The Biggest Streaming Showdown in Media History

The entertainment industry just entered its most consequential battle in a decade. On one side, you've got Paramount Global, armed with a

This isn't just about corporate ego or shareholder returns, though those matter. This is about who controls the future of streaming video, where premium content comes from, and whether consolidated entertainment giants can survive in a world dominated by Netflix. The lawsuit Paramount filed in Delaware Chancery Court opens a window into exactly why these two scenarios would play out so differently for Hollywood's future.

What makes this situation so fascinating is that it exposes a fundamental tension in modern media. Warner Bros. Discovery was already struggling to compete with Netflix's content machine and profitability. Netflix, meanwhile, sees the combination as a way to reclaim absolute dominance in streaming. Paramount sees opportunity in a way that mirrors how tech companies acquire their competition, but with billion-dollar stakes and decades of legacy businesses hanging in the balance.

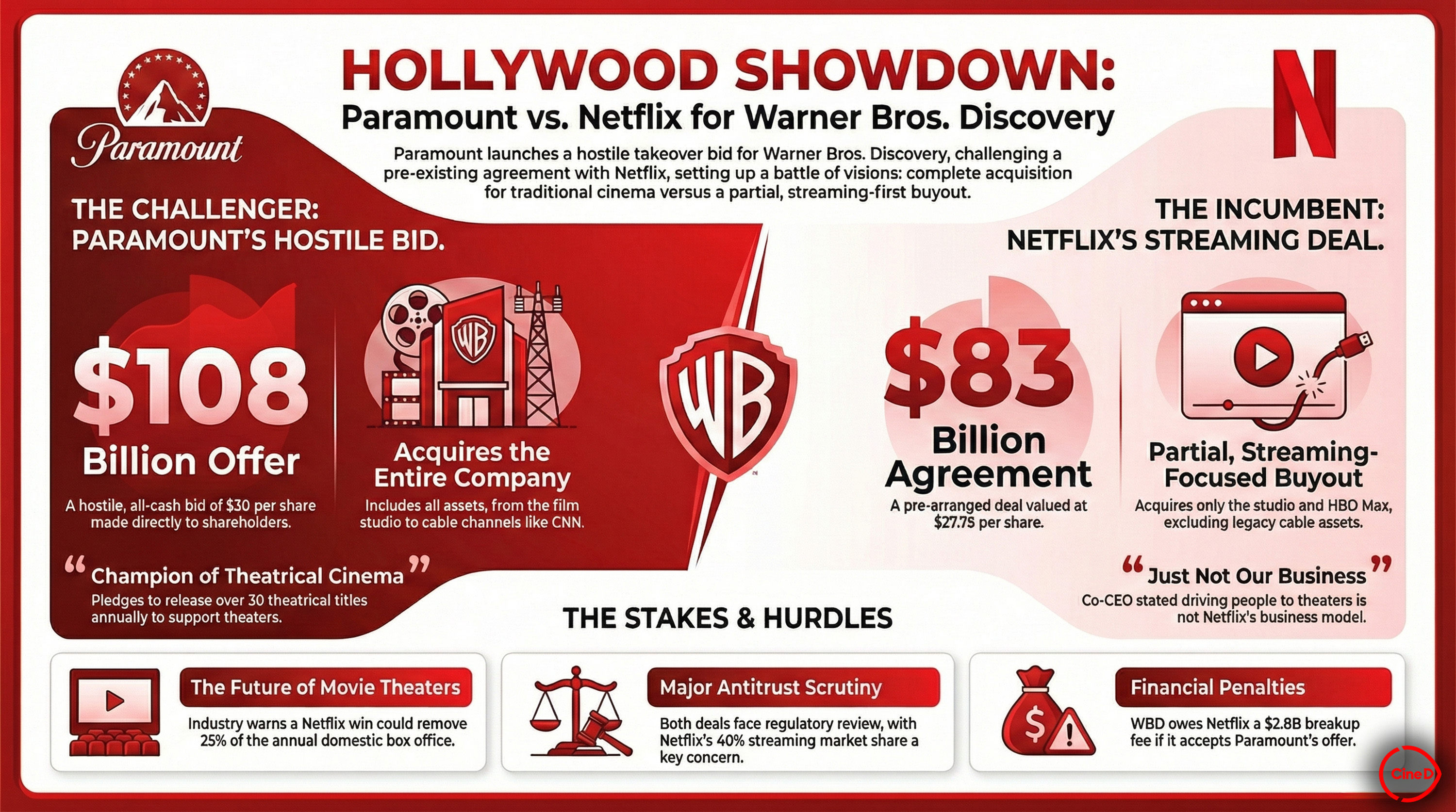

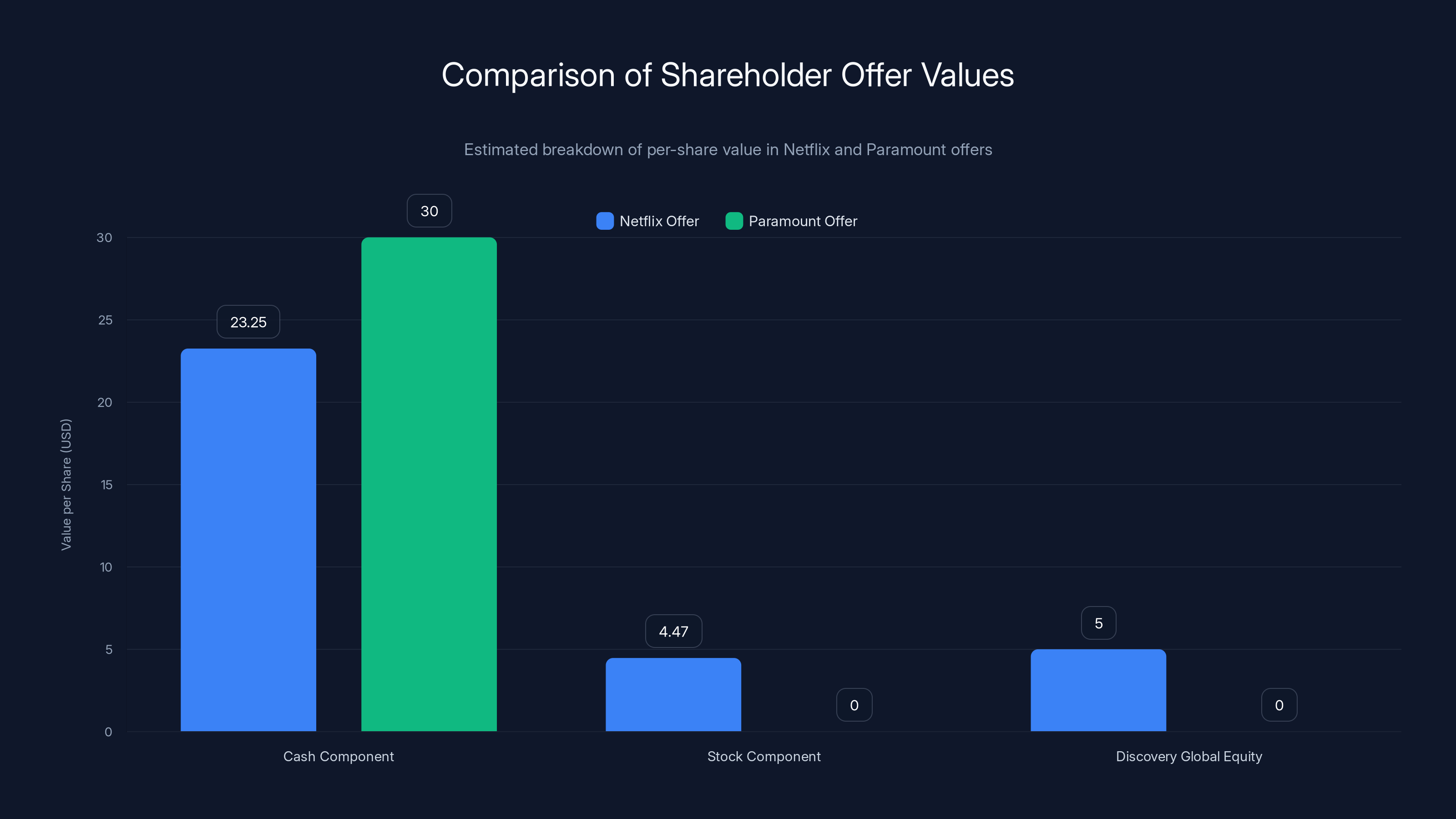

The mathematics behind each offer tells completely different stories. Netflix's deal values WBD at roughly

This article breaks down everything about the lawsuit, what each company's strategy reveals about their confidence in the future of streaming, and what the outcome might mean for the entertainment landscape. By the end, you'll understand why a $25.7 billion difference between bids doesn't automatically translate to victory, and why WBD's board might be making a rational choice despite appearing to leave shareholder value on the table.

TL; DR

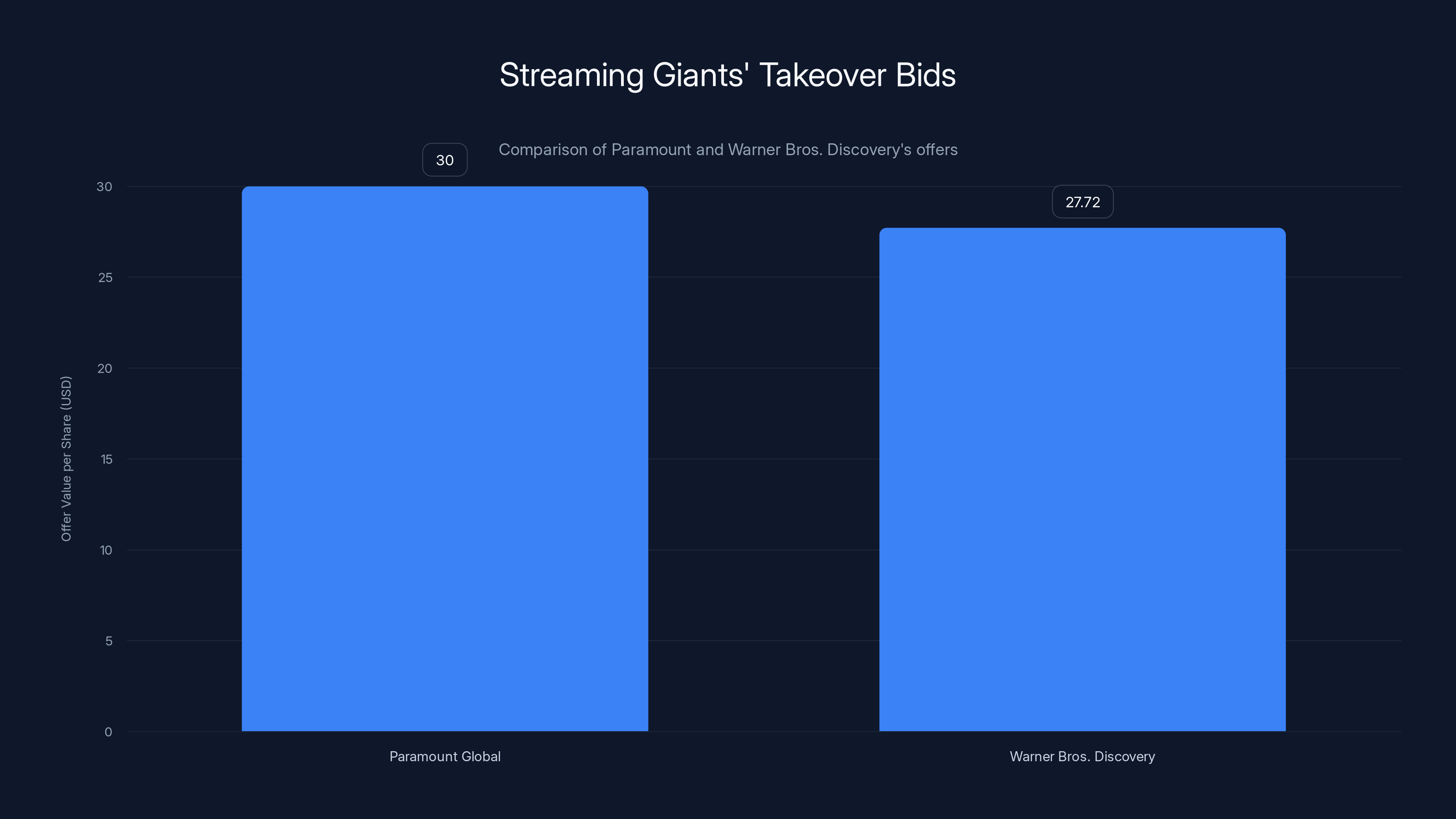

- Paramount's hostile bid: 30 per share with backing from Oracle's Larry Ellison

- Netflix's agreed deal: $82.7 billion for WBD's streaming and movie divisions, with cable networks spun into a separate entity

- The lawsuit: Paramount is demanding disclosure of WBD's valuation methodology and claiming the bidding process was unfair

- WBD's concerns: Paramount carries $87 billion in debt, a junk credit rating, and negative free cash flow compared to Netflix's A-rated stability

- Timeline pressure: Paramount's offer expires January 21, 2025, board director nominations open in three weeks, and regulatory approval could take 12-18 months

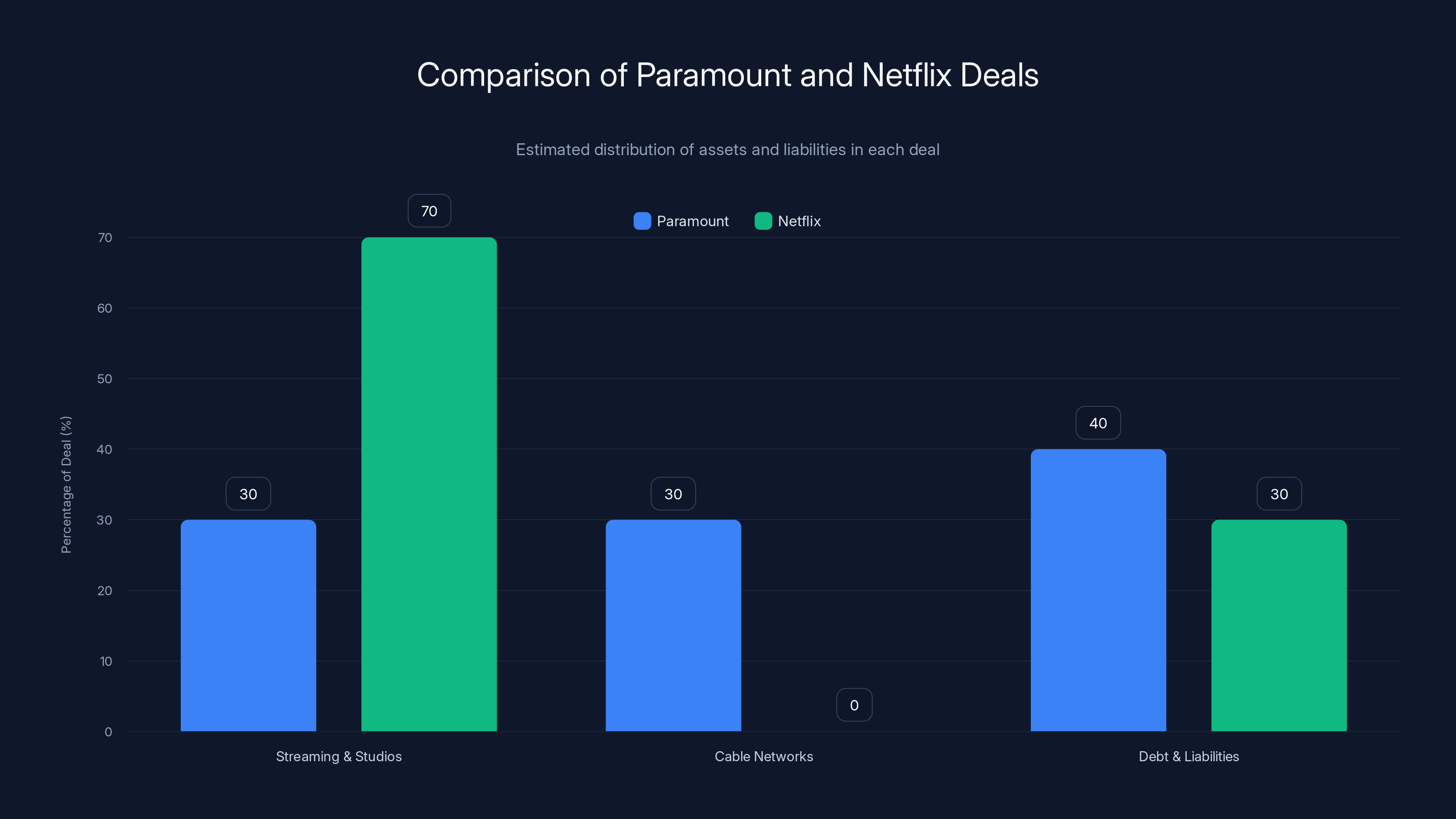

Paramount's deal includes all assets and liabilities, while Netflix focuses on high-growth streaming and studios, avoiding cable networks. Estimated data.

Understanding the Core Issue: Two Completely Different Deals

Most people assume that a higher price automatically wins a hostile takeover battle. Paramount's

The fundamental difference is what each company is actually purchasing. Paramount's bid is for 100% of Warner Bros. Discovery as it currently exists. That means all the cable networks (HBO, CNN, TBS, Adult Swim, DC Universe), all the movie studios (DC Films, Warner Bros. Pictures, New Line Cinema), all the streaming assets (Max, Discovery+), and all the accumulated debt, pension obligations, and legacy business liabilities that come with a media conglomerate.

Netflix's deal is strategically different. Netflix is buying WBD's streaming and movie studio operations specifically. WBD's legacy cable networks, which include beloved but mature franchises like CNN and HBO's traditional linear television operation, get spun out into a separate company called Discovery Global. This spinoff remains with WBD's current shareholders as a separate entity.

Why does this matter? Because cable networks are essentially cash-generating machines with declining growth prospects. They're not becoming more valuable. Meanwhile, streaming is where growth happens. By purchasing only the streaming and movie divisions, Netflix gets the highest-margin, fastest-growing parts of WBD's business without inheriting the legacy cable networks that require constant cost-cutting to maintain profitability.

Paramount, conversely, is taking on absolutely everything. That means integrating Paramount+ with Max, figuring out what to do with HBO's enormous cable footprint, managing CNN in an increasingly challenging news environment, and combining movie studios that have different cultures and strategies. The complexity multiplies the risk.

Paramount's proposed

The Paramount Lawsuit: What's Actually Being Challenged

On January 16, 2025, Paramount CEO David Ellison filed a lawsuit in Delaware Chancery Court that doesn't actually ask the court to force WBD to accept his offer. Instead, the lawsuit demands that WBD disclose specific financial information about how it valued the Netflix deal and the Discovery Global spinoff that will remain with current shareholders.

Specifically, Paramount wants WBD to reveal:

- How WBD valued the stub equity in Discovery Global (the cable networks company being spun out)

- How WBD calculated the overall value of the Netflix transaction

- The mechanics of the purchase price reduction for debt that Netflix negotiated

- The basis for WBD's "risk adjustment" in evaluating Paramount's offer

This is actually clever litigation strategy. Paramount isn't claiming the Netflix deal is illegal or that WBD's board violated fiduciary duties in a way that's obviously provable. Instead, the lawsuit says that WBD shareholders can't possibly make an informed decision without understanding the underlying financial assumptions that led the board to reject Paramount's offer.

The subtext is important here: Paramount suspects that WBD's board undervalued what the Discovery Global spinoff will be worth, which makes the Netflix deal look better than it actually is. If Paramount can prove that Discovery Global is worth less than WBD's board assumed, then the total value shareholders receive from the Netflix deal shrinks. That mathematically makes Paramount's $30 per share offer more attractive by comparison.

WBD's board rejected Paramount's bid on January 7, 2025, citing several concerns that the lawsuit indirectly addresses. Let's break down what each side is actually arguing about.

WBD's Financial Concerns: Why a Higher Price Doesn't Guarantee Victory

WBD's board cited three primary reasons for rejecting Paramount's offer, and each one reveals why financial sophistication matters more than raw dollar amounts in billion-dollar acquisitions.

Reason One: Extraordinary Debt Requirements

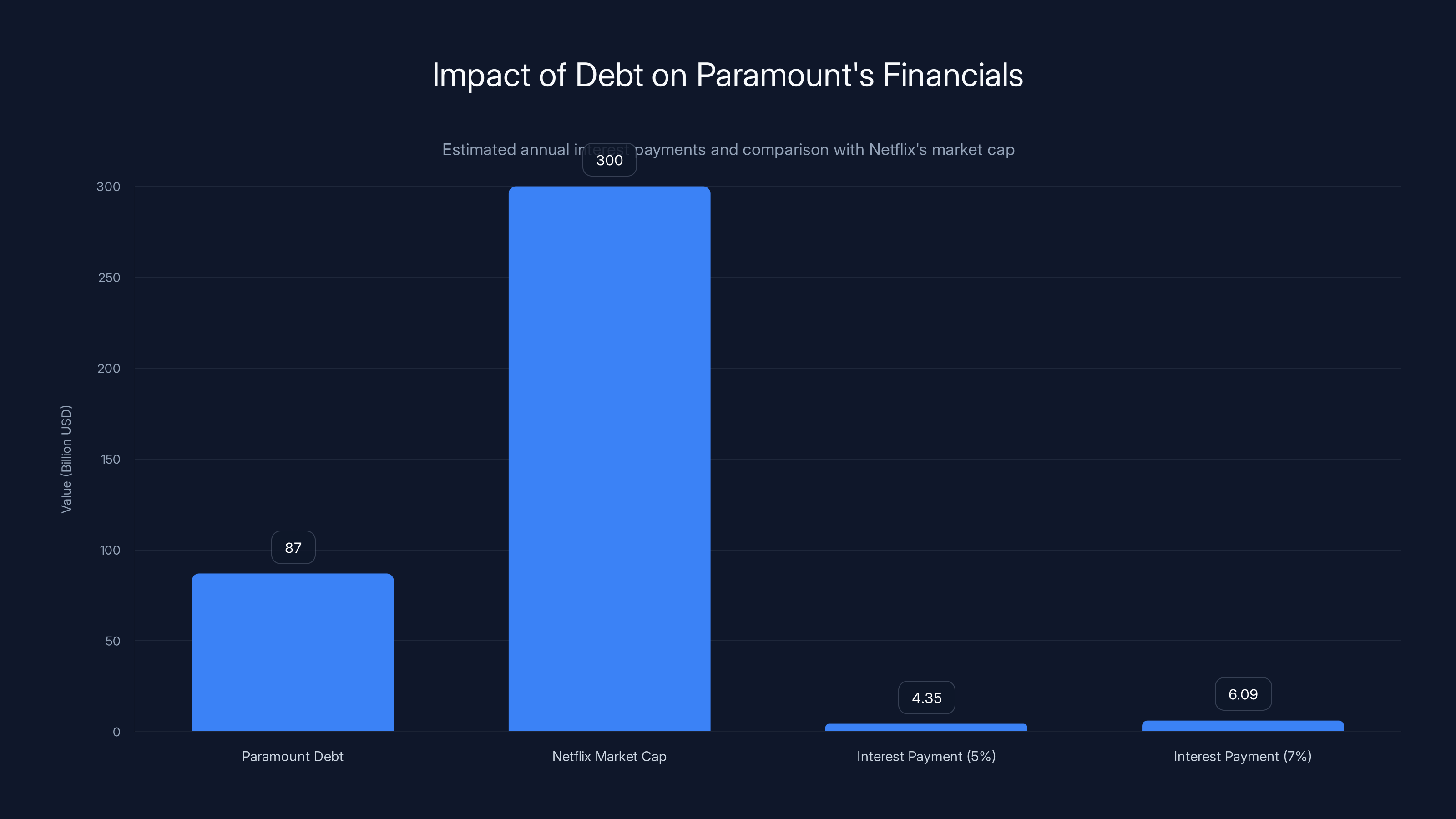

Paramount's bid requires

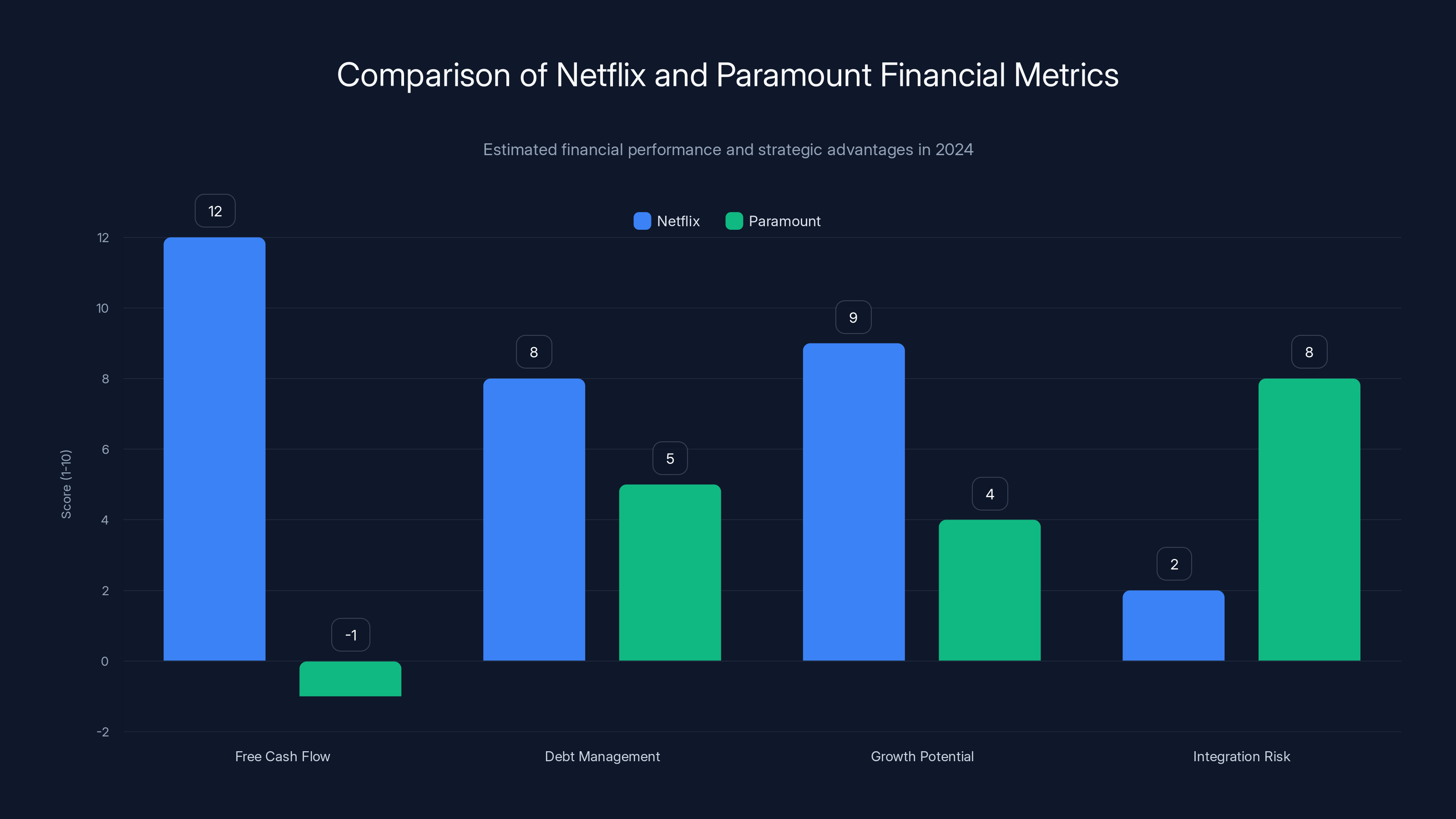

Why does this matter? Because debt carries interest payments. At current interest rates (around 5-7% depending on duration), Paramount would be paying

WBD's analysis shows that Paramount would enter this deal with negative free cash flow. Free cash flow is what's left after you pay for essential operations and capital expenditures. It's the money you can use to pay down debt, invest in new projects, or return to shareholders. Paramount, by their own financials, wouldn't have positive free cash flow to accelerate debt paydown. That's a problem when you're carrying $87 billion in obligations.

Reason Two: Credit Rating Implications

Paramount currently carries a junk credit rating. That means Paramount is rated below investment grade by credit agencies like Moody's and S&P. Netflix, by contrast, has an A/A3 credit rating, which is solidly investment grade. This isn't a minor distinction.

When Paramount borrows money for this acquisition, the interest rates they'll pay reflect their junk status. If Netflix borrows money to finance operations, Netflix pays lower rates because they're investment grade. Over the life of a multibillion-dollar debt package, that difference in interest rates compounds into hundreds of millions of additional costs.

Also, junk-rated companies face restrictions on what they can do with their balance sheet. Banks and institutional investors are less willing to work with them on refinancing. If debt maturities come due during economic downturns, rolling that debt over becomes more expensive or impossible.

Netflix's A-rated status means their debt is treated as reliable by global financial markets. They can access capital markets easily and cheaply. Paramount would be fighting against their own credit profile the entire time they're managing this merged company.

Reason Three: Breakup Fee Risk

Regulatory approval for a deal this large typically takes 12 to 18 months. During that period, conditions can change. Economic environments shift. Interest rates move. Competitive dynamics evolve. If Paramount's deal gets blocked by regulators, Paramount might have to pay WBD a breakup fee as compensation for the time and disruption.

Paramount's current financing plan doesn't clearly address how they'd cover that potential breakup fee while maintaining their debt obligations. Netflix's deal is already approved by Netflix's shareholders and Netflix management. The regulatory timeline is simpler because you're not merging two operational companies—you're one company acquiring specific divisions from another.

WBD's board noted that Paramount would potentially be stranded with massive debt and no acquisition to show for it if regulatory approval falls through. Netflix doesn't face that risk because their transaction is simpler and their balance sheet can absorb regulatory delays without financial stress.

Netflix's offer provides a total estimated value of

The Netflix Deal: Why Partial Ownership Might Create More Value

The Netflix transaction illustrates a different philosophy about how to create shareholder value in media. Rather than betting on Paramount's ability to integrate WBD's assets and manage $87 billion in debt, Netflix and WBD are structuring a deal that separates growth businesses from mature ones.

Netflix gets WBD's streaming division (Max), which has a global subscriber base and content library that complements Netflix's own catalog. Netflix also gets WBD's theatrical movie studios, which produce content that can be released on Max after theatrical windows. This is vertical integration in the streaming era: movies made by WBD can premiere on Netflix internationally (with some complexity around existing contracts, but the principle is sound).

WBD shareholders get cash and Netflix stock. The cash portion ($23.25 per share) provides immediate value and certainty. The Netflix stock portion gives them equity upside if Netflix continues to grow. Plus, WBD shareholders retain ownership of Discovery Global, the spun-out cable and digital media company.

Why would WBD shareholders prefer getting Netflix stock plus a spinoff company versus Paramount's all-cash offer? Because Netflix stock is a known entity with a proven business model and growth trajectory. Paramount stock, by contrast, is entirely dependent on whether Paramount can successfully integrate WBD without destroying value through integration costs, debt service, and cultural clashes.

Netflix generated an estimated $12+ billion in free cash flow in 2024. That gives them the financial flexibility to invest in the WBD assets they're acquiring and continue their global expansion. Paramount, with negative free cash flow in their current forecast, would be immediately defensive—cutting costs, pulling back investment, trying to prove they can service debt.

Larry Ellison's $40.4 Billion Personal Guarantee: What It Actually Means

One of Paramount's most significant moves in this battle was securing a personal guarantee from David Ellison's father, Larry Ellison, the Oracle founder and world's fourth richest person. Larry Ellison committed a personal guarantee of $40.4 billion toward the equity financing for Paramount's bid.

This sounds dramatic and signals serious commitment. But financial analysts and WBD's board quickly pointed out that a personal guarantee from a billionaire, while meaningful, doesn't actually solve the core problems with the transaction structure.

Here's why: the

Additionally, a personal guarantee from a billionaire, while valuable, is still less certain than actual balance sheet strength. If markets suddenly turn hostile to Paramount's equity offering and they can't raise the equity capital even with Ellison's guarantee, the whole structure falls apart. You're still dependent on capital markets cooperating.

Netflix's acquisition, by contrast, is financed primarily with Netflix's existing balance sheet strength and operational cash flow. Netflix isn't dependent on raising new equity or securing guarantees from anyone. That's the fundamental asymmetry: Netflix is paying for this with resources they already have. Paramount is assembling the financing like a puzzle where every piece needs to fit perfectly.

Still, Ellison's guarantee demonstrates Paramount's willingness to bet the family fortune on this acquisition. That signals real conviction about the value creation potential. But it doesn't change the fundamental leverage mathematics or the risk that integration could destroy value faster than the $25.7 billion premium Paramount is offering.

Netflix demonstrates stronger free cash flow and growth potential compared to Paramount, which faces higher integration risks and negative cash flow. (Estimated data)

The Bidding Process Dispute: Did WBD Actually Negotiate Fairly?

Paramount's lawsuit implicitly accuses WBD's board of not conducting a fair or thorough bidding process. David Ellison's letter to shareholders states that Paramount's December 4 offer "never received a response" from WBD and that the company "never attempted to clarify or negotiate any of the terms."

This is important in Delaware corporate law. If a company's board doesn't conduct a proper "go-shop" process—where all potential bidders get fair consideration—the company might face legal challenges from shareholders claiming the board violated their fiduciary duties to maximize shareholder value.

Paramount's argument is that WBD's board made a premature decision to accept Netflix's offer without giving Paramount a genuine opportunity to negotiate or increase its bid. Ellison noted in his letter that "there were few actual board meetings in the period leading up to the decision" and expressed surprise at "the lack of transparency on WBD's part regarding basic financial matters."

WBD's response essentially says that the bidding process was adequate, and Paramount's offer was rejected on the merits—not because the board didn't listen. WBD notes that Paramount has had the opportunity to increase its bid multiple times and hasn't. WBD chairman Samuel Di Piazza Jr. said on CNBC that "they've got to put something on the table that is compelling and is superior" if they want to change WBD's position.

Here's where it gets nuanced: WBD's board has the right to prefer one deal over another based on factors beyond just per-share price. They can consider financing certainty, timeline to close, regulatory risk, and the stability of the buyer's business model. Netflix doesn't have to put anything else on the table because Netflix has already won. Paramount would have to not just match Netflix's implied value per share—they'd have to overcome the board's concerns about financing and risk.

The lawsuit essentially says that shareholders can't make that judgment without seeing the full financial analysis. Paramount is betting that transparency will reveal the Netflix deal to be less attractive than it appears, which would pressure the board to reconsider.

Strategic Moves: Board Nominations and Bylaw Changes

Paramount announced that it will nominate board directors for election at WBD's annual shareholder meeting, which gives the company another angle of attack. If Paramount-aligned directors get elected, they could vote against the Netflix deal's approval and push for renegotiation with Paramount.

Paramount also proposed that WBD shareholders vote to require board approval for any spinoff of the cable networks division. Since the Netflix deal depends on spinning out Discovery Global, this proposed bylaw change would effectively give shareholders a veto over the Netflix transaction structure.

These moves signal that Paramount is playing a long game. The January 21 deadline for Paramount's offer is important, but if Paramount wins board seats and gets shareholders to demand changes to the deal structure, the Netflix transaction could unravel even if not formally blocked.

WBD shareholders have actually expressed divided opinions. Some large shareholders have stated they prefer Paramount's offer or would be open to higher bids. That creates political pressure on the WBD board. If a significant percentage of shareholders say they'd rather take Paramount's

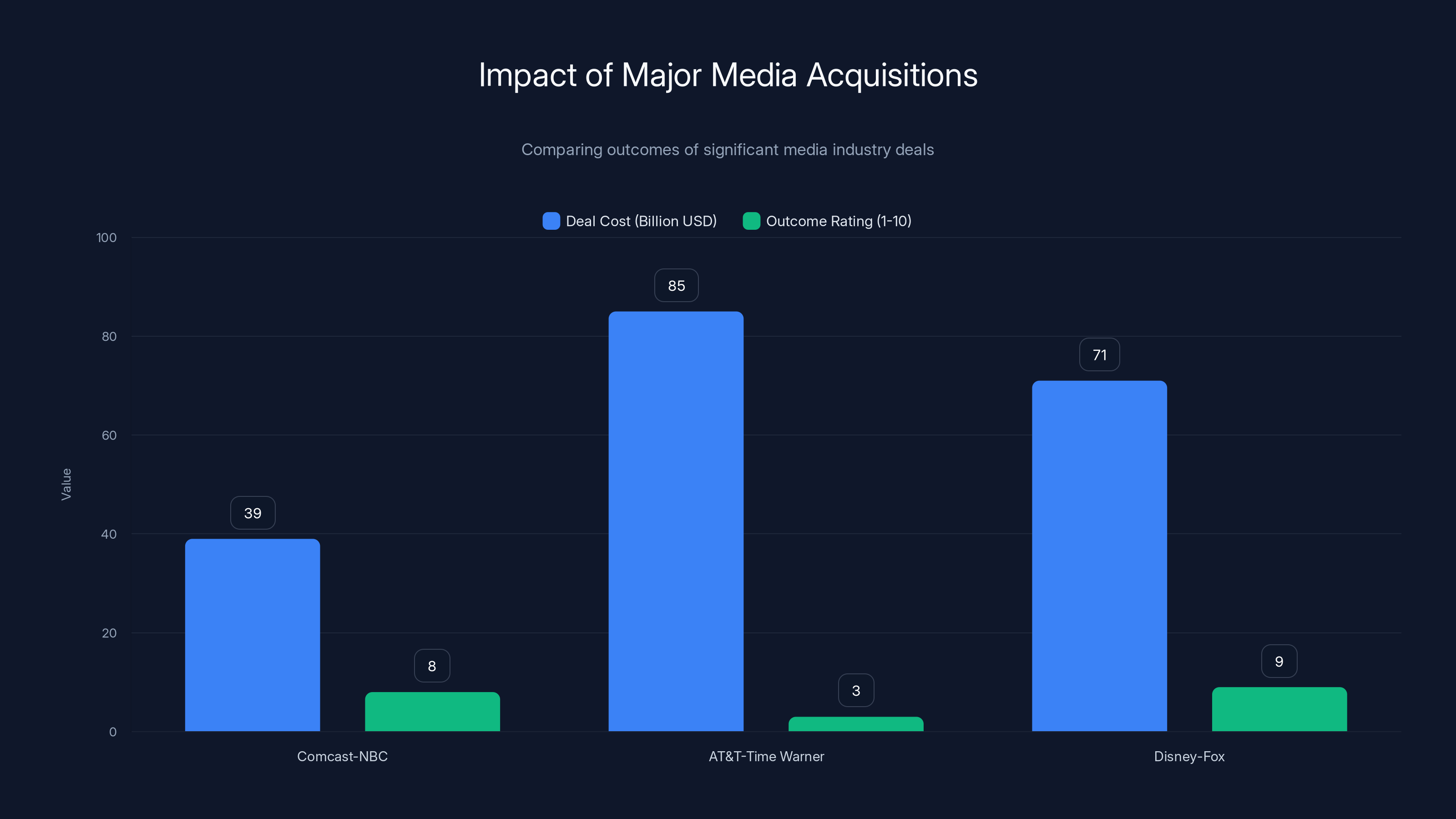

Comcast's acquisition of NBC and Disney's acquisition of Fox were successful, rated 8 and 9 respectively, while AT&T's acquisition of Time Warner is seen as a failure, rated 3. Estimated data based on historical context.

Content Strategy Implications: Why This Deal Matters Beyond Finance

The reason this battle matters beyond finance is that it determines who controls the world's largest content portfolios and where future content investment flows.

If Netflix wins, the entertainment landscape shifts dramatically. Netflix gets HBO's content library, DC Films' intellectual property, and WBD's theatrical studios. Netflix becomes not just a streaming platform but a vertically integrated content powerhouse. They produce content, they distribute it, they own the intellectual property. That gives Netflix unprecedented control over what stories get told and how they get monetized.

From a content perspective, this could be positive or negative depending on your viewpoint. Netflix's investment in DC Films could finally result in competent superhero content that competes with Marvel. Or Netflix could gut DC by removing budgets and creative autonomy. The theatrical studios could become primarily content factories for Netflix instead of focusing on theatrical windows. That's a fundamental shift in how Hollywood operates.

If Paramount wins, you get a different but equally significant outcome. Paramount would be managing both theatrical studios (Warner Bros. Pictures, New Line) and streaming services (Max and Paramount+). They'd have content made for premium networks that they'd want to keep exclusive to those networks. They'd have cable networks generating cash flow that could fund streaming content. The integration would be chaotic, expensive, and uncertain—but if it works, you'd have a truly integrated media company competing with Netflix on content volume and quality.

Neither outcome is bad for consumers in a simple way. Both could result in great content. Both involve consolidation, which eliminates some competition but potentially allows for larger production budgets. The strategic implications are genuinely complex.

Regulatory Approval: The Longest Part of This Battle

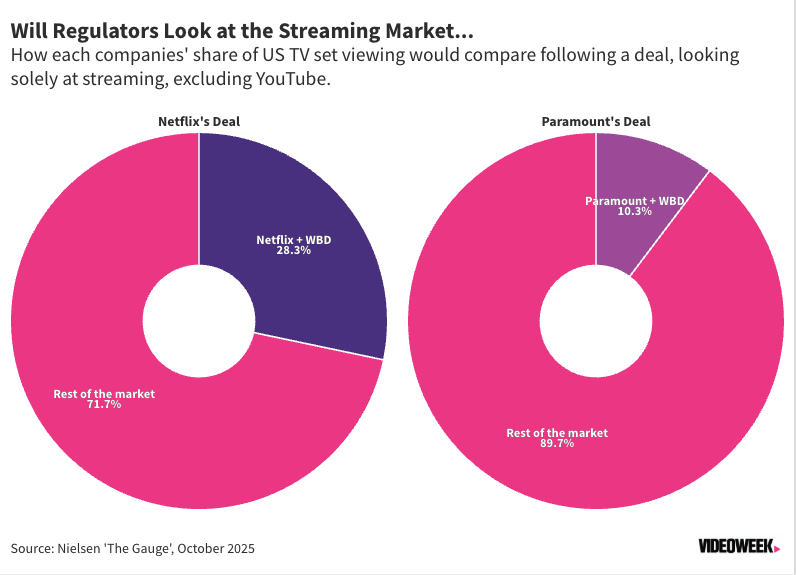

Whatever deal ultimately wins will need to clear regulatory scrutiny. For a transaction this large, that means the Federal Trade Commission and Department of Justice will examine whether combining these companies reduces competition in ways that harm consumers.

Netflix's acquisition of WBD's streaming division is less likely to trigger major regulatory concerns because Netflix isn't acquiring a direct streaming competitor. Max is already owned by WBD, so there's no "competitor reduces to just one" dynamic. The FTC approved Disney's acquisition of Fox's entertainment assets (which included streaming), so there's precedent for this type of deal passing regulatory review.

Paramount's acquisition would be more complex from a regulatory perspective. Paramount already owns Paramount+. WBD owns Max. A Paramount-WBD merger would combine two major streaming platforms. That could trigger concerns about market concentration. The FTC might require divestitures or other conditions before approving the deal.

Both deals could face scrutiny over cable television concentration. CNN and HBO are major cable players. Combining them with Paramount's own cable properties could trigger antitrust questions. But these concerns exist for either deal structure.

Regulatory approval is expected to take 12 to 18 months for whichever deal closes. That timeline means we're looking at mid-2026 or later for finality. A lot can change in 18 months. Netflix might hit growth challenges. Paramount's financial situation might deteriorate. Streaming economics could shift. The regulatory environment could become more or less favorable to consolidation depending on administration changes.

Paramount's all-cash offer of

The Financial Mathematics: Breaking Down Why Paramount's Number Isn't Actually Higher

WBD's board claims that even though Paramount's

Here's the math:

Paramount's offer: $30 per share for 100% of WBD.

Netflix's offer:

If Discovery Global is worth, say, $5 per share based on its cable networks and digital properties, then WBD shareholders would be getting:

- $23.25 in cash

- $4.47 in Netflix stock

- $5.00 in Discovery Global stock

- Total: $32.72 equivalent per share

Suddenly Netflix's deal looks better than Paramount's $30 per share. This is exactly what Paramount suspects WBD's board calculated, which is why the lawsuit demands disclosure of how Discovery Global was valued.

If Discovery Global is actually worth only $2 per share, then shareholders get:

- $23.25 in cash

- $4.47 in Netflix stock

- $2.00 in Discovery Global stock

- Total: $29.72 equivalent per share

Now Paramount's offer is actually superior. This valuation uncertainty is the entire crux of the lawsuit. Paramount is saying shareholders don't have enough information to make an informed decision. WBD is saying the valuation is solid and Paramount just doesn't want to pay more.

The Role of Institutional Shareholders: Who Actually Decides This Battle

Ultimately, this battle will be decided by WBD's largest institutional shareholders, primarily pension funds, mutual funds, and investment firms managing billions of dollars on behalf of clients.

These institutional investors don't care about media strategy or content quality. They care about three things:

-

Certainty of value: Is the $30 per share cash from Paramount certain, or is there real risk of deal failure? Is Netflix's stock reliable, and is Discovery Global's value real?

-

Tax efficiency: If shareholders have to pay capital gains taxes on sale proceeds, certain deal structures are more tax-efficient than others. A cash deal might be less tax-efficient than receiving stock and spinning off equity.

-

Optionality: Do shareholders get any upside if Netflix stock soars after the deal? With Paramount's all-cash offer, you're locked in at

35 or $50 per share in five years.

These factors explain why some major shareholders have expressed openness to Paramount's offer despite WBD's board rejection. The math isn't as one-sided as it appears to outsiders.

Paramount's strategy of nominating board directors and proposing shareholder votes is essentially an appeal directly to these institutional investors. Paramount is saying "we're betting our family fortune and offering more money. Do you really believe WBD's board is making the right call?" If enough institutional shareholders say no, they can force the board to reconsider.

Precedent and Historical Context: Learning From Past Media Mega-Deals

This battle doesn't exist in a vacuum. The media industry has a history of massive acquisitions that either created value or destroyed it. Understanding that history helps predict this deal's likely outcome.

Comcast's acquisition of NBC Universal (2011) cost roughly $39 billion, making it one of the largest media deals ever. Comcast integrated NBC's content studios, cable networks, and theme parks. The deal has generally been viewed as successful, though integration took years and required constant management attention. Comcast could afford the debt because they had massive cable subscriber revenues to service it.

AT&T's acquisition of Time Warner (2016) cost

Disney's acquisition of Fox's entertainment assets (2019) cost about $71 billion. Disney already had content studios and streaming assets, so the integration was about consolidation and combining similar businesses. It's been successful because Disney knew how to run entertainment companies and had the financial resources to invest in content. The deal worked because both sides were in the same business.

Paramount's situation is closer to AT&T's failure than Disney's success. Paramount is already carrying debt, and they'd be adding more debt to buy a media company they're less experienced managing. The integration would be complex, and success is uncertain. That's exactly why WBD's board is hesitant despite the higher price.

What Happens Next: The Timeline and Decision Points

The immediate timeline for this battle is compressed and specific:

January 21, 2025: Paramount's tender offer expires. If Paramount's offer hasn't been successful, this deadline passes and Paramount either withdraws the bid or extends the deadline. Most hostile bids get extended if there's still shareholder interest, but extensions signal weakness.

Early February 2025: Nominations window opens for WBD's annual shareholder meeting. Paramount will nominate board directors, and the fight moves from financial arguments to governance. Board elections typically happen at annual meetings, which for WBD would be later in 2025.

Delaware Court Decision: The lawsuit could be decided in weeks or months depending on how aggressively both sides litigate. Delaware courts move relatively quickly on these matters because time is money in M&A battles. But discovery could reveal information that shifts the negotiating balance.

April-June 2025: If the lawsuit reveals unfavorable information about Discovery Global's valuation or WBD's bidding process, pressure mounts on the board to reconsider Paramount's offer. Alternatively, the court dismisses the lawsuit and the path to Netflix closing clears.

Board Meeting/Shareholder Vote: WBD's board will need to put either the Netflix deal or Paramount's bid to a shareholder vote. If Paramount has won board seats, they'll demand reconsideration and potentially block the Netflix deal's approval.

2026: Whichever deal closes will enter the regulatory review period. Expect FTC scrutiny, possible information requests, and potential conditions or divestitures required for approval.

The entire process could take 18-24 months from today. That's a long time for certainty to hold in the entertainment industry. A lot can change in two years regarding streaming economics, content demand, and competitive dynamics.

Why This Matters Beyond Wall Street

If you're not personally invested in WBD stock, you might wonder why you should care about this battle. The answer is that this deal determines the future structure of the entertainment industry.

Scenario One (Netflix wins): Streaming consolidates around a Netflix-dominated content behemoth. Netflix owns production studios, distribution, content libraries, and subscriber relationships. Traditional theatrical windows disappear faster. Original series become the primary product. HBO's prestige gets preserved inside Netflix's system or diluted depending on management decisions. This scenario maximizes Netflix's power but potentially reduces the diversity of content strategies in the industry.

Scenario Two (Paramount wins): You get a new competitor attempting to challenge Netflix with a different model combining theatrical, cable, and streaming distribution. Paramount would try to leverage Warner Bros.' movie studios for theatrical releases while also feeding content to Max and Paramount+. This creates more competition in streaming but requires flawless execution and carries high financial risk. If Paramount fails at integration, you don't get better competition—you get a damaged Paramount+.

From a content creator perspective, this matters because it determines how films and television shows get financed, distributed, and monetized. From a consumer perspective, it determines what shows and movies are available on which platforms and at what price.

WBD's shareholders will decide this based purely on financial calculations. But the ripple effects extend far beyond shareholder returns.

The Financing Reality: Can Paramount Actually Close This Deal?

One critical question underlying everything: if Paramount wins the bidding war, can they actually close the deal and make it work financially?

Financing a $108 billion acquisition in today's market is genuinely difficult. You need capital markets cooperation. You need banks willing to underwrite massive debt. You need equity investors willing to buy Paramount stock at prices that make the economics work. That's not guaranteed, especially if market conditions deteriorate between now and regulatory approval.

Paramount's $40.4 billion personal guarantee from Larry Ellison helps, but it doesn't solve the fundamental problem: Paramount would be taking on debt that exceeds their annual revenue. That's a leverage ratio that makes institutional investors nervous, especially in media where content investments are risky and technological disruption is constant.

Paramount would likely need to divest assets to make the debt service work. They might sell Paramount's television networks or other properties to raise cash and reduce debt. That defeats some of the purpose of acquiring WBD—which was consolidation and integration, not asset stripping.

Netflix, by contrast, doesn't face financing constraints. Netflix can close this deal in months using their own balance sheet if they decide to proceed. From a financing certainty perspective, Netflix's offer is dramatically more attractive to WBD's board than Paramount's, regardless of which offer is nominally higher.

Expert Opinion and Market Reaction: What Analysts Are Saying

Media analysts and investment banks are generally skeptical of Paramount's chances, though not uniformly. Some analysts see real merit in Paramount's offer if the company can refinance their existing debt and manage the integration. Others believe Paramount is overpaying for a business (cable networks) that's in secular decline.

Most analysts agree on several points:

- Netflix's financial stability makes their offer more certain to close

- Paramount's debt load is higher than optimal for integration risk

- Discovery Global's valuation is genuinely uncertain, making comparison difficult

- WBD shareholders have real cause for complaint if they feel the bidding process was unfair

- This battle could take longer and get messier than either company publicly expects

Wall Street's consensus seems to be that Netflix wins, but not without drama. If Paramount successfully pressures the board through shareholder action and the Delaware court, Paramount might win an opportunity to increase its offer—but not without additional concessions from WBD.

The most likely scenario, according to several analysts, is that Paramount's lawsuit delays the Netflix deal by several months, creating uncertainty that helps Paramount's negotiating position. In that scenario, Paramount might win a slight price improvement from Netflix as compensation for the legal and regulatory delays they're introducing.

Future Implications: What This Teaches Us About Media Consolidation

Regardless of outcome, this battle reveals crucial truths about the future of media consolidation.

First, pure financial calculation isn't enough. Companies must have balance sheet strength, financial flexibility, and a coherent integration strategy. Paramount has conviction and money, but their financial situation raises real questions about whether they can absorb the risks.

Second, content businesses are still driven by execution and culture, not just IP portfolios. Buying HBO and DC Films doesn't automatically make you successful. You need to integrate those teams, maintain their creative autonomy (or lack thereof, depending on strategy), and navigate the transition from theatrical to streaming economics.

Third, shareholder sophistication is increasing. WBD shareholders aren't just looking at per-share prices. They're evaluating financing certainty, tax efficiency, and option value. Companies can't assume that higher prices automatically win. They need to make the complete case for value creation.

Fourth, this battle demonstrates that traditional media is still massive and important. A $100+ billion fight for media assets shows that despite Netflix's dominance, traditional studios retain tremendous value. That value exists because of content libraries, production capabilities, and distribution relationships that streaming hasn't fully replaced.

The future will likely see continued consolidation in media, but consolidation around companies that can actually afford it and manage it. That probably means Netflix accumulates more assets (like WBD's), while other traditional media companies struggle to compete independently. It's a story about the winners and losers in the streaming transition.

FAQ

What is the Paramount-WBD lawsuit about?

Paramount is suing WBD to force disclosure of financial information about how WBD valued the Netflix deal and the Discovery Global spinoff company. Paramount believes shareholders can't make an informed decision about whether to accept Netflix's

Why doesn't Paramount's 27.72 per share?

Because shareholders receive more than just per-share prices. With Netflix's deal, they get

What are WBD's main concerns about Paramount's offer?

WBD's board cites three primary concerns: Paramount would need $87 billion in debt that WBD says is an "extraordinary amount" for integration risk, Paramount carries a junk credit rating compared to Netflix's investment-grade rating, and Paramount has negative free cash flow meaning they can't service debt without selling assets or cutting costs. Additionally, if Paramount's deal fails regulatory approval, Paramount might be unable to pay breakup fees while managing the debt load. WBD views Netflix as a financially stable buyer with proven free cash flow generation.

How does Larry Ellison's $40.4 billion personal guarantee change the outcome?

Ellison's guarantee signals serious commitment and provides confidence that Paramount won't immediately fail to close the deal—but it doesn't solve the core problem. The guarantee covers equity financing, not debt service. Paramount would still face $87 billion in annual debt obligations that their operational cash flow might not cover. A personal guarantee from a billionaire is meaningful, but it's less certain than actual balance sheet strength and it doesn't address the integration complexity that could destroy value.

What timeline do we need to watch for this battle?

January 21, 2025 is Paramount's tender offer deadline. Early February 2025, nominations open for WBD's annual shareholder meeting where Paramount will nominate board directors. Delaware court should decide the lawsuit within weeks to months depending on discovery. Board elections at WBD's shareholder meeting (later in 2025) will determine board composition. Whichever deal closes will need regulatory approval taking 12-18 months. The entire process could extend through 2026.

Who actually decides between Paramount and Netflix?

WBD's largest institutional shareholders (pension funds, mutual funds, investment firms) make the ultimate decision through tender offers and shareholder votes. These investors care about certainty of value, tax efficiency, and potential upside. Some large shareholders have already expressed openness to Paramount's higher price, creating pressure on WBD's board. If Paramount wins board seats through director elections, they gain direct influence over the approval process.

Why does streaming consolidation matter to people who don't own WBD stock?

This deal determines the future structure of the entertainment industry. If Netflix wins, streaming consolidates around a single integrated powerhouse that controls production, distribution, and libraries. If Paramount wins, you get a different competitor attempting to challenge Netflix. Either outcome affects which shows and movies are available on which platforms, content quality depending on integration success, and how creators finance and distribute entertainment. The streaming transition fundamentally changed the industry, and this battle determines what the post-transition landscape looks like.

Could the Delaware court force WBD to accept Paramount's offer?

No. Delaware courts don't force companies to accept any particular offer. What courts can do is rule that WBD's board violated fiduciary duties by not conducting a fair bidding process or providing shareholders with adequate information. If the court rules that shareholders need more financial transparency, that could pressure the board to reconsider or extend negotiations with Paramount. But the ultimate decision remains with WBD's board and shareholders, not the court.

What's the most likely outcome?

Based on current information, Netflix's deal is most likely to close, but not without significant delays and potential pressure for a slight price improvement from Netflix to compensate for the legal battle. Paramount's lawsuit could delay regulatory approval by several months, giving Paramount negotiating leverage. Some analysts believe Paramount might win an opportunity to increase its offer slightly if the lawsuit reveals unfavorable valuations of Discovery Global. However, Paramount's financing challenges and junk credit rating make a complete reversal to Paramount winning unlikely unless Paramount is willing to pay significantly more, which they've shown reluctance to do.

The Paramount-WBD-Netflix battle represents a crucial moment in media history. It's not just about which company wins a hostile takeover—it's about the future structure of entertainment, the viability of traditional media companies in the streaming era, and how sophisticated shareholder bases evaluate complex financial transactions beyond simple per-share comparisons. Regardless of outcome, this lawsuit and bidding war will be studied in business schools for decades as a masterclass in modern M&A conflict, financial engineering, and the persistence of legacy media in a digital world. The winner doesn't just get assets—they get to define what the next era of entertainment looks like.

Key Takeaways

- Paramount's 27.72 per share when accounting for what shareholders actually receive including Discovery Global equity value

- WBD's concerns about Paramount's $87 billion debt load, junk credit rating, and negative free cash flow are materially relevant to long-term shareholder value and deal certainty

- Netflix's financial stability and A-rated credit status provide dramatically higher financing certainty compared to Paramount's complex debt structure requiring capital markets cooperation

- The Delaware Chancery Court lawsuit seeks disclosure of WBD's financial valuations rather than directly blocking the Netflix deal, making transparency the key to shifting shareholder leverage

- Paramount's strategy of nominating board directors and proposing bylaw changes signals a multi-month battle that could delay Netflix's deal and potentially force price renegotiation

Related Articles

- Paramount Skydance's Lawsuit Against Warner Bros. Discovery [2025]

- Warner Bros. Discovery Rejects Paramount Skydance Bid: Why Netflix Won [2025]

- The Complete History of TiVo: How It Changed TV Forever [2025]

- TikTok's 2026 World Cup Live Deal: What It Means for Sports Broadcasting [2025]

- Star Trek: Starfleet Academy Balances Teen Drama With Intergalactic Stakes [2025]

- Why Stranger Things Finale in Theaters Proved Streaming's Missing Piece [2025]

![Paramount vs. WBD Netflix Deal: The Hostile Takeover Battle Explained [2025]](https://tryrunable.com/blog/paramount-vs-wbd-netflix-deal-the-hostile-takeover-battle-ex/image-1-1768259232401.jpg)