Netflix's Bold Bet on Video Podcasts: A Comprehensive Look at 2025's Biggest Streaming Moves

Netflix just made a move that might seem counterintuitive. While the platform built its empire on scripted dramas, heist films, and true crime documentaries, it's now doubling down on something entirely different: podcasts. But not just any podcasts. We're talking about big-name talent, weekly episodes, and a format that's distinctly visual. In January 2025, Netflix announced two major original video podcast shows that signal a profound shift in how the streaming giant views content acquisition and audience engagement.

The first of these shows, "The White House with Michael Irvin," premiered on January 19. The second, "The Pete Davidson Show," launched on January 30 at 12:01 AM PT. These aren't random experiments. They represent a carefully calculated strategy to capture audiences who've outgrown traditional television but haven't quite settled into pure audio podcast consumption.

Here's what's interesting: Netflix isn't inventing this category. The podcast industry itself has been exploding for years. But streaming platforms have been slow to adapt. YouTube figured it out earlier. Apple created a dedicated podcast app. Spotify spent billions acquiring podcast networks. Netflix, historically focused on episodic scripted content, was conspicuously absent from this gold rush. Until now.

The implications are massive. For audiences, it means more diverse content on a platform they already pay for. For creators, it means another major distribution channel competing for their attention and their paychecks. For the entire media landscape, it suggests that the old boundaries between "podcasting" and "streaming" are officially collapsing.

Let's break down what Netflix is actually doing, why it matters, and what this means for the future of digital content consumption.

Understanding Netflix's Podcast Strategy Shift

Netflix's pivot toward podcasts didn't happen overnight. The company has been testing the waters for years. Back in 2021, Netflix started experimenting with podcast content, licensing shows from other creators. But licensing is just the appetizer. Creating original content is the main course.

The announcement of these two shows represents a fundamental commitment to original podcast production. This is different from simply making deals with existing podcast networks (though Netflix is doing that too). This is Netflix saying: "We're going to develop talent, produce content, and own the whole process."

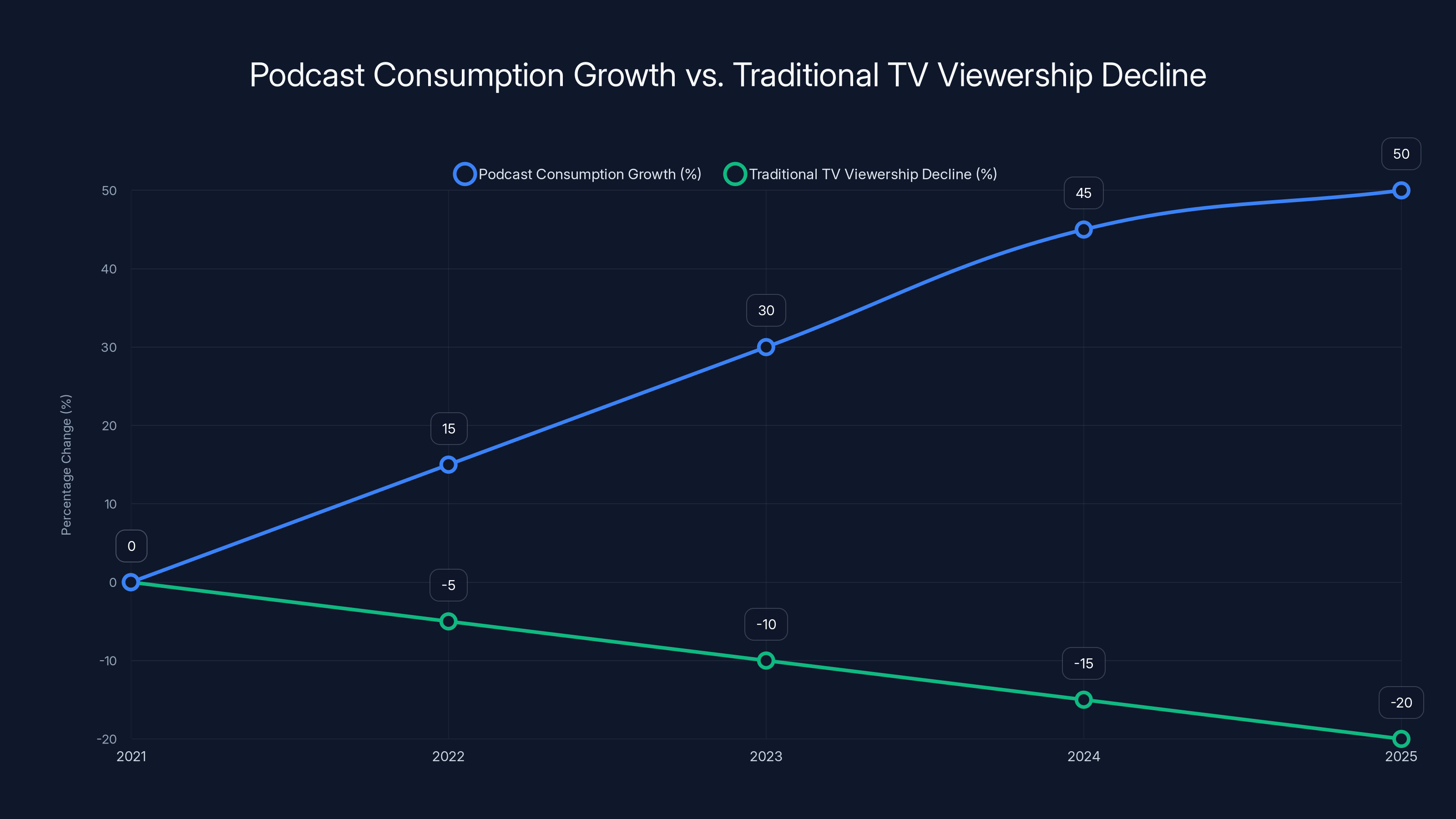

Why would a company that dominates scripted television suddenly care about podcasts? The answer lies in audience behavior. Podcast consumption has grown 50% over the past three years. Meanwhile, traditional television viewership continues to decline, especially among younger demographics. Podcasts offer something television doesn't: intimate, unscripted conversations that feel authentic. When you listen to a podcast for an hour, you feel like you know the host. That emotional connection is hard to manufacture in traditional media.

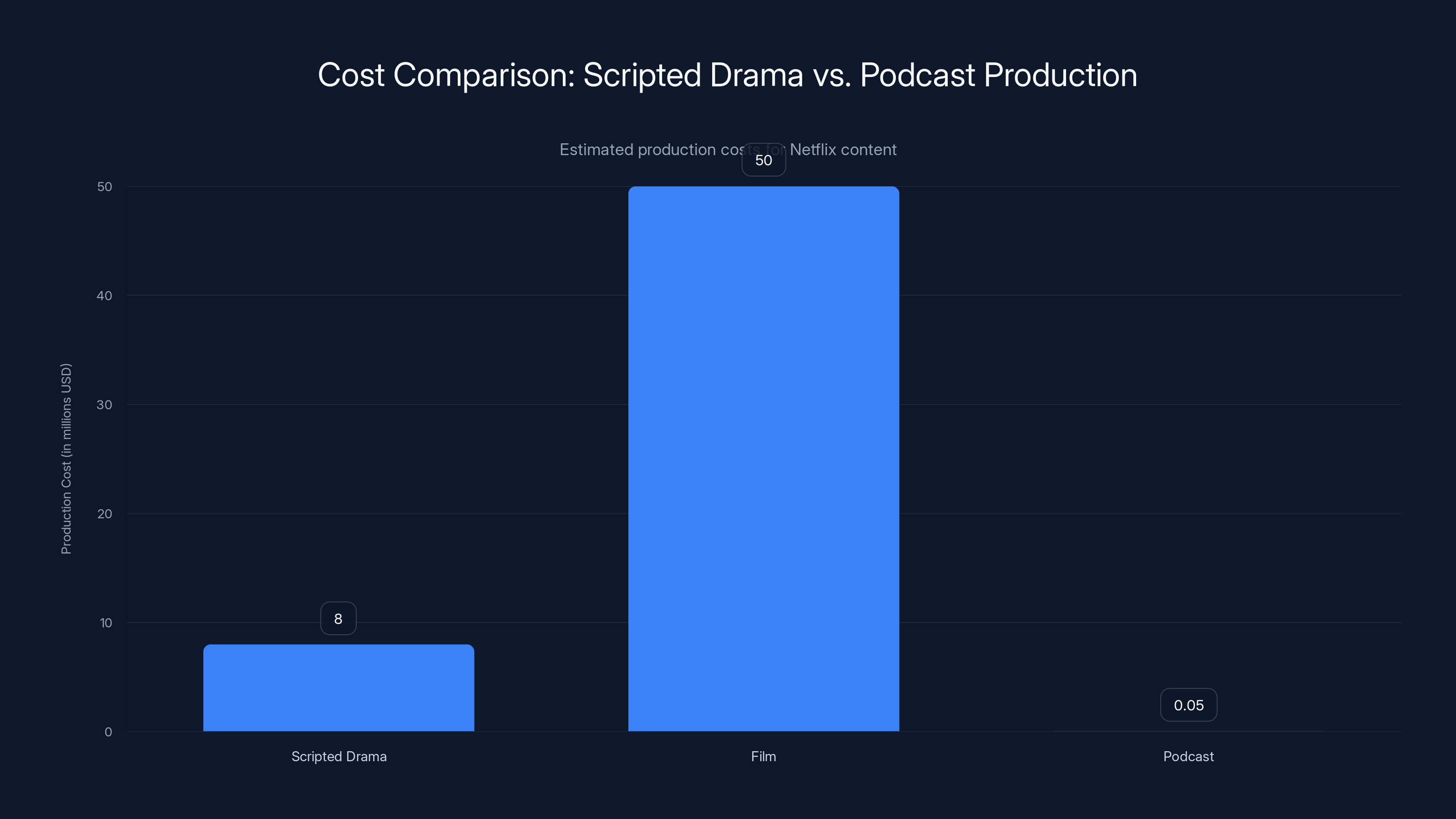

Netflix also recognizes a simple economic truth: podcasts are cheaper to produce than scripted dramas. You need talent, a microphone, a cameraman or two, and editing software. You don't need elaborate sets, costume departments, or armies of production assistants. The profit margins on successful podcasts can be stunning.

The strategic timing is worth noting too. Netflix announced these shows in early 2025, a period when the company is aggressively competing with emerging platforms. Disney+, Amazon Prime Video, and Max all have their own podcast ambitions. By securing A-list talent like Pete Davidson and Michael Irvin, Netflix sends a clear message: we're a major player in this space now.

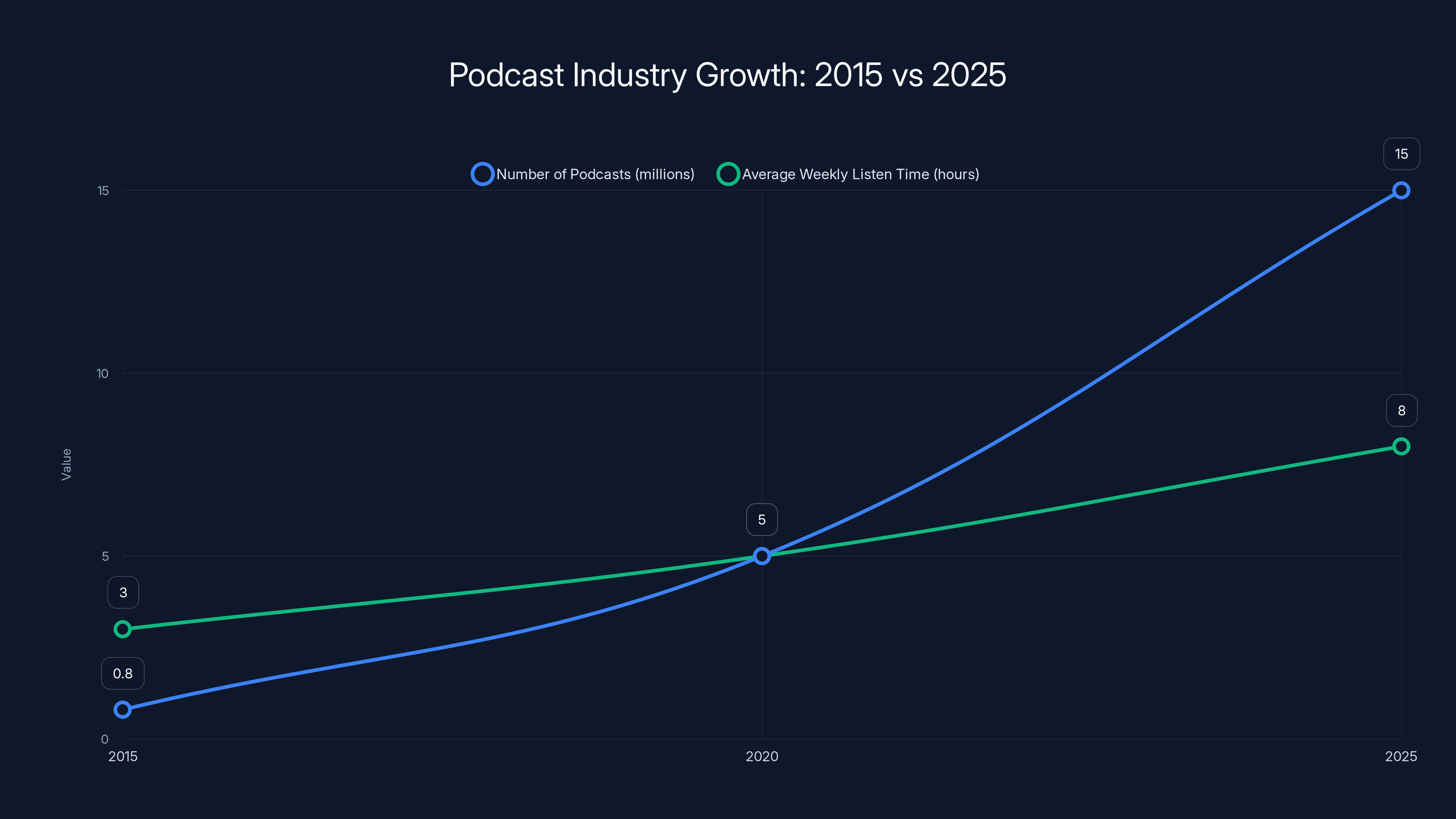

The podcast industry has seen a significant increase in both the number of podcasts and average weekly listen time from 2015 to 2025. Estimated data shows a growth from under 1 million podcasts in 2015 to over 15 million by 2025, with listen time rising from 3 to 8 hours per week.

The White House with Michael Irvin: A Closer Look

Let's examine the first show in detail. "The White House with Michael Irvin" premiered on January 19, 2025, and the title itself is a masterclass in clever branding.

Michael Irvin, for those unfamiliar, is a Hall of Famer who played for the Dallas Cowboys for 12 seasons. He won three Super Bowls with the team and is widely considered one of the greatest receivers in NFL history. More recently, he's become a prominent sports analyst and commentator. He's thoughtful, opinionated, and knows how to draw an audience.

But here's where it gets interesting: the show isn't about the White House. It's not about politics. The title refers to a building near the Dallas Cowboys facility. Irvin explained the reasoning himself: "In a crowded media landscape, recognition matters — and few names carry the same immediate weight." He wasn't wrong. By naming the show "The White House," he gets immediate recognition value. People do a double-take. They ask what it means. Then they learn it's about sports, and the clever misdirection has already done its job.

The format follows a traditional talk show structure, but with a sports focus. Irvin hosts new episodes twice weekly. Each episode features a rotating panel of co-hosts and guests discussing sports news, commentary, and analysis. This isn't one-off celebrity conversations. This is a consistent, serialized show with recurring elements.

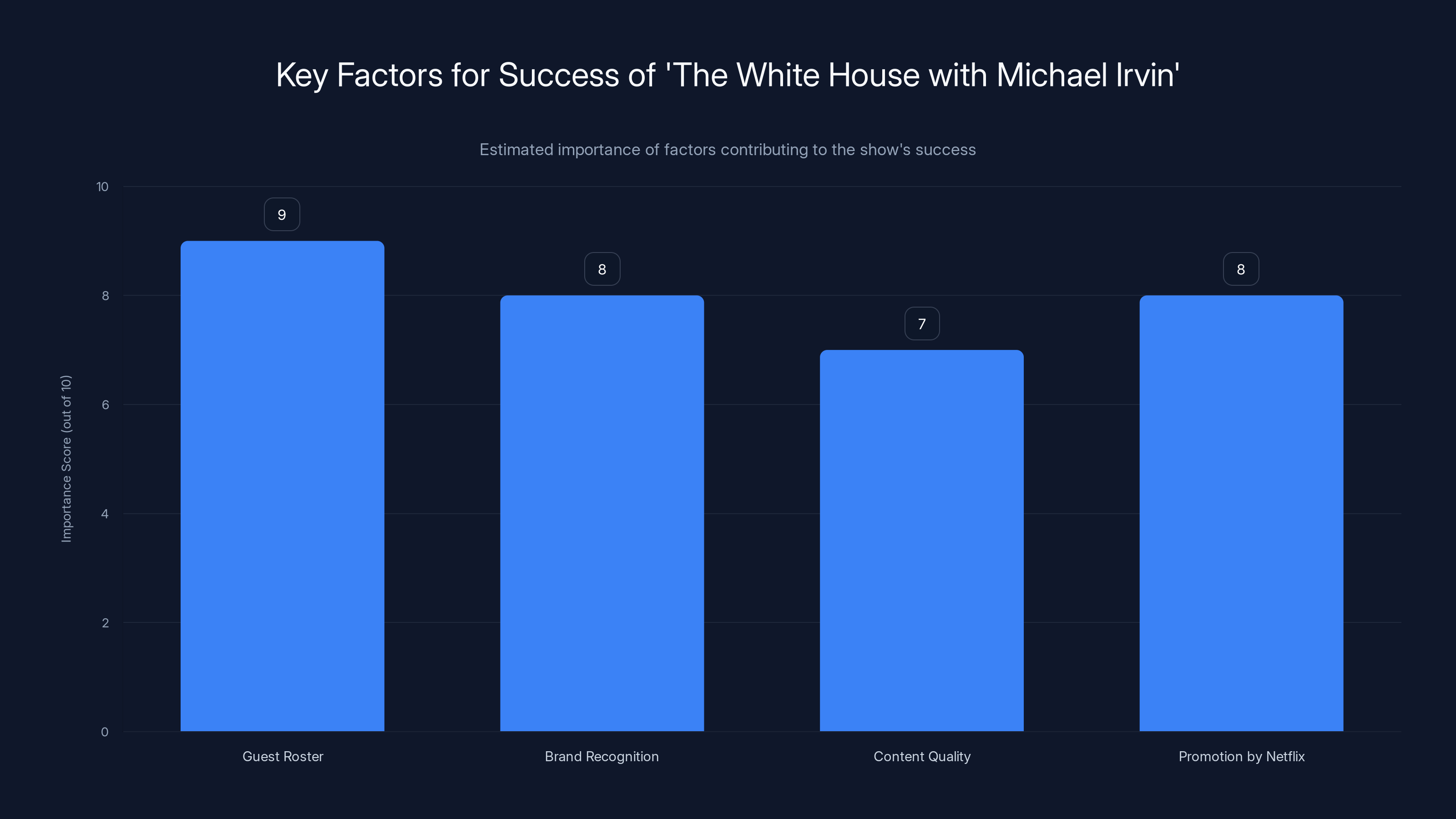

The guest roster will be crucial. Sports podcasts live or die based on who appears on them. If Irvin can secure interviews with current players, coaches, and prominent sports figures, the show will thrive. If it devolves into the same retired analysts talking to each other, it'll fade quickly. Netflix has the promotional power and distribution reach to attract major guests, which gives Irvin an advantage over independently-produced sports podcasts.

What's particularly clever about this move is how it positions Netflix within the sports media landscape. Traditional sports media has been fragmented across ESPN, Fox Sports, The Athletic, and countless independent podcasts. By bringing Irvin's sports analysis directly to its platform, Netflix inserts itself into daily sports discourse. A subscriber sitting on their couch can immediately watch Irvin's latest episode on sports news. They don't have to download a separate app, navigate a different interface, or deal with a different ecosystem.

The twice-weekly schedule is also strategically timed. It matches the rhythm of the sports calendar. Monday episodes can analyze the previous weekend's games. Thursday or Friday episodes can preview upcoming games. This cadence keeps the show relevant and gives audiences a reason to return regularly.

Producing a scripted drama or film is significantly more expensive than a podcast, with costs ranging from

The Pete Davidson Show: Comedy Meets Streaming

Now let's look at the second show, which launched on January 30, 2025, at 12:01 AM PT (a very Netflix-specific timestamp that signals exclusive content).

Pete Davidson is a former Saturday Night Live cast member, movie star, and comedian whose personal life has generated as much media attention as his professional work. He's been on the cover of tabloid magazines more times than most celebrities could count. But when it comes to comedy, he's genuinely talented. His stand-up specials have gotten strong reviews, and his movie roles have demonstrated range.

What makes Davidson particularly interesting for Netflix is his demographic appeal. He resonates strongly with Gen Z and younger millennials. He's been open about his mental health struggles, which has earned him credibility with audiences seeking authenticity over performative celebrity. In an era when manufactured content feels increasingly transparent, Davidson's seemingly unfiltered approach actually appeals to people.

The show itself is titled simply "The Pete Davidson Show," and the format is straightforward: weekly discussions with special guests. But there's a production twist that adds character. Episodes are filmed in Davidson's garage. This is the opposite of glossy studio production. It's intimate, casual, and deliberately anti-establishment. There's no fancy set design, no carefully curated background, no impression of wealth and celebrity excess. It's just Pete, his guests, and some garage lighting.

This aesthetic choice is brilliant because it plays to Davidson's strengths. He's never been the type of celebrity who needs a mansion or a yacht to define him. The garage recording reinforces the message that this is an authentic conversation between people, not a manufactured entertainment product.

The weekly schedule (compared to Michael Irvin's twice-weekly format) suggests Netflix is positioning these as different types of content for different audience segments. Sports fans get frequent Michael Irvin episodes to keep up with the news cycle. Comedy/pop culture fans get weekly Pete Davidson episodes that work more on a traditional talk show schedule.

Guest selection will be critical here too. Comedy podcasts succeed when interesting people are willing to come on and have real conversations. Davidson's personal connections and his appeal to younger celebrities should help him attract guests that other talk show hosts can't immediately secure. We might see musicians, actors, comedians, and internet personalities alongside traditional celebrities.

The Broader Context: Netflix's Podcast Deal Landscape

These two shows don't exist in isolation. Netflix has been building out a broader podcast strategy. In December 2025, the company inked a major deal with iHeartRadio to license content from its library. iHeartRadio owns hundreds of shows across comedy, sports, true crime, and other genres. By securing this content, Netflix significantly expanded its podcast catalog overnight.

Additionally, Netflix announced access to begin streaming some Spotify programming in 2025. This is particularly significant. Spotify has invested heavily in podcast exclusivity over the past five years, spending billions to acquire shows and networks. The fact that Netflix can now access some Spotify content represents a shift in how these platforms are thinking about competition and complementarity.

These deals serve multiple purposes. First, they allow Netflix to populate its platform with content immediately, without having to produce everything from scratch. Second, they signal to audiences that Netflix takes podcasting seriously. Third, they create licensing revenue for other platforms, which might seem counterintuitive but actually makes strategic sense. Netflix is saying: "We'll pay for your content if you're willing to let us reach your audiences." This is how content distribution often works.

The combination of original shows (Irvin, Davidson), licensed content (iHeartRadio), and acquired programming (Spotify) creates a comprehensive podcast experience within Netflix. For subscribers, it means opening Netflix might give them their sports analysis, comedy, true crime narrative, and niche interest content all in one place.

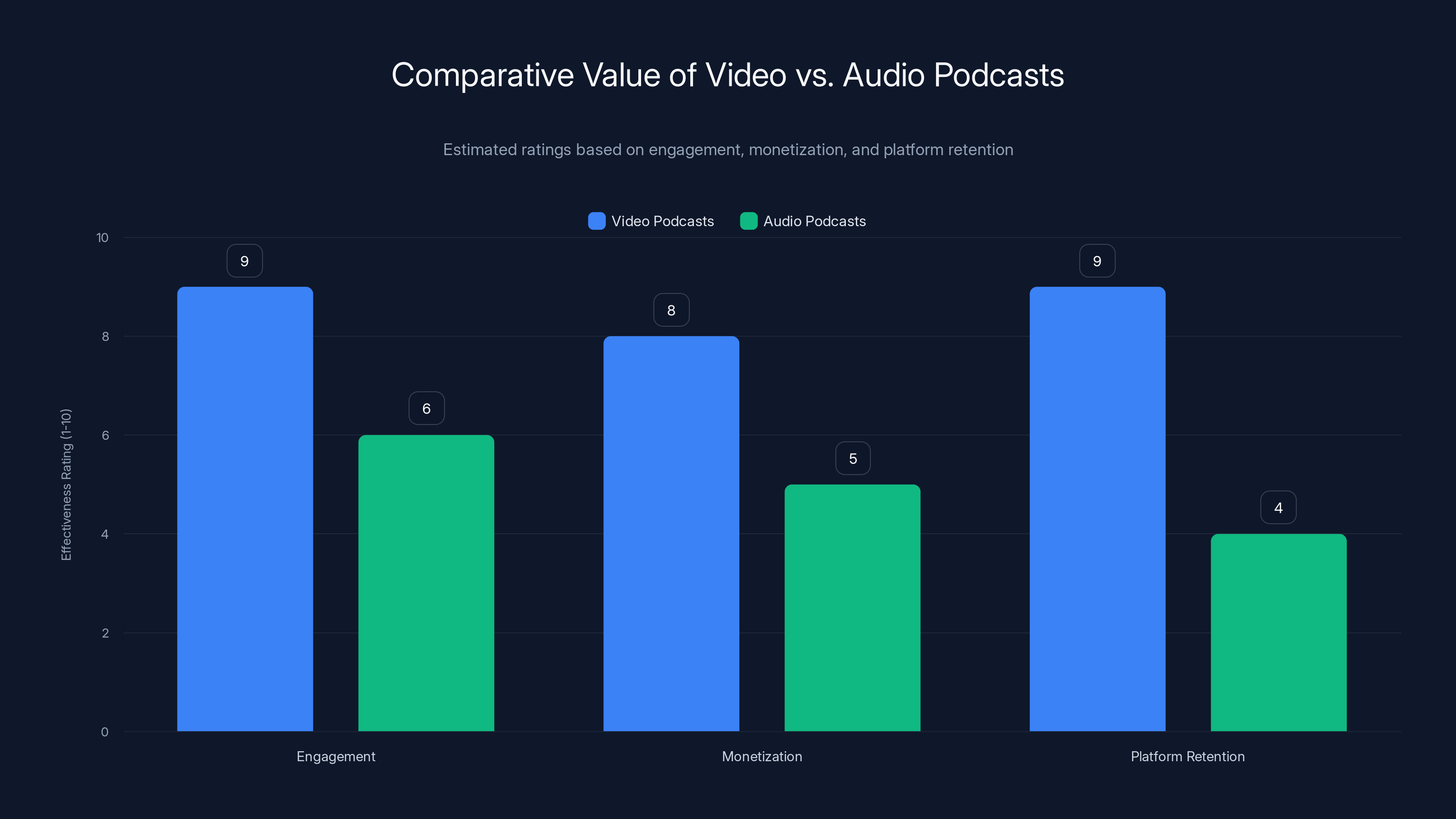

Video podcasts score higher in engagement, monetization potential, and platform retention compared to audio-only podcasts. (Estimated data)

Why Video Podcasts Matter More Than Audio-Only Shows

There's a crucial distinction between podcasts and video podcasts that shapes Netflix's strategy. Traditional podcasts are audio-only. You listen while commuting, exercising, or working. Video podcasts require your visual attention, but they offer something audio can't: facial expressions, body language, visual production, on-screen graphics, and multimedia elements.

Netflix is specifically emphasizing the "video" part of "video podcast." This makes sense for several reasons. First, it keeps viewers on the Netflix platform rather than sending them to YouTube or Spotify. If Pete Davidson's show was audio-only on Spotify, Netflix would be funneling subscribers away from its platform. Making it video-first keeps people watching on Netflix.

Second, video allows Netflix to employ its production expertise. The company has spent 15+ years perfecting how to shoot, edit, and present video content. It would be wasteful not to leverage that. A video podcast shot on Netflix's sound stages and edited by Netflix's teams will look polished in a way that garage-recorded audio simply can't match.

Third, video podcasts are more monetizable. Spotify's free ad-supported tier works fine for audio. But video advertising is more valuable. Brands pay more to appear in video ads than audio ads. More importantly, Netflix's subscription model works better with video content. If you're paying

The audience for video podcasts is also different from audio podcast audiences. Audio podcast listeners are often multitasking. Video podcast viewers are usually actively engaged, sitting down to watch. This changes the type of content that works. Michael Irvin can show game footage, break down plays, display statistics on screen. Pete Davidson can do visual comedy bits that wouldn't translate to audio. The medium shapes the content.

Market Analysis: The Podcast Industry in 2025

Why is Netflix jumping into podcasting now? To understand, you need to see where the podcast industry stands in 2025.

The podcast industry has experienced remarkable growth over the past decade. In 2015, there were fewer than 1 million podcasts. By 2025, that number had grown to over 15 million. More importantly, the listen-time metrics have exploded. The average American now spends about 8 hours per week consuming podcasts. That's equivalent to a full-time job's worth of listening each week.

But growth doesn't equal profitability. Most podcasts make virtually no money. Spotify's podcast investments have been famously unprofitable. Joe Rogan signed a $200 million exclusive deal with Spotify, but even with that massive investment, Spotify hasn't recovered its podcast spending costs. The economics of podcasting are notoriously difficult.

This is where Netflix's advantage becomes clear. Netflix doesn't need podcast revenue to come from podcast advertising or premium subscriptions to podcast-specific services. Instead, Netflix uses podcasts as subscriber acquisition and retention tools. If Michael Irvin's show attracts 50,000 new sports fans to Netflix, those people will also watch scripted dramas, reality shows, and movies. That's the business model. Podcasts aren't profit centers; they're marketing channels for the broader Netflix ecosystem.

The competitive landscape reflects this logic. Disney+ has been exploring podcast content. Amazon Prime Video has invested in audio content. Apple TV+ has experimented with audio shows. Every major streaming platform recognizes that podcasts represent a way to reach new audiences and deepen engagement with existing subscribers.

The 2025 landscape is also different from 2020 because audience expectations have evolved. Podcast production values have increased dramatically. People expect good sound quality, interesting guests, thoughtful editing, and a clear point of view. The days of one person rambling into a microphone and finding a massive audience are largely over. You need talent, production quality, and distribution power. Netflix has all three.

Podcast consumption has grown by 50% over the past three years, while traditional TV viewership has declined by 20%. Estimated data highlights the shift in audience behavior.

Content Strategy: Why These Specific Creators?

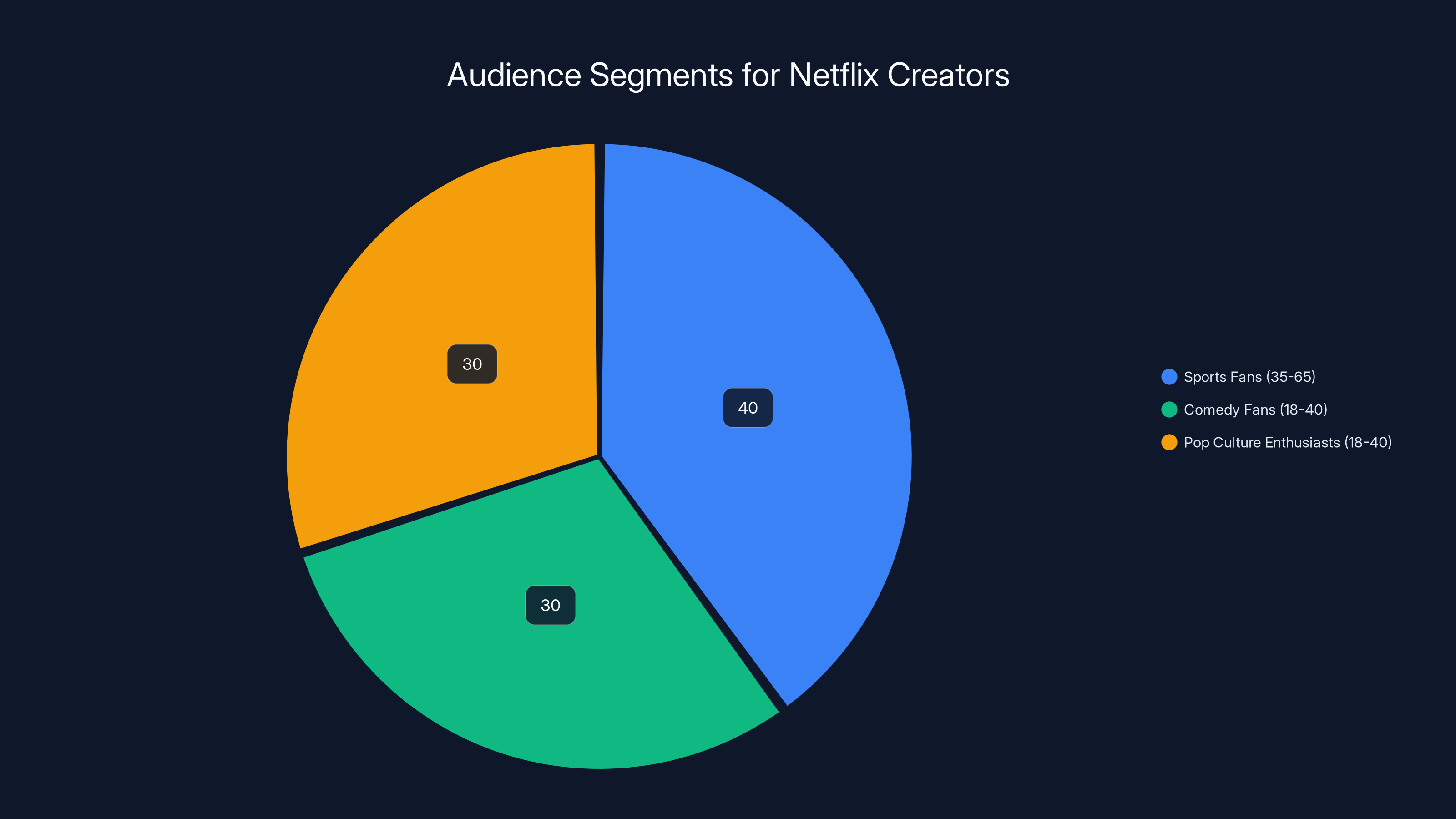

Netflix's selection of Michael Irvin and Pete Davidson reflects careful strategic thinking about audience segments and brand positioning.

Michael Irvin appeals to sports fans and older demographics. He's been a public figure for 25+ years. He has credibility in the sports world and relationships with active players and coaches. His podcast will attract the 35-65 demographic that's been somewhat neglected by Netflix's traditional scripted content strategy. Sports fans are highly engaged audiences who consume content regularly and frequently. They're loyal to personalities they trust. If Irvin builds audience trust, those people will become loyal Netflix viewers.

Pete Davidson appeals to younger demographics, comedy fans, and pop culture enthusiasts. He has massive social media followings and resonates with audiences aged 18-40. He's willing to discuss personal struggles, relationships, and controversies in ways that traditional entertainers often avoid. This authenticity appeals to younger audiences who distrust highly polished celebrity content.

Together, these shows cover different audience segments and different viewing habits. Morning sports fans might watch Michael Irvin's show before work. Late-night comedy fans might watch Pete Davidson in the evening. This content segmentation allows Netflix to stay relevant across different times of day and different viewing occasions.

Both creators also have something Netflix values: they drive conversation. Michael Irvin's sports analysis gets debated on social media. Pete Davidson's personal revelations trend on Twitter and TikTok. This creates free marketing for Netflix. The podcast becomes a cultural conversation point, which drives organic awareness and word-of-mouth promotion.

The Production Economics: Why This Makes Business Sense

From a pure economics perspective, video podcasts are exceptionally favorable for Netflix compared to traditional scripted content.

Consider the cost structure. A scripted drama episode might cost

Now consider audience value. A successful Netflix drama might attract 50 million viewers over its first month. A successful podcast might attract 3-5 million listeners in the same period. On a per-viewer basis, the drama seems more efficient. But consider subscriber impact and engagement metrics.

A viewer who watches a drama episode might not return for three weeks until the next episode. A podcast listener who becomes a fan typically returns weekly or even more frequently. Engagement metrics matter enormously for Netflix because they influence subscriber retention. A show that brings people back to the platform multiple times each week is more valuable than a show that brings them back once per month.

There's also the retention angle. Someone who subscribes to Netflix just to watch "Stranger Things" might cancel after the season ends. Someone who becomes a weekly listener of "The White House with Michael Irvin" has a recurring reason to keep their subscription active. This affects churn rates, which directly impact Netflix's financial performance.

Additionally, podcasts are lower-risk productions. If a drama doesn't work, Netflix has lost millions. If a podcast doesn't gain traction, the financial loss is contained. Netflix can experiment with different formats, personalities, and approaches at relatively low cost. Some will fail. But when one succeeds, the returns are substantial.

There's also the international angle. Netflix has ambitions to grow in international markets. Podcasts in English can theoretically reach English-speaking audiences everywhere. Michael Irvin's sports analysis will interest international viewers who follow the NFL. Pete Davidson's comedy will appeal to international audiences who consume English-language entertainment. Podcasts are more easily distributed globally than scripted content that requires dubbing and localization.

Guest roster is estimated to be the most crucial factor for the show's success, followed by brand recognition and Netflix's promotional power. Estimated data.

Competitive Implications: What This Means for Other Platforms

Netflix's podcast strategy doesn't exist in a vacuum. It directly challenges other platforms and creators.

First, consider YouTube. YouTube is the dominant platform for video content, including interview shows and comedy. When Pete Davidson releases a podcast episode on Netflix, it's not on YouTube. YouTube creators have long depended on celebrities and creators like Davidson to drive views. By bringing that content to Netflix, the platform is directly competing for viewing time that might have gone to YouTube.

Second, consider Spotify. Spotify owns the podcast space in terms of music and podcast integration. But Spotify's business model is built on free, ad-supported listening. Netflix's video podcasts can't easily be consumed via Spotify. Netflix is saying: "If you want video podcasts, you come to our platform." This is a competitive advantage, but it's also a risk. Some people prefer the flexibility of audio-only listening.

Third, consider independent podcast networks. iHeartRadio, Sirius XM, and other networks have built audiences by securing exclusive talent. Netflix's ability to write big checks and offer massive distribution is intimidating to independent creators. If you're a promising comedian or sports analyst, Netflix suddenly becomes a very attractive option.

Fourth, consider traditional television. Cable networks have long relied on talk shows, sports analysis, and entertainment news to fill programming. Netflix is now competing directly in these categories. When Michael Irvin appears on Netflix instead of ESPN, ESPN loses that content and the audience attention that comes with it.

The broader implication is that traditional content boundaries are collapsing. There's no longer a clear distinction between "podcasts," "streaming," "television," and "social media." Everything is converging into a few mega-platforms fighting for the same audiences. Netflix's podcast strategy is part of this consolidation.

What This Means for Creators and Talent

For creators, Netflix's podcast expansion represents both opportunity and pressure.

The opportunity is obvious: Netflix offers distribution, production resources, and subscriber access that most creators could never achieve independently. If you're Michael Irvin or Pete Davidson, Netflix is offering you a platform to reach millions of people with minimal distribution effort on your part. The company handles production, editing, technical infrastructure, and promotion.

But there's pressure too. Netflix's platform is very different from the podcast ecosystem where creators traditionally operate. On Spotify or Apple Podcasts, you build an audience relationship directly. Your listeners subscribe to your show, they download episodes, they own the relationship. On Netflix, Netflix owns the relationship with the subscriber. Viewers aren't subscribing to "Michael Irvin's show" in the abstract. They're subscribing to Netflix, which happens to include Irvin's show.

This creates creative constraints. Netflix will have editorial standards, content guidelines, and brand expectations that independent podcasts don't face. If Pete Davidson wants to do a 15-minute bit about his personal relationships, Netflix will have opinions about whether that fits the platform. If Michael Irvin wants to take a controversial stance on a sports issue, Netflix's legal team might flag it. This isn't censorship, exactly, but it is editorial control.

For existing podcasters, Netflix's moves are a reminder that the platform ecosystem is consolidating. Ten years ago, podcasters owned their distribution. A creator could build an audience on iTunes, then move to Spotify, then start their own website. The relationship with listeners was direct. Now, Spotify owns the top podcasts. Netflix is buying visibility. Amazon is investing in audio. Apple is leveraging iTunes. Independent creators are being squeezed.

There's also the money question. Spotify's exclusive deals with Joe Rogan and other top creators have inflated market expectations for podcast compensation. Netflix will likely be more selective about who gets nine-figure deals, but the existence of those deals changes what everyone expects to earn. This creates an unsustainable situation where top creators get very rich and everyone else gets very little.

Estimated data shows that Michael Irvin appeals to sports fans aged 35-65, while Pete Davidson attracts comedy and pop culture enthusiasts aged 18-40. This segmentation helps Netflix reach diverse audiences.

The User Experience: How Podcasts Fit Into Netflix

From a user perspective, finding podcasts on Netflix will be an interesting experience. The platform has never been organized around audio content before. Netflix's interface is built for browsing TV shows and movies, not podcasts.

Will there be a dedicated "Podcasts" tab? Or will podcasts be mixed with other content? Will Netflix create podcast-specific recommendation algorithms? Will there be a separate bookmark system for podcast episodes? These are open questions that Netflix will need to solve.

The early indication is that podcasts will be integrated into the regular Netflix interface, not segregated into a separate section. This means you might browse Netflix for something to watch and discover "The White House with Michael Irvin" right alongside actual TV shows. For some users, this is convenient. For others, it might be confusing to mix different types of content.

There's also the question of mobile optimization. Podcasts are often consumed on mobile devices during commutes or exercise. Netflix's mobile app will need to be optimized for podcast listening, with features like lock-screen controls, background audio, and the ability to resume from where you left off. The company probably has these features already, but they'll need to work seamlessly with Netflix's traditional video-watching experience.

Downloading and offline viewing is another consideration. Netflix already allows downloading shows for offline viewing. Will podcast episodes be downloadable? If they are, users can listen offline (on a plane, in a subway without service). If they're not, users need consistent internet connectivity. This affects the utility of the platform for podcast consumption.

The experience will also depend on Netflix's recommendation engine. Netflix has decades of expertise in predicting what users want to watch based on viewing history, similar user behavior, and explicit ratings. Will Netflix apply the same intelligence to podcasts? If you watch a lot of sports documentaries, will Netflix recommend Michael Irvin's show? If you watch comedy specials, will Pete Davidson's show appear in your recommendations? These algorithmic integrations are crucial to podcast success.

Future Predictions: Where Netflix Podcasts Are Headed

Based on Netflix's current strategy, it's reasonable to predict how podcast content will evolve on the platform.

First, expect more shows. These two are just the beginning. Netflix will likely invest in sports podcasts across different leagues (NFL, NBA, MLB, soccer, etc.). Comedy will get attention. True crime podcasts are already popular; expect Netflix to develop original true crime content alongside traditional documentaries. News and politics podcasts might follow. Technology and business content could appeal to the Netflix audience.

Second, expect higher production values. As Netflix gains experience producing podcasts, the quality will improve. Early shows might be relatively simple (person talking on camera). But Netflix will likely evolve toward more produced content with graphics, guest appearances, location-based episodes, and higher production budgets. This is what Netflix does—it takes a format and optimizes it.

Third, expect original exclusive talent. Netflix will use its resources to attract major personalities. Sports figures, comedians, musicians, and media personalities might see Netflix as an attractive opportunity. Over time, Netflix could have a more impressive roster of podcast hosts than Spotify or any other platform.

Fourth, expect international expansion. These initial shows are English-language. But Netflix will eventually develop podcasts in other languages for international markets. This is more complex than simply translating content; it requires understanding local media markets and attracting local talent. But Netflix has the resources and the distribution reach to make it work.

Fifth, expect integration with other Netflix content. Imagine a storyline in a Netflix drama that references something Michael Irvin discussed on his podcast. Or a movie star appearing on Pete Davidson's show right before their film releases on Netflix. These cross-promotional opportunities are the kind of synergy that streaming platforms can leverage.

Sixth, expect experimentation with monetization. Netflix's current model is ad-free subscriptions (with a new ad-supported tier). But podcasts typically monetize through advertising. Will Netflix introduce in-podcast advertising? Will premium podcast content require an additional subscription tier? Will there be sponsor integrations that are different from Netflix's traditional approach? These are open questions, but expect evolution.

Risks and Challenges: What Could Go Wrong

Netflix's podcast strategy isn't without risks. Understanding these challenges is important for predicting how successful this venture will be.

First, there's the talent risk. Michael Irvin and Pete Davidson are entertainment personalities with established fan bases. But popularity in one medium doesn't guarantee success in another. Michael Irvin is great at sports analysis, but will he be effective in a podcast format where he needs to drive conversation and engage audiences for multiple hours? Pete Davidson is a great comedian, but weekly episodes of conversation are different from a 90-minute comedy special. The format is new, and some celebrities struggle with format changes.

Second, there's the audience size question. Netflix has 250+ million subscribers. But not all subscribers are interested in podcasts. Sports fans might skip Pete Davidson. Comedy fans might skip Michael Irvin. Netflix's overall subscriber base is large, but the actual audience for each show might be much smaller than Netflix's total reach suggests. If fewer than 1 million people watch each show, Netflix might consider them underperforming.

Third, there's the execution risk. Netflix excels at scripted content, but podcasts are different. They require consistency, live conversational skills, and the ability to maintain interest across many episodes. Scripted content can be shot, edited, and perfected before release. Podcasts are often raw and immediate. Netflix's perfectionist approach might not suit the medium.

Fourth, there's the monetization problem. Netflix hasn't clearly explained how it will monetize these podcasts. Are they included in existing subscriptions? Are they available on ad-supported tiers? Will Netflix eventually introduce podcast-specific subscriptions? The business model isn't transparent, which makes it hard to assess whether this is actually profitable.

Fifth, there's the integration challenge. Mixing podcasts with Netflix's traditional content might create a confusing experience. Users might not know where podcasts are in the app. Podcast recommendations might not work well because the algorithm was built for visual content. Technical issues might arise with audio streaming, download management, and playback controls.

Sixth, there's the competition risk. Netflix isn't the only platform pursuing podcasts. Spotify is still the market leader in podcasting. Apple Podcasts is ubiquitous. YouTube has all the interview content anyone could want. Netflix's advantages (production quality, distribution reach) are real, but they're not insurmountable.

Conclusion: Netflix's Podcast Bet and What It Means for the Future

Netflix's announcement of original video podcasts from Michael Irvin and Pete Davidson represents more than just two new shows. It signals a fundamental shift in how Netflix sees its business and how the company intends to compete in an increasingly fragmented media landscape.

The podcast industry is booming. Audiences are consuming more audio and video content than ever before. But the economics of podcasting have been challenging for everyone except the largest platforms with massive distribution advantages. Netflix is betting that its subscriber base, production expertise, and distribution reach can make podcasting profitable in ways that have eluded others.

Michael Irvin's sports analysis show and Pete Davidson's comedy talk show are the proof of concept. If these shows gain traction with audiences and retain subscribers (the metrics that actually matter to Netflix), expect rapid expansion. Netflix will build out a full podcast strategy with shows across multiple genres, potentially in multiple languages, across different formats.

For audiences, this is mostly good news. More diverse content becomes available in a platform you already subscribe to. You don't need to switch apps or juggle multiple services to find your sports analysis, comedy, or true crime content. It's all potentially available in one place.

For creators, Netflix's moves represent both opportunity and risk. The opportunity to reach millions of people is real. The risk of losing independence and creative control is also real. Creators will need to weigh whether a Netflix deal is worth giving up direct audience relationships and editorial independence.

For competitors, Netflix's podcast strategy is a wake-up call. YouTube needs to ensure its creators have incentives to stay. Spotify needs to defend its market position. Apple needs to make its podcast app more attractive. The convergence of platforms is accelerating, and the competition for content and audience attention is intensifying.

In the end, Netflix's podcast strategy reflects a simple truth: audiences want great content. They don't particularly care whether that content is called a "TV show," a "movie," a "podcast," or a "web series." Netflix is recognizing that artificial distinctions between content types are fading. What matters is what's worth watching and why.

Michael Irvin will attract sports fans. Pete Davidson will attract comedy fans. Together, they represent Netflix's calculated bet that video podcasts represent the future of content consumption. Whether that bet pays off will depend on execution, audience engagement, and whether Netflix can create a podcast experience that feels native to its platform rather than bolted on as an afterthought.

The fact that Netflix is making this bet at all tells us something important about where the media industry is headed. Streaming platforms are no longer content-specific. They're not "movie services" or "TV services." They're general entertainment platforms that will include whatever content engages audiences and keeps them subscribed. Podcasts fit that description. So do live events, interactive content, gaming, and whatever else Netflix decides to add next.

What we're watching unfold is the final consolidation of media. The era of specialized platforms is ending. The era of mega-platforms offering everything is beginning. Netflix's podcast strategy is one move in a much larger game. The question isn't whether Netflix will succeed with Irvin and Davidson. The question is whether the company can maintain its position as the premier entertainment destination as the platform landscape continues to evolve.

FAQ

What is a video podcast?

A video podcast is an episodic audio or audiovisual show that combines the intimate conversation format of traditional podcasts with video production elements. Unlike audio-only podcasts that are consumed while multitasking, video podcasts require visual attention but offer additional storytelling elements like graphics, on-screen text, facial expressions, and visual comedy.

When do Netflix's new podcast shows premiere?

"The White House with Michael Irvin" premiered on January 19, 2025, with episodes released twice weekly. "The Pete Davidson Show" premiered on January 30, 2025, at 12:01 AM PT, with episodes released weekly. Both are exclusive to Netflix.

What is Michael Irvin's podcast about?

"The White House with Michael Irvin" focuses on sports news, commentary, and analysis. The show features Irvin alongside rotating panels of co-hosts and guests discussing NFL topics, player movements, coaching strategies, and broader sports industry news. The name refers to a building near Dallas Cowboys facilities, not political content.

What format does Pete Davidson's podcast follow?

"The Pete Davidson Show" features weekly episodes filmed in Davidson's garage with him hosting special guests for extended conversations. The setting emphasizes an intimate, informal atmosphere rather than a traditional studio environment, allowing for candid discussion across comedy, entertainment, and personal topics.

Why is Netflix investing in podcasts when it's primarily a video streaming service?

Netflix is pursuing podcasts for several strategic reasons: podcasts are significantly cheaper to produce than scripted dramas, they create recurring engagement that drives subscriber retention, they reach different audience segments and consumption occasions, and they allow the company to participate in the rapidly growing podcast industry without extensive format experimentation.

How does Netflix's podcast strategy compare to Spotify's approach?

Spotify built its podcast strategy around audio-first content and exclusive high-value deals with major creators like Joe Rogan. Netflix is prioritizing video podcasts that integrate with its existing streaming platform, leveraging its production expertise and subscriber base. Netflix views podcasts as engagement tools for its broader ecosystem rather than standalone products like Spotify does.

What other podcast content does Netflix offer beyond these two original shows?

Beyond the Irvin and Davidson originals, Netflix has licensed content from iHeartRadio's extensive podcast library and is offering access to selected Spotify programming. This combination of original shows, licensed content, and acquired programming creates a comprehensive podcast offering within the Netflix platform.

How will Netflix's podcast content affect subscriber retention?

Regular podcast episodes create recurring reasons for subscribers to engage with Netflix beyond traditional TV shows and movies. If audiences develop weekly habits around Michael Irvin's sports analysis or Pete Davidson's conversations, they're less likely to cancel their subscriptions. Podcasts essentially add high-frequency touchpoints that improve retention metrics.

Will Netflix introduce advertising within its podcast content?

Netflix hasn't publicly committed to podcast-specific advertising, but the company has introduced an ad-supported tier for its streaming service. Future evolution might include sponsor integrations or mid-roll advertising in podcast episodes, particularly on ad-supported subscription tiers, though this would require balancing monetization with user experience.

What does this move mean for the future of content distribution across platforms?

Netflix's podcast strategy signals the final collapse of artificial boundaries between content types. Streaming platforms are becoming general entertainment destinations offering whatever content drives engagement and retention. This trend suggests further convergence where platforms include podcasts, live events, gaming, interactive content, and traditional media alongside each other.

Key Takeaways

- Netflix launched original video podcasts from Michael Irvin (sports analysis) and Pete Davidson (weekly conversations) in January 2025, signaling major commitment to podcast content

- Video podcasts cost 100-1000x less to produce than scripted dramas while creating recurring engagement that improves subscriber retention metrics

- Netflix's podcast strategy reflects broader industry trend toward content consolidation, where streaming platforms offer everything rather than specializing in specific formats

- Competition from Spotify, Apple Podcasts, YouTube, and other platforms intensifies as audiences consume more audio/video content and platforms fight for viewer attention

- Success depends on execution, audience engagement with specific shows, and Netflix's ability to create podcast experience native to its platform rather than bolted-on feature

![Netflix's New Video Podcasts: Pete Davidson & Michael Irvin [2025]](https://tryrunable.com/blog/netflix-s-new-video-podcasts-pete-davidson-michael-irvin-202/image-1-1768432031502.jpg)