Netflix's Warner Bros. Deal: What It Means for Your Smart TV and Remote Control

Introduction: The Streaming Wars Enter a New Phase

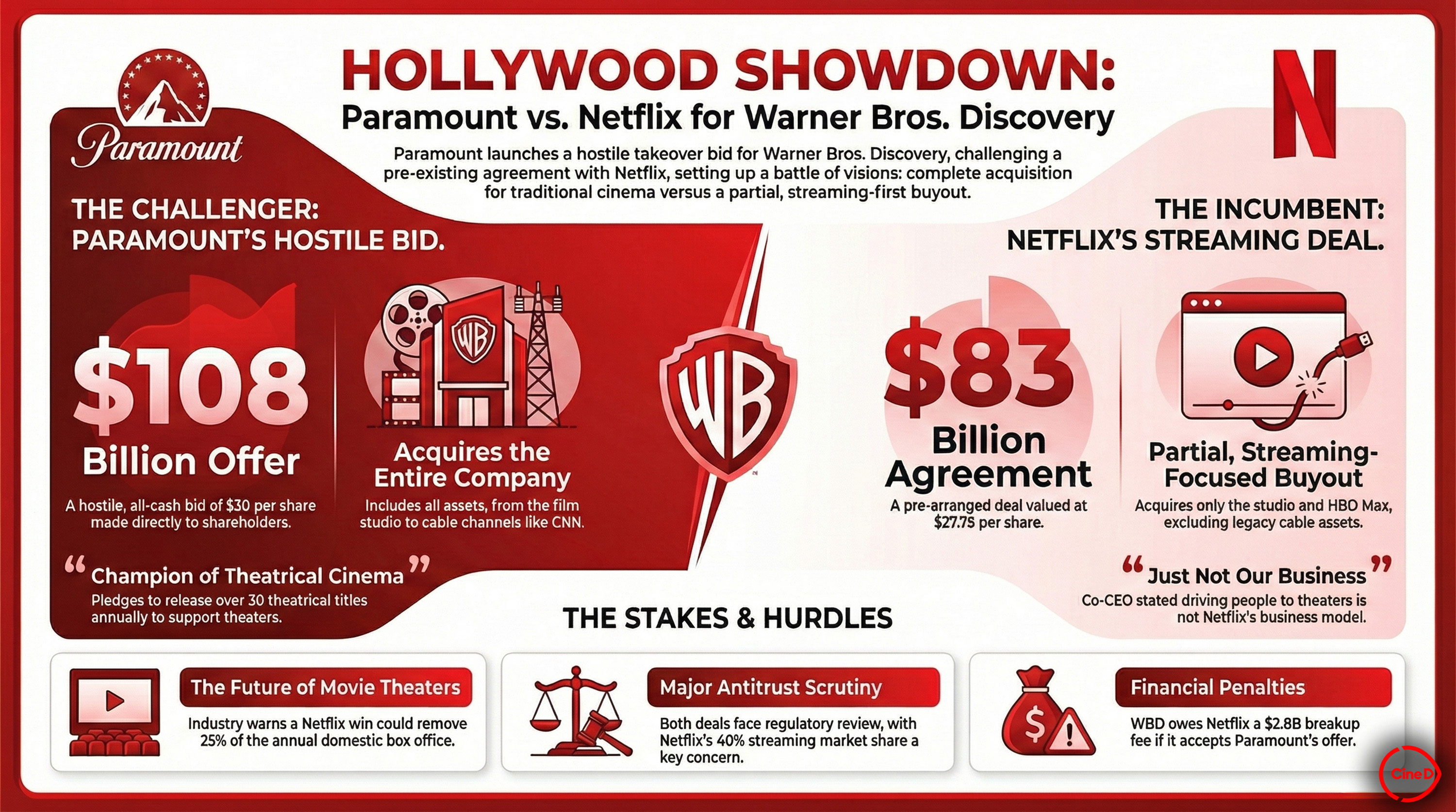

When Netflix announced its acquisition of Warner Bros.' HBO Max streaming service, the technology industry took notice—but not necessarily for the reasons mainstream media outlets emphasized. While headlines focused on content libraries, subscriber counts, and competitive positioning against Paramount Global, a quieter but potentially more consequential question emerged among smart TV manufacturers, hardware integrators, and streaming industry insiders: What happens to Netflix's ironclad control over smart TV user interfaces when it gains control of one of the entertainment world's largest content libraries?

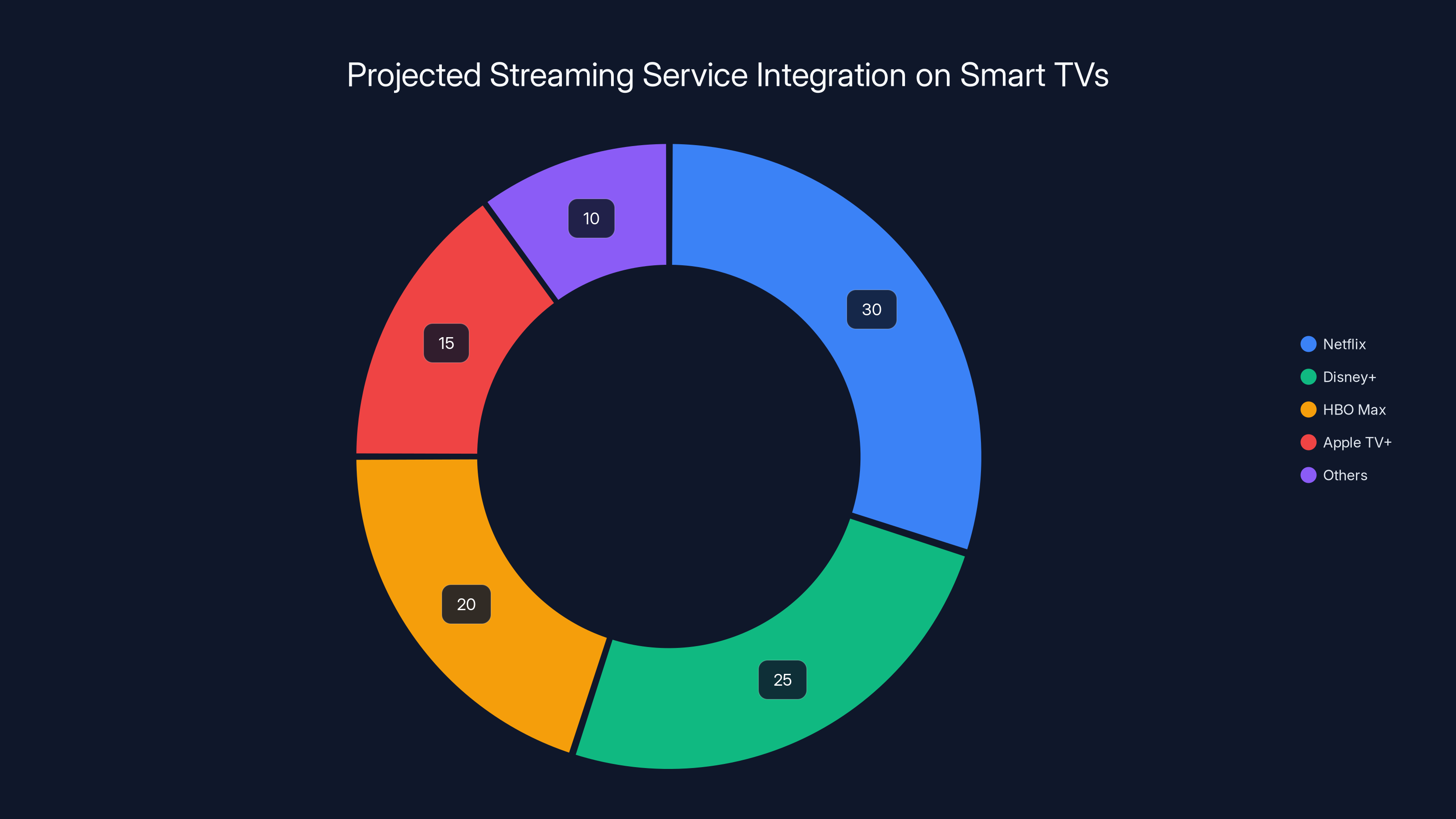

This question cuts to the heart of how streaming services have fundamentally reshaped the television experience over the past decade. Unlike traditional cable television, which distributed content equally across physical infrastructure, streaming services have created a hierarchical ecosystem where Netflix, Disney+, Amazon Prime Video, and other platforms compete not just for subscribers, but for premium real estate on the devices where consumers watch content. That real estate comes in the form of dedicated remote buttons, prominent homescreen placement, preferential access to viewer data, and integration privileges that can mean the difference between a streaming service thriving or struggling to gain visibility.

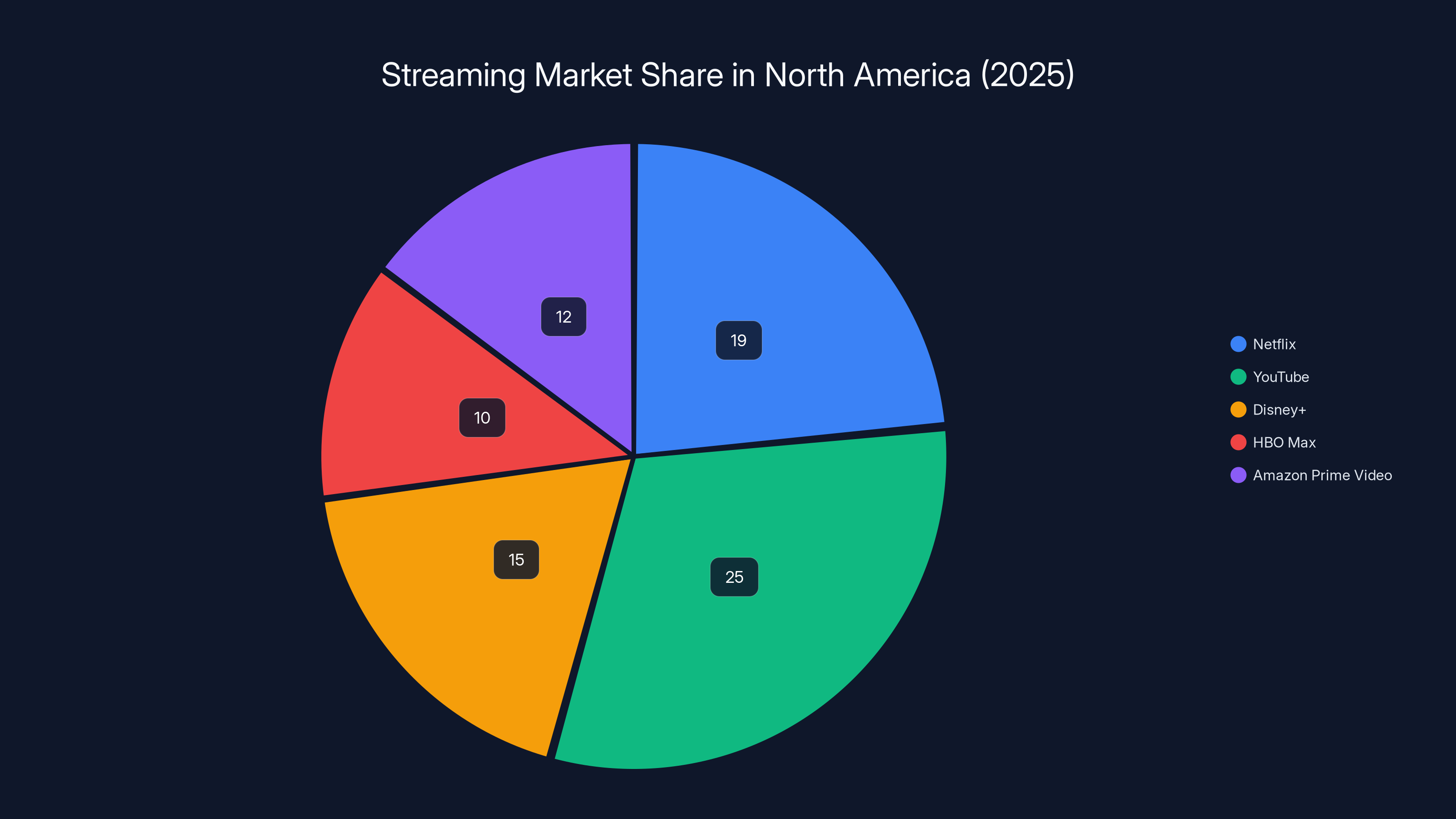

Netflix has been the most aggressive enforcer of these requirements. The company's "Netflix Ready" certification program—though not publicly detailed and protected by stringent nondisclosure agreements—has effectively forced smart TV manufacturers into an uncomfortable position: comply with Netflix's often-restrictive demands, or risk shipping a television that lacks the single most essential streaming app in the market. According to industry analysis, Netflix accounts for approximately 19 percent of all streaming traffic in North America, making it virtually impossible for TV manufacturers to omit the platform without facing significant commercial consequences.

Now, as Netflix integrates HBO Max into its ecosystem, industry observers are asking whether the company will extend these same requirements to its newly acquired HBO-branded content. Will smart TV remotes need HBO buttons alongside Netflix buttons? Will HBO Max content receive its own homescreen row and data integration privileges? Or will Netflix's desire to close the Warner Bros. deal—particularly in the face of regulatory scrutiny and competing bids from Paramount Global—force the company to moderate its historically restrictive approach to TV manufacturer relationships?

These questions have profound implications not just for Netflix and Warner Bros., but for consumers, smart TV manufacturers like Samsung, LG, and Sony, platform operators like Google TV and Roku, and the broader architecture of how we discover and consume entertainment on connected devices. Understanding these dynamics requires examining Netflix's current control mechanisms, the historical context of these requirements, the competitive landscape, and the potential outcomes of Netflix's massive content consolidation.

Netflix holds a significant 19% share of North American streaming traffic in 2025, second only to YouTube. Estimated data based on current trends.

The Architecture of Netflix's Control: How One Company Shaped Smart TV Design

Netflix's Certification Requirements and Technical Mandates

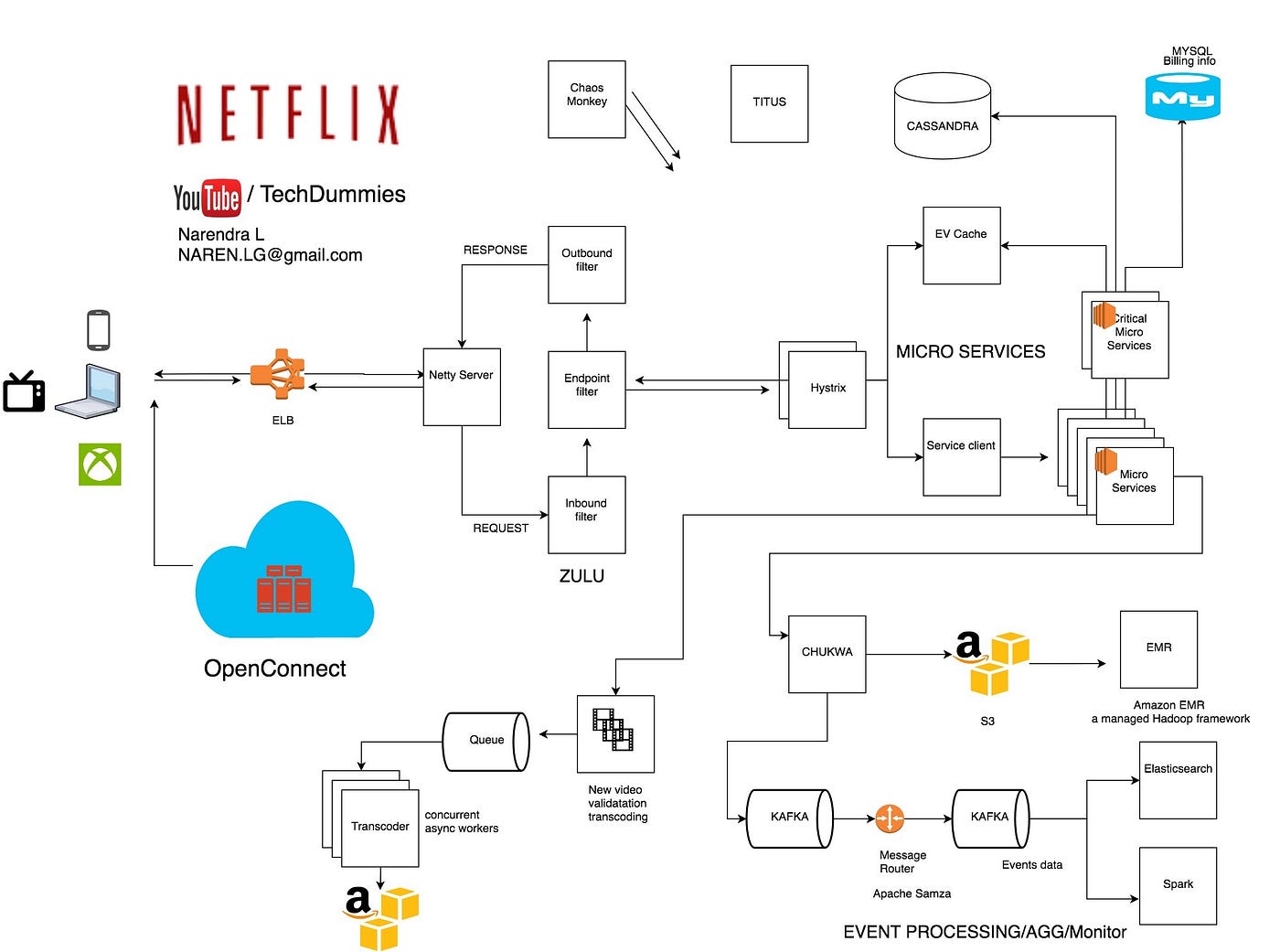

Netflix's influence over smart TV design extends far beyond simply having its logo appear on a remote button or its app sit in the homescreen app rail. The company has established a comprehensive certification framework that dictates technical specifications, security protocols, and integration parameters that TV manufacturers must meet to legally ship devices with the Netflix app.

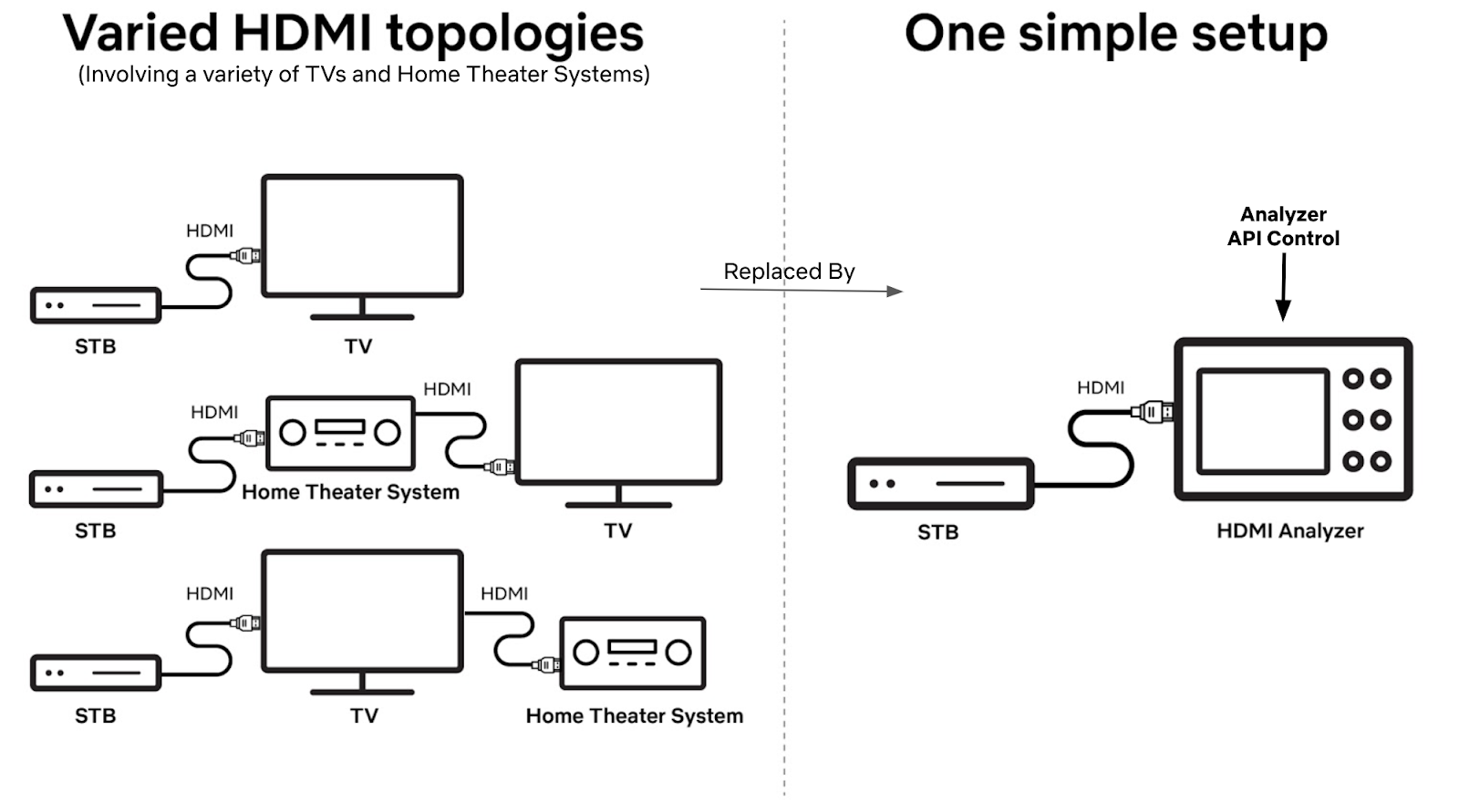

According to documentation from integration partners like Uniq Cast and technical frameworks available to manufacturers, Netflix's certification requirements include mandatory implementation of specific Digital Rights Management (DRM) technologies, codec support, and resolution standards. These technical requirements aren't arbitrary—they ensure that Netflix content plays reliably across thousands of different TV models with varying hardware capabilities. However, the scope extends beyond what's strictly necessary for technical compatibility.

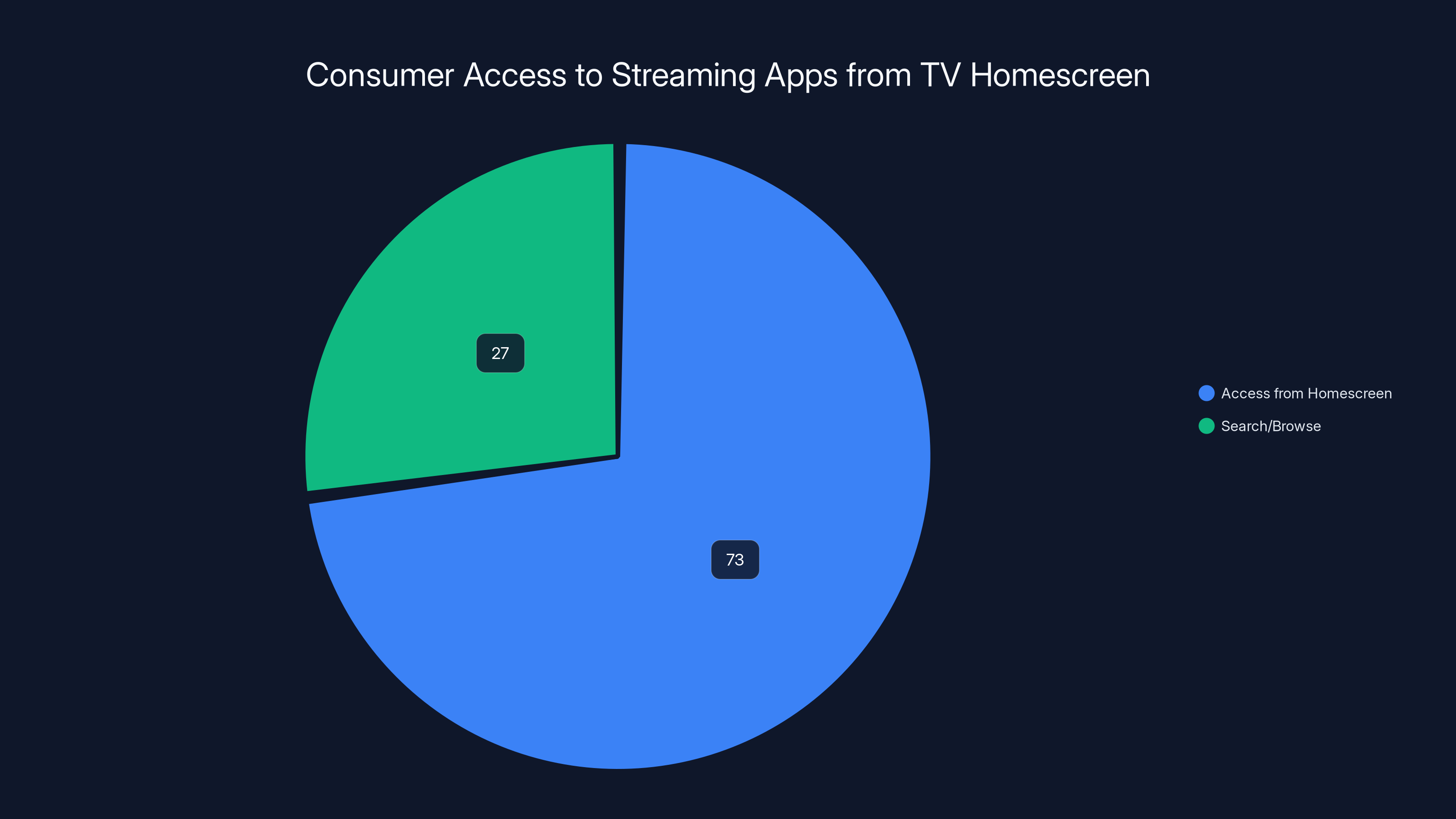

The certification process requires that Netflix's app be placed as the first item in the homescreen app rail on the initial launcher screen, with fully visible branding that adheres to Netflix's precise brand guidelines for colors, card dimensions, and visual hierarchy. This seemingly minor detail matters enormously in the context of user behavior research showing that approximately 73 percent of consumers access streaming apps from their TV's homescreen without searching or browsing. By securing the first position in this real estate, Netflix essentially guarantees that its app will be the first thing users see when they turn on their television, before they encounter competitors like Disney+, HBO Max, Apple TV+, or Amazon Prime Video.

The specificity of these requirements reveals Netflix's sophisticated understanding of user behavior and interface psychology. The company isn't simply asking to be "included" on smart TVs; it's demanding architectural primacy. TV manufacturers who have attempted to negotiate different placement arrangements or who've proposed featuring multiple streaming apps equally in the homescreen rail have reportedly faced resistance from Netflix's integration teams. The implicit threat is always present: fail to meet certification requirements, and your TV cannot legally include Netflix at all.

The Remote Control Button Mandate

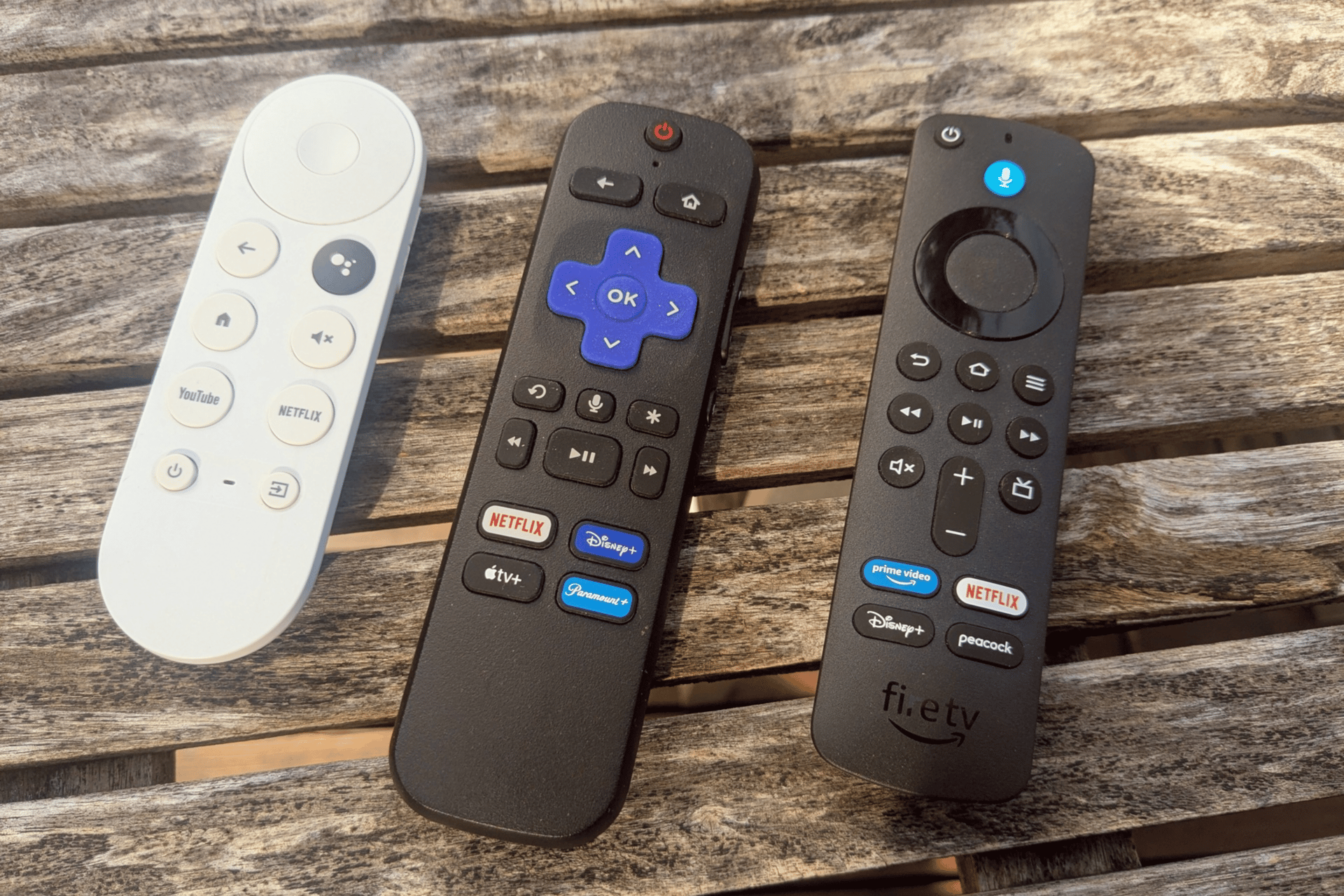

Perhaps no requirement illustrates Netflix's market power more vividly than its insistence on dedicated remote control buttons. Walk into any electronics retail store and examine smart TV remotes—you'll notice that virtually every one features a Netflix button, prominently placed among the quick-access buttons for volume, power, and input selection. These buttons aren't there because manufacturers wanted to prioritize Netflix above all other services; they're there because Netflix required it as a condition of certification.

This requirement has proven remarkably durable across different TV manufacturers and even across different regions globally. Whether you purchase a Samsung Smart TV running Tizen, an LG television powered by web OS, a TCL unit running Google TV, or a Hisense television running Fire TV, you'll almost certainly find a Netflix button. The uniformity is striking—and it reflects Netflix's market dominance more effectively than any market share chart.

Apple represents a notable exception to this mandate. Apple appears to be the only major technology company that has successfully negotiated an exemption from Netflix's remote button requirement, likely due to Apple's own significant negotiating leverage through its ecosystem of devices, its ability to include competing services (like Apple TV+) with equal prominence, and its willingness to walk away from negotiations if necessary. For every other manufacturer, the Netflix button remains non-negotiable.

The strategic importance of the remote button extends beyond visible branding. Remote buttons create what user experience researchers call "low-friction access patterns." A user who can press a single button to launch Netflix will use Netflix more frequently than they would if they had to navigate to the app through a homescreen menu. By reducing friction, Netflix secures not just visibility, but behavioral advantage. The remote button is a direct pipeline to user engagement.

Data Access Restrictions and Algorithmic Opacity

One of Netflix's most sophisticated control mechanisms has received less public attention but may be the most strategically significant: the company's restrictions on data sharing with smart TV platforms and its limitations on how those platforms can use Netflix data for content recommendations.

Consider the different experience between Netflix and competing services on a Google TV device. Google TV's homescreen displays multiple content recommendation rows—a "Top Picks for You" row, a "Trending Now" row featuring popular titles across all services, dedicated genre rows for comedies, action films, and dramas, and rows featuring award-winning content. These recommendations are generated through Google's machine learning algorithms, which analyze your viewing behavior across all compatible services to surface content most likely to interest you.

Notably, Netflix-exclusive titles almost never appear in these recommendation rows. You won't see "Stranger Things" trending on the homescreen unless you specifically search for it or visit the Netflix app. This isn't because Google TV's algorithms fail to recognize that Netflix content is popular or relevant to your interests—it's because Netflix restricts Google TV's algorithmic access to Netflix viewing data. Netflix's closed data approach means Google TV can only recommend content Netflix has explicitly allowed it to recommend, creating a situation where the platform's most popular streaming service remains algorithmically invisible to the device's discovery mechanisms.

Contrast this with how HBO Max, Disney+, and Amazon Prime Video operate on Google TV devices. These services permit Google TV's algorithms to access their content metadata and user viewing patterns, allowing their titles to appear throughout the device's recommendation rows and discovery features. A Google TV user browsing their homescreen will discover HBO Max content organically while Netflix content remains hidden unless they take explicit action to access the Netflix app.

This data restriction strategy serves multiple Netflix objectives simultaneously: it prevents smart TV platforms from developing sophisticated cross-service recommendation engines that might expose users to competitor content, it ensures Netflix remains dependent on its proprietary recommendation algorithm (accessible only within the Netflix app), and it reinforces the need to open the Netflix app specifically to discover Netflix content. In essence, Netflix uses data control to recreate the television experience that existed before streaming services—a model where each service was essentially a separate channel you had to actively select, rather than one option among many in a unified entertainment interface.

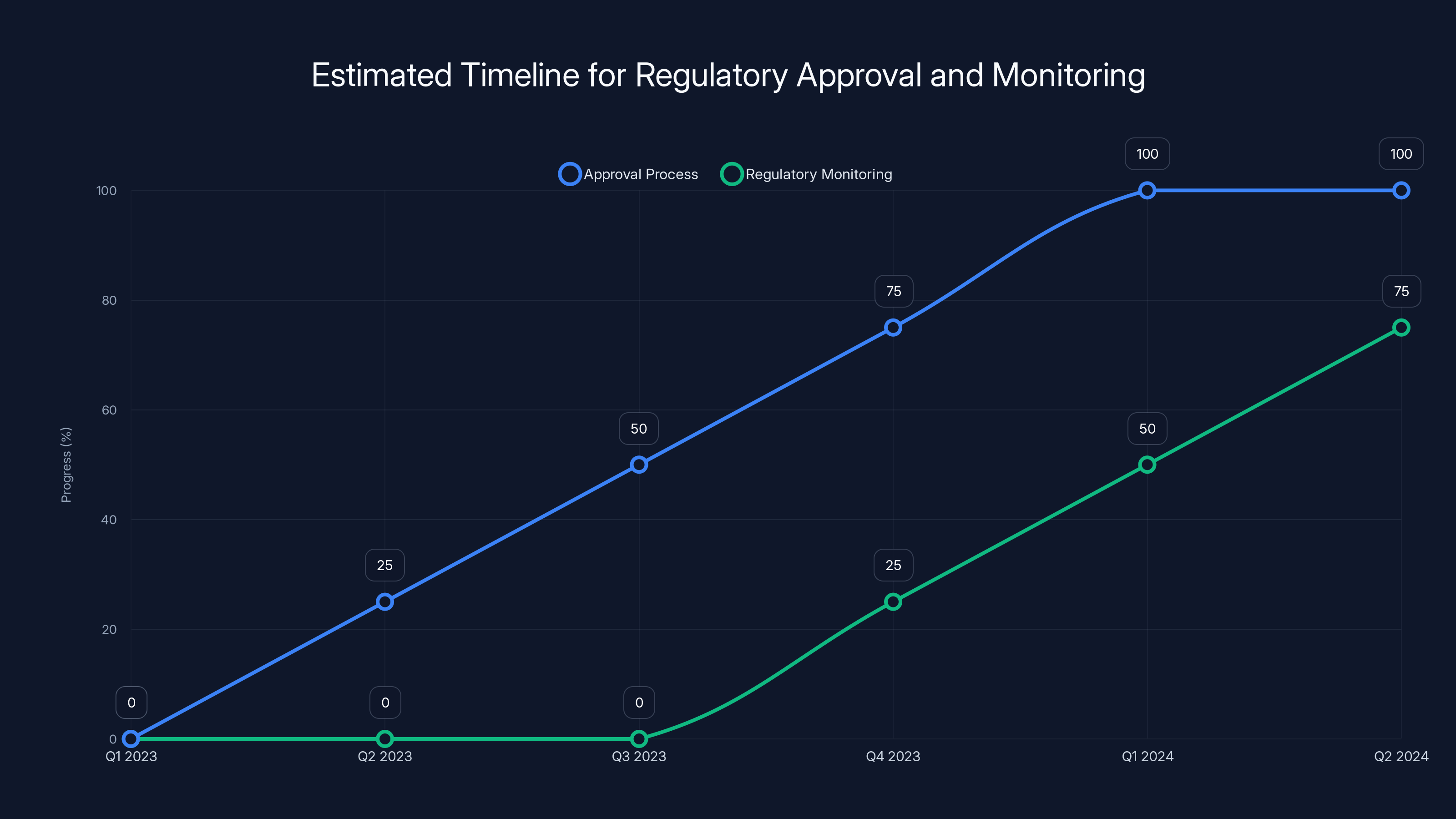

The approval process for Netflix's acquisition of HBO Max is estimated to span several quarters, with regulatory monitoring continuing post-approval. Estimated data.

The Current Competitive Landscape and Market Dynamics

Netflix's Market Position in 2025

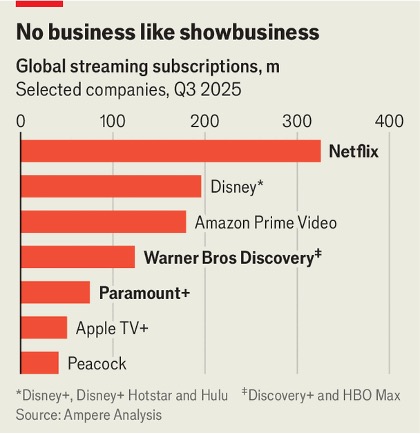

Netflix's ability to impose these restrictive requirements stems directly from its commanding market position in the streaming industry. With approximately 300 million subscribers globally and approximately 19 percent of North American streaming traffic, Netflix remains the gold standard for streaming success. This position wasn't achieved by accident—it resulted from years of content investment, subscriber acquisition strategy, and infrastructure development that created a level of scale that competitors have struggled to match.

More importantly, Netflix remains the second-most-downloaded app on smart TVs globally, second only to YouTube. This distinction matters because it shapes manufacturer behavior. A TV maker can theoretically ship a device without Disney+, without HBO Max, even without Amazon Prime Video—but shipping without Netflix would be viewed as a catastrophic product deficiency by consumers and retailers alike. Netflix has become essential in a way that few other services have achieved.

This essential status translates directly into negotiating power. When Netflix makes a demand—whether about remote buttons, app placement, or data sharing—manufacturers face a binary choice: comply, or lose access to the most essential streaming app in the market. The power asymmetry is complete.

Competing Services and Their Different Approaches

Different streaming services have taken fundamentally different approaches to smart TV integration, partly reflecting their different market positions and strategic priorities.

Disney+ has leveraged its brand strength and content portfolio to negotiate reasonably favorable terms with TV manufacturers, though Disney hasn't been as aggressive as Netflix in demanding exclusive UI treatment. Disney's content—particularly Marvel and Star Wars franchises—generates significant user interest that helps the service gain homescreen visibility through user demand rather than manufacturer requirements. Disney also owns ESPN+, which provides additional leverage in negotiations.

Amazon Prime Video has used its integration with Amazon's broader ecosystem (Fire TV devices, smart home integration through Alexa) to build competitive muscle in smart TV negotiations. Amazon's willingness to develop its own TV platform (Fire TV) and push that platform aggressively into the market has given Amazon leverage it might not otherwise possess. Prime Video's integration with Prime membership also creates retention dynamics that help it negotiate from a position of relative strength.

HBO Max (soon to be rebranded under Netflix ownership) has historically enjoyed reasonable placement and access terms, partly because Warner Bros.' extensive content library (including HBO-brand prestige content, DC Comics properties, and Warner Bros. film library) creates significant user demand. However, even with this valuable content, HBO Max has been unable to match Netflix's ability to demand premiere positioning.

Apple TV+ represents an interesting case study in negotiating alternative approaches. Apple's vertical integration—controlling both the platform (tvOS) and offering a competing service (Apple TV+)—creates a unique position. Apple can theoretically privilege Apple TV+ on its own platforms without need for certification. However, Apple's approach has been relatively measured, likely because Apple recognizes the value of maintaining relationships with content partners and because Apple TV+ is primarily positioned as a premium add-on rather than a mass-market service.

The Regulatory and Competitive Context

Netflix's aggressive requirements have existed for years with relatively little regulatory challenge, partly because Netflix's dominance in streaming wasn't seen as a threat to competition—rather, Netflix was seen as the driver of competition against traditional cable television. However, as streaming has matured and consolidated, regulatory attention has increased.

The European Union has been particularly scrutinous of Netflix's requirements, with some regulators questioning whether Netflix's data restrictions and UI demands violate fair competition principles. In some regulatory contexts, there's an emerging view that controlling the dominant streaming platform is less about legitimate technical requirements and more about anticompetitive behavior designed to prevent competitors from accessing the platform advantages that Netflix has secured.

The Warner Bros. acquisition exists within this regulatory context. The deal required approval from regulators in multiple jurisdictions, and the prospect of Netflix extending its control to HBO Max—consolidating even more streaming market share and potentially strengthening its negotiating position with TV manufacturers—would almost certainly draw additional regulatory scrutiny. Netflix's regulatory strategy for the acquisition probably includes some element of moderating its most aggressive requirements to demonstrate that the merged entity won't leverage consolidated power to further restrict competition.

The HBO Max Integration Question: What Netflix Could Demand

The Case for Extended Requirements

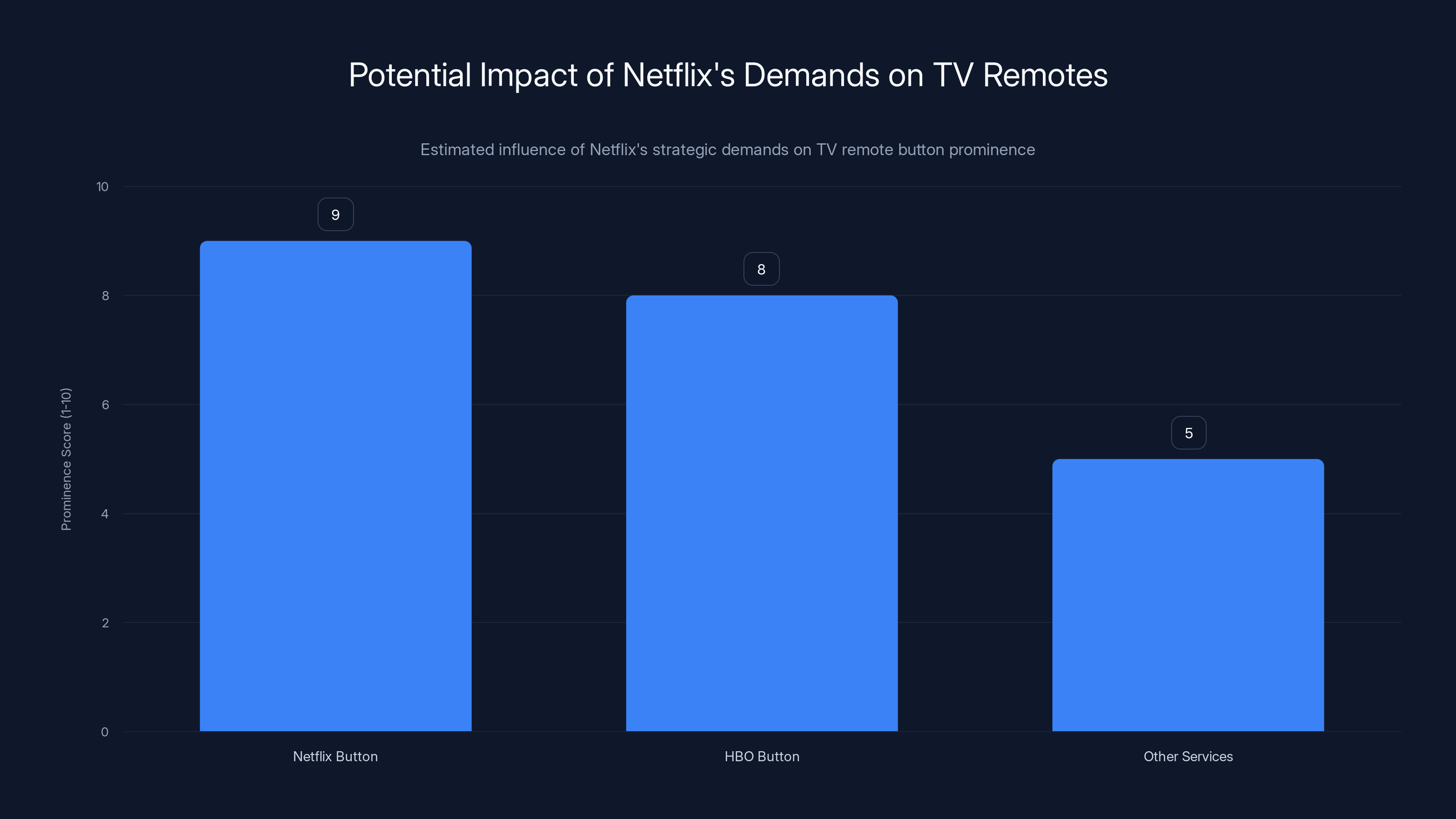

From Netflix's purely strategic perspective, there would be significant advantages to extending its certification requirements to HBO Max and to branded HBO content within Netflix's ecosystem. If Netflix required TV manufacturers to include an HBO-dedicated remote button alongside the existing Netflix button, the company would secure two first-position shortcuts to streaming content on every television remote in the market. This would establish Netflix-controlled services as even more architecturally primary than they currently are.

There's a precedent for multi-branded button requirements in the television market. For years, some TV remotes have included separate buttons for competing services (though typically in less prominent positions than Netflix's button). If Netflix demanded an HBO button, manufacturers would likely comply—they have little choice. The result would be that a TV remote might feature Netflix button, HBO button, and then everything else arranged below. This arrangement would signal to consumers, before they even turn their TV on, that Netflix's properties are the primary streaming choices.

Additionally, if Netflix extended its data restrictions to HBO Max content, the company could prevent Google TV, Roku, and Fire TV platforms from including HBO Max recommendations in their algorithmic recommendation rows. This would force HBO Max into the same situation Netflix currently occupies—requiring users to open the app specifically to discover content rather than encountering it through the platform's organic recommendation mechanisms. For Netflix, this would be strategically valuable because it would eliminate HBO Max's ability to gain visibility through competitor platform algorithms, forcing all HBO Max discovery through Netflix's own interface.

Netflix could also demand equal homescreen positioning for HBO-branded content, essentially requiring that TV manufacturers feature HBO Max as prominently as Netflix in their initial homescreen app rail. Some TV remotes already feature multiple branded app shortcuts in prominent positions, so this wouldn't represent a complete novelty, but it would further entrench Netflix's consolidated properties.

The Regulatory and Strategic Constraints

Despite the strategic appeal of extending its requirements, multiple factors probably constrain Netflix's ability to pursue this aggressive integration strategy.

First, the Warner Bros. acquisition itself is likely subject to conditions or commitments made to regulators regarding competitive behavior. European regulators, in particular, have expressed concern about vertical integration in media and technology sectors. If Netflix committed to regulators that it would maintain competitive neutrality in its platform requirements after acquiring HBO Max, aggressive extension of requirements would breach those commitments and potentially trigger regulatory intervention.

Second, Netflix faces competing pressure from other platforms and services. If Netflix demands that TV manufacturers feature both Netflix and HBO buttons, and prevents Google TV and Roku from recommending HBO Max content, those platforms have incentive to push back through their own regulatory channels or through public advocacy. Google, in particular, has demonstrated willingness to escalate disputes with dominant platforms through regulatory channels and public statements. Aggressive Netflix behavior could accelerate regulatory action.

Third, Netflix's desire to complete the Warner Bros. acquisition successfully probably involves some element of not antagonizing the TV manufacturer ecosystem further. Manufacturers already chafe under Netflix's requirements, but they comply because Netflix is essential. Demanding additional HBO requirements might push manufacturers toward active resistance or toward developing alternative strategies (like featuring competing services more prominently, or developing manufacturer-owned streaming services that don't require Netflix certification).

Fourth, there's a question of whether aggressive HBO requirements would actually benefit Netflix strategically. HBO Max is already valuable to Netflix subscribers—the question is whether it needs dedicated remote button prominence to drive adoption. For existing Netflix subscribers, offering HBO Max as a bundled or integrated service might drive adoption without requiring new manufacturer requirements. For potential customers, the decision to subscribe to Netflix/HBO bundle probably depends more on pricing and content quality than on whether the HBO button is first or second on the remote.

Approximately 73% of consumers access streaming apps directly from their TV's homescreen, highlighting the importance of app placement in user engagement. Estimated data based on user research.

Market Reactions and Manufacturing Ecosystem Pressure

The TV Manufacturer Perspective

Smart TV manufacturers have expressed varying levels of frustration with Netflix's requirements over the years, though few have done so publicly due to the commercial necessity of maintaining Netflix certification. Privately, though, TV makers have indicated that Netflix's requirements feel increasingly onerous as the number of streaming services has proliferated.

A typical smart TV in 2025 needs to accommodate Netflix, Disney+, HBO Max, Amazon Prime Video, Apple TV+, Hulu, Paramount+, Peacock, YouTube TV, and dozens of other services ranging from niche specialty services to YouTube to Tubi to Pluto TV. Each service has its own user base and content value, yet Netflix's placement requirements mean Netflix appears first in the app rail while others are relegated to secondary positions. Manufacturers increasingly view this as suboptimal for user experience—many users open their TV hoping to access Disney+ or HBO Max but must scroll past Netflix first.

Some manufacturers have experimented with alternative UI approaches that feature less rigid app hierarchies, allowing users to customize their homescreen or featuring multiple services equally. These alternative approaches sometimes face resistance from Netflix's integration teams, which view non-standard arrangements as violating certification requirements.

The economic incentive for manufacturers to resist Netflix's requirements may increase if Netflix extends those requirements to HBO Max. Additional dedicated remote buttons require additional physical space on remote controls, increasing manufacturing costs. Additional exclusive app placement requirements mean less valuable homescreen real estate for other services. Manufacturers may calculate that the cost of resistance—potentially losing Netflix certification—becomes lower than the cost of compliance if requirements become significantly more onerous.

Platform Operator Dynamics

Google TV, Roku, Fire TV, and webOS operators have different strategic interests relative to Netflix's requirements.

Google TV has increasingly emphasized its algorithmic recommendation engine as a differentiator, attempting to surface the best content across all services rather than forcing users to navigate to individual apps. Netflix's data restrictions undermine this strategy, so Google has incentive to resist or challenge Netflix's approach. Google's regulatory leverage—as a major technology company subject to antitrust scrutiny—may also embolden the company to push back more aggressively against Netflix's requirements.

Roku occupies a different position, having built its business partly on being a neutral platform that accommodates all services equally. Netflix's preferential requirements create tension with Roku's positioning, but Roku's smaller scale relative to Google means it has less regulatory leverage to challenge Netflix directly.

Fire TV is integrated into Amazon's broader ecosystem, and Amazon has demonstrated willingness to feature Amazon Prime Video prominently, so Amazon may have less philosophical opposition to Netflix receiving prominent placement. However, Amazon also has interest in promoting Fire TV as a platform where multiple services are treated fairly, so Amazon probably wouldn't want additional Netflix favoritism that might reduce the perceived value of competing services.

Historical Precedents: How Content Consolidation Changed Platform Requirements

The Cable Television Analog

To understand how Netflix's acquisition of HBO Max might reshape platform requirements, it's useful to examine historical precedents in broadcast and cable television. Throughout the 1980s and 1990s, cable operators negotiated with content owners regarding channel placement and bundling, gradually consolidating content ownership and renegotiating carriage terms in favor of consolidated media companies.

When Disney acquired ABC, for instance, the company gained both content (ABC's news and entertainment programming) and broadcast infrastructure (ABC affiliates across the country). This vertical integration gave Disney additional leverage in negotiations with cable operators. Similarly, when Comcast acquired NBCUniversal, the cable operator consolidated both distribution infrastructure (cable networks) and content (NBC, Universal Studios). These consolidations typically resulted in more favorable terms for the consolidated company's content, with content operators demanding higher carriage fees and better placement.

The Netflix/HBO Max consolidation follows a similar pattern—combining a dominant distribution platform (Netflix) with significant content assets (HBO Max's library). Historically, such consolidations have resulted in more aggressive negotiating positions regarding platform requirements and content placement.

Cross-Platform Bundling and Requirements

Another historical precedent involves how media companies have used bundling and consolidated requirements to entrench competitive positions. In the cable television era, when companies like Comcast controlled both cable distribution and multiple content channels, Comcast could bundle its own channels together and demand favorable carriage terms from cable operators. This practice eventually became subject to regulatory scrutiny, with regulators establishing rules about how consolidated companies could bundle content and impose carriage requirements.

If Netflix follows a similar pattern with HBO Max, the company might bundle Netflix and HBO content into a single "Netflix Universe" requiring unified placement and featuring requirements. This bundling could create the same anticompetitive dynamics that cable television's bundling created. Regulators who learned lessons from cable television's consolidation might intervene more aggressively to prevent streaming television from following the same trajectory.

If Netflix demands an HBO button on remotes, both Netflix and HBO buttons could achieve high prominence, overshadowing other services. Estimated data.

Regulatory Outlook and Antitrust Considerations

European Union Scrutiny

The European Union has been substantially more active than the United States in questioning Netflix's platform requirements. The EU's Digital Markets Act, designed to regulate large digital platforms, could potentially apply to Netflix's smart TV integration practices if Netflix is deemed a "gatekeeper" platform controlling essential infrastructure for content distribution.

Under the DMA framework, regulated platforms face restrictions on self-preferencing—using their dominant position to favor their own services over competitors. If Netflix's remote button requirements and data restrictions are analyzed through a self-preferencing lens, they could potentially violate DMA principles. The EU's regulatory agencies have indicated willingness to challenge platform practices that leverage dominant positions to restrict competitor access, suggesting that if Netflix aggressively extends its requirements to HBO Max, the company might face regulatory action.

Additionally, the EU's concerns about media concentration might apply to Netflix's acquisition of HBO Max itself, regardless of specific smart TV integration questions. If EU regulators view the Netflix/HBO Max consolidation as creating excessive concentration in streaming content distribution, they might impose conditions on the acquisition that restrict Netflix's ability to impose unified requirements on TV manufacturers.

United States Antitrust Enforcement

The United States has historically been more permissive of vertical integration than the European Union, but antitrust enforcement priorities have shifted in recent years toward examining how dominant platforms can use their position to restrict competitor access. Netflix's requirements could potentially be challenged under current enforcement principles, though the threshold for action remains somewhat uncertain.

The Federal Trade Commission and Department of Justice have both indicated increased focus on digital markets and platform power. If Netflix aggressively extends its requirements to HBO Max, either agency could potentially investigate whether this represents anticompetitive self-preferencing or whether it unreasonably restricts competitor access to essential distribution infrastructure.

The risk of regulatory action probably influences Netflix's strategic thinking regarding how aggressively to integrate HBO Max into its platform requirements. Even if Netflix believes extending those requirements would be strategically beneficial, the company likely calculates that the regulatory risk—potential antitrust investigations, conditions on the acquisition, or mandated changes to its practices—might outweigh the benefits.

Consumer Experience Impact: How Requirements Shape Discovery and Engagement

The Discoverability Problem

Netflix's current requirements create a specific discoverability problem for consumers: the easiest content to find on a smart TV is Netflix content, not necessarily the best content available across all services. This distorts consumer experience by making Netflix content artificially discoverable relative to competing services.

Consider a consumer interested in superhero content. The Netflix catalog includes some superhero series (Daredevil, Jessica Jones, Luke Cage—though some have been removed), but the most extensive superhero library exists on Disney+ (Marvel Cinematic Universe content) and Max/HBO Max (DC Universe content). Yet because Netflix's remote button is first and Netflix's homescreen placement is prominent, a consumer might assume Netflix has the most extensive superhero library when in fact competing services have substantially more content matching their interests.

This discoverability distortion doesn't just harm consumers seeking specific content—it also potentially harms the companies whose content is being hidden. If HBO Max's extensive prestige drama library remains algorithmically invisible to Google TV users who would be interested in that content, HBO Max loses potential viewers who would benefit from discovering that content. The consumer loses by not discovering content they'd enjoy; HBO Max loses by not reaching users who would value its content.

Netflix's requirements essentially create an artificial information asymmetry on smart TVs, where Netflix content visibility is subsidized through preferential placement while competing services must fight for user attention despite potentially having better content matches for individual users.

Search Behavior and Cold Start Problem

When users know exactly what they want to watch, Netflix's requirements matter less—a user searching for a specific HBO Max show will navigate to HBO Max regardless of whether Netflix is first on the homescreen. The requirements have the greatest impact on discoverability and cold start scenarios, where users turn on their TV and need to decide what to watch without a specific show in mind.

This cold start scenario is psychologically important. Research on decision-making shows that when faced with multiple options in an initially ambiguous situation, users exhibit strong default bias—they tend to select the first option presented to them. By ensuring Netflix is literally first in the app rail and accessible via a dedicated button, Netflix's requirements effectively capture a significant portion of "I want to watch something but I don't know what" decisions, directing those decisions toward Netflix content discovery rather than allowing users to choose among services based on preference.

If Netflix extended its requirements to HBO Max, the company would essentially be consolidating this default bias advantage, capturing both "Netflix first" decisions and "HBO Max first" decisions, while leaving other services to compete for the remaining mindshare.

Estimated data suggests that while Netflix will maintain a significant share, other services like Disney+ and HBO Max are expected to grow, driven by new interface technologies and user preferences.

The Competitive Response Scenario: How Competitors Might React

Google and YouTube TV's Potential Strategies

If Netflix aggressively extended its requirements to HBO Max, Google could respond with several strategies. Most directly, Google could escalate regulatory complaints about Netflix's practices, leveraging Google's own significant regulatory influence to bring antitrust attention to Netflix's behavior. Google has already been willing to escalate public disputes with other dominant platforms through regulatory and public advocacy channels.

Alternatively, Google could attempt to develop competing infrastructure that reduces dependence on Netflix. Google could accelerate YouTube TV development as a standalone option that provides comparable functionality to smart TV manufacturer platforms but with more favorable terms for competing services. This would be a longer-term strategic move, but it would reduce Netflix's current positional advantage.

Google could also work with TV manufacturers to develop alternative interface approaches that emphasize user choice rather than Netflix primacy. By developing UI frameworks where users customize their homescreen or where multiple services are featured equally, Google could undermine the value of Netflix's first-position button and app placement.

Amazon's Strategic Positioning

Amazon, controlling Fire TV as well as Prime Video, has flexibility in how aggressively to resist Netflix's requirements. Amazon could potentially accelerate Fire TV device manufacturing and push Fire TV into the market more aggressively as a Netflix alternative, though this would require significant investment and would compete against manufacturer interests in having access to multiple platforms.

Alternatively, Amazon could work with Google and other platform operators to develop unified standards for how streaming services are integrated into TV platforms, attempting to establish norms of equal treatment across all services rather than Netflix preferentialism.

The Roku and Smaller Platform Position

Roku faces a more constrained set of options due to its smaller scale relative to Google and Amazon. Roku probably cannot effectively escalate regulatory pressure independently, and Roku lacks the content assets or platform diversity to offer meaningful alternatives to Netflix. Roku's strategy would likely involve seeking alliances with other platforms and potentially working with regulators to raise concerns about Netflix's practices.

Data Integration and Algorithmic Transparency Questions

The Data Access Problem

One of the most significant implications of Netflix's HBO Max acquisition involves data integration and what level of algorithmic access Netflix should provide to platform operators like Google TV and Roku. Currently, Netflix restricts data access significantly—platform operators can't see detailed information about Netflix viewing patterns, genre preferences, or content recommendations.

This restricted data access creates algorithmic opacity problems. A Google TV device's recommendation algorithms can't fully serve users effectively if they can't see what Netflix content is available or what Netflix content matches user interests. The result is that Google TV users receive incomplete recommendations that cover Disney+, HBO Max, Amazon Prime Video, and other services but exclude the single most popular service.

If Netflix acquires HBO Max and consolidates control over both services, the question becomes whether Netflix should provide consolidated data access to platform operators. Providing such access would require Netflix to share detailed information about HBO Max's content library and users' viewing patterns. Restricting access would mean platform algorithms remain unable to recommend consolidated Netflix/HBO content effectively.

Regulators might view Netflix's data restrictions as anticompetitive, particularly if the restrictions prevent platform operators from providing effective service to users. The argument would be that Netflix's control of essential distribution infrastructure shouldn't include the ability to restrict information flow to platforms that need that information to serve users effectively.

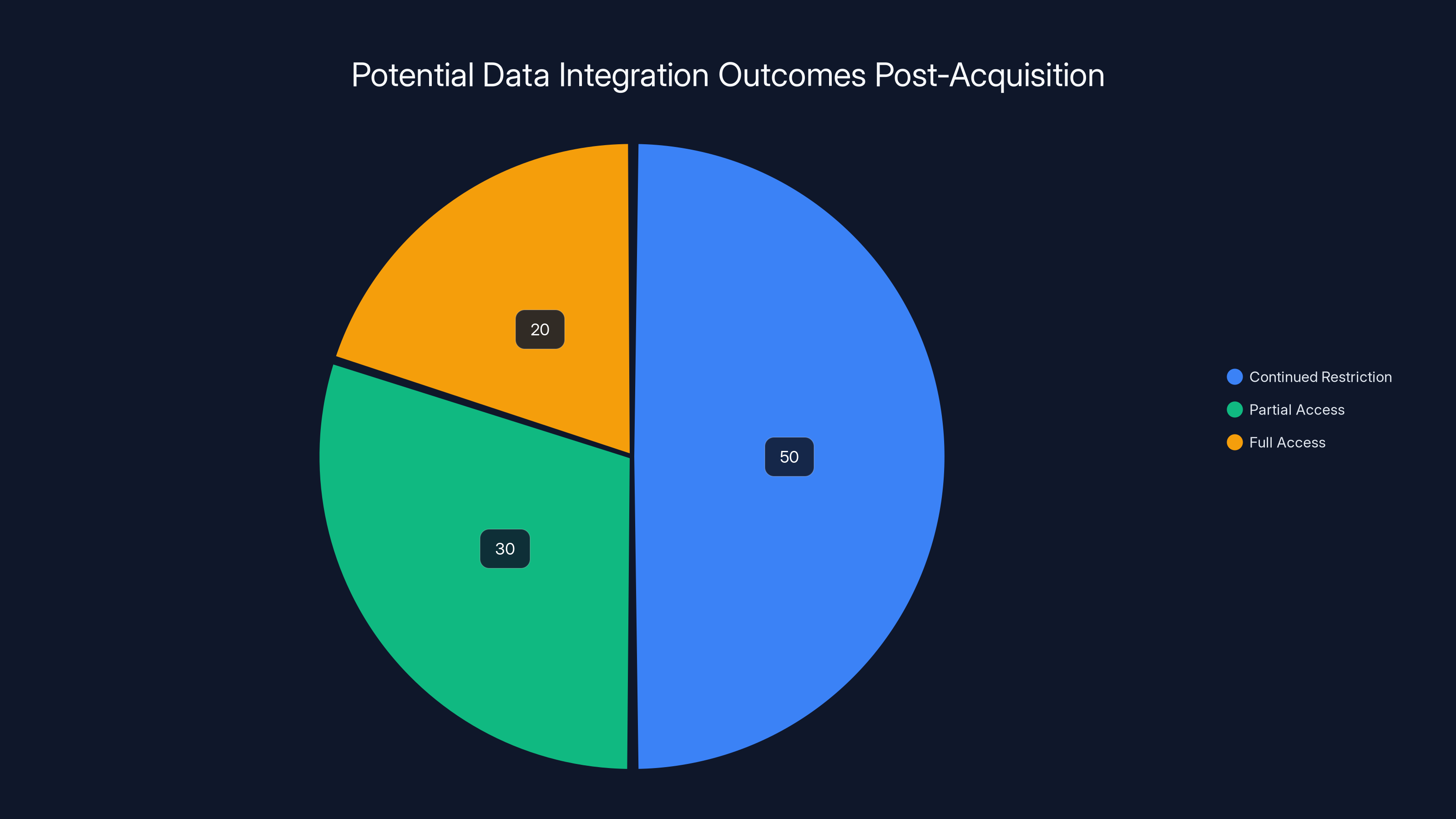

Potential Data Integration Outcomes

There are several possible outcomes regarding Netflix's data sharing after acquiring HBO Max:

Scenario 1: Continued Restriction - Netflix maintains current data restrictions for both Netflix and HBO Max, preventing platform operators from algorithmically recommending either service. This would be the most anticompetitive outcome but would also be most favorable to Netflix's strategic interests.

Scenario 2: Partial Integration - Netflix shares some HBO Max data with platform operators but maintains restrictions on Netflix data. This would allow HBO Max content to be recommended algorithmically while Netflix content remains hidden. This seems like a compromise position.

Scenario 3: Consolidated Data Access - Netflix provides full data access for both Netflix and HBO Max, allowing platform operators to treat consolidated Netflix/HBO content the same as other services. This would be most favorable to competition and user experience but least favorable to Netflix's strategic interests.

Scenario 4: Conditional Access - Netflix requires special agreements or revenue sharing arrangements in exchange for data access, creating a two-tiered system where platform operators willing to meet Netflix's terms get better access.

Regulators will likely scrutinize whichever approach Netflix ultimately chooses, with particular focus on whether the approach leverages Netflix's consolidated market position to disadvantage competitors.

Estimated data suggests Netflix is most likely to continue restricting data access post-acquisition, with a 50% likelihood. Partial access is estimated at 30%, while full access is least likely at 20%.

The Remote Control Redesign Question

Physical Design Constraints and Possibilities

If Netflix extended its requirements to HBO Max, one practical question becomes how to physically integrate dual Netflix/HBO branding on remote controls. Modern smart TV remotes have limited physical space for quick-access buttons, so adding an HBO button would require design changes.

Possible approaches include:

- Stacking buttons: Creating a Netflix/HBO button that opens a menu allowing users to select between services

- Splitting real estate: Reducing Netflix button prominence to accommodate an HBO button

- Alternative design: Creating a unified Netflix Entertainment button that opens Netflix's consolidated ecosystem

- No physical button: Retaining only the Netflix button but designing the Netflix app interface to feature HBO prominently

The first option would reduce the advantage of having a dedicated remote button, since users would need to make additional selections rather than pressing a single button to access HBO content. The second option would require manufacturers to reduce Netflix's button prominence, which Netflix would probably resist. The third option might be acceptable to Netflix, as it would still position Netflix/HBO properties first, but it might confuse consumers unfamiliar with the consolidated branding.

The fourth option—no separate HBO physical button—actually seems most likely. Netflix could simply redesign the Netflix app to feature HBO Max content prominently within the Netflix interface, without requiring physical button changes. This would allow Netflix to consolidate its control without inciting manufacturer resistance or regulatory concern about excessive button proliferation.

User Behavior and Button Utilization

Research on remote control button usage shows that most users primarily use a handful of buttons repeatedly and rarely explore additional buttons beyond their established habits. Adding an HBO button wouldn't necessarily increase total user engagement if Netflix simply moved HBO content into the Netflix app interface instead.

This suggests that from a pure user engagement perspective, physical remote button consolidation might actually be optimal. Users who currently press the Netflix button would continue doing so, and they'd discover HBO Max content within the Netflix interface. Netflix would drive adoption of HBO Max without needing to complicate remote design or trigger manufacturer resistance.

Timing and Regulatory Approval Dynamics

The Approval Process Timeline

Netflix's acquisition of HBO Max required approval from regulatory authorities in multiple jurisdictions, a process that typically extends over several quarters. During the approval process, Netflix likely made commitments to regulators regarding how the consolidated company would operate, particularly regarding competitive practices and customer treatment.

These commitments probably include explicit or implicit agreements not to aggressively extend Netflix's preferential requirements to HBO Max. Netflix would have calculated that demonstrating willingness to operate competitively after the acquisition would make approval more likely, while signaling intent to aggressively consolidate control would trigger regulatory obstacles.

The approval timeline also matters for competitive dynamics. Competitors like Google, Amazon, and Roku had opportunities to raise concerns during the regulatory process about how Netflix might use consolidated control. These companies probably did raise such concerns, and regulators probably took those concerns into account when evaluating whether the acquisition should proceed.

Once approval is granted, Netflix faces a period during which it's likely subject to informal regulatory monitoring regarding its competitive practices. Moving too aggressively to extend requirements would trigger new investigations or conditions. This creates incentive for Netflix to moderate its approach in the near term, even if the company ultimately intends to gradually extend its control over time.

Future Regulatory Developments

Beyond the immediate acquisition approval, broader regulatory developments could shape Netflix's options regarding smart TV integration requirements. The evolution of rules like the EU's Digital Markets Act, emerging U.S. antitrust enforcement priorities, and potential new regulations targeting platform power all influence Netflix's risk calculation regarding aggressive integration strategies.

If regulators increasingly scrutinize platform self-preferencing and data restrictions, Netflix's future ability to impose aggressive requirements will decrease regardless of whether the company initially intends to do so. Netflix's optimal strategy might be to establish precedent now of operating competitively, before regulatory environments become more restrictive, rather than aggressively extending control and then facing forced retreat when regulatory pressure increases.

Alternative Futures: Possible Outcomes for Smart TV Integration

The Status Quo Continuation Scenario

One possible outcome is that Netflix essentially maintains current Netflix requirements while gradually integrating HBO Max content into the Netflix app and interface. This would preserve Netflix's current competitive advantages while avoiding triggering significant manufacturer resistance or regulatory intervention. Netflix would promote HBO Max adoption through its existing Netflix subscriber base and through the Netflix interface redesign rather than through new remote button requirements.

In this scenario, consumers with Netflix subscriptions gain access to HBO Max content, competitors' content remains less discoverable on smart TVs than Netflix/HBO content, and the competitive landscape remains substantially similar to current conditions.

The Consolidated Requirements Scenario

An alternative outcome is that Netflix does extend its requirements to HBO Max, demanding unified placement, consolidated remote button treatment, and integrated data restrictions that cover both services. This scenario would substantially strengthen Netflix's competitive position on smart TVs and would likely trigger regulatory intervention.

In this scenario, regulatory challenges probably emerge within 12-24 months of Netflix extending requirements, with potential outcomes including mandated changes to Netflix's practices, conditions imposed on the acquisition, or regulatory investigations. Netflix would achieve short-term competitive advantage but would face long-term regulatory constraints.

The Competitive Response Scenario

A third outcome involves competitors responding to Netflix's consolidation by developing alternative approaches to streaming service integration. Platform operators like Google, Amazon, and Roku could potentially develop new smart TV interface standards that emphasize equal treatment of all services, reduce Netflix's ability to demand exclusive placement and remote button prominence, or create alternative distribution paths that reduce Netflix's positional advantages.

In this scenario, Netflix's consolidation triggers technological and competitive responses that ultimately limit the effectiveness of Netflix's preferential requirements. Users get better algorithmic recommendations that include all services equally, manufacturers get more flexibility in interface design, and competing services gain visibility they couldn't achieve under current Netflix-dominated conditions.

The Regulatory Intervention Scenario

A fourth outcome involves regulators becoming more aggressive about restricting Netflix's smart TV integration requirements entirely. If the EU or U.S. authorities decide that Netflix's current requirements already violate fair competition principles, or if Netflix's handling of HBO Max consolidation triggers aggressive regulatory action, the result could be mandated changes requiring Netflix to surrender its remote button, accept equal homescreen placement with other services, and provide data access to platform operators on equal terms with other services.

This regulatory intervention scenario would represent the most dramatic shift in smart TV interface design, potentially establishing new norms for how all streaming services are integrated into smart TVs rather than allowing individual services to negotiate preferential terms.

Industry Expert Perspectives and Commentary

TV Manufacturer Concerns

Smart TV manufacturers have privately expressed concerns about Netflix's requirements for years, though few have done so publicly. The concern involves having limited ability to differentiate their products based on user experience when Netflix's requirements dictate significant aspects of interface design and content discovery.

Manufacturers also worry about being caught in the middle between Netflix's demands and their own strategic interests. If manufacturers want to feature competing services prominently to provide better user experience, they face resistance from Netflix. If manufacturers want to develop proprietary content or services, Netflix's requirements can limit their ability to do so.

The Warner Bros. acquisition amplifies these concerns, as manufacturers worry about Netflix extending its requirements and further constraining their design flexibility. Some manufacturers have indicated they'd prefer a more standardized approach to streaming service integration that doesn't give any single service preferential treatment.

Platform Operator Perspectives

Google TV, Roku, and Fire TV operators have different perspectives based on their strategic positions. Google, as an advertising and technology company, is concerned about Netflix's data restrictions limiting the effectiveness of Google's recommendation algorithms. Roku, as a platform operator competing against Google and Amazon, is concerned that Netflix's preferential requirements disadvantage Roku relative to competitors that control their own devices.

Fire TV operators at Amazon have somewhat conflicting incentives—Amazon wants to promote Prime Video but also wants Fire TV to be seen as a neutral platform. This creates tension when Netflix demands preferential treatment.

All platform operators share a common interest in being able to provide users with effective recommendations that span all available services. Netflix's data restrictions and preferential placement requirements undermine this goal and frustrate platform operators' efforts to create integrated user experiences.

The Future of Streaming Service Integration on Smart TVs

Emerging Design Trends and Alternatives

While Netflix's current requirements dominate the current landscape, emerging trends suggest alternative approaches might eventually become more common. Some smart TV manufacturers and platform operators are experimenting with interface designs that feature less rigid app hierarchies, allow user customization, or feature multiple services equally.

tvOS (Apple's TV operating system) already features a design that treats content services more equally, without giving Netflix explicit preferential placement. This alternative design approach might become more common if manufacturers and platform operators increasingly value user experience and competitive neutrality.

Additionally, emerging technologies like voice interfaces and conversational AI could change how users discover and access streaming content. If users increasingly access streaming through voice commands rather than visual hierarchies and remote buttons, Netflix's current advantages around button placement and homescreen positioning might become less relevant.

The Voice and AI Interface Shift

As voice assistants become more sophisticated and more commonly used for entertainment discovery, the current smart TV interface paradigm might be disrupted. If a user says to their smart TV's voice assistant, "Show me superhero shows I'd enjoy," and the assistant returns results from across all available services (Disney+, HBO Max, Marvel services, etc.) ranked by relevance to that user, Netflix's current advantages around visual prominence might matter less.

This shift would require Netflix to compete on content quality and recommendation algorithms rather than on interface placement and button prominence. Netflix's content and algorithmic recommendation track record is strong, so the company might ultimately benefit from this shift. However, the shift would also require Netflix to accept more open data sharing with voice assistant platforms, which Netflix currently resists.

Long-term Structural Evolution

Over a longer timeframe, the smart TV entertainment ecosystem will likely continue evolving as consolidation proceeds, as regulatory environments clarify, and as technology platforms change. Possible long-term outcomes include:

- Vertical integration models where TV manufacturers increasingly develop proprietary streaming services and operate their own distribution platforms

- Content aggregation platforms that collect content from multiple services into unified experiences, reducing individual service prominence

- Subscription bundling models where services like Netflix/HBO Max bundles become standard, changing how users access content

- Open platform standards that require equal treatment of all services, potentially mandated by regulators

Each of these outcomes would substantially reshape how Netflix competes on smart TVs and whether Netflix's current preferential requirements would remain valuable or defensible.

Implications for Consumers and Content Discovery

The Current Content Discovery Experience

Current smart TV users face fragmented content discovery experience where each service maintains its own app, and platform algorithms cannot effectively recommend across services. A user interested in superhero content, prestige dramas, or comedy must manually navigate between apps to discover available content, with algorithmic recommendations available only within each individual service.

Netflix's requirements contribute to this fragmentation by preventing platform algorithms from including Netflix content in recommendations. If Netflix extended its control to HBO Max, this fragmentation would likely worsen, as consolidated Netflix/HBO content would remain invisible to platform algorithms while other services gained whatever recommendation visibility Netflix allowed.

The consumer impact is that intelligent content discovery becomes impossible—users cannot ask a smart TV's algorithm, "Show me the best prestige drama available across all services I subscribe to," and get a meaningful answer including Netflix content.

The Personalization Problem

Different users have different content preferences, and some users might prefer HBO Max content over Netflix content. Yet Netflix's interface placement and button prominence might push users toward Netflix content even when HBO Max content would better match their interests. By controlling both services, Netflix could theoretically optimize for combined subscriber satisfaction, but the company's incentive structure doesn't necessarily push in that direction.

If Netflix wanted to truly optimize personalization, the company could provide full data access to platform operators, allowing those operators to recommend Netflix, HBO Max, and other content based on user interests rather than based on each service's preferential placement. This would likely drive better user satisfaction, but it would require Netflix to accept that competitor services sometimes provide better matches than Netflix/HBO content.

The Competitive Implications

For competitors like Disney+, Amazon Prime Video, and others, Netflix's consolidation of HBO Max creates new challenges. These services have already struggled to compete with Netflix's button prominence and app placement. Netflix's acquisition of HBO Max—consolidating two of the three largest streaming services—substantially increases Netflix's competitive moat.

Competitors might respond by accelerating their own consolidation (Disney acquiring more content properties, Amazon expanding Prime Video), developing alternative distribution channels (developing proprietary TV platforms, partnering with manufacturers), or appealing to regulators to restrict Netflix's requirements.

Conclusion: Understanding the Broader Stakes

Netflix's acquisition of Warner Bros.' HBO Max isn't simply a content consolidation story—it represents a potential inflection point in how streaming services control access to consumers on the devices where consumers most frequently consume entertainment. The question of whether Netflix will extend its preferential requirements to HBO Max involves deep questions about competition, consumer choice, regulatory authority, and the future structure of entertainment distribution.

Netflix's current control mechanisms—remote buttons, homescreen placement, data restrictions—represent a form of market power that traditional media companies never possessed. Cable television operators could control channel placement, but consumers could more easily switch cable operators. Netflix controls distribution on devices that operate across multiple platforms and regions, giving Netflix strategic leverage that extends beyond any single jurisdiction or device manufacturer.

The stakes extend beyond Netflix and HBO Max's competitive position. The precedent Netflix sets regarding how consolidated streaming services can control smart TV interfaces will influence how other companies approach consolidation and control in the future. If Netflix successfully extends its requirements to consolidated properties without regulatory intervention, other media companies will likely follow suit, consolidating content properties and demanding preferential treatment on smart TVs.

Conversely, if regulators intervene to restrict Netflix's requirements, the precedent established could reshape how all streaming services integrate into smart TVs, potentially requiring more competitive neutrality in interface design and algorithmic recommendation. This could ultimately benefit consumers through better content discovery and more competitive platforms, but could also reduce individual services' ability to drive user adoption through interface prominence.

The outcome depends on multiple factors: how aggressively Netflix decides to extend its requirements, how forcefully competitors and regulators respond, how quickly technology platforms evolve (particularly regarding voice interfaces), and whether manufacturers develop coordinated responses to Netflix's demands.

For consumers, the practical implication is that your smart TV remote and homescreen interface may change substantially over the next few years, depending on how Netflix navigates this challenge. The button placements and app ordering you see today are not inevitable—they reflect specific business decisions and market power dynamics that may not persist as the streaming landscape continues consolidating and regulators increasingly scrutinize platform power.

Ultimately, Netflix's HBO Max integration will reveal whether streaming services can consolidate content properties while maintaining the preferential requirements that have characterized Netflix's control strategy. The answer will substantially shape the future of how consumers discover and access entertainment on connected devices.

FAQ

What is Netflix's "Netflix Ready" certification program?

Netflix Ready is Netflix's certification framework that smart TV manufacturers and platform operators must comply with to legally include the Netflix app on their devices. The program establishes technical requirements, interface specifications, and business terms that manufacturers must meet, including DRM technologies, codec support, dedicated remote buttons, prominent homescreen placement, and restrictions on how device platforms can access Netflix data for algorithmic recommendations. These requirements ensure Netflix content plays reliably across devices while also cementing Netflix's market position through preferential interface treatment.

How does Netflix control smart TV interfaces?

Netflix controls smart TV interfaces through multiple mechanisms: requiring a dedicated Netflix button on remote controls, mandating that the Netflix app appear first in the homescreen app rail, restricting data access to platform operators so competing services can be recommended algorithmically but Netflix content cannot, and enforcing these requirements through the certification process that manufacturers must pass to legally ship Netflix apps. These control mechanisms work together to ensure Netflix remains the most visible and accessible streaming service on smart TVs, even when users might prefer other services' content.

What does Netflix's acquisition of HBO Max mean for smart TV requirements?

Netflix's HBO Max acquisition creates uncertainty about whether Netflix will extend its preferential requirements to HBO-branded content. Netflix could demand dedicated HBO remote buttons, prominent homescreen placement for HBO content, and restrictions on algorithmic access to HBO Max data—essentially consolidating Netflix and HBO Max as the primary streaming properties on smart TVs. However, regulatory scrutiny and competitive pressure may constrain Netflix's ability to aggressively extend these requirements, as doing so could trigger antitrust investigations or conditions on the acquisition.

Why does Netflix restrict data sharing with platform operators?

Netflix restricts data access to prevent platform operators like Google TV and Roku from including Netflix recommendations in their algorithmic discovery interfaces. By keeping Netflix data proprietary, Netflix ensures users must open the Netflix app specifically to discover Netflix content, rather than encountering Netflix recommendations organically through the device's discovery algorithms. This strategy forces Netflix to compete directly through its proprietary recommendation engine rather than allowing platform-level competition, strengthening Netflix's ability to drive engagement and retention. Competitors like HBO Max, Disney+, and Amazon Prime Video allow platform operators access to their content metadata and viewing data, which allows their content to be recommended algorithmically.

What are the competitive implications of Netflix's control over smart TV interfaces?

Netflix's control over smart TV interfaces creates significant competitive advantages: the dedicated Netflix button reduces friction to Netflix access, prominent homescreen placement captures "cold start" decisions where users haven't decided what to watch, and data restrictions prevent platform algorithms from recommending competitors' content even when it might match users' interests better than Netflix content. These advantages help Netflix maintain subscriber growth and engagement despite increasing competition from Disney+, HBO Max, and other services. Competitors struggle to achieve visibility on smart TVs without similar requirements, creating a competitive moat that benefits Netflix disproportionately.

Could regulators force Netflix to change its smart TV requirements?

Yes, regulatory action against Netflix's requirements is possible, particularly in the European Union where antitrust enforcement is more aggressive regarding platform power. Regulators could analyze Netflix's requirements as anticompetitive self-preferencing or as unreasonable restrictions on competitor access to essential distribution infrastructure. The EU's Digital Markets Act could potentially apply to Netflix's practices, or regulators could impose conditions on Netflix's HBO Max acquisition regarding competitive behavior. Regulatory intervention could mandate that Netflix provide equal homescreen placement for competitors, share data with platform operators on equal terms, or eliminate dedicated remote button requirements.

How do Netflix's requirements affect consumer experience and content discovery?

Netflix's requirements distort consumer experience by making Netflix content artificially discoverable relative to competing services, regardless of whether Netflix content actually matches users' interests. Consumers might open a smart TV looking for superhero content or prestige dramas but encounter Netflix first because of button placement and homescreen prominence, even though HBO Max or Disney+ might have better content matches. Platform algorithms cannot recommend Netflix content algorithmically, limiting the effectiveness of smart TV recommendation engines. The result is fragmented content discovery where users must manually navigate between apps rather than relying on platform-wide algorithmic recommendations that span all available services.

What alternatives might emerge to replace Netflix's current smart TV control mechanisms?

Alternative approaches to smart TV interface design that might emerge include: voice-based discovery where users ask smart TV assistants to recommend content across all services rather than relying on app buttons and placement, unified content aggregation platforms that collect content from multiple services into integrated experiences, manufacturer-developed alternative distribution channels that reduce dependence on Netflix certification, open platform standards mandated by regulators requiring equal treatment of all services, and AI-powered recommendation systems that prioritize content quality match over service preference. Each of these alternatives would reduce Netflix's current advantages while potentially improving consumer experience through better content discovery.

How might Netflix's remote button requirements change if Netflix extends its control to HBO Max?

Netflix could pursue several approaches to remote button design after consolidating HBO Max: a stacked Netflix/HBO button that opens a menu allowing users to select between services, splitting remote real estate between Netflix and HBO buttons (though this would reduce Netflix's exclusive button prominence), creating a unified Netflix Entertainment button that launches Netflix's consolidated ecosystem featuring both Netflix and HBO content, or simply removing a separate HBO physical button and instead featuring HBO Max content prominently within the Netflix app interface. The fourth option seems most likely, as it would allow Netflix to consolidate control without complicating remote design or triggering manufacturer resistance about excessive button proliferation.

What historical precedents exist for how media consolidation affects platform requirements?

Historical precedents in cable television and broadcast media show that when companies consolidate content properties and distribution infrastructure, they typically use their consolidated position to demand more favorable carriage terms and preferential placement. When Disney acquired ABC, the company gained leverage to demand better cable carriage terms. When Comcast acquired NBCUniversal, the consolidated company could demand favorable treatment for its own channels while restricting competitors' access. Netflix's HBO Max consolidation follows this historical pattern—combining dominant distribution infrastructure (Netflix's smart TV presence) with significant content assets (HBO Max's library) typically results in more aggressive negotiating positions regarding platform requirements and content placement.

Key Takeaways

- Netflix controls smart TV interfaces through mandatory remote buttons, preferential app placement, and data access restrictions that prevent competitor algorithmic visibility

- The HBO Max acquisition raises questions about whether Netflix will extend these control mechanisms to consolidated HBO-branded properties

- Regulatory scrutiny, particularly from the EU, may constrain Netflix's ability to aggressively extend requirements despite strategic advantages

- Smart TV manufacturers face pressure balancing Netflix's essential certification requirements against user experience goals of treating services equally

- Platform operators like Google TV and Roku are disadvantaged by Netflix's data restrictions that prevent algorithmic Netflix content recommendations

- Consumer content discovery is distorted by Netflix's interface prominence requirements, making Netflix content artificially visible regardless of content-interest match

- Historical media consolidation precedents suggest consolidated companies typically extend control requirements to new properties

- Voice interfaces and AI-powered discovery could eventually disrupt Netflix's current interface control advantages

- Regulatory intervention could mandate more competitive neutrality in smart TV interface design across all streaming services

- The outcome will establish precedent for how future streaming consolidations affect platform requirements and consumer experience

Related Articles

- Spotify's 2026 Price Hike: What You Need to Know About Streaming Costs [2025]

- Best Streaming Services 2026: Complete Guide & Comparison

- Apple's Patreon Mandate: Creator Billing Changes Explained [2026]

- Big Tech's $7.8B Fine Problem: How Much They Actually Care [2025]

- Valve's $900M Steam Monopoly Lawsuit Explained [2025]

- Netflix Live Voting Feature: How Interactive TV Changes Entertainment [2025]

![Netflix's Warner Bros. Deal: Smart TV & Remote Control Implications [2025]](https://tryrunable.com/blog/netflix-s-warner-bros-deal-smart-tv-remote-control-implicati/image-1-1769704891644.jpg)