The Z-Mount Battleground: Understanding Nikon's Alleged Legal Stance

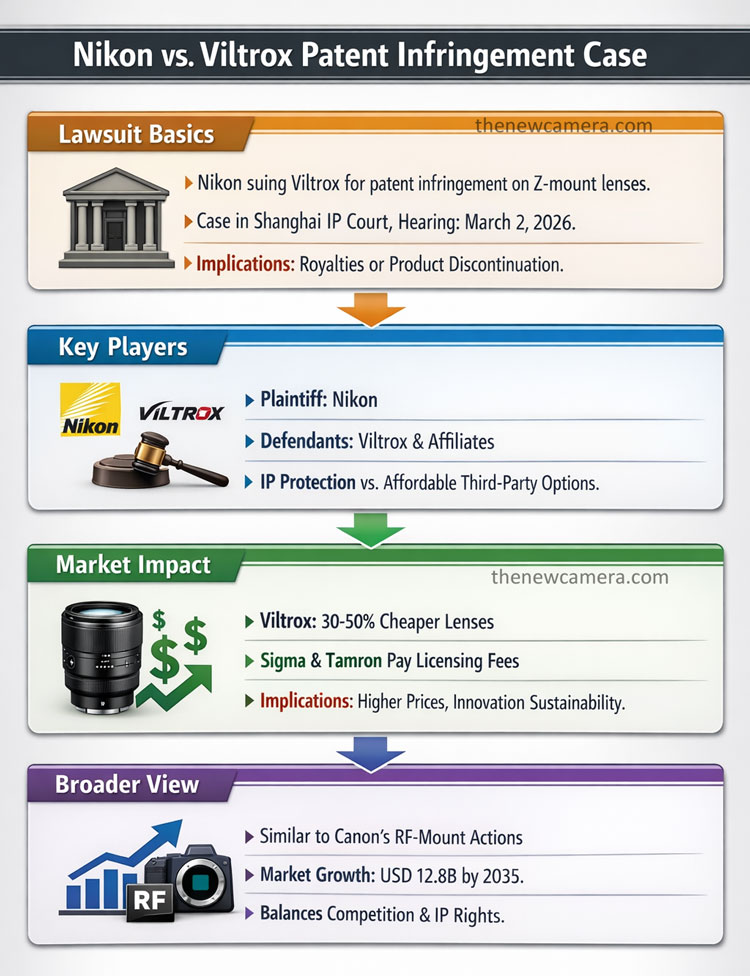

Here's the thing that's got the photography community buzzing. In late 2024, rumors started circulating that Nikon might be preparing legal action against Viltrox, the Chinese lens manufacturer known for producing affordable third-party lenses for Sony E-mount, Canon RF-mount, and yes, Nikon Z-mount. If true, this would mark a significant shift in how Nikon approaches third-party lens ecosystem management, potentially mirroring the controversial path Canon took in 2023 when the Japanese giant went after third-party RF-mount manufacturers with trademark and intellectual property claims.

But before you panic about your gear collection or your future lens buying options, let's break down what we actually know, what remains speculation, and why this matters for the broader camera market. The camera industry has always been a complex dance between camera makers wanting to protect their proprietary ecosystems and consumers wanting affordable alternatives. Nikon's rumored legal maneuver would represent a fundamental change in that dynamic.

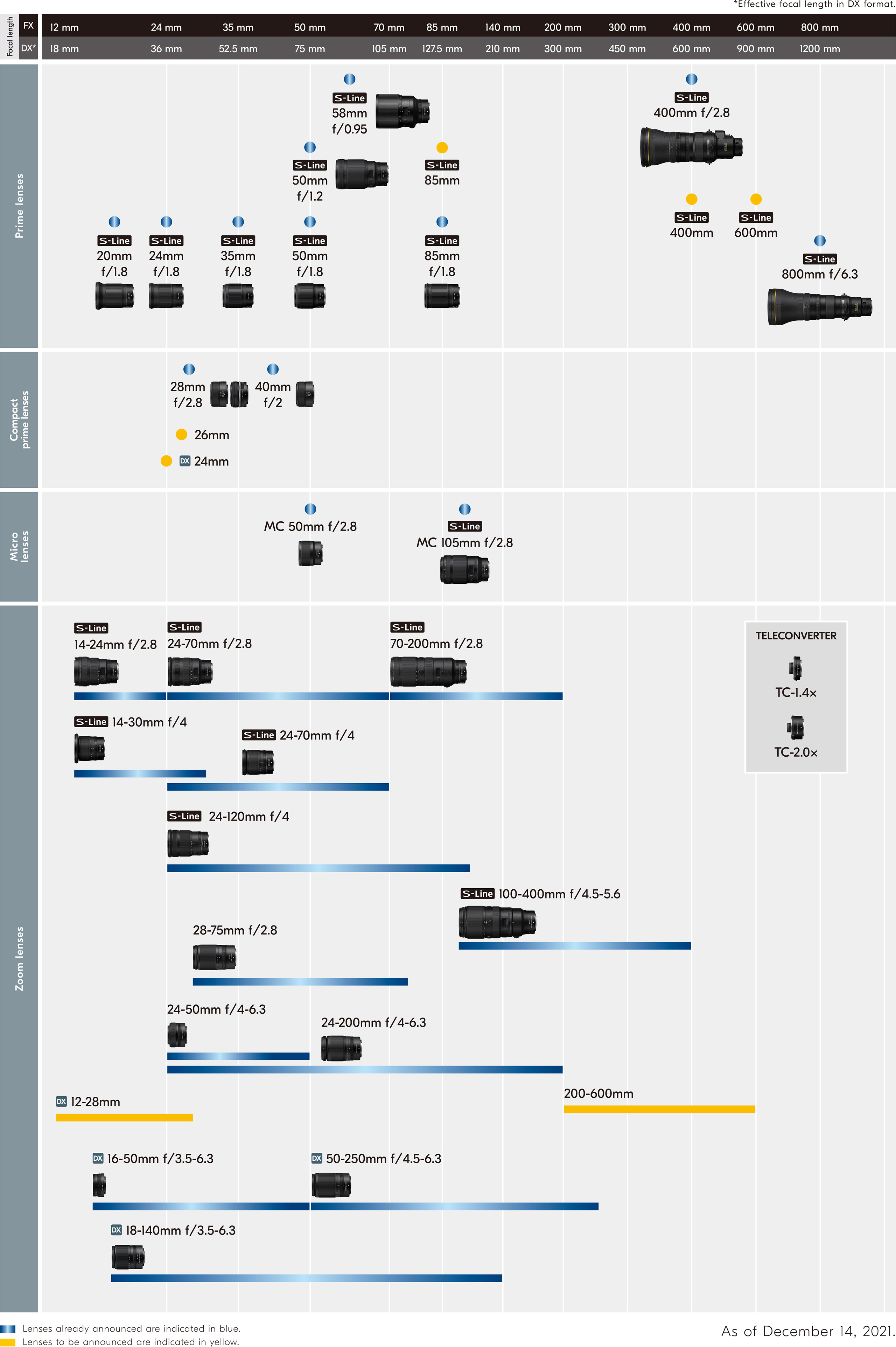

The Z-mount system, introduced in 2018 with the Nikon Z5, Z6, and Z7 mirrorless cameras, has been a relative bright spot for third-party innovation compared to some of Canon's more restrictive approaches. Viltrox, alongside companies like Sigma and Tamron, has filled crucial gaps in Nikon's native lens lineup, offering affordable zooms, primes, and specialty lenses at prices that made Z-mount cameras genuinely accessible to budget-conscious photographers. For nearly six years, this ecosystem functioned relatively smoothly. If Nikon pivots toward legal aggression, that changes everything.

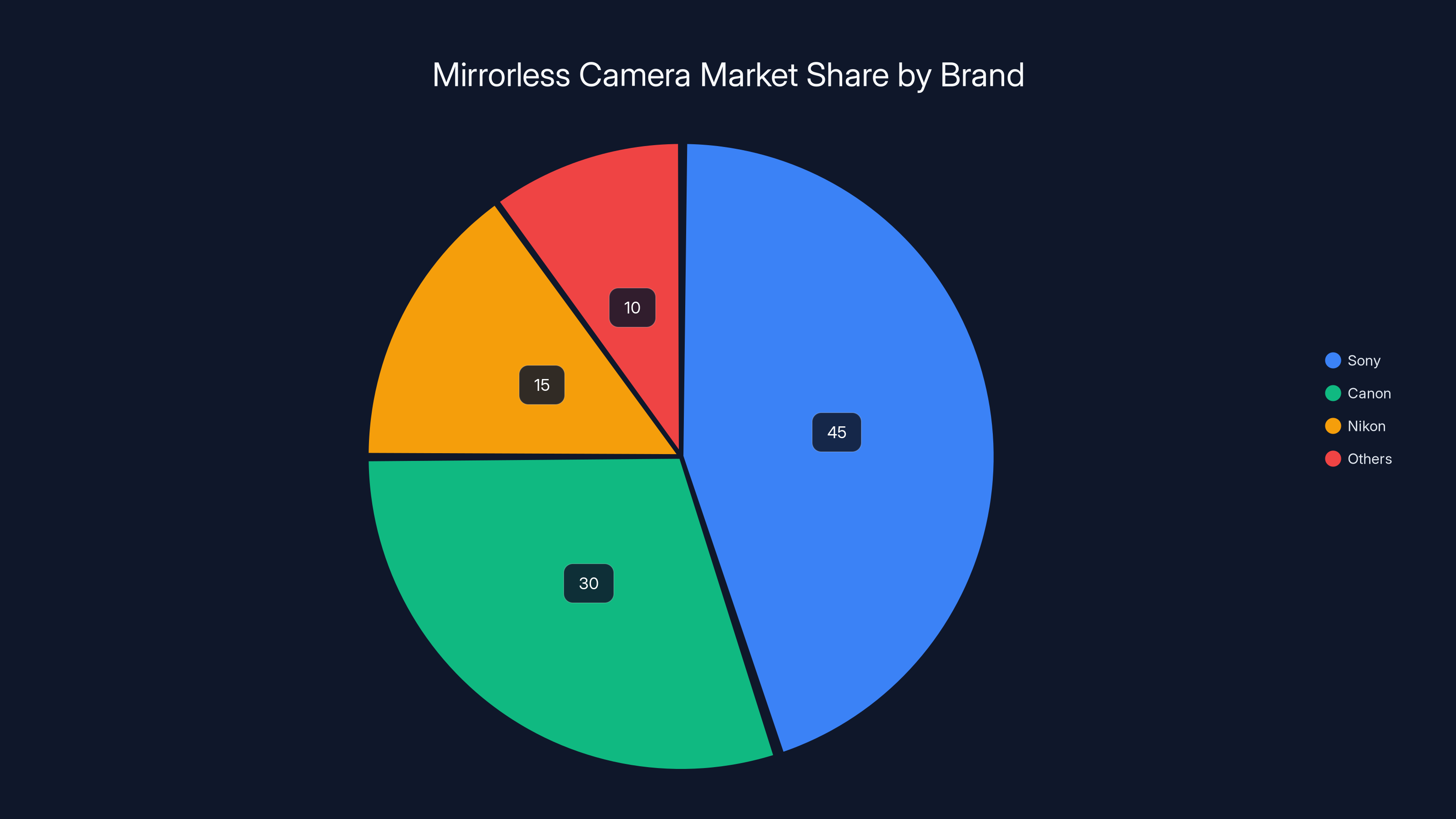

What makes this rumor particularly significant is the timing. Nikon's own lens roadmap is finally maturing after years of playing catch-up to Canon and Sony. The arrival of the Z6 III, Z8, and Z9 professional bodies, combined with a more complete native lens selection, means Nikon might feel less dependent on third-party manufacturers to fill their lineup gaps. Whether that translates into actual litigation remains to be seen, but the rumor itself has sparked important questions about the future of mirrorless lens ecosystems, consumer choice, and how camera manufacturers should balance brand protection with market accessibility.

The Canon Precedent: How RF-Mount Litigation Changed Everything

To understand why the Nikon rumors are causing such concern, you need to understand what happened with Canon first. In 2023, Canon filed lawsuits and complaints against multiple third-party lens manufacturers, including Viltrox, claiming trademark infringement and improper use of the RF-mount designation. Canon argued that third-party manufacturers were misusing Canon's intellectual property by labeling their lenses as "RF-mount compatible."

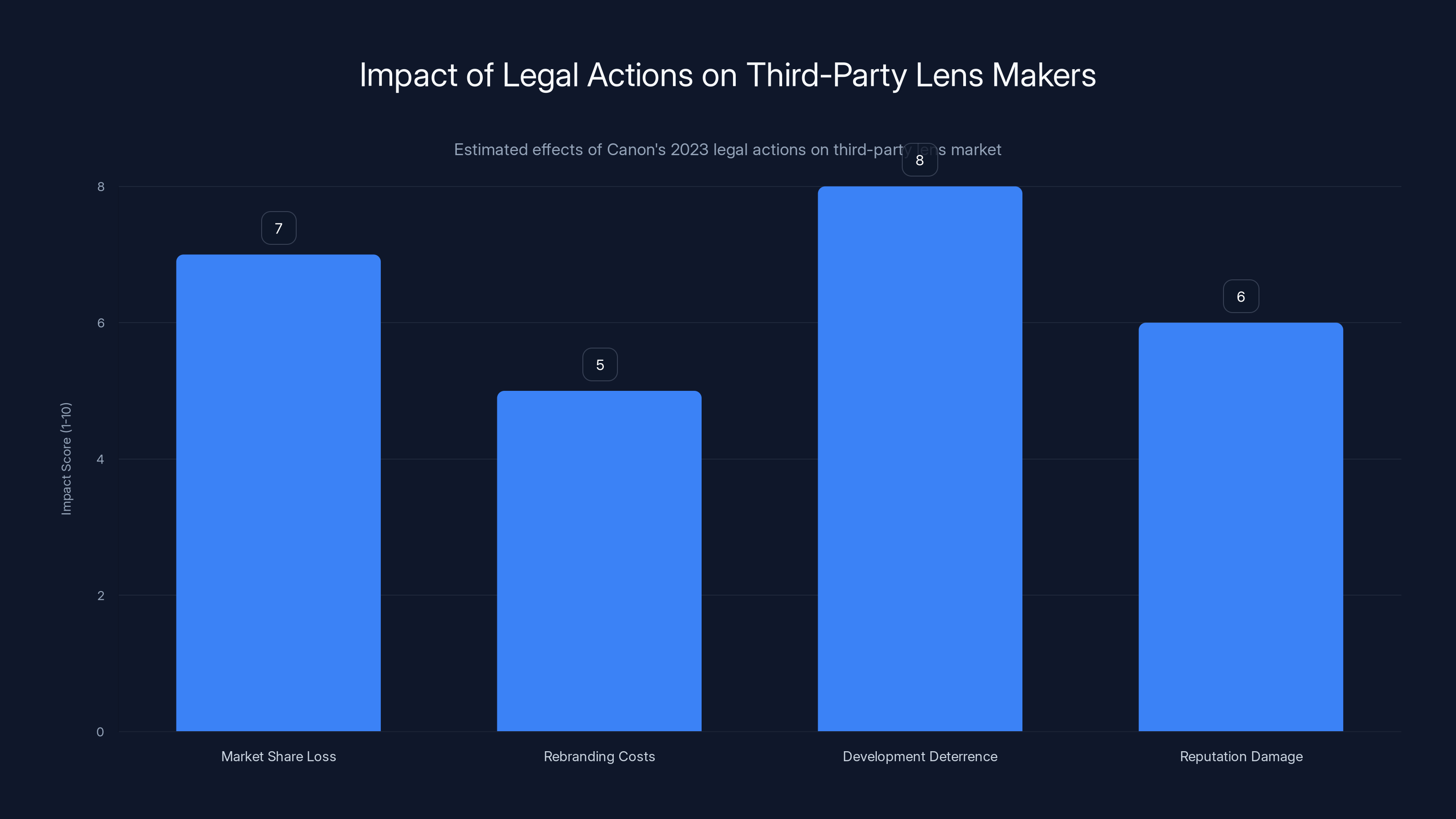

Canon's legal strategy was particularly aggressive. The company didn't just target Viltrox, but also went after Samyang and other manufacturers, sending cease-and-desist letters and filing complaints with customs agencies in multiple countries. Canon claimed that third-party makers were using Canon's proprietary RF-mount design without proper licensing, and that the RF designation itself was trademarked intellectual property that third parties couldn't legally use in marketing.

Here's what actually happened in the real world: third-party lens manufacturers essentially complied, mostly rebranding their RF-compatible lenses with terms like "for Canon EOS R" or just removing explicit mount designation references. Some stopped selling RF-mount lenses altogether in certain markets. The effect was chilling. It became harder for consumers to find third-party RF-mount options, and the prices of available third-party lenses sometimes increased due to reduced competition.

Photographers weren't happy. Canon took a massive reputation hit in online communities. The narrative became clear: Canon was using legal mechanisms not to protect genuine intellectual property violations, but to reduce competition and force photographers toward more expensive native Canon lenses. Whether that characterization was entirely fair became irrelevant when you have thousands of photographers on Reddit and DPReview threads expressing frustration.

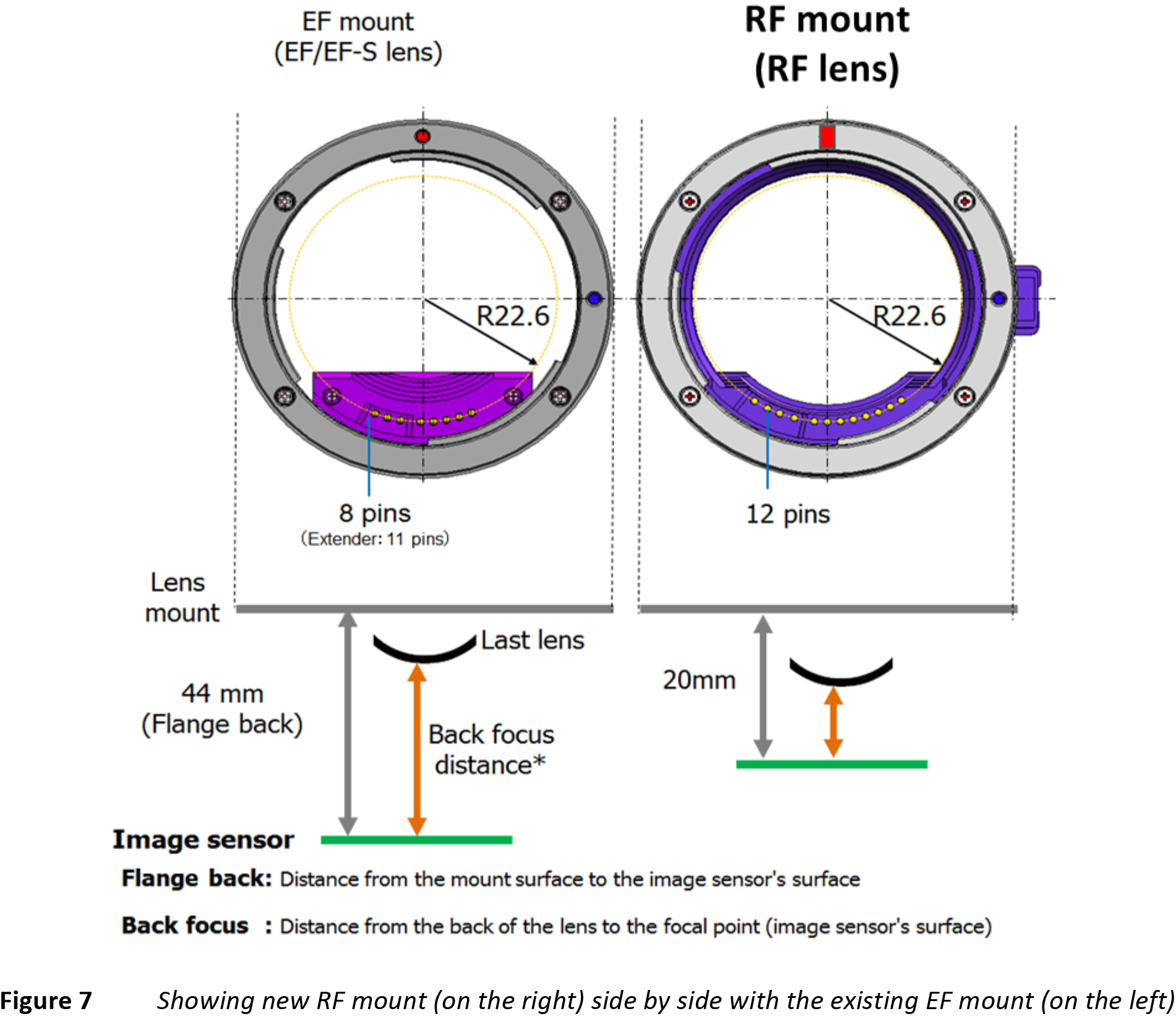

The Canon situation revealed something important about mount design: the RF-mount itself wasn't some revolutionary proprietary technology. It was a mechanical interface following industry standards. Other camera manufacturers had designed similar mounts. The legal argument that third-party makers couldn't say "RF-mount compatible" felt overly protective to many in the industry, because the RF designation is effectively the industry term for Canon's mirrorless mount.

If Nikon follows the same path, expect similar backlash. The photography community has become increasingly vocal about preserving third-party options, particularly as camera prices have climbed and native lens costs have become prohibitive for many users. The cost of entry to Nikon Z-mount has been significantly lower than Canon precisely because Viltrox, Sigma, and Tamron have offered affordable alternatives that Nikon didn't provide natively.

Estimated data shows that if Nikon restricts third-party lenses, only 20% of photographers might switch to the more expensive Nikon lens, while others may choose different options or reduce purchases.

Understanding Viltrox's Role in the Z-Mount Ecosystem

Viltrox isn't some fly-by-night operation. The company has been manufacturing lenses for decades and has gradually built a reputation for producing surprisingly capable glass at aggressive price points. When Nikon released the Z5 as their entry-level full-frame mirrorless camera, Viltrox was one of the earliest third-party manufacturers to offer Z-mount lenses.

The Viltrox Z-mount lineup includes the 24mm f/1.8, 35mm f/1.8, 50mm f/1.8, 85mm f/1.8, and 28-75mm f/2.8 zoom, among others. These lenses filled genuine holes in Nikon's native offering. When the Z5 launched in 2020, Nikon's native lens selection was painfully thin. A 24mm f/1.8 for around

Photographers buying Z5 cameras often paired them with Viltrox lenses simply because it was the most economically sensible choice. You could buy a Z5 body plus three Viltrox primes for less than a Z5 body plus one native Nikon zoom. That ecosystem calculus made Z-mount accessible to photographers who might have otherwise chosen Sony or Canon solely on price.

Viltrox's optical quality is... actually decent. They're not Zeiss or Leica optics, but they're respectable for the price. The build quality is competent, the autofocus performance on Z-mount is generally reliable, and the coatings are adequate. For travel photographers, hobbyists, and professional photographers on tight budgets, Viltrox lenses have become genuinely useful tools, not just cheap alternatives.

The company has also been responsive to the market. As Z-mount matured, Viltrox adjusted their lineup, discontinuing slower options and focusing on faster primes and versatile zooms. They've invested in R&D to improve optical designs and AF performance. This isn't a company coasting on cheap pricing alone. They're actively innovating within their market segment.

What makes Viltrox particularly vulnerable to legal action is that they're a Chinese company. Unlike Tamron or Sigma, which are established Japanese manufacturers with established relationships in the camera industry, Viltrox lacks the institutional protection that Japanese companies sometimes enjoy. They're also smaller and have fewer resources to fight protracted legal battles. If Nikon did take action, Viltrox would face a difficult choice: spend millions on litigation in multiple jurisdictions, or simply exit the Nikon market.

Viltrox lenses offer a cost-effective alternative to Nikon's native Z-mount lenses, often at less than a third of the price. Estimated data.

Why Nikon Might Consider (or Actually Be Pursuing) Legal Action

Here's the business logic that might drive Nikon toward the Canon path. Nikon's native lens lineup has genuinely improved. The company has released native Z-mount 24mm f/2.8, 35mm f/2.8, 28-75mm f/2.8, and other options at increasingly competitive price points. As Nikon's own optical quality improves and as manufacturing scales, Nikon lenses are becoming more price-competitive with third-party options.

Nikon's margins on lenses are substantially higher than on camera bodies. For a camera manufacturer, the real profit engine has always been lenses. A photographer buys one body, maybe every four to six years, but they often accumulate multiple lenses throughout a system's lifecycle. If Nikon can convince (or coerce) photographers to buy native lenses instead of third-party alternatives, the long-term revenue impact is enormous.

There's also brand protection to consider. Nikon has invested billions in developing the Z-mount standard, designing the mechanical and electrical interfaces, and certifying third-party lenses that meet those specifications. From Nikon's perspective, Viltrox and others are leveraging Nikon's investment without contributing to R&D costs. That's a legitimate concern, even if it doesn't necessarily justify legal action.

The Z-mount has historically been more open than Canon's RF-mount. Sigma and Tamron have been certified third-party manufacturers for years, and Nikon has seemed relatively accepting of this arrangement. But the camera industry's profit dynamics are shifting. As mirrorless matures and the upgrade cycle slows, camera makers are becoming increasingly protective of their ecosystems.

There's also competitive pressure from Sony. Sony's E-mount ecosystem remains the most diverse in the mirrorless world, with Sigma, Tamron, Rokinon, Tokina, and others all offering E-mount lenses. Sony has benefited enormously from this third-party ecosystem, and E-mount's openness is partly why Sony lenses are so affordable relative to Canon or Nikon native options. If Nikon wanted to reduce that competitive advantage, restricting third-party options would theoretically shift some photographers toward native lenses.

But here's where the logic breaks down: photographers aren't stupid. If Nikon restricts third-party lenses and forces them toward expensive native glass, they'll simply switch systems. A photographer with a Z5 and three Viltrox lenses who suddenly can't buy new Viltrox glass might sell their entire Z-mount system and move to Sony E-mount, where third-party options remain abundant and affordable.

The Intellectual Property Question: Does Nikon Have a Case?

Let's dig into the actual legal claims that Nikon might pursue, because understanding the IP question helps predict how this might unfold. There are essentially three types of intellectual property claims a camera manufacturer could theoretically make against third-party lens manufacturers:

Patent Claims: Nikon could argue that the Z-mount design infringes on Nikon's patents. However, mount designs are generally patents of modest strength. Nikon would need to demonstrate that Viltrox is using specific patented features that are non-obvious and that the patent claims cover third-party manufacturers. Most camera mounts use similar mechanical principles (centering mechanisms, contact patterns, etc.), so patent claims are usually weak unless there's something genuinely novel about the Z-mount design. Nikon would have a difficult time convincing courts that a standard optical mount design justifies preventing third-party compatibility.

Trademark Claims: Like Canon, Nikon could argue that third-party manufacturers are misusing the "Z-mount" designation as a trademark. This is where Canon's legal strategy focused. The argument is that "Z-mount" is a Nikon trademark, and third parties shouldn't be allowed to use it in marketing. However, this argument faces a serious problem: "Z-mount" has become genericized as the industry term for Nikon's mirrorless mount. If someone asks a photographer "what mount does your lens have," and the answer is "Z-mount," that's become generic terminology, not a trademark. Courts are generally skeptical of trademark claims against generic descriptive terms. Canada's initial ruling in Canon's case has reinforced this skepticism.

Design/Trade Secrets Claims: Nikon could argue that the specific mechanical implementation of the Z-mount is a trade secret or protected design. This is the weakest argument, because the Z-mount's mechanical design is observable, reverse-engineerable, and not substantially different from other camera mounts.

Canon's legal victories weren't actually that impressive legally speaking. In most jurisdictions, Canon's cases were either dropped, resulted in settlements that kept the case quiet, or faced significant pushback from courts skeptical of trademark claims on generic terms. Canada's initial IP tribunal rejected Canon's arguments on trademark grounds in 2024, suggesting that trademark-based strategies aren't as legally robust as manufacturers hope.

If Nikon pursued similar claims, they'd likely face similar legal vulnerabilities. The IP arguments aren't particularly strong. What Nikon would really be counting on is the expensive litigation process itself deterring third-party manufacturers, not actually winning in court. That's the real strategy: make it expensive enough that smaller companies exit the market regardless of legal merit.

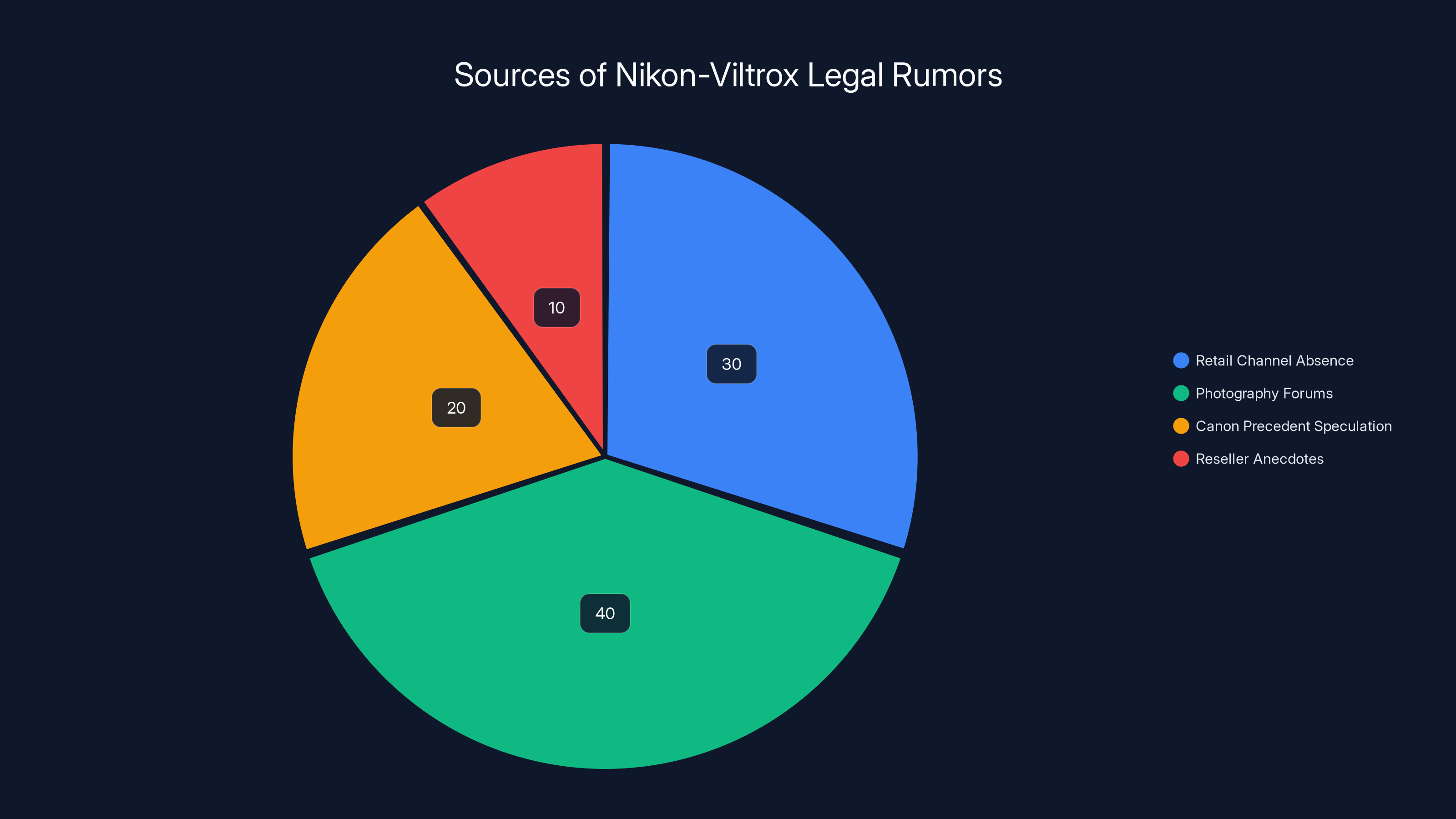

Estimated data shows that photography forums contribute the most to the Nikon-Viltrox legal rumors, followed by retail channel absences. Estimated data.

Market Impact: What Would Viltrox Restrictions Mean for Photographers?

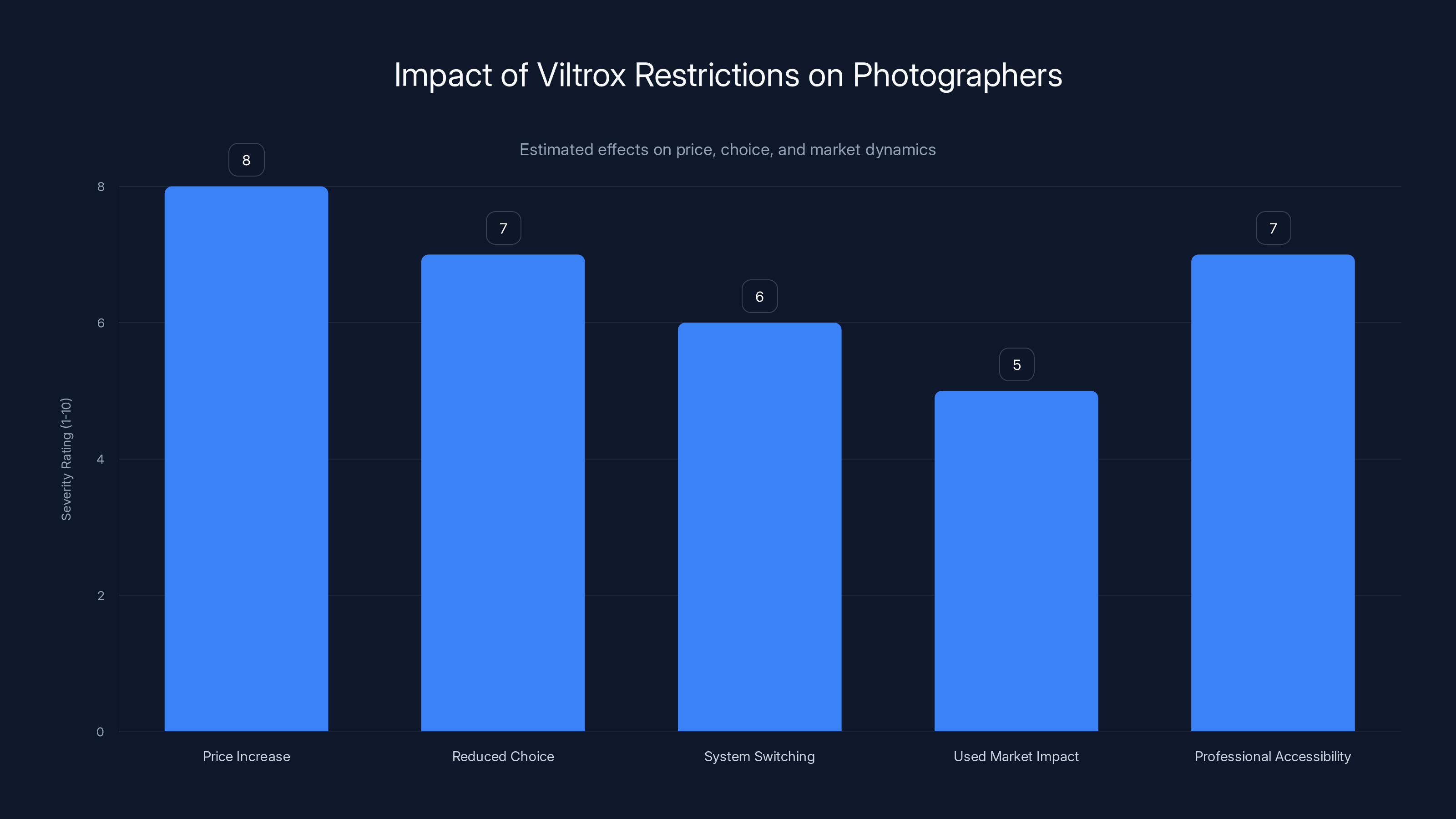

Let's be concrete about the real-world impact. If Nikon successfully restricted or eliminated Viltrox Z-mount lenses, here's what photographers would face:

Price Increases: Viltrox's entry-level primes currently cost

Reduced Choice: Nikon's native lens lineup is good but not complete. There are still gap-filling opportunities that Viltrox addresses. A hypothetical Nikon Z 16mm f/2.8 wide angle doesn't exist natively; Viltrox fills that void. Remove third parties and photographers have fewer tools available.

System Switching: Photographers evaluating Z-mount versus E-mount would suddenly have a much stronger reason to choose Sony. If the Z-mount ecosystem is restricted to native lenses only, while E-mount offers abundant third-party options, Sony becomes the more flexible choice.

Used Market Complications: Photographers who already own Viltrox lenses would find resale values declining as future buyers know no new Viltrox lenses will be released. That creates a stranded asset problem.

Professional Accessibility: Many professional photographers rent equipment for jobs. If Viltrox lenses disappear, rental houses will gradually exit that inventory, making it harder for professionals on budget to access affordable rental options.

The net effect would be making Z-mount more expensive to use, particularly for photographers building an affordable system. That benefits Nikon's lens revenue in the short term but could accelerate the long-term shift of photographers to more open systems like Sony E-mount.

The Broader Industry Dynamics: Are Camera Makers Moving Toward Closed Ecosystems?

The Viltrox rumors arrive in a moment when the entire mirrorless industry is consolidating. Sony still dominates mirrorless market share, Canon is aggressively pushing RF-mount despite controversy, and Nikon is finally scaling Z-mount production. The industry is no longer in growth mode; it's in optimization mode. That's when companies typically tighten control of their ecosystems.

Tamron and Sigma have also noticed this trend. Both companies have significantly reduced their third-party mount offerings in recent years, focusing resources on the most profitable systems (Sony and Nikon traditionally, with RF-mount receiving more recent attention). Sigma has essentially abandoned new third-party development for several legacy mounts, concentrating on contemporary systems and native offerings.

The photography industry is becoming more vertically integrated, with camera manufacturers increasingly trying to own more of the lens market share. This mirrors what happened in the smartphone industry, where Apple and Samsung moved from outsourcing components to designing and manufacturing proprietary parts. The economics drive this behavior: if you can capture the entire ecosystem margin, why share revenue with third parties?

But smartphone manufacturers operate in a different market reality. Apple controls iOS, so third-party app developers have no choice but to work within Apple's ecosystem. Camera manufacturers don't have that lock-in. A photographer can switch systems if one becomes too expensive or restrictive. That competitive pressure remains the real check on Nikon's options.

Estimated data shows significant price increases and reduced choice as major impacts of Viltrox restrictions, potentially driving photographers to alternative systems.

Nikon's Official Stance and the Rumor Mill

Here's where we need to separate confirmed fact from speculation. As of early 2025, Nikon has made no official announcement about any legal action against Viltrox. The rumors circulating online are largely based on:

- Viltrox's sudden absence from some retail channels in certain regions

- Rumors from photography forums and Reddit discussions claiming to have "inside information"

- Speculation based on Canon's precedent and aggressive IP enforcement

- Anecdotal reports of Nikon reseller pressure supposedly encouraging cameras with native lenses

None of this constitutes confirmed evidence of litigation. Viltrox's retail availability fluctuates for many reasons: supply chain issues, import tariffs, regional market conditions, and licensing agreements with retailers. The absence of a product from one retailer doesn't confirm legal action.

Photography rumors have historically been unreliable. The same forums that "confirmed" upcoming Nikon camera announcements have also spread speculation that proved false. The rumor mill generates a lot of noise, and separating signal from actual developments is difficult.

What we do know is that Nikon hasn't sued Viltrox (or hasn't publicly disclosed such a suit as of early 2025). The company continues to offer Z-mount lenses through various retailers. If litigation was underway, there would likely be official legal filings visible in court records, cease-and-desist letters would have been shared publicly by Viltrox, and the photography press would be reporting on confirmed developments rather than circulating rumors.

That said, rumors often precede actual developments in the camera industry. If Nikon is considering legal action, the rumor phase might reflect internal discussions or preliminary legal review before formal action is taken.

What Photographers Should Do Right Now

If you're a Z-mount photographer currently using or considering Viltrox lenses, here are some practical recommendations:

For Current Viltrox Users: Your gear isn't going anywhere. Viltrox lenses will continue to function regardless of future legal developments. The autofocus firmware might theoretically stop receiving updates, but manual focus capability will always exist. Your investment is safe in the short term.

For Photographers Considering Z-Mount Purchase: Don't let Viltrox rumors deter you from Z-mount. The system is viable even without third-party options, and Nikon's native lens lineup is genuinely good now. If you want to hedge against ecosystem uncertainty, Sony E-mount remains the most third-party-friendly option, but that shouldn't drive your decision if Z-mount cameras better suit your needs.

For Future Viltrox Buyers: If you're considering purchasing a Viltrox Z-mount lens right now, the risk-reward calculus is worth considering. Prices might decline if legal uncertainty increases, or they might increase if supply gets restricted. There's no perfect timing, but buying used Viltrox lenses through resale markets might be slightly safer than buying new in case discontinuation becomes necessary.

Diversify Your Lens Collection: If you're building a Z-mount system, a balanced approach combining affordable Viltrox options with at least a couple of native Nikon lenses gives you flexibility. That way, your system isn't entirely dependent on third-party support.

Support Tamron and Sigma: If you care about third-party lens availability in mirrorless systems, using and recommending Tamron and Sigma helps those companies justify continued investment in Z-mount development. Tamron especially has been supportive of diverse camera mounts, and their Z-mount offerings are excellent.

Canon's legal actions in 2023 had a significant impact on third-party lens makers, notably deterring development and causing market share loss. Estimated data based on industry analysis.

Historical Precedent: Why This Matters Beyond Just Nikon

The Viltrox rumors aren't just about Nikon and third-party lenses. They're part of a broader question about how camera ecosystems will develop as the industry matures. Previous technology transitions offer perspective.

When Canon introduced their EF mount in 1987, they could have restricted third-party manufacturers. They didn't, and EF became enormously successful partly because the ecosystem was open. The availability of affordable Sigma, Tamron, and Tokina EF-mount lenses meant photographers could build Canon systems at various price points. That openness contributed to Canon's dominance.

Sony's success with E-mount partly reflects the same dynamic. The mount has been relatively open, third-party manufacturers have invested in the system, and photographers have voting-with-their-feet chosen Sony partly because glass options are plentiful and affordable.

Closing ecosystems typically happens in declining industries, not thriving ones. When markets are growing, competition and ecosystem openness drive adoption. When markets are saturated, companies try to extract more margin from existing customers through lock-in and reduced competition. The mirrorless market isn't yet obviously declining, but the growth phase is clearly slowing.

Future Scenarios: How This Could Unfold

There are several possible futures for Nikon and third-party Z-mount lenses:

Scenario 1: Status Quo Continues: Nikon never pursues legal action, Viltrox continues producing Z-mount lenses, and the ecosystem remains relatively open. This is the most pleasant outcome for photographers and the least likely if industry consolidation pressures continue.

Scenario 2: Nikon Follows Canon's Path: Nikon files trademark or patent claims against Viltrox, initiating a legal battle that ultimately doesn't result in Viltrox's complete exit, but makes them cautious about future Z-mount development. This creates uncertainty around third-party support without actually closing the ecosystem entirely.

Scenario 3: Viltrox Voluntarily Exits: Facing potential legal costs and understanding the incentives aren't favorable, Viltrox independently decides to discontinue Z-mount development and focus resources elsewhere. This would look like a company decision rather than a forced exit, but the result is the same.

Scenario 4: Licensing Arrangement: Nikon and Viltrox reach a licensing agreement where Viltrox pays Nikon a royalty or fee to legally produce Z-mount lenses. This is actually how some third-party relationships work in other industries. It's less likely in cameras because the relationships have historically been informal rather than contractual.

Scenario 5: Mount Rebranding: Viltrox stops explicitly using "Z-mount" designations and instead labels lenses as "for Nikon Z bodies" without specifying the mount. This resembles the strategy third-party makers adopted in response to Canon's RF-mount pressure. It keeps the product available but creates some confusion in marketing.

Which scenario unfolds will depend partly on factors outside anyone's control: whether Nikon's lens roadmap becomes complete enough that they feel they've won the market share battle, whether photographer backlash against ecosystem restriction proves severe, and whether Viltrox faces financial or operational pressures independent of the Nikon situation.

Sony leads the mirrorless camera market with an estimated 45% share, followed by Canon and Nikon. Estimated data based on industry trends.

The Bigger Picture: Consumer Choice in an Era of Platform Control

The Viltrox rumors ultimately reflect a larger struggle in the technology industry over how much power companies should have over their ecosystems. Should camera manufacturers be able to completely control which lenses work with their mounts? Or should open standards allow third-party innovation?

There's a legitimate argument for camera manufacturer protection. Nikon has invested billions in Z-mount development, testing, and certification. They've built the infrastructure that allows third-party lenses to function reliably. Why shouldn't they be able to control that ecosystem?

But there's an equally strong counterargument: once a mount becomes standardized and third parties have invested in developing compatible products, restricting competition doesn't drive innovation, it restricts consumer choice. Camera companies benefit from a thriving third-party ecosystem because it expands the total addressable market, making their camera bodies more attractive to price-conscious buyers who can then invest in lenses.

The tension between these perspectives has always existed in the camera industry. Different manufacturers have handled it differently. Sony bet on openness and has been rewarded with robust ecosystem support. Canon has moved toward tighter control and faced significant customer backlash. Nikon has been relatively hands-off historically but shows signs of potentially changing course.

What's interesting is that photographers have revealed through their behavior that they value ecosystem openness. Every photography forum thread about Canon's RF-mount restrictions includes complaints about the company's strategy. That consumer sentiment hasn't stopped Canon from pursuing it, but it has created real competitive opportunity for other manufacturers.

If Nikon pursues aggressive IP enforcement against Viltrox, they'll face similar reputational costs. That's not a legal risk but a market risk. And unlike a patent infringement suit, market risk is something a corporation can't easily defend against.

What This Means for Other Third-Party Manufacturers

Tamron and Sigma have notably declined to comment on the Viltrox rumors, and for good reason. Both companies occupy a different position than Viltrox in the photography market. Tamron especially has cultivated relationships with camera manufacturers that Viltrox lacks. Tamron lenses are sometimes officially certified and promoted alongside native lenses. That institutional relationship provides some protection.

Sigma has also been careful to maintain professional relationships with manufacturers, positioning themselves as complementary to native lens offerings rather than direct competitors. Their Art and Contemporary lines occupy different market segments than third-party budget glass.

Viltrox, by contrast, directly competes on price. That's their value proposition: optical quality that's surprisingly good for the money. That positioning makes them more vulnerable to restriction because they're cannibalizing the low end of Nikon's potential lens sales. Tamron's 28-75mm f/2.8 also competes with native offerings, but at a different price point with different positioning.

If Nikon did target Viltrox specifically while leaving Tamron and Sigma relatively unmolested, it would suggest the goal is competitive restriction rather than genuine IP protection. That would likely provoke additional scrutiny from photography communities and potentially from regulatory authorities concerned about anti-competitive behavior.

Regulatory risk is something camera manufacturers rarely discuss publicly. But if one company successfully restricts third-party competition through IP enforcement, regulatory authorities might eventually ask whether such restrictions represent anti-competitive behavior. That's a small risk currently, but a risk nonetheless.

The Economic Reality: Why This Fight Matters

Let's talk about the money because that's ultimately what drives these decisions. A typical Viltrox 50mm f/1.8 costs approximately

But that calculation assumes photographers actually buy the native alternative. Many don't. Surveys consistently show that a significant percentage of photographers who might purchase a Viltrox lens at

Tamron has actually published data showing that the availability of affordable third-party lenses expands the total market, benefiting camera manufacturers even if they don't capture all the lens revenue. More photographers shoot more systems if buying into those systems is financially accessible. That increased usage drives accessory sales, used body prices, and community growth.

Nikon's management understands this logic. They've profited for years from an ecosystem where third-party options made Z-mount accessible. The calculus only changes if Nikon's own lens lineup becomes complete and price-competitive enough that the opportunity cost of supporting third parties exceeds the market expansion benefit. Whether that threshold has been reached is debatable.

Comparative Systems: How Other Manufacturers Handle This

Looking at other manufacturers offers perspective on different ecosystem strategies:

Sony E-Mount: Remains actively open, with continued Tamron, Sigma, and Viltrox development. Sony doesn't restrict third-party manufacturers. This has made E-mount the most diverse ecosystem but also the most fragmented in terms of native lens priority.

Fujifilm X-Mount: Also remains open, though Tamron and Sigma investment has been lighter. Fujifilm has cultivated a strong native lens lineup, and third-party manufacturers focus on niche products rather than mainstream offerings.

Panasonic L-Mount: Open by design, with three manufacturers sharing the mount standard. This has created a unique alliance ecosystem that some find appealing and others find messy.

Canon RF-Mount: Increasingly restricted through IP enforcement, leading to reduced third-party options and higher overall system costs. Canon's legal approach has made RF-mount notably expensive but also concentrated, with extensive native support.

Nikon Z-Mount: Historically open, currently in transition. This is the question we're wrestling with.

Each approach has tradeoffs. Restricted ecosystems like RF-mount provide superior ecosystem integration but higher costs. Open ecosystems like E-mount provide more choice but sometimes less coherence. Nikon's current position between these poles makes the question of which direction to move genuinely impactful.

The Real Test: What Photographers Actually Do

Ultimately, the future of Viltrox Z-mount lenses won't be determined by legal arguments but by photographer behavior. If Nikon restricts third-party lenses and photographers respond by switching to Sony, that will be the most decisive feedback Nikon receives.

That's what happened historically in the DSLR era when some manufacturers attempted various forms of lens lock-in. Photographers always have exit options. They can switch camera systems, buy used legacy glass, or build hybrid systems combining older mounts with modern bodies. The nuclear option always exists: abandon the system entirely and start over with a competitor.

Nikon knows this. Camera executives understand that ecosystem restrictions only work if the benefits are compelling enough to justify the friction. The question is whether that threshold has been reached. Nikon's rumored legal approach suggests someone in Nikon management believes it has. But that's a business judgment, not an inevitability.

The photography community will likely make its preference clear through marketplace behavior. That feedback will determine whether Nikon continues down a path of ecosystem restriction or reverses course to focus on competing through product excellence and value rather than legal restriction.

FAQ

What is the Viltrox lawsuit rumor about?

The Viltrox lawsuit rumor suggests that Nikon might be preparing or pursuing legal action against Viltrox, a Chinese lens manufacturer known for producing affordable third-party Z-mount lenses. The rumor circulates primarily through photography forums and social media and hasn't been officially confirmed by Nikon as of early 2025. The speculation is based partly on Canon's recent precedent of taking similar legal action against third-party RF-mount lens manufacturers in 2023.

Why would Nikon pursue legal action against Viltrox?

Nikon might consider legal action to restrict third-party competition and protect its own lens revenue. Third-party lenses like Viltrox's offerings cannibalize sales of more expensive native Nikon lenses, and as Nikon's own Z-mount lens lineup has improved and matured, the company has less competitive need for third-party manufacturers to fill gaps. Additionally, Nikon's profit margins on lenses are substantially higher than on camera bodies, creating incentive to maximize native lens sales.

What happened when Canon pursued legal action against third-party lens makers?

Canon filed trademark and intellectual property claims against manufacturers including Viltrox in 2023, arguing that third-party makers were misusing the RF-mount designation. The legal outcomes were mixed, with some jurisdictions rejecting Canon's trademark claims on the grounds that RF-mount had become generic terminology. Canon's strategy did successfully deter some third-party development and forced manufacturers to rebrand their products, but the company faced significant reputation damage and photographer backlash for the aggressive approach.

How strong are Nikon's potential legal claims against Viltrox?

Nikon's potential legal claims would likely be similarly weak to Canon's. Patent claims on mount designs are typically modest in strength since optical mounts use standard mechanical principles. Trademark claims on the Z-mount designation face the problem that Z-mount has become generic terminology for Nikon's mirrorless mount. Design and trade secret claims are even weaker since mount designs are observable and reverse-engineerable. Nikon's real strategy would likely rely on making litigation expensive enough to deter third parties rather than winning on legal merit.

What would happen to Viltrox lens owners if the manufacturer stopped producing Z-mount lenses?

Existing Viltrox Z-mount lenses would continue functioning perfectly. The lenses wouldn't suddenly stop working, and autofocus capability would remain intact regardless of future development. However, resale values might decline as future buyers recognize that no new Viltrox Z-mount lenses will be released, creating a stranded asset problem for photographers wanting to upgrade or expand their lens collections. Used lens markets would be the primary avenue for future Viltrox availability.

Should I buy a Viltrox Z-mount lens right now given the uncertainty?

That depends on your specific needs and risk tolerance. Viltrox lenses remain available and functional, and buying used Viltrox lenses through reputable resale markets provides good value. If you're considering new Viltrox purchases, the decision hinges on whether you're comfortable with the possibility of limited future support. Alternatively, investing in at least some native Nikon lenses alongside any third-party glass diversifies your system and reduces dependence on third-party support.

How does this compare to other camera ecosystems like Sony E-mount?

Sony's E-mount ecosystem remains significantly more open and third-party friendly than Canon's RF-mount. Viltrox, Sigma, Tamron, Tokina, and other manufacturers continue producing E-mount lenses with minimal restriction. If ecosystem openness is important to you, Sony E-mount currently offers more choice and less legal uncertainty than Nikon Z-mount might offer under a restrictive scenario. However, Nikon's native lens quality and Z-mount camera capabilities are genuinely excellent and shouldn't be dismissed based solely on third-party ecosystem concerns.

Could Nikon license Viltrox to produce Z-mount lenses rather than pursue litigation?

A licensing agreement between Nikon and Viltrox is theoretically possible, though historically unlikely in the camera industry. Licensing would require Viltrox to pay royalties to Nikon, reducing their profit margins and potentially raising consumer lens prices. Such arrangements work in some industries but haven't been common in camera manufacturing. Nikon would likely need to perceive significant competitive or regulatory pressure to pursue licensing rather than either maintaining status quo or pursuing restriction.

What signals should photographers watch for to confirm legal action is actually happening?

Confirmed indicators of actual litigation would include official legal filings visible in court records, public cease-and-desist letters from Nikon to Viltrox, official statements from Nikon regarding IP enforcement, coverage in mainstream photography press reporting confirmed developments, and changes in product availability with official explanations from either Nikon or Viltrox. Absence of these confirmed signals means rumors remain unsubstantiated speculation, however plausible the scenarios seem.

How might photographer backlash influence Nikon's decision on legal action?

Photographer backlash and reputation risk represent Nikon's most significant constraints. Canon's RF-mount legal strategy succeeded in reducing third-party competition but damaged brand perception and created marketing advantages for competitors positioning themselves as more photographer-friendly. Nikon management understands this risk. If pursuing legal action against Viltrox would generate similar reputational costs and accelerate photographer migration to Sony systems, that competitive risk might ultimately prevent Nikon from following Canon's path despite the short-term lens revenue benefits.

Key Takeaways and What This Means Going Forward

The Viltrox lawsuit rumors represent a potential inflection point for the mirrorless lens ecosystem. While the legal claims Nikon might pursue remain weak, the strategic intent would be clear: restricting third-party competition to maximize native lens revenue. That approach has worked for Canon in the short term but at significant reputational cost.

Photographers should understand that their behavior will ultimately determine the outcome more than legal arguments will. If you value ecosystem openness and third-party options, choosing systems that support those values sends a market signal. Conversely, photographers willing to pay premium prices for integrated native ecosystems enable manufacturers to justify ecosystem restriction strategies.

The most likely outcome remains uncertainty in the near term. Viltrox will likely continue producing Z-mount lenses until presented with clear evidence that doing so is legally or commercially impossible. Nikon will likely avoid making any official pronouncements that might alienate photographers or attract regulatory scrutiny. The rumor mill will continue generating speculation without confirmation.

For photographers making purchasing decisions right now, Nikon Z-mount remains a viable, excellent system with or without third-party support. The question is less about whether Z-mount is worth using and more about whether you're comfortable betting on an ecosystem that might become increasingly restricted in the coming years. That's ultimately a personal decision based on your priorities, budget, and preference for ecosystem openness versus integrated native support.

Related Articles

- Best Gear & Tech Releases This Week [2025]

- Anna's Archive Court Order: Why Judges Can't Stop Shadow Libraries [2025]

- AI Identity Crisis: When Celebrities Own Their Digital Selves [2025]

- Ricoh GR IV Monochrome: The $2,200 Black-and-White Camera Revolution [2025]

- Ricoh GR III X Monochrome Camera: Is the Price Worth the Trade-offs? [2025]

- Matthew McConaughey Trademarks Himself: The New AI Likeness Battle [2025]

![Nikon Viltrox Lawsuit: What It Means for Z-Mount Lenses [2025]](https://tryrunable.com/blog/nikon-viltrox-lawsuit-what-it-means-for-z-mount-lenses-2025/image-1-1768862323918.jpg)