The Netflix and Sony Deal That Changes Everything

Something massive just happened in streaming, and if you haven't heard yet, you're about to understand why this matters for what you watch next. Netflix and Sony Pictures Entertainment announced a landmark global streaming agreement that fundamentally shifts how major studio content reaches audiences worldwide. This isn't just another licensing deal buried in corporate paperwork. This is the kind of partnership that reshapes the entire streaming landscape.

For years, the streaming wars have been fragmented. You'd subscribe to Disney+ for Marvel, Paramount+ for Hollywood blockbusters, Max for prestige content. Now Netflix is consolidating major Sony entertainment under one roof, which means fewer subscriptions needed and more content in one place. The deal represents a strategic shift where streaming giants are finally acknowledging that bundling matters more than silos.

What makes this particularly significant is the scope. We're talking about theatrical releases, Spider-Man universe films, adult dramas, action franchises, and family content all flowing into Netflix's platform globally. This isn't regional. This isn't limited to certain markets. Sony's entire film output is now moving to Netflix worldwide, making this one of the most comprehensive licensing agreements in streaming history.

The timing is crucial. Streaming platforms have been bleeding money on content spending while fighting for subscriber growth. Netflix realized that exclusive original content alone doesn't guarantee loyalty. People want breadth, variety, and access to cultural touchstones. Sony has exactly that. The studio produces Spider-Man movies, action franchises like Bad Boys, dramatic content, and family films. Adding this to Netflix's already massive library creates an almost impossible-to-ignore platform.

But here's what you actually care about: what movies are coming? Let's dig into the confirmed titles that'll hit Netflix through this deal.

Breaking Down the Deal Structure and What It Means

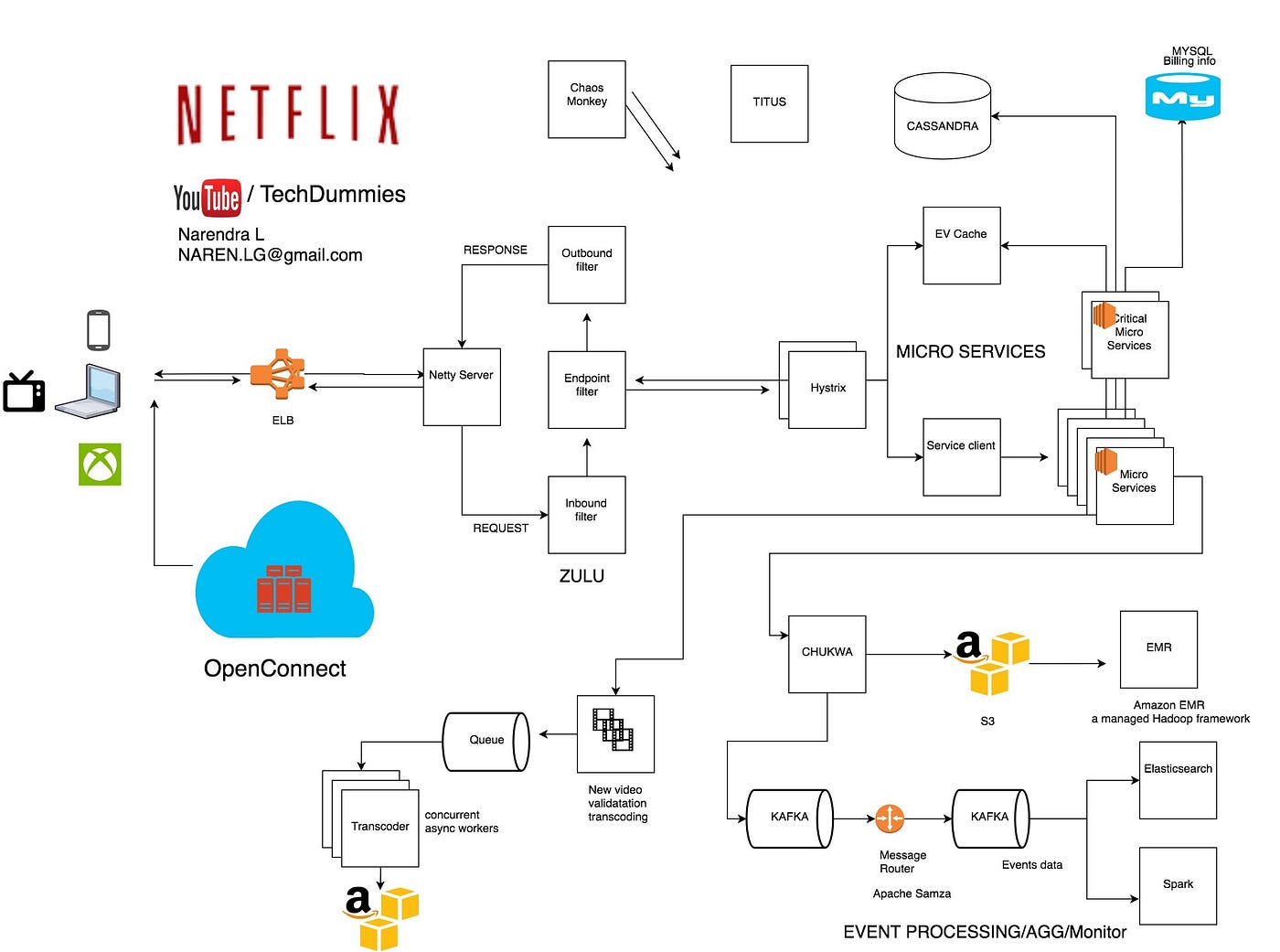

Before we jump into specific movies, understanding how this deal actually works is important. The Netflix-Sony agreement creates a tiered release window. When Sony releases a theatrical film, it'll eventually land on Netflix instead of bouncing between Paramount+, physical media, and regional platforms.

The deal operates on a global, non-exclusive basis for certain windows, meaning Sony films get Netflix distribution rights worldwide with specific timing. New theatrical releases will hit Netflix faster than the traditional 120+ day theatrical window, followed by premium VOD. This compression matters because audiences aren't patient anymore. If a movie isn't immediately accessible, they'll find it elsewhere or move on entirely.

Sony Pictures produces roughly 6 to 8 theatrical films annually that would fall under this agreement. That's meaningful volume. We're not talking about a handful of movies here. This represents substantial content flow. The deal also includes Sony's direct-to-streaming productions and library content, which means older Sony films you may have missed will also populate Netflix's catalog.

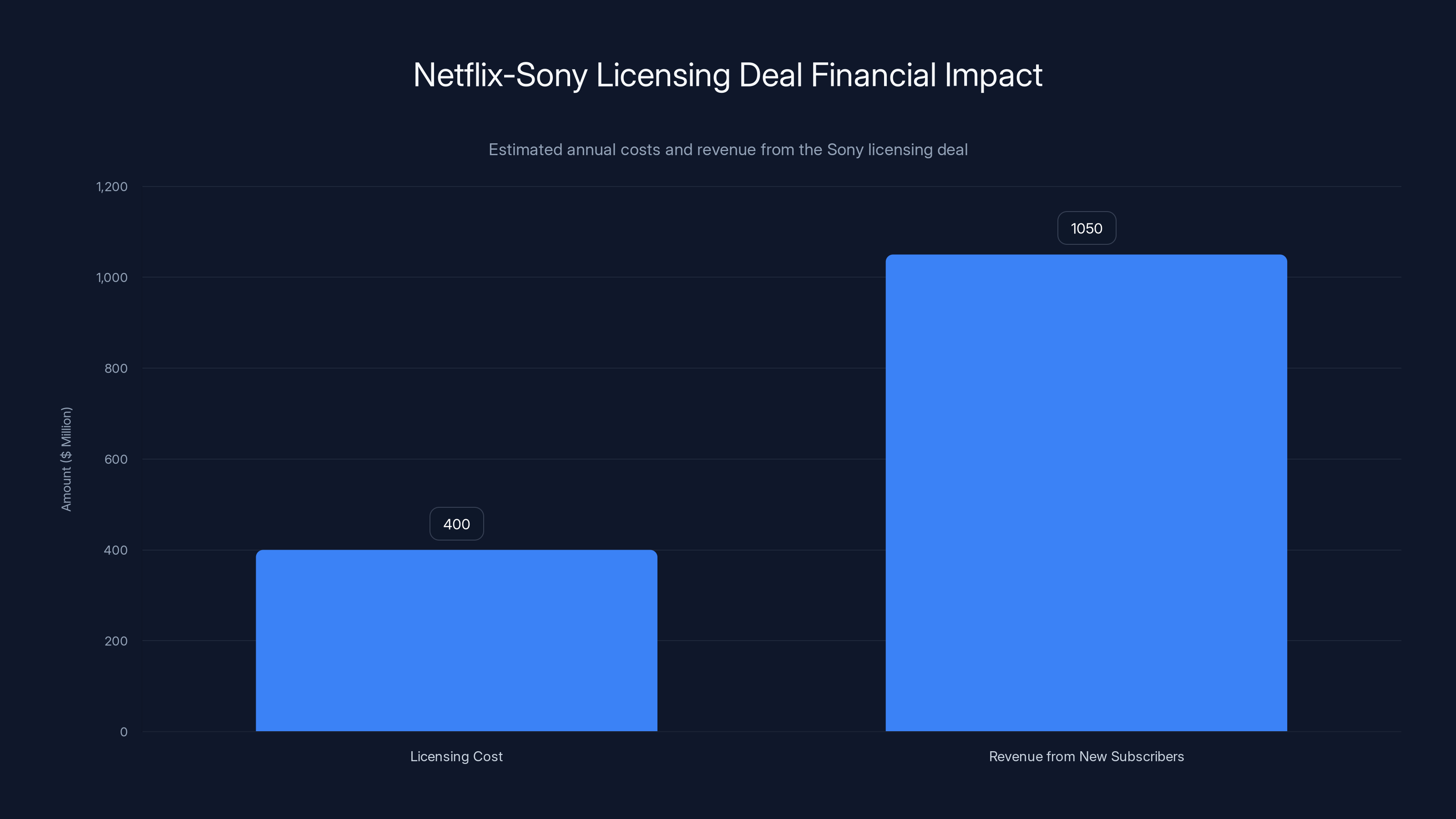

What surprised industry analysts most was Netflix's upfront willingness to commit substantial licensing fees. This suggests Netflix's profitability focus has shifted. Rather than betting everything on originals, they're willing to invest heavily in licensed content that drives retention and attracts subscribers. The subscription economics work if the content brings people in faster than the licensing costs them.

One critical detail: Sony maintains theatrical distribution. Movies still get theatrical releases first. Netflix isn't replacing cinema. Instead, Netflix becomes the premium streaming home for Sony content after its theatrical run, replacing the old windowed approach where films bounced between multiple platforms over years.

Estimated data shows Netflix's licensing cost of

Movie #1: Madame Web and the Spider-Verse Connection

Let's start with one that connects to the broader Spider-Man Universe that Sony maintains. Madame Web, starring Dakota Johnson, represents Sony's continued investment in exploring Marvel characters through a non-traditional lens. This film arrived in theaters in early 2024 and will make its way to Netflix under this deal, giving millions more access to the film.

Madame Web is particularly interesting because it's not your typical superhero blockbuster. The film explores Cassandra Webb, a clairvoyant character with deep connections to Spider-Man lore, but approaches her story through a thriller/sci-fi lens rather than straightforward action sequences. Dakota Johnson brings a muted intensity to the character, playing against the typical superhero movie archetype.

What makes this relevant under the Netflix deal is that Sony is actively building extended universe content around Marvel characters it holds rights to. Madame Web connects to the broader Spider-Man mythology while standing alone narratively. For Netflix subscribers, this represents access to content that was previously exclusive to theatrical and cable distribution. The film explores time manipulation, precognition, and how individual choices ripple through multiple timelines, adding philosophical depth to superhero storytelling.

The significance here extends beyond just another Marvel-adjacent movie. Sony is demonstrating it can make character-driven stories within the superhero space. Madame Web didn't rely on massive action sequences or constant quips. It trusted Dakota Johnson's performance to carry narrative weight. This distinction matters for Netflix's positioning. They're not just getting generic blockbusters. They're getting diverse approaches to entertainment.

When Madame Web arrives on Netflix, expect it to perform well with audiences interested in female-led superhero content and darker character explorations. The streaming release also gives the film a second life. While theatrical audiences had specific windows to see it, Netflix's global reach means audiences in regions where theatrical distribution was limited now get full access.

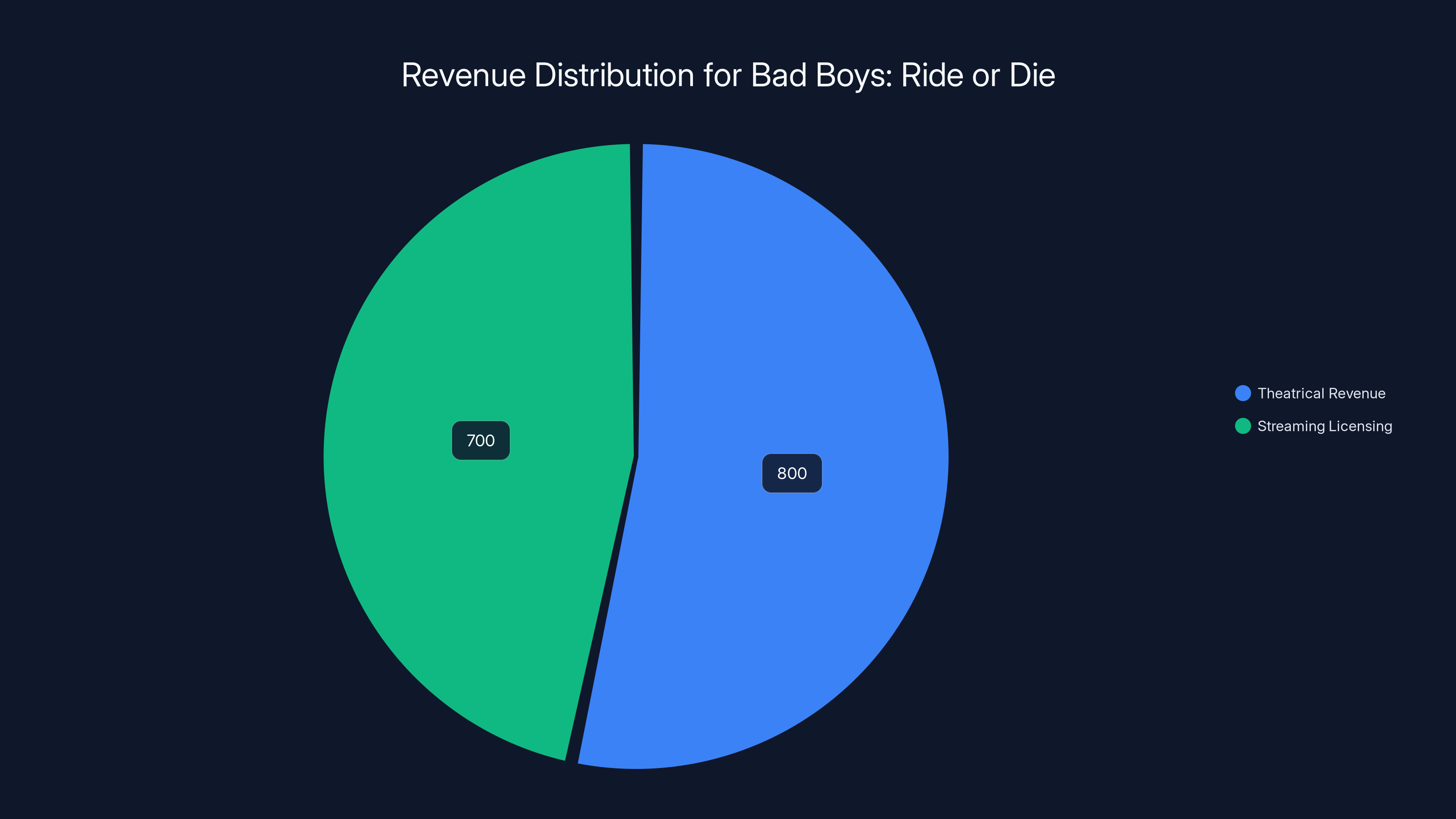

Theatrical and streaming licensing are crucial revenue streams for Bad Boys: Ride or Die, with estimated revenue of

Movie #2: Bad Boys Franchise and Action Spectacle

Now we're talking about something that absolutely matters to action movie lovers. The Bad Boys franchise is core to Sony's theatrical output, and these films become Netflix originals (in the sense of Netflix being the streaming home) under this deal. Bad Boys: Ride or Die, the latest entry in the franchise, represents exactly the kind of content that drives streaming engagement.

The Bad Boys films, starring Will Smith and Martin Lawrence, have generated over $1.5 billion in global box office revenue across multiple films. These aren't experiments. These are proven franchises with massive audiences. When Ride or Die hits Netflix, it's bringing proven entertainment value, not gambling on whether audiences will care.

What makes Bad Boys relevant to the Netflix deal is understanding why studios like Sony still invest in theatrical releases. Bad Boys: Ride or Die cost roughly

For Netflix, getting Bad Boys content means accessing films with proven appeal across demographics. The franchise balances comedy, action, and chemistry between leads. Will Smith and Martin Lawrence have genuinely funny interactions that work for broad audiences. The action sequences are elaborate. The pacing moves quickly. These are films engineered for streaming consumption because they don't require theatrical immersion to work.

The Bad Boys franchise also represents something important: franchise optimization through multiple distribution channels. Sony makes money in theatrical, then through licensing. Netflix gets proven content that attracts subscribers. Audiences get easier access. Everyone wins in this model. When Ride or Die lands on Netflix, expect viewership numbers to spike significantly because action films perform extremely well in streaming metrics.

Movie #3: Ghostbusters Franchise Expansion

Sony owns the Ghostbusters franchise, and this is where the deal gets interesting for legacy content lovers. Films like Ghostbusters: Frozen Empire and the older Ghostbusters entries become more accessible through Netflix, alongside newer entries that continue the franchise.

Ghostbusters represents something crucial in the current streaming landscape: nostalgia-driven entertainment. The original Ghostbusters films carry genuine cultural weight. They define an era of comedy-horror filmmaking. Parents watch them. Kids discover them. The franchise has multi-generational appeal that few properties maintain.

Under the Netflix deal, the franchise gets consolidated into one place. Instead of hunting across multiple platforms for Ghostbusters content, Netflix subscribers find the entire saga—originals, reboots, sequels—in one location. This matters for discovery and platform stickiness. Netflix isn't fighting to explain why it has only one Ghostbusters film. It has them all.

The newer Ghostbusters films, like Frozen Empire, continue the franchise with new cast members while honoring original characters. This balance—respecting legacy while building new stories—is exactly what streaming platforms need. It attracts older audiences who grew up with the originals while introducing younger viewers to the franchise through contemporary production values.

Ghostbusters also performs consistently well on Netflix. Comedy-horror films are algorithm-friendly. They get recommended frequently, have high completion rates, and generate strong word-of-mouth. When Ghostbusters content sits on a streaming platform, it works quietly in the background, driving engagement metrics while people discover it through recommendations.

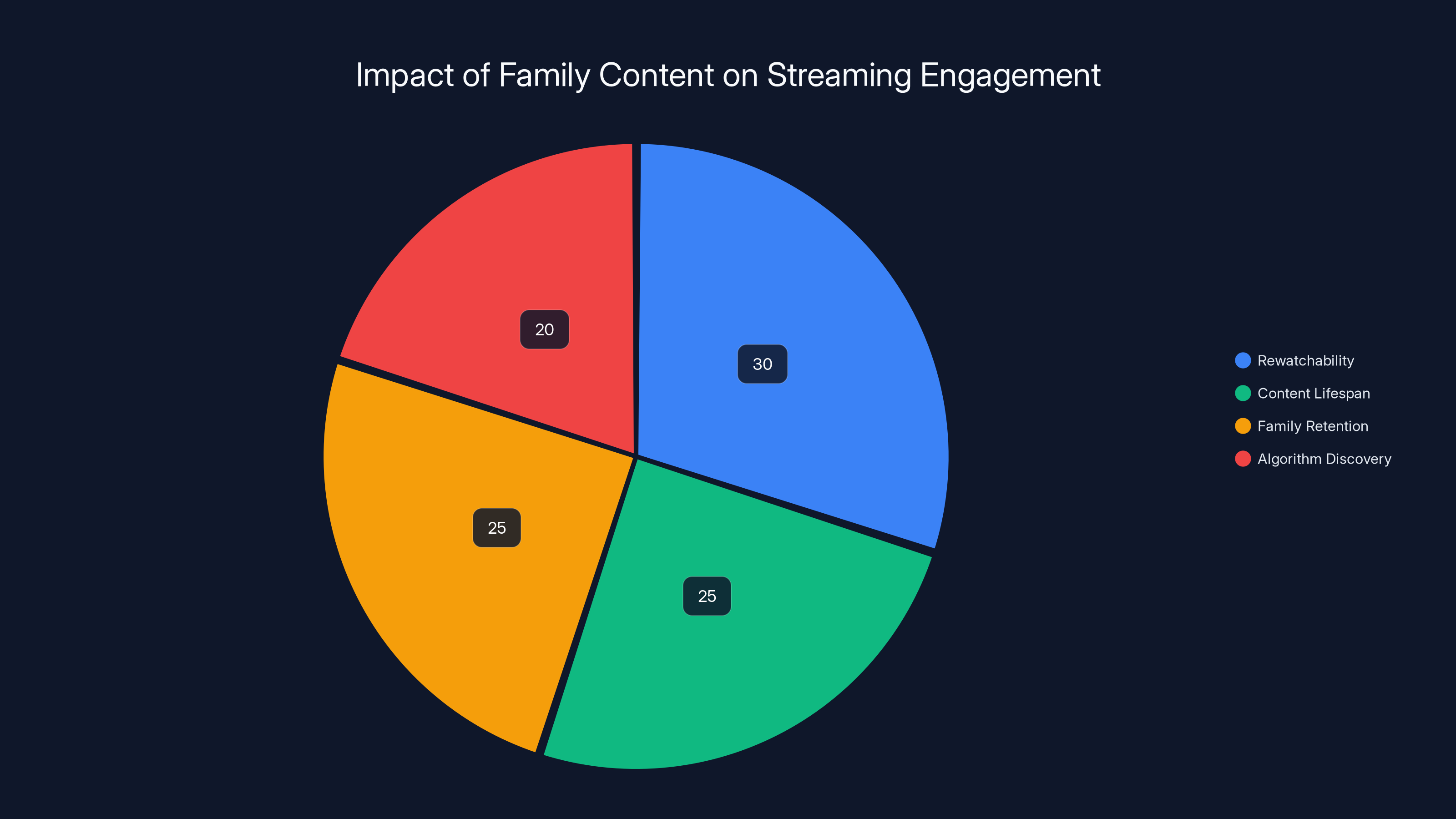

Family content significantly boosts streaming engagement through high rewatchability, extended content lifespan, and strong family retention. (Estimated data)

Movie #4: Sony's Prestige Drama Content

Beyond blockbusters and franchises, the Sony deal includes prestige dramatic content that Netflix actually needs. Sony produces grown-up films for adult audiences—something streaming platforms constantly chase. Films like those in Sony's drama slate represent quality filmmaking aimed at audiences older than 25, which streaming services historically struggle to retain.

Sony's drama content includes character-driven narratives, intimate storytelling, and performances from established actors who still draw theatrical audiences. These aren't tentpole productions. They're the kind of mid-budget films ($20-50 million) that used to anchor theatrical lineups but increasingly struggle to find theatrical audiences. Netflix becomes the natural home for these films.

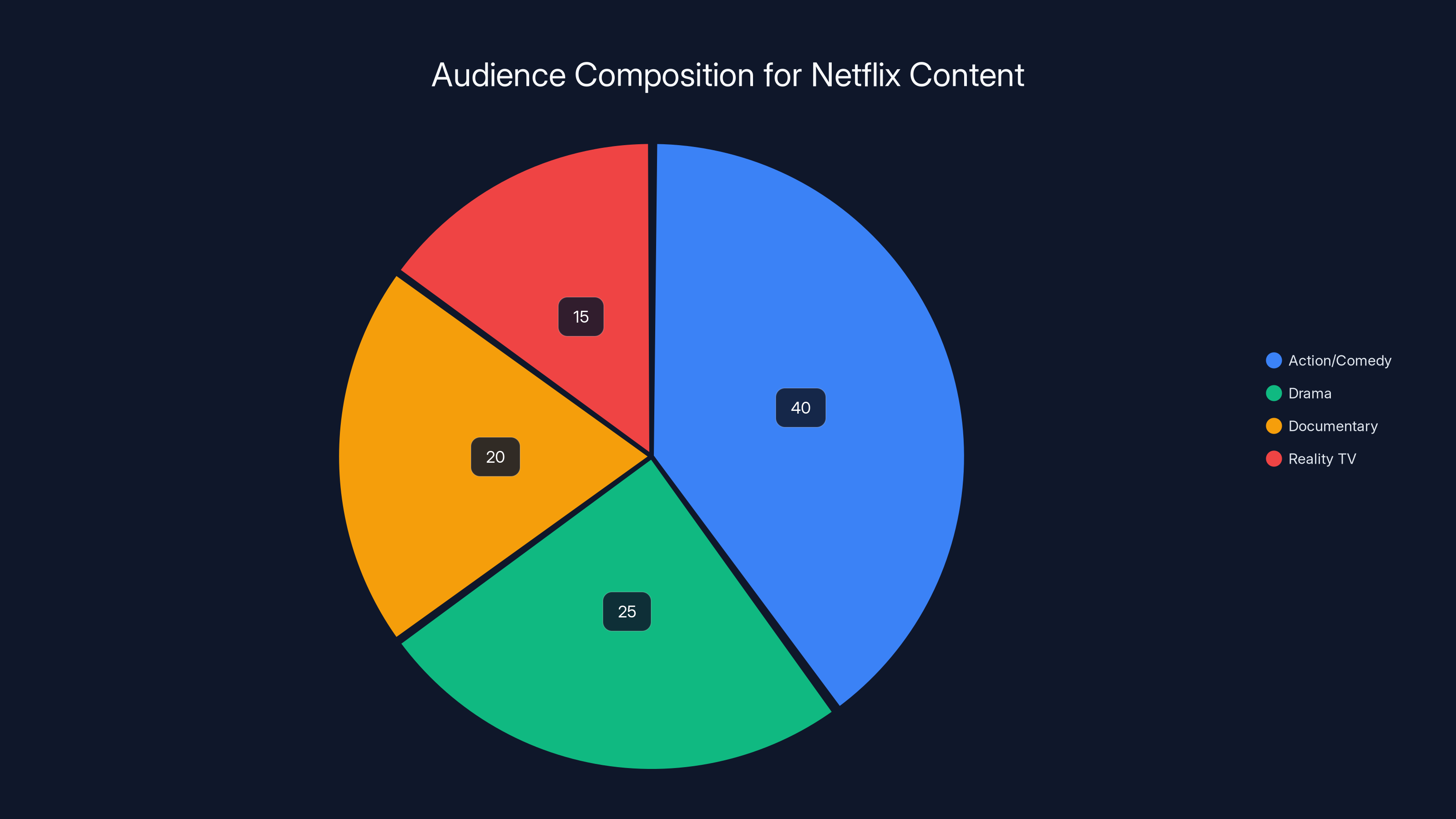

What matters here is audience composition. Netflix's core subscriber base skews slightly younger, and the algorithm tends to promote action and comedy. Drama content gets buried. But bringing Sony's drama slate to Netflix expands the platform's appeal to viewers seeking substantive entertainment. A 45-year-old subscriber might casually browse Netflix and discover a well-crafted drama they'd never see in theaters, but would absolutely watch at home.

These films also have international appeal. Sony's drama content plays at film festivals, travels globally, and translates across cultures better than high-concept action franchises. Netflix gains international prestige by hosting this content, even if domestic engagement numbers are lower than Bad Boys or Ghostbusters.

Movie #5: Family Content and Animated Features

Don't sleep on Sony's family and animated content. This category represents massive engagement because families subscribe as units, and parents actively search for content their kids can watch. Sony produces animated films and family-friendly entertainment that Netflix desperately needs.

Animated films carry multiple benefits for streaming platforms. They rewatch well—kids watch the same movie repeatedly, which looks great in engagement metrics. They have longer content lifespans; a good animated film stays relevant for years. They also drive family retention because parents subscribe partly for content their kids enjoy.

Sony's animated slate includes films with genuine quality and creative ambition. These aren't low-budget productions. They're theatrical-quality animations with A-list voice casts and substantial production budgets. When these land on Netflix, they expand the platform's family offering, which is critical for subscriber growth in markets with high family subscription penetration.

Family content also performs differently in algorithms. It gets discovered repeatedly as new parents sign up, grandparents search for content to watch with grandchildren, and existing subscribers look for viewing options during specific times (sick days, rainy afternoons, travel). Netflix's family content drives daily active users, and Sony's contributions meaningfully expand this metric.

The deal's inclusion of family content suggests Netflix understands that subscriber growth now requires broadening appeal across age groups. A 30-year-old couple with young children needs different content than a 20-year-old single professional. Sony's family slate helps Netflix serve both demographics better.

Estimated data shows that while action/comedy dominates Netflix's audience, drama content attracts a significant portion, potentially increasing engagement and retention.

The Streaming Wars Context: Why This Deal Matters Now

Understanding why the Netflix-Sony deal happened requires context about the broader streaming landscape. For years, studios built proprietary streaming platforms because they assumed owning distribution meant owning the customer relationship. Disney+ launched. Paramount+ followed. Peacock arrived. Prime Video existed.

What happened next: audiences hated it. Subscribing to 7-10 streaming services cost as much as cable, fragmented content, and created decision paralysis. People abandoned subscriptions or resorted to alternatives. Studio streaming platforms struggled to achieve profitability because content spending dwarfed subscriber revenue.

Netflix's play here is elegant: pay studios licensing fees instead of spending on originals. It's cheaper than producing 100+ original series annually, faster than development cycles, and lower risk than betting on original content. Sony gets licensing revenue. Netflix gets content. Audiences get consolidated access.

The deal also reflects changing market dynamics. Netflix's profitability demonstrates that sustainable streaming requires monetization beyond just subscriber fees. Ad-supported tiers, password sharing crackdowns, and now aggressive licensing deals all supplement traditional subscription revenue. Sony, facing theatrical decline and streaming platform failures, accepts that licensing to Netflix is better economics than maintaining proprietary distribution.

This represents a fundamental shift from "streaming wars" to "streaming consolidation." The battle for exclusive content is being replaced by battles for licensing rights. Winners will be platforms that can afford the licenses and use content strategically. Netflix clearly has the financial capacity. Sony clearly needs the cash flow. The deal reflects both parties accepting new realities.

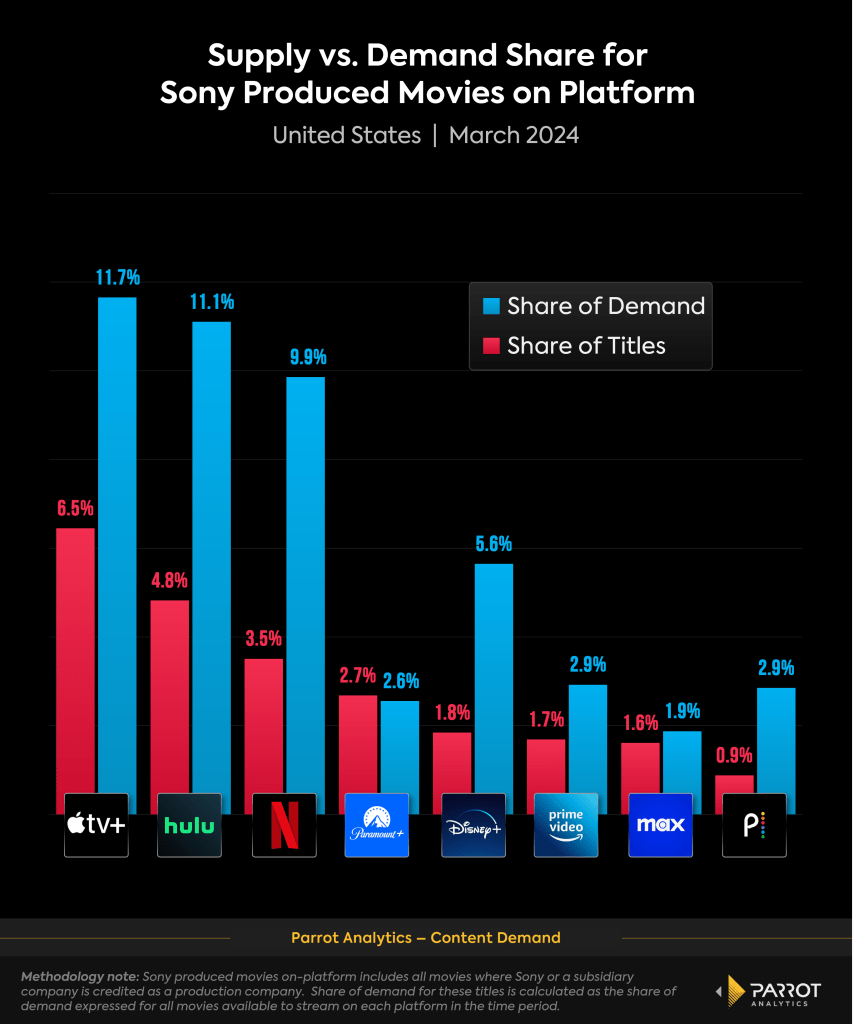

How Sony Content Transforms Netflix's Competitive Position

Let's be specific about Netflix's competitive advantages after this deal. Before: Netflix had originals and some licensed content. Now: Netflix has originals, licensed content, major franchises, prestige films, family content, and theatrical releases funneling into its platform regularly.

Compare this to Disney+, which owns its content through Marvel, Pixar, and Star Wars, but relies heavily on originals for new content. Paramount+ has theatrical access but less streaming infrastructure. Netflix now occupies a unique position where it has exclusive access to one major studio's entire output, ongoing theatrical releases, and originals.

This changes subscriber behavior. Cord-cutters considering streaming options now see Netflix as offering: originals they can't get elsewhere, Sony theatrical releases they'd otherwise miss, catalog content for discovery, and multiple demographic appeal. That combination makes subscribing worth $12-23 monthly depending on tier.

The deal also shifts what Netflix spends on originals. Instead of trying to beat everyone at original content production, Netflix can be strategic. Spend big on prestige projects that justify higher tiers, maintain mid-budget content that performs consistently, and rely on Sony's licensed output to fill catalog depth. This portfolio approach is fundamentally different from Netflix's historical strategy.

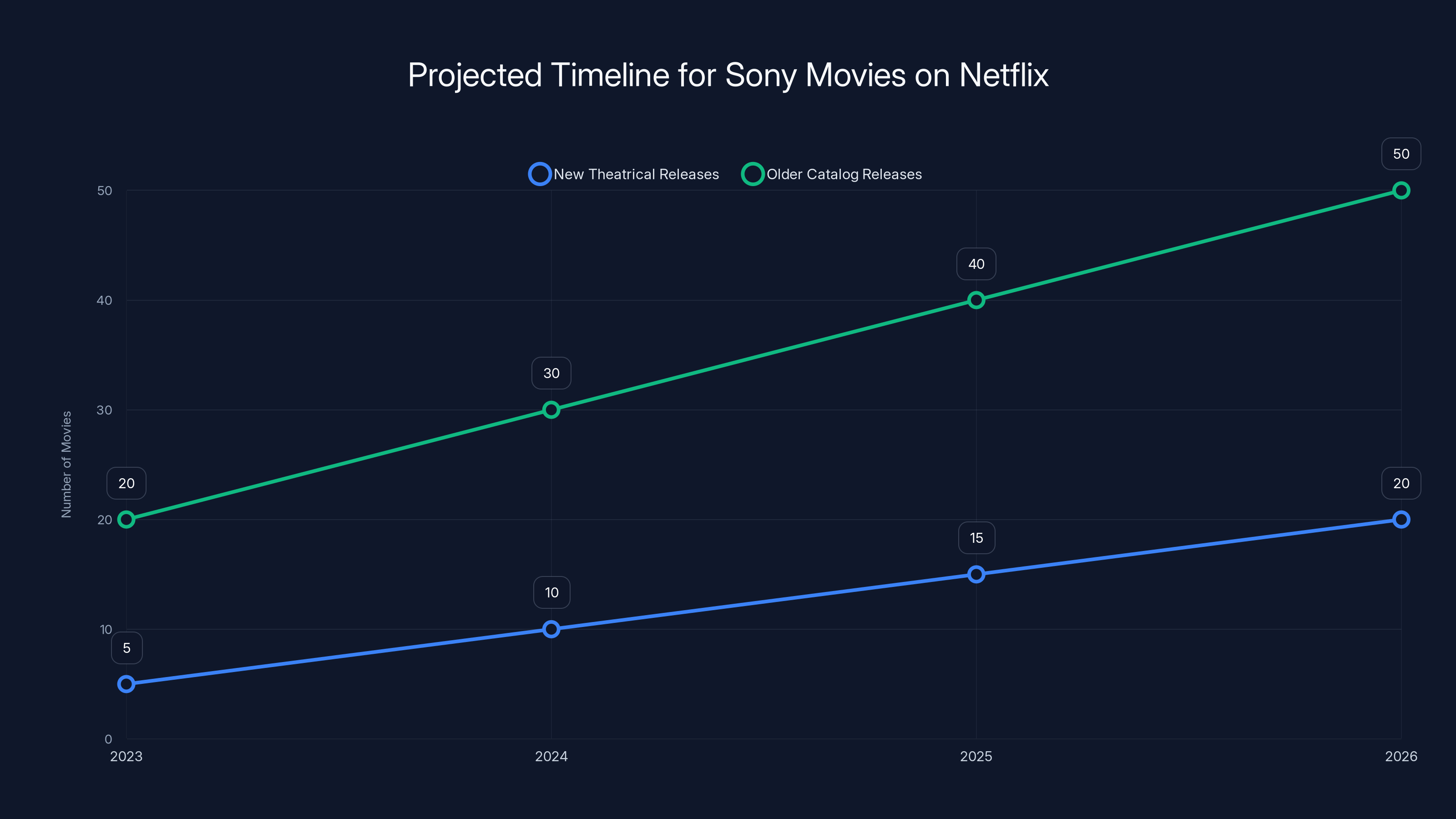

Estimated data shows a gradual increase in both new theatrical and older catalog Sony movies available on Netflix over the next few years.

Release Windows and When You'll Actually See These Movies

Here's what confuses people: just because Netflix has a deal doesn't mean movies appear instantly. Release timing follows theatrical windows. New Sony theatrical releases will premier in cinemas first, then hit Netflix typically within 4-6 months, depending on specific contract terms. This isn't Netflix getting same-day releases.

Why does this matter? Because it maintains theatrical value. Sony films still work as theatrical events. Premium seats, huge screens, opening weekend experiences. Then they become Netflix originals. This sequence protects theatrical economics while eventually rewarding Netflix subscribers with the content.

Older Sony films already released theatrically will migrate to Netflix on a rolling basis. This happens faster because there's no theatrical window to protect. Catalog content provides immediate value while new releases create ongoing appointment viewing.

For practical purposes, here's what you should expect: check Netflix quarterly for new Sony releases. The content won't all appear simultaneously. Instead, stagger releases happen throughout the year as theatrical films complete their windows and reach Netflix. This rolling approach actually works better for subscriber retention than dumping 20 films at once. New content arriving gradually gives continuous reasons to stay subscribed.

Global Implications: Why Worldwide Matters

Notice that the deal is explicitly global. This is genuinely significant. Regional licensing has fragmented streaming forever. A film available on Netflix in the US might require a different platform in Europe or Asia. This deal eliminates that fragmentation for Sony content.

Global licensing simplifies everything. Sony doesn't license to different platforms in different regions. Netflix gets worldwide rights. This matters because it means international subscribers see the same content as US subscribers. A film discussed globally on social media is available everywhere simultaneously (after theatrical windows). This uniformity strengthens Netflix's competitive position in international markets where regional platforms have advantages.

It also simplifies international marketing. Sony and Netflix can coordinate promotions globally. Audiences in markets where Netflix faces competition from local services now see Hollywood blockbusters and prestige content they might not get elsewhere. This shifts competitive dynamics, particularly in markets where Amazon Prime Video and other platforms compete with weaker local catalogs.

For viewers: this is purely positive. Content becomes more universally accessible. A film released in theaters globally now reaches streaming audiences globally within consistent timeframes. The fragmentation that made streaming frustrating gets slowly replaced by consolidated access through major platforms.

The Financial Reality: What This Costs and Why It Works

Nobody publicly discloses Netflix licensing rates, but industry analysts estimate the Sony deal represents hundreds of millions annually in licensing fees. This is substantial money. Why does it make sense?

Let's do basic math. If the deal costs Netflix

This explains why major licensing deals suddenly make sense. Streaming profitability isn't about cost minimization anymore. It's about unit economics. Paying more for proven content that converts subscribers is economically rational if the cost-per-acquisition stays below lifetime subscriber value.

For Sony, the deal provides certainty in a fractured entertainment landscape. Instead of gambling on theatrical-exclusive releases or maintaining expensive proprietary streaming platforms, Sony gets guaranteed licensing revenue. This is cash flow they can rely on, which is valuable for a company managing theatrical decline and streaming investment risks.

The deal also benefits both parties by reducing financial risk. Netflix doesn't have to greenlight risky original content to fill catalog holes. Sony doesn't have to bet on theatrical-only releases in a declining theatrical market. They split the risk and share revenue. It's a rational compromise that reflects streaming's maturation from "growth at all costs" to "sustainable profitable growth."

Subscriber Impact: What Changes for You

If you're a Netflix subscriber, the Sony deal means your subscription immediately becomes more valuable. More content options, major theatrical franchises, established properties with proven appeal. The price doesn't change, but the value increases.

If you've been subscribing to Paramount+ partly for Sony films, you can now consolidate to Netflix and potentially drop another service. This is exactly what Netflix wants: consolidating your entertainment spend into a single subscription.

If you're currently unsubscribed, this deal might be the trigger to resubscribe. Bad Boys, Ghostbusters, Madame Web, quality dramas, family content—that's a broader appeal than Netflix could muster on originals alone.

If you prefer theatrical releases and want to support cinema, you still can. Sony films still premiere theatrically. You can see them in IMAX or premium formats if you value that experience. Then they'll be on Netflix for casual viewing. Best of both worlds.

What This Means for Other Streaming Platforms

Disney+, Paramount+, and other platforms now face strategic pressure. Netflix just secured one major studio's entire output. This raises the question: what's the future of proprietary studio platforms?

Disney probably maintains its strategy because Marvel, Pixar, and Star Wars are truly exclusive and valuable. But mid-tier platforms face challenges. If Sony is licensing to Netflix, why should audiences maintain separate subscriptions to niche platforms? This accelerates consolidation, where viewers maintain 2-3 major services instead of 5-7.

For industry competitors, the Sony-Netflix deal signals that exclusive content isn't as defensible as previously assumed. Studios increasingly view licensing strategically rather than as brand betrayal. This opens possibilities for similar deals. Paramount might license archive content. Warner Bros. could follow suit. The "peak streaming" moment—where audiences must subscribe to everything—might actually be passing.

Streaming's future probably involves 3-4 major platforms with consolidated content, rather than 10+ fragmented services. The Sony-Netflix deal accelerates this consolidation trend.

The TL; DR on Netflix and Sony's Historic Deal

Let's recap what actually matters here.

The Deal: Netflix and Sony announced a global streaming agreement where Sony's entire film output now streams on Netflix after theatrical releases and premium VOD windows.

What's Coming: Bad Boys franchise, Ghostbusters films, Madame Web, prestige dramas, family content, and ongoing new theatrical releases. We're talking hundreds of films across multiple genres.

Timeline: Theatrical releases hit Netflix typically 4-6 months after theatrical premiere. Older catalog content arrives faster on a rolling basis.

Impact for You: Netflix becomes significantly more valuable as a subscription. More content options, major franchises, quality variety. Other streaming services become less essential.

Why It Happened: Streaming profitability requires consolidation. Studios realized exclusive content doesn't guarantee platform success. Netflix and Sony benefit financially from licensing rather than competing separately.

The Bigger Picture: This signals a shift from streaming fragmentation to consolidation. Expect similar deals to follow. Audiences will maintain fewer subscriptions with deeper content catalogs.

Bottom Line: The Netflix-Sony deal is the streaming wars' quiet surrender. Netflix won by offering such comprehensive content that competitors can't compete on breadth alone.

FAQ

What exactly is the Netflix and Sony streaming deal?

Netflix and Sony Pictures Entertainment announced a landmark global licensing agreement where Sony's theatrical films, dramas, family content, and new releases will stream on Netflix after theatrical and premium VOD windows. This represents one of the most comprehensive licensing deals in streaming history, giving Netflix exclusive streaming rights to one major studio's entire output worldwide.

When will the Sony movies be available on Netflix?

New theatrical releases will arrive on Netflix typically 4-6 months after their theatrical premiere, depending on specific contract terms negotiated between the two companies. Older Sony films already released theatrically will migrate to Netflix on a rolling basis, with catalog content arriving faster since there's no theatrical window to protect. Expect staggered releases throughout each year rather than simultaneous bulk additions.

Which specific Sony movies are confirmed for Netflix?

Confirmed titles include the Bad Boys franchise (Bad Boys: Ride or Die and future entries), Ghostbusters films including Frozen Empire, Madame Web starring Dakota Johnson, Sony's prestige drama slate, family animated content, and all future theatrical releases from Sony Pictures. Additionally, Sony's entire film library will migrate to Netflix on rolling basis, though specific release dates vary by title.

Does this deal include Spider-Man movies?

The deal includes Sony's Spider-Man Universe films like Madame Web, which connect to Spider-Man mythology. However, Spider-Man movies themselves have separate licensing agreements involving Marvel and Disney, which may affect their availability on Netflix. Spider-Universe content featuring characters like Madame Web transitions to Netflix, but core Spider-Man films have different distribution arrangements.

How much does this affect Netflix pricing?

The Netflix price remains unchanged. More content is added to existing subscription tiers, making your subscription more valuable without additional cost. This represents Netflix's strategy of improving content depth rather than raising prices, which is significant given that bundling more titles helps retention and reduces subscriber churn.

Will Sony movies stop appearing on other streaming platforms?

Sony films will still have theatrical releases first, and some may appear on other platforms before transitioning to Netflix depending on windows and territorial rights. However, Netflix becomes Sony's primary streaming home globally after theatrical windows, meaning Paramount+ and other services lose Sony theatrical content they previously licensed.

Is this deal good for theatrical movies?

Yes. Theatrical releases still happen first. Films premiere on big screens in IMAX and premium formats before reaching Netflix. This maintains theatrical economics while eventually rewarding streaming subscribers. The compressed window (4-6 months instead of 120+ days) reflects modern viewing patterns where theatrical attendance relies more on event experiences than exclusive content timing.

What does this mean for Netflix subscribers?

Your subscription immediately becomes more valuable with significantly expanded content options, major theatrical franchises, established properties with proven appeal, and quality depth across multiple genres. If you've considered canceling or maintaining multiple services, this deal provides substantive reasons to maintain or upgrade your Netflix subscription instead of juggling competitors.

Will this affect which streaming services I need?

Likely yes. The consolidation of major theatrical content on Netflix makes competing services less essential unless you specifically want exclusive franchises (like Disney's Marvel or Pixar content). Many subscribers will find maintaining Netflix plus one or two niche services sufficient, rather than the 5-7 service juggling that characterized peak streaming fragmentation.

How does this compare to Disney+ and Paramount+?

Disney+ owns its content through exclusive Marvel, Pixar, and Star Wars properties, so it maintains advantage through ownership rather than licensing. Paramount+ has theatrical access but now loses Sony content to Netflix, weakening its competitive position. Netflix's strategy differs by acquiring licensing rights to comprehensive studio output, making it appeal to broader audiences than specialty platforms.

What's the future of other streaming platforms after this deal?

Consolidation accelerates. Audiences increasingly subscribe to 2-3 major platforms with deep catalogs rather than 5+ fragmented services. Similar licensing deals may follow as studios realize exclusive platforms aren't economically viable. The "streaming wars" are effectively shifting toward consolidation where major platforms dominate through content breadth rather than exclusive franchises alone.

How long is the Netflix-Sony deal valid?

Specific deal duration hasn't been publicly disclosed, but these licensing agreements typically run 5-10 years with renewal options. Multi-year commitments make sense for both parties given substantial financial investment and the need for planning around theatrical release schedules and content strategy.

Why This Deal Changes Everything: Final Perspective

You know what's wild about the Netflix-Sony deal? It's not really about movies. It's about surrender. For over a decade, streaming was pitched as revolutionary. Studios would own their platforms. Audiences would subscribe directly to Disney, Warner Bros., and NBC. Streaming would democratize entertainment.

Then reality arrived. Audiences hated subscribing to 10 services. Studios hemorrhaged money on proprietary platforms. Streaming became as fragmented and frustrating as cable. The experiment failed spectacularly.

Netflix's response: consolidate everything. Rather than competing on original content alone, they said, "We'll be the platform where everything lives." Sony's response: get paid instead of struggling. Rather than maintaining an expensive streaming platform, they said, "Licensing is better than ownership."

This pragmatism marks streaming's maturation. No more fantasies about platform revolutions. Just cold economics: Netflix has money to spend on licenses, audiences want consolidated access, and Sony needs cash flow. Everybody wins.

But here's what matters for you personally: your entertainment just got better. Fewer subscriptions required. More content in one place. Quality franchises and serious films accessible immediately. The streaming wars didn't end with a winner. They ended with a surrender that actually benefits viewers.

The Bad Boys franchise arrives soon. Ghostbusters returns. Prestige dramas you've never heard of sit waiting for discovery. Family content for kids and grandkids. This isn't Netflix padding its catalog with filler. This is Netflix consolidating legitimate, proven entertainment.

Is the Netflix-Sony deal perfect? No. Some people prefer theatrical experiences. Some want competition that drives innovation. Some think streaming fragmentation is better than subscription consolidation. Valid points all.

But objectively, this deal signals that streaming has matured into a sustainable model where major platforms can offer comprehensive entertainment without requiring audiences to maintain Netflix, Disney+, Paramount+, HBO Max, Apple TV+, Peacock, and specialty services simultaneously. We might finally be exiting the streaming chaos phase.

Which means you can stop feeling guilty about dropping subscriptions you weren't using. The consolidation is just beginning.

Key Takeaways

- Netflix and Sony announced a landmark global streaming agreement where Sony's entire film output, including theatrical releases, drama content, and family entertainment, now streams on Netflix after theatrical windows

- Confirmed movies include Bad Boys: Ride or Die, Ghostbusters franchise films, Madame Web, prestige dramas, and Sony's animated family content with ongoing theatrical releases

- New Sony theatrical releases will reach Netflix within 4-6 months of theatrical premiere, while older catalog content arrives faster on a rolling basis throughout the year

- The deal signals streaming's shift from fragmented competition to consolidation, where Netflix's financial capacity to license major studio content makes it strategically superior to proprietary platform competitors

- For Netflix subscribers, the deal immediately increases subscription value through expanded content options across genres without price increases, potentially eliminating the need to maintain multiple streaming services

Related Articles

- How to Watch What Drives You with John Cena Season 2 Free [2025]

- Star Wars' New Leadership Team: Can They Revive The Franchise? [2025]

- Dave Filoni Takes Over Lucasfilm: What It Means for Star Wars [2025]

- A Knight of the Seven Kingdoms Review: Game of Thrones Gets Funny [2025]

- Spotify's AI Music Stance: What It Really Means for Creators [2025]

- Most Controversial Film of 2024: Prime Video's Hidden Gem [2025]

![Netflix and Sony Streaming Deal: 5 Must-Watch Movies [2025]](https://tryrunable.com/blog/netflix-and-sony-streaming-deal-5-must-watch-movies-2025/image-1-1768570543163.jpg)