7 Biggest Tech Stories of the Week: Major Shifts in Apple, Google, Meta, and Beyond [2025]

So here's the thing. Every single week, tech companies make announcements that feel huge in the moment. Then you wake up Wednesday morning, check your phone, and realize the entire landscape shifted overnight.

This week? That's exactly what happened.

We're talking about Apple taking a hit from Google in ways nobody predicted. Meta basically admitting its metaverse bet didn't work out. And a cascade of announcements from nearly every major player in Silicon Valley that fundamentally changes how we think about smartphones, artificial intelligence, and virtual reality.

If you missed it, you're not alone. This stuff moves fast. But understanding what happened this week matters because these aren't just corporate news blips. They're signals about where technology is actually headed, not where executives want it to go.

Let's break down all seven stories you need to know about, starting with the biggest bombshell.

1. Apple Gets Outmaneuvered by Google in Search and AI Integration

The Reality: Apple's Search Dominance Cracks

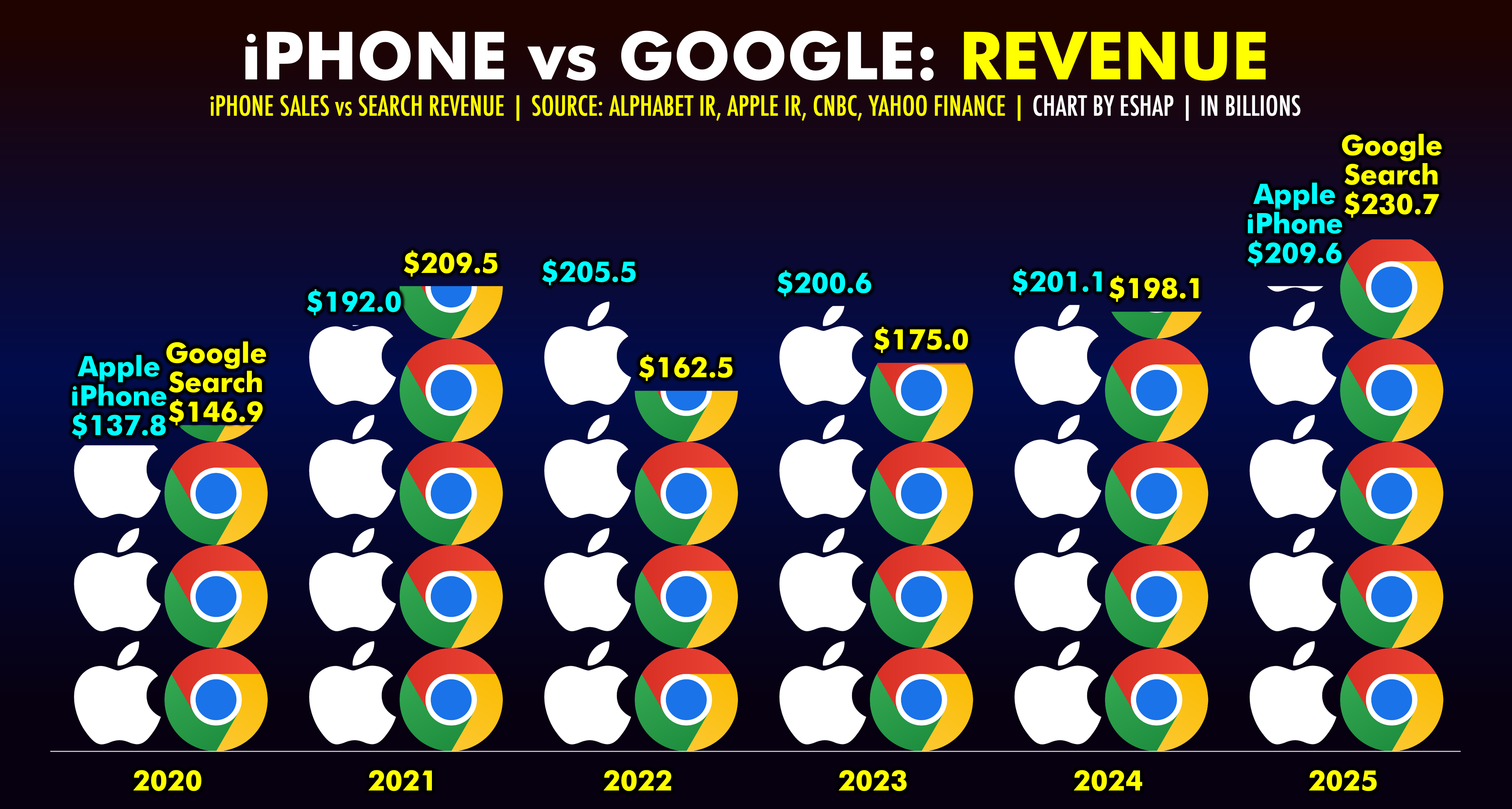

For years, Apple has quietly dominated search through Siri and its default integrations. You ask your iPhone a question, and it works. Not perfectly, but it works. The company made billions from that position without ever building its own search engine.

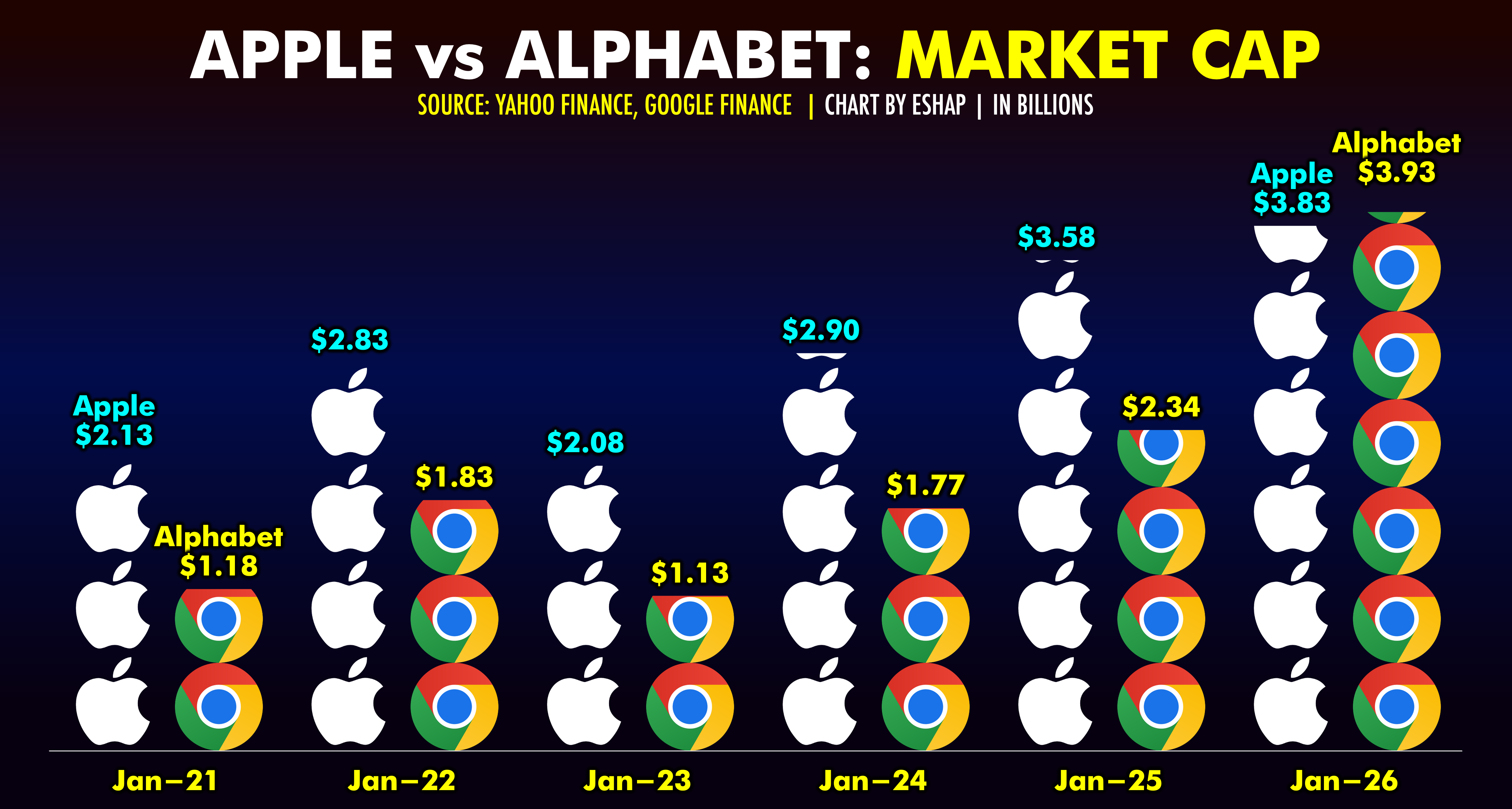

But this week, Google announced deeper integration of its AI directly into Android, iOS, and web experiences in ways that fundamentally break Apple's historical advantage. We're not talking about small feature parity anymore. Google is baking real AI reasoning into its ecosystem, and Apple is suddenly playing catch-up. According to PhoneArena, this shift could significantly impact Apple's market position.

The signals started weeks ago with Google's AI announcements, but this week solidified something uncomfortable: Apple's proprietary approach to AI isn't keeping pace. While Apple Intelligence exists and works reasonably well on newer devices, it's not the same caliber of capability that Google's now pushing into mainstream Android and web experiences.

What makes this worse for Apple? The timing. iPhone sales already face headwinds. Average upgrade cycles are stretching. And now consumers are seeing tangible reasons to switch that go beyond price or design. They're seeing capability gaps.

Why This Matters More Than You Think

Apple's business model depends on ecosystem lock-in. You buy an iPhone because your Mac works with it, because AirPods pair instantly, because the experience "just works." But if Google's AI is measurably better at understanding what you actually want, that lock-in weakens considerably.

This doesn't mean Apple's doomed tomorrow. But it does mean the company's margin for error just got smaller. And Apple doesn't typically operate well under that kind of pressure. They tend to either dominate or abandon markets entirely.

What's fascinating is that this didn't happen because Google built something revolutionary. It happened because Google simply shipped first and shipped consistently. They integrated AI into search, maps, photos, and everything else while Apple deliberated about privacy-first approaches and on-device processing. A Business Insider report highlights how Google's Gemini is set to power Siri's AI capabilities, further emphasizing this shift.

The Broader Signal

The old playbook—where Apple could sit back and profit from first-mover advantages—stopped working this week. Google proved it's willing to burn through capital and resources to win in AI. Apple is now forced to compete on speed and capability, not just design and ecosystem harmony. And that's a game Apple hasn't played well in years.

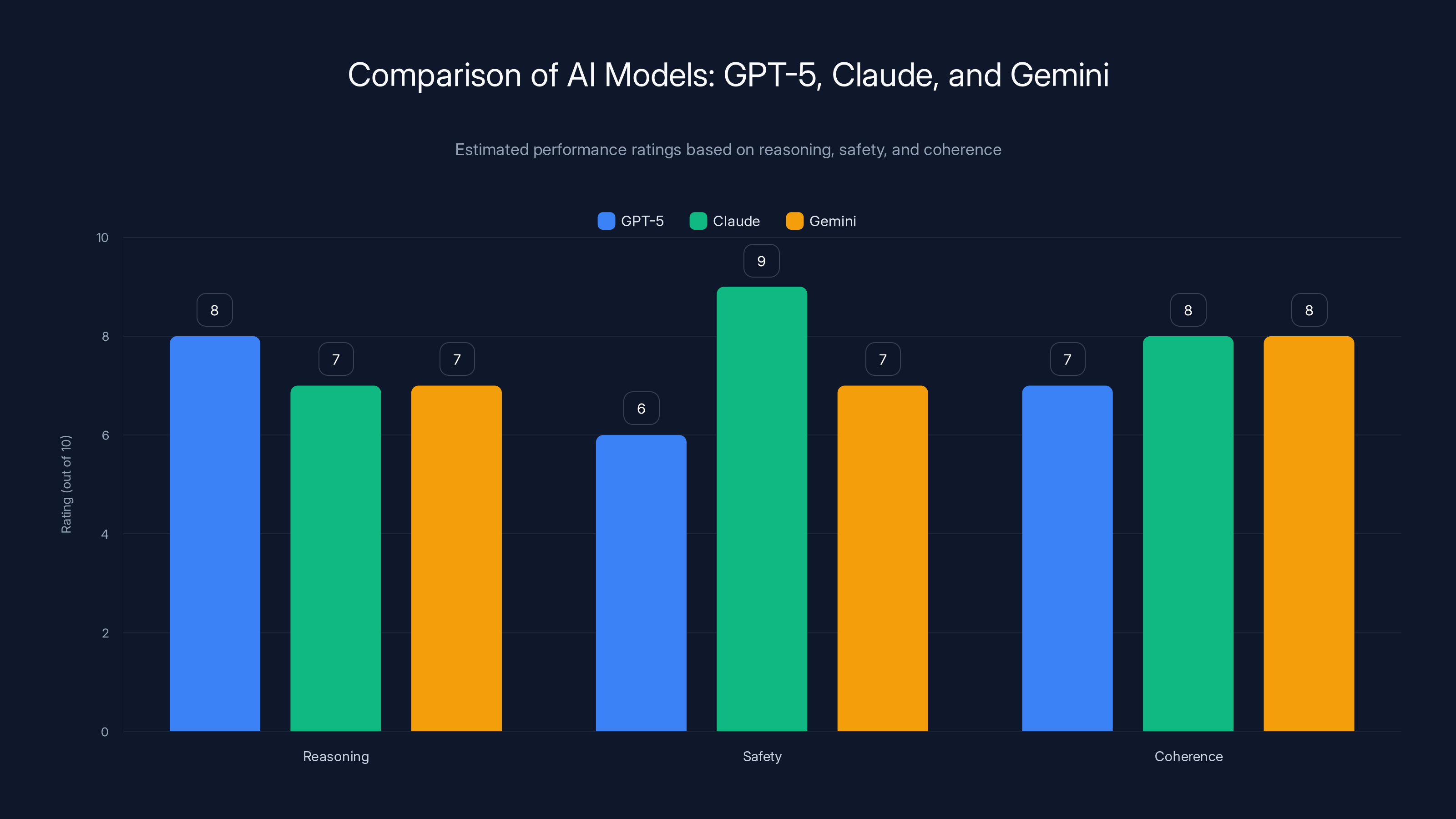

Estimated data shows GPT-5 excels in reasoning, while Claude leads in safety and coherence. Gemini maintains balanced performance.

2. Meta Quietly Abandons Its VR Metaverse Dreams

What Actually Happened

Meta didn't issue a press release with a banner headline reading "We're Giving Up on VR." That's not how these things work in corporate America. Instead, the company reshuffled its Reality Labs division, reallocated billions in R&D spend, and quietly refocused on AI initiatives instead.

But let's be honest about what that restructuring really means: the metaverse bet lost. Not temporarily. Not pending a strategy pivot. Lost.

Remember when Mark Zuckerberg stood on stage and promised the metaverse would be bigger than social media? When Meta committed $10 billion annually to building that vision? When executives confidently predicted billions of people would spend hours daily inside virtual worlds?

Well, those people never showed up.

What Meta discovered—what anyone who tried a Quest headset could have told you—is that VR remains fundamentally uncomfortable for extended use. The social experience feels sterile compared to actual human interaction. And the use cases that do work well (enterprise training, games, niche applications) don't justify a multi-billion-dollar annual commitment.

The Financial Reality

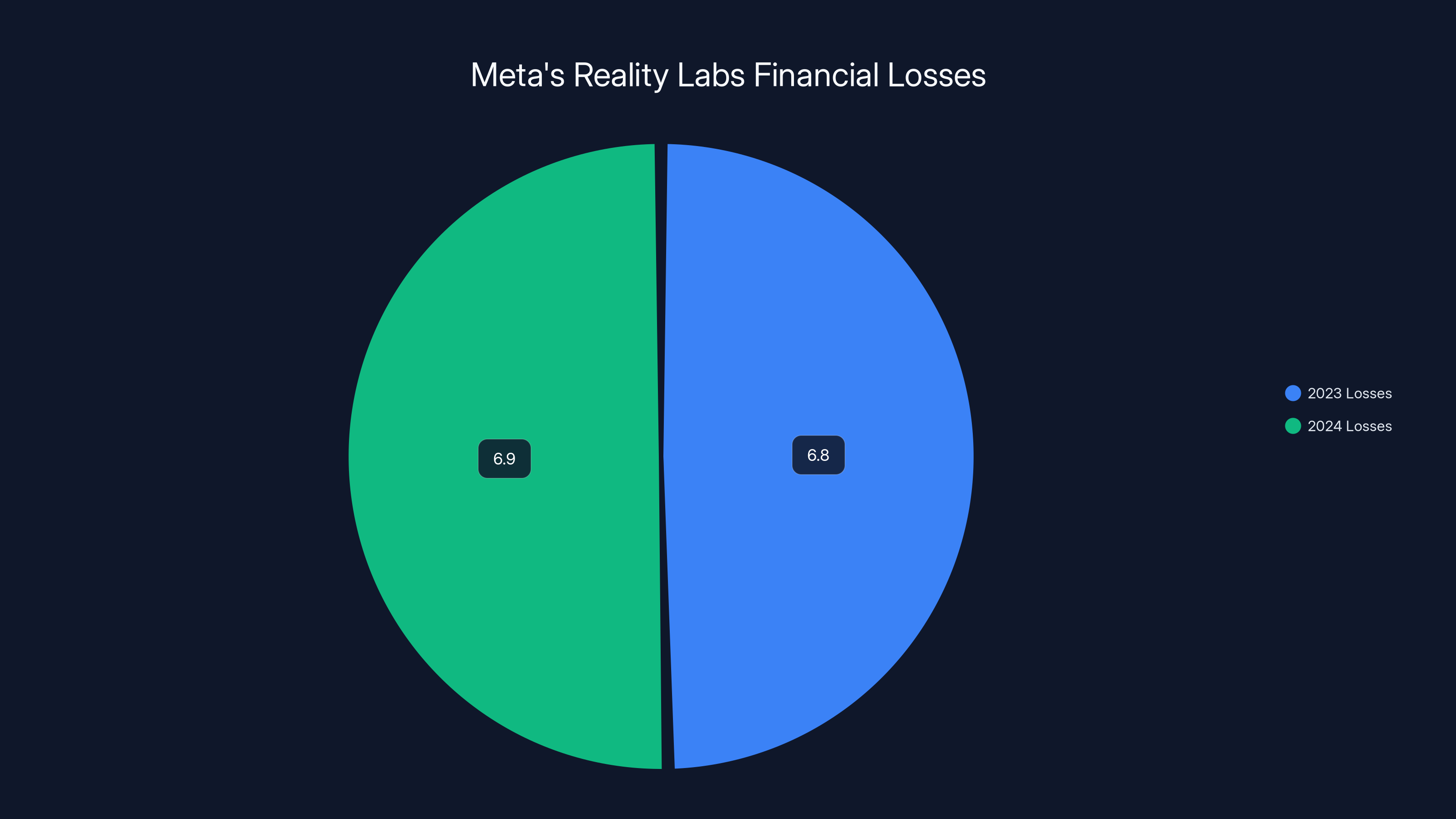

Reality Labs lost approximately $13.7 billion in 2023 and 2024 combined. Not a typo. Thirteen point seven billion dollars. That's not venture risk capital. That's the operating loss of a major tech company's entire division. According to Financial Content, this financial strain is part of a broader tech sell-off impacting major companies.

Meta's executives realized this week—or finally admitted publicly what they probably realized months ago—that throwing more money at VR wouldn't fix the fundamental problem: people just don't want to spend significant time in virtual worlds created by a social media company.

So they're shifting. Reality Labs is still alive, technically. But its budget is shrinking. Its headcount is being redirected. And its leadership is being reassigned to AI projects where Meta believes the real future lies.

What This Means for the VR Industry

When Meta—the company with unlimited capital and the most aggressive VR bet in history—essentially taps out, it sends a message to the entire industry: maybe this isn't the path forward.

Other companies won't abandon VR entirely. Apple still has its Vision Pro, though sales numbers suggest consumers remain skeptical. Sony continues its PSVR strategy, but it's contained within gaming. Microsoft and smaller players will keep experimenting.

But the "metaverse" as a concept? The vision of everyday people spending their leisure time in virtual worlds created by tech companies? That died this week. What we'll likely see instead are specialized VR applications for specific use cases: gaming, professional training, architecture visualization. Useful tools. Not the future of human communication.

The Honest Assessment

Meta's problem wasn't execution. It was prediction. The company got the timeline completely wrong. VR might eventually become mainstream, but we're talking 10, 15, maybe 20 years out. Meta bet that would happen in 5. That's a generational timing miss, and it costs billions to fix.

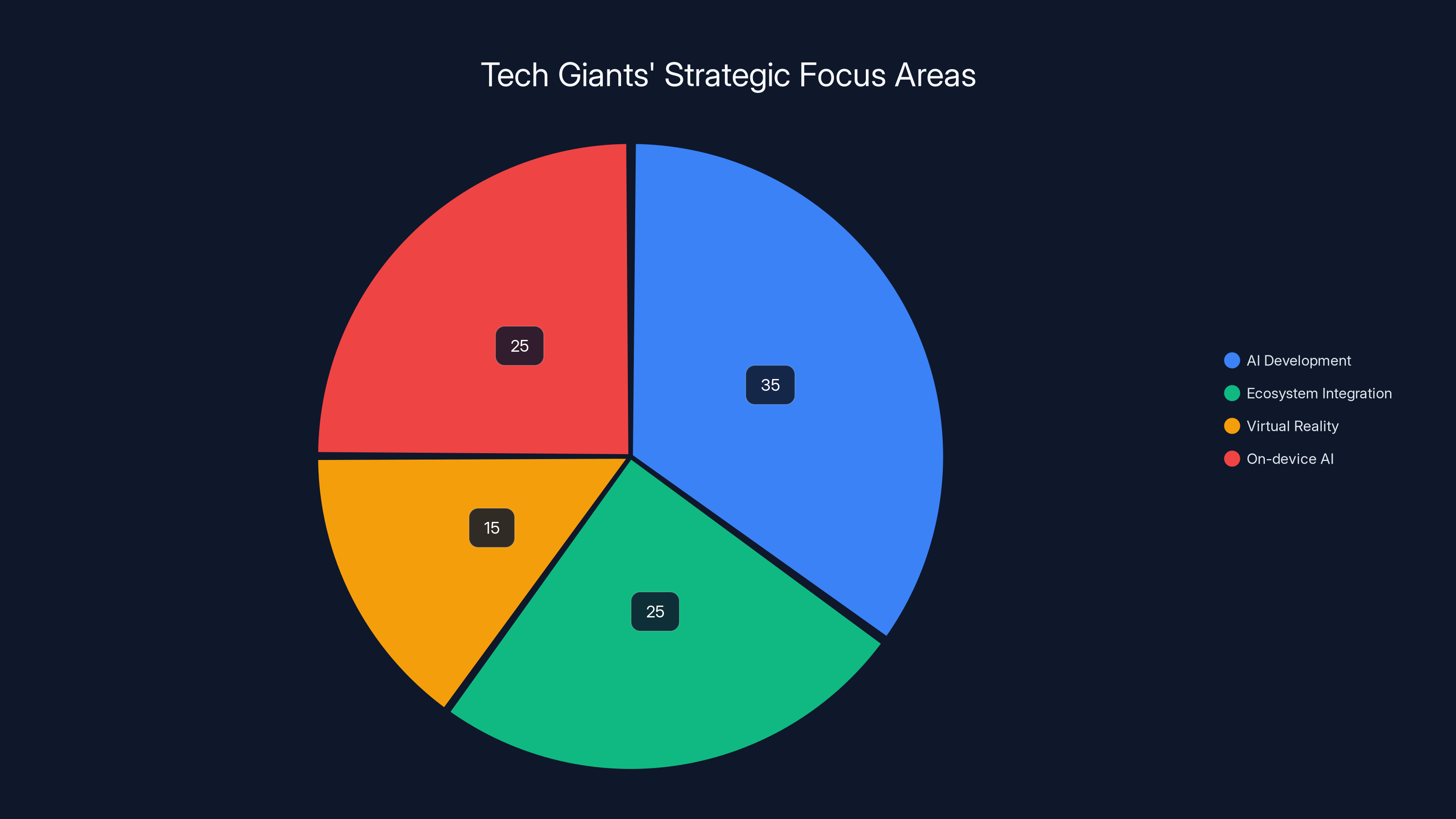

Estimated data showing the strategic focus areas of major tech companies. AI development and on-device AI are significant areas of interest, reflecting industry trends.

3. Open AI Announces GPT-5 with Surprising Limitations and Breakthrough Reasoning

The Announcement Nobody Fully Expected

Open AI released details about GPT-5 this week, and honestly? It's weirder than the hype suggested.

Yes, it's more capable. Yes, it reasons better. Yes, it passes more benchmarks. But Open AI also publicly acknowledged something they usually hide: the model has specific weaknesses in emerging domains where training data doesn't exist yet. It hallucinates less, but it still confuses itself on novel problems.

This matters because the entire narrative around AI has been "throw more scale at it and capability emerges." And that's true. But GPT-5 proves there are actual limits to that approach. The model is hitting diminishing returns on tasks where it needs to reason about things outside its training data distribution.

What breakthrough did come is reasoning. GPT-5 demonstrates markedly improved ability to work through complex problems step-by-step, similar to how humans approach unfamiliar territory. It's not perfect reasoning. But it's legitimately better than what we've seen before.

The Competitive Landscape Shifts Again

This announcement matters mostly for what it reveals about the competitive dynamics. Anthropic's Claude has been gaining ground by focusing on safety and coherence over raw capability. Google's Gemini is improving rapidly. And now Open AI is essentially admitting the scale game has limits.

That shifts the competition toward efficiency, specialization, and domain-specific optimization. Which means companies that got caught in the "bigger model" arms race might find themselves at a disadvantage.

What This Means for Developers and Teams

If you're building AI-powered products, GPT-5 changes your calculus. You might still need multiple models for different tasks instead of using one model for everything. That's actually better long-term because it forces you to think about optimal solutions instead of brute-forcing everything through one black box.

Tools that abstract away model selection are becoming more valuable. Platforms that can intelligently route requests to different models based on task complexity and type will win. And companies like Runable that focus on workflow automation and AI-powered document generation starting at $9/month are better positioned because they're already thinking about multi-model architectures and practical implementation.

Use Case: Automatically generate technical documentation and reports using AI while maintaining quality and consistency across your team.

Try Runable For Free

4. Samsung Announces Its Most Aggressive AI Smartphone Push Ever

The Galaxy Shift

Samsung announced this week that its entire 2025 Galaxy lineup will feature on-device AI capabilities baked into the operating system. Not as an optional feature. Not as a premium tier. As the baseline expectation across all devices.

This is significant because Samsung historically follows, not leads. The company builds excellent hardware and reasonable software, but it's rarely first with transformative technology. This week changed that narrative.

The company is positioning AI not as a gimmick but as the core value proposition of the next generation of phones. Everything from photo editing to message composition to real-time translation happens locally on the device, powered by on-device models that Samsung optimized specifically for its Snapdragon and Exynos chips.

Why This Matters

Apple's been talking about on-device AI for months with Apple Intelligence. Google's been shipping AI features gradually. But Samsung is going all-in with no half measures. If the execution works—and Samsung has strong hardware engineers, so there's reason to believe it will—then the company could genuinely own the AI phone category.

That would be a massive shift. It would mean consumers have a compelling reason to choose Samsung specifically because of capability, not just price or design. For a company that's spent the last five years competing primarily on value, that's a game-changing position.

The Technical Challenge

Here's what makes this risky: running real AI models locally on mobile hardware is hard. It requires optimization that most software teams struggle with. Samsung's investing significant engineering resources to make this work. If they pull it off, competitive advantage. If they don't, it's just another feature that doesn't quite work right.

But the company's track record with optimization suggests they're serious about execution, not just messaging.

Meta's Reality Labs division lost a combined $13.7 billion over 2023 and 2024, with losses distributed nearly evenly across the two years. Estimated data.

5. Microsoft Announces Office Integration With Copilot at Scale

The Productivity Reimagined Moment

Microsoft announced this week that Copilot integration is expanding dramatically across Office 365 applications. We're talking real-time collaborative writing assistance in Word, intelligent data analysis in Excel that actually works (not just suggests), and presentation generation in PowerPoint that understands your content.

But here's the meaningful part: it's shipping as a core feature to all enterprise subscribers, not as a premium add-on. Microsoft is making a bet that AI-assisted productivity is now essential, not optional.

What's interesting about this announcement is that Microsoft isn't claiming the Copilot integration will make you smarter or more creative. The company's messaging is surprisingly humble: Copilot handles the mechanical parts of document creation so humans can focus on actual thinking.

The Enterprise Implications

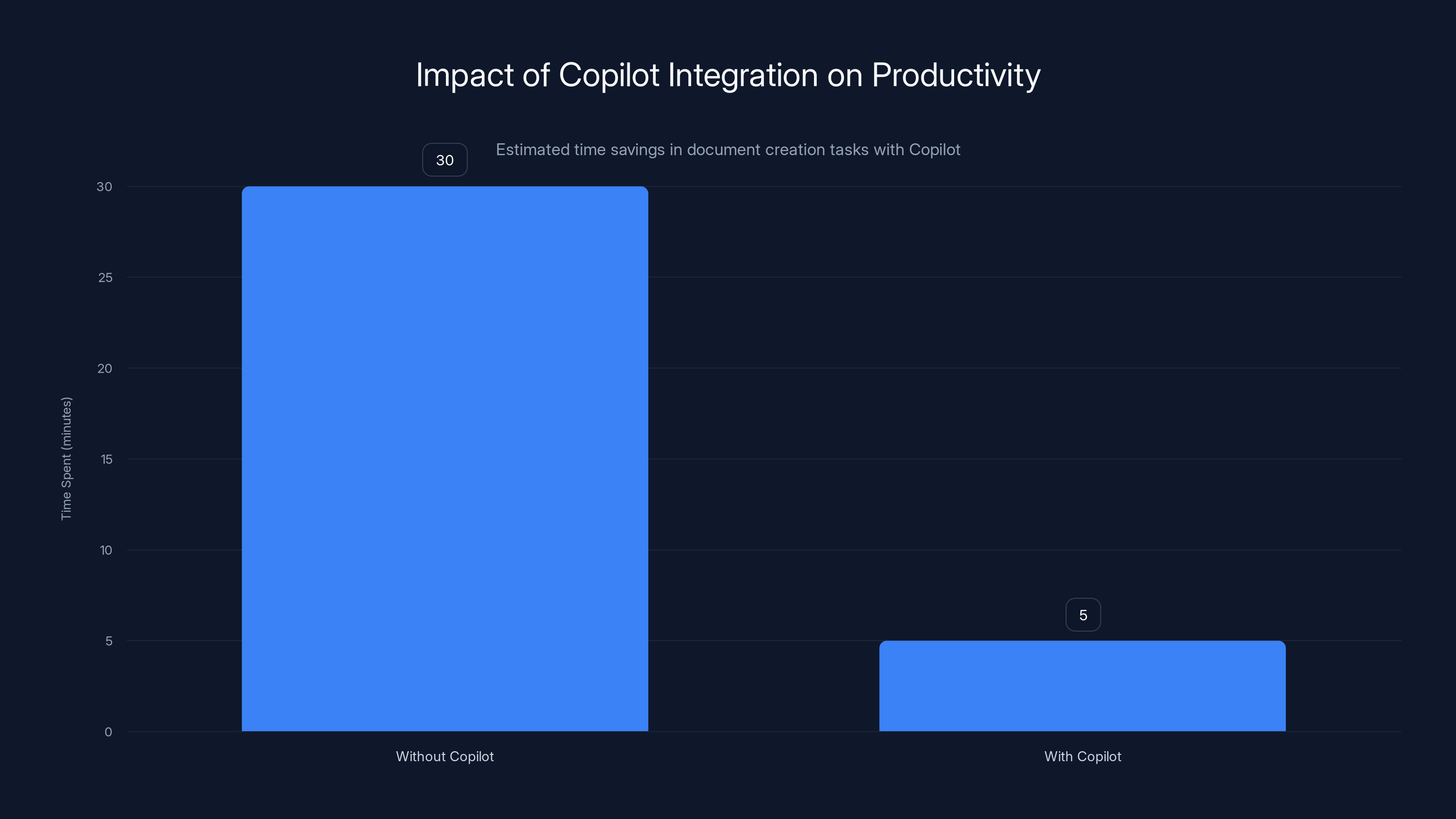

For knowledge workers using Office apps (which is basically everyone in corporate environments), this changes workflow significantly. Instead of spending 30 minutes formatting a report and creating slides, you spend 5 minutes giving Copilot direction and 20 minutes actually thinking about the content.

That's not revolutionary in the dramatic sense. But it's the kind of incremental improvement that compounds across millions of workers across thousands of organizations.

Microsoft's also positioning this as a foundation for future capabilities. The infrastructure supporting Copilot in Office will eventually support more complex automation. Teams that figure out how to leverage this effectively will have genuine productivity advantages over competitors who don't.

The Comparison Point

Tools like Runable are thinking about similar problems from a different angle—how do you automate document and presentation generation entirely, not just assist with it? It's the flip side of the same coin. Microsoft is optimizing for human-assisted creation. Runable is optimizing for AI-driven automation. Both are responses to the same underlying problem: manual document creation is a bottleneck.

6. Amazon Quietly Acquires a Major AI Robotics Startup

The M&A Nobody Saw Coming

Amazon announced an acquisition of a significant AI robotics startup this week. The company's not making a big deal about it publicly, but internally? It's massive.

Amazon's been investing in warehouse automation and robotics for years, but this acquisition represents a fundamental shift in strategy. Instead of building robotics in-house, the company's acquiring expertise in AI-driven autonomous systems.

The strategic logic is clear: warehouse automation is moving from scripted, predictable movements to dynamic, AI-assisted operations. Amazon needs robots that can handle unpredictability, learn from mistakes, and adapt to new situations. An external startup with deep expertise in that problem is faster to acquire than building it internally.

What This Signals About Amazon's Future

This isn't just about warehouses. Amazon's signaling that it believes AI-driven robotics will be central to logistics over the next decade. Every competitor in e-commerce, delivery, and logistics is watching this move and doing the math: are we falling behind?

Other companies will follow. This is how tech trends consolidate. One player makes a major move, competitors respond, and suddenly there's an industry-wide shift.

The Labor Market Implications

It's worth acknowledging what this means: Amazon is continuing its shift toward automation of labor-intensive tasks. That has both positive and negative implications. On the positive side, it makes fulfillment more efficient, which eventually means lower prices or better service. On the negative side, it's one more category of jobs being displaced by technology.

The company's argument—and it's not unreasonable—is that automation allows them to reinvest capital in faster shipping, better infrastructure, and lower prices. Whether workers benefit from those improvements is a separate question.

Copilot integration in Office 365 reduces time spent on document formatting from 30 to 5 minutes, allowing more time for content creation. Estimated data.

7. European Regulators Announce New AI Governance Framework

The Regulatory Shift

European regulators announced a new governance framework for AI this week that essentially creates a two-tier system. High-risk AI (like employment decisions, criminal justice, content moderation) gets heavy regulation. Lower-risk AI gets lighter touch oversight.

The framework isn't perfect. It's probably not even good. But it's a signal about where regulation is headed globally. And it's forcing tech companies to think about compliance in ways they haven't before.

Why This Matters

For US and international tech companies, this means you can't just ship AI products globally without considering regulatory compliance. Europe's not a market you can ignore. So if you're building AI products, you now need to think about how your system behaves in different regulatory contexts.

This is actually healthy long-term. It forces companies to be more thoughtful about AI safety and bias instead of shipping fast and apologizing later. But it does slow down innovation cycles and raise costs.

The Global Pattern

What's interesting is that this announcement follows similar moves by regulators in the UK, Canada, and other jurisdictions. We're watching real-time regulatory convergence around AI governance. Companies that can adapt to multiple frameworks will win. Companies betting on regulatory arbitrage will lose.

What This Week Actually Means

The Bigger Pattern

Step back from individual announcements, and a pattern emerges. This week represents a maturation moment for technology broadly.

Apple's challenges in AI aren't about Apple. They're about an industry where first-mover advantage in software no longer guarantees dominance. Meta's VR retreat isn't about VR specifically. It's about an industry learning that not every bold bet works out, and that's okay.

Samsung's AI push, Microsoft's Office integration, Amazon's robotics acquisition—these are all signals that AI has moved from "exciting frontier" to "core business value." Companies that treat it as a commodity lose. Companies that treat it as essential infrastructure win.

The Implications for Your Business

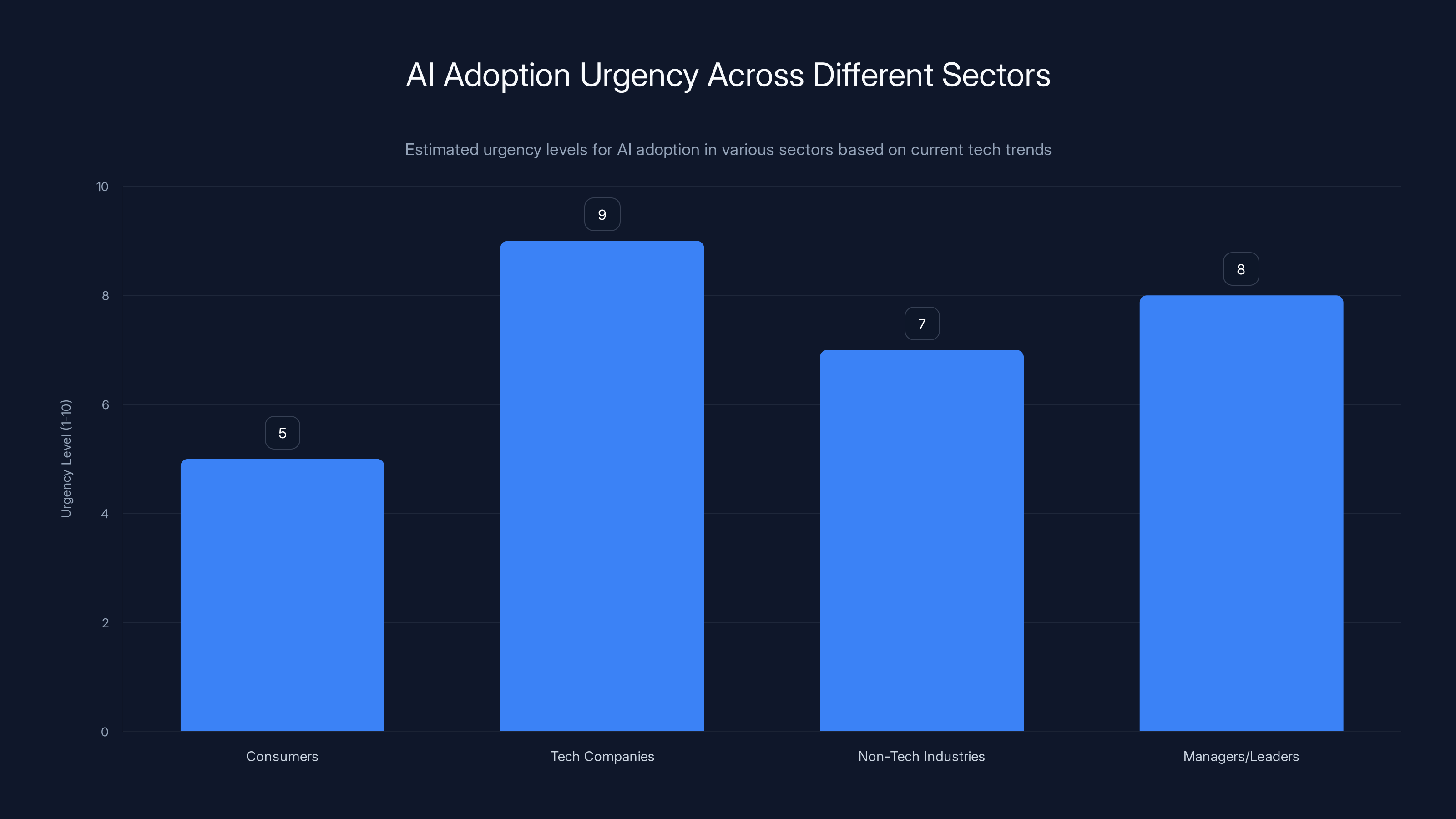

If you work in tech, this week accelerates timelines. You can't wait for AI to stabilize. It already has, in many domains. The question is whether you're implementing it.

If you work outside tech, this week's announcements still matter because they signal where computing is headed. Your industry's probably next to face disruption from AI-driven optimization and automation.

The Honest Take

There's a temptation to treat weeks like this as the end of something—the end of Apple's dominance, the end of the metaverse dream, the end of purely software-defined business models. And there's truth in that.

But really, this week is the beginning of something else. An era where AI isn't novel. Where automation isn't aspirational. Where the companies that integrated these technologies effectively months ago are already seeing competitive advantages.

The next companies to move will still have time to catch up. But the time window is closing faster than people realize.

Tech companies face the highest urgency to adopt AI, followed by managers/leaders and non-tech industries. Consumers have moderate urgency. Estimated data based on current trends.

Why These Stories Matter More Than They Seem

Technology Doesn't Move Linearly

One of the biggest mistakes people make when following tech news is treating announcements as isolated events. "Apple lost to Google on AI" feels like it's about smartphones. It's not. It's about the entire ecosystem of consumer technology and how rapidly preferences can shift.

When consumers start choosing products based on capability rather than brand loyalty, that's a threshold moment. Markets don't go backward from that. They accelerate.

The Acceleration Never Stops

People said the same thing about mobile phones ten years ago. "Nokia and Blackberry can't fall apart that fast." Then they did. The companies betting on yesterday's advantages didn't survive the transition to today's capabilities.

That's not about tech executives being incompetent. It's about how rapidly the competitive landscape can shift when new capabilities become mainstream.

Your Business Probably Isn't Immune

If you're reading this and thinking "well, this is interesting tech news but doesn't affect my industry," you might be wrong. AI, automation, and intelligent systems are diffusing into every sector faster than anyone predicted.

Retail's disrupted by Amazon. Manufacturing's being automated. Services are being AI-assisted. Distribution is being optimized. Every business model is vulnerable to disruption from companies applying these technologies better.

The Week Ahead

What to Watch

Following this week's announcements, several things are worth monitoring:

-

Apple's next product event: Will the company respond aggressively to Google's AI push, or will it stick with incremental improvements? The answer tells you everything about Tim Cook's confidence in the current strategy.

-

Microsoft's Office adoption metrics: How many enterprises actually enable Copilot integration? That number will signal how serious companies are about AI-assisted productivity.

-

Samsung's Galaxy sales data: If AI-first phones actually drive upgrade cycles, we'll see it in sales numbers within two quarters.

-

Meta's next earnings call: Watch for how the company discusses Reality Labs and whether the division continues shrinking.

-

Regulatory responses to the European framework: Will other regions adopt similar governance models, or will we see fragmentation?

The Longer View

This week matters not because any single announcement is revolutionary in isolation. It matters because collectively, these announcements prove that the tech industry has fundamentally shifted.

We're past the exploration phase for AI, automation, and intelligent systems. We're in the integration phase. Companies are making strategic bets about where these technologies go next. Winners and losers will be determined by execution, not by press releases.

TL; DR

- Apple faces real competition from Google in AI integration: The company's ecosystem advantage weakens when capability differences become obvious to consumers.

- Meta abandons its metaverse vision: The company restructures Reality Labs and redirects billions to AI, admitting the VR bet failed on timeline.

- GPT-5 shows reasoning improvements but fundamental limits: Open AI proves that scale has diminishing returns and specialized models will dominate.

- Samsung goes all-in on AI phones: The company positions on-device AI as the core value proposition for its entire 2025 lineup.

- Microsoft makes AI-assisted productivity central to Office: Copilot integration ships to all enterprise users, signaling the shift from optional to essential.

- Amazon acquires major AI robotics expertise: The company's betting that autonomous systems are critical to next-generation logistics.

- European regulators establish AI governance framework: Real regulation is coming, forcing companies to think about compliance before shipping.

Bottom line: This week marks a maturation point where AI, automation, and intelligent systems transition from "exciting frontier" to "core business value." Companies that treat these as essential now have significant advantages over those that don't.

FAQ

What is the significance of Apple losing market position to Google this week?

Apple's historical advantage came from ecosystem lock-in and superior integration. But when Google demonstrates measurably better AI capabilities across search, Android, and web experiences, that advantage weakens. Consumers will switch not because of price or design, but because Google's AI is more useful. This is a threshold moment for Apple because the company rarely recovers ground once it loses technological leadership.

Why did Meta really abandon the metaverse?

Meta didn't abandon VR entirely, but it restructured its metaverse bet after realizing the timeline was wrong. The company spent $13.7 billion and users never materialized at scale. The underlying problem wasn't execution—it was that people simply don't want to spend significant time in corporate-controlled virtual worlds. Meta's learning to cut losses and reallocate capital to areas with better returns, like AI.

How does GPT-5 differ from previous Open AI models?

GPT-5 shows improved reasoning capabilities, particularly for complex multi-step problems. But Open AI openly acknowledged that the model has specific weaknesses in novel domains where training data doesn't exist. This proves that the "more scale equals more capability" approach has limits, which shifts the competitive landscape toward specialized models and efficient implementation.

Should I care about Samsung's AI phone announcement as a consumer?

Yes, if you use smartphones. On-device AI means faster responses, better privacy (data stays on your phone), and more capable features. If Samsung executes well, it could force Apple and Google to improve their own on-device AI, which benefits all consumers. If Samsung fumbles execution, it's just another feature that doesn't quite work.

What does Microsoft's Office Copilot integration mean for enterprise users?

It means knowledge workers will spend less time on mechanical document tasks and more time on actual thinking. Word, Excel, and PowerPoint will offer AI-powered assistance as standard features, not premium add-ons. Organizations that teach employees to use these tools effectively will see productivity gains. Those that don't will fall behind.

How will European AI regulation affect tech companies globally?

European regulation creates compliance requirements for companies serving European customers. This raises costs and slows deployment, but it also forces companies to be more thoughtful about AI safety and bias. The framework likely signals where global regulation is headed, so companies should prepare for similar requirements in other regions eventually.

Will Meta's VR retreat affect the broader VR industry?

It signals that the consumer metaverse vision isn't materializing on current timelines. But VR continues as a viable technology for specialized use cases: gaming, professional training, architecture visualization. We won't see everyday people spending hours in corporate virtual worlds, but we will see VR as a useful tool for specific applications.

What's the connection between these seven stories?

Collectively, they signal that the tech industry is transitioning from exploration mode to integration mode. AI, automation, and intelligent systems are no longer novel—they're becoming central to how companies compete. Winners will be determined by execution and implementation, not by being first to the technology.

How quickly will these announcements affect actual products I use?

Samsung's AI phones ship this quarter, so that's immediate. Microsoft's Copilot expansion rolls out over the next six months. Apple's response depends on their product roadmap, probably visible at the spring event. Google's AI integration is already shipping gradually. So most of these changes will affect your actual devices within two to three quarters.

Should I switch phones or platforms based on this week's announcements?

Not immediately. Wait for reviews and actual real-world usage from early adopters. Software features announced at executive presentations often don't work as advertised in practice. Give it six weeks, watch tech reviews from trusted sources, then decide if the capability improvements justify switching. The companies making the announcements won't disappear if you wait.

What You Should Do Now

If You're a Consumer

Pay attention to the next 90 days. That's when these announcements translate into actual products in your hands. Watch for reviews of Samsung's AI phones. Try Microsoft's new Copilot features if you use Office 365. See if Apple announces a competitive response. Use this period to gather real data instead of trusting marketing messages.

If You Work in Tech

This week accelerates timelines. If your company hasn't integrated AI into core products or operations, now is the time. The competitive window is closing. Companies that wait another year will struggle to catch up to those moving now.

If You Work Outside Tech

Your industry is probably next. Start thinking about how AI, automation, and intelligent systems will affect your business model. What processes could be automated? What decisions could be AI-assisted? How will your competitors disrupt your market? Getting ahead of these questions matters more than most people realize.

For Managers and Leaders

This week proved something important: technological leadership is temporary. Apple, Microsoft, Google—none of these companies can rest on previous advantages. They have to continuously innovate and execute. That's the lesson for your organization too. If you're not actively thinking about the next disruption, your competitors are. And they'll win.

This week in tech matters not because of individual announcements but because collectively they prove the industry has matured. AI isn't coming. It's here. Automation isn't a future scenario. It's happening now. The only real question is whether you're positioned to benefit from these shifts or become disrupted by them.

The smart move isn't to panic or get overwhelmed. It's to pay attention, understand the patterns, and start making decisions based on where the market is actually heading, not where it was.

Key Takeaways

- Apple's ecosystem advantage weakens as Google demonstrates superior AI capabilities, proving first-mover advantage in software no longer guarantees market dominance

- Meta's $13.7 billion metaverse investment failed to materialize users, forcing the company to restructure and admit the VR bet missed timelines by a generation

- OpenAI's GPT-5 shows reasoning improvements but proves scaling has diminishing returns, signaling industry shift toward specialized models over generalist approaches

- Samsung's aggressive on-device AI positioning across entire 2025 lineup represents rare leadership move from historically follower-positioned company

- Collective announcements signal technology industry maturation from exploration phase to integration phase, determining winners through execution not just innovation

Related Articles

- ChatGPT Ads Are Coming: Everything You Need to Know [2025]

- Enterprise AI Needs Business Context, Not More Tools [2025]

- AI Accountability & Society: Who Bears Responsibility? [2025]

- xAI's Grok Deepfake Crisis: What You Need to Know [2025]

- Meta Kills Workrooms VR Meetings: What It Means for Remote Work [2025]

- AI Identity Crisis: When Celebrities Own Their Digital Selves [2025]

![7 Biggest Tech Stories: Apple Loses to Google, Meta Abandons VR [2025]](https://tryrunable.com/blog/7-biggest-tech-stories-apple-loses-to-google-meta-abandons-v/image-1-1768646237346.png)