Monaco AI Sales Platform: The Startup Challenging Salesforce [2025]

Salesforce has dominated the CRM market for two decades, but a new wave of AI-native competitors is starting to crack the fortress. One of the most ambitious challengers just emerged from stealth with some seriously impressive backing. Monaco, co-founded by Sam Blond (formerly of Founders Fund) and his brother Brian, is taking a fundamentally different approach to sales automation. Instead of replacing salespeople with AI, they're supercharging them.

This isn't just another AI SDR tool. Monaco is building an entire sales stack from the ground up, specifically designed for early-stage startups that can't afford enterprise sales infrastructure but desperately need it to grow. With $35 million in funding and backing from the Collison brothers (Stripe founders), Y Combinator's Garry Tan, and other heavy-hitters, Monaco has the resources and credibility to potentially reshape how companies think about sales technology.

But here's what matters: the startup has spotted something real that incumbents missed. The market is ready for a platform that combines the best of AI automation with human expertise, tailored specifically for the companies that need it most. Let's dig into what Monaco is actually building, why it matters, and what it means for the future of sales technology.

TL; DR

- What It Is: Monaco is an AI-native CRM platform that combines autonomous sales agents with human sales experts to automate outreach, prospecting, and meeting scheduling

- The Funding: Raised 10M seed, $25M Series A) led by Founders Fund with backing from Stripe co-founders Patrick and John Collison

- The Difference: Uses a human-in-the-loop model where AI handles grunt work but experienced salespeople oversee and execute customer meetings

- Target Market: Early-stage startups (seed to Series A) that need sophisticated sales infrastructure but can't afford enterprise teams

- Bottom Line: Monaco represents a new category of sales tools that augment rather than replace human salespeople, positioning itself as the "Cursor for sales"

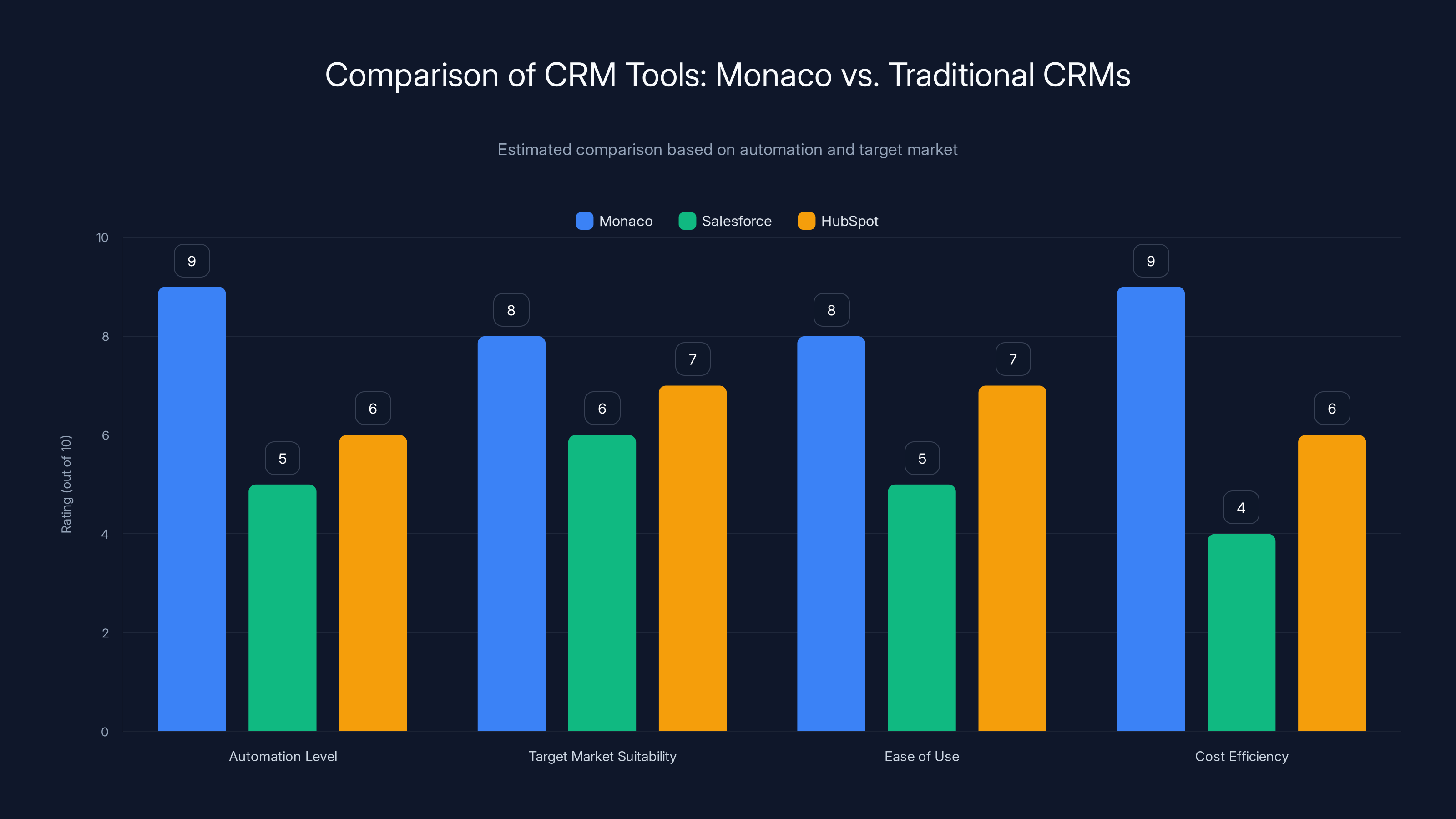

Monaco excels in automation and cost efficiency, making it ideal for startups, while traditional CRMs like Salesforce and HubSpot are more suited for larger enterprises and marketing teams. (Estimated data)

The Problem Monaco Is Solving

Early-stage startups face a brutal reality: you need sales expertise to grow, but you can't afford to hire experienced sales leaders. The typical path involves hiring junior sales development representatives (SDRs) at

Meanwhile, HubSpot dominates the startup CRM space, and Salesforce owns enterprise. But neither was built with the modern startup in mind. HubSpot works okay, but it's still fundamentally a manual tool that requires significant human effort to operate effectively. Salesforce is completely overkill, with enterprise features most early-stage companies will never use.

There's also a new wave of AI SDR tools—companies like 11x, Artisan, and 1 Mind—that promise to automate outreach completely. But they have a credibility problem. When a prospect realizes they're talking to an AI, the conversion rate plummets. These tools work best for volume plays where you're okay with lower quality interactions.

Monaco spotted the gap: startups need someone to coordinate their entire sales process, from finding the right prospects to actually closing the deal. They need expertise, but they need it accessible and affordable. That's the problem Monaco is solving.

Sam Blond's Path to Building Monaco

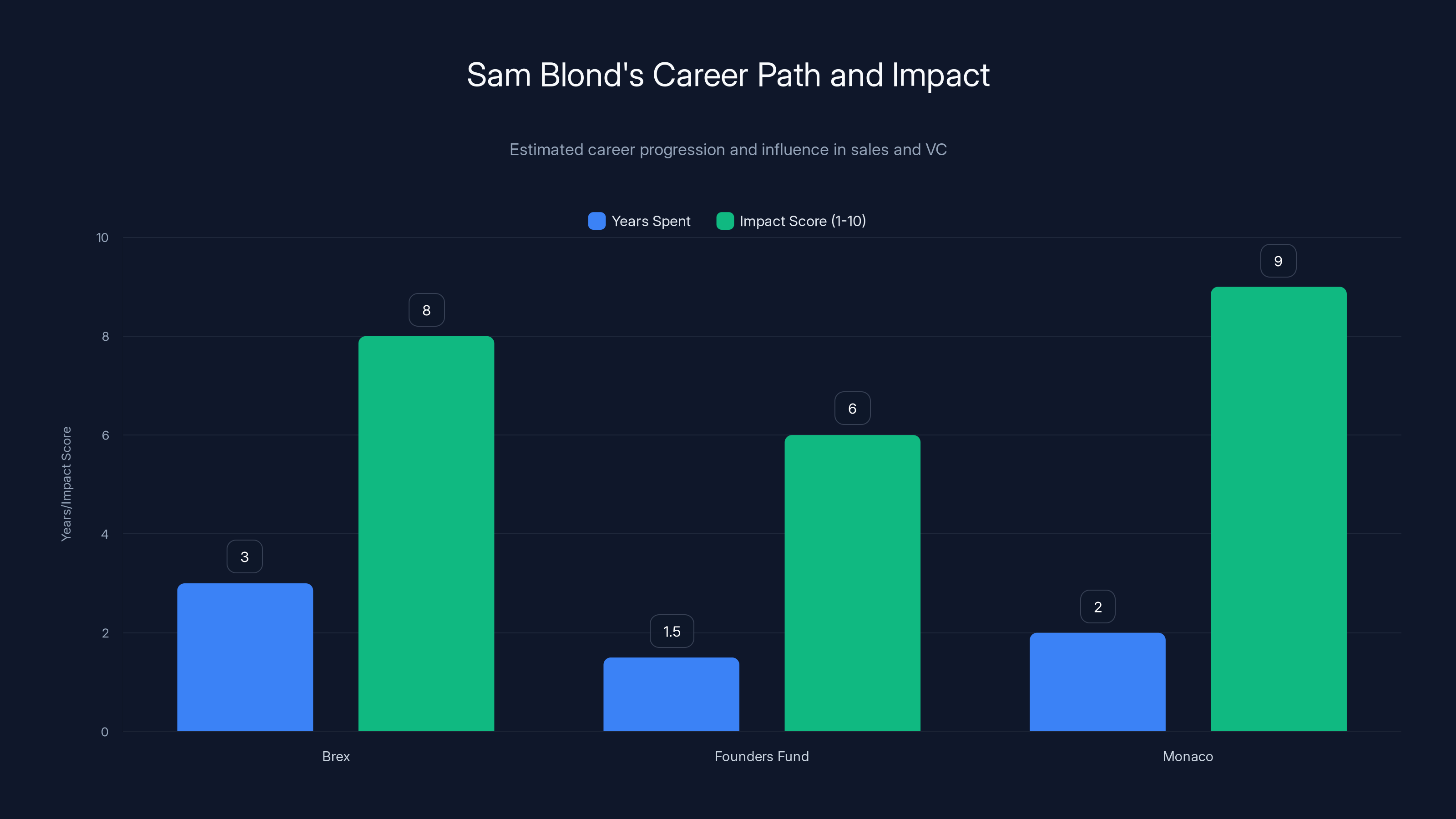

Sam Blond's background is unusual for a startup founder, which is exactly why Monaco makes sense. He wasn't an engineer who pivoted to sales. He was a career sales guy who understood the market so deeply that he became a VC.

Before joining Founders Fund, Blond was head of sales at Brex during its hypergrowth phase. That means he lived the early-stage sales experience from the inside. He understood the chaos of rapid hiring, the challenge of scaling sales processes, and the friction of tools that weren't built for speed and flexibility.

When he joined Founders Fund as a VC, Blond wasn't there for long—just 18 months. He realized VC work wasn't for him. As he put it, he wasn't building anything. He was sitting in meetings analyzing other people's businesses. For someone with his operating background, that must have felt suffocating.

So he did what many successful operators do: he went back to operating. But instead of joining a fast-growing company, he started one. And he brought his brother Brian along, who had similar pedigree (sales professional turned VC at Human Capital and Sutter Hill).

The other two co-founders brought critical technical expertise. Abishek Viswanathan was Chief Product Officer at Apollo and Qualtrics, so he understands both the product side and the data side of sales tools. Malay Desai was Senior Vice President of Engineering at Clari, a revenue intelligence platform that raised over $100 million. This is a founder team that actually knows the sales tech market from multiple angles.

What's remarkable is that Sam Blond got this team funded quickly and effectively. Founders Fund led both the seed and Series A, which makes sense given his previous employment there. But the angel list is what's really impressive: the Stripe co-founders are betting on this. Garry Tan is betting on this. These aren't passive investors; these are people who can open doors and provide strategic guidance.

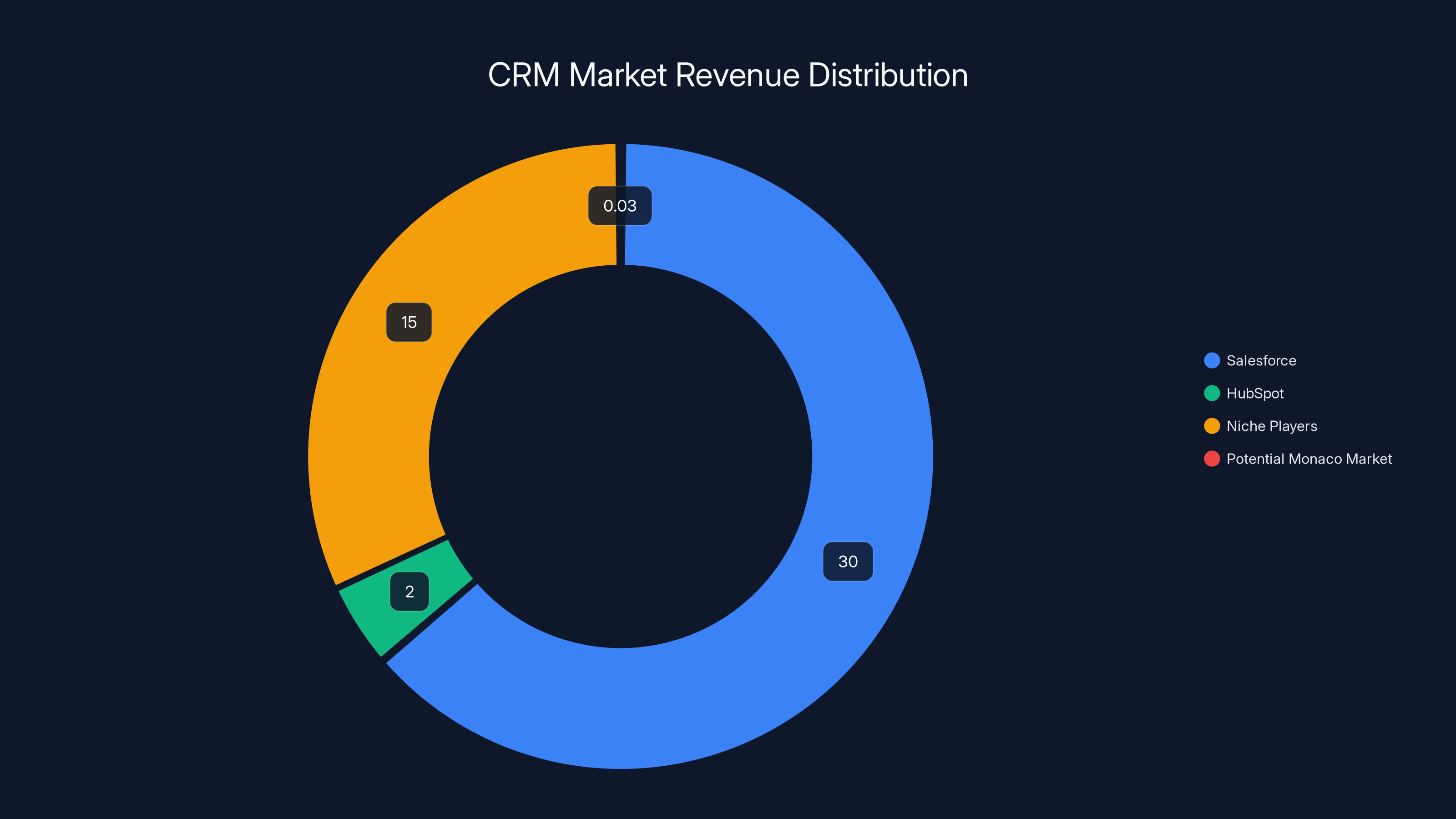

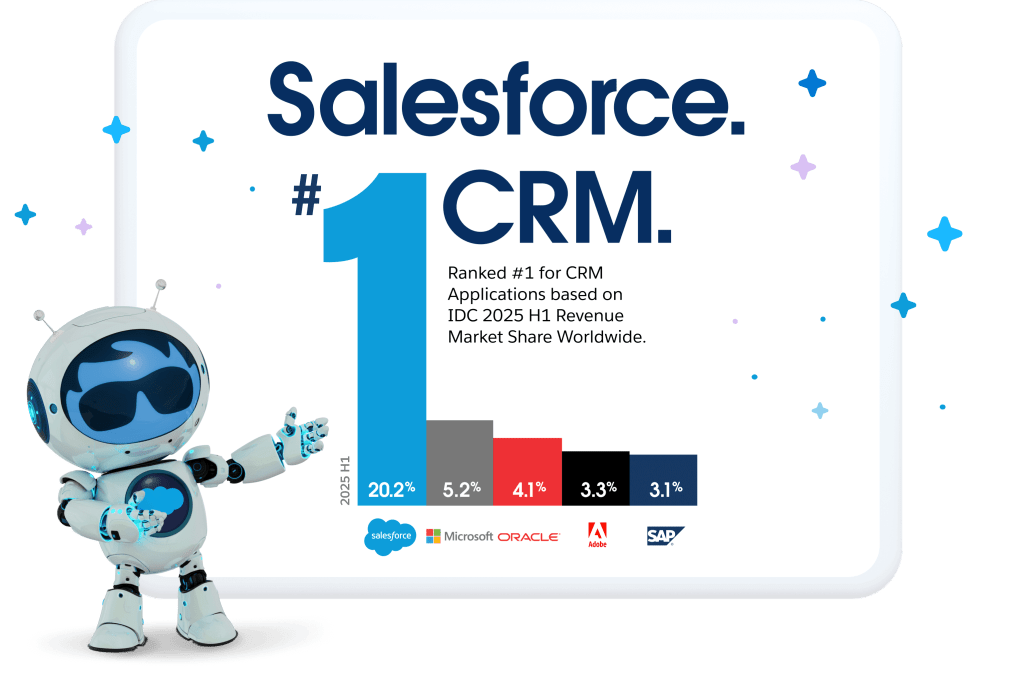

Salesforce leads the CRM market with

The Architecture: AI Agents With Human Oversight

Monaco's core innovation is its architecture. Instead of pure automation or pure manual sales, it uses what Blond calls a "human-in-the-loop" model. Here's how it works:

The AI Layer: Monaco builds an AI-native CRM that understands your sales process. It connects to your data sources, analyzes prospect information, and identifies patterns about what kind of companies and individuals are most likely to buy from you.

The AI can then generate outreach campaigns. It drafts emails, sequences them, suggests timing, and handles personalization at scale. The key difference from other AI tools is that these emails aren't sent automatically. They're reviewed, edited, and approved by human salespeople before they go out.

The Database Layer: Monaco built its own database of prospects, similar to ZoomInfo but AI-powered. This means it's not just pulling from existing data sources; it's actively enriching and validating prospect information. The system identifies the right people at target companies and understands the optimal sequence for reaching them.

The Meeting Orchestration: Once conversations start, Monaco orchestrates the scheduling. The AI suggests meeting times, handles the back-and-forth calendar coordination, and gets the prospect locked in. But here's the crucial part: actual customer meetings are conducted by real humans. No AI avatars. No chatbots pretending to be salespeople.

The Oversight Function: Throughout all of this, experienced salespeople are supervising the process. They review what the AI is doing, train it on company-specific knowledge, and step in when nuance is needed. They also conduct the actual customer meetings where relationships are built.

This architecture solves several problems at once. First, it prevents the credibility disaster of AI-to-human outreach. When a prospect gets on a call, they're talking to a real person who knows their product and can actually sell. Second, it gives early-stage companies access to experienced salespeople without hiring them full-time. Third, it's more efficient than pure manual work because the AI handles the repetitive parts.

The Feature Set: What Monaco Actually Does

Monaco isn't just a CRM with some AI sprinkled on. It's rethinking what a sales platform should include. Here's what they're building:

AI-Native CRM Foundation: The core is a CRM designed from scratch for AI. Unlike Salesforce or HubSpot, which are built around manual data entry and human workflows, Monaco assumes AI is generating most of the data and insights. This changes architecture decisions around data structure, automation, and user interface.

Prospect Database: Monaco built a proprietary database of company information and decision-makers. This isn't a licensing deal with ZoomInfo; it's their own enrichment engine. They're crawling web data, LinkedIn, SEC filings, and other sources to build a picture of organizations and the people inside them.

AI Outreach Campaigns: The system can generate and execute email sequences. It understands context, personalizes at scale, and manages follow-ups. The difference from competitors is that execution happens with human review and approval.

Meeting Scheduling and Notetaking: Monaco includes meeting coordination (getting prospects on calendars) and meeting notes synthesis. After a call, the system generates notes, identifies action items, and updates the CRM automatically.

Workflow Automation: Blond mentioned that Monaco can "replace full workflows with agents." This means entire processes—from prospect identification to meeting scheduling—can be automated with human oversight.

What's notably absent: anything that looks like traditional CRM features. Monaco doesn't seem to include pipeline management dashboards, forecasting, or other analytics-focused tools. That might seem like a gap, but it's actually strategic. For seed and Series A startups, pipeline management is secondary to actually getting meetings. Once you have consistent pipeline, you can add forecasting. Monaco is solving the earlier problem.

Positioning Against Incumbents

The CRM market is enormous and fragmented. Salesforce dominates enterprise with over

Monaco is neither trying to unseat Salesforce nor knock off HubSpot directly. Instead, it's targeting a specific segment: seed and Series A startups that need sales infrastructure but currently lack it. This is a market that's been underserved by both incumbents and most startups because the TAM (total addressable market) seems small at first glance.

But here's the economics: if there are 20,000 venture-backed startups in the US at any given time, and even 20% of them would benefit from Monaco's product, that's 4,000 potential customers. At even a modest

Monaco's positioning is also clever because it's not competing on features with the incumbents. Salesforce has thousands of features; HubSpot has hundreds. Monaco is competing on simplicity, AI-native architecture, and accessibility. For a startup that's never used a CRM before, Monaco promises to be faster to value and easier to operate than legacy tools.

Blond himself acknowledged the crowded competitive landscape. There are 11x, Artisan, 1 Mind, and others doing AI SDR work. There's Attio, Clay, and Conversion doing modern CRM experiences. There's Salesforce, HubSpot, and Zoho all adding AI features. Despite this, Blond made an interesting observation: "There definitely is not the 'Cursor for sales.'" He's referring to Cursor, the AI-powered code editor that's taken significant market share from traditional tools by being AI-native from day one.

Monaco wants to be that. The company built specifically from the ground up as AI-native, with no legacy features holding it back.

Sam Blond spent significant time at Brex and Monaco, with high impact scores reflecting his influence and success in sales and startup environments. (Estimated data)

The Competitive Landscape: Who Else Is Building?

Monaco doesn't exist in a vacuum. The sales tech space is exploding with AI innovation, and understanding the competitive context is important for evaluating Monaco's chances.

Pure AI SDR Competitors: Companies like 11x, Artisan, and 1 Mind focus narrowly on automating outreach. They promise to replace the SDR completely. The advantage is cost and scale; the disadvantage is that pure AI outreach has lower conversion rates because prospects know they're talking to automation.

Modern CRM Platforms: Attio and Clay are building modern CRM experiences, but they're less focused on automation and more on being beautiful, easy-to-use databases. They're picking off HubSpot customers who want better design. They're not trying to fundamentally automate the sales process.

Incumbent AI Additions: Salesforce, HubSpot, and Zoho are all adding AI features to their platforms. Salesforce has Einstein AI; HubSpot has their own automation tools. The advantage of these tools is that they integrate with existing customer bases. The disadvantage is that they're tacked-on to legacy platforms, not core to the architecture.

Sales Intelligence Tools: Companies like Clari (where one of Monaco's co-founders worked) focus on revenue intelligence, helping sales leaders understand pipeline. This is orthogonal to what Monaco is doing; you could use both together.

Monaco's advantage is that it combines multiple capabilities (prospecting, outreach, CRM, meeting scheduling) into one integrated platform with AI-native architecture and human-in-the-loop execution. Most competitors do one or two of these things well. Monaco is trying to do all of them.

The risk is that this is a broader surface area than many successful startups tackle. Usually, winners in enterprise software start narrow ("we do prospecting better") and expand. Monaco is starting broad, which is harder. But it's also better for customers if they can execute it well.

Funding and Investor Backing

Monaco's

Breaking down the capital structure:

Human Capital (where Brian Blond is a partner) also participated, showing that the co-founder's firm is backing him. That's a good signal.

The angel list is the most impressive part: Patrick and John Collison (Stripe), Garry Tan (Y Combinator), and Neil Mehta (Greenoaks Capital). These aren't passive investors who wrote a check. These are operators and investors with deep networks and credibility.

The Collison brothers bring specific value: they've scaled Stripe's sales organization from zero to world-class. They understand the problem Monaco is solving intimately. If anyone can give advice on sales infrastructure, it's them.

Garry Tan brings Y Combinator's network. Thousands of startups come through YC, and many of them would be perfect customers for Monaco. This is strategic positioning more than anything else.

Neil Mehta and Greenoaks bring capital and experience with growth-stage companies. Monaco will likely raise follow-on funding, and these relationships matter.

The funding level suggests that investors believe in the team and the market, but they're not betting the farm on Monaco being the next Salesforce. It's a meaningful bet, not a moonshot bet. That's actually healthy for Monaco—it means they have enough runway to get to product-market fit without the pressure of needing to become a $50 billion company.

The Culture and Team

Monaco employs about 40 people at launch, which is the right size for a company at this stage. About 18 months of development, 40 people is a focused, tight-knit group.

What's notable is that many of them come from sales backgrounds. Blond specifically mentioned that the office is "filled with fellow career salespeople." This is intentional. Monaco isn't hiring engineers to build a sales tool; it's hiring experienced salespeople to guide engineers in building the right sales tool.

The office culture reflects the mission. They have WWII-style motivational posters with slogans like "Save Startups" and "Build the future with Monaco." There's even an office gong that rings out every time an AI meeting gets scheduled. Small touches, but they reveal a lot about company values.

The sales focus in hiring is risky in one way: startups that grow fast usually need strong engineering and product leadership. If Monaco hasn't attracted top engineering talent, that could be a problem. But the co-founder team (particularly Viswanathan and Desai) brings strong technical credibility, so hopefully they can recruit.

The sales culture is also an advantage: when you're building sales tools, having your team actually use them and understand pain points at a deep level is incredibly valuable. It prevents you from building features that look good in theory but don't work in practice.

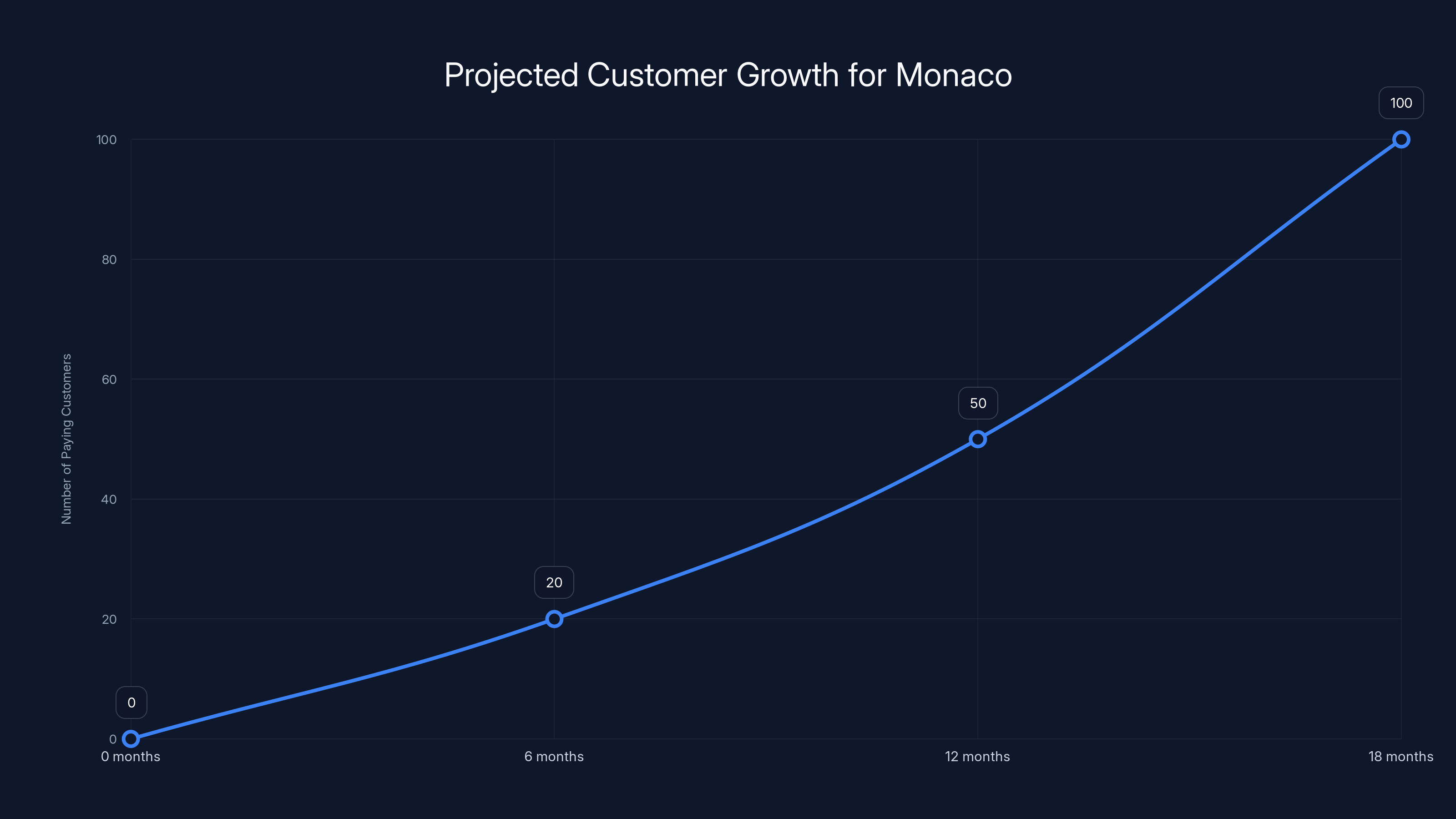

Monaco's projected growth suggests reaching 100+ paying customers by 18 months, indicating potential product-market fit. Estimated data.

Pricing Strategy and Market Positioning

Blond declined to reveal Monaco's pricing, except to say it's a flat fee (not usage-based or per-seat) and currently discounted during beta. This is smart positioning. Here's why:

Flat Fee Strategy: This appeals to startups because they know exactly what they're paying. It also incentivizes Monaco to deliver value beyond just time saved. You're not paying per email or per meeting; you're paying for the platform.

Beta Discount: Launching at a discount attracts early customers and generates case studies. The discount also signals that pricing will go up, which incentivizes early adopters to lock in at lower rates.

The likely pricing range is probably

For reference, some AI SDR tools charge

The real pricing question is: what's your alternative? Hiring an SDR costs

Product-Market Fit Signals

Monaco has been in private beta for several months and is now opening to public beta. The transition from private to public beta is significant because it suggests they've found something that works.

Private beta feedback likely showed them: Are prospects interested? Are they getting meetings? Is the AI doing what it claims? Are customers coming back for more? If the answers were no, they wouldn't open to public beta.

The fact that they have angel backing from operators like the Collison brothers and Garry Tan is itself a signal. These people talk to hundreds of startups. If they thought Monaco had the wrong idea or wrong execution, they wouldn't back it. They backed it, which suggests the early feedback is positive.

That said, moving from private to public beta is not the same as being proven. Product-market fit in sales tools usually takes 12-24 months to truly establish. You need to see cohorts of customers who are adopting the product at a predictable rate and expanding usage over time. Monaco is just beginning that journey.

The real test will be: In 12 months, do they have 50+ paying customers? In 18 months, do they have 100+? Are those customers expanding? Are they churning? These are the metrics that will tell the real story.

The Vision: A New Category of Sales Tools

Sam Blond's ambition for Monaco is not to be a niche tool for startups. He views this as the beginning of a market shift. His statement is telling: "In the broad category of sales technology, there's a market leader right now. That market leader is Salesforce. We are in the early innings of the next platform shift that will lead to a new market leader."

This is a bold claim, but it's not crazy. Salesforce was built in the 1990s for a different era of sales: territory-based teams, complex deal tracking, forecast reporting. The nature of enterprise sales has changed, but Salesforce's DNA hasn't. It's added AI, it's added new modules, but it's still fundamentally a legacy system.

If there is a platform shift in sales technology, it would be to a system that's AI-native, simpler, and more aligned with how modern sales actually happens. That's what Monaco is betting on.

The question is whether it will be Monaco or someone else. The "Cursor for sales" doesn't exist yet, according to Blond. That means the market is still open. First mover isn't guaranteed to win, but it helps.

Monaco has about an 18-month window to establish dominance before larger competitors notice and copy the model. Salesforce and HubSpot won't ignore AI-native CRM players for long. Once they recognize the threat, they'll throw resources at it.

That's actually why the funding, team, and investor backing matter so much. Monaco needs to move fast enough to establish credibility and customer lock-in before the incumbents take it seriously.

Monaco's estimated pricing of

Why This Moment? Why Now?

Sales tools have been due for disruption for years. The fact that it's happening now is no accident. Several trends converged:

1. AI Capability: Large language models are now good enough to handle sales-level writing and reasoning. Even two years ago, AI-generated emails were obviously robotic. Now they pass the smell test.

2. Founder Frustration: A generation of founders has grown up frustrated with Salesforce's complexity and HubSpot's limitations. Sam Blond is one of them. When experienced operators become frustrated, that's when new companies start.

3. Venture Appetite for Sales Tech: VCs have seen the success of recent sales tools and are actively looking for the next generation. They know Salesforce is vulnerable. Monaco is positioned exactly where investors are looking.

4. Startup Proliferation: There are more early-stage startups than ever, and they all need sales. Y Combinator alone graduates 200+ companies per batch, twice a year. The market for early-stage sales tools is large and growing.

5. Open Funding Environment: While not all markets are well-funded, investor appetite for proven teams and sensible business models is strong. Monaco has both.

All of these factors converged in early 2025. That's why Monaco launching now makes sense.

Challenges Monaco Faces

Despite the strong positioning, Monaco has real challenges ahead:

Execution Risk: Building a comprehensive sales platform is hard. You need AI that works, a database that's accurate, a CRM that's usable, and a marketplace of salespeople who are actually good. Any one of these can fail.

Competitor Response: Once HubSpot and Salesforce notice Monaco gaining traction, they'll respond. They have brand, existing customer relationships, and capital. Don't underestimate them.

Sales Motion: Ironically, Monaco has to sell its sales tool. That's meta and hard. They need to get in front of founders, prove value quickly, and convert. Most sales tools struggle with this.

Unit Economics: If Monaco's platform requires experienced salespeople to oversee the AI, that limits their margin. If they can't automate the human component eventually, the model breaks down at scale.

Market Size Assumption: Monaco is betting there's a large market of startups willing to pay for this product. That might be smaller than expected if founders continue to hire in-house salespeople instead.

These aren't fatal flaws, but they're real. Executing on this vision is genuinely difficult.

The Broader Implications for Sales Teams

Monaco isn't just a company; it's a signal about the direction of sales technology. The human-in-the-loop model suggests that the future of sales isn't automation replacing salespeople. It's augmentation.

This has practical implications. If you're building a sales team, you should expect:

More Leverage Per Salesperson: As tools improve, each salesperson can handle more prospects and do more work because AI is handling grunt tasks.

Different Skills Matter: You need salespeople who can work with AI, provide feedback, and handle higher-level conversations. You need fewer SDRs and more Account Executives.

Emphasis on Judgment: The parts of sales that require human judgment and relationships become more valuable. The parts that are pure execution become commoditized.

Speed Increases: Sales cycles get faster because more work happens asynchronously and automatically. Time-to-meeting decreases even if close rates stay the same.

For founders and sales leaders, this is actually good news. It means the bar for hiring top salespeople gets lower (you need fewer of them) even as the problems they solve become more complex.

Using Monaco can save a Series A startup approximately $207,000 annually compared to hiring a traditional sales team. Estimated data.

Implementation: How Startups Would Use Monaco

Let's get concrete. Imagine you're a Series A SaaS startup with $5 million in funding. You've got product-market fit with early customers, but you need to scale revenue. You have two options:

Option 1: Hire an VP of Sales (

Option 2: Use Monaco at

For the Series A founder, Option 2 is radically more attractive. The only reason not to do it is if you want to build a long-term, in-house sales organization. But many founders delay that decision until Series B anyway.

Monaco's target customer is exactly this founder: understands they need sales help, wants to de-risk, and prefers to outsource initially.

Comparison to Incumbents

Let's think through how Monaco stacks up to the major players:

vs. Salesforce: Salesforce is vastly more feature-rich but exponentially more complex. Monaco is simple and AI-native. For startups, Monaco wins. For enterprises, Salesforce still dominates.

vs. HubSpot: HubSpot is user-friendly but still requires manual work. Monaco automates that work. HubSpot has better reporting; Monaco has better execution. For startups at pre-Series A, Monaco might win. For growth-stage companies, HubSpot probably still works.

vs. AI SDR Tools: Tools like 11x are cheaper and do pure outreach. Monaco is more comprehensive and adds human quality. Depends on whether you want volume (11x) or quality (Monaco).

vs. Attio/Clay: These tools are more modern design-wise but less automation-focused. Monaco is more automation-heavy. Different markets.

Monaco's position is strongest in the early-stage startup segment where complexity is low, automation is high-value, and founders are willing to try new things.

What Happens Next?

Over the next 12-18 months, watch for these signals:

Customer Acquisition: Can Monaco sign up 50+ paying customers in the first year? This is the basic test.

Product Expansion: Will Monaco add features like pipeline management, forecasting, or reporting? Or stay focused on outreach and meeting generation?

Ecosystem Development: Will Monaco build integrations with other startup tools (Stripe for payments, Slack for communication, etc.)? Ecosystem strength predicts longevity.

Competitive Response: How do HubSpot and Salesforce respond? Do they ignore Monaco, or do they launch competitive products?

Follow-on Funding: Will Monaco raise a Series B? That's crucial for long-term viability.

Team Hiring: Do they attract top engineering and product talent? That determines whether the product actually reaches its vision.

Monaco is positioned well, but it's still unproven. The next 18 months will determine whether it becomes a significant player or becomes an acqui-hire that Salesforce or HubSpot picks up.

The Bigger Picture: AI's Impact on Sales

Monaco is one instance of a larger trend: AI is reshaping every function of startups, and sales is next. Over the next 2-3 years, expect:

Prospecting to Become Automated: Finding the right leads will be a system, not a skill.

Outreach to Be Templated: Most initial outreach will be AI-generated and AI-approved.

Meetings to Become Easier to Schedule: Calendar coordination will be instant, not a multi-day back-and-forth.

Analysis to Be Real-Time: Sales leaders will see what's happening immediately, not in monthly reviews.

But here's what won't change: the close. Actually selling requires human connection, understanding customer pain, and building trust. That's where experienced salespeople will always add value.

Monaco's insight—that the future is augmentation, not replacement—is probably correct. The companies that get this right will own the market. The companies that promise to "replace the salesperson" will face credibility issues.

Lessons for Other Founders

Monaco's launch offers insights for anyone thinking about building a startup:

1. Know Your Market Deeply: Sam Blond built Monaco because he lived the problem. He wasn't a consultant analyzing sales; he was a seller who moved to VC and moved back to operations. That credibility matters.

2. Recruit Credible Co-Founders: The Monaco team is impressive because each co-founder brought domain expertise. Viswanathan at Apollo and Qualtrics. Desai at Clari. These aren't generic tech people; they're people who know the space.

3. Build an Advisory Board That Actually Helps: The Stripe founders, Garry Tan, and Neil Mehta are people who can open doors and provide strategic insight. Not all angel investors can do that.

4. Focus on a Specific, Underserved Segment: Monaco isn't trying to be Salesforce. It's trying to own the early-stage startup segment. That focus is strength.

5. Be Bold About Your Vision: "There will be a new market leader" is a bold statement. You need that conviction to compete against incumbents.

The Sales Tech Arms Race

Monaco's success (if it achieves it) will trigger a wave of investment in sales tech. VCs will look at Monaco's metrics and think: "If Monaco can do this with AI, what about customer success? What about marketing automation? What about account management?"

Expect the next 2-3 years to see dozens of new startups trying to replicate Monaco's formula in adjacent categories. Some will work. Most won't. The ones that work will be started by people who deeply understand the category (like Sam Blond understands sales).

This is actually healthy for the market. New entrants force incumbents to innovate. Healthy competition drives product improvement. Startups benefit from better tools.

Monaco isn't guaranteed to win, but the category it's creating is guaranteed to be important.

FAQ

What exactly is Monaco?

Monaco is an AI-native customer relationship management platform that combines autonomous sales agents with human sales expertise. It automates lead prospecting, email outreach, and meeting scheduling while keeping experienced salespeople in the loop to ensure quality and handle actual customer conversations. The platform is designed specifically for early-stage startups that need sales infrastructure but can't afford to hire full-time sales teams.

How does Monaco differ from traditional CRM tools like Salesforce or HubSpot?

Traditional CRMs like Salesforce and HubSpot require significant manual work: data entry, email writing, and calendar management are all human-driven. Monaco automates these tasks using AI while maintaining human oversight. Additionally, Salesforce was built for enterprise sales (complex deals, multiple stakeholders) while HubSpot was built for inbound marketing teams. Monaco was designed from the ground up as AI-native, specifically for startup sales motions where you need to generate outbound pipeline quickly.

Why did Sam Blond leave Founders Fund to start Monaco?

After 18 months as a VC, Blond realized he preferred operating to analyzing. As someone with deep sales experience from his time as head of sales at Brex, he saw a clear problem: early-stage startups needed sales expertise but couldn't afford it. Rather than advising other founders on this problem, he decided to solve it himself by building Monaco.

Who is backing Monaco and why does it matter?

Monaco raised $35 million with Founders Fund leading both the seed and Series A rounds. Angel investors include Patrick and John Collison (Stripe founders), Garry Tan (Y Combinator CEO), and Neil Mehta (Greenoaks Capital founder). These aren't passive investors. The Collison brothers have scaled Stripe's sales organization and can provide strategic guidance. Garry Tan can introduce Monaco to thousands of portfolio companies through Y Combinator. This backing signals that experienced operators believe in the product and vision.

What's the "human-in-the-loop" model Monaco uses?

Rather than letting AI operate independently, Monaco uses human salespeople to oversee and guide the AI's work. The AI might draft outreach emails and identify prospects, but experienced salespeople review and approve everything before it goes out. More importantly, actual customer conversations and meetings are always conducted by humans. The AI handles grunt work and optimization, but humans handle judgment calls and relationship-building.

How is Monaco priced and is it affordable for startups?

Monaco hasn't announced final pricing, but early reports suggest a flat monthly fee (not per-seat or usage-based). During beta, it's discounted. Based on comparable tools and value provided, expect

What's Monaco's competitive advantage over AI SDR tools like 11x or Artisan?

Companies like 11x and Artisan focus purely on automating outreach, which is efficient but has credibility problems: prospects know they're talking to AI. Monaco combines AI outreach with human-executed customer meetings. This preserves the relationship-building aspect of sales that customers expect. Additionally, Monaco provides the full stack (prospecting, outreach, CRM, meeting scheduling) rather than just outreach, reducing the number of tools startups need to maintain.

Who is the ideal customer for Monaco?

Monaco's primary target is seed and Series A startups that have achieved product-market fit with early customers and need to scale revenue. These founders typically have $2-10 million in funding, understand they need sales expertise, want to avoid the hiring and management overhead of building a sales team, and prefer to outsource initially. Secondary targets include early-stage B2B SaaS companies, marketplaces, and developer tools that rely on direct sales.

How does Monaco generate revenue and what's the business model?

Monaco operates as a Software-as-a-Service (SaaS) business with a monthly or annual subscription model at a flat fee. The business model includes two revenue streams: (1) the core CRM platform and AI agents that startups subscribe to, and (2) potentially revenue from the salespeople providing human-in-the-loop oversight (either as employees or as a managed service). This dual model allows Monaco to offer comprehensive value without requiring customers to hire their own sales leadership.

Is Monaco better than HubSpot for early-stage startups?

It depends on your needs. HubSpot's free and starter plans are simpler but require more manual work. For founders who want to minimize operational overhead and maximize automation, Monaco is probably better. For founders who want flexibility and plan to hire their own sales team, HubSpot might be more suitable. Monaco is specifically optimized for the "bootstrap your sales with AI" use case, while HubSpot is a more general CRM that works for various team structures.

What are Monaco's major challenges and risks?

Monaco faces several significant challenges: (1) Execution risk—building a comprehensive sales platform combining AI, database, CRM, and human team is complex; (2) Competitive response from HubSpot and Salesforce once they recognize the threat; (3) Sales motion challenges—they have to sell their own sales tool; (4) Unit economics—if the human oversight component is expensive, margins may suffer at scale; (5) Market size uncertainty—whether there's truly a large market of startups willing to pay for this versus hiring their own SDRs; (6) Product complexity—balancing AI automation with human control without creating confusing workflows.

What would make Monaco successful in the next 18 months?

Success metrics include: (1) achieving 50+ paying customers by month 12, with high retention rates; (2) strong product-market fit signals like high net promoter scores and organic word-of-mouth growth; (3) successful fundraising of a Series B round; (4) hiring top engineering and product talent to accelerate platform development; (5) establishing integrations with complementary startup tools; (6) case studies showing measurable revenue impact for customers; (7) positive sentiment in the startup and VC communities; (8) growing headcount to 75-100+ employees as demand increases.

Conclusion

Monaco represents something important: a founder who deeply understands their market, a team with relevant expertise, and timing that aligns with how AI is reshaping software. Sam Blond didn't wake up one day and decide to "disrupt sales tech." He lived the problem as head of sales at Brex, analyzed it as a VC, and decided the best way to solve it was to build the solution himself.

The company's human-in-the-loop model is strategic genius. It avoids the credibility problem that pure AI SDR tools face (prospects don't like talking to robots) while still delivering significant automation. It gives startups access to experienced salespeople without the full hiring overhead. And it's built on an AI-native architecture that gives Monaco advantages in speed and simplicity compared to legacy incumbents.

The funding and investor backing are impressive but not shock-and-awe. $35 million is enough to execute without creating unrealistic expectations. The investor list—Founders Fund, the Collison brothers, Garry Tan—is strategically strong rather than just financially large.

Will Monaco become the "Cursor for sales" that Sam Blond envisions? That's still uncertain. The company faces real execution challenges, competition from well-funded competitors, and the fundamental difficulty of selling to founders who are themselves often skeptical of sales tools.

But here's what we can say with confidence: the sales tech market is ready for disruption. Salesforce's dominance is brittle because it's built on legacy architecture. HubSpot is solid but not cutting-edge. The window for a new market leader to emerge is open. Monaco has the right team, the right funding, and the right product positioning to capture that opportunity.

If you're a founder thinking about your sales strategy, Monaco is worth tracking. If you're a VC interested in where AI is creating new categories, Monaco deserves attention. And if you've been frustrated with your CRM, Monaco might just be the relief you've been looking for.

The sales software revolution isn't coming. It's already here. Monaco is just the most ambitious version we've seen so far.

Key Takeaways

- Monaco is an AI-native CRM platform that combines autonomous sales agents with human salespeople, solving the early-stage startup problem of needing sales expertise without hiring overhead

- The company raised $35 million backed by serious operators including Founders Fund, Stripe co-founders, and Y Combinator's Garry Tan, signaling strong investor conviction

- Sam Blond's background as head of sales at Brex and subsequent VC role at Founders Fund gave him credibility and insider knowledge to spot the market gap Monaco addresses

- The human-in-the-loop model solves credibility problems that pure AI SDR tools face while still delivering significant automation of sales grunt work like prospecting and outreach generation

- Monaco's positioning targets early-stage startups (seed to Series A) who represent an underserved market segment between DIY CRMs and enterprise solutions, with strong economics versus hiring SDRs

![Monaco AI Sales Platform: The Startup Challenging Salesforce [2025]](https://tryrunable.com/blog/monaco-ai-sales-platform-the-startup-challenging-salesforce-/image-1-1770826112201.jpg)