Netflix's $82.7B Warner Bros Deal: The Streaming Wars Heat Up

The streaming wars just got a lot more expensive, and frankly, a lot more complicated. If you've been following the drama between Netflix, Warner Bros. Discovery, and Paramount over the past few months, you know this isn't just another corporate deal. This is about who gets to own some of the most valuable entertainment assets on the planet, and the money involved is absolutely staggering.

In early 2025, Netflix made a strategic move that caught everyone's attention: it revised its offer to pay all cash for Warner Bros. Discovery's movie studio and streaming assets. The kicker? The price remained the same at

Let me break down why this matters so much and what it means for the entire streaming industry. The entertainment landscape is shifting in real time, and whoever wins this battle will essentially control a massive portion of what you watch.

TL; DR

- Netflix revised its offer to all-cash: Maintains 27.75/share) but removes stock component, reducing shareholder risk

- Paramount's counter-offer loses ground: Skydance's 40B debt guarantee from Larry Ellison) faces skepticism about financing risk

- Deal structure matters more than price: Netflix's lower-risk financing model outweighs Paramount's slightly higher nominal value

- Streaming consolidation accelerates: Winner controls HBO Max, Max originals, DC/Warner Bros IP, and massive streaming infrastructure

- Industry precedent set: All-cash offers become new standard for major entertainment M&A deals requiring board certainty

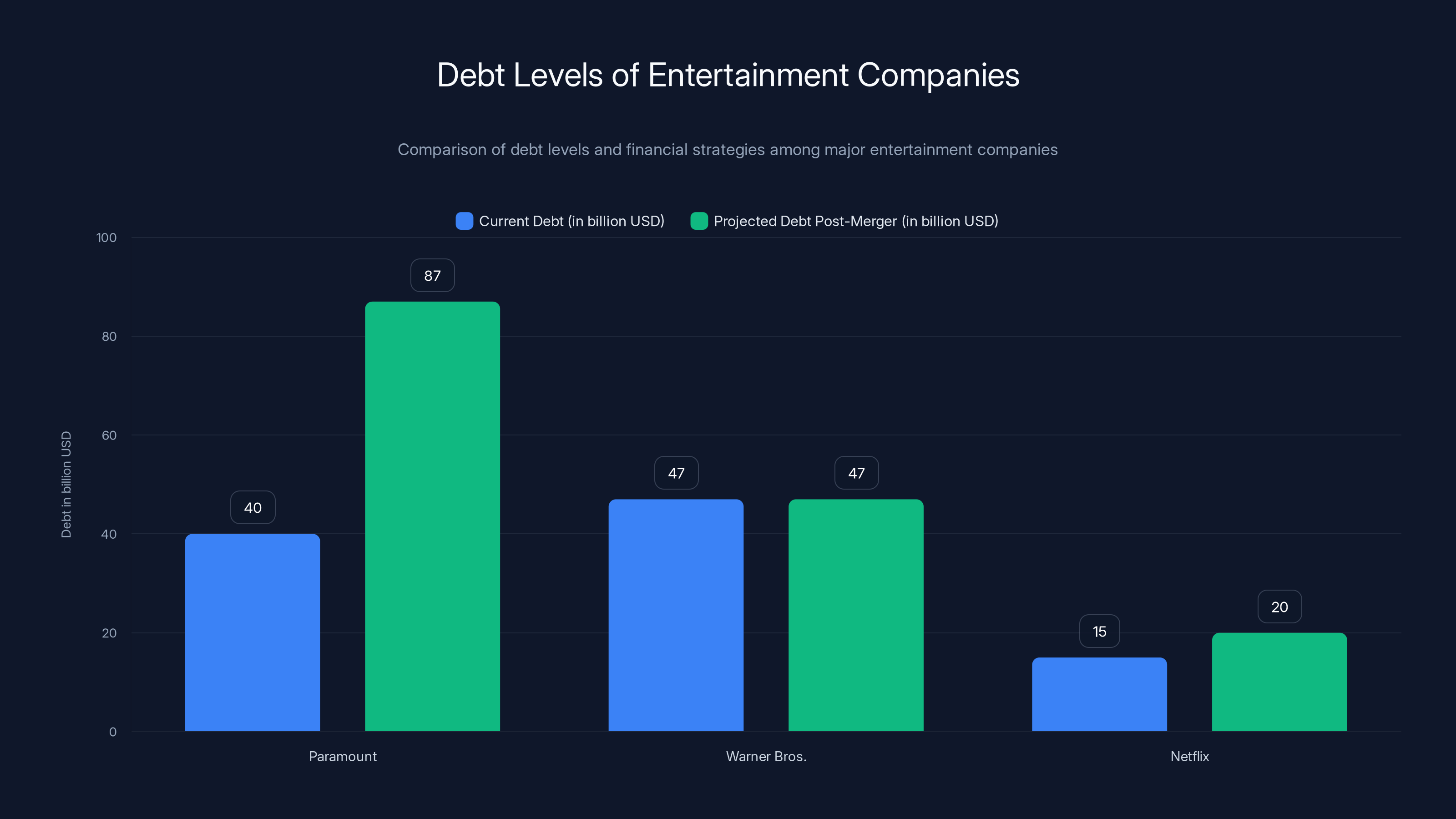

Paramount's debt would rise significantly to $87 billion post-merger, constraining strategic decisions, while Netflix maintains a manageable debt level due to positive cash flow. Estimated data.

Why This Deal Is Bigger Than Just Money

When most people see "$82.7 billion" they think about the number itself. But that number represents something far more consequential. Warner Bros. Discovery isn't just a company that makes movies and TV shows. It's a portfolio that includes some of the most recognizable franchises and properties in entertainment history.

We're talking about DC Comics superheroes, the Harry Potter universe, Game of Thrones, Friends (which still generates enormous licensing revenue), and the HBO empire that basically invented prestige television. The company also operates Max, which competes directly with Netflix, Disney Plus, and every other streaming platform you subscribe to.

From Netflix's perspective, this acquisition would be transformational. It would instantly give Netflix access to a back catalog of thousands of hours of content, physical film studios, and most importantly, a proven production pipeline that creates content people actually want to watch. Think about it this way: Netflix has been spending tens of billions annually just on content creation. By acquiring Warner Bros., Netflix wouldn't have to buy content from competitors anymore. They'd own it.

But here's where it gets really interesting. The deal isn't straightforward. The board is backing Netflix, but the shareholders might have different ideas. That's why structure matters so much.

The Cash vs. Stock Question: Why It's Not Just Semantics

On the surface, the difference between Netflix's original mixed deal and its revised all-cash offer seems like accounting minutiae. But it's actually the difference between certainty and hope.

When you offer someone stock as part of a deal, you're essentially saying: "Here's cash, and here's a bet on my company's future performance." If Netflix stock drops 30% over the next year, those WBD shareholders are holding the bag. They get the cash portion, sure, but the stock portion just got a lot less valuable. Paramount's deal has a similar problem, except it's also heavily leveraged.

The all-cash offer eliminates this risk completely. WBD shareholders know exactly what they're getting, in real dollars, on day one. No surprises. No waiting to see if Netflix stock tanks. This is why institutional investors and public shareholders often prefer all-cash deals. It's not more money—it's guaranteed money.

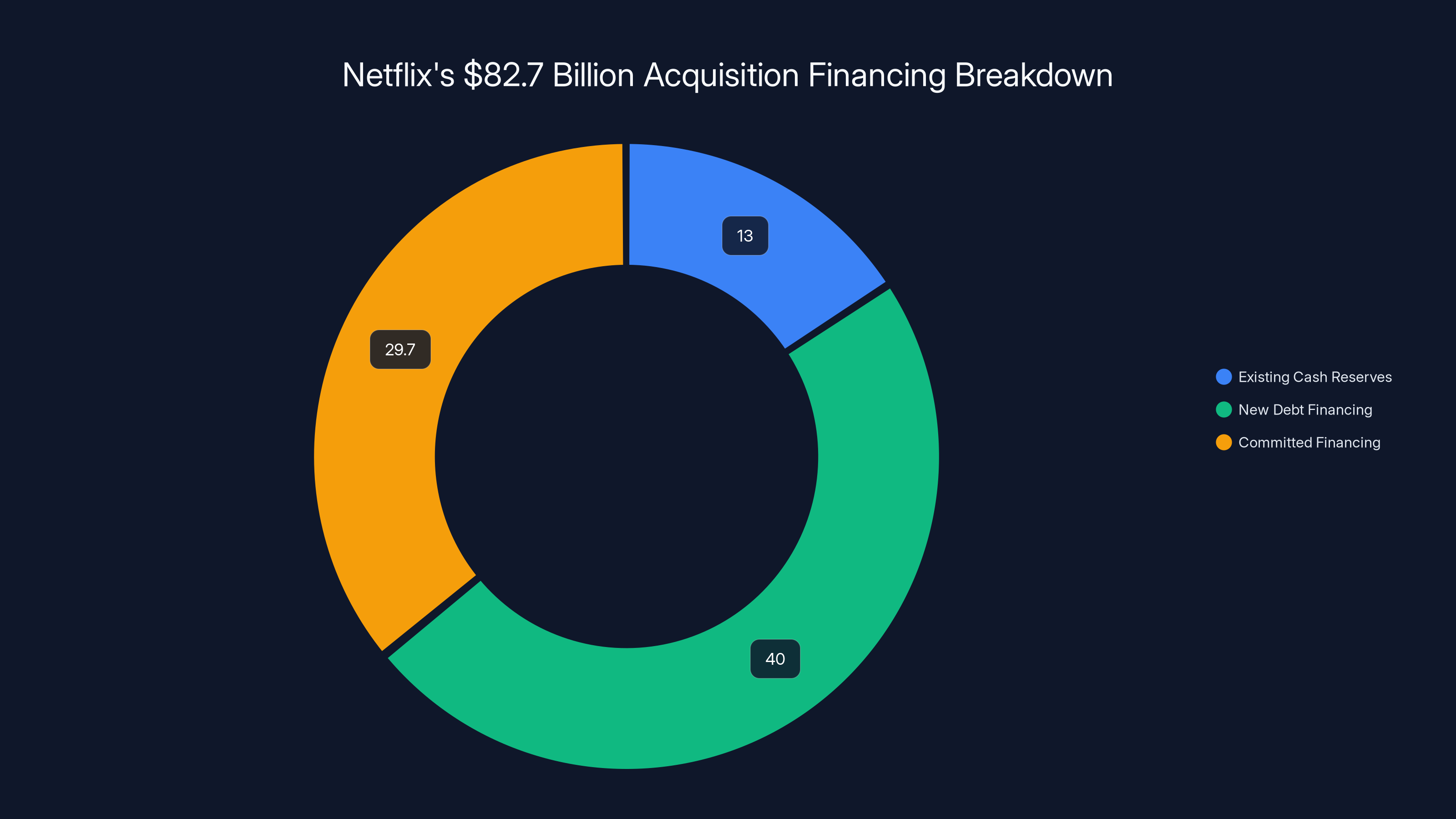

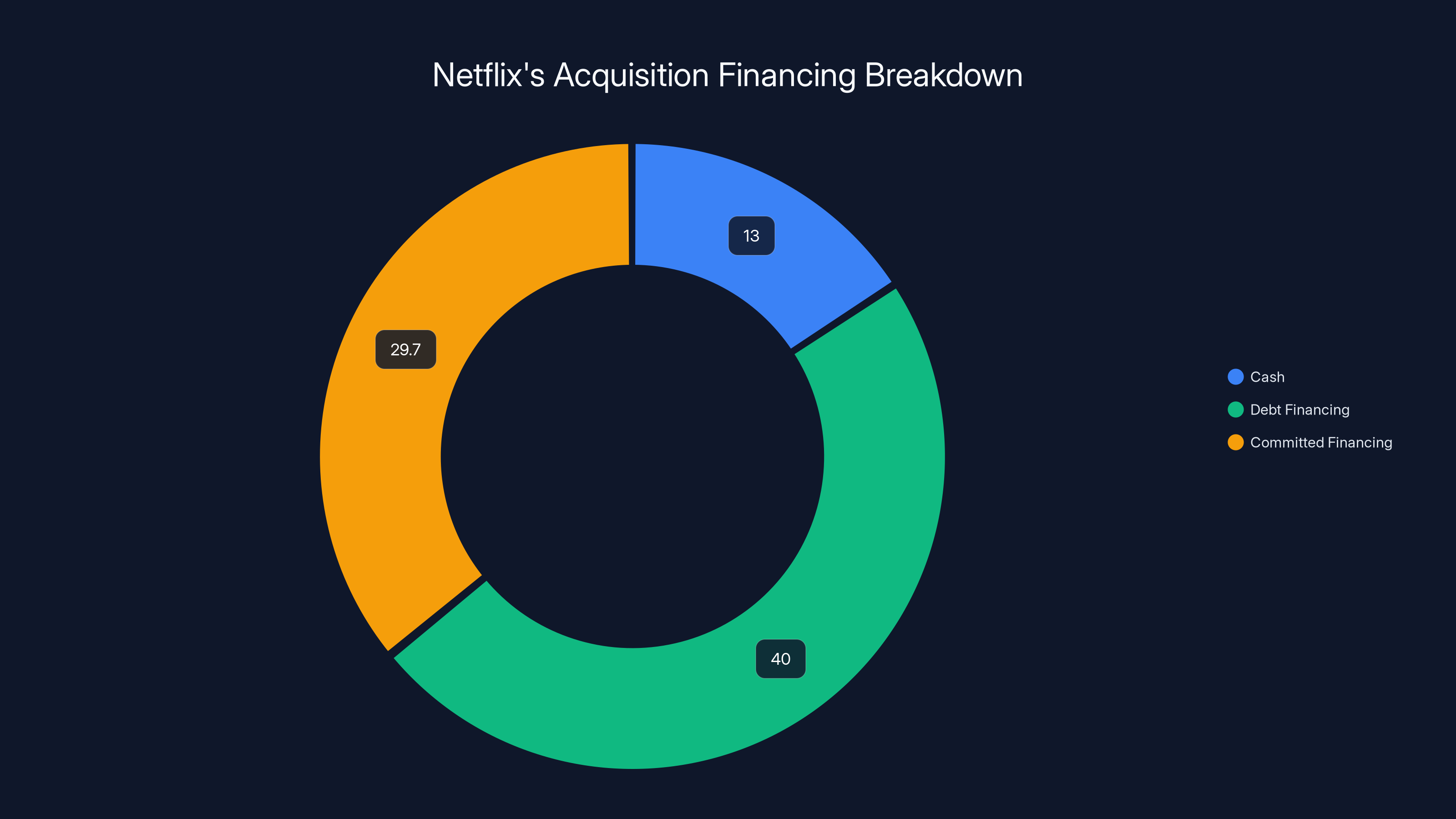

Netflix said it would finance this through a combination of cash reserves, debt, and what it called "committed financing." That's financial speak for "we've got the money locked down." They've been aggressively managing their balance sheet for exactly this kind of situation.

Paramount's situation is different. Skydance is offering

Netflix is financing its $82.7 billion acquisition through a combination of existing cash reserves, new debt financing, and committed financing arrangements. Estimated data.

The Risk Calculus: Why Debt Matters in Entertainment

Let me explain why the debt situation is absolutely critical here, and why Warner Bros.' board has been so skeptical of Paramount's approach.

Entertainment companies are capital intensive. They need to constantly invest in new content, new infrastructure, and new talent. Unlike software companies where profit margins can be 40%, 50%, or even higher, streaming and content production typically operate on much slimmer margins. When you add enormous debt to an already capital-intensive business, you create a compounding problem.

Paramount already has a junk-rated credit rating. That means the bond market already sees it as a risky investment. Now imagine adding $40 billion more debt on top of that. The combined entity would be financing content production, infrastructure, and debt service simultaneously. That's a precarious position.

Warner Bros.' financial analysis concluded that Paramount's deal would saddle the combined company with $87 billion in total debt. That's not just a big number. That's a number that would constrain every strategic decision the merged company could make. Every dollar going to debt service is a dollar not going to new content, technology, or customer acquisition.

Netflix's all-cash approach sidesteps this entirely. Yes, Netflix will take on some debt to finance the deal, but the company's balance sheet and cash flow position is completely different from Paramount. Netflix has been generating positive free cash flow for years. It can absorb debt in a way Paramount simply cannot.

This is the real reason the board backed Netflix. It's not sentiment. It's financial reality.

What This Means for Streaming Competition

If Netflix wins this deal, the streaming landscape changes dramatically. Let's look at what the combined entity would control.

Netflix already has the largest subscriber base of any streaming service. Add Warner Bros.' content library, production capabilities, and franchises, and you're looking at a company that could effectively set terms for the entire industry. Other streaming platforms would have to compete against Netflix's massive content advantage.

Disney+, which has Marvel, Star Wars, and a century of Disney content, would remain competitive, but even Disney would be up against a much stronger rival. Amazon Prime Video would still have deep pockets, but it would lose access to Warner Bros. content. HBO Max customers would migrate to Netflix or face losing that content portfolio.

The ripple effects would be immediate. Content licensing becomes more complicated. International expansion becomes easier for Netflix but harder for everyone else. Production costs might actually stabilize because Netflix would internalize more of the supply chain.

But here's something else worth considering. This kind of consolidation usually comes with regulatory scrutiny. Antitrust regulators might look at a Netflix-Warner Bros. deal and say it's too dominant. We've already seen regulatory concerns raised about streaming consolidation. A deal this large would almost certainly trigger a formal review.

The Paramount Counter-Attack: Lawsuits and Board Tactics

Paramount didn't take the revised Netflix offer lying down. The company filed lawsuits against Warner Bros. seeking more information about Netflix's deal structure and financing. Paramount also attempted to nominate new board members to Warner Bros.' board of directors, hoping to install directors more sympathetic to its offer.

This is standard activist playbook stuff. When you can't win the argument on merits, you challenge the process. Paramount's legal team demanded that the court accelerate the lawsuit to speed up their access to Netflix's deal details. But the court rejected that request, which is a win for Netflix and Warner Bros.

The board nomination strategy is interesting though. Paramount was trying to argue that the current board wasn't properly considering all alternatives. If Paramount could get its own directors elected, it could force a board vote on Paramount's deal. But Warner Bros.' board has been remarkably united in its opposition to Paramount, so the nomination effort was always going to be an uphill battle.

What's notable is how quickly Paramount escalated this. Instead of gradually building shareholder pressure, Paramount went for the nuclear options: lawsuits and board challenges. This suggests Paramount is worried it's losing on the merits. The company knows that an all-cash offer, even at a lower price, is hard to argue against when you're proposing something that comes with massive debt and execution risk.

Netflix is using a combination of cash, debt, and committed financing to fund its

How Netflix's Financing Actually Works

Let's get into the mechanics of how Netflix is actually funding this. The company said it would use "cash, debt, and committed financing." That's a specific formula worth understanding.

First, the cash component. Netflix has roughly

Second, debt financing. Netflix would go to the bond market and borrow money specifically to fund this acquisition. The company has an excellent credit rating, so it can borrow at favorable rates. This is the traditional M&A financing approach. You borrow money at, say, 5-6% interest, and the acquired company's cash flows help pay back that debt over time.

Third, "committed financing." This is the financial commitment from banks and institutional investors that they'll fund whatever portion of the deal Netflix needs. When you see this language in a deal announcement, it means the banks have already agreed to underwrite the debt. It's not "we hope to finance this." It's "the financing is locked in."

The beauty of this structure is that it's boring but stable. Netflix isn't trying to do something exotic. It's using the most straightforward acquisition financing mechanism available. That's exactly what you want to see when you're a shareholder evaluating risk.

The IP Question: Why Content Ownership Matters More Than Ever

One factor that doesn't always get enough attention in these deals is intellectual property ownership. Warner Bros. owns the rights to generate revenue from their content pretty much forever. That's not true for Netflix, which licenses content from other studios and has to constantly renew licenses or deal with content expiring.

By owning Warner Bros., Netflix would own the underlying IP. If you own Harry Potter, you own the rights to make new shows, new movies, merchandising, theme park licensing, everything. You can make decisions about that IP based on Netflix's strategy, not on what some external studio thinks is best.

This is actually worth billions of dollars over time. It's the difference between renting a house and owning it. As an owner, you can renovate, expand, or modify things. As a renter, you're limited in what you can do.

Paramount hasn't really emphasized this angle in its counter-offer, which is interesting. Maybe because Paramount already owns Paramount Pictures and has its own IP portfolio, so the IP argument doesn't resonate the same way. But for Netflix, owning Warner Bros. IP is strategic gold.

The Strategic Timing: Why Now?

You might wonder why this deal is happening now, in early 2025. There are a few reasons worth considering.

First, the streaming market is maturing. The era of explosive subscriber growth is over. Netflix, Disney+, Amazon Prime, and other services have saturated most developed markets. Growth now comes from price increases and from squeezing more revenue out of existing subscribers. That requires content differentiation and something neither Netflix nor competitors can easily replicate.

Second, content costs have exploded. Production budgets for premium streaming content have become absurd. Shows cost

Third, competition from international players is heating up. Services from China, India, and other regions are getting aggressive about content. The traditional Hollywood studios are facing competition they've never seen before. Consolidation allows them to compete more effectively.

Fourth, and this is important, the advertiser-supported tier is becoming increasingly important. Netflix and others are seeing that users will tolerate ads if it reduces their subscription cost. Advertising is a high-margin business compared to pure subscription, and Warner Bros.' content is perfect for advertising. The combined Netflix-Warner Bros. entity would be incredibly valuable to advertisers.

Market maturity, rising content costs, and the growing importance of ad-supported tiers are key factors influencing the strategic timing of streaming deals in 2025. Estimated data.

Shareholder Perspective: What WBD Shareholders Are Actually Thinking

Let's zoom out and think about this from a Warner Bros. shareholder's perspective. You're sitting on WBD stock, and suddenly you've got two very different offers on the table.

Netflix: $27.75 per share, all cash, certainty of value, no execution risk on your end. You cash out, the deal closes, you move on.

Paramount:

If you're a rational shareholder, the Netflix offer actually might look better, even at a lower price. That's because the all-cash nature of the deal eliminates the risk that Paramount's deal falls apart due to financing complications or regulatory issues.

Warner Bros.' board clearly thinks this way. The board has multiple fiduciary duties to shareholders. They need to act in shareholders' best interests. The board has consistently said Netflix's offer is superior not because it's a higher price, but because it's lower risk.

Now, activist investors and hedge funds might see this differently. They might think "if we keep pushing, we can get Paramount to raise their bid to

Regulatory Considerations: The Elephant in the Room

Let's be honest: a Netflix-Warner Bros. deal will face serious regulatory scrutiny. The U. S. Department of Justice, the Federal Trade Commission, and potentially international regulators will all have opinions about whether this deal should be allowed.

On one hand, streaming is still relatively fragmented. Netflix, Disney+, Amazon Prime, Max, Paramount+, and others all compete. Adding Warner Bros. to Netflix doesn't eliminate competition entirely.

On the other hand, Netflix already has about 30% of the global streaming market by subscriber count. Add Warner Bros., and Netflix becomes almost unchallengeable in content quality and quantity. That's exactly what regulators worry about.

The counterargument, which Netflix will probably make, is that traditional media companies like Disney and Paramount are also consolidating. If Disney can own multiple studios, why can't Netflix own Warner Bros.? It's a fair point, but regulators often move slowly and unpredictably.

Paramount's deal faces similar regulatory questions, by the way. If Skydance merges with Paramount, that also creates concentration concerns. But the financial risk makes Paramount's deal less likely, so regulators might not even need to worry about it.

My guess is that Netflix's deal faces a 6-9 month regulatory review process. The deal likely gets approved, but with some conditions. Maybe Netflix has to agree not to raise prices for a certain period. Maybe they have to commit to certain content spending levels. Those are the kinds of remedies regulators typically impose.

International Expansion: The Hidden Advantage

One advantage of the Netflix-Warner Bros. deal that doesn't get enough press is international expansion. Warner Bros. has a massive international presence. The company produces content globally and has relationships with broadcasters, regulators, and distributors worldwide.

Netflix has global reach, but it's a relatively new player in many markets. It doesn't have the regulatory relationships and the local partnerships that Warner Bros. has developed over a century of operations.

By combining these, Netflix could accelerate its international expansion significantly. Imagine Netflix being able to leverage Warner Bros.' relationships in Europe, Asia, and Latin America to expand faster and negotiate better content rights. That's worth real money.

Similarly, Warner Bros. could leverage Netflix's technology and data science capabilities to improve its streaming operations. Netflix is the gold standard in recommendation algorithms, personalization, and understanding user behavior. Warner Bros. would gain access to that institutional knowledge.

This kind of strategic fit is often undervalued in deal analysis. Financial folks focus on balance sheets and cash flows, but operational synergies can be equally important.

Netflix's all-cash offer provides lower risk compared to Paramount's higher offer with significant leverage. Estimated data.

Content Production: The Economics of Vertical Integration

Let's talk about what this deal means for how content actually gets made.

Right now, Netflix buys content from studios. The studio gets paid, Netflix gets the content rights for a specific period (usually 3-7 years). Then the rights revert back to the studio or expire entirely. This is why Netflix has to spend $17-18 billion annually just to maintain its content library. They're not building equity. They're renting.

By owning Warner Bros., Netflix would own the content vertically. Netflix could make a decision to invest in a show because it knows that show will exist in Netflix's catalog forever. The economics change dramatically.

Production costs might actually go down because Netflix would streamline the production process. There would be less negotiation, fewer approval loops, and faster decision-making. Warner Bros.' production teams would report to Netflix management, not to external business units making decisions based on theatrical release windows or licensing deals.

This is how Disney operates with Marvel and Lucasfilm. Disney controls the entire value chain from production to distribution. It's more efficient and more profitable than licensing arrangements.

Netflix wants to move in that direction. The Warner Bros. deal accelerates that shift dramatically.

The Talent Question: Do Directors, Producers, and Actors Care Who Owns the Studio?

Here's a question that comes up less often but is genuinely important: does it matter to creators whether their content is owned by Warner Bros. or Netflix?

In the short term, probably not much. Directors and producers have contracts that specify their payment, creative control, and backend participation. Those contracts don't change just because Netflix acquires the studio. A deal that required Netflix to renegotiate thousands of talent contracts would be a nightmare.

In the long term, this could change. If Netflix can demonstrate that it gets better distribution, better audience metrics, and better financial returns for creators, then creators might prefer Netflix-owned platforms over traditional studios.

There's also a cultural question. Hollywood has a very specific culture. It's been developed over a century. Netflix, by contrast, is a technology company that happens to make content. Those cultures are different. Some creators thrive in traditional Hollywood. Others love the Netflix model. A merged company would have to figure out how to blend those cultures.

This is actually one of the reasons some M&A deals in creative industries fail. The talent leaves, and suddenly the value proposition disappears. Netflix and Warner Bros. would need to be incredibly thoughtful about managing this transition.

The Precedent This Sets: Future Streaming Consolidation

Whatever happens with this deal, it sets a precedent for how streaming consolidation works. If Netflix successfully acquires Warner Bros., other deals will follow. Maybe Amazon buys Paramount. Maybe Apple buys something significant. Maybe International players start making acquisitions in the U. S. market.

The playbook becomes clear: to be relevant in streaming long-term, you need massive content libraries, global distribution, and strong technology. You can build those things independently, but acquisition is faster. The Netflix-Warner Bros. precedent shows that M&A in streaming is viable, even at multi-billion-dollar scales.

This also has implications for independent creators and smaller studios. If the big players are consolidating, what happens to everyone else? Do they remain independent? Do they get acquired? Do they find niche markets and thrive without being part of a massive conglomerate?

These are the questions the industry will be grappling with over the next 5-10 years. The Netflix-Warner Bros. deal is the opening move in a much larger game of consolidation.

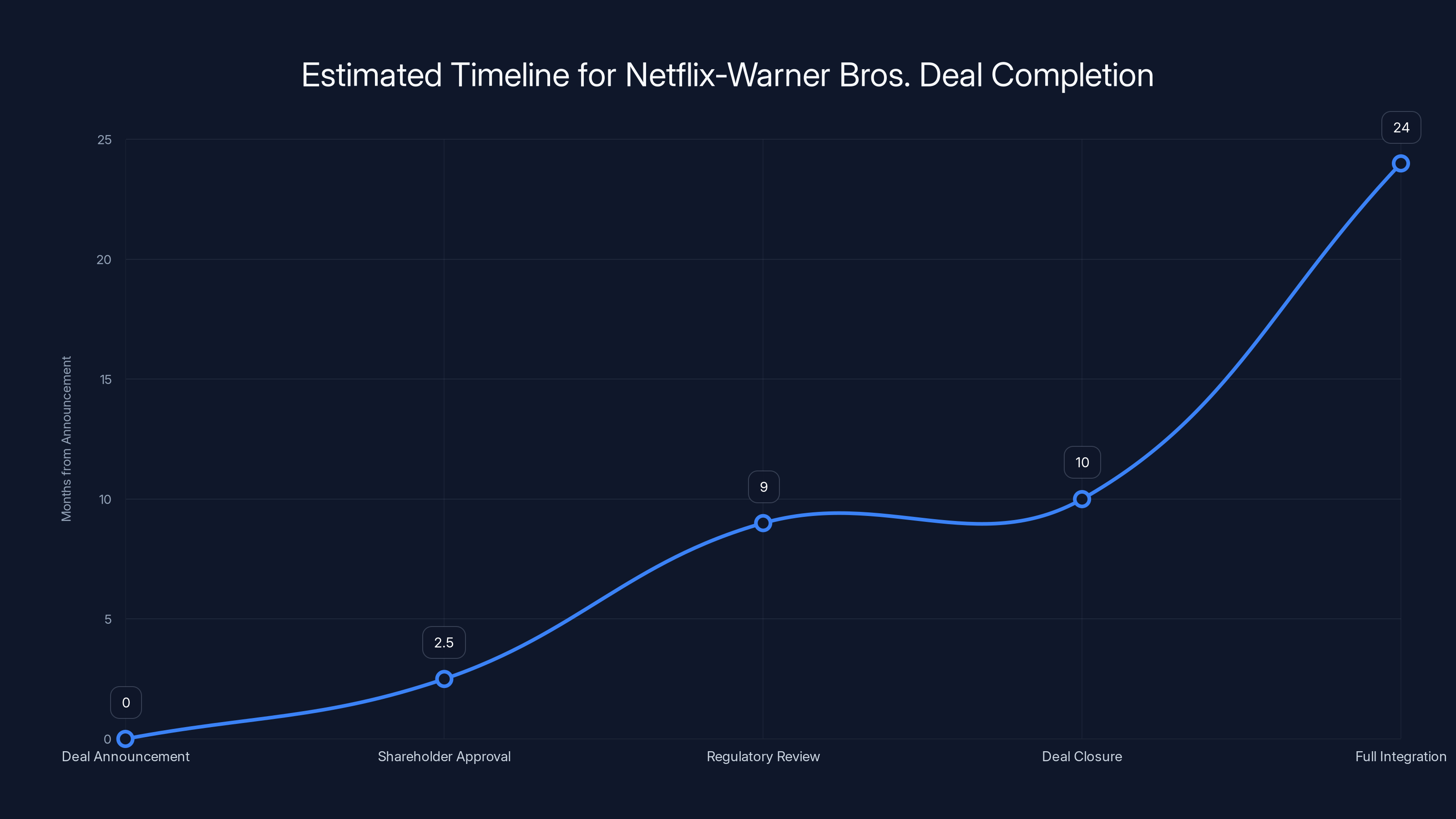

The timeline for the Netflix-Warner Bros. deal spans approximately 18-24 months from announcement to full integration, with key phases including shareholder approval, regulatory review, and operational integration. (Estimated data)

Paramount's Future: What Happens if Netflix Wins?

Let's talk about what this means for Paramount if the Netflix deal closes.

Paramount Skydance would miss out on acquiring Warner Bros. The question then becomes: what does Paramount do next? Does the company remain independent? Does it get acquired by someone else? Does it merge with another content company?

Paramount is in a precarious position. The company has lost streaming subscribers, theatrical market share, and cultural relevance over the past few years. The appointment of David Ellison as CEO was supposed to change that, but it's clear from this situation that Ellison's vision includes combining with a major content player.

If Paramount can't acquire Warner Bros., the company will need to find another path to scale. One possibility is that Paramount accelerates its advertising-focused strategy. Instead of trying to compete with Netflix on subscriber count, Paramount focuses on becoming an advertising-supported network. That's a lower-risk strategy than pursuing billion-dollar acquisitions.

Another possibility is that Paramount gets acquired by someone else. Could Apple acquire Paramount? Could Microsoft? Could an international player make a move? These are all possibilities.

What seems unlikely is that Paramount continues as an independent, pure-play streaming company. The economics don't work. You need scale, content, and technology. Paramount has some of each, but not enough to compete against Netflix, Disney, and Amazon independently.

Stock Market Reaction: What This Tells Us About Deal Value

One of the best ways to understand how the market views a deal is to look at how stocks react to the news. When Netflix announced its revised all-cash offer, how did various stocks move?

Warner Bros. stock likely moved slightly. The all-cash nature of the offer provided certainty, but the price didn't change, so there's no immediate upside. However, the removal of financing risk means WBD shareholders know the deal is more likely to close.

Netflix stock probably traded down slightly. Investors worry that Netflix is paying too much or taking on too much risk. But Netflix's balance sheet can handle this deal, so the sell-off is probably temporary.

Paramount stock likely dropped. Paramount's offer suddenly looks weaker because Netflix basically called Paramount's bluff. Paramount said it would make a better offer, but it can't match Netflix's certainty of value.

This is exactly the kind of signaling that happens in competitive M&A situations. Deals are won and lost not just on price, but on perception of certainty. Netflix communicated certainty with an all-cash offer. Paramount communicated uncertainty with its debt-heavy structure.

Timeline and Next Steps: What Actually Happens Now

Assuming the Netflix deal proceeds, here's approximately what the timeline looks like.

First, Warner Bros. shareholders vote on the deal. The board is recommending it, so it should pass. But you never know with shareholder votes. There could be activist investors or pension funds that oppose the deal. Still, the board recommendation matters a lot. Shareholder approval likely happens within 2-3 months of the deal being announced.

Second, regulatory review begins. The FTC and DOJ will examine whether the deal violates antitrust law. This process typically takes 6-9 months. During this time, Netflix and Warner Bros. will have to justify why the deal doesn't create unfair market concentration. The companies might have to agree to certain conditions, like divesting certain assets or committing to certain business practices.

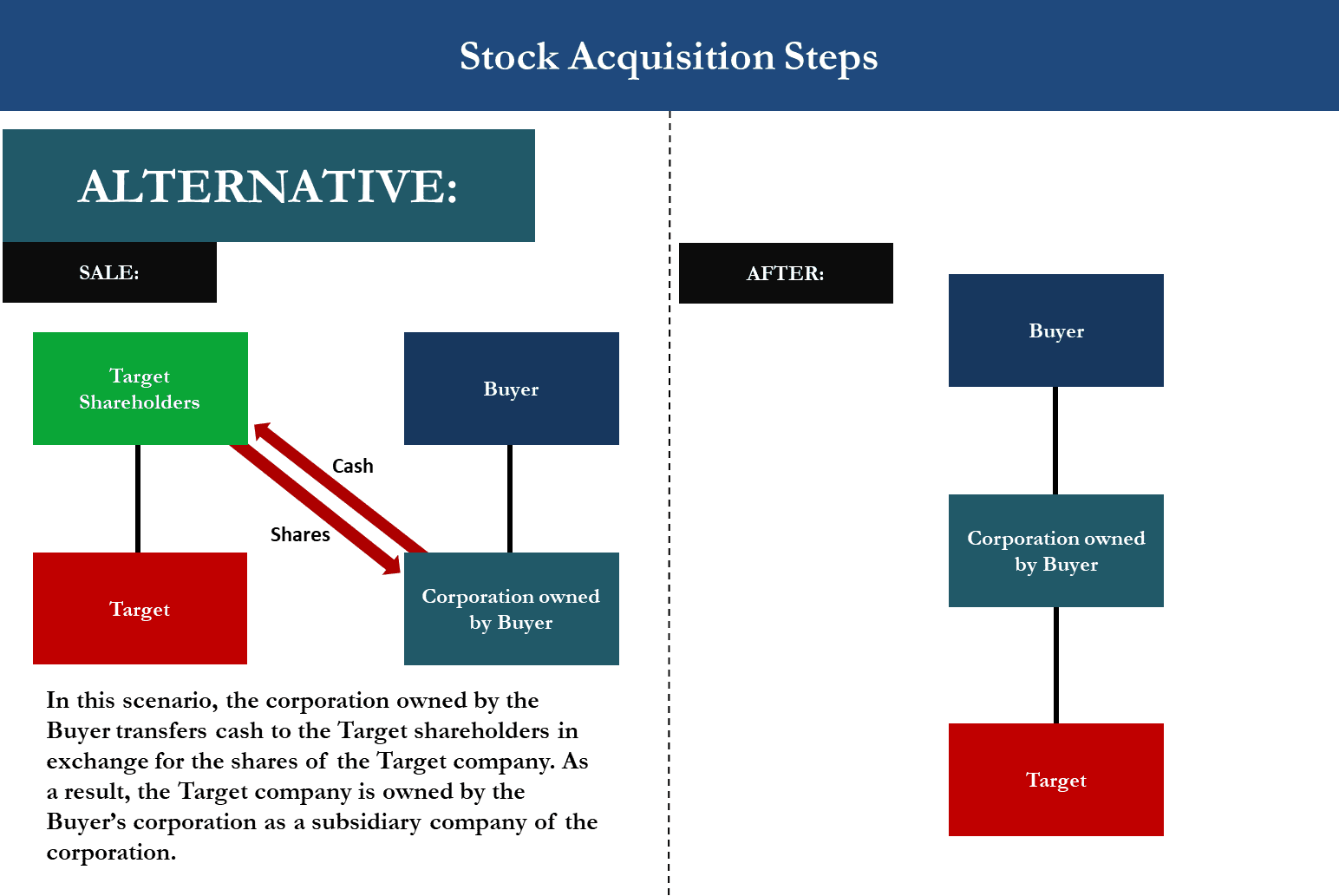

Third, assuming regulatory approval, the deal closes. All Warner Bros. shares are converted to cash (at $27.75 per share). Warner Bros. becomes a fully owned subsidiary of Netflix. Warner Bros. management and Netflix management figure out how to integrate the organizations.

Fourth, the real work begins. Netflix has to actually integrate thousands of employees, consolidate operations, and capture synergies. This process typically takes 1-2 years. During this time, there will be disruption, redundancies, and organizational friction.

The entire process, from announcement to full integration, probably takes 18-24 months. That's a long time, which gives Paramount plenty of opportunity to make trouble or find an alternative deal. But the Netflix-Warner Bros. deal has significant momentum.

Industry Implications: What This Means for Everyone

Let's zoom out and think about the industry-wide implications of this deal.

First, content licensing becomes more complicated. Netflix would no longer need to license content from Warner Bros. That content moves into Netflix. Other streaming platforms lose access to that content. This means a fundamental shift in content distribution economics.

Second, production incentives change. If you're a filmmaker or showrunner, you have to think about whether you want to work with an independent studio, with a platform like Netflix-Warner Bros., or with someone else. The platforms have resources and reach that independent studios can't match.

Third, advertising opportunities shift. Warner Bros. content on Netflix gives Netflix a massive library to sell advertising against. That advertising revenue becomes incredibly valuable, especially if Netflix can match viewers' interests with targeted ads.

Fourth, international markets become more concentrated. Netflix is already strong globally. Add Warner Bros., and Netflix becomes almost impossible to compete against in most markets outside China.

Fifth, consumer pricing might change. With a larger content library and more leverage, Netflix might be able to raise prices less frequently or offer better value at each price point. Or, Netflix might raise prices because it has a monopoly-like position. Economics could cut either way.

All of this suggests that the industry is moving toward more consolidation, more vertical integration, and potentially higher market concentration. That's good for companies like Netflix and Disney that are consolidating, but it might be bad for consumers, independent creators, and smaller competitors.

FAQ

Why did Netflix change its offer from cash-and-stock to all-cash?

Netflix changed its offer structure to eliminate shareholder uncertainty about the value they'd receive. With a mixed cash-and-stock deal, shareholders face risk that Netflix stock could decline, reducing their total proceeds. An all-cash offer removes this risk and makes the deal more attractive to risk-averse institutional investors. Additionally, an all-cash offer signals confidence in Netflix's financing capabilities and simplifies the deal structure, reducing the likelihood of regulatory complications.

How is Netflix actually financing the $82.7 billion purchase price?

Netflix is financing the deal through a three-part structure: existing cash reserves (roughly $13 billion), new debt financing from capital markets (taking advantage of Netflix's excellent credit rating), and committed financing arrangements with major banks and institutional investors. This traditional M&A financing approach allows Netflix to spread the burden across multiple sources of capital while preserving flexibility for future investment in content and technology.

Why is Warner Bros.' board rejecting Paramount's higher $30-per-share offer?

Warner Bros.' board argues that Paramount's deal comes with significantly higher risk due to its reliance on

What content and assets would Netflix gain by acquiring Warner Bros. Discovery?

Netflix would gain ownership of HBO and Max (the streaming platform), the entire Warner Bros. film and television production studios, the DC Comics universe and characters, the Harry Potter franchise, Game of Thrones, Friends, and thousands of hours of premium content. The acquisition also includes Warner Bros.' physical studios, production facilities, distribution relationships, and management expertise developed over more than a century. Additionally, Netflix would own valuable IP that generates licensing revenue from merchandise, theme parks, and future adaptations.

How long will this deal take to close, and what regulatory hurdles must it clear?

The complete process from shareholder approval to full integration typically takes 18-24 months. Netflix and Warner Bros. must clear U. S. Department of Justice and Federal Trade Commission antitrust reviews, which typically take 6-9 months. Regulators will examine whether the deal creates unfair market concentration in streaming entertainment. The companies may need to agree to certain conditions such as content distribution commitments or pricing agreements to satisfy regulators, but the deal is likely to be approved given that entertainment remains relatively fragmented with multiple strong competitors (Disney+, Amazon Prime, Paramount+, etc.).

What happens to Paramount and Skydance if Netflix completes this acquisition?

If Netflix acquires Warner Bros., Paramount Skydance must decide on an alternative strategy. The company could remain independent and focus on becoming an advertising-supported platform rather than competing on subscriber numbers. Alternatively, Paramount could pursue mergers with other media companies, get acquired by a technology company (Apple, Microsoft, Amazon), or find strategic investors to strengthen its competitive position. Paramount's long-term viability likely depends on whether it can find partners or investors willing to invest significant capital to help it compete against Netflix, Disney, and other consolidated media giants.

How does this deal affect content creators, actors, and filmmakers?

In the short term, most creative talent won't see significant changes because existing contracts typically don't change hands during corporate acquisitions. However, over the longer term, creators might experience changes in how projects are greenlit, financed, and distributed. Netflix's culture emphasizes data-driven decision-making and global distribution, which differs from traditional Hollywood. Creators might find that Netflix ownership offers advantages like global reach and non-traditional formats, or they might prefer the established relationships and processes at independent studios.

What does this deal mean for international streaming and global content markets?

The Netflix-Warner Bros. merger would accelerate Netflix's international expansion by combining Netflix's technology platform with Warner Bros.' century-old relationships with broadcasters, regulators, and distributors worldwide. This gives Netflix unprecedented leverage in international markets outside China. For consumers globally, this likely means more coordinated content releases, better integration across markets, and potentially more uniform pricing. For international content creators, Netflix's consolidated position could become both an opportunity (access to global distribution) and a threat (reduced negotiating power versus a dominant platform).

Could regulatory authorities block this deal?

While a Netflix-Warner Bros. deal faces antitrust scrutiny, complete rejection is unlikely. The streaming market remains relatively competitive with multiple strong players (Disney, Amazon, Paramount, Apple). However, regulators could impose conditions such as content licensing requirements, pricing restrictions, or commitments to maintain certain spending levels. U. S. antitrust enforcement under recent administrations has been more aggressive, so the review process will likely be thorough. International regulators in Europe and other jurisdictions will also review the deal independently. Approval is probable but not certain.

How does Netflix's all-cash offer compare financially to other major tech acquisitions?

Netflix's

Conclusion: The Streaming Landscape After Netflix and Warner Bros.

The Netflix-Warner Bros. deal, if completed, represents a watershed moment for streaming entertainment. We're not talking about Netflix acquiring another streaming service or a production company. We're talking about Netflix acquiring one of the five major entertainment conglomerates that have shaped entertainment for a century.

This deal says something fundamental about where the streaming industry is heading. It's not moving toward fragmentation or niche specialization. It's moving toward consolidation and dominance. Netflix is saying: we're going to own the content, the technology, the distribution, and the platform. We're going to compete on every dimension simultaneously.

Paramount's counter-offer tried to argue for a different future: one where traditional media companies consolidate with each other, maintain independence, and compete on traditional strengths. But that argument lost credibility the moment Netflix pivoted to an all-cash offer. All-cash is the language of certainty and power. It says: we don't need your help, we don't need to negotiate, we're buying this and we're financing it ourselves.

For consumers, this probably means fewer choices and higher prices over time, even though the short-term effect might be more investment in content quality. For creators, it means more resources but less independence. For employees at Warner Bros., it means significant organizational change as Netflix integrates the company. For shareholders, it means a probably-profitable exit if you own WBD shares, and probably some volatility if you own Netflix or Paramount shares.

The dominoes are falling, and we're watching it happen in real time. Streaming consolidation isn't a question of if, it's a question of how fast it happens and which companies end up on top. Netflix just made a clear statement about its intentions. It wants to be on top, and it's willing to spend $82.7 billion to make sure that happens.

The question now is whether regulators, competitors, and consumers will allow that vision to become reality. That's the real story that plays out over the next 12-24 months.

Key Takeaways

- Netflix switched from mixed cash-and-stock to all-cash offer at same $27.75/share, eliminating shareholder financing risk

- Paramount's 87B combined debt load and junk credit rating concerns

- All-cash offer signals Netflix's financial confidence and improves deal closure certainty for shareholders

- Warner Bros. gains ownership of HBO Max, DC Comics, Harry Potter, Game of Thrones, and century of entertainment IP

- Deal requires 6-9 month antitrust review but is likely approved given remaining streaming competition

Related Articles

- Netflix's $82B Warner Bros Deal: What It Means for Movie Theaters [2025]

- Paramount vs. WBD Netflix Deal: The Hostile Takeover Battle Explained [2025]

- Netflix's Warner Bros. All-Cash Bid: What It Means for Streaming [2025]

- HBO Max's Spoiler Problem: Why Modern Streaming Trailers Ruin Everything [2025]

- Watch A Knight of the Seven Kingdoms Online From Anywhere [2025]

- A Knight of the Seven Kingdoms Episode 1 Release Date on HBO Max [2025]

![Netflix's $82.7B Warner Bros Deal: The Streaming Wars Heat Up [2025]](https://tryrunable.com/blog/netflix-s-82-7b-warner-bros-deal-the-streaming-wars-heat-up-/image-1-1768919785559.jpg)