Introduction: A Bold Move Against Industry Expectations

When Nothing's CEO Carl Pei announced that there would be no Phone 4 flagship in 2026, it felt like a curveball in an industry obsessed with annual refresh cycles. Every major smartphone manufacturer from Apple to Samsung treats the yearly flagship launch like clockwork, treating it as an almost religious obligation to shareholders and consumers alike. But here's the thing: Nothing is betting that breaking this pattern isn't a weakness—it's a strength.

This decision reveals something important about how smaller players navigate the smartphone market. Instead of chasing the treadmill of incremental improvements, Pei's company is asking a different question: what if we only launch when we have something genuinely worth launching? What if "evolution" doesn't mean new every year?

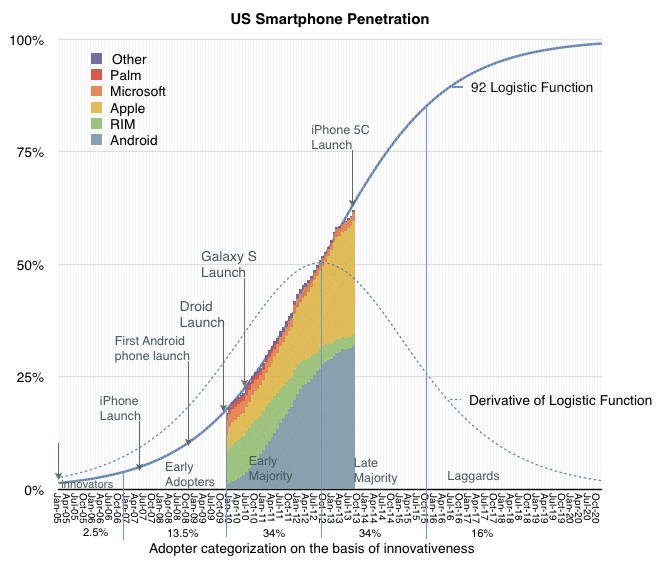

The move also speaks to a larger shift happening in consumer electronics. We're seeing fatigue with annual upgrades. People are keeping phones longer. The differences between flagship phones are getting smaller, not bigger. In that context, Nothing's choice to skip the Phone 4 and focus resources on perfecting the Phone 4A midrange option isn't just a business decision—it's a statement about where the company thinks the real opportunity lies.

Understanding this decision requires looking at several angles. What's driving Nothing's strategy? What does it mean for the midrange phone market? How might other manufacturers respond? And most importantly, what should consumers take away from this announcement about where phones are heading?

TL; DR

- No Phone 4 flagship coming: Nothing CEO Carl Pei confirmed via YouTube that the company won't release a flagship Phone 4 in 2026, keeping the Phone 3 as the flagship.

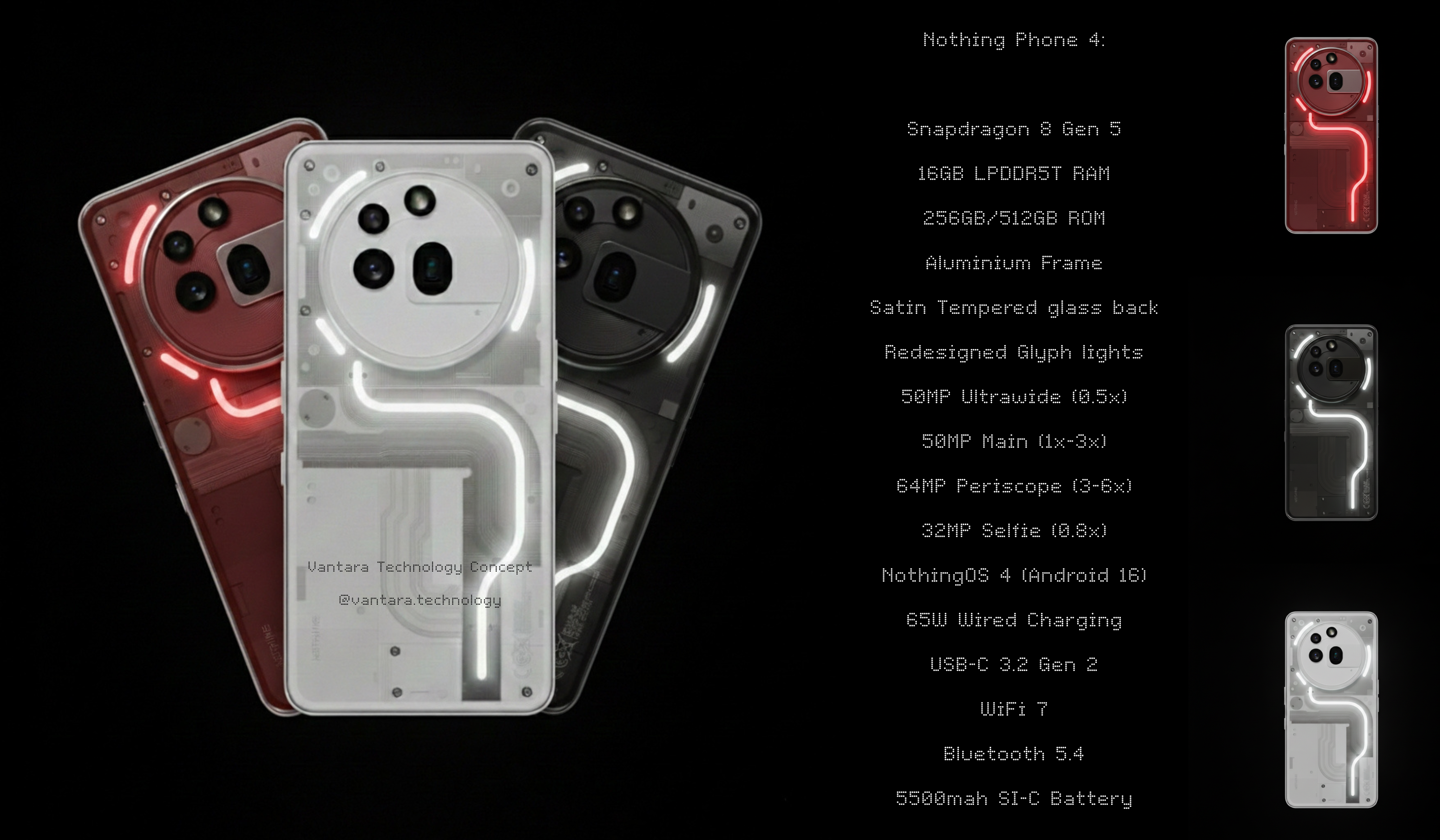

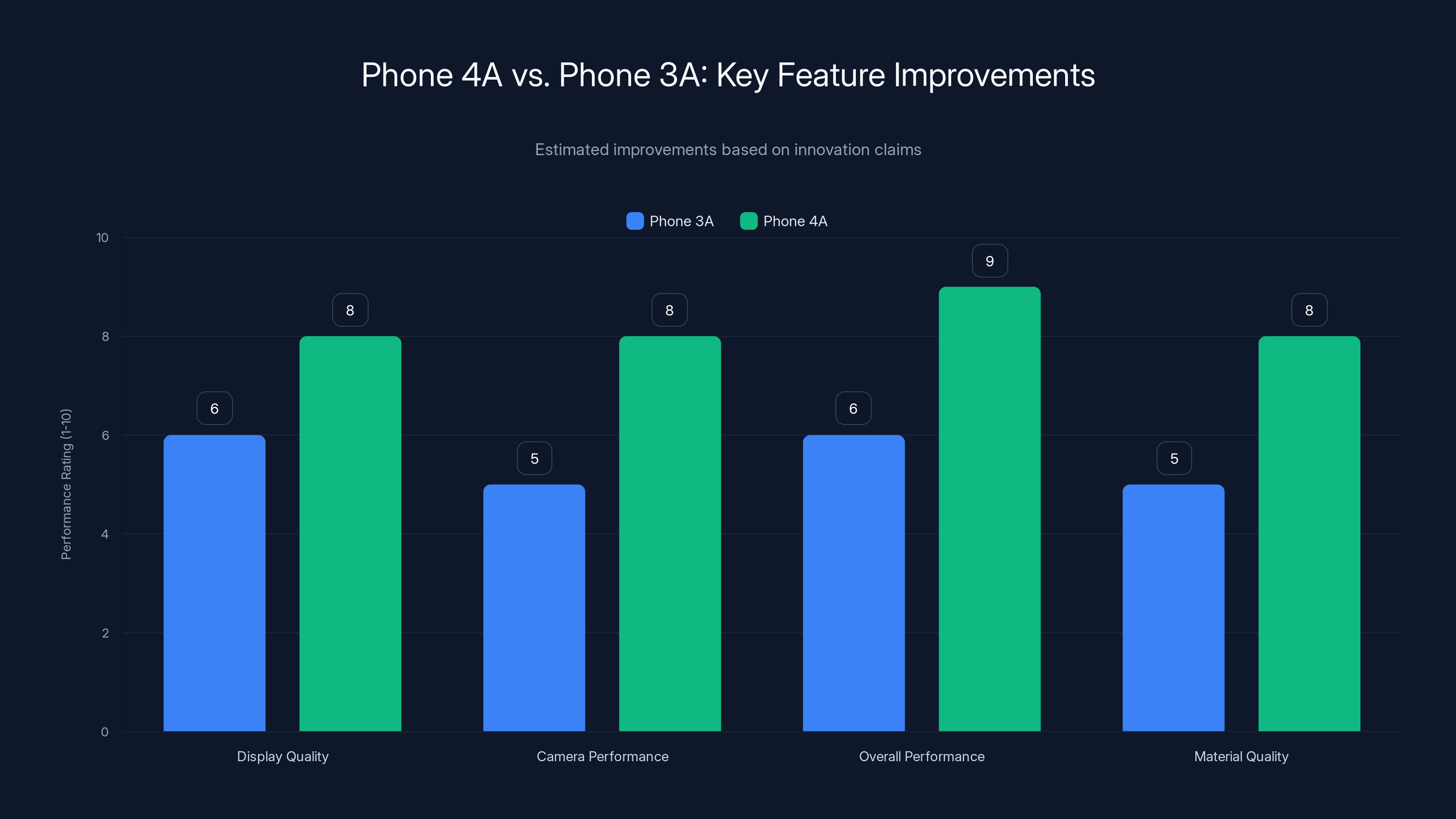

- Focus shifts to midrange: The Phone 4A series will receive major improvements across display, camera, and performance, positioning it closer to a flagship experience than the 3A.

- Strategy over cycles: Pei emphasizes the company doesn't want to "churn out" phones annually, preferring meaningful upgrades over marketing timelines.

- Premium materials and colors coming: The 4A will feature new materials and "bold new experimentation" in color options, suggesting design-forward differentiation.

- Industry pattern rejection: Nothing is intentionally breaking the annual flagship launch cycle that dominates the smartphone market, betting consumers value substance over predictability.

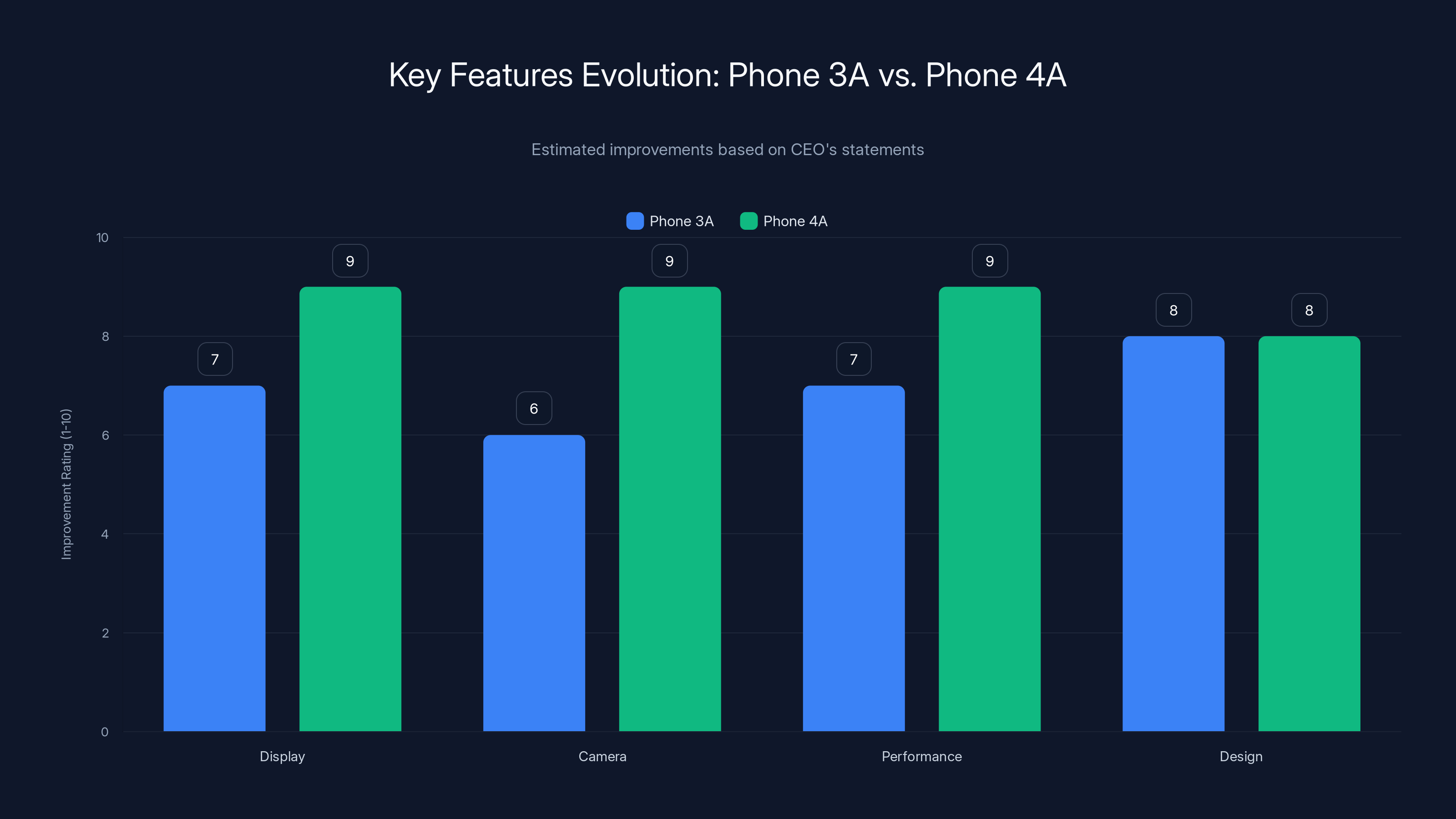

The Phone 4A is expected to significantly improve upon the 3A in display, camera, performance, and material quality, aiming for a flagship experience at a midrange price. Estimated data.

Why Nothing Is Skipping the Flagship Cycle

Carl Pei's statement carries real weight because he's not a newcomer defending inexperience. He previously led OnePlus, which built a massive following specifically by challenging the annual flagship treadmill. OnePlus started with "never settle" as a philosophy, but even that company eventually succumbed to the industry pressure of releasing multiple phones yearly. Nothing seems determined not to repeat that cycle.

The decision to skip the Phone 4 isn't about failure or resource constraints. Nothing has backing from serious investors including Qualcomm and Glade Brook Capital. They've proven the Phone 3 can compete with flagships from much larger companies. So this move is calculated strategy, not desperation.

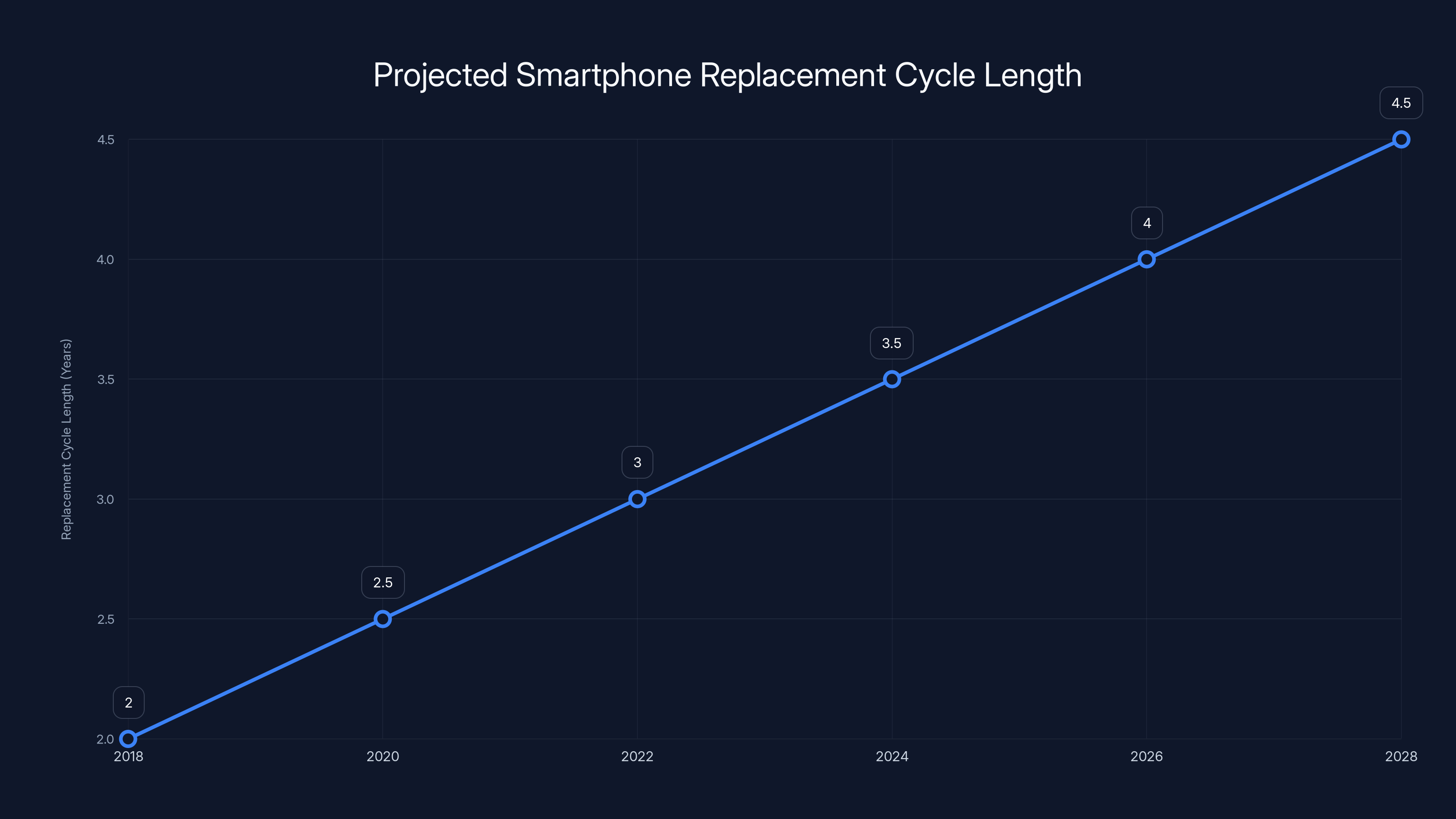

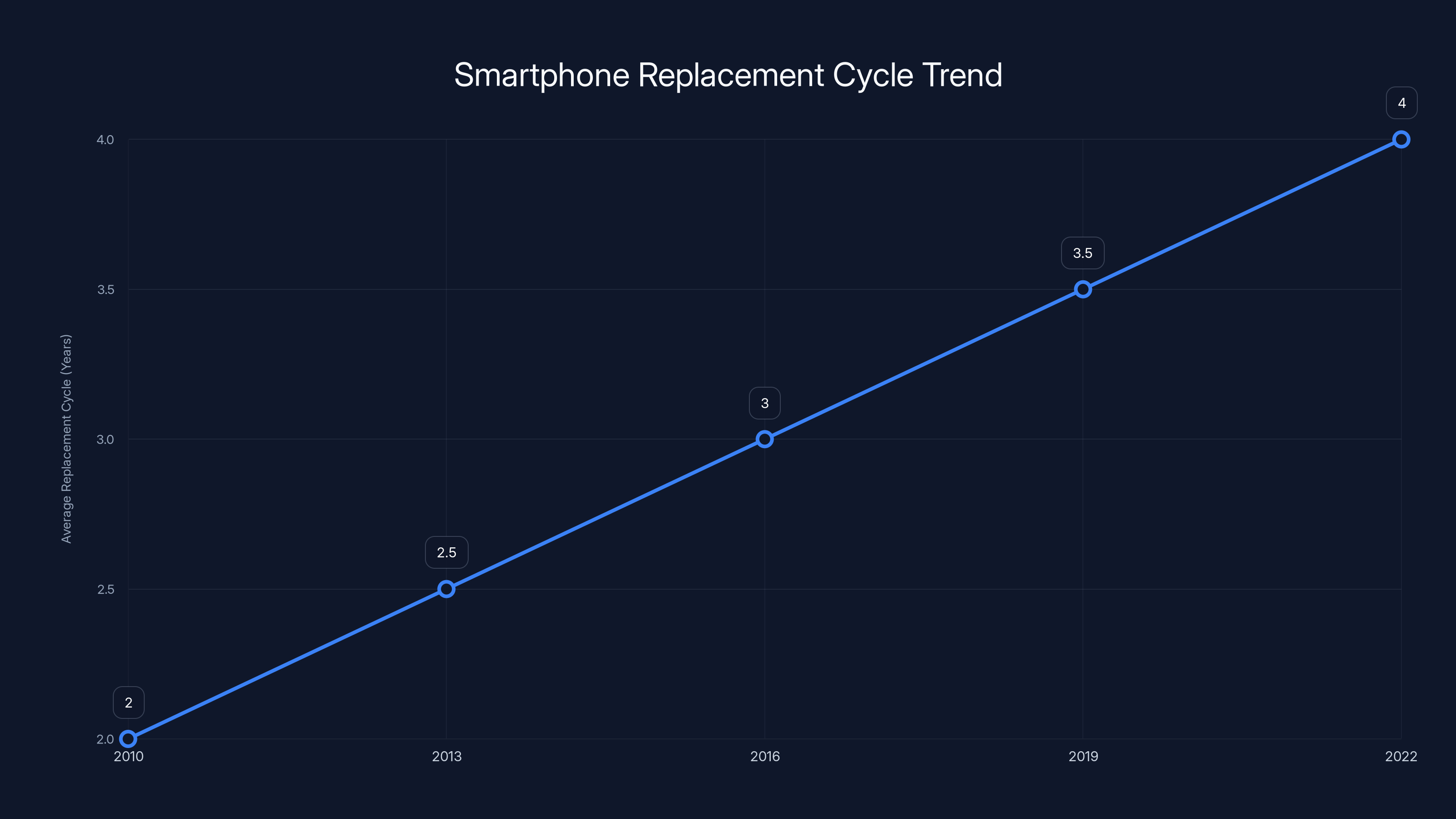

What's driving this? Several factors appear to be at play. First, the smartphone market has matured to a point where incremental flagship improvements are genuinely hard to differentiate. The gap between a flagship from 2023 and 2024 is often just computational photography improvements, slightly faster processors, and cosmetic changes. Consumers increasingly notice this. Phone upgrade cycles have lengthened significantly, with average replacement times now sitting around 3-4 years for most users.

Second, Nothing has finite resources as a newer brand. Splitting development between a flagship and multiple variants stretches engineering teams thin. By consolidating around the Phone 3 as the flagship and pouring resources into the 4A, Nothing can potentially deliver more meaningful improvements in a specific segment rather than spreading thin across the lineup.

Third, there's a perception management angle. Companies that constantly refresh flagships get accused of planned obsolescence. By deliberately spacing out flagship releases, Nothing positions itself as thoughtful and consumer-first, even if the business logic is identical to what other companies do.

Pei's quote about not wanting "to churn out a new flagship every year for the sake of it" directly addresses this positioning. It's saying: we're not slaves to marketing calendars. We're engineering-focused. We'll wait until we have something meaningful to show. In a market saturated with hype, this messaging resonates with a specific type of consumer—the one who reads spec sheets rather than just looking at marketing photos.

The Phone 4A as the Real Innovation Play

While the Phone 4 gets the headlines for not existing, the Phone 4A is where Nothing's actually putting its innovation chips. This is the interesting part of the announcement, because it reveals where the company genuinely sees growth and opportunity.

Pei described the 4A as "a complete evolution over its predecessor across the board, from display, to camera, to overall performance." This language is specific. He's not saying "better spec bumps." He's saying "complete evolution," which suggests fundamental rethinking rather than just faster chips and additional megapixels.

For context, the previous 3A was a solid device but clearly cost-compromised compared to the flagship 3. The display was adequate but not exceptional. The camera worked fine but couldn't match the flagship's capabilities. Performance was good enough for daily use but stuttered on demanding tasks. If the 4A is a "complete evolution," Nothing is essentially trying to compress flagship-level experience into the midrange price point.

This is genuinely difficult to accomplish. Every smartphone maker tries to do this, and most fail because compromises become obvious when you use the phone daily. The thermals suffer because you can't justify the same cooling solutions at midrange prices. The optics don't match because premium sensors and lenses cost money. The software gets feature-limited because not all processors support the same capabilities.

But this is also where Nothing has a structural advantage. The company doesn't have the legacy product lines and carrier relationships that constrain Samsung or other manufacturers. Nothing can make weird decisions. They can use unconventional suppliers. They can skip certain markets entirely if it doesn't make business sense.

The mention of "premium materials" is also telling. This suggests nothing won't use plastic backs or other obvious cost-cutting measures. The use of quality materials usually drives up prices, which means the 4A pricing might be higher than previous A-series phones. That's a risk, because the A-series audience often prioritizes price over prestige. But it also positions the 4A as something genuinely different from what competitors offer at similar price points.

Estimated data shows a trend towards longer smartphone replacement cycles, potentially reaching 4.5 years by 2028. This reflects technological plateaus and market shifts towards sustainability.

The Color and Design Innovation Angle

Pei specifically mentioned "bold new experimentation in terms of color" for the 4A, and this detail matters more than it might appear. Nothing has built its entire brand identity around distinctive design, particularly the transparent backs and glyph interface that made the Phone 3 immediately recognizable.

Color is one of the few design elements that feels fresh without requiring massive R&D investment. A new color doesn't need new silicon or different camera sensors. It's marketing-friendly and manufacturing-flexible. But "bold new experimentation" suggests Nothing isn't thinking about simple color variations. The language implies something more ambitious.

This could mean several things. Maybe it's collaborative colors with designers or artists. Maybe it's color-changing materials that shift in different lighting. Maybe it's returning to some of the wild color palettes that other brands have abandoned. Whatever it is, the fact that Pei mentioned it specifically suggests the design team has something genuinely interesting in the pipeline.

Design differentiation is becoming increasingly important because hardware specs have plateaued. Two phones with the same processor and camera sensor will perform identically on benchmarks, but if one looks distinctly better or more unique, that psychological factor influences purchase decisions more than you'd expect. That's especially true in the Instagram age where phones appear in content constantly.

Nothing's commitment to design-forward phones positions them similarly to how Apple uses design as a primary differentiator. Most Android manufacturers treat design as an afterthought—they spec the chip first, then wrap plastic and metal around it. Nothing does the opposite. The design language comes first, and everything else is architecture around that vision.

Industry-Wide Implications: Breaking the Annual Cycle

If Nothing successfully maintains this "no annual flagship" strategy and the Phone 4A succeeds, it could have ripple effects across the industry. Not everyone will follow, but it might give permission to other companies to break the cycle.

Consider the economic pressures that drive annual launches. Smartphone makers need quarterly earnings growth. Shareholders expect refresh cycles. Carriers want new phones to drive upgrade incentives. The entire supply chain—from component manufacturers to marketing agencies—is built around annual launches.

Breaking this cycle requires either tremendous confidence in your ability to generate growth through other means, or comfort with slower growth. Nothing has chosen the former, betting that they can build customer loyalty and brand strength without the annual refresh treadmill.

This mirrors what happened with gaming consoles. Microsoft and Sony used to chase shorter cycles, but they found that launching every 5-7 years actually works better. It gives developers time to master the hardware. It keeps prices higher longer. It reduces e-waste. And it allows companies to make bigger jumps in capability when they do launch.

Smartphones could theoretically move in the same direction. The technology plateau is real. Battery tech hasn't dramatically improved in years. Processing power is ahead of what software needs. Camera improvements are incremental. The biggest innovation in phones recently has been AI integration, which can largely be delivered through software updates.

If more manufacturers followed Nothing's path, it would reshape the entire industry. Phone prices might stabilize. People might keep devices longer. The used market would shift. Component suppliers would need to adjust capacity planning. It would be genuinely disruptive.

Understanding the Phone 3 as the Flagship Anchor

By keeping the Phone 3 as the flagship, Nothing has essentially bought itself time to breathe in a market that rarely allows such luxury. The Phone 3 is less than two years old (as of this announcement in early 2026), which means it's still competitive with phones that launched more recently.

Looking at flagship phone lifecycles, most devices drop significantly in competitive ranking by year two. By year three, they're often considered outdated even if they function perfectly fine. Nothing is betting that the Phone 3 is different—that its design and core capabilities have enough staying power to remain relevant as the flagship choice for another year or more.

This requires something most flagships don't have: timeless design. And here's where Nothing's transparent back and clean industrial design actually has an advantage. Look at flagship phones from 2019-2020 and they look dated now. Look at Nothing's Phone 1 from 2022 and it still looks contemporary. The design language simply isn't trendy in a way that dates itself.

The Phone 3 also has solid specifications for a 2025 device. The Snapdragon chip is capable. The camera system is actually quite good. The display is high-refresh-rate OLED. The battery life is reasonable. None of these are class-leading anymore, but they're not embarrassing either.

The bet is that keeping the flagship stable allows Nothing to allocate more resources to software improvements. Better camera processing. Performance optimizations. New features in Nothing OS. These updates don't require new hardware, and they can genuinely improve the experience for existing users.

Compare this to most flagship manufacturers, who release a new phone and immediately start pulling developers off the old model to work on the next generation. Nothing is instead saying: let's keep supporting the Phone 3 seriously for another year while we improve the rest of the lineup. It's a different philosophy that actually serves users better, even if it's not what the marketing departments prefer.

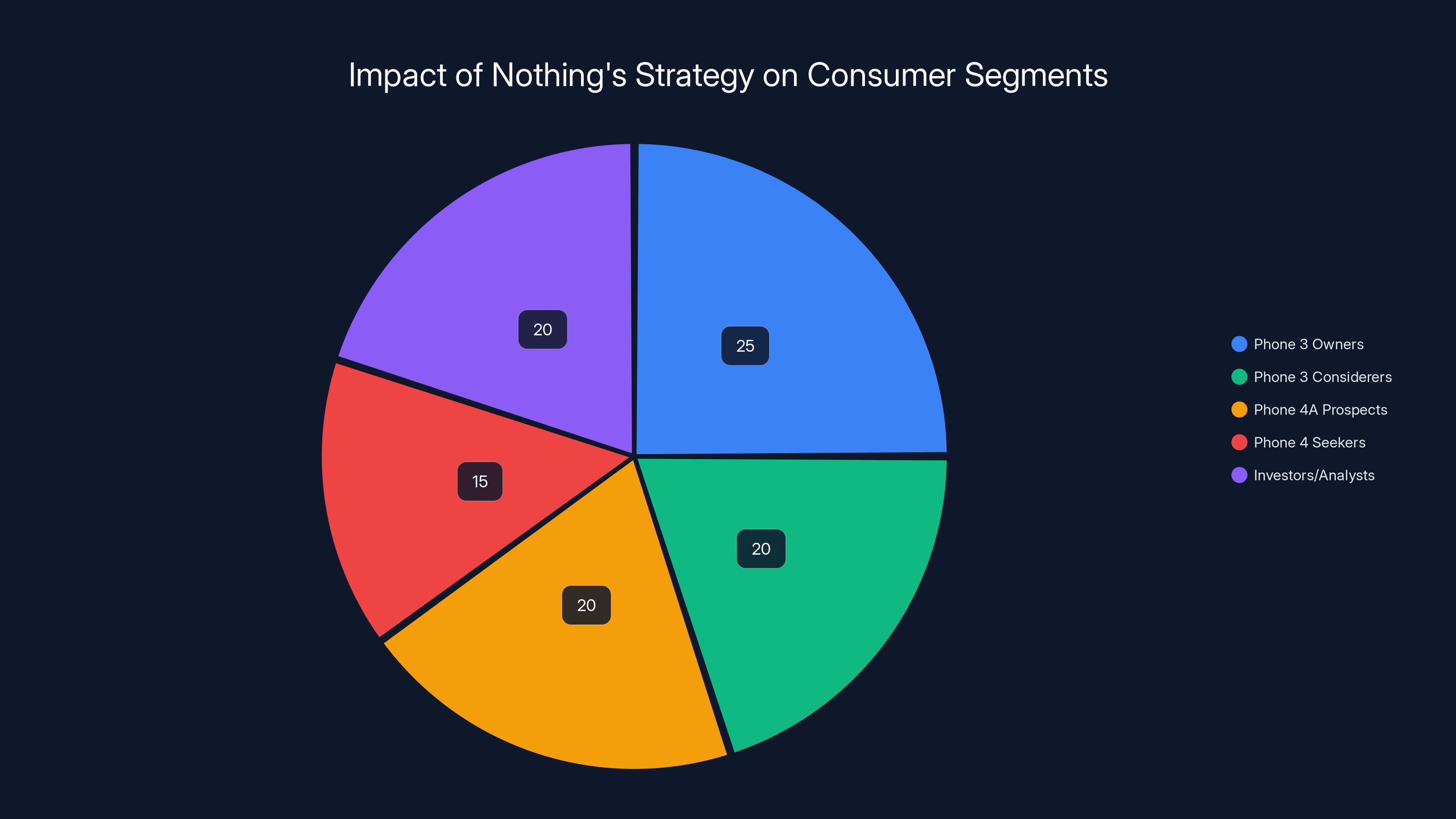

Estimated data shows that Phone 3 owners and considerers, along with Phone 4A prospects, form the majority of positively impacted segments, while Phone 4 seekers are the least satisfied.

The Competitive Landscape: Why Timing Matters

Nothing's decision to skip 2026's flagship launch happens at a specific moment in the smartphone market. This timing is important context.

Apple just released the iPhone 17 lineup in fall 2025, and they'll do the same in fall 2026. Samsung's Galaxy S lineup is on its annual refresh. Google's Pixel phones are cycling annually. OnePlus, Motorola, and other brands all have flagship refresh cycles locked in.

By skipping 2026, Nothing is essentially deciding not to compete directly against what will be the newest iPhone, Galaxy, and Pixel lineups. This is either smart or risky depending on perspective. The smart argument: why exhaust resources competing against three months of hype for new flagships? Focus where you can differentiate. The risky argument: people shopping for flagships in 2026 will choose from iPhone 17, Galaxy S26, and Pixel 9, probably not remembering Nothing has the 2025 Phone 3.

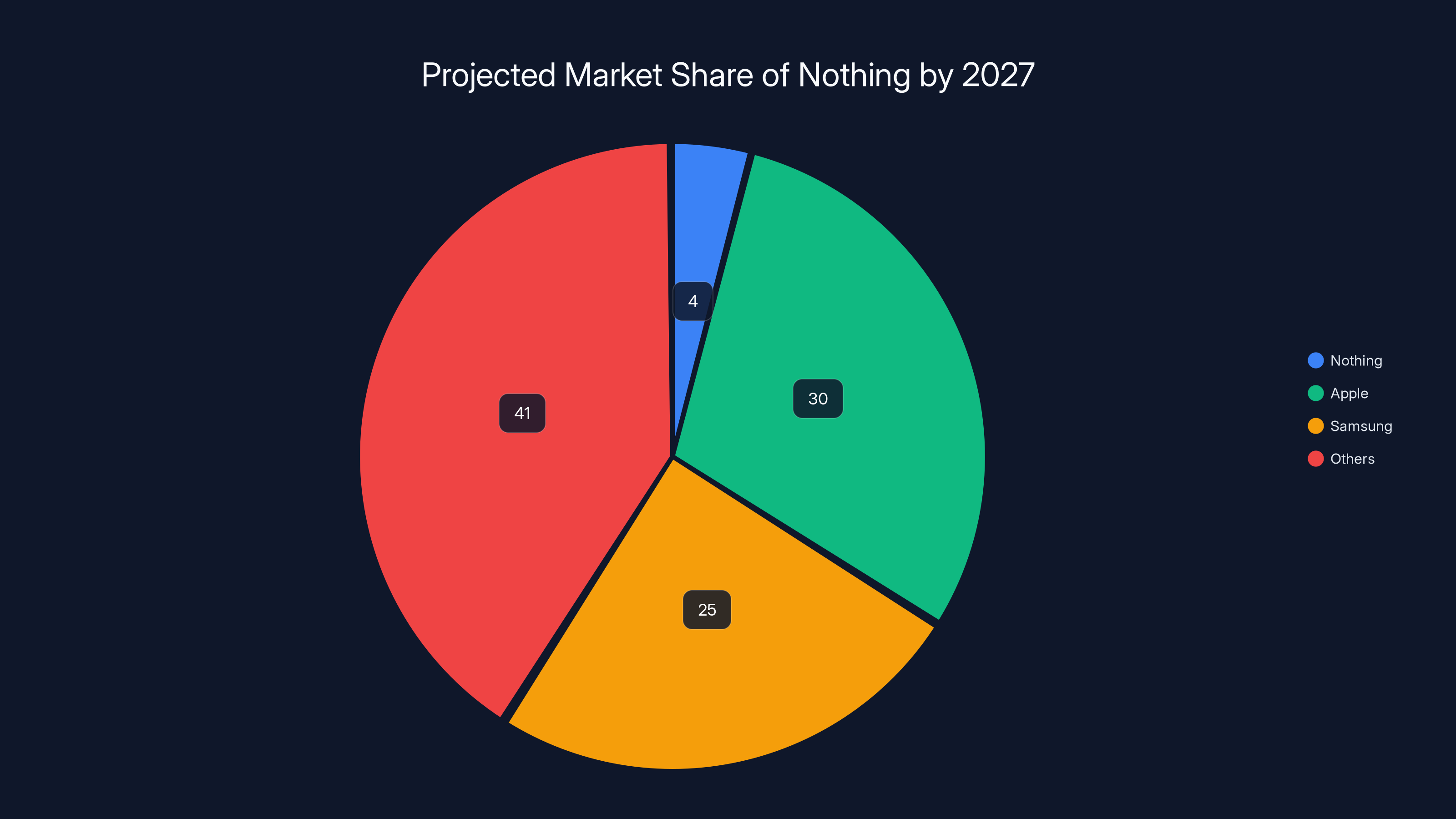

Nothing's market share is already small—probably around 2-3% globally depending on region. The company isn't going to overtake Apple's dominance or Samsung's market position in the next year anyway. So the question becomes: how does a small player maximizing resources compete? And the answer is: you don't compete where the big players are strongest. You compete where they're ignoring or taking for granted.

The midrange is actually where this logic works. Samsung's A-series and Apple's SE are mature products, but they're not where either company's focus is. Google's budget Pixels don't get the same design attention as the flagship. And OnePlus's midrange phones are often forgotten in the shadow of the flagship line.

If Nothing can make the 4A significantly better than competitor midrange options, they could actually gain share there. And midrange is where volumes are higher anyway. One popular midrange phone beats three competing flagship models in total units sold.

What This Means for Different Consumer Segments

Nothing's strategy affects different groups of potential customers very differently. Let's break it down.

For Nothing Phone 3 owners: The announcement is basically good news. Your phone remains the flagship, gets continued support, and won't be immediately superseded by a flashy new model. Resale value stabilization. Continued software updates. No pressure to upgrade next year.

For people considering the Phone 3: The decision actually makes it more attractive. You're buying a phone that the company has committed to keeping as flagship-tier for at least another year. That suggests continued developer attention and software support. It's a safer purchase than buying a phone the company is already moving past.

For Phone 4A prospects: These are people who wanted a Nothing phone but balked at flagship pricing or wanted smaller form factors. The 4A announcement suggests substantial improvements, which could make it genuinely competitive against midrange flagships from bigger brands.

For people who wanted a Phone 4: This is the only segment disappointed. If you were hoping for a new flagship with the latest chips and design, you'll have to wait until at least 2027. Or you switch to Samsung, Apple, or Google. This is a real risk for Nothing—you might lose potential customers who were ready to upgrade and looking at flagship options.

For investors and analysts: The strategy suggests Nothing is prioritizing profitability and long-term brand building over short-term market share growth. That's actually attractive to serious investors but worrying to those betting on rapid expansion.

The reality is that Nothing is making a deliberate choice to be smaller but more thoughtful. They're accepting that they'll lose some customers who want the latest flagship hype. In exchange, they're building reputation as a company that actually respects its users' time and money.

The Philosophy Behind the Decision

Pei's statement that "just because the rest of the industry does things a certain way it doesn't mean we will do the same" reveals the underlying philosophy. This isn't unique marketing speak—it's actually a fundamental positioning that goes back to Nothing's founding.

Nothing was founded on the premise that the phone industry had become too formulaic. Every company was copying every other company's playbook. The design language had converged. The feature sets were identical. Nothing was going to be different, which is why the transparent back and glyph interface actually mattered—they were genuinely different ideas.

But differentiation can't just be design gimmicks if you want to build a sustainable company. Real differentiation comes from fundamentally different ways of thinking about problems. Skipping the annual flagship launch is part of that different thinking. It says: we're not playing the same game as Samsung and Apple. We're not competing on the same metrics.

This is actually quite risky because it's betting on a counter-cultural positioning that might not resonate widely. Most people probably don't care whether Nothing launches annually or every two years. What they care about is whether the phone works well and looks good.

But for a small brand trying to build loyalty against much larger competitors, differentiation in philosophy can be surprisingly powerful. It creates narrative. It gives media something to talk about. It attracts users who are genuinely tired of the traditional smartphone industry playbook.

The risk is that people get bored waiting for the next flagship, or competitors manage to differentiate more effectively. But the potential upside is building a brand that people actually trust and want to support, rather than just defaulting to Apple because everyone else does.

The average smartphone replacement cycle has extended from 2 years in 2010 to approximately 4 years in 2022, reflecting consumer trends towards longer device usage. (Estimated data)

Financial and Strategic Implications

From a pure business perspective, this decision has several interesting implications.

First, it suggests Nothing isn't under immediate revenue pressure. A company struggling financially would typically accelerate product launches, not extend timelines. The fact that they're willing to skip a flagship launch suggests investor confidence and sufficient cash runway.

Second, it reveals where Nothing thinks profitability actually comes from. If the company believed flagship sales were the main profit driver, this would be financial suicide. But if midrange volumes drive most revenue, skipping flagship makes sense economically.

Third, it's a hedge against the possibility of smartphone market decline. If people are genuinely keeping phones longer and upgrading less frequently, then flooding the market with annual flagships becomes wasteful. Better to maintain flagship prestige while building solid midrange volume.

Fourth, there's the R&D optimization angle. Flagship development is expensive. Multiple design iterations, cutting-edge component sourcing, pushing manufacturing tolerances. The Snapdragon 8 Elite costs more to license than the 8 Gen 3 Elite. These costs add up. By skipping a year, Nothing saves development costs that can be reinvested in the 4A and other products.

Fifth, the move affects supply chain strategy. Component manufacturers and contract manufacturers can plan better with less volatility. Design partners can focus deeper on fewer products. Manufacturing can optimize for stability rather than constant retooling.

None of this guarantees success. A company could have all these strategic advantages and still fail if the products are mediocre or if market conditions shift unexpectedly. But the financial logic of skipping a flagship cycle isn't as crazy as it initially seems—it's actually quite rational from a long-term planning perspective.

The Phone 4A's Burden: Delivering on Expectations

While the Phone 4 announcement gets attention, the real pressure falls on the Phone 4A to actually deliver on Pei's promises. The burden of expectation here is substantial.

The 3A was competent but clearly the budget option. It was acceptable if you wanted Nothing's design language at a lower price point. But "acceptable" doesn't drive word-of-mouth or loyalty. The 4A can't just be slightly better—it needs to genuinely close the gap with the flagship.

This is harder than it sounds. Flagships have cost advantages through scale and supplier relationships that midrange phones can't match. A flagship might get the latest Snapdragon chip at better pricing because they order millions of units annually. They can negotiate better deals on OLED panels. They can absorb higher costs because customers expect to pay more.

But here's where Nothing's smaller scale actually becomes an advantage. They don't have legacy supply chain commitments. They can be flexible. If using a slightly older but still capable Snapdragon chip costs half the price, they can do that without worrying about alienating dozens of carrier partners who have specific expectations.

The design differentiation through color and materials could also give the 4A an advantage over competitors' midrange phones, which tend to be quite boring. Nothing can make a midrange phone that's actually desirable from a design perspective, not just a budget alternative.

The real test will be pricing. If the 4A costs

Pei didn't mention pricing in the announcement, which either means they haven't locked it yet or they're avoiding the anchor before the reveal. The full specifications will likely come with a formal announcement closer to the actual release date.

Software and Service as Differentiators

One advantage Nothing hasn't explicitly mentioned but has in reality is the ability to differentiate through software and services, not just hardware.

Nothing OS is relatively simple and clean, which appeals to Android purists. But it's also completely customizable through partnerships and integrations. Nothing could theoretically add AI features, unique camera software, or exclusive partnerships that differentiate the experience beyond raw hardware specs.

For instance, integration with specific cloud services, exclusive AI features, or partnerships with app developers could make the 4A feel premium even if the silicon isn't cutting-edge. Apple does this constantly—the iPhone isn't always the most powerful phone, but the integration between hardware, software, and services makes it feel more capable.

Nothing could also use the 4A as an entry point to broader ecosystem play. Hypothetically, owning a Nothing phone could give you benefits or features when used with Nothing smartwatches, earbuds, or other products. This creates stickiness beyond just the phone itself.

The smartphone-as-hub philosophy is growing stronger. People aren't just buying devices in isolation; they're buying into ecosystems. Nothing has an opportunity to position the 4A as entry point to their broader ecosystem, with benefits that increase as you adopt more Nothing products.

Estimated data suggests Nothing could achieve a 3-5% market share by 2027, positioning itself as a design-first hardware company. This would allow them to maintain a healthy business without directly competing with giants like Apple and Samsung.

Regional Strategy and Market Variations

Nothing's strategy isn't uniform globally. The company likely has different market approaches in different regions.

In India, Nothing has developed a meaningful presence. The smartphone market is competitive but values design and brand differentiation differently than Western markets. Design-forward phones without flagship pricing can be very successful there.

In Europe, Nothing has also built presence, particularly in design-focused markets like the UK and Germany. The western market tends to be more price-sensitive and Apple/Samsung dominated, but smaller brands can carve out niches if they're distinctive.

In the US, Nothing has almost no presence. The market is dominated by Apple, Samsung, Google, and OnePlus. A new brand trying to break in needs either aggressive pricing or a unique angle that resonates. Nothing's design-forward approach could work, but it requires marketing investment and carrier relationships that take time to build.

Nothing's decision to skip the Phone 4 flagship might make sense in India and Europe where the brand is more established. In the US, it's riskier because you're not competing for the flagship mindshare in a market where that's disproportionately important for brand perception.

Regional flexibility is important here. Nothing could theoretically launch the Phone 4 in certain markets while skipping it in others. This would allow them to maximize opportunity where it exists while not overextending where it doesn't.

The Elephant in the Room: What About Flagship Features?

There's a practical challenge that Nothing hasn't addressed in the announcement: what happens when new processors or camera technologies are so good that not having them in a flagship becomes a competitive liability?

Imagine the Snapdragon 9 Gen 3 Elite (or whatever it's called) comes out in late 2026 and it's so much better than the Snapdragon that's in the Phone 3 that the gap becomes immediately obvious. Or a new camera sensor becomes available that offers capabilities the Phone 3 can't deliver. At what point does waiting for the Phone 4 become untenable?

Nothing could answer this by doing major mid-life updates to the Phone 3, but there are limits to what you can improve without hardware changes. You can't make the camera better with software if the sensor itself is limited. You can't make processor-intensive AI features work if the chip doesn't support them.

This is where the "complete evolution" promise for the 4A becomes important. If the 4A is truly the second-best option, it gives flexibility. Not everyone needs the absolute cutting edge. Many people would choose the 4A if it's genuinely good enough.

But flagships have always been the first choice because they're the absolute best. If that changes—if the 4A becomes the better value and the Phone 3 starts to feel dated—it undercuts the entire strategy.

Nothing is implicitly betting that the technology improvements from 2025-2026 won't be dramatic enough to make the Phone 3 seem outdated. This is a calculated risk. It could be right, or the market could move faster than expected.

User Experience Implications: When Software Replaces Hardware

One of the underappreciated aspects of the Nothing strategy is how it shifts focus toward software and user experience rather than raw hardware chasing.

When companies are constantly iterating hardware annually, software often suffers. Features get half-baked because the team is already thinking about the next generation. Updates slow down because engineering talent is allocated to new products.

By stabilizing the flagship, Nothing could theoretically invest more in software quality. Better optimization. Fewer bugs. More thoughtful features. Camera software that really masters the existing hardware's potential rather than always chasing new camera sensors.

This is speculative, but it's plausible. The best phones often aren't the latest ones—they're the ones that have had 18 months of software refinement. By giving the Phone 3 an extra year of support and focus, Nothing could actually make it a better device experience by the time the Phone 4 launches in 2027.

User experience has become surprisingly important in phone differentiation. Most flagship phones are reliable and perform well now. The differences are in the details—how smooth animations are, how intuitively features are organized, how responsive the UI feels. These things are determined as much by software engineering as hardware specs.

Nothing could win loyalty by being the company that actually makes the interface feel good, not just listing better specs on paper.

The Phone 4A is expected to offer significant improvements in display, camera, and performance compared to the Phone 3A, based on the CEO's emphasis on 'complete evolution'. Estimated data.

The Broader Industry Trend: Flagship Fatigue

Nothing's strategy exists within a larger context of flagship phone fatigue in the market.

Consumer surveys consistently show that people keep phones longer than they used to. The average replacement cycle has extended from 2-3 years to 3-4 years or longer. This is partly financial—phones are expensive—and partly because the differences between devices have become minor.

Carriers are also pushing less aggressively toward upgrades. The unlimited plans and device financing make sense for incumbents, but the urgency to replace is gone. You can keep your three-year-old phone on a plan just fine.

The used phone market is also maturing. Refurbished flagship phones from a year or two ago can compete with new midrange phones at lower prices. This cannibalizes new phone sales, especially in price-conscious markets.

Regulatory pressure is also increasing around e-waste and device longevity. The EU is pushing right-to-repair laws. Extended software support is becoming expected. All of this incentivizes fewer launches, not more.

Nothing's decision to skip flagship launches isn't bucking a trend—it's actually riding one that's already in motion. Other companies will probably follow suit eventually, because the economics increasingly favor it.

The question is whether being first or early with this strategy gives competitive advantage or just shows weakness. Time will tell, but the early signs from Nothing's growth trajectory suggest the bet is paying off.

What to Expect From Nothing in 2027 and Beyond

Assuming the Phone 4A succeeds and Nothing maintains this strategy philosophy, what's the likely trajectory?

2027 Phone 4: Probably a major redesign with new technology, since Nothing will have two years between launches. This suggests they'll wait for important new capabilities to arrive rather than rushing.

Software trajectory: Nothing OS continues evolving, potentially with more AI integration and exclusive features that differentiate from stock Android.

Ecosystem expansion: More wearables, earbuds, tablets potentially. Nothing could position as a design-first hardware company, not just a phone brand.

Possible exit scenarios: Nothing could get acquired by a larger tech company, go public, or continue as a private company. The founder-led structure and thoughtful product strategy actually makes acquisition appealing to larger companies looking for design talent.

Market share: Realistically, Nothing probably caps out at 3-5% global share unless they do something dramatically different. That's still a healthy business for a small brand and doesn't require competing head-to-head with Apple or Samsung.

The interesting question is whether this strategy becomes a template for other brands. If Nothing succeeds financially while skipping flagship launches, you'll see others follow. If they struggle while competitors thrive on annual cycles, the industry learns the opposite lesson.

Likely the truth is somewhere in the middle. Nothing probably does fine with this strategy in design-conscious markets like Europe and Asia, while struggling in markets like the US where flagship prestige matters disproportionately.

Competitive Responses: Will Others Follow?

If Nothing's strategy works, expect to see competitive responses from other companies.

OnePlus (Oppo subsidiary): Might extend flagship cycles but probably won't fully adopt Nothing's approach because they're embedded in a larger corporate structure.

Samsung: Too committed to annual Galaxy refreshes and investor expectations. Unlikely to change.

Google: The Pixel is deeply tied to Android launch cycles. They'll probably keep annual releases.

Apple: Needs the iPhone refresh cycle for iPhone segment growth. Unlikely to change.

Motorola: Could potentially adopt this strategy but is also tied to quarterly business cycles.

The companies most likely to follow Nothing's path are smaller, newer brands without the structural constraints of major corporations. Brands like Nothing, Realme, Poco, and others that are more agile could potentially shift to longer flagship cycles.

What's more likely is a bifurcation. Premium flagship segment keeps annual releases because that's where prestige and margin live. Midrange and budget segments extend cycles because that's where smart buying decisions trump fashion cycles.

Nothing's real insight might be that the midrange is where the actual future is, and they're positioning there early with a premium product rather than a cheap phone. That's a different competitive positioning than most brands attempt.

Marketing and Consumer Communications

One often overlooked aspect of product strategy is how you market it. The way Nothing communicates this decision matters as much as the decision itself.

Positive framing: "We're taking extra time to make meaningful improvements rather than iterating annually like everyone else." This appeals to thoughtful consumers and differentiates on brand personality.

Risk in framing: "We can't afford to make a flagship this year," which is how some might interpret it despite that not being accurate.

Nothing's marketing will need to emphasize the thoughtfulness angle, the design philosophy, the commitment to users over quarterly profits. This plays to their existing brand positioning.

The risk is that markets and segments that don't value this narrative just think Nothing phones are obsolete or the company is struggling. In the US specifically, this messaging might not land well. Americans tend to prefer more frequent updates and the perception of always having the latest.

Nothing's global marketing strategy should probably vary by region. In Europe, emphasize thoughtfulness and sustainability. In India, emphasize design and value. In the US, they might need to emphasize technical capabilities and performance rather than philosophy.

Future of the Smartphone Market: Towards Longer Cycles

Zooming out from Nothing specifically, the decision reflects a larger evolution in the smartphone market toward longer product cycles.

The reasons are multiple. Battery technology has plateaued—we're not getting dramatically better batteries every year. Processor improvements are incremental once you're above a threshold where performance is sufficient. Camera improvements are computational more than optical—better algorithms, not necessarily better sensors.

Five years ago, there was genuine differentiation between flagship and midrange. Today, the gap is smaller. A

This is actually healthy for the industry from a sustainability perspective. Fewer phones manufactured means less e-waste, less environmental impact, less resource extraction. Longer device lifecycles mean better total cost of ownership for consumers.

The challenge is that the entire industry is built on growth. Phone makers need to grow revenue annually. Carriers need to grow subscribers. Component suppliers need to grow orders. A shift toward longer cycles disrupts this growth model.

Some companies will adapt by competing on services, ecosystem value, and software rather than hardware generations. Some will struggle because they don't know how to compete on anything except specs. This disruption is exactly what markets need—it filters for companies that actually add value versus ones that just chase cycles.

Nothing's strategy is essentially betting on this future arriving soon and positioning now for a market where frequency matters less and thoughtfulness matters more.

FAQ

Why didn't Nothing release a Phone 4 in 2026?

CEO Carl Pei stated that the company doesn't want to "churn out a new flagship every year for the sake of it" and instead prefers to release phones only when they have "significant" upgrades to deliver. By keeping the Phone 3 as the flagship for another year, Nothing can allocate more resources to genuinely improving the Phone 4A midrange series rather than spreading development thin across a flagship update cycle.

What does "complete evolution" mean for the Phone 4A?

According to Pei, the Phone 4A will be a "complete evolution" across display, camera, and overall performance compared to the Phone 3A. This suggests substantial improvements rather than incremental bumps, positioning the 4A closer to a flagship experience than previous A-series phones. The exact specifications weren't announced, but the language indicates fundamental rethinking rather than just adding megapixels or making the processor slightly faster.

Is the Phone 3 still competitive by 2026?

Yes, Nothing is betting that the Phone 3 remains competitive enough as a flagship into 2026 and potentially beyond. The device launched in 2025 with solid specifications—capable processor, OLED display, respectable camera system—and Nothing's design language doesn't age as quickly as competitors' phones tend to. By focusing on software improvements and feature additions rather than hardware replacements, Nothing can keep the Phone 3 relevant longer than traditional annual flagship cycles allow.

When will the Phone 4 actually launch?

Nothing hasn't announced an official date for the Phone 4, but the company's statement that it won't arrive in 2026 implies a 2027 launch or later. By skipping a year, Nothing is essentially buying time to ensure the Phone 4 brings significant enough improvements to justify its existence and investment. This gives the company flexibility to wait for important new technologies or capabilities rather than forcing a launch just because it's time for the annual refresh cycle.

How does Nothing's strategy compare to competitors?

Most major manufacturers like Apple, Samsung, and Google maintain annual flagship launch cycles to drive revenue growth and satisfy investor expectations. Nothing's approach is unconventional, more similar to how gaming console manufacturers or premium automotive brands operate with longer development cycles. This positions Nothing as differentiated but also carries risk if consumers expecting new flagships annually choose competitors instead.

What's the significance of the "bold new experimentation" in colors?

CEO Pei's mention of new color options suggests the Phone 4A design team has something visually distinctive in development beyond standard color variations. Given Nothing's brand identity around distinctive design and transparency, bold color experimentation could mean collaborative designs, color-changing materials, or returning to palettes that major manufacturers have abandoned. Design differentiation is important for Nothing because it's one of few areas where a small brand can compete without matching competitor budgets.

Will software support continue for the Phone 3?

While not explicitly stated, Nothing's commitment to keeping the Phone 3 as flagship implies continued software support and feature development for the device. Companies typically maintain longer software support for phones that remain part of the active lineup. However, specific support timelines and OS update guarantees weren't announced, so potential buyers should verify these details before purchasing.

Is the Phone 4A a budget phone or premium phone?

Based on Pei's description of premium materials and "complete evolution" across key components, the Phone 4A is positioned as an elevated midrange device rather than a budget phone. It's designed to offer more premium experience and capabilities than typical A-series midrange phones, though specifics on pricing and exact positioning versus competitors weren't provided in the announcement.

What happens if new smartphone technology makes the Phone 3 obsolete?

This is a legitimate risk to Nothing's strategy. If breakthrough technologies in processor capabilities, camera sensors, or other areas emerge in 2026, the Phone 3 could feel dated faster than expected. Nothing has hedged this by positioning the Phone 4A as a strong alternative, but there's an inherent risk in skipping flagship cycles. The company is betting that technology advancement will be incremental rather than revolutionary, which is historically accurate but not guaranteed.

Conclusion: A Different Path for a Different Brand

Nothing's decision to skip the Phone 4 flagship and focus resources on the Phone 4A midrange represents a genuinely different strategic choice in an industry built on predictable annual cycles. This isn't marketing differentiation—it's structural differentiation that affects how the company develops products, allocates resources, and positions itself against larger competitors.

Carl Pei's statement that Nothing won't just "churn out a new flagship every year for the sake of it" cuts to the heart of what makes this decision significant. Most companies do exactly that—launch not because they have meaningful innovation, but because the marketing calendar and investor expectations demand it. Nothing is explicitly rejecting that logic.

Whether this strategy succeeds depends on multiple factors. The Phone 4A needs to deliver on Pei's promise of "complete evolution" and justify its positioning between the Phone 3 and traditional midrange competitors. Consumers need to value the philosophy of less-frequent-but-better launches over the prestige of always having the newest flagship. The smartphone market needs to actually be plateauing in capability growth as expected, not accelerating unexpectedly.

If all of that aligns, Nothing could pioneer a template that other small brands follow, essentially proving that you don't need annual flagship launches to build a successful phone company. You need thoughtful products, distinctive design, and genuine customer respect—things that are harder to measure than quarterly revenue but more valuable long-term.

If the strategy doesn't work, Nothing might discover that markets still demand the symbolic prestige of flagship phones even if the performance gaps have shrunk. That would be a valuable lesson for other companies considering similar paths.

What's certain is that Nothing's announcement signals a fundamental question being asked in the smartphone industry: do we need this annual refresh cycle, or have we built it that way because it's profitable, not because it's necessary? A small brand like Nothing can afford to ask those questions. Larger companies with investor obligations can't. But if the answer turns out to be that the cycle isn't necessary, eventually even large companies will have to adapt.

For now, the Nothing Phone 3 remains the flagship, the Phone 4A becomes the focus, and the phone that might never come stays in the imagination of a market getting progressively tired of perpetual newness over actual progress.

Key Takeaways

- Nothing CEO Carl Pei confirmed no Phone 4 flagship launching in 2026, keeping Phone 3 as the company's flagship device.

- The Phone 4A will receive substantial improvements across display, camera, and performance, positioned closer to flagship experience than previous A-series phones.

- Nothing rejects the annual flagship refresh cycle followed by competitors, betting on meaningful upgrades over marketing calendars.

- The midrange segment represents 70% of global smartphone sales, making the 4A focus strategically sound for volume and profitability.

- Smartphone replacement cycles have extended to 3.8+ years, supporting longer development timelines and reduced annual launches.

Related Articles

- This Week in Tech: Apple's AI Pin, NexPhone's Triple OS, and the Sony-TCL Merger [2025]

- Small Phones Are Making a Comeback in 2025 [2025]

- OnePlus Denies Demise Rumors: What's Really Happening [2025]

- iPhone 18 Pro Design Leak: New Colors & Changes [2025]

- Why I Miss the iPhone 5s: The Phone Design Apple Got Right [2025]

- 7 Biggest Tech Stories: Apple Loses to Google, Meta Abandons VR [2025]

![Nothing Phone 4 Delayed: What Carl Pei's Strategy Means for 2026 [2025]](https://tryrunable.com/blog/nothing-phone-4-delayed-what-carl-pei-s-strategy-means-for-2/image-1-1769690207063.jpg)