Netflix's Warner Bros. All-Cash Bid: What It Means for Streaming [2025]

Last week, Netflix made a strategic power move that nobody expected: it flipped its entire acquisition strategy for Warner Bros. Discovery by switching to an all-cash offer. The shift happened fast, and honestly, it tells you everything you need to know about the current state of the streaming wars.

The original deal was supposed to be clean. Netflix proposed acquiring Warner Bros. Discovery for

Here's what actually happened, why it matters, and what this tells us about the future of streaming consolidation.

TL; DR

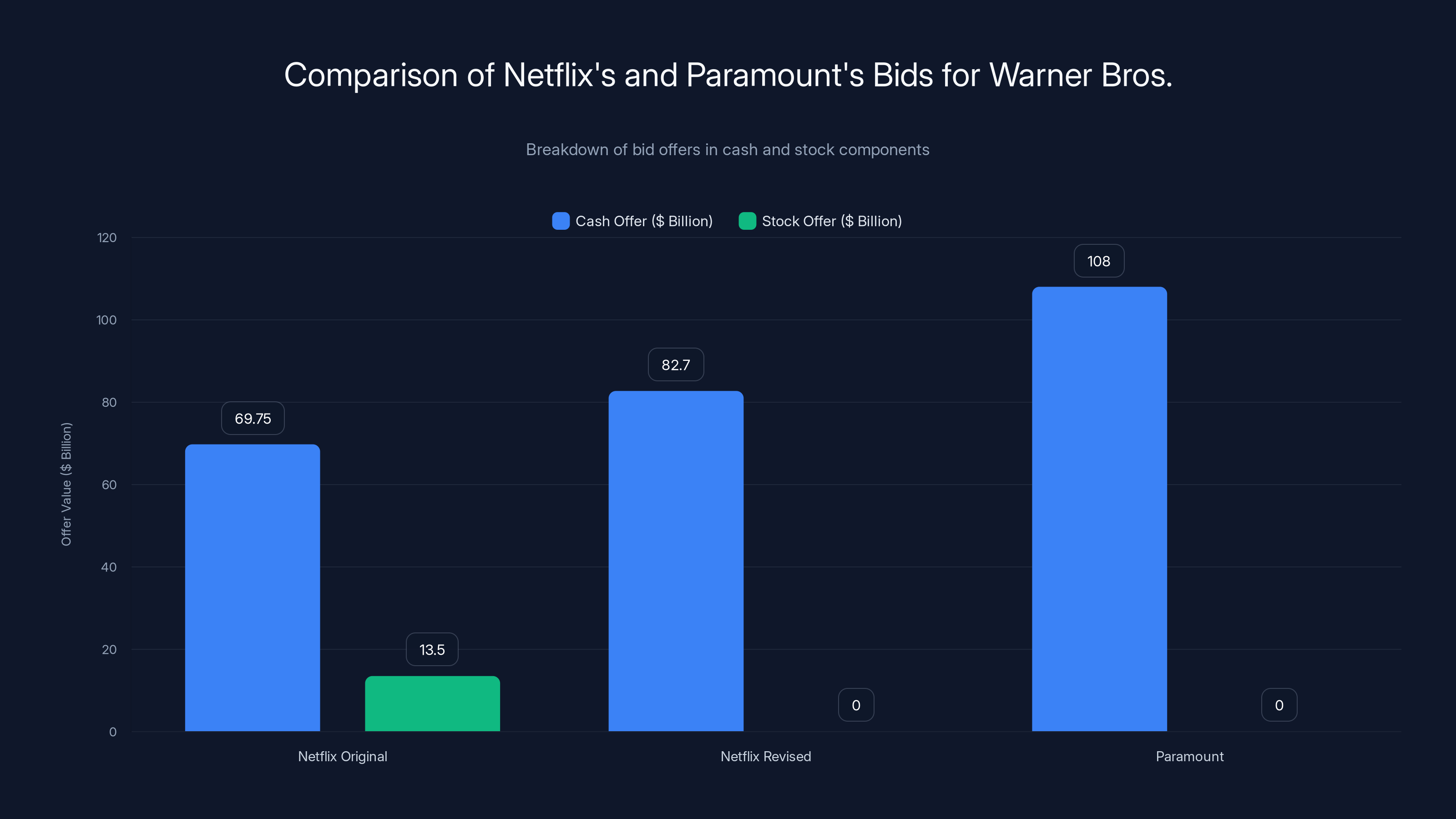

- Netflix revamped its offer: Changed from a 27.75 per share, with an additional separation value from Discovery Global

- Speed was the goal: The all-cash structure eliminates stock price volatility concerns and removes a major advantage Paramount was using against Netflix

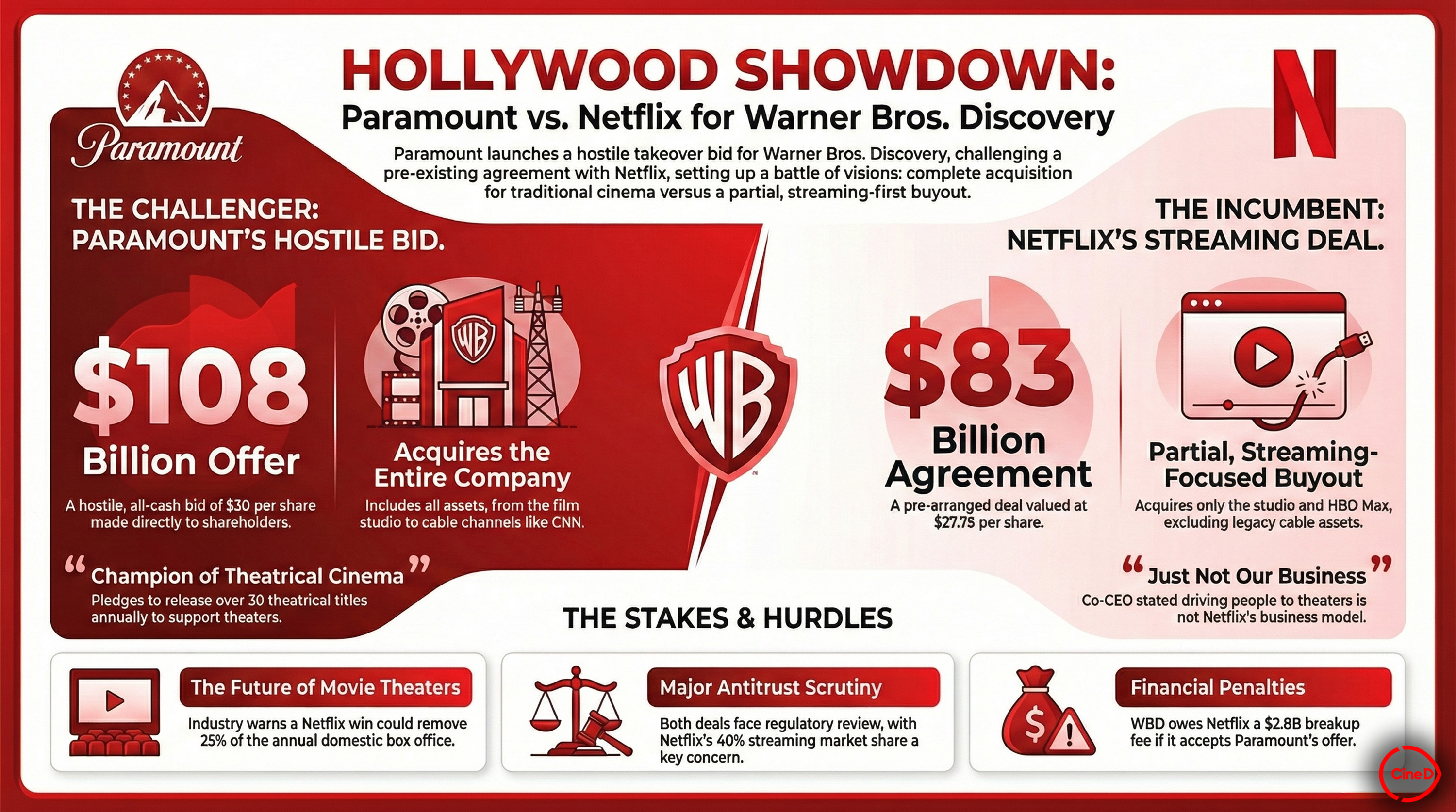

- Paramount's pressure worked: Rival bidder Paramount forced Netflix to strengthen its hand by launching a $108 billion hostile bid in December

- Regulatory approval still matters: Despite the structural improvements, both companies still need SEC and shareholder approval to close

- Streaming consolidation accelerates: This move signals that the era of industry fragmentation is ending, with mega-deals reshaping the entire entertainment landscape

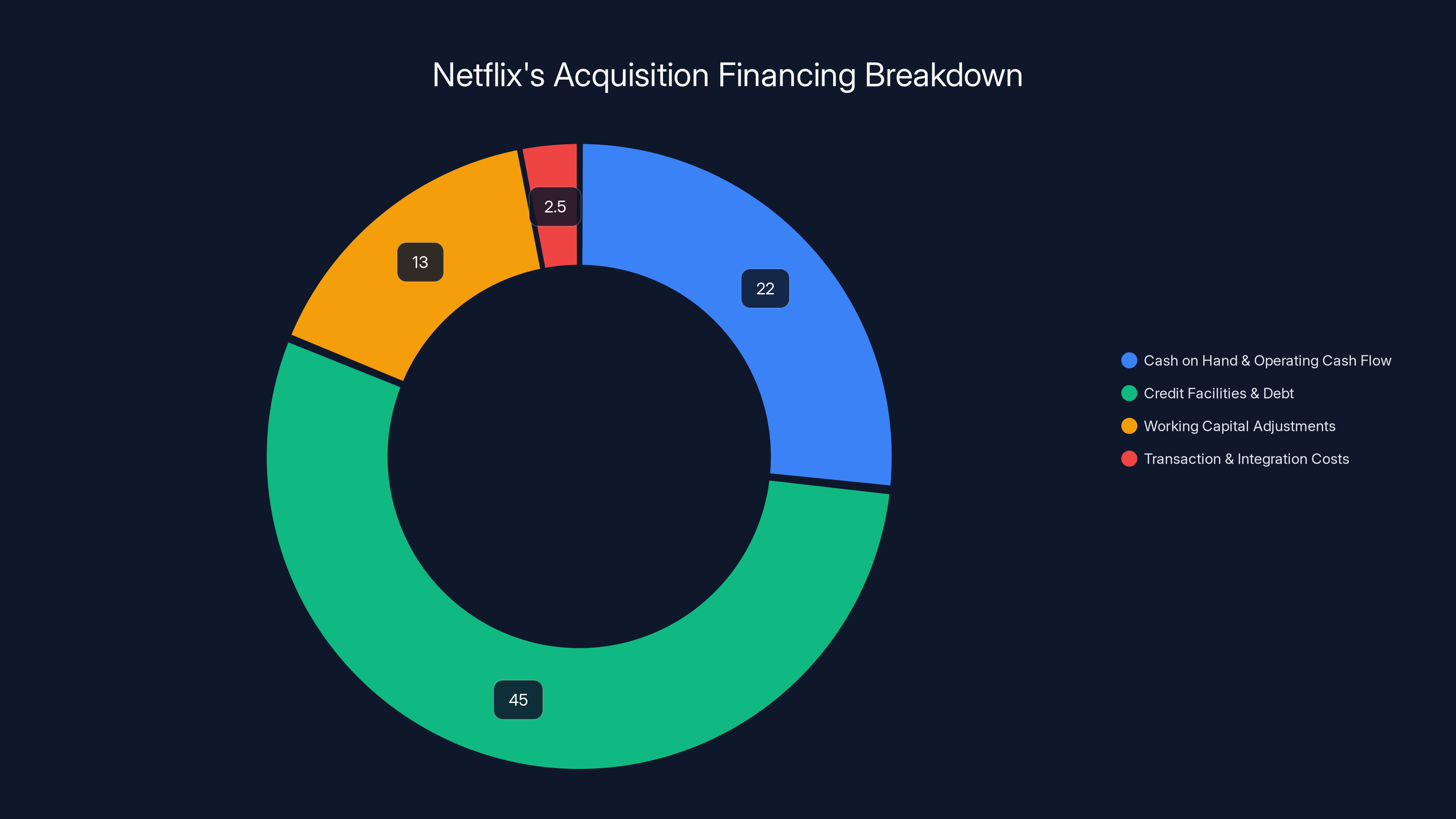

Netflix's acquisition is primarily funded through credit facilities and debt (approximately

The Original Deal Wasn't Broken—It Was Just Vulnerable

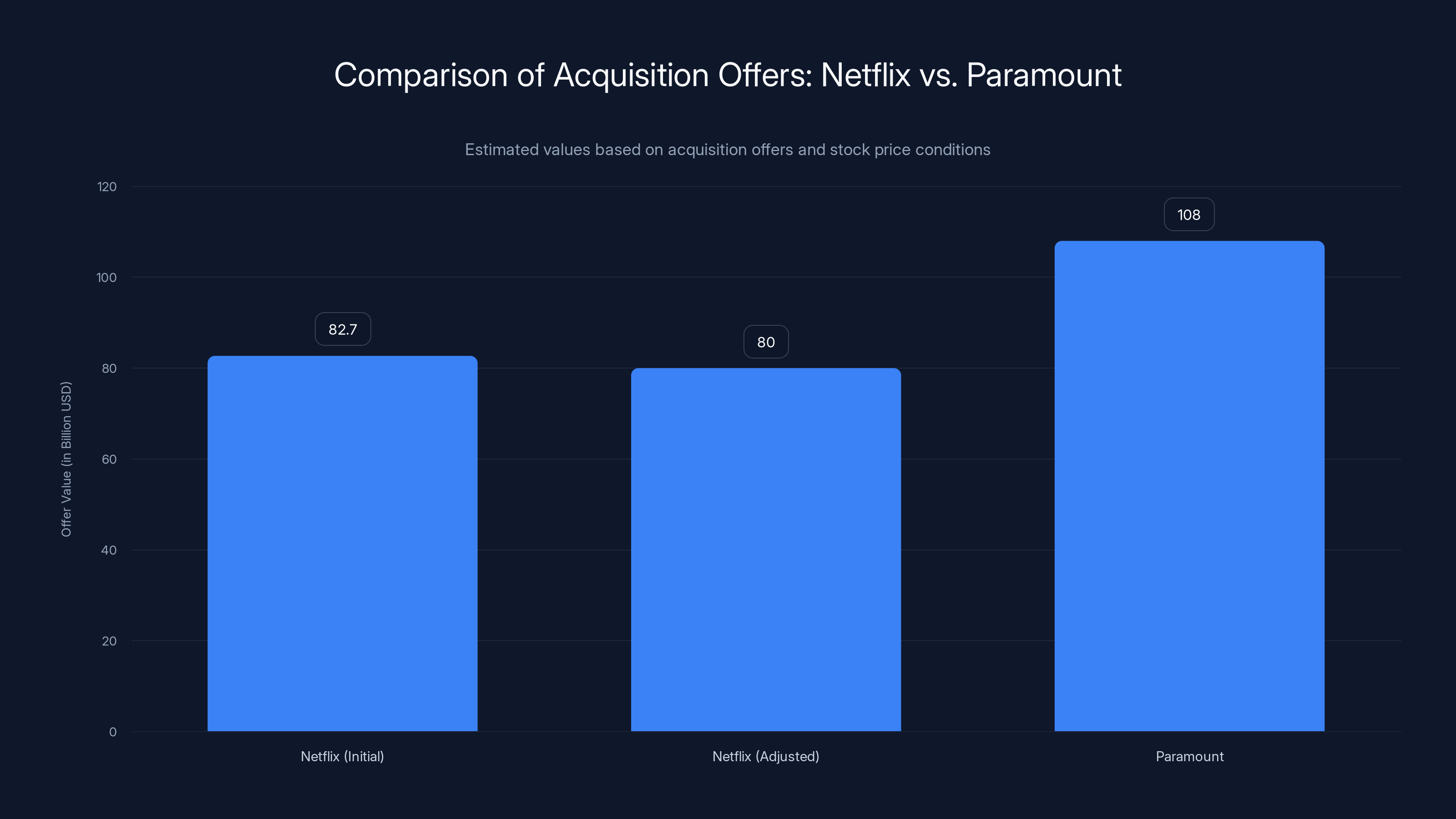

When Netflix first announced its acquisition of Warner Bros. Discovery on December 5th, the terms seemed reasonable. Netflix offered to pay shareholders

But there was a catch hidden in the fine print: a price collar. If Netflix's stock price fell below $97.91 per share before the deal closed, shareholders would receive extra shares to make up the difference. If it rose above that level, they'd receive fewer shares. On the surface, this sounds protective. In reality, it became Netflix's Achilles heel.

Netflix shares dropped below that threshold by December 8th. Suddenly, the math changed. Instead of receiving the fixed amount they expected, shareholders were looking at potential volatility. Their payout wasn't locked in—it depended on Netflix's stock performance, which is wildly volatile in the best of times.

This created exactly the opening Paramount was looking for. When Paramount announced its hostile $108 billion all-cash counterbid just hours after Netflix's stock dipped, they specifically attacked Netflix's mixed structure. Paramount's argument was blunt: we're offering 100% certainty at a higher total value, while Netflix is asking you to gamble on their stock price. It was a masterclass in leveraging structural weakness against a larger competitor.

Ted Sarandos, Netflix's co-CEO, had to watch from the sidelines as Paramount positioned itself as the safer bet. That's not a position Netflix is used to being in. So they did what Netflix does: they adjusted strategy mid-game.

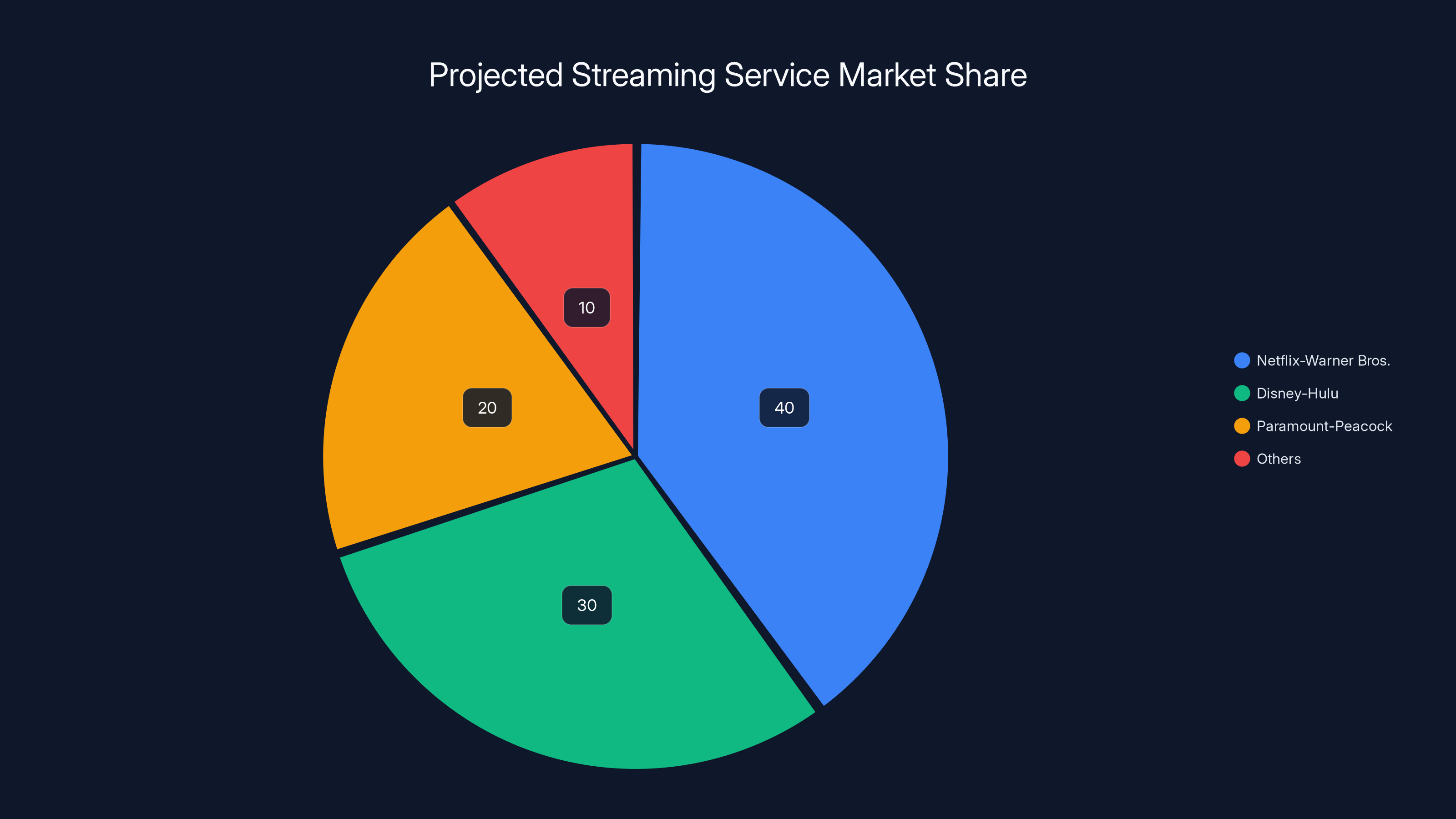

Estimated data shows Netflix-Warner Bros. could capture the largest market share post-mergers, with Disney-Hulu and Paramount-Peacock also holding significant portions.

Why All-Cash Is a Game-Changer in M&A Strategy

The shift to an all-cash offer at $27.75 per share seems like a simple structural change. It's not. It's actually a sophisticated move that addresses every structural weakness Paramount exploited.

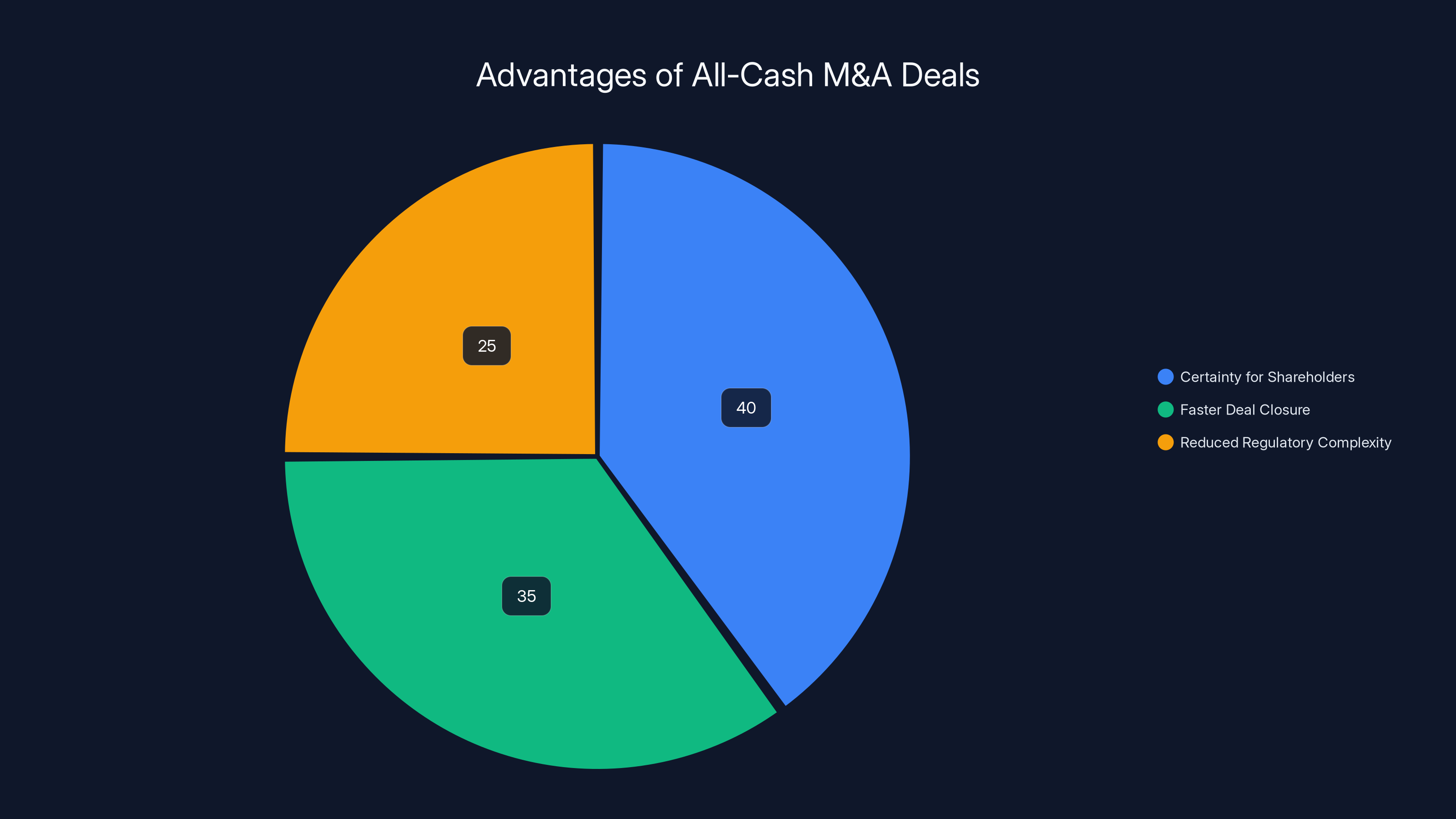

First, let's understand what all-cash actually means in merger negotiations. When you offer pure cash, you're removing several layers of uncertainty. The shareholder doesn't have to worry about your company's stock price. They don't have to calculate implied value based on future performance. They don't have to pray that regulatory approval doesn't tank your share price between announcement and closing. They know exactly what they're getting.

This is why all-cash bids have such an advantage in hostile situations. They feel more real. Psychologically, shareholders prefer certainty, even if the total value is slightly lower. Netflix recognized this and adjusted.

But there's a secondary effect that's equally important: cash-based acquisitions close faster. Stock deals require extensive regulatory scrutiny of the acquiring company's financial health because shareholders are receiving equity in that company. Regulators need to ensure the stock is real, the company is solvent, and shareholders aren't being defrauded. It's thorough, which means it's slow.

All-cash deals avoid most of this complexity. The acquiring company is simply transferring ownership for money. The regulatory review still happens, but it's streamlined because there's no stock component to evaluate. Netflix knew that speed would be a massive advantage against Paramount's prolonged legal and regulatory battles.

The financial mechanics matter too. Netflix has substantial cash reserves—the company reported over

Netflix also stripped out the Discovery Global separation variable from the per-share calculation, simplifying the deal further. Instead of shareholders wondering what the separation would be worth, Netflix absorbed that uncertainty and paid for it upfront. Another layer of complexity eliminated.

The Paramount Threat: How Competition Forced Netflix's Hand

It's impossible to understand Netflix's decision without examining Paramount's role as the catalyst. Paramount didn't win this fight, but it absolutely shaped how the fight unfolded.

Paramount's $108 billion all-cash hostile bid was bold, and honestly, it wasn't a serious attempt to acquire Warner Bros. It was a pressure play. David Ellison, Paramount's controlling shareholder and CEO, knew that outbidding Netflix on pure cash value was nearly impossible. What he could do was make Netflix's deal look inferior by comparison.

Paramount's public messaging was surgical: "Netflix's deal is risky. It's dependent on their stock price. Warner Bros. shareholders are being asked to accept stock that could drop tomorrow." This framing worked because it was partially true. Netflix's stock had just dipped below the price collar threshold, validating Paramount's concerns about volatility.

The hostile bid also triggered litigation. Paramount sued Warner Bros. Discovery asking the company to disclose more details about the Netflix merger agreement. If Paramount could force transparency, it could identify additional weak points. It's classic hostile takeover playbook: apply pressure everywhere simultaneously.

Warner Bros. rejected Paramount's advances consistently. The WBD board stood by Netflix, in part because the companies had a pre-existing relationship and strategic alignment, but also because Netflix adjusted its terms when pressured. This is actually a critical lesson: in competitive M&A situations, the company willing to move first often wins.

Netflix could have dug in and defended its original offer. Instead, it recognized that Paramount had created a credibility problem and solved it by eliminating the structure that Paramount was attacking. This cost Netflix additional cash, but it removed the primary talking point Paramount was using to court shareholders.

All-cash M&A deals offer significant advantages, including certainty for shareholders (40%), faster deal closure (35%), and reduced regulatory complexity (25%). Estimated data.

The Financial Reality: What Netflix Is Actually Paying

Let's do the math on what Netflix is actually paying and where that money comes from, because this is where deal complexity really matters.

At

The all-cash offer also includes contingent payments based on the performance of the Discovery Global separation. This is standard in large acquisitions. Netflix isn't betting the whole amount upfront on whether the separation succeeds. There are milestones and performance targets.

So where does the money come from? Netflix structured this as follows:

Cash on hand and operating cash flow: Netflix generated over

Credit facilities and debt: Netflix tapped into existing credit lines and issued new debt in the capital markets. The company has investment-grade credit ratings, so borrowing at favorable rates is straightforward. Figure another $40-50 billion coming from debt financing.

Additional working capital adjustments: Asset sales, cost reductions, and operational optimization contribute another 10-20% of the funds needed.

This financing structure is important because it shows Netflix isn't overextending. The company isn't betting everything on this deal. It's using reasonable leverage ratios and maintaining financial flexibility. This actually strengthens the deal's credibility with regulators.

The total cash outlay also includes transaction costs, financing costs, and integration expenses. Large mergers typically cost 3-5% of the transaction value in administrative and integration fees. So add another $2.5-4 billion on top of the purchase price.

Why Warner Bros. Said Yes (Even Facing $108 Billion)

On paper, Paramount's $108 billion offer seems better than Netflix's revised deal. So why did Warner Bros. stick with Netflix?

The answer involves strategy, credibility, and realistic deal probability. Yes, Paramount offered a higher number. But nobody on the Warner Bros. board believed Paramount would successfully execute that bid. Here's why:

Antitrust concerns: A Paramount-Warner Bros. merger would create a combined entity with extraordinary market power. Paramount already owns CBS, MTV Networks, and Pluto TV. Adding Warner Bros.' HBO, Max, DC Films, Game of Thrones, and massive catalog would be a regulatory nightmare. The FTC would likely challenge it. Even if challenged, the deal would take years to litigate. Netflix, meanwhile, is primarily a platform without content production (though it's increasing original content). A Netflix acquisition is far cleaner from an antitrust perspective.

Paramount's financial position: Paramount Global has struggled. The company posted declining revenues and mounting losses in 2024. Raising $108 billion in cash on Paramount's credit profile would be extraordinarily expensive and difficult. Paramount would likely have to sell assets or take on crushing debt. Netflix, by contrast, can access capital markets at better rates.

Time value of money: Even if Paramount's bid eventually succeeded, the regulatory process could take 18-24 months. Warner Bros. shareholders would be waiting years for a payout. Netflix's all-cash deal has a faster path to close, meaning shareholders get paid sooner. In finance, a dollar today is worth more than a dollar tomorrow. A certain

Strategic alignment: Warner Bros. Discovery has already been collaborating with Netflix on various projects. There's organizational chemistry. Paramount would have required massive restructuring and layoffs to eliminate duplicate operations. Netflix would integrate more smoothly.

So the Warner Bros. board's decision wasn't irrational. They chose the deal most likely to actually close, from a partner with proven execution ability, over a higher bid with significant execution risk.

Paramount's all-cash offer of

The Regulatory Pathway: What Approval Actually Requires

The deal still needs regulatory and shareholder approval, and this is where things get genuinely complicated. Netflix can offer all the cash in the world, but if the FTC or international regulators block the deal, none of it matters.

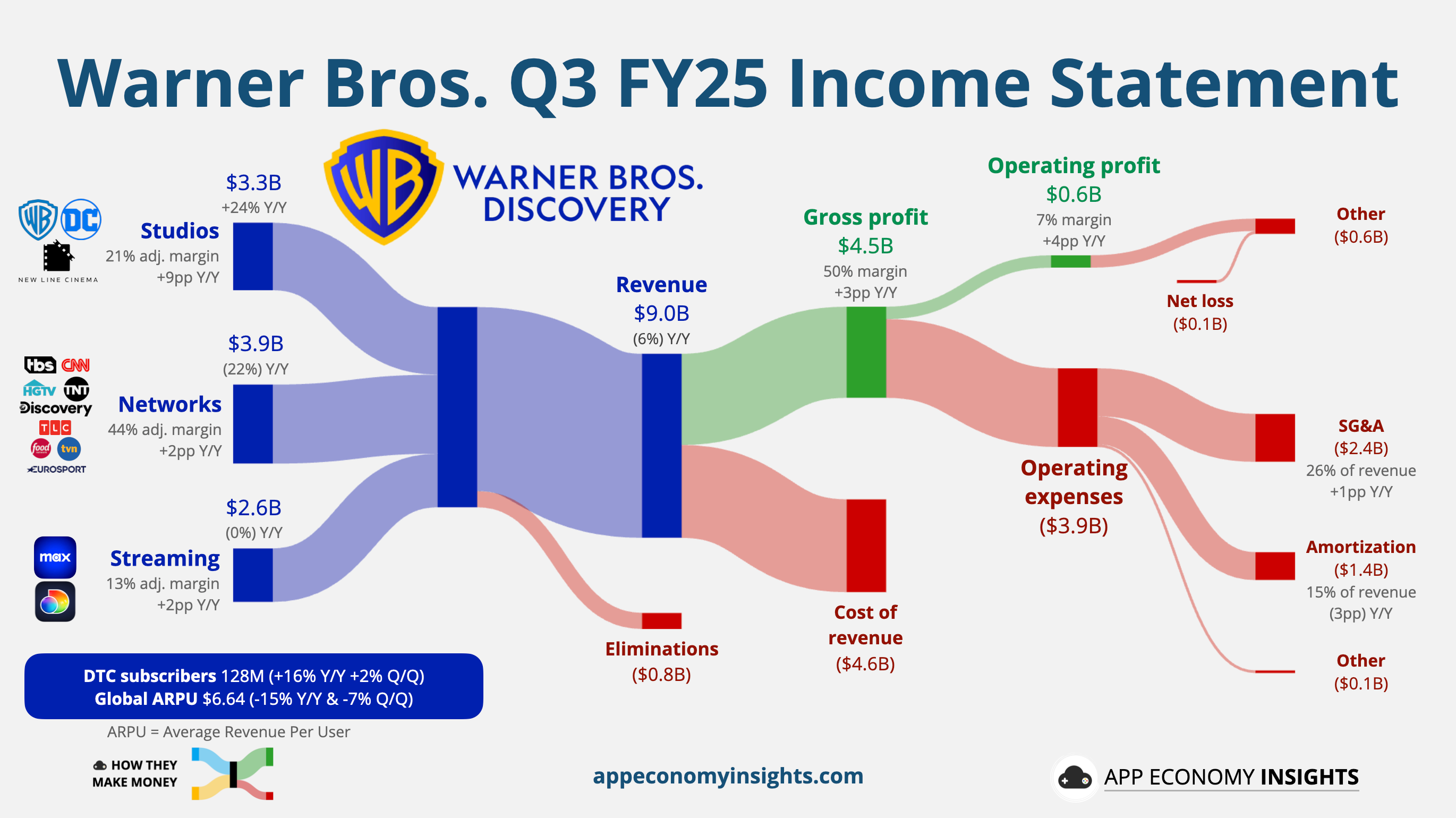

The FTC's primary concern in streaming consolidation is content access and competition. Netflix acquiring Warner Bros. would combine two of the largest content creators with two of the largest distribution platforms. However, the FTC's analysis has to account for the current fragmented streaming market. Consumers already choose between Netflix, Disney Plus, Max, Paramount Plus, and numerous others. Adding Warner Bros.' content to Netflix might actually improve consumer choice by bundling premium content on a single platform.

Compare this to Paramount acquiring Warner Bros., which would consolidate two traditional media conglomerates with overlapping cable, broadcast, and streaming operations. That's a merger of duplicate capabilities, which regulators scrutinize heavily. Netflix acquiring Warner Bros. is more about content aggregation on a pure-play streaming platform, which is viewed more favorably.

That said, regulators will examine whether Netflix has any exclusive content deals that would prevent other platforms from accessing Warner Bros. properties. They'll look at whether the combined entity could unfairly advantage Netflix's platform over competitors. They'll want to ensure content can still be licensed to other services.

Netflix has prepared for this by committing that Warner Bros. content will still be available for licensing to competitors under reasonable commercial terms. This proactive approach reduces regulatory friction. The company learned from other large tech acquisitions that transparency and commitments beat defensiveness.

International regulators are another layer. The UK, EU, Canada, and Australia all have merger review processes. Netflix will need to satisfy each jurisdiction's competitive standards. This adds time and complexity but isn't typically a deal-killer for entertainment M&A.

Shareholder approval is actually the easier hurdle. With the board recommending the deal unanimously, and with Netflix substantially improving the terms, shareholder votes usually pass. The key is avoiding any shareholder lawsuits claiming the board violated fiduciary duties by accepting an inadequate price. Netflix's willingness to move from mixed to all-cash actually reduces this litigation risk.

Why This Deal Signals Streaming's Consolidation Phase

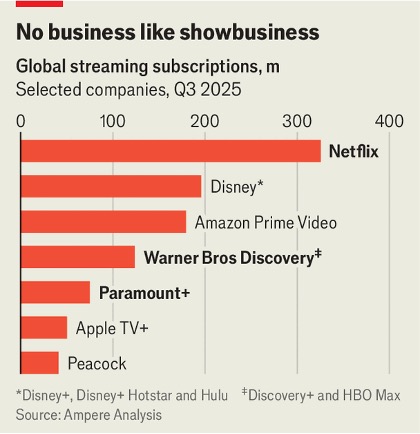

This Netflix-Warner Bros. deal isn't just about two companies merging. It's a signal that the streaming industry's fragmentation phase is ending and consolidation is beginning.

For the past five years, streaming was characterized by platform proliferation. Every major entertainment company launched its own service: Disney Plus, Paramount Plus, HBO Max, Peacock, Apple TV Plus, Amazon Prime Video, Hulu, and dozens of others. Consumers were forced to subscribe to multiple services, paying $15-20 per service per month.

This model is unsustainable. Subscriber growth has plateaued, churn is increasing, and profitability remains elusive for most services except Netflix. Wall Street is now demanding that streaming companies either consolidate to improve profitability or accept permanent low-margin economics.

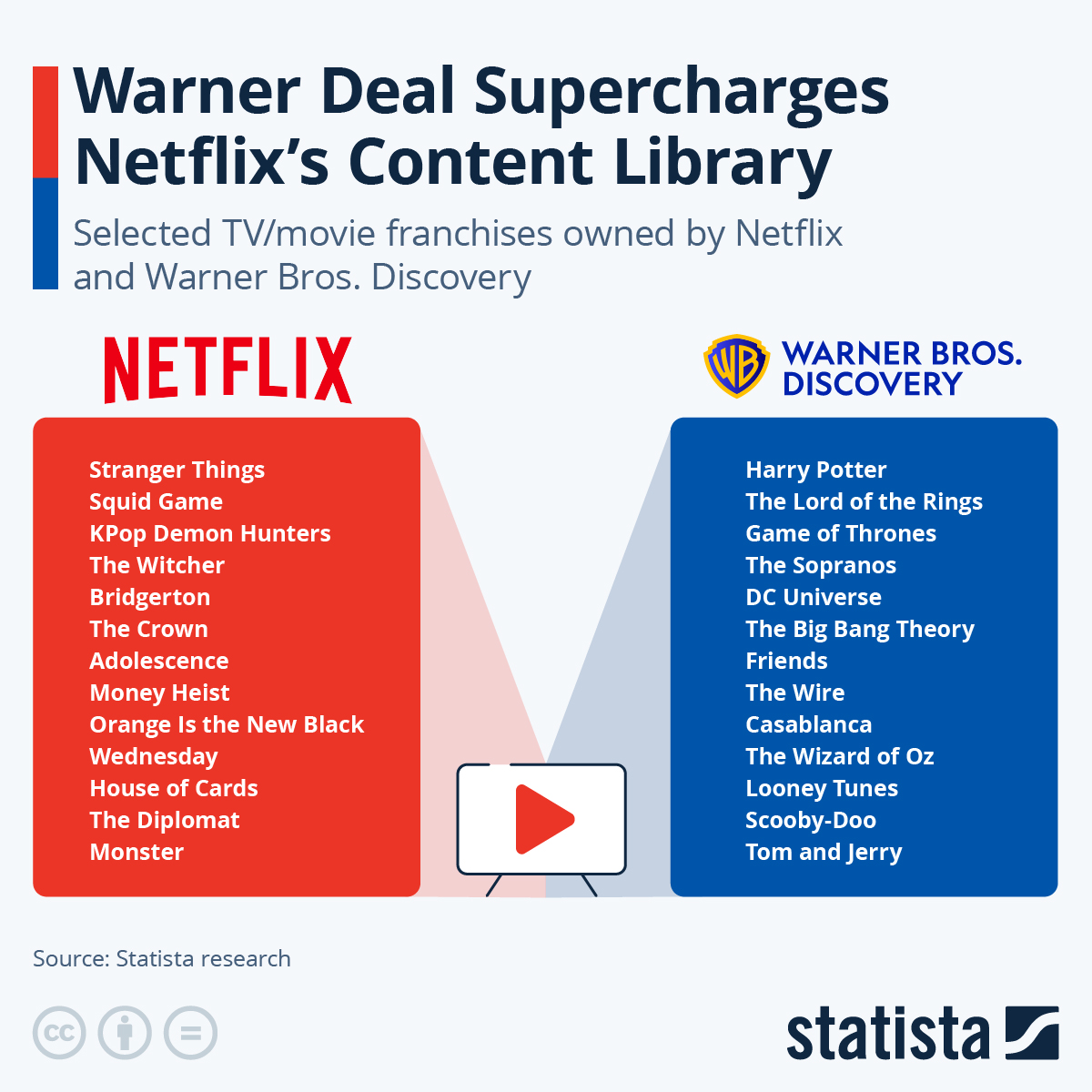

Netflix's acquisition of Warner Bros. is a direct response to this pressure. By combining Netflix's subscription expertise with Warner Bros.' massive content library, Netflix can offer a more compelling value proposition. Subscribers get HBO's entire catalog plus Netflix's originals in a single service. The combined entity can eliminate duplicate overhead and improve margins substantially.

We'll see more of this. Disney is likely to consolidate Hulu and Disney Plus into a single service. Paramount Plus and Peacock are rumored to be in merger discussions. The era of "launch a direct-to-consumer service" is ending because the unit economics don't work. The era of "consolidate with a stronger platform" is beginning.

For consumers, this is simultaneously good and bad. Good because you're moving toward a simpler, more affordable ecosystem where a few high-quality services replace 10-15 mediocre ones. Bad because reduced competition could mean higher prices long-term. The market will likely stabilize around 3-4 dominant services instead of the current 8-10.

Netflix's revised all-cash offer of

Integration Complexity: What Comes After the Deal Closes

Closing the deal is actually just the beginning. Integration is where acquisitions succeed or fail.

Warner Bros. Discovery is a complex organization. It owns HBO, Max, Discovery Channel, TLC, Animal Planet, CNN, and a massive film and television studio. Netflix has to absorb all of this while maintaining HBO's operational independence (brands don't merge; talent gets confused and leaves).

Netflix will consolidate the streaming platforms immediately. Max and Netflix will likely eventually merge into a single interface, though they might maintain separate branding initially. The company will eliminate duplicate tech teams, marketing departments, and administrative functions. Conservative estimates suggest 15-25% cost reduction through redundancy elimination.

Content strategy will be the real test. Netflix has a distinct editorial philosophy: data-driven green-lighting with heavy focus on completion rates and engagement metrics. HBO has a prestige brand built on creative autonomy and critical acclaim. These don't always align. Netflix will have to decide which shows get the Netflix treatment (more promotion, aggressive marketing) versus the HBO treatment (premium positioning, critic-baiting content).

International expansion becomes interesting too. Warner Bros. has relationships with broadcasters and cable operators worldwide. Netflix has direct relationships with consumers. The company will have to manage both distribution models for years during the transition, avoiding channel conflicts and regulatory issues.

Talent retention is critical. The entertainment industry's biggest assets are people, not assets. If Warner Bros.' top producers, directors, and creative executives leave for Paramount or Disney, the integration fails. Netflix's typically lower compensation relative to legacy media companies could cause attrition. The company will likely create retention bonuses and equity packages to keep key talent.

Finally, debt service matters. Netflix is borrowing substantial capital to fund this deal. Rising interest rates mean rising debt costs. The company needs to hit integration targets and margin improvements to service this debt comfortably. Miss the targets, and the financial profile deteriorates quickly. This creates pressure to execute flawlessly.

The Paramount Factor: What Happens Next

Paramount didn't win this round, but the company isn't going away quietly. Warner Bros. rejected its bid, and the board recommended Netflix. But Paramount has other options.

One possibility: Paramount could increase its bid further, forcing Netflix into another round of escalation. But the company's financial position makes this increasingly difficult. Another possibility: Paramount merges with a different company, potentially creating a rival to Netflix-Warner Bros. There's been speculation about Paramount Plus and Peacock merging, which would create a more formidable competitor.

The third and most likely scenario: Paramount accepts defeat on this specific deal and focuses on strengthening its own competitive position through its own consolidation moves. David Ellison and Paramount leadership will reposition the company as a distribution company acquiring content, rather than continuing to chase failed acquisition targets.

Regardless, Paramount's aggressive pursuit of Warner Bros. forced Netflix to improve its offer and clarify its strategy. Even in losing, Paramount influenced how streaming consolidation actually happens. That's not nothing.

What This Means for Streaming Consumers

If and when this deal closes, what does it actually change for you as a Netflix subscriber or someone evaluating streaming services?

Short-term, not much. Netflix isn't immediately integrating Max into the Netflix app or eliminating the Max subscription. Regulatory requirements likely prevent that for at least a year or two. You'll probably still need separate subscriptions initially, though at some point they'll merge.

Mid-term, you're looking at a significantly expanded Netflix offering. All of HBO's content—Game of Thrones, True Detective, The Last of Us, The Sopranos' entire catalog—comes to Netflix. This fundamentally changes Netflix's content positioning. The service is no longer primarily about Netflix originals and licensed content. It becomes the premium streaming bundle.

Pricing will increase. Netflix has already raised prices substantially, but a Netflix that includes HBO-quality content will command premium pricing. Expect tiering that includes a basic Netflix plan and a "Netflix with HBO" premium tier at $25-30 per month.

The competitive landscape shifts dramatically. If Paramount Plus and Peacock merge, and if Disney consolidates Hulu and Disney Plus, you're left with 3-4 major services instead of 8-10. This is actually better for consumers in some ways (simpler choice architecture, lower total cost) but worse in others (reduced competition, less churn incentive to improve).

For content creators, the landscape becomes more challenging. Netflix-Warner Bros. becomes incredibly powerful, controlling an enormous percentage of scripted content production. Independent creators and smaller production companies find it harder to get greenlit unless they partner with the major consolidated platforms.

The Bigger Picture: Media Industry Consolidation Accelerates

The Netflix-Warner Bros. deal is just one move in a larger board game. The entire media industry is consolidating because streaming economics demand it.

Streaming was supposed to disrupt the centralized media gatekeepers. Instead, it's reconcentrating power into fewer, larger players with stronger balance sheets. The companies that built empires on cable and broadcast are the ones actually winning at streaming because they already had content, relationships, and financial resources.

Netflix tried to be the scrappy outsider that didn't need traditional media's content. That worked for years. But competing with Disney Plus's Marvel and Star Wars content, with HBO's prestige library, and with Amazon's shopping-platform subsidized Prime Video required Netflix to acquire content more aggressively. Eventually, outsiders have to admit they're insiders. Netflix is that moment for the streaming industry.

Looking forward, expect:

Consolidation waves: More mergers as companies try to create platforms that can compete with Netflix-Warner Bros. and Disney.

Price increases: Fewer competing services means less pressure to keep prices low. Expect industry-wide price increases over the next two years.

Content exclusivity: With fewer platforms, content exclusivity becomes harder to maintain. Most content will be available on 2-3 services, just not day-and-date (same-day release).

Technology convergence: The barriers between streaming platforms, cable, and broadcast weaken as companies offer bundles combining multiple distribution methods.

International complexity: Regulatory approval takes longer in each country, creating regional variations in how fast consolidation happens.

The streaming wars aren't ending. They're just entering a new phase where the competitors are better-capitalized, better-integrated, and far more formidable. The days of launching a streaming service with 20 shows and hoping to reach profitability are over.

FAQ

What exactly changed in Netflix's Warner Bros. bid?

Netflix revised its acquisition offer from a mixed deal (

Why did Netflix switch from a mixed deal to all-cash?

Netflix's stock price fell below the price collar threshold in the original agreement, creating uncertainty for shareholders. Paramount exploited this weakness by offering a rival all-cash bid, positioning Netflix's mixed structure as risky. Netflix responded by offering pure cash, removing Paramount's primary attack point and improving closing probability.

How much is Netflix actually paying for Warner Bros. Discovery?

The total consideration is approximately

Will Paramount's higher bid force Netflix to pay more?

Unlikely. Warner Bros. rejected Paramount's offer because executing that deal faced significant regulatory and financial obstacles. Paramount's $108 billion bid, while nominally higher, had lower execution certainty. Netflix's deal is more likely to actually close, which makes it more valuable to shareholders despite the lower nominal price.

How long will regulatory approval take?

The FTC review typically takes 6-12 months for acquisitions of this size. International reviews (EU, UK, Canada, Australia) add another 6-12 months depending on jurisdiction. Netflix likely anticipates 12-18 months total from closing announcement to deal completion, assuming no major regulatory objections.

What happens to Max (HBO's streaming service) after the deal closes?

Initially, Max will remain operational as a separate service due to regulatory and integration requirements. Long-term, Netflix will likely integrate Max content into the Netflix platform, though the timeline and branding approach remain uncertain. Some content might maintain the Max brand for prestige positioning.

How will this affect Netflix pricing?

Netflix will likely introduce premium pricing tiers that include HBO content access. Expect the current

Does this deal require shareholder votes from both companies?

Yes. Netflix shareholders vote on the financing and commitment of capital. Warner Bros. Discovery shareholders vote on accepting Netflix's offer and agreeing to the merger terms. Both votes are typically scheduled within 6 months of the deal's regulatory approval.

What are the main regulatory risks to this deal closing?

The FTC might require Netflix to maintain content licensing commitments to competitors or limit exclusive distribution arrangements. International regulators might impose additional conditions. The probability of complete deal failure is low, but regulatory conditions could delay closing or require operational adjustments.

How will this affect consumers who currently subscribe to both Netflix and Max?

Short-term, minimal change—you'll likely maintain separate subscriptions. Mid-term, Netflix will bundle these services or create pricing packages that combine them. Long-term, Max as a standalone service will probably disappear as content integrates into the Netflix platform.

Looking Ahead: The New Streaming Reality

Netflix's all-cash acquisition of Warner Bros. Discovery represents a fundamental shift in how streaming will compete going forward. The era of fragmented, undifferentiated streaming services is ending. What emerges is a consolidated industry dominated by 3-4 massive platforms with unmatched scale, content depth, and financial resources.

For Netflix, this deal isn't just about acquiring content. It's about acquiring infrastructure, international relationships, talent, and production capability that would take years to build independently. It's about converting an existential competitive threat into a strategic asset. It's about answering the question "How do you compete when Disney has infinite content budget and Marvel/Star Wars IP?"

For Warner Bros. shareholders, this deal provides exit certainty and immediate liquidity at a solid valuation, even if it's lower than Paramount's offer. The company has been struggling with streaming losses for years. Netflix's willingness to pay all-cash, all at once, solves that problem cleanly.

For Paramount and other traditional media companies, this deal is a warning. The streaming wars are real, the consolidation pressure is intense, and companies that don't adapt quickly will find themselves absorbed or sidelined. Paramount's aggressive (if ultimately unsuccessful) counterbid shows the company understands this. What comes next is how Paramount executes its own consolidation strategy.

For consumers, this is ultimately a simplification. You'll have fewer platforms to choose from, which is easier. But less competition means less pressure on pricing and innovation. The streaming wars aren't being won by the best service anymore. They're being won by the service with the biggest library, the strongest balance sheet, and the most aggressive acquisition strategy.

Netflix started as a disruptor. With this deal, it becomes the new incumbent. That's not a criticism—it's just how markets work. Disruptors disrupt until they become powerful enough to be the thing disrupted. The question now is: who disrupts Netflix?

That answer might come from an unexpected direction. AI-powered content creation could change the economics of streaming entirely. Shorter-form video platforms like Tik Tok are already proving that consumers prefer infinite feed experiences to curated libraries. International players from markets Netflix hasn't dominated might emerge as regional competitors. The streaming wars aren't over. They're just entering a new chapter with different competitors and different weapons.

But for now, Netflix's all-cash offer for Warner Bros. Discovery represents a dominant move by a market leader consolidating its position. The strategic brilliance isn't just in the acquisition itself. It's in how Netflix used Paramount's pressure to improve the deal, eliminate structural weaknesses, and signal to the market that it's willing to adapt when challenged. That flexibility, combined with Netflix's scale and execution ability, might be the most dangerous competitive advantage of all.

Key Takeaways

- Netflix switched from a mixed 27.75 per share, addressing shareholder concerns about stock volatility

- Paramount's aggressive $108B hostile bid forced Netflix to strengthen its offer by eliminating structural complexity that rivals could exploit

- All-cash deals accelerate closing timelines and satisfy regulatory requirements faster because they eliminate stock component scrutiny

- The merger signals the beginning of streaming industry consolidation, where profitability requires combining platforms with large content libraries

- Deal approval requires navigating FTC antitrust review, international regulatory approval, and dual shareholder votes before closing

Related Articles

- Paramount vs. WBD Netflix Deal: The Hostile Takeover Battle Explained [2025]

- Netflix's Video Podcast Bet: Pete Davidson and Michael Irvin [2025]

- Warner Bros. Discovery Rejects Paramount Skydance Bid: Why Netflix Won [2025]

- Netflix's $82B Warner Bros Deal: What It Means for Movie Theaters [2025]

- Netflix's Sony Deal: Zelda Movie, $7B Investment & Global Streaming Rights [2025]

- Paramount Skydance's Lawsuit Against Warner Bros. Discovery [2025]

![Netflix's Warner Bros. All-Cash Bid: What It Means for Streaming [2025]](https://tryrunable.com/blog/netflix-s-warner-bros-all-cash-bid-what-it-means-for-streami/image-1-1768912554300.jpg)