Netflix's $82 Billion Warner Bros Deal and the Future of Movie Theaters

Something massive just shifted in Hollywood, and honestly, most people are missing the real story.

Netflix's potential acquisition of Warner Bros for approximately $82 billion isn't just another corporate power move. It's a fundamental restructuring of how movies get made, distributed, and watched. And the biggest casualty? The theatrical experience that's defined cinema for over a century.

But here's the twist: Netflix isn't planning to kill movie theaters outright. Netflix co-CEO Ted Sarandos recently pushed back hard against rumors that the company would shorten the exclusive theatrical window for Warner Bros films from the industry-standard 45 days. Instead, he doubled down on Netflix's competitive ambitions, suggesting they'd actually respect—or even extend—theatrical exclusivity windows.

Let's break down what's really happening here, because the implications are staggering for studios, theater owners, streamers, and everyone who loves movies.

TL; DR

- Netflix's $82B acquisition of Warner Bros would make Netflix a full vertically-integrated studio controlling production, distribution, and streaming simultaneously

- 45-day theatrical windows are NOT being eliminated, according to Ted Sarandos, contradicting rumors about immediate streaming releases

- Competitive strategy: Netflix wants to win in theaters because they understand theatrical releases drive subscription growth through cultural impact

- Industry transformation: This deal creates an unprecedented hybrid model combining theatrical releases with streaming exclusivity

- Theater owners should breathe easy (for now) because shorter windows would actually hurt Netflix's competitive advantage more than help it

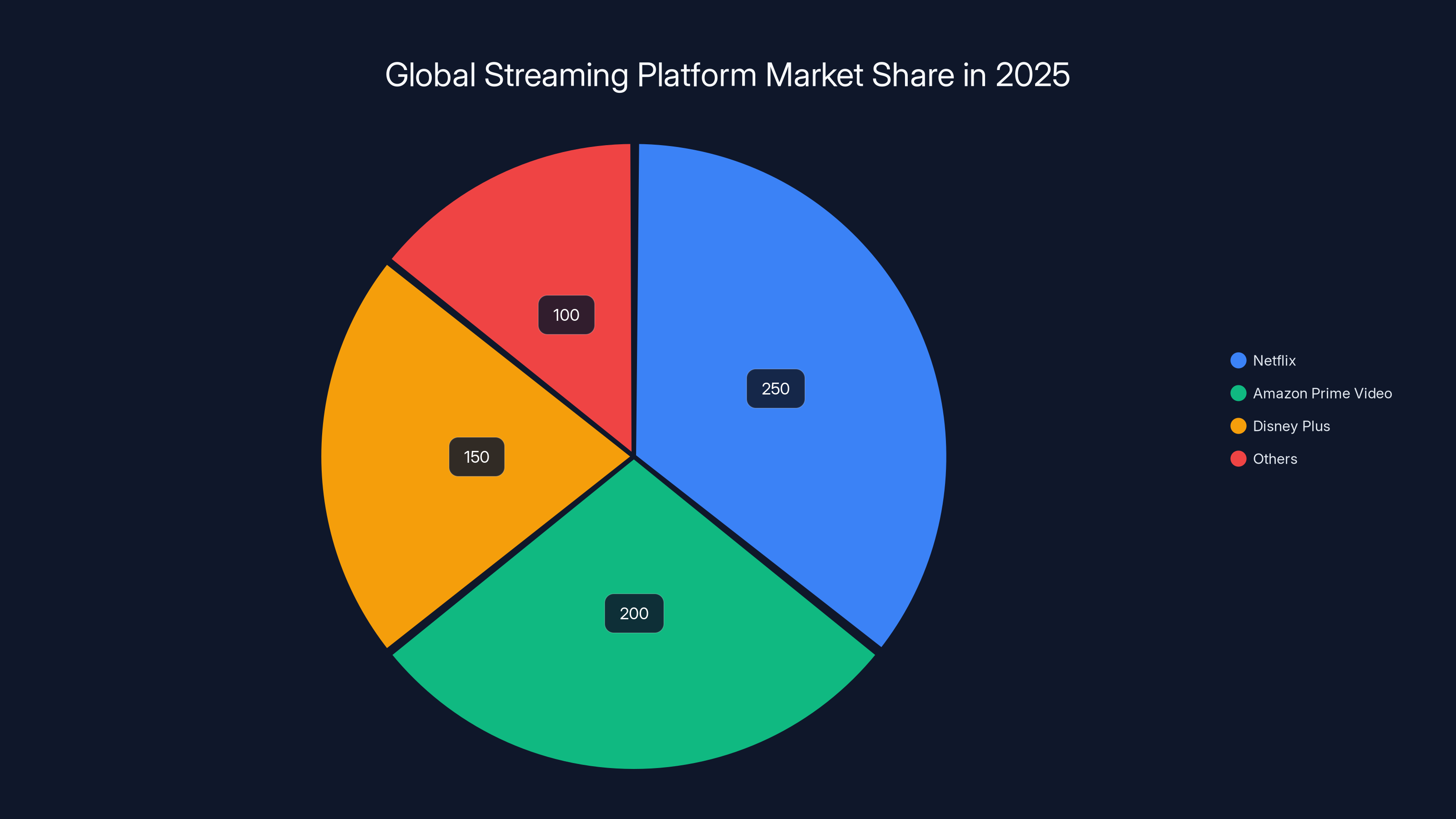

Netflix leads the streaming market with 250 million subscribers, followed by Amazon Prime Video and Disney Plus. Smaller platforms collectively hold a significant portion but face challenges in a consolidating market. (Estimated data)

The $82 Billion Deal That's Reshaping Entertainment

Let's start with the basics because this isn't a typical acquisition. Netflix acquiring Warner Bros would fundamentally restructure the entertainment industry in ways we've never seen before.

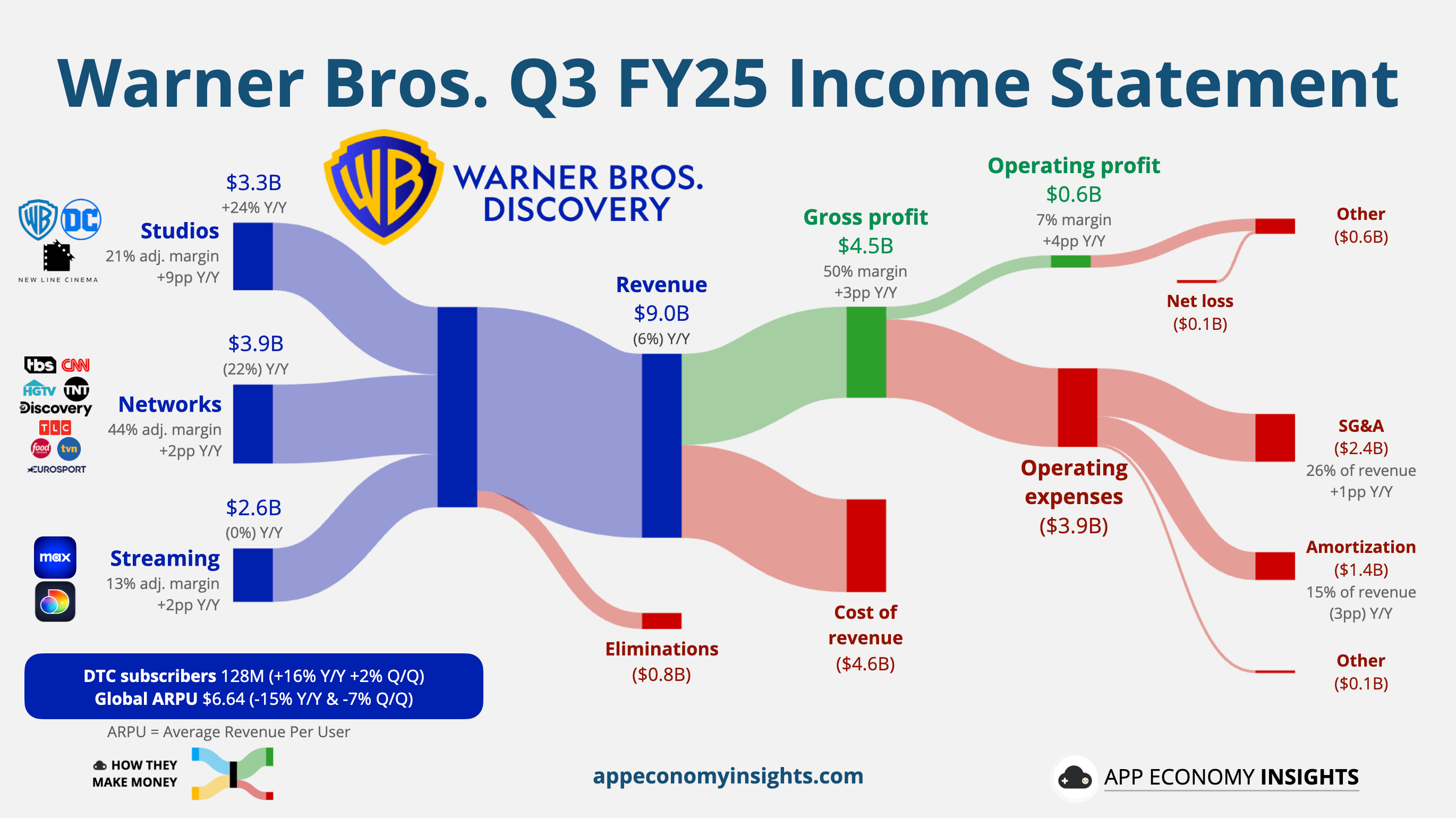

Warner Bros Discovery currently owns an enormous portfolio. We're talking about HBO, Max, the Warner Bros film studio, DC Comics, the CW network, and thousands of hours of content spanning decades. The studio has produced some of the highest-grossing films of all time, from the Harry Potter franchise to the Dark Knight trilogy to Dune.

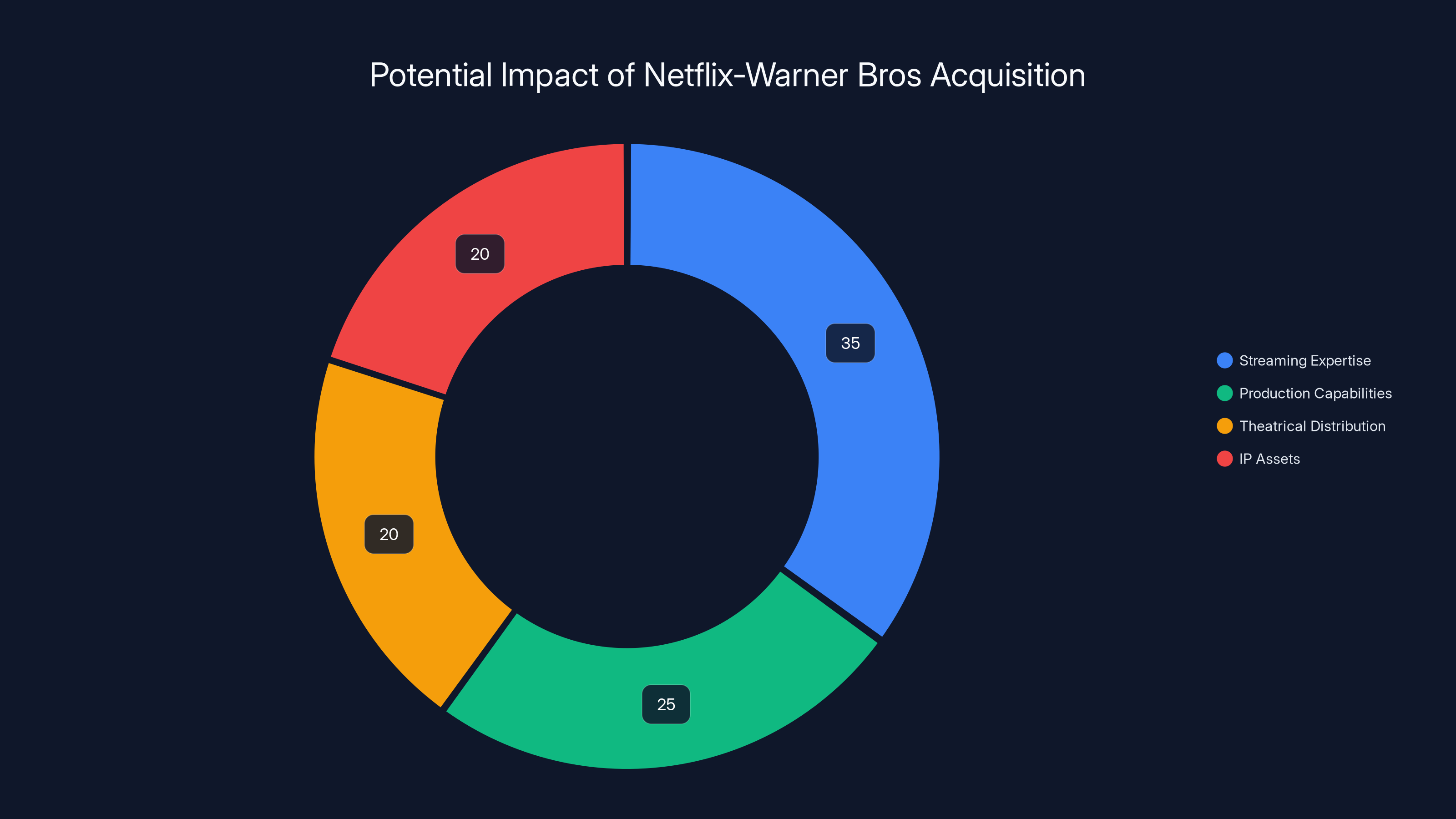

When Netflix acquires Warner Bros, they're not just getting a streaming platform. They're getting a full-stack entertainment company that produces content, owns distribution channels, and controls how that content reaches audiences. This vertical integration is unprecedented for a streamer.

Previously, Netflix had to license content or produce it internally. They didn't own the production infrastructure, the theatrical distribution channels, or the broadcast networks. Warner Bros gives them all of that. Suddenly, Netflix controls the entire value chain from development to theatrical release to streaming to merchandise.

The estimated price tag of

The 45-Day Theatrical Window Controversy

Here's where things get interesting, and frankly, where most of the controversy lives.

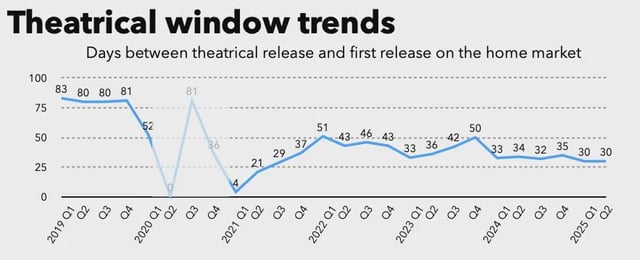

The film industry has traditionally operated on what's called a "theatrical window." This is the exclusive period between when a movie releases in theaters and when it can be released on home video, streaming, or other formats. For decades, this window was 90 days or longer. But the industry has been compressing it.

The National Association of Theater Owners has been fighting to preserve theatrical windows because shorter windows directly impact their revenue. If a movie goes to streaming too quickly, fewer people bother going to theaters. Theater attendance translates directly to popcorn sales, ticket revenue, and premium experience upcharges.

When rumors circulated that Netflix might compress the theatrical window to just 45 days (or eliminate it entirely for some films), panic set in. Theater owners envisioned a future where Warner Bros films hit streaming immediately after a token theatrical run, cannibalizing ticket sales.

But Ted Sarandos pushed back hard. In recent comments, he emphasized that Netflix understands the strategic value of theatrical releases. The company wants to win in theaters, not abandon them.

Sarandos's argument is actually compelling: theatrical releases drive cultural momentum. When a Warner Bros film gets a massive theatrical launch—think the scale of a Marvel premiere or a Dune sequel—it generates massive media coverage, social media buzz, and word-of-mouth. That buzz drives subscription growth for Netflix. People subscribe to Netflix specifically because they want to watch that movie when it arrives on the platform.

Shorter windows would actually reduce the cultural impact of theatrical releases. If a movie goes to streaming in 45 days, the media conversation dies down. The FOMO factor decreases. By contrast, a 90-day theatrical window builds anticipation. People who missed it in theaters become increasingly eager to watch at home, driving subscription conversions.

In other words, Netflix's competitive interests actually align with theater owners' interests—at least when it comes to Warner Bros films.

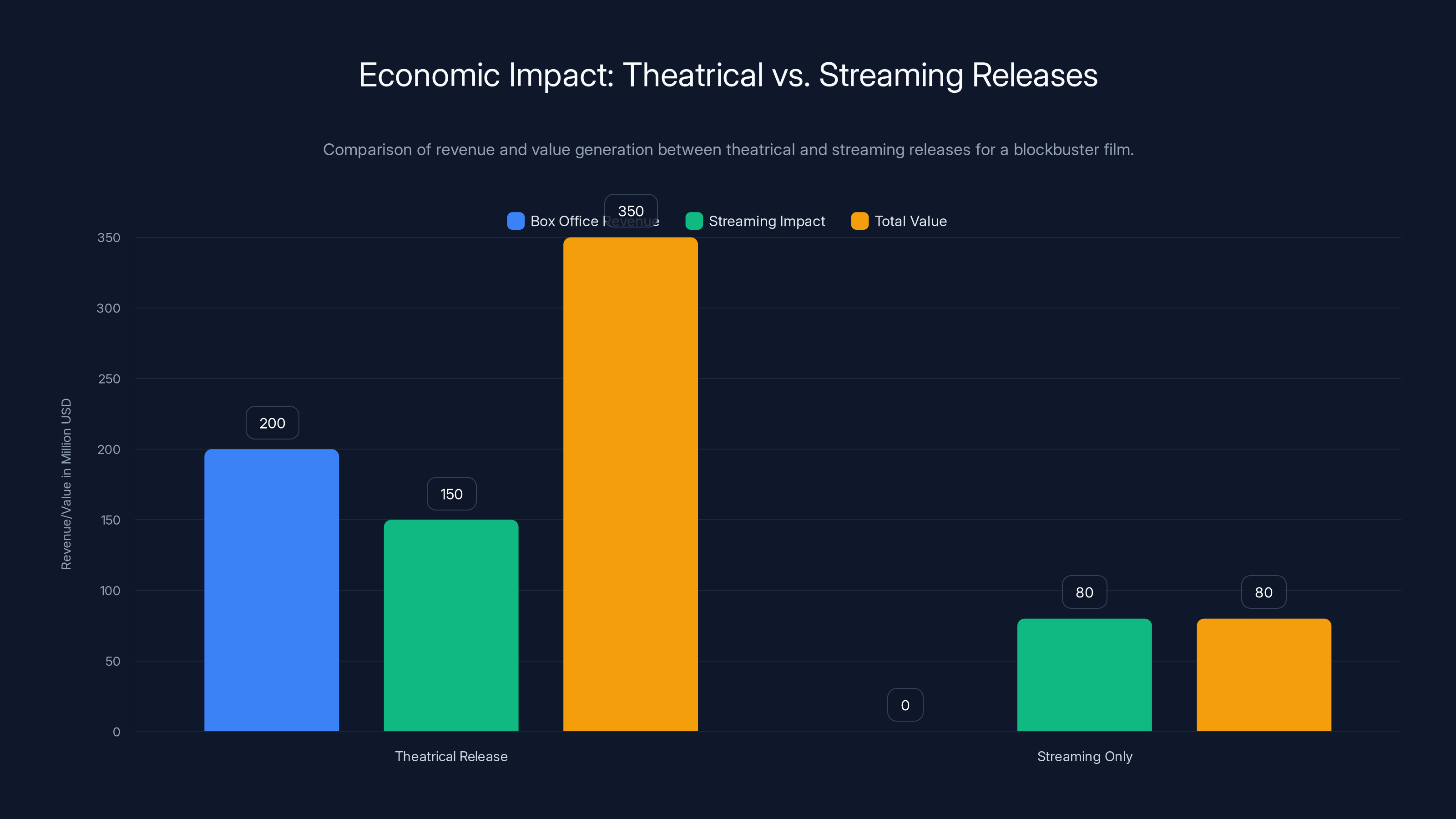

Theatrical releases generate higher total value (

Why Netflix Actually Wants Theatrical Releases to Succeed

This might seem counterintuitive, but it's the core insight that explains why Netflix isn't abandoning theaters despite being a streaming company.

Streaming companies have long been considered existential threats to theatrical exhibition. Netflix, Amazon Prime Video, and Disney Plus all competed with movie theaters for the same entertainment dollar. People have limited free time and limited money for entertainment. If you can watch a blockbuster at home for

But the economic calculation changes dramatically when Netflix owns the film studio.

Consider the revenue structure of a traditional theatrical release. A film makes money through:

- Box office revenue (split between studios and theaters)

- Home video sales and rentals (after the theatrical window closes)

- Streaming rights sales to third-party platforms

- International licensing to regional distributors

- Merchandise, toys, and ancillary products

When Netflix owns the studio, the revenue calculation changes. Box office becomes pure profit that would otherwise go to a theater chain Netflix doesn't own. But here's the crucial part: theatrical success drives streaming success.

Imagine Netflix releases a tentpole film. It makes $500 million at the global box office. That's pure profit. But beyond that, the theatrical success creates cultural gravity. Entertainment journalists write about it. Social media explodes. Everyone's talking about it.

Then the film arrives on Netflix. Suddenly, millions of subscribers who wanted to see it in theaters but didn't get around to it now have instant access. Viewership spikes. Engagement metrics skyrocket. That engagement drives retention. It drives word-of-mouth. It convinces people to maintain or upgrade their subscriptions.

So Netflix's interest in theatrical success isn't sentimental. It's coldly logical. Theatrical releases are a marketing engine for the streaming platform. The bigger the theatrical success, the bigger the marketing boost when the film hits streaming.

This is actually a more sophisticated understanding of the theatrical window than most traditional studios have. Many studios see theatrical windows as a constraint they tolerate before they can make real money on streaming. Netflix sees theatrical releases as an investment in streaming success.

Ted Sarandos and the Competitive Mindset

To understand why Sarandos pushed back against the theatrical window rumors, you have to understand how Netflix thinks about competition.

Netflix is obsessed with winning. The company's internal culture emphasizes competitive advantage, data-driven decision-making, and ruthless optimization. Sarandos came up through the licensing and content acquisition side of Netflix, where he learned to think about content not as art but as strategic assets.

His comment that "we're competitive—we want to win" reveals his framework. Netflix isn't interested in being a good industry citizen or respecting traditional theatrical exhibition out of principle. Netflix is interested in winning, which means acquiring more subscribers, commanding higher prices, and dominating market share.

But here's the crucial insight: Sarandos understands that winning doesn't require destroying theaters. Instead, it requires building competitive advantages that theaters can't match.

When you own the studio, the distribution, the theatrical exhibition infrastructure, and the streaming platform, you have control over the entire customer journey. A traditional studio sells their film to theaters and hopes audiences show up. Netflix, by owning both sides, can optimize for total engagement.

Maybe you release a blockbuster in IMAX theaters and premium formats, capturing the audience segment that wants theatrical spectacle. Then you release it on streaming at home, capturing everyone else. You're not competing with theaters; you're using theaters as one channel in a multi-channel distribution strategy.

This is the future of entertainment under Netflix ownership of Warner Bros. The company won't destroy theaters because theaters serve a strategic purpose in their competitive ecosystem.

The Vertical Integration Advantage

Let's talk about why vertical integration actually strengthens Netflix's hand in the streaming wars.

Prior to acquiring Warner Bros, Netflix was dependent on content creators and studios. The company had to negotiate licensing deals, produce original content internally, or hope creators would sell them their work. This was expensive and unpredictable.

With Warner Bros, the economics completely flip. Netflix now controls the content pipeline at every stage:

Development: Warner Bros has development departments that create scripts, options books and comics, and develops projects. Netflix gets direct input into what gets made.

Production: Warner Bros has production infrastructure, talent relationships, and technical capabilities. Netflix can produce content more efficiently than before.

Distribution: Warner Bros has theatrical distribution relationships and capabilities. Netflix can release films in theaters with professional marketing, something that would cost billions if Netflix had to build from scratch.

Streaming: Netflix has the platform where all content eventually lives. The content pipeline feeds directly into their subscription service.

Ancillary: Warner Bros owns massive IP portfolios (DC Comics, gaming, merchandise) that Netflix can monetize across multiple channels.

This vertical integration creates what economists call "network effects" and "switching costs." Once Warner Bros content is deeply integrated into Netflix's ecosystem, it becomes harder for competitors to compete. Disney can't access that content. Amazon can't license it without paying Netflix. Competitors lose access to some of the most valuable entertainment franchises in the world.

From a competitive standpoint, Netflix acquiring Warner Bros is like adding a massive moat around their business. Once the deal closes, Netflix controls a vertically integrated entertainment empire that competitors will struggle to match.

This is why Sarandos can afford to be confident about theatrical windows. Netflix isn't worried about being threatened by theaters or competing with theatrical exhibition. Netflix wants to dominate every channel of entertainment distribution.

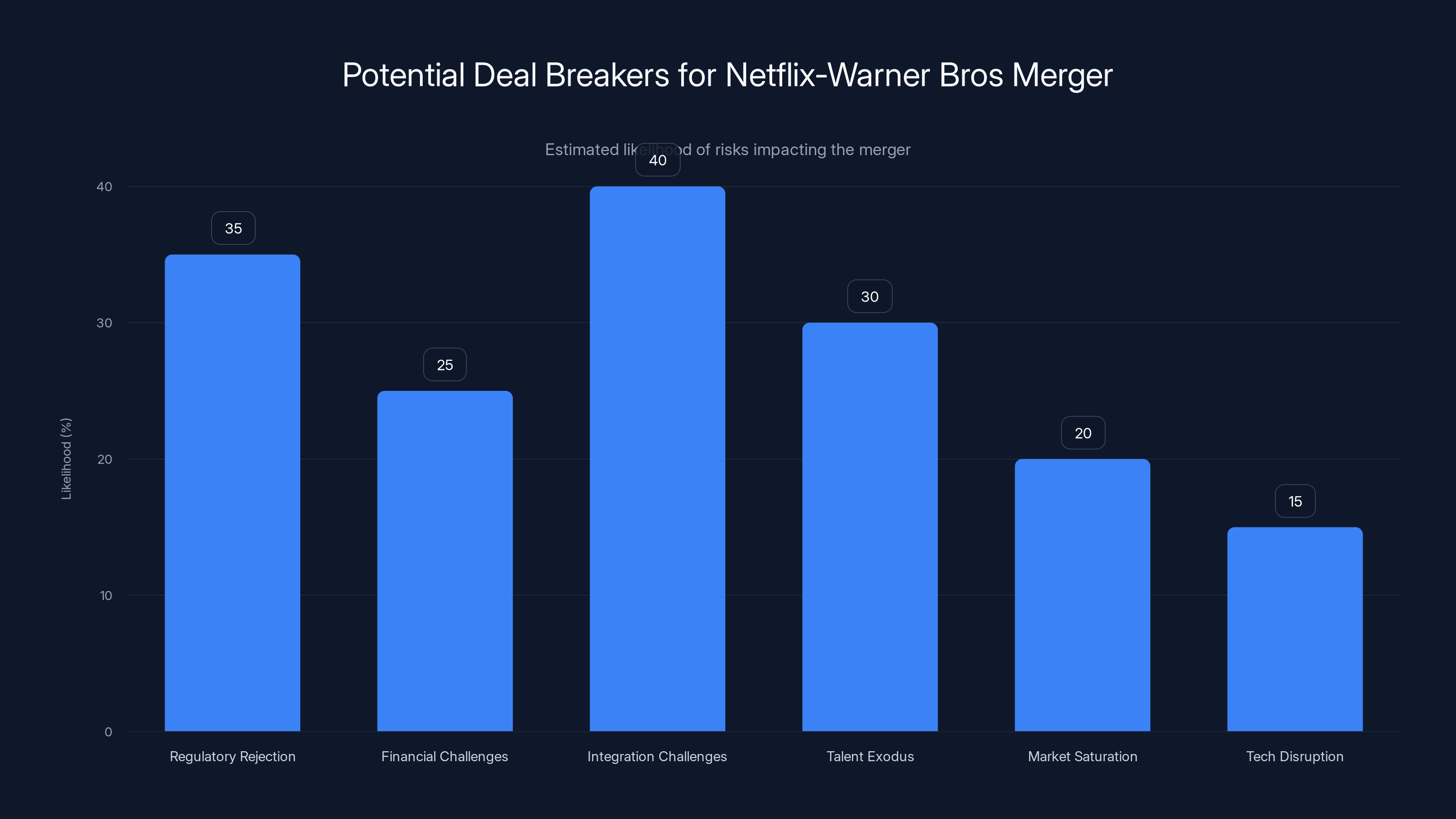

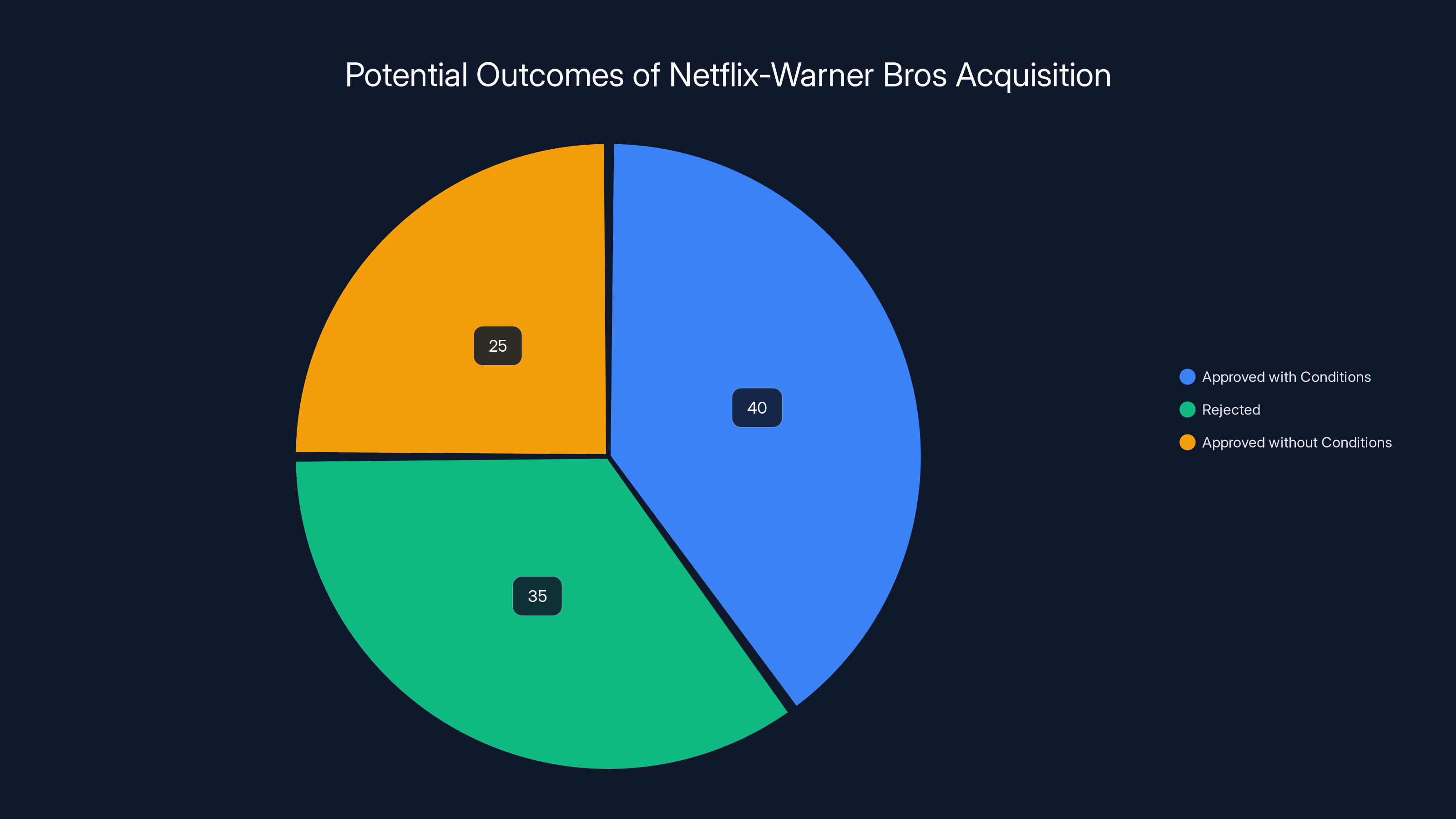

Integration challenges are estimated to be the most likely risk at 40%, followed by regulatory rejection at 35%. Estimated data based on narrative context.

What This Means for Theater Owners

If you're a theater owner, what does this deal mean for your business?

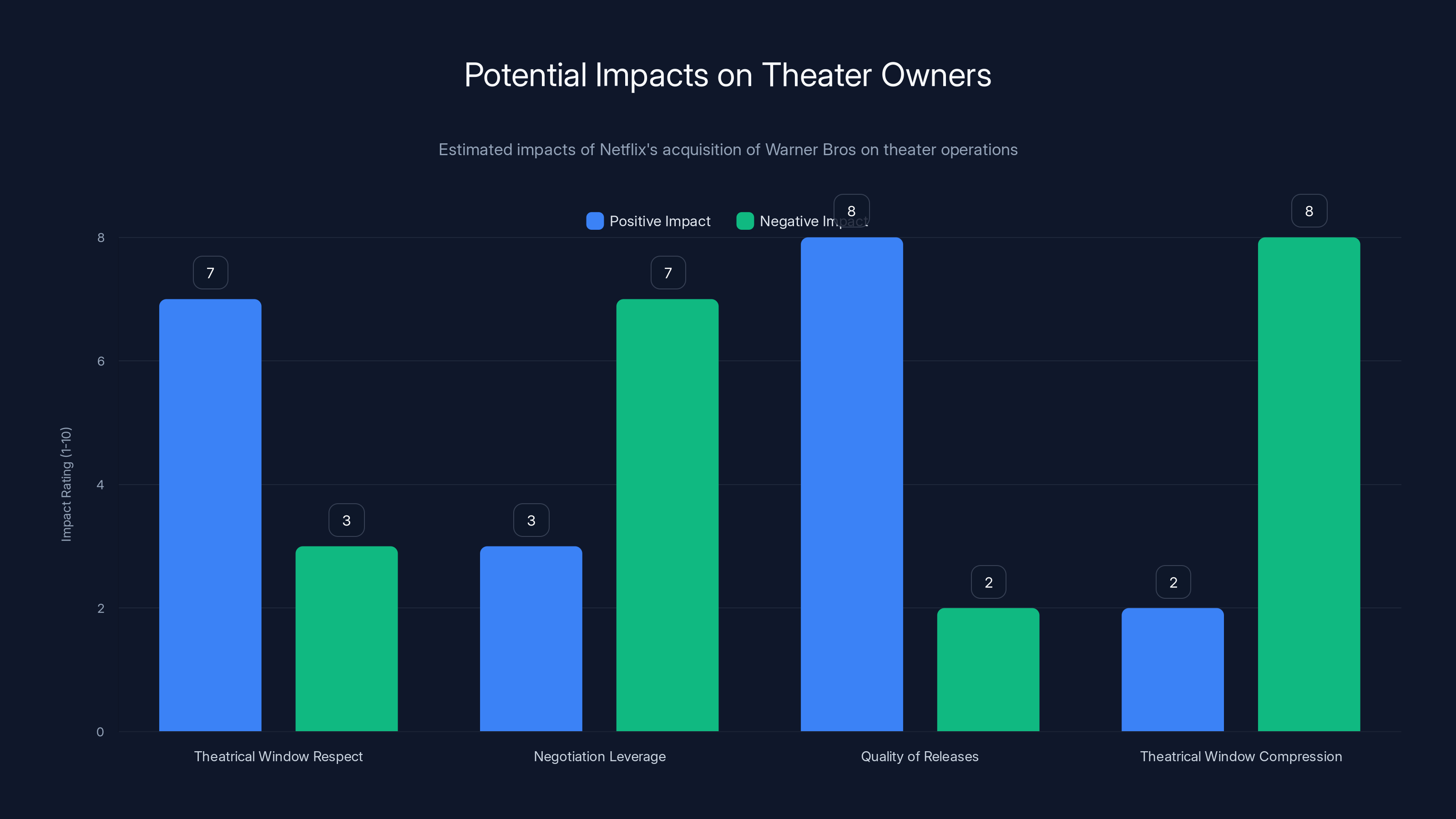

Honestly, it's complicated. On one hand, you should feel somewhat reassured that Sarandos committed to respecting theatrical windows. This suggests that Netflix understands the value of theatrical exhibition and isn't planning to kill it.

On the other hand, consolidation is always a double-edged sword. With Netflix owning Warner Bros, theater owners go from negotiating with an independent studio to negotiating with a vertically integrated streaming platform. Netflix has leverage that Warner Bros didn't have alone.

Historically, studios and theater owners have had an adversarial relationship where both sides needed the other but neither particularly liked the other. Studios wanted to shorten theatrical windows to maximize streaming revenue. Theater owners wanted to extend windows to protect ticket sales.

With Netflix controlling both theatrical and streaming distribution, they can optimize for their total revenue rather than having the two sides fight it out.

This could actually be good for theater owners in some ways. Netflix might use theatrical releases strategically, concentrating theatrical runs on films where theatrical performance drives the most streaming engagement. This could mean fewer but higher-quality theatrical releases, which could improve per-theater averages.

But it could also be bad if Netflix decides that theatrical releases are more valuable as marketing spend than as independent profit centers. Netflix might compress theatrical windows more aggressively, knowing that the lost theatrical revenue is more than offset by incremental streaming engagement.

The worst-case scenario for theaters would be if Netflix abandons theatrical exhibition for certain genres or market segments. Imagine Netflix deciding that mid-budget dramas and thrillers don't justify theatrical releases—they go straight to streaming. But big-budget action films and superhero movies still get theatrical releases. That bifurcation would be catastrophic for theaters that depend on the full slate of studio releases.

The best-case scenario would be if Netflix figures out how to make theatrical releases more economically valuable than they currently are. Maybe through premium formats, dynamic pricing, or integrated marketing. Maybe by releasing theatrical-exclusive content that drives more urgency than traditional home releases.

The Competitive Landscape Shift

Understanding this deal requires understanding the broader competitive dynamics in streaming and entertainment.

As of 2025, the streaming wars have reached a turning point. Early-stage streaming companies like Netflix that were pure software plays are now becoming media companies. Disney Plus is part of an entertainment conglomerate. Amazon Prime Video is part of a diversified tech company. Hulu and ESPN Plus are bundled with Disney. Paramount Plus is part of Paramount Global.

But Netflix has historically been the only pure-play streaming company. They don't have legacy television networks, theme parks, or retail operations. They're purely a streaming platform supported by licensing deals and original content.

The Warner Bros acquisition changes that calculus. Suddenly, Netflix is no longer a software platform that relies on content deals. They're a vertically integrated media company with content production, theatrical distribution, and streaming delivery.

This puts them on more equal footing with Disney, which has always had production, theatrical, and streaming capabilities. It actually accelerates the trend toward consolidation where only massive media conglomerates can compete at scale.

For independent studios and production companies, this is bad news. The barriers to entry keep rising. You need massive capital to fund content, distribution infrastructure to reach audiences, and streaming platforms to monetize that content. Independent creators increasingly have to license their content to one of these mega-platforms or get shut out of distribution entirely.

For consumers, the consolidation is a mixed bag. On one hand, you get more content choices within each streaming platform. On the other hand, you have to subscribe to multiple platforms to get access to content, and pricing keeps going up. The era of cheap, abundant streaming is over.

The Economic Math Behind Theatrical vs. Streaming

Let's dig into the actual economics of why theatrical windows matter, even for a streaming company.

Consider a typical blockbuster film budget. A major Warner Bros film might cost

Theaterically, that film needs to make back its budget plus generate profit. The theater takes roughly 45-55% of box office revenue. The studio keeps 45-55%. So a

For a streaming-only release, the economics are worse. You have the same production budget ($150-200 million) but no theatrical revenue. You're just eating the full cost and hoping that the film drives subscription growth.

But here's the key insight: theatrical releases create content that drives streaming engagement.

Let's say a Warner Bros film makes

The total value of the theatrical release becomes

If Netflix had released the film straight to streaming, they'd have maybe

Where streaming value is proportional to theatrical success and cultural impact.

This math explains why Sarandos is confident about theatrical windows. Netflix's business model now includes theatrical revenue as a profit center, not just as a competitor to streaming.

Estimated data shows Netflix's acquisition of Warner Bros would diversify its capabilities, with streaming expertise and production capabilities being the most significant benefits.

Historical Context: How We Got Here

To understand the Netflix-Warner Bros deal, you have to understand how we got here historically.

For most of cinema history, theatrical release was the primary distribution channel. Movies went to theaters for exclusive runs (often 6+ months), then eventually came to home video (VHS, then DVD), then cable TV, then broadcast. This sequence created windows of exclusivity that studio could monetize at each stage.

Netflix disrupted this model by introducing streaming as a content distribution channel. Initially, Netflix was just a rental service for DVDs, competing with Blockbuster. Then they moved to streaming, where they licensed content from studios for fixed fees.

This was hugely disruptive to the traditional window structure. Studios were used to chronological windows where theatrical came first, then home video, then TV. But streaming disrupted that. Suddenly, content could be available on streaming while still in theaters, cannibalizing theatrical attendance.

The pandemic accelerated this shift dramatically. Theater closures and audience hesitation drove studios to compress windows aggressively. Films that would normally have 90-day windows started going to streaming after 30-45 days. Some films went straight to streaming ("day and date" releases).

But by 2024, the market was adjusting. Audiences were returning to theaters. Studios realized that day-and-date releases were cannibalizing theatrical revenue without clear streaming benefits. Theater owners fought back against compressed windows.

The industry started settling on something close to the traditional structure: 45-day theatrical windows for some films, 60-day for major releases, with streaming rights negotiated separately.

In this context, the Netflix-Warner Bros deal represents the next evolution. Rather than streaming competing with theatrical, Netflix will own both channels and optimize across them.

The DC Universe and IP Strategy

One of the biggest assets Netflix would gain from the Warner Bros acquisition is the DC Universe intellectual property.

DC Comics is one of the most valuable entertainment franchises on the planet. It includes Batman, Superman, Wonder Woman, The Flash, Green Lantern, Aquaman, and dozens of other characters with massive fan bases.

But the DC Universe has been struggling creatively and financially. The DC Extended Universe films have underperformed compared to rival Marvel films. Films like Aquaman and Wonder Woman did well, but films like The Flash and Blue Beetle underperformed expectations.

Under Netflix, the DC Universe strategy would likely change completely. Rather than trying to build a cinematic universe with interconnected films (a strategy that's proven expensive and difficult), Netflix might pursue a more diversified approach:

Theatrical tentpoles: Big-budget Batman or Superman films released in theaters globally, the way Marvel does with Avengers films.

Streaming series: HBO Max has proven that DC characters work incredibly well in television format. Harley Quinn, Peacemaker, and Doom Patrol have been critical and commercial successes. Netflix would likely continue and expand this.

Animated content: DC has a long tradition of high-quality animated films and series. Netflix could invest heavily here.

Gaming: DC characters could anchor gaming strategies, from mobile games to console titles.

Merchandise: Licensed toys, clothing, and merchandise generate billions annually.

Netflix's advantage is having direct control over all these channels. Marvel has to coordinate between theatrical releases (Disney), streaming (Disney Plus), TV (ABC, FX), merchandise (Hasbro), and gaming (various partners). Netflix would control most of this internally.

This integration could be worth billions. If Netflix can revitalize the DC Universe and make it competitive with Marvel again, that's a franchise worth $100+ billion in total value.

Regulatory Challenges and Approval Risks

Here's the thing about mega-deals: they don't automatically happen just because someone has $82 billion.

The Netflix-Warner Bros acquisition would face significant regulatory scrutiny. Antitrust authorities in the US, EU, and UK would examine whether the deal creates excessive market concentration in entertainment.

Arguments for approval:

- The combined Netflix-Warner Bros would still compete with Disney (the larger media company), Amazon, Apple, and others

- Content distribution remains competitive; streaming is still an emerging sector with low barriers to entry

- The deal might actually improve competition by giving Netflix resources to compete more effectively with Disney

Arguments against approval:

- Market concentration in entertainment production and distribution would increase substantially

- Netflix would control a huge percentage of major theatrical releases (Warner Bros is one of the "big three" studios alongside Disney and Paramount)

- Vertical integration could allow Netflix to impose unfavorable terms on competing platforms, theater chains, or creators

- International regulators (particularly in the EU) are aggressive about blocking media consolidation deals

Historically, mega-media deals have become harder to approve. The Disney-Fox deal faced intense regulatory scrutiny before approval (and Disney had to divest some assets). The Microsoft-Activision deal took over two years to approve and faced global regulatory challenges.

The Netflix-Warner Bros deal might face similar or worse scrutiny. The US Federal Trade Commission has been aggressive about blocking consolidation, particularly in technology and media. International regulators would also need to approve.

A realistic timeline assumes 2-3 years for regulatory approval, if the deal is approved at all. Some analysts estimate there's a 60-70% chance of approval, maybe lower if political winds shift toward stricter antitrust enforcement.

The acquisition could lead to higher-quality releases but also increased negotiation challenges and potential for compressed theatrical windows. Estimated data.

The Streaming Wars in 2025 and Beyond

To understand this deal's implications, you need to understand where the streaming wars stand in 2025.

The early promise of streaming—unlimited content at low prices—has given way to a more mature market. Streaming platforms are now fighting for subscriber share, raising prices, and consolidating.

Netflix remains the largest player with roughly 250 million subscribers globally. But growth is slowing. Netflix has shifted focus from subscriber growth to profit per subscriber through price increases and advertising-tier expansion.

Disney Plus has exploded to 150+ million subscribers, but the platform is losing money due to aggressive pricing and massive content spending. Disney is now raising prices and focusing on profitability over growth.

Amazon Prime Video has 200+ million subscribers but many are Prime members bundled into the service. The economics of standalone video streaming are challenging.

Paramount Plus, HBO Max, Apple TV Plus and other platforms are fighting for niches.

The trend is clear: massive consolidation. Only the largest media companies can afford to sustain streaming platforms while investing in original content production, theatrical distribution, and other media properties.

Small, pure-play streamers can't compete. You need massive capital reserves to sustain losses while building scale. You need content production capabilities. You need distribution infrastructure. You need ancillary revenue streams (advertising, merchandise, licensing).

Netflix acquiring Warner Bros accelerates this consolidation. The message is clear: scale up or get acquired. Independent creators, independent studios, even mid-size streaming platforms can't compete with vertically integrated giants.

For consumers, this consolidation means fewer choices, higher prices, and a return to something resembling the cable TV bundle model that streaming was supposed to disrupt. You'll likely need subscriptions to 4-5 major platforms to get comprehensive entertainment access, paying $15-20 per month for each.

What Happens to HBO and Max?

If Netflix acquires Warner Bros, what happens to HBO Max (recently rebranded as just "Max")?

This is a critical question because HBO Max is itself a significant streaming platform with millions of subscribers.

The most likely scenario is that Netflix and Max eventually merge into a single platform. Having two separate streaming services owned by the same parent company doesn't make economic sense. You'd have duplicate infrastructure, overlapping content, and confused messaging.

The merger would likely happen in stages. Initially, Netflix and Max might remain separate services but with some content sharing and coordination. Then gradually, original series and films would get exclusive to one platform or the other. Eventually, the services would be integrated.

The question is which brand survives. Given Netflix's massive scale and global brand recognition, it's likely that Max would eventually be folded into Netflix. But there might be premium Max-branded tiers within Netflix that preserve the HBO brand heritage.

Alternatively, Netflix might keep Max as a standalone product for certain markets or audiences who prefer the Max brand and content focus (Max traditionally had a focus on prestige HBO originals).

What's certain is that having two separate streaming services would be wasteful and inefficient. Some integration is inevitable.

The International Implications

Netflix is a global company, but its strategic position varies by country.

In the US, Netflix dominates. But in Europe, Netflix faces fierce competition from local streaming services and traditional broadcasters. In Asia, Netflix competes against local champions like Hotstar (India), i Qiyi (China), and others.

The Warner Bros acquisition gives Netflix massive content advantages globally. Warner Bros has deep relationships with international broadcasters, production companies, and talent. The studio produces films and content globally, not just in the US.

This could help Netflix compete more effectively in international markets where local content is crucial. Instead of licensing content from regional studios, Netflix would have internal production capacity to create region-specific content.

But international regulators might see this as concerning. The EU, in particular, has been protective of European media independence. Acquiring a major studio could trigger concerns about American companies dominating European entertainment.

Similarly, China has strict rules about foreign media company operations. Netflix expanding through the Warner Bros acquisition would likely face Chinese regulatory barriers.

So while the deal might be great for Netflix's global ambitions, regulatory approval is likely to be easier in some countries (US, maybe UK) than others (EU, definitely China).

Estimated data suggests a 40% chance of the Netflix-Warner Bros deal being approved with conditions, reflecting common regulatory practices in mega-media deals.

Content Strategy and Creative Control

One of the most interesting questions is how Netflix would handle creative control over Warner Bros content.

Traditionally, studios have given directors and producers significant creative freedom, constrained mainly by budgets and audience expectations. But Netflix has been more interventionist. The company uses data extensively to guide creative decisions, often overruling directors or producers when data suggests a different approach would drive more engagement.

Would Netflix impose this data-driven creative model on Warner Bros? Or would Warner Bros maintain its traditional creative autonomy?

Historically, successful acquisitions require maintaining the acquired company's culture and capabilities. If Netflix strips away Warner Bros creative independence, they might kill the very things that make Warner Bros content valuable.

But Netflix's track record suggests they tend toward integration rather than preservation. The company is confident in its data capabilities and tends to believe that Netflix's way is the best way.

The most likely scenario is a hybrid approach: Netflix would maintain creative relationships for major theatrical releases (where traditional filmmaking excellence is crucial), but would be more interventionist for streaming content where Netflix's data and audience understanding are valuable.

This could create internal tensions. Some Warner Bros talent might chafe under Netflix's data-driven oversight. Some might thrive with the resources and global platform Netflix provides. The outcome would likely vary by project and person.

The Timeline and Deal Structure

Assuming the deal gets regulatory approval (a big if), what does the timeline look like?

Most estimates suggest:

Announcement and Negotiation (already happening): 3-6 months of negotiations between Netflix and Warner Bros Discovery leadership

Regulatory Filing: 1-2 months to prepare and file regulatory documents

Regulatory Review: 18-24 months for US FTC review, with international regulators (EU, UK, etc.) adding 6-12 months more

Closing: Once regulatory approval is granted, 2-4 months for deal closing and integration planning to begin

So realistically, we're looking at a 3-5 year timeline from announcement to regulatory approval, assuming the deal is approved.

The deal structure would likely involve a mix of cash and stock. Netflix would probably borrow heavily ($20-30 billion in debt) and use stock for the rest. The financing would be complex given the size.

One alternative scenario is that Netflix doesn't acquire the entire Warner Bros Discovery company, but rather just the Warner Bros film studio and content assets, excluding Discovery (the cable networks and streaming assets). This would be a smaller deal, easier to regulate, but might also reduce the strategic value.

Competitive Responses from Rivals

If Netflix successfully acquires Warner Bros, what would competing studios and platforms do?

Disney might look to acquire remaining major independent studios or networks. Disney already owns significant content production capabilities through Pixar, Marvel, Lucasfilm, and others. But further consolidation might strengthen their position.

Paramount and Sony might accelerate consolidation through partnering or acquisition. Paramount in particular has struggled to compete and might look for strategic partners.

Amazon might acquire more content production capabilities. Prime Video has been investing in original content but lacks the theatrical and broadcast distribution that a studio acquisition would provide.

Apple has massive capital but has been cautious about media acquisitions, preferring to cherry-pick individual projects and creators.

The net effect would be accelerated consolidation. The Netflix-Warner Bros deal would be the opening shot in a new wave of mega-acquisitions in the media industry.

Risks and Potential Deal Breakers

What could go wrong with this deal?

Regulatory rejection: The FTC might simply say no, blocking the deal entirely. This is probably 30-40% likely depending on how aggressive antitrust enforcement becomes.

Financial challenges: If Netflix's streaming business faces headwinds (subscribers decline, churn increases), the company might not be able to finance the deal. A major recession could also make the $82 billion commitment impossible.

Integration challenges: Actually integrating two massive companies is incredibly difficult. Warner Bros and Netflix have different cultures, systems, and strategies. Integration failures could destroy value.

Talent exodus: If top creatives at Warner Bros don't like Netflix's direction, they could leave, taking valuable relationships and IP with them.

Market saturation: If the streaming market becomes oversaturated (too many platforms, subscriber growth stalls), the strategic value of Warner Bros content decreases.

Tech disruption: If some new technology (like AI-generated content) disrupts the entertainment industry in unforeseen ways, the value of traditional content libraries could drop.

These risks are non-trivial. Major M&A deals frequently fail or disappoint relative to expectations.

The Bottom Line: What This Means

Let's step back and look at the big picture.

The Netflix-Warner Bros acquisition, if approved, would mark a fundamental shift in entertainment. Streaming companies would no longer be pure-play software platforms that license content. They'd be full media conglomerates controlling production, distribution, and exhibition.

For theater owners, Ted Sarandos's commitment to respecting 45-day theatrical windows is reassuring but not a guarantee. The strategic calculation could change in the future. What matters now is that Netflix understands theatrical success drives streaming success, so theatrical windows serve Netflix's interest.

For consumers, this deal signals that the era of cheap, abundant, fragmented streaming is ending. The future will look more like the cable TV era, with a handful of major platforms controlling most content, charging $15-20/month each, and requiring subscriptions to multiple services for comprehensive access.

For creators and independent studios, consolidation means fewer options and more pressure to work within the ecosystems controlled by Netflix, Disney, Amazon, and others.

For investors and the entertainment industry, this is a watershed moment. If Netflix successfully completes this acquisition and integrates Warner Bros, other mega-deals will follow. The entertainment industry will become even more consolidated, with only massive conglomerates able to compete at scale.

The competitive landscape is shifting. The question now is whether Netflix can execute, whether regulators will allow it, and what the industry looks like when the dust settles.

FAQ

What is the Netflix-Warner Bros acquisition?

Netflix's proposed acquisition of Warner Bros Discovery for approximately $82 billion would make Netflix a vertically integrated media conglomerate. Rather than just being a streaming platform that licenses content, Netflix would own the studios, networks, and theatrical distribution capabilities that create and distribute entertainment. This combines Netflix's streaming expertise with Warner Bros' production, theatrical distribution, and IP assets including DC Comics, HBO, and major film franchises.

How would theatrical windows change under Netflix ownership?

According to Ted Sarandos, Netflix would respect the industry-standard 45-day theatrical window, contradicting rumors that the company would eliminate theatrical exclusivity. Netflix actually benefits from theatrical releases because they drive cultural momentum and audience engagement, which translates to increased streaming subscriptions when films eventually arrive on the platform. The theatrical window is essentially a marketing investment for Netflix's streaming service.

Why would Netflix want to maintain theatrical windows if they own the streaming platform?

Netflix's economic interests have changed. When Netflix was purely a streaming company competing against theaters, shorter windows made sense. But owning both theatrical and streaming distribution, Netflix optimizes for total revenue. A blockbuster that makes $400 million in theaters and drives millions of streaming views is more valuable than a streaming-only release. The theatrical release creates cultural momentum that drives streaming engagement, making the combined value greater than either channel alone.

What regulatory challenges does the deal face?

The acquisition would likely face significant antitrust scrutiny from the US Federal Trade Commission and international regulators, particularly in Europe. Regulators would examine whether the deal creates excessive market concentration in entertainment production and distribution. The deal would give Netflix control over a major film studio, which combined with their streaming dominance could raise competition concerns. Some analysts estimate 60-70% approval odds, but this could change with shifting political winds around antitrust enforcement.

When might the deal close, and what's the timeline?

Assuming the deal is announced and moves forward, regulatory approval typically takes 18-24 months for US regulators, with international review adding 6-12 months more. Total timeline from announcement to closing is realistically 3-5 years. The deal would require complex financing involving both debt and equity, and significant integration planning post-closing to combine Netflix and Warner Bros operations.

What happens to HBO Max if Netflix acquires Warner Bros?

The most likely scenario is that HBO Max (now branded as "Max") would eventually be integrated into Netflix's streaming platform. Having two separate streaming services owned by the same company would be inefficient. The integration would likely happen in stages, with content eventually consolidated and Max potentially becoming a premium tier or sub-brand within Netflix rather than a standalone platform. However, some aspects of Max's distinctive content strategy might be preserved to maintain differentiation.

How would this affect competition with Disney and other streaming platforms?

The acquisition would accelerate consolidation in the entertainment industry, but Netflix would still compete with Disney (which is larger), Amazon, Apple, and others. However, it would create a more level competitive landscape where Netflix has the scale and vertically integrated assets to compete with Disney's production and distribution capabilities. This might paradoxically improve competition by giving Netflix the resources to challenge Disney's dominance, though it would likely reduce competition overall by consolidating the industry further.

What would change about Warner Bros film releases and strategy?

Netflix would likely pursue a more integrated strategy for Warner Bros content, coordinating theatrical releases, streaming availability, TV productions, gaming, and merchandise as a unified ecosystem rather than having them managed separately. Major franchises like DC Comics might get revitalized through new creative approaches. The company would have more strategic control over how intellectual property is developed and monetized across multiple channels simultaneously.

Conclusion: The Future of Entertainment Is Here

The Netflix-Warner Bros acquisition represents a watershed moment for entertainment. Whether it's ultimately approved or not, the deal signals where the industry is heading: toward massive vertically integrated platforms that control content from creation through final delivery.

For decades, entertainment was fragmented. Studios made films and TV shows. Networks distributed them. Platforms streamed them. Everyone had conflicting interests.

Netflix changing all that. By owning production, distribution, and streaming, Netflix eliminates conflicts and optimizes globally. This is more efficient, more powerful, and more threatening to everyone else in the ecosystem.

Ted Sarandos' comment that "we're competitive—we want to win" captures the philosophy perfectly. Netflix isn't interested in being a good industry citizen or respecting traditions. They're interested in dominating entertainment.

Their commitment to theatrical windows isn't sentimental. It's strategic. Theaters work better for Netflix when Netflix owns both sides.

For consumers, creators, theater owners, and everyone else in the entertainment ecosystem, this deal reshapes the landscape. The comfortable fragmentation of the past is ending. The consolidated giants are taking control.

The question isn't whether consolidation is coming. It's already here. The question is what you do about it.

If you're a theater owner, you should be negotiating fiercely with Netflix now, before they own everything. If you're a creator, you should be thinking about how to maintain leverage and creativity within the increasingly consolidated industry. If you're a consumer, you should brace for higher prices and fewer platform choices. If you're an investor, you should pay attention to which companies will win in the consolidated future.

The Netflix-Warner Bros deal is the first domino in a chain reaction that will reshape entertainment for the next decade. Stay tuned.

Key Takeaways

- Netflix's $82B Warner Bros acquisition would create unprecedented vertical integration in entertainment, controlling production, distribution, and streaming simultaneously

- Ted Sarandos clarified Netflix would respect 45-day theatrical windows because theatrical success drives streaming engagement—they complement rather than compete

- The deal accelerates industry consolidation, with only massive vertically integrated platforms able to compete at scale in the future

- Theater owners should view this positively (commitment to theatrical) but cautiously (Netflix now has leverage in negotiations)

- Consumer impact includes higher prices and fewer platform choices as the industry consolidates into a few mega-companies controlling most entertainment

Related Articles

- Netflix's Sony Deal: Zelda Movie, $7B Investment & Global Streaming Rights [2025]

- A Knight of the Seven Kingdoms Episode 1 Release Date on HBO Max [2025]

- Netflix's 45-Day Theater Window: What It Means for WBD [2025]

- Netflix and Sony Streaming Deal: 5 Must-Watch Movies [2025]

- Star Wars' New Leadership Team: Can They Revive The Franchise? [2025]

- Kathleen Kennedy Steps Down from Lucasfilm: What It Means for Star Wars [2025]

![Netflix's $82B Warner Bros Deal: What It Means for Movie Theaters [2025]](https://tryrunable.com/blog/netflix-s-82b-warner-bros-deal-what-it-means-for-movie-theat/image-1-1768581529657.jpg)