The AI Funding Boom: Understanding the 2025 Landscape

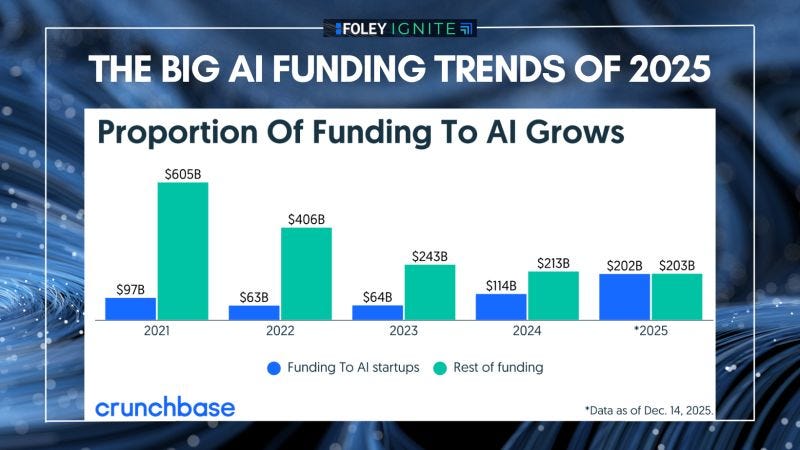

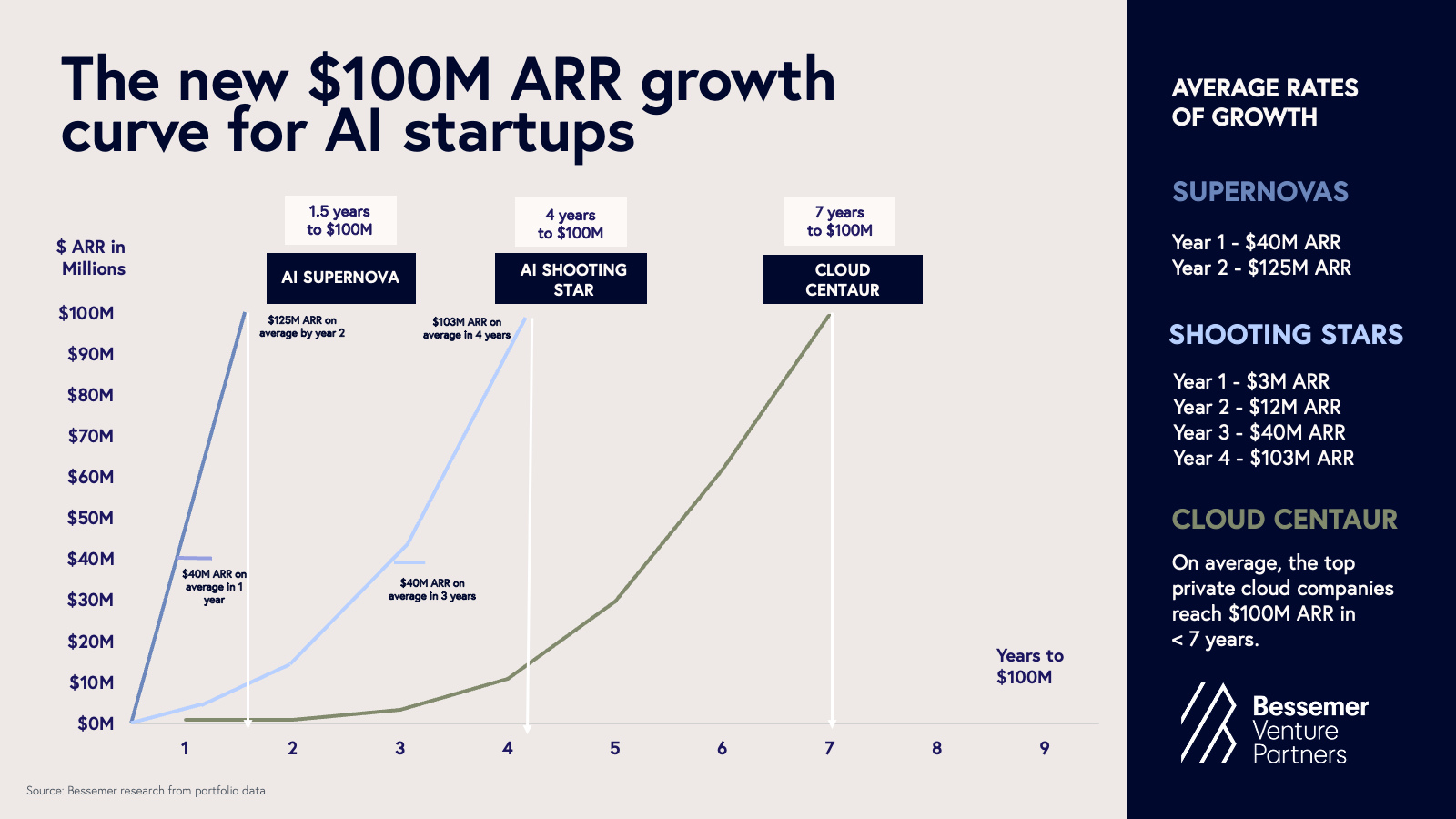

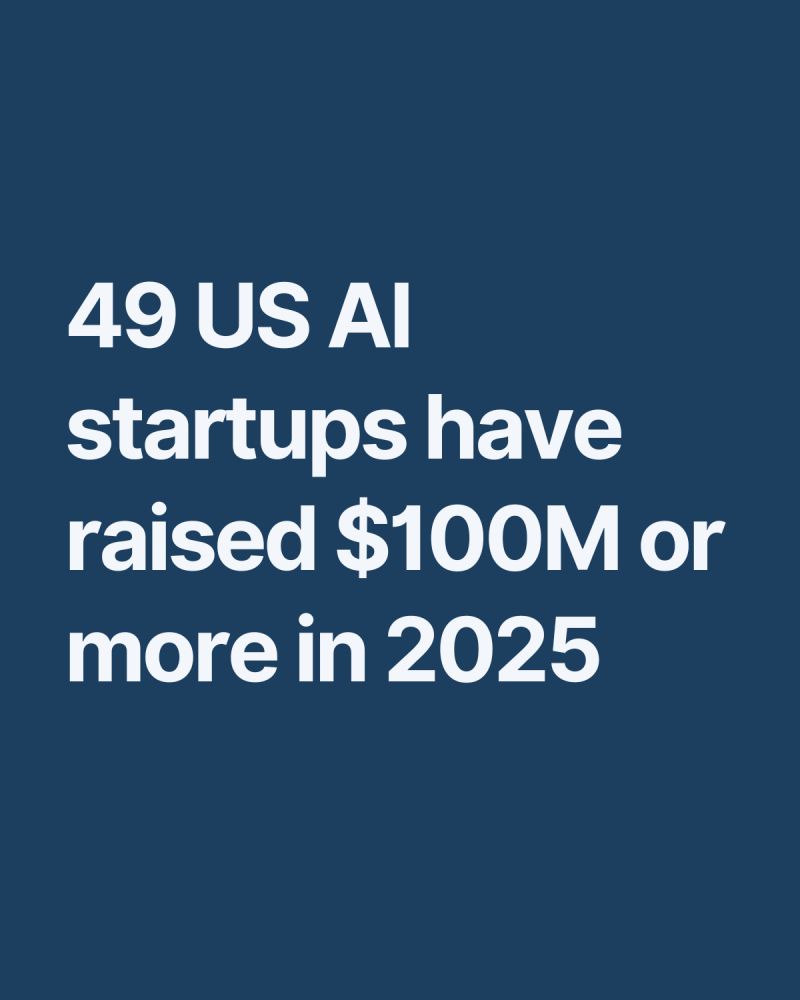

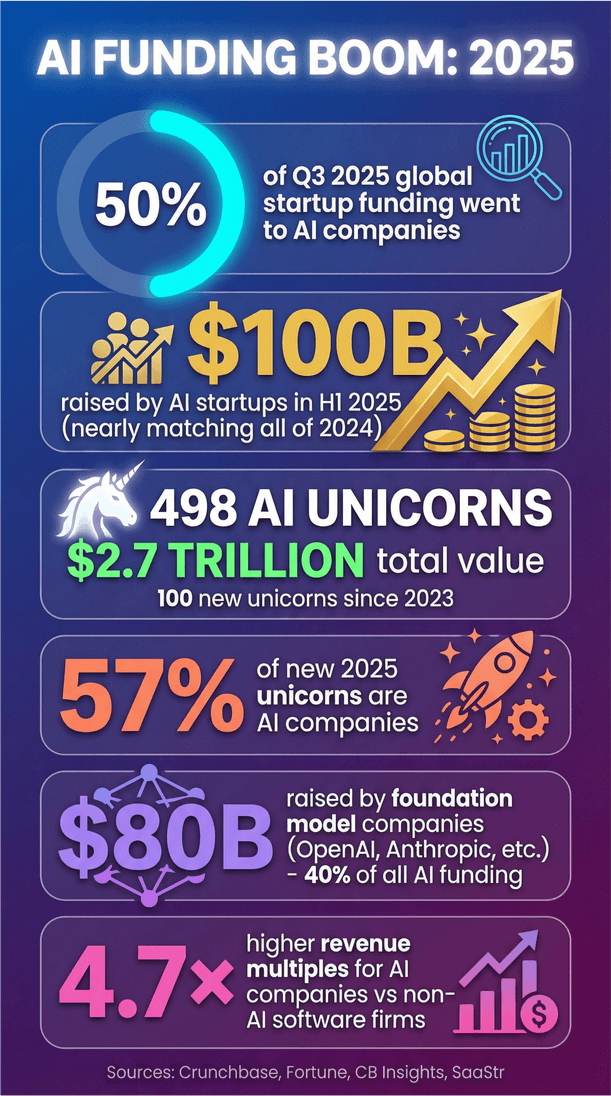

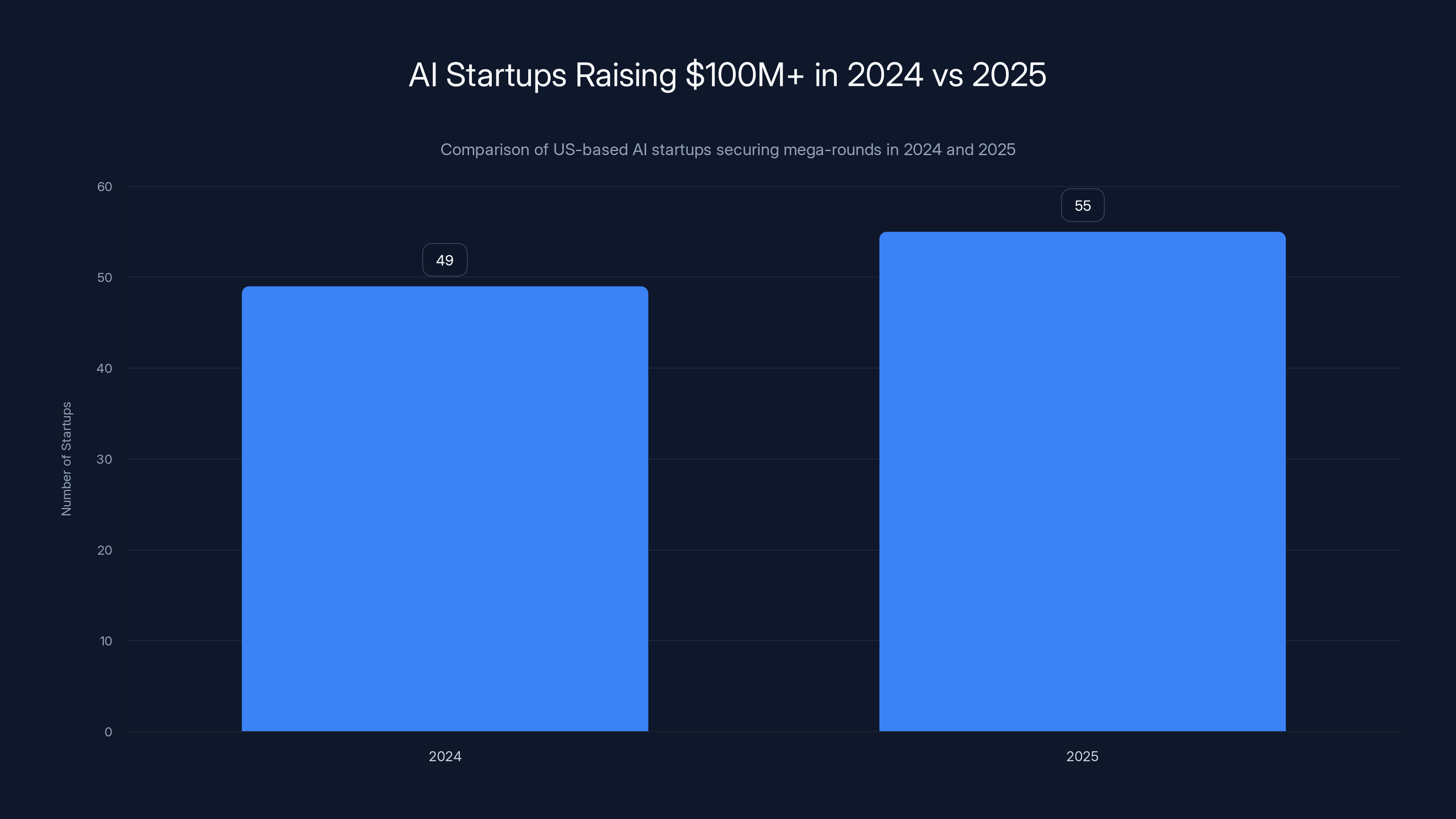

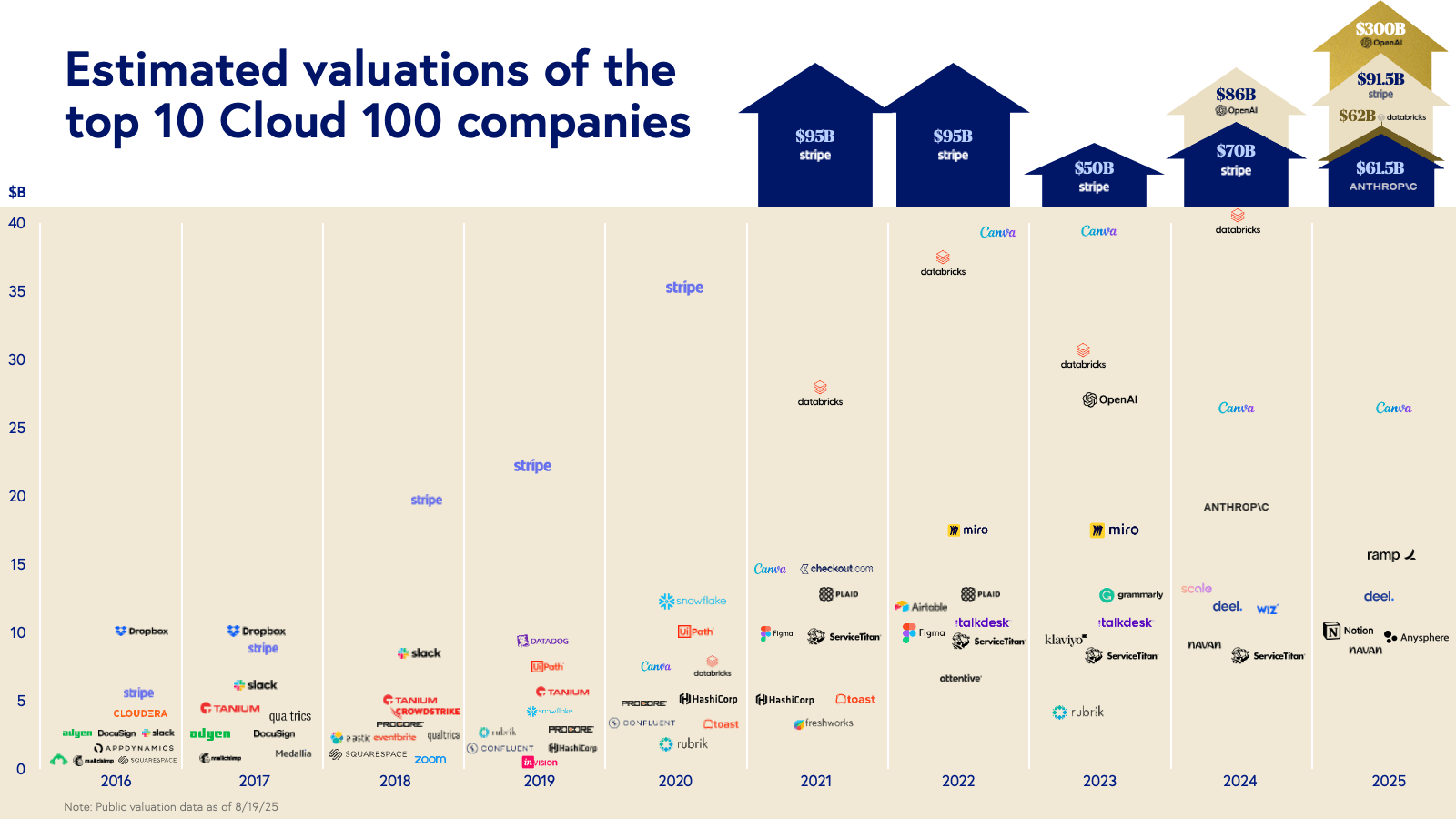

The venture capital market for artificial intelligence has experienced unprecedented growth over the past two years, with 2025 marking a pivotal inflection point in how investors evaluate and fund AI companies. The emergence of 55 US-based AI startups that successfully raised $100 million or more in 2025 represents not just a continuation of a trend, but a fundamental shift in how venture capital flows through the technology ecosystem. This figure marks a substantial increase from 2024's 49 mega-round-raising companies, indicating that despite some economic headwinds and market corrections, investor confidence in AI-driven innovation remains exceptionally strong.

The significance of tracking these companies extends beyond simple funding numbers. When a startup raises $100 million or more in a single round, it typically signals several critical factors: the company has achieved meaningful product-market fit, demonstrated exceptional technical capabilities, or both. Investors writing checks of this magnitude are conducting exhaustive due diligence, analyzing competitive landscapes, assessing management team quality, and evaluating the total addressable market with microscopic precision. The fact that 55 companies cleared this threshold in 2025 suggests that the AI market has matured beyond a handful of well-funded unicorns, and venture capitalists now see viable, scalable paths to profitability across multiple AI sub-sectors.

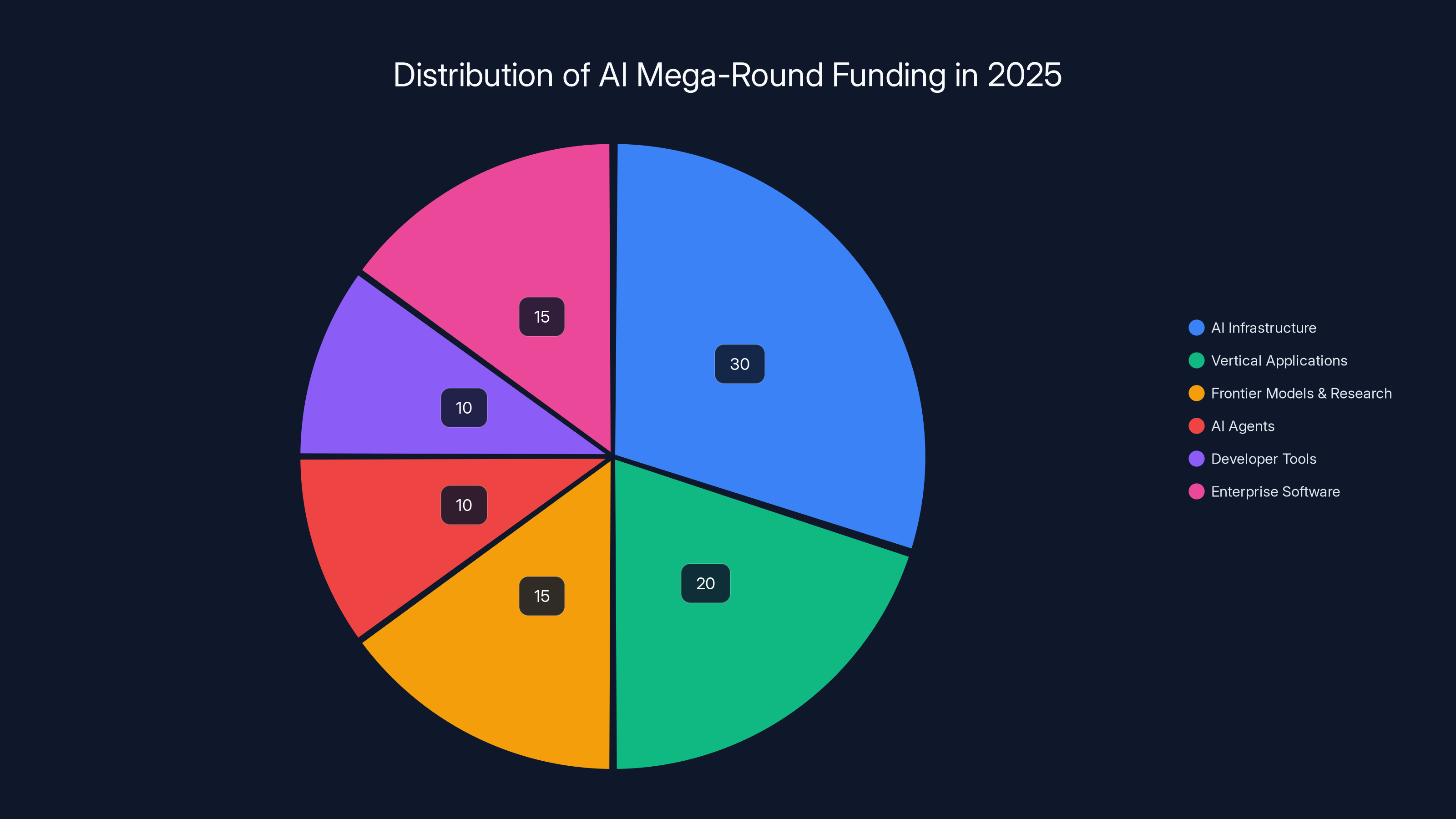

The composition of this year's mega-round recipients reveals fascinating patterns about where capital believes the greatest opportunities lie. Unlike the early days of the generative AI boom, when large language model companies dominated funding conversations, 2025's biggest rounds span a diverse ecosystem including AI infrastructure providers, vertical-specific AI agents, biotech applications, creative tools, and enterprise software. This diversification suggests that the initial hype cycle of generative AI has matured into a productive differentiation phase where investors distinguish between companies with durable competitive advantages and those with merely fashionable technology.

One particularly notable trend involves the concentration of multi-round mega-funders. Eight companies raised multiple rounds of $100 million or more in 2025, compared to only three in 2024. This concentration indicates that institutional investors are increasingly willing to deploy capital in follow-on rounds to companies they've already backed, suggesting confidence in execution and progress toward critical milestones. The speed at which some companies returned to fundraising—often within months of their previous rounds—demonstrates how quickly burn rates accelerate when building AI-intensive products that require substantial computational resources and top-tier talent acquisition.

The funding mechanisms themselves have evolved substantially. While traditional venture capital firms like Sequoia, Andreessen Horowitz, and Lightspeed continue to dominate mega-round leadership, 2025 saw increased participation from strategic corporate investors. Tech titans like Nvidia, AMD, Apple, and major cloud providers recognized that AI startups would become either their future partners or competitors, prompting them to take active positions in early-stage companies. This dynamic adds complexity to cap tables while simultaneously providing additional resources beyond capital—from GPU access to cloud compute discounts to potential enterprise partnerships.

Geographically, the concentration of mega-funded AI startups mirrors broader venture capital patterns. California continues to dominate with companies headquartered in the Bay Area, Los Angeles, and San Diego representing roughly 40% of all mega-round recipients. However, emerging hubs in Boston (historically a biotech and enterprise software center) and Austin (increasingly a center for AI infrastructure and developer tools) are gaining ground. This geographic diversification reflects both the maturation of regional venture ecosystems and the increasing realization that building transformative AI companies doesn't require proximity to San Francisco's venture capital community.

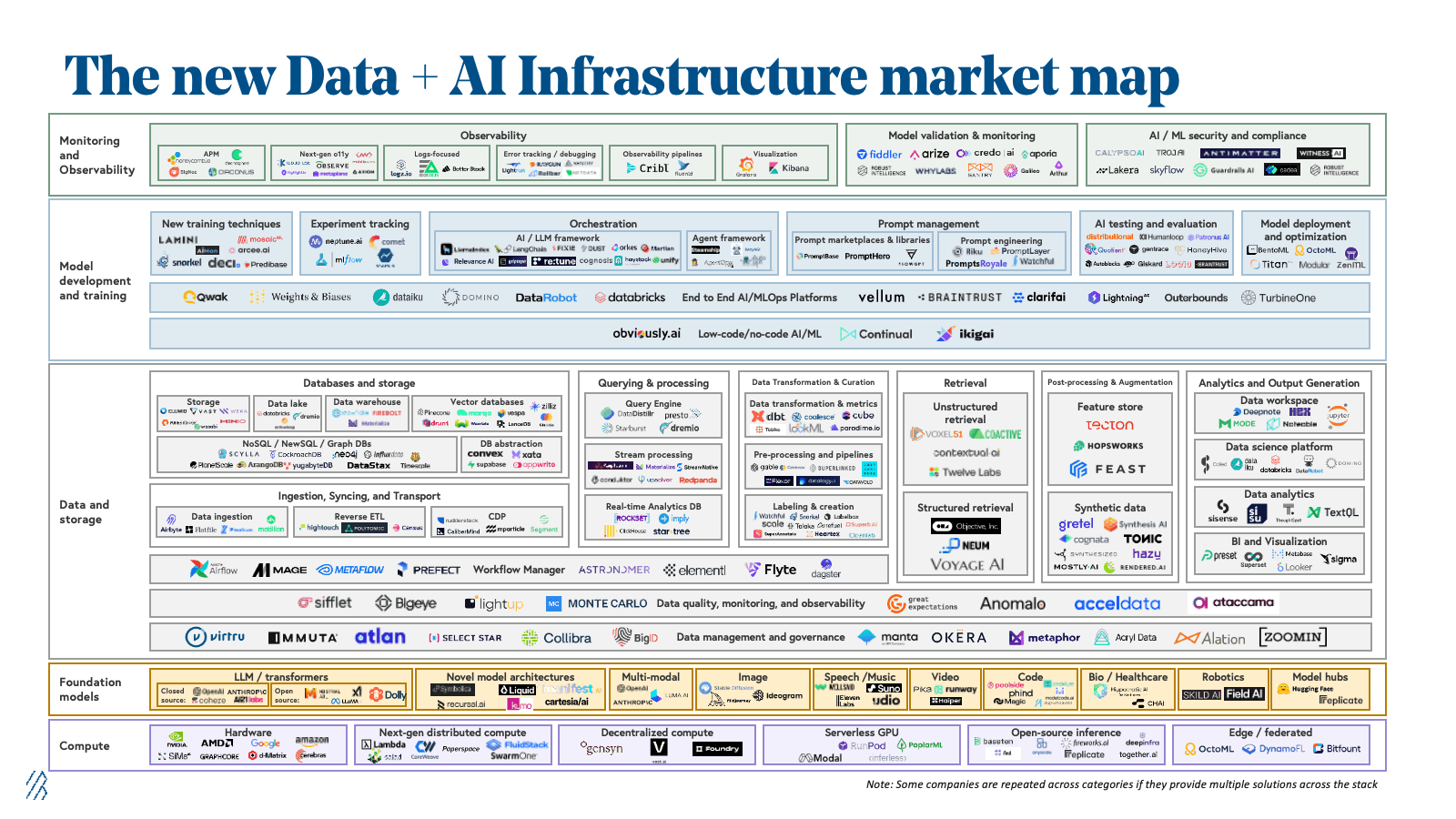

AI Infrastructure: The Foundation Layer of the Boom

AI infrastructure represents the bedrock upon which every other AI application is built. Companies in this category—those providing compute optimization, model serving platforms, and specialized hardware—received some of the largest funding rounds in 2025. These companies address a fundamental bottleneck: as AI models grow in sophistication and size, the computational cost of training and deploying them becomes prohibitive without specialized solutions.

Specialized Compute and Optimization

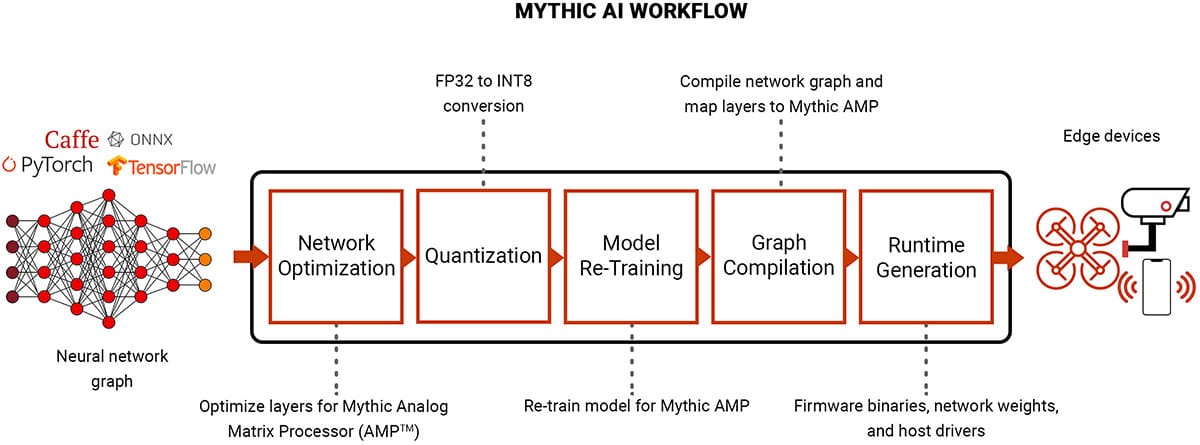

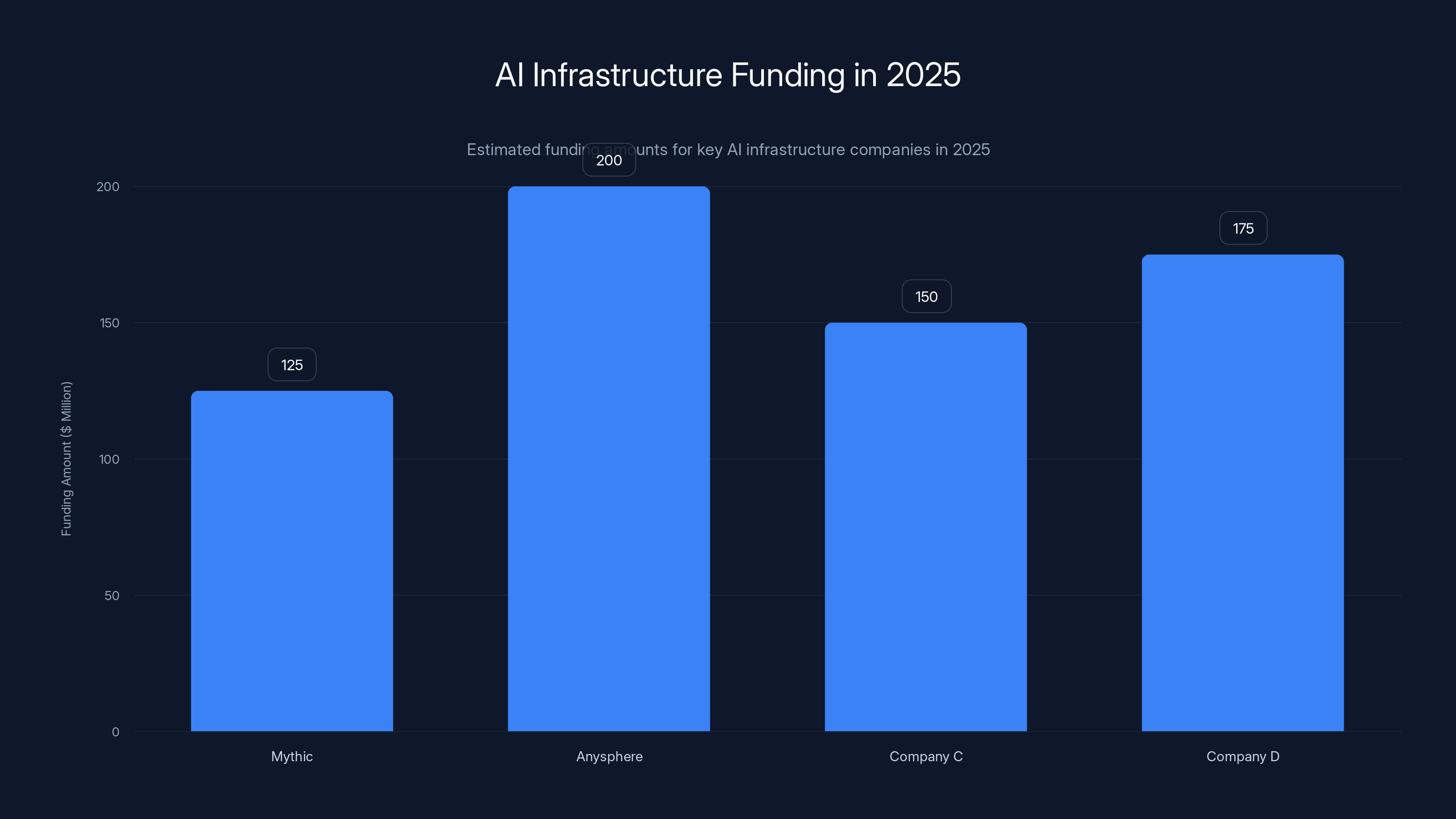

Mythic, an Austin-based company specializing in power-efficient compute for AI workloads, exemplifies the infrastructure trend. Their $125 million Series C round, led by DCVC and including Soft Bank and NEA, reflects investor conviction that optimizing hardware and computational efficiency will remain critical as AI adoption spreads globally. The challenge Mythic addresses is deceptively complex: modern AI models like large language models consume enormous amounts of electricity during inference (the deployment phase when models answer user queries). As AI systems become ubiquitous—from data centers to edge devices to mobile phones—the cumulative electricity consumption becomes economically untenable without efficiency improvements.

Mythic's approach involves developing processors and software stacks that reduce power consumption without sacrificing performance. This matters tremendously for companies that deploy AI models at scale. A cloud provider managing millions of inference requests daily might reduce operating costs by 30-40% with more efficient compute. For edge deployments—say, AI features running directly on a smartphone or IoT device—power efficiency determines whether advanced AI features are practically feasible. The market opportunity scales with every new AI application, making infrastructure optimization a perpetually valuable category.

Anysphere, the company behind the viral code editor Cursor, raised

Model Serving and Deployment Platforms

Fireworks AI, which raised

This represents a crucial evolution in the AI ecosystem: the commoditization of certain AI capabilities. When serving models becomes a standardized, utility-like service available from multiple providers, competition intensifies around efficiency, reliability, and customer support. Companies like Fireworks benefit from this trend because they're building what amounts to an essential infrastructure component that enables hundreds of downstream applications.

Specialized Hardware and Chip Design

Cerebras Systems, an AI infrastructure company, raised a massive

The competition in AI chips intensifies as training requirements grow. NVIDIA's graphics processors have become the default choice for AI computing, but their dominance creates strategic vulnerabilities for companies dependent on their supply. Large cloud providers, hyperscalers like Meta and Microsoft, and chip design specialists all recognize that developing alternatives to NVIDIA reduces supply chain risk and potentially improves performance for proprietary workloads. Cerebras' $1.1 billion round reflects investor confidence that specialized AI chip startups can capture meaningful market share despite NVIDIA's formidable position.

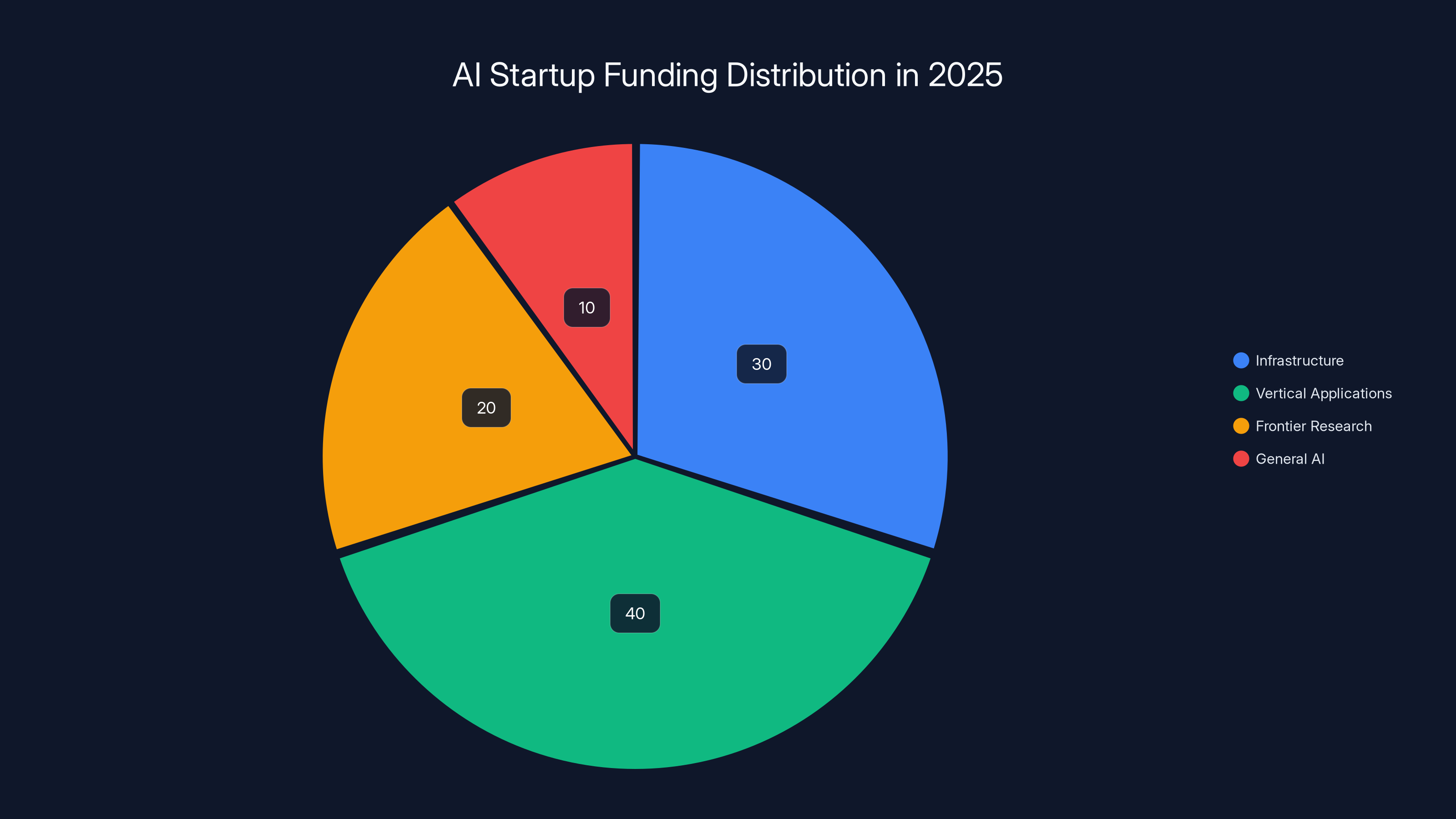

AI Infrastructure companies received the largest share of mega-round funding in 2025, reflecting investor focus on foundational technology. Estimated data based on typical funding trends.

Vertical AI Applications: Industry-Specific Intelligence

While horizontal AI platforms (tools applicable across multiple industries) dominate popular discourse, 2025's funding patterns reveal substantial investor capital flowing toward vertical AI companies—those solving specific problems within particular industries. These companies often achieve higher gross margins, develop defensible competitive positions, and secure larger enterprise contracts than generalist tools.

Healthcare and Life Sciences

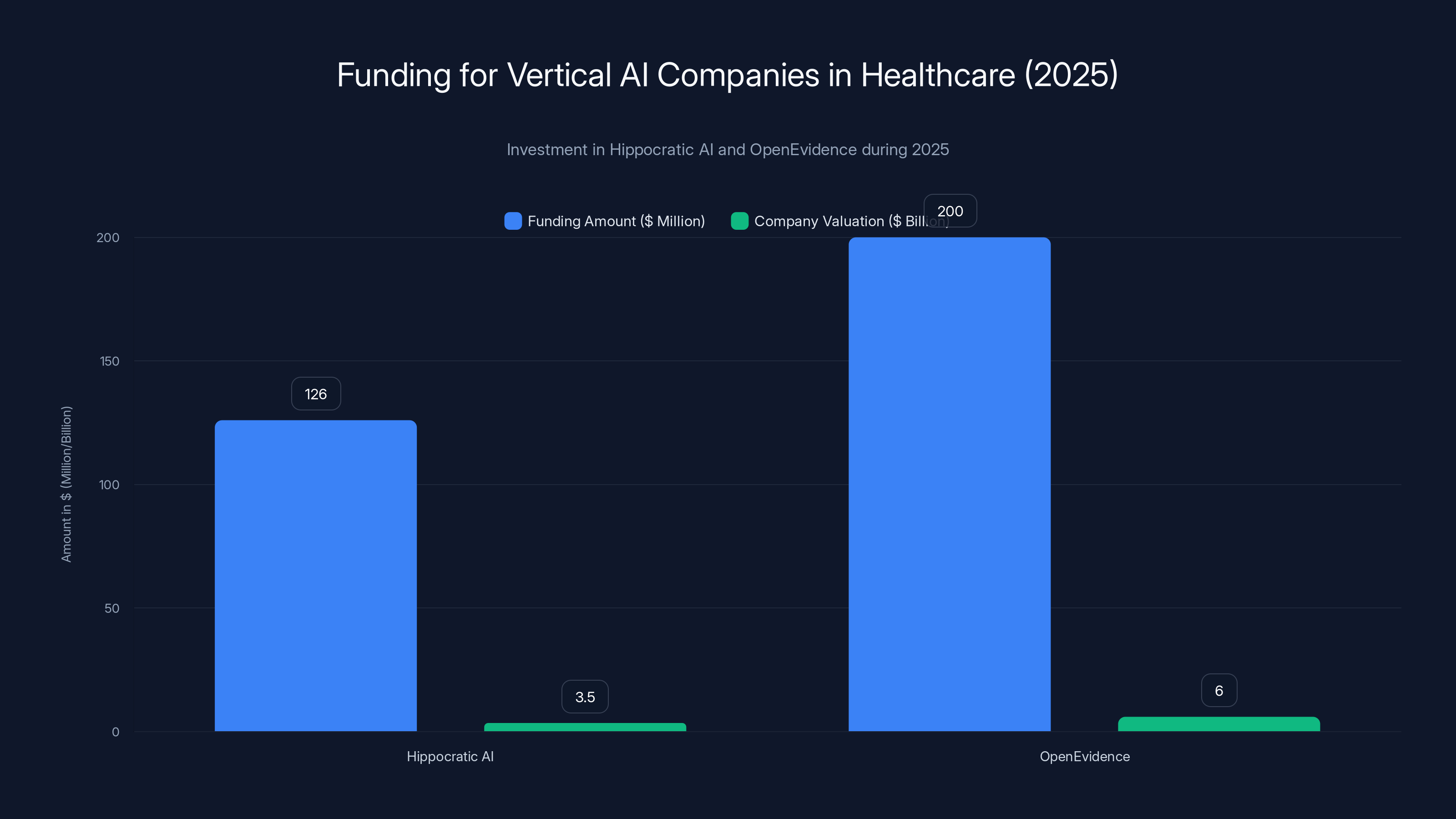

Hippocratic AI, which develops healthcare AI agents, raised

Hippocratic specifically addresses administrative inefficiency in healthcare—tasks like prior authorization, patient documentation, claims processing, and clinical coordination consume enormous time without directly providing patient care. An AI agent that reduces these administrative burdens by 20-30% creates immediate value that healthcare systems can measure and quantify. The company's back-to-back mega-rounds suggest rapid revenue growth, expanding customer base, and validation that their agents meaningfully improve healthcare operations.

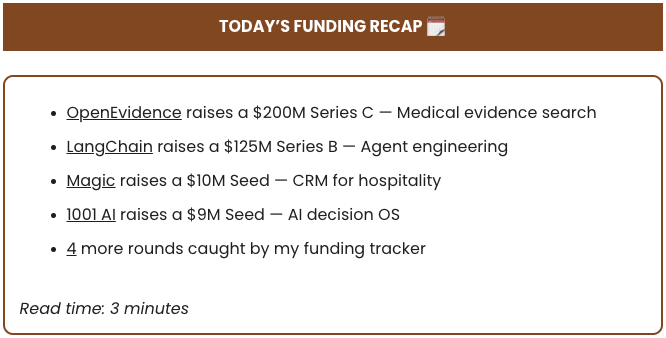

Open Evidence, which builds AI chatbots for the medical field, raised

Chai Discovery, valued at

Legal and Financial Services

Even Up, which develops AI specifically for the personal injury legal field, raised

Even Up's Series E position (meaning this was the company's fifth fundraising round) indicates substantial maturation. The company has likely achieved meaningful revenue, demonstrated retention and expansion metrics, and built defensible relationships with law firms that rely on its tools. The valuation approaching $2 billion represents investor confidence that the legal AI category will support multiple large, profitable companies.

Enterprise Software and General Productivity

Genspark, an all-in-one AI workspace platform, raised

Distyl AI, which builds AI enterprise software, raised

In 2025, Hippocratic AI and OpenEvidence secured significant funding, highlighting investor confidence in vertical AI solutions for healthcare. Estimated data based on reported funding rounds.

Next-Generation AI Architectures: Reimagining Computation

Some of the most intriguing companies from 2025's mega-round cohort are reimagining fundamental assumptions about how computation works in the age of AI. These companies recognize that traditional computing architectures, built over decades for different use cases, may not be optimal for AI workloads.

Rethinking Computer Architecture

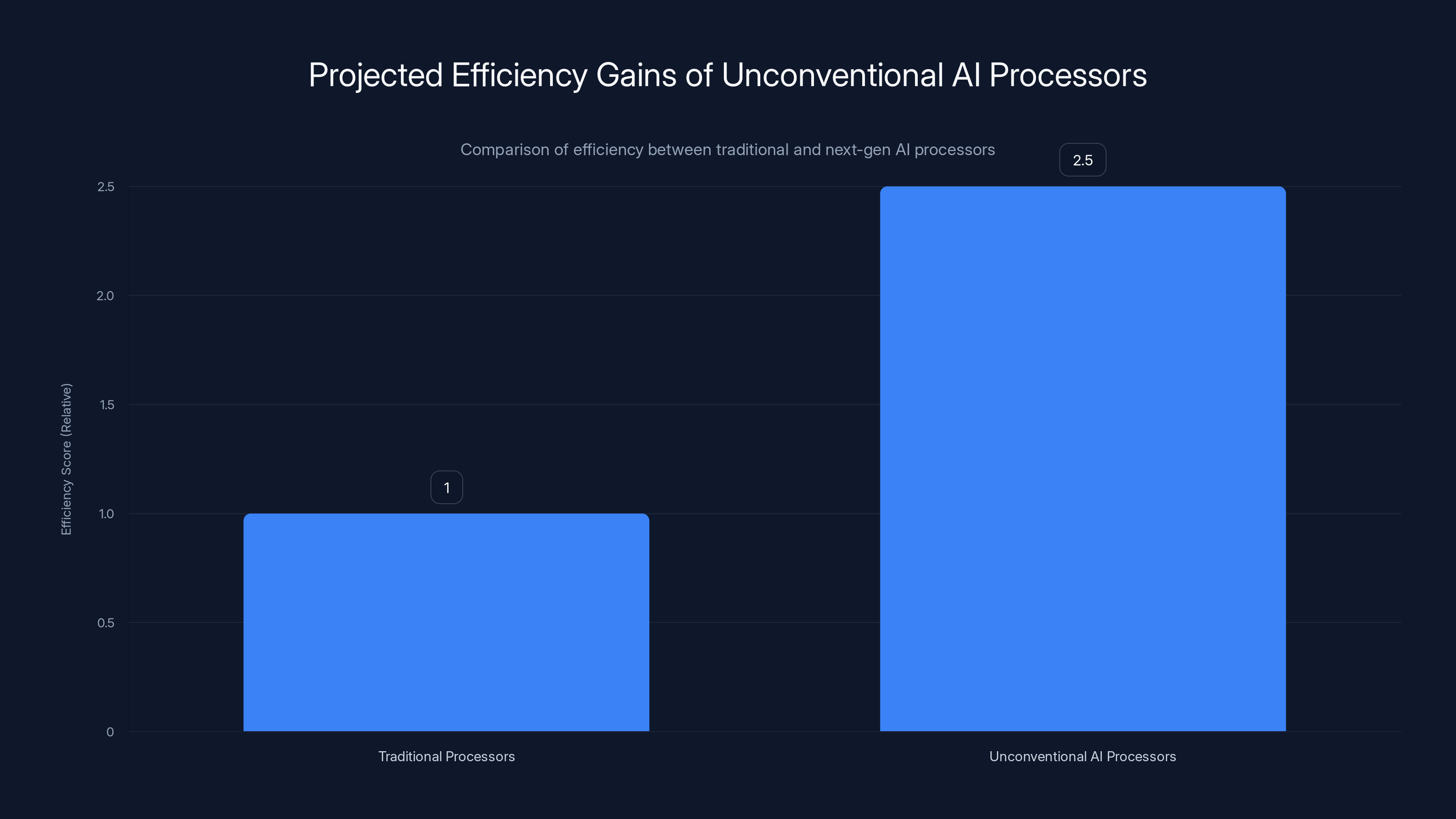

Unconventional AI announced a remarkable

Unconventional AI's mission involves fundamentally rethinking computer architecture for the AI era. Rather than adapting existing processor designs and manufacturing processes to AI workloads, the company contemplates whether entirely different architectures might be superior. This represents research at the absolute frontier of computing—comparable in ambition to the architectural innovations that enabled modern computing in the first place.

The

Specialized Inference and Model Optimization

Groq, an AI inference company, raised a

Groq's approach involves custom processors designed specifically for the inference patterns of large language models. Rather than using general-purpose GPUs, Groq develops processors optimized for the specific operations required when running LLMs. The company has demonstrated impressive performance benchmarks—in some cases serving LLM queries with dramatically lower latency than GPU-based alternatives.

The company's Series D raise at such a substantial valuation indicates that customers are finding value in Groq's solution and that the company is generating material revenue. The distinction between training and inference is crucial: while training requires enormous computational resources but happens infrequently (once per model or update), inference happens continuously as users interact with deployed models. Companies that can reduce inference costs or latency unlock economic advantages that compound perpetually.

Frontier AI Models and Research: The Next Frontier

While the mega-round recipients span many categories, companies building next-generation AI models themselves also feature prominently. These companies continue the work of training ever-larger, more capable models.

Large Language Models and Multimodal Systems

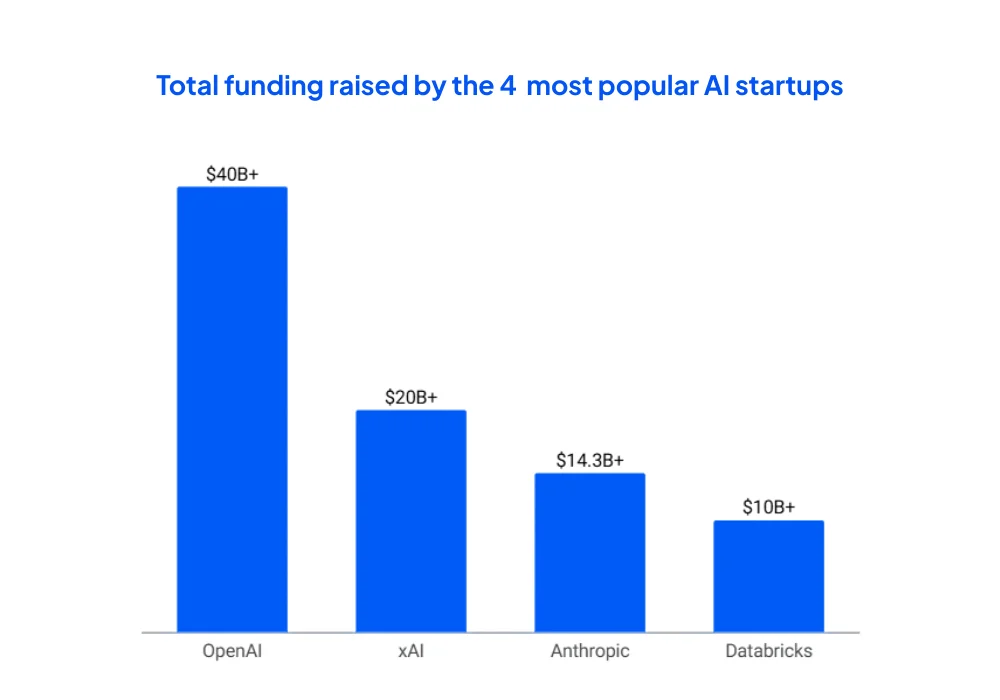

Anthropic, the AI safety-focused company behind Claude, raised two rounds exceeding $1 billion in 2025, securing multiple billions in total capital. The company competes with OpenAI and Google in developing frontier large language models while emphasizing safety and interpretability research. Anthropic's repeated mega-rounds suggest sustained investor confidence in the company's technical approach and commercialization progress.

Reflection AI announced its second mega-round of 2025—a

Specialized Model Development

Luma AI, which develops models specifically for photo and video creation, raised

The creative media generation category attracted substantial funding in 2025. Fal, a generative media platform, announced its third funding round of 2025—a

AI infrastructure companies like Mythic received substantial funding in 2025, reflecting the critical role of compute optimization and specialized hardware. Estimated data.

AI Agents: The Next Evolution of AI Applications

A significant trend throughout 2025's mega-round recipients involves companies building AI agents—autonomous systems that can plan, execute, and iterate toward accomplishing goals without continuous human direction. This represents an evolution beyond simple chatbots toward systems that can actually perform work.

Autonomous Systems for Knowledge Work

Parallel, which builds web infrastructure for AI agents, raised $100 million in a Series A round co-led by Index Ventures and Kleiner Perkins. The company's focus on infrastructure suggests recognition that as AI agents become more sophisticated and prevalent, the underlying systems supporting them need specialized optimization. Just as web browsers required specialized infrastructure companies in the 1990s, AI agents will require similarly specialized layers in coming years.

Periodic Labs, valued at over

Enterprise Agents

Several companies in the mega-round cohort build AI agents specifically for enterprise workflows. The distinction between general-purpose assistants and purpose-built agents is crucial: agents developed specifically for particular domains (healthcare, legal, finance) can incorporate specialized knowledge, regulatory requirements, and quality assurance mechanisms that general tools cannot.

The success of companies like Hippocratic AI, Open Evidence, and Even Up demonstrates that customers will fund development of specialized agents at substantial scale. This contrasts with earlier assumptions that general-purpose AI assistants would dominate. In practice, most valuable AI agent applications require domain specialization.

Developer-Focused AI Tools: Productivity Amplification

Developers represent among the earliest and most enthusiastic adopters of AI tools. Companies that help developers write, test, and deploy code more efficiently access a large market of high-value users with clear ROI metrics.

AI-Powered Development Environments

Anysphere's Cursor achieved viral adoption among developers by embedding Claude (from Anthropic) into a code editor. The

Cursor demonstrates exceptional product-market fit with developers—users enthusiastically adopt it and pay subscriptions. The product solves genuine pain points: writing, understanding, and debugging code. When Claude can suggest entire functions, refactor code, or explain complex systems, productivity gains are both real and measurable. Developers report writing features 2-3x faster with AI assistance, translating to substantial value for companies paying developer salaries.

The billion-dollar valuation also reflects recognition that Cursor is capturing share from traditional IDEs (Integrated Development Environments) like Visual Studio Code. If Cursor eventually becomes the default code editor for millions of developers—capturing even a modest percentage of VSCode's user base—the addressable market extends into tens of billions of dollars. Moreover, Cursor's embed of Claude suggests that developer tools could become an important distribution channel for frontier AI models.

In 2025, vertical applications received the largest share of $100M+ funding rounds, highlighting the trend towards specialization. (Estimated data)

Enterprise Infrastructure and Dev Ops

Several mega-round recipients address infrastructure and operations challenges specific to organizations deploying AI systems.

Model Operations and Management

Modular announced a $250 million funding round on September 24, led by the US Innovative Technology Fund and including GV, Greylock, and General Catalyst. The company's focus on infrastructure for AI systems suggests it's solving deployment, monitoring, and optimization challenges that arise when organizations move AI models from research to production.

As organizations deploy AI models widely, they encounter operational challenges: how to monitor model performance, detect degradation, optimize efficiency, and manage versions. Companies addressing these challenges occupy important infrastructure positions—much like infrastructure companies supporting web development in the 2000s.

The Venture Capital Dynamics: Who's Funding AI Startups

Analyzing which venture firms led the most mega-rounds in 2025 reveals shifts in venture capital power and strategy.

Traditional Venture Capital Dominance

Sequoia Capital appears multiple times among mega-round leaders in 2025, including co-leading Fal's

Andreessen Horowitz (a16z), which has made AI a strategic focus, appears as co-lead on Luma AI's funding and as a participant in Periodic Labs' $300 million seed round. The firm's substantial AI thesis—articulated through numerous published perspectives—has positioned it to attract exceptional founders and negotiate favorable terms.

Lightspeed Venture Partners emerges as particularly active in AI in 2025, leading the extraordinary $475 million seed round for Unconventional AI and participating in multiple Series C and later rounds. The firm's technical partnership approach and operational support apparently resonates with AI founders navigating the unique challenges of scaling technical talent, compute infrastructure, and go-to-market strategies.

Strategic and Corporate Investors

A notable 2025 trend involves strategic corporate investors taking major roles in mega-rounds. Nvidia participates in multiple AI funding rounds, including leading Reflection AI's $2 billion Series B. This makes strategic sense: as an AI chip company, Nvidia benefits directly when its customers (AI startups) succeed and expand, driving demand for Nvidia processors.

Snowflake, Databricks, and AMD similarly appear as participants or co-leaders in mega-rounds. These technology companies recognize that AI startups will become important customers, partners, or acquisition targets. Taking early equity positions provides strategic optionality while potentially offering customers (Snowflake cloud credits, Databricks partnership opportunities) that create switching costs and deepen relationships.

Unconventional AI aims to develop processors that are 2-3x more efficient than traditional options, potentially revolutionizing AI computation. Estimated data based on company goals.

Market Trends: Where Capital Flows and Why

Analyzing the distribution of mega-rounds across 2025 reveals several consistent patterns about which categories investors prioritize.

Infrastructure Concentration

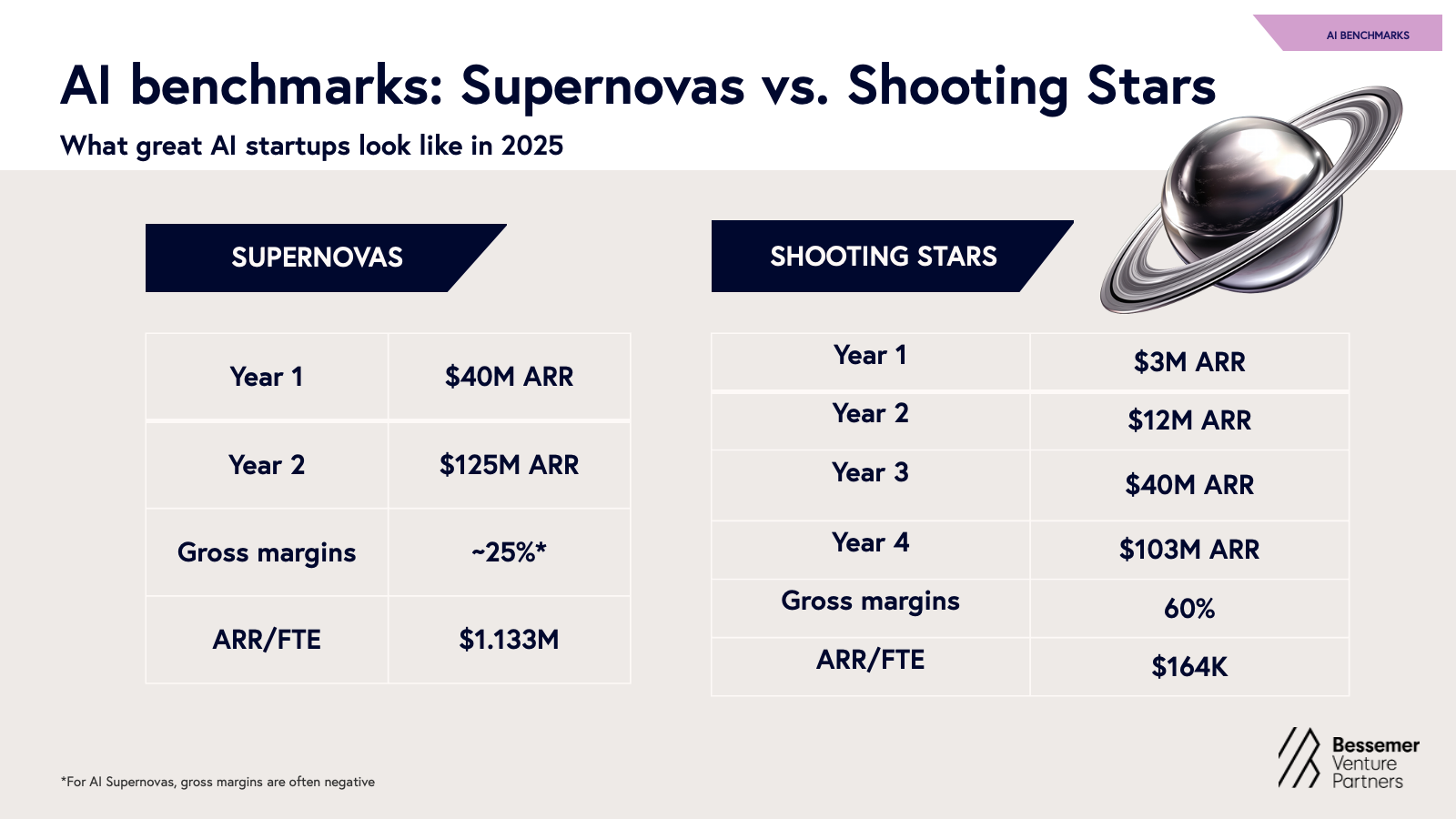

Infrastructure companies—those providing compute, model serving, or specialized hardware—represent disproportionate funding concentration relative to their number. This reflects investor recognition that infrastructure bottlenecks often create the greatest value capture opportunities. In many technology shifts, infrastructure companies achieve higher margins and longer competitive advantages than application companies.

The logic is straightforward: if 1,000 startups are building AI applications, they all depend on the underlying infrastructure. A company that becomes the standard infrastructure layer for even 10-20% of these companies captures value at an aggregate scale larger than any individual application.

Vertical Specialization Over Horizontal

Funding patterns show increasing preference for vertical AI applications—tools optimized for specific industries—over horizontal "AI for everyone" tools. Healthcare, legal, and biotech startups particularly stand out as recipients of mega-round capital. This reflects several dynamics: healthcare has the deepest pockets and clearest ROI metrics, legal work contains regulatory complexity that creates defensibility, and biotech benefits from AI's theoretical potential to accelerate molecular research.

This vertical emphasis contrasts with earlier AI enthusiasm that focused on general-purpose assistants. While Chat GPT and similar tools generated public excitement, venture investors increasingly recognize that the largest dollar opportunities lie in domain-specific applications where AI solves acute problems within industries accustomed to substantial technology spending.

Team Quality and Pedigree

Many mega-round recipients feature founding teams with exceptional pedigree: researchers from leading AI labs, operators from successful tech companies, or industry veterans. This reflects venture investors' growing confidence that AI company success correlates strongly with founding team quality. When building technically complex products in a domain evolving extremely rapidly (AI), having founding teams that have "seen the movie before"—whether at leading AI labs or prior successful ventures—substantially reduces execution risk.

Burn Rates and Economics: The Cost of AI

Companies raising mega-rounds in 2025 face unique economic pressures compared to companies in other technology categories.

Computational Costs and Infrastructure

Building AI products requires access to expensive computational resources. Companies training large models or running computationally intensive workloads face monthly GPU and cloud computing costs in the millions. A company might burn

Mega-round capital allows companies to sustain high burn rates while reaching meaningful revenue scale. A company raising $250 million can sustain 2-3 years of operations at burn rates that would be catastrophic at smaller scale. This timeline provides runway to recruit teams, develop products, achieve product-market fit, and approach revenue scale—a much longer journey than many non-AI software companies require.

Capital Intensity and Runway Calculations

The computational cost structure explains why AI startups raise larger rounds than comparable software companies. A SaaS startup in 2010 might raise

This creates an interesting dynamic: mega-round AI companies have less room for error than well-funded but less richly-funded companies. A

In 2025, 55 US-based AI startups raised $100M+ in funding rounds, up from 49 in 2024, indicating robust investor confidence despite economic challenges.

Competitive Dynamics: The Race for AI Dominance

As capital concentrates on AI companies in 2025, competition intensifies within sub-categories.

Consolidation Pressures

With dozens of companies targeting similar problems and venture investors willing to fund competition, the eventual market structure likely involves substantial consolidation. Companies raising mega-rounds face pressure to expand aggressively, acquire complementary technologies, and build defensible competitive positions before larger competitors emerge.

Larger tech companies (Google, Microsoft, Amazon, Meta) also compete with well-funded startups. While startups can move faster and focus narrowly, big tech companies control cloud infrastructure, have proprietary data, and command distribution advantages. Several mega-round recipients likely represent potential acquisition targets for these companies, with investors and founders understanding that exit opportunities exist even if the startup doesn't achieve IPO-scale independence.

Winner-Take-Most Dynamics

In infrastructure and platform categories, winner-take-most dynamics often emerge. The company providing the best-in-class model serving platform, inference optimization, or AI chip design might eventually dominate their category, with competitors struggling to maintain viability. This explains why multiple companies compete in each category despite the massive capital available—the payoff for winning a category is enormous enough to justify betting that your company will emerge victorious.

International Context and US Dominance

The concentration of mega-round recipients in the United States reflects several factors unique to the American venture capital ecosystem.

Capital Availability and Venture Tradition

The US venture capital market contains more capital, more experienced investors, and more established support infrastructure (legal, accounting, recruiting) than anywhere else. American entrepreneurs founding AI companies benefit from access to venture firms with actual experience deploying capital at similar scale, investment theses developed over years of AI observation, and networks facilitating customer introductions and hiring.

This concentration in the US also reflects which countries trained the researchers driving AI advancement. While AI research is increasingly global, many foundational breakthroughs over the past decade emerged from US universities and tech companies, creating an ecosystem of experienced researchers accustomed to working with venture capital.

The Deep Seek Challenge

The emergence of Deep Seek—a Chinese AI startup developing surprisingly capable models—demonstrates that US dominance is not inevitable. Deep Seek's achievement of competitive performance with lower computational costs than many observers expected raised questions about whether AI leadership requires access to the most capital, or whether clever technical approaches could compete with brute-force resource application.

Companies like Reflection AI positioning themselves as "Deep Seek competitors" suggest that some US startups are rising to meet this challenge, though Deep Seek's model is not widely deployed in US enterprise environments due to geopolitical constraints.

Future Outlook: Predicting 2026 and Beyond

Extrapolating from 2025's patterns provides perspective on likely future trajectories.

Continued Strong Funding, But With Increased Selectivity

Early 2026 results—including x AI's

Consolidation and Acquisition Activity

As mega-round recipients mature and larger tech companies recognize the strategic value of leading AI startups, acquisition activity likely accelerates. Tech companies increasingly see startup acquisitions not as hiring expensive talent, but as acquiring proven product-market fit, defensible technology, and established customer relationships. Mega-round recipients could become prime acquisition targets, with valuations potentially justifying founder and investor returns despite sub-IPO outcomes.

Market Maturation and Efficiency

As the AI ecosystem matures, capital efficiency likely improves. Early-stage startups currently raise large rounds based on opportunity thesis and team quality with limited revenue. As successful examples demonstrate which approaches generate defensible businesses, later startups will require less total capital to achieve equivalent outcomes. This could reduce mega-round frequency even if aggregate AI funding continues growing—the capital concentrates on fewer, more selected companies.

Lessons for Entrepreneurs and Investors

The patterns evident in 2025's mega-round cohort offer insights applicable beyond just fundraising.

Pattern 1: Technical Depth Matters

The founders and teams that raised mega-rounds typically demonstrated exceptional technical depth. Founders from leading AI labs, prior successful tech companies, or with demonstrated research contributions disproportionately represented mega-round recipients. For entrepreneurs, this suggests that deep technical expertise remains among the most important assets when fundraising for AI companies.

Pattern 2: Problem Clarity Attracts Capital

Companies addressing extremely clear problems in well-defined markets attracted mega-round capital more readily than companies pursuing moonshot innovations. Healthcare AI, legal AI, and developer tools all address acute problems with quantifiable solutions and existing customer budgets. This contrasts with some more speculative bets on entirely new categories.

Pattern 3: Specialization Over Generalization

Vertical and specialized approaches outperformed horizontal "AI for everything" applications in attracting mega-round capital. This suggests investors increasingly believe AI success requires domain-specific optimization rather than hoping general intelligence translates to domain excellence.

Pattern 4: Infrastructure Positions Create Moats

Infrastructure companies attracted disproportionate capital relative to their number, suggesting investor conviction that infrastructure positions create defensible competitive advantages. For entrepreneurs, this implies that building foundational technology serving multiple downstream applications can justify extraordinary capital amounts.

Regulatory and Ethical Considerations

As AI funding accelerates, regulatory scrutiny increases in parallel.

Regulatory Uncertainty

Despite substantial funding, AI companies operate within increasing regulatory uncertainty. Questions about AI safety, bias, transparency, and intellectual property remain substantially unresolved at regulatory and legal levels. Companies raising mega-rounds must navigate this uncertainty while building products that eventually need to comply with regulations that don't yet fully exist.

This creates strategic optionality: companies focused on sectors with established regulatory frameworks (healthcare, finance, legal) may face clearer compliance pathways than companies building consumer-facing tools where regulations remain in flux. The concentration of funding on regulated-industry-focused AI companies may partly reflect this dynamic.

Safety and Alignment

Anthropic's prominence among mega-round recipients reflects investor recognition that AI safety is simultaneously important and increasingly prioritized by enterprise customers. Healthcare providers, financial institutions, and legal firms want AI solutions that they can understand, audit, and trust. Companies demonstrating these qualities attract premium valuations and customer confidence.

The Broader Technology Ecosystem Impact

The concentration of mega-round capital on AI startups creates spillover effects throughout the technology ecosystem.

Talent Market Disruption

AI startups raising mega-rounds can offer substantial compensation—both salary and equity—to recruit top technical talent. This creates significant competition for engineers and researchers from traditional tech companies and non-AI startups. The talent concentration in AI arguably reduces innovation in adjacent fields where capital, but not talent, remains available.

Infrastructure Provider Beneficiaries

Cloud providers (AWS, Google Cloud, Azure), GPU suppliers (Nvidia, AMD), and specialized infrastructure companies benefit directly from AI startup growth. As startups scale compute spending, these providers see increased revenue and usage growth. This dynamic ensures continued investment in AI infrastructure by well-capitalized tech companies.

Venture Capital Concentration

The mega-round concentration on AI reflects venture capital's structural tendency toward concentration. Once a sector gains momentum—in this case, AI—capital floods that sector seeking winners while other promising areas receive reduced attention. This creates cycles where capital-intensive innovation happens in trendy sectors while unsexy problems go underserved.

What This Means for Builders and Teams

For teams considering AI startups in the current environment, the mega-round ecosystem offers both opportunities and challenges.

Opportunities

Funding availability remains exceptional for AI startups with credible technical approaches and teams. If you've built impressive AI technology or solved a meaningful problem with AI, capital is likely available at scale. The venture market's appetite for AI startups means that the traditional "bootstrapping to product-market fit" path faces less pressure—capital can fund that journey.

Additionally, the infrastructure available to AI startups has improved dramatically. Cloud providers offer AI development tools, research papers explaining best practices continue emerging, and the community of AI engineers continues expanding. Building AI products today benefits from accumulated knowledge and tooling unavailable to earlier AI startups.

Challenges

Mega-round funding creates extremely high expectations for execution. Investors backing $200 million Series C rounds don't expect 3-5 year journeys to profitability; they expect measurable progress toward substantive revenue and market position within 12-24 months. The high burn rates driven by computational costs mean that capital depletes quickly despite impressive absolute amounts.

Additionally, with dozens of well-funded competitors in each category, differentiation becomes paramount. Teams must build meaningful defensibility—whether through novel technical approaches, access to unique data, or deep customer relationships—rather than hoping technological execution alone generates victory.

Conclusion: Understanding the 2025 AI Funding Landscape

The emergence of 55 US-based AI startups raising $100 million or more in 2025 represents a substantive inflection point in how venture capital approaches AI. The abundance of mega-round recipients across diverse categories—from infrastructure to vertical applications to frontier research—demonstrates that AI's potential impact extends far beyond the handful of companies dominating public discourse.

The funding concentration reflects genuine optimization: venture investors examining the global opportunity space identify AI as offering extraordinary return potential relative to other investment categories. As generative AI capabilities improve and adoption accelerates, the companies building on these capabilities justify tremendous capital deployment toward growth, team building, and product development.

Several patterns emerge clearly from analyzing 2025's mega-round cohort. First, technical depth remains paramount—founding teams with exceptional AI expertise and prior successful execution attract capital at greater scale than teams with mere enthusiasm. Second, problem clarity beats speculation—companies addressing acute problems in well-defined markets attract capital more readily than moonshot bets on entirely new categories.

Third, specialization outperforms generalization in the current funding environment. Vertical AI companies focused on healthcare, legal, biotech, or other domains attracted disproportionate funding relative to horizontal "AI for everyone" platforms. Fourth, infrastructure positions create defensible value—companies providing foundational technology serving multiple downstream applications justify extraordinary capital amounts through leverage and network effects.

Looking forward, the mega-round trajectory likely continues through at least 2026, though with potential modulation based on execution results from 2024-2025 mega-round recipients. Companies demonstrating clear revenue growth and path to profitability will likely attract continued mega-round funding. Companies with impressive technology but unclear business models may face increasingly difficult capital environments, shifting venture investment toward demonstrated commercial traction.

The ecosystem created by this capital concentration extends far beyond the mega-round recipients themselves. Infrastructure providers, service companies, and supporting technologies all benefit directly. Talent concentration in AI creates both opportunity and challenge for the broader technology ecosystem. The regulatory frameworks governing AI will evolve significantly as these companies scale to maturity.

For entrepreneurs, the current environment offers unprecedented opportunity to build ambitious AI companies with substantial capital backing. For investors, the AI opportunity set remains expansive with new categories and applications emerging regularly. For everyone else, the concentration of AI innovation on mega-round-backed companies suggests that the next decade of technological progress will be shaped powerfully by the companies and teams these capital flows support.

The question moving forward is not whether AI continues attracting venture capital—that seems virtually certain given demonstrated capabilities and market enthusiasm. The question is whether the execution matches the funding, whether 55 mega-round recipients in 2025 eventually consolidate into a smaller number of dominant players, and whether the innovations developed at tremendous capital cost deliver genuine value to customers or primarily enrich investors and founders. History suggests that roughly 10-20% of venture-funded companies with mega-round backing achieve substantial outcomes, another 30-40% exit modestly, and the remainder return losses or minimal gains. The AI cohort of 2025 will follow similar patterns despite the exceptional capital and talent deployed.

FAQ

What defines a mega-round in the AI funding context?

A mega-round refers to a funding round where a startup raises $100 million or more in a single institutional investment round. In the AI context, mega-rounds have become increasingly common as investors recognize the capital intensity of AI product development, the potential market opportunities, and the computational costs required to compete in the sector. Mega-rounds typically indicate that a company has achieved meaningful product-market fit, demonstrated exceptional technical capabilities, or both, and that professional investors have conducted extensive diligence before committing such substantial capital.

Why do AI companies require more funding than traditional software startups?

AI companies face substantially higher capital requirements than traditional software startups primarily due to three factors: computational infrastructure costs, talent acquisition expenses, and extended timelines to revenue. Training and serving AI models requires expensive GPU infrastructure that can cost startups

What are the main categories of AI startups receiving mega-round funding in 2025?

The 55 mega-round recipients in 2025 span several primary categories: AI infrastructure (compute optimization, model serving, chip design), vertical applications (healthcare AI, legal AI, biotech AI), frontier models and research, AI agents, developer tools, and enterprise software. Infrastructure companies disproportionately attracted mega-round capital, suggesting investor conviction that foundational technology companies capture value at larger scale than individual application companies. Vertical applications—AI tools optimized for specific industries—particularly attracted funding in regulated industries like healthcare and legal services where problems are acute and customer budgets are substantial.

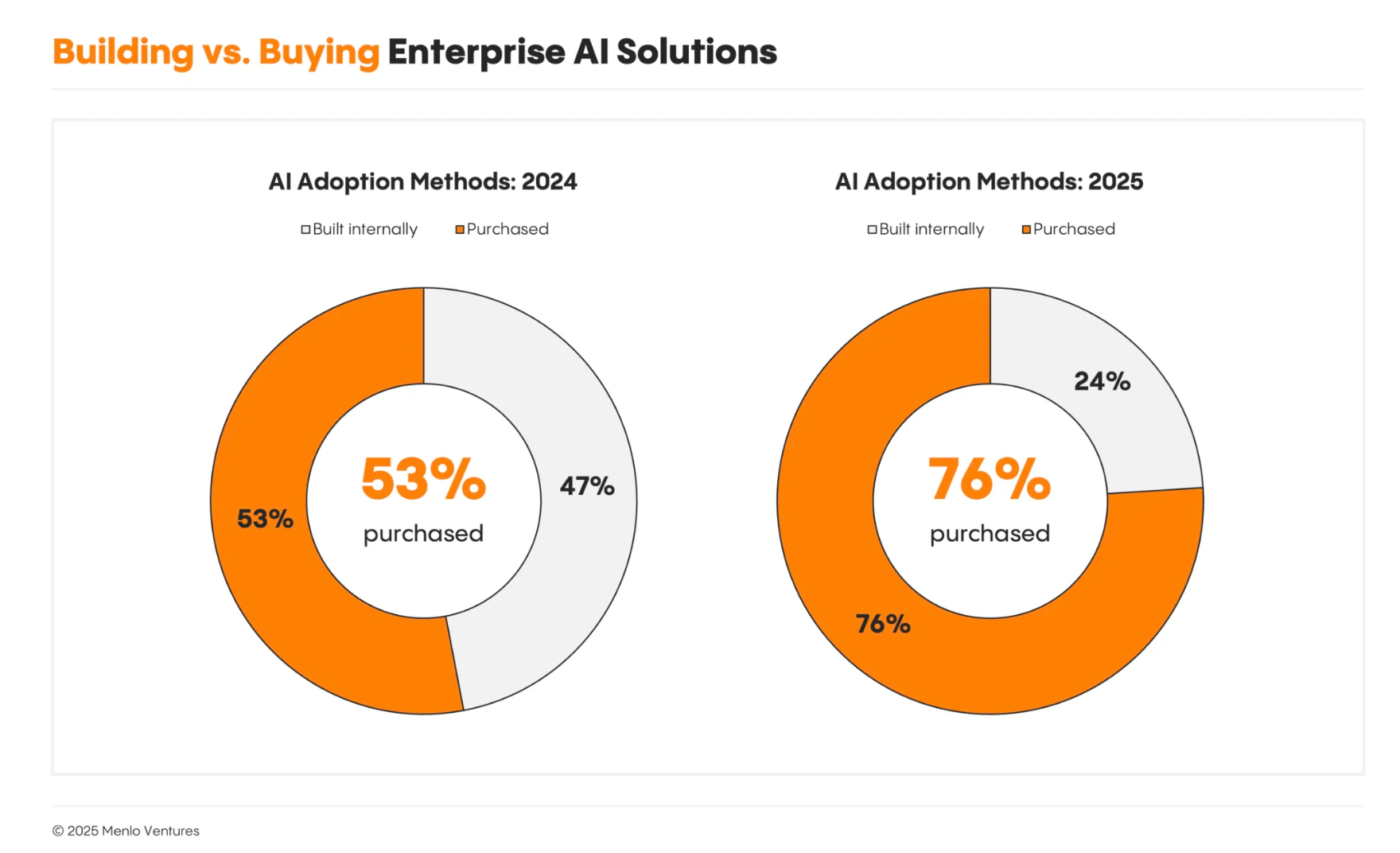

How does venture funding for AI in 2025 compare to 2024 and prior years?

While the exact number varies (49 mega-round recipients in 2024 versus 55 in 2025), the trend shows consistent strong funding for AI startups with some interesting variations. In 2024, three companies raised multiple mega-rounds, while in 2025, eight companies achieved multiple mega-round funding. This suggests that successful companies are accessing follow-on mega-rounds more readily, indicating strong execution and investor confidence in top performers. Additionally, fewer companies exceeded $1 billion individual rounds in 2025 compared to 2024, potentially reflecting market maturation or increased investor selectivity around valuations. The aggregate capital deployed remains substantial even if mega-round frequency shows modest variation.

Which venture capital firms most actively led mega-rounds in 2025?

Sequoia Capital, Andreessen Horowitz, and Lightspeed Venture Partners appear most frequently among mega-round leaders in 2025. These firms have developed strong AI theses, built relationships with exceptional founders, and demonstrated ability to provide value beyond capital through operational expertise and customer introductions. Notably, strategic corporate investors like Nvidia, Snowflake, Databricks, and AMD played increasingly active roles in mega-rounds, either as co-leads or major participants. This reflects recognition by infrastructure companies that AI startups represent important customers or strategic acquisition opportunities.

What business models emerge as most attractive to mega-round investors?

Vertical specialization models, particularly in regulated industries with clear ROI metrics, attracted disproportionate mega-round capital in 2025. Healthcare, legal, and biotech-focused AI companies represented among the most well-funded recipients. Infrastructure companies—those providing foundational technology serving multiple downstream applications—similarly attracted substantial capital based on leverage and network effects. Conversely, horizontal "AI for everyone" platforms attracted less mega-round funding, suggesting investor skepticism about general-purpose approaches competing against specialized solutions. For-service models where AI companies provide specialized services rather than platforms also appeared attractive to mega-round investors seeking businesses with defensible unit economics.

What happens to mega-round recipients over the following 24-36 months?

Historically, venture-backed companies receiving mega-round funding achieve varied outcomes. Approximately 10-20% achieve exceptional success—IPO, multi-billion dollar acquisition, or independent profitability at scale. Another 30-40% achieve modest exits through acquisition or manage to achieve profitability, returning investor capital with reasonable returns. The remaining 40-50% either shut down, require additional funding at reduced valuations, or generate minimal returns. AI mega-round recipients likely follow similar distributions despite exceptional capital and talent deployment. Success correlates strongly with execution quality, market timing, and founder judgment about prioritizing profitability over growth.

How does mega-round funding affect team building and hiring in AI startups?

Mega-round funding fundamentally changes team building dynamics by enabling substantial salary and equity compensation that can compete with large technology companies for top talent. AI startups with

What regulatory and compliance challenges do mega-round AI startups face?

Regulatory uncertainty represents a significant challenge for AI startups operating in domains with emerging regulatory frameworks. Healthcare AI companies must navigate FDA requirements, data privacy regulations, and clinical validation standards. Legal AI companies address ethical obligations regarding attorney responsibility and client communication. Financial services AI faces regulatory scrutiny around fairness, bias, and disclosure. This regulatory complexity explains why mega-round capital sometimes concentrates on companies addressing highly regulated domains—the regulatory barriers create competitive moats and customer willingness to pay for compliant solutions. Conversely, consumer-facing AI tools face less clear regulatory pathways, potentially deterring some mega-round investment.

What are the most important success factors for AI startups seeking mega-round funding?

Based on analyzing 2025's mega-round recipients, several success factors emerge as consistently important. First, founding team technical depth—founders from leading AI labs, prior successful tech companies, or with demonstrated research contributions disproportionately accessed mega-round funding. Second, problem clarity—companies addressing acute problems with quantifiable solutions and existing customer budgets attracted capital more readily than moonshot bets on entirely new categories. Third, product-market fit evidence—companies demonstrating meaningful usage, revenue, or both received mega-rounds more readily than those with merely impressive technology. Fourth, clear competitive differentiation—companies articulating defensible advantages through novel algorithms, unique data access, or superior unit economics attracted capital more readily than those claiming technology leadership alone.

How will AI mega-round funding likely evolve through 2026 and beyond?

Based on early 2026 signals and 2025 patterns, mega-round funding will likely continue strongly through 2026, though with increased selectivity. Companies demonstrating clear revenue growth and path to profitability will attract continued mega-round funding and follow-on capital. Companies with impressive technology but ambiguous business models may face increasingly difficult capital environments. Consolidation and acquisition activity will likely accelerate, particularly as larger tech companies recognize the strategic value of proven AI companies. Market efficiency likely improves over time—earlier-stage startups eventually requiring less total capital to achieve equivalent outcomes as successful models demonstrate which approaches generate defensible businesses. The fundamental opportunity thesis around AI remains intact, but capital allocation toward increasingly proven and profitable companies will likely intensify.

Key Takeaways

- 55 US AI startups raised $100M+ in 2025, reflecting exceptional capital availability and investor conviction in AI opportunities

- Infrastructure companies attracted disproportionate mega-round capital, suggesting investor belief that foundational technologies create defensible competitive advantages

- Vertical AI applications, particularly in healthcare and legal, outperformed horizontal platforms in mega-round fundraising, indicating preference for domain-specific solutions

- Founding team technical depth emerges as critical success factor—teams from leading AI labs and prior successful ventures disproportionately accessed mega-round funding

- Mega-round AI companies face exceptional execution pressure with burn rates requiring revenue progress toward sustainability within 12-24 months of funding

- Strategic corporate investors increasingly participate in mega-rounds as tech companies recognize AI startups as important customers or acquisition opportunities

- Regulatory clarity in established industries like healthcare and legal partially explains funding concentration toward vertical applications

- While mega-round funding accelerates growth, historical venture outcomes suggest only 10-20% of recipients achieve exceptional success despite high capital deployment

- Consolidation and acquisition activity will likely accelerate as larger tech companies compete for proven AI companies and technology

- Market efficiency improvements expected as successful business models become clearer, potentially reducing mega-round frequency while maintaining aggregate AI funding

Related Articles

- AI Bubble Myth: Understanding 3 Distinct Layers & Timelines

- Elon Musk's $134B OpenAI Lawsuit: What's Really at Stake [2025]

- Startup Battlefield 200 2026: Complete Guide for Founders [2025]

- Why Agentic AI Pilots Stall & How to Fix Them [2025]

- IT Spending Hits $1.4 Trillion in 2026: Where Money Really Goes [2025]

- How Bucket Robotics Conquered CES 2026: YC Startup's First Big Show [2026]