How Satellite Imagery Became the Next Data Goldmine

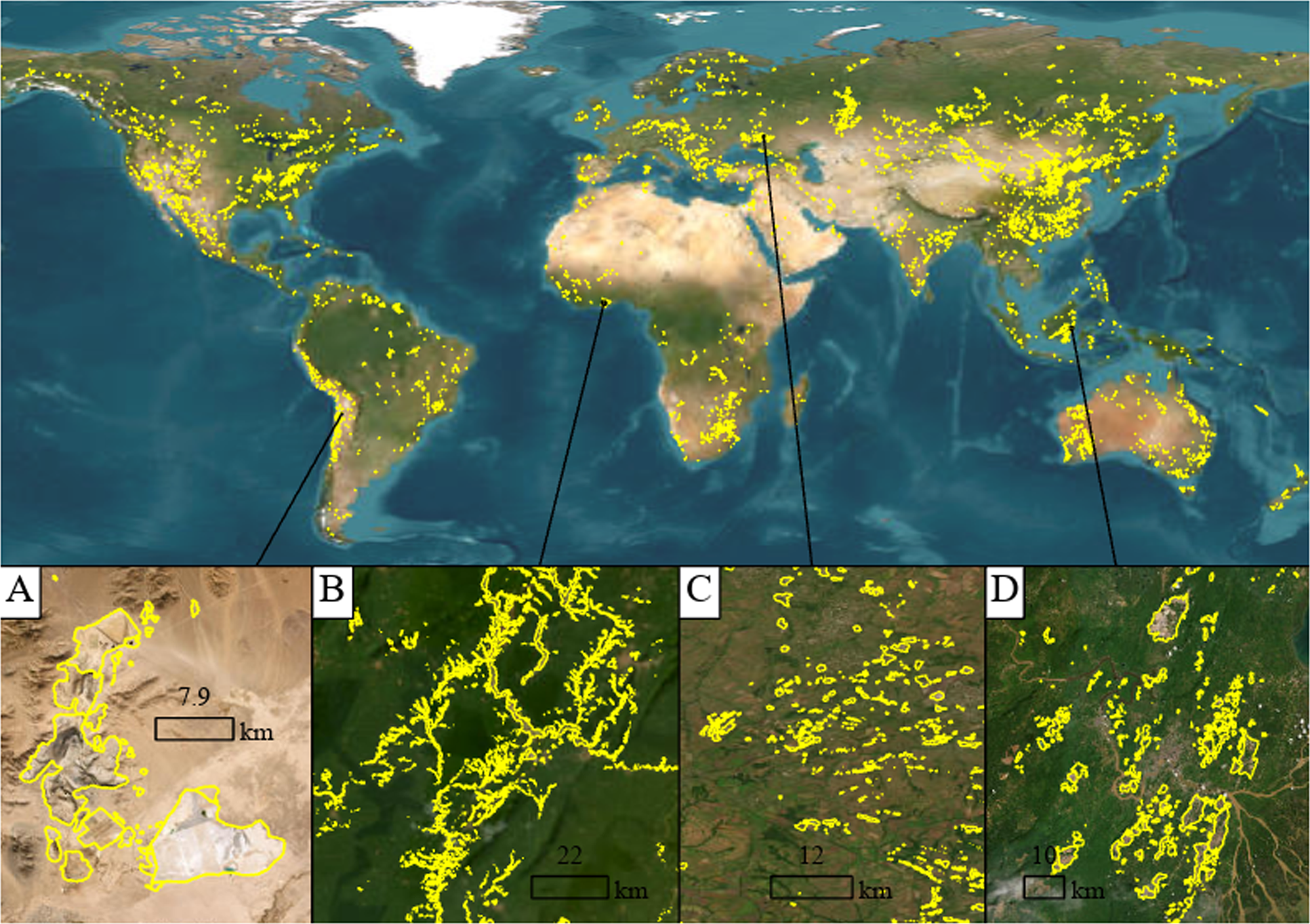

There's something humbling about realizing that the sky above your head is basically a constant surveillance camera. Thousands of satellites orbit Earth at this very moment, capturing images of everything from your neighborhood to major infrastructure projects to agricultural patterns across continents. The problem? For years, accessing those images felt like hunting for a needle in a haystack while wearing oven mitts.

Then along came SkyFi, an Austin-based startup that's fundamentally changed how businesses, governments, and enterprises get their hands on satellite imagery. Think of it as a combination of Getty Images and Google Maps on steroids, but specifically designed to turn raw pixel data into answers that matter.

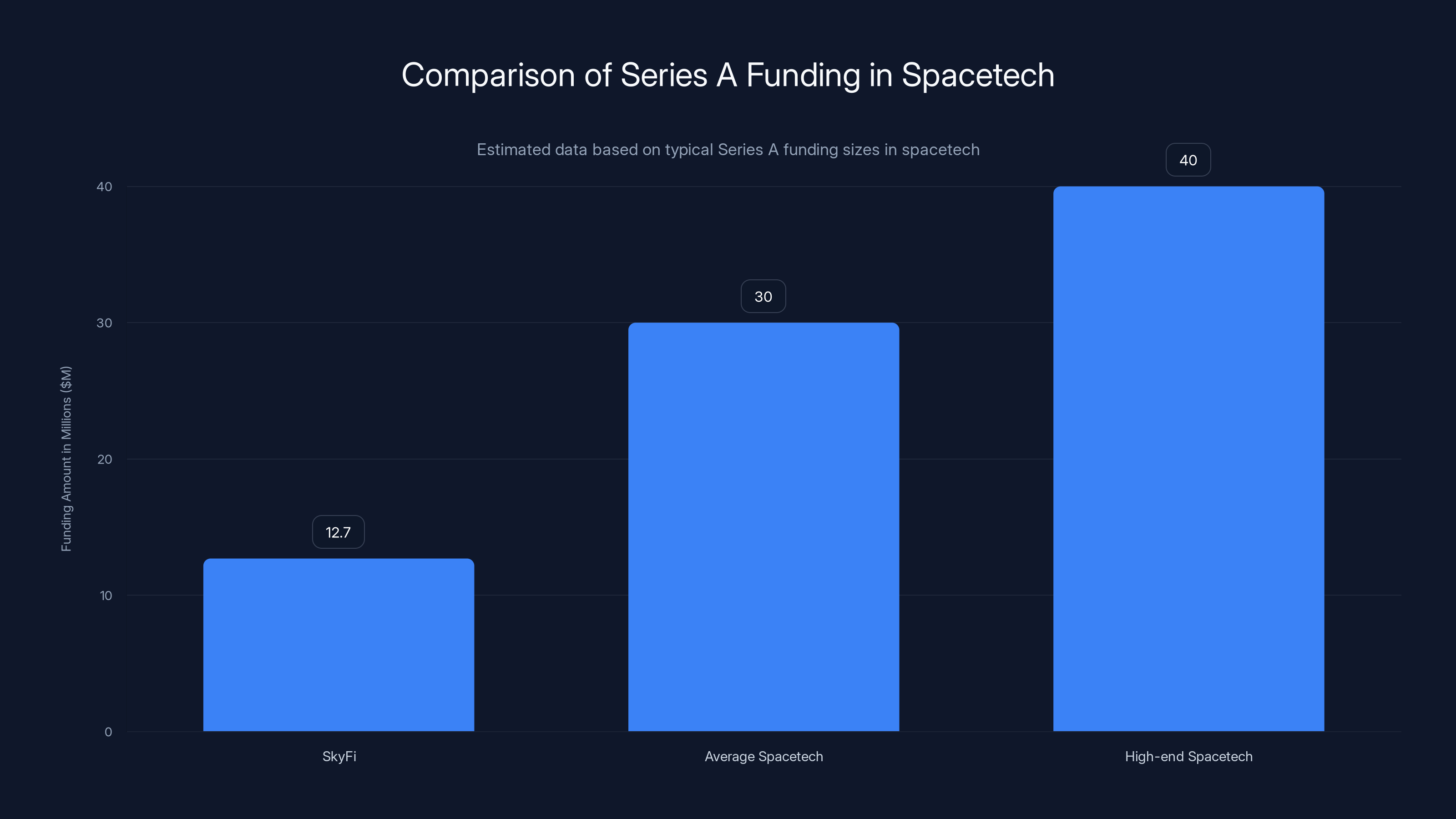

The company just closed a $12.7 million Series A funding round, a signal that the market for satellite-derived insights has matured from niche technical tool to essential business infrastructure. But what's really interesting isn't the funding itself. It's what the funding enables, and what it tells us about where geospatial intelligence is headed.

Let's dig into what SkyFi is actually doing, why it matters, and what this funding says about the future of space-based data as a competitive advantage.

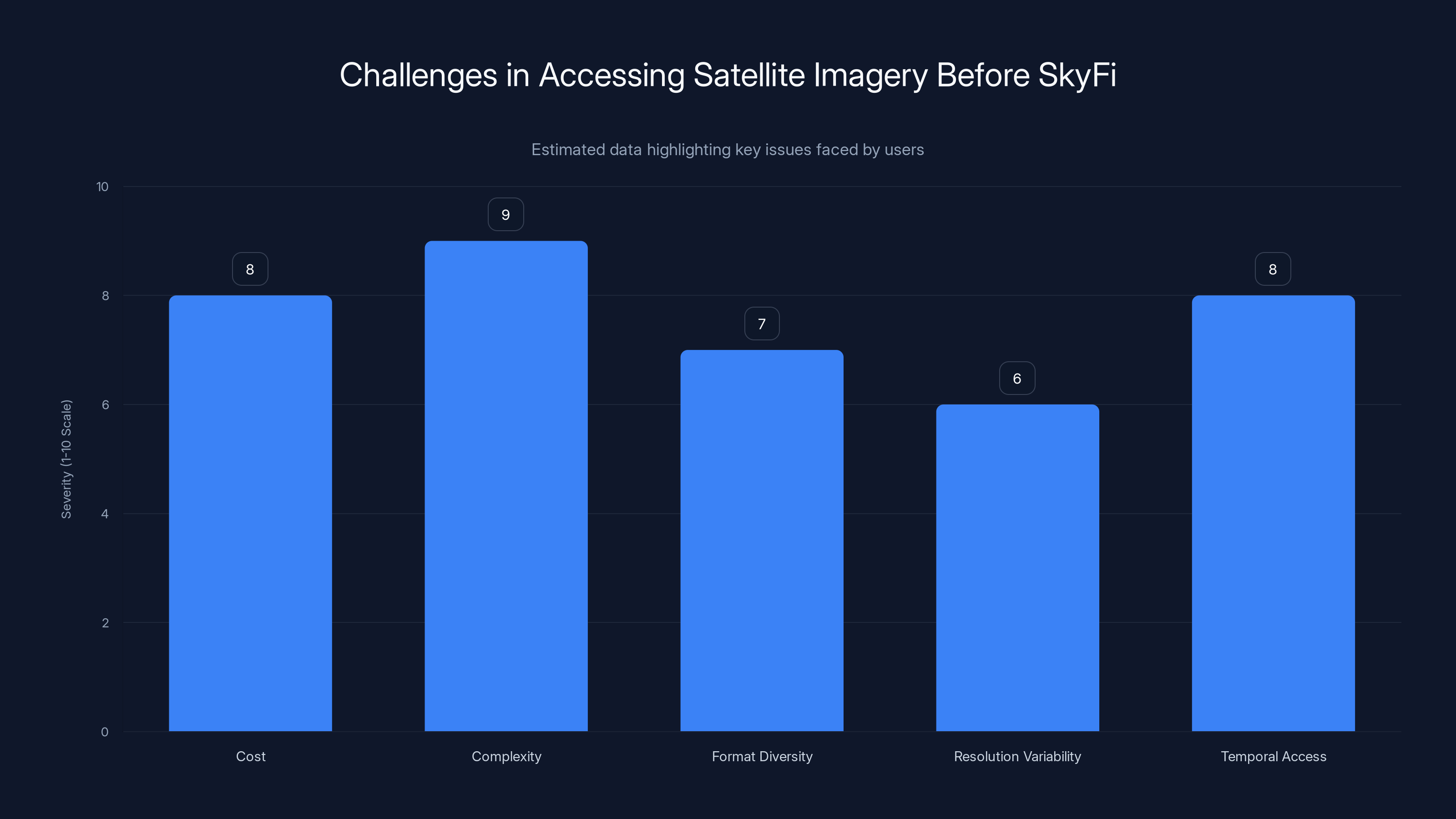

The Messy Reality of Satellite Imagery Before SkyFi

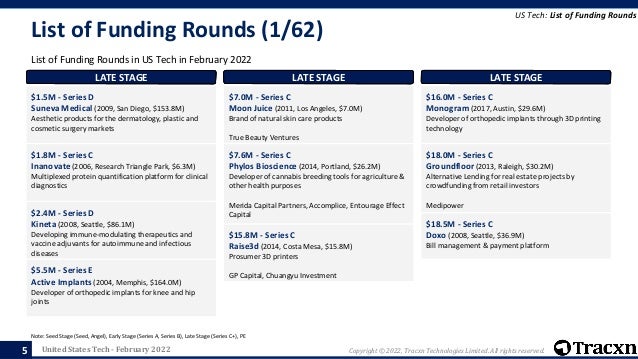

For decades, accessing satellite imagery was a bureaucratic nightmare. Organizations had a few unpleasant choices: purchase expensive one-off imagery from providers like Maxar or Planet Labs, navigate complex APIs from multiple providers, or hire a consultant who specialized in geospatial data just to figure out what was available.

Worse, different satellite operators used different formats, different resolutions, different temporal frequencies. Want imagery from a specific location on a specific date? Good luck coordinating across five different data providers with five different systems, pricing models, and technical specifications.

The underlying technology was powerful. Satellites have been capable of capturing high-resolution imagery for decades. But the distribution layer was fragmented, expensive, and time-consuming. It's the classic Silicon Valley problem: powerful underlying technology, terrible user experience.

SkyFi identified this gap and built what's essentially a unified marketplace. The platform aggregates imagery from more than 50 space-based imagery providers and makes it accessible through a single interface. But here's the critical part: SkyFi didn't stop at distribution. The company pivoted to what CEO Luke Fischer calls "the real goal for us," which is providing answers, not just imagery.

SkyFi's

SkyFi's Business Model: From Commodity to Insight

Early on, SkyFi operated as a straightforward marketplace. You needed satellite imagery? You found it on SkyFi's platform, purchased it, downloaded it, and went on your way.

But Fischer and co-founder Bill Perkins—who comes from the hedge fund world—realized that customers cared less about the raw imagery and far more about what they could do with it. A hedge fund doesn't want satellite pictures. They want to know whether retail traffic at a competitor's store locations is increasing or decreasing. An insurance company doesn't want image files. They want to know the extent of damage after a natural disaster.

This insight drove a fundamental shift in the company's strategy. Instead of selling imagery as a commodity, SkyFi began layering analytics and intelligence on top of it.

The company built tools that allow customers to:

- Extract actionable insights from imagery rather than just viewing raw satellite photos

- Task satellites to capture images of specific locations at specific times (this is huge—it means you're not limited to existing image archives, but can request fresh observation)

- Access insights through mobile and web platforms that don't require specialized geospatial expertise to navigate

- Integrate satellite data into existing business workflows and decision systems

This is a classic software-first pivot. Instead of being in the imagery business, SkyFi is in the insights business. The satellite data is just the input layer.

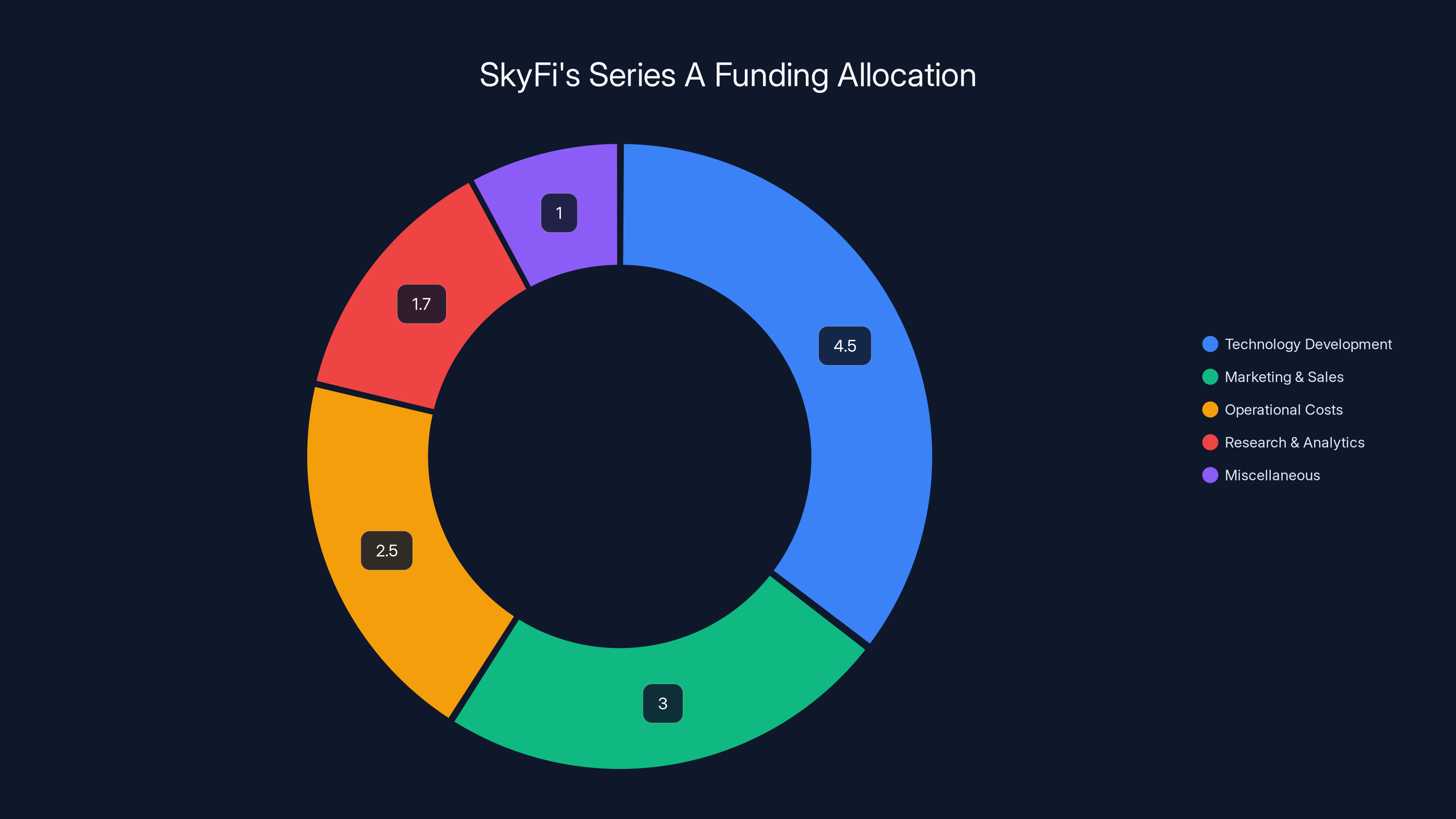

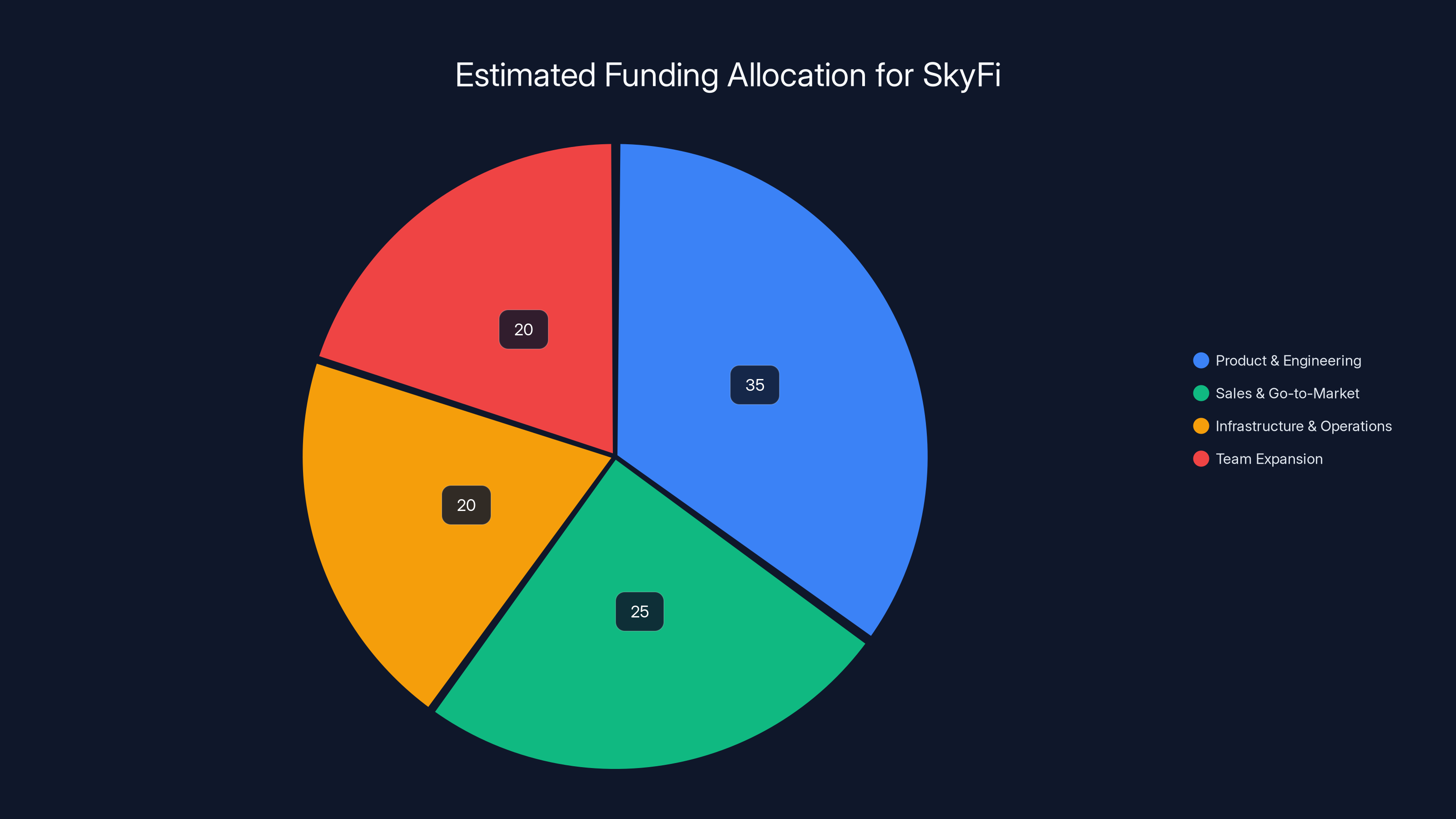

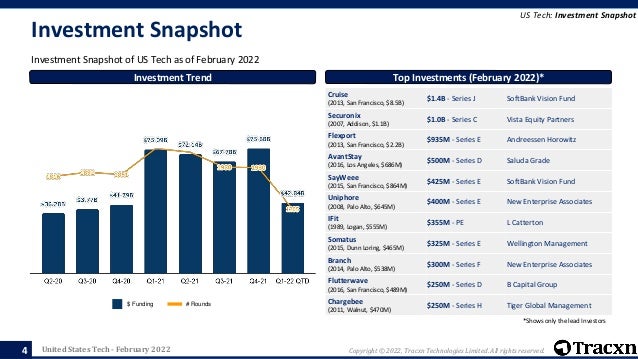

SkyFi's Series A funding round exceeded targets, raising $12.7 million. Estimated allocation shows a focus on technology development and marketing.

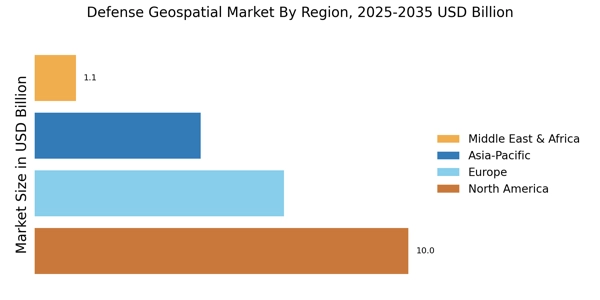

Why Defense Investment Is Pouring Into Geospatial Intelligence

Look at SkyFi's Series A investors and you'll see something striking: climate-focused fund Buoyant Ventures and Iron Gate Capital Advisors, which specifically invests in dual-use companies. Also on the cap table: DNV Ventures (from a 160-year-old maritime company), Beyond Earth Ventures (space-focused), and TFX Capital (which focuses on defense-related space investments).

This investor mix isn't random. It reflects a broader geopolitical reality: satellite imagery has become a national security asset, and the private sector is increasingly providing capabilities that were once exclusive to government.

Fischer mentioned that 2025 was a record year for defense-related investments. SkyFi initially sought to raise

Why the explosive demand? Several factors converge here.

First, geopolitical tension has increased the value of real-time intelligence. When you can watch activities across borders or monitor infrastructure without putting people at risk, satellite imagery becomes a strategic asset. Ukraine's use of commercial satellite imagery during its conflict with Russia normalized the idea that civilian space tech could serve defense purposes.

Second, climate and infrastructure challenges are massive. Insurance companies need to assess disaster damage. Infrastructure companies need to monitor project progress. Supply chain operators need to track port activity, agricultural productivity, and resource extraction. Satellite imagery provides an objective, difficult-to-fake data source.

Third, there's a skills bottleneck. Organizations want satellite data, but they don't want to hire specialized geospatial scientists to extract value from it. They want platforms that abstract away the complexity.

SkyFi addresses all three of these dynamics.

The Virtual Constellation: SkyFi's Data Advantage

Fischer uses the term "virtual constellation" to describe SkyFi's competitive moat. Rather than owning and operating satellites (which would be capital intensive and operationally complex), SkyFi essentially controls access to a vast array of satellite operators and sensor types.

This is smart architecture for several reasons.

Capital efficiency: Satellites cost hundreds of millions of dollars to build and launch. By acting as a software layer on top of existing satellite operators, SkyFi avoids this capital burden entirely. They're a software company, not a hardware company—which is important because software companies get software valuations, and hardware companies face lower margins and longer capital cycles.

Data supply diversity: Different satellites capture different types of data. Some provide high-resolution optical imagery. Others capture multispectral data (useful for agricultural monitoring, water quality analysis, etc.). Still others capture synthetic aperture radar (SAR), which can see through clouds and darkness. By integrating with 50+ providers, SkyFi can offer customers the right sensor type for their specific use case.

Feedback loop advantage: Because SkyFi processes thousands of customer requests, the company gains insight into what customers actually care about. Fischer describes it this way: "We know better than anyone what they're asking for." This knowledge becomes proprietary. It drives product development. It informs which analytics features to build next.

He drew an analogy to his time at Uber: "Uber has data on where people move in the world. They layer different products. We have that equivalent data on what people are looking at in the world and what they're asking of that data." This feedback loop gives SkyFi visibility into customer needs that even the satellite operators themselves might not have.

Estimated data suggests that SkyFi will allocate a significant portion of its $12.7 million funding to Product & Engineering (35%) and Sales & Go-to-Market (25%), reflecting its strategic focus on expanding analytics capabilities and market reach.

Real-World Applications: Where Satellite Insights Prove Their Worth

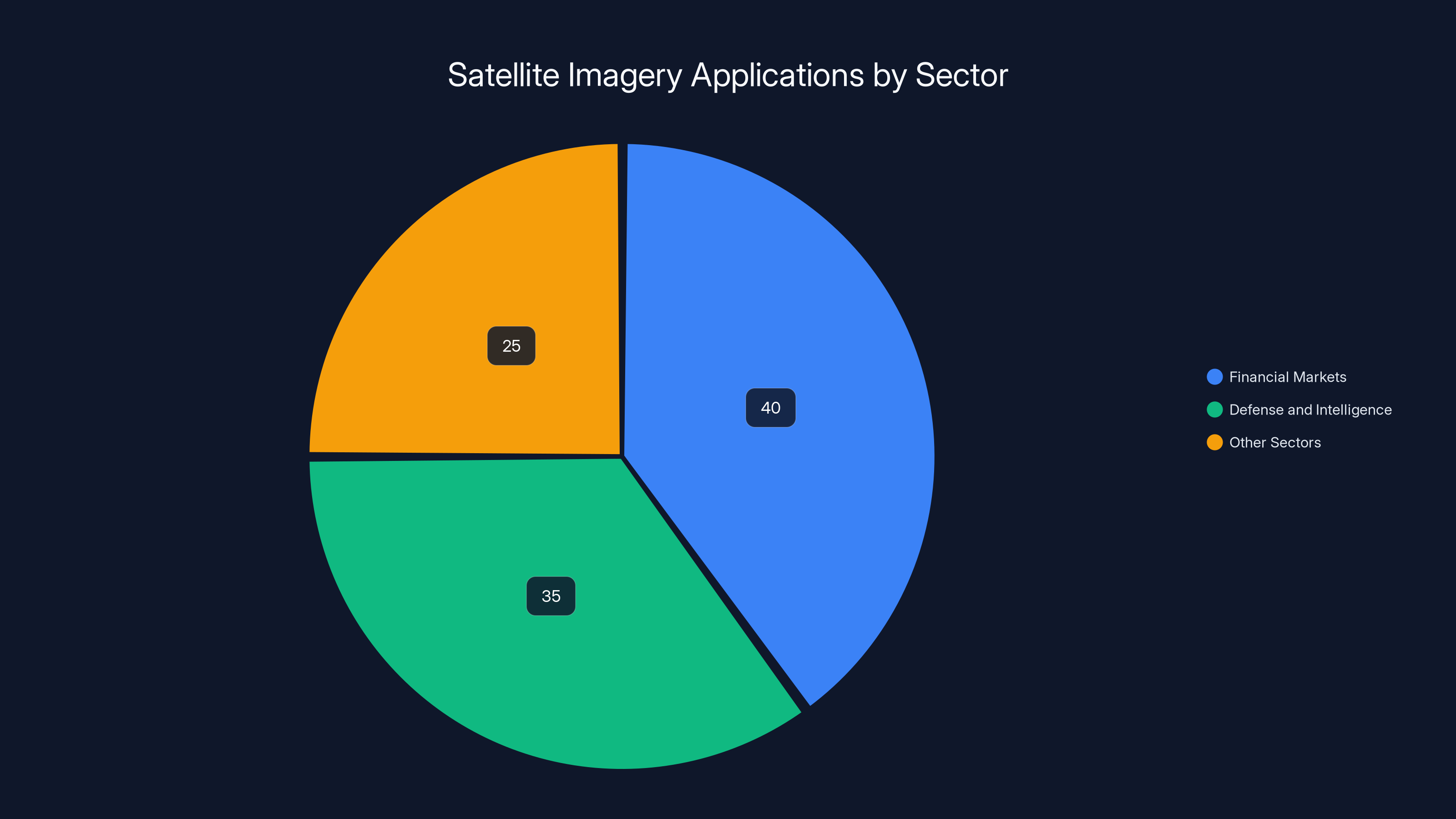

SkyFi's customer base spans several core verticals, each with distinct use cases.

Financial Markets and Intelligence

Hedge funds were early adopters. The use case is straightforward but powerful: alternative data. Traditional financial data comes from quarterly reports, earnings calls, press releases—all of which are public and widely available. To gain a competitive edge, sophisticated investors hunt for alternative data sources.

Satellite imagery provides that alternative data. A hedge fund can monitor retail foot traffic at a competitor's store locations by analyzing satellite imagery over time. Are parking lots getting fuller or emptier? Are loading docks busier? Is construction activity increasing or decreasing?

This kind of ground-truth data can inform investment decisions before the company reports quarterly results. It's legal, it doesn't involve insider information, but it's ahead of public consensus.

Fischer notes that some customers in this category want to do their own analytics—they have data science teams and want to build proprietary models. These customers are less interested in SkyFi's analytics layer; they just want access to imagery. But Fischer also notes that this is a shrinking segment. Most customers increasingly want SkyFi's insights baked in.

Defense and Intelligence

Government agencies, allied military operations, and defense contractors all need persistent geospatial intelligence. The ability to task satellites to capture imagery of specific locations at specific times is particularly valuable here. Rather than waiting for the next scheduled overflight of a region, you can request an urgent observation.

The defense use case also drives demand for certain data types—SAR imagery, which works in darkness and clouds, is particularly valuable for military applications. SkyFi's integration with multiple sensor types means government customers can access the right tool for the mission.

Infrastructure and Project Management

Constructing a major infrastructure project involves coordinating contractors, materials, equipment, and timelines across months or years. Satellite imagery provides an objective record of progress. You can use time-series satellite data to track construction timelines, verify contractor work, and identify project delays.

This might seem niche, but consider the scale: major infrastructure projects are worth billions. A 5% delay might cost millions. Having objective progress verification can prevent disputes and identify issues early.

Insurance and Natural Disaster Response

When hurricanes, floods, or earthquakes strike, insurance companies need to rapidly assess damage across thousands of properties. Satellite imagery provides quick, comprehensive coverage. Rather than sending adjusters to every property (expensive and slow), insurers can use pre-incident and post-incident satellite imagery to evaluate damage.

SkyFi's analytics layer becomes valuable here because the company can automate damage detection—using computer vision and machine learning to identify damaged structures, flooding extent, and other indicators of loss.

The Accessibility Story: Teenagers Can Now Task Satellites

One of the most revealing moments in Fischer's comments was almost throwaway: "My teenage daughters task satellites for their high school, and now college, homework on their iPhones."

Think about that for a moment. Just a few years ago, accessing satellite imagery required specialized knowledge and significant expense. Now, a high school student can request a satellite observation through a mobile app.

This is a critical validation of SkyFi's product design. The company hasn't just created a technical platform—it's created an accessible platform. The company didn't just make it easier for experts to access imagery; it made it possible for non-experts to use it.

This democratization of satellite imagery access is genuinely consequential. It means:

- Students studying environmental science can access real satellite data for research projects

- NGOs monitoring deforestation or resource extraction don't need to hire specialized consultants

- Local governments can assess their own infrastructure without expensive external analysts

- Small businesses can access the same satellite intelligence that hedge funds and governments use

This is textbook platform democratization. As tools become more accessible, their use cases multiply. The company that makes satellite imagery usable by non-experts unlocks entirely new markets.

Estimated data shows that financial markets and defense sectors are major users of satellite insights, with financial markets slightly leading.

Understanding the Funding: Why $12.7M and Why Now

The Series A size is informative.

But several factors explain the size:

Efficient capital model: Because SkyFi is software-first, not hardware-first, the company doesn't need massive capital to build satellites, launch them, or operate them. The capital goes toward engineering, product development, and sales. The underlying infrastructure is funded by existing satellite operators.

Strong revenue pull-through: SkyFi's Series A oversubscription suggests the company already had strong traction. Fischer mentioned that customer demand exceeded expectations, which drove up the round size from initial targets. Companies with strong product-market fit don't need to raise as much capital because they're already generating revenue.

Investor motivation: The investor mix reveals strategic rather than purely financial motivation. DNV Ventures invested because DNV—a maritime classification and certification company—uses satellite data for ocean monitoring. Iron Gate Capital focuses on dual-use companies because of their national security implications. These investors care about strategic access and market positioning, not just capital return multiples.

The timing also matters. 2025 is indeed seeing record defense spending and government investment in space-related capabilities. Companies positioned to provide geospatial intelligence to government agencies are well-positioned to benefit.

The Competitive Landscape: SkyFi's Position

SkyFi isn't operating in a vacuum. The satellite imagery and geospatial intelligence space includes several competitors and adjacent players.

Direct competitors like Planet Labs and Maxar Technologies operate satellites and sell imagery directly. Their advantage is that they control the entire supply chain. Their disadvantage is capital intensity—they need to constantly fund satellite development, launches, and operations.

Platform competitors like Palantir provide analytics and intelligence platforms, though they typically focus on different data sources (financial records, communications data, etc.) and serve primarily government customers.

Emerging platforms are building analytics on top of public satellite data from providers like Landsat and Sentinel.

SkyFi's competitive advantage is that it sits in an interesting middle ground. The company controls neither the satellites nor the customers' downstream applications, but it controls the critical middle layer: the aggregation, access, and insight extraction. This is actually a powerful position because it doesn't require the capital intensity of satellite operations or the government relationships required for platform companies like Palantir.

The line chart illustrates the estimated growth in defense-related investments in geospatial intelligence, highlighting a significant increase from 2020 to 2025. Estimated data based on industry trends.

The Analytics Layer: Where the Real Value Gets Created

Here's where SkyFi's strategic shift from imagery provider to insights provider becomes crucial. Raw satellite images are increasingly commoditized. Planet Labs, Maxar, and others have made high-resolution imagery increasingly affordable.

But extracting value from that imagery requires analytics. And here's the opportunity: most organizations lack the geospatial expertise to do that extraction effectively.

SkyFi's approach is to build vertical-specific analytics. For insurance customers, damage detection. For financial customers, foot traffic and activity monitoring. For infrastructure customers, progress tracking.

These aren't generic analytics. They're built from deep understanding of customer needs, driven by Fischer's insight that the company's thousands of customer requests provide a feedback loop unmatched by traditional satellite operators.

Over time, this analytics layer becomes the stickiest part of the product. Customers can switch satellite providers relatively easily. Switching the analytics layer that they've integrated into their workflows? That's friction.

Onboarding Satellite Providers: From Difficult to Table Stakes

Fischer mentioned something important: it "took a little bit" to convince satellite imagery providers to give SkyFi access to their data. But now, "onboarding new providers is table stakes."

This reflects a maturation in the market. Early on, satellite operators were nervous about disintermediation. If SkyFi controlled customer access, couldn't SkyFi eventually take over the relationship?

But satellite operators came to understand that SkyFi wasn't a threat—it was a sales channel. SkyFi makes it easier to sell imagery to customers who wouldn't otherwise bother navigating complex satellite operator APIs. It's a distribution channel.

Now, satellite operators want to be on SkyFi's platform because it brings customers. The dynamics have flipped. Instead of SkyFi begging for access, providers are competing for inclusion.

This is a textbook platform dynamics play. As the platform becomes more valuable to customers (because it integrates more providers), it becomes more valuable to providers (because it brings more customers). The platform wins by controlling the center.

Before SkyFi, users faced high costs, complexity, and variability in accessing satellite imagery. Estimated data highlights these challenges.

The Software-First Advantage: Why Uber's Playbook Applies Here

Fischer's analogy to Uber isn't casual. It reflects a deliberate product philosophy.

Uber didn't own the cars. It didn't employ the drivers (officially). It built a software platform connecting supply (drivers) and demand (passengers). The platform didn't own the underlying asset—it aggregated access to assets and charged a percentage.

SkyFi is doing something similar. The company doesn't own satellites. It aggregates access to satellite operators (supply) and connects them with customers who want insights (demand). The platform charges a percentage or usage fee.

The advantage of this model:

- Asset-light capital structure: No need to fund multi-billion-dollar satellite development and launches

- Flexibility: Can quickly add or remove data sources without operational complexity

- Margin leverage: As the platform scales, the company can increase software fees without proportional increases in costs

- Product agility: Can release new analytics features weekly, not on the satellite development cycle

Fischer notes explicitly that the company doesn't have "the burden of having to pay for hardware capital expenses." This is crucial because it means more capital can flow to engineering, product, and sales—the activities that drive SaaS growth.

Market Dynamics: Why Geospatial Intelligence Matters More Than Ever

Satellite imagery has always been technically possible. What's changed is the ecosystem around it.

Satellite supply has exploded: Companies like Planet Labs have democratized access. Where it used to take weeks to get suitable imagery of a location, now it might take days or hours. This abundance changes the game—when imagery is abundant, the value shifts to analysis.

Computer vision and machine learning have matured: Extracting meaningful information from images is no longer a PhD-level task. Modern ML models can automate many of the analyses that once required human experts.

Geopolitical tension has increased demand: The normalization of commercial satellite imagery for military and government purposes (particularly Ukraine's use of civilian satellite data) has increased government budgets for this capability.

Climate and infrastructure challenges drive business demand: Companies need better visibility into supply chains, infrastructure projects, agricultural productivity, and climate-related risks. Satellite data provides that visibility.

Data science maturation has changed expectations: Companies now expect to operationalize data into workflows. They don't want data as a one-time report—they want it continuously updated, integrated with their systems, and actionable.

All of these factors converge to create a growing market for satellite-derived insights. SkyFi is well-positioned within that market.

Funding Allocation: What the Capital Will Support

While Fischer didn't break down the specific uses of the $12.7 million, we can infer from the company's strategy where the capital is likely flowing.

Product and engineering: Building more vertical-specific analytics. Expanding the mobile and web platform. Improving the user experience for non-expert users. Integrating more data sources and sensor types.

Sales and go-to-market: Expanding into new verticals beyond finance, defense, and insurance. Building partnerships with systems integrators and consultants who sell to enterprises.

Infrastructure and operations: Improving the technical infrastructure to handle higher data volumes. Reducing latency. Scaling the analytics pipelines.

Team expansion: Hiring specialists in geospatial analysis, machine learning, product management, and sales.

The fact that the round was oversubscribed and included strategic investors suggests the company has more near-term capital efficiency than the $12.7 million implies. The company probably doesn't need to raise again for 24-36 months if execution goes according to plan.

The Broader Implications: Satellite Imagery as Enterprise Infrastructure

What SkyFi is building points to a future where satellite imagery becomes as routine to enterprise decision-making as other data sources.

Imagine a future where:

- Insurance companies automatically incorporate satellite imagery into every property assessment

- Supply chain management systems automatically incorporate satellite observations of ports, logistics hubs, and production facilities

- Real estate platforms automatically include current satellite imagery as a standard feature

- Investment research platforms automatically include satellite-derived metrics alongside financial data

- Climate and ESG reporting incorporates satellite-verified data on deforestation, water usage, and emissions

This future requires infrastructure like SkyFi—not because satellite imagery is new, but because making it accessible and actionable across enterprise workflows requires a layer that satellite operators themselves can't easily provide.

SkyFi is building that layer.

Risks and Constraints: What Could Limit Growth

No story is entirely upside. There are real constraints and risks worth considering.

Commoditization of analytics: If satellite imagery analytics become standardized—which they will—then the analytics layer itself becomes a commodity. SkyFi's advantage is built on being early with vertical-specific analytics. But over time, cloud vendors like AWS and GCP will offer comparable analytics, and SkyFi's moat could erode.

Regulatory uncertainty: Government policies around commercial access to satellite imagery could tighten. National security concerns could drive restrictions. Privacy regulations could limit what SkyFi can offer.

Competitive dynamics: Satellite operators could build their own customer platforms, bypassing SkyFi entirely. Major cloud vendors could build competitive offerings. This would compress margins.

Data quality and latency constraints: Some use cases (real-time monitoring, high-frequency updates) require satellite revisit frequencies that aren't yet available at scale. This limits addressable market.

Customer concentration: Early success often relies on a small number of high-value customers. If a few major customers represent a large portion of revenue, customer churn could be catastrophic.

These risks are real but not necessarily disqualifying. The strategic investor base suggests the market believes SkyFi can navigate them.

Looking Forward: The Next Phase of Growth

Fischer's comments suggest the company's immediate focus is on expanding the insights layer. This makes sense. Intelligence and analytics have better margins, stickier customer relationships, and more defensible moats than commodity imagery distribution.

The next phase likely involves:

Vertical expansion: Building purpose-built solutions for agriculture, real estate, supply chain logistics, and other verticals with clear use cases for satellite-derived insights.

Enterprise integration: Making SkyFi's insights plug into enterprise software systems (CRMs, supply chain management platforms, climate reporting tools, etc.).

Government expansion: While SkyFi serves government customers, there's significant untapped opportunity in expanding relationships with defense, intelligence, and civil government agencies.

International expansion: So far, SkyFi has primarily served US-based customers. International expansion (particularly in Europe, where GDPR and data sovereignty create different requirements) is a significant growth lever.

New sensor types: As new satellite capabilities emerge (hyperspectral imaging, AI-powered satellite processing, etc.), SkyFi could expand its analytics offerings.

None of this is guaranteed, but the Series A funding and oversubscription suggest investors believe SkyFi can execute across multiple of these growth vectors.

Conclusion: When Infrastructure Becomes the Business

SkyFi's Series A funding is significant not because $12.7 million is a huge number, but because it validates a specific thesis: satellite imagery and geospatial intelligence are shifting from niche technical tools to essential enterprise infrastructure.

The company's smart positioning—neither satellite operator nor end-user application, but the critical middle layer—gives it leverage across the value chain. SkyFi controls the customer relationship, aggregates the data supply, and increasingly controls the analytics that extract value from that data.

Fischer's background at Uber provides a helpful framework. Just as Uber didn't need to own cars but became essential infrastructure for urban mobility, SkyFi doesn't need to own satellites but is becoming essential infrastructure for geospatial intelligence.

The defense-focused investor base reflects recognition that satellite imagery has become a strategic capability. The financial investor base reflects recognition that satellite-derived insights create real economic value. The climate and infrastructure investors reflect the growing recognition that Earth observation is critical infrastructure for climate adaptation and infrastructure management.

For organizations that aren't yet using satellite imagery in their decision-making, SkyFi makes that capability more accessible. For organizations already using satellite data, SkyFi's analytics layer potentially unlocks more value from that data.

The Series A funding isn't the end of SkyFi's story—it's really the beginning. The company now has the capital to scale product development, expand the team, and pursue the broader market opportunity. If execution matches ambition, SkyFi could become the critical infrastructure layer for satellite-derived intelligence the same way Stripe became infrastructure for payments or Twilio became infrastructure for communications.

That's a bigger opportunity than just distributing satellite imagery. That's why investors were willing to exceed initial fundraising targets. That's why SkyFi closed a $12.7 million Series A. And that's why satellite imagery, far from being a niche technology, is becoming a core input to how modern organizations understand and navigate the world.

FAQ

What exactly is SkyFi and what problem does it solve?

SkyFi is a platform that aggregates satellite imagery from over 50 different space-based imagery providers and combines it with analytics to deliver actionable insights. The core problem it solves is accessibility—historically, accessing satellite imagery required navigating multiple providers, complex APIs, expensive one-off purchases, and specialized technical expertise. SkyFi simplifies this by providing a unified marketplace with built-in analytics that don't require geospatial expertise to use effectively.

How does SkyFi's business model work?

SkyFi operates as a software-first platform sitting between satellite operators (data suppliers) and customers (demand). Rather than owning satellites or building imagery, the company aggregates access to existing satellite data, applies analytics and machine learning to extract insights, and charges customers for access to imagery and insights. This asset-light model avoids the massive capital requirements of operating satellites while still controlling the valuable middle layer—the customer relationship and insights extraction.

What are the main applications and use cases for SkyFi's platform?

SkyFi serves several key verticals including financial markets (hedge funds using satellite data for alternative alpha), defense and government intelligence, infrastructure project management and monitoring, insurance and disaster response, agriculture, supply chain logistics, and climate monitoring. Each vertical has specific use cases—financial firms track retail foot traffic, insurers assess disaster damage, infrastructure companies monitor construction progress, and governments conduct intelligence operations.

Why did SkyFi's Series A funding round exceed initial targets?

Fischer stated that the company initially sought

What makes SkyFi's "virtual constellation" concept valuable?

The virtual constellation refers to SkyFi's aggregated access to 50+ satellite operators and various sensor types without actually owning or operating satellites. This is valuable because it provides capital efficiency (avoiding billion-dollar satellite development and launch costs), data supply diversity (access to optical, multispectral, and SAR imagery), and a powerful feedback loop (thousands of customer requests inform product development priorities). Satellite operators increasingly view SkyFi as a valuable distribution channel rather than competition.

How does SkyFi differentiate itself from satellite operators like Maxar or Planet Labs?

Satellite operators control data supply but typically focus on selling imagery as a commodity, while SkyFi focuses on extracting insights from imagery for specific use cases. Satellite imagery is increasingly commoditized, so the differentiation has shifted to analytics and accessibility. SkyFi's software-first approach means the company can rapidly build vertical-specific analytics, integrate with enterprise systems, and make satellite data accessible to non-experts—capabilities that hardware-focused satellite operators struggle with due to their different business models and organizational structures.

What does the fact that high school students can task satellites on SkyFi tell us about the platform?

This demonstrates successful product democratization. By making satellite tasking and imagery accessible through a mobile app simple enough for non-experts to use, SkyFi has unlocked entirely new use cases and markets. This accessibility is critical to platform scaling—it means adoption isn't limited to organizations with specialized geospatial teams. It validates that SkyFi's product design is focused on users rather than technical capabilities.

What are the main risks or limitations to SkyFi's growth?

Key risks include commoditization of satellite imagery analytics (as cloud vendors like AWS build competing offerings), regulatory uncertainty around commercial satellite imagery access, competitive threats from satellite operators building their own platforms, data quality and latency constraints limiting certain real-time use cases, and potential customer concentration in early stages. Additionally, privacy regulations and national security policies could restrict SkyFi's operations in certain geographies or for certain use cases.

How does SkyFi's model compare to other platform infrastructure companies like Uber or Stripe?

SkyFi follows a similar pattern to companies like Uber and Stripe—it positions itself as the critical middle layer connecting supply (satellite operators) and demand (customers needing insights). Like Uber, it doesn't own the underlying assets (cars/satellites) but controls the customer relationship and increasingly controls valuable derivatives of that relationship (analytics/algorithm quality). This software-first approach provides margin leverage, product agility, and lower capital requirements than owning underlying infrastructure.

What should we expect from SkyFi's product roadmap in the next year or two?

Based on the company's strategic positioning and the oversubscribed funding, expect expansion in three areas: first, vertical-specific analytics tailored to different industries (agriculture, real estate, supply chain); second, deeper enterprise integration with systems like CRMs and supply chain management platforms; and third, geographic expansion, particularly into international markets with specific data sovereignty requirements. The company will likely prioritize analytics sophistication over raw feature count, given that insights—not imagery—are where value accrues.

The Takeaway

SkyFi's $12.7 million Series A represents more than just a company reaching a funding milestone. It's validation that satellite imagery is transitioning from niche technical tool to essential enterprise infrastructure. The company's software-first approach, focus on insights over commodity imagery distribution, and strategic positioning as the middle layer between satellite operators and end customers positions it well to capture significant value as geospatial intelligence becomes mainstream.

For organizations currently operating without satellite data, SkyFi's platform makes this capability accessible. For those already using satellite imagery, the company's expanding analytics capabilities unlock more value from that data. That dual appeal—combining accessibility with sophistication—is why investors lined up to support this funding round, and why SkyFi's Series A is worth watching as a bellwether for the broader geospatial intelligence market.

Key Takeaways

- SkyFi closed a $12.7M Series A that was oversubscribed, reflecting strong product-market fit and increasing market demand for geospatial intelligence.

- The company has pivoted from commodity imagery distribution to analytics-driven insights, positioning software capabilities as the primary value driver.

- Defense spending records and geopolitical tensions significantly increased investor demand, with specialized defense and climate funds participating in the round.

- SkyFi's 'virtual constellation' aggregates 50+ satellite operators without capital-intensive satellite ownership, enabling asset-light software scaling.

- Market applications span financial services (alternative data), government intelligence, insurance damage assessment, and infrastructure project monitoring.

- Accessibility through mobile apps and web interfaces demonstrates successful product democratization, enabling non-expert users to task satellites.

- The investor base reflects strategic rather than purely financial motivations—DNV Ventures, IronGate Capital, and defense-focused funds see geospatial intelligence as critical infrastructure.

- Competition from both satellite operators and cloud vendors poses margin pressure, making the analytics layer increasingly important to long-term differentiation.

Related Articles

- Harmattan AI Defense Unicorn: $200M Series B, Dassault Aviation [2025]

- Hupo's AI Sales Coaching Pivot: From Mental Wellness to $15M Startup [2025]

- Over 100 New Tech Unicorns in 2025: The Complete List [2025]

- SandboxAQ Executive Lawsuit: Inside the Extortion Claims & Allegations [2025]

- Cyera's $9B Valuation: How Data Security Became Tech's Hottest Market [2025]

- Niko Bonatsos Launches New VC Firm After 15 Years at General Catalyst [2025]

![SkyFi's $12.7M Funding: Satellite Imagery as a Service [2025]](https://tryrunable.com/blog/skyfi-s-12-7m-funding-satellite-imagery-as-a-service-2025/image-1-1768392383175.jpg)