International Dimension

One element that makes the Palantir situation more complex is NATO interoperability. The UK is a NATO member, and NATO military operations require that systems from different allied nations can communicate and share data. Palantir's systems are designed with NATO interoperability in mind.

That creates a constraint on the Mo D's procurement choices. If the Mo D wants to ensure NATO compatibility, and Palantir systems are widely adopted across NATO, then switching away from Palantir becomes even harder. It's not just about replacing a British military system. It's about breaking compatibility with systems that other NATO countries depend on.

Palantir has, unsurprisingly, leveraged this advantage. The company markets heavily on NATO interoperability and has specifically positioned itself as a bridge between different allied systems. This gives Palantir strategic value beyond just the quality of its technology.

It also means that decisions made by the UK affect other NATO members. If the UK commits to Palantir as its primary data integration platform, other countries face pressure to do the same for interoperability. It's a network effect that works in Palantir's favor and against would-be competitors.

Future Outlook: Will Palantir Remain Entrenched?

Looking forward, there are a few possible scenarios for Palantir's role in UK defense. The most likely scenario is continued entrenchment. The company has won three more years of stable funding. It has officials scattered throughout the Mo D and British defense ecosystem. Its systems are integrated into critical operations. Absent a major change in policy or a catastrophic failure, Palantir will likely win the next contract renewal as well.

A second scenario involves European competition. As the EU develops its own defense industrial base and pushes for strategic autonomy from the US, there might be political pressure to favor European data integration vendors over American ones. That could create an opening for European competitors. But it would require a major policy shift and significant investment in building indigenous capacity.

A third scenario involves new entrants with different technology. Artificial intelligence is advancing rapidly, and new data integration and analysis tools might emerge that obsolete Palantir's current platforms. If a fundamentally better technology becomes available, it could overcome Palantir's incumbent advantage. But that's a longer-term prospect.

The most optimistic scenario for competition involves the UK government deliberately architecting its systems to reduce vendor lock-in. If the government mandated vendor-neutral interfaces and planned for periodic vendor rotation, it could maintain competition while still achieving interoperability. But that would require committing to higher short-term costs and administrative complexity. Few governments are willing to make that trade-off.

Most likely, Palantir will remain the dominant data integration platform for UK defense for the next five to ten years. The company will probably win more contracts, expand its European footprint, and become even more embedded in British defense infrastructure. Whether that's good or bad depends on your assessment of the company's reliability, ethics, and long-term trustworthiness.

What The NHS Contract Tells Us About Palantir's Strategy

The NHS contract provides insight into how Palantir is expanding its role in British government beyond just defense. In November 2023, the NHS awarded Palantir a seven-year, £330 million contract to build a Federated Data Platform. This platform is supposed to help the NHS integrate patient data across different hospitals and healthcare systems, improving care coordination and enabling better health analytics.

On the surface, that sounds reasonable. The NHS desperately needs better data integration. Hospitals don't share patient data effectively with each other. Treatment records are fragmented. Analytics are limited. A better data platform could genuinely improve healthcare outcomes.

But the NHS contract became more controversial than the defense contract, which is interesting. Civil liberties groups raised concerns about patient privacy and the lack of transparency in procurement. The British Medical Association worried about data security. Cybersecurity researchers questioned whether a healthcare system built on a platform designed for intelligence surveillance was appropriate.

The NHS controversy revealed something important about Palantir's expansion strategy: the company is trying to position itself as the central data integration platform for all of British government, not just defense. Healthcare, defense, and other government agencies would all feed data into Palantir systems. That creates incredible power and influence for the company, but it also creates concentrated risk.

If Palantir's systems fail, the impact would extend across healthcare and defense. If the company makes a security error, millions of sensitive records could be exposed. If the UK later decides it needs to move away from Palantir, the cost and disruption would be enormous.

For Palantir, it's a brilliant strategy. Being the central data platform makes the company indispensable and creates multiple revenue streams. But for the UK government, it's worth questioning whether concentrating this much control in a single private vendor is wise.

Regulatory and Compliance Implications

One aspect of the Palantir contract that received less attention is the regulatory framework governing it. The UK has data protection regulations under the UK GDPR (which retained EU GDPR rules after Brexit) and is developing new AI regulation. How do those regulations apply to Palantir's work?

For the defense contract, much of this is probably exempt from standard data protection rules because defense and national security data can be handled differently under law. But the NHS contract is supposed to be subject to standard healthcare privacy rules and GDPR requirements.

There's a potential conflict there. Palantir's technology is optimized for finding patterns and connections in data. GDPR is designed to limit data processing and ensure that data isn't used for purposes beyond what was originally intended. If Palantir's platform is designed to enable flexible, expansive data analysis, and GDPR is designed to restrict data processing, those goals tension against each other.

The NHS has argued that it has safeguards in place to ensure GDPR compliance. But critics worry that once data is integrated into a Palantir platform, it becomes so easily queryable and analyzable that restrictions become mere guidelines rather than hard technical constraints.

This tension is going to become more important as governments increasingly deploy AI and data analytics systems. The UK and EU are developing AI regulations that require explainability and transparency in algorithmic decision-making. Palantir's systems, like most data analytics platforms, can make it hard to explain why a particular result came back. "The algorithm found a pattern in the data" is technically true but not very explanatory.

Meeting those regulatory requirements will require Palantir to build new capabilities and ensure its systems are compatible with explainability and transparency requirements. Whether the company can do that without compromising the core functionality of its platform remains to be seen.

Lessons for Other Governments and Defense Ministries

The Palantir situation in the UK isn't unique to the UK. Defense ministries and government agencies around the world face similar decisions about which vendors to trust with critical data infrastructure. Some lessons from the UK experience might apply elsewhere.

First, vendor lock-in is real and hard to reverse. Once a vendor becomes embedded, it's nearly impossible to switch without enormous cost and disruption. Defense ministries should be aware of this and should actively plan for vendor diversity and exit strategies.

Second, competitive procurement matters, even if it's slower and more expensive. The discipline of competition keeps vendors honest and drives innovation. Using exemptions to skip competition should be rare and genuinely justified, not routine.

Third, transparency and accountability are worth the effort, even for classified systems. Redacting sensitive details while publishing basic contract terms and pricing helps ensure public trust and accountability.

Fourth, the revolving door between government and contractors is a real concern. Strong conflict-of-interest rules and ethics enforcement help mitigate the risks.

Fifth, concentrating too much critical infrastructure in a single private vendor is risky. Governments should push for competition and diversity in critical systems, even if it's more complex.

These lessons probably won't change how most governments operate. Bureaucratic inertia, budget constraints, and pressure for efficiency all push toward the status quo. But they're worth thinking about, especially as governments increasingly depend on private technology vendors for critical functions.

TL; DR

- Palantir secured a £240.6 million, three-year contract with the UK Ministry of Defence for data analytics capabilities, awarded without competitive procurement using a defense and security exemption

- The contract skipped competitive bidding, which is controversial but justified by the Mo D on national security grounds and the integration of Palantir systems into existing military operations

- Five former Mo D officials joined Palantir in 2025, including a former director of policy, raising revolving-door concerns about conflict of interest and insider advantage

- Palantir is becoming increasingly embedded in UK government infrastructure, with major contracts in both defense and healthcare, creating vendor lock-in that makes it difficult to switch providers

- The broader lesson is that vendor lock-in in government procurement is a real strategic risk, and governments should actively plan for competitive alternatives and exit strategies rather than defaulting to incumbent vendors

FAQ

What is Palantir Technologies?

Palantir is a Denver-based software company specializing in data integration and analytics platforms. The company builds tools that help organizations aggregate and analyze data from disparate sources. Palantir's primary products are Gotham (focused on defense and intelligence work) and Foundry (focused on commercial clients). The company was founded in 2003 and has become one of the largest government contractors in the world.

Why didn't the UK Ministry of Defence hold a competitive procurement for the Palantir contract?

The Mo D used a defense and security exemption under UK procurement law, which allows government agencies to award contracts without competitive bidding when national security interests are at stake. The Mo D argued that Palantir's systems are so integrated into existing military operations that rebidding the contract would disrupt critical functions. Critics argue that the exemption was too broadly applied and that a restricted tender (open only to cleared vendors) would have been possible.

What are the concerns about Palantir's role in UK government?

The primary concerns are vendor lock-in (once embedded, Palantir becomes difficult to replace), lack of competition (which can lead to higher prices and slower innovation), revolving-door issues (former government officials moving to Palantir), and surveillance concerns (Palantir's history with intelligence agencies raises questions about whether its data platforms could be used for population surveillance). Additionally, the company is rapidly becoming embedded across both defense and healthcare systems, concentrating critical infrastructure in a single private vendor.

How much is Palantir getting paid from the UK government?

Palantir is receiving £240.6 million over three years, which breaks down to approximately £80.2 million annually. This is in addition to other British government contracts, including the £330 million, seven-year NHS contract for building a Federated Data Platform announced in November 2023.

What does Palantir's data integration platform actually do?

Palantir's platforms take data from hundreds of different sources and make it queryable and analyzable in a unified way. In a military context, this means correlating data from radar systems, communications networks, logistics databases, satellite feeds, and personnel records to give commanders a unified operational picture. The platform uses structured data ontologies (ways of describing relationships between data elements) to understand how different pieces of information relate to each other.

Is Palantir a surveillance company?

Palantir describes itself as a data integration and analytics company, not a surveillance company. However, the company was founded to fight terrorism and has deep ties to US intelligence agencies. Palantir's work with ICE (US Immigration and Customs Enforcement) on deportation targeting, combined with its history with the NSA and CIA, has led civil liberties advocates to view the company as inherently focused on surveillance. Palantir argues it's not responsible for how governments use its neutral data integration tools, but critics counter that tools designed specifically for finding and tracking people implicitly enable surveillance.

Could the UK government replace Palantir with a different vendor?

Technically yes, but practically it would be very expensive and disruptive. Palantir's systems are so integrated into UK military and government operations that switching vendors would require retraining personnel, migrating data, rebuilding interfaces, and ensuring NATO compatibility. The longer Palantir remains embedded, the harder and more costly replacement becomes. This is called vendor lock-in, and it's a deliberate outcome of awarding long-term contracts without competitive alternatives.

What happened with the ex-Mo D officials who joined Palantir?

According to reporting by Open Democracy, five former Ministry of Defence employees joined Palantir in 2025. Most notably, Barnaby Kistruck, who served as Director of Policy at the Mo D, moved to Palantir shortly after leaving government. This raised conflict-of-interest concerns because Kistruck would have had detailed knowledge of Mo D strategy and procurement processes. The Mo D placed restrictions on Kistruck's role and said it conducts due diligence on government officials' business appointments, but critics worry that the underlying knowledge advantage remains.

Is the NHS Palantir contract related to the defense contract?

The two contracts are separate but part of a broader pattern of Palantir expanding its role across UK government. The NHS contract (£330 million over seven years) is for building a Federated Data Platform to integrate patient data across the healthcare system. The defense contract (£240.6 million over three years) is for providing data analytics capabilities to the military. Both contracts reflect Palantir's strategy to become the central data integration platform for all of British government, which concentrates significant power in the company while creating dependency risks.

What are the privacy concerns about Palantir's healthcare work?

The NHS contract raised concerns because healthcare data is extremely sensitive. Critics worried that integrating this data into Palantir's platform (which is designed for flexible, expansive data analysis) could lead to uses beyond the original healthcare purpose. GDPR and UK privacy law restrict how data can be used, but once data is integrated into a powerful analytics platform, restrictions can become difficult to enforce in practice. Additionally, Palantir's history with intelligence agencies raised questions about whether data protection safeguards would be adequate.

How does Palantir's UK strategy fit into its global business?

Palantir is expanding from being primarily a US government contractor to a global company. The company announced in September 2025 that it would establish a European operations center in the UK to handle its growing European defense work. This expansion is driven by NATO procurement opportunities and the company's desire to position itself as a European company, not just an American contractor. However, Palantir remains a US-based company, and data processed in the UK could potentially be accessed by US authorities under national security agreements.

Key Takeaways

- Palantir secured a £240.6 million, three-year UK MoD contract without competitive procurement, using a defense and security exemption

- Vendor lock-in makes it nearly impossible to switch away from incumbent defense contractors once systems are integrated into critical operations

- Former government officials moving to Palantir creates revolving-door concerns and potential conflicts of interest in procurement decisions

- Palantir is expanding across UK government (defense and healthcare), concentrating critical infrastructure in a single private vendor

- Lack of public transparency in government contracts prevents taxpayer accountability even when national security isn't at stake

Related Articles

- Northwood Space Lands 50M Space Force Contract [2026]

- Palantir's ICE Contract: The Ethics of AI in Immigration Enforcement [2025]

- SpaceX's Starlink Broadband Grant Demands: What States Need to Know [2025]

- Tech CEOs on ICE Violence, Democracy, and Trump [2025]

- Anduril's AI Grand Prix: How a Drone Racing Contest Became Silicon Valley's Wildest Recruiting Event [2025]

- Tech Workers Demand CEO Action on ICE: Corporate Accountability in Crisis [2025]

![Palantir's £240 Million UK MoD Contract: What It Means for Defense Tech [2025]](https://tryrunable.com/blog/palantir-s-240-million-uk-mod-contract-what-it-means-for-def/image-1-1769699356289.jpg)